Investor & Analyst Day – October 2015

2 In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition . These and other risk factors are more fully discussed in the Company's filings with the Securities and Exchange Commission. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Trust or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security. Safe Harbor

3 Management Team Attending Monty J. Bennett Chairman & Chief Executive Officer Ashford/Predecessor Experience: 26 yrs Douglas A. Kessler President Ashford/Predecessor Experience: 13 yrs Jeremy J. Welter EVP – Asset Management Ashford/Remington Experience: 10 yrs David A. Brooks Chief Operating Officer & General Counsel Ashford/Predecessor Experience: 23 yrs Deric S. Eubanks Chief Financial Officer Ashford Experience: 12 yrs J. Robison Hays III Chief Strategy Officer Ashford Experience: 10 yrs

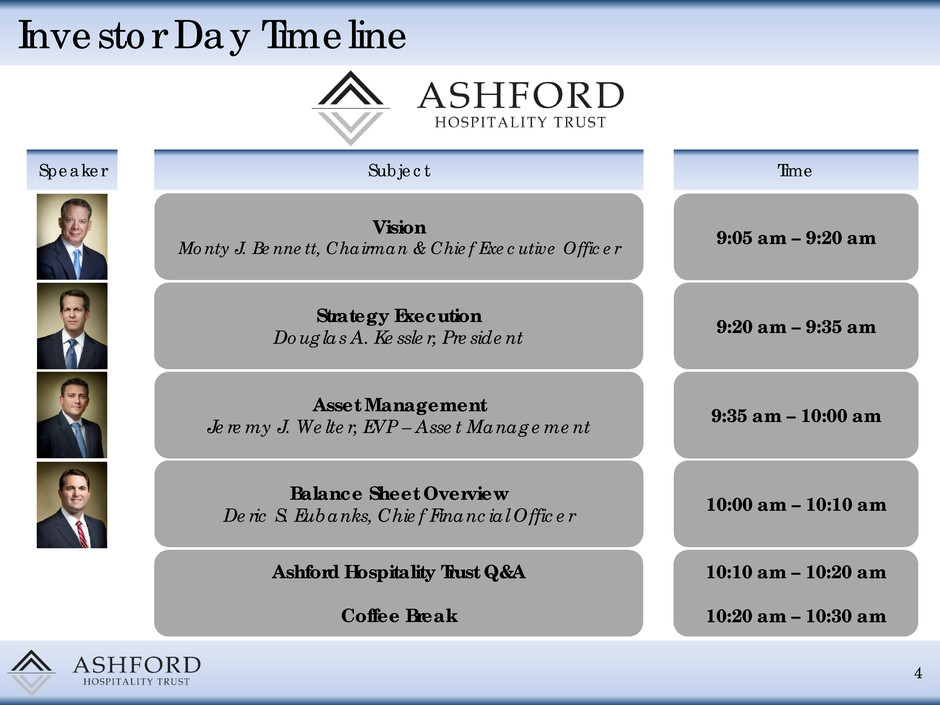

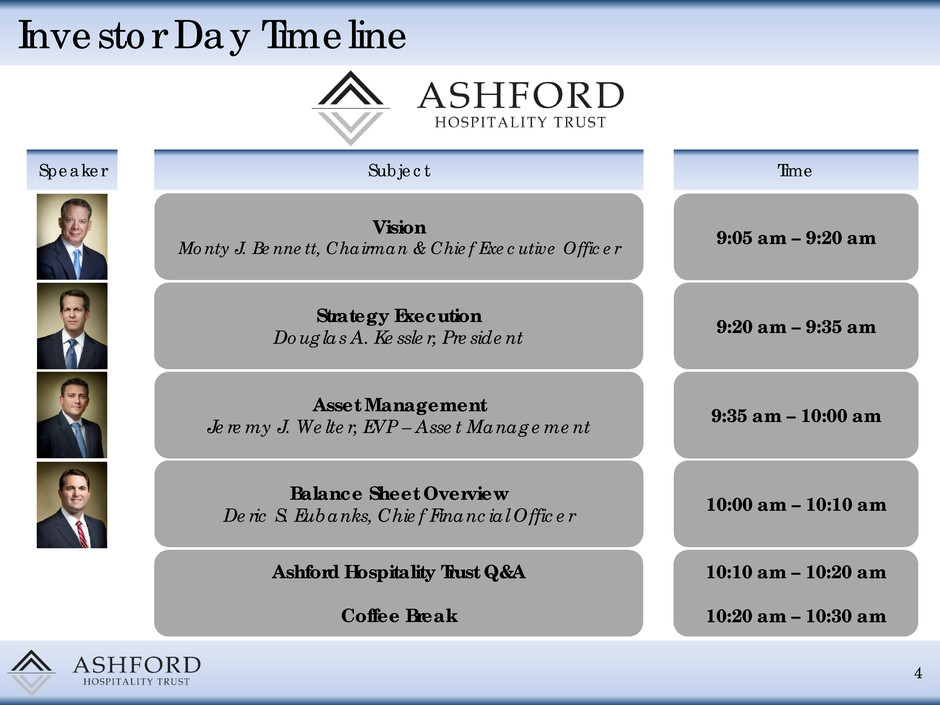

4 Investor Day Timeline Vision Monty J. Bennett, Chairman & Chief Executive Officer Strategy Execution Douglas A. Kessler, President Asset Management Jeremy J. Welter, EVP – Asset Management Balance Sheet Overview Deric S. Eubanks, Chief Financial Officer Speaker Subject Time 9:05 am – 9:20 am 9:20 am – 9:35 am 9:35 am – 10:00 am 10:00 am – 10:10 am Ashford Hospitality Trust Q&A Coffee Break 10:10 am – 10:20 am 10:20 am – 10:30 am

5 Ashford on Mobile & Social Media Follow Chairman and Chief Executive Officer, Monty J. Bennett, on Twitter at www.twitter.com/MBennettAshford or @MBennettAshford The Ashford App is now available for free download at Apple's App Store and Google Play Store by searching "Ashford”

Vision – Monty Bennett, Chairman & CEO W Atlanta Downtown Atlanta, GA

Ashford Hospitality Trust Vision Opportunistic platform focused on full-service hotels 7 Management team more highly-aligned with shareholders than our peers Appropriate use of financial leverage Best in class hotel managers Superior long-term total shareholder return performance Announced strategy refinements to improve shareholder value

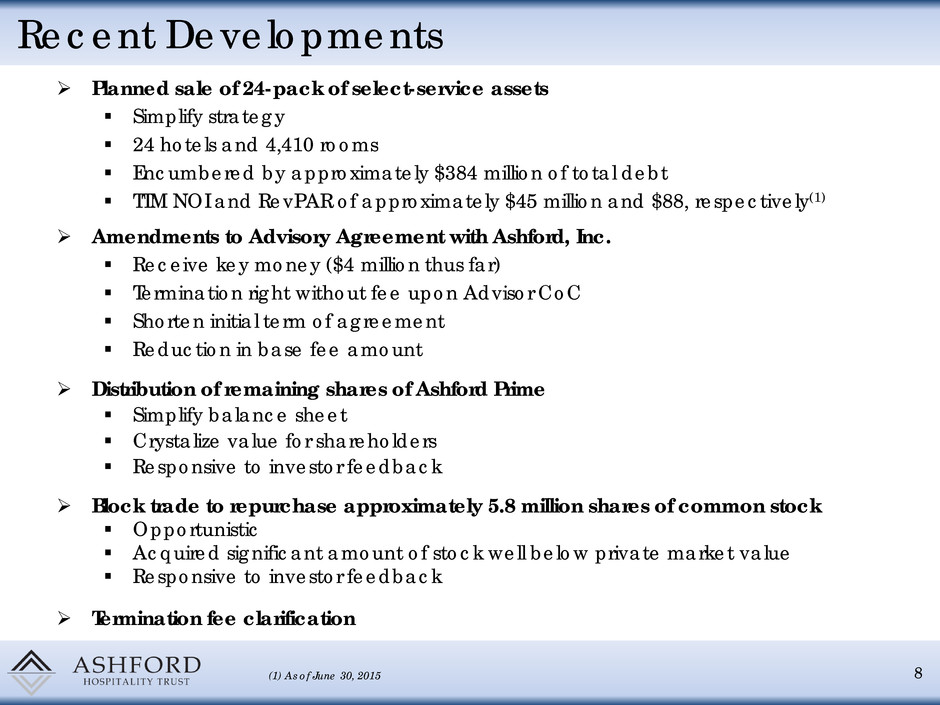

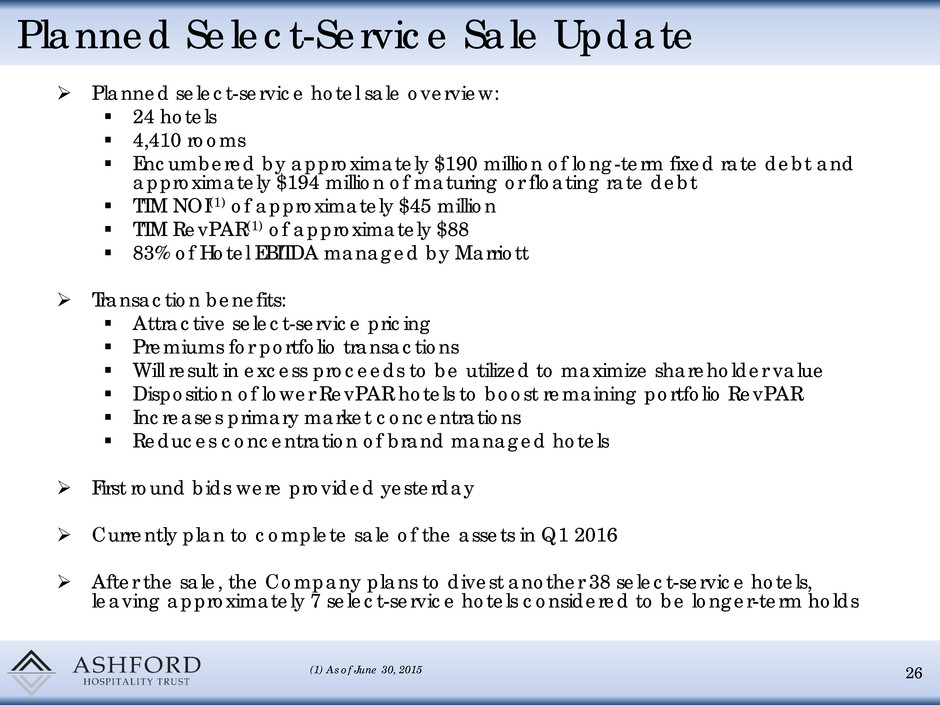

Recent Developments 8 Planned sale of 24-pack of select-service assets Simplify strategy 24 hotels and 4,410 rooms Encumbered by approximately $384 million of total debt TTM NOI and RevPAR of approximately $45 million and $88, respectively(1) Amendments to Advisory Agreement with Ashford, Inc. Receive key money ($4 million thus far) Termination right without fee upon Advisor CoC Shorten initial term of agreement Reduction in base fee amount Distribution of remaining shares of Ashford Prime Simplify balance sheet Crystalize value for shareholders Responsive to investor feedback Block trade to repurchase approximately 5.8 million shares of common stock Opportunistic Acquired significant amount of stock well below private market value Responsive to investor feedback Termination fee clarification (1) As of June 30, 2015

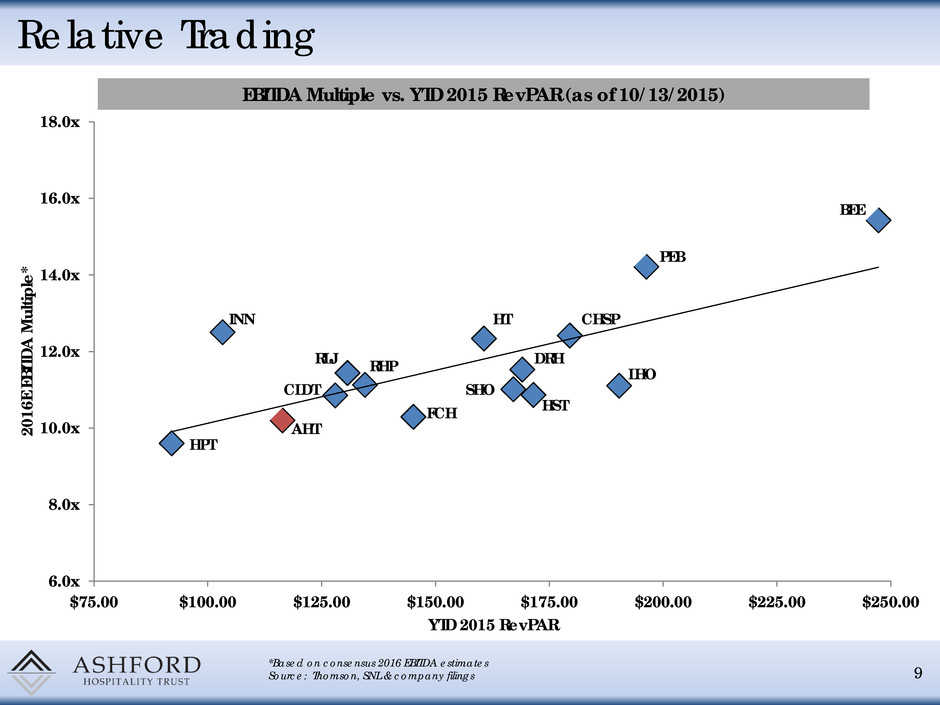

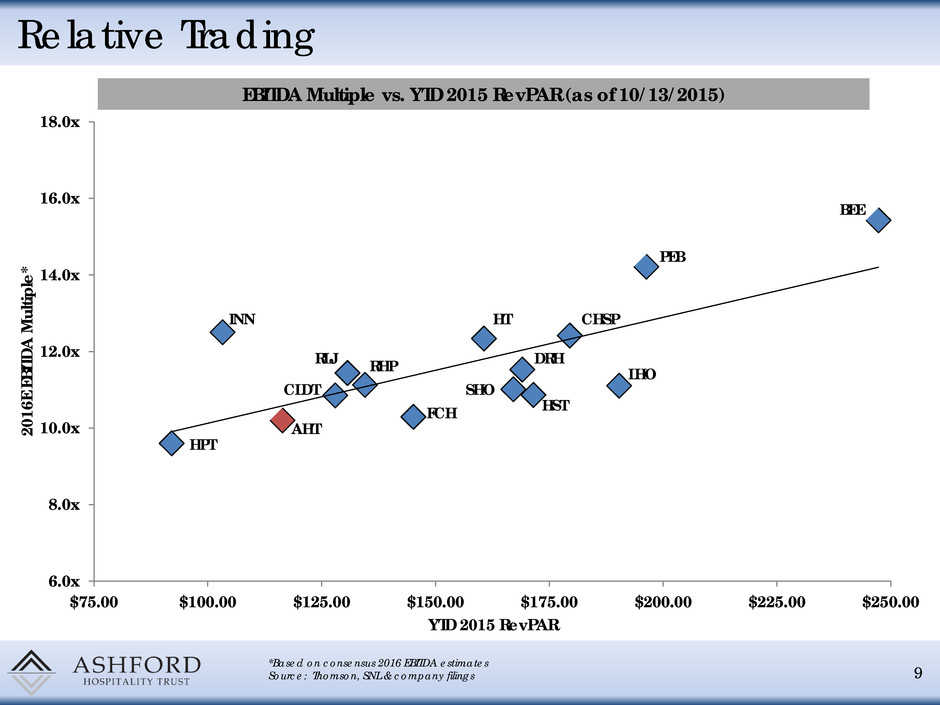

Relative Trading 9 EBITDA Multiple vs. YTD 2015 RevPAR (as of 10/13/2015) *Based on consensus 2016 EBITDA estimates Source: Thomson, SNL & company filings 6.0x 8.0x 10.0x 12.0x 14.0x 16.0x 18.0x $75.00 $100.00 $125.00 $150.00 $175.00 $200.00 $225.00 $250.00 2016E EBITDA Multiple * YTD 2015 RevPAR PEB BEE HT LHO CHSP HST DRH FCH SHO RHP CLDT RLJ AHT INN HPT

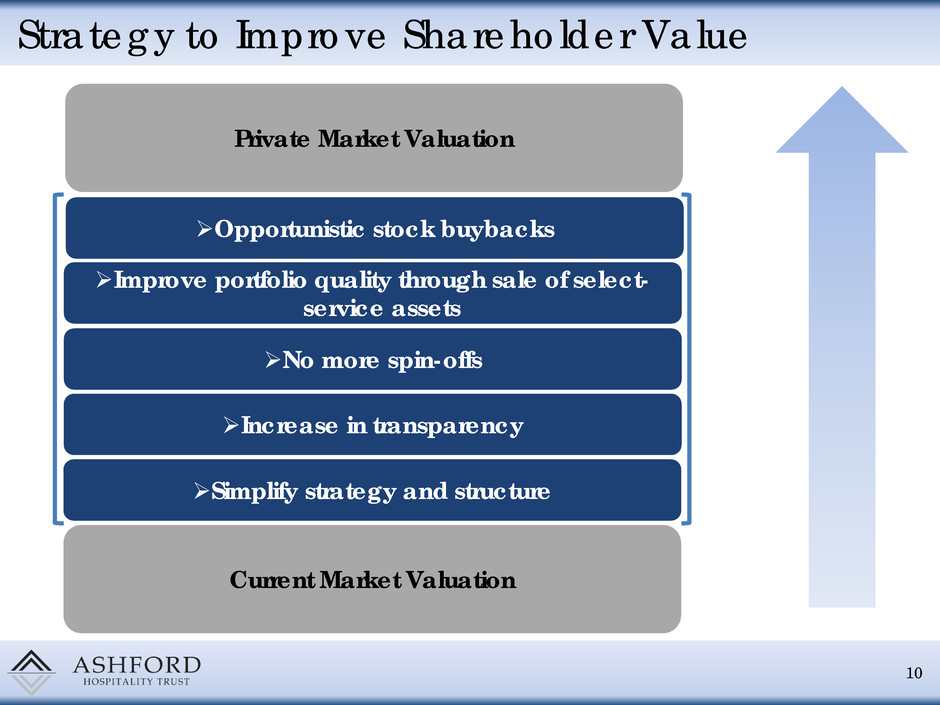

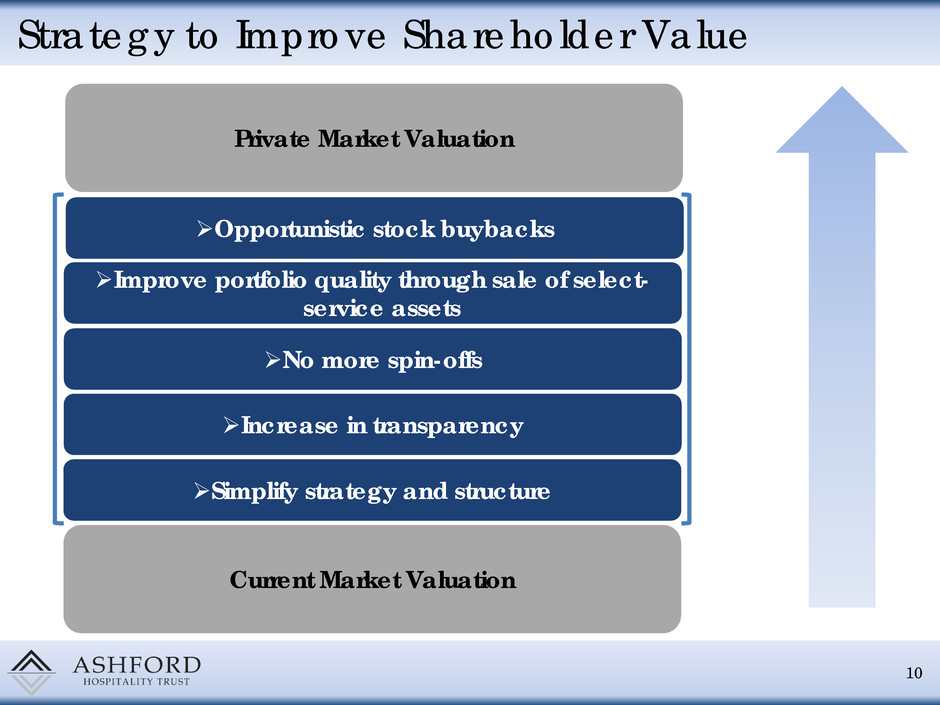

Strategy to Improve Shareholder Value 10 Current Market Valuation Increase in transparency No more spin-offs Improve portfolio quality through sale of select- service assets Private Market Valuation Simplify strategy and structure Opportunistic stock buybacks

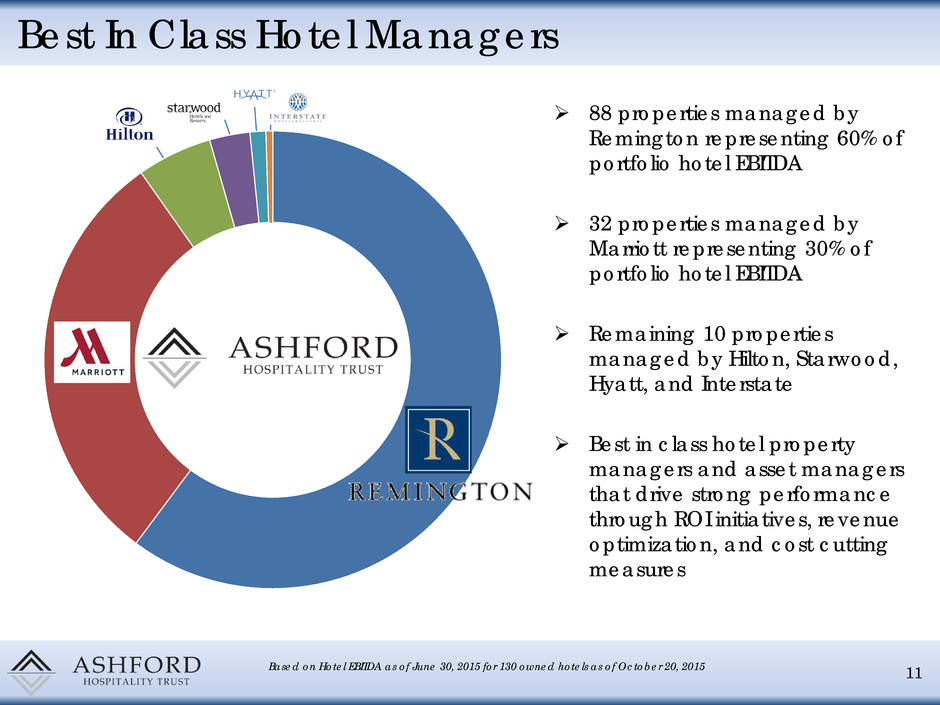

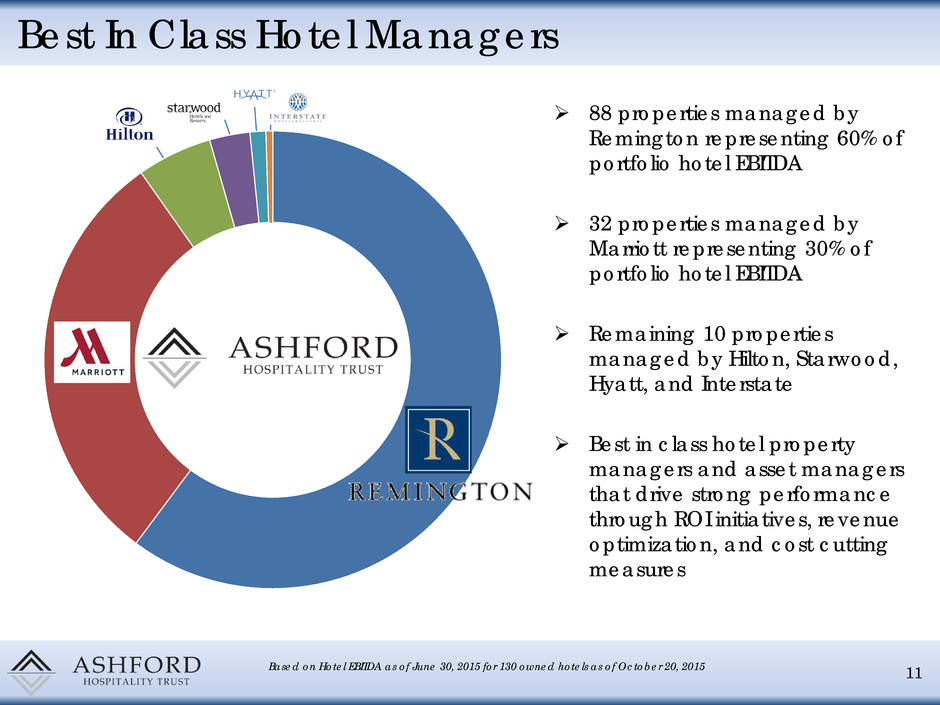

Best In Class Hotel Managers 88 properties managed by Remington representing 60% of portfolio hotel EBITDA 32 properties managed by Marriott representing 30% of portfolio hotel EBITDA Remaining 10 properties managed by Hilton, Starwood, Hyatt, and Interstate Best in class hotel property managers and asset managers that drive strong performance through ROI initiatives, revenue optimization, and cost cutting measures 11 Based on Hotel EBITDA as of June 30, 2015 for 130 owned hotels as of October 20, 2015

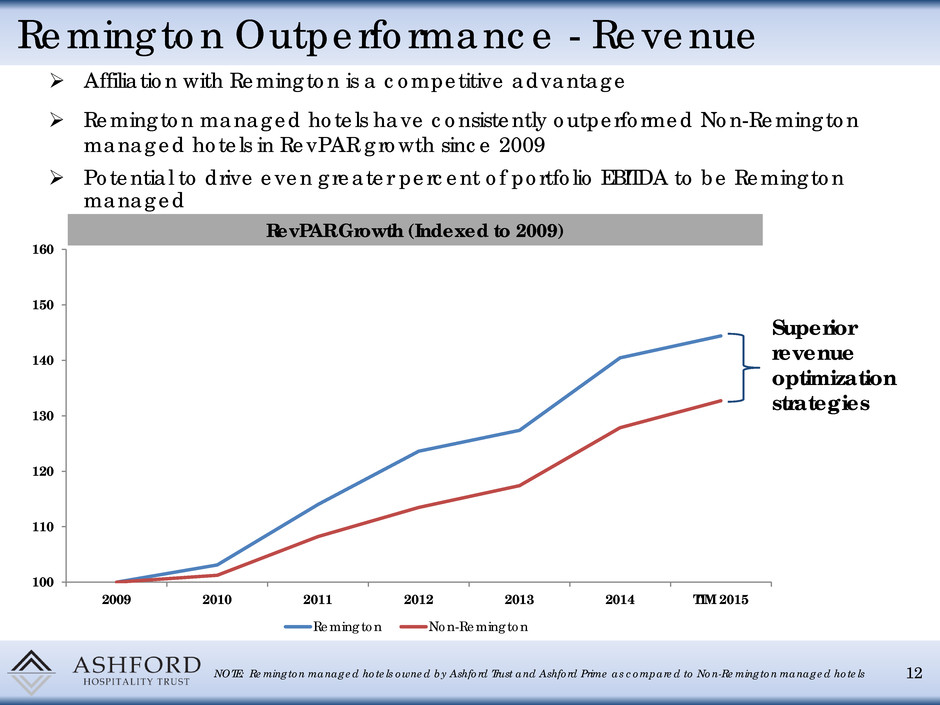

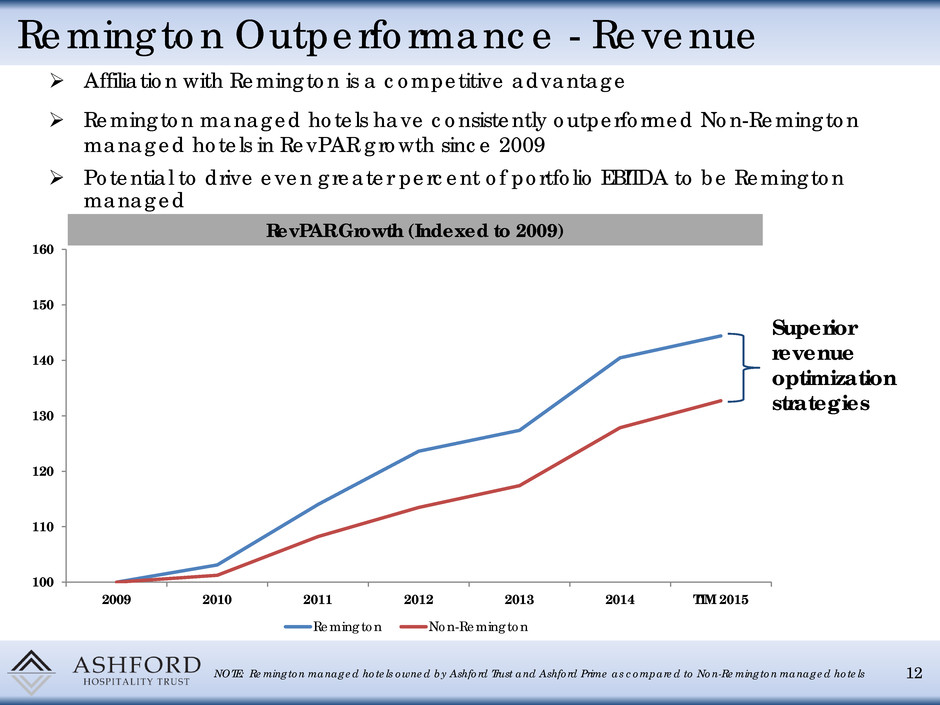

Remington Outperformance - Revenue Affiliation with Remington is a competitive advantage 12 100 110 120 130 140 150 160 2009 2010 2011 2012 2013 2014 TTM 2015 Remington Non-Remington NOTE: Remington managed hotels owned by Ashford Trust and Ashford Prime as compared to Non-Remington managed hotels Superior revenue optimization strategies RevPAR Growth (Indexed to 2009) Remington managed hotels have consistently outperformed Non-Remington managed hotels in RevPAR growth since 2009 Potential to drive even greater percent of portfolio EBITDA to be Remington managed

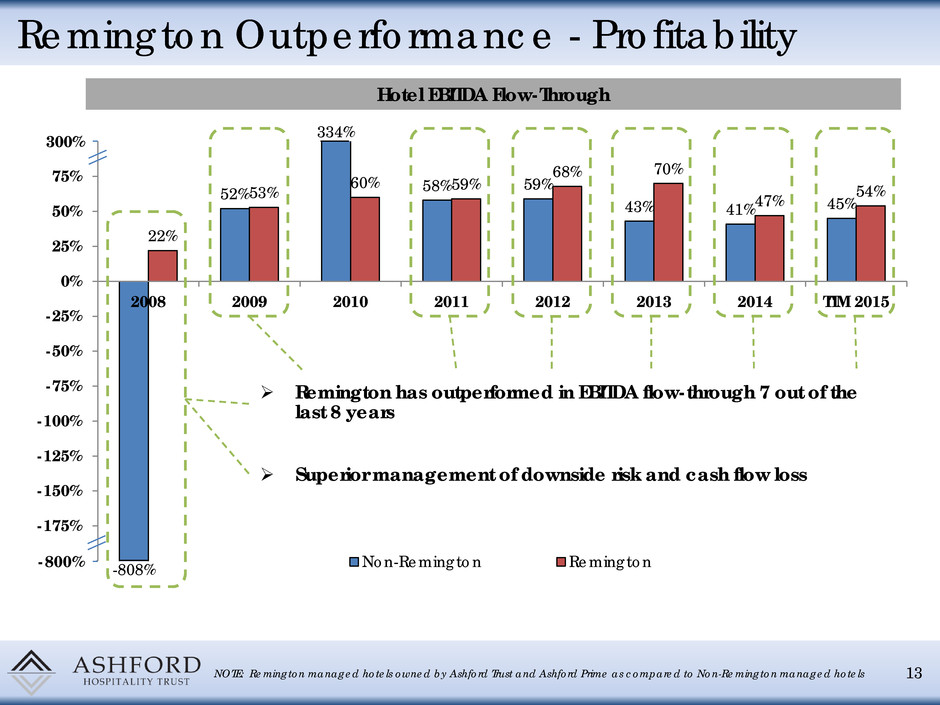

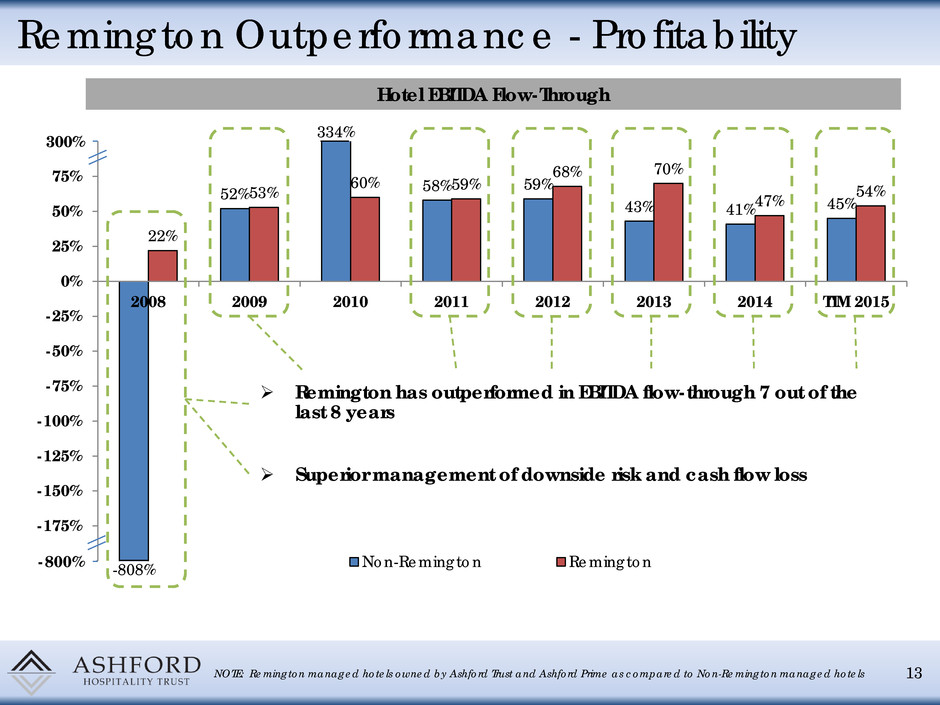

52% 58% 59% 43% 41% 45% 22% 53% 60% 59% 68% 70% 47% 54% -200% -175% -150% -125% -100% -75% -50% -25% 0% 25% 50% 75% 100% 2008 2009 2010 2011 2012 2013 2014 TTM 2015 Non-Remington Remington Remington Outperformance - Profitability Remington has outperformed in EBITDA flow-through 7 out of the last 8 years 13 NOTE: Remington managed hotels owned by Ashford Trust and Ashford Prime as compared to Non-Remington managed hotels Hotel EBITDA Flow-Through Superior management of downside risk and cash flow loss 300 -800 -808% 334%

103% 18% -13% -19% 138% 89% 50% 118% 59% 23% 1% 141% 94% 47% 64% 538% 271% 46% 79% 64% -2% -16% -100% 0% 100% 200% 300% 400% 500% 600% Inception 10-Yr 9-Yr 8-Yr 7-Yr 6-Yr 5-Yr 4-Yr 3-Yr 2-Yr 1-Yr Peer Avg AHT Demonstrated Long-Term Track Record 14 (1) Since IPO on August 26, 2003 Peer average includes: CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, RLJ, SHO Returns as of 10/13/15 Source: SNL Total Shareholder Return Focused on recent performance Long-term performance proves management's ability to create value for shareholders (1)

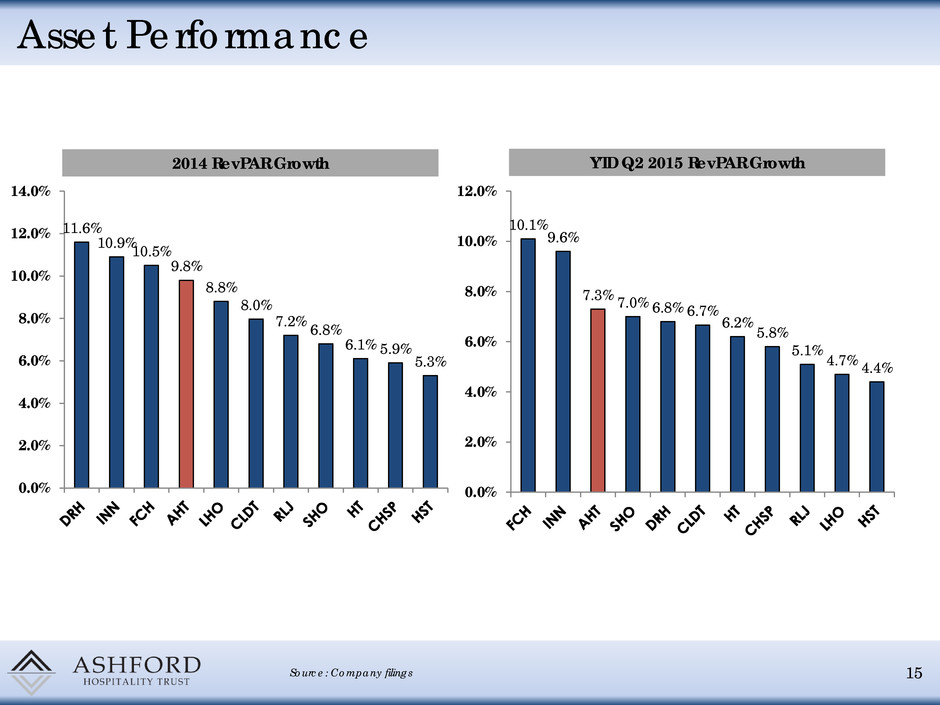

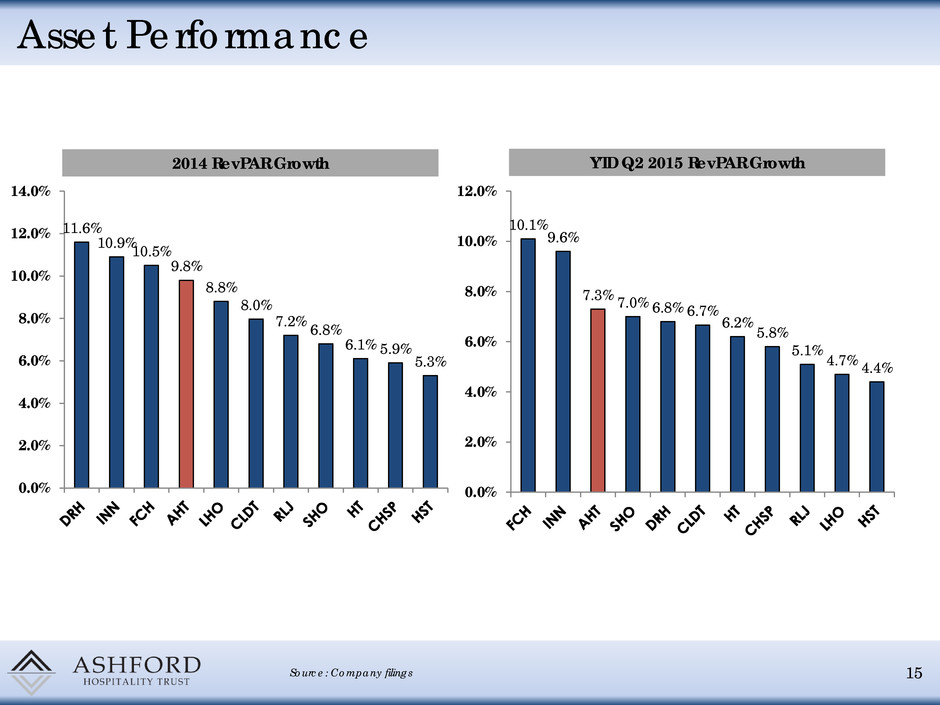

Asset Performance 15 Source: Company filings 2014 RevPAR Growth YTD Q2 2015 RevPAR Growth 11.6% 10.9% 10.5% 9.8% 8.8% 8.0% 7.2% 6.8% 6.1% 5.9% 5.3% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 10.1% 9.6% 7.3% 7.0% 6.8% 6.7% 6.2% 5.8% 5.1% 4.7% 4.4% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0%

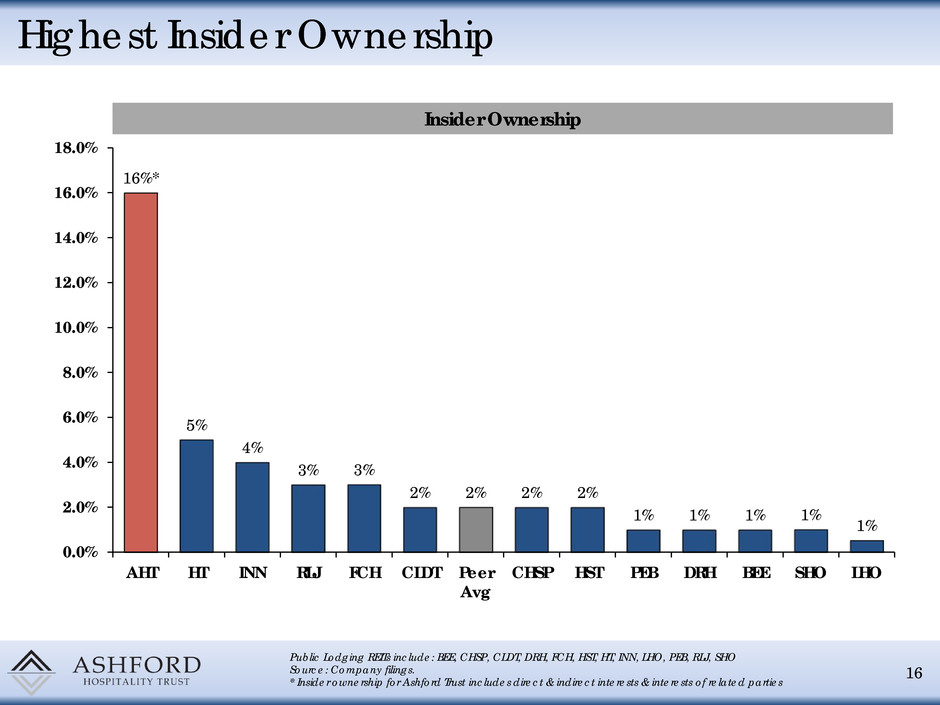

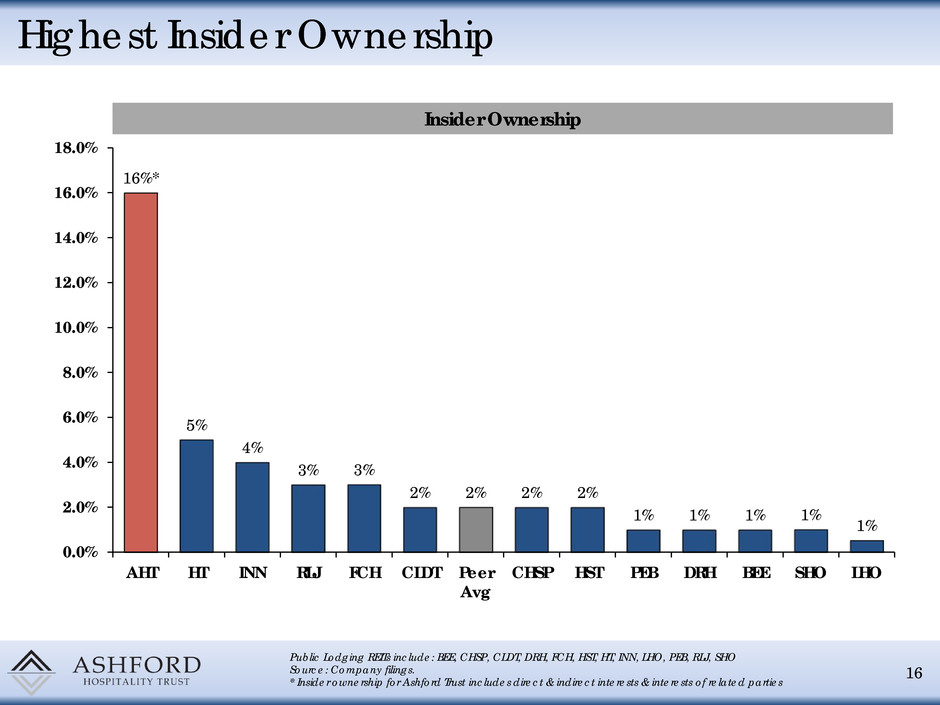

Highest Insider Ownership 16 16%* 5% 4% 3% 3% 2% 2% 2% 2% 1% 1% 1% 1% 1% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% AHT HT INN RLJ FCH CLDT Peer Avg CHSP HST PEB DRH BEE SHO LHO Public Lodging REITs include: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Source: Company filings. * Insider ownership for Ashford Trust includes direct & indirect interests & interests of related parties Insider Ownership

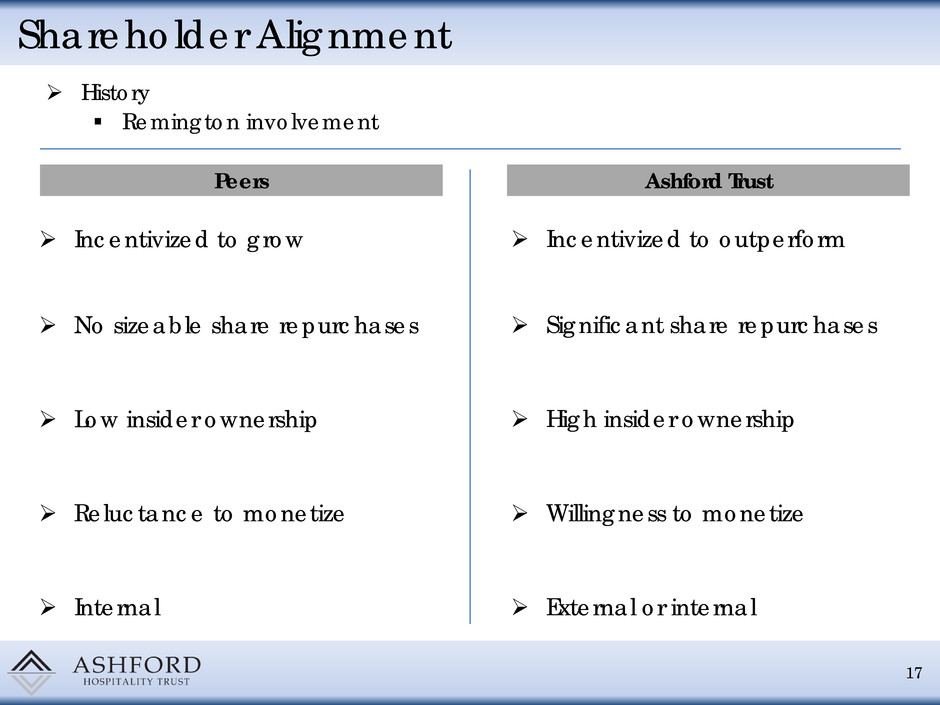

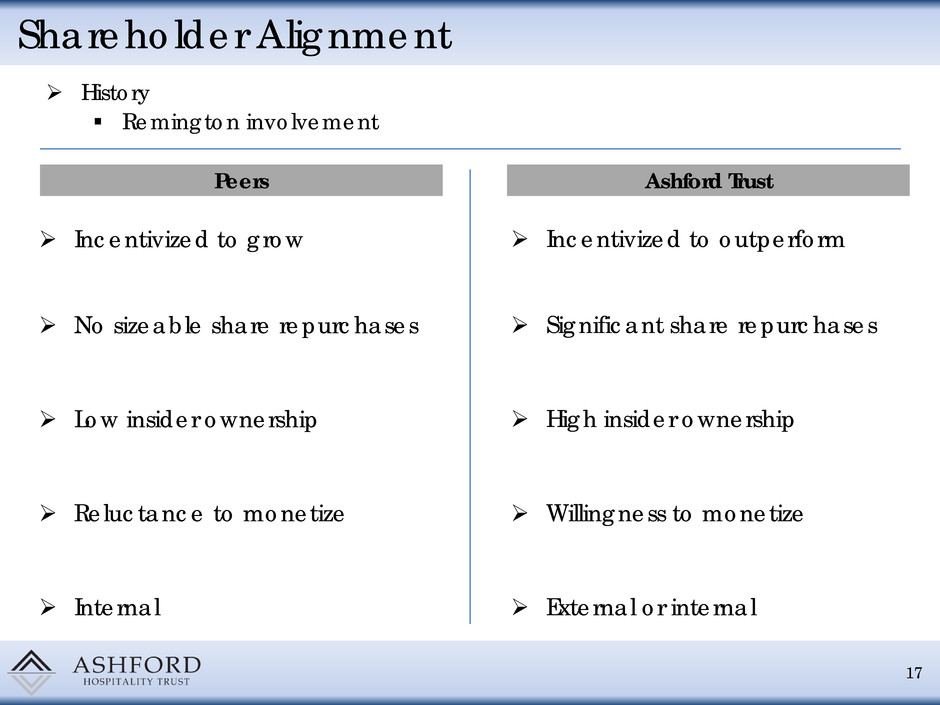

17 Shareholder Alignment Peers Ashford Trust Incentivized to grow No sizeable share repurchases Low insider ownership Reluctance to monetize Internal Incentivized to outperform Significant share repurchases High insider ownership Willingness to monetize External or internal History Remington involvement

Attractive Dividend Yield 18 Source: Company filings. 7.0% 6.6% 5.2% 5.0% 4.9% 4.7% 4.7% 4.6% 4.3% 4.2% 3.7% 3.7% 2.9% 2.7% 1.7% 1.4% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% AHT APLE LHO XHR HST CLDT RLJ CHSP HT Peer Avg DRH INN PEB AHP FCH SHO BEE Dividend Yield (as of 10/13/15) Highest dividend yield in the industry and with coverage ratio of 2.5x Dividend Yield

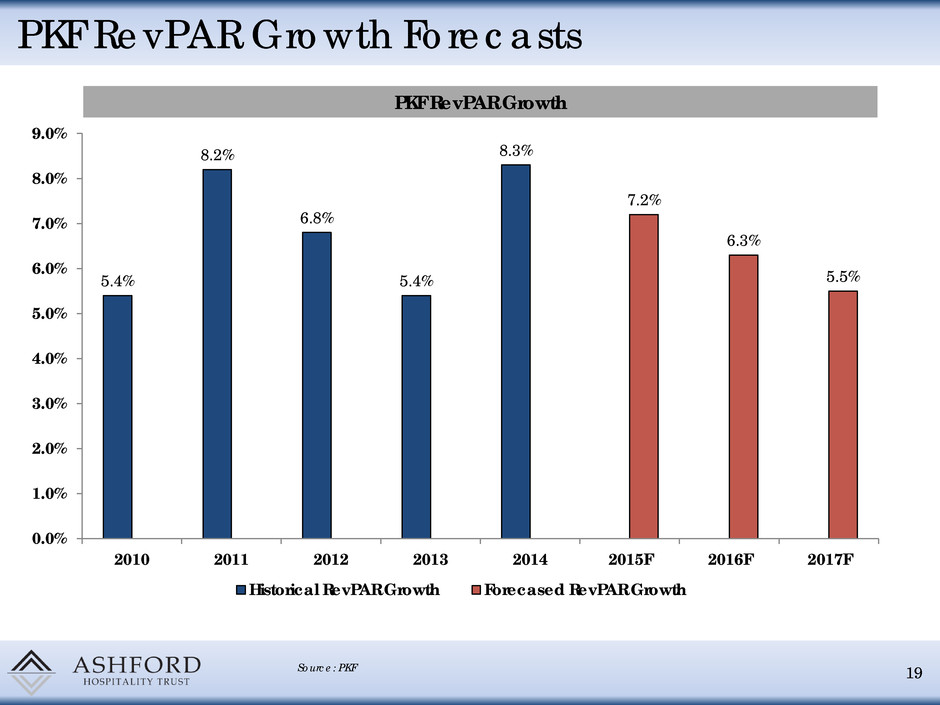

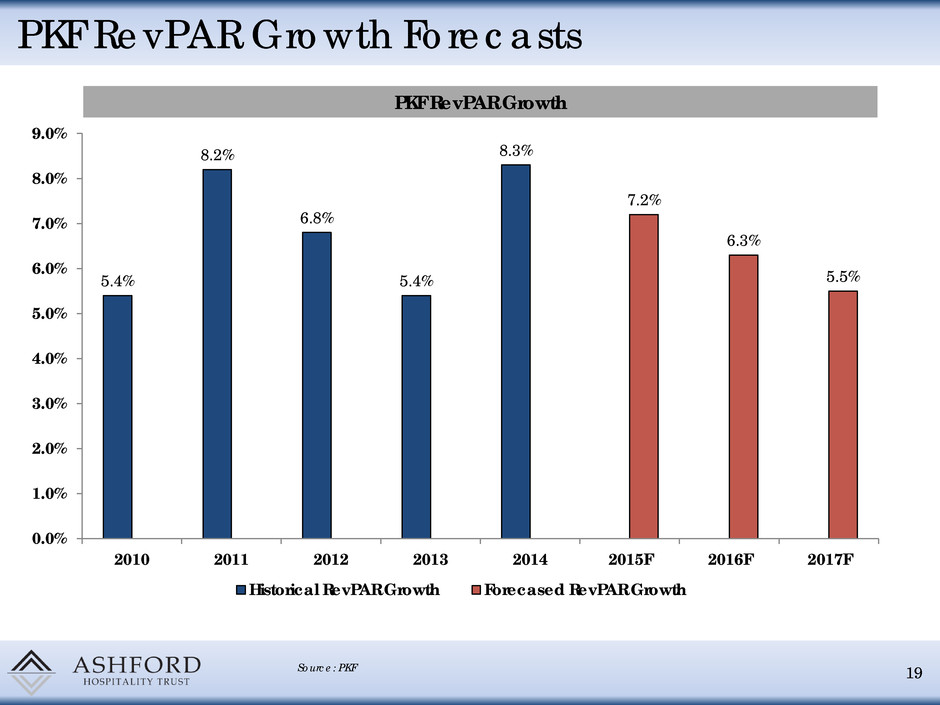

PKF RevPAR Growth Forecasts 19 PKF RevPAR Growth 5.4% 8.2% 6.8% 5.4% 8.3% 7.2% 6.3% 5.5% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 2010 2011 2012 2013 2014 2015F 2016F 2017F Historical RevPAR Growth Forecased RevPAR Growth Source: PKF

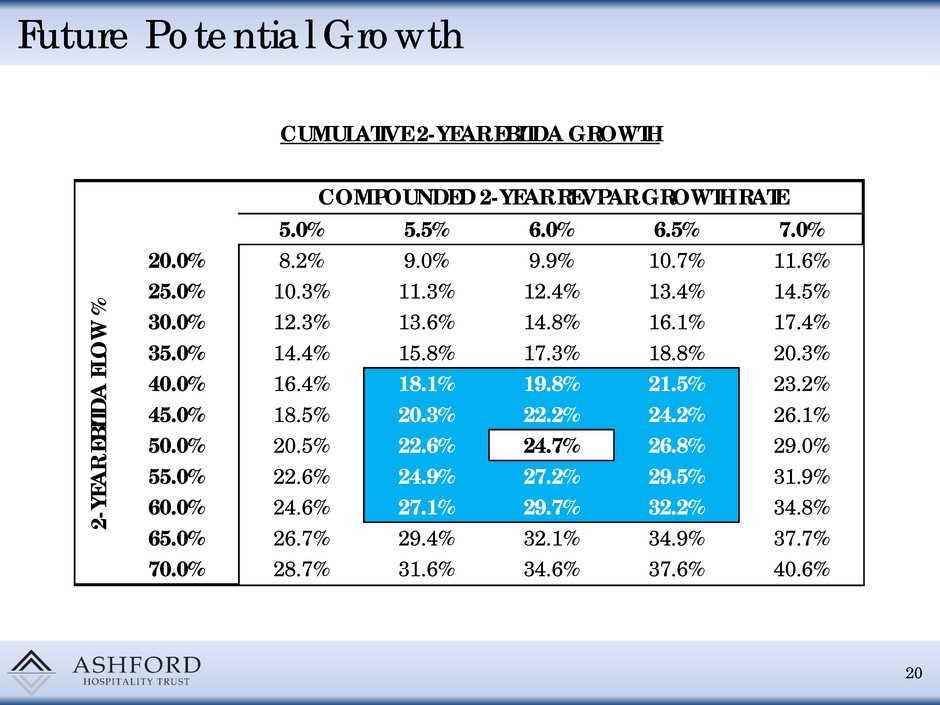

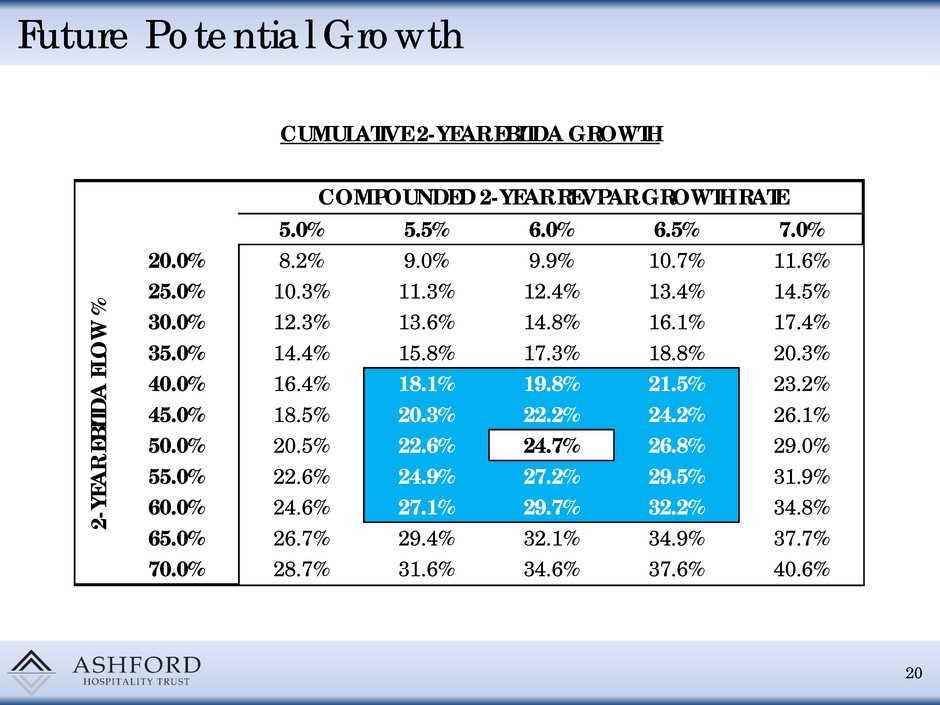

Future Potential Growth 20 COMPOUNDED 2-YEAR REVPAR GROWTH RATE 24.3% 5.0% 5.5% 6.0% 6.5% 7.0% 20.0% 8.2% 9.0% 9.9% 10.7% 11.6% 25.0% 10.3% 11.3% 12.4% 13.4% 14.5% 30.0% 12.3% 13.6% 14.8% 16.1% 17.4% 35.0% 14.4% 15.8% 17.3% 18.8% 20.3% 40.0% 16.4% 18.1% 19.8% 21.5% 23.2% 45.0% 18.5% 20.3% 22.2% 24.2% 26.1% 50.0% 20.5% 22.6% 24.7% 26.8% 29.0% 55.0% 22.6% 24.9% 27.2% 29.5% 31.9% 60.0% 24.6% 27.1% 29.7% 32.2% 34.8% 65.0% 26.7% 29.4% 32.1% 34.9% 37.7% 70.0% 28.7% 31.6% 34.6% 37.6% 40.6% 2- YE A R EB IT D A F LO W % CUMULATIVE 2-YEAR EBITDA GROWTH

Key Takeaways 21 Focused on increasing shareholder value through: Improving portfolio quality No more spin-offs Increase in transparency Simplify strategy and structure Attractive industry fundamentals Strong management team with a long track record of creating shareholder value Highest dividend yield in the industry Highly-aligned platform through management structure and high insider ownership

Strategy Execution – Douglas Kessler, President Le Pavillon Hotel New Orleans, LA

Long-Term Track Record of Execution Expertise 23 Transaction History Track record of disciplined, opportunistic single asset and portfolio transactions Purchased 197 hotels representing over $7 billion in value Sold 64 hotels representing approximately $1.8 billion in value Bought back approximately $392.2 million of stock Over $1.1 billion returned to shareholders through cash dividends and buybacks $18.2 $106.8 $92.0 $50.4 $73.0 $51.8 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $0.0 $500.0 $1,000.0 $1,500.0 $2,000.0 $2,500.0 $3,000.0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 YTD 2015 St o c k Bu yb a c ks ( m m ) A c q ui si tio ns /D is p o si tio ns ( m m ) Hotel Acquisitions Hotel Dispositions / Spin-Off Stock Buybacks

24 Ashford Trust Hotels High Quality, Geographically Diverse Portfolio Le Pavillon Hotel New Orleans, LA Lakeway Resort & Spa Austin, TX Hilton Costa Mesa Costa Mesa, CA Marriott Fremont Fremont, CA Le Meridien Minneapolis Minneapolis, MN Chicago Silversmith Chicago, IL Hilton Back Bay Boston, MA The Churchill Washington, D.C. W Atlanta Downtown Atlanta, GA Crowne Plaza Key West Key West, FL Marriott Sugar Land Sugar Land, TX Hilton Santa Fe Santa Fe, NM Renaissance Nashville Nashville, TN Westin Princeton Princeton, NJ Marriott Beverly Hills Beverly Hills, CA Embassy Suites Portland Portland, OR Marriott Gateway Arlington, VA

TTM Hotel % of EBITDA Total Washington DC Area $45,065 9.9% NY/NJ Metro Area $31,402 6.9% Los Angeles Metro Area $28,983 6.4% San Fran/Oakland, CA $28,949 6.4% Atlanta, GA $27,495 6.0% Boston, MA $25,206 5.5% DFW, TX $24,753 5.4% Orlando, FL $19,868 4.4% Houston, TX $15,038 3.3% Miami Metro Area $11,592 2.5% Total Portfolio $455,447 100.0% Top 25 70% Top 50 21% Other 9% Portfolio Overview 25 Hotel EBITDA as of June 30, 2015 for 130 owned hotels as of October 20, 2015 Hotel EBITDA in thousands Hotel EBITDA by Brand Hotel EBITDA by Manager Hotel EBITDA by MSA Hotel EBITDA by Chainscale Marriott 51% Hilton 28% Hyatt 4% IHG 4% Starwood 7% Independent 6% Marriott 30% Hilton 5% Hyatt 3% Remington 60% Starwood 1% Interstate 1% Upscale 35% Upper-Upscale 53% Luxury 3% Upper-Midscale 5% Independent 4% Top Ten Markets

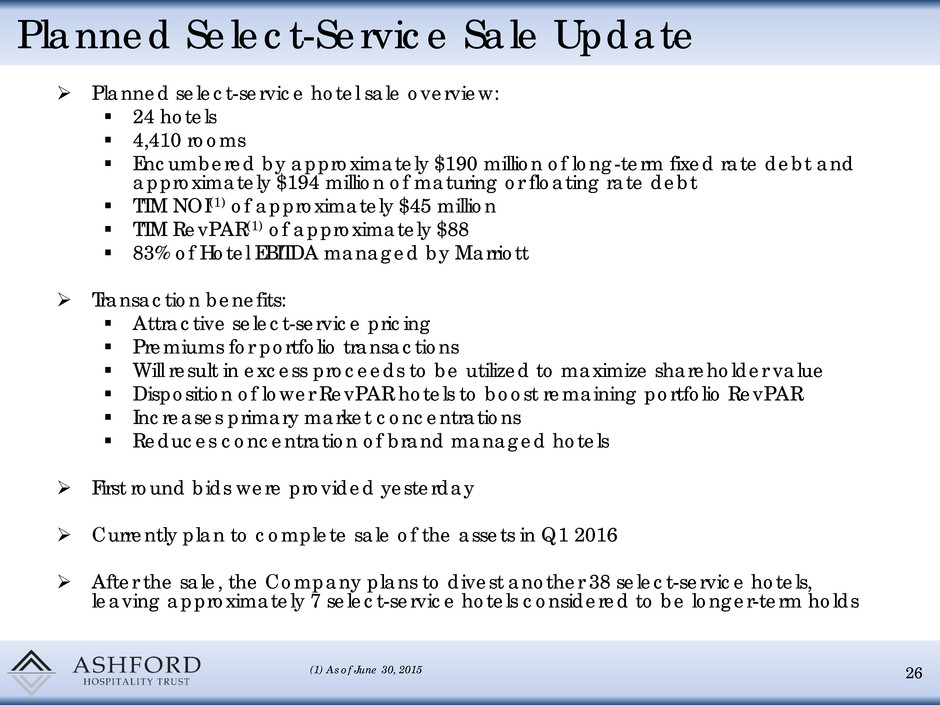

Planned Select-Service Sale Update Planned select-service hotel sale overview: 24 hotels 4,410 rooms Encumbered by approximately $190 million of long-term fixed rate debt and approximately $194 million of maturing or floating rate debt TTM NOI(1) of approximately $45 million TTM RevPAR(1) of approximately $88 83% of Hotel EBITDA managed by Marriott Transaction benefits: Attractive select-service pricing Premiums for portfolio transactions Will result in excess proceeds to be utilized to maximize shareholder value Disposition of lower RevPAR hotels to boost remaining portfolio RevPAR Increases primary market concentrations Reduces concentration of brand managed hotels First round bids were provided yesterday Currently plan to complete sale of the assets in Q1 2016 After the sale, the Company plans to divest another 38 select-service hotels, leaving approximately 7 select-service hotels considered to be longer-term holds 26 (1) As of June 30, 2015

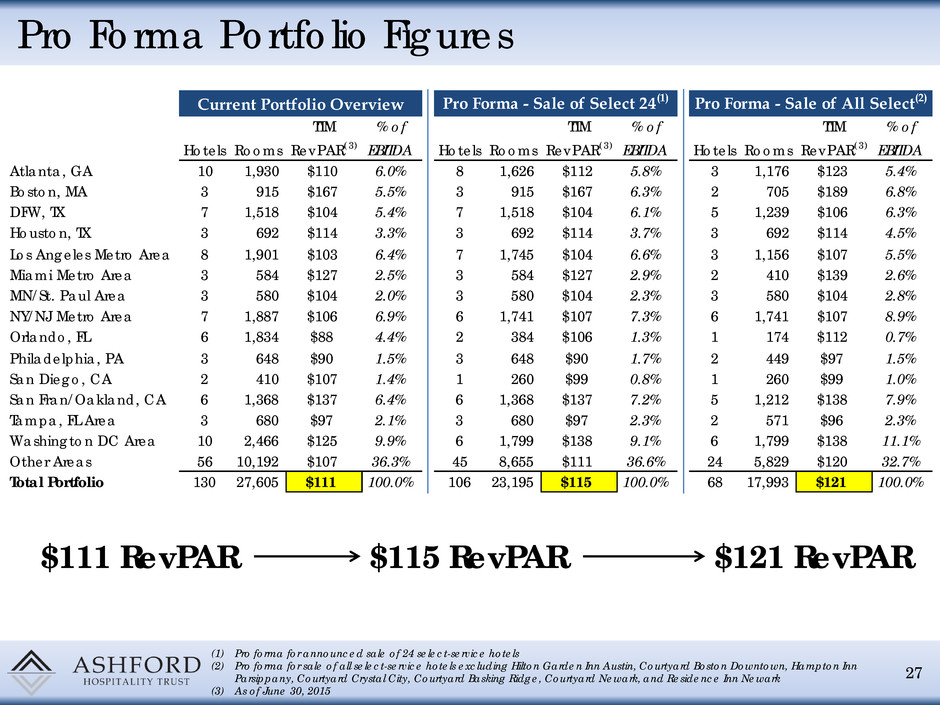

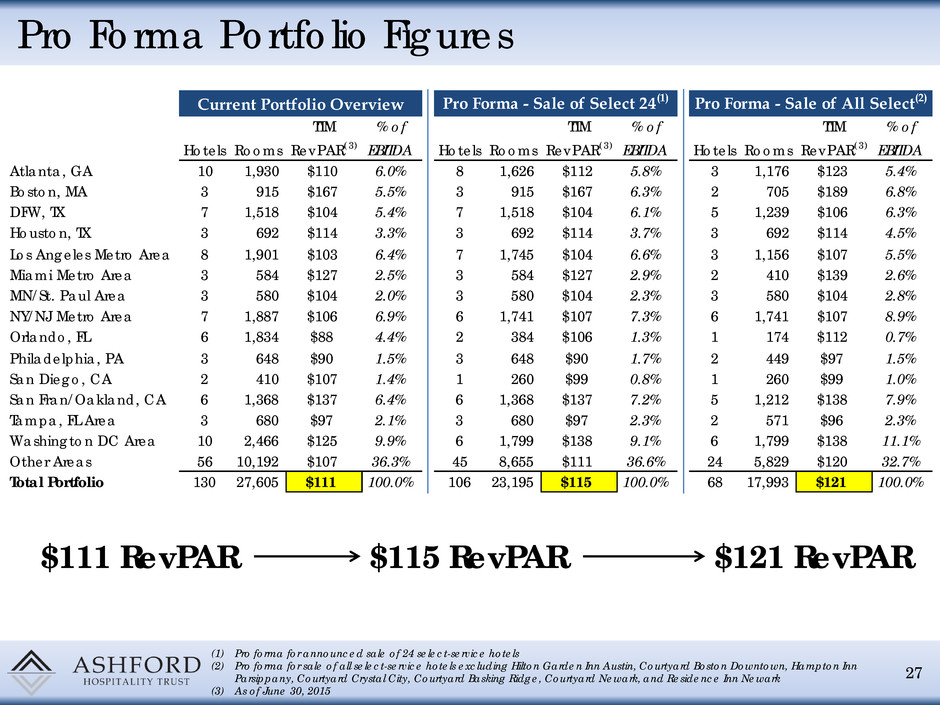

27 (1) Pro forma for announced sale of 24 select-service hotels (2) Pro forma for sale of all select-service hotels excluding Hilton Garden Inn Austin, Courtyard Boston Downtown, Hampton Inn Parsippany, Courtyard Crystal City, Courtyard Basking Ridge, Courtyard Newark, and Residence Inn Newark (3) As of June 30, 2015 Pro Forma Portfolio Figures $111 RevPAR $115 RevPAR $121 RevPAR Current Portfolio Overview Pro Forma - Sale of Select 24(1) Pro Forma - Sale of All Select(2) TTM % of TTM % of TTM % of Hotels Rooms RevPAR(3) EBITDA Hotels Rooms RevPAR(3) EBITDA Hotels Rooms RevPAR(3) EBITDA Atlanta, GA 10 1,930 $110 6.0% 8 1,626 $112 5.8% 3 1,176 $123 5.4% Boston, MA 3 915 $167 5.5% 3 915 $167 6.3% 2 705 $189 6.8% DFW, TX 7 1,518 $104 5.4% 7 1,518 $104 6.1% 5 1,239 $106 6.3% Houston, TX 3 692 $114 3.3% 3 692 $114 3.7% 3 692 $114 4.5% Los Angeles Metro Area 8 1,901 $103 6.4% 7 1,745 $104 6.6% 3 1,156 $107 5.5% Miami Metro Area 3 584 $127 2.5% 3 584 $127 2.9% 2 410 $139 2.6% MN/St. Paul Area 3 580 $104 2.0% 3 580 $104 2.3% 3 580 $104 2.8% NY/NJ Metro Area 7 1,887 $106 6.9% 6 1,741 $107 7.3% 6 1,741 $107 8.9% Orlando, FL 6 1,834 $88 4.4% 2 384 $106 1.3% 1 174 $112 0.7% Philadelphia, PA 3 648 $90 1.5% 3 648 $90 1.7% 2 449 $97 1.5% San Diego, CA 2 410 $107 1.4% 1 260 $99 0.8% 1 260 $99 1.0% San Fran/Oakland, CA 6 1,368 $137 6.4% 6 1,368 $137 7.2% 5 1,212 $138 7.9% Tampa, FL Area 3 680 $97 2.1% 3 680 $97 2.3% 2 571 $96 2.3% Washington DC Area 10 2,466 $125 9.9% 6 1,799 $138 9.1% 6 1,799 $138 11.1% Other Areas 56 10,192 $107 36.3% 45 8,655 $111 36.6% 24 5,829 $120 32.7% Total Portfolio 130 27,605 $111 100.0% 106 23,195 $115 100.0% 68 17,993 $121 100.0%

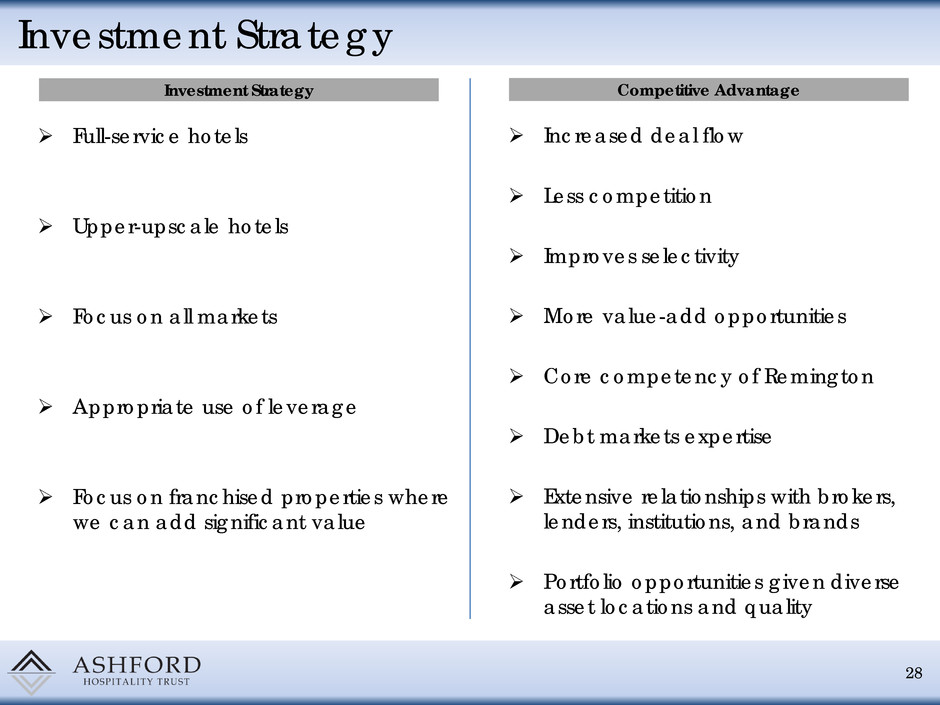

Investment Strategy 28 Full-service hotels Upper-upscale hotels Focus on all markets Appropriate use of leverage Focus on franchised properties where we can add significant value Investment Strategy Competitive Advantage Increased deal flow Less competition Improves selectivity More value-add opportunities Core competency of Remington Debt markets expertise Extensive relationships with brokers, lenders, institutions, and brands Portfolio opportunities given diverse asset locations and quality

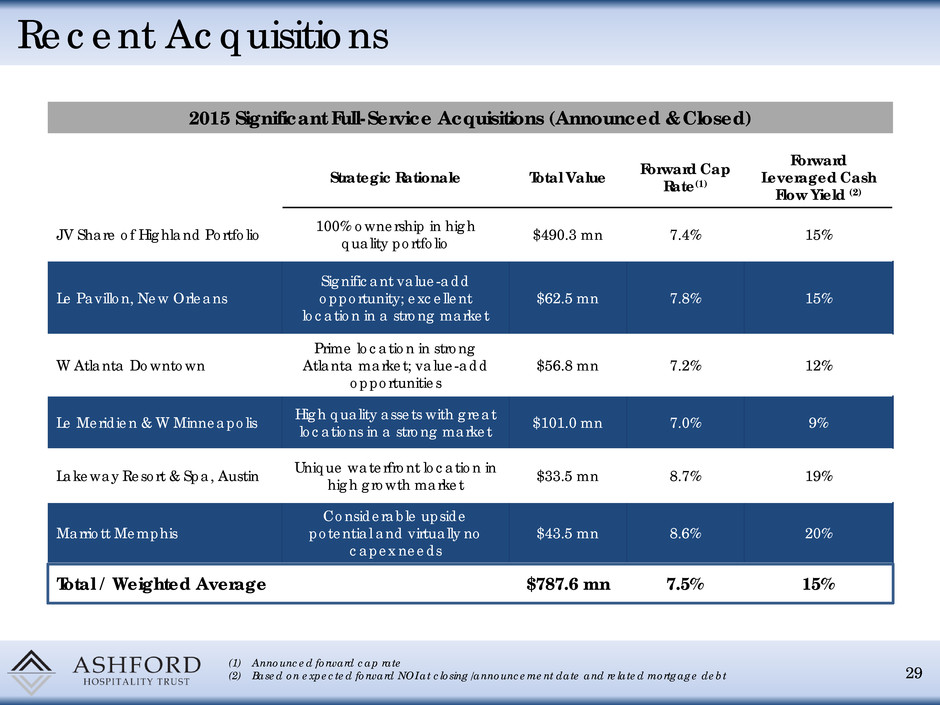

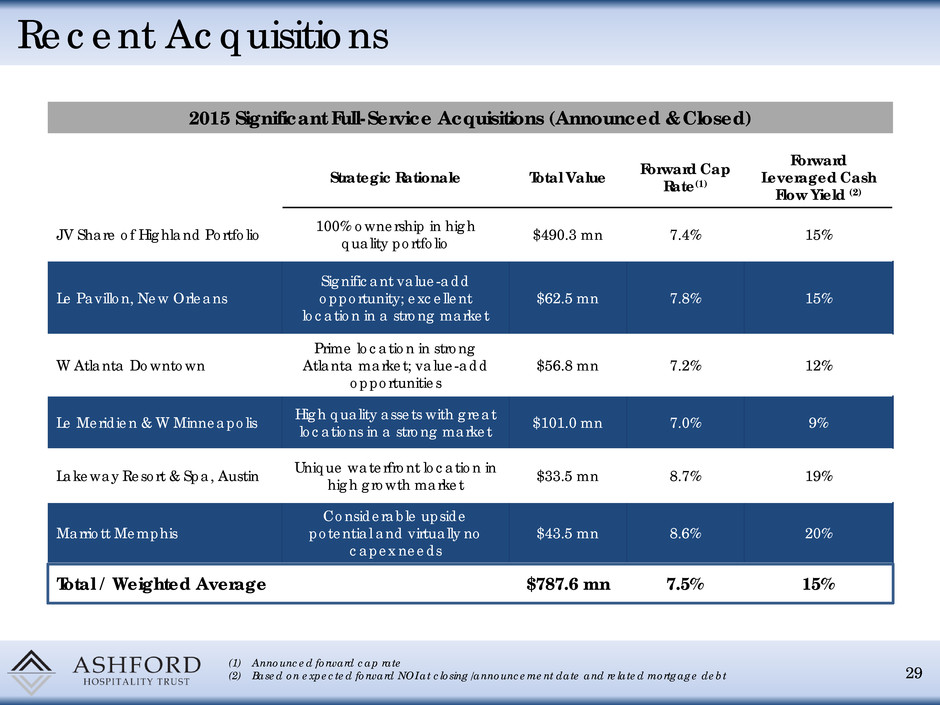

Recent Acquisitions 29 Strategic Rationale Total Value Forward Cap Rate(1) Forward Leveraged Cash Flow Yield (2) JV Share of Highland Portfolio 100% ownership in high quality portfolio $490.3 mn 7.4% 15% Le Pavillon, New Orleans Significant value-add opportunity; excellent location in a strong market $62.5 mn 7.8% 15% W Atlanta Downtown Prime location in strong Atlanta market; value-add opportunities $56.8 mn 7.2% 12% Le Meridien & W Minneapolis High quality assets with great locations in a strong market $101.0 mn 7.0% 9% Lakeway Resort & Spa, Austin Unique waterfront location in high growth market $33.5 mn 8.7% 19% Marriott Memphis Considerable upside potential and virtually no capex needs $43.5 mn 8.6% 20% Total / Weighted Average $787.6 mn 7.5% 15% 2015 Significant Full-Service Acquisitions (Announced & Closed) (1) Announced forward cap rate (2) Based on expected forward NOI at closing/announcement date and related mortgage debt

Asset Management – Jeremy Welter, EVP Marriott Fremont Fremont, CA

Asset Management Overview 31 Strong Operational Performance Prudent Capital Investment Ownership Value Add

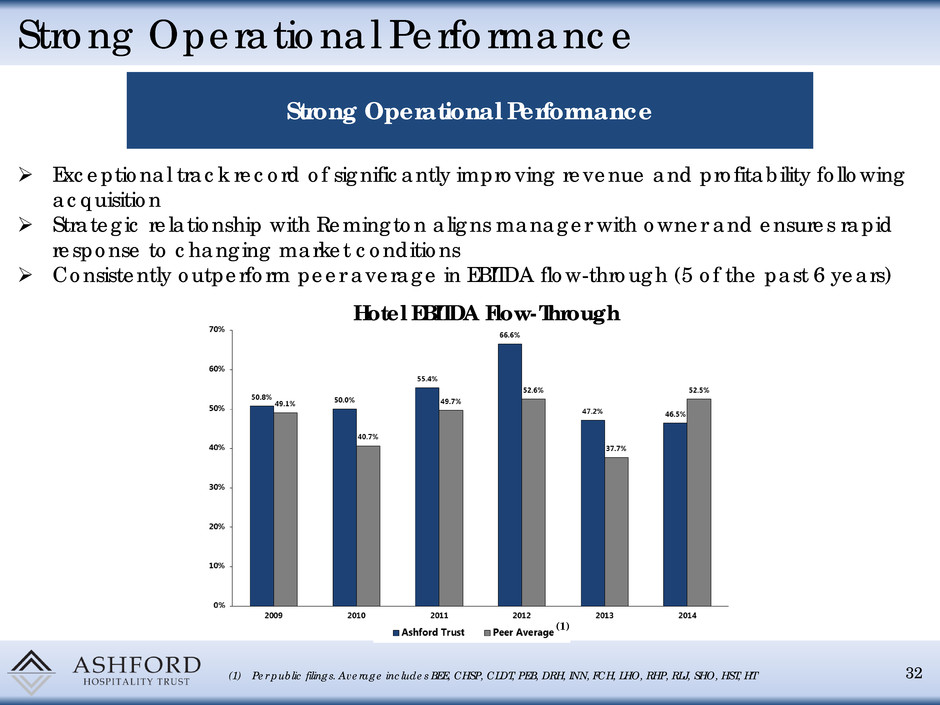

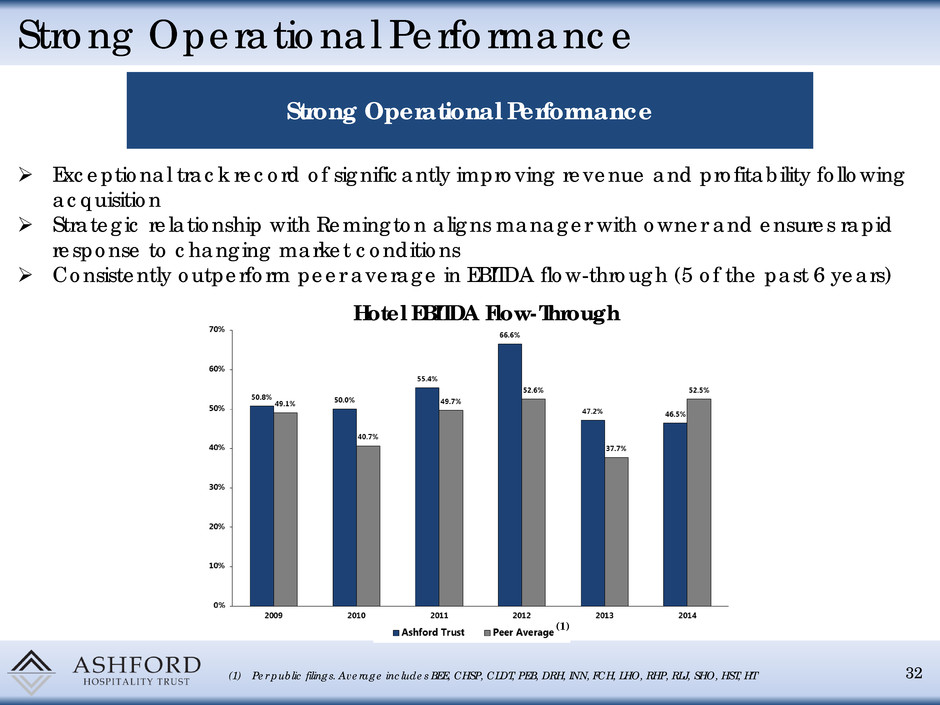

Strong Operational Performance 32 Strong Operational Performance Exceptional track record of significantly improving revenue and profitability following acquisition Strategic relationship with Remington aligns manager with owner and ensures rapid response to changing market conditions Consistently outperform peer average in EBITDA flow-through (5 of the past 6 years) (1) Per public filings. Average includes BEE, CHSP, CLDT, PEB, DRH, INN, FCH, LHO, RHP, RLJ, SHO, HST, HT (1) Hotel EBITDA Flow-Through

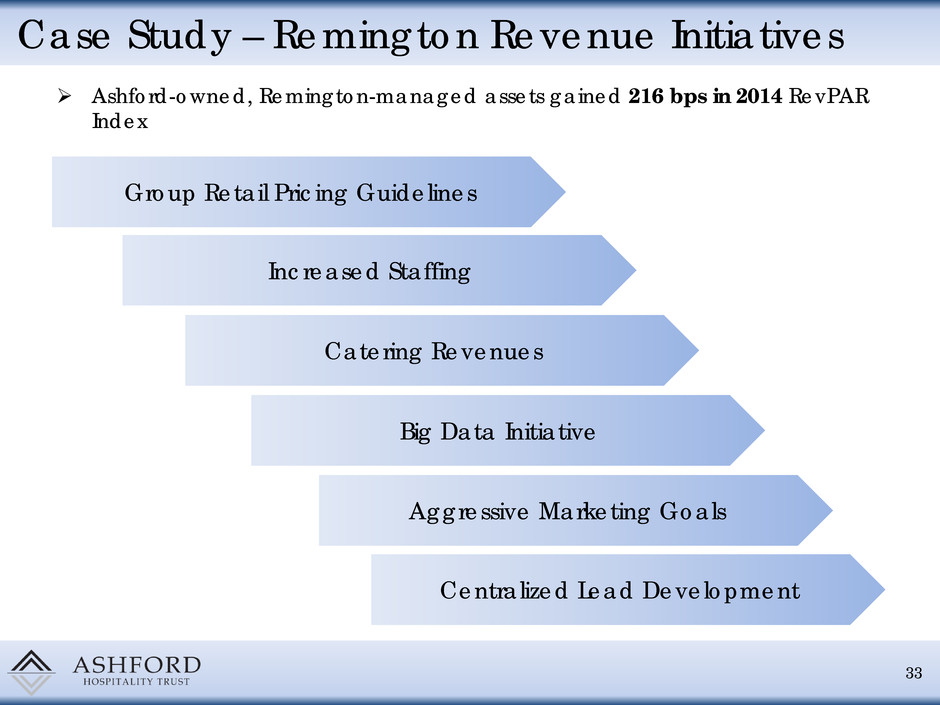

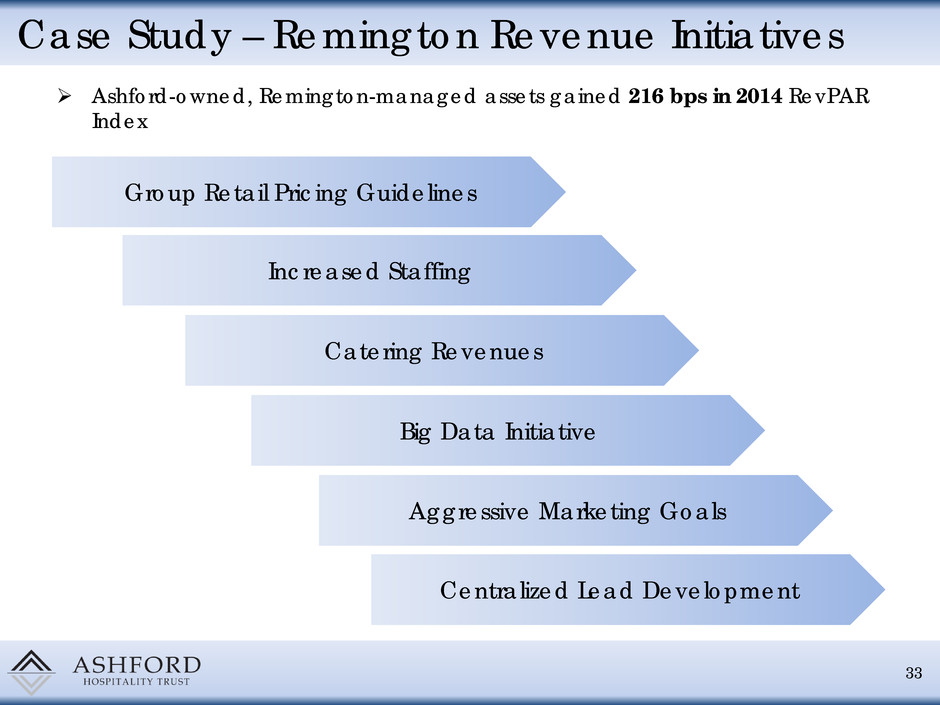

Case Study – Remington Revenue Initiatives 33 Ashford-owned, Remington-managed assets gained 216 bps in 2014 RevPAR Index Group Retail Pricing Guidelines Increased Staffing Catering Revenues Big Data Initiative Aggressive Marketing Goals Centralized Lead Development

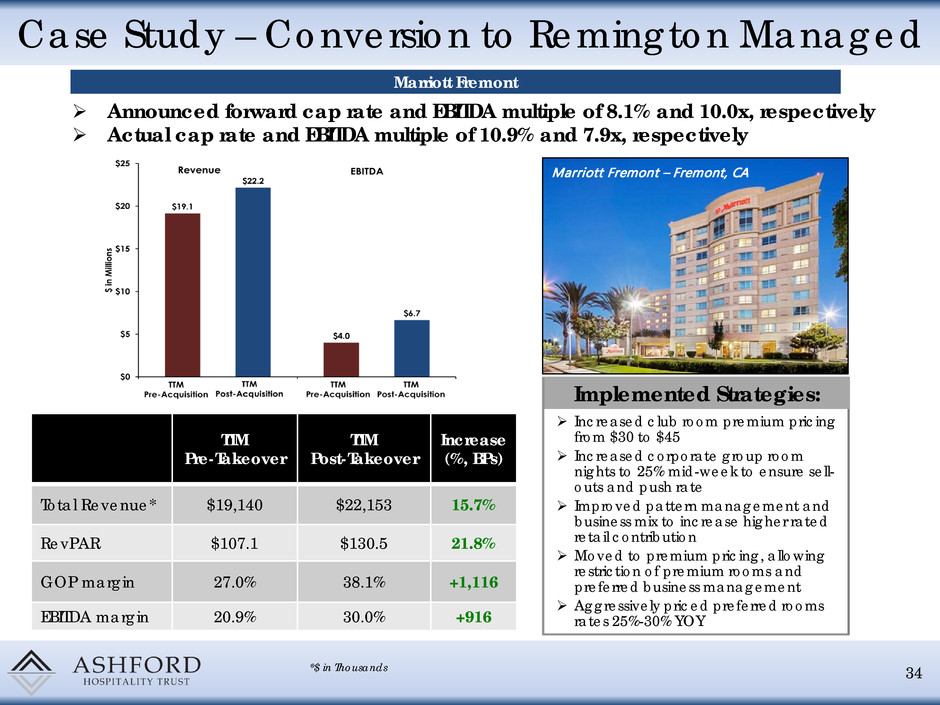

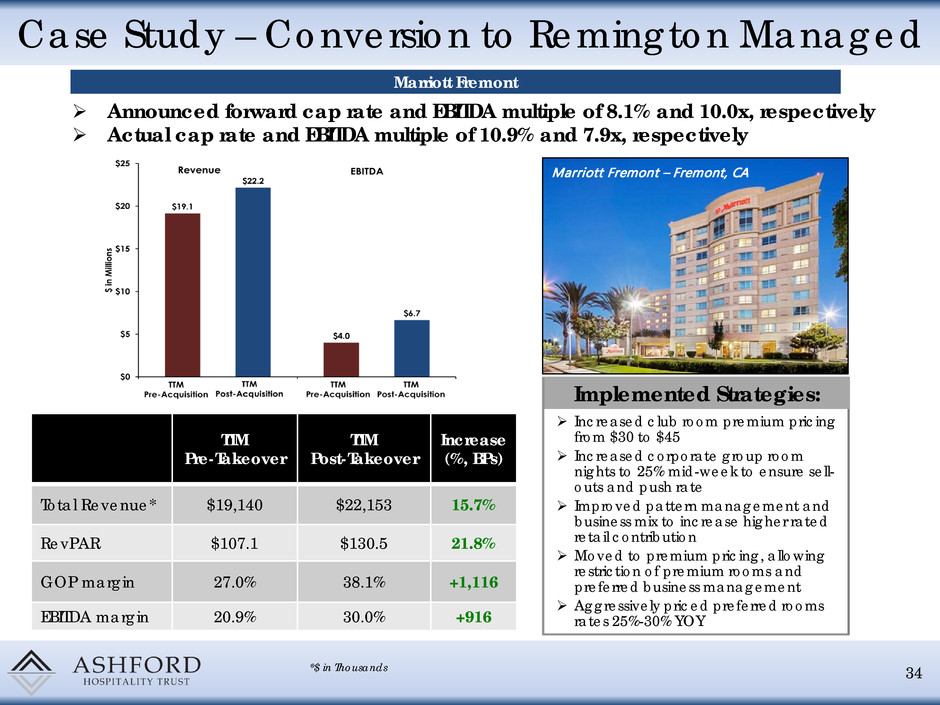

Case Study – Conversion to Remington Managed 34 Implemented Strategies: Increased club room premium pricing from $30 to $45 Increased corporate group room nights to 25% mid-week to ensure sell- outs and push rate Improved pattern management and business mix to increase higher rated retail contribution Moved to premium pricing, allowing restriction of premium rooms and preferred business management Aggressively priced preferred rooms rates 25%-30% YOY Marriott Fremont – Fremont, CA *$ in Thousands Announced forward cap rate and EBITDA multiple of 8.1% and 10.0x, respectively Actual cap rate and EBITDA multiple of 10.9% and 7.9x, respectively TTM Pre-Takeover TTM Post-Takeover Increase (%, BPs) Total Revenue* $19,140 $22,153 15.7% RevPAR $107.1 $130.5 21.8% GOP margin 27.0% 38.1% +1,116 EBITDA margin 20.9% 30.0% +916 Marriott Fremont

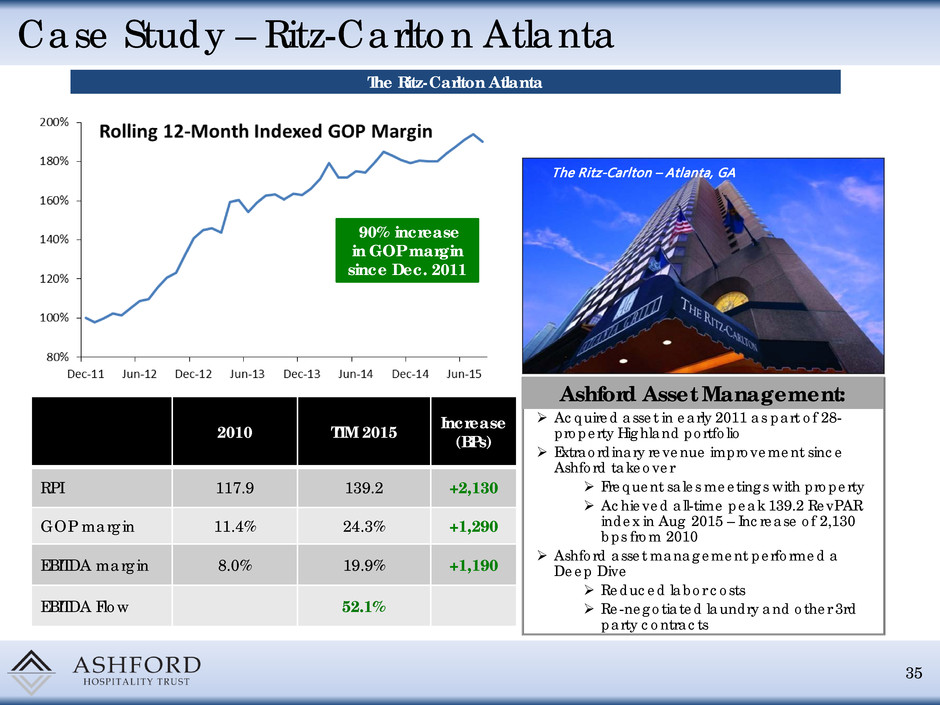

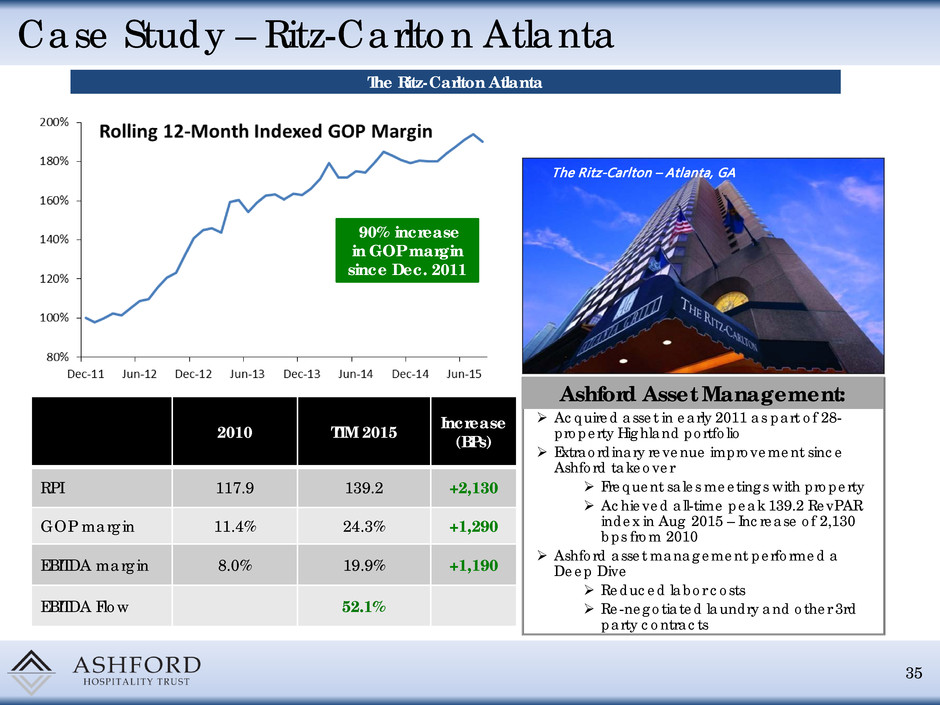

Case Study – Ritz-Carlton Atlanta 35 Ashford Asset Management: Acquired asset in early 2011 as part of 28- property Highland portfolio Extraordinary revenue improvement since Ashford takeover Frequent sales meetings with property Achieved all-time peak 139.2 RevPAR index in Aug 2015 – Increase of 2,130 bps from 2010 Ashford asset management performed a Deep Dive Reduced labor costs Re-negotiated laundry and other 3rd party contracts The Ritz-Carlton – Atlanta, GA 2010 TTM 2015 Increase (BPs) RPI 117.9 139.2 +2,130 GOP margin 11.4% 24.3% +1,290 EBITDA margin 8.0% 19.9% +1,190 EBITDA Flow 52.1% The Ritz-Carlton Atlanta 90% increase in GOP margin since Dec. 2011

Prudent Capital Investment 36 Prudent Capital Investment Typically spend 10% less than peers on CapEx while strategically repositioning assets and generating superior operating results 12.8% 11.1% 8.4% 7.4% 6.9% 8.8% 10.6% 9.8% 0.0% 4.0% 8.0% 12.0% 16.0% 20.0% 2007 2008 2009 2010 2011 2012 2013 2014 Ashford Portfolio Peer Average (1) Per public filings and SNL. Average includes BEE, CHSP, CLDT, PEB, DRH, INN, FCH, LHO, RHP, RLJ, SHO, HST, HT (1)

Case Study – Marriott Beverly Hills Conversion 37

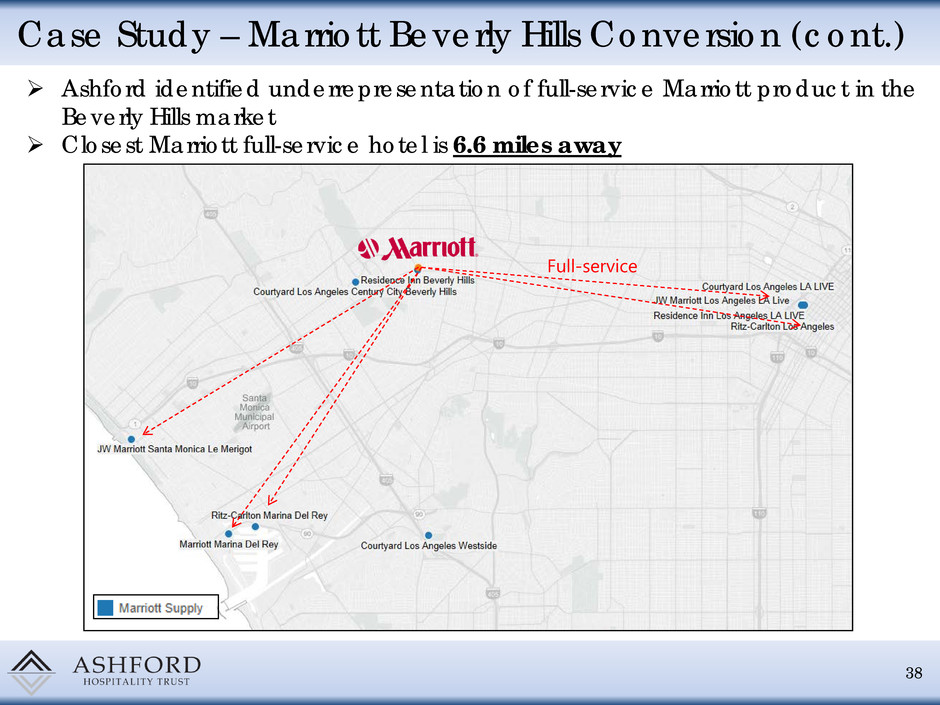

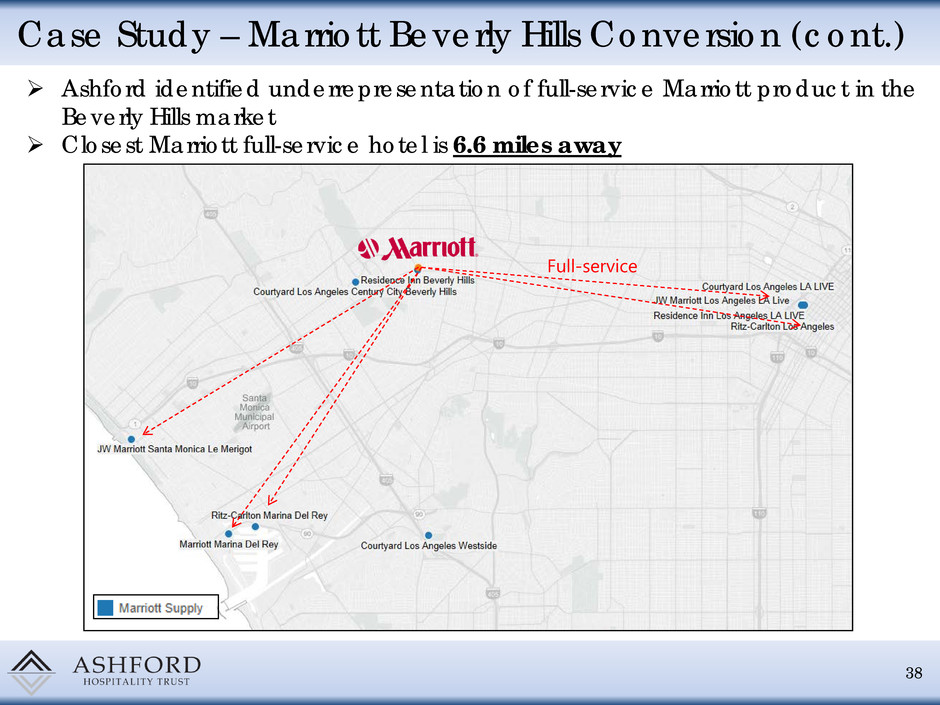

38 Case Study – Marriott Beverly Hills Conversion (cont.) Ashford identified underrepresentation of full-service Marriott product in the Beverly Hills market Closest Marriott full-service hotel is 6.6 miles away Full-service

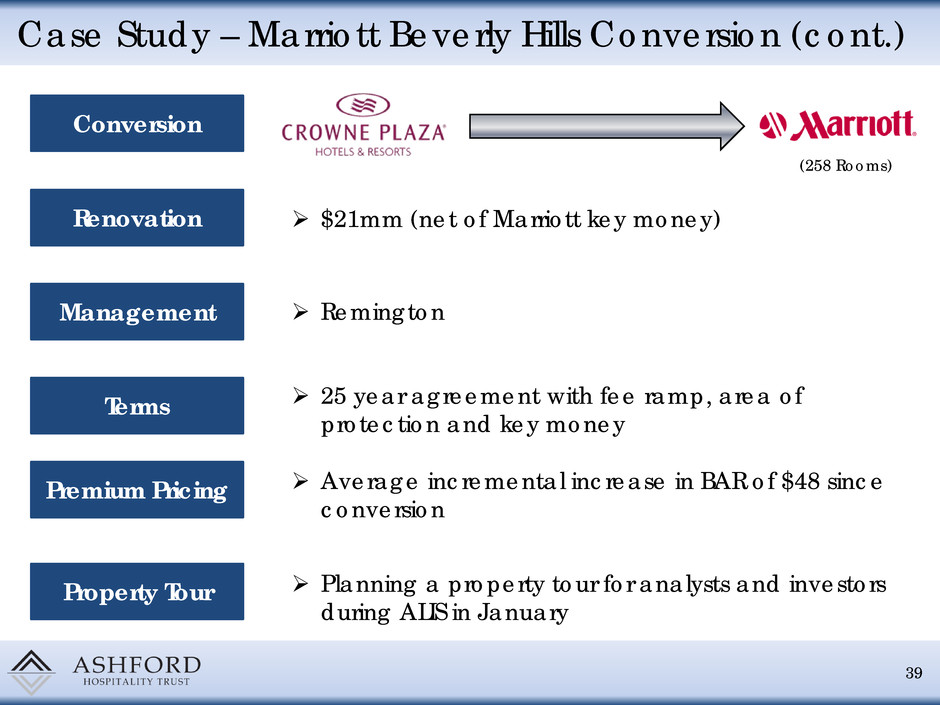

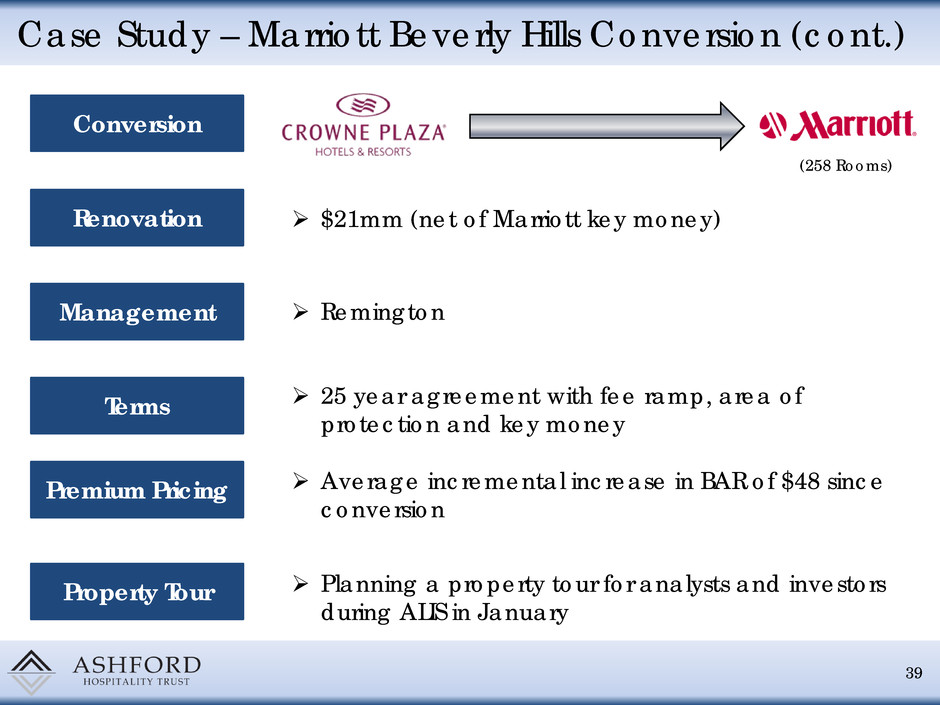

39 Case Study – Marriott Beverly Hills Conversion (cont.) Renovation Management Terms $21mm (net of Marriott key money) Remington 25 year agreement with fee ramp, area of protection and key money Conversion (258 Rooms) Premium Pricing Average incremental increase in BAR of $48 since conversion Property Tour Planning a property tour for analysts and investors during ALIS in January

40 Case Study – Marriott Beverly Hills Conversion Lobby Bar Restaurant Front Desk Lobby

41 Case Study – Marriott Beverly Hills Conversion (cont.) Guestroom Boardroom Guestroom Club Lounge

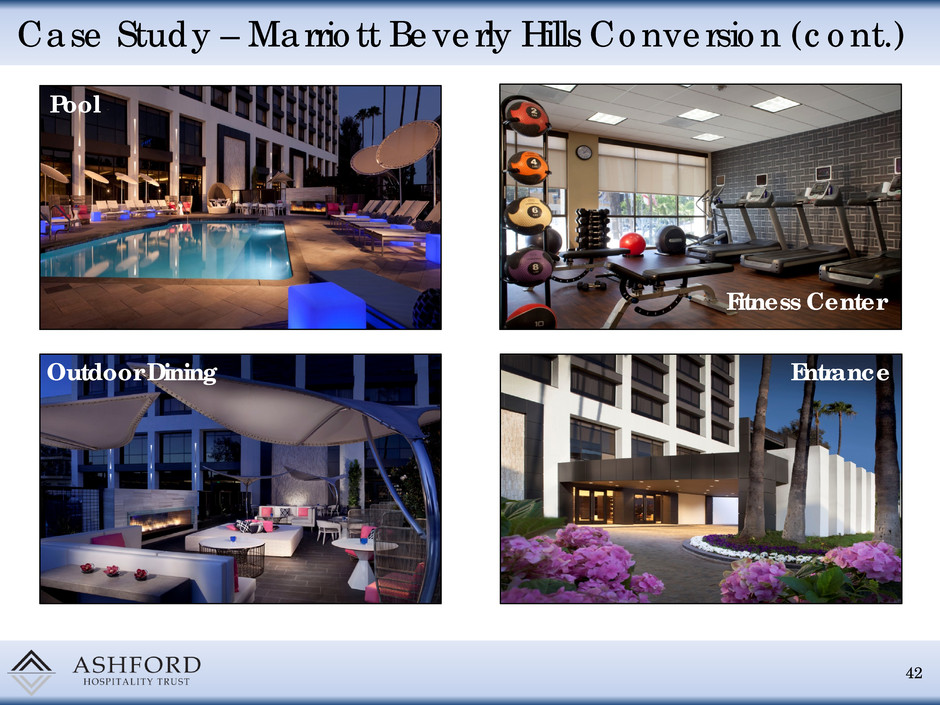

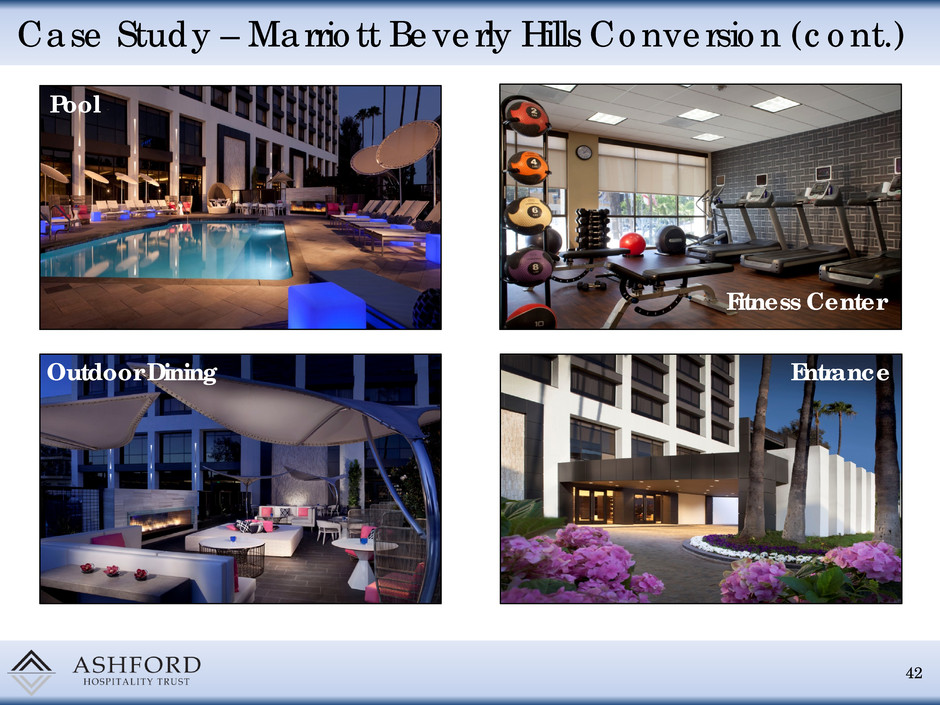

42 Case Study – Marriott Beverly Hills Conversion (cont.) Entrance Pool Fitness Center Outdoor Dining

Case Study – The Silversmith Renovation 43

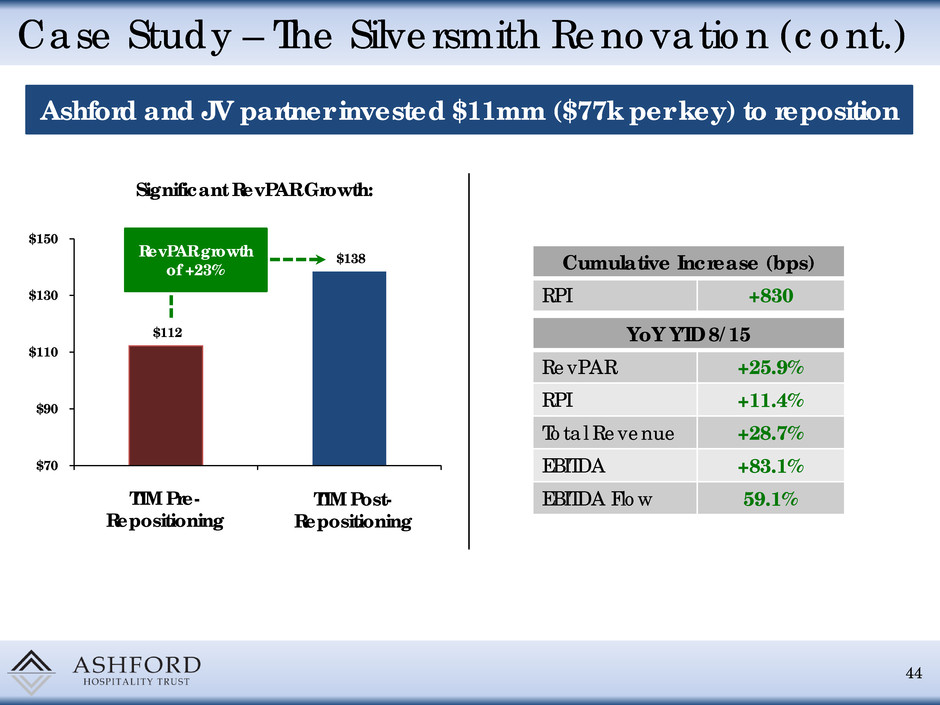

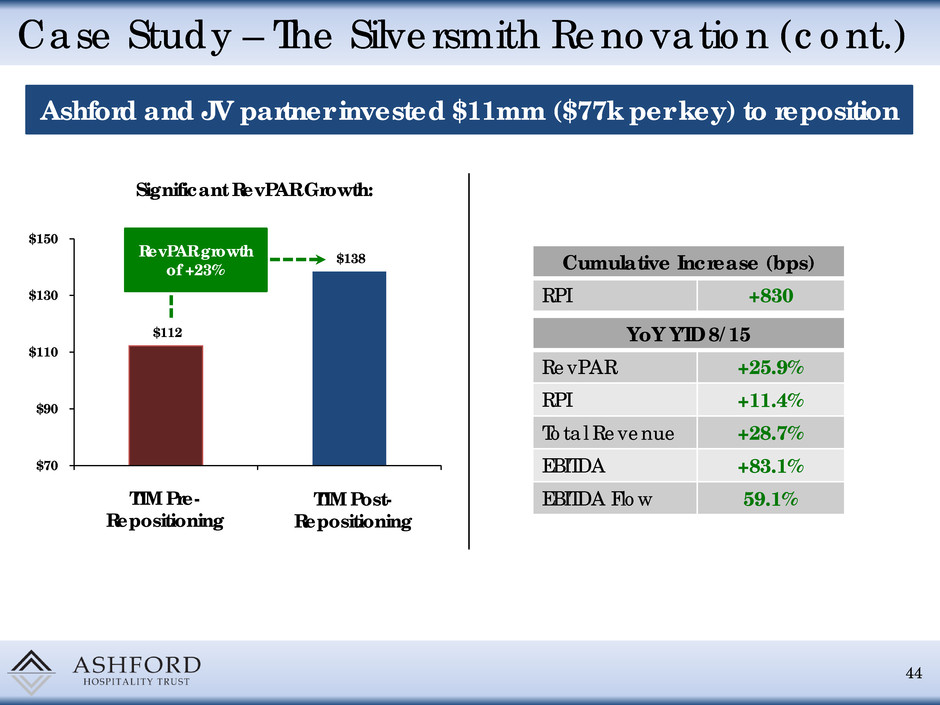

44 Case Study – The Silversmith Renovation (cont.) Ashford and JV partner invested $11mm ($77k per key) to reposition Significant RevPAR Growth: $112 $138 $70 $90 $110 $130 $150 1 2 TTM Pre- Repositioning TTM Post- Repositioning RevPAR growth of +23% YoY YTD 8/15 RevPAR +25.9% RPI +11.4% Total Revenue +28.7% EBITDA +83.1% EBITDA Flow 59.1% Cumulative Increase (bps) RPI +830

45 Before After Lobby Lobby Restaurant / Bar Restaurant / Bar Case Study – The Silversmith Renovation (cont.)

46 Case Study – The Silversmith Renovation (cont.) Before After Guestroom Guestroom Board Room Board Room

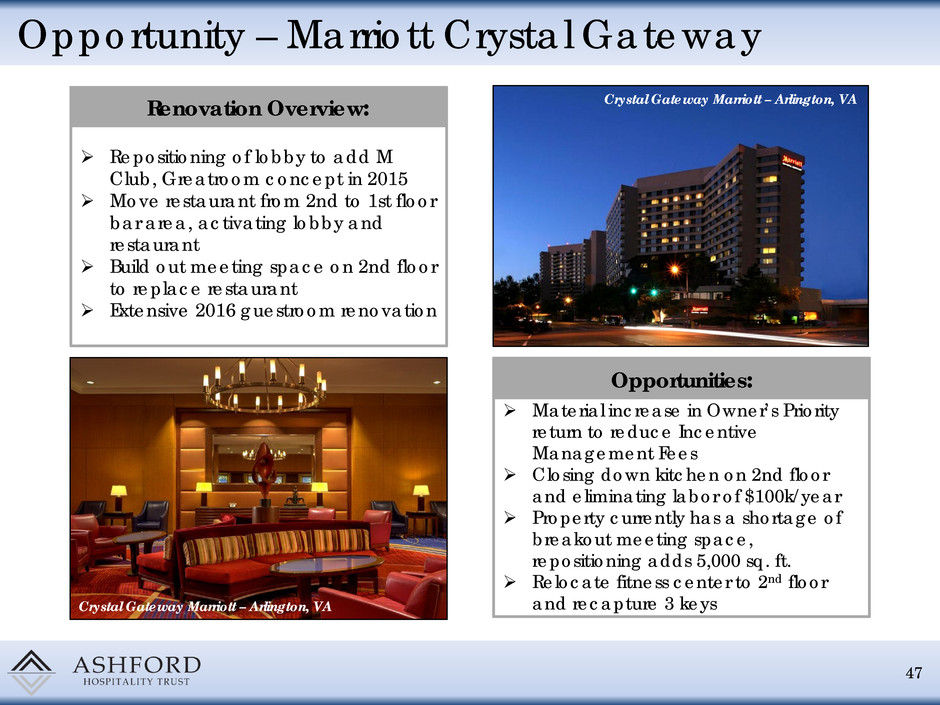

Opportunity – Marriott Crystal Gateway 47 Repositioning of lobby to add M Club, Greatroom concept in 2015 Move restaurant from 2nd to 1st floor bar area, activating lobby and restaurant Build out meeting space on 2nd floor to replace restaurant Extensive 2016 guestroom renovation Crystal Gateway Marriott – Arlington, VA Crystal Gateway Marriott – Arlington, VA Renovation Overview: Material increase in Owner’s Priority return to reduce Incentive Management Fees Closing down kitchen on 2nd floor and eliminating labor of $100k/year Property currently has a shortage of breakout meeting space, repositioning adds 5,000 sq. ft. Relocate fitness center to 2nd floor and recapture 3 keys Opportunities:

Ownership Value Add 48 Ownership Value Add Continuously look to acquire or extend ground leases to improve asset valuations Proactively extend management and franchise agreements, targeting all assets with less than 5 years of remaining term, significantly limiting risk of losing flag Constantly look to improve or identify ancillary revenue opportunities throughout the portfolio Market lease space Renegotiate terms with third party parking managers Identify antenna opportunities

Case Study – Lease Acquisitions & Extensions 49 Marriott Fremont – Fremont, CA Marriott San Antonio – San Antonio, TX Renaissance Nashville – Nashville, TN Acquired fee simple interest in hotel for minimal consideration Negotiated long-term lease on additional space 30,000 sf of meeting space and 50,000 sf of prefunction and lobby space for a minimum of 15 years with no rental costs Eliminated $500,000 annual lease expense and added 24 years to the term of the ground lease containing valuable ancillary facilities Transaction Summary: Hotel leases 2 historic buildings from City of San Antonio containing 7,800 sf and 42 parking spaces Term of lease expires March 2028 with no additional extensions Successfully negotiated the acquisition of the fee simple interest and expected to result in $300,000 in annual incremental profit Transaction Summary:

Case Study – Lease Acquisitions & Extensions (cont.) 50 Marriott Fremont – Fremont, CA Successfully extended parking garage ground lease with the City of Ft. Worth for an additional 40 years Renegotiated ground lease payment structure resulting in estimated annual savings of ~$200,000 Transaction Summary: Hilton Ft. Worth – Ft. Worth, TX Hotel ground lease expired in April 2056 with no extensions Ashford successfully acquired the fee simple interest for $3.4mm which was a discount to market comps Transaction Summary: Westin Princeton – Princeton, NJ

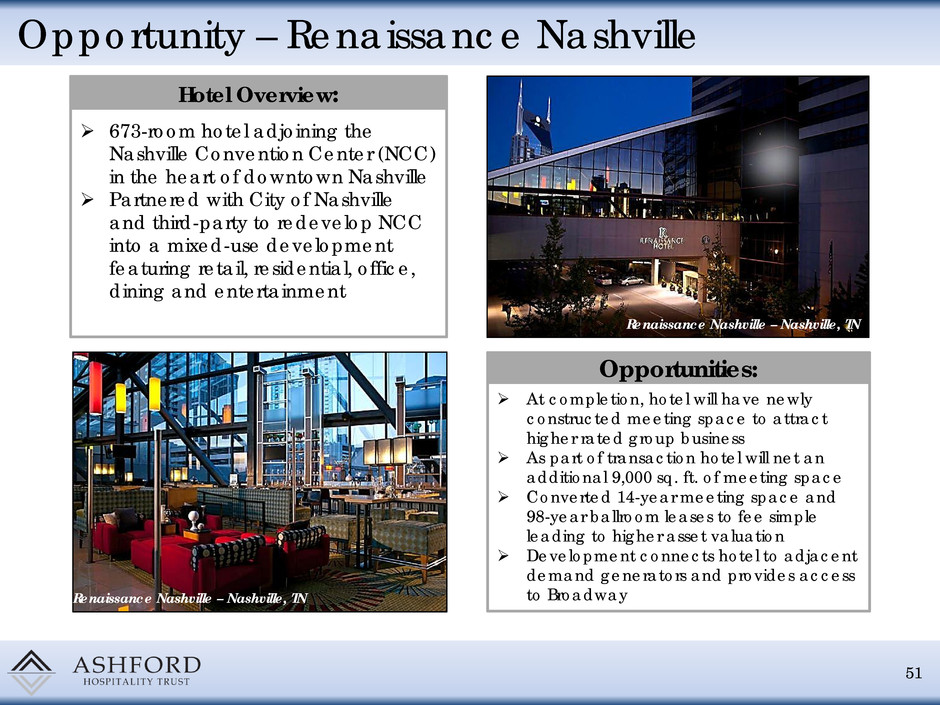

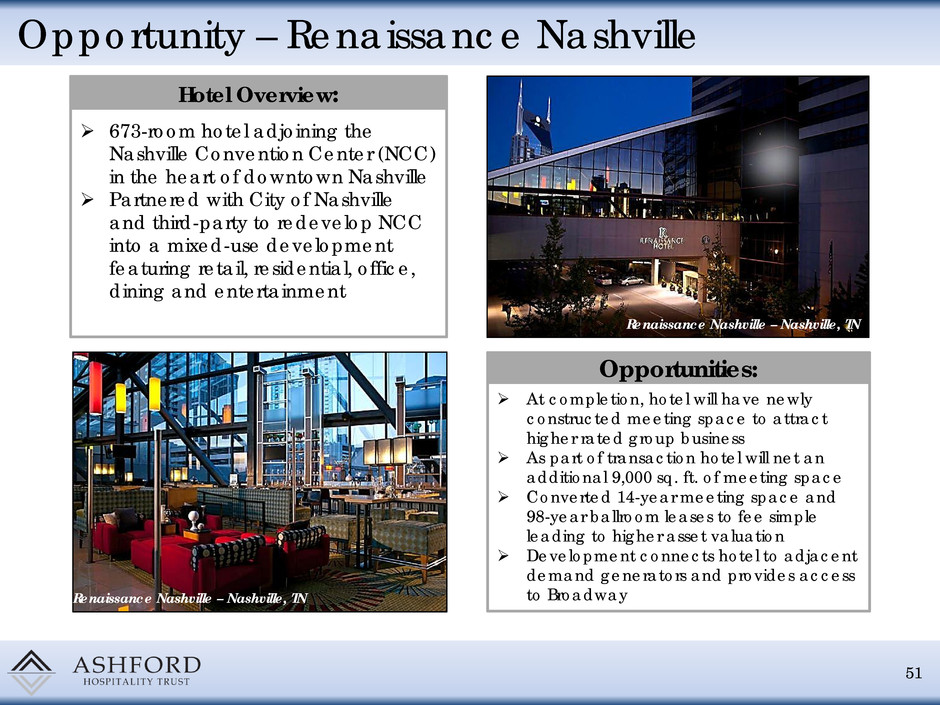

Opportunity – Renaissance Nashville 51 673-room hotel adjoining the Nashville Convention Center (NCC) in the heart of downtown Nashville Partnered with City of Nashville and third-party to redevelop NCC into a mixed-use development featuring retail, residential, office, dining and entertainment Renaissance Nashville – Nashville, TN Renaissance Nashville – Nashville, TN At completion, hotel will have newly constructed meeting space to attract higher rated group business As part of transaction hotel will net an additional 9,000 sq. ft. of meeting space Converted 14-year meeting space and 98-year ballroom leases to fee simple leading to higher asset valuation Development connects hotel to adjacent demand generators and provides access to Broadway Hotel Overview: Opportunities:

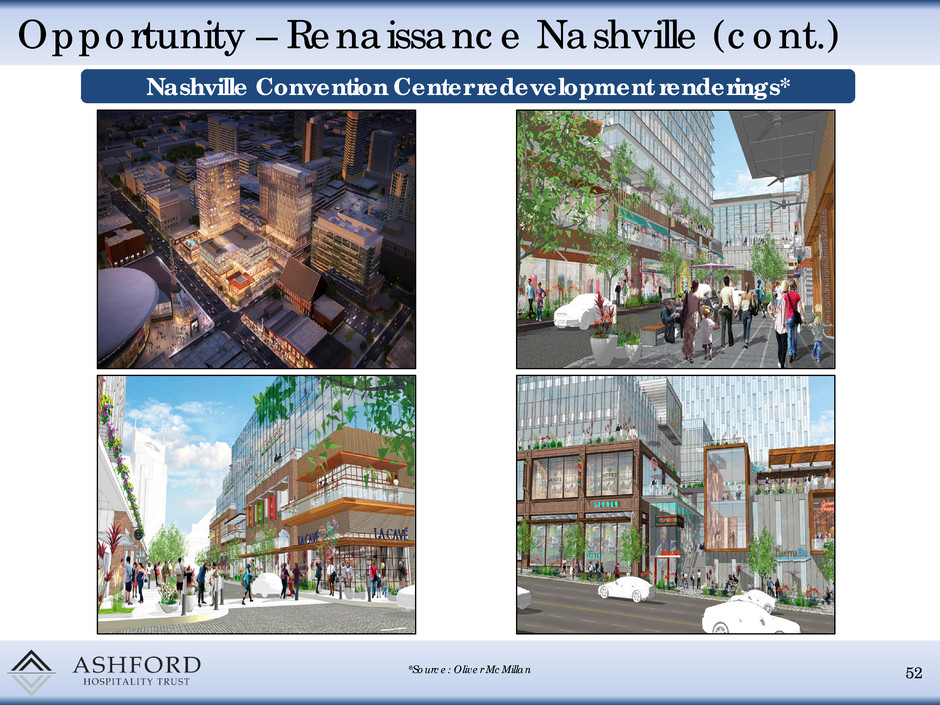

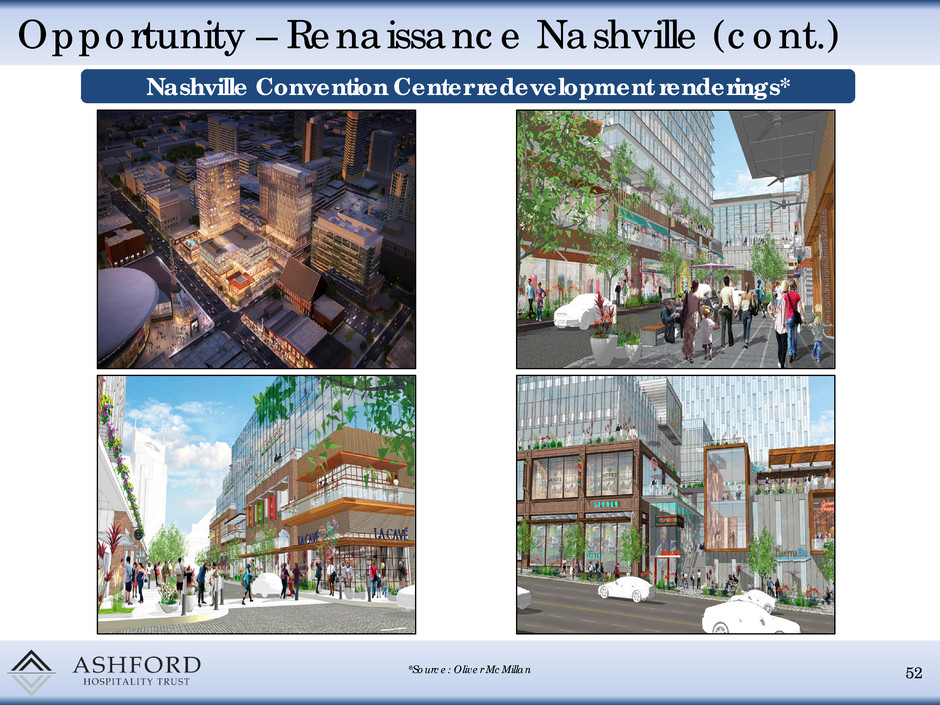

Opportunity – Renaissance Nashville (cont.) 52 Nashville Convention Center redevelopment renderings* *Source: Oliver McMillan

Opportunity – W Atlanta Downtown 53 Acquired in July 2015 237 keys, 9,000 sq. ft. of meeting space Located in the heart of Downtown Atlanta Close proximity to the downtown and midtown demand generators: Centennial Olympic Park, the Atlanta Aquarium, and Georgia Dome Potential to reconcept or lease underutilized food and beverage outlets Aggressively market the 3,500 sq. ft. LED billboard facing southbound I-85/I-75 traffic Renegotiate valet parking agreement Potential impact to EBITDA of approximately +$950,000 Expected forward 12-month leveraged cash flow yield of 12.0% W Atlanta – Atlanta, GA W Atlanta – Atlanta, GA Hotel Overview: Opportunities:

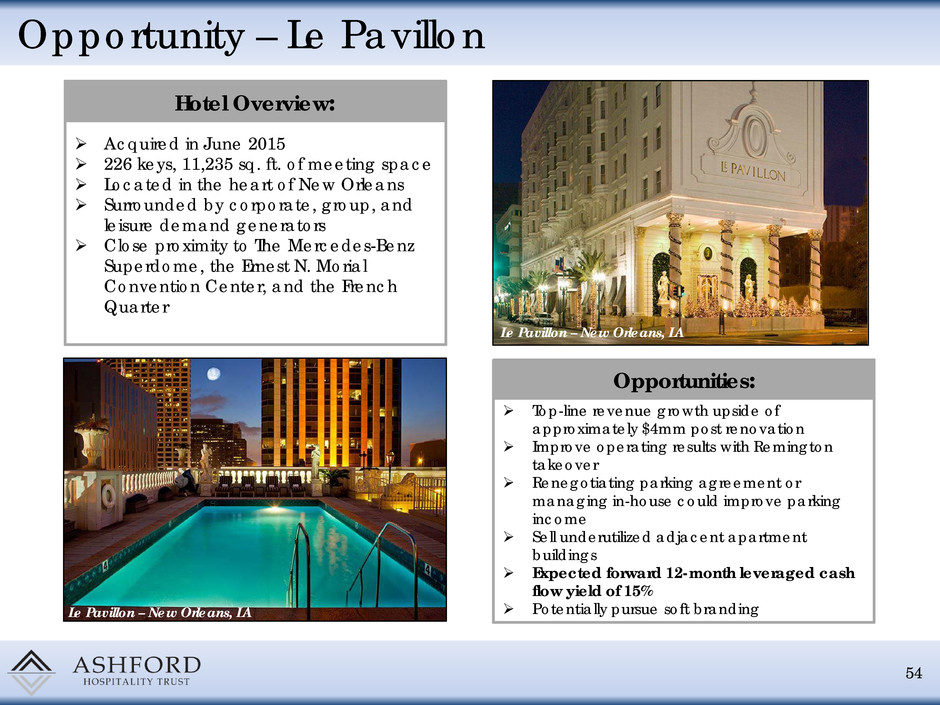

Opportunity – Le Pavillon 54 Le Pavillon – New Orleans, LA Le Pavillon – New Orleans, LA Acquired in June 2015 226 keys, 11,235 sq. ft. of meeting space Located in the heart of New Orleans Surrounded by corporate, group, and leisure demand generators Close proximity to The Mercedes-Benz Superdome, the Ernest N. Morial Convention Center, and the French Quarter Hotel Overview: Top-line revenue growth upside of approximately $4mm post renovation Improve operating results with Remington takeover Renegotiating parking agreement or managing in-house could improve parking income Sell underutilized adjacent apartment buildings Expected forward 12-month leveraged cash flow yield of 15% Potentially pursue soft branding Opportunities:

Asset Management Overview (cont.) 55 Exceptional Guest Service Risk Management & Property Taxes Energy Cost Management Preventive Maintenance Increased Ashford Trust portfolio scores 860 bps for the YTD period since implementing GSS recognition strategies Risk Management – Reduced General Liability per key by 25% since 2007 Property Taxes – Reduced assessed values YTD 2015 by ~$150mm, resulting in $2.9mm in tax payment savings Conservative hedging strategy to minimize volatility while optimizing market price lows Ashford Trust realized a savings of $2.6m in 2014 in deregulated markets against published utility rates Active conservation support through best practices and energy ROI projects Proprietary asset care program which sets quantitative and qualitative measures on preventative care of assets Trust realized a 10% improvement in measured quality care criteria over the prior year based on asset manager scoring system

Balance Sheet – Deric Eubanks, CFO One Ocean Resort Atlantic Beach, FL

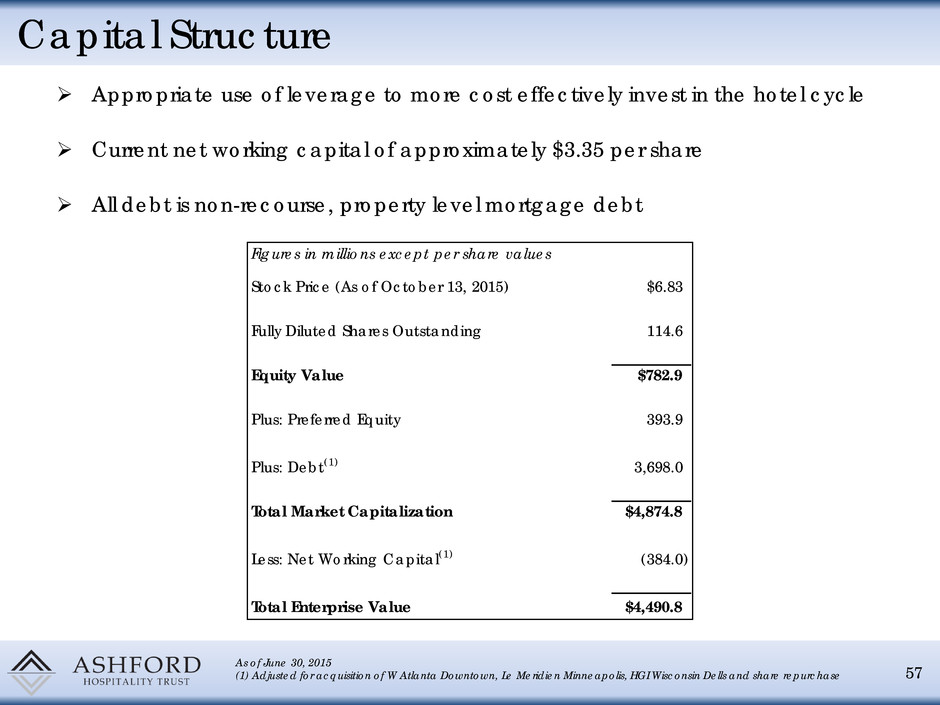

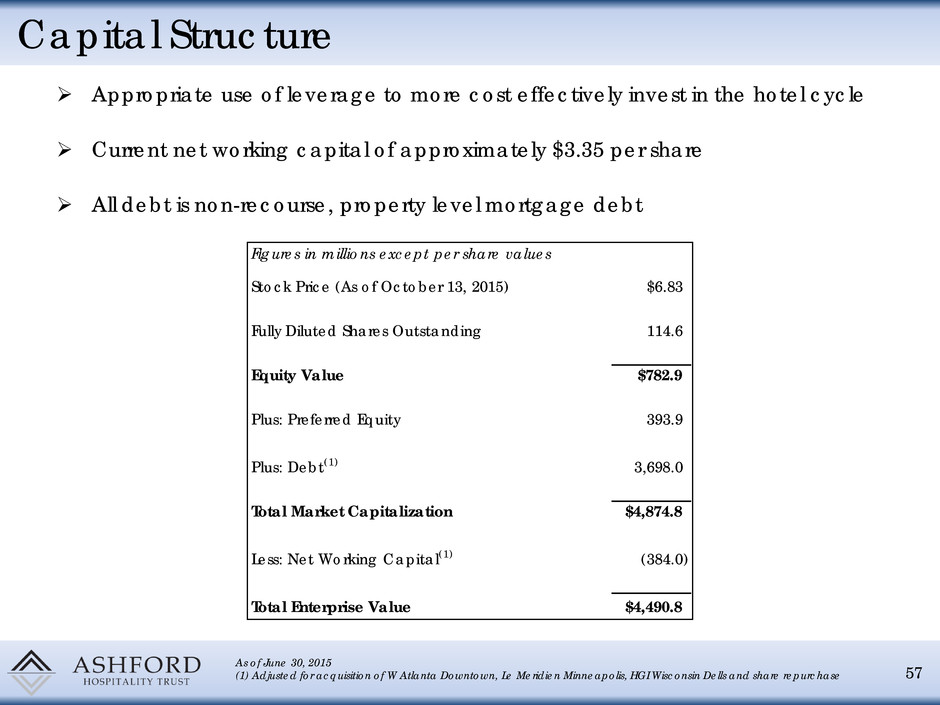

Capital Structure Appropriate use of leverage to more cost effectively invest in the hotel cycle Current net working capital of approximately $3.35 per share All debt is non-recourse, property level mortgage debt 57 As of June 30, 2015 (1) Adjusted for acquisition of W Atlanta Downtown, Le Meridien Minneapolis, HGI Wisconsin Dells and share repurchase Figures in millions except per share values Stock Price (As of October 13, 2015) $6.83 Fully Diluted Shares Outstanding 114.6 Equity Value $782.9 Plus: Preferred Equity 393.9 Plus: Debt(1) 3,698.0 Total Market Capitalization $4,874.8 Less: Net Working Capital(1) (384.0) Total Enterprise Value $4,490.8

Target Cash Balance and Net Working Capital Targeted cash balance of 25% to 30% of market capitalization Maintain excess cash balance to capitalize on opportunities Hedge unfavorable economic shocks Dry powder to execute opportunistic acquisitions Exclusive use of non-recourse, property level mortgage debt 58 As of June 30, 2015 (excluding investment in AHP) (1) Adjusted for acquisition of W Atlanta Downtown, Le Meridien Minneapolis, HGI Wisconsin Dells and share repurchase (2) At market value as of October 13, 2015 Strategy Cash balance currently slightly above target range Cash & Cash Equivalents(1) $195.7 Restricted Cash 149.7 Investment in AIM REHE, LP 58.4 Accounts Receivable, net 55.9 Prepaid Expenses 17.7 Due From Affiliates, net (8.3) Due from Third Party Hotel Managers 35.4 Market Value of Ashford, Inc. Investment(2) 39.5 Total Current Assets $544.0 Accounts Payable, net & Accrued Expenses $136.6 Dividends Payable 23.4 Total Current Liabilities $160.0 Net Working Capital $384.0

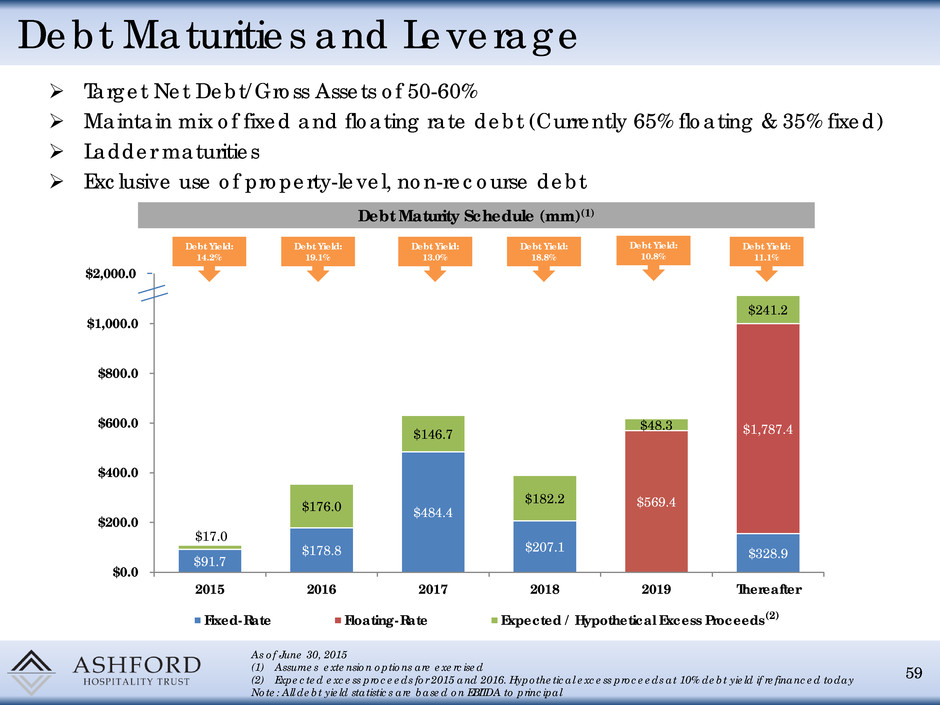

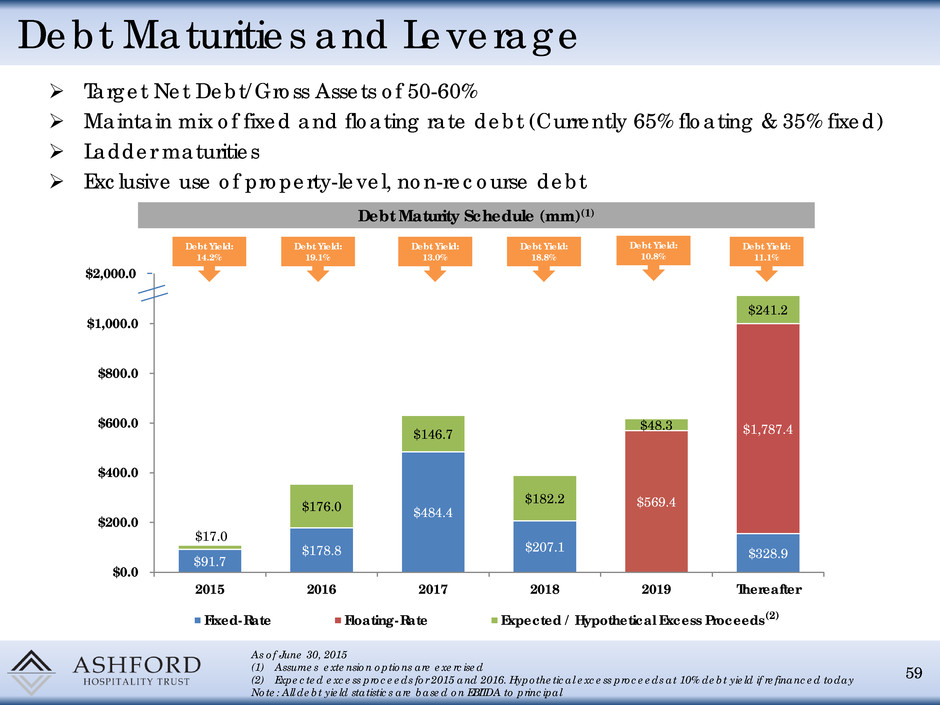

$91.7 $178.8 $484.4 $207.1 $328.9 $569.4 $1,787.4 $17.0 $176.0 $146.7 $182.2 $48.3 $241.2 $0.0 $200.0 $400.0 $600.0 $800.0 $1,000.0 $1,200.0 2015 2016 2017 2018 2019 Thereafter Fixed-Rate Floating-Rate Expected / Hypothetical Excess Proceeds Debt Maturities and Leverage Target Net Debt/Gross Assets of 50-60% Maintain mix of fixed and floating rate debt (Currently 65% floating & 35% fixed) Ladder maturities Exclusive use of property-level, non-recourse debt 59 As of June 30, 2015 (1) Assumes extension options are exercised (2) Expected excess proceeds for 2015 and 2016. Hypothetical excess proceeds at 10% debt yield if refinanced today Note: All debt yield statistics are based on EBITDA to principal Debt Maturity Schedule (mm)(1) Debt Yield: 10.8% Debt Yield: 18.8% Debt Yield: 13.0% Debt Yield: 19.1% Debt Yield: 14.2% (2) Debt Yield: 11.1% 2,0 .

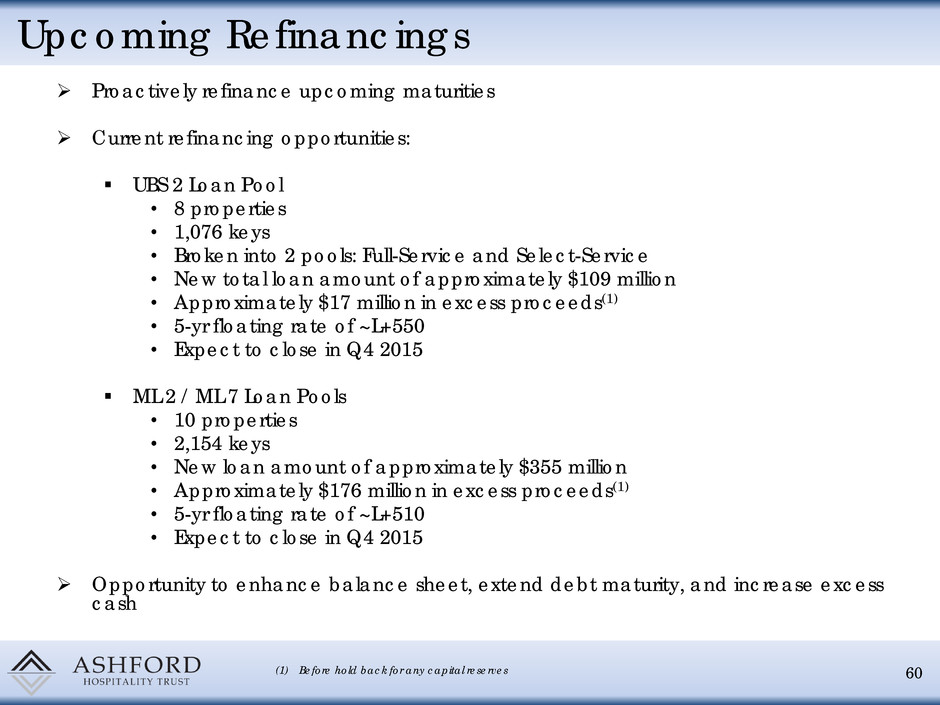

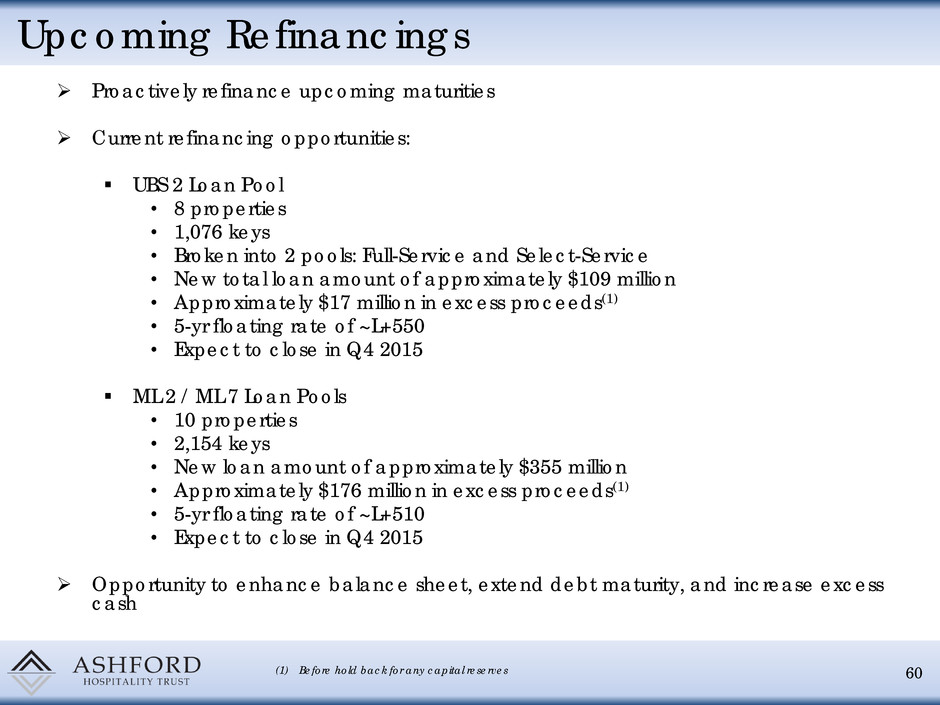

Upcoming Refinancings Proactively refinance upcoming maturities Current refinancing opportunities: UBS 2 Loan Pool • 8 properties • 1,076 keys • Broken into 2 pools: Full-Service and Select-Service • New total loan amount of approximately $109 million • Approximately $17 million in excess proceeds(1) • 5-yr floating rate of ~L+550 • Expect to close in Q4 2015 ML 2 / ML 7 Loan Pools • 10 properties • 2,154 keys • New loan amount of approximately $355 million • Approximately $176 million in excess proceeds(1) • 5-yr floating rate of ~L+510 • Expect to close in Q4 2015 Opportunity to enhance balance sheet, extend debt maturity, and increase excess cash 60 (1) Before hold back for any capital reserves

Ashford Trust Q&A The Churchill Washington D.C.

Investor & Analyst Day – October 2015