March 2022

2 In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. Certain statements and assumptions in this press release contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this press release include, among others, statements about the Company’s strategy and future plans. These forward- looking statements are subject to risks and uncertainties. When we use the words “will likely result,” “may,” “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” or similar expressions, we intend to identify forward-looking statements. Such statements are subject to numerous assumptions and uncertainties, many of which are outside Ashford Trust’s control. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated, including, without limitation: the impact of COVID-19, and the rate of adoption and efficacy of vaccines to prevent COVID-19, on our business and investment strategy; our ability to meet the NYSE continued listing standards; our ability to maintain S-3 eligibility; our ability to repay, refinance or restructure our debt and the debt of certain of our subsidiaries; anticipated or expected purchases or sales of assets; our projected operating results; completion of any pending transactions; our understanding of our competition; market trends; projected capital expenditures; the impact of technology on our operations and business; general volatility of the capital markets and the market price of our common stock and preferred stock; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the markets in which we operate, interest rates or the general economy; and the degree and nature of our competition. These and other risk factors are more fully discussed in Ashford Trust’s filings with the Securities and Exchange Commission. The forward-looking statements included in this press release are only made as of the date of this press release. Such forward-looking statements are based on our beliefs, assumptions, and expectations of our future performance taking into account all information currently known to us. These beliefs, assumptions, and expectations can change as a result of many potential events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity, results of operations, plans, and other objectives may vary materially from those expressed in our forward-looking statements. You should carefully consider this risk when you make an investment decision concerning our securities. Investors should not place undue reliance on these forward-looking statements. The Company can give no assurance that these forward-looking statements will be attained or that any deviation will not occur. We are not obligated to publicly update or revise any forward-looking statements, whether as a result of new information, future events or circumstances, changes in expectations, or otherwise, except to the extent required by law. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price or debt amount. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC or in the appendix to this presentation. The calculation of implied equity value is derived from an estimated blended capitalization rate (“Cap Rate”) for the entire portfolio using the capitalization rate method. The estimated Cap Rate is based on recent Cap Rates of publically traded peers involving a similar blend of asset types found in the portfolio, which is then applied to Net Operating Income (“NOI”) of the company’s assets to calculate a Total Enterprise Value (“TEV”) of the company. From the TEV, we deduct debt and preferred equ ity and then add back working capital to derive an equity value. The capitalization rate method is one of several valuation methods for estimating asset value and implied equity value. Among the limitations of using the capitalization rate method for determining an implied equity value are that it does not take into account the potential change or variability in future cash flows, potential significant future capital expenditures, the intended hold period of the asset, or a change in the future risk profile of an asset. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Trust, Inc. or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security. Our business has been and will continue to be materially adversely affected by the impact of COVID-19. Prior to investing in Ashford Hospitality Trust, Inc. potential investors should carefully review Ashford Hospitality Trust, Inc.’s periodic filings made with the Securities and Exchange Commission, including but not limited to Ashford Hospitality Trust, Inc.’s most current Form 10-K, Form 10-Q and Form 8-K’s, including the risk factors therein. F o r wa r d L o o k i n g S t a t e m e n t s a n d N o n - G A A P M e a s u r e s

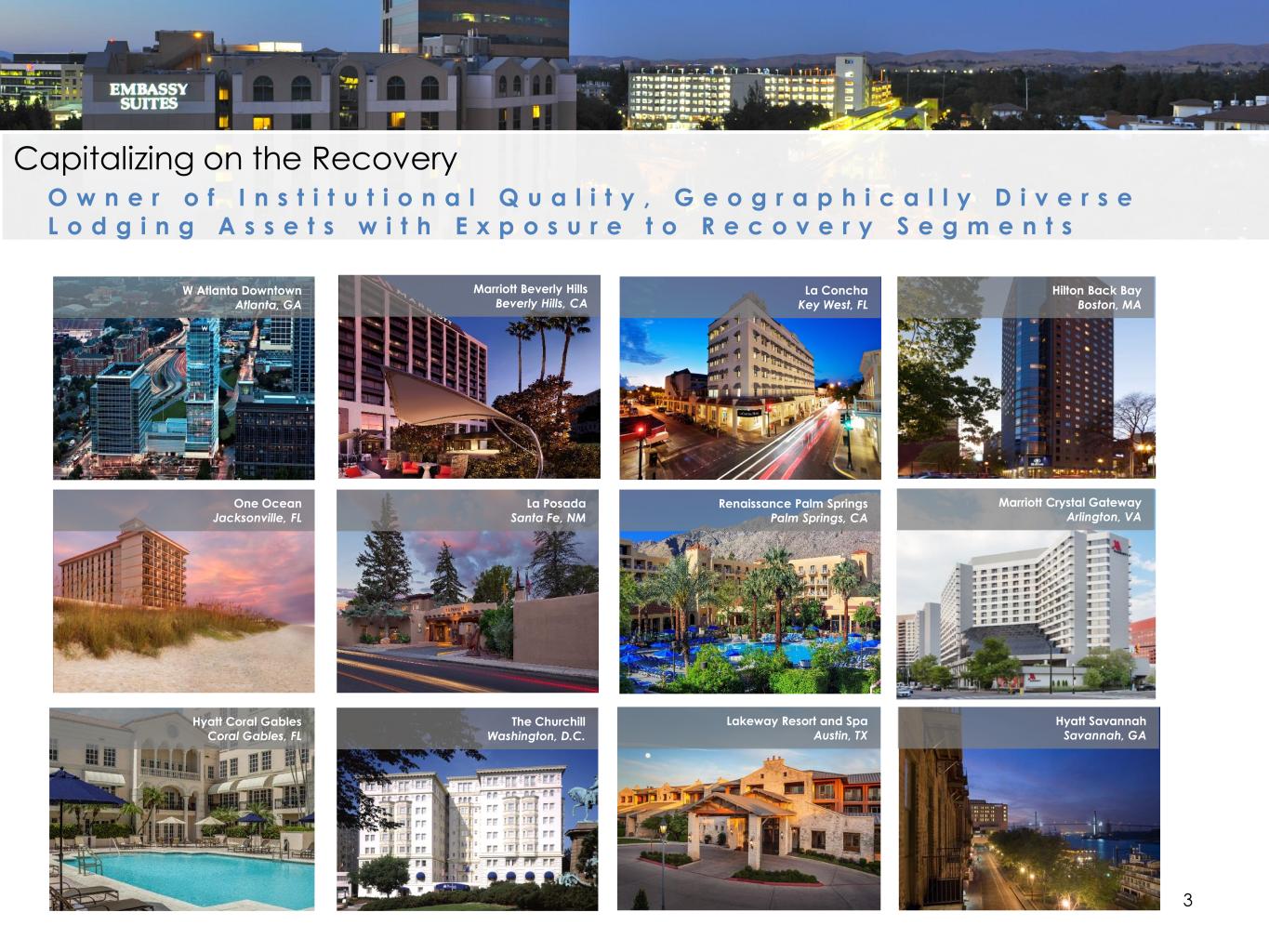

Capitalizing on the Recovery O w n e r o f I n s t i t u t i o n a l Q u a l i t y , G e o g r a p h i c a l l y D i v e r s e L o d g i n g A s s e t s w i t h E x p o s u r e t o R e c o v e r y S e g m e n t s 3 La Concha Key West, FL W Atlanta Downtown Atlanta, GA Marriott Beverly Hills Beverly Hills, CA Hilton Back Bay Boston, MA One Ocean Jacksonville, FL La Posada Santa Fe, NM Renaissance Palm Springs Palm Springs, CA Marriott Crystal Gateway Arlington, VA Hyatt Coral Gables Coral Gables, FL The Churchill Washington, D.C. Lakeway Resort and Spa Austin, TX Hyatt Savannah Savannah, GA

Overview 4 Clear Path Forward to Capitalize on the Recovery Portfolio Positioned for the Recovery Significant Balance Sheet & Liquidity Enhancements

D e r i c E u b a n k s C h i e f F i n a n c i a l O f f i c e r 21 years of hospitality experience 18 years with Ashford 3 years with ClubCorp CFA Charterholder Southern Methodist University, BBA J . R o b i s o n H a y s C h i e f E x e c u t i v e O f f i c e r & P r e s i d e n t 16 years of hospitality experience 16 years with Ashford 3 years of M&A experience at Dresser Inc. & Merrill Lynch Princeton University, AB J e r e m y W e l t e r C h i e f O p e r a t i n g O f f i c e r 16 years of hospitality experience 11 years with Ashford (5 years with predecessor) 5 years with Stephens Investment Bank Oklahoma State University, BS 5 Executive Management Team P r o v e n E x p e r i e n c e

Significant Balance Sheet & Liquidity Enhancements A H T H a s T a k e n N u m e r o u s S t e p s t o I m p r o v e t h e B a l a n c e S h e e t & L i q u i d i t y P r o f i l e 6 Significant Liquidity: Net Working Capital of $600M+ Attractive Debt Maturity Schedule Achieved Substantive Corporate Deleveraging since mid-2020 1 2 3

Net Working Capital 7 A C l o s e r L o o k a t C a s h & L i q u i d i t y P o s i t i o n December 31, 2021 Cash and cash equivalents $ 592,110 Restricted cash 99,534 Accounts receivable, net 37,720 Prepaid expenses 13,385 Due from third-party hotel managers, net 25,692 Due from affiliates, net 6,756 Total currents assets $ 775,197 Accounts payable, net & accrued expenses 132,602 Dividends and distributions payable 3,104 Total currents liabilities 135,706 Net Working Capital $ 639,491 NWC Per Share(1) $18.33 NWC Per Share vs. Stock Price(2) 191% (1) Net working capital (as of 12/31/2021) divided by common shares and units outstanding as of 12/31/2021 (2) Assumes stock price of 9.60, as of 12/31/2021

Significant Balance Sheet & Liquidity Enhancements W e l l - L a d d e r e d M a t u r i t y S c h e d u l e 8(1) As of 12/31/2021. Assumes extension options are exercised; totals for each year exclude scheduled amortization payments. $0 $132 $497 $2,621 $620 $0 $1,000 $2,000 $3,000 2022 2023 2024 2025 2026 Debt Final Maturity Schedule(1) ($ in 000's)

Significant Balance Sheet & Liquidity Enhancements D e c i s i v e A c t i o n s H a v e R e s u l t e d i n A p p r o x i m a t e l y $ 1 . 1 B o f D e l e v e r a g i n g s i n c e Q 2 2 0 2 0 9 $3,842,167 $3,167,286 $564,735 $162,970 $3,000,000 $3,500,000 $4,000,000 $4,500,000 6/30/2020 12/31/2021 Net Debt + Preferred Equity (in $ thousands) Net Debt Perpetual Preferred Face Value $3,332,252 (~$1.1 billion) $4,406,902 Steps to Long-Term Deleveraging: • Asset Sales • Buy Assets Unleveraged or With Lower Leverage • Refinance Assets at Lower Leverage Levels • Debt Pay Downs • Reduction in Preferred Equity Via Exchanges, Redemptions & Tenders • Raising Common Equity Opportunistically • Hand Back Uneconomic Assets to Lenders Note: 6/30/20 data from Q2’20 earnings release for net indebtedness, cash + equivalents, restricted cash, due from third-party hotel managers, and perpetual preferred; 12/31/2021 data from Q4’21 earnings release indebtedness, cash + equivalents, restricted cash, due from third-party hotel managers, and perpetual preferred outstanding

Portfolio Positioned for the Recovery W e l l - p o s i t i o n e d t o C a p i t a l i z e o n t h e L o d g i n g R e c o v e r y 10 Lodging Recovery Expected Over Next 4+ Years Best-in-Class Hotel Brands and Management Companies with Remington Driving Outperformance Chain Scale Mix with RevPAR Growth Expected Portfolio Positioned to Capture Leisure & Transient Demand with Low Historical Reliance Upon Group Business Well Diversified Asset Base Across Top 25 Markets May Outperform and Mitigate Market Concentration Risk Significant Portfolio Exposure to Domestic Migration Trends 1 2 3 4 5 6

Occupancy and RevPAR near Full Recovery and ADR Fully Recovering in 2022 U . S . K P I s , I n d e x e d t o 2 0 1 9 11 Source: STR 87.4 96.8 100.3 101.3 101.8 0 20 40 60 80 100 120 2021 2022 2023 2024 2025 Occupancy Index 83.2 99.4 107 111.7 115.5 0 20 40 60 80 100 120 2021 2022 2023 2024 2025 RevPAR Index 95.2 102.7 106.8 110.3 113.5 0 20 40 60 80 100 120 2021 2022 2023 2024 2025 ADR Index

Portfolio Positioned for the Recovery R e v P A R h a s R e b o u n d e d S t r o n g l y f r o m D e p t h s o f t h e C r i s i s 12 -100.0% -90.0% -80.0% -70.0% -60.0% -50.0% -40.0% -30.0% -20.0% -10.0% AHT RevPAR as % of ‘19 (as of Feb ‘22) Source: AHT internal reporting, Room RevPAR as % of same month 2019

Portfolio Positioned for the Recovery L o w F o r e c a s t e d S u p p l y G r o w t h 13Source: STR February 2021 Forecast; TRI methodology includes adjustments for temporary hotel closures due to COVID-19 2.0% 2.2% 2.3% 0.9% 1.6% 1.3% 1.0% 1.1% 1.0% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 2017 2018 2019 2020 2021F 2022F 2023F 2024F 2025F % Change Upper Upscale Room Night Supply

Portfolio by Hotel EBITDA(2) CHAIN SCALE UPPER UPSCALE 63% UPSCALE INDEPENDENT 6% LUXURY 4% UPPER MIDSCALE 2% REMINGTON 58% 32% HILTON 6% HYATT 4% INTERSTATE <1% 14 FULL-SERVICE 75% SELECT-SERVICE 25% SERVICE TYPE 100 H O T E L S ( 1 ) 28 S T A T E S ( 1 ) 22,307 H O T E L R O O M S ( 1 ) MARRIOTTHILTON 31% INDEPENDENT 6% HYATT 5% IHG 2% 56% MARRIOTT 25% HOTEL BRAND PROPERTY MANAGER Portfolio Positioned for the Recovery S i g n i f i c a n t A s s e t s i n E a r l y R e c o v e r y S e g m e n t s a n d H i g h - G r o w t h C h a i n S c a l e s w i t h B e s t - i n - C l a s s B r a n d s & M a n a g e r s (1) As of December 31, 2021; excludes WorldQuest (2) Pro forma TTM Hotel EBITDA as of December 31, 2019 excluding assets disposed of in 2020 and 2021, and WorldQuest Note: 2019 pro forma Hotel EBITDA is $437,479 (In thousands)

Portfolio Positioned for the Recovery H i g h E x p o s u r e t o T r a n s i e n t L e i s u r e , L o w E x p o s u r e t o G r o u p 15 73% 24% 3% AHT 2019 Pro Forma Hotel Revenue Transient Group Other 71% 23% 6% AHT 2019 Pro Forma Transient Hotel Revenue Leisure Business Other Note: Pro forma TTM Hotel Revenues as of December 31, 2019 excluding assets disposed of in 2020 and 2021; excludes WorldQuest.

Portfolio Positioned for the Recovery G e o g r a p h i c a l l y D i v e r s e P o r t f o l i o F o c u s e d o n T o p 2 5 M a r k e t s 16 AHT 2019 Hotel EBITDA by MSA TOP 25 76% TOP 26-50 10% OTHER 14% -57.6% -39.7% -60.0% -50.0% -40.0% -30.0% -20.0% -10.0% 0.0% Top 25 Markets All Others 2020 YoY RevPAR % Decline(a) • Importance of Market Diversification Highlighted by Covid-19 • Top 25 Markets Poised for Recovery Outperformance after 2020 Underperformance a) Source: STR Note: Pro forma TTM Hotel EBITDA as of December 31, 2019 excluding assets disposed of in 2020 and 2021; excludes WorldQuest

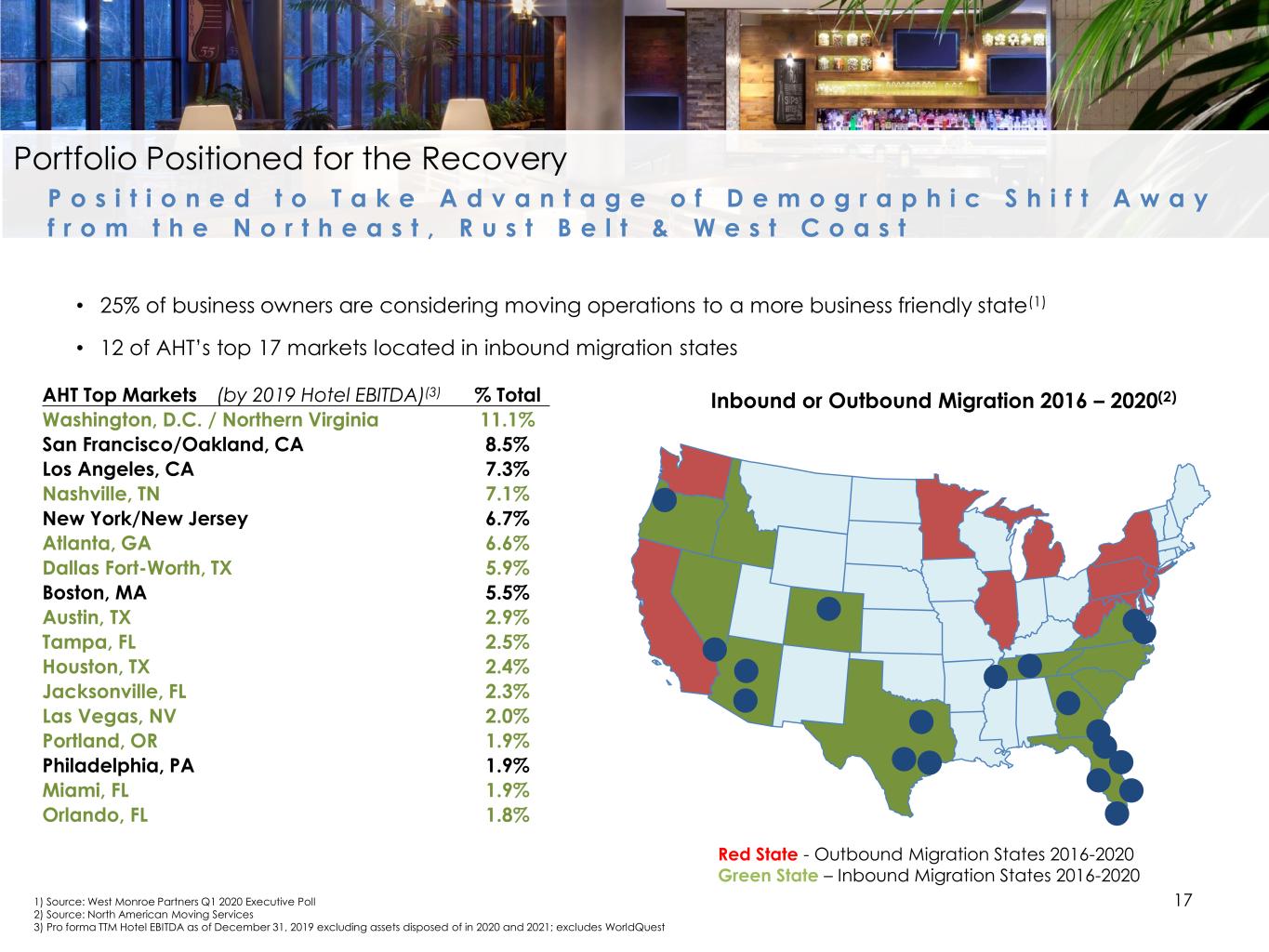

Portfolio Positioned for the Recovery P o s i t i o n e d t o T a k e A d v a n t a g e o f D e m o g r a p h i c S h i f t A w a y f r o m t h e N o r t h e a s t , R u s t B e l t & W e s t C o a s t 17 Inbound or Outbound Migration 2016 – 2020(2) • 25% of business owners are considering moving operations to a more business friendly state(1) • 12 of AHT’s top 17 markets located in inbound migration states Red State - Outbound Migration States 2016-2020 Green State – Inbound Migration States 2016-2020 1) Source: West Monroe Partners Q1 2020 Executive Poll 2) Source: North American Moving Services 3) Pro forma TTM Hotel EBITDA as of December 31, 2019 excluding assets disposed of in 2020 and 2021; excludes WorldQuest AHT Top Markets (by 2019 Hotel EBITDA)(3) % Total Washington, D.C. / Northern Virginia 11.1% San Francisco/Oakland, CA 8.5% Los Angeles, CA 7.3% Nashville, TN 7.1% New York/New Jersey 6.7% Atlanta, GA 6.6% Dallas Fort-Worth, TX 5.9% Boston, MA 5.5% Austin, TX 2.9% Tampa, FL 2.5% Houston, TX 2.4% Jacksonville, FL 2.3% Las Vegas, NV 2.0% Portland, OR 1.9% Philadelphia, PA 1.9% Miami, FL 1.9% Orlando, FL 1.8%

Conclusion 18 Clear Path Forward to Capitalize on the Recovery Portfolio Positioned for the Recovery Significant Balance Sheet & Liquidity Enhancements

Appendix

Reconci l ia t ion of Net Income to Hote l EB I TDA 23 December 31, 2019 TTM Net income (loss) 168,758$ Non-property adjustments 7,341 Interest income (306) Interest expense 19,208 Amortization of loan costs 1,763 Depreciation and amortization 268,896 Income tax expense (benefit) 324 Non-hotel EBITDA ownership expense 10,394H tel EBITDA including amounts attributable to noncontrolling interest 476,378 Non-comparable adjustments (38,900) Comparable hotel EBITDA 437,478$ (unaudited) ASHFORD HOSPITALITY TRUST, INC. AND SUBSIDIARIES RECONCILIATION OF NET INCOME TO HOTEL EBITDA (in thousands)

March 2022