UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

☐ | Preliminary Proxy Statement |

| | | | | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | | |

☒ | Definitive Proxy Statement |

| | | | | |

☐ | Definitive Additional Materials |

| | | | | |

☐ | Soliciting Material under §240.14a-12 |

Ashford Hospitality Trust, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | | | | | | | | | | | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | | No fee required. |

☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | | Title of each class of securities to which transaction applies: |

| | | | | | |

| | | (2) | | | Aggregate number of securities to which transaction applies: |

| | | | | | |

| | | (3) | | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | | |

| | | (4) | | | Proposed maximum aggregate value of transaction: |

| | | | | | |

| | | (5) | | | Total fee paid: |

| | | | | | |

☐ | | Fee paid previously with preliminary materials. |

☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | | Amount Previously Paid: |

| | | | | | |

| | | (2) | | | Form, Schedule or Registration Statement No.: |

| | | | | | |

| | | (3) | | | Filing Party: |

| | | | | | |

| | | (4) | | | Date Filed: |

| | | | | | |

2024 Proxy Statement

Annual Meeting of Stockholders

Tuesday, May 14, 2024

9:00 A.M., Central Daylight Time

Ashford Hospitality Trust, Inc.

14185 Dallas Parkway, Suite 1200

Dallas, Texas 75254

March 29, 2024

Dear Stockholders of Ashford Hospitality Trust, Inc.:

On behalf of the Board of Directors of Ashford Hospitality Trust, Inc., I cordially invite you to attend the 2024 annual meeting of stockholders of the Company, which will be held at 9:00 A.M., Central Daylight Time, on Tuesday, May 14, 2024 at our offices located at 14185 Dallas Parkway, Suite 1200, Dallas, Texas 75254.

At year-end, our hotel portfolio consisted of 90 hotels containing 20,549 total rooms across 23 states and Washington, D.C. While our focus is investing in predominantly upper upscale full-service hotels, we also own some upscale properties. We believe our geographical diversity is a strong competitive advantage, the importance of which has undoubtedly been highlighted by the uneven market recovery across the industry over the past few years.

We have made significant progress improving our company despite the significant headwinds of inflation, high interest rates, and recessionary fears. This includes deleveraging our portfolio by over $1 billion over the past few years, improving our cash flow, disposing of lower quality assets, and executing on a focused strategy to pay off our strategic financing in 2024.

Our best-in-class asset management team continues to be focused on pursuing initiatives to enhance our operating performance, including working closely with our property managers on aggressive cost control initiatives, driving ancillary revenue, and increasing operating margins. In addition, we are looking for opportunities to go on the offense to grow our portfolio and take advantage of what we believe may be strong industry tailwinds in the years to come.

Our business is managed with the oversight and direction of our Board of Directors, which regularly considers the optimal strategy for the strategic advancement and growth of the Company and the long-term interests of our stockholders. When making decisions, our Board of Directors considers the views of our stockholders. To understand our stockholders’ perspectives about the Company, our management team conducts outreach and engagement with our stockholders throughout the year and regularly provides our Board of Directors with management’s summaries of such feedback.

We encourage you to review the proxy statement and to return your proxy card as soon as possible so that your shares will be represented at the meeting.

Thank you.

Sincerely,

Monty J. Bennett

Founder and Chairman of the Board

Notice of 2024 Annual Meeting of Stockholders

| | | | | |

| Meeting Date: | Tuesday, May 14, 2024 |

| |

| Meeting Time: | 9:00 A.M., Central Daylight Time |

| |

| Location: | Ashford Hospitality Trust Inc. |

| 14185 Dallas Parkway, Suite 1200 |

| Dallas, Texas 75254 |

Agenda

1.Election of nine directors;

2.Advisory approval of our executive compensation;

3.Ratification of the appointment of BDO USA, P.C. as our independent auditor for 2024; and

4.Transaction of any other business that may properly come before the annual meeting.

Record Date

You may vote at the 2024 annual meeting of stockholders the shares of common stock of which you were the holder of record at the close of business on March 14, 2024.

Review your proxy statement and vote in one of the four ways:

•In person: Attend the annual meeting and vote by ballot.

•By telephone: Call the telephone number and follow the instructions on your proxy card.

•Via the internet: Go to the website address shown on your proxy card and follow the instructions on the website.

•By mail: Mark, sign, date and return the enclosed proxy card in the postage paid envelope.

By order of the Board of Directors,

Deric S. Eubanks

Chief Financial Officer

14185 Dallas Parkway, Suite 1200

Dallas, Texas 75254

March 29, 2024

TABLE OF CONTENTS

| | | | | |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON May 14, 2024. | |

| |

The Company's Proxy Statement for the 2024 Annual Meeting of Stockholders and the Annual Report to Stockholders for the fiscal year ended December 31, 2023, including the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, are available at www.ahtreit.com by clicking the "Investor" tab, then the "SEC Filings" tab and then the "Annual Meeting Material" link. | |

SUMMARY

This summary highlights selected information contained in this proxy statement, but it does not contain all the information you should consider in determining how to vote your shares of our common stock at the 2024 annual meeting of stockholders of the Company. We urge you to read the entire proxy statement before you vote. This proxy statement was first mailed to stockholders on or about March 29, 2024.

We are providing these proxy materials in connection with the solicitation by the Board of Directors of Ashford Hospitality Trust, Inc. of proxies to be voted at our 2024 annual meeting of stockholders.

In this proxy statement:

•"we," "our," "us," "Ashford Trust" and the "Company" each refers to Ashford Hospitality Trust, Inc., a Maryland corporation and real estate investment trust ("REIT"), shares of the common stock of which are listed for trading on the New York Stock Exchange ("NYSE") under the ticker symbol "AHT";

•"Annual Meeting" refers to the 2024 annual meeting of stockholders of the Company;

•"Ashford Inc.” refers to Ashford Inc. (NYSE American: AINC), a Nevada corporation;

•"Ashford LLC" refers to Ashford Hospitality Advisors LLC, a Delaware limited liability company and a subsidiary of Ashford Inc.;

•"Board" or "Board of Directors" refers to the Board of Directors of Ashford Hospitality Trust, Inc.;

•"Braemar" refers to Braemar Hotels & Resorts Inc. (NYSE: BHR), a Maryland corporation and REIT;

•"Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

•"Premier" refers to Premier Project Management LLC, a Maryland limited liability company and a subsidiary of Ashford LLC. On August 8, 2018, Ashford Inc. completed its acquisition of Premier, formerly owned by Remington Lodging (as defined below). As a result, Ashford Inc. (through its indirect subsidiary, Premier) provides us with construction management, interior design, architecture, and the purchasing, expediting, warehousing, freight management, installation and supervision of property and equipment and related services;

•"Remington Lodging" refers to Remington Lodging & Hospitality, LLC, a Delaware limited liability company and hotel management company that was owned by Mr. Monty J. Bennett, our Chairman of the Board, and his father, Mr. Archie Bennett, Jr., our Chairman Emeritus, before its acquisition by Ashford Inc. on November 6, 2019. "Remington Hospitality" refers to the same entity after the acquisition was completed, resulting in Remington Lodging & Hospitality, LLC becoming a subsidiary of Ashford Inc.;

•“SEC” refers to the U.S. Securities and Exchange Commission;

•“Securities Act” means the Securities Act of 1933, as amended; and

•“Stockholders” refers to holders of our common stock, par value $0.01 per share.

Ashford Inc. and Ashford LLC together serve as our external advisor. In this proxy statement, we refer to Ashford Inc. and Ashford LLC collectively as our "advisor."

Annual Meeting of Stockholders

| | | | | | | | |

| Time and Date | | Record Date |

| 9:00 A.M., Central Daylight Time, May 14, 2024 | | March 14, 2024 |

| | | | | | | | |

| | Number of Common Shares Eligible to Vote at the Annual Meeting as of March 14, 2024 |

| | 39,708,792 |

Voting Matters

| | | | | | | | | | | | | | |

| Matter | | Board Recommendation | | Page Reference (for more detail) |

| Election of Directors | | ✔ For each director nominee | | |

| Advisory Approval of Our Executive Compensation | | ✔ For | | |

| Ratification of Appointment of BDO USA, P.C. | | ✔ For | | |

Board Nominees

The following table provides summary information about each director nominee. All directors of the Company are elected annually and, in an uncontested election, by a majority of the votes cast at the Annual Meeting.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name, Age | | Director Since | | Principal Occupation | | Committee Memberships* | | Other U.S. Public Company Boards |

| A | | NCG | | CC | | RC | | AC | |

| Monty J. Bennett, 58 | | 2003 | | Chairman of Ashford Trust; Chairman and CEO of Ashford Inc.; Chairman of Braemar | | | | | | | | | | ✔ (C) | | Ashford Inc.; Braemar |

| Amish Gupta, 44 (L) | | 2014 | | Co-Founder and Managing Member of Montfort Capital Partners, LLC | | | | | | | | ✔ (C) | | ✔ | | |

| J. Robison Hays, III, 46 | | 2020 | | CEO and President of Ashford Trust; Senior Managing Director of Ashford Inc. | | | | | | | | | | | | |

| Kamal Jafarnia, 57 | | 2013 | | General Counsel, Executive Vice President and Secretary of Opto Investments, Inc. | | | | ✔ (C) | | ✔ | | | | | | Bluerock Homes Trust, Inc.; Bluerock Total Income + Real Estate Fund; Bluerock High Income Institutional Credit Fund |

| David W. Johnson, 62 | | | | Co-Founder and Managing Director at Horizon Capital Partners LLC | | | | | | | | | | | | Hilton Grand Vacations Inc. |

| Frederick J. Kleisner, 79 (F) | | 2016 | | Retired CEO of Morgans Hotel Group Co. | | ✔ | | ✔ | | ✔ | | | | | | |

| Sheri L. Pantermuehl, 67 (F) | | 2018 | | Chief Financial Officer of Alan Ritchey Inc. | | ✔ (C) | | | | | | ✔ | | | | |

| Davinder "Sonny" Sra, 71 | | 2023 | | Retired Senior Vice President of Operations at Remington Lodging & Hospitality, LLC | | | | | | | | | | | | |

| Alan L. Tallis, 77 (F) | | 2013 | | Principal of Alan L. Tallis & Associates | | ✔ | | | | ✔ (C) | | ✔ | | | | |

* Reflects current committee membership of current directors standing for re-election only and is not intended to imply any future committee membership after the election of our directors at the Annual Meeting. Our Board, in consultation with the Nominating and Corporate Governance Committee, will determine the appropriate committee membership for the forthcoming year after the completion of the Annual Meeting.

A: Audit Committee

NCG: Nominating and Corporate Governance Committee

CC: Compensation Committee

RC: Related Party Transactions Committee

AC: Acquisitions Committee

(L): Lead Director

(F): Audit Committee financial expert

(C): Chair

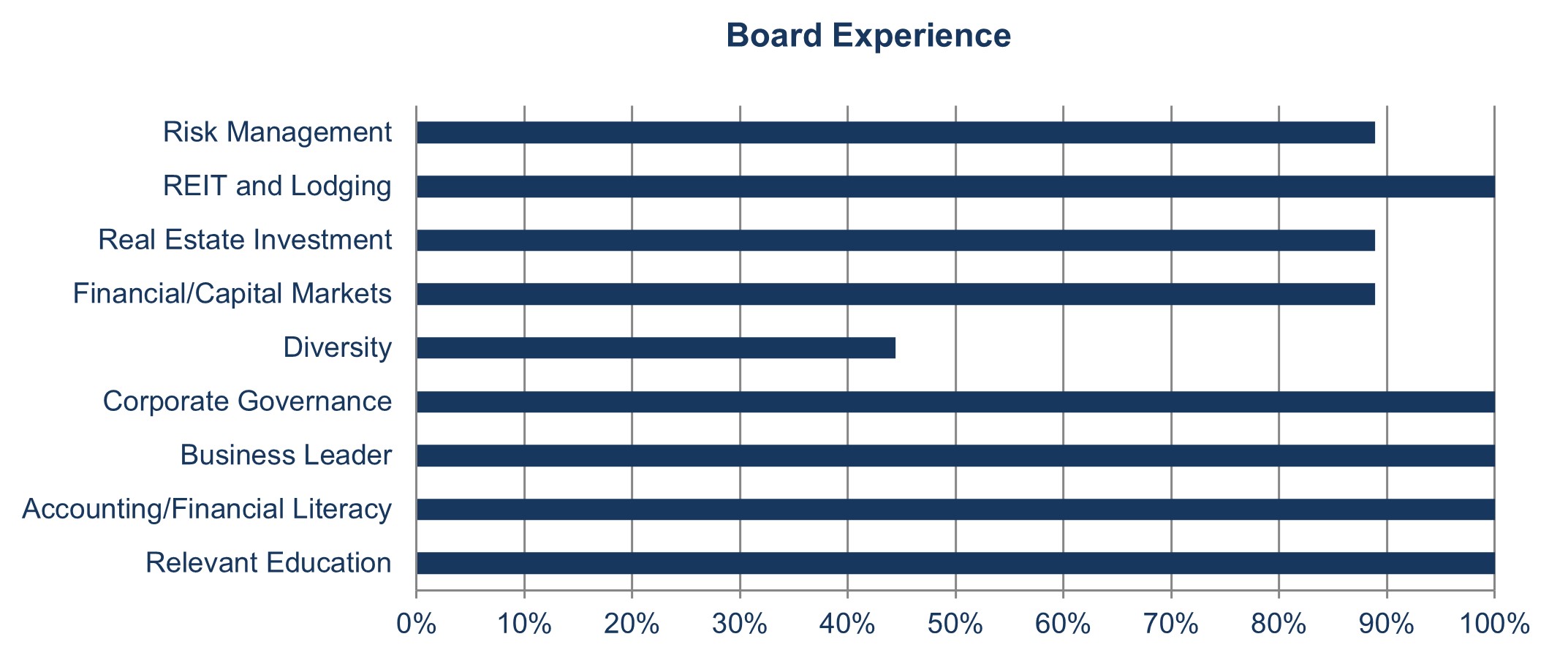

Summary of Director Diversity and Experience

Our Board embodies a broad and diverse set of experiences, qualifications, attributes and skills. Below is a brief summary of some of the attributes, skills and experience of our director nominees. For a more complete description of each director nominee’s qualifications, please see their biographies starting on page 7.

Corporate Governance Highlights

We are committed to the values of effective corporate governance and high ethical standards. Our Board believes that these values are conducive to the strong performance of the Company and creating long-term stockholder value. Our governance framework gives our independent directors the structure necessary to provide oversight, direction, advice and counsel to the management of the Company. This framework is described in more detail in our Corporate Governance Guidelines and codes of conduct, which can be found on our website at www.ahtreit.com by clicking the "Investor" tab, then the "Corporate Governance" tab and then the "Governance Documents" link.

Set forth below is a summary of our corporate governance framework.

| | | | | | | | | | | |

| Board Independence |

| • | | | All directors except our Chairman and Mr. Hays are independent |

| | | | | | | | | | | | | | | | | | | | |

| Board Committees |

| • | | | We have five standing Board committees: |

| | | • | | | Audit Committee |

| | | • | | | Compensation Committee |

| | | • | | | Nominating and Corporate Governance Committee |

| | | • | | | Related Party Transactions Committee |

| | | • | | | Acquisitions Committee |

| • | | | All committees, except the Acquisitions Committee, are composed entirely of independent directors |

| • | | | All three Audit Committee members are "financial experts" |

| | | | | | | | | | | |

| Leadership Structure |

| • | | | Chairman of the Board separate from CEO |

| • | | | Independent and empowered Lead Director with broadly-defined authority and responsibilities |

| | | | | | | | | | | |

| Risk Oversight |

| • | | | Regular Board review of enterprise risk management and related policies, processes and controls |

| • | | | Board committees exercise oversight of risk for matters within their purview |

| | | | | | | | | | | |

| Open Communication |

| • | | | We encourage open communication and strong working relationships among the Lead Director, Chairman, CEO and other directors and officers |

| • | | | Our directors have direct access to our officers and management and employees of our advisor |

| | | | | | | | | | | | | | | | | | | | |

| Stock Ownership |

| • | | | Stock ownership and equity award retention guidelines for directors and executives |

| | | • | | | Our directors should own shares of our common stock in excess of 3x his or her annual board retainer fee in effect at the time of such director's election to the Board |

| | | • | | | Our CEO should own shares of our common stock in excess of 3x his annual base salary from our advisor in effect at the time of his appointment as CEO |

| | | • | | | Our other executive officers should own shares of our common stock in excess of 1.5x his or her annual base salary in effect at the time of his or her appointment to such office |

| | | • | | | Our directors and executive officers may not sell any stock granted to them for service to the Company until the required ownership levels described above are met |

| • | | | Comprehensive insider trading policy |

| • | | | Prohibitions on hedging and pledging transactions |

| | | | | | | | | | | |

| Accountability to Stockholders |

| • | | | Directors elected by majority vote in uncontested director elections |

| • | | | We have a non-classified Board and elect every director annually |

| • | | | We do not have a stockholder rights plan |

| • | | | We have opted out of the Maryland Control Share Acquisition Act (which provides certain takeover defenses) |

| • | | | We have not elected to be subject to the provisions of the Maryland Unsolicited Takeover Act, which would permit our Board to classify itself without a stockholder vote |

| • | | | Stockholders holding a stated percentage of our outstanding voting shares may call special meetings of stockholders |

| • | | | Board receives regular updates from management regarding interaction with stockholders and prospective investors |

| | | | | | | | | | | |

| Board Practices |

| • | | | Robust annual Board and committee self-evaluation process |

| • | | | Balanced and diverse Board composition |

| • | | | Limits on outside public company board service |

| | | | | | | | | | | |

| Conflicts of Interest |

| • | | | Matters relating to our advisor or any other related party are subject to the approval of our independent directors or Related Party Transactions Committee |

PROPOSAL NUMBER ONE-ELECTION OF DIRECTORS

All of our directors are elected annually by our stockholders. Our Nominating and Corporate Governance Committee has recommended, and our Board has nominated, Monty J. Bennett, Amish Gupta, J. Robison Hays, III, Kamal Jafarnia, David W. Johnson, Frederick J. Kleisner, Sheri L. Pantermuehl, Davinder "Sonny" Sra and Alan L. Tallis for election as our directors.

Each of the persons nominated as director who receives a majority vote at the Annual Meeting will serve until the next annual meeting of stockholders and until his or her successor is duly elected and qualified. Under the terms of our bylaws, in uncontested elections of directors of our Company, a nominee is elected as a director by the affirmative vote of a majority of the votes cast in the election for that nominee (with abstentions and broker non-votes not counted as a vote cast either for or against that director’s election) at the meeting of stockholders at which such election occurs. Under our Corporate Governance Guidelines, if an incumbent director who is a nominee for reelection does not receive the affirmative vote of the holders of a majority of the shares of common stock so voted for such nominee, such incumbent director must promptly tender his or her resignation as a director for consideration by the Nominating and Corporate Governance Committee of our Board and ultimate decision by the Board. The Nominating and Corporate Governance Committee will promptly consider any such tendered resignation and will make a recommendation to our Board as to whether such tendered resignation should be accepted or rejected, or whether other action should be taken with respect to such offer to resign. Any incumbent director whose tendered resignation is under consideration may not participate in any deliberation or vote of the Nominating and Corporate Governance Committee or our Board regarding such tendered resignation. The Nominating and Corporate Governance Committee and our Board may consider any factors they deem relevant in deciding whether to accept, reject or take other action with respect to any such tendered resignation. Within 90 days after the date on which certification of the stockholder vote on the election of directors is made, our Board will publicly disclose its decision and rationale regarding whether to accept, reject or take other action with respect to the tendered resignation. If any incumbent director’s tendered resignation is not accepted by our Board, such director will continue to serve until the next annual meeting of stockholders and until his or her successor is elected and qualified or his or her earlier death or resignation.

Set forth below are the names, principal occupations, committee memberships, ages, directorships held with other companies, if any, and other biographical data for each of the nine nominees for director, as well as the month and year each nominee first began his or her service on our Board. For a discussion of such person’s beneficial ownership of our common stock, see the “Security Ownership of Management and Certain Beneficial Owners” section of this proxy statement.

If any nominee becomes unable to stand for election as a director, an event that our Board does not presently expect, our Board reserves the right to nominate substitute nominees prior to the meeting. In such a case, the Company will file an amended proxy statement that will identify each substitute nominee, disclose whether such nominee has consented to being named in such revised proxy statement and to serve, if elected, and include such other disclosure relating to such nominee as may be required under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Our Board unanimously recommends a vote FOR all nominees.

Nominees for Election as Directors

| | | | | |

| MONTY J. BENNETT |

Age: 58 Director since 2003 Committees: • Acquisitions (chair) | Mr. Bennett was first appointed to our Board in May 2003 and has served as Chairman of our Board since January 2013. He previously served as our Chief Executive Officer from May 2003 to February 2017. Mr. Bennett also currently serves as chair of our Acquisitions Committee. Mr. Bennett is also the Founder, Chairman and Chief Executive Officer of Ashford Inc. and is the Founder and Chairman of Braemar. Mr. Bennett has over 25 years of experience in the hotel industry and has experience in virtually all aspects of the hospitality industry, including hotel ownership, finance, operations, development, asset management and project management. In addition to his roles at Ashford, over his career Mr. Bennett has been a member and leader in numerous industry associations. Mr. Bennett is a lifelong advocate of civic engagement and takes pride in giving back to the Dallas-Fort Worth community. Together with the Ashford companies, he supports numerous charitable organizations including Alzheimer's Association, Habitat for Humanity, North Texas Food Bank, the S.M. Wright Foundation and the Special Olympics. He holds a Master's degree in Business Administration from Cornell's S.C. Johnson Graduate School of Management and received a Bachelor of Science degree with distinction from the School of Hotel Administration also at Cornell. He is a life member of the Cornell Hotel Society. Mr. Bennett's extensive industry experience as well as the strong and consistent leadership qualities he has displayed in his prior role as the Chief Executive Officer and a director of the Company and his experience with, and knowledge of, the Company and its operations gained in those roles and in his role as Chief Executive Officer and director of Ashford Inc. since its inception, are vital qualifications and skills that make him uniquely qualified to serve as a director of the Company and as the Chairman of our Board. |

| |

| | | | | |

| AMISH GUPTA |

Age: 44 Director since 2014 Independent Lead Director Committees: • Related Party Transactions (chair) • Acquisitions | Mr. Gupta was first elected to our Board in May 2014 and currently serves as our lead independent director ("Lead Director"), chair of our Related Party Transactions Committee and as a member of our Acquisitions Committee. Mr. Gupta is the co-founder of Montfort Capital Partners (“Montfort”), an asset management firm specializing in value-add real estate investments throughout the southern United States and has served as Montfort’s Managing Member since 2021. During this time, Montfort has acquired or is under development for over $275 million in assets and secured a programmatic partnership with a national private equity firm. Previously, Mr. Gupta served as a Managing Partner for RETC, LLC from 2010 to 2023, a property tax advisory firm that has represented over $40 billion in asset value nationally, where he was responsible for overall operations and strategy. In March 2023, Mr. Gupta guided RETC through a successful sale to Ryan, a global tax services and software provider that is the largest firm in the world dedicated exclusively to business taxes. Prior to joining RETC, Mr. Gupta served as a real estate associate at the Carlyle Group, a private equity firm headquartered in Washington D.C. with more than $189 billion in assets under management, a position he held for three years. Mr. Gupta received his MBA from the Kellogg School of Management and his B.A. from Emory University. Mr. Gupta’s extensive real estate knowledge, stemming from his experiences with Montfort, RETC, and the Carlyle Group, combined with his business acumen, will generate valuable insights into the economic environment of the real estate industry for the Board. |

| | | | | |

| J. ROBISON HAYS, III |

Chief Executive Officer and President Age: 46 Director since 2020 | Mr. Hays was appointed to our Board effective June 2020. He has served as our Chief Executive Officer and President since May 2020 and prior to that served as our Chief Strategy Officer since 2015 and our Senior Vice President-Corporate Finance and Strategy since 2010. He has been with our Company since 2005. Mr. Hays also currently serves as Senior Managing Director at Ashford Inc. and served on its board of directors until June 2020. Mr. Hays also previously served as Chief Strategy Officer for Braemar until May 2020. Prior to 2013, in addition to his other responsibilities, Mr. Hays was in charge of our investor relations group. Mr. Hays is a frequent speaker at industry and Wall Street investor conferences. Prior to joining our Company, Mr. Hays worked in the Corporate Development office of Dresser, Inc., a Dallas-based oil field service and manufacturing company, where he focused on mergers, acquisitions and strategic direction. Before working at Dresser, Mr. Hays was a member of the Merrill Lynch Global Power & Energy Investment Banking Group based in Texas. Mr. Hays has been a frequent speaker at various lodging, real estate and alternative investment conferences around the globe. He earned his A.B. degree in Politics with a certificate in Political Economy from Princeton University and later studied philosophy at the Pontifical University of the Holy Cross in Rome, Italy. Mr. Hays' extensive industry experience as well as the strong and consistent leadership qualities he has displayed as Chief Executive Officer and President and as a director of the Company and his experience with, and knowledge of, the Company and its operations gained in such roles are vital qualifications and skills that make him uniquely qualified to serve as a director of the Company. |

| | | | | |

| KAMAL JAFARNIA |

Age: 57 Director since 2013 Independent Committees: • Nominating and Corporate Governance (chair) • Compensation | Mr. Jafarnia was appointed to our Board effective January 2013 and currently serves as chair of our Nominating and Corporate Governance Committee and as a member of our Compensation Committee. Mr. Jafarnia currently serves as General Counsel, Executive Vice President and Secretary of Opto Investments, Inc. (f/k/a Lonsdale Investment Technology, Inc.). Effective May 2021, the Board of Trustees of Bluerock Total Income + Real Estate Fund appointed Mr. Jafarnia to serve as an Independent Trustee, and, since March of 2022 Mr. Jafarnia has served as an Independent Trustee of the Bluerock High Income Institutional Credit Fund. From June 2019 through October 2022, he served as a non-executive independent director of Bluerock Residential Growth REIT (NYSE American: BRG), a publicly listed REIT that focuses on the acquisition of multi-family apartment properties which ultimately sold its assets to Blackstone. Since October 2022 Mr. Jafarnia has served as a non-executive independent director of Bluerock Homes Trust, Inc. (NYSE: BHM), a publicly listed REIT that focuses on the acquisition of single-family residential properties. Previously, Mr. Jafarnia served as General Counsel and Chief Compliance Officer at Artivest Holdings, Inc., which position he held from October 2018 to February 2021, and as Chief Compliance Officer of Altegris Advisors, LLC, which was the advisor to the Altegris KKR Commitments Fund. Prior to that, Mr. Jafarnia served as Managing Director for Legal and Business Development at Provasi Capital Partners LP. Prior to that, from October 2014 to December 2017, he served as Senior Vice President of W.P. Carey Inc. (NYSE: WPC), as well as Senior Vice President and Chief Compliance Officer of Carey Credit Advisors, Inc. and as Chief Compliance Officer and General Counsel of Carey Financial, LLC. Prior to joining W. P. Carey Inc., Mr. Jafarnia served as Counsel to two American Lawyer Global 100 law firms in New York. From March 2014 to October 2014, Mr. Jafarnia served as Counsel in the REIT practice group at the law firm of Greenberg Traurig, LLP. From August 2012 to March 2014, Mr. Jafarnia served as Counsel in the Financial Services & Products Group and was a member of the REIT practice group of Alston & Bird, LLP. Between 2006 and 2012, Mr. Jafarnia served as a senior executive, in-house counsel, and Chief Compliance Officer for several alternative investment program sponsors, including, among others, American Realty Capital, a real estate investment program sponsor, and its affiliated broker-dealer, Realty Capital Securities, LLC. Mr. Jafarnia received his J.D. from Temple University School of Law and LL.M. from Georgetown University. Mr. Jafarnia is a licensed attorney admitted to practice law in four states and the District of Columbia and has spent a majority of his career specifically as a regulatory compliance officer. Mr. Jafarnia has over 24 years of experience in the real estate and financial services industry as an attorney, owner, principal, compliance officer and executive. His experience in these multiple roles provides unique perspectives and benefits to the Board, including specifically with respect to regulatory compliance. Mr. Jafarnia also has and maintains numerous relationships in the real estate industry that may be beneficial to his service on the Board. In addition, Mr. Jafarnia brings his experience with, and knowledge of, the Company and its operations gained as a director of the Company since January 2013 to his role as a director of the Company. |

| | | | | |

| DAVID W. JOHNSON |

Age: 62 Age: 62Director Nominee | Mr. Johnson is the Co-Founder and Managing Director at Horizon Capital Partners LLC ("Horizon Capital"), a commercial, residential, and mixed-use land acquisition and development company located in McKinney, Texas. Prior to Horizon Capital, Mr. Johnson founded Aimbridge Hospitality, Inc. and served as its Chief Executive Officer from 2003 to 2021. Earlier, he spent 17 years at Wyndham International, as the President of Wyndham Hotels, among other senior-level operations, sales and marketing positions. Mr. Johnson currently serves on the U.S. Travel Association ("USTA") board as a member of the Chairman’s Circle and as a member of USTA’s CEO Roundtable. Mr. Johnson has served as a director of Hilton Grand Vacations Inc. (NYSE: HGV) since 2017. Mr. Johnson previously served on several boards of directors, including Strategic Hotel (NYSE: BEE), where he was also a member of its audit committee and corporate governance committee from 2012 to 2016. From 2009 to 2012, Mr. Johnson served as a director of Gaylord Entertainment (NYSE: GET). He also serves on several nonprofit boards, including the Juvenile Diabetes Research Foundation and the Plano YMCA. Mr. Johnson received his undergraduate degree in business economics from Northeastern Illinois University, graduating with highest honors. The Company believes that Mr. Johnson’s extensive experience at premier hotel management companies as well as his marketing background, will provide our Board with valuable insights. |

| | | | | |

| FREDERICK J. KLEISNER |

Age: 79 Director since 2016 Independent Committees: • Compensation • Audit • Nominating and Corporate Governance Audit Committee Financial Expert | Mr. Kleisner was appointed to our Board in September 2016. Mr. Kleisner held a long illustrious career in the industry, serving as President and a director of Hard Rock Hotel Holdings, LLC, a destination casino and resort company, from October 2007 to March 2011. From December 2007 until March 2011, Mr. Kleisner also served as Chief Executive Officer of Morgans Hotel Group Co. (NASDAQ: MHGC), or Morgans, a hospitality company, and as President and Chief Executive Officer (including interim President and Chief Executive Officer) of Morgans from September 2007 until March 2009. Mr. Kleisner also served as a director of Morgans from February 2006 until March 2011. From January 2006 to September 2007, Mr. Kleisner was the Chairman and Chief Executive Officer of Rex Advisors, LLC, a hotel advisory firm. From August 1999 to December 31, 2005, Mr. Kleisner served as President, Chief Operating Officer and, from March 2000 to August, 2005, Chairman, President and Chief Executive Officer of Wyndham International, Inc., a global hotel company. Mr. Kleisner also served as Chairman of Wyndham International’s Board from October 2000 to August 2005. From January 1998 to August 1999, he served as President and Chief Operating Officer of The Americas for Starwood Hotels & Resorts Worldwide, Inc. Hotel Group. He has held senior positions with Westin Hotels and Resorts Worldwide, where he served as President and Chief Operating Officer from 1995 to 1998,Interstate Hotels Company, where he served as Executive Vice President and Group President of Operations from 1990 to 1995, the ITT Sheraton Corporation, where he served as Senior Vice President, Director of Operations, North America Division-East from 1985 to 1990, and Hilton Hotels, Corp. where for 16+ years he served as General Manager or Managing Director of several landmark hotels. Mr. Kleisner served as a director of Caesars Entertainment Corporation (NASDAQ: CZR) from 2013 to October 2017, Kindred Healthcare, Inc. (NYSE: KND) from 2009 to July 2018, and Apollo Residential Mortgage, Inc. (formerly NYSE: AMTG), a real estate investment trust, from July 2011 to August 2016. From November 2007 to August 2010, Mr. Kleisner served as a director of Innkeepers USA Trust, a subsidiary of Apollo Investment Corporation (NASDAQ: AINV). He is currently a director of Athora Holdings, Ltd., a specialist solutions provider for the European insurance and reinsurance market, European Gtd. Life & Reinsurance Co, Playtime, LLC, a manufacturer of antibacterial and antimicrobial playground equipment and play systems from 2018 to 2021, and Aimbridge Hospitality, Inc., a hotel investment and management firm from 2017 to 2019. Mr. Kleisner graduated from Michigan State University with a B.A. in Hotel Management, and currently serves as a Real Estate Investment Management Advisory Board member of Michigan State University's Eli Broad College of Business, School of Hospitality Business. He also completed advanced studies at the University of Virginia, Darden School of Business and attended the Catholic University of America. Mr. Kleisner's extensive, impressive experience in the management and operation of companies in the hospitality industry enables him to provide the Board with a wealth of knowledge regarding operational issues facing companies in the hospitality industry and a business acumen essential to guiding the Company's strategy. |

| | | | | |

| SHERI L. PANTERMUEHL |

Age: 67 Director since 2016 Independent Committees: • Audit (chair) • Related Party Transactions Audit Committee Financial Expert | Ms. Pantermuehl was first elected to our Board in May 2018 and currently serves as the chair of our Audit Committee and as a member of our Related Party Transactions Committee. Ms. Pantermuehl has served as the Chief Financial Officer of Alan Ritchey, Inc. since May 2015, which has operations in the transportation and agriculture segments. From February 2011 to April 2015, Ms. Pantermuehl performed back office functions and acted as the Chief Financial Officer for a number of small to medium size firms, including a software development/document imaging firm and a bio-technology firm. From April 2007 to January 2011, Ms. Pantermuehl served as Controller and Chief Financial Officer of Riptide Worldwide, Inc. Prior to that, Ms. Pantermuehl served as the Chief Financial Officer of Intrametrics Corporation and Vertical Computer Systems, Inc., and as Director of Finance of Blockbuster, Inc. Ms. Pantermuehl is a former Treasurer and member of the board of directors of the Arthritis Foundation. Ms. Pantermuehl received a bachelor's degree in Business Administration with an emphasis in Accounting and Finance from Texas A&M University and graduated magna cum laude. As a financial executive with over 28 years of experience as chief financial officer/controller of different companies and an innovative leader with significant successes in reducing operational costs and implementing effective strategies for business growth, Ms. Pantermuehl brings a valuable perspective on financial and related matters to the Board. |

| | | | | |

| DAVINDER "SONNY" SRA |

Age: 71 Director since 2023 Independent

| Mr. Sra was first elected to our Board in July 2023. From 1995 to March 2020, Mr. Sra served in positions of escalating importance with Remington Lodging & Hospitality, LLC (“Remington Hospitality”). Remington Hospitality is a hotel management company and was acquired by Ashford Inc., the Company’s advisor, in November 2019. Mr. Sra retired from Remington Hospitality in March 2020 as Senior Vice President of Operations. Mr. Sra received a Bachelor of Science degree from Punjab University, India, and a Master of Business Administration degree from Georgia Southern University. Mr. Sra brings over 28 years of senior leadership experience in the hotel industry to his role as a member of our Board. Mr. Sra is a results-driven operations executive with a strong track record of success in high-end luxury brands, hotels, resorts and spas. |

| | | | | |

| ALAN L. TALLIS |

Age: 77 Director since 2013 Independent Committees: • Compensation (chair) • Audit • Related Party Transactions Audit Committee Financial Expert | Mr. Tallis has served on our Board since his appointment in January 2013. Mr. Tallis currently serves as the chair of our Compensation Committee and as a member of our Audit Committee and Related Party Transactions Committee. Mr. Tallis is currently principal of Alan L. Tallis & Associates, a consulting firm principally engaged in serving the lodging industry and providing litigation support. Mr. Tallis was appointed to the Advisory Board of Stonehill Strategic Hotel Credit Opportunity Fund II in 2008 and currently serves on a number of Advisory Boards for ownership and debt funds sponsored by or through Peachtree Hotel Group. From March 2008 through February 2011, Mr. Tallis served as Executive Vice President, Asset Management for our Company, and from February 2011 through January 2012, Mr. Tallis served as a consultant to our Company. From June 2006 to May 2007, Mr. Tallis served as a senior advisor to Blackstone Real Estate Advisors following its acquisition of La Quinta Corporation. From July 2000 until May 2006, Mr. Tallis served in various positions with La Quinta Corporation, most recently serving as President and Chief Development Officer of LQ Management LLC and President of La Quinta Franchising LLC. Prior to joining La Quinta Corporation, Mr. Tallis held various positions with Red Roof Inns, including serving as Executive Vice President-Chief Development Officer and General Counsel from 1994 to 1999. Mr. Tallis received an MBA from the Red McCombs School of Business at the University of Texas at Austin and a J.D. from the University of Miami. Mr. Tallis has over 44 years of experience in the lodging industry, including his responsibility for the growth of both of La Quinta Inns and Red Roof Inns. His diverse experience has included extensive transaction work, brand management and brand relations. In addition to his extensive experience in the lodging industry, Mr. Tallis' service with our Company, first as our Executive Vice President, Asset Management and then as a consultant and as a director of the Company, allows him to bring a valuable perspective to the Board. |

Summary of Director Qualifications, Skills, Attributes and Experience

Our Nominating and Corporate Governance Committee and the full Board believe a complementary mix of diverse qualifications, skills, attributes, and experiences will best serve the Company and its stockholders. The summary of our director nominees' qualifications, skills, attributes, and experiences that appears below, and the related narrative for each director nominee appearing in the directors' biographies above, notes some of the specific experience, qualifications, attributes, and skills for each director that our Board considers important in determining that each nominee should serve on the Board in light of the Company's business, structure, and strategic direction. The absence of a checkmark for a particular skill does not mean the director in question is unable to contribute to the decision-making process in that area.

(1) Mr. Hays does not subscribe to certain notions of gender and therefore chose to identify as "Other" rather than Male or Female.

CORPORATE GOVERNANCE

Our Board is committed to corporate governance practices that promote the long-term interests of our stockholders. The Board regularly reviews developments in corporate governance and updates the Company's corporate governance framework, including its corporate governance policies and guidelines, as it deems necessary and appropriate. Our policies and practices reflect corporate governance initiatives that comply with the listing requirements of the NYSE and the corporate governance requirements of the Sarbanes-Oxley Act of 2002. We maintain a corporate governance section on our website, which includes key information about our corporate governance initiatives including our Corporate Governance Guidelines, charters for the committees of our Board, our Code of Business Conduct and Ethics and our Code of Ethics for the Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer. The corporate governance section can be found on our website at www.ahtreit.com by clicking the "Investor" tab, then the "Corporate Governance" tab, and then the "Governance Documents" link.

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics applies to each of our directors and officers (including our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer and our Executive Vice President, General Counsel and Secretary (or their respective successors)) and employees. The term "officers and employees" includes individuals who (i) are employed directly by us, if any (we do not currently employ any employees) or (ii) are employed by Ashford Inc., our advisor or their subsidiaries and (a) have been named one of our officers by our Board or (b) have been designated as subject to the Code of Business Conduct and Ethics by the legal department of our advisor. Among other matters, our Code of Business Conduct and Ethics is designed to deter wrongdoing and to promote:

•honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest;

•full, fair, accurate, timely and understandable disclosure in our reports filed with the SEC and our other public communications;

•compliance with applicable governmental laws, rules and regulations;

•prompt internal reporting of violations of the code to appropriate persons identified in the code;

•protection of Company assets, including corporate opportunities and confidential information; and

•accountability for compliance to the code.

Any waiver of the Code of Business Conduct and Ethics for our executive officers or directors may be made only by our Board or one of our Board committees and will be promptly disclosed if and to the extent required by law or stock exchange regulations.

Stockholder Outreach

We value the views and opinions of our stockholders and believe strong corporate governance practices demand regular outreach and conversations with our stockholders. We understand the vital role of effective communication with our stockholders. As part of that understanding, management actively engages with stockholders at numerous investor road shows, industry and investment community conferences, and meetings with analysts. We also respond to individual stockholders who express interest in our business. During 2023, we proactively reached out to approximately the top 50 institutional stockholders (who held approximately 35% of shares outstanding) and offered them an opportunity to discuss operations, financial, governance, compensation or any other issues they wanted to discuss. As part of that outreach initiative, we created a comprehensive investor deck that highlighted 1) our company strategy, 2) our focus on corporate social responsibility, 3) our executive compensation program, and 4) our commitment to strong corporate governance. In addition to this proactive outreach program, we also met with many of our stockholders by presenting virtual investor presentations, conducting analyst meetings and attending investor conferences and meetings. We regularly discuss our operations, financial performance, industry, governance and compensation matters with stockholders. During 2023, we obtained meaningful feedback on our stockholders’ perception and understanding of our business, markets and industry as well as our strategic financing and governance practices as follows:

| | | | | |

| What We Heard Stockholders Request | How We Responded |

| Pay Down Strategic Financing | In 2024, we provided an update on our plan to pay off our strategic financing, which has a final maturity date in January 2026. This plan includes raising sufficient capital through a combination of asset sales, mortgage debt refinancings, and non-traded preferred capital raising. As detailed in a January 31, 2024 announcement, the Company currently has several assets at various stages of the sales process. The Company is unlikely to sell all of these assets, but plans to determine which assets are capturing the most attractive valuations and resulting in the largest impact to its deleveraging effort. Additionally, the Company believes there could be substantial excess proceeds from the refinancing of the Renaissance Nashville loan which can be used to pay down the Company’s strategic financing. |

| Deleverage the Company's Balance Sheet | The Company is committed to significantly deleveraging and has reduced debt by over $1 billion over the past several years. Additional deleveraging will occur as the Company continues to sell certain assets and pays down its strategic financing. In addition, on March 11, 2024 the Company announced progress on its deleveraging plan with the sale of the Residence Inn Salt Lake City for $19.2 million. When adjusted for the Company’s anticipated capital expenditures, the sale price represented a 4.6% capitalization rate on 2023 net operating income, or 18.2x 2023 Hotel EBITDA. Excluding the anticipated capital spend, the sale price represented a 6.0% capitalization rate on 2023 net operating income, or 14.0x 2023 Hotel EBITDA. All of the proceeds from the sale were used to pay down debt. |

| Create a Path to Reinstate the Common Dividend | The Company is currently prohibited from paying a common dividend due to the terms of its strategic financing. To the extent the Company is successful in paying off its strategic financing, the Board of Directors will consider reinstating a common dividend that is appropriate for the Company at that time, taking into account numerous factors including the state of the lodging industry, the health of the economy, interest rates, and inflation. |

| Continue to Focus on Broadening Diversity | The Company believes that having different perspectives and backgrounds is an important factor in corporate governance. As a result, we added an additional person from an underrepresented minority group to the Board in 2023, and five of the nine proposed directors bring either ethnic or gender diversity perspectives to our Board. The Board and the Nominating and Corporate Governance Committee continue to assess the effectiveness of the Board’s diversity efforts as part of the annual board evaluation process. |

| Explanation of 2021 Reverse Stock Split | In 2021, we implemented a reverse share split to meaningfully increase the Company’s market price of the stock above the threshold required by many institutional investors to hold shares and to ensure we remained in compliance with the New York Stock Exchange’s continued listing standards. |

| Continue Commitment to Corporate Governance | Mr. Jafarnia has served on our board of directors since 2013 and brings substantial industry expertise to our board. In particular, Mr. Jafarnia's extensive experience in raising capital in the independent broker-dealer industry is crucial for the Company as it believes that a substantive amount of its future growth capital going forward may be sourced from the independent broker-dealer sector. In addition, in his role as Chair of the Nominating and Corporate Governance Committee, Mr. Jafarnia has recruited an additional person from an underrepresented minority group to serve as a director on our Board. |

Board Leadership Structure

Our Board regularly considers the optimal leadership structure for the Company and its stockholders. In making decisions related to our leadership structure, the Board considers many factors, including the specific needs of the Company in light of its current strategic initiatives and the best interests of stockholders.

To further minimize the potential for future conflicts of interest, our bylaws and our Corporate Governance Guidelines, as well as the NYSE rules applicable to its listed companies, require that the Board must maintain a majority of independent directors at all times, and our Corporate Governance Guidelines require that if the Chairman of the Board is not an independent director, at least two-thirds of the directors must be independent. Currently, all of our directors other than Mr. Monty J. Bennett and Mr. Hays are independent directors. Our Board must also comply with each of our conflict of interest policies discussed in "Certain Relationships and Related Person Transactions-Conflict of Interest Policies." Our bylaw provisions, governance policies and conflicts of interest policies are designed to provide a strong and independent board and ensure independent director input and control over matters involving potential conflicts of interest.

In 2019, our Board appointed Amish V. Gupta to serve as the Lead Director for a one-year term. In subsequent years, our Board re-appointed Mr. Gupta to serve as the Lead Director for an additional one-year term. Under our Corporate Governance Guidelines, the Lead Director has the following duties and responsibilities:

•preside at all executive sessions of the independent or non-executive directors of the Company;

•advise Chairman of the Board and Chief Executive Officer of decisions reached and suggestions made at meetings of independent directors or non-executive directors;

•serve as liaison between the Chairman of the Board and the independent directors;

•approve information sent to the Board;

•approve meeting agendas for the Board;

•approve meeting schedules to assure that there is sufficient time for discussion of all agenda items;

•authorize the calling of meetings of the independent directors; and

•if requested by major stockholders, be available for consultation and direct communication.

Our Board believes that our leadership structure provides a very well-functioning and effective balance between strong company leadership and appropriate safeguards and oversight by independent directors.

Board Role

Subject to the advisory agreement entered into by the Company, Ashford Inc., Ashford Hospitality Limited Partnership ("AHLP"), Ashford TRS Corporation and Ashford LLC, as amended from time to time (the "advisory agreement"), the business and affairs of the Company are managed by or under the direction of our Board in accordance with Maryland law. Our Board provides direction to, and oversight of, management of the Company. In addition, our Board establishes the strategic direction of the Company and oversees the performance of the Company's business, management and the employees of our advisor who provide services to the Company. Subject to our Board's supervision, our advisor is responsible for the day-to-day operations of the Company and is required to make available sufficient experience and appropriate personnel to serve as executive officers of the Company. The management of the Company is responsible for presenting business objectives, opportunities and/or strategic plans to our Board for review and approval and for implementing the Company's strategic direction and the Board's directives.

Strategy

Our Board recognizes the importance of ensuring that our overall business strategy is designed to create long-term value for our stockholders and maintains an active oversight role in formulating, planning and implementing the Company's strategy. Our Board regularly considers the progress of, and challenges to, the Company's strategy and related risks throughout the year. At each regularly-scheduled Board meeting, the management and the Board discuss strategic and other significant business developments since the last meeting and the Board considers, recommends and approves changes, if any, in strategies for the Company.

Risk Oversight

Our full Board has ultimate responsibility for risk oversight, but the committees of our Board help oversee risk in areas over which they have responsibility. The Board does not view risk in isolation. Risks are considered in virtually every business decision and as part of the Company's business strategy. Our Board and the Board committees receive regular updates related to various risks for both our Company and our industry. The Audit Committee regularly receives and discusses reports from members of management who are involved in the risk assessment and risk management functions of our Company. The Compensation Committee annually reviews the overall structure of our equity compensation programs to ensure that those programs do not encourage executives to take unnecessary or excessive risks.

Succession Planning

Our Board, acting through the Nominating and Corporate Governance Committee, has reviewed and concurred in a management succession plan, developed by our advisor in consultation with the Chairman, to ensure continuity in senior management. This plan, on which the Chief Executive Officer is to report to the Board from time to time, addresses:

•emergency Chief Executive Officer succession;

•Chief Executive Officer succession in the ordinary course of business; and

•succession for the other members of senior management.

The plan also includes an assessment of senior management experience, performance, skills and planned career paths.

Board Observers

On January 15, 2021, the Company entered into a credit agreement with certain funds and accounts managed by Oaktree Capital Management, L.P. ("Oaktree"). In connection with the transactions contemplated by the credit agreement, on January 15, 2021, Ashford Trust entered into an Investor Agreement (the "Investor Agreement") with Oaktree. The Investor Agreement, among other things, provides Oaktree the right to appoint two observers to the Board, until such time, and subject to certain limitations, as more fully described in the Investor Agreement.

Board Refreshment

In addition to ensuring the Board reflects an appropriate mix of experiences, qualifications, attributes and skills, the Nominating and Corporate Governance Committee also focuses on director succession. In 2023, based on consideration of best corporate governance practices and upon the recommendation of the Nominating and Corporate Governance Committee, the Board amended its Corporate Governance Guidelines to remove the requirement that a director, upon attaining the age of 70 and annually thereafter, or an individual who would be 70 years of age at the time of his or her election as a director, may not serve on the Board unless the Board waives such limitation.

Director Nomination Procedures by the Company

The Nominating and Corporate Governance Committee recommends qualified candidates for Board membership based on the following criteria:

•integrity, experience, achievements, judgment, intelligence, competence, personal character, expertise, skills, knowledge useful to the oversight of the Company's business, ability to make independent analytical inquiries, willingness to devote adequate time to board duties and likelihood of a sustained period of service on the Board;

•business or other relevant experience; and

•the extent to which the interplay of the candidate's expertise, skills, knowledge and experience with that of other board members will build a board that is effective, collegial and responsive to the needs of the Company.

In connection with the merit-based selection of nominees for director, the Board has regard for the need to consider director candidates from different and diverse backgrounds, including sex, race, color, ethnicity, age and geography. Consideration will also be given to the Board's desire for an overall balance of professional diversity, including background, experience, perspective, viewpoint, education and skills. In early 2018, our Board approved specific amendments to the "Selection of Directors" section of our Corporate Governance Guidelines to more specifically include diversity of sex, race, color, ethnicity, age and geography when considering director candidates. The Board, taking into consideration the recommendations of the Nominating and Corporate Governance Committee, is responsible for selecting the director nominees for election by the stockholders and for appointing directors to the Board between annual meetings to fill vacancies, with primary emphasis on the criteria set forth above. The Board and the Nominating and Corporate Governance Committee assess the effectiveness of the Board's diversity efforts as part of the annual board evaluation process.

Stockholder Nominations

Our bylaws permit stockholders to nominate candidates for election as directors of the Company at an annual meeting of stockholders. Stockholders wishing to nominate director candidates can do so by providing a written notice to the Corporate Secretary, Ashford Hospitality Trust, Inc., 14185 Dallas Parkway, Suite 1200, Dallas, Texas 75254. Stockholder nomination notices and the accompanying certificate, as described below, must be received by the Corporate Secretary not earlier than November 29, 2024 and not later than 5:00 p.m., Eastern time, on December 29, 2024 for the nominated individuals to be considered for candidacy at the 2025 annual meeting of stockholders. Such nomination notices must include all information regarding the proposed nominee that would be required to be disclosed in connection with the solicitation of proxies for the election of the proposed nominee as a director in an election contest pursuant to the SEC's proxy rules under the Exchange Act, as well as certain other information regarding the proposed nominee, the stockholder nominating such proposed nominee and certain persons associated with such stockholder, and must be accompanied by a certificate of the nominating stockholder as to certain matters, all as prescribed in the Company's bylaws. A detailed description of the information required to be included in such notice and the accompanying certificate is included in the Company's bylaws. You may contact the Corporate Secretary at the address above to obtain a copy of the relevant bylaw provisions regarding the requirements for making stockholder nominations. Failure of the notice and certificate to comply fully with the

requirements of the Company's bylaws in such regard will result in the stockholder nomination being invalid and the election of the proposed nominee as a director of the Company not being voted on at the pertinent annual meeting of stockholders.

Stockholder and Interested Party Communication with our Board of Directors

Stockholders and other interested parties who wish to contact any of our directors either individually or as a group may do so by writing to them c/o the Corporate Secretary, Ashford Hospitality Trust, Inc., 14185 Dallas Parkway, Suite 1200, Dallas, Texas 75254. Stockholders' and other interested parties' letters are reviewed by Company personnel based on criteria established and maintained by our Nominating and Corporate Governance Committee, which includes filtering out improper or irrelevant topics such as solicitations.

Director Orientation and Continuing Education

Our Board and senior management conduct a comprehensive orientation process for new directors to become familiar with our vision, strategic direction, core values including ethics, financial matters, corporate governance policies and practices and other key policies and practices through a review of background material and meetings with senior management. Our Board also recognizes the importance of continuing education for directors and is committed to providing education opportunities to improve both our Board's and its committees' performance. Senior management will assist in identifying and advising our directors about opportunities for continuing education, including conferences provided by independent third parties.

Director Change in Occupation

Upon the time a director's principal occupation or business association changes substantially from the position he or she held when originally invited to join the Board, a director is required to tender a letter of proposed resignation from our Board to the chair of our Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee, in consultation with our Chairman, will review the director's continuation on our Board and recommend to the Board whether, in light of all the circumstances, our Board should accept such proposed resignation or request that the director continue to serve.

Hedging and Pledging Policies

We maintain a policy that prohibits our directors and executive officers from holding Company securities in a margin account or pledging Company securities as collateral for a loan. Our policy also prohibits our directors and executive officers from engaging in speculation with respect to Company securities, and specifically prohibits our executives from engaging in any short-term, speculative securities transactions involving Company securities and engaging in hedging transactions.

BOARD OF DIRECTORS AND COMMITTEES

Our business is managed through the oversight and direction of our Board. Members of our Board are kept informed of our business through discussions with the Chairman of the Board, Chief Executive Officer, Lead Director and other officers, by reviewing materials provided to them and by participating in meetings of our Board and its committees.

The Board has retained Ashford Inc. and Ashford LLC to manage our operations and our portfolio of hotel assets, subject to the Board's oversight and supervision and the terms and conditions of the advisory agreement. Because of the conflicts of interest created by the relationships among us, Ashford Inc., Braemar, and any other related party, and each of their respective affiliates, many of the responsibilities of the Board have been delegated to our independent directors, as discussed below and under "Certain Relationships and Related Person Transactions- Conflict of Interest Policies."

During the year ended December 31, 2023, our Board held five regular meetings and our non-executive directors, each of whom is an independent director, held four meetings and/or executive sessions. Our Board must hold at least two regularly scheduled meetings per year of the non-executive directors without management present. All of our incumbent directors standing for re-election attended in person or by telephone, at least 75% of all meetings of our Board and committees on which such director served, held during the period for which such person was a director or was a member of such committees, as applicable.

Board Member Independence

Our Board determines the independence of our directors in accordance with our Corporate Governance Guidelines and Section 303A.02(a) of the NYSE Listed Company Manual, which requires an affirmative determination by our Board that the director has no material relationship with us that would impair independence. In addition, Section 303A.02(b) of the NYSE Listed Company Manual sets forth certain tests that, if any of them is met by a director automatically disqualifies that director from being independent from management of our Company. Moreover, our Corporate Governance Guidelines provide that if any director receives, during any 12-month period within the last three years, more than $120,000 per year in direct compensation from the Company, exclusive of director and committee fees and pension or other forms of deferred compensation, he or she will not be considered independent. Our Corporate Governance Guidelines also provide that at all times that the Chairman of the Board is not an independent director, at least two-thirds of the members of the Board should consist of independent directors. The full text of our Board's Corporate Governance Guidelines can be found on our website at www.ahtreit.com by clicking the "Investor" tab, then the "Corporate Governance" tab and then the "Governance Documents" link.

Following deliberations, our Board has affirmatively determined that, with the exception of Mr. Monty J. Bennett, our Chairman, and Mr. J. Robison Hays, III, our Chief Executive Officer and President, each nominee for election as a director of the Company is independent of Ashford Trust and its management and has been such during his or her term as a director commencing with the annual meeting of stockholders of the Company, held on May 9, 2023, under the standards set forth in our Corporate Governance Guidelines and the NYSE Listed Company Manual, and our Board has been since such date and is comprised of a majority of independent directors, as required by Section 303A.01 of the NYSE Listed Company Manual. Any reference to an independent director herein means such director satisfies both the standards set forth in our Corporate Governance Guidelines and the NYSE independence tests.

In addition, each current member of our Audit Committee and our Compensation Committee has been determined by our Board to be independent and to have been independent at all pertinent times under the heightened independence standards applicable to members of audit committees of board of directors and to members of compensation committees of board of directors of companies with equity securities listed for trading on the NYSE and under the rules of the SEC under the Exchange Act and that each nominee for election as a director of the Company at the Annual Meeting is independent under those standards.

In making the independence determinations with respect to our current directors, our Board examined all relationships between each of our directors or their affiliates and Ashford Trust or its affiliates. Our Board determined that none of these transactions impaired the independence of the directors involved.

Board Committees and Meetings

Historically, the standing committees of our Board have been the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, the Related Party Transactions Committee and the Acquisitions Committee. Each of the Audit Committee, Compensation Committee and the Nominating and Corporate Governance Committee is governed by a written charter that has been approved by our Board. A copy of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee charters can be found on our website at www.ahtreit.com by clicking the "Investor" tab, then the "Corporate Governance" tab and then the "Governance Documents" link. The committee members of each active committee and a description of the principal responsibilities of each such committee follows:

Current Committee Membership

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Audit | | Compensation | | Nominating and Corporate Governance | | Related Party Transactions Committee | | Acquisitions |

| Monty J. Bennett | | | | | | | | | | |

| Benjamin J. Ansell, M.D. | | | | | | | | | | |

| Amish Gupta | | | | | | | | | | |

| Kamal Jafarnia | | | | | | | | | | |

| Frederick J. Kleisner | | | | | | | | | | |

| Sheri L. Pantermuehl | | | | | | | | | | |

| Alan L. Tallis | | | | | | | | | | |

(C): Chair

| | | | | | | | | | | | | | |

| Audit Committee |

| Current Members: | | Sheri L. Pantermuehl (chair), Frederick J. Kleisner and Alan L. Tallis |

| Independence | | All of the members of the Audit Committee have been determined by our Board to be independent at all pertinent times, including under the heightened independence standards for members of audit committees of boards of directors. |

| Number of Meetings in 2023: | | Five |

| Key Responsibilities | | • | | Evaluate the performance, qualifications and independence of the independent auditors; |

| | • | | review with the independent auditors and the Chief Financial Officer and Chief Accounting Officer the audit scope and plan; |

| | • | | approve in advance all audit and non-audit engagement fees; |

| | • | | if necessary, to appoint or replace our independent auditors; |

| | • | | meet to review with management and the independent auditors the annual audited and quarterly financial statements; |

| | • | | recommend to our Board whether the Company's financial statements should be included in the Annual Report on Form 10-K; |

| | • | | prepare the audit committee report that the SEC rules and regulations require to be included in the Company's annual proxy statement; |

| | • | | discuss with management the Company's major financial risk exposures and management's policies on financial risk assessment and risk management, including steps management has taken to monitor and control such exposures; |

| | • | | annually review the effectiveness of the internal audit function; |

| | • | | review with management the Company's disclosure controls and procedures and internal control over financial reporting, and review the effectiveness of the Company's system for monitoring compliance with laws and regulations, including the Company's code of conduct and cybersecurity; and |

| | • | | evaluate its own performance and deliver a report to the Board setting forth the results of such evaluation. |

Each current Audit Committee member qualifies as an "audit committee financial expert," as defined by the applicable rules and regulations of the Exchange Act. All of the members of our Audit Committee on and after January 1, 2023 are "financially literate" under the NYSE listing standards.

| | | | | | | | | | | | | | |

| Compensation Committee |

| Current Members: | | Alan L. Tallis (chair), Kamal Jafarnia and Frederick J. Kleisner |

| Independence | | All of the members of the Compensation Committee have been determined by our Board to be independent at all pertinent times, including under the heightened standards for members of the compensation committees of boards of directors. |

| Number of Meetings in 2023: | | Three |

| Key Responsibilities | | • | | Review the Company's equity compensation programs to ensure the alignment of the interests of key leadership with the long-term interests of stockholders; |

| | • | | either as a committee or together with the other independent directors (as directed by our Board), determine and approve the Chief Executive Officer's and Chairman of our Board's equity compensation; |

| | • | | make recommendations to our Board with respect to the equity compensation of other executive officers; |

| | • | | review the performance of our officers; |

| | • | | review and approve the officer compensation plans, policies and programs; |

| | • | | annually review the compensation paid to non-executive directors for service on our Board and make recommendations to our Board regarding any proposed adjustments to such compensation; |

| | • | | prepare an annual report on executive compensation for the Company's annual proxy statement; and |

| | • | | administer the Company's equity incentive plan. |

The Compensation Committee has the authority to retain and terminate any compensation consultant to assist it in the evaluation of officer compensation, or to delegate its duties and responsibilities to one or more subcommittees as it deems appropriate. In 2023, the Compensation Committee retained Gressle & McGinley LLC ("Gressle & McGinley") as its independent compensation consultant. Gressle & McGinley provided competitive market data to support the Compensation Committee's decisions on the value of equity to be awarded to our named executive officers. Gressle & McGinley has not performed any other services for the Company and performed its services only on behalf of, and at the direction of, the Compensation Committee. Our Compensation Committee reviewed the independence of Gressle & McGinley in light of SEC rules and NYSE listing standards regarding compensation consultant independence and has affirmatively concluded that Gressle & McGinley is independent from management of the Company and has no conflicts of interest relating to its engagement by our Compensation Committee.

| | | | | | | | | | | | | | |

| Nominating and Corporate Governance Committee |

| Current Members: | | Kamal Jafarnia (chair), Benjamin J. Ansell, M.D. and Frederick J. Kleisner |

| Independence | | All of the members of the Nominating and Corporate Governance Committee have been determined by our Board to be independent at all pertinent times. |

| Number of Meetings in 2023: | | Seven |

| Key Responsibilities | | • | | Assess, develop and communicate with our Board for our Board's approval the appropriate criteria for nominating and appointing directors; |

| | • | | recommend to our Board the director nominees for election at the next annual meeting of stockholders; |

| | • | | identify and recommend candidates to fill vacancies on our Board occurring between annual stockholder meetings; |

| | • | | when requested by our Board, recommend to our Board director nominees for each committee of our Board; |

| | • | | develop and recommend to our Board our Corporate Governance Guidelines and periodically review and update such Corporate Governance Guidelines as well as make recommendations concerning changes to the charters of each committee of our Board; |

| | • | | perform a leadership role in shaping our corporate governance policies and procedures; and |

| | • | | oversee a self-evaluation of our Board. |

| | | | | | | | | | | | | | |

| Related Party Transactions Committee |

| Members: | | Amish Gupta (chair), Sheri L. Pantermuehl and Alan L. Tallis |

| Number of Meetings in 2023: | | Four |

| Key Responsibilities | | • | | Review any transaction in which our officers, directors, Ashford Inc. or Braemar or their officers, directors or respective affiliates have an interest, including any other related party and their respective affiliates, before recommending approval by a majority of our independent directors. The Related Party Transactions Committee can deny a new proposed transaction or recommend for approval to the independent directors. Also, the Related Party Transactions Committee periodically reviews and reports to our independent directors on past approved related party transactions. |

| | | | | | | | | | | | | | |

| Acquisitions Committee |

| Members: | | Monty J. Bennett (chair), Benjamin J. Ansell, M.D. and Amish Gupta |

| Number of Meetings in 2023: | | None |

| Key Responsibilities | | • | | Review and approve any acquisition or disposition (and any related property level financing) by the Company, or its affiliates of assets valued at under $100 million. |

Director Compensation

From January 1, 2023 to May 8, 2023, each of our non-executive directors (other than our Chairman, Mr. Monty J. Bennett) was entitled to a base cash retainer in an annualized amount of $140,000. Commencing effective as of May 9, 2023, the annual base cash retainer was decreased to $95,000, and each director became eligible for an additional fee of $3,000 for each Board meeting that he or she attends during a year in excess of four meetings. Non-executive directors serving in the following capacities also receive the additional annual cash retainers set forth below:

| | | | | | | | |

| Capacity | | Additional Annual Retainer ($) |

| Lead Director | | $ | 50,000 | |

| Audit Committee Chair | | $ | 25,000 | |

| Compensation Committee Chair | | $ | 15,000 | |