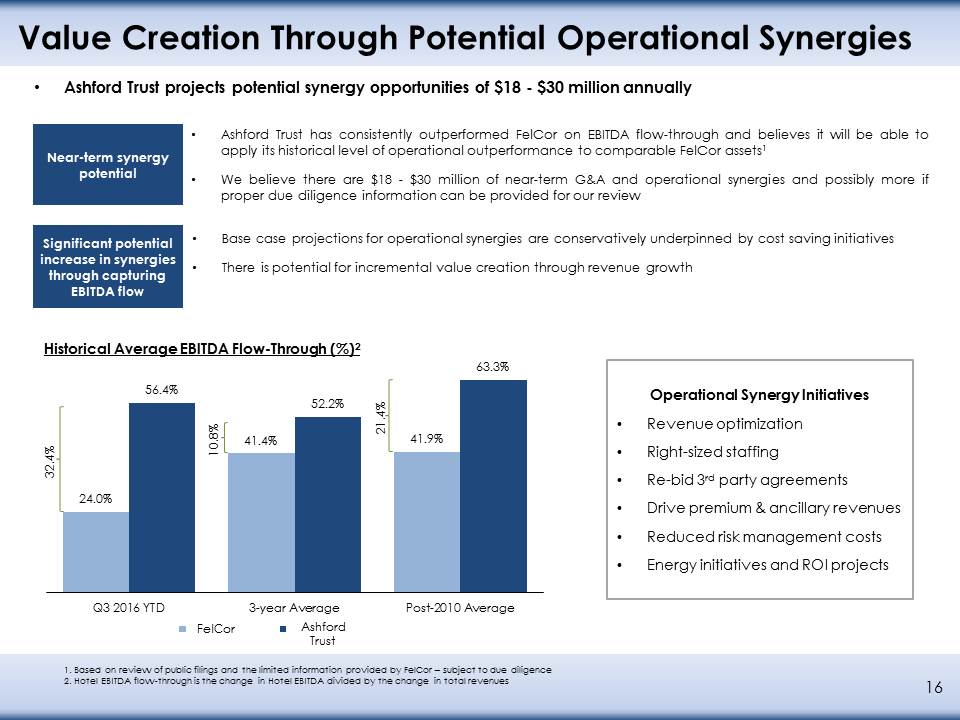

Safe Harbor 3 Forward Looking StatementsIn keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the Company's filings with the Securities and Exchange Commission. In addition, material risks that could cause actual results to differ from forward-looking statements include: the inherent uncertainty associated with financial or other projections; the ability to successfully integrate Ashford Hospitality Trust, Inc. and FelCor Lodging Trust Incorporated; and the ability to recognize the anticipated benefits from the proposed combination of Ashford Hospitality Trust, Inc. and FelCor Lodging Trust Incorporated, including the anticipated synergies resulting from the proposed combination.Non-GAAP Financial MeasuresThis presentation includes certain non-GAAP financial measures, including but not limited to net operating income and EBITDA (collectively, “non-GAAP financial measures”). These non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC.Ashford Trust believes that the presentation of these financial measures enhances an investor’s understanding of Ashford Trust’s and FelCor’s financial performance. Ashford Trust further believes that these financial measures are useful financial metrics to assess operating performance from period to period by excluding certain items that it believes are not representative of Ashford Trust’s and FelCor’s respective core businesses. Ashford Trust also believes that these financial measures provide investors with a useful tool for assessing the comparability between periods of Ashford Trust’s and FelCor’s respective abilities to generate cash from operations sufficient to pay taxes, to service debt and to undertake capital expenditures. Ashford Trust believes these financial measures are commonly used by investors in our industry to evaluate companies’ performance. However, the use of these non-GAAP financial measures in this presentation may vary from that of other companies in Ashford Trust’s and FelCor’s industry. These non-GAAP financial measures should not be considered as alternatives to performance measures derived in accordance with GAAP.