Use these links to rapidly review the document

TABLE OF CONTENTS

VASO ACTIVE PHARMACEUTICALS, INC. INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on November 13, 2003

Registration No. 333-106785

| | | | |

OMB APPROVAL

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM SB-2 |

|

OMB Number: 3235-0418

Expires: February 28, 2006

Estimated average burden

hours per response: 137.0

|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

VASO ACTIVE PHARMACEUTICALS, INC.

DELAWARE

(State of Other Jurisdiction

of Incorporation or Organization) | | 2834

(Primary Standard Industrial Classification

Identification "SIC" Number) | | 02-0670926

(IRS Employment

or "EIN" Number) |

VASO ACTIVE PHARMACEUTICALS, INC.

99 ROSEWOOD DRIVE, SUITE 260

DANVERS, MASSACHUSETTS 01923

(978) 750-0090

(Address and telephone number of principal executive offices)

99 ROSEWOOD DRIVE, SUITE 260

DANVERS, MASSACHUSETTS 01923

(Address of principal place of business or intended principal place of business)

JOHN J. MASIZ

PRESIDENT AND CHIEF EXECUTIVE OFFICER

99 ROSEWOOD DRIVE, SUITE 260

DANVERS, MASSACHUSETTS 01923

(978) 750-0090

(Name, address and telephone number of agent for service)

APPROXIMATE DATE OF PROPOSED SALE TO THE PUBLIC:As soon as practicable after the effective date of this Registration Statement.

Copies to:

Gregory Sichenzia, Esq.

Thomas A. Rose, Esq.

Sichenzia Ross Friedman Ference LLP

1065 Avenue of the Americas

New York, NY 10018

(212) 930-9700 | | David A. Garbus, Esq.

J. Michael Wirvin, Esq.

Robinson & Cole LLP

One Boston Place

Boston, Massachusetts 02108

(617) 557-5900

|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be registered

| | Dollar amount to

be registered

| | Proposed maximum

offering price per unit

| | Proposed maximum

aggregate

offering price

| | Amount of

Registration Fee

|

|---|

|

| Class A common stock, $.0001 par value per share(1) | | $7,475,000 | | $5.00 | | $7,475,000 | | $610.71 |

|

| Representative's Warrants to purchase Class A common stock, $.0001 par value per share(2) | | 130,000 | | $.0001 | | $13.00 | | $— |

|

| Class A common stock, $.0001 par value per share issuable upon exercise of Representative's Warrants | | $780,000 | | $6.00 | | $780,000 | | $63.72 |

|

| Total | | | | | | | | $674.43(3) |

|

- (1)

- Includes 195,000 shares of Class A common stock which the underwriters have the option to purchase to cover over-allotments, if any.

- (2)

- In connection with the Registrant's sale of the Securities offered hereby, the Registrant is granting to the Representative warrants to purchase 130,000 shares of Class A common stock.

- (3)

- Includes $622.55 previously paid.

No market currently exists for the Registrant's Class A common stock. The proposed maximum offering price per share is estimated solely for the purposes of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state in which the offer or sale is not permitted.

Subject to completion, dated November 13, 2003

PROSPECTUS

1,300,000 Shares

VASO ACTIVE PHARMACEUTICALS, INC.

1,300,000 Shares Class A Common Stock

This is the initial public offering of Vaso Active Pharmaceuticals, Inc., and we are offering 1,300,000 shares of our Class A common stock. We have applied for listing on the Nasdaq Small Cap Market under the symbol "VAHP" and on the Boston Stock Exchange under the symbol • . No public market currently exists for our shares.

We have two classes of common stock, Class A common stock and Class B common stock. The Class A common stock is substantially identical to the Class B common stock, except with respect to voting power. With respect to all matters on which stockholders are entitled to vote, holders of the Class A common stock are entitled to one vote per share of Class A common stock held. Holders of the Class B common stock are entitled to three votes per share of Class B common stock held.

Investing in our Class A common stock involves risks. See "Risk Factors" beginning on page 7.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | Price to Public

| | Underwriting Discounts

and Commissions

| | Proceeds Before Expenses

|

|---|

| Per Share | | $ | 5.00 | | $ | .50 | | $ | 4.50 |

| Total | | $ | 6,500,000 | | $ | 650,000 | | $ | 5,850,000 |

- *

- As additional compensation to the underwriters, we have granted to the representative of the underwriters five year warrants to purchase 130,000 shares of our Class A common stock at an exercise price equal to 120% of the initial offering price to the public.

We have granted the underwriters the right to purchase up to an additional 195,000 shares of Class A common stock to cover over-allotments.

KASHNER DAVIDSON

SECURITIES CORP.

THE DATE OF THIS PROSPECTUS IS , 2003

TABLE OF CONTENTS

In this prospectus, the terms "Vaso Active", "we", "our" and "us" refer to Vaso Active Pharmaceuticals, Inc. unless otherwise specified. You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from the information contained in this prospectus. We are offering to sell shares of Class A common stock, and seeking offers to buy shares of Class A common stock, only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of when this is delivered or when any sale of our Class A common stock occurs.

2

PROSPECTUS SUMMARY

You should read the following summary together with the more detailed information regarding our company and the Class A common stock being sold in this offering, including the "Risk Factors" section and our financial statements and accompanying notes, which are included elsewhere in this prospectus.

Our Business

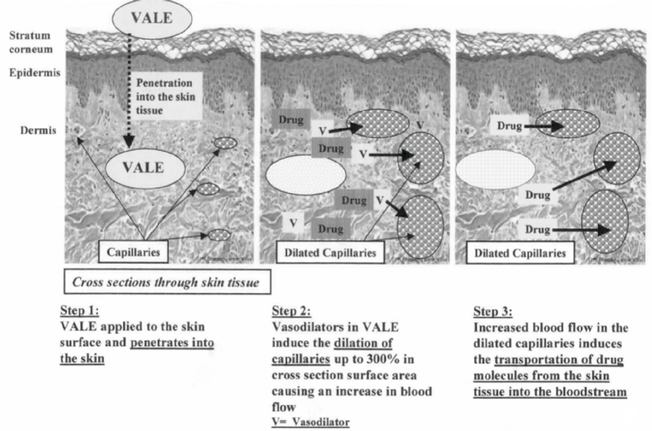

We are an early-stage company focused on commercializing, marketing and selling over-the-counter, or OTC, pharmaceutical products, with a particular focus on drugs that incorporate the vaso active lipid encapsulated, or VALE, transdermal delivery technology. We began our operations as a division of BioChemics, Inc., a biopharmaceutical company focused on the development of transdermal drug delivery systems, in January 2001. In January 2003, we were formed as an independent subsidiary of BioChemics to further commercialize our OTC products and further develop our OTC product candidates, although BioChemics continues to provide us with administrative support services, manufacturing and development services and technology licenses.

BioChemics currently holds patents for the Vaso Active Lipid Encapsulated transdermal delivery system. We refer to this as VALE technology. VALE technology can be thought of as a "liquid needle", given its ability to introduce drugs into the bloodstream in an efficient and highly effective manner. We believe that the VALE technology provides an efficient, predictable and reliable transdermal drug delivery system that eliminates the need for a patch and allows for the efficient and effective delivery of a myriad of drugs that could not otherwise be effectively delivered using existing transdermal delivery technology.

We have an exclusive, worldwide license to use and practice the VALE technology in the development, marketing and sale of products in the OTC pharmaceutical market. We do not currently, nor do we intend to, participate in the manufacturing of, nor conduct any research and development with respect to, any of our products or product candidates. Prior to the consummation of this offering, we will enter into an agreement with BioChemics with respect to the ongoing manufacturing and development of our products and product candidates. Under this agreement, BioChemics will research, develop and manufacture products for us pursuant to specific purchase orders submitted by us from time to time. BioChemics will charge us a development and manufacturing fee at a rate of cost plus 10%. We will then market, commercialize, distribute and sell these products.

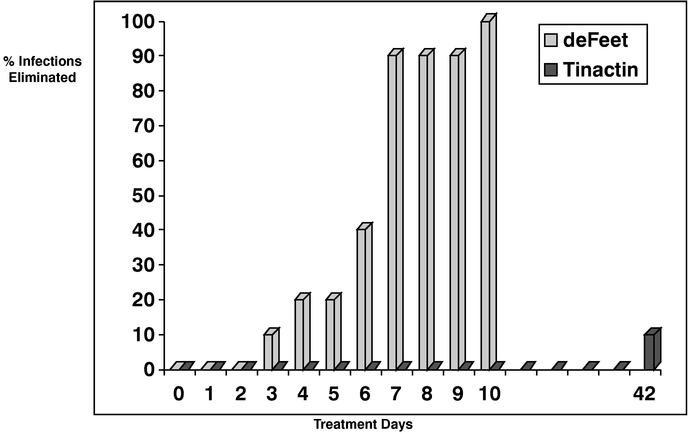

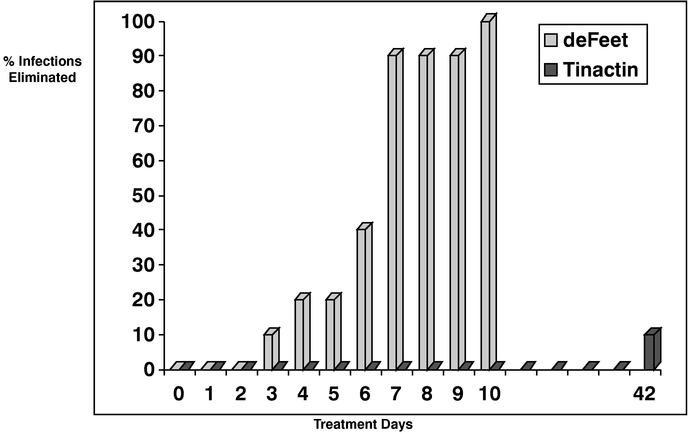

Before we were established, BioChemics initiated the marketing and commercialization of the following products on a limited basis:

- •

- deFEET®, for treatment of athlete's foot fungal infections;

- •

- Athlete's Relief, for treatment of pain associated with athletic activity; and

- •

- Osteon®, for treatment of arthritis pain.

Currently, we market Athlete's Relief and Osteon in the United States. We have begun negotiating agreements with third parties for the marketing of Osteon and Athlete's Relief in the United States and internationally. We plan to rebrand the deFEET athlete's foot anti-fungal medication product as Termin8 and/or Xtinguish, depending on targeted markets in the United States. In accordance with this plan, BioChemics has begun to remove all deFEET branded product currently in circulation. We have applied for trademark protection in the United States for the marks Termin8 and Xtinguish.

In addition to expanding our launch of these three products, we have identified and are currently developing, in collaboration with BioChemics, six additional OTC products utilizing the VALE technology. Our current OTC product candidates according to their medical or clinical indication are:

- •

- Analgesic;

- •

- Toenail fungus treatment;

- •

- Acne treatment;

3

- •

- First aid treatment;

- •

- Hand and body lotion; and

- •

- Psoriasis treatment.

Technology Behind Our Products and Product Candidates

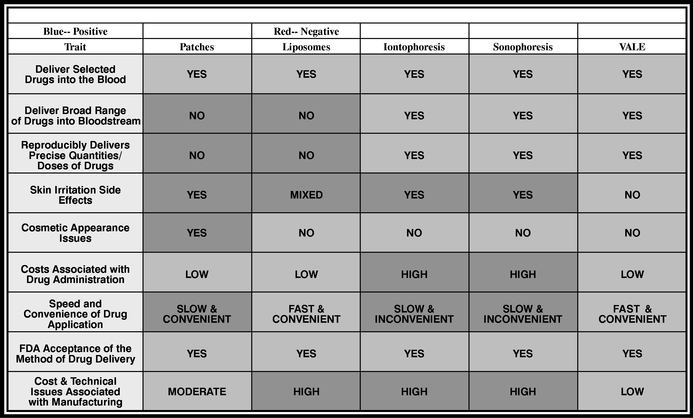

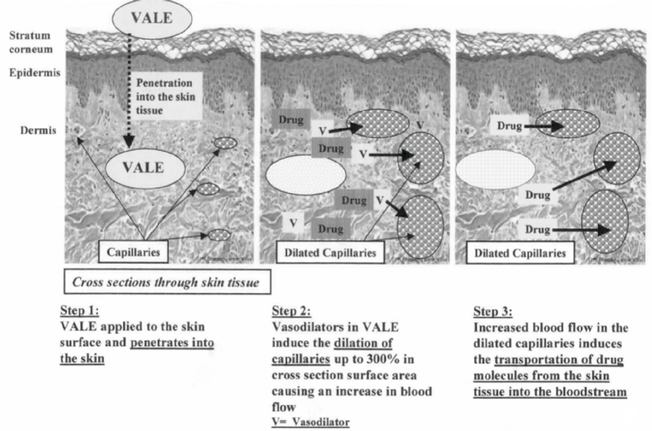

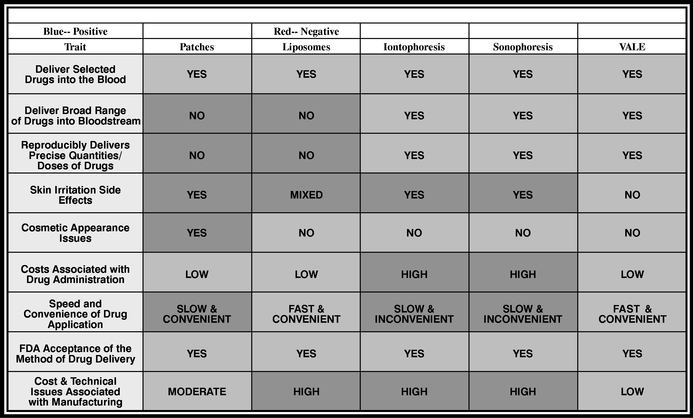

Transdermal drug delivery is the process of delivering drugs into or through the skin without requiring the use of an invasive instrument such as a needle. There are many different approaches to accomplishing transdermal drug delivery and numerous technologies exist to carry it out. The most common technologies employed use either (i) liposomes, which are applied topically, (ii) patches that adhere to the skin, holding the drug in place while it is administered, or (iii) an outside energy source producing electricity (iontophoresis) or sound (sonophoresis) to help move the drug through the skin layers.

In order to efficiently and effectively move drugs through the skin and into the blood stream, a drug delivery system must penetrate three skin barriers. Competitive technologies using patch and/or liposome technologies are able to penetrate the first and second barriers but, except for a few limited instances where more complicated and costly technologies such as iontophoresis and sonotophoresis are used, they are generally unable to penetrate the capillaries and enter the bloodstream. Unlike competing technologies, the VALE process "unlocks" this final barrier and promotes the efficient and complete transportation of drugs from the skin's second barrier, or dermis, into the bloodstream. We believe that the VALE delivery system is the only transdermal system that penetrates all three skin barriers in a timely and efficient fashion.

BioChemics has been issued three U.S. patents relating to the VALE technology. In addition, foreign patents have been issued to BioChemics in 17 foreign countries and are pending in seven others. The first of the U.S. patents expires in 2013. BioChemics has filed for second generation patents on a number of its existing products.

Our Commercialization Strategy

We intend to utilize a portion of the offering proceeds to implement our product rollout strategy. Our plan is focused on the systematic rollout of our products into major retail drug store chains, select independent pharmacies, and nontraditional channels, including websites and catalogues.

The initial phase of our OTC marketing and sales strategy is to expand the launch of Osteon and Athlete's Relief into the retail marketplace and initiate the commercialization, marketing and distribution of our Termin8 and Xtinguish brands. This will be accomplished through our own marketing efforts or through licensing agreements with third parties.

Organization and Offices

We organized as a Delaware corporation on January 13, 2003. Our principal executive offices are located at 99 Rosewood Drive, Suite 260, Danvers, MA 01923. Our telephone number is (978) 750-0090 and our website is located at www.vasoactive.us.

"Vaso Active" and our logo are trademarks of Vaso Active. Osteon® and PENtoCORE® are registered trademarks of BioChemics. deFEET® is a registered trademark of a third party, De Feet International, Inc., which has been licensed to BioChemics. We license from BioChemics the Osteon and PENtoCORE trademarks under our license agreement, as amended, with BioChemics. In addition, we have applied for U.S. trademark protection for the marks "Termin8" and "Xtinguish" for our athlete's foot preparations. Any reference in this prospectus relating to the functionality, formulation or performance of deFEET shall apply in all respects to Termin8 and Xtinguish. This prospectus also contains trademarks and tradenames of other parties.

4

THE OFFERING

| Class A common stock offered by us in this offering | | 1,300,000 shares |

| Class A common stock outstanding after this offering | | 1,514,000 shares |

| Class B common stock outstanding after this offering | | 1,500,000 shares |

| Class A and Class B common stock taken together and outstanding after this offering | | 3,014,000 shares |

| Use of proceeds | | The proceeds of this offering will be used for continued development, commercialization and sale of our products and product candidates; to implement our strategic marketing and commercialization plan; to recruit and hire individuals for key senior management positions; to repay BioChemics for management fees and other charges paid by BioChemics on our behalf; and for working capital and general corporate purposes. |

| Nasdaq Small Cap Market Symbol | | "VAPH" |

| Boston Stock Exchange Symbol | | • |

Unless otherwise noted, this prospectus:

- •

- assumes that no shares of Class A common stock were issued and outstanding as of September 30, 2003;

- •

- excludes 450,000 shares of Class A common stock issuable upon exercise of options to be granted pursuant to our 2003 stock incentive plan and 300,000 shares of Class A common stock issuable upon exercise of options to be granted pursuant to our 2003 non-employee director compensation plan;

- •

- assumes the issuance, upon the consummation of this offering, of 214,000 shares of Class A common stock issuable upon conversion of our 10% convertible subordinated pay-in-kind promissory notes outstanding as of September 30, 2003, including accrued pay-in-kind interest;

- •

- assumes no exercise of the underwriter's over-allotment option; and

- •

- assumes an initial public offering price of $5.00 per share of Class A common stock.

In addition to our Class A common stock, 1,500,000 shares of our Class B common stock are issued and outstanding as of September 30, 2003. Each share of Class B common stock is convertible at any time into Class A common stock on a share-for-share basis. With respect to all matters on which stockholders are entitled to vote, holders of the Class A common stock will be entitled to one vote per share of Class A common stock held. Holders of the Class B common stock will be entitled to three votes per share of Class B common stock held.

5

SUMMARY FINANCIAL DATA

Statement of Operations Data:

| | Years Ended

December 31,

| | Nine Months Ended

September 30,

| |

|---|

| | 2001

| | 2002

| | 2002

| | 2003

| |

|---|

| |

| |

| | (Unaudited)

| |

|---|

| Revenues | | $ | 100,209 | | $ | 91,957 | | $ | 76,499 | | $ | 51,876 | |

| Cost of sales | | | 40,791 | | | 40,811 | | | 32,779 | | | 31,279 | |

| | |

| |

| |

| |

| |

| Gross Profit | | | 59,418 | | | 51,146 | | | 43,720 | | | 20,597 | |

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Marketing, advertising and promotion | | | 556,614 | | | 38,962 | | | 11,565 | | | 87,125 | |

| | Selling, general and administrative | | | 545,748 | | | 464,832 | | | 340,526 | | | 296,538 | |

| | |

| |

| |

| |

| |

| Total operating expenses | | | 1,102,362 | | | 503,794 | | | 352,091 | | | 383,663 | |

| | |

| |

| |

| |

| |

| Loss from operations | | | (1,042,944 | ) | | (452,648 | ) | | (308,371 | ) | | (363,066 | ) |

| | |

| |

| |

| |

| |

| Other (income) expenses | | | (2,549 | ) | | (5,786 | ) | | (6,621 | ) | | (13,115 | ) |

| | |

| |

| |

| |

| |

| Net loss | | $ | (1,040,395 | ) | $ | (446,862 | ) | $ | (301,750 | ) | $ | (349,951 | ) |

| | |

| |

| |

| |

| |

| | Basic and diluted loss per share | | $ | — | | $ | — | | $ | — | | $ | (0.64 | ) |

| | |

| |

| |

| |

| |

| Shares used in computing basic and diluted loss per share amounts | | | — | | | — | | | — | | | 549,451 | |

| | |

| |

| |

| |

| |

No shares were issued as of any of the periods presented except for the period ended September 30, 2003, during which period we issued to BioChemics 1,500,000 shares of Class B common stock pursuant to our license agreement dated as of February 1, 2003.

Shares used in the computation of basic and diluted loss per share represent the weighted average shares outstanding over the six-month period ended September 30, 2003, which includes the issuance of 1,500,000 shares of Class B common stock to BioChemics on June 20, 2003.

Balance Sheet Data:

| | As of September 30, 2003

|

|---|

| | Actual

| | Pro Forma

| | Pro Forma

as Adjusted

|

|---|

| | (in thousands)

|

|---|

| Cash and cash equivalents | | $ | 159 | | $ | 159 | | $ | 5,179 |

| Working capital | | | (350 | ) | | 144 | | | 5,227 |

| Total assets | | | 821 | | | 787 | | | 5,227 |

| Total stockholders' (deficit) equity | | | (350 | ) | | 144 | | | 5,227 |

The preceding table presents a summary of our unaudited balance sheet data as of September 30, 2003:

- •

- on an actual basis;

- •

- on a pro forma basis to give effect to the automatic conversion of $500,000 principal amount of our 10% pay-in-kind promissory notes, including accrued pay-in-kind interest, into 214,000 shares of our Class A common stock upon the consummation of this offering; and

- •

- on a pro forma as adjusted basis to give effect to the issuance and the sale of 1,300,000 shares of Class A common stock offered by this prospectus at an assumed initial public offering price of $5.00 per share, after deducting the underwriting discounts and commissions and estimated offering expenses, and our receipt of the net proceeds from that sale.

6

RISK FACTORS

AN INVESTMENT IN OUR STOCK INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE FOLLOWING RISK FACTORS AND UNCERTAINTIES AND ALL OTHER INFORMATION CONTAINED IN THIS PROSPECTUS BEFORE MAKING AN INVESTMENT DECISION. THIS SECTION SETS FORTH WHAT WE BELIEVE ARE ALL OF THE MATERIAL RISKS TO AN INVESTMENT IN VASO ACTIVE. IF ANY OF THE FOLLOWING RISKS AND UNCERTAINTIES OCCURS, OUR BUSINESS, FINANCIAL CONDITION OR RESULTS OF OPERATIONS COULD BE MATERIALLY ADVERSELY AFFECTED.

Risks Related to Our Business

We are an early stage company with a history of losses and may never achieve or sustain profitability.

We have never been profitable and we may not achieve profitability in the foreseeable future, if at all. Our ability to generate profits in the future will depend on a number of factors, including:

- •

- start-up costs relating to the commercialization, sale and marketing of our products;

- •

- costs of acquiring product candidates;

- •

- general and administrative costs relating to our operations;

- •

- increases in our research and development costs; and

- •

- charges related to purchases of technology or other assets.

At September 30, 2003, we had an accumulated deficit of approximately $350,000 and a working capital deficiency in the same approximate amount.

If we are not successful in completing this offering or obtaining other sources of funding through product sales or otherwise, we may not be able to fund our operations or support our capital needs and business strategy. Accordingly our ability to continue as a going concern is in question. We believe that the proceeds from this offering, together with our current cash and investment position, will be sufficient to fund our operations and capital expenditures at least through the next 12 months.

We are an early stage company that has a limited operating history.

We are an early stage company focused on commercializing, marketing and selling over-the-counter, or OTC, pharmaceutical products. We began our operations as a division of BioChemics, Inc. in January 2001. We have only operated as an entity independent of BioChemics since January 2003. Our operating history is therefore limited. The deFEET, Athlete's Relief and Osteon products are in the early stages of commercialization. Other of our product candidates are only in the early stages of development. With the exception of the introduction of deFEET to the marketplace by BioChemics while we were still a division of BioChemics, we have not yet commercialized, marketed or sold any products or recognized significant revenue from product sales. You should evaluate the likelihood of financial and operational success in light of the uncertainties and complexities present in an early-stage company, many of which are beyond our control, including:

- •

- our potential inability to distribute, sell and market our products; and

- •

- the significant investment to achieve our commercialization, marketing and sales objectives.

Our operations have been limited to organizing and staffing our company, acquiring our license, developing and testing our revenue distribution models and test marketing our products. These

7

operations provide a limited basis for you to assess our ability to commercialize our products and product candidates and the advisability of investing in us.

We depend on BioChemics to provide us with certain support and services. The loss of such support and services would have a material adverse effect on our business.

We were originally formed as a division of BioChemics and the viability and financial strength of BioChemics is critical to our success. Throughout our development, we have relied on services and financing provided to us by BioChemics. When we became an independent operating entity, we entered into a license agreement and, prior to the consummation of this offering, will enter into a manufacturing and development agreement, with BioChemics. We presently maintain our executive offices on premises that we share with BioChemics. We do not have a lease agreement with BioChemics. We believe that we can obtain suitable alternative space without any material disruption of our business and that such space will be available to us in the future on commercially reasonable terms. In addition, BioChemics provides us with back office support and management services. Allocations of BioChemics' expenses for centralized accounting, data processing, utilities, office space rental, supplies, telephone and other corporate services and infrastructure are charged back to us as a management fee. These amounts approximated $135,600 and $114,150 for the years ended December 31, 2002 and 2001 respectively, and approximated $99,000 for the nine months ended September 30, 2003. The loss of the services provided by BioChemics or the loss of the license of the VALE transdermal delivery technology under the license agreement would have a material adverse effect on our business, financial condition and results of operations.

In this regard, potential investors should be aware that BioChemics has never been profitable and most likely will not achieve profitability in the near future, if ever. Although BioChemics was founded in 1989, and incorporated in 1991, it is still a development stage company. It has generated significant losses through December 31, 2002, has limited revenue, and is likely to sustain operating losses in the foreseeable future. BioChemics' operations are subject to all of the risks inherent in the establishment of a business enterprise. Through December 31, 2002, BioChemics had an accumulated deficit of approximately $9.9 million. BioChemics anticipates that it will continue to incur net losses and be unprofitable for the foreseeable future. There can be no assurance that BioChemics will ever operate at a profit even if its or our products are commercialized.

In addition, it is expected that BioChemics will encounter significant marketing difficulties and will also face significant regulatory hurdles. The likelihood of success of BioChemics must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with any non-profitable business enterprise, including but not limited to the identification and development of new products, difficulties with corporate partners, vendors, and a very competitive environment. Additionally, BioChemics itself requires additional capital and/or revenues to continue its operations and there is no guarantee that it will be able to fund its own operations or those of Vaso Active.

We depend on a small number of customers for the majority of our gross revenue. The loss any one of these customers, or a substantial reduction of the product purchased and sold by them, would have a material adverse affect on our business.

Since our inception, substantially all of our gross revenue has been generated as a result of sales to a small number of customers, the largest being the Walgreens drug store chain. Sales to Walgreens accounted for approximately 66% of our 2002 gross revenues. Walgreens and Eckerd drug stores accounted for approximately 98% of 2001 gross revenues. Accounts receivable from these customers were $53,437 in 2002 and $0 in 2001. In the nine months ended September 30, 2003, Walgreens

8

accounted for approximately 96% of our net revenues. At September 30, 2003, we had no accounts receivable.

In accordance with our plan to rebrand the deFEET product as Termin8 and/or Xtinguish, BioChemics has begun to remove deFeet products from the Walgreens drug stores. Since we are in this transition period, there can be no assurance that Walgreens will continue as one of our customers. Although we plan to market our products to other customers, the loss of Walgreens as a customer could result in a substantial reduction in our gross revenue and have a materially adverse impact on our business and on our ability to continue to operate.

The development of additional products and product candidates will be subject to a number of risk factors and may not be successful.

The development of our product candidates by BioChemics is subject to the risks of failure inherent in the development of new pharmaceutical products and product candidates based on new technologies. These risks include:

- •

- delays in product development or manufacturing;

- •

- unplanned expenditures for product development or manufacturing;

- •

- failure of our product candidates to have the desired effect or an acceptable safety profile;

- •

- failure to receive required regulatory approvals;

- •

- emergence of superior or equivalent products;

- •

- inability to manufacture on our own, or through others, product candidates on a commercial scale;

- •

- inability to market products due to third-party proprietary rights; and

- •

- failure by our collaborative partners to successfully develop products.

Because of these risks, our research and development efforts or those of our collaborative partners may not result in any commercially viable products. If a significant portion of these development efforts is not successfully completed, required regulatory approvals are not obtained, or any approved products are not commercially successful, we are not likely to generate significant revenues or become profitable.

We depend on BioChemics and third parties to develop and manufacture our products and product candidates and our commercialization of our products could be stopped, delayed or made less profitable if BioChemics or those third parties fail to provide us with sufficient quantities at acceptable prices.

We currently have limited product development capability. As a result, we depend on collaborations with third parties, such as BioChemics, for development of our product candidates. In addition, we have no manufacturing capability. As a result, we will depend on BioChemics, which in turn will rely upon third parties to manufacture our products. Although our strategy is based on leveraging BioChemics' ability to develop and manufacture our products for commercialization in the OTC marketplace, we will be dependent on BioChemics' collaborations with drug development and manufacturing collaborators. If we and BioChemics are not able to maintain existing collaborative arrangements or establish new arrangements on commercially acceptable terms, we would be required to undertake product manufacturing and development activities at our own expense, which would increase our capital requirements or require us to limit the scope of our development activities. Moreover, we have limited or no experience in conducting full scale bioequivalence studies, preparing and submitting regulatory applications and manufacturing and marketing controlled release products. There can be no assurance that we will be successful in performing these activities and any failure to

9

perform such activities could have a material adverse effect on our business, financial condition and results of our operations.

If any of our developmental collaborators, especially BioChemics, breach or terminate their agreements with us or otherwise fail to conduct their collaborative activities in a timely manner, the preclinical and/or clinical development and/or commercialization of our product candidates will be delayed, and we would be required to devote additional resources to product development and commercialization or terminate certain development programs. Also, these relationships generally may be terminated at the discretion of our collaborators, in some cases with only limited notice to us. The termination of collaborative arrangements could have a material adverse effect on our business, financial condition and results of operations. There also can be no assurance that disputes will not arise with respect to the ownership of rights to any technology developed with third parties. These and other possible disagreements with collaborators could lead to delays in the development or commercialization of our product candidates or could result in litigation or arbitration, which could be time consuming and expensive and could have a material adverse effect on our business, financial condition and results of operations.

If we or BioChemics fail to adequately protect or enforce our intellectual property rights, we may be unable to operate effectively.

BioChemics owns proprietary technology developed in connection with its three U.S. patents. In addition, foreign patents have been issued to BioChemics in 17 foreign countries and are pending in seven others. BioChemics also owns fifteen registered trademarks, including Osteon and PENtoCORE. Our license agreement, as amended, with BioChemics permits us to commercialize, market and sell our products and product candidates using these patents and the Osteon and PENtoCORE trademarks. Our success and ability to compete are substantially dependent on the patents and trademarks. Although both we and BioChemics believe that the patents and associated trademarks and licenses are valid, there can be no assurance that they will not be challenged and subsequently invalidated and/or canceled. The invalidation or cancellation of any one or all of the patents or trademarks would significantly damage our commercial prospects. Further, BioChemics may find it necessary to legally challenge parties infringing its patents or trademarks or licensed trademarks to enforce its rights thereto. There can be no assurance that any of the patents would ultimately be held valid or that efforts to defend any of the patents, trade secrets, know-how or other intellectual property rights would be successful.

If we infringe on the intellectual property rights of others, our business and profitability may be adversely affected.

Our commercial success will also depend, in part, on us and BioChemics not infringing on the patents or proprietary rights of others. There can be no assurance that the technologies and products used or developed by BioChemics and marketed and sold by Vaso Active will not infringe such rights. If such infringement occurs and neither we nor BioChemics is able to obtain a license from the relevant third party, we will not be able to continue the development, manufacture, use, or sale of any such infringing technology or product. There can be no assurance that necessary licenses to third-party technology will be available at all, or on commercially reasonable terms. In some cases, litigation or other proceedings may be necessary to defend against or assert claims of infringement or to determine the scope and validity of the proprietary rights of third parties. Any potential litigation could result in substantial costs to, and diversion of, our resources and could have a material and adverse impact on us. An adverse outcome in any such litigation or proceeding could subject us and/or BioChemics to significant liabilities, require us to cease using the subject technology or require us and/or BioChemics to license the subject technology from the third party, all of which could have a material adverse effect on our business.

10

In addition, BioChemics is party to a settlement agreement and license with De Feet International, Inc. dated April 20, 2002, pursuant to which BioChemics licenses the trademark "deFEET" from De Feet International, Inc. Pursuant to the settlement agreement and license, BioChemics was granted a non-exclusive, non-transferable and non-assignable license to use the "deFEET" trademark throughout the United States in connection with the manufacturing, advertisement, promotion, distribution and sale of athlete's foot preparations. In the event that BioChemics breaches the terms of the settlement and licensing agreement with De Feet International, Inc., BioChemics could lose its right to use the "deFEET" trademark in connection with its athlete's foot preparation product and could be prevented from selling its athlete's foot preparation product until such product had been rebranded. In that event, we would not realize any revenue from Biochemics' sale of its athlete's foot preparation product which could have a material adverse affect on our business and results of operations.

If we lose the services of John J. Masiz or other key personnel, our business will suffer.

We are highly dependent on the principal members of our scientific and management staff, particularly John J. Masiz, our chief executive officer. Mr. Masiz is also the chief executive officer of BioChemics. Although Mr. Masiz intends to initially devote approximately 70% of his business time to our affairs, as BioChemics and our respective operations continue to grow, there can be no assurance that he will be able to continue to do so. Our chief scientific officer, Dr. Stephen Carter, will devote approximately 30% of his business time to our affairs. For us to pursue our product development, marketing and commercialization plans, we will need to hire personnel with experience in clinical testing, government regulation, manufacturing, marketing and finance. We may not be able to attract and retain personnel on acceptable terms given the intense competition for such personnel among high technology enterprises, including biotechnology, pharmaceutical and healthcare companies, universities and non-profit research institutions. If we lose any of these persons, or are unable to attract and retain qualified personnel, our business, financial condition and results of operations may be materially and adversely affected.

We operate in a competitive environment and there can be no assurances that competing technologies would not harm our business development.

We are engaged in a rapidly evolving field. Competition from numerous pharmaceutical companies including Pfizer, Bristol-Myers Squibb, Schering-Plough, and biotechnology companies including, Alza, Cygnus and Elan, as well as research and academic institutions, is intense and expected to increase. The market for transdermal drug delivery systems is large and growing rapidly and is likely to attract new entrants. Numerous biotechnology and biopharmaceutical companies have focused on developing new drug delivery systems and most, if not all of these companies, have greater financial and other resources and development capabilities than we do. They also have greater collective experience in undertaking pre-clinical and the clinical testing of products; obtaining regulatory approvals; and manufacturing and marketing OTC and pharmaceutical products. Accordingly, certain of our competitors may succeed in obtaining approval for products more rapidly than us. In addition to competing with universities and other research institutions in the development of products, technologies and processes, we may compete with other companies in acquiring rights to products or technologies from universities. There can be no assurance that our products, existing or to be developed, will be more effective or achieve greater market acceptance than competitive products, or that our competitors will not succeed in developing products and technologies that are more effective than those being developed by us or that would render our products and technologies less competitive or obsolete.

11

Technological advancement by our competitors could result in the obsolescence of some or all of our products and may harm business development.

The areas in which we are commercializing, distributing, and/or selling products involve rapidly developing technology. There can be no assurance that we will be able to establish ourselves in such fields, or, if established, that we will be able to maintain our position. There can be no assurance that the development by others of new or improved products will not make our products and product candidates, if any, superfluous or our products and product candidates obsolete.

Should product liability claims be brought successfully against us exceeding the product liability coverage we currently have in place there can be no assurances that such events would not materially impact our performance and viability.

The sale of our products may expose us to potential liability resulting from the sale and use of such products. Liability might result from claims made directly by consumers or by pharmaceutical companies or by others selling such items. We currently maintain $5.0 million of product liability insurance. There can be no assurance that we will be able to renew our current insurance, renew it at a rate comparable to what we now pay, or that the coverage will be adequate to protect us against liability. If we were held liable for a claim or claims exceeding the limits of our current or future insurance coverage, or if coverage was discontinued for any reason, it could have a materially adverse effect on our business and our financial condition.

Our limited sales and marketing experience may adversely impact our ability to successfully commercialize and sell our products.

We have limited sales and marketing experience, particularly with respect to marketing and selling products in commercial quantities. If we are unable to expand our sales and marketing capabilities we may not be able to effectively commercialize our products and product candidates.

Our principal stockholder is also the principal stockholder of BioChemics and will have substantial control over our affairs, possibly to the detriment of other holders of our Class A common stock.

Our principal stockholder, BioChemics, owns 1,500,000 shares of our Class B common stock, which will represent approximately 75% of our voting interests after giving effect to this offering. Mr. Masiz, as President, Chief Executive Officer and Chairman of both us and BioChemics and, as the principal stockholder in BioChemics, will be able to control the outcome of stockholder votes, including votes concerning the election of our directors, the adoption or amendment to provisions in our certificate of incorporation or by-laws, the approval of mergers and/or acquisitions, decisions affecting our capital structure and other significant corporate transactions. This concentration of ownership may delay, deter or prevent transactions that would result in a change of control, which in turn could reduce the value of our common stock.

In the event of a conflict of interest between BioChemics and us, our stockholders could be negatively affected.

There are likely to be situations where our best interests and those of BioChemics will conflict. To the extent that decisions are made that will enhance the value to Biochemics versus the value to us, our stockholders could be negatively affected. Buyers of our Class A common stock should be aware of these potential conflicts.

12

Risks Associated with this Offering

Our stock price could be volatile, and your investment could suffer a decline in value.

The trading price of our stock is likely to be highly volatile and could be subject to wide fluctuations in price in response to various factors, many of which are beyond our control, including:

- •

- changes in, or failure to achieve, financial estimates by ourselves and others such as investors and securities analysts;

- •

- new products or services introduced or announced by us or our competitors;

- •

- announcements of technological innovations by us or our competitors;

- •

- actual or anticipated variations in quarterly operating results;

- •

- conditions or trends in the biotechnology and pharmaceutical industries;

- •

- announcements by us of significant acquisitions, strategic partnerships, joint ventures or capital commitments;

- •

- additions or departures of key personnel; and

- •

- sales of our common stock.

In addition, the stock market in general, and the Nasdaq Small Cap Market in particular, has experienced significant price and volume fluctuations. Volatility in the market price for particular companies has often been unrelated or disproportionate to the operating performance of those companies. Further, there has been particular volatility in the market prices of securities of biotechnology and pharmaceutical companies. These broad market and industry factors may seriously affect the market price of our Class A common stock, regardless of our operating performance.

There may not be an active, liquid trading market for our Class A common stock.

Prior to this offering, there has been no public market for our Class A common stock. An active trading market for our Class A common stock may not develop or be sustained following this offering. You may not be able to sell your shares quickly or at the market price if trading in our stock is not active. The initial public offering price will be determined by negotiations between us and representatives of the underwriters based upon a number of factors. The initial public offering price may not be indicative of prices that will prevail in the trading market.

Future sales of our Class A common stock may depress our stock price.

The market price of our Class A common stock could decline as a result of sales of substantial amounts of our common stock in the public market, or the perception that these sales could occur. In addition, these factors could make it more difficult for us to raise funds through future offerings of common stock. There will be an aggregate of 1,500,000 shares of Class B common stock outstanding before the consummation of this offering, each share convertible into one share of Class A common stock, and 1,514,000 shares of Class A common stock outstanding immediately after this offering, after giving effect to conversion of our 10% convertible pay-in-kind promissory notes upon the consummation of this offering, and an aggregate of 1,709,000 shares of Class A common stock outstanding if the underwriters exercise their over-allotment option in full. All of the shares of Class A common stock sold in the offering will be freely transferable without restriction or further registration under the Securities Act, except for any shares purchased by our "affiliates," as defined in Rule 144 of the Securities Act. The remaining shares of our Class A common stock outstanding will be "restricted securities" as defined in Rule 144. These shares may be sold in the future without registration under the Securities Act to the extent permitted by Rule 144 or other exemptions under the Securities Act.

13

You will experience immediate and substantial dilution.

The initial public offering price of our Class A common stock is expected to be substantially higher than the pro forma net tangible book value per share of our common stock. Therefore, if you purchase shares of our Class A common stock in this offering, you will incur immediate dilution of approximately $3.27 in the pro forma net tangible book value per share of common stock from the price per share that you pay for the Class A common stock. Accordingly, if you purchase Class A common stock in this offering, you will incur immediate and substantial dilution of your investment.

We do not intend to pay cash dividends on our common stock.

We intend to retain any future earnings to finance the growth and development of our business and we do not plan to pay cash dividends on our common stock in the foreseeable future.

14

STATEMENTS CONCERNING FUTURE PERFORMANCE

This prospectus contains forward-looking statements. The forward-looking statements are principally contained in the sections entitled "Prospectus Summary," "Business" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to differ, perhaps materially, from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

- •

- our marketing, sales and commercialization activities and projected expenditures;

- •

- our manufacturing and development partnerships with BioChemics and third parties and our ability to maintain and increase those and other strategic partnerships;

- •

- the use of the proceeds of this offering;

- •

- our capital requirements;

- •

- implementation of our corporate strategy; and

- •

- our financial forecast and performance.

In some cases, you can identify forward-looking statements by terms such as "may," "should," "expect," "plan," "anticipate," believe," "estimate," "project," "predict," "intend," "potential," and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We discuss many of these risks in greater detail under the heading "Risk Factors." Also, these forward-looking statements represent our estimates and assumptions only as of the date of this prospectus.

You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is part, completely and with the understanding that our actual future results may be materially different from what we expect. We may not update these forward-looking statements, even though our situation may change in the future, unless we have obligations under the federal securities laws to update and disclose material developments related to previously disclosed information. We qualify all of our forward-looking statements by these cautionary statements.

15

USE OF PROCEEDS

We estimate that the net proceeds from the sale of the shares of Class A common stock we are offering will be approximately $5.08 million, or approximately $5.96 million if the underwriter's over-allotment option is exercised in full, assuming an initial public offering price of $5.00 per share and after deducting the estimated underwriting discounts and commissions and estimated offering expenses. Based on an initial public offering price of $5.00 per share, the gross proceeds from the sale of Class A common stock we are offering will be $6.5 million. If the underwriter's over-allotment option is exercised in full, the gross proceeds from the offering will be $7.5 million. Underwriting discounts and commissions will be $650,000, or $747,500 if the underwriter's over-allotment option is exercised in full. We estimate the offering expenses to be approximately $770,000.

We anticipate using the net proceeds from the sale of our Class A common stock offered hereby as follows:

- •

- to fund our continued development, commercialization and sale of our products and product candidates, which we estimate will require approximately $1.1 million (21.7% of net proceeds);

- •

- to implement our strategic marketing and commercialization plan, which we estimate will require approximately $1.5 million (29.5% of net proceeds), of which approximately $1.2 million is allocated to fund our radio advertising campaign;

- •

- to recruit and hire individuals for key senior management positions, which we estimate will require approximately $200,000 (3.9% of net proceeds);

- •

- to cover the cost of providing sales incentives, products samples and discounts, which we estimate will require approximately $350,000 (6.9% of net proceeds);

- •

- to repay, without interest, BioChemics approximately $99,000 (1.9% of net proceeds) for management fees charged back to us since we became a stand-alone entity upon our incorporation for centralized accounting, data processing, utilities, office space rental, supplies, telephone and other BioChemics corporate services and infrastructure costs, and approximately $347,000 (6.8% of net proceeds) for other operational charges paid by BioChemics to third parties on our behalf since that time; and

- •

- to provide working capital and for general corporate purposes, which we estimate will require approximately $1.46 million (28.7% of net proceeds).

We anticipate, based on our current plans and assumptions relating to our operations, that the net proceeds of this offering, together with net cash from operations, should be sufficient to satisfy our cash requirements for at least twelve months after the date of this prospectus.

Although we have no current plans, agreements or commitments with respect to any acquisition, we may, if the opportunity arises, use an unspecified portion of the net proceeds to acquire or invest in products, technologies or companies.

Until we use the net proceeds of this offering for the above purposes, we intend to invest the funds in short-term, investment grade, interest-bearing securities. We cannot predict whether the proceeds invested will yield a favorable return.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our capital stock. We anticipate that we will retain any earnings to support operations and to finance the growth and development of our business. Therefore, we do not expect to pay cash dividends in the foreseeable future. Any future determination relating to our dividend policy will be made at the discretion of our board and will depend on a number of factors, including future earnings, capital requirements, financial conditions and future prospects and other factors the board may deem relevant.

16

CAPITALIZATION

The following table sets forth our capitalization as of September 30, 2003:

- •

- on an actual basis;

- •

- on a pro forma basis to give effect to the automatic conversion of $500,000 principal amount of our 10% pay-in-kind promissory notes, including accrued pay-in-kind interest, into 214,000 shares of our Class A common stock upon the consummation of this offering; and

- •

- on a pro forma as adjusted basis to give effect to the issuance and the sale of 1,300,000 shares of Class A common stock offered by this prospectus at an assumed initial public offering price of $5.00 per share, after deducting the underwriting discounts and commissions and estimated offering expenses, and our receipt of the net proceeds from that sale.

| | September 30, 2003 (Unaudited)

| |

|---|

| | Actual

| | Pro Forma

| | Pro Forma

As Adjusted

| |

|---|

| Total current liabilities | | $ | 1,170,755 | | $ | 642,672 | | $ | — | |

Stockholders' equity (deficit): |

|

|

|

|

|

|

|

|

|

|

| Undesignated preferred stock—$.0001 par value; authorized 10,000,000 shares; issued and outstanding, none | | | — | | | — | | | — | |

Class A common stock—$.0001 par value; authorized 10,000,000 shares; no shares issued; 214,000 shares issued and outstanding pro forma; 1,514,000 shares issued and outstanding, pro forma as adjusted |

|

|

— |

|

|

21 |

|

|

151 |

|

Class B common stock—$.0001 par value; authorized 5,000,000 shares; 1,500,000 issued and outstanding; 1,500,000 shares issued and outstanding pro forma; 1,500,000 shares issued and outstanding, pro forma as adjusted |

|

|

150 |

|

|

150 |

|

|

150 |

|

Additional paid-in capital |

|

|

— |

|

|

1,035,778 |

|

|

6,118,742 |

|

Accumulated deficit |

|

|

(349,951 |

) |

|

(891,617 |

) |

|

(891,617 |

) |

Total stockholders' equity (deficit) |

|

|

(349,801 |

) |

|

144,332 |

|

|

5,227,426 |

|

| | |

| |

| |

| |

Total capitalization |

|

$ |

820,954 |

|

$ |

787,004 |

|

$ |

5,227,426 |

|

| | |

| |

| |

| |

17

DILUTION

Our pro forma net tangible book value as of September 30, 2003 was $144,332 or $0.08 per share, based on the pro forma number of shares of common stock outstanding of 1,714,000 as of September 30, 2003, calculated after giving effect to the automatic conversion of $500,000 principal amount and accrued pay-in-kind interest of our 10% pay-in-kind promissory notes into an aggregate of 214,000 shares of our Class A common stock upon the consummation of this offering.

Dilution in pro forma net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of our common stock in this offering and the pro forma net tangible book value per share of our common stock immediately afterwards, after giving effect to the sale of 1,300,000 shares in this offering at an assumed initial offering price of $5.00 per share and after deducting underwriting discounts and commissions and offering expenses. This represents an immediate increase in pro forma net tangible book value of $1.65 per share to existing stockholders and an immediate dilution in pro forma net tangible book value of $3.27 per share to new investors.

The following table illustrates this per share dilution:

| Initial public offering price per share | | | | | $ | 5.00 |

| Pro forma net tangible book value per share as of September 30, 2003 | | $ | 0.08 | | | |

| Increase per share attributable to new investors | | $ | 1.65 | | | |

| Pro forma as adjusted net tangible book value per share after this offering | | | | | $ | 1.73 |

| Dilution per share to new investors | | | | | $ | 3.27 |

In percentage terms, the dilution per share to new investors will be approximately 65% of the initial public offering price of $5.00.

The following table summarizes, on a pro forma basis as of September 30, 2003, after giving effect to this offering, the total number of shares of Class A common stock purchased from us and the total consideration and the average price per share paid by existing stockholders and by new investors:

| | Shares Issued(1)

| | Total Consideration

| |

|

|---|

| | Average Price

Per Share

|

|---|

| | Number

| | Percent

| | Amount

| | Percent

|

|---|

| Existing Stockholders(2) | | 1,714,000 | | 57 | % | $ | 533,000 | | 8 | % | $ | 0.31 |

| New Investors | | 1,300,000 | | 43 | % | | 6,500,000 | | 92 | % | | 5.00 |

| | |

| |

| |

| |

| |

|

| Total | | 3,014,000 | | 100 | % | $ | 7,033,000 | | 100 | % | | |

- (1)

- The Class A common stock is entitled to one vote per share, while the Class B common stock is entitled to three votes per share, with the Class A and Class B common stock voting together as a class on substantially all matters including the appointment of directors. After giving effect to the sale of the Class A common stock offered hereby, the outstanding shares of the Class A common stock held by new investors will represent approximately 21.6% of the total combined voting power of both classes of common stock outstanding, while the outstanding shares of Class A common stock and Class B common stock held by existing stockholders will represent approximately 3.6% and 74.8%, respectively, or 78.4% taken together, of the total combined voting power of both classes of common stock outstanding.

- (2)

- Includes 1,500,000 shares of Class B common stock issued and outstanding as of September 30, 2003 and which are convertible on a share-for-share basis into shares of Class A common stock, and 214,000 shares of Class A common stock to be issued upon conversion of our 10% pay-in-kind promissory notes upon the consummation of this offering.

18

SELECTED FINANCIAL DATA

You should read the following selected financial data in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the financial statements and related notes included elsewhere in this prospectus. The selected balance sheet data set forth below, as of December 31, 2001 and 2002 and the selected statements of operations data for the years ended December 31, 2001 and 2002 are derived from our financial statements, which are included elsewhere in this prospectus and which have been audited by Stowe & Degon, independent certified public accountants. The selected financial data presented below as of and for the nine months ended September 30, 2002 and September 30, 2003 have been derived from our unaudited financial statements, which in the opinion of management include all adjustments necessary for a fair presentation of the data for interim periods. The results of operations for the nine months ended September 30, 2003 are not necessarily indicative of the results that may be expected for the full fiscal year.

Statement of Operations Data:

| | Years Ended December 31,

| | Nine Months Ended

September 30,

| |

|---|

| | 2001

| | 2002

| | 2002

| | 2003

| |

|---|

| |

| |

| | (Unaudited)

| |

|---|

| Revenues | | $ | 100,209 | | $ | 91,957 | | $ | 76,499 | | $ | 51,876 | |

| Cost of Sales | | | 40,791 | | | 40,811 | | | 32,779 | | | 31,279 | |

| | |

| |

| |

| |

| |

| Gross profit | | | 59,418 | | | 51,146 | | | 43,720 | | | 20,597 | |

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Marketing, advertising and promotion | | | 556,614 | | | 38,962 | | | 11,565 | | | 87,125 | |

| | Selling, general and administrative | | | 545,748 | | | 464,832 | | | 340,526 | | | 296,538 | |

| | |

| |

| |

| |

| |

| Total operating expenses | | | 1,102,362 | | | 503,794 | | | 352,091 | | | 383,663 | |

| | |

| |

| |

| |

| |

| Loss from operations | | | (1,042,944 | ) | | (452,648 | ) | | (308,371 | ) | | (363,066 | ) |

| | |

| |

| |

| |

| |

| Other (income) expenses | | | (2,549 | ) | | (5,786 | ) | | (6,621 | ) | | (13,115 | ) |

| | |

| |

| |

| |

| |

| Net loss | | $ | (1,040,395 | ) | $ | (446,862 | ) | $ | (301,750 | ) | $ | (349,951 | ) |

| | |

| |

| |

| |

| |

| Basic and diluted loss per share | | $ | — | | $ | — | | $ | — | | $ | (0.64 | ) |

| | |

| |

| |

| |

| |

| Shares used in computing basic and diluted loss per share amounts | | | — | | | — | | | — | | | 549,451 | |

| |

Balance Sheet Data:

| | As of December 31,

| | As of September 30,

| |

|---|

| | 2001

| | 2002

| | 2003

| |

|---|

| |

| |

| | (Unaudited)

| |

|---|

| Cash and cash equivalents | | $ | — | | $ | — | | $ | 158,576 | |

| Working capital | | | — | | | — | | | (349,801 | ) |

| Total assets | | | 25,983 | | | 72,243 | | | 820,954 | |

| Accumulated (deficit) | | | (1,040,395 | ) | | (1,487,257 | ) | | (349,951 | ) |

19

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion in conjunction with our financial statements, the related notes and other financial information appearing elsewhere in this prospectus. This discussion may contain forward-looking statements based upon current beliefs of management and expectations that involve risks and uncertainties. Our actual results, performance or achievements and the timing of selected events could differ materially from those anticipated in these forward-looking statements as a result of many factors, including those set forth under "Risk Factors" and elsewhere in this prospectus.

Overview

We are an early-stage company focused on commercializing, marketing and selling over-the-counter, or OTC, pharmaceutical products. We began our operations as a division of BioChemics in January 2001. In January 2003, we were formed as an independent subsidiary of BioChemics to further commercialize our OTC products and further develop our OTC product candidates, although BioChemics continues to provide us with administrative support services, manufacturing and development services and technology licenses. By becoming a subsidiary of BioChemics, as opposed to continuing as a BioChemics division, we have facilitated our ability to obtain independent financing for our operations and reduced our exposure to the potential liabilities inherent in the development and manufacturing of pharmaceutical products.

Our parent, BioChemics, is a biopharmaceutical company focused on the development of transdermal drug delivery systems and is based in Danvers, Massachusetts. BioChemics was founded by John J. Masiz in 1989 and incorporated in Delaware in 1991. BioChemics is controlled by Mr. Masiz, its President and Chief Executive Officer. Biochemics began developing the VALE technology in 1989. BioChemics has subsequently been issued three patents on this technology by the U.S. Patent Office. In addition, foreign patents have been issued to BioChemics in 17 foreign countries and are pending in 7 others. Prior to being established as a subsidiary of BioChemics, we operated as a division of BioChemics, responsible for the commercialization, distribution, marketing and sales of BioChemics' OTC products. BioChemics also manufactures and develops prescription drugs through its Xevex Pharmaceuticals division as well as veterinary drugs through its MediVet Pharmaceuticals division.

Although BioChemics was founded in 1989, and incorporated in 1991, it is still a development stage company. BioChemics has never been profitable. Through December 31, 2002, BioChemics had an accumulated deficit of approximately $9.9 million. BioChemics anticipates that it will continue to incur net losses and be unprofitable for the foreseeable future.

Upon our formation, we agreed to issue to BioChemics 1,500,000 shares of our Class B common stock in return for the exclusive worldwide rights to the vaso active lipid encapsulation, or VALE, technology as it relates to the OTC marketplace as well as to the existing BioChemics portfolio of OTC products. Our board of directors authorized issuance of these shares on June 20, 2003. For accounting purposes, the value of the issued shares of our Class B common stock and the related rights to the license agreement were calculated in accordance with Staff Accounting Bulletin No. 48, "Transfers of Nonmonetary Assets by Promoters or Shareholders," and, as a result, were reported using BioChemics' historical cost basis which is zero.

We have incurred net losses since our inception and have generated limited net revenue from product sales. We incurred net losses of approximately $1.04 million in 2001, $447,000 in 2002 and $350,000 in the nine months ended September 30, 2003. Since we commenced operations, we have incurred an accumulated net loss attributable to our Class A common stockholders of approximately $1.84 million through September 30, 2003. During 2001 and 2002, BioChemics made contributions to our capital to cover our deficits. These contributions totaled approximately $1.04 million in 2001 and $447,000 in 2002. Historically, BioChemics has also provided us with office space, industry expertise,

20

financial support and certain administrative assistance. Pursuant to an administrative services agreement effective September 1, 2003, BioChemics will continue to provide us, at our request, with administrative support services such as secretarial support, accounting and tax services, data processing services, utilities, designated office, warehouse and storage space, office supplies, telephone and computer services, for which BioChemics will charge us an administrative services fee at a rate of cost plus 10%. In addition, as we continue to grow our operations as a stand-alone entity and segregate our operations from those of BioChemics, we anticipate that our operating expenses will increase. For example, compensation expenses for senior personnel and other employees, marketing, advertising and promotional expenses relating to the commercialization, marketing and distribution of our products, expenses, including royalty payments related to deFEET and legal and accounting expenses will increase our over-all expenses as we operate as a stand-alone entity. We expect that our operating expenses will begin to increase as we begin to implement our roll out strategy following consummation of, and the availability of the net proceeds from, this offering. We expect that we will not begin to offset these increasing costs until we realize increasing revenues from the commercialization of our products. We expect this to occur during the second and third quarters of 2004.

Our financial statements up to and including the year ended December 31, 2002, are based on operations of the OTC pharmaceutical division of BioChemics, our predecessor. The financial statements have been prepared using BioChemics' historical book value in the assets and liabilities and historical results of operation of this division. BioChemics' net investment in us is reflected as additional paid-in capital. Transactions were processed through an inter-company account whose balance represents the net obligation from BioChemics to us. Additionally, these financial statements are included in BioChemics's consolidated financial statements using the consolidated method.

The results of operations of this division include allocations of certain BioChemics expenses, such as centralized accounting, data processing, utilities, office space rental, supplies, telephone and other BioChemics corporate services and infrastructure costs. These expenses have been charged back to us as a management fee. These amounts approximated $135,600 and $114,150 for the years ended December 31, 2002 and 2001 respectively. For the nine months ended September 30, 2003, we incurred management fees of approximately $99,000 and other operational charges of approximately $347,000 that had been paid by BioChemics to third parties on our behalf. We will repay these amounts from the net proceeds of this offering. The expense allocations have been determined on the basis that we and BioChemics consider to be reasonable reflections of the utilization of services provided for the benefit received by us. The financial information included herein may not reflect our financial position, operating results, changes in stockholder's deficiency and cash flows in the future or what they would have been had we been a separate stand-alone entity during the periods presented. However, we believe that these results would not be significantly different.

Critical Accounting Policies

Going Concern Assumption. Our financial statements do not include any adjustments relating to the recoverability and classification of assets or the amounts and classification liabilities that might be necessary should we be unable to continue as a going concern. If the financial statements were prepared on a liquidation basis, the carrying value of our assets and liabilities would be adjusted to net realizable amounts. In addition, the classification of the assets and liabilities would be adjusted to reflect the liquidation basis of accounting.

Revenue Recognition. The Company recognizes revenue from product sales in accordance with generally accepted accounting principles in the United States, including the guidance in Staff Accounting Bulletin 101. Revenue from product sales is recognized when there is persuasive evidence of an arrangement, delivery has occurred, the price is fixed and determinable, and collectibility is reasonably assured. However, because our products are sold with limited rights of return, our recognition of revenue from product sales is also subject to Statement of Financial Accounting

21

Standards No. 48 (SFAS 48) "Revenue Recognition When Right of Return Exists." Under SFAS 48, revenue is recognized when the price to the buyer is fixed, the buyer is obligated to pay us and the obligation to pay is not contingent on resale of the product, the buyer has economic substance apart from the us, we have no obligation to bring about the sale of the product and the amount of returns can be reasonably estimated.

The Company records allowances for product returns, rebates and discounts, and reports revenue net of such allowances. We must make judgments and estimates in preparing the allowances that could require adjustments in the future. For instance, our customers have the right to return any product that is held past the labeled expiration date. We base our estimates on historic patterns of returns and on the expiration dates of product currently being shipped, or as a result of an actual event that may give rise to a significant return amount such as the discontinuance of a product.

We do not recognize revenue unless collectibility is reasonably assured. We maintain allowances for doubtful accounts for estimated losses resulting from the inability of our customers to make required payments. If the financial condition of our customers were to deteriorate and result in an impairment of their ability to make payments, additional allowances may be required.

Expense Allocations. BioChemics provides us certain administrative, marketing and management services, as well as our facilities and general corporate infrastructure. Our statement of operations includes allocations of these costs that we and BioChemics considered to be reasonable.

Deferred Income Taxes. Prior to 2003, we were a division of BioChemics and were not subject to federal or state income tax reporting requirements. Effective 2003, we will begin preparing our income taxes on a stand-alone basis. We account for income taxes and deferred tax assets and liabilities in accordance with Statement of Financial Accounting Standards (SFAS) No. 109, "Accounting for Income Taxes." Because we project future operating losses in the near term, we will provide a full valuation allowance against the deferred tax assets created by these losses.

Stock-based Compensation. As part of our compensation programs offered to our employees, we grant stock options. We grant stock options to employees based on their value at the grant date. We account for stock-based compensation in accordance with SFAS No. 123, "Accounting for Stock-Based Compensation."

Operating Plan

Net Revenues. During the year ended December 31, 2002, we were engaged in ongoing negotiations with a large pharmaceutical company regarding a proposed private label strategic alliance that would have permitted that company to distribute and market our pain relief products under its private label. A private label strategic alliance is a licensing arrangement in which a third party is given all the rights to package, market and distribute a company's products under the third party's own name label in return for a distributor's fee or royalty fee payable to the licensing company on a per unit basis. As part of our negotiations with the large pharmaceutical company, that company advised that it would be seeking exclusive rights with respect to distribution and marketing. No formal agreement was executed, but we reduced our efforts to market, distribute or replenish our retail supply of our pain relief products during the negotiation period so as to prevent the excessive cost of recalling these products in the event that the exclusivity rights that this company was seeking were granted. Near the end of the year ended December 31, 2002, we determined that we did not wish to grant exclusivity rights to this company with respect to our pain relief products and the negotiations ended.

Effective January 2003, we began the commercialization of two of these pain relief products, Osteon and Athlete's Relief. In addition, BioChemics continued to directly commercialize, market and distribute deFEET. BioChemics assigned its revenues from deFEET to us pursuant to an amendment to our license agreement with BioChemics. Under this amendment, we agreed to be responsible for all

22

expenses related to these revenues, including the royalty payments payable by BioChemics to De Feet International, Inc.