Jazz to acquire GW Pharmaceuticals Creating an INNOVATIVE, High-Growth, Global Biopharma LEADER February 3, 2021 Exhibit 99.1

Forward-Looking Statements “Safe Harbor" Statement Under The Private Securities Litigation Reform Act of 1995 This communication contains forward-looking statements regarding Jazz Pharmaceuticals and GW Pharmaceuticals, including, but not limited to, statements related to the proposed acquisition of GW Pharmaceuticals and the anticipated timing, results and benefits thereof, including the potential for Jazz Pharmaceuticals to accelerate its growth and neuroscience leadership, and for the acquisition to provide long-term growth opportunities to create shareholder value; Jazz Pharmaceuticals’ expected financing for the transaction; and other statements that are not historical facts. You can generally identify forward-looking statements by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “explore,” “evaluate,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” or “will,” or the negative thereof or other variations thereon or comparable terminology. These forward-looking statements are based on each of the companies’ current plans, objectives, estimates, expectations and intentions and inherently involve significant risks and uncertainties, many of which are beyond Jazz Pharmaceuticals’ or GW Pharmaceuticals’ control. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks and uncertainties associated with: Jazz Pharmaceuticals’ and GW Pharmaceuticals’ ability to complete the acquisition on the proposed terms or on the anticipated timeline, or at all, including risks and uncertainties related to securing the necessary regulatory and shareholder approvals, the sanction of the High Court of Justice of England and Wales and satisfaction of other closing conditions to consummate the acquisition; the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive transaction agreement relating to the proposed transaction; risks related to diverting the attention of GW Pharmaceuticals and Jazz Pharmaceuticals management from ongoing business operations; failure to realize the expected benefits of the acquisition; significant transaction costs and/or unknown or inestimable liabilities; the risk of shareholder litigation in connection with the proposed transaction, including resulting expense or delay; the risk that GW Pharmaceuticals’ business will not be integrated successfully or that such integration may be more difficult, time-consuming or costly than expected; Jazz Pharmaceuticals’ ability to obtain the expected financing to consummate the acquisition; risks related to future opportunities and plans for the combined company, including the uncertainty of expected future regulatory filings, financial performance and results of the combined company following completion of the acquisition; GW Pharmaceuticals’ dependence on the successful commercialization of Epidiolex/Epidyolex and the uncertain market potential of Epidiolex; pharmaceutical product development and the uncertainty of clinical success; the regulatory approval process, including the risks that GW Pharmaceuticals may be unable to submit anticipated regulatory filings on the timeframe anticipated, or at all, or that GW Pharmaceuticals may be unable to obtain regulatory approvals of any of its product candidates, including nabiximols and Epidiolex for additional indications, in a timely manner or at all; disruption from the proposed acquisition, making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; effects relating to the announcement of the acquisition or any further announcements or the consummation of the acquisition on the market price of Jazz Pharmaceuticals’ ordinary shares or GW Pharmaceuticals’ American depositary shares or ordinary shares; the possibility that, if Jazz Pharmaceuticals does not achieve the perceived benefits of the acquisition as rapidly or to the extent anticipated by financial analysts or investors, the market price of Jazz Pharmaceuticals’ ordinary shares could decline; potential litigation associated with the possible acquisition; regulatory initiatives and changes in tax laws; market volatility; and other risks and uncertainties affecting Jazz Pharmaceuticals and GW Pharmaceuticals, including those described from time to time under the caption “Risk Factors” and elsewhere in Jazz Pharmaceuticals’ and GW Pharmaceuticals’ Securities and Exchange Commission (SEC) filings and reports, including Jazz Pharmaceuticals’ Annual Report on Form 10-K for the year ended December 31, 2019 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, GW Pharmaceuticals’ Annual Report on Form 10-K for the year ended December 31, 2019 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, and future filings and reports by either company. In addition, while Jazz Pharmaceuticals and GW Pharmaceuticals expect the COVID-19 pandemic to continue to adversely affect their respective business operations and financial results, the extent of the impact on the combined company’s ability to generate sales of and revenues from its approved products, execute on new product launches, its clinical development and regulatory efforts, its corporate development objectives and the value of and market for its ordinary shares, will depend on future developments that are highly uncertain and cannot be predicted with confidence at this time. Moreover, other risks and uncertainties of which Jazz Pharmaceuticals or GW Pharmaceuticals are not currently aware may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ materially from those anticipated. Investors are cautioned that forward-looking statements are not guarantees of future performance. The forward-looking statements made in this communication are made only as of the date hereof or as of the dates indicated in the forward-looking statements and reflect the views stated therein with respect to future events as at such dates, even if they are subsequently made available by Jazz Pharmaceuticals or GW Pharmaceuticals on their respective websites or otherwise. Neither Jazz Pharmaceuticals nor GW Pharmaceuticals undertakes any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made. February 2021 Life-Changing Medicines. Redefining Possibilities.

In connection with the proposed transaction, GW Pharmaceuticals intends to file a proxy statement with the SEC. Each of Jazz Pharmaceuticals and GW Pharmaceuticals may also file other relevant documents with the SEC regarding the proposed transaction. The definitive proxy statement (if and when available) will be mailed to shareholders of GW Pharmaceuticals. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (WHICH WILL INCLUDE AN EXPLANATORY STATEMENT IN RESPECT OF THE SCHEME OF ARRANGEMENT OF GW PHARMACEUTICALS, IN ACCORDANCE WITH THE REQUIREMENTS OF THE U.K. COMPANIES ACT 2006) AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the proxy statement (if and when available) and other documents containing important information about Jazz Pharmaceuticals, GW Pharmaceuticals and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Jazz Pharmaceuticals will be available free of charge on Jazz Pharmaceuticals’ website at https://www.jazzpharma.com. Copies of the documents filed with the SEC by GW Pharmaceuticals will be available free of charge on GW Pharmaceuticals’ website at https://www.gwpharm.com. Participants in the Solicitation Jazz Pharmaceuticals, GW Pharmaceuticals, their respective directors and certain of their executive officers and other employees may be deemed to be participants in the solicitation of proxies from GW Pharmaceuticals’ security holders in connection with the proposed transaction. Information about GW Pharmaceuticals’ directors and executive officers is set forth in GW Pharmaceuticals’ proxy statement on Schedule 14A for its 2020 Annual General Meeting, which was filed with the SEC on April 7, 2020, and its Current Report on Form 8-K filed with the SEC on September 10, 2020 and subsequent statements of beneficial ownership on file with the SEC. Information about Jazz Pharmaceuticals’ directors and executive officers is set forth in Jazz Pharmaceuticals’ proxy statement on Schedule 14A for its 2020 Annual General Meeting, which was filed with the SEC on June 12, 2020 and subsequent statements of beneficial ownership on file with the SEC. Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of GW Pharmaceuticals security holders in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement when it is filed with the SEC. No Offer Or Solicitation This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made in the United States absent registration under the U.S. Securities Act of 1933, as amended (Securities Act), or pursuant to an exemption from, or in a transaction not subject to, such registration requirements. The Jazz Pharmaceuticals securities issued in the proposed transaction are anticipated to be issued in reliance upon an available exemption from such registration requirements pursuant to Section 3(a)(10) of the Securities Act. January 2020 Additional Information and Where to Find It

Creating an Innovative, High-Growth, Global Biopharma Leader Three High-Growth Commercial Franchises One Patient-Centric Mission Leadership in Sleep Disorders NEUROSCIENCE Leadership in Epilepsies NEUROSCIENCE Rapidly-Growing Oncology Business ONCOLOGY February 2021

Patient-Centric Innovation Drives our High-Growth Strategy NEUROSCIENCE & ONCOLOGY Focus on patients with high unmet needs Target addressable physician audiences for efficient commercialization Identify and develop durable, long-lived, differentiated assets Leverage our integrated capabilities and global infrastructure Targeting two therapeutic areas with significant opportunities February 2021

TRANSACTIONS PharmaMar U.S. and Canadian rights to Zepzelca (lurbinectedin) SpringWorks Acquired FAAH inhibitor (JZP-150) Redx Pharma Collaboration on two cancer targets Ras/Raf/MAP kinase pathway COMMERCIAL Execute up to five key product launches through 2020 and 2021 Launched in 2020 Xywav (EDS or cataplexy in narcolepsy) Zepzelca (2L SCLC) Sunosi (EDS in OSA or narcolepsy; EU rolling launch) Preparing for 2021 U.S. Launches1 JZP-458 (ALL / LBL) JZP-258 (IH) PIPELINE Xywav for EDS or Cataplexy in Narcolepsy FDA approval JZP-458 for ALL / LBL Initiated BLA submission Real-Time Oncology Review JZP-258 for IH Compelling topline data Initiated rolling sNDA submission 1 Subject to FDA approval 2L SCLC = Second Line Small Cell Lung Cancer; ALL = Acute Lymphoblastic Leukemia; BLA = Biologics License Application; EDS = Excessive Daytime Sleepiness; FDA = U.S. Food and Drug Administration; IH = Idiopathic Hypersomnia; LBL = Lymphoblastic Lymphoma; MAP = Mitogen-activated Protein; OSA = Obstructive Sleep Apnea; PharmaMar = Pharma Mar, S.A.; sNDA = Supplemental New Drug Application; SpringWorks = SpringWorks Therapeutics, Inc.; FAAH = Fatty Acid Amide Hydrolase 2020 Execution Drives Long-Term Value Key Achievements February 2021

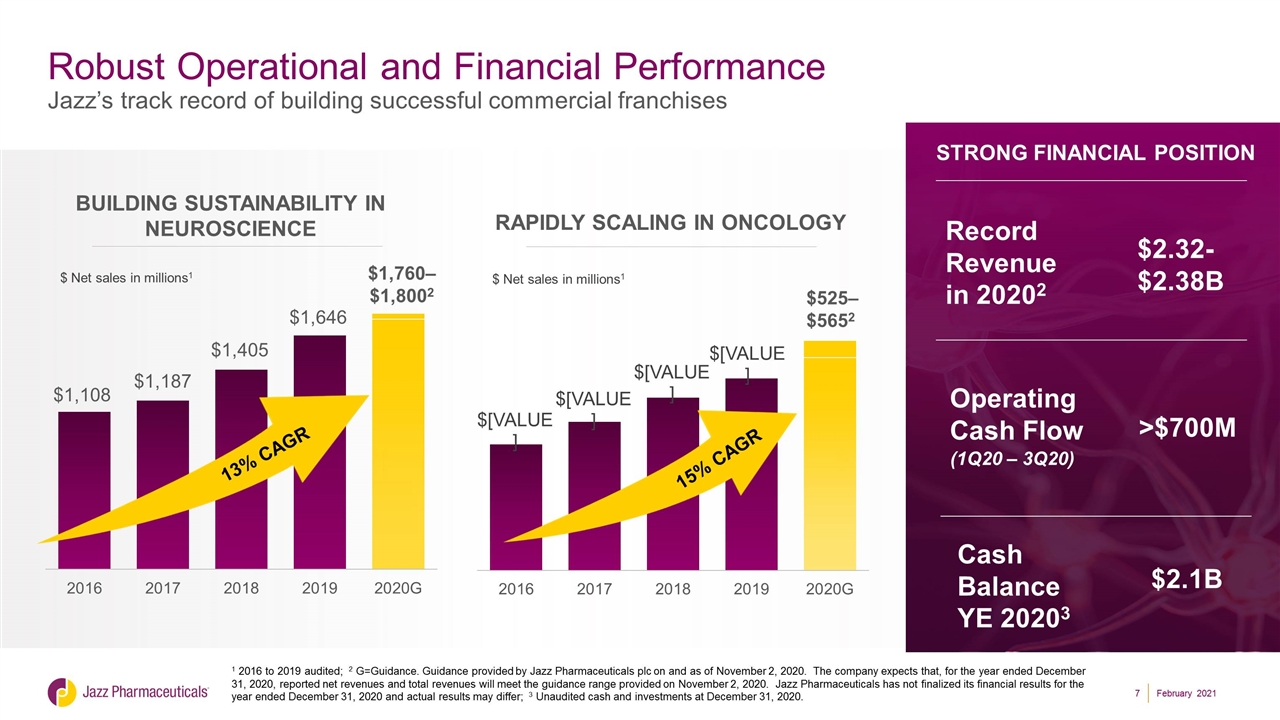

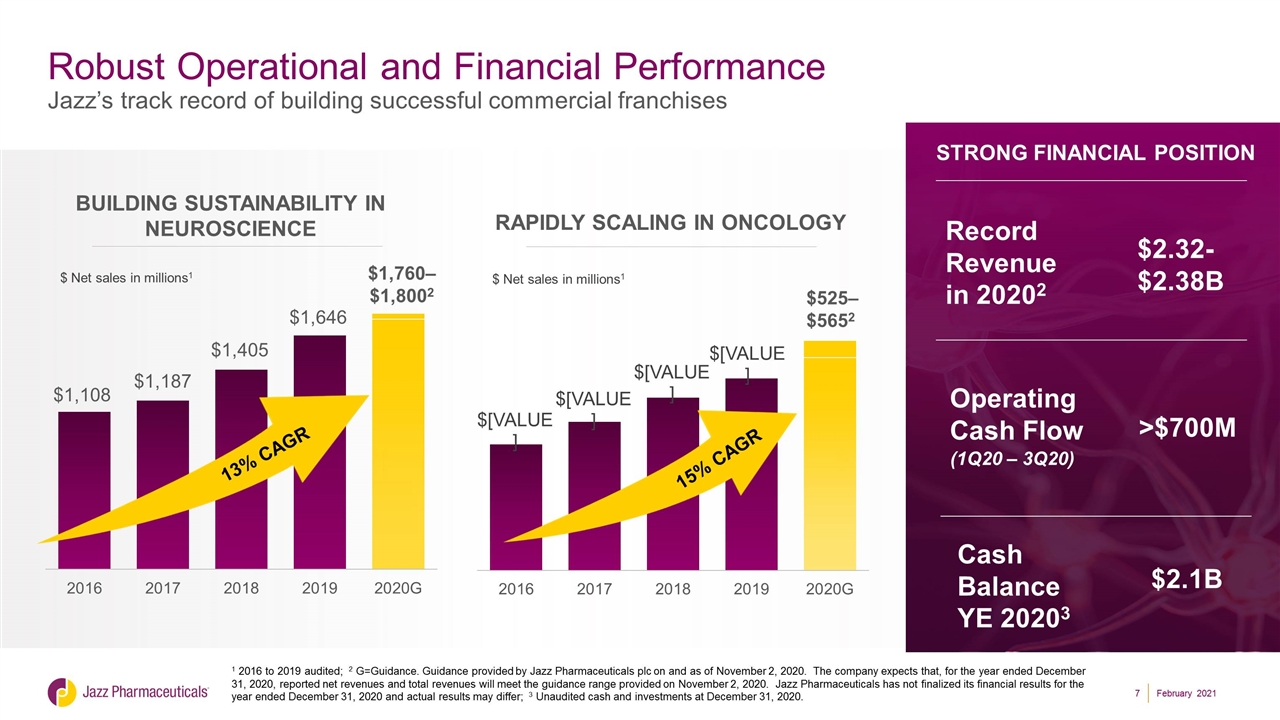

1 2016 to 2019 audited; 2 G=Guidance. Guidance provided by Jazz Pharmaceuticals plc on and as of November 2, 2020. The company expects that, for the year ended December 31, 2020, reported net revenues and total revenues will meet the guidance range provided on November 2, 2020. Jazz Pharmaceuticals has not finalized its financial results for the year ended December 31, 2020 and actual results may differ; 3 Unaudited cash and investments at December 31, 2020. Robust Operational and Financial Performance Jazz’s track record of building successful commercial franchises Building SUSTAINABILITY in NEUROSCIENCE $ Net sales in millions1 $1,760– $1,8002 13% CAGR $ Net sales in millions1 $525– $5652 RAPIDLY SCALING in oncology 15% CAGR 2020: STRONG RESULTS $525– $5652 STRONG FINANCIAL POSITION $2.32-$2.38B $2.1B Record Revenue in 20202 Cash Balance YE 20203 >$700M Operating Cash Flow (1Q20 – 3Q20) February 2021

GW Acquisition Expected to Drive Substantial Shareholder Value Creates an innovative, global, high-growth biopharma leader with a robust pipeline and one patient-centric mission Epidiolex has near-term blockbuster potential Combined Neuroscience business has global commercial and operational footprint to maximize value of Xywav, Epidiolex and other Neuroscience products Accelerates revenue growth and diversification Adding a third high-growth commercial franchise for critical unmet patient needs within: 1) sleep disorders 2) oncology 3) epilepsies Robust pro forma pipeline in Neuroscience and Oncology to drive sustainable growth: 19 clinical development programs GW’s industry leading cannabinoid platform and scientific expertise significantly expands Jazz’s neuroscience pipeline Anticipated to be EPS accretive in first full year of combined operations and substantially accretive thereafter Strong cash flow generation Commitment to rapid deleveraging; targeting net leverage of <3.5x1 by the end of 2022 February 2021 1 Net debt to EBITDA ratio

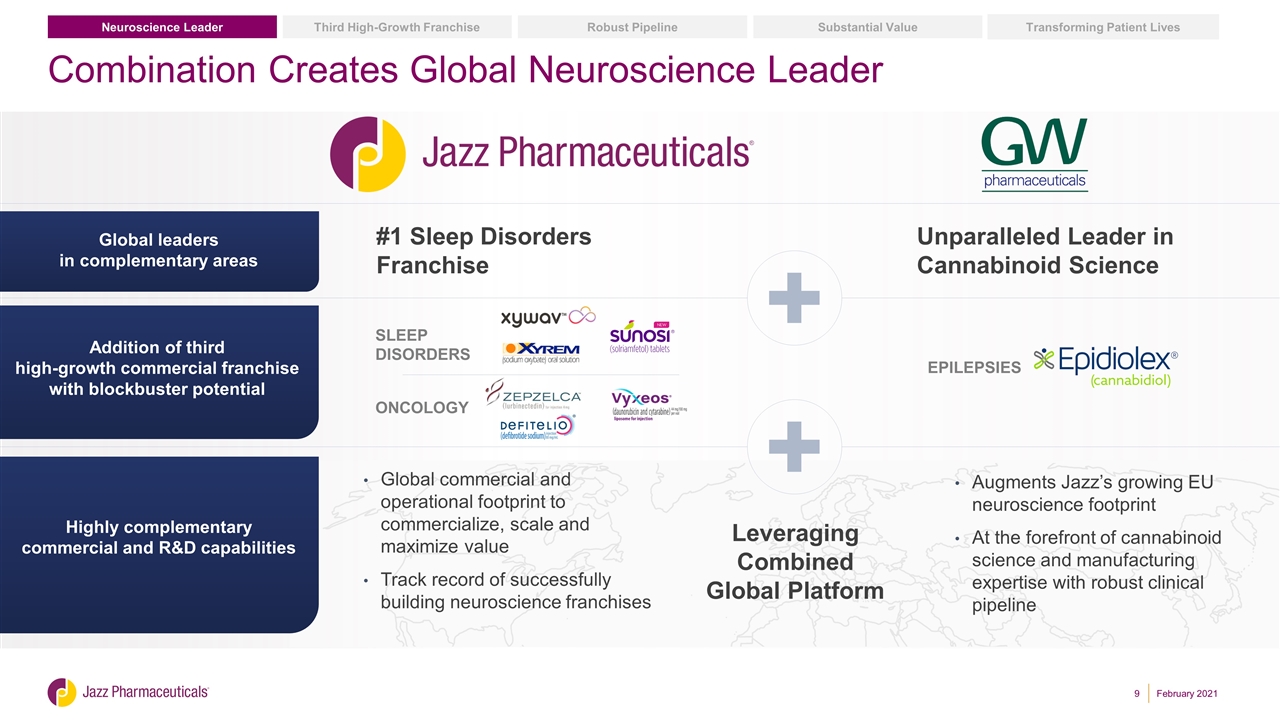

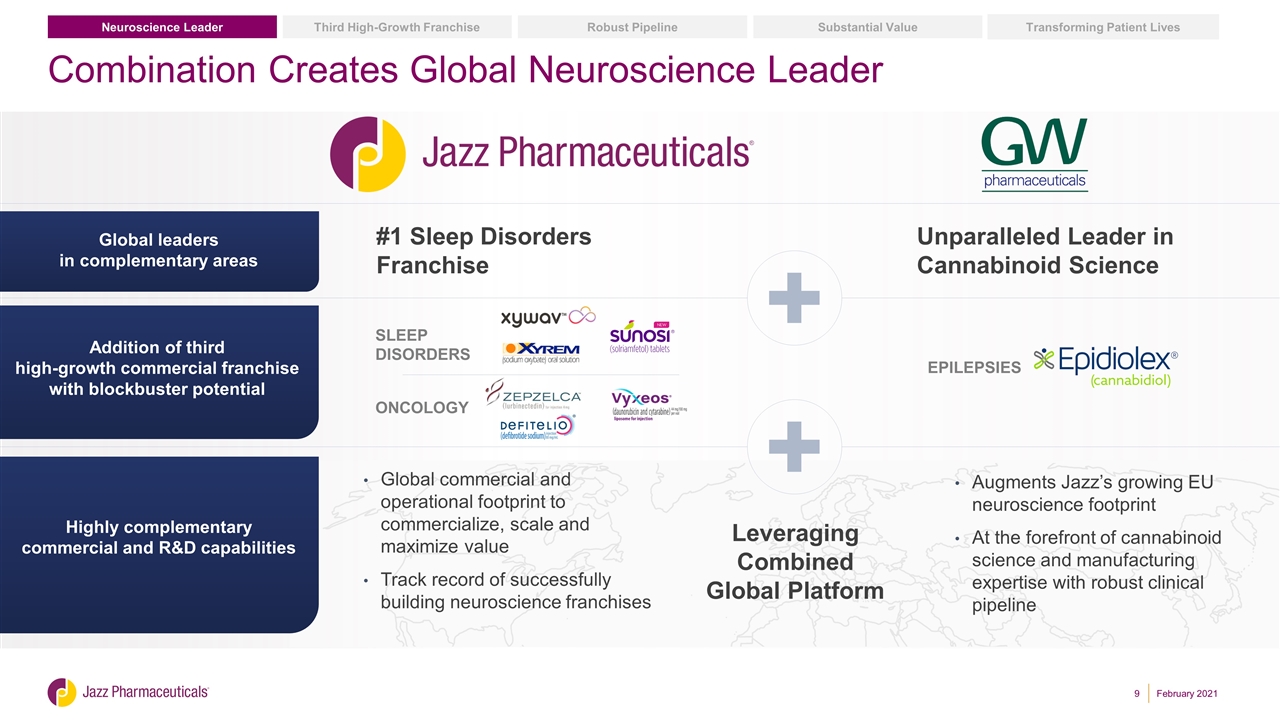

Combination Creates Global Neuroscience Leader EPILEPSIES #1 Sleep Disorders Franchise Unparalleled Leader in Cannabinoid Science SLEEP DISORDERS ONCOLOGY Global leaders in complementary areas Addition of third high-growth commercial franchise with blockbuster potential Highly complementary commercial and R&D capabilities Global commercial and operational footprint to commercialize, scale and maximize value Track record of successfully building neuroscience franchises Augments Jazz’s growing EU neuroscience footprint At the forefront of cannabinoid science and manufacturing expertise with robust clinical pipeline Leveraging Combined Global Platform Substantial Value Transforming Patient Lives Robust Pipeline Third High-Growth Franchise Neuroscience Leader February 2021

Epidiolex: A Transformative Treatment in Childhood-Onset Epilepsy Pioneering Cannabinoid Therapeutics First and only FDA-approved prescription plant-derived cannabinoid Approved in U.S., EU and Australia Serves Treatment-Resistant Populations with High Unmet Need Approved to treat seizures associated with LGS, Dravet Syndrome or TSC in patients 1 years of age or older1 Highly Successful Global Launch Underway ~$510M WW sales in 2020, the second full year of launch – 72% YoY Sales Growth2 >97% of U.S. lives have coverage3 Launched in U.S., UK, Germany; Additional EU launches expected in 2021 Proprietary Manufacturing and IP 14 Orange Book listed patents; 13 with expiry dates in 2035 Highly specialized, wholly owned manufacturing and supply operation Substantial Value Transforming Patient Lives Robust Pipeline Third High-Growth Franchise Neuroscience Leader 1 TSC not yet approved by EMA; EMA approval for use in patients 2 years of age or older 2 Based on preliminary unaudited financial information 3 As of 12 January 2021; Via https://www.mmitnetwork.com and https://www.policyreporter.com. February 2021

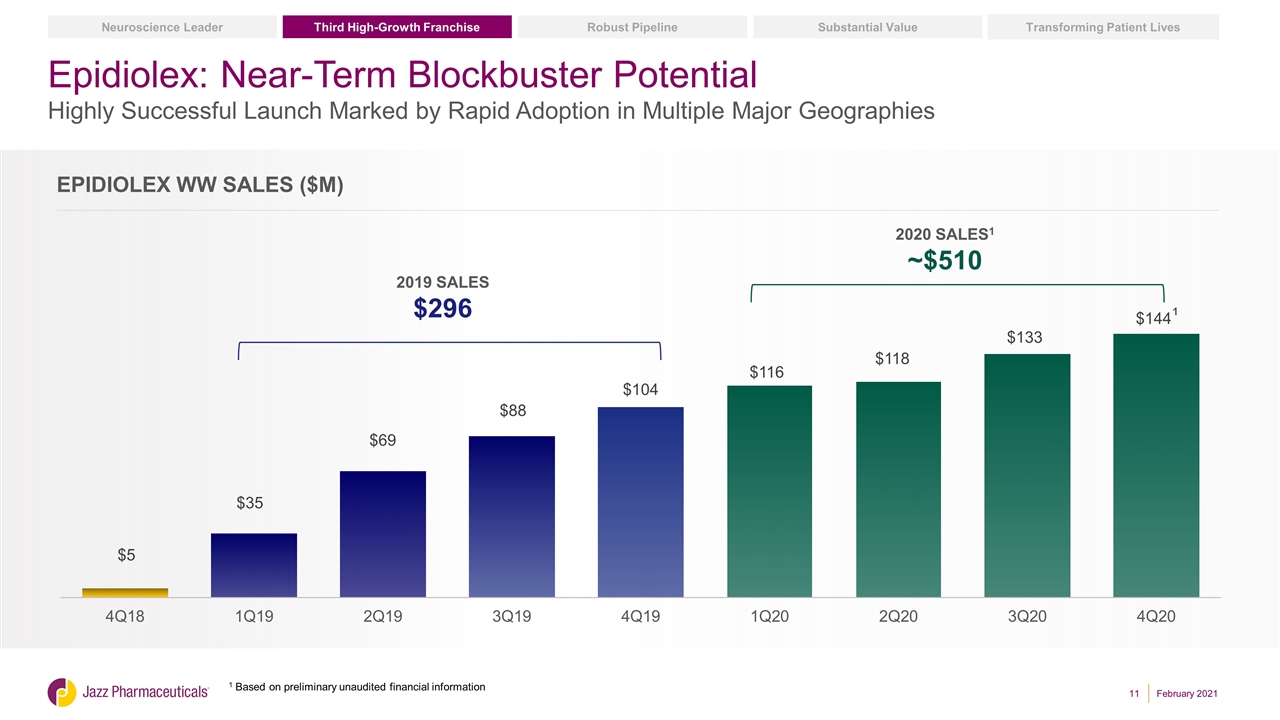

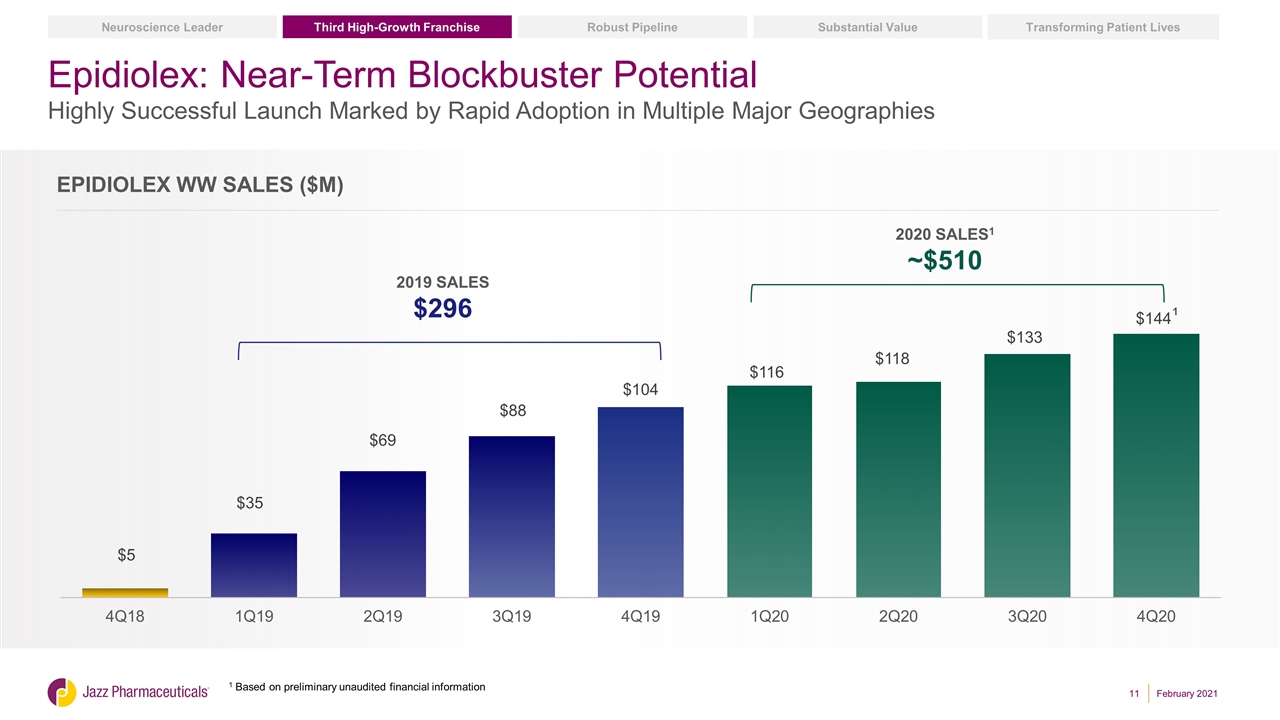

Epidiolex: Near-Term Blockbuster Potential Highly Successful Launch Marked by Rapid Adoption in Multiple Major Geographies 2019 SALES $296 2020 SALES1 ~$510 Epidiolex WW Sales ($m) Substantial Value Transforming Patient Lives Robust Pipeline Third High-Growth Franchise Neuroscience Leader February 2021 1 Based on preliminary unaudited financial information 1

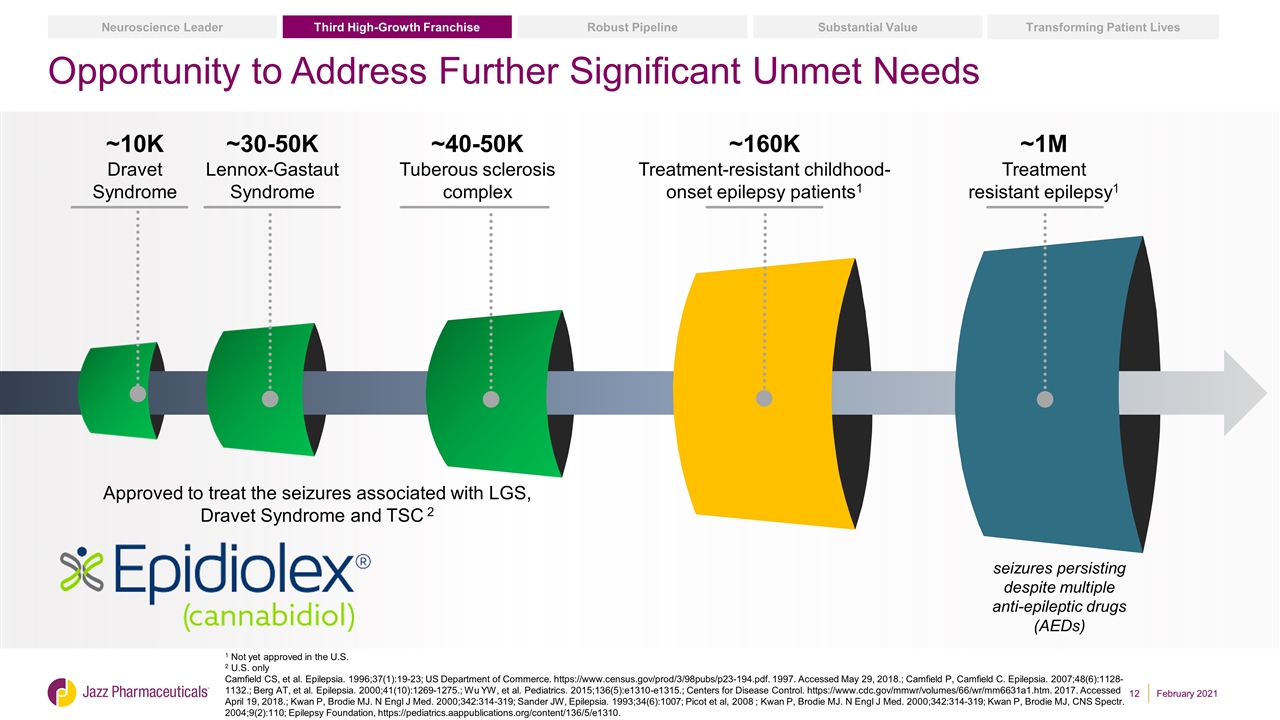

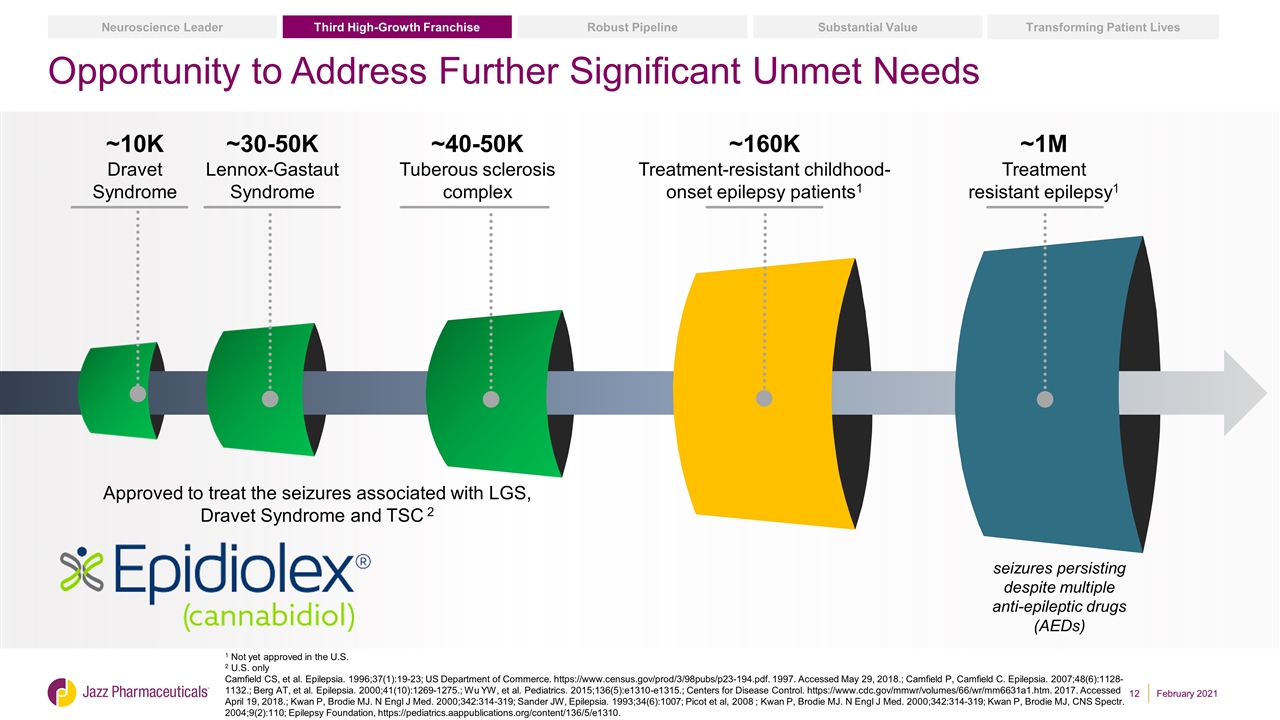

Opportunity to Address Further Significant Unmet Needs ~30-50K Lennox-Gastaut Syndrome ~40-50K Tuberous sclerosis complex ~160K Treatment-resistant childhood-onset epilepsy patients1 ~1M Treatment resistant epilepsy1 seizures persisting despite multiple anti-epileptic drugs (AEDs) ~10K Dravet Syndrome 1 Not yet approved in the U.S. 2 U.S. only Camfield CS, et al. Epilepsia. 1996;37(1):19-23; US Department of Commerce. https://www.census.gov/prod/3/98pubs/p23-194.pdf. 1997. Accessed May 29, 2018.; Camfield P, Camfield C. Epilepsia. 2007;48(6):1128-1132.; Berg AT, et al. Epilepsia. 2000;41(10):1269-1275.; Wu YW, et al. Pediatrics. 2015;136(5):e1310-e1315.; Centers for Disease Control. https://www.cdc.gov/mmwr/volumes/66/wr/mm6631a1.htm. 2017. Accessed April 19, 2018.; Kwan P, Brodie MJ. N Engl J Med. 2000;342:314-319; Sander JW, Epilepsia. 1993;34(6):1007; Picot et al, 2008 ; Kwan P, Brodie MJ. N Engl J Med. 2000;342:314-319; Kwan P, Brodie MJ, CNS Spectr. 2004;9(2):110; Epilepsy Foundation, https://pediatrics.aappublications.org/content/136/5/e1310. Approved to treat the seizures associated with LGS, Dravet Syndrome and TSC 2 Substantial Value Transforming Patient Lives Robust Pipeline Third High-Growth Franchise Neuroscience Leader February 2021

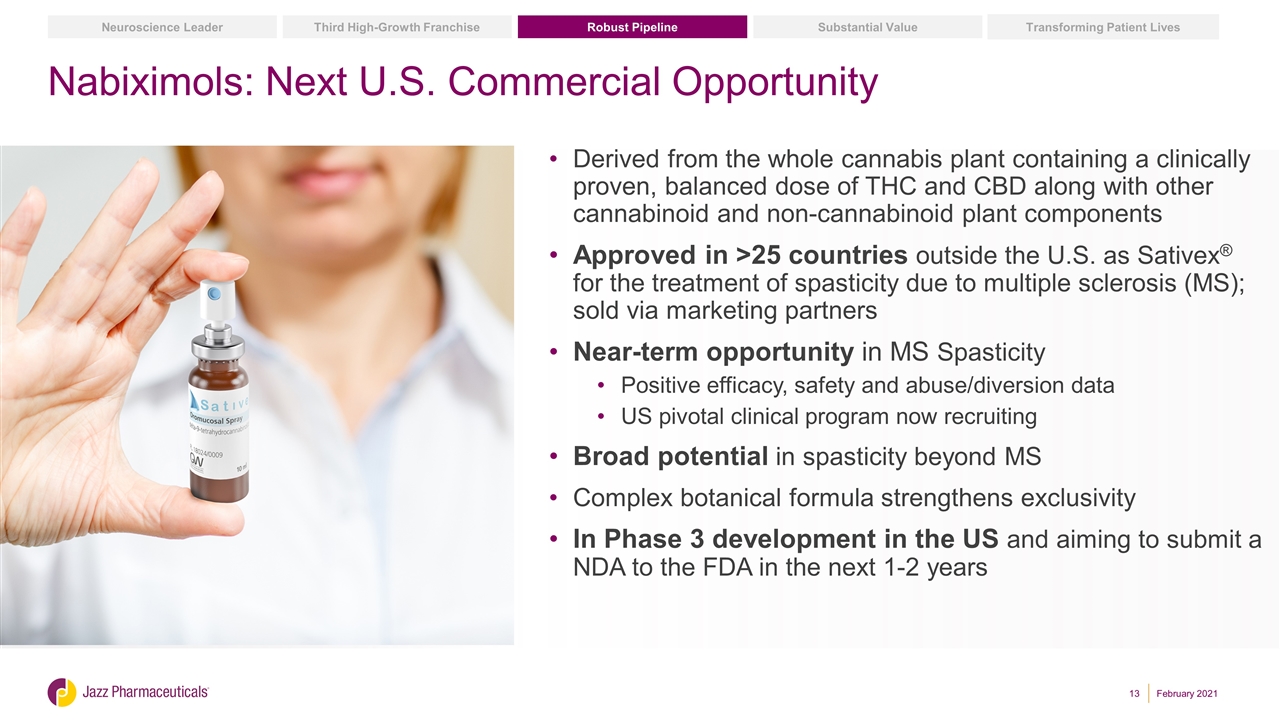

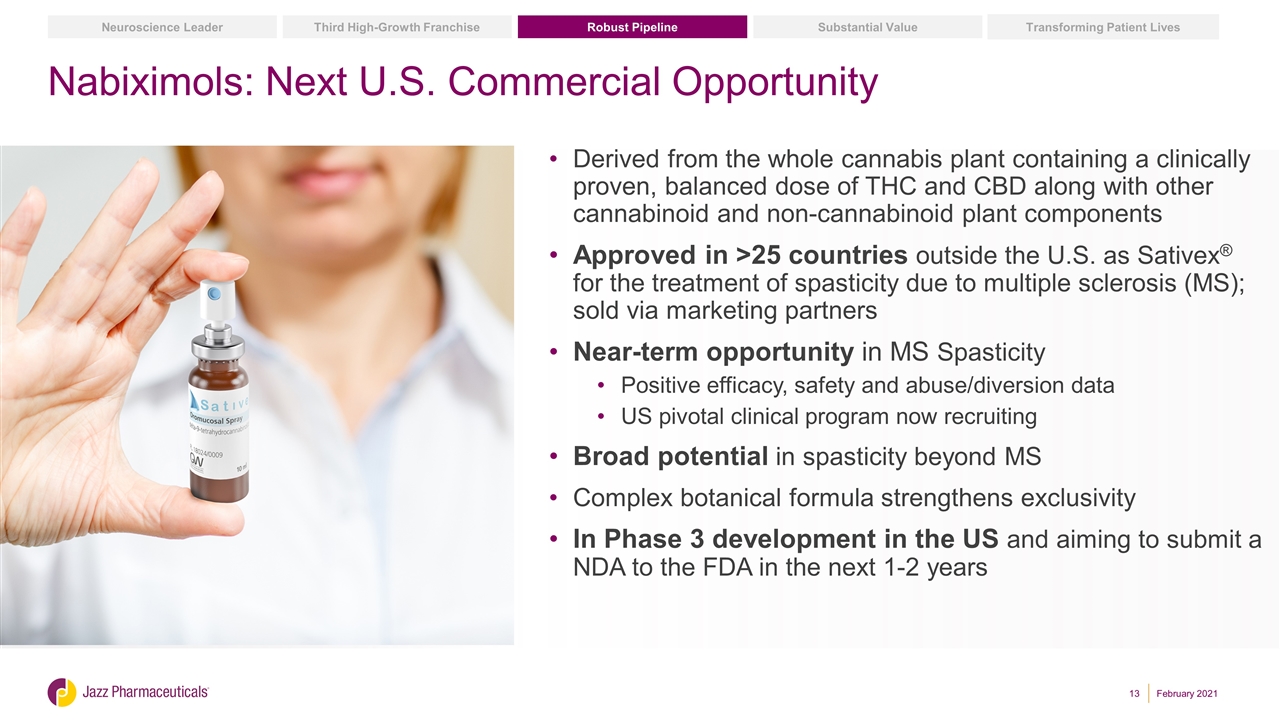

Nabiximols: Next U.S. Commercial Opportunity Derived from the whole cannabis plant containing a clinically proven, balanced dose of THC and CBD along with other cannabinoid and non-cannabinoid plant components Approved in >25 countries outside the U.S. as Sativex® for the treatment of spasticity due to multiple sclerosis (MS); sold via marketing partners Near-term opportunity in MS Spasticity Positive efficacy, safety and abuse/diversion data US pivotal clinical program now recruiting Broad potential in spasticity beyond MS Complex botanical formula strengthens exclusivity In Phase 3 development in the US and aiming to submit a NDA to the FDA in the next 1-2 years February 2021 Substantial Value Transforming Patient Lives Robust Pipeline Third High-Growth Franchise Neuroscience Leader

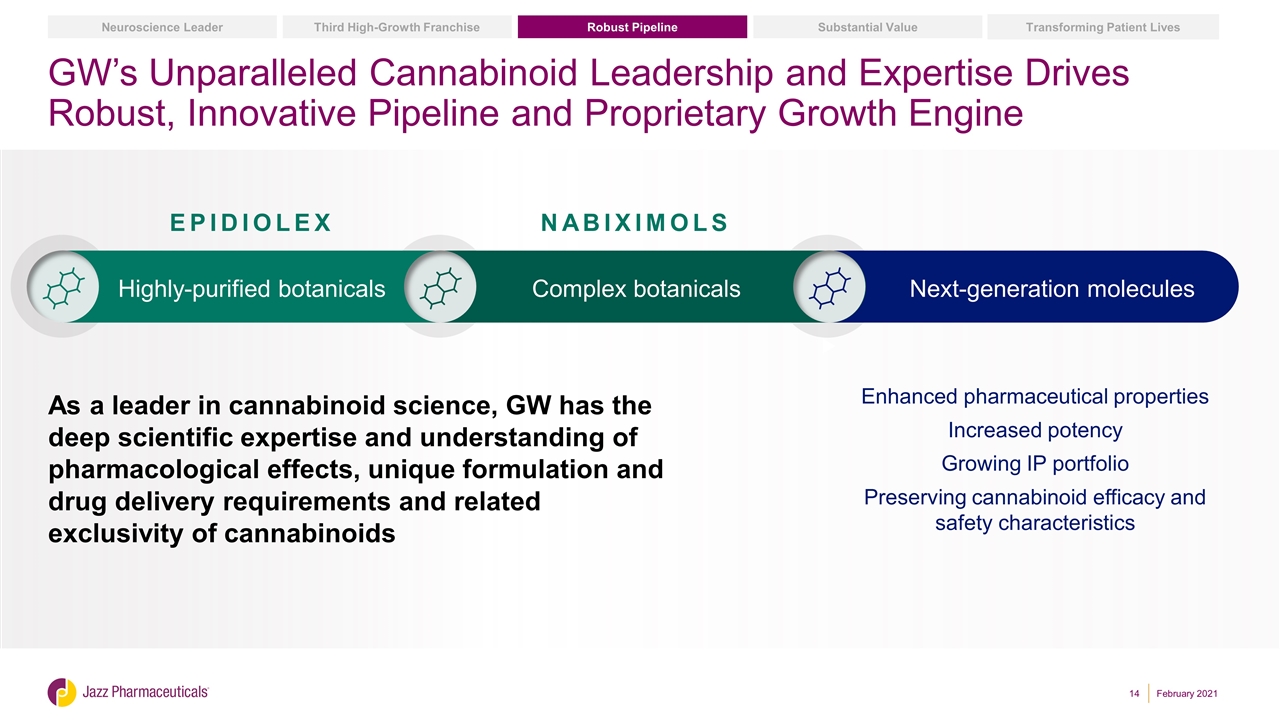

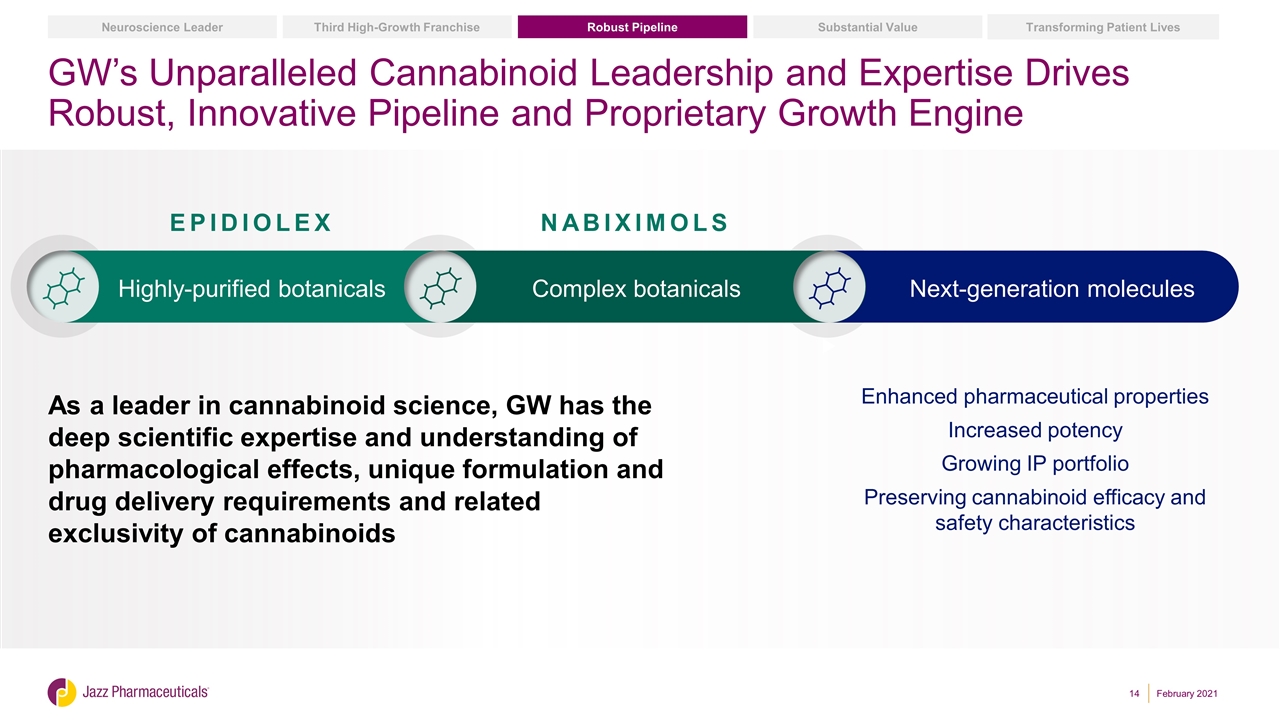

GW’s Unparalleled Cannabinoid Leadership and Expertise Drives Robust, Innovative Pipeline and Proprietary Growth Engine Enhanced pharmaceutical properties Increased potency Growing IP portfolio Preserving cannabinoid efficacy and safety characteristics Highly-purified botanicals Complex botanicals Next-generation molecules NABIXIMOLS EPIDIOLEX As a leader in cannabinoid science, GW has the deep scientific expertise and understanding of pharmacological effects, unique formulation and drug delivery requirements and related exclusivity of cannabinoids Substantial Value Transforming Patient Lives Robust Pipeline Third High-Growth Franchise Neuroscience Leader February 2021

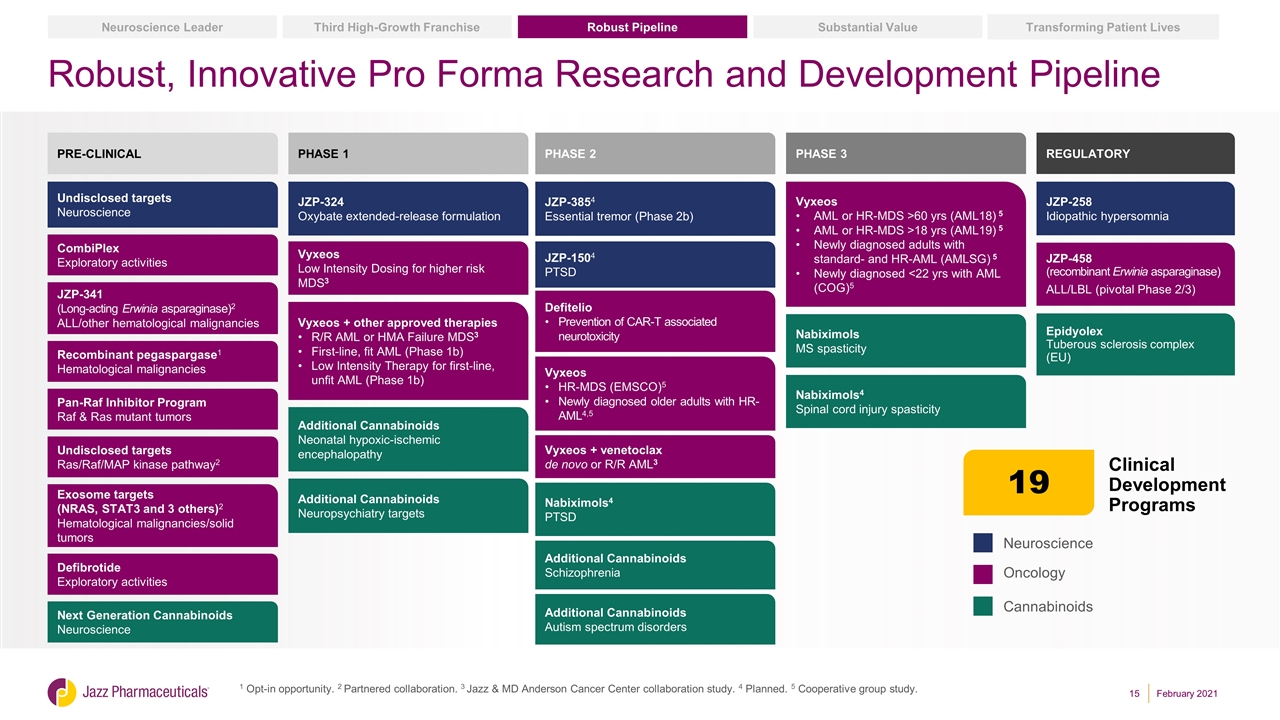

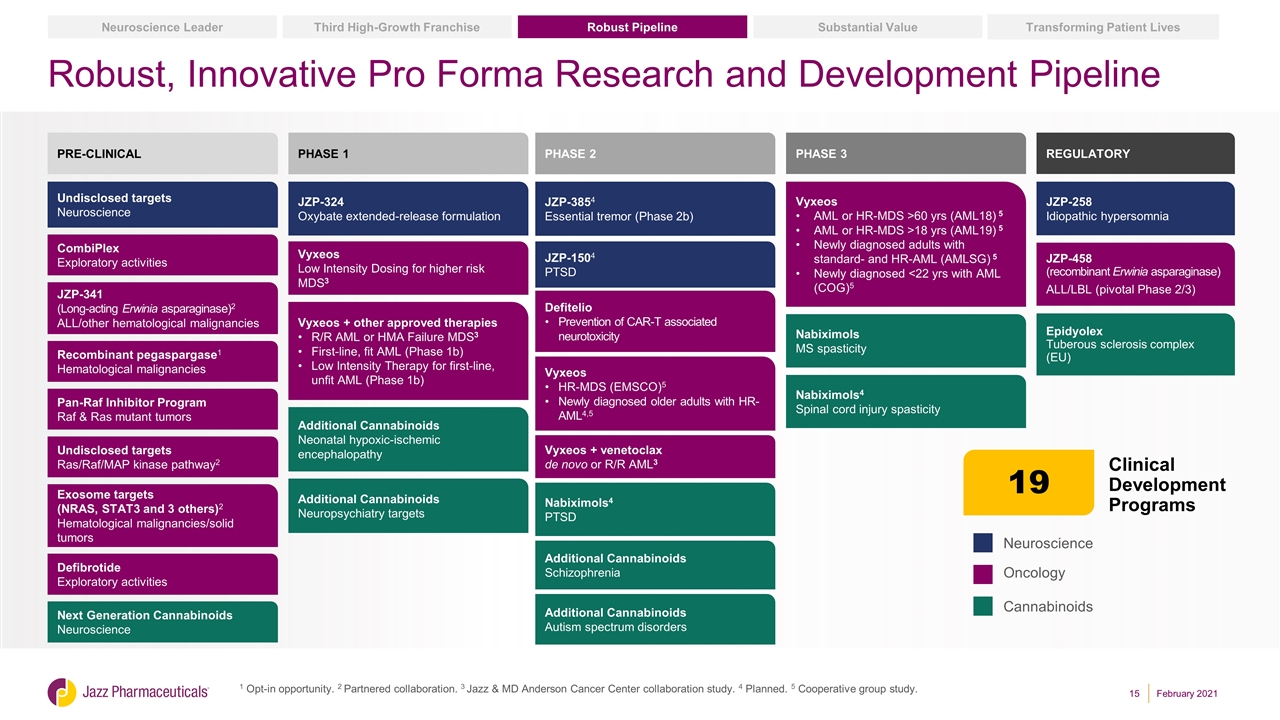

Robust, Innovative Pro Forma Research and Development Pipeline 1 Opt-in opportunity. 2 Partnered collaboration. 3 Jazz & MD Anderson Cancer Center collaboration study. 4 Planned. 5 Cooperative group study. Neuroscience Oncology Cannabinoids PRE-CLINICAL CombiPlex Exploratory activities JZP-341 (Long-acting Erwinia asparaginase)2 ALL/other hematological malignancies Recombinant pegaspargase1 Hematological malignancies Pan-Raf Inhibitor Program Raf & Ras mutant tumors Exosome targets (NRAS, STAT3 and 3 others)2 Hematological malignancies/solid tumors Defibrotide Exploratory activities JZP-3854 Essential tremor (Phase 2b) PHASE 2 Defitelio Prevention of CAR-T associated neurotoxicity Vyxeos + venetoclax de novo or R/R AML3 Vyxeos HR-MDS (EMSCO)5 Newly diagnosed older adults with HR-AML4,5 JZP-258 Idiopathic hypersomnia PHASE 3 Vyxeos AML or HR-MDS >60 yrs (AML18) 5 AML or HR-MDS >18 yrs (AML19) 5 Newly diagnosed adults with standard- and HR-AML (AMLSG) 5 Newly diagnosed <22 yrs with AML (COG)5 JZP-458 (recombinant Erwinia asparaginase) ALL/LBL (pivotal Phase 2/3) PHASE 1 Vyxeos Low Intensity Dosing for higher risk MDS3 Vyxeos + other approved therapies R/R AML or HMA Failure MDS3 First-line, fit AML (Phase 1b) Low Intensity Therapy for first-line, unfit AML (Phase 1b) JZP-324 Oxybate extended-release formulation Undisclosed targets Neuroscience Additional Cannabinoids Neonatal hypoxic-ischemic encephalopathy Nabiximols4 PTSD Additional Cannabinoids Schizophrenia Nabiximols4 Spinal cord injury spasticity Nabiximols MS spasticity Undisclosed targets Ras/Raf/MAP kinase pathway2 JZP-1504 PTSD REGULATORY Clinical Development Programs 19 Additional Cannabinoids Neuropsychiatry targets Additional Cannabinoids Autism spectrum disorders Epidyolex Tuberous sclerosis complex (EU) Substantial Value Transforming Patient Lives Robust Pipeline Third High-Growth Franchise Neuroscience Leader Next Generation Cannabinoids Neuroscience February 2021

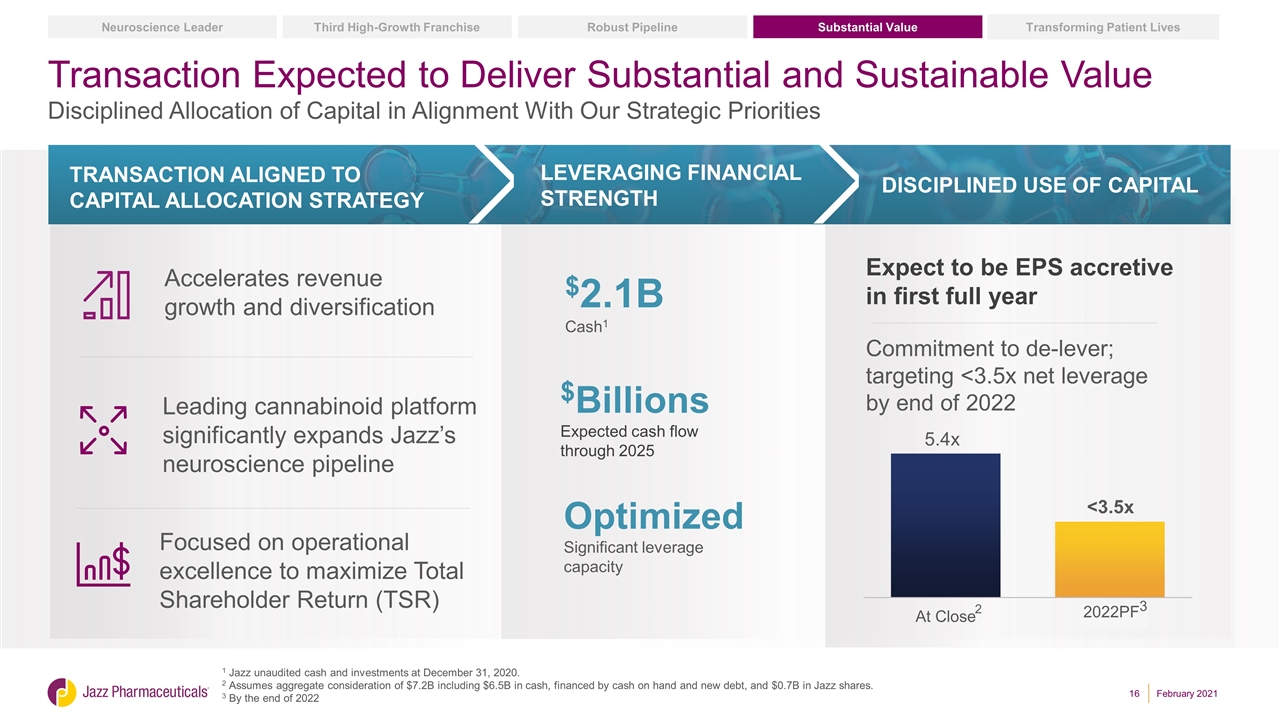

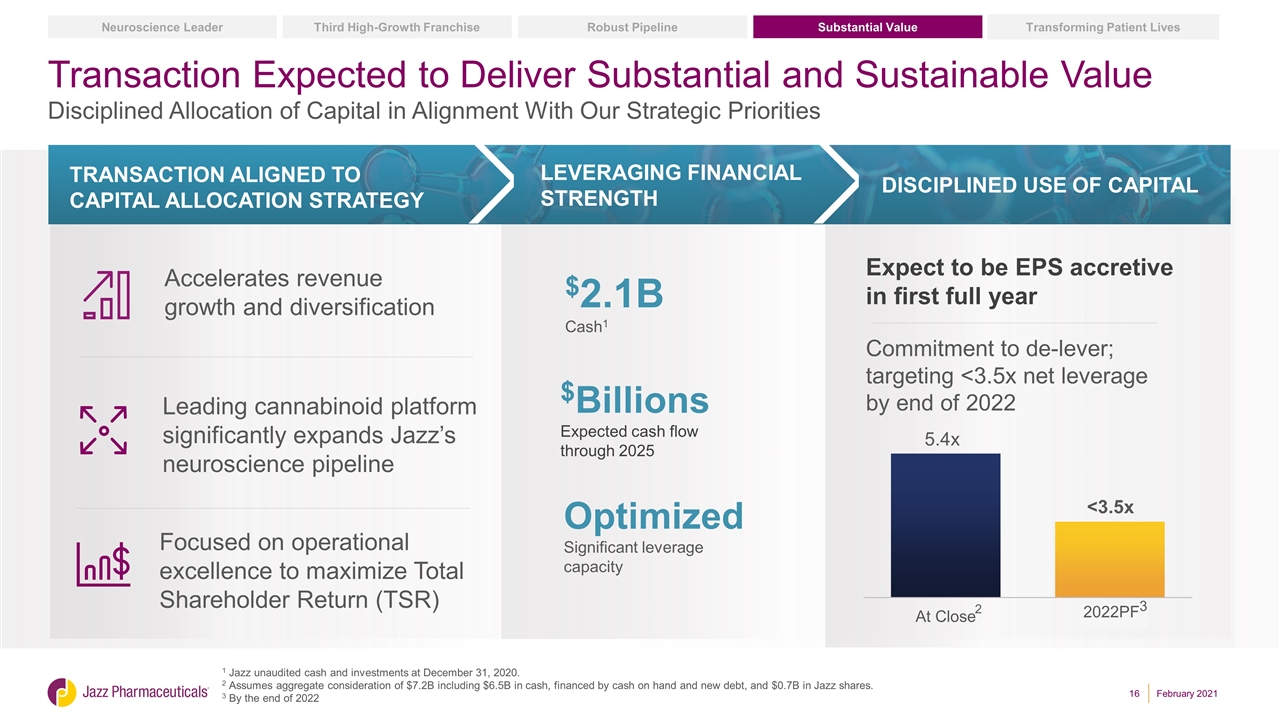

1 Jazz unaudited cash and investments at December 31, 2020. 2 Assumes aggregate consideration of $7.2B including $6.5B in cash, financed by cash on hand and new debt, and $0.7B in Jazz shares. 3 By the end of 2022 Leveraging financial strength Transaction Aligned to capital allocation strategy DISCIPLINED use of capital Accelerates revenue growth and diversification Leading cannabinoid platform significantly expands Jazz’s neuroscience pipeline Focused on operational excellence to maximize Total Shareholder Return (TSR) Expect to be EPS accretive in first full year Commitment to de-lever; targeting <3.5x net leverage by end of 2022 $Billions Expected cash flow through 2025 $2.1B Cash1 Optimized Significant leverage capacity Transaction Expected to Deliver Substantial and Sustainable Value Disciplined Allocation of Capital in Alignment With Our Strategic Priorities Substantial Value Transforming Patient Lives Robust Pipeline Third High-Growth Franchise Neuroscience Leader 2 February 2021 2022PF3

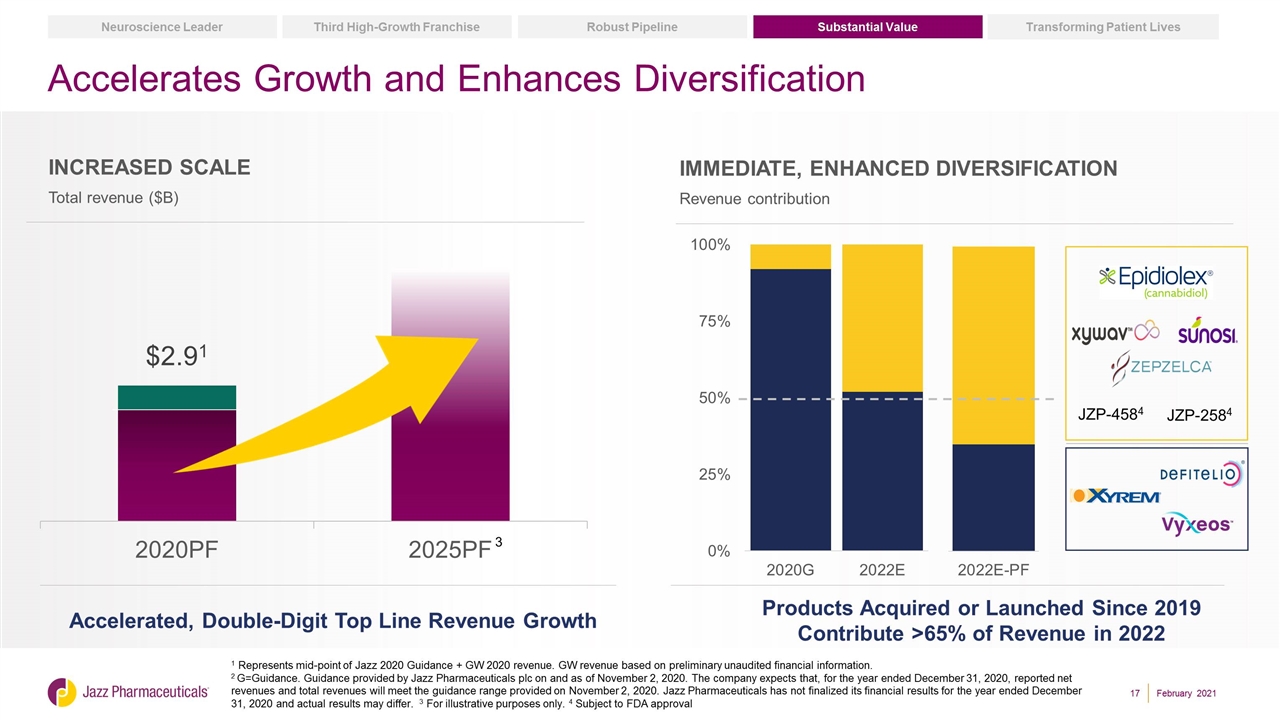

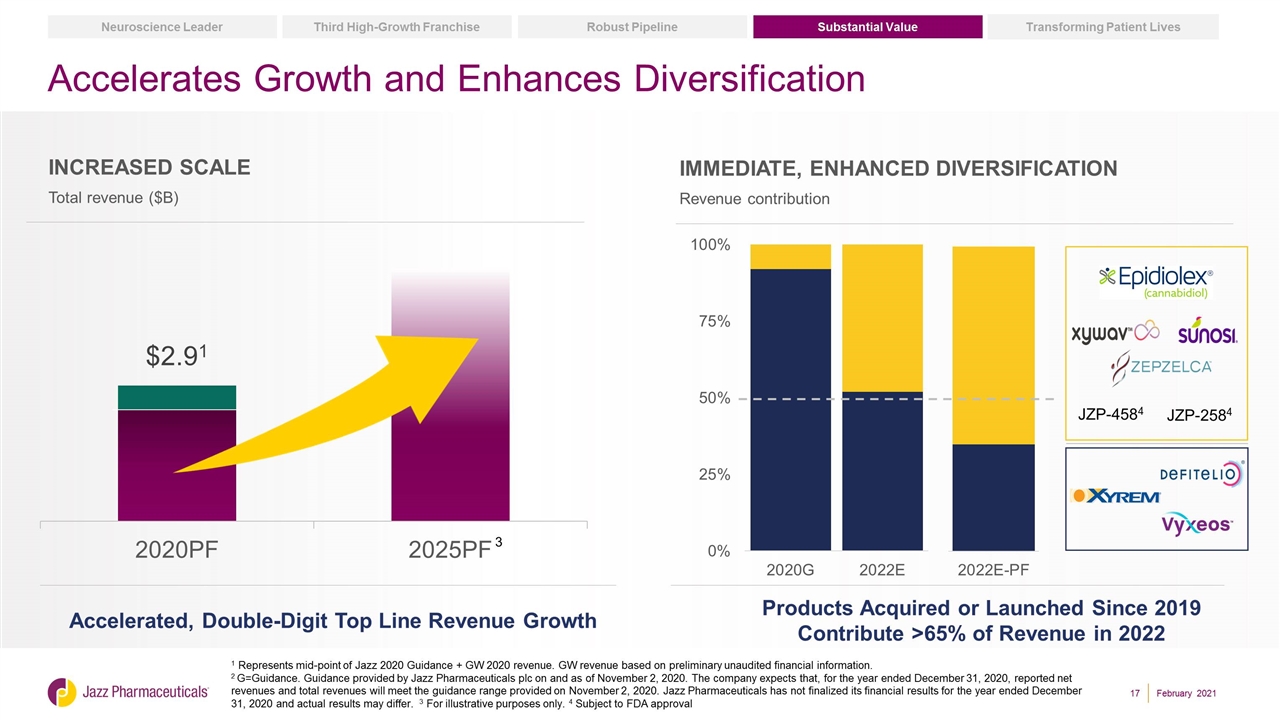

Accelerates Growth and Enhances Diversification Immediate, Enhanced Diversification Revenue contribution Accelerated, Double-Digit Top Line Revenue Growth Products Acquired or Launched Since 2019 Contribute >65% of Revenue in 2022 1 Represents mid-point of Jazz 2020 Guidance + GW 2020 revenue. GW revenue based on preliminary unaudited financial information. 2 G=Guidance. Guidance provided by Jazz Pharmaceuticals plc on and as of November 2, 2020. The company expects that, for the year ended December 31, 2020, reported net revenues and total revenues will meet the guidance range provided on November 2, 2020. Jazz Pharmaceuticals has not finalized its financial results for the year ended December 31, 2020 and actual results may differ. 3 For illustrative purposes only. 4 Subject to FDA approval Substantial Value Transforming Patient Lives Robust Pipeline Third High-Growth Franchise Neuroscience Leader February 2021 Increased Scale Total revenue ($B) JZP-4584 JZP-2584 3

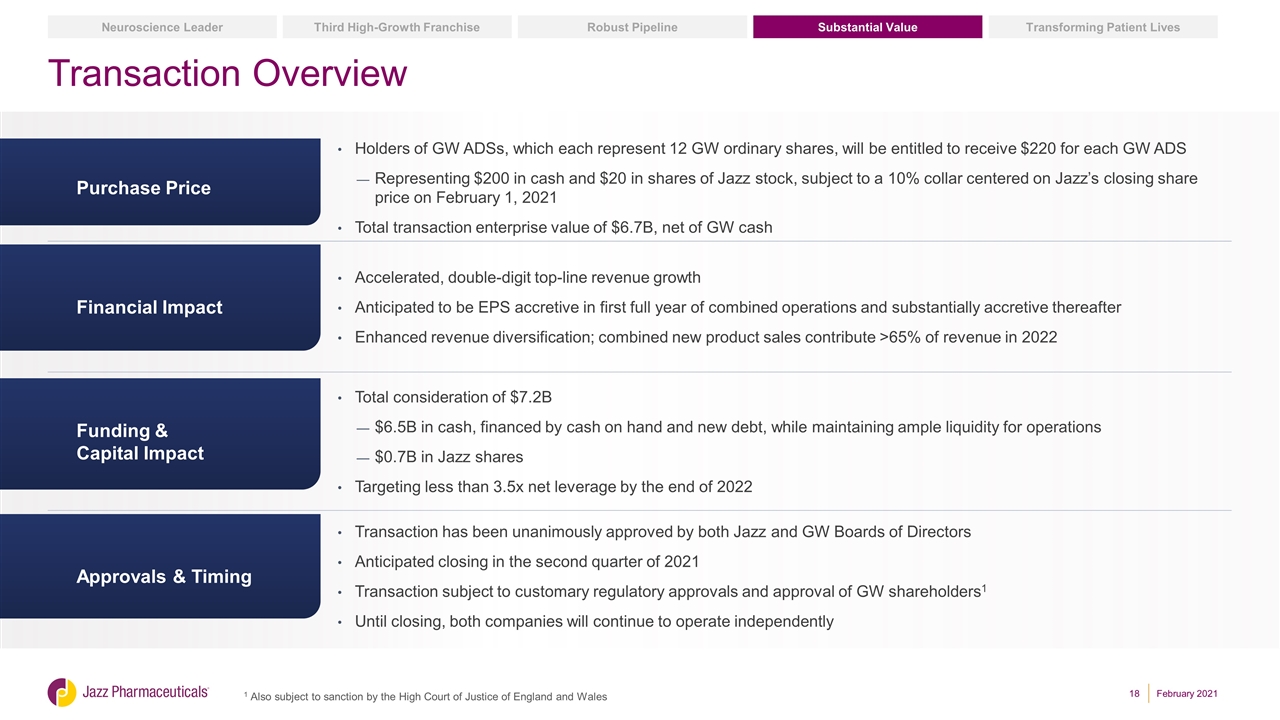

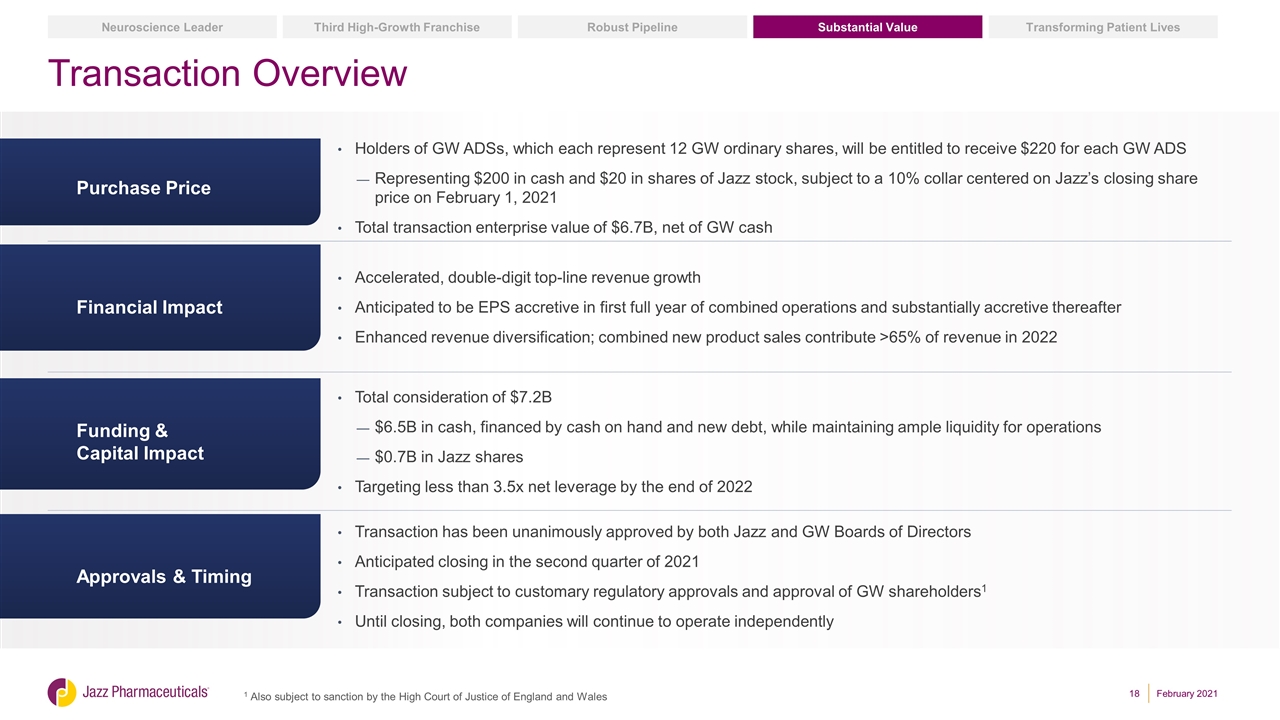

Purchase Price Holders of GW ADSs, which each represent 12 GW ordinary shares, will be entitled to receive $220 for each GW ADS Representing $200 in cash and $20 in shares of Jazz stock, subject to a 10% collar centered on Jazz’s closing share price on February 1, 2021 Total transaction enterprise value of $6.7B, net of GW cash Financial Impact Accelerated, double-digit top-line revenue growth Anticipated to be EPS accretive in first full year of combined operations and substantially accretive thereafter Enhanced revenue diversification; combined new product sales contribute >65% of revenue in 2022 Funding & Capital Impact Total consideration of $7.2B $6.5B in cash, financed by cash on hand and new debt, while maintaining ample liquidity for operations $0.7B in Jazz shares Targeting less than 3.5x net leverage by the end of 2022 Approvals & Timing Transaction has been unanimously approved by both Jazz and GW Boards of Directors Anticipated closing in the second quarter of 2021 Transaction subject to customary regulatory approvals and approval of GW shareholders1 Until closing, both companies will continue to operate independently Transaction Overview 1 Also subject to sanction by the High Court of Justice of England and Wales February 2021 Substantial Value Transforming Patient Lives Robust Pipeline Third High-Growth Franchise Neuroscience Leader

Shared Commitment to Innovating to Transform Patient Lives Life-Changing Medicines. Redefining Possibilities. Shared Culture and Exceptional Talent Will Advance our Mission to Transform the Lives of Patients The only low-sodium oxybate for cataplexy or EDS in narcolepsy Sara Narcolepsy Patient1 Novel treatment for childhood-onset epilepsy and pioneering cannabinoid therapeutic Piper Dravet Patient First approval in second-line SCLC treatment in over 20 years Making “small wins” big again Substantial Value Transforming Patient Lives Robust Pipeline Third High-Growth Franchise Neuroscience Leader 1 Participant in JZP-258 trial February 2021

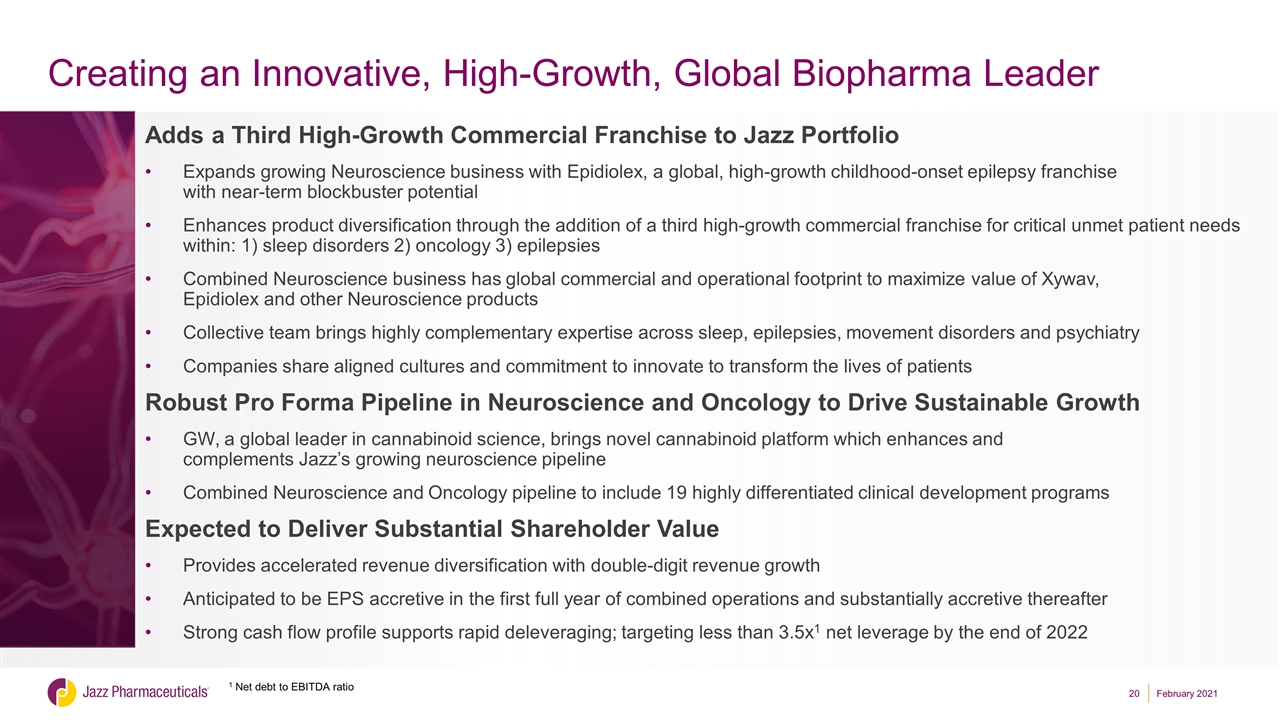

February 2021 Adds a Third High-Growth Commercial Franchise to Jazz Portfolio Expands growing Neuroscience business with Epidiolex, a global, high-growth childhood-onset epilepsy franchise with near-term blockbuster potential Enhances product diversification through the addition of a third high-growth commercial franchise for critical unmet patient needs within: 1) sleep disorders 2) oncology 3) epilepsies Combined Neuroscience business has global commercial and operational footprint to maximize value of Xywav, Epidiolex and other Neuroscience products Collective team brings highly complementary expertise across sleep, epilepsies, movement disorders and psychiatry Companies share aligned cultures and commitment to innovate to transform the lives of patients Robust Pro Forma Pipeline in Neuroscience and Oncology to Drive Sustainable Growth GW, a global leader in cannabinoid science, brings novel cannabinoid platform which enhances and complements Jazz’s growing neuroscience pipeline Combined Neuroscience and Oncology pipeline to include 19 highly differentiated clinical development programs Expected to Deliver Substantial Shareholder Value Provides accelerated revenue diversification with double-digit revenue growth Anticipated to be EPS accretive in the first full year of combined operations and substantially accretive thereafter Strong cash flow profile supports rapid deleveraging; targeting less than 3.5x1 net leverage by the end of 2022 Creating an Innovative, High-Growth, Global Biopharma Leader 1 Net debt to EBITDA ratio

Q&A