Credit Suisse Conference - August 2013 1

Safe Harbor 2 In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the Company's filings with the Securities and Exchange Commission. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Trust, Inc. and may not be relied upon in connection with the purchase or sale of any such security.

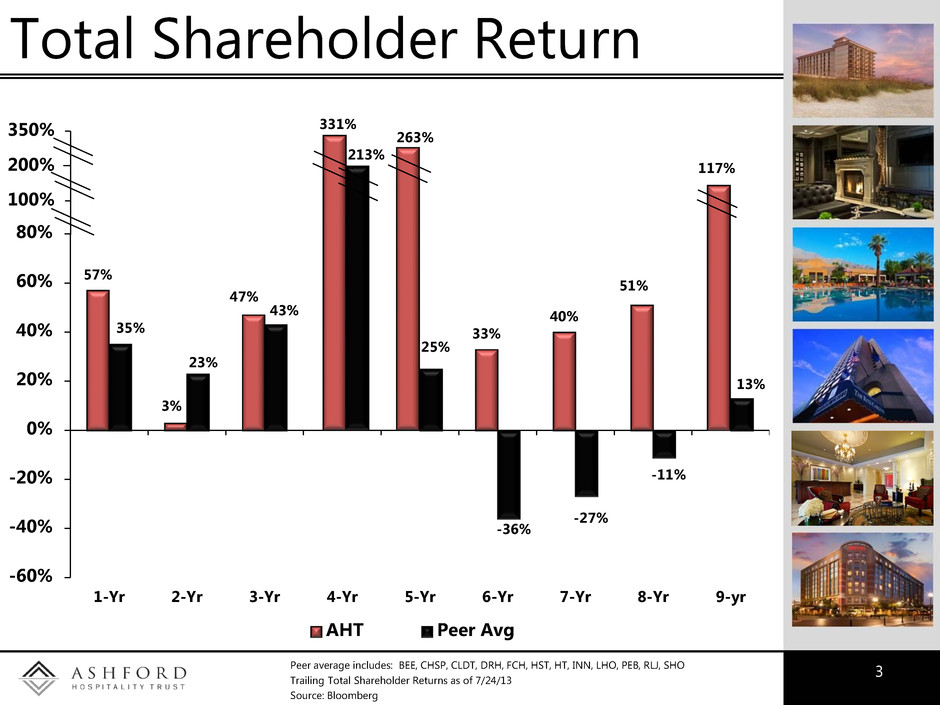

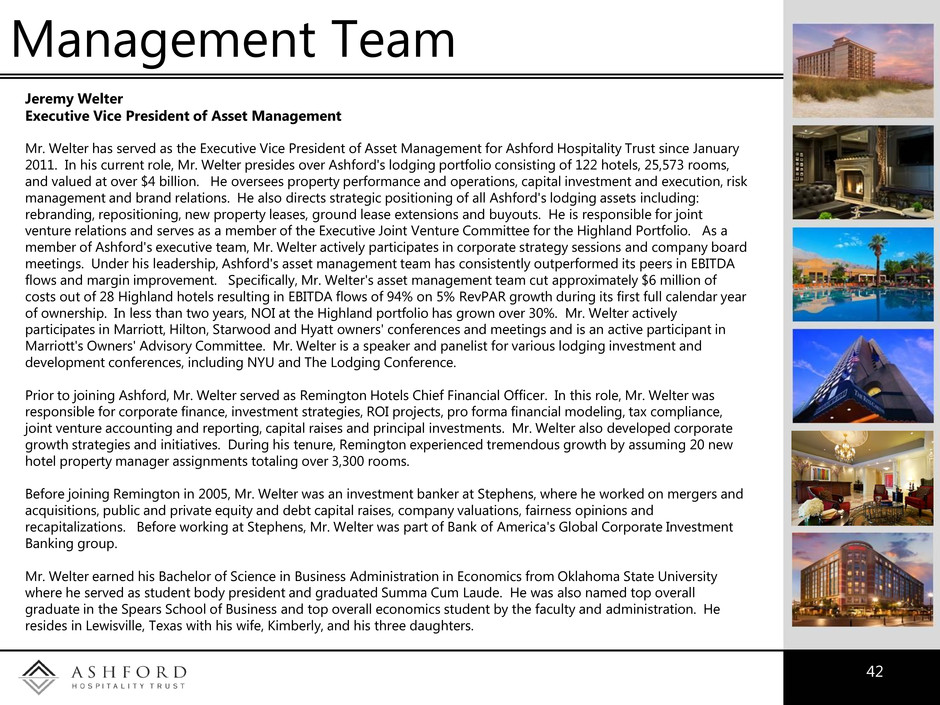

Total Shareholder Return 3 57% 3% 47% 33% 40% 51% 35% 23% 43% 25% -36% -27% -11% 13% -60% -40% -20% 0% 20% 40% 60% 80% 1-Yr 2-Yr 3-Yr 4-Yr 5-Yr 6-Yr 7-Yr 8-Yr 9-yr AHT Peer Avg 350% 331% 213% Peer average includes: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Trailing Total Shareholder Returns as of 7/24/13 Source: Bloomberg 100% 200% 263% 117%

Total Shareholder Return - Volatility 4 20% 30% 40% 50% 60% 70% 80% 1-Yr 2-Yr 3-Yr 4-Yr 5-Yr 6-Yr 7-Yr 8-Yr 9-yr AHT Peer Avg Peer average includes: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Trailing Volatility as of 7/24/13 Source: Bloomberg − Ashford's volatility has been lower than the peer average

Real RevPAR Growing 5 Source: U.S. Dept. of Commerce: BEA & Historical Statistics of the United States: - Cambridge $54.00 $56.00 $58.00 $60.00 $62.00 $64.00 $66.00 $68.00 $70.00 $72.00 $74.00 $76.00 Seasonally-Adjusted Real RevPAR (as of June 2013) Average 3-mo Avg

Hotel Demand Driven by Economy 6 -8.0 -6.0 -4.0 -2.0 0.0 2.0 4.0 6.0 8.0 Real GDP Growth Hotel Demand Growth R-squared = 0.58 Source: Smith Travel Research & U.S. Dept. of Commerce: BEA

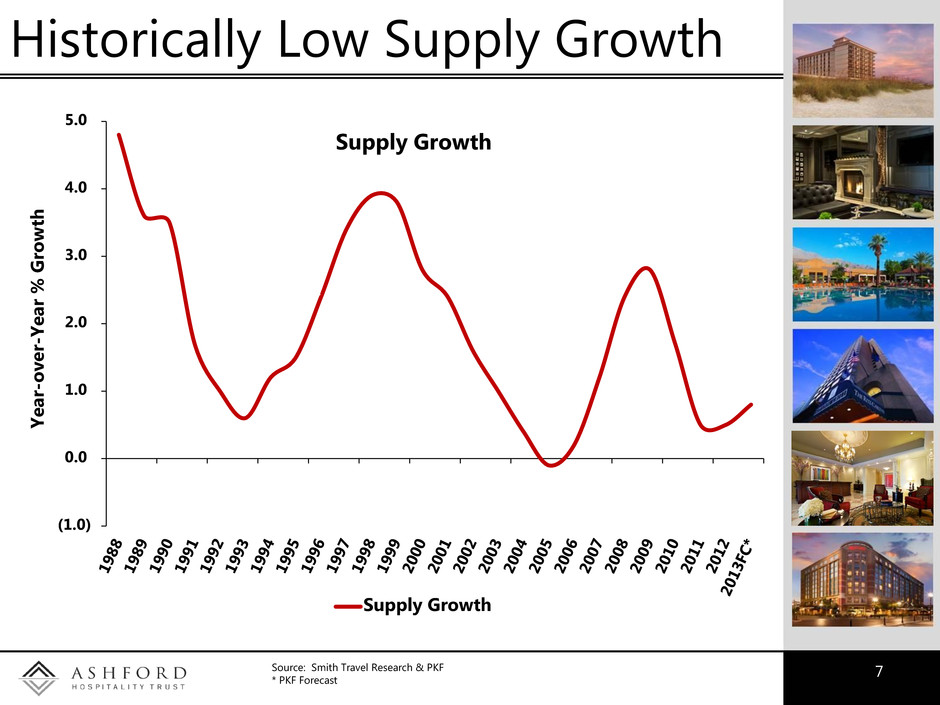

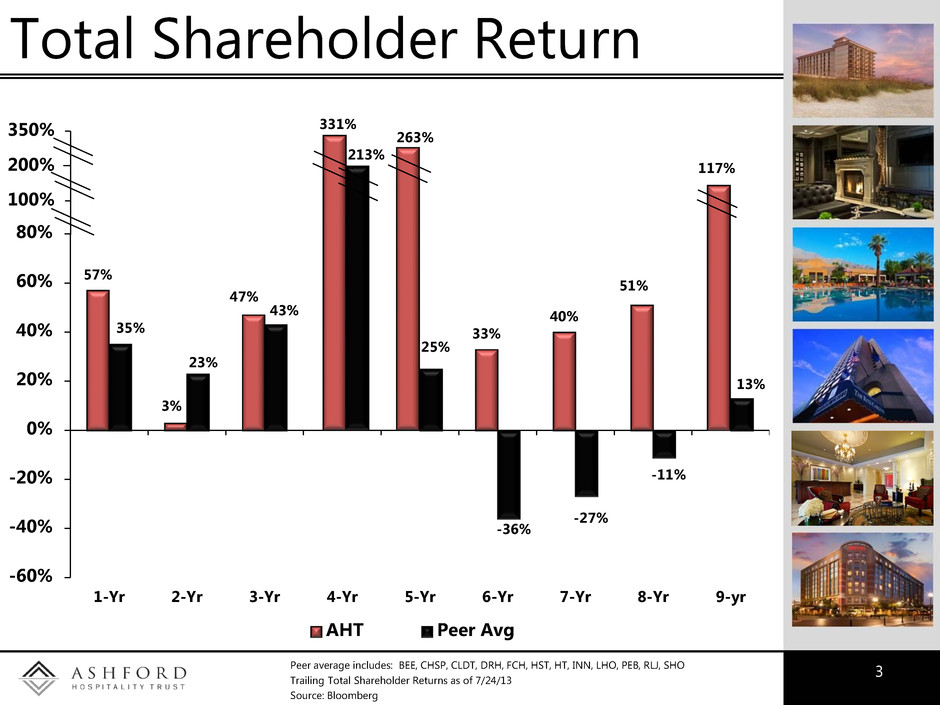

Historically Low Supply Growth 7 (1.0) 0.0 1.0 2.0 3.0 4.0 5.0 Supply Growth Supply Growth Y e a r- o v e r- Y e ar % Gr o w th Source: Smith Travel Research & PKF * PKF Forecast

Historical Stock Returns 8 − Historically, attractive returns from this point in the cycle 0% 50% 100% 150% 200% 250% 300% 350% 0 12 24 36 48 60 72 84 96 108 Months from Peak to Peak 1989-1997 1997-2007 2007-? Index includes AHT, BEE, DRH, FCH, HST, HT, LHO, and SHO. * Companies are included in the data from the time of their IPO.

7.7% 6.1% -2.0% -16.7% 5.4% 8.2% 6.8% 6.1% 7.7% 8.5% 5.3% 2.3% -20.0% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% Historical RevPAR Growth Forecasted RevPAR Growth RevPAR Forecast - PKF 9 5-Year RevPAR Growth CAGR: 6.0% Source: Smith Travel Research & PKF

Potential Industry EBITDA Growth Rates 10 − With strong potential RevPAR gains, those companies with reasonable flow-throughs could experience significant EBITDA growth − PKF estimates 2-year cumulative EBITDA growth of about 29%* *Based on PKF RevPAR/ADR/Occupancy projections and EBITDA growth resulting from PKF EBITDA change regression equation COMPOUNDED 2-YEAR REVPAR GROWTH RATE COMPOUNDED 2-YEAR REVPAR GROWTH RATE 28.6% 6.0% 6.5% 7.0% 7.5% 8.0% 20.0% 9.9% 10.7% 11.6% 12.5% 13.3% 25.0% 12.4% 13.4% 14.5% 15.6% 16.6% 30.0% 14.8% 16.1% 17.4% 18.7% 20.0% 35.0% 17.3% 18.8% 20.3% 21.8% 23.3% 40.0% 19.8% 21.5% 23.2% 24.9% 26.6% 45.0% 22.2% 24.2% 26.1% 28.0% 30.0% 50.0% 24.7% 26.8% 29.0% 31.1% 33.3% 55.0% 27.2% 29.5% 31.9% 34.2% 36.6% 60.0% 29.7% 32.2% 34.8% 37.4% 39.9% 65.0% 32.1% 34.9% 37.7% 40.5% 43.3% 70.0% 34.6% 37.6% 40.6% 43.6% 46.6% 2- YE AR EB IT DA FL OW % CUMULATIVE 2-YEAR EBITDA GROWTH

Company Highlights 11

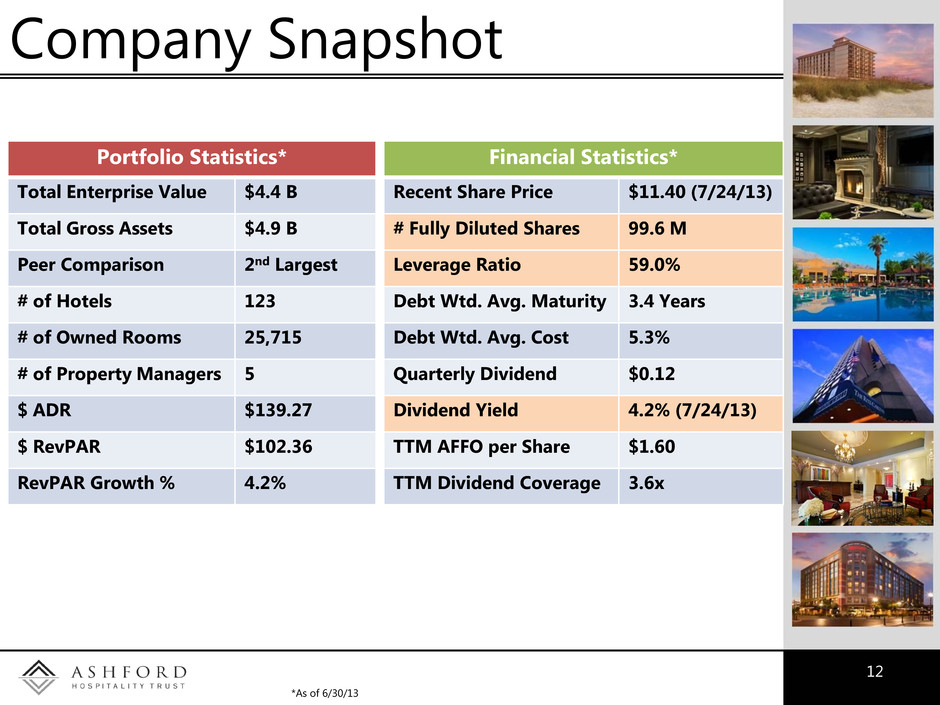

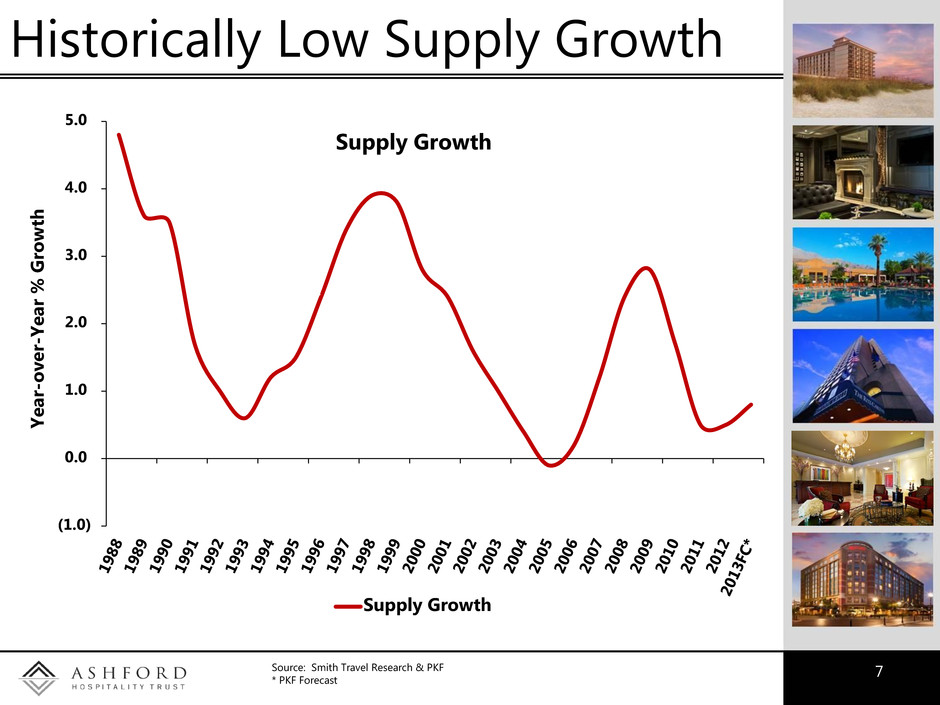

Company Snapshot 12 Portfolio Statistics* Total Enterprise Value $4.4 B Total Gross Assets $4.9 B Peer Comparison 2nd Largest # of Hotels 123 # of Owned Rooms 25,715 # of Property Managers 5 $ ADR $139.27 $ RevPAR $102.36 RevPAR Growth % 4.2% Financial Statistics* Recent Share Price $11.40 (7/24/13) # Fully Diluted Shares 99.6 M Leverage Ratio 59.0% Debt Wtd. Avg. Maturity 3.4 Years Debt Wtd. Avg. Cost 5.3% Quarterly Dividend $0.12 Dividend Yield 4.2% (7/24/13) TTM AFFO per Share $1.60 TTM Dividend Coverage 3.6x *As of 6/30/13

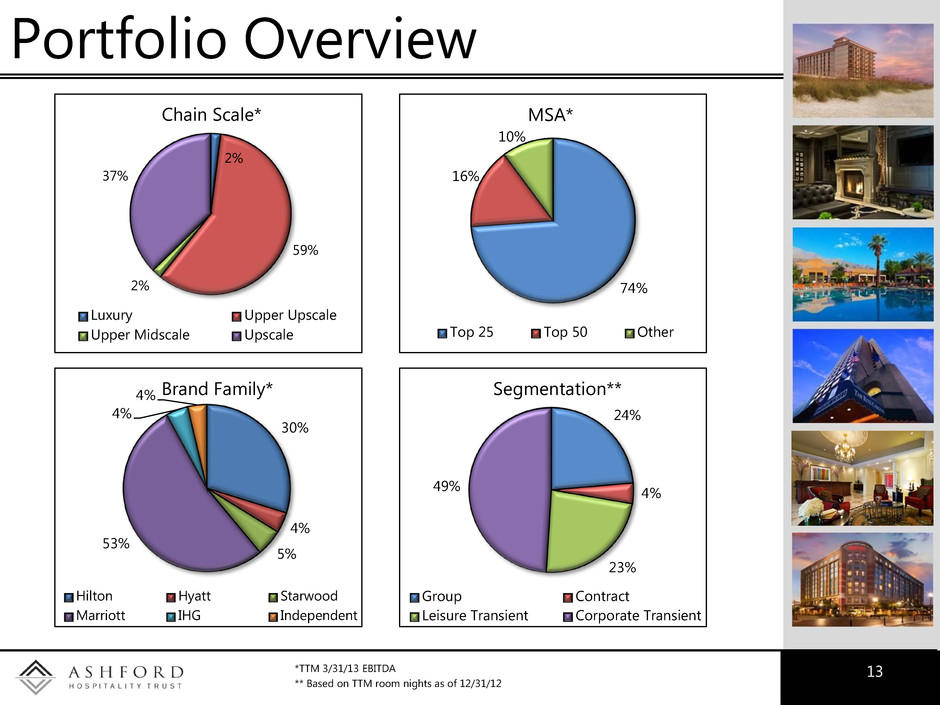

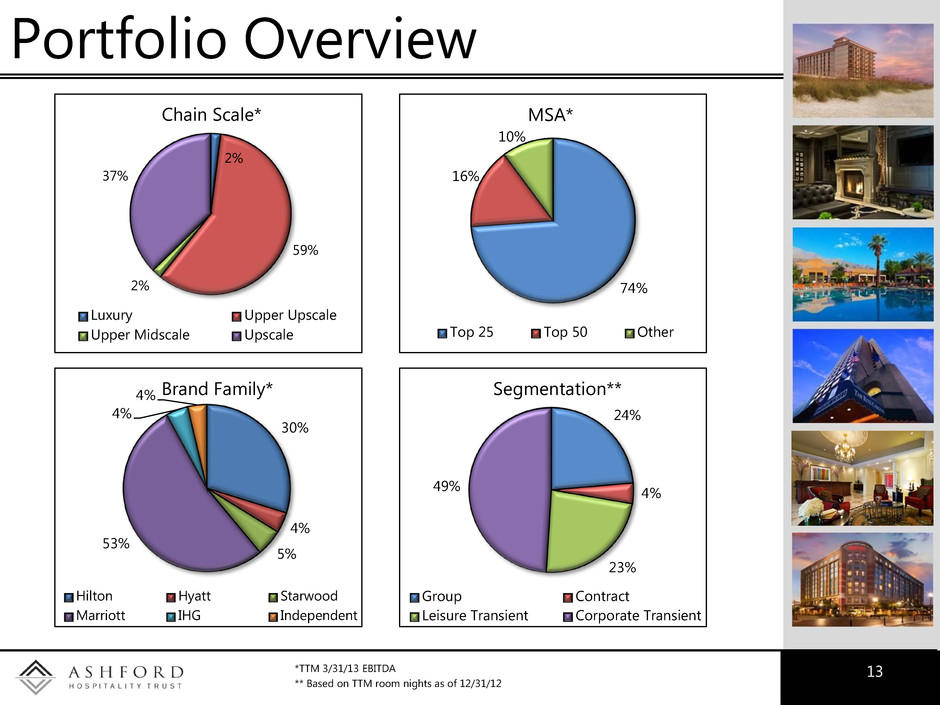

Portfolio Overview 13 2% 59% 2% 37% Chain Scale* Luxury Upper Upscale Upper Midscale Upscale 30% 4% 5% 53% 4% 4% Brand Family* Hilton Hyatt Starwood Marriott IHG Independent 24% 4% 23% 49% Segmentation** Group Contract Leisure Transient Corporate Transient 74% 16% 10% MSA* Top 25 Top 50 Other *TTM 3/31/13 EBITDA ** Based on TTM room nights as of 12/31/12

Asset Management Outperformance 14 39% 8% 49% 41% 50% 53% 51% 37% 53% 104% 63% 65% 0% 20% 40% 60% 80% 100% 120% 2007 2008 2009 2010 2011 2012 Peer Avg AHT − Ashford consistently beats peers in hotel EBITDA flow throughs Peers include: BEE, CHSP, DRH, FCH, HST, HT, LHO, PEB, SHO Source: Company Filings

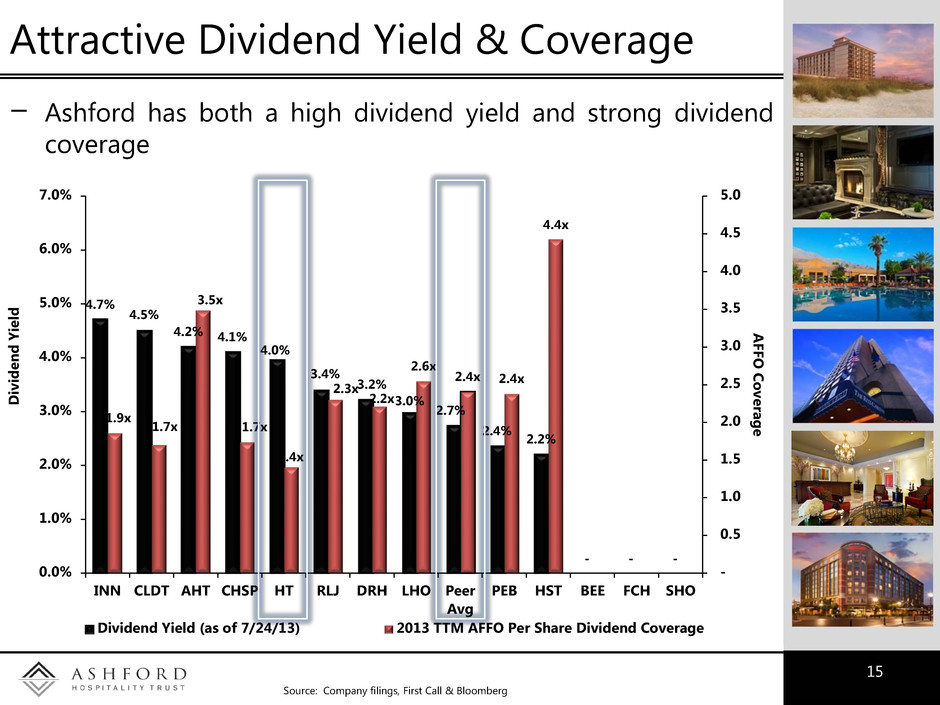

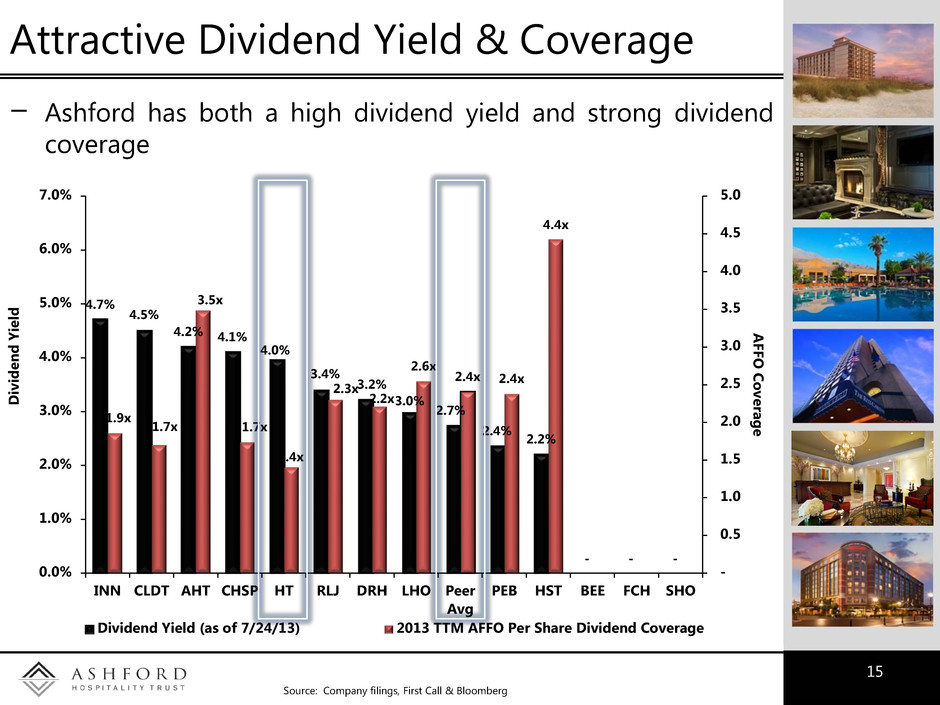

4.7% 4.5% 4.2% 4.1% 4.0% 3.4% 3.2% 3.0% 2.7% 2.4% 2.2% - - - 1.9x 1.7x 3.5x 1.7x 1.4x 2.3x 2.2x 2.6x 2.4x 2.4x 4.4x - 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% INN CLDT AHT CHSP HT RLJ DRH LHO Peer Avg PEB HST BEE FCH SHO A F F O C ove ra g e Divid e n d Yiel d Dividend Yield (as of 7/24/13) 2013 TTM AFFO Per Share Dividend Coverage Attractive Dividend Yield & Coverage 15 − Ashford has both a high dividend yield and strong dividend coverage Source: Company filings, First Call & Bloomberg

Most Highly-Aligned Management 16 19% 4% 4% 4% 4% 3% 3% 3% 2% 2% 2% 2% 1% 1% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 22.0% AHT HT FCH CLDT CHSP INN RLJ Peer Avg HST SHO BEE PEB DRH LHO Insider ownership % Source: Company Filings & SNL

Compelling Valuation 17 − Ashford currently trades at about 12.1x 2013 Consensus EBITDA − Multiple discount relative to peers has expanded over the past several months Source: Citi Equity Research 2013 Consensus EBITDA Multiple As of 10/26/12 As of 7/25/13 Ashford 11.2x 11.7x Hotel REIT Peer Avg. 11.8x 14.2x AHT Variance to Peer Avg. (0.6x) (2.5x)

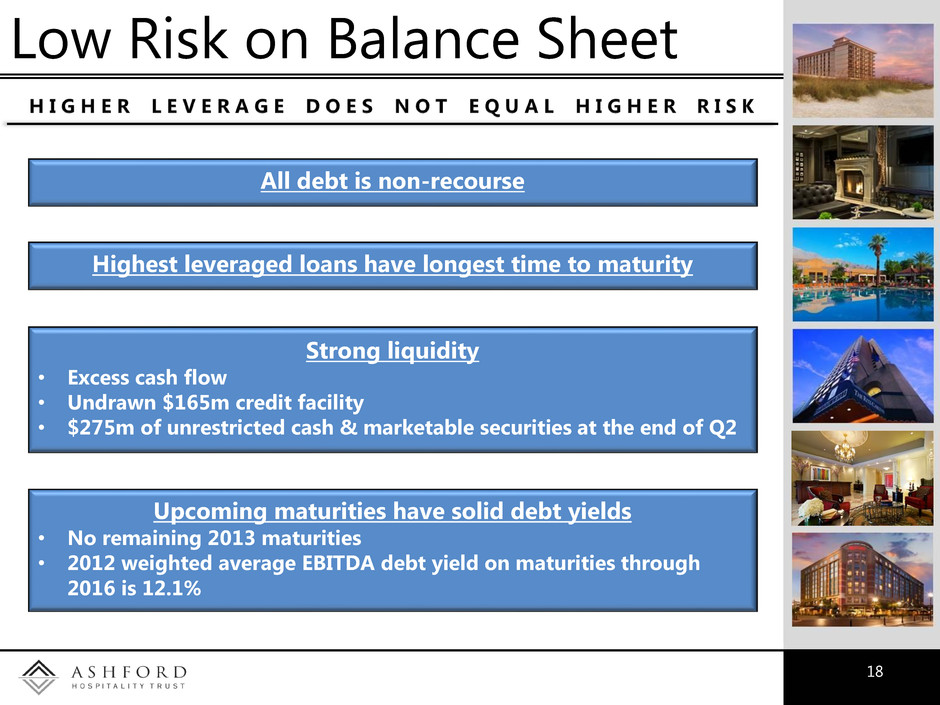

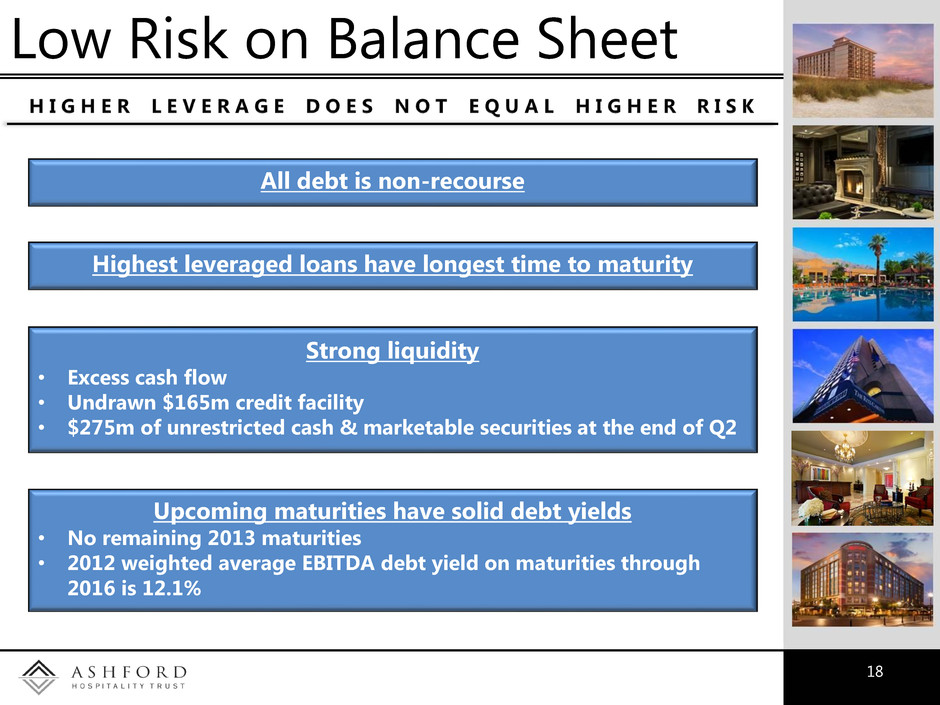

Low Risk on Balance Sheet 18 Strong liquidity • Excess cash flow • Undrawn $165m credit facility • $275m of unrestricted cash & marketable securities at the end of Q2 Highest leveraged loans have longest time to maturity Upcoming maturities have solid debt yields • No remaining 2013 maturities • 2012 weighted average EBITDA debt yield on maturities through 2016 is 12.1% All debt is non-recourse

Pier House Resort & Spa Acquisition Highlights: • Purchase Price of $90 million • $634,000/key • 6.2% TTM Cap Rate After Operational Synergies/Remington Mgmt: • Pro forma 8.4% Cap Rate • Pro forma 10.5x EBITDA Multiple 19

Pier House Resort & Spa 20 • Hotel has been owner-managed • Remington manages 3 other hotels in Key West Operational Synergies • Hotel had $275 RevPAR in 2012 • Recently renovated; very little capex needed High Quality Asset • Key West has 2nd highest RevPAR in US • Very high barriers to entry Great Market

21 Spin-Off Overview

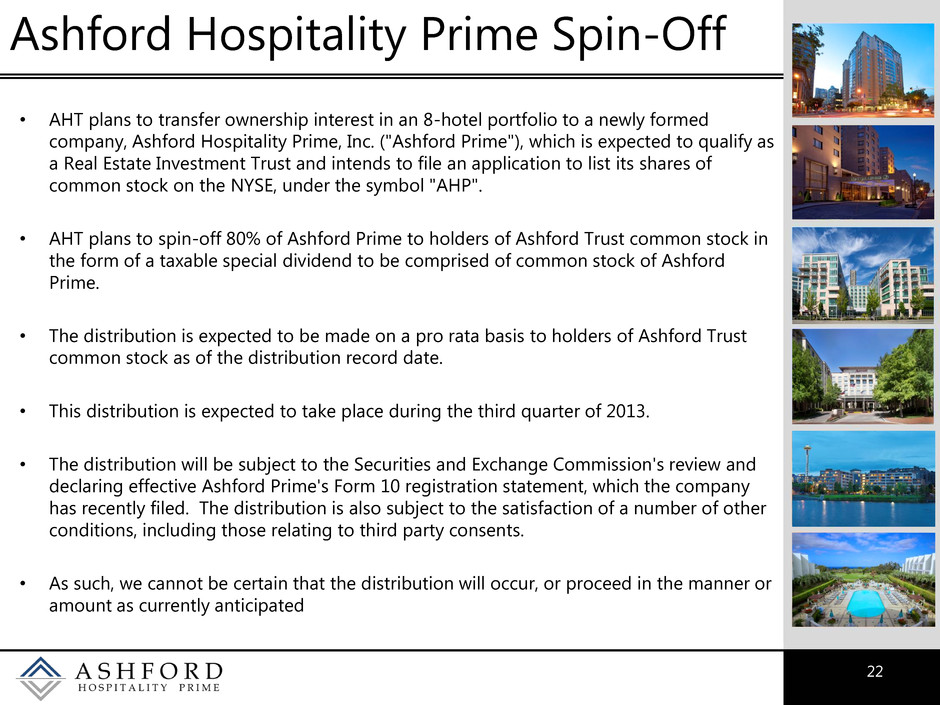

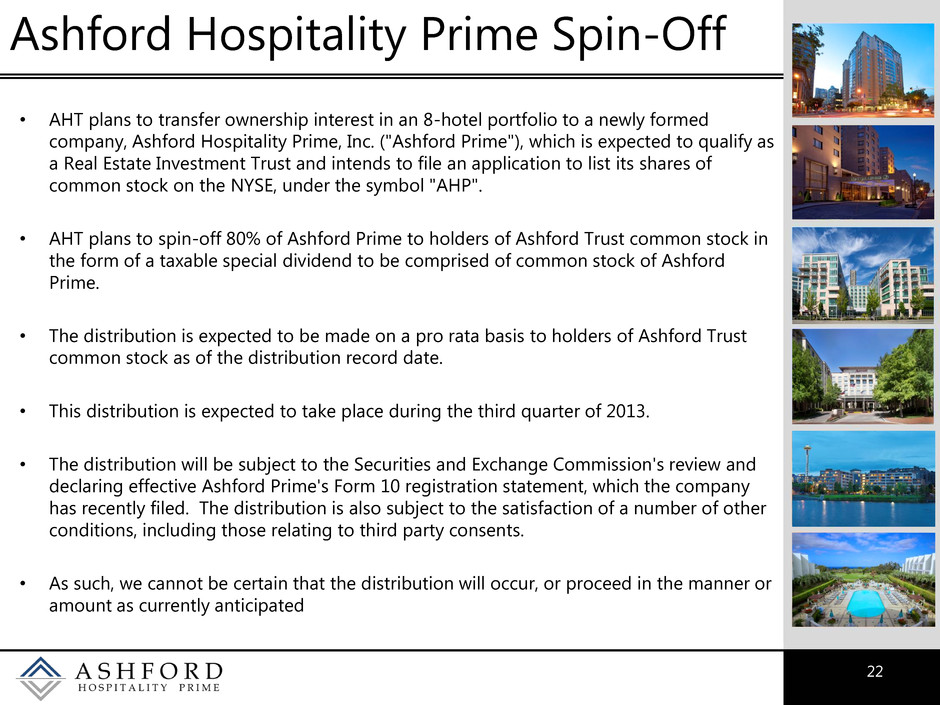

22 Ashford Hospitality Prime Spin-Off • AHT plans to transfer ownership interest in an 8-hotel portfolio to a newly formed company, Ashford Hospitality Prime, Inc. ("Ashford Prime"), which is expected to qualify as a Real Estate Investment Trust and intends to file an application to list its shares of common stock on the NYSE, under the symbol "AHP". • AHT plans to spin-off 80% of Ashford Prime to holders of Ashford Trust common stock in the form of a taxable special dividend to be comprised of common stock of Ashford Prime. • The distribution is expected to be made on a pro rata basis to holders of Ashford Trust common stock as of the distribution record date. • This distribution is expected to take place during the third quarter of 2013. • The distribution will be subject to the Securities and Exchange Commission's review and declaring effective Ashford Prime's Form 10 registration statement, which the company has recently filed. The distribution is also subject to the satisfaction of a number of other conditions, including those relating to third party consents. • As such, we cannot be certain that the distribution will occur, or proceed in the manner or amount as currently anticipated

23 Strategic Rationale Creation of Two Focused Companies Creates Clarity Potential for Higher Aggregate Market Value for Stockholders Tailored Capital Structure More Efficient More Conservative Capital Structure

24 Transaction Overview 122 Hotels 25,573 Rooms 2012 RevPAR: $99 2012 Hotel EBITDA: $374.5mm 8 hotels 3,146 Rooms 2012 RevPAR: $140 2012 Hotel EBITDA: $73.0mm 114 Hotels 22,427 Room 2012 RevPAR: $94 2012 Hotel EBITDA: $301.4mm Spin-off Contributed Capital Purchase Option on 2 Hotels and ROFO on 12 Hotels External Advisor As of 12/31/12 Note: Figure for Ashford Trust post-spinoff does not include pro rata share of Ashford Prime.

25 Ashford Prime Overview High Quality Hotel Portfolio • Geographically diversified and concentrated predominantly in top 20 U.S. markets • Premium portfolio RevPAR of $140 • EBITDA per room of over $23,000 • Strong market share as evidenced by RevPAR penetration index of 110.6 • All current hotels branded and managed by Marriott and Hilton Focused Investment Strategy • Luxury, upper-upscale & upscale hotels in domestic gateway markets • Select investment in resort hotels and international gateway cities • Hotels with RevPAR 2x the then current national average Strong Acquisition Pipeline • Purchase Option to acquire Pier House Resort with $276 RevPAR and Crystal Gateway Marriott with $137 RevPAR • Right-of-First-Offer on additional 12 high RevPAR hotels in Ashford Trust portfolio totaling 3,110 rooms

26 Ashford Prime Overview • Institutional Investor Tailored Platform Highly-Aligned Management Structure • Ashford Trust expected to own 20% of Ashford Prime on a pro forma basis • Management and related parties are expected to hold approximately 19% equity interest in Ashford Prime • The highest inside ownership percentages of all the publicly-traded lodging REITs Attractive Corporate Governance • Advisor owned by Ashford Trust will provide strong transparency and offer investors ability to own shares in publicly-traded advisor • Fee compensation to be tied to enterprise value and total shareholder return • Non-classified Board of Directors to consist of 5 independent directors (including the lead director) and 2 members of the management team • Advisor's 20% ownership interest will generally be non-voting on shareholder matters Prudent and Low Leverage Structure • Targeted leverage level over time of 5.0x or lower (Net Debt + Preferred Equity) / EBITDA • Attractive maturity profile with no maturities before 2017 • Anticipated unsecured credit facility would provide additional liquidity and flexibility

27 Differentiated Investment Strategy Ashford Prime Ashford Trust Investment Focus High-quality, High-RevPAR hotels in major markets expected to generate RevPAR of at least 2x the national average All segments of the hospitality industry excluding the High-RevPAR hotels targeted by Ashford Prime Investment Type Direct equity investments and joint ventures All parts of the capital structure Geography U.S. gateway cities, select resort locations and international gateway cities All domestic and limited international locations Chain Scale Predominantly luxury & upper-upscale hotels Various chain scale segments Mix of Service Predominantly full-service hotels Full-service and select-service Capital Structure Conservative Opportunistic Leverage Policy Target < 5.0x Net Debt + Preferred to EBITDA Strategic use of debt designed to maximize returns Brand Strategy Premium brands (Hilton, Marriott, Starwood, etc.) and high-quality independent hotels Premium brands (Hilton, Marriott, Starwood, etc.) and high-quality independent hotels Management Existing Ashford Trust management Existing Ashford Trust management • Ashford Prime will differentiate itself from existing Ashford Trust by its investment focus on higher-quality, higher-RevPAR hotels and its geographic focus on both domestic and international locations

28 Ashford Prime Properties San Francisco San Francisco Courtyard 405 Rooms Seattle Marriott Seattle Waterfront 358 Rooms Seattle Courtyard 250 Rooms Philadelphia Philadelphia Courtyard 498 Rooms Dallas Marriott Plano Legacy 404 Rooms San Diego Hilton Torrey Pines 394 Rooms Hotel Market Rooms Ritz-Carlton Atlanta, GA 444 Rooms Hilton Back Bay Boston, MA 390 Rooms Courtyard Downtown Boston, MA 315 Rooms Embassy Suites Portland, OR 276 Rooms Embassy Suites Crystal City Washington, D.C. 267 Rooms Crowne Plaza Beverly Hills Los Angeles, CA 260 Rooms Hyatt Regency Coral Gables Miami, FL 242 Rooms Melrose Washington, D.C. 240 Rooms One Ocean Jacksonville, FL 193 Rooms Churchill Washington, D.C. 173 Rooms Crowne Plaza Key West Key West, FL 160 Rooms Embassy Suites Houston, TX 150 Rooms Right of First Offer Assets Initial Assets Right of First Offer Assets Option Assets Hotel Market Rooms Marriott Crystal Gateway Washington, D.C. 697 Rooms Pier House Resort & Spa Key West, FL 142 Rooms Option Assets Tampa Tampa Renaissance 293 Rooms Washington, D.C. Capital Hilton 544 Rooms

29 High RevPAR Focus • With 2012 RevPAR of $140, Ashford Prime compares favorably to the public lodging REIT universe. Through targeted acquisitions, we expect Ashford Prime to increase its comparative RevPAR profile over time $140 $127 $99 $94 $65 $55 $70 $85 $100 $115 $130 $145 Public Lodging REIT Average U.S. Average Rev P A R Public Lodging REITs include: BEE, CHSP, CLDT, DRH, FCH, HPT, HST, HT, INN, LHO, PEB, RLJ, SHO Source: Company filings. Note: Figure for Ashford Trust post-spinoff does not include pro rata share of Ashford Prime. Ashford Trust Post Spin-Off Ashford Trust Existing Ashford Prime 2012 RevPAR Existing Post Spin-Off

30 RevPAR Drives Multiple... • As the chart below shows, there is a very high correlation between RevPAR and EBITDA Multiple for the Hotel REIT universe. Ashford Prime, with its higher RevPAR assets and investment focus, should benefit from this correlation Public Lodging REITs include: AHT, BEE, CHSP, CLDT, DRH, FCH, HPT HT, INN, LHO, PEB, RLJ, SHO. Excludes HST due to its significantly higher market capitalization. Source: Bloomberg, First Call, SNL and Company filings. Q2 2013 Forward 12 Month Consensus EBITDA Multiple vs. RevPAR R² = 0.8672 10.0x 11.0x 12.0x 13.0x 14.0x 15.0x 16.0x 17.0x $50 $70 $90 $110 $130 $150 $170 $190 E B IT D A M u lt ip le RevPAR PEB BEE INN CLDT CHSP LHO SHO DRH HT RLJ FCH AHT HPT

31 ...Market Cap Does Not • Conversely, there is no correlation between Market Capitalization and EBITDA Multiple for the Hotel REIT universe. This is further evidence that the overall valuation of Ashford Prime should be based more on its RevPAR focus than by its market capitalization Public Lodging REITs include: AHT, BEE, CHSP, CLDT, DRH, FCH, HPT, HT, INN, LHO, PEB, RLJ, SHO. Excludes HST due to its significantly higher market capitalization. Source: Bloomberg, First Call, SNL and Company filings. Q2 2013 Forward 12 Month Consensus EBITDA Multiple vs. Market Capitalization R² = 0.0005 10.0x 11.0x 12.0x 13.0x 14.0x 15.0x 16.0x 17.0x $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 E B IT D A M ult ip le Market Cap ($Millions) CLDT INN LHO RLJ PEB BEE DRH SHO HT CHSP FCH AHT HPT

32 External Management • Additionally, the chart below shows that external management does not have an adverse effect on the valuation of Mortgage REITs (of which there are several that are externally-managed) versus their internally-managed peers. As of 7/29/13 Externally-managed Mortgage REITs include: AGNC, CIM, TWO, IVR, CYS, STWD, CXS, ABR. Internally-managed Mortgage REITs include NLY, MFA, CMO, ARR, RWT, NRF, SFI, RSO, RAS. Source: Bloomberg Average Price/Book Value Per Share for Externally-Managed vs. Internally-Managed Mortgage REITs 1.10 0.97 0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70 0.80 0.90 1.00 1.10 1.20 Externally-Managed Mortgage REITs Internally-Managed Mortgage REITs P ri ce/B o o k Value p er S h a re

33 Highly-Aligned Management • With insider ownership* of both platforms anticipated to be approximately 19%, management is highly-aligned with shareholder interests Public Lodging REITs include: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Source: Company filings. * Insider ownership for Ashford entities includes interests of related parties Ashford Trust Post Spin-Off Ashford Trust Existing Ashford Prime Publicly-Traded REIT Insider Ownership 19% 19% 19% 4% 4% 4% 4% 3% 3% 2% 2% 2% 2% 1% 1% 0% 5% 10% 15% 20% 25% O w n ersh ip P erce n ta g e H O S P I T A L I T Y T R U S T P O S T S P I N OFF H O S P I T A L I T Y T R U S T E X I S T I N G H O S P I T A L I T Y P R I M E A S H F O R D

34 Spin-Off Overview

Executive Bios 35

Management Team 36 Monty J. Bennett Chairman & Chief Executive Officer Mr. Bennett serves as Founder, Chairman, & Chief Executive Officer of Ashford Hospitality Trust, a Real Estate Investment Trust (REIT) formed in August 2003. Ashford focuses exclusively on investing in the hospitality industry across all segments and at all levels of the capital structure, including direct hotel investments, first mortgages, mezzanine loans, and sale-leaseback transactions. Ashford went public with six hotels valued at $130 million. Today, Ashford has over $4 billion in assets and has outperformed its peers in total shareholder return since its IPO. Mr. Bennett is a member of the American Hotel & Lodging Association's Industry Real Estate Finance Advisory Council (IREFAC), the Urban Land Institute's Hotel Council, and is on the Advisory Editorial Board for GlobalHotelNetwork.com. He is also a member of the CEO Fiscal Leadership Council for Fix the Debt, a non- partisan group dedicated to reducing the nation's federal debt level and on the advisory board of Texans for Education Reform. Formerly, Mr. Bennett was a member of Marriott's Owner Advisory Council and Hilton's Embassy Suites Franchise Advisory Council. Mr. Bennett is a frequent speaker and panelist for various hotel development and investment conferences including the NYU conference and the ALIS conference. Mr. Bennett received the Top-Performing CEO Award from HVS for 2011. This award is presented each year to the CEO in the hospitality industry who offers the best value to shareholders based on HVS's pay-for-performance model. The model compares financial results relative to CEO compensation, as well as a stock appreciation, company growth and increases in EBITDA. Mr. Bennett holds a Masters in Business Administration from Cornell's S.C. Johnson Graduate School of Management and received a Bachelor of Science degree with distinction from the School of Hotel Administration also at Cornell. He is a life member of the Cornell Hotel Society and resides in Dallas, Texas with his wife, Marissa.

Management Team 37 Douglas A. Kessler President Mr. Kessler is the President of Ashford Hospitality Trust (NYSE: AHT) and a member of the Board of Directors. He had previously served as Chief Operating Officer and Head of Acquisitions for the Company. Mr. Kessler has spearheaded virtually all of Ashford's key initiatives including: investments, sales, capital market activities, property financing, corporate credit facilities, joint ventures, and strategic direction. Mr. Kessler has been responsible for several billion dollars of capital transactions along with the growth of the company's asset base to in excess of $4 billion. Notable transactions include the $2.4 billion CNL transaction and the $1.3 billion Highland Hospitality investment, which was nominated for Transaction of the Year at Americas Lodging Investment Summit. He oversaw $1.2 billion of asset sales along with Ashford's $400 million debt platform. He has been responsible for in excess of $5.8 billion of property financings as well as the corporate credit facilities. He has led all corporate capital market efforts including: $1.4 billion common equity, $450 million preferred, and $75 million convertible preferred. Previously, Mr. Kessler was a Managing Director of the Company's predecessor before leading Ashford's initial public offering. Prior to that time, Mr. Kessler spent approximately 10 years with Goldman Sachs' Whitehall Street Real Estate Funds where he asset managed more than $11 billion of real estate and served on the Board or Executive Committee of several companies including: Westin Hotels and Resorts, Strategic Hotel Capital, WCB Holdings, Horizon Bay Senior Communities, and Westmont-Whitehall joint ventures in the U.S. and Europe. The diversity of Mr. Kessler's real estate experience while at Goldman Sachs included: lodging, industrial, office, retail, residential, mobile home communities, and senior housing. Mr. Kessler co-led teams to establish asset management operations in France. While at Goldman Sachs he was a recipient of the Innovation Award. Formerly, Mr. Kessler also worked at Trammell Crow Ventures where he was involved in sales, financings, and asset management. Prior to Trammell Crow, Mr. Kessler was employed at McMahan Real Estate Advisors where he acquired and managed real estate assets along with participating in capital raising initiatives. Mr. Kessler has 30 years experience in real estate corporate strategy, investments, sales, finance, asset management, and capital markets. He is a member of ULI's Hotel Council and a frequent speaker and panelist at lodging industry conferences including: International Hotel Investment Forum, Americas Lodging Investment Summit, Meet the Money, and The Lodging Conference. Mr. Kessler earned his MBA and BA from Stanford University.

Management Team 38 David A. Brooks Chief Operating Officer and General Counsel Prior to joining Remington Hotel Corporation and Ashford Financial Corporation in January of 1992, Mr. Brooks, a licensed CPA and attorney, practiced law with the law firm of Sheinfeld, Maley & Kay in both Houston and Dallas offices. As a partner in the Real Estate and Corporate Practice Group, Mr. Brooks' concentrated areas of practice included real estate; corporate and commercial lending; workouts; reorganizations and related tax planning; corporate law including business combinations, mergers and acquisitions; and hospitality related transactions including development, acquisitions, finance and management. Mr. Brooks was a frequent author and speaker for various continuing legal education seminars on the topics of commercial and real estate lending, commercial leases, corporate and partnership matters, reorganizations and tax. In January of 1992, Mr. Brooks joined Remington Hotel Corporation, and its affiliate, Ashford Financial Corporation, in the capacity of Executive Vice President and General Counsel. In such capacity, Mr. Brooks was responsible for the management and oversight of the asset management department, the acquisition group, financing, development, and the legal department. Mr. Brooks co-led the formation of investment partnerships between Remington/Ashford and major institutional investors, including, among others, G. Soros Realty, Inc., Gordon Getty, Trust, The Fisher Brothers, Nomura Asset Capital, Olympus Real Estate Partners and Goldman Sachs Whitehall Real Estate Funds. While at Remington, Mr. Brooks negotiated and closed the acquisition of over $1 billion in hotels and hotel related mortgages making Remington/Ashford the largest buyer of hospitality related assets from the RTC. In addition, Mr. Brooks managed the development of seven hotels and asset managed over 145 predominately non-performing hospitality loans (with a book value of approximately $750 million). In 2003, Mr. Brooks, together with the Ashford management team, successfully negotiated and completed the initial public offering for Ashford Hospitality Trust, Inc., raising approximately $220 million in capital for the newly formed real estate investment trust. Since that time, Mr. Brooks has direct responsibility for the negotiation and closing of all company acquisitions, dispositions, financings, capital transactions and offerings, loan originations and the legal department. Mr. Brooks is currently Chief Operating Officer and General Counsel of Ashford Hospitality Trust, Inc. Mr. Brooks earned his Bachelor of Business Administration in Accounting from the University of North Texas in 1981, his Juris Doctorate from the University of Houston Law Center in 1984 and his CPA from the State of Texas in 1984 (currently non-practicing status).

Management Team 39 David Kimichik Chief Financial Officer Mr. Kimichik has served as the Chief Financial Officer for Ashford Hospitality Trust, Inc. since May 2003. In addition to his duties as Chief Financial Officer he has held the position of Director of Asset Management where he was responsible for leading a team of Asset Managers in the daily supervision of the Company's Hotels and the Company's annual capital improvement activities. He is also part of a very active acquisitions team being responsible for the company's underwriting function where he leads a team to underwrite all financial projections of any new deal. The company currently has 122 hotels that Mr. Kimichik has underwritten. As part of the acquisitions team for Ashford, Mr. Kimichik has played an integral role in several large transactions. In the first quarter of 2005 Ashford acquired a 21 hotel portfolio from the Fisher Brother, the Gordon Getty Trust and George Soros. The portfolio was comprised of 4,094 rooms and was acquired for $250 million. During the second quarter 2005 Ashford acquired a 30 property hotel portfolio from CNL Hotels and Resorts. The portfolio was comprised of 4,328 rooms and was acquired for $465 million. During the first quarter 2007 Ashford acquired a 51 hotel portfolio from CNL Hotels and Resorts. The portfolio was comprised of 13,524 rooms and was purchased for $2.4 billion. Finally Ashford acquired 28 hotels in a transaction called the Highland Hospitality portfolio in the first quarter 2011. The portfolio comprised of 8,227 rooms was acquired for $1.3 billion. He has been associated with the principals of the Company's predecessor for the past 30 years and was President of Ashford Financial Corporation from 1992 until August 2003. As President During his involvement with Ashford Financial Corporation, Mr. Kimichik played an integral role in the acquisition of 160 hotel assets and mortgage loans secured by hotel assets with book values in excess of $800 million. In this capacity Mr. Kimichik was responsible for the acquisition of approximately 140 non-performing loans held by the Resolution Trust Corporation that were ultimately converted to hotel ownership. Through Mr. Kimichik's direction the hotels were capital improved, rebranded and ultimately sold. Mr. Kimichik previously served as Executive Vice President of Mariner Hotel Corporation, in which capacity he administered all corporate activities, including business development, financial management and operations. Mariner Hotel Corporation was a hotel developer and owner and at one time was Marriott Corporations largest Franchisor. Mr. Kimichik holds a Bachelor of Science degree from the School of Hotel Administration at Cornell University.

Management Team 40 Deric S. Eubanks, CFA Senior Vice President of Finance As Senior Vice President of Finance, Mr. Eubanks is responsible for assisting the CEO and CFO with all corporate finance and financial reporting initiatives and capital market activities including equity raises, debt financings, and loan modifications. He also oversees Investor Relations and is responsible for overseeing and executing the company's hedging strategies. Mr. Eubanks specifically spearheaded the company's strategy to swap all of its fixed rate debt to floating rate in 2008 as well as the associated Flooridor strategy. Since the inception of the interest hedging strategy, the company has received approximately $230 million in cash flow from these hedges. Some of the notable transactions that Mr. Eubanks has played an integral role in include the $2.4 billion acquisition of the CNL Portfolio and the $1.3 billion acquisition of the Highland Hospitality Portfolio. The Highland Hospitality acquisition was nominated for Transaction of the Year at Americas Lodging Investment Summit. He also oversaw Ashford's $400 million debt platform. Prior to his role as Senior Vice President of Finance, Mr. Eubanks was Vice President of Investments and was responsible for sourcing and underwriting hotel investments including direct equity investments, joint venture equity, preferred equity, mezzanine loans, first mortgages, B-notes, construction loans, and other debt securities. Since joining Ashford, Mr. Eubanks has been involved in the sourcing and underwriting of over $14 billion in hotel investments, capital raising activities totaling over $6.0 billion of debt and equity capital, and hedging strategies involving over $19.0 billion in notional amount. He has been with Ashford since its IPO in August of 2003. Mr. Eubanks has written several articles for industry publications and is a frequent speaker at industry conferences and industry round tables. Before joining Ashford, Mr. Eubanks was a Manager of Financial Analysis for ClubCorp, where he assisted in underwriting and analyzing investment opportunities in the golf and resort industries. Mr. Eubanks earned a BBA from Southern Methodist University and is a CFA charter holder. He is a member of the CFA Institute and the CFA Society of Dallas-Fort Worth.

Management Team 41 Rob Hays Senior Vice President - Corporate Finance & Strategy Mr. Hays has served as Senior Vice President of Corporate Finance & Strategy of Ashford Hospitality Trust since 2010 and has been with the Company since April 2005. Mr. Hays is responsible for the formation and execution of the strategic initiatives of the company, working closely with Ashford's Chief Executive Officer, Monty J. Bennett. Some of the strategic initiatives Mr. Hays has been intimately involved in include Ashford's highly accretive common stock & preferred stock buyback programs, its industry-leading interest rate hedging program, and several transformational transactions including its 2007 CNL and 2011 Highland Hospitality acquisitions. He also oversees all financial analysis as it relates to the corporate model, including acquisitions, divestitures, refinancing's, hedging, capital market transactions and major capital outlays. His analyses have been the foundation for billions of dollars of transactions over the past decade. Mr. Hays is also responsible for forming Ashford's internal research-based lodging/real estate industry views and its global macroeconomic perspective. Mr. Hays has also overseen Ashford's securities investment platform, Ashford Investment Management, since its launch in June 2011. Prior to 2013, in addition to his other responsibilities, Mr. Hays was in charge of Ashford's investor relations group, spearheading many innovative initiatives, such as organizing the first company specific investor day in the history of the lodging REIT industry. Mr. Hays has been a frequent speaker at industry and Wall Street investor conferences around the globe. Prior to joining Ashford, Mr. Hays worked in the Corporate Development office of Dresser, Inc., a Dallas-based oil field service & manufacturing company, where he focused on mergers, acquisitions, and strategic direction. Before working at Dresser, Mr. Hays was a member of the Merrill Lynch's Global Power & Energy Investment Banking Group based in Texas. Mr. Hays earned his A.B. in Politics with a certificate in Political Economy from Princeton University and later studied philosophy at the Pontifical University of the Holy Cross in Rome, Italy. He is the co-founder of the Dallas chapter of the Business Ethics Forum, a group of executives that meets quarterly to develop and implement philosophically sound and actionable frameworks for ethical and effective business management.

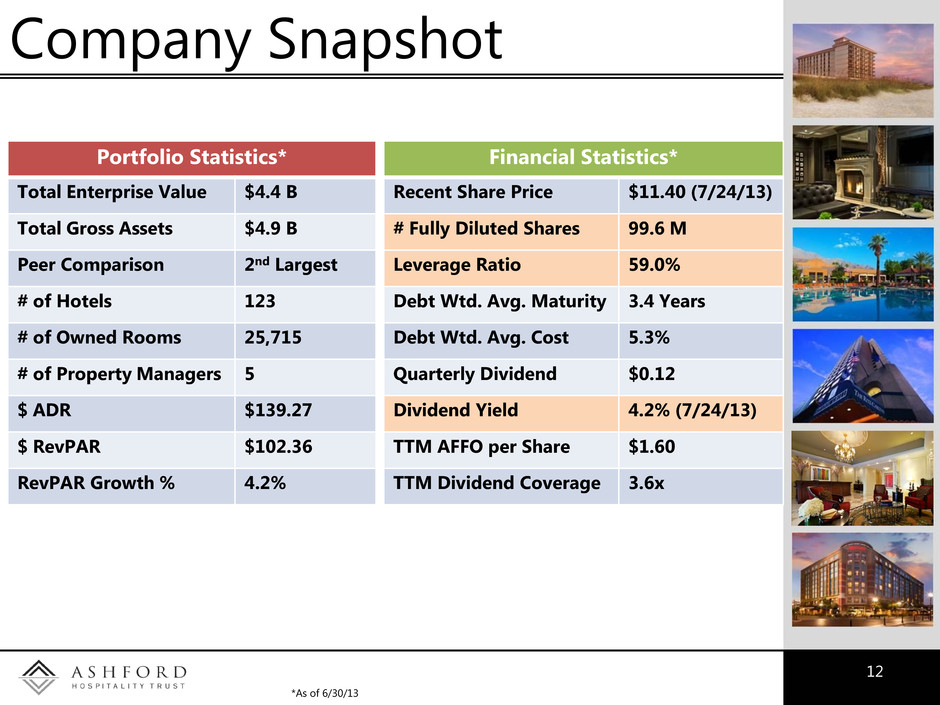

Management Team 42 Jeremy Welter Executive Vice President of Asset Management Mr. Welter has served as the Executive Vice President of Asset Management for Ashford Hospitality Trust since January 2011. In his current role, Mr. Welter presides over Ashford's lodging portfolio consisting of 122 hotels, 25,573 rooms, and valued at over $4 billion. He oversees property performance and operations, capital investment and execution, risk management and brand relations. He also directs strategic positioning of all Ashford's lodging assets including: rebranding, repositioning, new property leases, ground lease extensions and buyouts. He is responsible for joint venture relations and serves as a member of the Executive Joint Venture Committee for the Highland Portfolio. As a member of Ashford's executive team, Mr. Welter actively participates in corporate strategy sessions and company board meetings. Under his leadership, Ashford's asset management team has consistently outperformed its peers in EBITDA flows and margin improvement. Specifically, Mr. Welter's asset management team cut approximately $6 million of costs out of 28 Highland hotels resulting in EBITDA flows of 94% on 5% RevPAR growth during its first full calendar year of ownership. In less than two years, NOI at the Highland portfolio has grown over 30%. Mr. Welter actively participates in Marriott, Hilton, Starwood and Hyatt owners' conferences and meetings and is an active participant in Marriott's Owners' Advisory Committee. Mr. Welter is a speaker and panelist for various lodging investment and development conferences, including NYU and The Lodging Conference. Prior to joining Ashford, Mr. Welter served as Remington Hotels Chief Financial Officer. In this role, Mr. Welter was responsible for corporate finance, investment strategies, ROI projects, pro forma financial modeling, tax compliance, joint venture accounting and reporting, capital raises and principal investments. Mr. Welter also developed corporate growth strategies and initiatives. During his tenure, Remington experienced tremendous growth by assuming 20 new hotel property manager assignments totaling over 3,300 rooms. Before joining Remington in 2005, Mr. Welter was an investment banker at Stephens, where he worked on mergers and acquisitions, public and private equity and debt capital raises, company valuations, fairness opinions and recapitalizations. Before working at Stephens, Mr. Welter was part of Bank of America's Global Corporate Investment Banking group. Mr. Welter earned his Bachelor of Science in Business Administration in Economics from Oklahoma State University where he served as student body president and graduated Summa Cum Laude. He was also named top overall graduate in the Spears School of Business and top overall economics student by the faculty and administration. He resides in Lewisville, Texas with his wife, Kimberly, and his three daughters.

Credit Suisse Conference - August 2013 43