Company Presentation – January 2016

Safe Harbor 2 In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the Company's filings with the Securities and Exchange Commission. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Trust, Inc. or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security.

Ashford Hospitality Trust Vision Opportunistic platform focused on full-service hotels 3 Management team more highly-aligned with shareholders than our peers Appropriate use of financial leverage Best in class hotel managers Superior long-term total shareholder return performance Announced strategy refinements to improve shareholder value

Recent Developments 4 Sale of select-service assets Simplify strategy Marketing 24-hotel portfolio in smaller groups and individually Pursuing the opportunistic sale of remaining 39 select-service hotels over time Amendments to Advisory Agreement with Ashford, Inc. Receive key money ($4 million thus far) Termination right without fee upon Advisor CoC Shorten initial term of agreement Reduction in base fee amount Distribution of remaining shares of Ashford Prime Simplify balance sheet Crystalize value for shareholders Responsive to investor feedback Block trade to repurchase approximately 5.8 million shares of common stock Opportunistic Acquired significant amount of stock well below private market value Responsive to investor feedback Termination fee clarification

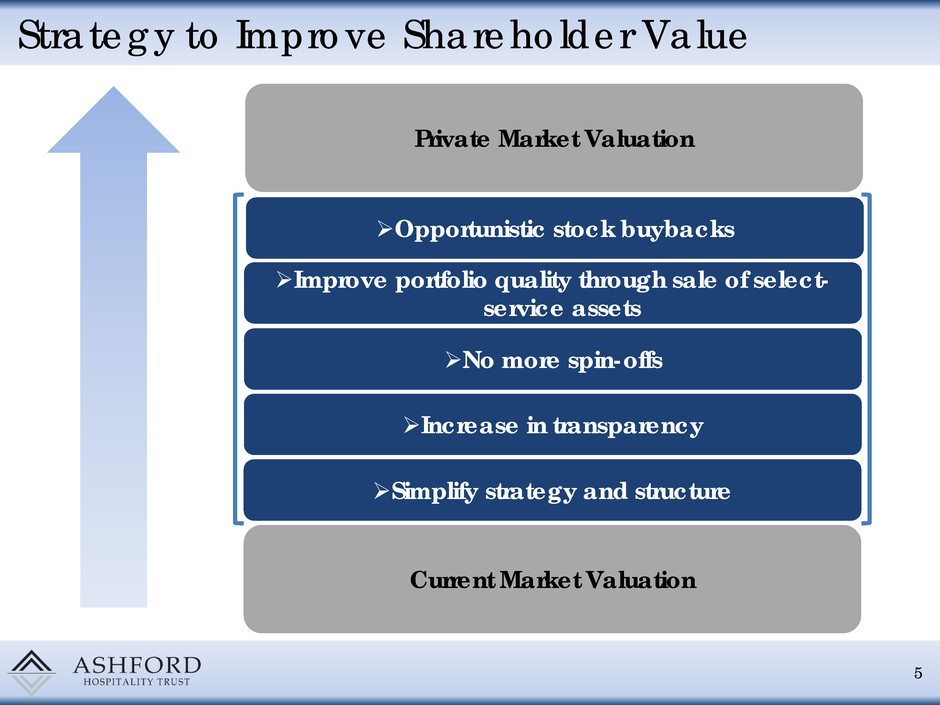

Strategy to Improve Shareholder Value 5 Current Market Valuation Increase in transparency No more spin-offs Improve portfolio quality through sale of select- service assets Private Market Valuation Simplify strategy and structure Opportunistic stock buybacks

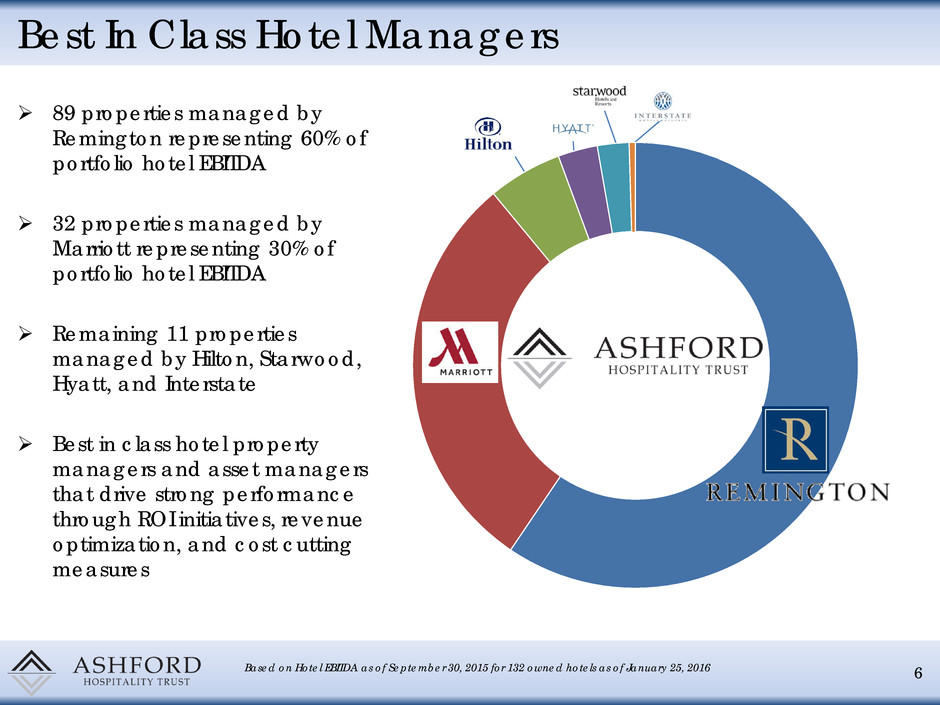

Best In Class Hotel Managers 89 properties managed by Remington representing 60% of portfolio hotel EBITDA 32 properties managed by Marriott representing 30% of portfolio hotel EBITDA Remaining 11 properties managed by Hilton, Starwood, Hyatt, and Interstate Best in class hotel property managers and asset managers that drive strong performance through ROI initiatives, revenue optimization, and cost cutting measures 6 Based on Hotel EBITDA as of September 30, 2015 for 132 owned hotels as of January 25, 2016

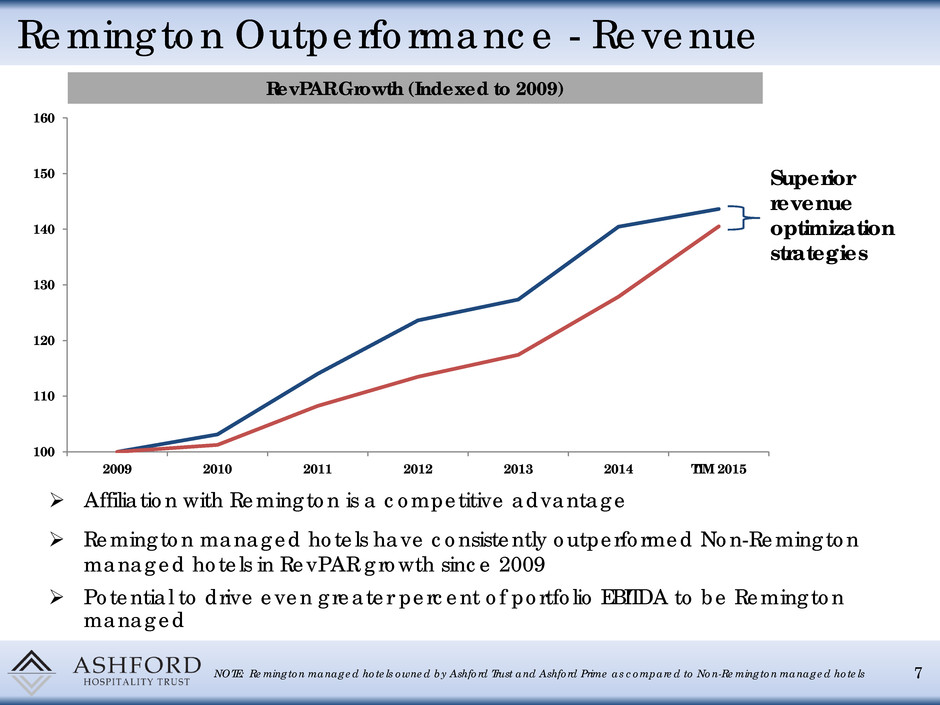

100 110 120 130 140 150 160 2009 2010 2011 2012 2013 2014 TTM 2015 Remington Outperformance - Revenue Affiliation with Remington is a competitive advantage 7 NOTE: Remington managed hotels owned by Ashford Trust and Ashford Prime as compared to Non-Remington managed hotels Superior revenue optimization strategies RevPAR Growth (Indexed to 2009) Remington managed hotels have consistently outperformed Non-Remington managed hotels in RevPAR growth since 2009 Potential to drive even greater percent of portfolio EBITDA to be Remington managed

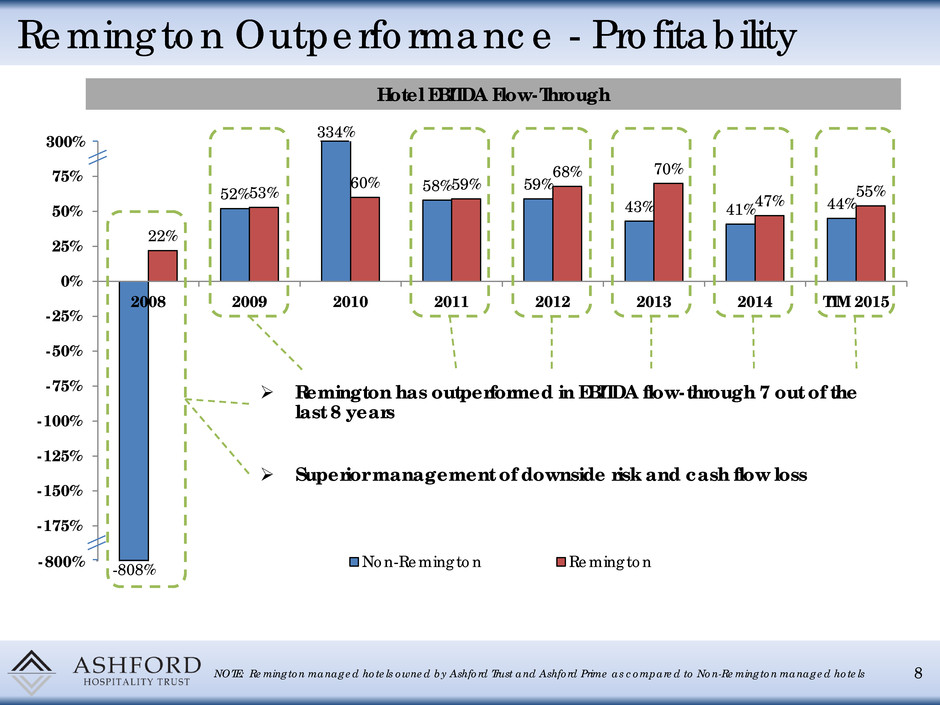

52% 58% 59% 43% 41% 44% 22% 53% 60% 59% 68% 70% 47% 55% -200% -175% -150% -125% -100% -75% -50% -25% 0% 25% 50% 75% 100% 2008 2009 2010 2011 2012 2013 2014 TTM 2015 Non-Remington Remington Remington Outperformance - Profitability Remington has outperformed in EBITDA flow-through 7 out of the last 8 years 8 NOTE: Remington managed hotels owned by Ashford Trust and Ashford Prime as compared to Non-Remington managed hotels Hotel EBITDA Flow-Through Superior management of downside risk and cash flow loss 300 -800 -808% 334%

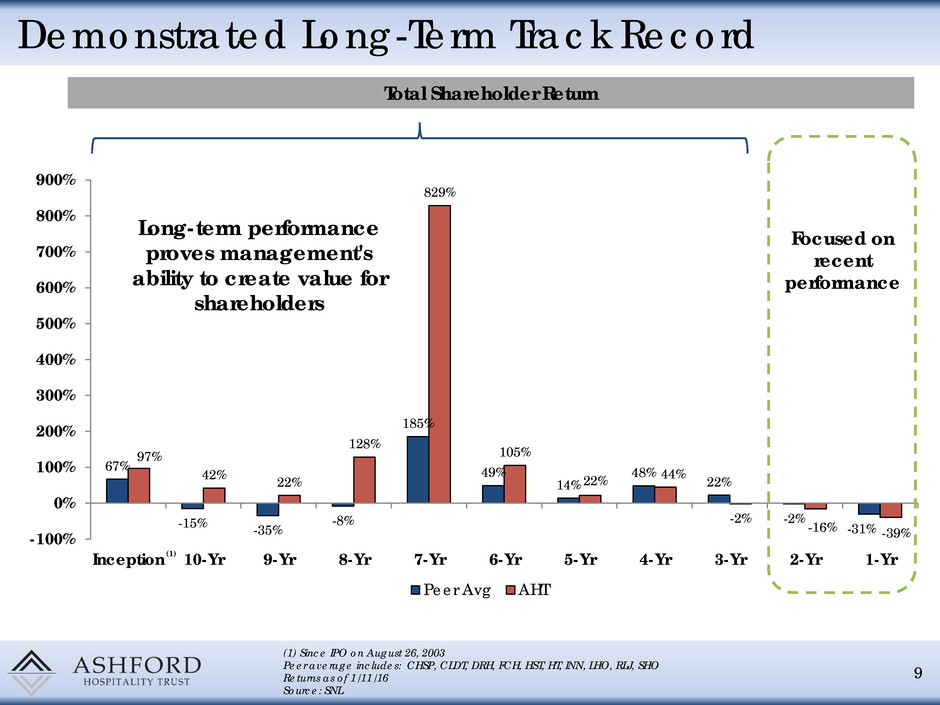

67% -15% -35% -8% 185% 49% 14% 48% 22% -2% -31% 97% 42% 22% 128% 829% 105% 22% 44% -2% -16% -39% -100% 0% 100% 200% 300% 400% 500% 600% 700% 800% 900% Inception 10-Yr 9-Yr 8-Yr 7-Yr 6-Yr 5-Yr 4-Yr 3-Yr 2-Yr 1-Yr Peer Avg AHT Demonstrated Long-Term Track Record 9 (1) Since IPO on August 26, 2003 Peer average includes: CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, RLJ, SHO Returns as of 1/11/16 Source: SNL Total Shareholder Return Focused on recent performance Long-term performance proves management's ability to create value for shareholders (1)

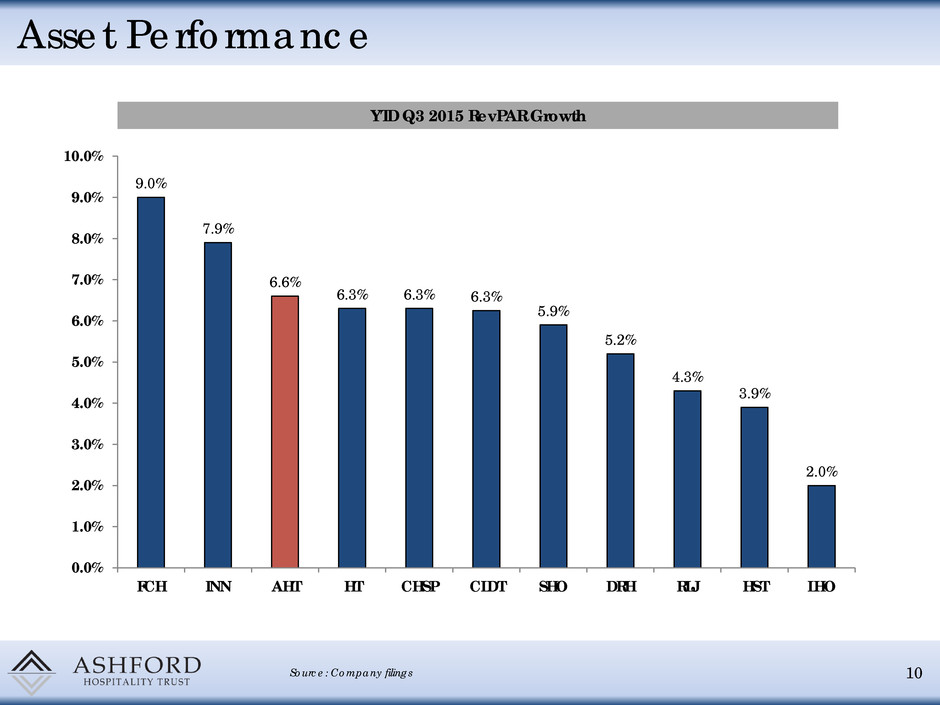

Asset Performance 10 Source: Company filings YTD Q3 2015 RevPAR Growth 9.0% 7.9% 6.6% 6.3% 6.3% 6.3% 5.9% 5.2% 4.3% 3.9% 2.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% FCH INN AHT HT CHSP CLDT SHO DRH RLJ HST LHO

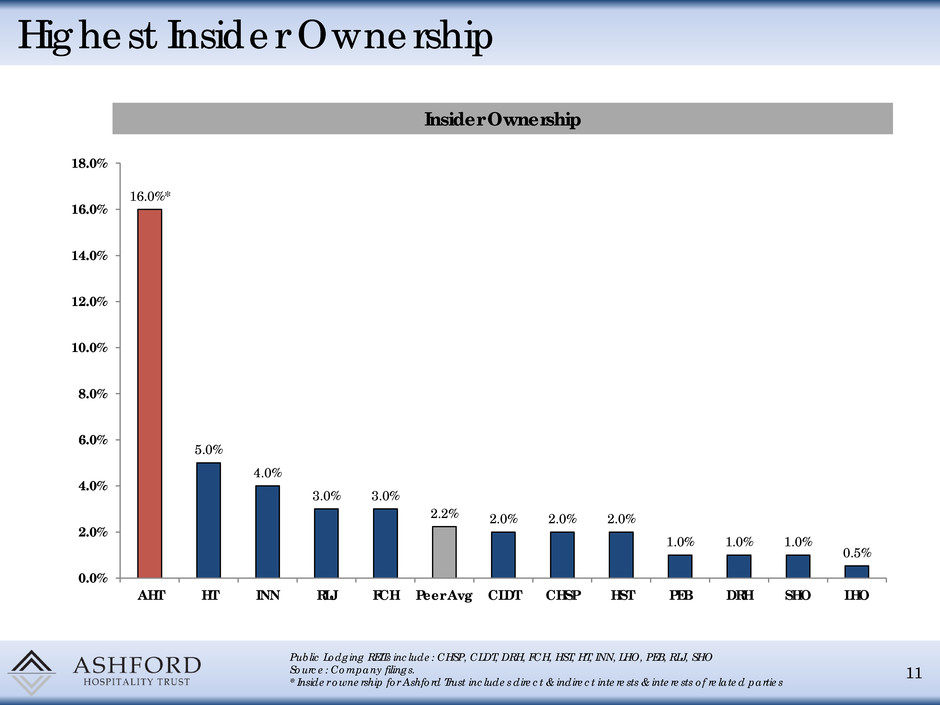

Highest Insider Ownership 11 Public Lodging REITs include: CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Source: Company filings. * Insider ownership for Ashford Trust includes direct & indirect interests & interests of related parties Insider Ownership 16.0%* 5.0% 4.0% 3.0% 3.0% 2.2% 2.0% 2.0% 2.0% 1.0% 1.0% 1.0% 0.5% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% AHT HT INN RLJ FCH Peer Avg CLDT CHSP HST PEB DRH SHO LHO

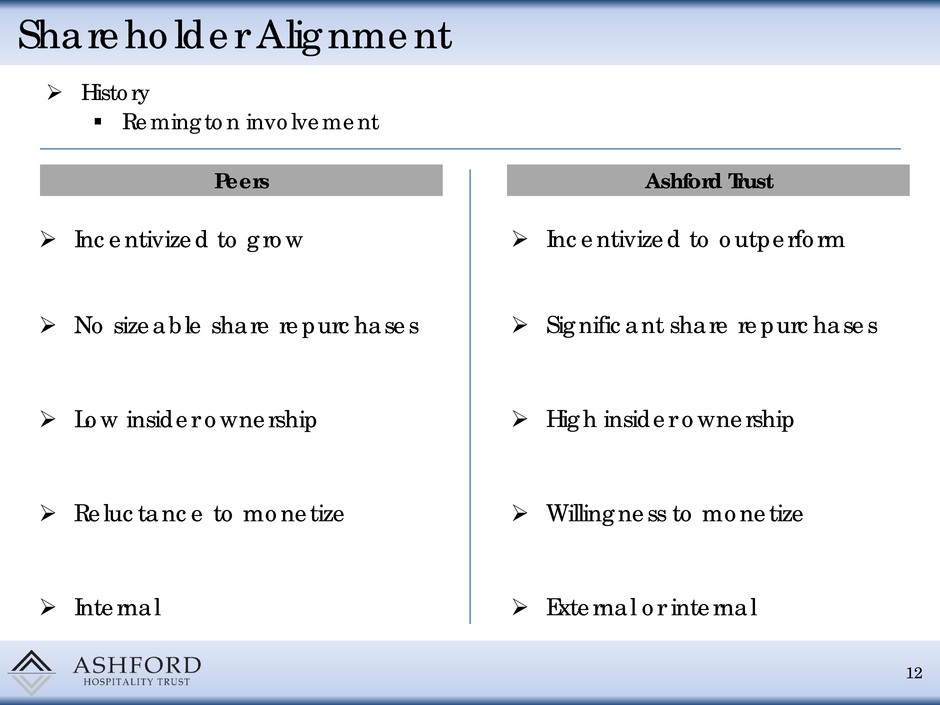

12 Shareholder Alignment Peers Ashford Trust Incentivized to grow No sizeable share repurchases Low insider ownership Reluctance to monetize Internal Incentivized to outperform Significant share repurchases High insider ownership Willingness to monetize External or internal History Remington involvement

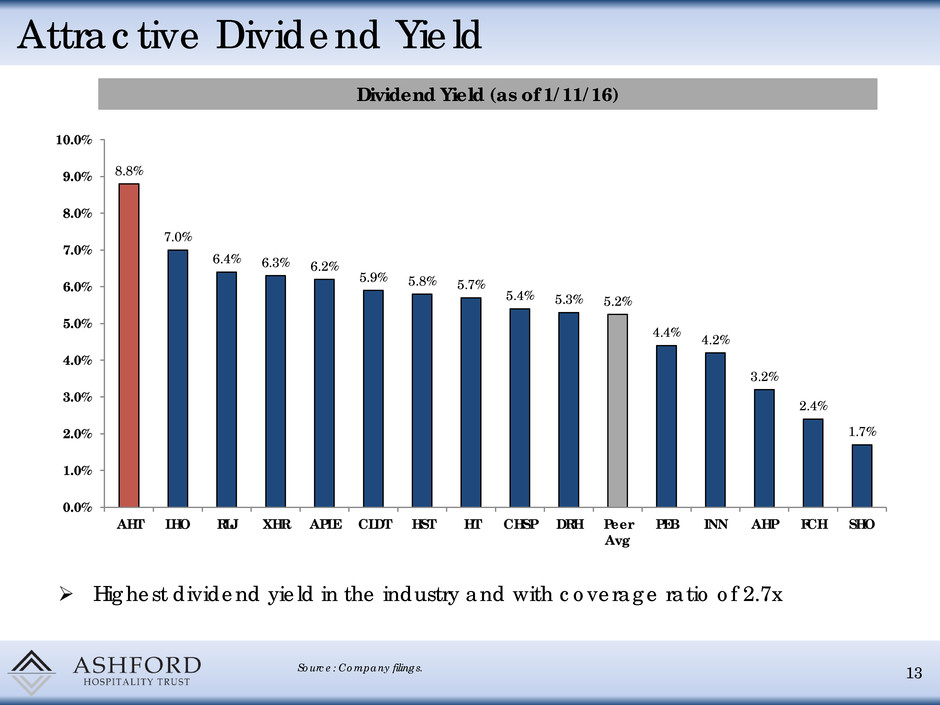

Attractive Dividend Yield 13 Source: Company filings. Highest dividend yield in the industry and with coverage ratio of 2.7x Dividend Yield (as of 1/11/16) 8.8% 7.0% 6.4% 6.3% 6.2% 5.9% 5.8% 5.7% 5.4% 5.3% 5.2% 4.4% 4.2% 3.2% 2.4% 1.7% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% AHT LHO RLJ XHR APLE CLDT HST HT CHSP DRH Peer Avg PEB INN AHP FCH SHO

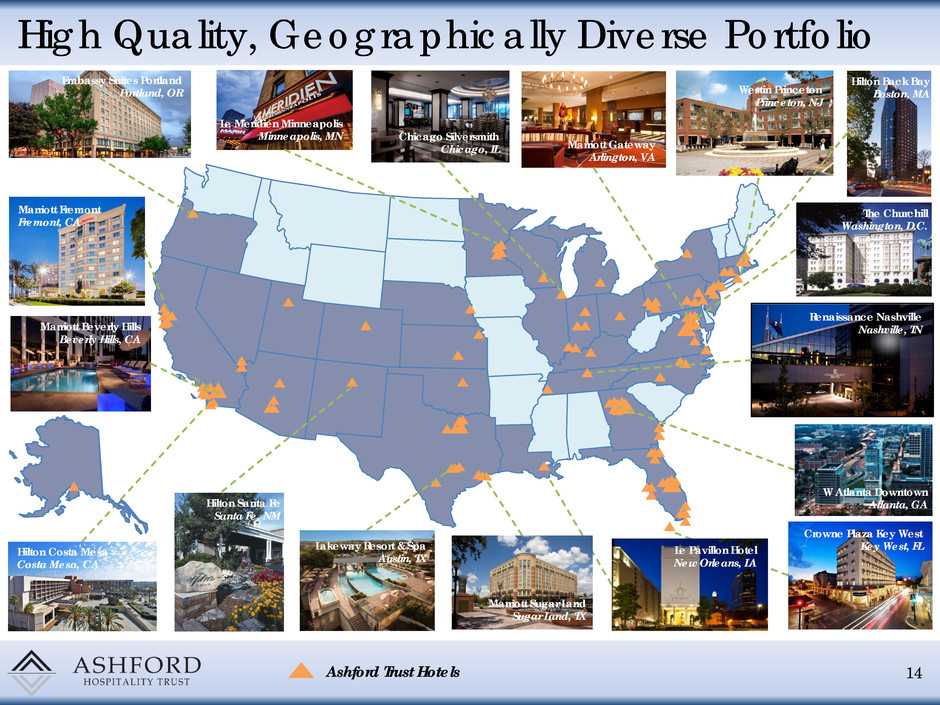

14 Ashford Trust Hotels High Quality, Geographically Diverse Portfolio Le Pavillon Hotel New Orleans, LA Lakeway Resort & Spa Austin, TX Hilton Costa Mesa Costa Mesa, CA Marriott Fremont Fremont, CA Le Meridien Minneapolis Minneapolis, MN Chicago Silversmith Chicago, IL Hilton Back Bay Boston, MA The Churchill Washington, D.C. W Atlanta Downtown Atlanta, GA Crowne Plaza Key West Key West, FL Marriott Sugar Land Sugar Land, TX Hilton Santa Fe Santa Fe, NM Renaissance Nashville Nashville, TN Westin Princeton Princeton, NJ Marriott Beverly Hills Beverly Hills, CA Embassy Suites Portland Portland, OR Marriott Gateway Arlington, VA

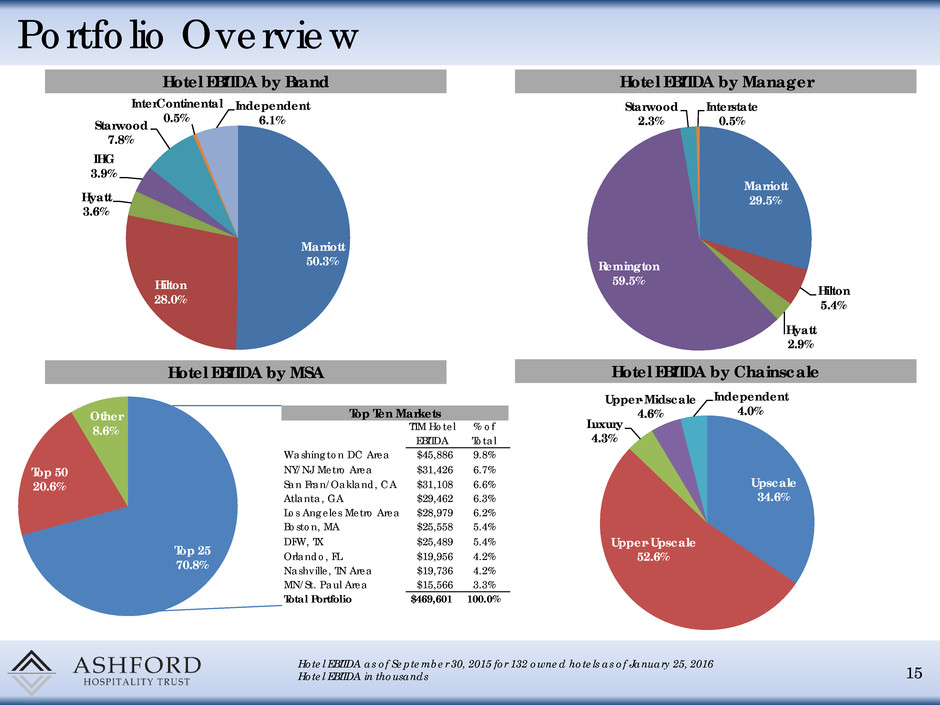

Top 25 70.8% Top 50 20.6% Other 8.6% Portfolio Overview 15 Hotel EBITDA as of September 30, 2015 for 132 owned hotels as of January 25, 2016 Hotel EBITDA in thousands Hotel EBITDA by Brand Hotel EBITDA by Manager Hotel EBITDA by MSA Hotel EBITDA by Chainscale Top Ten Markets Marriott 50.3% Hilton 28.0% Hyatt 3.6% IHG 3.9% Starwood 7.8% InterContinental 0.5% Independent 6.1% Marriott 29.5% Hilton 5.4% Hyatt 2.9% Remington 59.5% Starwood 2.3% Interstate 0.5% Upscale 34.6% Upper-Upscale 52.6% Luxury 4.3% Upper-Midscale 4.6% Independent 4.0% TTM Hotel % of EBITDA Total Washington DC Area $45,886 9.8% NY/NJ Metro Area $31,426 6.7% San Fran/Oakland, CA $31,108 6.6% Atlanta, GA $29,462 6.3% Los Angeles Metro Area $28,979 6.2% Boston, MA $25,558 5.4% DFW, TX $25,489 5.4% Orlando, FL $19,956 4.2% Nashville, TN Area $19,736 4.2% MN/St. Paul Area $15,566 3.3% Total Portfolio $469,601 100.0%

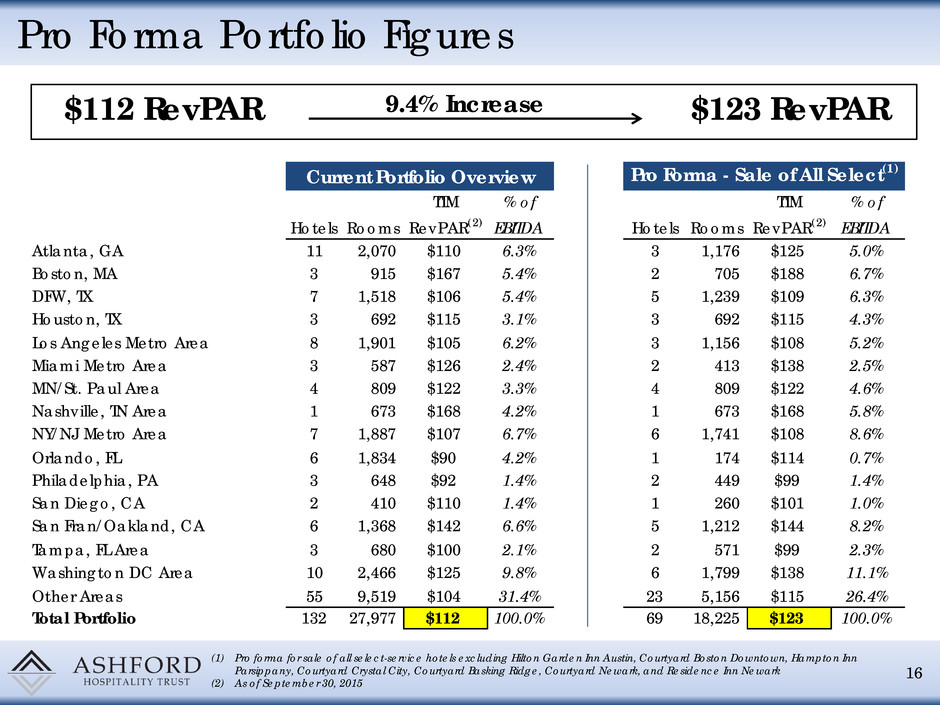

16 (1) Pro forma for sale of all select-service hotels excluding Hilton Garden Inn Austin, Courtyard Boston Downtown, Hampton Inn Parsippany, Courtyard Crystal City, Courtyard Basking Ridge, Courtyard Newark, and Residence Inn Newark (2) As of September 30, 2015 Pro Forma Portfolio Figures $112 RevPAR $123 RevPAR 9.4% Increase Current Portfolio Overview Pro Forma - Sale of All Select(1) TTM % of TTM % of Hotels Rooms RevPAR(2) EBITDA Hotels Rooms RevPAR(2) EBITDA Atlanta, GA 11 2,070 $110 6.3% 3 1,176 $125 5.0% Boston, MA 3 915 $167 5.4% 2 705 $188 6.7% DFW, TX 7 1,518 $106 5.4% 5 1,239 $109 6.3% Houston, TX 3 692 $115 3.1% 3 692 $115 4.3% Los Angeles Metro Area 8 1,901 $105 6.2% 3 1,156 $108 5.2% Miami Metro Area 3 587 $126 2.4% 2 413 $138 2.5% MN/St. Paul Area 4 809 $122 3.3% 4 809 $122 4.6% Nashville, TN Area 1 673 $168 4.2% 1 673 $168 5.8% NY/NJ Metro Area 7 1,887 $107 6.7% 6 1,741 $108 8.6% Orlando, FL 6 1,834 $90 4.2% 1 174 $114 0.7% Philadelphia, PA 3 648 $92 1.4% 2 449 $99 1.4% San Diego, CA 2 410 $110 1.4% 1 260 $101 1.0% San Fran/Oakland, CA 6 1,368 $142 6.6% 5 1,212 $144 8.2% Tampa, FL Area 3 680 $100 2.1% 2 571 $99 2.3% Washington DC Area 10 2,466 $125 9.8% 6 1,799 $138 11.1% Other Areas 55 9,519 $104 31.4% 23 5,156 $115 26.4% Total Portfolio 132 27,977 $112 100.0% 69 18,225 $123 100.0%

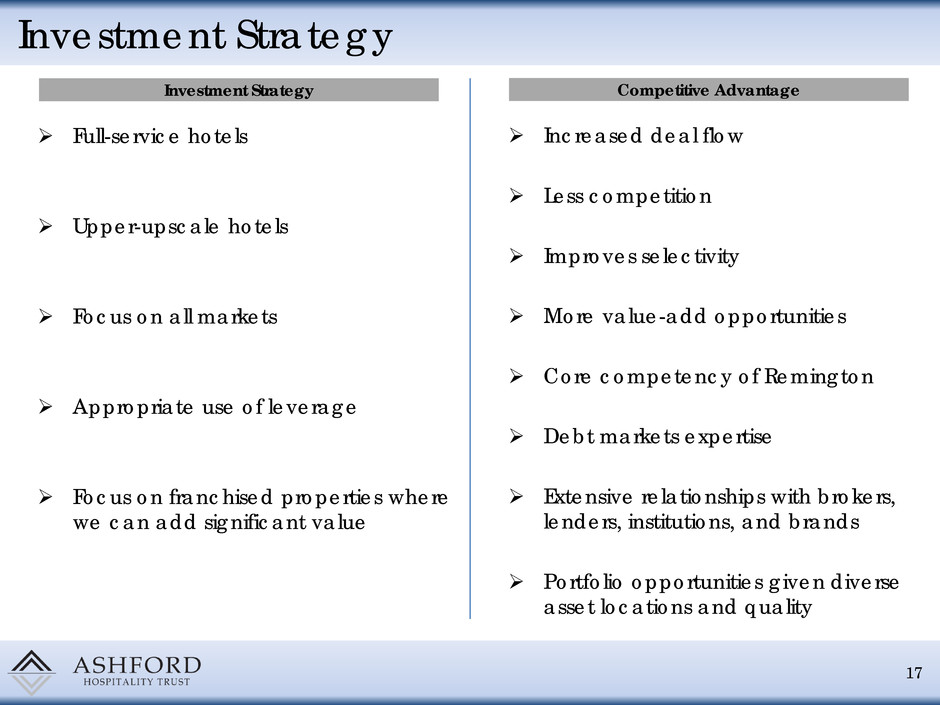

Investment Strategy 17 Full-service hotels Upper-upscale hotels Focus on all markets Appropriate use of leverage Focus on franchised properties where we can add significant value Investment Strategy Competitive Advantage Increased deal flow Less competition Improves selectivity More value-add opportunities Core competency of Remington Debt markets expertise Extensive relationships with brokers, lenders, institutions, and brands Portfolio opportunities given diverse asset locations and quality

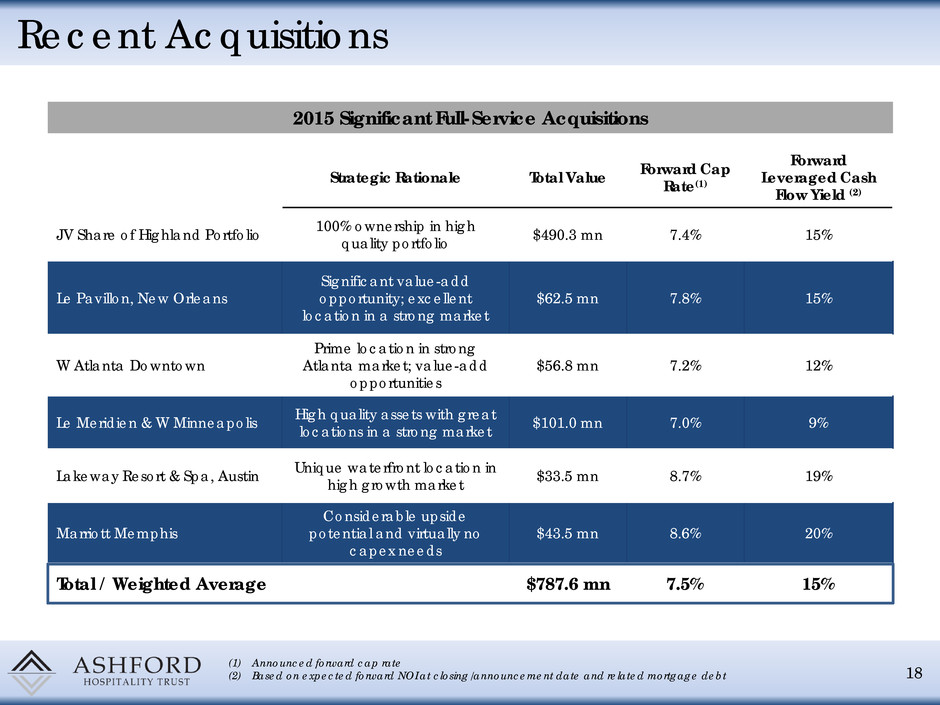

Recent Acquisitions 18 Strategic Rationale Total Value Forward Cap Rate(1) Forward Leveraged Cash Flow Yield (2) JV Share of Highland Portfolio 100% ownership in high quality portfolio $490.3 mn 7.4% 15% Le Pavillon, New Orleans Significant value-add opportunity; excellent location in a strong market $62.5 mn 7.8% 15% W Atlanta Downtown Prime location in strong Atlanta market; value-add opportunities $56.8 mn 7.2% 12% Le Meridien & W Minneapolis High quality assets with great locations in a strong market $101.0 mn 7.0% 9% Lakeway Resort & Spa, Austin Unique waterfront location in high growth market $33.5 mn 8.7% 19% Marriott Memphis Considerable upside potential and virtually no capex needs $43.5 mn 8.6% 20% Total / Weighted Average $787.6 mn 7.5% 15% 2015 Significant Full-Service Acquisitions (1) Announced forward cap rate (2) Based on expected forward NOI at closing/announcement date and related mortgage debt

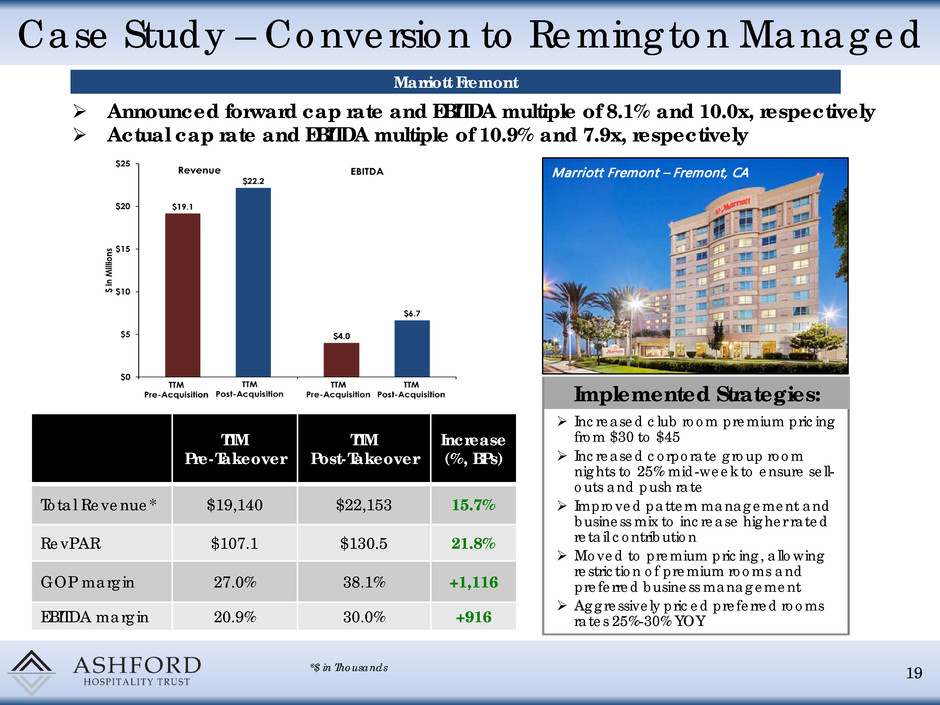

Case Study – Conversion to Remington Managed 19 Implemented Strategies: Increased club room premium pricing from $30 to $45 Increased corporate group room nights to 25% mid-week to ensure sell- outs and push rate Improved pattern management and business mix to increase higher rated retail contribution Moved to premium pricing, allowing restriction of premium rooms and preferred business management Aggressively priced preferred rooms rates 25%-30% YOY Marriott Fremont – Fremont, CA *$ in Thousands Announced forward cap rate and EBITDA multiple of 8.1% and 10.0x, respectively Actual cap rate and EBITDA multiple of 10.9% and 7.9x, respectively TTM Pre-Takeover TTM Post-Takeover Increase (%, BPs) Total Revenue* $19,140 $22,153 15.7% RevPAR $107.1 $130.5 21.8% GOP margin 27.0% 38.1% +1,116 EBITDA margin 20.9% 30.0% +916 Marriott Fremont

Case Study – Marriott Beverly Hills Conversion 20

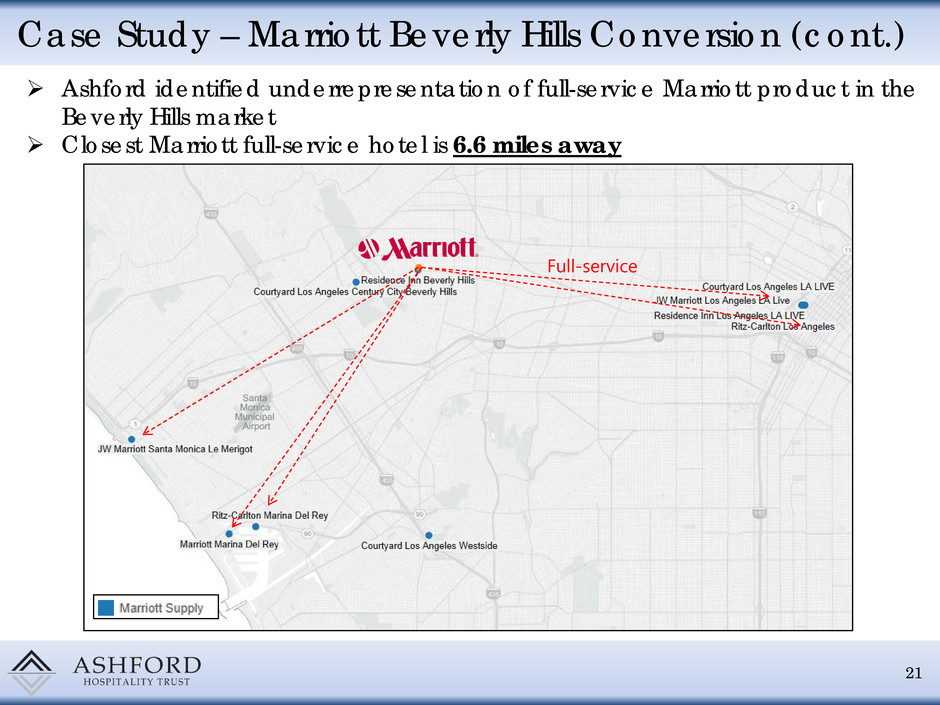

21 Case Study – Marriott Beverly Hills Conversion (cont.) Ashford identified underrepresentation of full-service Marriott product in the Beverly Hills market Closest Marriott full-service hotel is 6.6 miles away Full-service

22 Case Study – Marriott Beverly Hills Conversion (cont.) Renovation Management Terms $21mm (net of Marriott key money) Remington 25 year agreement with fee ramp, area of protection and key money Conversion (258 Rooms) Premium Pricing Average incremental increase in BAR of $42 since conversion Property Tour Property tour for analysts and investors

23 Case Study – Marriott Beverly Hills Conversion (cont.) Lobby Bar Restaurant Front Desk Lobby

24 Case Study – Marriott Beverly Hills Conversion (cont.) Guestroom Boardroom Guestroom Club Lounge

25 Case Study – Marriott Beverly Hills Conversion (cont.) Entrance Pool Fitness Center Outdoor Dining

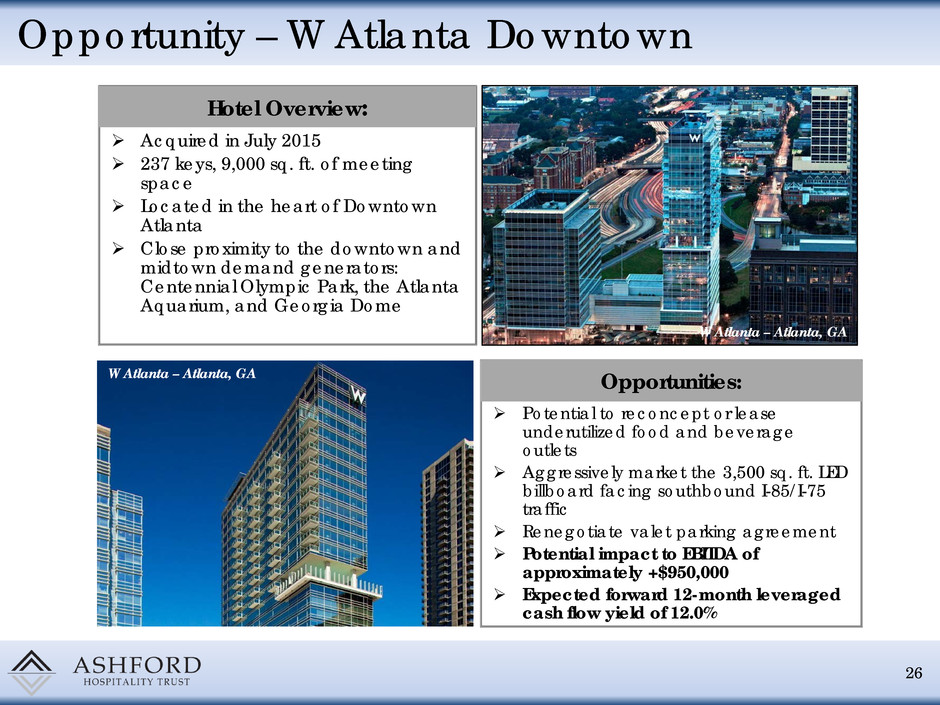

Opportunity – W Atlanta Downtown 26 Acquired in July 2015 237 keys, 9,000 sq. ft. of meeting space Located in the heart of Downtown Atlanta Close proximity to the downtown and midtown demand generators: Centennial Olympic Park, the Atlanta Aquarium, and Georgia Dome Potential to reconcept or lease underutilized food and beverage outlets Aggressively market the 3,500 sq. ft. LED billboard facing southbound I-85/I-75 traffic Renegotiate valet parking agreement Potential impact to EBITDA of approximately +$950,000 Expected forward 12-month leveraged cash flow yield of 12.0% W Atlanta – Atlanta, GA W Atlanta – Atlanta, GA Hotel Overview: Opportunities:

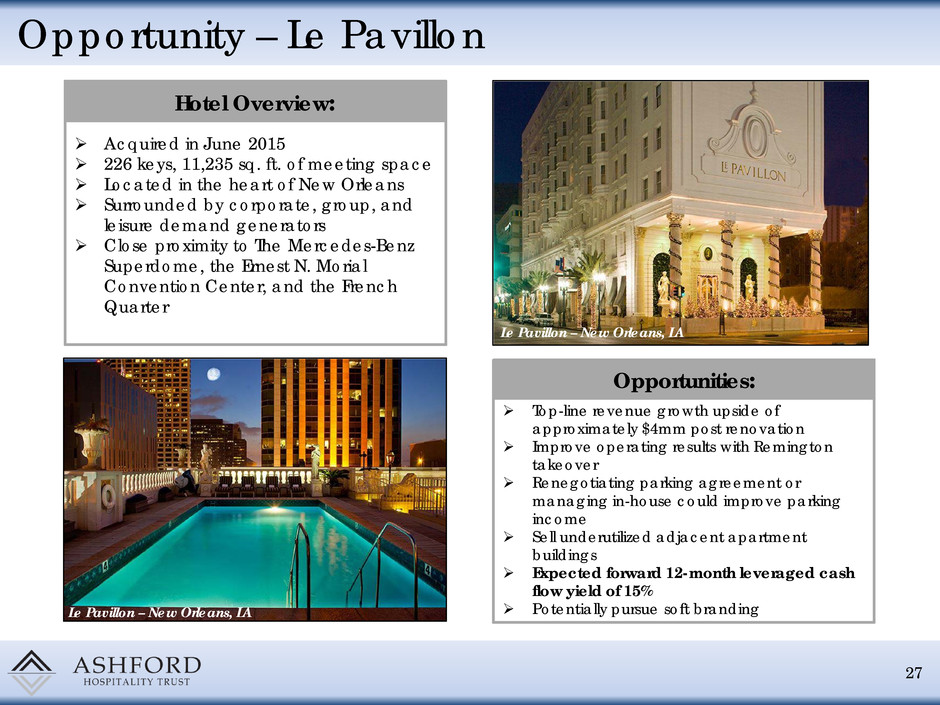

Opportunity – Le Pavillon 27 Le Pavillon – New Orleans, LA Le Pavillon – New Orleans, LA Acquired in June 2015 226 keys, 11,235 sq. ft. of meeting space Located in the heart of New Orleans Surrounded by corporate, group, and leisure demand generators Close proximity to The Mercedes-Benz Superdome, the Ernest N. Morial Convention Center, and the French Quarter Hotel Overview: Top-line revenue growth upside of approximately $4mm post renovation Improve operating results with Remington takeover Renegotiating parking agreement or managing in-house could improve parking income Sell underutilized adjacent apartment buildings Expected forward 12-month leveraged cash flow yield of 15% Potentially pursue soft branding Opportunities:

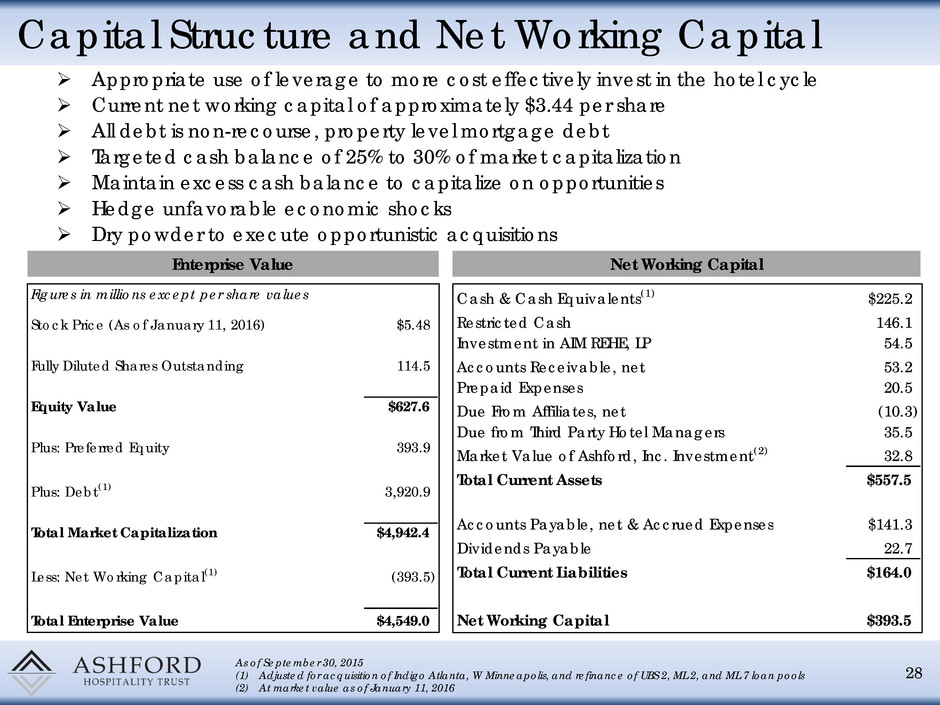

Capital Structure and Net Working Capital Appropriate use of leverage to more cost effectively invest in the hotel cycle Current net working capital of approximately $3.44 per share All debt is non-recourse, property level mortgage debt Targeted cash balance of 25% to 30% of market capitalization Maintain excess cash balance to capitalize on opportunities Hedge unfavorable economic shocks Dry powder to execute opportunistic acquisitions 28 As of September 30, 2015 (1) Adjusted for acquisition of Indigo Atlanta, W Minneapolis, and refinance of UBS 2, ML 2, and ML 7 loan pools (2) At market value as of January 11, 2016 Enterprise Value Net Working Capital Figures in millions except per share values Stock Price (As of January 11, 2016) $5.48 Fully Diluted Shares Outstanding 114.5 Equity Value $627.6 Plus: Preferred Equity 393.9 Plus: Debt(1) 3,920.9 Total Market Capitalization $4,942.4 Less: Net Working Capital(1) (393.5) Total Enterprise Value $4,549.0 Cash & Cash Equivalents(1) $225.2 Restricted Cash 146.1 Investment in AIM REHE, LP 54.5 Accounts Receivable, net 53.2 Prepaid Expenses 20.5 Due From Affiliates, net (10.3) Due from Third Party Hotel Managers 35.5 Market Value of Ashford, Inc. Investment(2) 32.8 Total Current Assets $557.5 Accounts Payable, net & Accrued Expenses $141.3 Dividends Payable 22.7 Total Current Liabilities $164.0 Net Working Capital $393.5

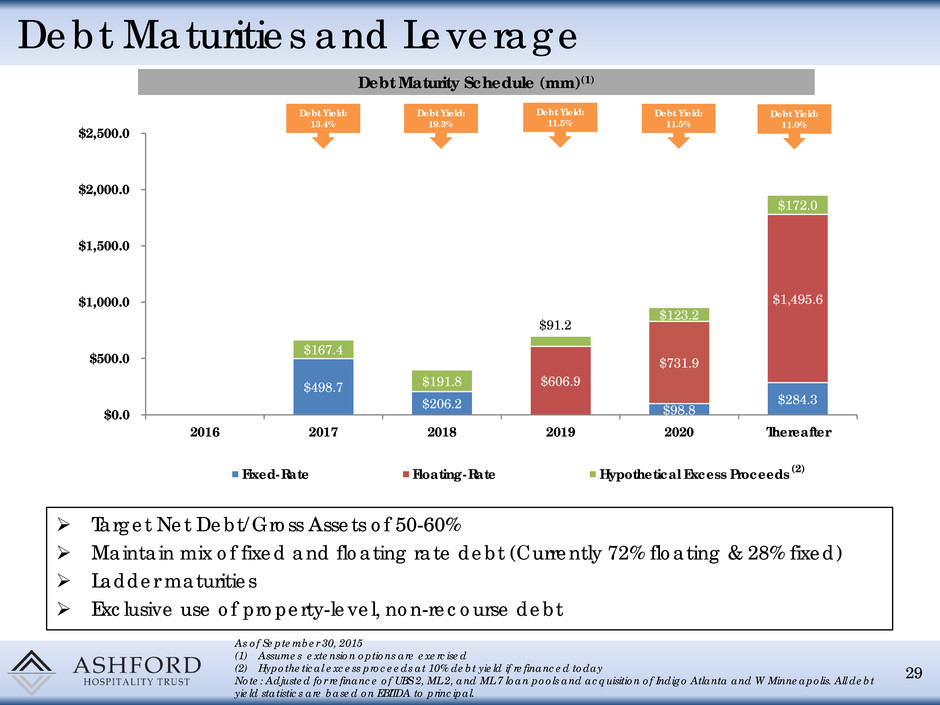

$498.7 $206.2 $98.8 $284.3 $606.9 $731.9 $1,495.6 $167.4 $191.8 $91.2 $123.2 $172.0 $0.0 $500.0 $1,000.0 $1,500.0 $2,000.0 $2,500.0 2016 2017 2018 2019 2020 Thereafter Fixed-Rate Floating-Rate Hypothetical Excess Proceeds Debt Maturities and Leverage Target Net Debt/Gross Assets of 50-60% Maintain mix of fixed and floating rate debt (Currently 72% floating & 28% fixed) Ladder maturities Exclusive use of property-level, non-recourse debt 29 As of September 30, 2015 (1) Assumes extension options are exercised (2) Hypothetical excess proceeds at 10% debt yield if refinanced today Note: Adjusted for refinance of UBS 2, ML 2, and ML 7 loan pools and acquisition of Indigo Atlanta and W Minneapolis. All debt yield statistics are based on EBITDA to principal. Debt Maturity Schedule (mm)(1) Debt Yield: 11.5% Debt Yield: 19.3% Debt Yield: 13.4% (2) Debt Yield: 11.5% Debt Yield: 11.0%

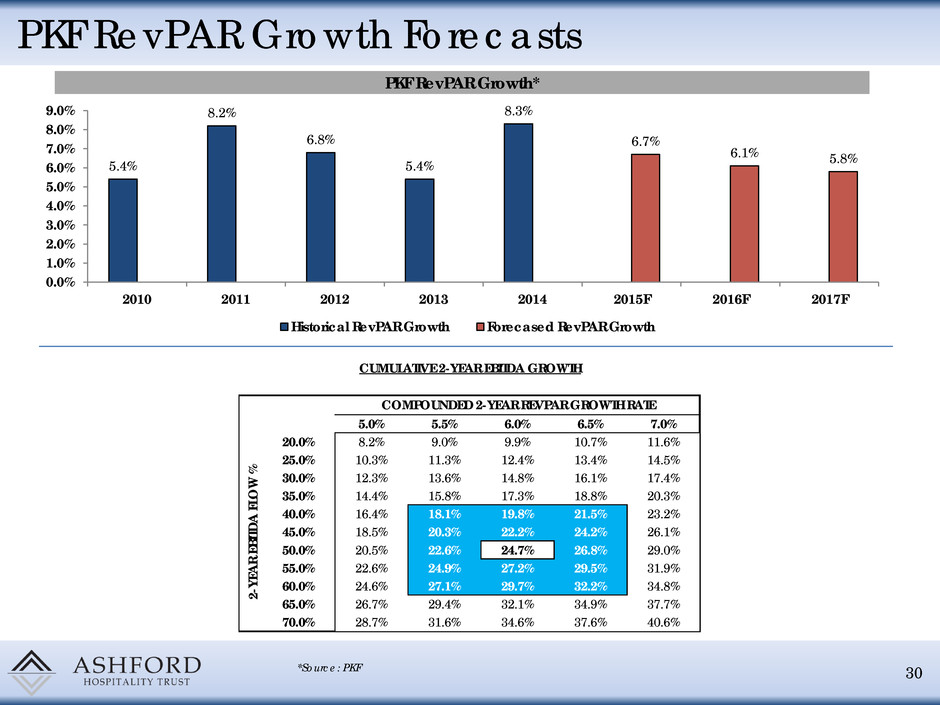

PKF RevPAR Growth Forecasts 30 PKF RevPAR Growth* *Source: PKF 5.4% 8.2% 6.8% 5.4% 8.3% 6.7% 6.1% 5.8% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 2010 2011 2012 2013 2014 2015F 2016F 2017F Historical RevPAR Growth Forecased RevPAR Growth COMPOUNDED 2-YEAR REVPAR GROWTH RATE 24.5% 5.0% 5.5% 6.0% 6.5% 7.0% 20.0% 8.2% 9.0% 9.9% 10.7% 11.6% 25.0% 10.3% 11.3% 12.4% 13.4% 14.5% 30.0% 12.3% 13.6% 14.8% 16.1% 17.4% 35.0% 14.4% 15.8% 17.3% 18.8% 20.3% 40.0% 16.4% 18.1% 19.8% 21.5% 23.2% 45.0% 18.5% 20.3% 22.2% 24.2% 26.1% 50.0% 20.5% 22.6% 24.7% 26.8% 29.0% 55.0% 22.6% 24.9% 27.2% 29.5% 31.9% 60.0% 24.6% 27.1% 29.7% 32.2% 34.8% 65.0% 26.7% 29.4% 32.1% 34.9% 37.7% 70.0% 28.7% 31.6% 34.6% 37.6% 40.6% 2- YE A R EB IT D A F LO W % CUMULATIVE 2-YEAR EBITDA GROWTH

Key Takeaways 31 Focused on increasing shareholder value through: Improving portfolio quality No more spin-offs Increase in transparency Simplify strategy and structure Attractive industry fundamentals Strong management team with a long track record of creating shareholder value Highest dividend yield in the industry Highly-aligned platform through management structure and high insider ownership

Company Presentation – January 2016