|

Exhibit 99.2

|

Acquisition of Gentium

Adds Defitelio, an EMA-approved orphan drug

Overview Presentation

December 19, 2013

Forward-Looking Statements

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995

This presentation contains forward-looking statements, including, but not limited to, statements related to the anticipated consummation of the tender offer for Gentium S.p.A. ordinary shares and American Depositary Shares and the timing and benefits thereof, Jazz Pharmaceuticals’ expected financing for the transaction, the plan to launch Defitelio™ and the timing thereof, the potential to develop Defitelio for approval in other conditions, future commercial opportunities, future financial results, anticipated pipeline opportunities and future regulatory matters as well as other statements that are not historical facts. These forward-looking statements are based on the company’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to Jazz Pharmaceuticals’ ability to complete the acquisition on the proposed terms and schedule, including risks and uncertainties related to the satisfaction of closing conditions and the availability and terms of the financing for the transaction; risks associated with business combination transactions, such as the risk that the acquired business will not be integrated successfully or that such integration may be more difficult, time-consuming or costly than expected; risks related to future opportunities and plans for the combined company, including uncertainty of the expected financial performance and results of the combined company following completion of the proposed acquisition; disruption from the proposed acquisition, making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; the calculations of, and factors that may impact the calculations of, the acquisition price in connection with the proposed transaction and the allocation of such acquisition price to the net assets acquired in accordance with applicable accounting rules and methodologies; and the possibility that if Jazz Pharmaceuticals does not achieve the perceived benefits of the proposed acquisition of Gentium as rapidly or to the extent anticipated by financial analysts or investors, the market price of Jazz Pharmaceuticals’ ordinary shares could decline; as well as other risks related the company’s business, including risks and uncertainties associated with maintaining and increasing sales of and revenue from Xyrem®; effectively commercializing the company’s other marketed products, including Erwinaze® and Prialt®; protecting and expanding the company’s intellectual property rights; obtaining appropriate pricing and reimbursement for the company’s products in an increasingly challenging environment; ongoing regulation and oversight by U.S. and non-U.S. regulatory agencies; dependence on key customers and sole source suppliers, the difficulty and uncertainty of pharmaceutical product development; and those other risks detailed under the caption “Risk Factors” and elsewhere in Jazz Pharmaceuticals plc’s U.S. Securities and Exchange Commission (“SEC”) filings and reports, including in the Quarterly Report on Form 10-Q for the quarter ended September 30, 2013 filed with the SEC and future filings and reports by the company. Jazz Pharmaceuticals undertakes no duty or obligation to update any forward-looking statements contained in this presentation as a result of new information, future events or changes in its expectations.

2

Strategic Rationale

Executing on Growth Strategy

January 2012

Merger with

Azur Pharma

June 2005

Acquired

Orphan Medical February 2013

Agreement with Concert

Pharmaceuticals

JZP-386

March 2003 February 2007 June 2012 Expect to close 1Q14

Jazz Licensed from Acquired Acquisition of Gentium

Pharmaceuticals Solvay Pharmaceuticals EUSA Pharma

Founded Defitelio™

4

New Addition to our Commercial Portfolio

HEMATOLOGY/

SLEEP PAIN PSYCHIATRY

ONCOLOGY

Defitelio™

(defibrotide)

5

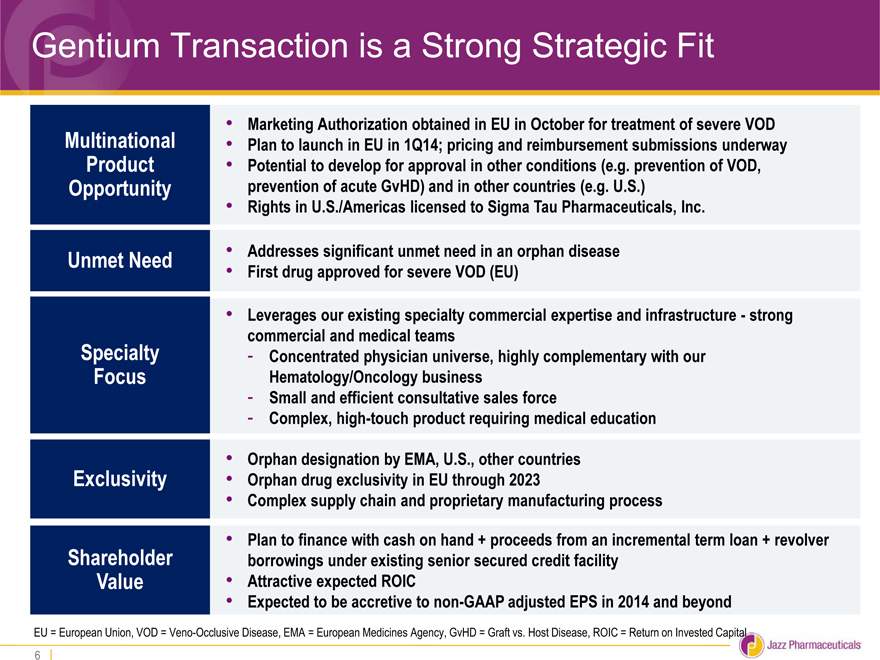

Gentium Transaction is a Strong Strategic Fit

• Marketing Authorization obtained in EU in October for treatment of severe VOD

Multinational • Plan to launch in EU in 1Q14; pricing and reimbursement submissions underway

Product • Potential to develop for approval in other conditions (e.g. prevention of VOD,

Opportunity prevention of acute GvHD) and in other countries (e.g. U.S.)

• Rights in U.S./Americas licensed to Sigma Tau Pharmaceuticals, Inc.

Unmet Need • Addresses significant unmet need in an orphan disease

• First drug approved for severe VOD (EU)

• Leverages our existing specialty commercial expertise and infrastructure—strong

commercial and medical teams

Specialty—Concentrated physician universe, highly complementary with our

Focus Hematology/Oncology business

—Small and efficient consultative sales force

—Complex, high-touch product requiring medical education

• Orphan designation by EMA, U.S., other countries

Exclusivity • Orphan drug exclusivity in EU through 2023

• Complex supply chain and proprietary manufacturing process

• Plan to finance with cash on hand + proceeds from an incremental term loan + revolver

Shareholder borrowings under existing senior secured credit facility

Value • Attractive expected ROIC

• Expected to be accretive to non-GAAP adjusted EPS in 2014 and beyond

EU = European Union, VOD = Veno-Occlusive Disease, EMA = European Medicines Agency, GvHD = Graft vs. Host Disease, ROIC = Return on Invested Capital

6

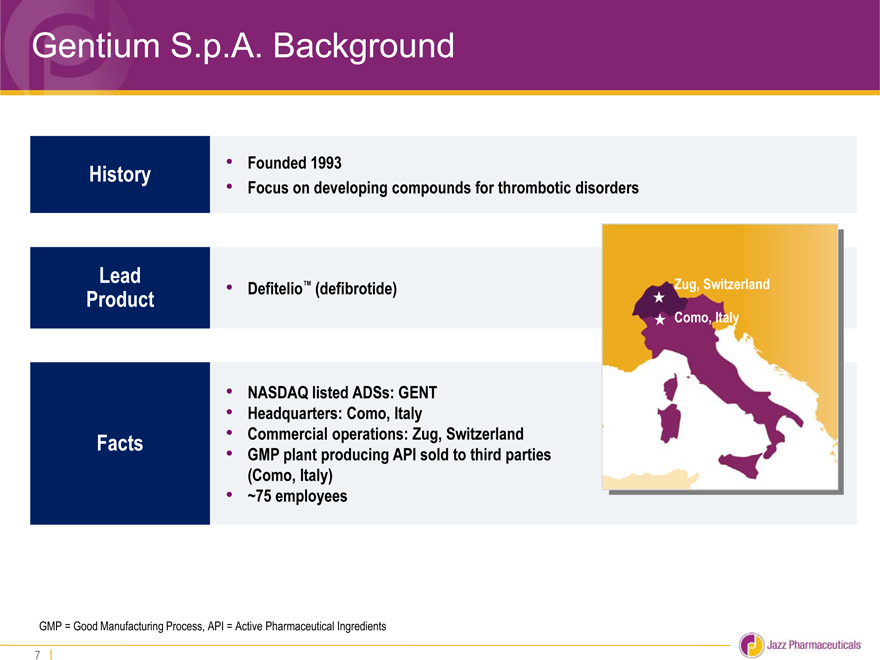

Gentium S.p.A. Background

History • Founded 1993

• Focus on developing compounds for thrombotic disorders

Lead

Product • Defitelio™ (defibrotide) Zug, Switzerland

Como, Italy

• NASDAQ listed ADSs: GENT

• Headquarters: Como, Italy

Facts • Commercial operations: Zug, Switzerland

• GMP plant producing API sold to third parties

(Como, Italy)

• ~75 employees

GMP = Good Manufacturing Process, API = Active Pharmaceutical Ingredients

7

Clinical Overview

About Veno-Occlusive Disease (VOD)

A life-threatening orphan disease and unmet medical need

A life-threatening complication of hematopoietic stem cell transplants

- Thought to begin with injury to hepatic venous endothelium that can be

caused by chemotherapy or radiation such as what is administered during

conditioning therapy prior to hematopoietic stem cell transplantation

- Endothelial damage can lead to vascular occlusion, hepatocellular necrosis,

fibrosis, and ultimately lead to liver failure

- Severe VOD is associated with multiple-organ failure and high rates of

morbidity and mortality

100-day mortality > 80%1

Studies have reported a wide range of incidence rates. On average, the incidence of

VOD is approximately 14% for patients undergoing hematopoietic stem cell

transplants1

Already widely used on a named-patient basis and recommended in EU level and

national treatment guidelines

There are no approved treatments for VOD in the U.S.—defibrotide is only available

to patients via a Treatment IND

1 Coppell JA, et al. Biol Blood Marrow Transplant. 2010;16(2):157-68.

9

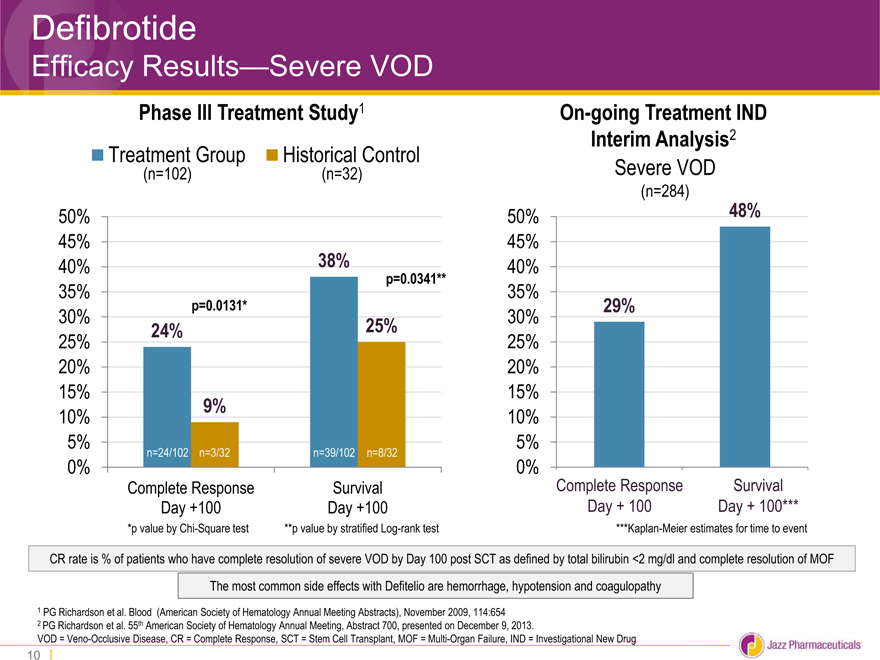

Defibrotide

Efficacy Results—Severe VOD

Phase III Treatment Study1

Treatment Group Historical Control

(n=102)(n=32)

50%

45%

40% 38%

p=0.0341**

35%

p=0.0131*

30% 24% 25%

25%

20%

15%

10% 9%

5% n=24/102 n=3/32 n=39/102 n=8/32

0%

Complete Response Survival

Day +100 Day +100

*p value by Chi-Square test **p value by stratified Log-rank test

On-going Treatment IND

Interim Analysis2

Severe VOD

(n=284)

50% 48%

45%

40%

35%

30% 29%

25%

20%

15%

10%

5%

0%

Complete Response Survival

Day + 100 Day + 100***

***Kaplan-Meier estimates for time to event

CR rate is % of patients who have complete resolution of severe VOD by Day 100 post SCT as defined by total bilirubin <2 mg/dl and complete resolution of MOF The most common side effects with Defitelio are hemorrhage, hypotension and coagulopathy

1 PG Richardson et al. Blood (American Society of Hematology Annual Meeting Abstracts), November 2009, 114:654

2 PG Richardson et al. 55th American Society of Hematology Annual Meeting, Abstract 700, presented on December 9, 2013.

VOD = Veno-Occlusive Disease, CR = Complete Response, SCT = Stem Cell Transplant, MOF = Multi-Organ Failure, IND = Investigational New Drug

10

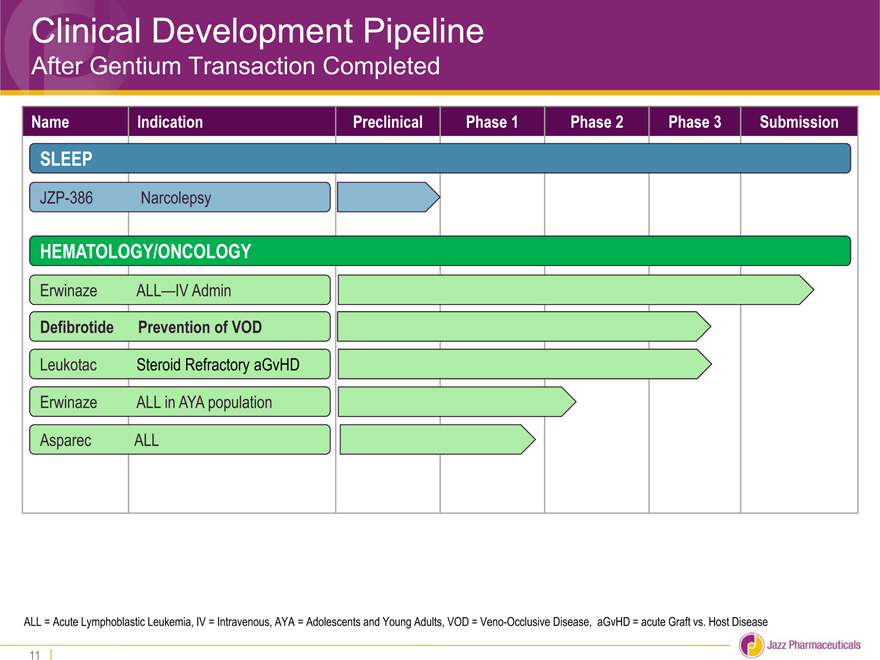

Clinical Development Pipeline

After Gentium Transaction Completed

Name Indication Preclinical Phase 1 Phase 2 Phase 3 Submission

SLEEP

JZP-386 Narcolepsy

HEMATOLOGY/ONCOLOGY

Erwinaze ALL—IV Admin

Defibrotide Prevention of VOD

Leukotac Steroid Refractory aGvHD

Erwinaze ALL in AYA population

Asparec ALL

ALL = Acute Lymphoblastic Leukemia, IV = Intravenous, AYA = Adolescents and Young Adults, VOD = Veno-Occlusive Disease, aGvHD = acute Graft vs. Host Disease

11

Commercial Opportunity

About Defibrotide

Defibrotide is a complex mix of oligonucleotides that bind to various sites of the vascular endothelium

EU/ROW

EU Marketing Authorization obtained in October for

severe VOD; launch preparedness underway

Orphan Drug Status granted by EMA and other

countries

EMA��s COMP issued positive opinion for Orphan

Drug status for prevention of GvHD

Defibrotide is available in 40 countries through 10

distribution partnerships on a named patient basis

Physician familiarity with product

Existing relationships with physician audience

U.S./AMERICAS

Orphan Drug Status granted by U.S. FDA to treat and prevent VOD

Received U.S. FDA Fast Track Designation to treat VOD

Not FDA approved—currently available to patients via a Treatment IND

Rights in U.S./Americas licensed to Sigma Tau Pharmaceuticals

EU = European Union, ROW = Rest of World, VOD = Veno-Occlusive Disease, EMA = European Medicines Agency, COMP = Committee for Orphan Medicinal Products, GvHD = Graft vs. Host Disease, FDA = Food and Drug Administration, IND = Investigational New Drug

13

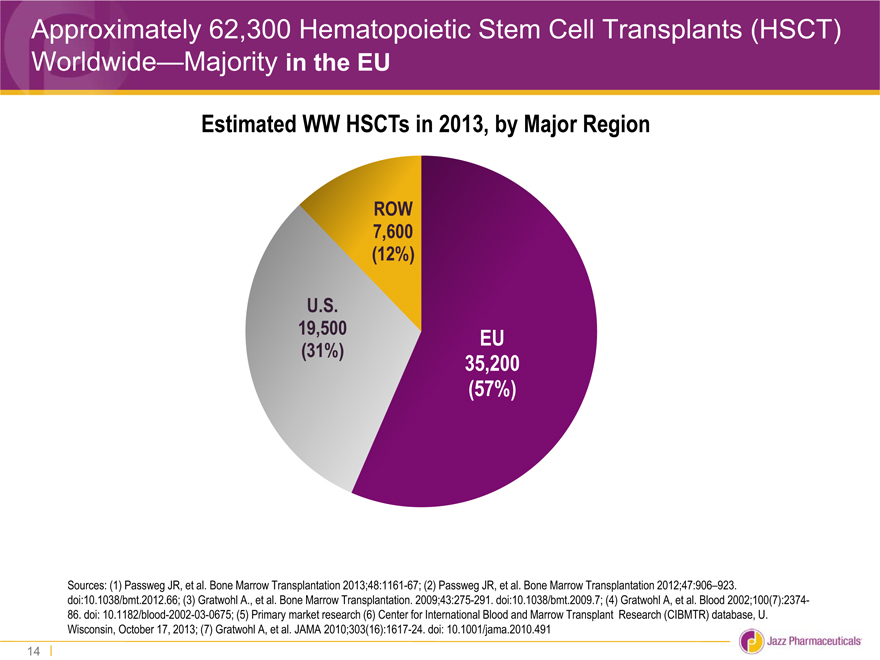

Approximately 62,300 Hematopoietic Stem Cell Transplants (HSCT) Worldwide—Majority in the EU

Estimated WW HSCTs in 2013, by Major Region

ROW

7,600

(12%)

U.S.

19,500 EU

(31%) 35,200

(57%)

Sources: (1) Passweg JR, et al. Bone Marrow Transplantation 2013;48:1161-67; (2) Passweg JR, et al. Bone Marrow Transplantation 2012;47:906–923. doi:10.1038/bmt.2012.66; (3) Gratwohl A., et al. Bone Marrow Transplantation. 2009;43:275-291. doi:10.1038/bmt.2009.7; (4) Gratwohl A, et al. Blood 2002;100(7):2374-86. doi: 10.1182/blood-2002-03-0675; (5) Primary market research (6) Center for International Blood and Marrow Transplant Research (CIBMTR) database, U. Wisconsin, October 17, 2013; (7) Gratwohl A, et al. JAMA 2010;303(16):1617-24. doi: 10.1001/jama.2010.491

14

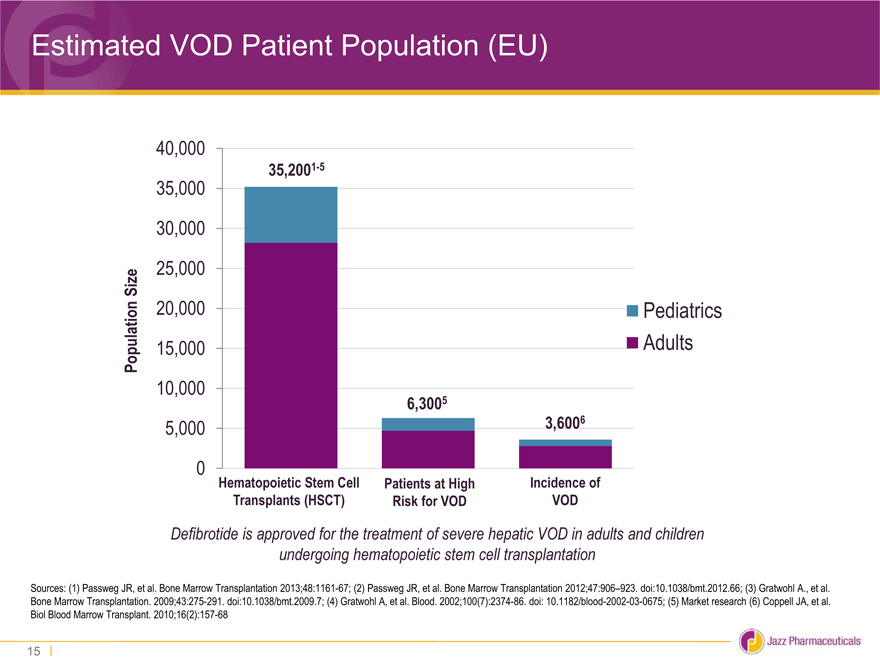

Estimated VOD Patient Population (EU)

40,000

35,2001-5

35,000

30,000

Size 25,000

20,000 Pediatrics

Population 15,000 Adults

10,000

6,3005

5,000 3,6006

0 Hematopoietic Stem Cell Patients at High Incidence of

Transplants (HSCT) Risk for VOD VOD

Defibrotide is approved for the treatment of severe hepatic VOD in adults and children

undergoing hematopoietic stem cell transplantation

Sources: (1) Passweg JR, et al. Bone Marrow Transplantation 2013;48:1161-67; (2) Passweg JR, et al. Bone Marrow Transplantation 2012;47:906–923. doi:10.1038/bmt.2012.66; (3) Gratwohl A., et al. Bone Marrow Transplantation. 2009;43:275-291. doi:10.1038/bmt.2009.7; (4) Gratwohl A, et al. Blood. 2002;100(7):2374-86. doi: 10.1182/blood-2002-03-0675; (5) Market research (6) Coppell JA, et al. Biol Blood Marrow Transplant. 2010;16(2):157-68

15

Financial Review

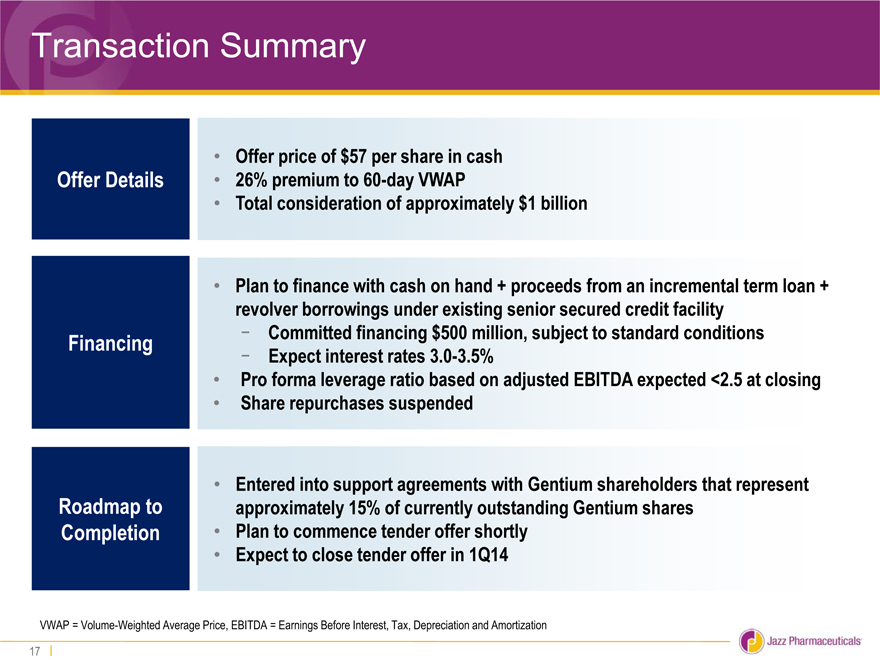

Transaction Summary

• Offer price of $57 per share in cash

Offer Details • 26% premium to 60-day VWAP

• Total consideration of approximately $1 billion

• Plan to finance with cash on hand + proceeds from an incremental term loan +

revolver borrowings under existing senior secured credit facility

Financing—Committed financing $500 million, subject to standard conditions

—Expect interest rates 3.0-3.5%

• Pro forma leverage ratio based on adjusted EBITDA expected <2.5 at closing

• Share repurchases suspended

• Entered into support agreements with Gentium shareholders that represent

Roadmap to approximately 15% of currently outstanding Gentium shares

Completion • Plan to commence tender offer shortly

• Expect to close tender offer in 1Q14

VWAP = Volume-Weighted Average Price, EBITDA = Earnings Before Interest, Tax, Depreciation and Amortization

17

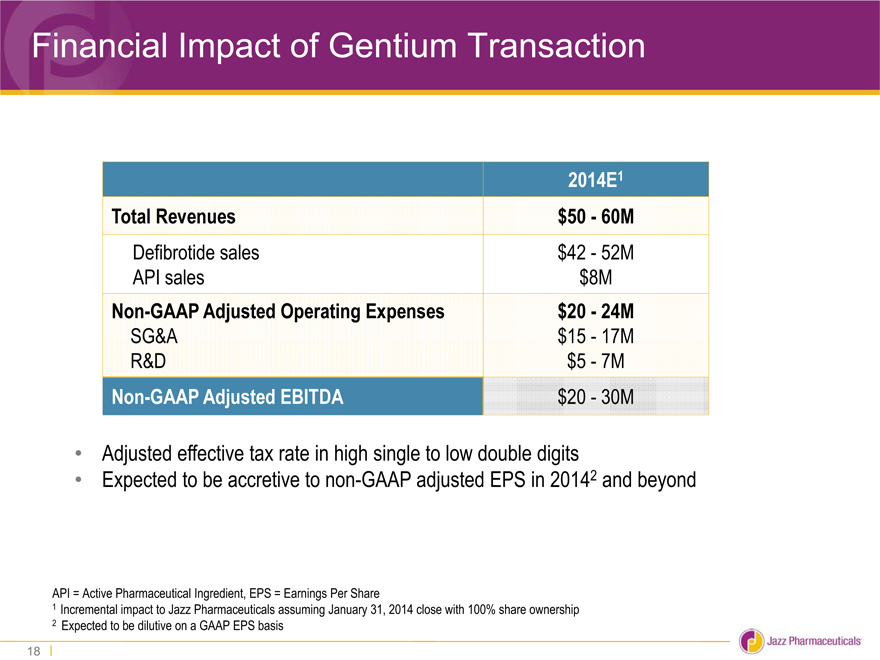

Financial Impact of Gentium Transaction

2014E1

Total Revenues $50—60M

Defibrotide sales $42—52M

API sales $8M

Non-GAAP Adjusted Operating Expenses $20—24M

SG&A $15—17M

R&D $5—7M

Non-GAAP Adjusted EBITDA $20—30M

Adjusted effective tax rate in high single to low double digits

Expected to be accretive to non-GAAP adjusted EPS in 20142 and beyond

API = Active Pharmaceutical Ingredient, EPS = Earnings Per Share

1 Incremental impact to Jazz Pharmaceuticals assuming January 31, 2014 close with 100% share ownership

2 Expected to be dilutive on a GAAP EPS basis

18

Expected Benefits To Jazz

Strategic fit with an attractive financial profile

Synergistic with and enhances our Hematology/Oncology business Leverages our corporate structure Grows and diversifies our revenue base Increases short-term and long-term revenue growth Accretive to non-GAAP EPS – augments earnings growth profile Balance sheet remains strong

19

Additional Information

The tender offer for the outstanding shares of Gentium (including those shares represented by American Depositary Shares) referenced in this presentation has not yet commenced. The statement in this presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Gentium, nor is it a substitute for the tender offer materials that Jazz Pharmaceuticals and its acquisition subsidiary will file with the SEC upon commencement of the tender offer. At the time the tender offer is commenced, Jazz Pharmaceuticals and its acquisition subsidiary will file tender offer materials on Schedule TO, and Gentium will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. The tender offer materials (including an Offer to Purchase, a related Letter of Transmittal and certain other tender offer documents) and the Solicitation/Recommendation Statement will contain important information. Holders of shares of Gentium are urged to read these documents when they become available because they will contain important information that holders of Gentium securities should consider before making any decision regarding tendering their securities. The Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of shares of Gentium at no expense to them. Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with the SEC at the SEC’s web site at http://www.sec.gov or by (i) directing a request to Jazz Pharmaceuticals plc, c/o Jazz Pharmaceuticals, Inc., 3180 Porter Drive, Palo Alto, California 94304, U.S.A., Attention: Investor Relations, (ii) calling +353 1 634 7892 (Ireland) or + 1 650 496 2800 (U.S.) or (iii) sending an email to investorinfo@jazzpharma.com. Investors and security holders may also obtain free copies of the documents filed with the SEC on Jazz Pharmaceuticals’ website at www.jazzpharmaceuticals.com under the heading “Investors” and then under the heading “SEC Filings.”

In addition to the Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the

Solicitation/Recommendation Statement, Jazz Pharmaceuticals and Gentium file annual, quarterly (except in the case of Gentium) and special reports and other information with the SEC. You may read and copy any reports or other information filed by Jazz Pharmaceuticals or Gentium at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Jazz Pharmaceuticals’ and Gentium’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

20

Non-GAAP Financial Measures

This presentation contains forward-looking estimates of non-GAAP adjusted EBITDA and non-GAAP adjusted operating expenses (the combination of adjusted SG&A expense and adjusted R&D expense) resulting from the proposed business combination. As used in this presentation, with respect to estimated adjusted EBITDA contribution resulting from the proposed business combination, Jazz Pharmaceuticals defines adjusted EBITDA as GAAP net income before interest, taxes, depreciation and amortization, excluding stock-based compensation, transaction and integration costs and inventory purchase price adjustments associated with the proposed business combination between Jazz Pharmaceuticals and Gentium S.p.A. With respect to estimated adjusted SG&A expense and adjusted R&D expenses, Jazz Pharmaceuticals excludes from GAAP SG&A expense and GAAP R&D expense, respectively, stock-based compensation expense, transaction and integration costs and inventory purchase price adjustments associated with the proposed business combination, as applicable. Reconciliations of estimated adjusted EBITDA contribution, estimated adjusted SG&A expense and estimated R&D expense to their respective comparable GAAP measures are not provided because the comparable GAAP measures from the Gentium S.p.A. operations for the applicable future period are not accessible or estimable at this time. In this regard, for example, Jazz Pharmaceuticals has not yet completed the necessary valuation of the various assets to be acquired in the proposed acquisition, for accounting purposes, or an allocation of the purchase price among the various types of assets. In addition, the final interest and debt expense associated with the transactions contemplated by the commitment letter have not been finalized and are therefore unavailable. Accordingly, the amount of depreciation and amortization and interest and debt expense that will be included in the additional GAAP net income assuming the proposed acquisition is consummated is not accessible or estimable at this time, and is therefore not available without unreasonable effort. The amount of such additional resulting depreciation and amortization and applicable interest and debt expense could be significant, such that actual GAAP net income would vary substantially from the estimated adjusted EBITDA contribution included in this presentation.

21

Jazz Pharmaceuticals

Innovation that performs