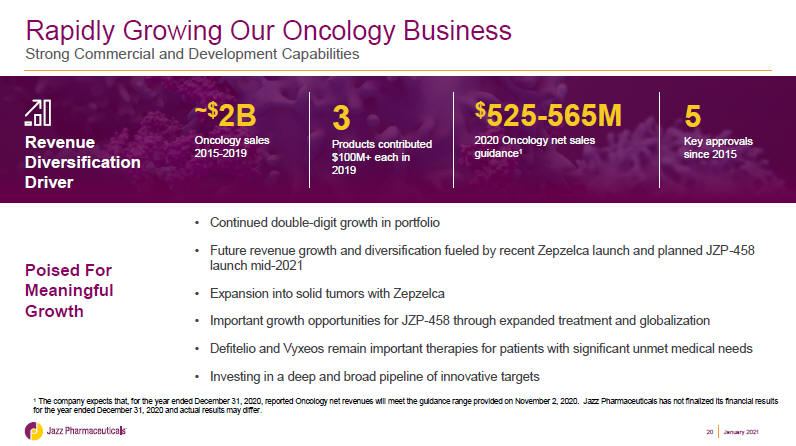

We had a great first quarter of launch, with $37 million in third quarter sales, with additional growth in the fourth quarter. We believe Zepzelca has significant potential in second-line, small-cell lung cancer, where there are currently 17,000 patients a year receiving treatment, but also an additional 8,000 patients per year who’ve chosen not to receive second-line treatment based on the efficacy and tolerability of previously available treatments. And beyond that, we’re excited to partner with PharmaMar to jointly develop lurbinectedin in other tumor types, and also to explore it in first-line, small-cell lung cancer in combination with immuno-oncology and other agents.

Questions and Answers

Jessica Macomber Fye - JPMorgan Chase & Co, Research Division – Analyst

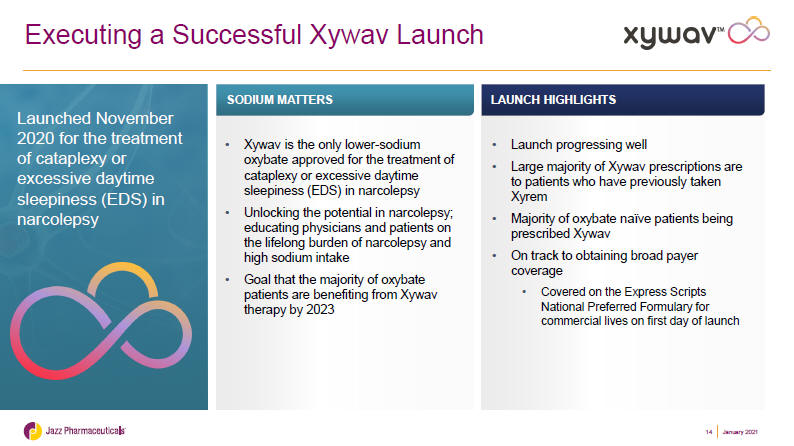

... Maybe just to build off of one of the comments that you made, Bruce, about the Xywav launch. I think you said it’s going very well. Can you elaborate that a little bit more? And maybe outline a framework to help us think about the near-term dynamics with the oxybate franchise?

...

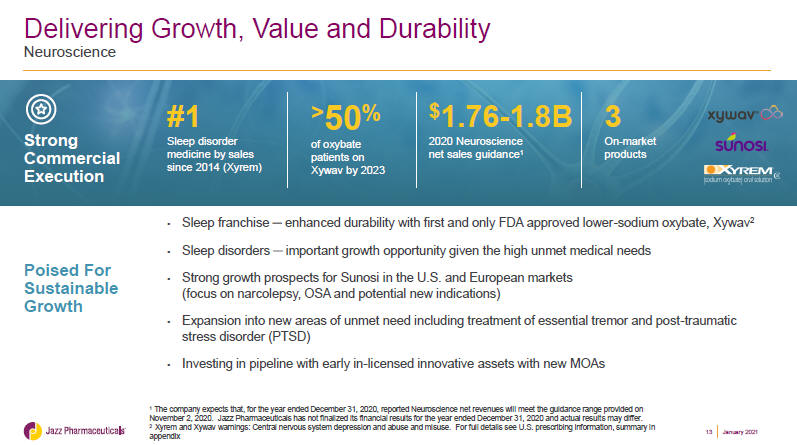

Daniel N. Swisher - Jazz Pharmaceuticals plc - President & COO

... Thanks, Jess. So we just launched the product in November, but already with our well-established relationships with the sleep docs we’ve had very good engagement, both virtually and in person where possible. The focus of the business initially is patients already on Xyrem, giving them the opportunity to switch over and get on to Xywav and really get the benefit of for a lifelong therapy where there’s an increased risk of cardiovascular disease. Yes, similar strong control and efficacy control, but without those risks. I’m also pleased, though, that in a short period of time, we’re seeing a majority of new patients that are coming on to oxybate therapy are coming on to Xywav over Xyrem.

So in terms of the dynamics, our focus was really educating physicians. We’re just starting to reach out now to patients that we’ve established that education with physicians. It’s surprising to us how few physicians actually knew how much sodium was in a Xyrem dose. And so with sodium being — reducing sodium has been a modifiable risk factor this is a real benefit on moving over to Xywav.

So we priced at parity at the launch with Xyrem. We’ve got a suite of services as we’re building up contracts with the PBMs, we’re very pleased that we had ESI on a preferred national formulary at the time of launch. And so that’s really sort of the focus at this point is the education, the ability to switch over and the feedback we’re hearing from physicians and patients who have been using Xywav is very strong.

...

Jessica Macomber Fye - JPMorgan Chase & Co, Research Division - Analyst

... [Y]ou touched on kind of the suite of services as coverage kind of comes online. And one of the questions that we’re getting is kind of how to interpret near-term oxybate revenue numbers, while you’ve got this switch dynamic happening that may be either a drag on gross-to-nets or involve free bottles. So can you kind of maybe lay out kind of what the key metrics you think are best for investors to focus on? And whether or not – and maybe address just this question of whether or not folks should be concerned about maybe a kind of optically lower revenue number in the short-term as this switch proceeds?

Bruce C. Cozadd - Jazz Pharmaceuticals plc - Co-Founder, Chairman & CEO

Yes. Before I hand it over to Dan, I’ll just say, our goal is very clear, which is to make Xywav the oxybate product over the next couple of years. And while we’re certainly watching early dynamics, and I’ll let Dan address your question a little more directly. At Jazz we want to make sure people understand if they’re worried about gross-to-nets in the near-term because the launch is going really well. We want to make sure patients and physicians understand this dynamic about long-term chronic use of a high sodium product and how they make the right choices again for patients and on the physician side. Dan?

Daniel N. Swisher - Jazz Pharmaceuticals plc - President & COO

Yes. I mean, just to sort of build on what Bruce said is we’ll be updating, of course, with our earnings call and providing further guidance at that point for the oxybate franchise. We’re not expecting meaningful revenue in the fourth quarter necessarily as we’re ramping up patient experience and physician access. But as Bruce said, I mean, the primary driver for us is not about price. It’s really to ensure that there’s a seamless transition for the patients who could benefit and we believe all patients who are currently on oxybate therapy would benefit from Xywav. And so the ability to go gram per gram and have that transition and educate physicians and patients is the primary driver.

...