1 Company Presentation - June 2015

2 Safe Harbor In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward- looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the Company's filings with the Securities and Exchange Commission. Historical results are not indicative of future performance. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Trust, Inc. or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security.

Compelling Opportunity 3

4 Opportunistic Strategy Opportunistically invest in non-luxury hotel assets in all market locations Highly-aligned management team with proven track record of long-term value creation Leveraged way to invest in hotel cycle Industry leading dividend yield

5 Compelling Opportunity Attractive industry fundamentals with demand growth exceeding supply growth Currently seeking accretive hotel acquisition opportunities Affiliated property manager results in strong operating results and flow- throughs Upcoming refinancings with potential for significant excess proceeds Net working capital of $664 million at 3/31/15

6 Strong Track Record & Performance

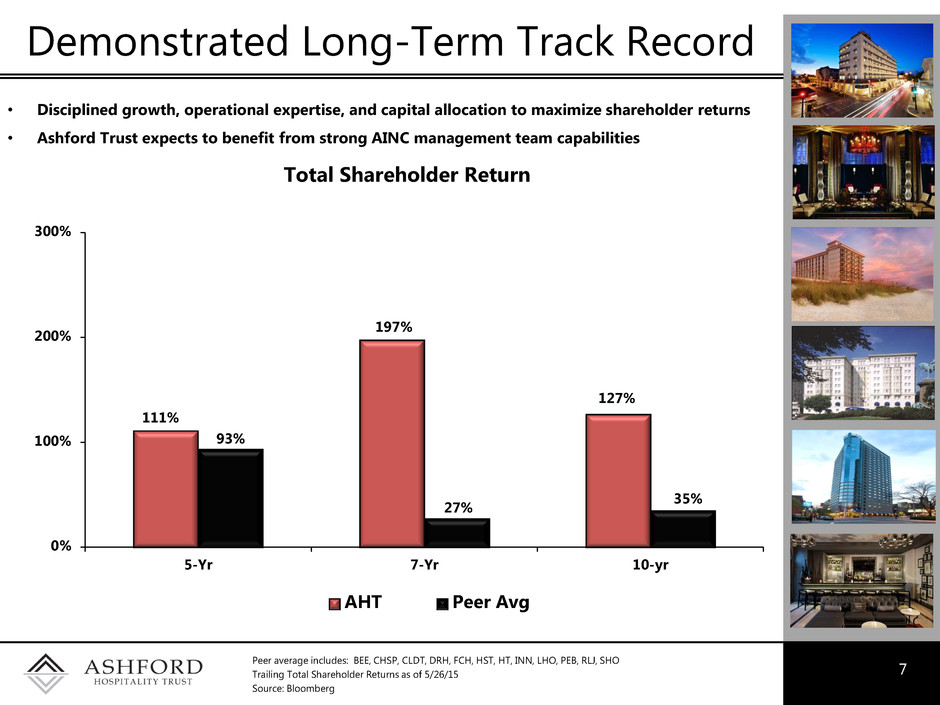

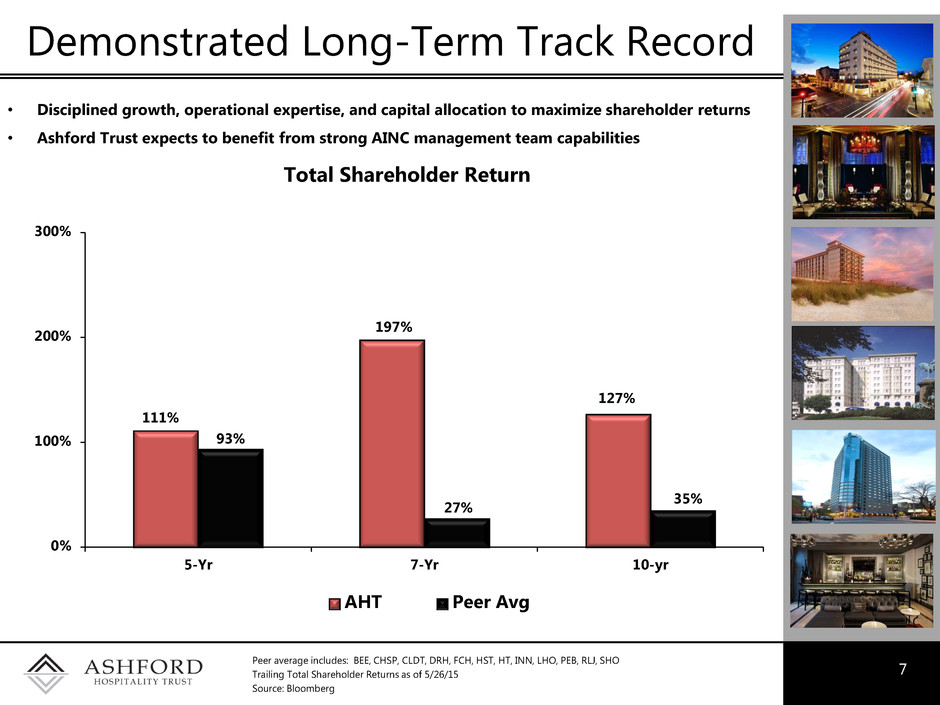

Demonstrated Long-Term Track Record 7 • Disciplined growth, operational expertise, and capital allocation to maximize shareholder returns • Ashford Trust expects to benefit from strong AINC management team capabilities Peer average includes: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Trailing Total Shareholder Returns as of 5/26/15 Source: Bloomberg Total Shareholder Return 111% 197% 127% 93% 27% 35% 0% 100% 200% 300% 5-Yr 7-Yr 10-yr AHT Peer Avg

Highly-Aligned Management 8 • With insider ownership* of approximately 15% for AHT, management is highly-aligned with shareholder interests Publicly-Traded Hotel REIT Insider Ownership Public Lodging REITs include: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Source: Company filings. * Insider ownership for Ashford entities includes direct & indirect interests & interests of related parties 15%* 14%* 5% 4% 3% 3% 2% 2% 2% 2% 1% 1% 1% 1% 0.5% 0% 2% 4% 6% 8% 10% 12% 14% 16%

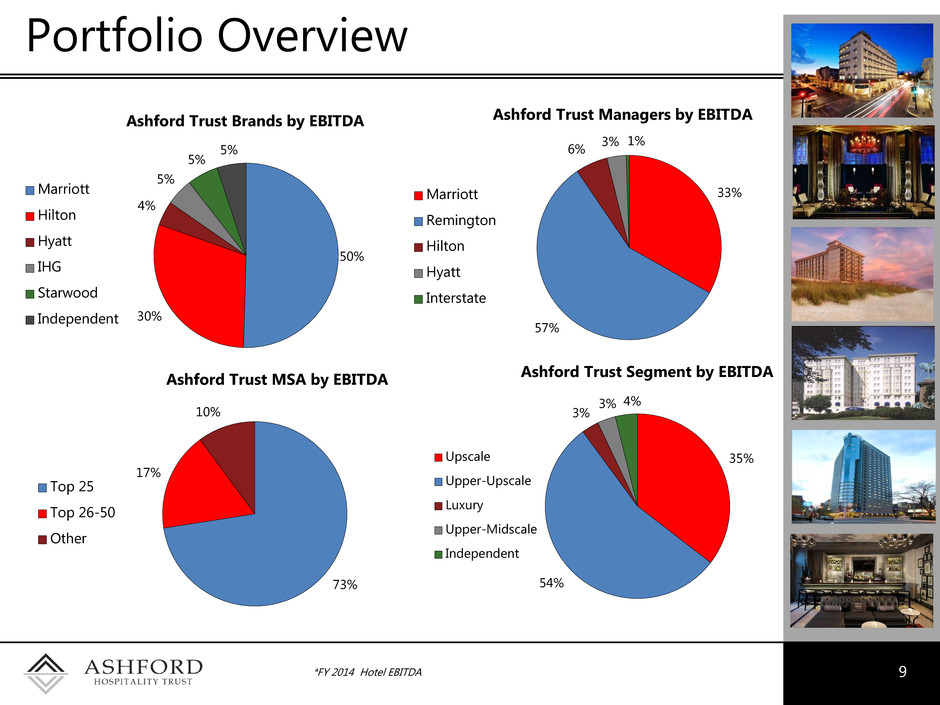

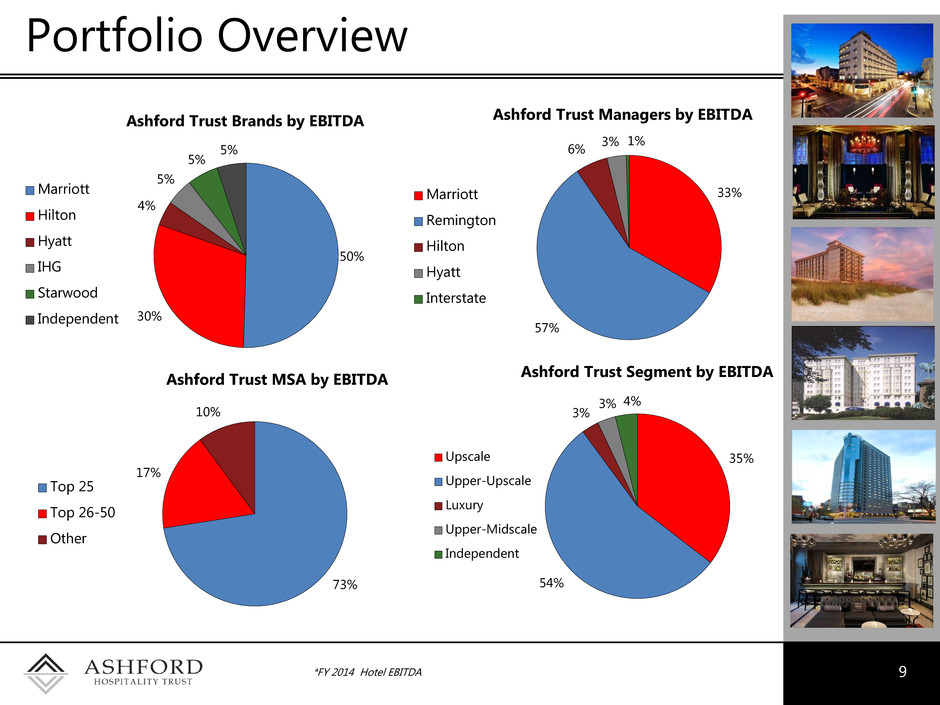

Portfolio Overview 9 *FY 2014 Hotel EBITDA 50% 30% 4% 5% 5% 5% Ashford Trust Brands by EBITDA Marriott Hilton Hyatt IHG Starwood Independent 33% 57% 6% 3% 1% Ashford Trust Managers by EBITDA Marriott Remington Hilton Hyatt Interstate 73% 17% 10% Ashford Trust MSA by EBITDA Top 25 Top 26-50 Other 35% 54% 3% 3% 4% Ashford Trust Segment by EBITDA Upscale Upper-Upscale Luxury Upper-Midscale Independent

10 2013 2014 Var Q1 2014 Q1 2015 Var RevPAR $95.94 $105.39 9.8% $102.04 $110.69 8.5% Hotel Revenue $1,031,840 $1,117,739 8.3% $305,113 $326,443 7.0% Hotel EBITDA $312,766 $354,513 13.3% $92,757 $104,545 12.7% EBITDA Flow 48.6% 55.3% The above table assumes the properties owned and included in continuing operations as of December 31, 2014 (115) and March 31, 2015 (116) were owned as of the beginning of each of the periods shown Revenue and EBITDA figures displayed in $000's Strong Asset Performance 50.1% 42.8% 60.0% 69.4% 55.3% 48.6% 55.3% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 2009 2010 2011 2012 2013 2014 Q1 2015 Annual Hotel EBITDA Flow-Through

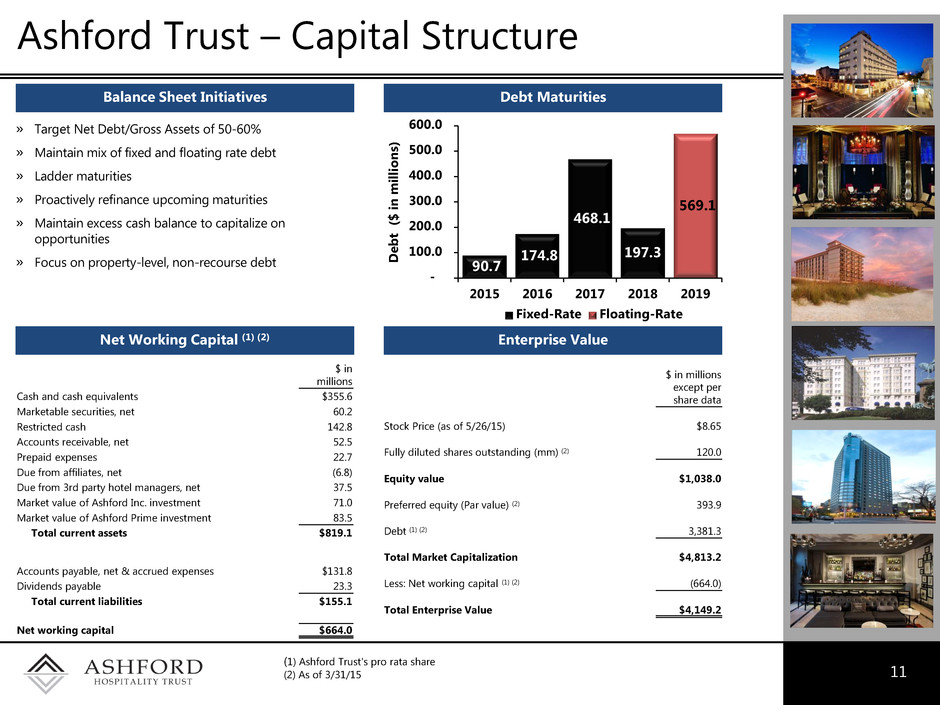

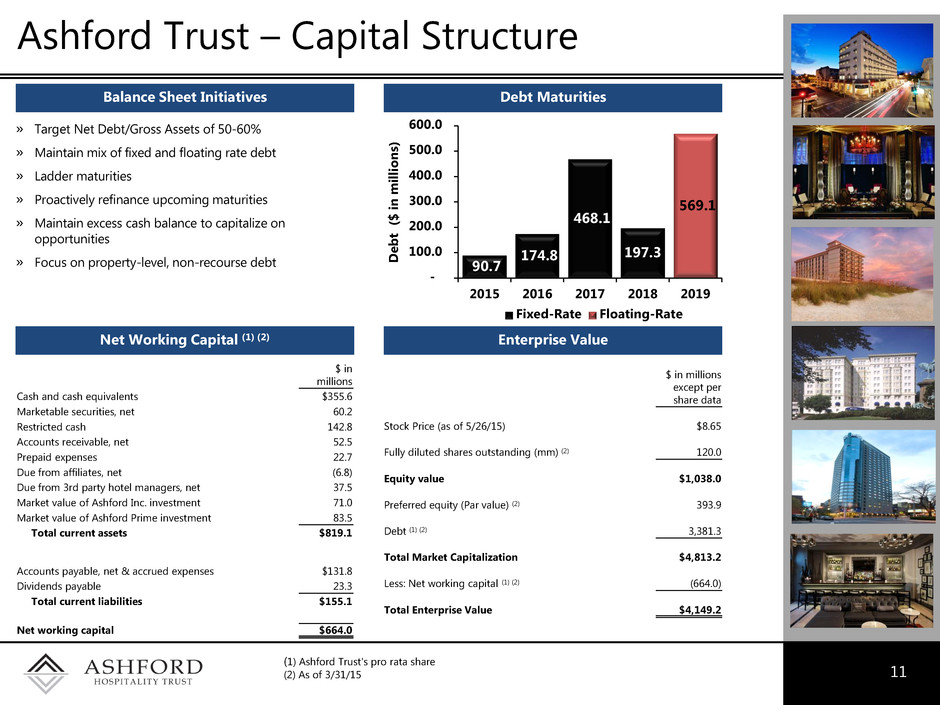

Ashford Trust – Capital Structure 11 » Target Net Debt/Gross Assets of 50-60% » Maintain mix of fixed and floating rate debt » Ladder maturities » Proactively refinance upcoming maturities » Maintain excess cash balance to capitalize on opportunities » Focus on property-level, non-recourse debt Balance Sheet Initiatives Debt Maturities Net Working Capital (1) (2) Enterprise Value 90.7 174.8 468.1 197.3 569.1 - 100.0 200.0 300.0 400.0 500.0 600.0 2015 2016 2017 2018 2019 De b t ( $ i n m il li o n s) Fixed-Rate Floating-Rate (1) Ashford Trust's pro rata share (2) As of 3/31/15 $ in millions Cash and cash equivalents $355.6 Marketable securities, net 60.2 Restricted cash 142.8 Accounts receivable, net 52.5 Prepaid expenses 22.7 Due from affiliates, net (6.8) Due from 3rd party hotel managers, net 37.5 Market value of Ashford Inc. investment 71.0 Market value of Ashford Prime investment 83.5 Total current assets $819.1 Accounts payable, net & accrued expenses $131.8 Dividends payable 23.3 Total current liabilities $155.1 Net working capital $664.0 $ in millions except per share data Stock Price (as of 5/26/15) $8.65 Fully diluted shares outstanding (mm) (2) 120.0 Equity value $1,038.0 Preferred equity (Par value) (2) 393.9 Debt (1) (2) 3,381.3 Total Market Capitalization $4,813.2 Less: Net working capital (1) (2) (664.0) Total Enterprise Value $4,149.2

12 Ashford Trust Recent Developments Q1 2015 RevPAR up 8.5%, Hotel EBITDA up 12.7% and EBITDA flow-through was 55% In January 2015, the Company refinanced two mortgage loans resulting in excess proceeds of over $100 million after closing costs and reserves Also in February 2015, the Company closed on the acquisition of the Marriott Memphis East for $43.5 million ($187,500 per key) and subsequent financing of a $33.3 million floating rate loan in March 2015 In February 2015, the Company closed on the acquisition of the Lakeway Resort & Spa in Austin, TX for $33.5 million ($199,000 per key) and subsequent financing of a $25.1 million floating rate loan in April 2015 In March 2015, the Company acquired the remaining interest in the Highland Portfolio from its JV partner for $250.1 million (total transaction value of $1.735 billion or $215,000 per key) and simultaneously refinanced 24 properties in the portfolio resulting in net proceeds of approximately $200 million In April 2015, the Company closed on the acquisition of the Hampton Inn & Suites Gainesville for $25.3 million ($204,000 per key)

13 Marriott Memphis Transaction *TTM through 3/31/15 Strengths/Opportunities: • Excellent physical condition with minimal capex needs –recent renovation prior to conversion to Marriott • No new material competitive supply projected for the submarket and stable corporate demand generators • Opportunity to install Remington as manager to drive better operational performance • In first full month of operation increased RevPAR index by 19.1% Acquisition Overview: • Purchase Price: $43.5 million • Purchase Price/Key: $187,500 • RevPAR of $105* • Purchased at approx. 37% discount to replacement cost • Estimated forward 12-month NOI cap rate of 8.6% • Estimated forward 12-month EBITDA multiple of 10.3x • Location: Memphis, TN • Rooms: 232 • Year Built: 1986 • 8,960 sf of meeting space • Fee simple • Segmentation: 84% transient; 16% group Property Information:

14 Lakeway Resort & Spa Transaction *TTM through 3/31/15 Strengths/Opportunities: • Unique lakefront location in Austin, one of the fastest growing MSAs in the country • Excellent physical condition with minimal capex needs – recent renovation of guestrooms • Opportunity to install Remington as manager to drive better operational performance Acquisition Overview: • Purchase Price: $33.5 million • Purchase Price/Key: $199,000 • RevPAR of $109* • Purchased at approx. 32% discount to replacement cost • Estimated forward 12-month NOI cap rate of 8.7% • Estimated forward 12-month EBITDA multiple of 9.5x • Location: Austin, TX • Rooms: 168 • Year Built: 1966 • 24,175 sf of meeting space • Fee simple • Segmentation: 70% transient; 30% group Property Information:

Growth & Acquisition Strategy 15

16 Highly quantitative approach focused on long-term accretion Proven track record of value-creating opportunistic acquisitions Disciplined capital allocation Multiple ways to grow platform: Internal growth from asset performance Portfolio/single asset acquisitions Excess cash from potential refinancings Partial ownership of Ashford Prime Partial ownership of Ashford Inc. Growth & Acquisition Strategy

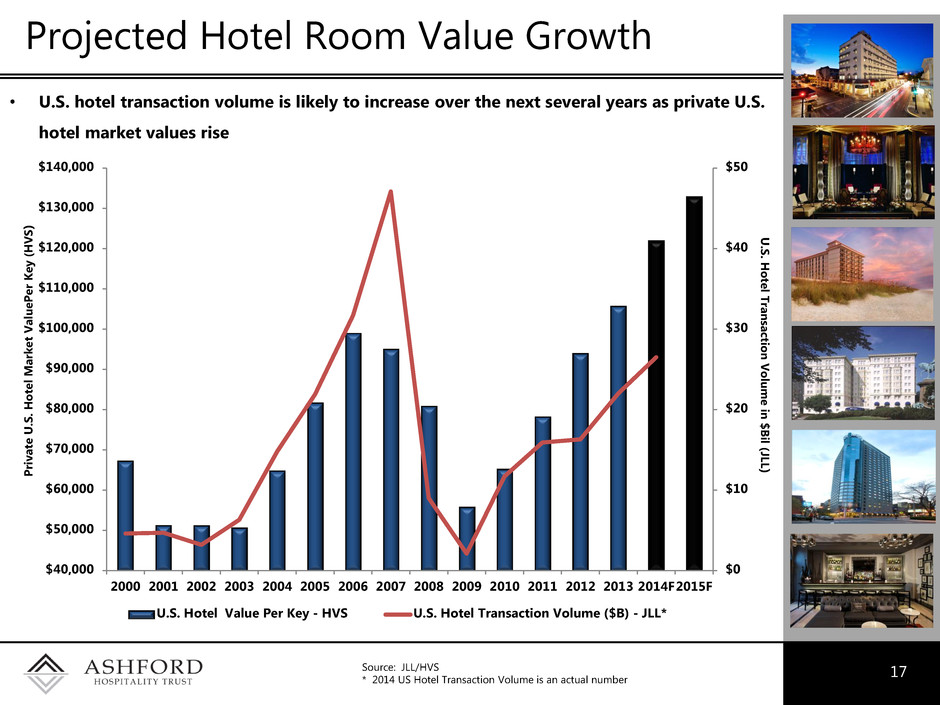

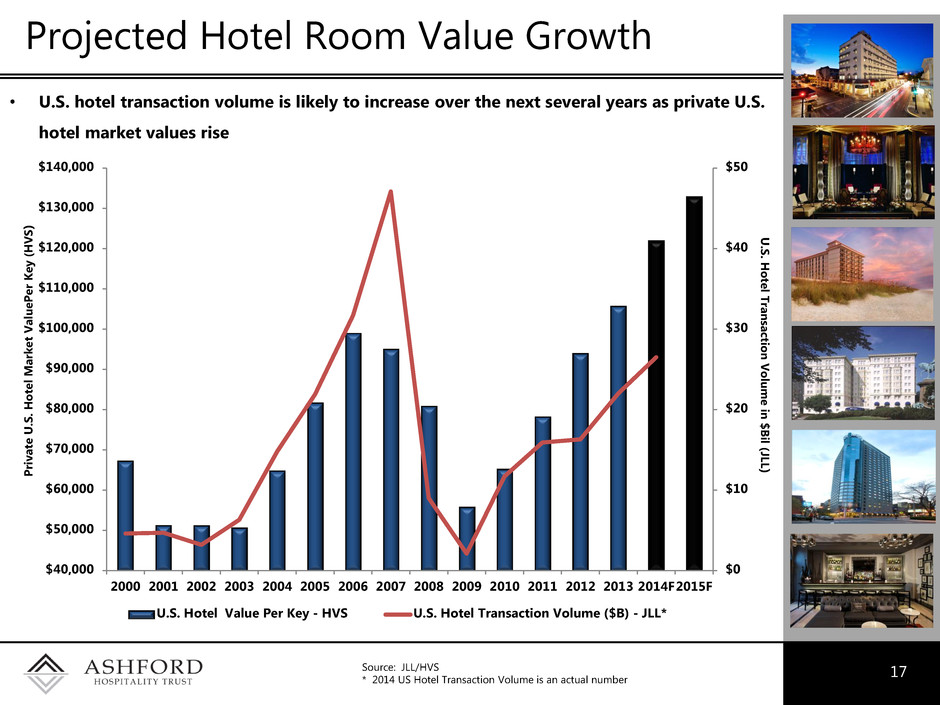

Projected Hotel Room Value Growth 17 Source: JLL/HVS * 2014 US Hotel Transaction Volume is an actual number • U.S. hotel transaction volume is likely to increase over the next several years as private U.S. hotel market values rise $0 $10 $20 $30 $40 $50 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 $110,000 $120,000 $130,000 $140,000 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014F2015F U .S . H ot e l Tra n sa ct ion Vol u m e in $ B il (JL L) Priva te U .S . H ot e l M a rk e t V a lu e P e r K e y ( H V S ) U.S. Hotel Value Per Key - HVS U.S. Hotel Transaction Volume ($B) - JLL*

Accretive Growth 18 - Ashford Trust management is focused on accretive growth - Our definition of accretion: the 5-year Total Shareholder Return (TSR) post-transaction must be greater than the 5-year TSR pre-transaction - Transactions are modeled on a leverage-neutral basis Base Model Transaction (Leverage-Neutral) Combined Model 5-year TSR 5-year TSR Combined 5-year TSR > Base 5-year TSR

19 APPENDIX

20 Industry Overview

• Demand expected to exceed supply through at least 2015 21 Attractive Supply/Demand Imbalance Source: PKF -8.0 -6.0 -4.0 -2.0 0.0 2.0 4.0 6.0 8.0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015F Supply Growth Demand Growth Yea r- o v e r- Year % Gro w th PKF Forecast

22 Source: PKF 7.7% 6.1% -2.0% -16.7% 5.4% 8.2% 6.8% 5.4% 8.3% 7.3% 6.5% -20.0% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% Historical RevPAR Growth Forecasted RevPAR Growth PKF RevPAR Growth Forecasts

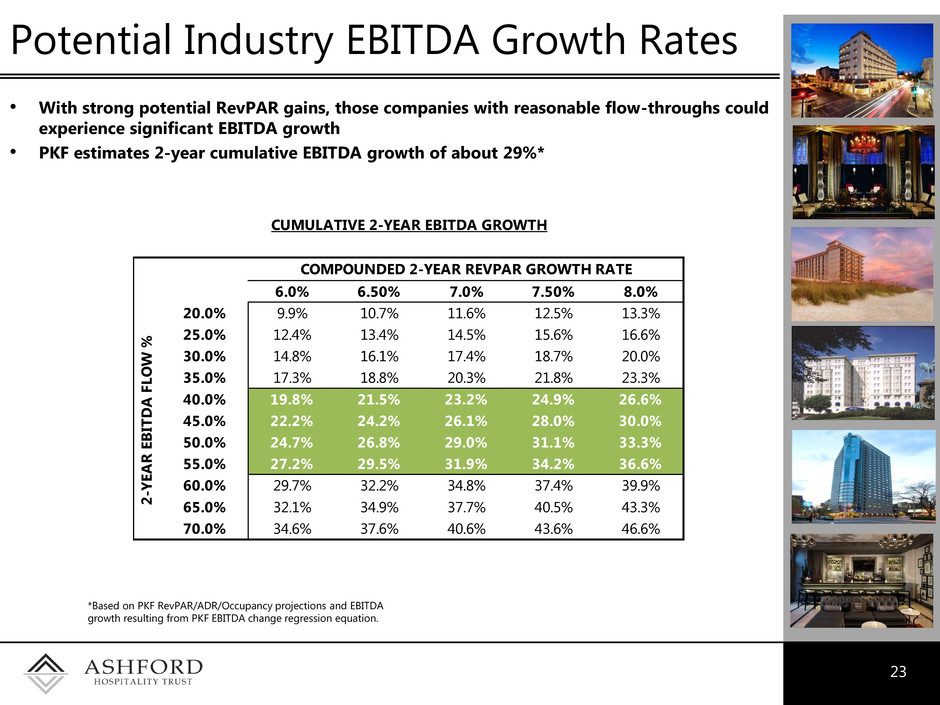

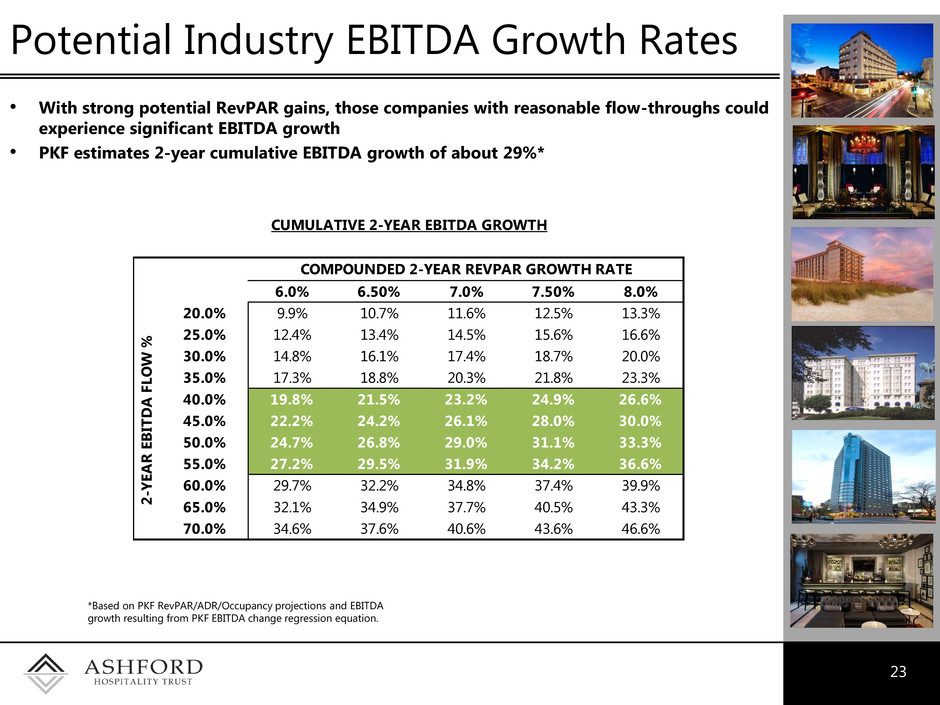

23 Potential Industry EBITDA Growth Rates *Based on PKF RevPAR/ADR/Occupancy projections and EBITDA growth resulting from PKF EBITDA change regression equation. • With strong potential RevPAR gains, those companies with reasonable flow-throughs could experience significant EBITDA growth • PKF estimates 2-year cumulative EBITDA growth of about 29%* COMPOUNDED 2-YEAR REVPAR GROWTH RATE COMPOUNDED 2-YEAR REVPAR GROWTH RATE 28.5% 6.0% 6.50% 7.0% 7.50% 8.0% 20.0% 9.9% 10.7% 11.6% 12.5% 13.3% 25.0% 12.4% 13.4% 14.5% 15.6% 16.6% 30.0% 14.8% 16.1% 17.4% 18.7% 20.0% 35.0% 17.3% 18.8% 20.3% 21.8% 23.3% 40.0% 19.8% 21.5% 23.2% 24.9% 26.6% 45.0% 22.2% 24.2% 26.1% 28.0% 30.0% 50.0% 24.7% 26.8% 29.0% 31.1% 33.3% 55.0% 27.2% 29.5% 31.9% 34.2% 36.6% 60.0% 29.7% 32.2% 34.8% 37.4% 39.9% 65.0% 32.1% 34.9% 37.7% 40.5% 43.3% 70.0% 34.6% 37.6% 40.6% 43.6% 46.6% 2- YE AR EB IT DA FL OW % CUMULATIVE 2-YEAR EBITDA GROWTH

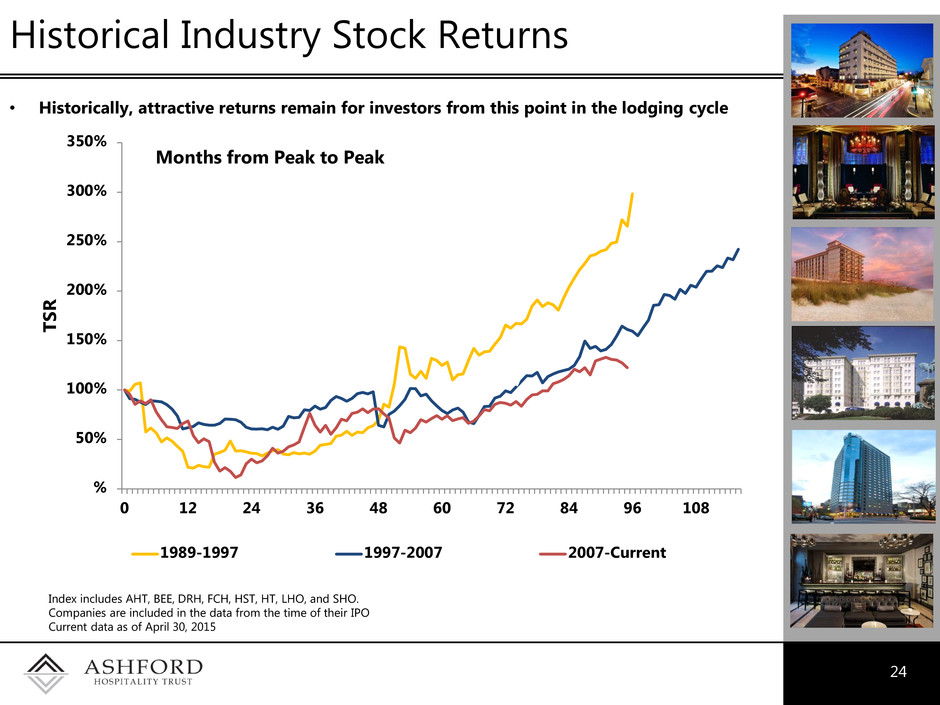

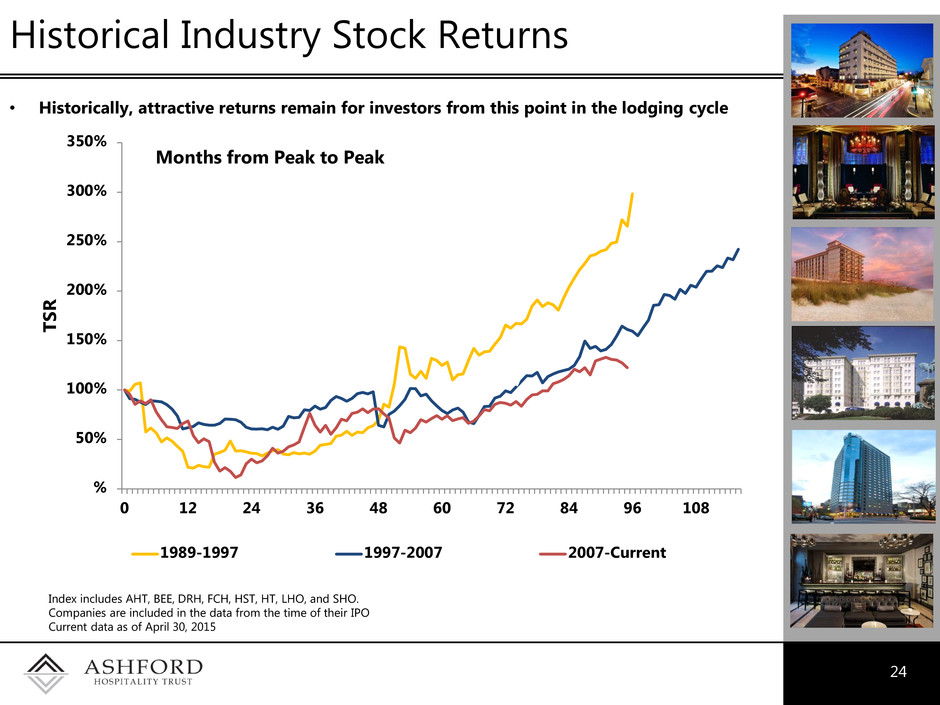

• Historically, attractive returns remain for investors from this point in the lodging cycle 24 Historical Industry Stock Returns Index includes AHT, BEE, DRH, FCH, HST, HT, LHO, and SHO. Companies are included in the data from the time of their IPO Current data as of April 30, 2015 % 50% 100% 150% 200% 250% 300% 350% 0 12 24 36 48 60 72 84 96 108 T S R Months from Peak to Peak 1989-1997 1997-2007 2007-Current

25 Executive Bios

26 Executive Bios Monty J. Bennett Chief Executive Officer & Chairman of the Board Douglas A. Kessler President Mr. Kessler is the President of Ashford (NYSE.MKT:AINC) and serves as the President of both Ashford Hospitality Trust (NYSE: AHT) and Ashford Hospitality Prime (NYSE: AHP). He is currently on the Board of Directors of AHP, and was previously on the Board of Directors of AHT. Prior to being appointed President, Mr. Kessler served as Ashford Trust's Chief Operating Officer and Head of Acquisitions beginning in May 2003. Mr. Kessler has spearheaded numerous key initiatives while at Ashford Trust and has been responsible for several billion dollars of capital transactions along with the growth of the company's asset base to in excess of $4 billion. From July 2002 until August 2003, Mr. Kessler also served as the managing director/chief investment officer of Remington Hotel Corporation. Prior to joining Remington Hotel Corporation in 2002, from 1993 to 2002, Mr. Kessler was employed at Goldman Sachs’ Whitehall Real Estate Funds, where he assisted in the management of more than $11 billion of real estate (including $6 billion of hospitality investments) involving over 20 operating partner platforms worldwide. During his nine years at Whitehall, Mr. Kessler served on the boards or executive committees of several lodging companies, including Westin Hotels and Resorts and Strategic Hotel Capital. Mr. Kessler has diverse real estate experience totaling nearly 30 years and is a member of Urban Land Institute's Hotel Council and is a frequent speaker and panelist at lodging industry conferences including International Hotel Investment Forum, Americas Lodging Investment Summit and the NYU Lodging Conference. Mr. Kessler has a Master's degree in Business Administration and a Bachelor of Arts degree from Stanford University. Mr. Bennett is the Founder, Chairman, & Chief Executive Officer of Ashford (NYSE.MKT:AINC) and serves as the Founder, Chairman, & Chief Executive Officer of both Ashford Hospitality Trust (NYSE: AHT) and Ashford Hospitality Prime (NYSE: AHP). Mr. Bennett is a member of the American Hotel & Lodging Association's Industry Real Estate Finance Advisory Council (IREFAC), the Urban Land Institute's Hotel Council, the Global Advisory Council of Hoftel, a worldwide hotel ownership group, and is on the Advisory Editorial board for GlobalHotelNetwork.com. He is also a member of the CEO Fiscal Leadership Council for Fix the Debt, a non-partisan group dedicated to reducing the nation's federal debt level and on the advisory board of Texans for Education Reform. Formerly, Mr. Bennett was a member of Marriott's Owner Advisory Council and Hilton's Embassy Suites Franchise Advisory Council. Mr. Bennett is a frequent speaker and panelist for various hotel development and investment conferences including the NYU conference and the ALIS conference. Mr. Bennett received the Top-Performing CEO Award from HVS for 2011. This award is presented each year to the CEO in the hospitality industry who offers the best value to shareholders based on HVS's pay-for-performance model. The model compares financial results relative to CEO compensation, as well as a stock appreciation, company growth and increases in EBITDA. Mr. Bennett holds a Master's degree in Business Administration from Cornell's S.C. Johnson Graduate School of Management and received a Bachelor of Science degree with distinction from the School of Hotel Administration also at Cornell. He is a life member of the Cornell Hotel Society. Mr. Bennett's extensive industry experience as well as the strong and consistent leadership qualities he has displayed in his role as the chief executive officer and a director of Ashford Trust since its inception are vital skills that make him uniquely qualified to serve as the chairman of our board of directors.

27 Executive Bios David A. Brooks Chief Operating Officer, General Counsel & Secretary Mr. Brooks is the Chief Operating Officer, General Counsel & Secretary of Ashford (NYSE.MKT:AINC) and serves as Chief Operating Officer, General Counsel & Secretary of both Ashford Hospitality Trust (NYSE: AHT) and Ashford Hospitality Prime (NYSE: AHP). Prior to assuming the role of Chief Operating Officer of Ashford Trust, he served as Chief Legal Officer, Head of Transactions and Secretary from August 2003 to January 2009. Prior to that, he served as Executive Vice President and General Counsel for Remington Hotel Corporation and Ashford Financial Corporation, an affiliate of Ashford Trust, from January 1992 until August 2003, where he co-led the formation of numerous investment partnerships, negotiated and closed approximately $1 billion in asset acquisitions and asset managed nearly $750 million dollars in non-performing hospitality loans. Prior to joining Remington Hotel Corporation, Mr. Brooks served as a partner with the law firm of Sheinfeld, Maley & Kay. Mr. Brooks earned his Bachelor of Business Administration in Accounting from the University of North Texas in 1981, his Juris Doctor from the University of Houston Law Center in 1984 and became licensed as a CPA in the State of Texas in 1984 (currently non-practicing status). Deric S. Eubanks Chief Financial Officer Mr. Eubanks is the Chief Financial Officer and Treasurer of Ashford (NYSE.MKT:AINC) and serves as the Chief Financial Officer and Treasurer of both Ashford Hospitality Trust (NYSE: AHT) and Ashford Hospitality Prime (NYSE: AHP). Mr. Eubanks oversees all corporate finance and financial reporting initiatives and is involved in all capital market activities including equity raises, debt financings, and loan modifications. He oversees Investor Relations and is responsible for overseeing and executing Ashford Hospitality Trust's and Ashford Hospitality Prime's hedging strategies. Mr. Eubanks formally served as the Senior Vice President of Finance. Prior to his role as Senior Vice President of Finance, Mr. Eubanks was Vice President of Investments and was responsible for sourcing and underwriting hotel investments including direct equity investments, joint venture equity, preferred equity, mezzanine loans, first mortgages, B-notes, construction loans, and other debt securities for Ashford Trust. Mr. Eubanks has been with Ashford Trust since its initial public offering in August of 2003. Mr. Eubanks has written several articles for industry publications and is a frequent speaker at industry conferences and industry round tables. Before joining Ashford Trust, Mr. Eubanks was a Manager of Financial Analysis for ClubCorp, where he assisted in underwriting and analyzing investment opportunities in the golf and resort industries. Mr. Eubanks earned a BBA from Southern Methodist University and is a CFA charter holder. He is a member of the CFA Institute and the CFA Society of Dallas-Fort Worth.

28 Executive Bios J. Robison Hays Chief Strategy Officer Mr. Hays is the Chief Strategy Officer of Ashford (NYSE.MKT:AINC) and serves as the Chief Strategy Officer of both Ashford Hospitality Trust (NYSE: AHT) and Ashford Hospitality Prime (NYSE: AHP). Mr. Hays is responsible for the formation and execution of our strategic initiatives, working closely with our Chief Executive Officer. He also oversees all financial analysis as it relates to the corporate model, including acquisitions, divestitures, refinancings, hedging, capital market transactions and major capital outlays. Prior to 2013, in addition to his other responsibilities, Mr. Hays was in charge of Ashford Trust's investor relations group. Mr. Hays has been a frequent speaker at industry and Wall Street investor conferences. Prior to joining Ashford Trust, Mr. Hays worked in the Corporate Development office of Dresser, Inc., a Dallas-based oil field service & manufacturing company, where he focused on mergers, acquisitions, and strategic direction. Before working at Dresser, Mr. Hays was a member of the Merrill Lynch Global Power & Energy Investment Banking Group based in Texas. Jeremy J. Welter Executive Vice President of Asset Management Mr. Welter is the Executive Vice President of Asset Management of Ashford (NYSE.MKT:AINC) and serves as the Executive Vice President of Asset Management of both Ashford Hospitality Trust (NYSE: AHT) and Ashford Hospitality Prime (NYSE: AHP). Mr Welter has served as the Executive Vice President of Asset Management for Ashford Hospitality Trust since January 2011 where he oversees a $4 billion portfolio of 122 hotels. From August 2005 until December 2010, Mr. Welter was employed by Remington Hotels, LP in various capacities, most recently serving as Chief Financial Officer. He is a current member of Marriott's Owner Advisory Council. From July 2000 through July 2005, Mr. Welter was an investment banker at Stephens, where he worked on mergers and acquisitions, public and private equity and debt, capital raises, company valuations, fairness opinions and recapitalizations. Before working at Stephens, Mr. Welter was part of Bank of America's Global Corporate Investment Banking group. Mr. Welter is a speaker and panelist for various lodging investment and development conferences, including the NYU Lodging Conference. Mr. Welter earned his Bachelor of Science in Business Administration in Economics from Oklahoma State University, where he served as student body president and graduated Summa Cum Laude.

29 Executive Bios Mark L. Nunneley Chief Accounting Officer Mr. Nunneley is the Chief Accounting Officer of Ashford (NYSE.MKT:AINC) and serves as the Chief Accounting Officer of both Ashford Hospitality Trust (NYSE: AHT) and Ashford Hospitality Prime (NYSE: AHP). He has served as the Chief Accounting Officer of Ashford Hospitality Trust since May 2003 where he is responsible for the tax, accounting, ad valorem tax and treasury functions. From 1992 until 2003, Mr. Nunneley served as Chief Financial Officer of Remington Hotel Corporation. He previously served as a tax consultant at Arthur Andersen & Company and as a tax manager at Deloitte & Touche. Mr. Nunneley is a certified public accountant (CPA) in the State of Texas and is a member of the American Institute of Certified Public Accountants, Texas Society of CPAs and Dallas Chapter of CPAs. Mr. Nunneley holds a Bachelor of Science degree in Business Administration from Pepperdine University and a Master of Science in Accounting from the University of Houston.

30 Company Presentation - June 2015