CONSENT AGREEMENT

(MEZZ 1)

THIS CONSENT AGREEMENT (this “Agreement”) is entered into as of this 27th day of December, 2012, by and among (i) AMERICAN EQUITY INVESTMENT LIFE INSURANCE COMPANY (“American”), ATHENE ANNUITY & LIFE ASSURANCE COMPANY (“Athene”), NEWCASTLE CDO VIII 1, LIMITED (“Newcastle VIII”), NEWCASTLE CDO IX 1, LIMITED (“Newcastle IX”), PRINCIPAL LIFE INSURANCE COMPANY (“Principal”; American, Athene, Newcastle VIII, Newcastle IX and Principal, individually and/or collectively, as the context may require, together with their respective successors and assigns, “Lender”), (ii) HH SWAP A LLC, HH SWAP C LLC, HH SWAP C-1 LLC, HH SWAP D LLC, HH SWAP F LLC, HH SWAP F-1 LLC, and HH SWAP G LLC, each a Delaware limited liability company (individually and collectively as the context may require, “Borrower”), and (iii) Ashford Hospitality Limited Partnership, a Delaware limited partnership (“Ashford Guarantor”) and PRISA III REIT Operating LP, a Delaware limited partnership (“Prudential Guarantor”; Ashford Guarantor and Prudential Guarantor, individually and/or together, as the context may require, “Guarantor”).

RECITALS

A.Pursuant to that certain Amended and Restated Mezzanine 1 Loan Agreement, dated as of March 10, 2011 (the “Closing Date”), by and between (i) Borrower and (ii) BRE/HH Acquisitions L.L.C. (“Prior Blackstone Lender”) and Barclays Capital Real Estate Finance Inc. (“Prior Barclays Lender”, together with Prior Blackstone Lender, “Prior Lender”) (as amended, restated, supplemented, or otherwise modified prior to the date hereof, the “Loan Agreement”), Prior Lender amended and restated a loan to Borrower in the then outstanding principal amount of $144,745,920.40 (the “Loan”), as evidenced by (i) that certain Second Amended and Restated Promissory Note A-1, dated as of the Closing Date, by Borrower in favor of Prior Blackstone Lender in the original principal amount of $115,796,736.32 (“Restructuring Note A-1”) and (ii) that certain Amended and Restated Promissory Note A-2, dated as of the Closing Date, by Borrower in favor of Prior Barclays Lender in the original principal amount of $28,949,184.08 and (“Restructuring Note A-2”).

B.Restructuring Note A-1 and Restructuring Note A-2 were canceled and replaced with that certain Replacement Mezzanine 1 Promissory Note A-1 dated as of May 23, 2011, by Borrower in favor of American in the principal amount of $59,500,000.00 (“Note A-1”), that certain Replacement Mezzanine 1 Promissory Note A-2 dated as of May 23, 2011, by Borrower in favor of Liberty Life Insurance Company in the principal amount of $12,840,681.73 (“Note A-2”), that certain Replacement Mezzanine 1 Promissory Note A-3 dated as of May 23, 2011, by Borrower in favor of Newcastle VII in the principal amount of $19,991,080.02 (“Note A-3”), that certain Replacement Mezzanine 1 Promissory Note A-4 dated as of May 23, 2011, by Borrower in favor of Newcastle IX in the principal amount of $19,991,080.02 (“Note A-4”), that certain Replacement Mezzanine 1 Promissory Note A-5 dated as of May 23, 2011, by Borrower in favor of Fir Tree REOF II Master Fund, LLC in the principal amount of $12,403,203.71 (“Note A-5”), and that certain Replacement Mezzanine 1 Promissory Note A-6 dated as of May 23, 2011, by

Borrower in favor of Fir Tree Capital Opportunity Master Fund, L.P. in the principal amount of $19,955,317.97 (“Note A-6”, collectively with Note A-1, Note A-2, Note A-3, Note A-4 and Note A-5, the “Note”).

C.American is the current holder of Note A-1 the outstanding principal balance of which, prior to application of any prepayments contemplated by this Agreement, is $54,565,793.32.

D.Athene is the current holder of Note A-2 the outstanding principal balance of which, prior to application of any prepayments contemplated by this Agreement, is $11,775,831.68.

E.Newcastle VIII is the current holder of Note A-3 the outstanding principal balance of which, prior to application of any prepayments contemplated by this Agreement, is $18,333,262.86.

F.Newcastle IX is the current holder of Note A-4 the outstanding principal balance of which, prior to application of any prepayments contemplated by this Agreement, is $18,333,262.82.

G.Principal is the current holder of Note A-5 the outstanding principal balance of which, prior to application of any prepayments contemplated by this Agreement, is $11,374,632.76.

H.Principal is the current holder of Note A-6 the outstanding principal balance of which, prior to application of any prepayments contemplated by this Agreement, is $18,300,466.48.

I.In connection with the Loan, Guarantor executed a Mezzanine 1 Guaranty and Indemnity Agreement, dated as of the Closing Date (the “Guaranty”).

J.Simultaneously with the initial funding of the Loan, Wachovia (predecessor-in-interest to Wells Fargo), in its capacity as mortgage lender, and Barclays Capital Real Estate Inc., a Delaware corporation (“Barclays Mortgage Lender”; Barclays Mortgage Lender and Wachovia, collectively, “Original Wells Fargo Mortgage Loan Lender”) made a loan in the original principal amount of $700,000,000 (the “Original Wells Fargo Mortgage Loan”) to the entities set forth on Schedule I to the Existing Wells Fargo Mortgage Loan Agreement (as hereinafter defined), as borrowers (collectively, “Wells Fargo Borrower”) and the entities set forth on Schedule II attached to the Existing Wells Fargo Mortgage Loan Agreement (as hereinafter defined) (collectively, “ Wells Fargo Operating Lessee”; together with Wells Fargo Borrower, collectively, “Wells Fargo Mortgage Loan Borrower”) pursuant to that certain Mortgage Loan Agreement, dated as of July 17, 2007 (as amended, restated, supplemented or otherwise replaced prior to the date hereof, the “Existing Wells Fargo Mortgage Loan Agreement”) among Original Wells Fargo Mortgage Loan Lender, Wells Fargo Mortgage Loan Borrower, HH Gaithersburg, LLC, a Delaware limited liability company, HH Baltimore LLC, a Delaware limited liability company, and HH Annapolis LLC, a Delaware limited liability company (collectively, “Maryland Owner”). The Original Wells Fargo Mortgage Loan is

evidenced by (i) the Second Amended and Restated Promissory Note A-1 in the original principal amount of $560,000,000 dated December 28, 2007 and effective July 17, 2007 made by Wells Fargo Mortgage Loan Borrower to the order of Wachovia and (ii) Promissory Note A-2 in the original principal amount of $140,000,000 dated December 28, 2007 and effective July 17, 2007 made by Wells Fargo Mortgage Loan Borrower to the order of Barclays Mortgage Lender ((i) and (ii) collectively, the “Existing Wells Fargo Mortgage Note”) and is secured by, among other things, each of the Mortgages (as defined in the Existing Wells Fargo Mortgage Loan Agreement) (the “Original Mortgages”) made by the applicable Wells Fargo Mortgage Loan Borrower, Operating Lessee or Maryland Owner, as the case may be, in favor of Original Wells Fargo Mortgage Loan Lender, pursuant to which the applicable Wells Fargo Mortgage Loan Borrower, Operating Lessee and/or Maryland Owner has granted to Original Wells Fargo Mortgage Loan Lender a first-priority mortgage on, among other things, the real property and other collateral as more fully described in each such Original Mortgage (individually and/or collectively as the context may require, the “Wells Fargo Mortgage Loan Property”).

K.Connecticut General Life Insurance Company, a Connecticut corporation, having its principal place of business c/o CIGNA Realty Investors, 280 Trumbull Street, Hartford, Connecticut 06103 (“CIGNA”), as mortgage lender, made a loan in the original principal amount of Fifty-Two Million and No/100 Dollars ($52,000,000.00) (as such loan may have been or may be increased or decreased from time to time, the “HH Nashville Mortgage Loan”) to HH Nashville LLC, a Delaware limited liability company (“HH Nashville”) pursuant to that certain Leasehold Deed of Trust and Security Agreement, dated as of March 13, 2006, and granted by HH Nashville and HHC TRS Nashville LLC, a Delaware limited liability company (“Nashville Operating Lessee”), in favor of CIGNA, as beneficiary (“Nashville DOT”) and that certain Assignment of Rents and Leases dated as of March 13, 2006, granted by Nashville Operating Lessee and HH Nashville in favor of CIGNA (“Nashville ALR”; Nashville ALR and Nashville DOT, as each may have been or may be amended, restated, replaced, supplemented or otherwise modified from time to time, collectively, the “CIGNA Nashville Security Instrument”), which HH Nashville Mortgage Loan is evidenced by that certain Promissory Note, dated as of March 13, 2006, made by HH Nashville to CIGNA, as the same may have been or may be amended, restated, replaced, supplemented or otherwise modified from time to time. Pursuant to the CIGNA Nashville Security Instrument, HH Nashville has granted to CIGNA a first-priority mortgage on, among other things, HH Nashville’s leasehold interest in certain real property and other collateral as more fully described in the CIGNA Nashville Security Instrument (the “CIGNA Nashville Property”).

L.CIGNA, as mortgage lender, made a loan in the original principal amount of Thirty-Five Million and No/100 Dollars ($35,000,000.00) (as such loan may have been or may be increased or decreased from time to time, the “HH Princeton Mortgage Loan”, and together with the HH Nashville Mortgage Loan and the CIGNA Boston Mortgage Loan, individually and/or collectively as the context may require, the “CIGNA Mortgage Loan”; the CIGNA Mortgage Loan together with the Wells Fargo Mortgage Loan, individually and/or collectively as the context may require, the “Mortgage Loan”) to HH Princeton LLC, a Delaware limited liability company (“HH Princeton”; HH Princeton together with HH Nashville and HH Boston, individually and/or collectively as the context may require, “CIGNA Mortgage Borrower”) pursuant to that certain Leasehold Mortgage, Security Agreement, Assignment of Rents and Leases and Fixture Filing,

dated as of January 6, 2006, and granted by HH Princeton and HHC TRS Princeton LLC (“Princeton Operating Lessee”, Princeton Operating Lessee, together with Nashville Operating Lessee and Boston Operating Lessee, individually and/or collectively as the context may require, the “CIGNA Operating Lessee”; CIGNA Operating Lessee together with Wells Fargo Operating Lessee, individually and and/or collectively as the context may require, “Operating Lessee”; CIGNA Operating Lessee together with CIGNA Mortgage Borrower, together, “CIGNA Mortgage Loan Borrower”) in favor of CIGNA (“Princeton Mortgage”), and that certain Assignment of Rents and Leases dated as of January 6, 2006, made by HH Princeton and Princeton Operating Lessee in favor of CIGNA (“Princeton ALR”; Princeton ALR and Princeton Mortgage, as each may have been or may be amended, restated, replaced, supplemented or otherwise modified from time to time, the “CIGNA Princeton Security Instrument”), which HH Princeton Mortgage Loan is evidenced by that certain Promissory Note, dated as of January 6, 2006, made by HH Princeton to CIGNA, as the same may have been or may be amended, restated, replaced, supplemented or otherwise modified from time to time. Pursuant to the CIGNA Princeton Security Instrument, HH Princeton has granted to CIGNA a first-priority mortgage on, among other things, HH Princeton’s leasehold interest in that certain real property and other collateral as more fully described in such CIGNA Princeton Security Instrument (the “CIGNA Princeton Property”).

M.CIGNA, as mortgage lender, made a loan in the original principal amount of Sixty-Nine Million and No/100 Dollars ($69,000,000.00) (as such loan may have been or may be increased, decreased, refinanced or replaced from time to time, the “HH Boston Mortgage Loan”), to HH Boston Back Bay LLC, a Delaware limited liability company (“HH Boston Borrower”), pursuant to that certain Mortgage, Security Agreement, Assignment of Rents and Leases and Fixture Filing, dated as of December 6, 2005, and granted by HH Boston and HHC TRS OP LLC (“HH Boston Operating Lessee”) in favor of CIGNA, as beneficiary (“HH Boston DOT”), and that certain Assignment of Rents and Leases dated as of December 6, 2005, granted by HH Boston Operating Lessee and HH Boston in favor of CIGNA (“HH Boston ALR”; Boston ALR and HH Boston DOT, as each may have been or may be amended, restated, replaced, supplemented or otherwise modified from time to time, collectively, the “HH Boston Security Instrument”), which HH Boston Mortgage Loan is evidenced by that certain Promissory Note, dated as of December 6, 2005, made by HH Boston Borrower to CIGNA, as the same may have been or may be amended, restated, replaced, supplemented or otherwise modified from time to time. Pursuant to the HH Boston Security Instrument, HH Boston Borrower granted to CIGNA a first-priority mortgage on, among other things, the real property and other collateral as more fully described in such HH Boston Security Instrument (the “Boston Property”).

N.On December 17, 2012, the Boston Property was transferred to PIM Boston Back Bay LLC (“PIM Boston Borrower”), the leasehold interest in the Boston Operating Lease was transferred to PIM TRS Boston Back Bay LLC (“PIM Boston Operating Lessee”), and the HH Boston Mortgage Loan was refinanced with the proceeds of a mortgage loan from Morgan Stanley Mortgage Capital Holdings LLC (together with its successors and assigns, “MS Boston Lender”) to PIM Boston Borrower, as borrower, and PIM Boston Operating Lessee, as operating lessee (the “MS Boston Loan”).

O.On the date hereof, the Nashville Property is being transferred to PIM Nashville LLC (“PIM Nashville Borrower”), the leasehold interest in the Nashville Operating Lease is being transferred to PIM TRS Nashville LLC (“PIM Nashville Operating Lessee”), and the HH Nashville Mortgage Loan and the HH Princeton Mortgage Loan are being refinanced with the proceeds of a mortgage loan from Morgan Stanley Mortgage Capital Holdings LLC (together with its successors and assigns, “MS NP Lender”) to PIM Nashville Borrower and HH Princeton, together, as borrower, and PIM Nashville Operating Lessee and Princeton Operating Lessee, together, as operating lessee (the “MS NP Loan”) evidenced by that certain Loan Agreement dated as of the date hereof between PIM Nashville Borrower and HH Princeton, as borrower, PIM Nashville Operating Lessee and Princeton Operating Lessee, as operating lessee, and MS NP Lender, as lender (the “MS NP Loan Agreement”). Such transfer and refinancing are sometimes referred to herein as the “Transaction”.

P.In connection with the transfer of the Nashville Property and the Nashville Operating Lease, Borrower is entering into that certain Pledge and Security Agreement (Mezz 1 – Nashville/Princeton) (the “NP Pledge Agreement”).

Q.The Note, the Loan Agreement, and all other documents executed by Borrower and/or others in connection with the Loan in effect immediately prior to the date hereof are hereafter collectively referred to as the “Original Loan Documents”. The Original Loan Documents (as amended by this Agreement), this Agreement, the NP Pledge Agreement, and all other documents executed in connection with this Agreement are hereafter collectively referred to as the “Loan Documents”.

R.All capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Loan Agreement.

NOW, THEREFORE, in consideration of the covenants and agreements set forth herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Consents.

(a) Transaction Consent. Subject to each of the terms and conditions set forth herein, Lender hereby consents to (i) the Transaction, (ii) the execution of the Transaction Documents by the parties thereto, and (iii) the release of the interests in HH Nashville and Nashville Operating Lessee from the Collateral under the Pledge Agreement. Furthermore, the parties hereto agree that Lender’s consent to the Transaction is a one-time consent restricted to the Transaction, and such consent shall not otherwise constitute a consent, waiver or modification of any right, remedy or power of Lender under any of the Loan Documents or otherwise. The refinancing of the HH Nashville Mortgage Loan and the HH Princeton Mortgage Loan with the MS NP Loan shall be considered a Permitted CIGNA Mortgage Loan Refinancing for all purposes under the Loan Documents.

(b) Fee Interest Acquisition Consent.

i. Borrower is permitted to consummate the Nashville Fee Interest Acquisition (as defined in the MS NP Loan Agreement), provided that, in connection therewith, each of the following conditions are satisfied as reasonably determined by Lender: (i) the MS NP Lender has approved the Nashville Fee Interest Acquisition in accordance with the MS NP Loan Agreement, (ii) all terms and conditions set forth in Section 8.6 of the MS NP Loan Agreement have been satisfied (a) as if such terms and conditions had been set forth in this Agreement in their entirety, (b) as if the Lender in each case has the related approval right, consent, or right to make a determination rather than the MS NP Lender, and (c) in each case anything has to satisfy the “Prudent Lender Standard,” (as defined in the MS NP Loan Agreement) or such standard applies, then in each such case Lender shall have approved such item in its reasonable discretion, (iii) Borrower and, if required by Lender, Guarantor, shall enter into such amendments or other modifications to the Loan Documents as may be reasonably required by Lender, (iv) Borrower shall obtain such title insurance as may be reasonably required by Lender, and (v) such other conditions as Lender shall reasonably require.

ii. Borrower is permitted to consummate the Princeton Fee Interest Acquisition (as defined in the MS NP Loan Agreement), provided that, in connection therewith, each of the following conditions are satisfied as reasonably determined by Lender: (i) the MS NP Lender has approved the Princeton Fee Interest Acquisition in accordance with the MS NP Loan Agreement, (ii) all terms and conditions set forth in Section 8.5 of the MS NP Loan Agreement have been satisfied (a) as if such terms and conditions had been set forth in this Agreement in their entirety, (b) as if the Lender in each case has the related approval right, consent, or right to make a determination rather than the MS NP Lender, and (c) in each case anything has to satisfy the “Prudent Lender Standard,” (as defined in the MS NP Loan Agreement) or such standard applies, then in each such case Lender shall have approved such item in its reasonable discretion, (iii) Borrower and, if required by Lender, Guarantor, shall enter into such amendments or other modifications to the Loan Documents as may be reasonably required by Lender, (iv) Borrower shall obtain such title insurance as may be reasonably required by Lender, and (v) such other conditions as Lender shall reasonably require.

2. Representations and Warranties.

(a) Borrower Organizational Documents. Borrower represents and warrants to Lender that the certificates of formation, articles of organization, limited liability company operating agreement, limited partnership agreement and the other organizational documents, as applicable, of Mortgage Borrower and Borrower (and if any individual Mortgage Borrower is a limited partnership, of its general partner) delivered to Lender in connection with the Restructuring (as defined in the Loan Agreement) have not been amended, modified or revoked since the Closing Date, other than any such amendment or modification that was effectuated in accordance with the Loan Documents and is attached as an exhibit to any officer’s or member’s certificate delivered to Lender in connection with this Agreement.

(b) Execution, Delivery, Authority, No Violations. Each of Borrower and Guarantor represents and warrants to Lender that: (i) it is duly formed, validly existing and in good standing as a limited liability company, limited partnership, or corporation, as applicable,

under the laws of the state of its formation, with full power and authority to own its assets and conduct its business, and is duly qualified in all jurisdictions in which the ownership or leasing of its property or the conduct of its business requires such qualification; (ii) this Agreement and the other documents executed in connection with the Transaction by such entity have been duly executed and delivered and constitute the legal, valid and binding obligations of such entity, enforceable against such entity in accordance with their terms, except as such enforcement may be limited by bankruptcy, insolvency, moratorium or other laws affecting the enforcement of creditors’ rights, or by the application of the rules of equity; and (iii) the execution and delivery of this Agreement and the other documents executed in connection herewith by such entity, and the performance of its respective obligations hereunder and thereunder, and the consummation of the transactions contemplated hereunder, (A) have been duly authorized by all requisite organizational action on the part of such entity and will not violate any provision of any applicable legal requirements, decree, order, injunction or demand of any court or other governmental authority applicable to such entity, or any organizational document of such entity and (B) do not require any consent, approval, authorization or order of any court, governmental authority or any other Person, other than for those which have already been obtained by such entity prior to the date hereof.

(c) Property Agreements. Borrower represents and warrants to Lender that: (i) except as has been obtained on or prior to the date hereof, no consent, approval or authorization to the Transaction or the execution and delivery of this Agreement and the other documents executed in connection herewith by such entity, and the performance of its respective obligations hereunder and thereunder, and the consummation of the transactions contemplated hereunder is required pursuant to any Property Agreement (as defined below) and (ii) neither the Transaction nor the execution and delivery of this Agreement and the other documents executed in connection herewith, and the performance of its respective obligations (and the obligations of its respective Affiliates) hereunder and thereunder, and the consummation of the transactions contemplated hereunder and thereunder does, nor will, (A) result in a default under any material Property Agreement, (B) adversely affect the use, possession, ownership or operation of the Property under or with respect to any material Property Agreement, (C) affect any right, privilege, benefit, liability or obligation of Mortgage Borrower under or with respect to any material Property Agreement, and (D) deprive Lender of any direct or indirect benefits of, or rights under, any material Property Agreement. For the purposes of this Section 2(c), “Property Agreement” shall mean each document or agreement to which Mortgage Borrower is a party or to which the Property is subject, including, without limitation, any ground lease, Lease, operating agreement, management agreement, franchise agreement, or any document or agreement of record, affecting or relating to the Property, including, without limitation, any covenant, condition, easement, encumbrances, lien or other restriction, in each case as amended, supplemented or otherwise modified as of the date hereof.

(d) No Defaults. Borrower represents and warrants to Lender that (i) to the best of its knowledge, no default, or event which with the giving of notice or the passage of time, or both, would constitute an Event of Default has occurred and remains uncured under any of the Loan Documents and (ii) no Event of Default has occurred and remains uncured under any of the Loan Documents.

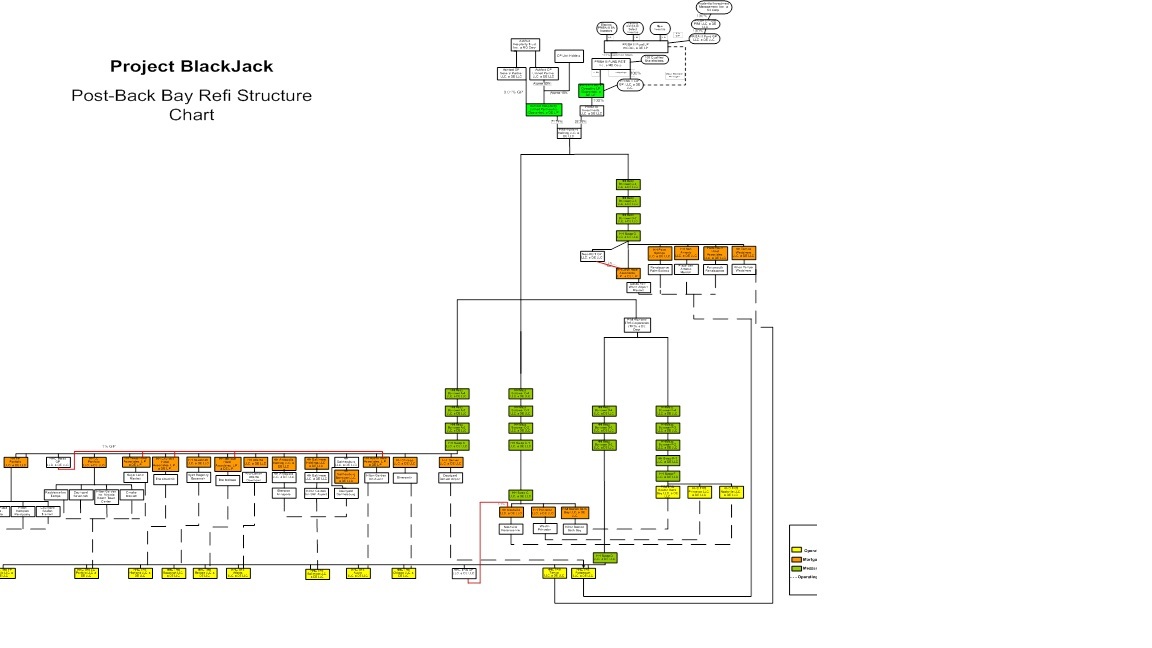

(e) Organizational Chart. Borrower represents and warrants to Lender that the organizational chart attached hereto as Schedule 1 relating to Borrower, Guarantor and the other named persons and/or entities therein is true, correct and complete immediately after the consummation of the Transaction.

(f) Transaction Documents. Borrower represents and warrants to Lender that (a) Schedule 2 attached hereto contains a true and complete list of all documents evidencing and/or securing the MS NP Loan, and all amendments or modifications thereto, (b) Schedule 2 and Schedule 3 attached hereto contain a true and complete list of all documents evidencing the Transaction (collectively, the “Transaction Documents”), and (c) true, correct and complete copies of the Transaction Documents have been delivered to Lender on or prior to the date hereof.

(g) Wells Fargo Loan. Borrower represents and warrants to Lender that for purposes of Section 11.1(x) of the Wells Fargo Mortgage Loan Agreement, the Pro Forma DSCR (as defined in the Wells Fargo Mortgage Loan Agreement) immediately following (and taking into account) the Transaction is equal to or greater than the Pro Forma DSCR (as defined in the Wells Fargo Mortgage Loan Agreement) immediately prior to the Transaction.

(h) Additional Paydown Requirement. Borrower represents that, as of the date hereof, $1,479,978.08 has been applied against the Additional Paydown Requirement and $48,520,021.92 remains.

(i) Reserve Balances. Borrower and Lender confirm that as of the date hereof (i) the balance of the CIGNA Property Capital Replacement Reserve Account is $12,452,112.64, (ii) the balance of the CIGNA Property FF&E Replacement Reserve Account is $0.00, (iii) the balance of the CIGNA Property Ground Rent Reserve Account is $0.00, (iv) the balance of the CIGNA Property Tax and Insurance Reserve Account is $0.00, (v) the balance of the Mezzanine Debt Yield Reserve Account is $0.00, and (vi) the balance of the CIGNA Property Operating Expense Reserve Account is $0.00. Borrower represents that as of December 24, 2012 the balance of the Borrower Residual Account is $5,849,499.21.

3. Prepayment of the Loan. On the date hereof and in connection with the refinancing of the HH Nashville Mortgage Loan and the HH Princeton Mortgage Loan with the MS NP Loan, Borrower will cause PIM Nashville Borrower and HH Princeton Borrower to make a distribution to Borrower in the amount of the “Principal Paydown” for each Note as set forth on the distribution of proceeds scheduled attached hereto as Schedule 4 (the “Distribution Schedule”), which amount Borrower will deliver to Lender for application to the outstanding principal balance of the Loan (the “Prepayment”). After application of the Prepayment, the outstanding principal balance of each Note will be as set forth on the Distribution Schedule. On the date hereof, Borrower will pay to Lender the amount of the “Prorata 1% Premium” set forth on the Distribution Schedule as payment of the Prepayment Premium due in connection with the Prepayment. The Prepayment shall not be applied against the Additional Paydown Requirement.

4. Transfer Tax. Without limiting anything set forth in the Loan Documents, to the extent any transfer tax is now or hereafter due and payable in connection with the Transaction, Borrower and Guarantor shall timely cause such tax to be paid.

5. MS NP Refinance Date. Lender, Borrower and Guarantor hereby (i) confirm that the MS NP Refinance Date (as defined in the Loan Agreement) is the date hereof and (ii) agree that any provisions in the Loan Documents which by their terms are only effective from and after the MS NP Refinance Date shall be effective from and after the date hereof.

6. Intentionally Omitted.

7. Borrower Confirmation of Loan Documents. Except as expressly set forth herein, neither the Transaction nor anything contained herein shall limit, impair, terminate or revoke the obligations of Borrower under the Loan Documents, and such obligations shall continue in full force and effect in accordance with the respective terms and provisions of the Loan Documents. Borrower hereby ratifies and agrees to pay when due all sums due or to become due or owing under the Note, the Loan Agreement or the other Loan Documents and shall hereafter faithfully perform all of its obligations under and be bound by all of the provisions of the Loan Documents and hereby ratifies and reaffirms all of its obligations and liabilities under the Note, the Loan Agreement and the other Loan Documents. Borrower has no offsets or defenses to its obligations under the Loan Documents and to the extent Borrower would be deemed to have any such offsets or defenses as of the date hereof, Borrower hereby knowingly waives and relinquishes such offsets or defenses.

8. Confirmation of Guaranty. Except as expressly set forth herein, neither the Transaction nor anything contained herein shall limit, impair, terminate or revoke the obligations of Guarantor under the Guaranty, and such obligations shall continue in full force and effect in accordance with the terms and provisions of the Guaranty. Guarantor hereby ratifies and reaffirms all of its obligations and liabilities under the Guaranty and reaffirms its waiver of each and every one of the defenses to such obligations as set forth in the Guaranty.

9. Release. Each of Borrower and Guarantor, on behalf of itself and each of their respective past, present and future subsidiaries, affiliates, divisions, directors, shareholders, officers, employees, partners, members, managers, representatives, advisors, servicers, attorneys and agents and each of their respective heirs, transferees, executors, administrators, personal representatives, legal representatives, predecessors, successors and assigns (including any successors by merger, consolidation or acquisition of all or a substantial portion of any such Persons’ assets and business), each in their capacity as such (collectively, the “Releasing Parties”), hereby releases and forever discharges all Indemnified Parties from any and all Liabilities (including any Liabilities which any Releasing Party does not know or suspect to exist in its favor as of the date hereof, which if known by such Releasing Party might have affected such Releasing Party’s release of an Indemnified Party, and including any Servicing Claims) that are or may be based in whole or part on any act, omission, transaction, event, or other circumstance taking place or existing on or prior to the date hereof, which the Releasing Parties or any of them may have or which may hereafter be asserted or accrue against Indemnified Parties or any of them, resulting from or in any way relating to any act or omission done or committed by Indemnified Parties, or any of them, prior to the date hereof in each case connection with or arising out of the Loan or the Loan Documents. The releases contained in this Section 9 apply to all Liabilities which the Releasing Parties or any of them have or which may hereafter arise against the Indemnified Parties or any of them in connection with or arising out of the Loan or the Loan Documents, as a result of acts or omissions

occurring before the date hereof, whether or not known or suspected by the parties hereto. Each of Borrower and Guarantor expressly acknowledges that although ordinarily a general release does not extend to claims which the releasing party does not know or suspect to exist in his, her or its favor, which if known by him, her or it must have materially affected his, her or its settlement with the party released, each of Borrower and Guarantor has carefully considered and taken into account in determining to enter into this Agreement the possible existence of such unknown losses or claims. Without limiting the generality of the foregoing, each of Borrower and Guarantor, on behalf of itself and all of the Releasing Parties expressly waives any and all rights conferred upon it by any statute or rule of law which provides that a release does not extend to claims which the claimant does not know or suspect to exist in his, her or its favor at the time of executing the release, which if known by him, her or it must have materially affected his, her or its settlement with the released party, including the following provisions of California Civil Code Section 1542:

“A general release does not extend to claims which the creditor does not know or suspect to exist in his or her favor at the time of executing the release, which if known by him or her must have materially affected his or her settlement with the debtor.”

This release by Releasing Parties shall constitute a complete defense to any Liability released pursuant to this release. Nothing in this release shall be construed as (or shall be admissible in any legal action or proceeding as) an admission by any Co-Lender or any other Indemnified Party that any Liability exists which is within the scope of those hereby released. This Section 9 shall survive the repayment and performance of all obligations under the Loan Documents, and the reconveyance, foreclosure, or other extinguishment of any related security instruments. For the avoidance of doubt, by agreeing to this Section 9, Releasing Parties represent and acknowledge that none of them may seek to use any of the Liabilities released herein as a set-off of any other obligation that may exist between any Releasing Party and Indemnified Party. In addition, Liabilities released herein shall include any Releasing Party’s right to contribution or any other similar demand that might otherwise exist (and the terms of this sentence shall control over any conflicting provision in any other Loan Document).

In no event shall the provisions of this Section 9 be deemed to limit any other release of any Indemnified Parties under any other Loan Document and all such releases of any Indemnified Parties shall be read in the broadest possible manner notwithstanding anything contained herein.

10. Costs and Expenses. The following fees, costs and expenses charged or incurred by Lender in connection with the Transaction, this Agreement and the transactions contemplated hereunder shall be the obligations of Borrower and Guarantor and paid by Borrower or Guarantor on or prior to the date hereof: (i) attorney’s fees incurred by Lender’s counsel; (ii) any title insurance premiums or costs for endorsements, if any, required by Lender; and (iii) all related costs and expenses incurred by Lender. The effectiveness of this Agreement is subject to and conditioned upon payment by Borrower of the foregoing fees, costs and expenses.

11. Notices. With respect to all notices or other written communications hereunder, such notice or written communication shall be given, and shall be deemed effective, pursuant to the Loan Documents, addressed as follows:

| |

| If to Borrower or Guarantor: | c/o Ashford Hospitality Trust

14185 Dallas Parkway

Suite 1100

Dallas, Texas 75254

Attention: David Brooks

Facsimile No.: (972) 490-9605 |

| |

| With a copy to: | c/o Prudential Real Estate Investors

8 Campus Drive

Parsippany, New Jersey 07054

Attention: Soultana Reigle

Facsimile No.: (973) 734-1550 |

and

c/o PREI Law Department 8 Campus Drive

Parsippany, New Jersey 07054

Attention: Law Department

Facsimile No.: (973) 734-1550

and

Goodwin Procter LLP

Exchange Place

53 State Street

Boston, Massachusetts 02109

Attention: Minta Kay

Facsimile No.: (617) 523-1231

| |

| If to Lender: | American Equity Investment Life Insurance Company

c/o Athene Asset Management LLC

818 Manhattan Beach Blvd., Suite 100

Manhattan Beach, CA 90266

Attention: James R. Belardi and Legal Department

Facsimile No: (310) 698-4492 |

With copies to:

Apollo Global Real Estate

9 West 57th Street

New York, New York 10019

Attention: Scott M. Weiner

Facsimile No.: (646) 607-0674

And:

Athene Annuity & Life Assurance Company

2000 Wade Hampton Blvd.

Greenville, SC 29615

Attn: Guy H. Smith III

Facsimile No: (864) 608-1307

And:

Athene Annuity & Life Assurance Company

818 Manhattan Beach Blvd., Suite 100

Manhattan Beach, CA 90266

Attention: James R. Belardi and Legal Department

Facsimile No: (310) 698-4492

And:

Apollo Global Real Estate

9 West 57th Street

New York, New York 10019

Attention: Scott M. Weiner

Facsimile No.: (646) 607-0674

And:

Newcastle CDO VIII 1, Limited

c/o Newcastle Investment Corp.

1345 Avenue of the Americas, 46th Floor

New York, NY 10105

Attention: Phillip Evanski, Jason Corn, Peter Shea

Facsimile No: (212) 798-6060

And:

Newcastle CDO IX 1, Limited

c/o Newcastle Investment Corp.

1345 Avenue of the Americas, 46th Floor

New York, NY 10105

Attention: Phillip Evanski, Jason Corn, Peter Shea

Facsimile No: (212) 798-6060

And:

Principal Life Insurance Company

c/o Principal Real Estate Investors, LLC

801 Grand Ave.

Des Moines, IA 50392

Attn: William May

Facsimile No.: (515) 246-4970

And:

Dechert LLP

One Maritime Plaza, Suite 2300

San Francisco, CA 94111

Attention: David M. Linder

Facsimile No.: (415) 262-4555

12. Loan Documents. This Agreement and all other documents executed in connection herewith shall each constitute a Loan Document for all purposes under the Note, the Loan Agreement and the other Loan Documents. All references in each of the Loan Documents to the Loan Agreement shall be deemed to be a reference to the Loan Agreement as amended by this Agreement, and as the same may be further amended, restated, replaced, supplemented, renewed, extended or otherwise modified from time to time. All references in each of the Loan Documents to the Loan Documents or to any particular Loan Document shall be deemed to be a reference to such Loan Documents as amended by this Agreement, and as the same may be further amended, restated, replaced, supplemented, renewed, extended or otherwise modified from time to time. All references in the Loan Documents to a particular section of a Loan Document shall be deemed to be a reference to the particular section of such Loan Document as amended by this Agreement, and as the same may be further amended, restated, replaced, supplemented, renewed, extended or otherwise modified from time to time.

13. No Other Amendments. Except as expressly amended hereby, each Original Loan Document shall remain in full force and effect in accordance with its terms and provisions, without any waiver, amendment or modification of any provision thereof.

14. No Further Modifications. This Agreement may not be amended, modified or otherwise changed in any manner except by a writing executed by all of the parties hereto.

15. Severability. In case any provision of this Agreement shall be invalid, illegal, or unenforceable, such provision shall be deemed to have been modified to the extent necessary to make it valid, legal and enforceable. The validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby.

16. Successors and Assigns. This Agreement is binding on, and shall inure to the benefit of the parties hereto, their administrators, executors, and successors and assigns; provided, however, that each of Borrower and Guarantor may only assign its rights hereunder to the extent permitted in the Loan Documents.

17. Governing Law. This Agreement shall be governed by, and construed in accordance with, the laws of the State of New York, without giving effect to the conflict of laws provisions of said state.

18. Entire Agreement. This Agreement constitutes all of the agreements among the parties relating to the matters set forth herein and supersedes all other prior or concurrent oral or written letters, agreements and understandings with respect to the matters set forth herein.

19. Counterparts. This Agreement may be signed in any number of counterparts by the parties hereto, all of which taken together shall constitute one and the same instrument.

[Signatures appear on the following pages]

IN WITNESS WHEREOF, the undersigned have caused this Agreement to be executed as of the day and year first above written.

LENDER:

NOTE A-1 HOLDER:

AMERICAN EQUITY INVESTMENT LIFE INSURANCE COMPANY,

a company organized under the laws of the State of Iowa

| |

| By: | Athene Asset Management LLC, its investment adviser of that certain funds withheld account created pursuant to that certain trust agreement between American Equity Investment Life Insurance Company, Athene Life Re Ltd. and State Street Bank and Trust Company dated as of August 13, 2009

By: /s/ James M. Hassett

Name: James M. Hassett

Title: Executive Vice President, Credit |

NOTE A-2 HOLDER:

ATHENE ANNUITY & LIFE ASSURANCE COMPANY,

a company organized under the laws of the State of Delaware

| |

| By: | Athene Asset Management LLC, its investment advisor

|

By: /s/ James M. Hassett

Name: James M. Hassett

Title: Executive Vice President, Credit

NOTE A-3 HOLDER:

NEWCASTLE CDO VIII 1, LIMITED

| |

| By: | Newcastle Investment Corp.,

its collateral manager

By: /s/ Brian Sigman

Name: Brian Sigman |

Title: Chief Financial Officer

NOTE A-4 HOLDER:

NEWCASTLE CDO IX 1, LIMITED

| |

| By: | Newcastle Investment Corp.,

its collateral manager

By: /s/ Brian Sigman

Name: Brian Sigman |

Title: Chief Financial Officer

NOTE A-5 HOLDER AND NOTE A-6 HOLDER:

PRINCIPAL LIFE INSURANCE COMPANY,

an Iowa corporation

| |

| By: | Principal Real Estate Investors, LLC,

a Delaware limited liability company,

its authorized signatory |

By: /s/ Kevin Vaughan___________________________

Name: Kevin Vaughan

Title: Senior CMBS Servicing Portfolio Manager

By: /s/ Darin L. Bennigsdorf

Name: Darin L. Bennigsdorf

Title: Assistant Managing Director Special Servicing

|

| | |

| | BORROWER: |

| | |

| | HH SWAP A LLC, |

| | a Delaware limited liability company |

| | |

| | |

| | By: | /s/ David Brooks |

| | | Name: David Brooks |

| | | Title: Vice President |

| | | |

| | | |

| | HH SWAP C LLC, |

| | a Delaware limited liability company |

| | |

| | |

| | By: | /s/ David Brooks |

| | | Name: David Brooks |

| | | Title: Vice President |

| | | |

| | | |

| | HH SWAP D LLC, |

| | a Delaware limited liability company |

| | |

| | |

| | By: | /s/ David Brooks |

|

| | |

| | | Name: David Brooks |

| | | Title: Vice President |

| | | |

| | | |

| | HH SWAP F LLC, |

| | a Delaware limited liability company |

| | |

| | |

| | By: | /s/ David Brooks |

| | | Name: David Brooks |

| | | Title: Vice President

|

| | HH SWAP G LLC, |

| | a Delaware limited liability company |

| | |

| | |

| | By: | /s/ David Brooks |

| | | Name: David Brooks |

| | | Title: Vice President

|

| | HH SWAP C-1 LLC, |

| | a Delaware limited liability company |

| | |

| | |

| | By: | /s/ David Brooks |

| | | Name: David Brooks |

| | | Title: Vice President |

| | | |

| | | |

| | HH SWAP F-1 LLC, |

| | a Delaware limited liability company |

| | |

| | |

| | By: | /s/ David Brooks |

| | | Name: David Brooks |

| | | Title: Vice President |

| | | |

| | | |

GUARANTOR:

ASHFORD HOSPITALITY LIMITED PARTNERSHIP

By: Ashford OP General Partner LLC

By: /s/ David A. Brooks

Name: David A. Brook

Title: Vice President

PRISA III REIT OPERATING LP

| |

| By: | PRISA III OP GP, LLC,

its general partner

By: PRISA III FUND LP,

its manager

By: PRISA III FUND GP, LLC,

its general partner |

By: PRISA III FUND PIM, LLC,

its sole member

By: Prudential Investment Management, Inc.,

its sole member

By: /s/ Scott M. Dalrymple

Name: Scott M. Dalrymple

Title: Vice President

SCHEDULE 1

Organizational Chart of Borrower

(Attached)

SCHEDULE 2

MS NP Loan Documents

| |

| 1. | The MS NP Loan Agreement; |

| |

| 2. | Promissory Note dated as of the date hereof from HH Princeton LLC and PIM Nashville LLC to MS NP Lender in the principal amount of $112,600,000.00; |

| |

| 3. | Leasehold Mortgage, Assignment of Leases and Rents, Security Agreement, dated as of the date hereof, by HH Princeton LLC to MS NP Lender; |

| |

| 4. | Leasehold Deed of Trust, Assignment of Leases and Rents, Security Agreement and Fixture Filing for Commercial Purposes, dated as of the date hereof, by PIM Nashville LLC to Joseph B. Pitt, as trustee, for the benefit of MS NP Lender; |

| |

| 5. | Assignment of Leases and Rents and Security Agreement dated as of the date hereof by HHC TRS Princeton LLC to MS NP Lender; |

| |

| 6. | Assignment of Leases and Rents and Security Agreement dated as of the date hereof by PIM TRS Nashville LLC to MS NP Lender; |

| |

| 7. | Environmental Indemnity Agreement dated as of the date hereof made by Borrower, Ashford Hospitality Limited Partnership, PRISA III REIT Operating LP, HHC TRS Princeton LLC and PIM TRS Nashville LLC in favor of MS NP Lender; |

| |

| 8. | Guaranty of Recourse Obligations dated as of the date hereof made by Ashford Hospitality Limited Partnership and PRISA III REIT Operating LP in favor of MS NP Lender; |

| |

| 9. | Operating Lease Subordination and Attornment Agreement dated as of the date hereof among HHC TRS Princeton LLC, PIM TRS Nashville LLC and MS NP Lender; |

| |

| 10. | Cash Management Agreement dated as of the date hereof among Borrower, MS NP Lender, PIM TRS Nashville LLC, HHC TRS Princeton LLC and Remington Lodging & Hospitality, LLC; |

| |

| 11. | Restricted Account Agreement dated as of the date hereof among Borrower, Wells Fargo Bank, National Association, MS NP Lender, PIM TRS Nashville LLC, HHC TRS Princeton LLC, and Remington Lodging & Hospitality, LLC; |

| |

| 12. | Borrower’s Certification dated as of the date hereof given by Borrower in favor of MS NP Lender; |

| |

| 13. | Conditional Assignment of Management Agreement and Subordination of Management Agreement dated as of the date hereof among Princeton Borrower, HHC TRS Princeton LLC, Remington Lodging & Hospitality in favor of MS NP Lender; |

| |

| 14. | Assignment of Management Agreement, Subordination, Non-Disturbance and Attornment Agreement and Consent of Manager by and among MS NP Lender, PIM Nashville LLC, PIM TRS Nashville LLC and Renaissance Hotel Management Company, LLC; |

| |

| 15. | Title Escrow Instruction Letter by Alston & Bird LLP and accepted and agreed to by Chicago Title Insurance Company and Borrower; |

| |

| 16. | UCC-1 Financing Statement naming HH Princeton LLC, as Debtor and MS NP Lender, as Secured Party to be filed in the Office of the Secretary of State of the State of Delaware; |

| |

| 17. | UCC-1 Financing Statement naming HH Princeton LLC, as Debtor and MS NP Lender, as Secured Party to be filed in the Office of the Clerk of the County of Middlesex of the State of New Jersey; |

| |

| 18. | UCC-1 Financing Statement naming HHC TRS Princeton LLC, as Debtor and MS NP Lender, as Secured Party to be filed in the Office of the Secretary of State of the State of Delaware; |

| |

| 19. | UCC-1 Financing Statement naming HHC TRS Princeton LLC, as Debtor and MS NP Lender, as Secured Party to be filed in the Office of the Clerk of the County of Middlesex of the State of New Jersey; |

| |

| 20. | UCC-1 Financing Statement naming PIM Nashville LLC, as Debtor and MS NP Lender, as Secured Party to be filed in the Office of the Secretary of State of the State of Delaware; |

| |

| 21. | UCC-1 Financing Statement naming PIM Nashville LLC, as Debtor and MS NP Lender, as Secured Party to be filed in the Office of the Clerk of the County of Davidson of the State of Tennessee |

| |

| 22. | UCC-1 Financing Statement naming PIM TRS Nashville LLC, as Debtor and MS NP Lender, as Secured Party to be filed in the Office of the Secretary of State of the State of Delaware. |

| |

| 23. | UCC-1 Financing Statement naming PIM TRS Nashville LLC, as Debtor and MS NP Lender, as Secured Party to be filed in the Office of the Clerk of the County of Davidson of the State of Tennessee. |

SCHEDULE 3

Other Transaction Documents

| |

| 1. | Quitclaim Deed of Leasehold Interest dated as of the date hereof, by HH Nashville to PIM Nashville Borrower; |

| |

| 2. | Assignment and Assumption of Leasehold Interest Agreement dated as of the date hereof, by and between HH Nashville and PIM Nashville Borrower; |

| |

| 3. | Bill of Sale, Assignment and Assumption Agreement dated as of the date hereof, by and between HH Nashville and PIM Nashville Borrower; |

| |

| 4. | Bill of Sale, Assignment and Assumption Agreement dated as of the date hereof, by and between Nashville Operating Lessee and PIM Nashville Operating Lessee; |

| |

| 5. | Assignment and Assumption of Lessor’s Interest in Lease dated as of the date hereof, by and between HH Nashville and PIM Nashville Borrower; |

| |

| 6. | Assignment and Assumption of Lessee’s Interest in Lease dated as of the date hereof, by and between Nashville Operating Lessee and PIM Nashville Operating Lessee; |

| |

| 7. | Assignment and Assumption of Management Agreement dated as of the date hereof, by and between Nashville Operating Lessee and PIM Nashville Operating Lessee, and consented to by Renaissance Hotel Management Company, LLC; |

| |

| 8. | Assignment and Assumption of Owner Agreement dated as of the date hereof, by and among HH Nashville, Nashville Operating Lessee, PIM Nashville Borrower and PIM Nashville Operating Lessee, and consented to by Renaissance Hotel Management Company, LLC; |

| |

| 9. | Non-Imputation Affidavit dated as of the date hereof, by Borrower, HH Nashville, PIM Nashville Borrower, and HH Princeton; |

| |

| 10. | Endorsement (ALTA Endorsement Form 16-06(Mezzanine Financing)) dated as of the date hereof by and among Lender and PIM Nashville Borrower; |

| |

| 11. | Tennessee Allocation Affidavit dated as of the date hereof, by PIM Nashville Borrower; |

| |

| 12. | First Extension Option Letter to the Loan Agreement, by Borrower; |

| |

| 13. | Second Extension Option Letter to the Loan Agreement, by Borrower; |

| |

| 14. | Authorization Letter to Morgan Stanley authorizing Extension of the Loan Agreement, by Borrower; |

| |

| 15. | First Extension Option Letter to Mezzanine 2 Loan Agreement, by Mezzanine 2 Borrower; |

| |

| 16. | Second Extension Option Letter to Mezzanine 2 Loan Agreement, by Mezzanine 2 Borrower; |

| |

| 17. | Authorization Letter to Morgan Stanley authorizing Extension of Mezzanine 2 Loan Agreement, by Mezzanine 2 Borrower; |

| |

| 18. | First Extension Option Letter to Mezzanine 3 Loan Agreement, by Mezzanine 3 Borrower; |

| |

| 19. | Second Extension Option Letter to Mezzanine 3 Loan Agreement, by Mezzanine 3 Borrower; |

| |

| 20. | Authorization Letter to Morgan Stanley authorizing Extension of Mezzanine 3 Loan Agreement, by Mezzanine 3 Borrower; |

| |

| 21. | First Extension Option Letter to Mezzanine 4 Loan Agreement, by Mezzanine 4 Borrower; |

| |

| 22. | Second Extension Option Letter to Mezzanine 4 Loan Agreement, by Mezzanine 4 Borrower; |

| |

| 23. | Authorization Letter to Morgan Stanley authorizing Extension of Mezzanine 4 Loan Agreement, by Mezzanine 4 Borrower; |

| |

| 24. | First Extension Option Letter to Wells Fargo Mortgage Loan Agreement, by Wells Fargo Mortgage Loan Borrower; |

| |

| 25. | Second Extension Option Letter to Wells Fargo Mortgage Loan Agreement, by Wells Fargo Mortgage Loan Borrower; |

| |

| 26. | Authorization Letter to Morgan Stanley authorizing Extension of Wells Fargo Mortgage Loan Agreement, by Wells Fargo Mortgage Loan Borrower; |

| |

| 27. | Certificate of Interests and Assignment of Interests dated as of the date hereof, by PIM Nashville Borrower and HH Swap C LLC; |

| |

| 28. | Certificate of Interests and Assignment of Interests dated as of the date hereof, by PIM Nashville Operating Lessee and HH Swap F LLC; |

| |

| 29. | Certificate of Interests and Assignment of Interests dated as of the date hereof, by PIM Princeton Borrower and HH Swap C LLC; |

| |

| 30. | Certificate of Interests and Assignment of Interests dated as of the date hereof, by Princeton Operating Lessee and HH Swap F LLC; |

| |

| 31. | Certificate of Cancellation of HHC TRS Nashville LLC dated as of the date hereof; |

| |

| 32. | Certificate of Cancellation of HH Nashville LLC dated as of the date hereof; |

| |

| 33. | Certificate of Cancellation of HHC TRS GP LLC dated as of the date hereof; |

| |

| 34. | Limited Liability Company Agreement of PIM Nashville Borrower dated as of the date hereof, by HH Swap C LLC and HH Swap F LLC, as Members, and Victor A. Duva and Jennifer Schwartz, as Independent Managers; |

| |

| 35. | Limited Liability Company Agreement of PIM Nashville Operating Lessee dated as of the date hereof, by HH Swap F LLC, as Member, and Victor A. Duva and Jennifer Schwartz, as Independent Managers; |

| |

| 36. | Second Amended and Restated Limited Liability Company Agreement of HH Princeton dated as of the date hereof, by HH Swap C LLC, as Member, and Victor A. Duva and Jennifer Schwartz, as Independent Managers; |

| |

| 37. | Second Amended and Restated Limited Liability Company Agreement of Princeton Operating Lessee dated as of the date hereof, by HH Swap F LLC, as Member, and Victor A. Duva and Jennifer Schwartz, as Independent Managers; |

| |

| 38. | Second Amendment to Second Amended and Restated Limited Liability Company Agreement of HH Swap A LLC dated as of the date hereof; |

| |

| 39. | Second Amendment to Second Amended and Restated Limited Liability Company Agreement of HH Swap C LLC dated as of the date hereof; |

| |

| 40. | Second Amendment to Second Amended and Restated Limited Liability Company Agreement of HH Swap C-1 LLC dated as of the date hereof; |

| |

| 41. | Second Amendment to Second Amended and Restated Limited Liability Company Agreement of HH Swap D LLC dated as of the date hereof; |

| |

| 42. | Second Amendment to Second Amended and Restated Limited Liability Company Agreement of HH Swap F LLC dated as of the date hereof; |

| |

| 43. | Second Amendment to Second Amended and Restated Limited Liability Company Agreement of HH Swap F-1 LLC dated as of the date hereof; |

| |

| 44. | Second Amendment to Second Amended and Restated Limited Liability Company Agreement of HH Swap G LLC dated as of the date hereof; |

| |

| 45. | Consent Agreement (Mezz 2) dated as of the date hereof, by and among HH Mezz Borrower A-2 LLC, HH Mezz Borrower C-2 LLC, HH Mezz Borrower D-2 LLC, HH Mezz Borrower F-2 LLC, HH Mezz Borrower G-2 LLC, Guarantor and Starwood Property Mortgage Sub-10-A, L.L.C.; |

| |

| 46. | Consent Agreement (Mezz 3) dated as of the date hereof, by and among HH Mezz Borrower A-3 LLC, HH Mezz Borrower C-3 LLC, HH Mezz Borrower D-3 LLC, HH Mezz Borrower F-3 LLC, HH Mezz Borrower G-3 LLC, Guarantor and LVS SPE II, LLC; |

| |

| 47. | Consent Agreement (Mezz 4) dated as of the date hereof, by and among HH Mezz Borrower A-4 LLC, HH Mezz Borrower C-4 LLC, HH Mezz Borrower D-4 LLC, HH Mezz Borrower F-4 LLC, HH Mezz Borrower G-4 LLC, Guarantor and GSR3LP, LLC; and |

| |

| 48. | Amendment to Mutual Recognition and Non-Disturbance Agreement (Mezz 2) dated as of the date hereof by and among HH Mezz Borrower A-2 LLC, HH Mezz Borrower C-2 LLC, HH Mezz Borrower D-2 LLC, HH Mezz Borrower F-2 LLC, HH Mezz Borrower G-2 LLC, HH Nashville, PIM Nashville Borrower, Nashville Operating Lessee, PIM Nashville Operating Lessee and Renaissance Hotel Management Company, LLC. |

| |

| 49. | Amendment to Mutual Recognition and Non-Disturbance Agreement (Mezz 3) dated as of the date hereof by and among HH Mezz Borrower A-3 LLC, HH Mezz Borrower C-3 LLC, HH Mezz Borrower D-3 LLC, HH Mezz Borrower F-3 LLC, HH Mezz Borrower G-3 LLC, HH Nashville, PIM Nashville Borrower, Nashville Operating Lessee, PIM Nashville Operating Lessee and Renaissance Hotel Management Company, LLC. |

| |

| 50. | Amendment to Mutual Recognition and Non-Disturbance Agreement (Mezz 4) dated as of the date hereof by and among HH Mezz Borrower A-4 LLC, HH Mezz Borrower C-4 LLC, HH Mezz Borrower D-4 LLC, HH Mezz Borrower F-4 LLC, HH Mezz Borrower G-4 LLC, HH Nashville, PIM Nashville Borrower, Nashville Operating Lessee, PIM Nashville Operating Lessee and Renaissance Hotel Management Company, LLC. |

SCHEDULE 4

Distribution Schedule

|

| | | | | | | | | | | | | | | | | | | | | | |

| Highland Hospitality Senior Mezzanine Positions | | | | | | |

| | | | | | | | | | |

| Debt Positions as of December 19, 2012 | | | | Principal | | *Prorata | Prorata 1% |

| | | | | | | Paydown | | Interest | Premium |

| Lender/Investor | | Position | Closing Balance | Current Balance | Prorata % | $ | 3,756,200.44 |

| New Balance | $ | 27,091.29 |

| $ | 37,562.00 |

|

| Athene- AEL | Note A-1 | Mezz 1 (Pari-Passu) | $ | 59,526,549 |

| $ | 54,565,793.32 |

| 14.86 | % | $ | 558,076.46 |

| $ | 54,007,716.86 |

| $ | 3,363.96 |

| $ | 5,580.76 |

|

| Athene | Note A-2 | Mezz 1 (Pari-Passu) | 12,846,411 |

| 11,775,831.68 |

| 3.21 | % | 120,438.36 |

| 11,655,393.32 |

| 725.98 |

| 1,204.38 |

|

| Newcastle VI | Note A-3 | Mezz 1 (Pari-Passu) | 20,000,000 |

| 18,333,262.86 |

| 4.99 | % | 187,505.06 |

| 18,145,757.80 |

| 1,130.24 |

| 1,875.05 |

|

| Newcastle IX | Note A-4 | Mezz 1 (Pari-Passu) | 20,000,000 |

| 18,333,262.84 |

| 4.99 | % | 187,505.06 |

| 18,145,757.78 |

| 1,130.24 |

| 1,875.05 |

|

| Principal | Note A-5 | Mezz 1 (Pari-Passu) | 12,408,738 |

| 11,374,632.76 |

| 3.10 | % | 116,335.06 |

| 11,258,297.70 |

| 701.24 |

| 1,163.35 |

|

| Principal | Note A-6 | Mezz 1 (Pari-Passu) | 19,964,222 |

| 18,300,466.48 |

| 4.98 | % | 187,169.63 |

| 18,113,296.85 |

| 1,128.22 |

| 1,871.70 |

|

| Starwood Property Trust | Note A-1 | Mezz 2 (Pari-Passu) | 110,235,896 |

| 101,049,099.46 |

| 27.51 | % | 1,033,488.57 |

| 100,015,610.89 |

| 7,119.59 |

| 10,334.89 |

|

| Starwood Property Trust | Note A-2 | Mezz 2 (Pari-Passu) | 27,558,974 |

| 25,262,274.85 |

| 6.88 | % | 258,372.14 |

| 25,003,902.71 |

| 1,779.90 |

| 2,583.72 |

|

| PIMCO Bravo Fund | | Mezz 3 (Pari-Passu) | 118,109,889 |

| 108,266,981.70 |

| 29.48 | % | 1,107,310.10 |

| 107,159,671.60 |

| 10,011.93 |

| 11,073.10 |

|

| Total Debt | | | $ | 400,650,679 |

| $ | 367,261,605.95 |

| 100.00 | % | $ | 3,756,200.44 |

| $ | 363,505,405.51 |

| $ | 27,091.29 |

| $ | 37,562.00 |

|

| | | | | | | | | | |