Exhibit 99.1

Exhibit 99.1

ASHFORD HOSPITALITY TRUST

Barclays Capital Conference

Highland Hospitality Update

December 2011

Safe Harbor

In keeping with the SEC’s “Safe Harbor” guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words “will likely result,” “may,” “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures.

These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the Company’s filings with the Securities and Exchange Commission.

EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC.

This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Trust, Inc. and may not be relied upon in connection with the purchase or sale of any such security.

Highland Portfolio

Hilton Parsippany Renaissance Palm Springs The Melrose – Washington, DC Marriott DFW Airport Hyatt Regency Wind Watch

Marriott Plaza San Antonio Boston Back Bay Hilton Hilton Tampa Westshore Renaissance Nashville Marriott Sugar Land

Hyatt Regency Savannah Ritz-Carlton Atlanta Westin Princeton Renaissance Portsmouth The Silversmith—Chicago

Highland Transaction Summary

Transformational 28-hotel, $1.3 billion acquisition with 8,084 rooms

Primarily upper-upscale and luxury full-service assets

Expands Ashford’s presence in key markets (Washington D.C and NY/NJ) and into new markets (Boston and Nashville)

Significant growth potential with affiliate manager Remington taking over management of 19 hotels

2010 EBITDA flows of 18% vs. AHT’s of 104% and NOI 36% below peak

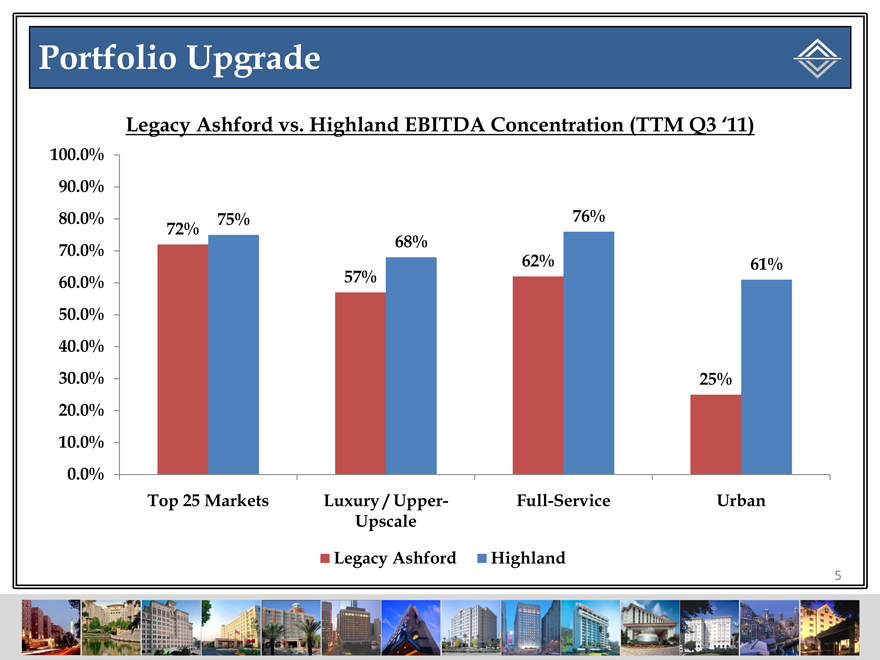

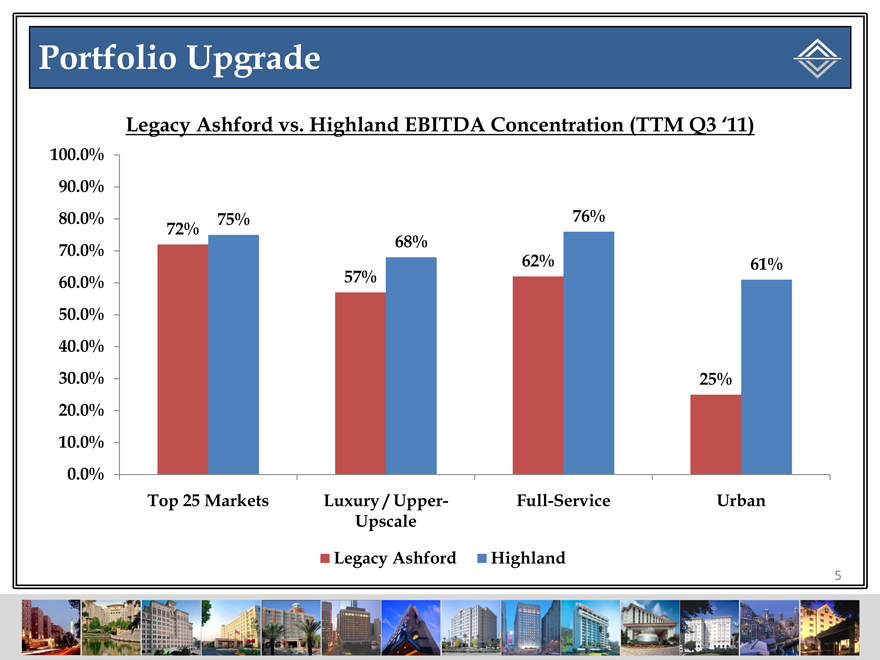

Portfolio Upgrade

Legacy Ashford vs. Highland EBITDA Concentration (TTM Q3 ‘11)

100.0%

90.0%

80.0%

75%

76%

72%

70.0%

68%

62%

61%

60.0%

57%

50.0%

40.0%

30.0%

25%

20.0%

10.0%

0.0%

Top 25 Markets

Luxury / Upper- Upscale

Full-Service

Urban

Legacy Ashford

Highland

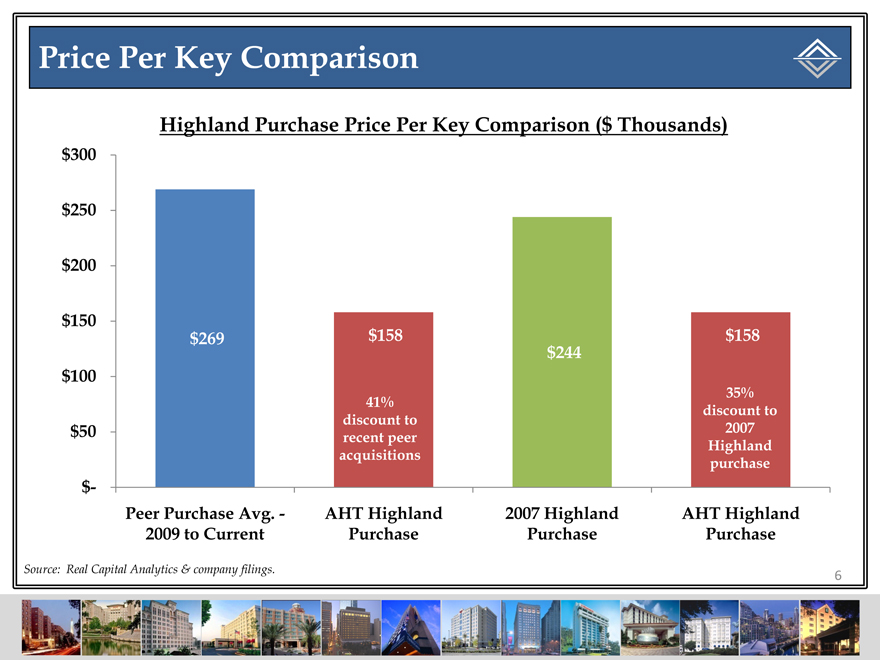

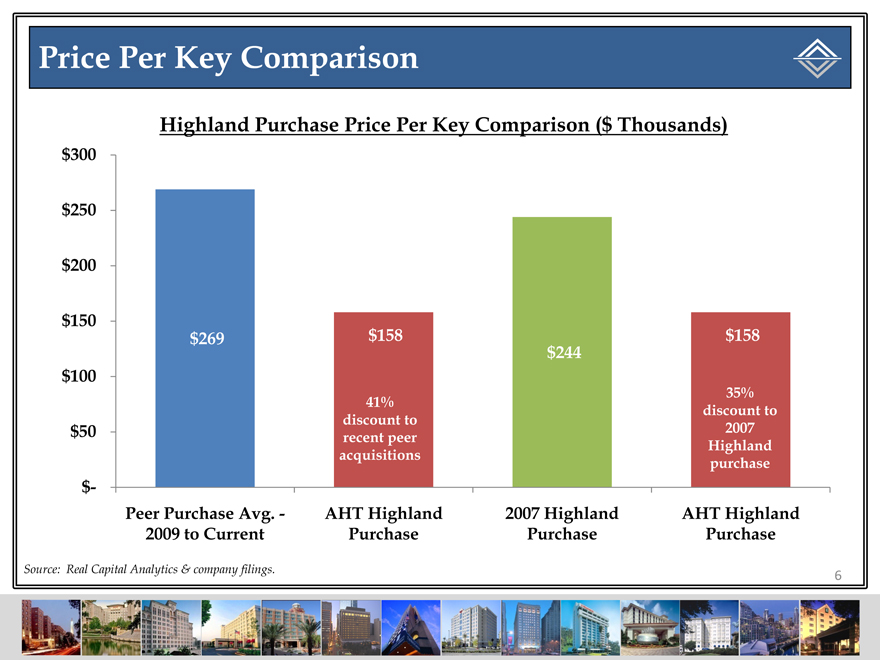

Price Per Key Comparison

Highland Purchase Price Per Key Comparison ($ Thousands)

$300

$250

$200

$150

$100

$269

$158

$244

$158

35%

$50

41%

discount to

discount to

2007

$—

recent peer

Highland

acquisitions

purchase

Peer Purchase Avg. -

AHT Highland

2007 Highland

AHT Highland

2009 to Current

Purchase

Purchase

Purchase

Source: Real Capital Analytics & company filings.

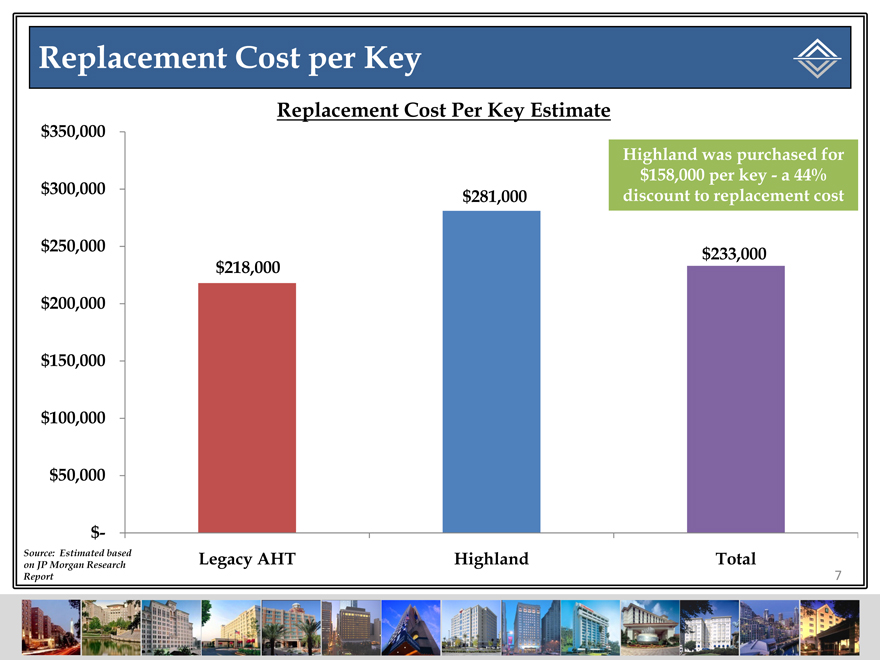

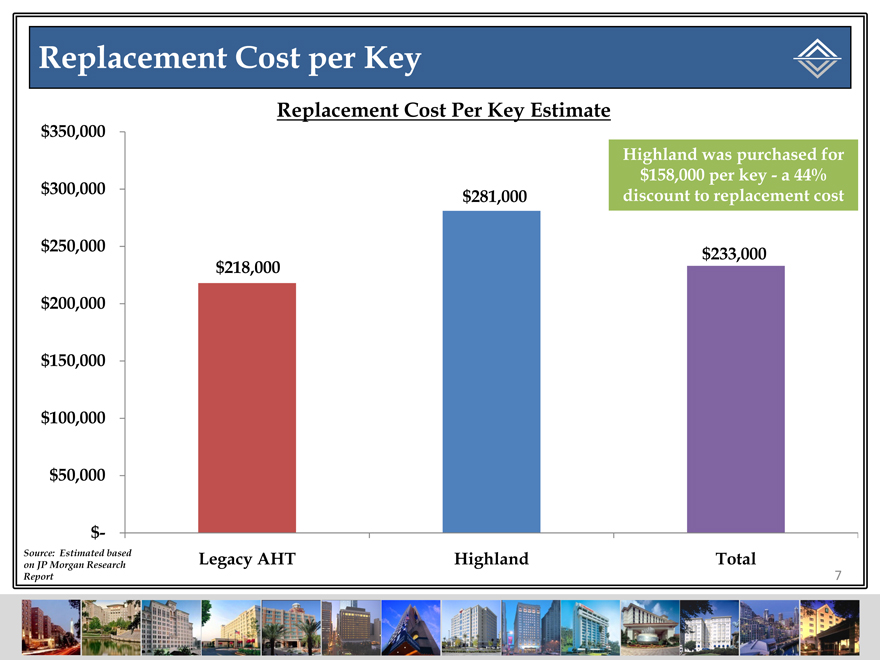

Replacement Cost per Key

Replacement Cost Per Key Estimate

$350,000

Highland was purchased for

$158,000 per key - a 44%

$300,000

discount to replacement cost

$250,000

$218,000

$281,000

$233,000

$200,000

$150,000

$100,000

$50,000

$—

Legacy AHT

Highland

Total

Source: Estimated based on JP Morgan Research Report

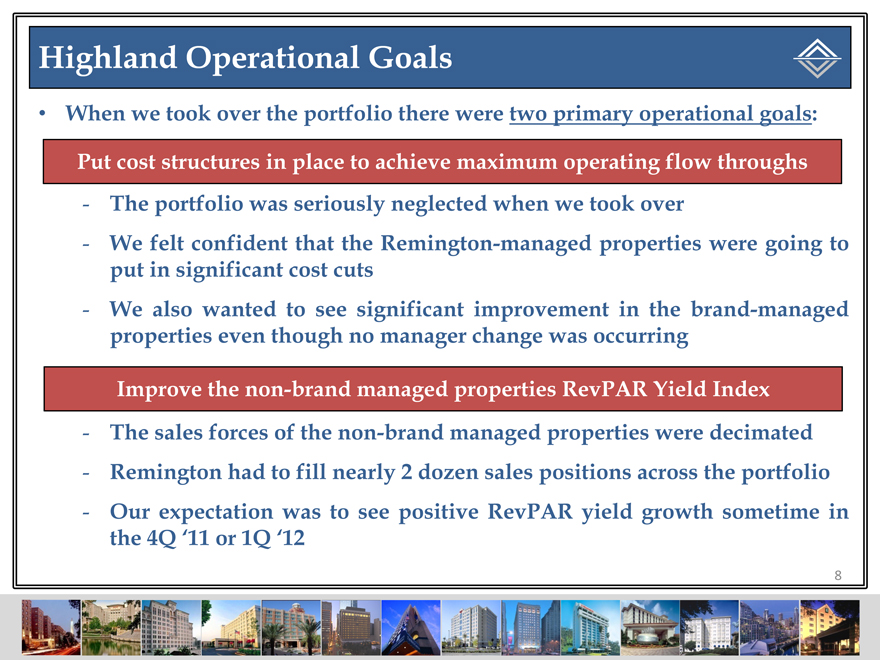

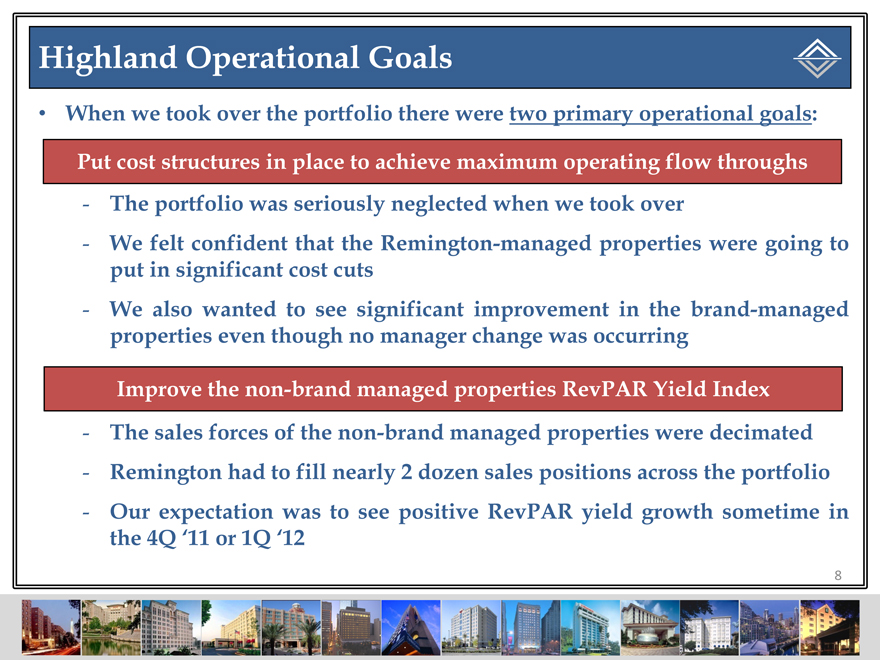

Highland Operational Goals

When we took over the portfolio there were two primary operational goals: Put cost structures in place to achieve maximum operating flow throughs

The portfolio was seriously neglected when we took over

We felt confident that the Remington-managed properties were going to put in significant cost cuts

We also wanted to see significant improvement in the brand-managed properties even though no manager change was occurring

Improve the non-brand managed properties RevPAR Yield Index

The sales forces of the non-brand managed properties were decimated

Remington had to fill nearly 2 dozen sales positions across the portfolio

Our expectation was to see positive RevPAR yield growth sometime in the 4Q ‘11 or 1Q ‘12

8

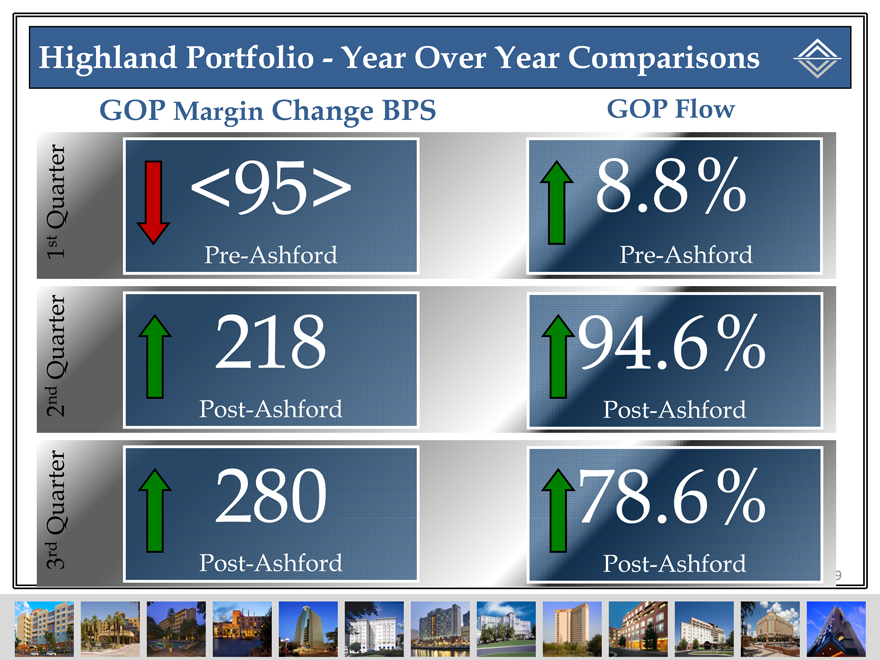

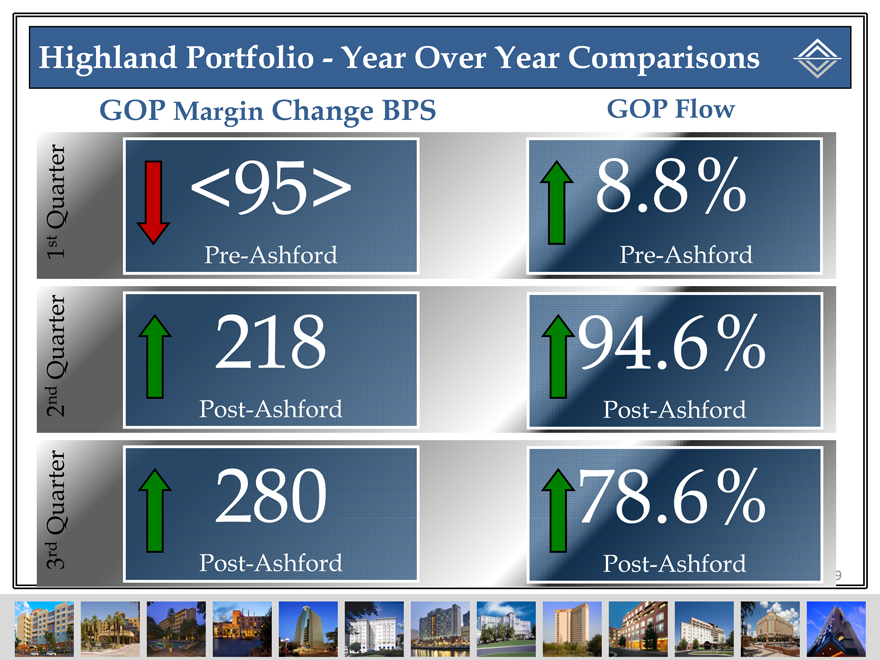

Highland Portfolio—Year Over Year Comparisons

GOP

Margin Change

BPS

GOP Flow

<95>

8.8%

1st Quarter

Pre-Ashford

Pre-Ashford

218

94.6%

2nd Quarter

Post-Ashford

Post-Ashford

280

78.6%

3rd Quart er

Post-Ashford

Post-Ashford

9

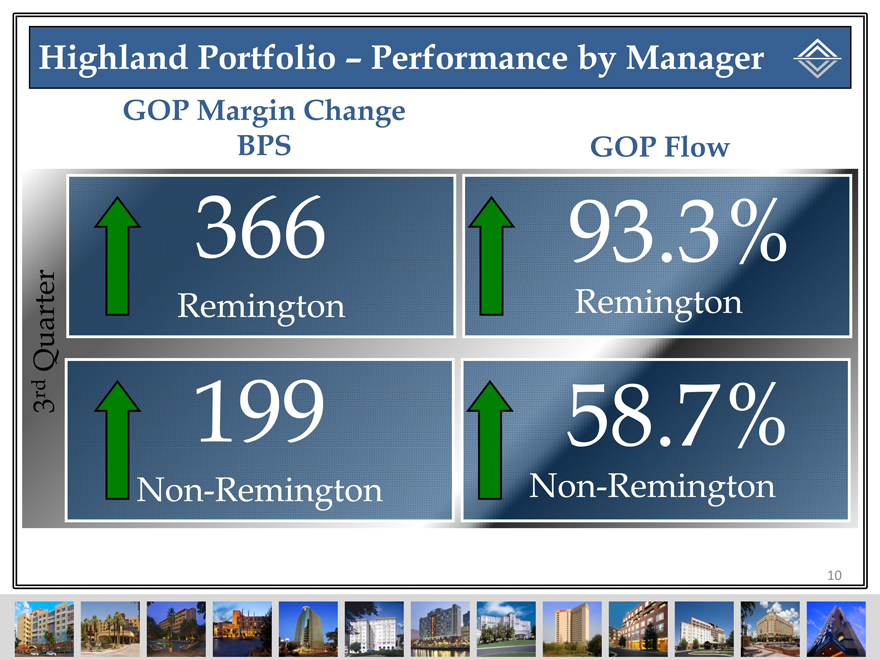

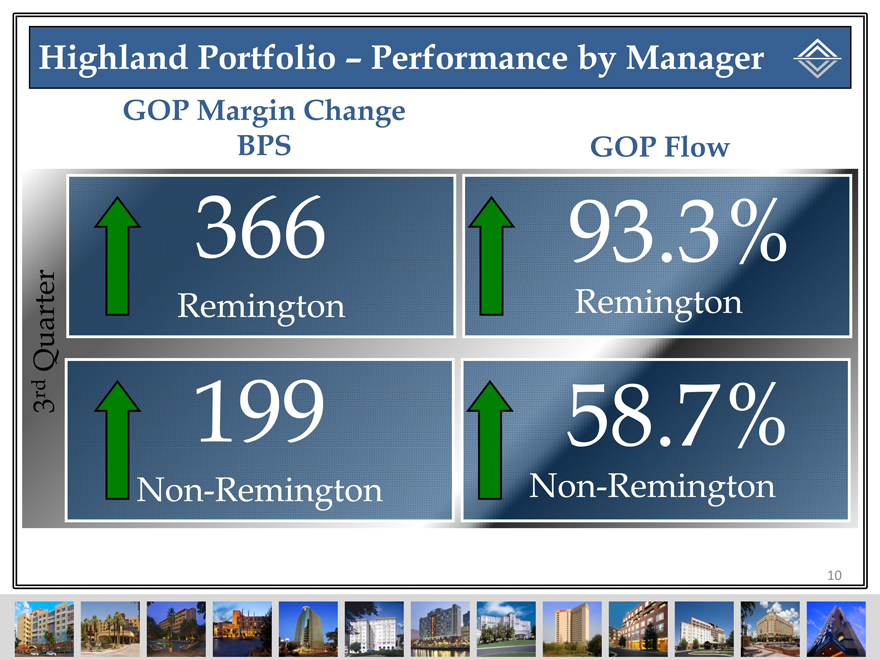

Highland Portfolio – Performance by Manager

GOP Margin Change BPS

GOP Flow

366

93.3%

Remington

Remington

3rd Quarter

199

58.7%

Non-Remington

Non-Remington

10

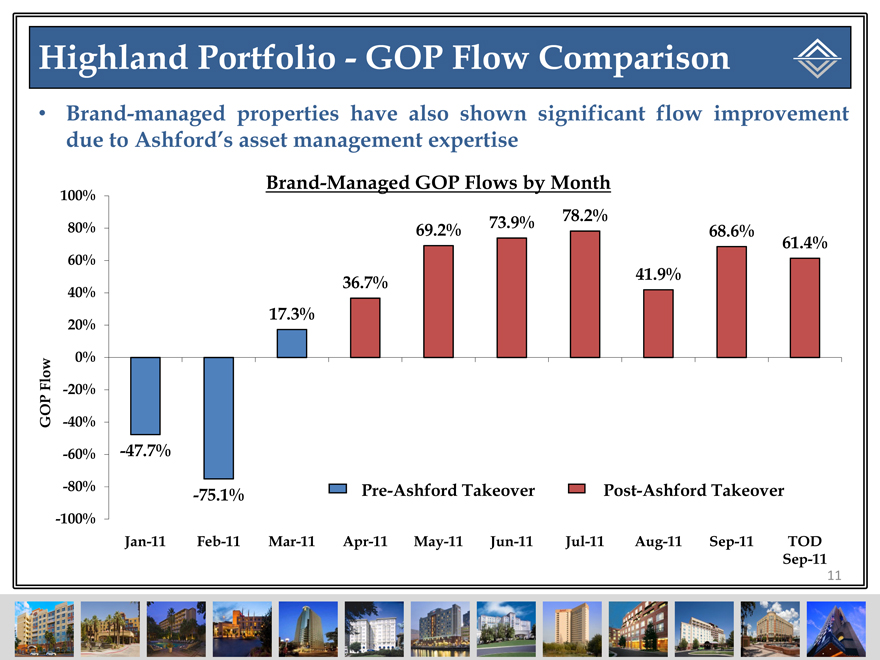

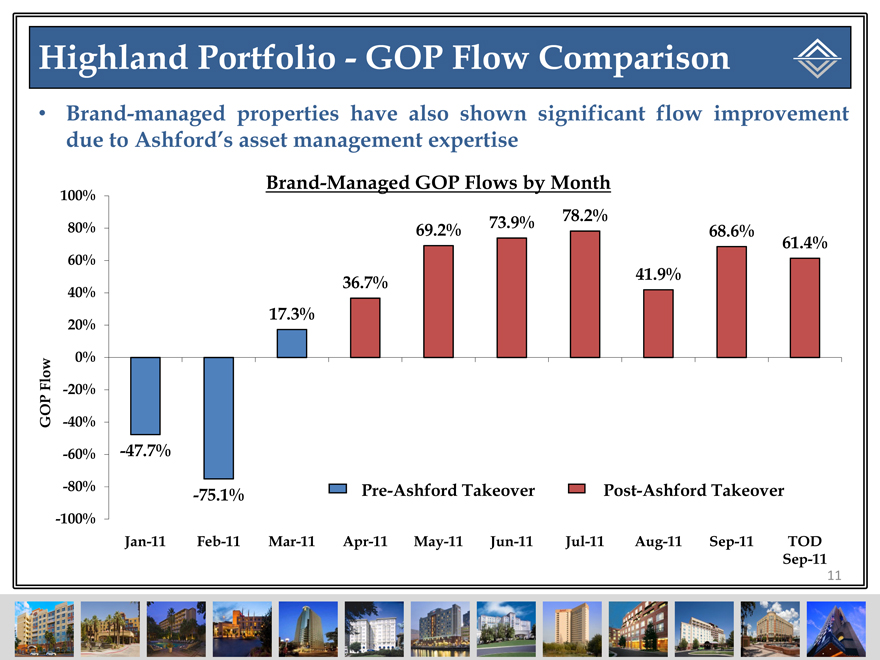

Highland Portfolio—GOP Flow Comparison

Brand-managed properties have also shown significant flow improvement due to Ashford’s asset management expertise

Brand-Managed GOP Flows by Month

GOP Flow

100%

73.9%

78.2%

80%

69.2%

68.6%

61.4%

60%

36.7%

41.9%

40%

20%

17.3%

0%

-20%

-40%

-60%

-47.7%

-80%

Pre-Ashford Takeover

Post-Ashford Takeover

-75.1%

-100%

Jan-11

Feb-11

Mar-11

Apr-11

May-11

Jun-11

Jul-11

Aug-11

Sep-11

TOD

Sep-11

11

Remington RevPAR Index Improvement

RevPAR for Remington-managed properties is improving sooner than expected and is beginning to more closely match brand-managed properties

2.0%

1.4%

1.0%

0.9%

0.2%

0.0%

-1.0%

-0.7%

-2.0%

-1.9%

-3.0%

-4.0%

-5.0%

-5.2%

-6.0%

Remington RevPAR Index

Brand-Managed RevPAR Index

Total Highland RevPAR Index

Q2 2011

Q3 2011

12

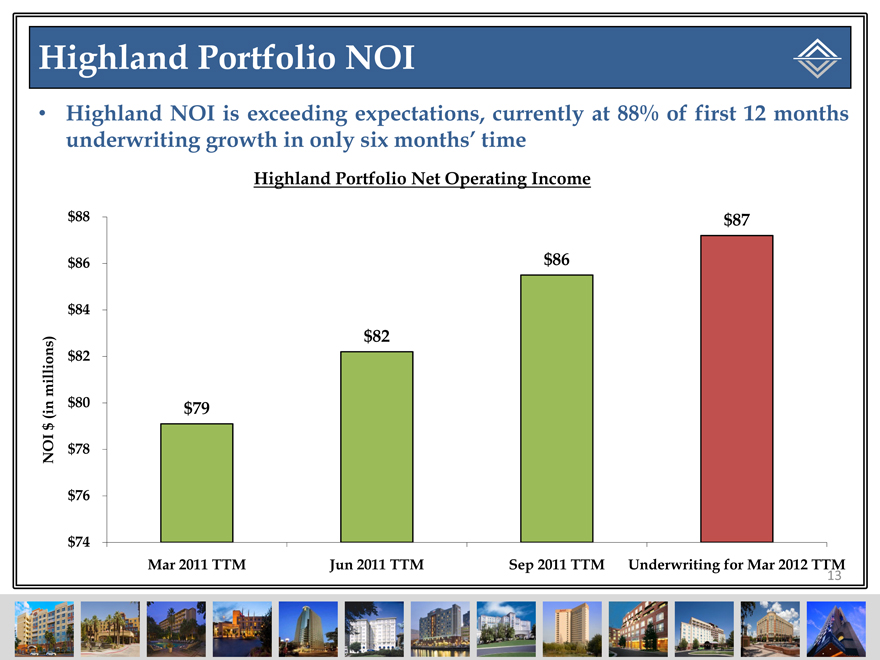

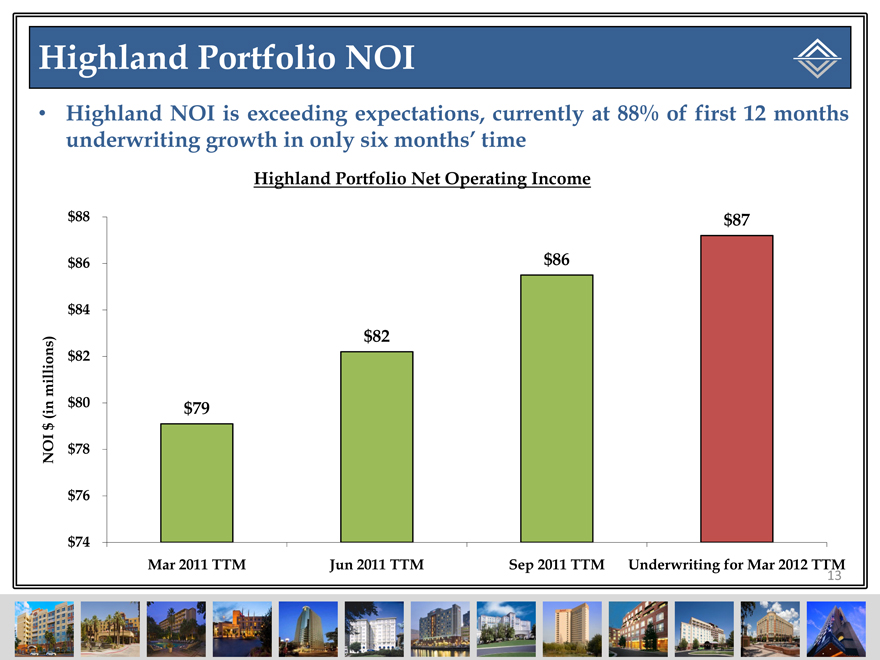

Highland Portfolio NOI

Highland NOI is exceeding expectations, currently at 88% of first 12 months underwriting growth in only six months’ time

Highland Portfolio Net Operating Income

$88

$86

$84

$82

$80

$78

$76

$74

$79

$82

$86

$87

Mar 2011 TTM

Jun 2011 TTM

Sep 2011 TTM

Underwriting for Mar 2012 TTM

NOI $ (in millions)

13

13

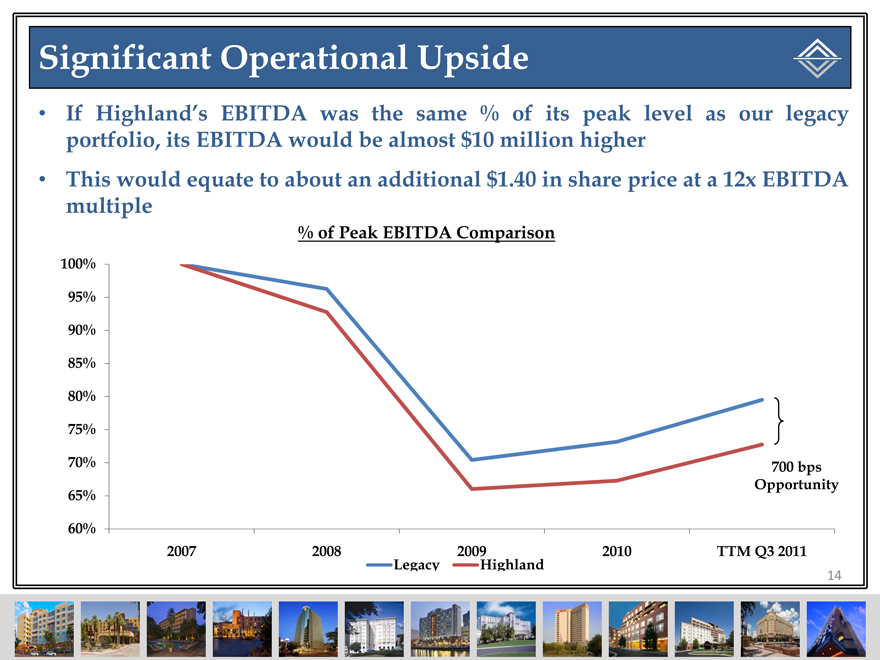

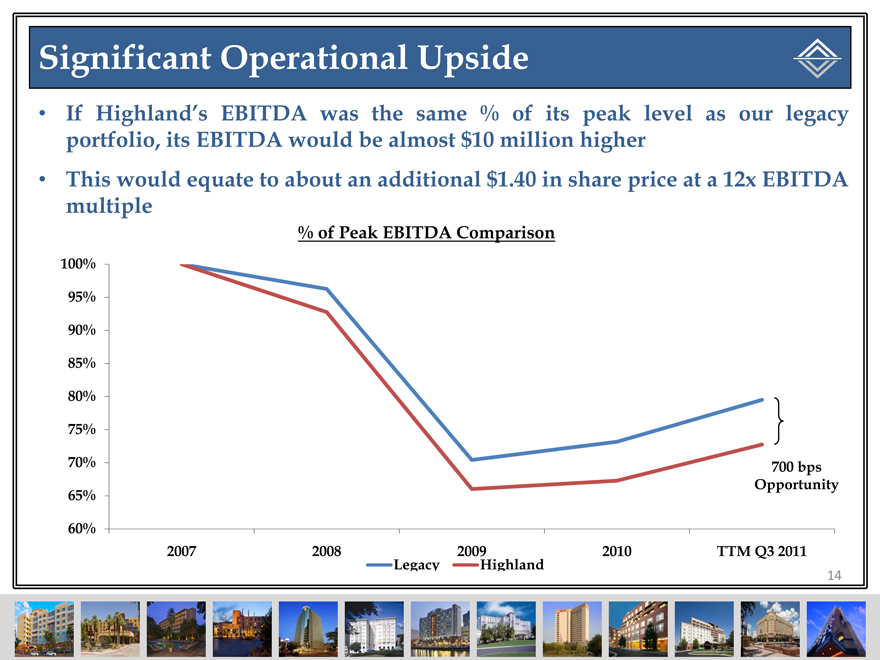

Significant Operational Upside

If Highland’s EBITDA was the same % of its peak level as our legacy portfolio, its EBITDA would be almost $10 million higher

This would equate to about an additional $1.40 in share price at a 12x EBITDA multiple

% of Peak EBITDA Comparison

100%

95%

90%

85%

80%

75%

70%

700 bps

Opportunity

65%

60%

2007

2008

2009

2010

TTM Q3 2011

Legacy

Highland

14

Key Capex Renovations

Property

Project

Scheduled Start Date

Budget

Courtyard Denver

Lobby Bistro

Completed in Q2’11

$875,000

Hyatt Windwatch

Exterior Façade

In progress

$1,400,000

Marriott Omaha

Lobby & Restaurant

Early November

$1,350,000

The Churchill

Lobby & Restaurant

Mid-November

$871,000

The Melrose

Guestrooms & Public Space

Late-November

$8,050,000

Courtyard Savannah

Guestrooms & Bistro Lobby

Early-December

$2,475,000

Marriott San Antonio

Guestrooms & Corridors

Mid-December

$3,815,000

Courtyard Boston Tremont

HVAC

January-February

$5,781,000

Hilton Boston Back Bay

66 Guestrooms & Meeting Space

February

$2,160,000

Ritz-Carlton Atlanta

Meeting Space

February

$757,000

HGI Virginia Beach

Guestrooms & Corridor

Q1 2012

$2,000,000

The Silversmith

Guestrooms & Public Space

Q2 2012

$5,000,000

On Hold for

Marriott DFW

Restaurant Renovation

$750,000

Repositioning

15

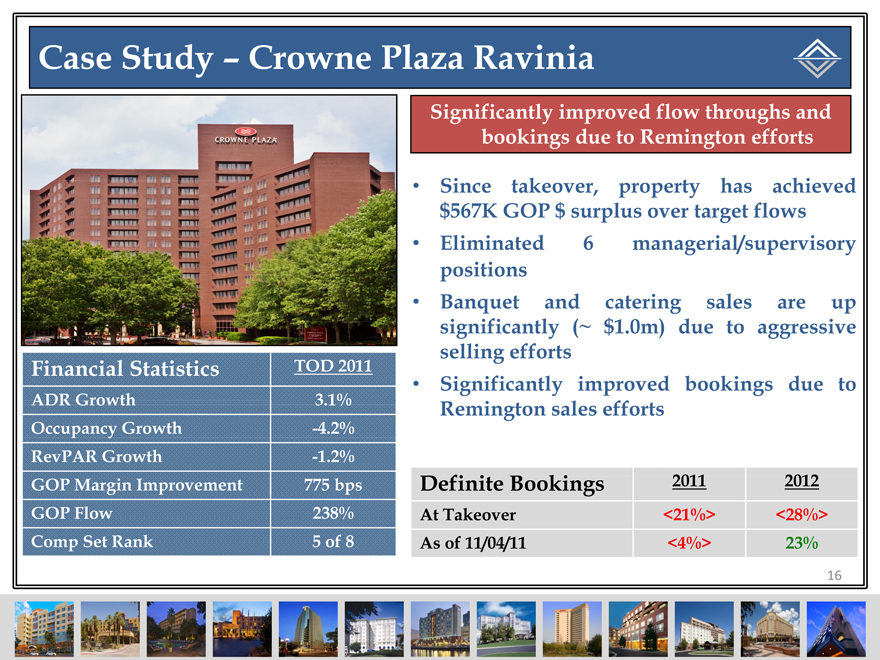

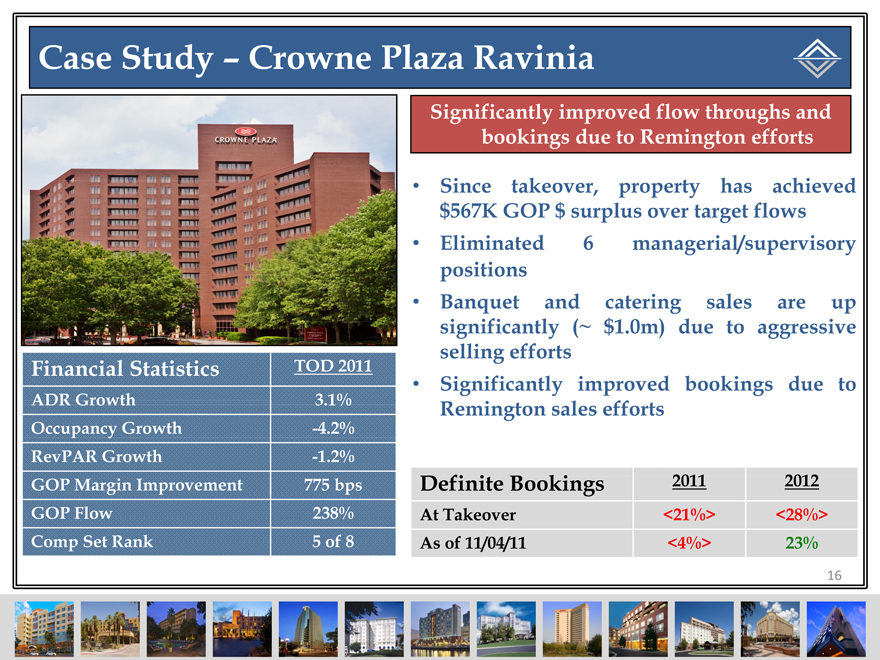

Case Study – Crowne Plaza Ravinia

Financial Statistics

TOD 2011

ADR Growth

3.1%

Occupancy Growth

-4.2%

RevPAR Growth

-1.2%

GOP Margin Improvement

775 bps

GOP Flow

238%

Comp Set Rank

5 of 8

Significantly improved flow throughs and bookings due to Remington efforts

Since takeover, property has achieved $567K GOP $ surplus over target flows

Eliminated 6 managerial/supervisory positions

Banquet and catering sales are up significantly (~ $1.0m) due to aggressive selling efforts

Significantly improved bookings due to Remington sales efforts

Definite Bookings 2011 2012

At Takeover <21%> <28%>

As of 11/04/11 <4%> 23%

16

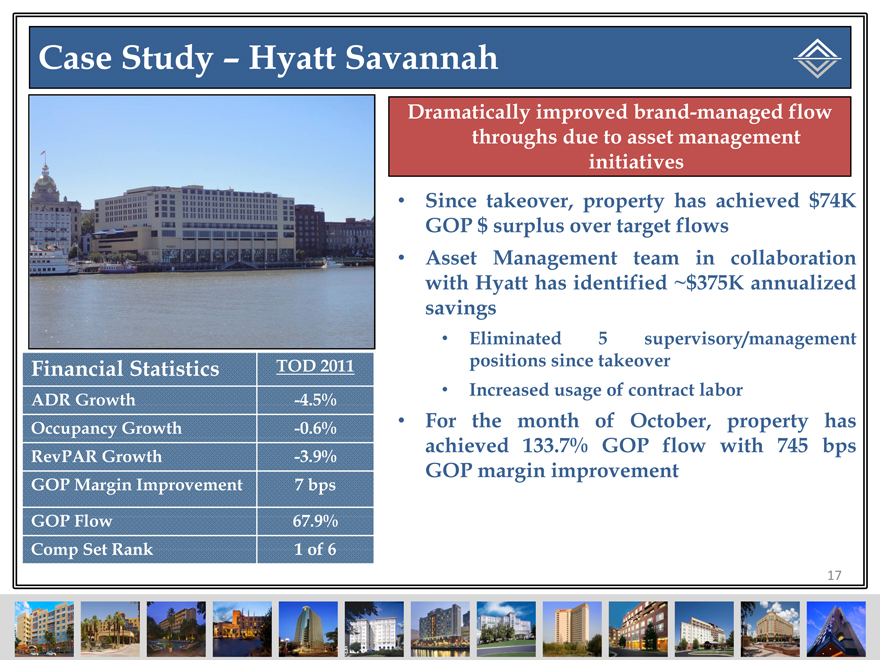

Case Study – Hyatt Savannah

Dramatically improved brand-managed flow throughs due to asset management initiatives

Since takeover, property has achieved $74K GOP $ surplus over target flows

Asset Management team in collaboration with Hyatt has identified ~$375K annualized savings

Eliminated 5 supervisory/management positions since takeover

Increased usage of contract labor

For the month of October, property has achieved 133.7% GOP flow with 745 bps GOP margin improvement

Financial Statistics

TOD 2011

ADR Growth

-4.5%

Occupancy Growth

-0.6%

RevPAR Growth

-3.9%

GOP Margin Improvement

7 bps

GOP Flow

67.9%

Comp Set Rank

1 of 6

17

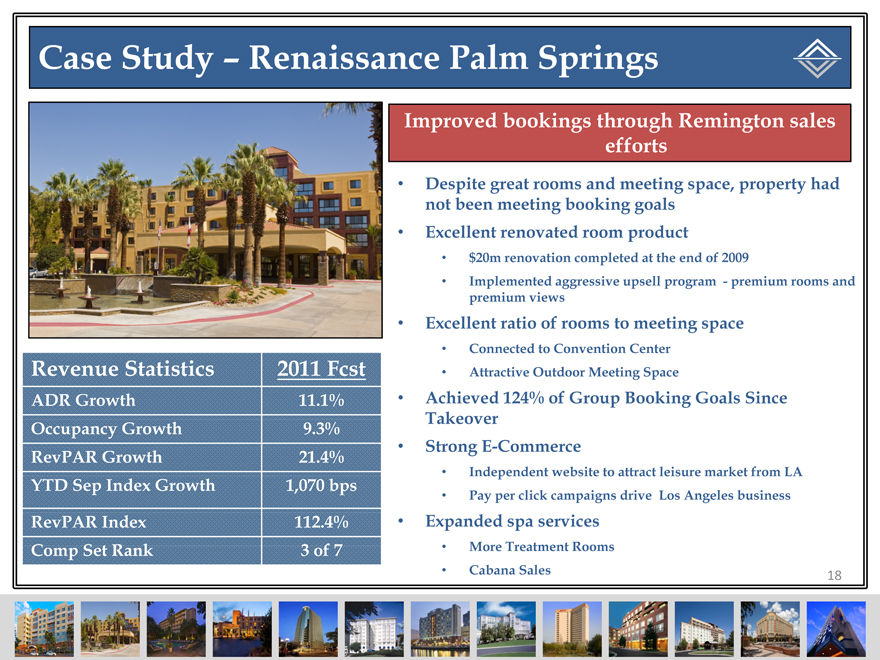

Case Study – Renaissance Palm Springs

Revenue Statistics

2011 Fcst

ADR Growth

11.1%

Occupancy Growth

9.3%

RevPAR Growth

21.4%

YTD Sep Index Growth

1,070 bps

RevPAR Index

112.4%

Comp Set Rank

3 of 7

Improved bookings through Remington sales efforts

Despite great rooms and meeting space, property had not been meeting booking goals

Excellent renovated room product

$20m renovation completed at the end of 2009

Implemented aggressive upsell program—premium rooms and premium views

Excellent ratio of rooms to meeting space

Connected to Convention Center

Attractive Outdoor Meeting Space

Achieved 124% of Group Booking Goals Since Takeover

Strong E-Commerce

Independent website to attract leisure market from LA

Pay per click campaigns drive Los Angeles business

Expanded spa services

More Treatment Rooms

Cabana Sales

18

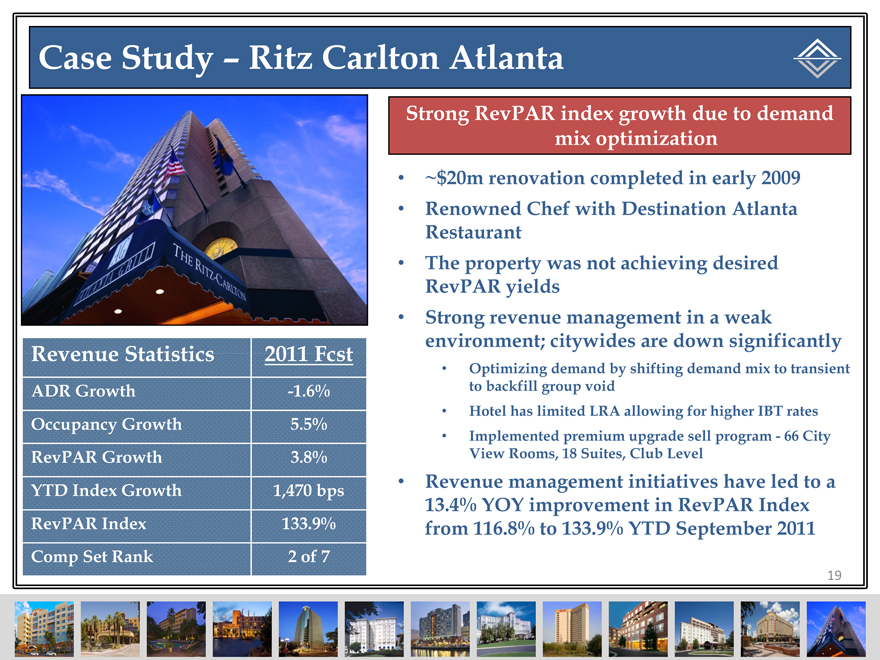

Case Study – Ritz Carlton Atlanta

Revenue Statistics

2011 Fcst

ADR Growth

-1.6%

Occupancy Growth

5.5%

RevPAR Growth

3.8%

YTD Index Growth

1,470 bps

RevPAR Index

133.9%

Comp Set Rank

2 of 7

Strong RevPAR index growth due to demand mix optimization

~$20m renovation completed in early 2009

Renowned Chef with Destination Atlanta Restaurant

The property was not achieving desired RevPAR yields

Strong revenue management in a weak environment; citywides are down significantly

Optimizing demand by shifting demand mix to transient to backfill group void

Hotel has limited LRA allowing for higher IBT rates

Implemented premium upgrade sell program—66 City View Rooms, 18 Suites, Club Level

Revenue management initiatives have led to a 13.4% YOY improvement in RevPAR Index from 116.8% to 133.9% YTD September 2011

19

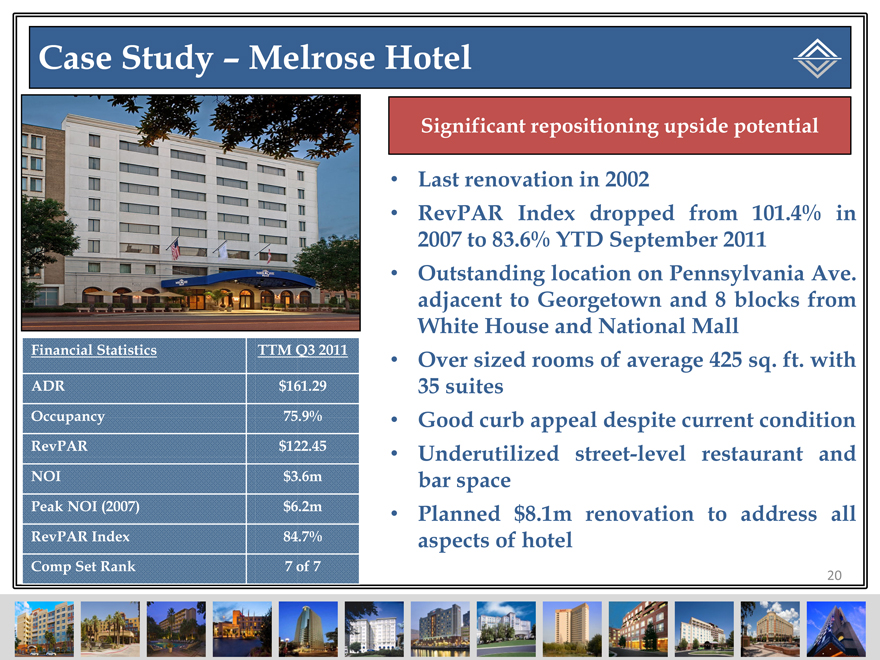

Case Study – Melrose Hotel

Financial Statistics

TTM Q3 2011

ADR

$161.29

Occupancy

75.9%

RevPAR

$122.45

NOI

$3.6m

Peak NOI (2007)

$6.2m

RevPAR Index

84.7%

Comp Set Rank

7 of 7

Significant repositioning upside potential

Last renovation in 2002

RevPAR Index dropped from 101.4% in 2007 to 83.6% YTD September 2011

Outstanding location on Pennsylvania Ave. adjacent to Georgetown and 8 blocks from White House and National Mall

Over sized rooms of average 425 sq. ft. with 35 suites

Good curb appeal despite current condition

Underutilized street-level restaurant and bar space

Planned $8.1m renovation to address all aspects of hotel

20

Highland Transaction Conclusion

We purchased a remarkable portfolio for nearly half of its replacement cost and materially below what our peers are paying for assets

We have made significant progress in achieving operational flow throughs and pushing RevPAR yield index

In only six months’ time our asset management group has managed to achieve nearly 90% of its 1st year NOI target

The Highland portfolio is off its peak substantially more than our legacy portfolio, providing us with additional upside

Our strategic capex will help realize additional upside potential

21

ASHFORD HOSPITALITY TRUST

Barclays Capital Conference

Highland Hospitality Update

December 2011