1 Spin-Off Overview

2 Safe Harbor In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the Company's filings with the Securities and Exchange Commission. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price. EBITDA, FFO, AFFO, CAD and other terms are non- GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Trust, Inc. or Ashford Hospitality Prime, Inc. and may not be relied upon in connection with the purchase or sale of any such security.

3 Ashford Hospitality Prime Spin-Off • AHT plans to transfer ownership interest in an 8-hotel portfolio to a newly formed company, Ashford Hospitality Prime, Inc. ("Ashford Prime"), which is expected to qualify as a Real Estate Investment Trust and intends to file an application to list its shares of common stock on the NYSE, under the symbol "AHP". • AHT plans to spin-off 80% of Ashford Prime to holders of Ashford Trust common stock in the form of a taxable special dividend to be comprised of common stock of Ashford Prime. • The distribution is expected to be made on a pro rata basis to holders of Ashford Trust common stock as of the distribution record date. • This distribution is expected to take place during the third quarter of 2013. • The distribution will be subject to the Securities and Exchange Commission's review and declaring effective Ashford Prime's Form 10 registration statement, which the company has recently filed. The distribution is also subject to the satisfaction of a number of other conditions, including those relating to third party consents. • As such, we cannot be certain that the distribution will occur, or proceed in the manner or amount as currently anticipated

4 Strategic Rationale Creation of Two Focused Companies Creates Clarity Potential for Higher Aggregate Market Value for Stockholders Tailored Capital Structure More Efficient More Conservative Capital Structure

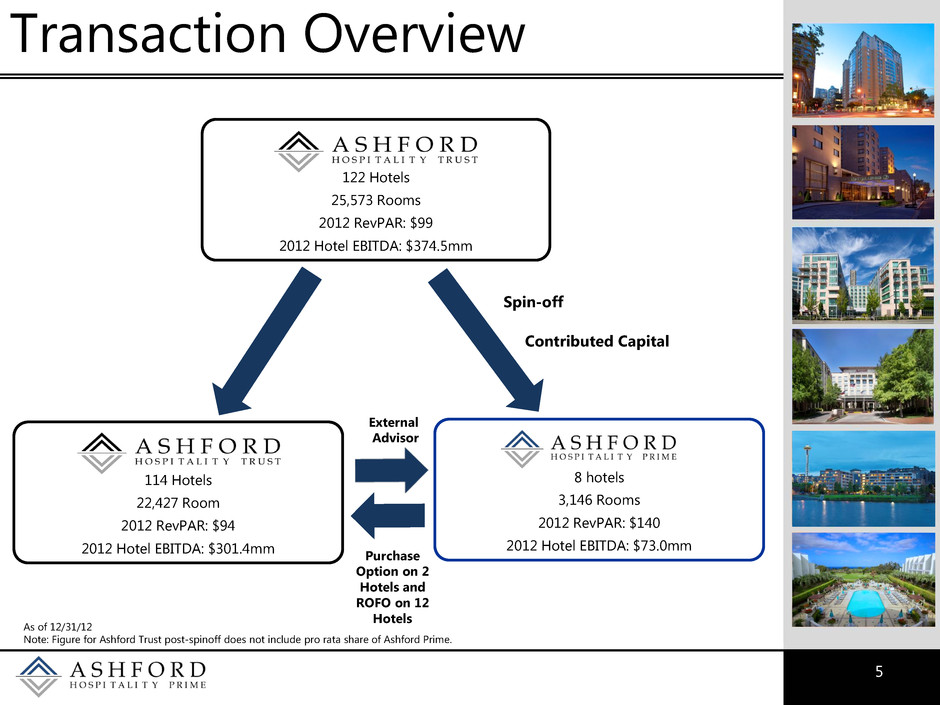

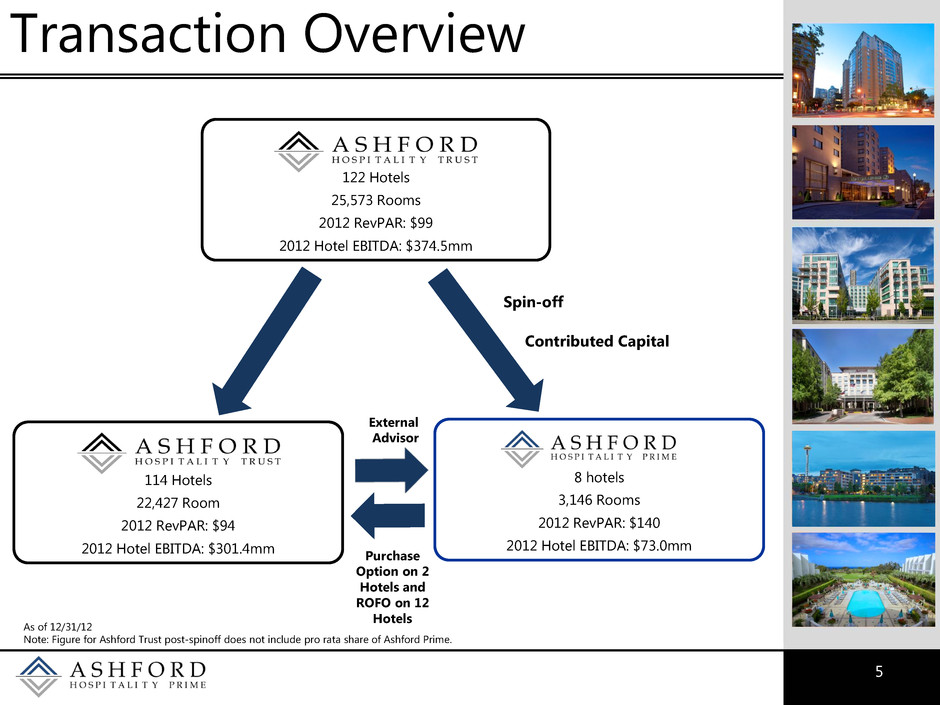

5 Transaction Overview 122 Hotels 25,573 Rooms 2012 RevPAR: $99 2012 Hotel EBITDA: $374.5mm 8 hotels 3,146 Rooms 2012 RevPAR: $140 2012 Hotel EBITDA: $73.0mm 114 Hotels 22,427 Room 2012 RevPAR: $94 2012 Hotel EBITDA: $301.4mm Spin-off Contributed Capital Purchase Option on 2 Hotels and ROFO on 12 Hotels External Advisor As of 12/31/12 Note: Figure for Ashford Trust post-spinoff does not include pro rata share of Ashford Prime.

6 Ashford Prime Overview High Quality Hotel Portfolio • Geographically diversified and concentrated predominantly in top 20 U.S. markets • Premium portfolio RevPAR of $140 • EBITDA per room of over $23,000 • Strong market share as evidenced by RevPAR penetration index of 110.6 • All current hotels branded and managed by Marriott and Hilton Focused Investment Strategy • Luxury, upper-upscale & upscale hotels in domestic gateway markets • Select investment in resort hotels and international gateway cities • Hotels with RevPAR 2x the then current national average Strong Acquisition Pipeline • Purchase Option to acquire Pier House Resort with $276 RevPAR and Crystal Gateway Marriott with $137 RevPAR • Right-of-First-Offer on additional 12 high RevPAR hotels in Ashford Trust portfolio totaling 3,110 rooms

7 Ashford Prime Overview • Institutional Investor Tailored Platform Highly-Aligned Management Structure • Ashford Trust expected to own 20% of Ashford Prime on a pro forma basis • Management and related parties are expected to hold approximately 19% equity interest in Ashford Prime • The highest inside ownership percentages of all the publicly-traded lodging REITs Attractive Corporate Governance • Advisor owned by Ashford Trust will provide strong transparency and offer investors ability to own shares in publicly-traded advisor • Fee compensation to be tied to enterprise value and total shareholder return • Non-classified Board of Directors to consist of 5 independent directors (including the lead director) and 2 members of the management team • Advisor's 20% ownership interest will generally be non-voting on shareholder matters Prudent and Low Leverage Structure • Targeted leverage level over time of 5.0x or lower (Net Debt + Preferred Equity) / EBITDA • Attractive maturity profile with no maturities before 2017 • Anticipated unsecured credit facility would provide additional liquidity and flexibility

8 Differentiated Investment Strategy Ashford Prime Ashford Trust Investment Focus High-quality, High-RevPAR hotels in major markets expected to generate RevPAR of at least 2x the national average All segments of the hospitality industry excluding the High-RevPAR hotels targeted by Ashford Prime Investment Type Direct equity investments and joint ventures All parts of the capital structure Geography U.S. gateway cities, select resort locations and international gateway cities All domestic and limited international locations Chain Scale Predominantly luxury & upper-upscale hotels Various chain scale segments Mix of Service Predominantly full-service hotels Full-service and select-service Capital Structure Conservative Opportunistic Leverage Policy Target < 5.0x Net Debt + Preferred to EBITDA Strategic use of debt designed to maximize returns Brand Strategy Premium brands (Hilton, Marriott, Starwood, etc.) and high-quality independent hotels Premium brands (Hilton, Marriott, Starwood, etc.) and high-quality independent hotels Management Existing Ashford Trust management Existing Ashford Trust management • Ashford Prime will differentiate itself from existing Ashford Trust by its investment focus on higher-quality, higher-RevPAR hotels and its geographic focus on both domestic and international locations

9 Ashford Prime Properties San Francisco San Francisco Courtyard 405 Rooms Seattle Marriott Seattle Waterfront 358 Rooms Seattle Courtyard 250 Rooms Philadelphia Philadelphia Courtyard 498 Rooms Dallas Marriott Plano Legacy 404 Rooms San Diego Hilton Torrey Pines 394 Rooms Hotel Market Rooms Ritz-Carlton Atlanta, GA 444 Rooms Hilton Back Bay Boston, MA 390 Rooms Courtyard Downtown Boston, MA 315 Rooms Embassy Suites Portland, OR 276 Rooms Embassy Suites Crystal City Washington, D.C. 267 Rooms Crowne Plaza Beverly Hills Los Angeles, CA 260 Rooms Hyatt Regency Coral Gables Miami, FL 242 Rooms Melrose Washington, D.C. 240 Rooms One Ocean Jacksonville, FL 193 Rooms Churchill Washington, D.C. 173 Rooms Crowne Plaza Key West Key West, FL 160 Rooms Embassy Suites Houston, TX 150 Rooms Right of First Offer Assets Initial Assets Right of First Offer Assets Option Assets Hotel Market Rooms Marriott Crystal Gateway Washington, D.C. 697 Rooms Pier House Resort & Spa Key West, FL 142 Rooms Option Assets Tampa Tampa Renaissance 293 Rooms Washington, D.C. Capital Hilton 544 Rooms

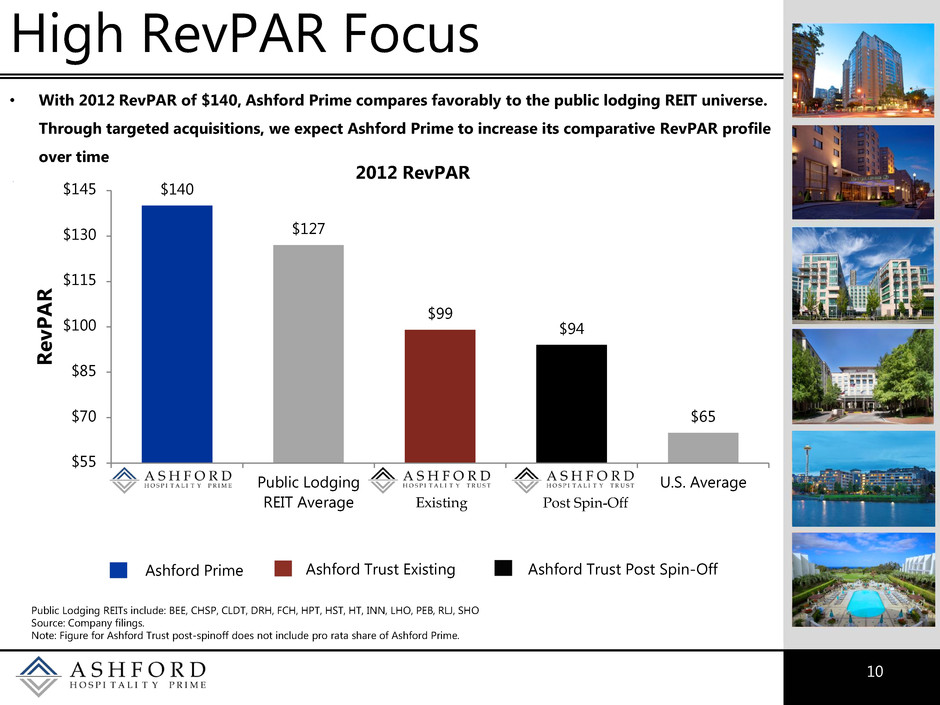

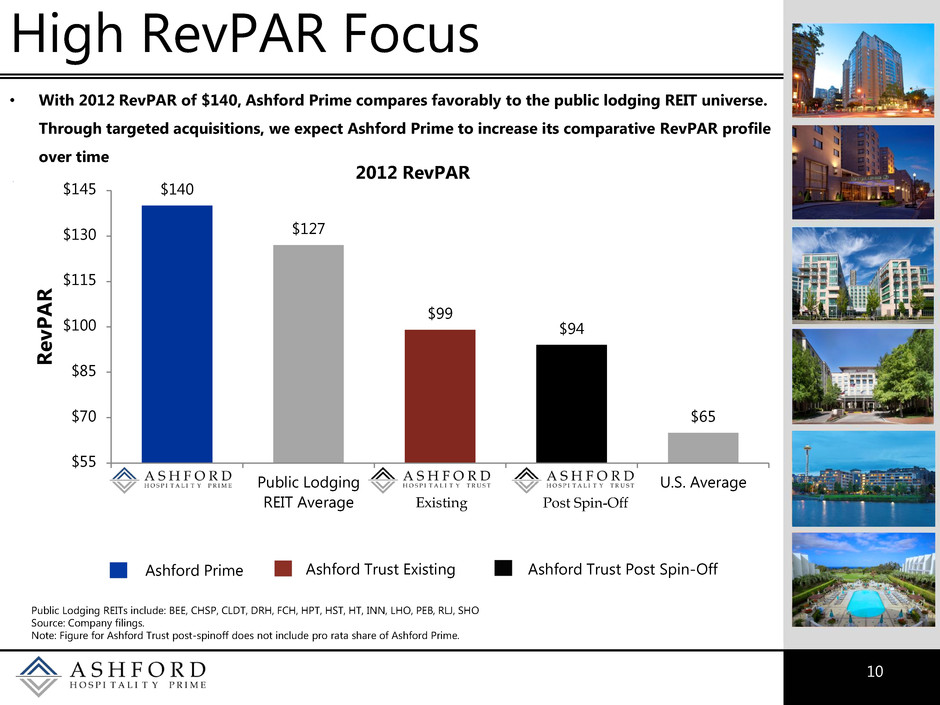

10 High RevPAR Focus • With 2012 RevPAR of $140, Ashford Prime compares favorably to the public lodging REIT universe. Through targeted acquisitions, we expect Ashford Prime to increase its comparative RevPAR profile over time $140 $127 $99 $94 $65 $55 $70 $85 $100 $115 $130 $145 Public Lodging REIT Average U.S. Average Rev P A R Public Lodging REITs include: BEE, CHSP, CLDT, DRH, FCH, HPT, HST, HT, INN, LHO, PEB, RLJ, SHO Source: Company filings. Note: Figure for Ashford Trust post-spinoff does not include pro rata share of Ashford Prime. Ashford Trust Post Spin-Off Ashford Trust Existing Ashford Prime 2012 RevPAR Existing Post Spin-Off

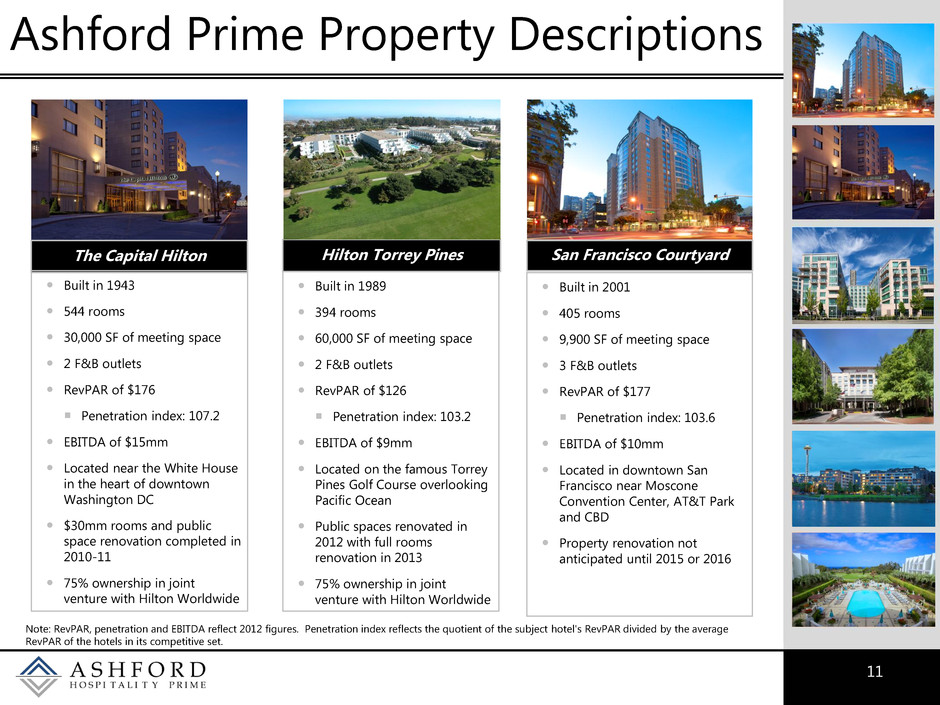

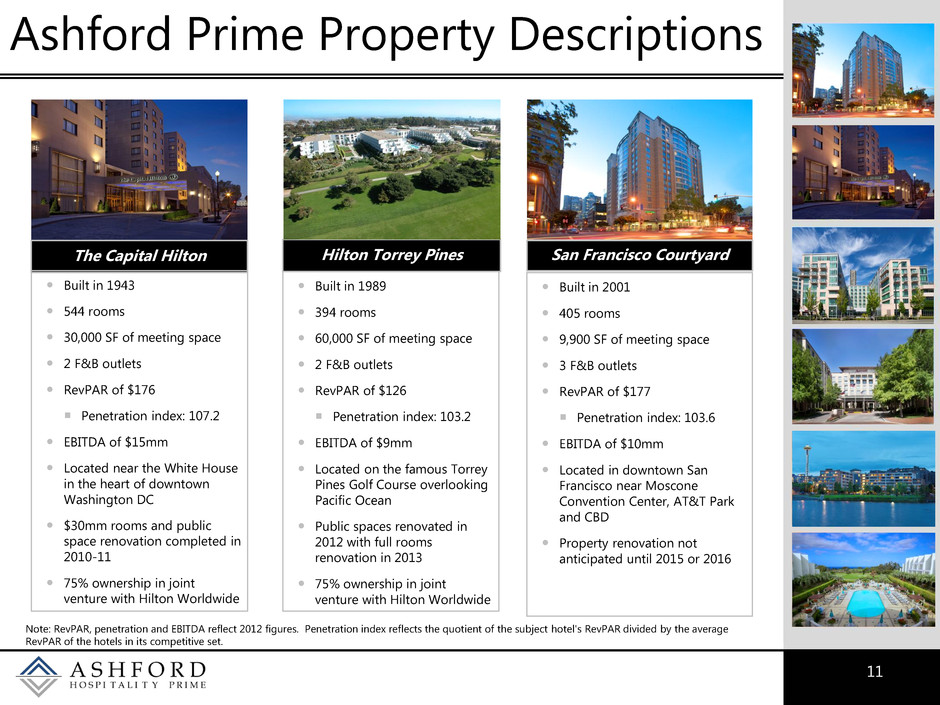

11 Ashford Prime Property Descriptions Hilton Torrey Pines Built in 1989 394 rooms 60,000 SF of meeting space 2 F&B outlets RevPAR of $126 Penetration index: 103.2 EBITDA of $9mm Located on the famous Torrey Pines Golf Course overlooking Pacific Ocean Public spaces renovated in 2012 with full rooms renovation in 2013 75% ownership in joint venture with Hilton Worldwide The Capital Hilton Built in 1943 544 rooms 30,000 SF of meeting space 2 F&B outlets RevPAR of $176 Penetration index: 107.2 EBITDA of $15mm Located near the White House in the heart of downtown Washington DC $30mm rooms and public space renovation completed in 2010-11 75% ownership in joint venture with Hilton Worldwide Built in 2001 405 rooms 9,900 SF of meeting space 3 F&B outlets RevPAR of $177 Penetration index: 103.6 EBITDA of $10mm Located in downtown San Francisco near Moscone Convention Center, AT&T Park and CBD Property renovation not anticipated until 2015 or 2016 San Francisco Courtyard Note: RevPAR, penetration and EBITDA reflect 2012 figures. Penetration index reflects the quotient of the subject hotel's RevPAR divided by the average RevPAR of the hotels in its competitive set.

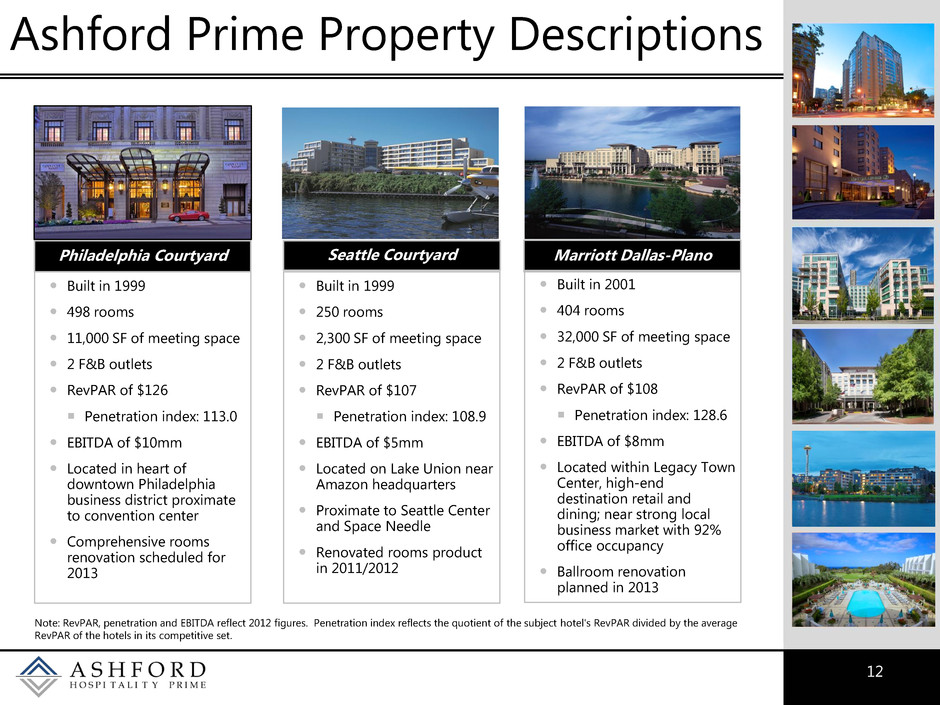

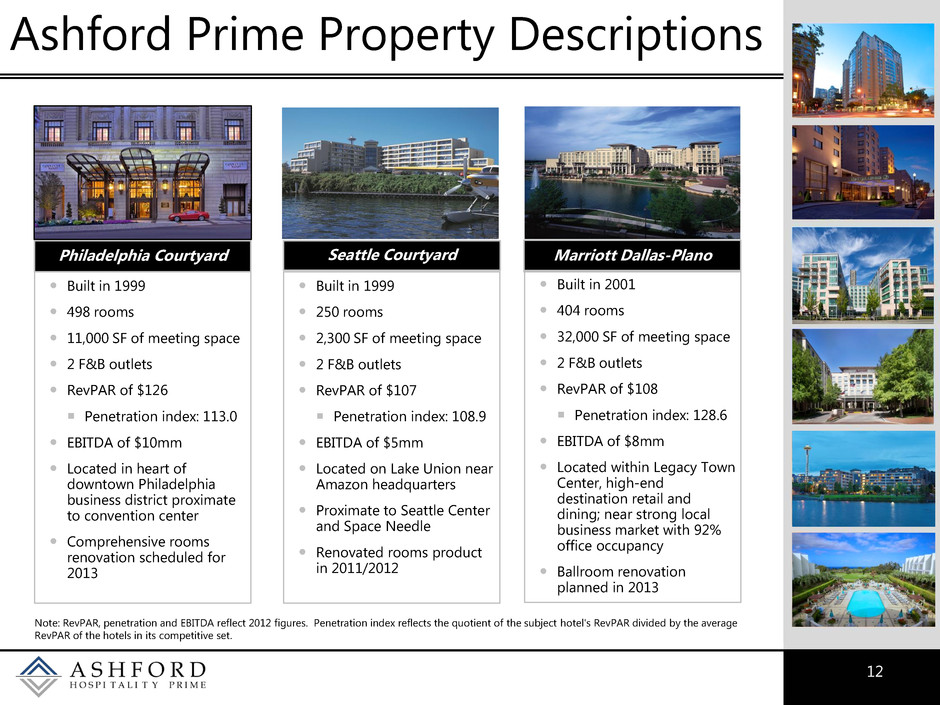

12 Ashford Prime Property Descriptions Philadelphia Courtyard Built in 1999 498 rooms 11,000 SF of meeting space 2 F&B outlets RevPAR of $126 Penetration index: 113.0 EBITDA of $10mm Located in heart of downtown Philadelphia business district proximate to convention center Comprehensive rooms renovation scheduled for 2013 Built in 1999 250 rooms 2,300 SF of meeting space 2 F&B outlets RevPAR of $107 Penetration index: 108.9 EBITDA of $5mm Located on Lake Union near Amazon headquarters Proximate to Seattle Center and Space Needle Renovated rooms product in 2011/2012 Seattle Courtyard Marriott Dallas-Plano Built in 2001 404 rooms 32,000 SF of meeting space 2 F&B outlets RevPAR of $108 Penetration index: 128.6 EBITDA of $8mm Located within Legacy Town Center, high-end destination retail and dining; near strong local business market with 92% office occupancy Ballroom renovation planned in 2013 Note: RevPAR, penetration and EBITDA reflect 2012 figures. Penetration index reflects the quotient of the subject hotel's RevPAR divided by the average RevPAR of the hotels in its competitive set.

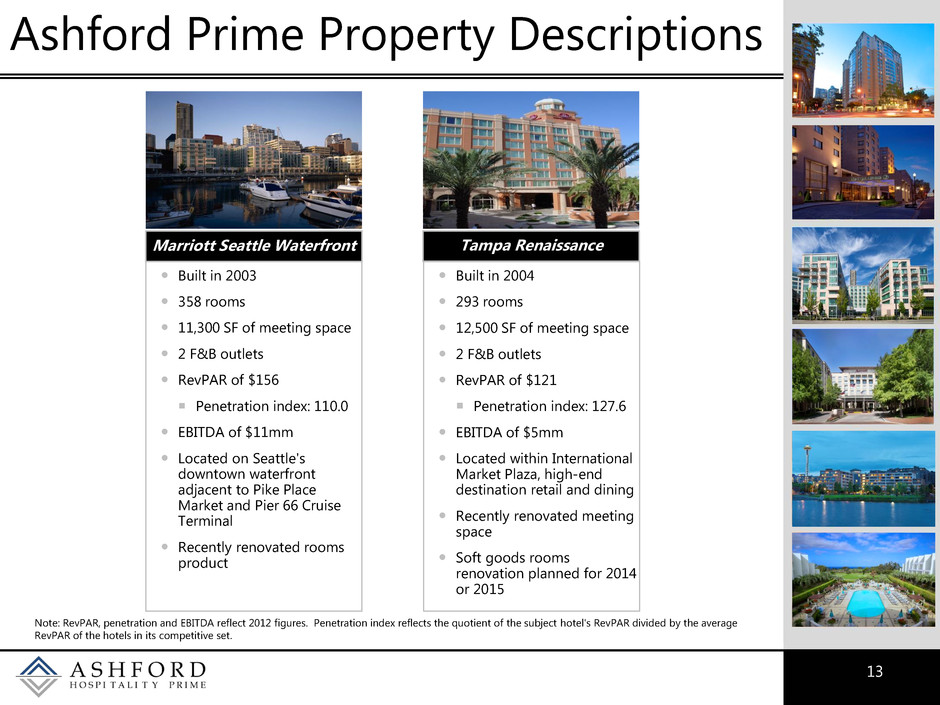

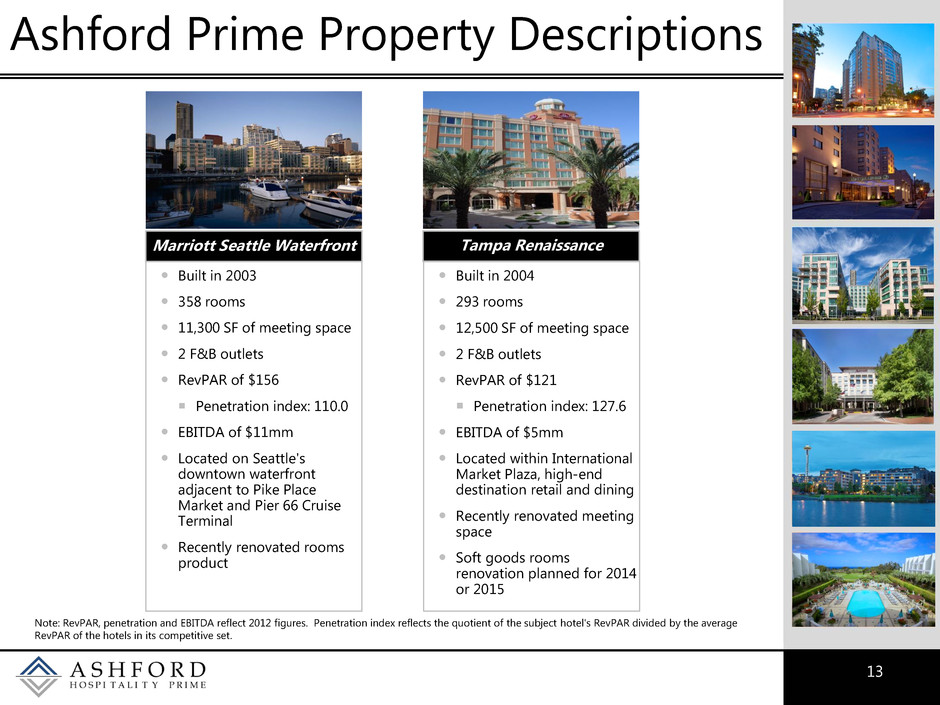

13 Ashford Prime Property Descriptions Note: RevPAR, penetration and EBITDA reflect 2012 figures. Penetration index reflects the quotient of the subject hotel's RevPAR divided by the average RevPAR of the hotels in its competitive set. Marriott Seattle Waterfront Built in 2003 358 rooms 11,300 SF of meeting space 2 F&B outlets RevPAR of $156 Penetration index: 110.0 EBITDA of $11mm Located on Seattle's downtown waterfront adjacent to Pike Place Market and Pier 66 Cruise Terminal Recently renovated rooms product Tampa Renaissance Built in 2004 293 rooms 12,500 SF of meeting space 2 F&B outlets RevPAR of $121 Penetration index: 127.6 EBITDA of $5mm Located within International Market Plaza, high-end destination retail and dining Recently renovated meeting space Soft goods rooms renovation planned for 2014 or 2015

14 Option and Right of First Offer Properties Note: RevPAR, penetration and EBITDA reflect 2012 figures. Penetration index reflects the quotient of the subject hotel's RevPAR divided by the average RevPAR of the hotels in its competitive set. * Subject to joint venture approval. Pier House Resort & Spa Option Price of $90 million, subject to owner funded capital expenditures and increase over time Built in 1968 142 rooms 2,600 SF of meeting space &10,000 SF spa 3 F&B outlets RevPAR of $276 Penetration index: 97.2 EBITDA of $6mm Minimal near-term capital needed after $20 million in renovations from 2006-2008 Consistently strong market with high barriers to entry, trailing only New York City in terms of annual RevPAR Transition from family run to institutional management to improve operational performance Marriott Crystal Gateway Option price based on market value Built in 1982 697 rooms 34,300 SF of meeting space 3 F&B outlets RevPAR of $137 Penetration index: 112.5 EBITDA of $16mm Group destination hotel located near Pentagon and Reagan National Airport Comprehensive renovation completed in 2008 Meeting space targeted for renovation in 2013 Strong location with several demand generators nearby Institutional quality asset in stable market Additional Growth Opportunities From Right of First Offer on High Quality Assets Crowne Plaza Beverly Hills Embassy Suites Crystal City Crowne Plaza Key West Hyatt Coral Gables One Ocean Jacksonville Houston Embassy Suites Portland Embassy Suites Ritz-Carlton Atlanta* Hilton Boston Back Bay* Courtyard Boston Downtown* The Churchill, Washington D.C.* The Melrose, Washington D.C.* • Option and ROFO Hotels provide avenue for growth for Ashford Prime

15 Highly-Aligned Management • With insider ownership* of both platforms anticipated to be approximately 19%, management is highly-aligned with shareholder interests Public Lodging REITs include: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Source: Company filings. * Insider ownership for Ashford entities includes interests of related parties Ashford Trust Post Spin-Off Ashford Trust Existing Ashford Prime Publicly-Traded REIT Insider Ownership 19% 19% 19% 4% 4% 4% 4% 3% 3% 2% 2% 2% 2% 1% 1% 0% 5% 10% 15% 20% 25% O w n ersh ip P erce n ta g e H O S P I T A L I T Y T R U S T P O S T S P I N OFF H O S P I T A L I T Y T R U S T E X I S T I N G H O S P I T A L I T Y P R I M E A S H F O R D

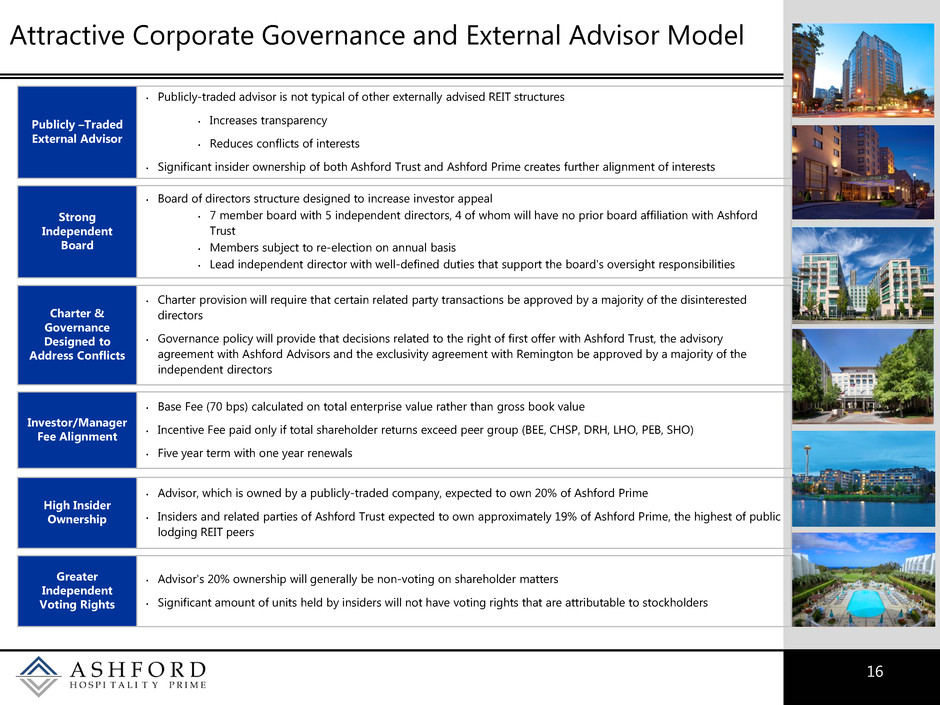

16 Attractive Corporate Governance and External Advisor Model • Publicly-traded advisor is not typical of other externally advised REIT structures • Increases transparency • Reduces conflicts of interests • Significant insider ownership of both Ashford Trust and Ashford Prime creates further alignment of interests Publicly –Traded External Advisor • Board of directors structure designed to increase investor appeal • 7 member board with 5 independent directors, 4 of whom will have no prior board affiliation with Ashford Trust • Members subject to re-election on annual basis • Lead independent director with well-defined duties that support the board's oversight responsibilities Strong Independent Board • Charter provision will require that certain related party transactions be approved by a majority of the disinterested directors • Governance policy will provide that decisions related to the right of first offer with Ashford Trust, the advisory agreement with Ashford Advisors and the exclusivity agreement with Remington be approved by a majority of the independent directors Charter & Governance Designed to Address Conflicts • Base Fee (70 bps) calculated on total enterprise value rather than gross book value • Incentive Fee paid only if total shareholder returns exceed peer group (BEE, CHSP, DRH, LHO, PEB, SHO) • Five year term with one year renewals Investor/Manager Fee Alignment • Advisor, which is owned by a publicly-traded company, expected to own 20% of Ashford Prime • Insiders and related parties of Ashford Trust expected to own approximately 19% of Ashford Prime, the highest of public lodging REIT peers High Insider Ownership • Advisor's 20% ownership will generally be non-voting on shareholder matters • Significant amount of units held by insiders will not have voting rights that are attributable to stockholders Greater Independent Voting Rights

17 Spin-Off Overview