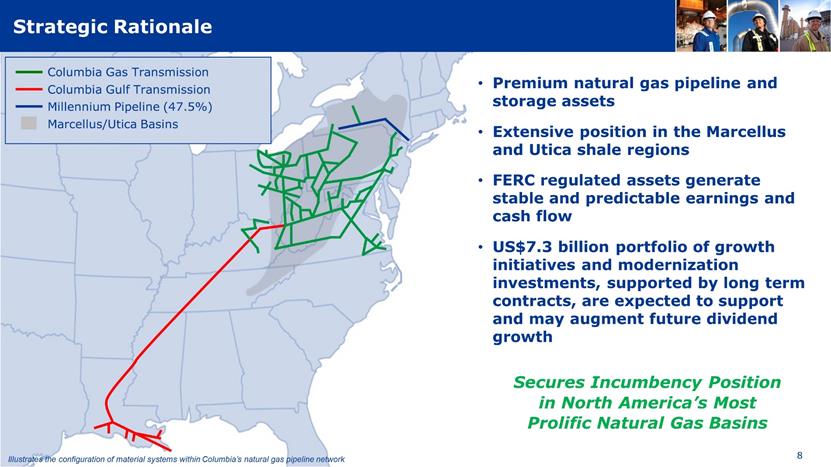

Forward Looking Information This presentation includes “forward-looking information” and “forward-looking statements” (collectively, “forward-looking information”) which is intended to provide potential investors with information regarding TransCanada Corporation (“TransCanada” or “the Corporation”), including management’s assessment of our future plans and financial outlook. In some cases the words “anticipate”, “expect”, “believe”, “may”, “will”, “should”, “estimate”, “project”, “outlook”, “forecast”, “intend”, “target”, “plan” or other similar words are used to identify such forward-looking information. Forward-looking information in this presentation may include, but is not limited to, statements regarding: anticipated business prospects; our financial and operational performance, including the performance of our subsidiaries; expectations or projections about strategies and goals for growth and expansion; expected cash flows and future financing options available to us; expected costs for planned projects, including projects under construction and in development; expected schedules for planned projects (including anticipated construction and completion dates); expected regulatory processes and outcomes; expected impact of regulatory outcomes; expected capital expenditures and contractual obligations; expected operating and financial results; expected industry, market and economic conditions; the planned acquisition transaction (the "Acquisition") including the expected closing thereof; plans regarding financing for the Acquisition repayment of the credit facilities, through planned divestitures; planned changes in the Corporation’s business including the divestiture of certain assets; expected impacts of the Acquisition on EBITDA composition, earnings, cash flow and dividend growth; transportation services to the liquefied natural gas sector and growth opportunities and modernization initiatives relating to Columbia Pipeline Group, Inc.'s ("Columbia") business. This forward-looking information reflects our beliefs and assumptions based on information available at the time the information was stated and as such is not a guarantee of future performance. By its nature, forward-looking information is subject to various assumptions, risks and uncertainties which could cause our actual results and achievements to differ materially from the anticipated results or expectations expressed or implied in such statements. Key assumptions on which our forward-looking information is based include, but are not limited to, assumptions about: the timing and completion of the Acquisition including receipt of regulatory and Columbia stockholder approval; fulfillment by the underwriters of their obligations pursuant to the underwriting agreement; that no event will occur which would allow the underwriters to terminate their obligations under the underwriting agreement; the planned monetization of TransCanada's U.S. Northeast merchant power business and of a minority interest in its Mexican natural gas pipeline business; inflation rates, commodity prices and capacity prices; timing of financings and hedging; regulatory decisions and outcomes; foreign exchange rates; interest rates; tax rates; planned and unplanned outages and the use of our and Columbia’s pipeline and energy assets; integrity and reliability of our assets; access to capital markets; anticipated construction costs, schedules and completion dates; acquisitions and divestitures; and the realization of the anticipated benefits and synergies of the Acquisition to TransCanada including impacts on growth and accretion in various financial metrics. The risks and uncertainties that could cause actual results or events to differ materially from current expectations include, but are not limited to: our ability to successfully implement our strategic initiatives; whether our strategic initiatives will yield the expected benefits; the operating performance of our and Columbia’s pipeline and energy assets; amount of capacity sold and rates achieved in our and Columbia’s pipeline business; the availability and price of energy commodities; the amount of capacity payments and revenues we receive from our energy business; regulatory decisions and outcomes; outcomes of legal proceedings, including arbitration and insurance claims; performance and credit risk of our counterparties; changes in market commodity prices; changes in the political environment; changes in environmental and other laws and regulations; competitive factors in the pipeline and energy sectors; construction and completion of capital projects; costs for labour, equipment and material; access to capital markets; interest, tax and foreign exchange rates; weather; cybersecurity; technological developments; economic conditions in North America as well as globally; uncertainty regarding the length of time to complete the Acquisition and uncertainty regarding the ability of TransCanada to realize the anticipated benefits of the Acquisition; and the timing and execution of TransCanada’s planned asset sales. Additional information on these and other factors will be discussed in the amended and restated preliminary short form prospectus and the documents incorporated by reference therein. Readers are cautioned against placing undue reliance on forward-looking information, which is given as of the date it is expressed in this presentation or otherwise, and not to use future-oriented information or financial outlooks for anything other than their intended purpose. We undertake no obligation to publicly update or revise any forward-looking information in this presentation or otherwise, whether as a result of new information, future events or otherwise, except as required by law.