UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

o Definitive Proxy Statement

x Definitive Additional Materials

o Soliciting material Pursuant to Rule 14a-12

MEDIA GENERAL, INC.

(Name of Registrant as Specified In Its Charter)

HARBINGER CAPITAL PARTNERS MASTER FUND I, LTD.

HARBINGER CAPITAL PARTNERS SPECIAL SITUATIONS FUND, L.P.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1) Title of each class of securities to which transaction applies: | |

| 2) Aggregate number of securities to which transaction applies: | |

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was

determined): _______________________________ |

| 4) Proposed maximum aggregate value of transaction: ___________________________ | |

| 5) Total fee paid:_______________________________________________________ | |

| | | | | | |

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify

the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

| 1) Amount Previously Paid:_______________________________________________ |

| 2) Form, Schedule or Registration Statement No.: ______________________________ | |

| 3) Filing Party: | |

| 4) Date Filed: _______________________________________________ | |

| | | | |

The presentation entitled “Rebuilding Value at Media General” attached hereto as Exhibit 1, is filed herewith as additional solicitation materials by Harbinger Capital Partners Master Fund I, Ltd. and Harbinger Capital Partners Special Situations Fund, L.P.

Exhibit 1

Rebuilding Value at

April 1, 2008

HARBINGER CAPITAL PARTNERS

2

Introductions

-- Thank you

-- Attendees from Harbinger

-- Class A nominees

-- Presentation available on EDGAR

3

Agenda

-- Opening Remarks

-- Media General Today: How Did We Get Here?

-- Prescription For The Company

-- Our Nominees

4

Opening Remarks

5

Harbinger’s Investment

-- Harbinger is Media General’s second largest shareholder,

with an 18.2% stake

-- We invested because we believed MEG was undervalued

and an attractive investment, and that management would

act quickly to address the company's declining share price

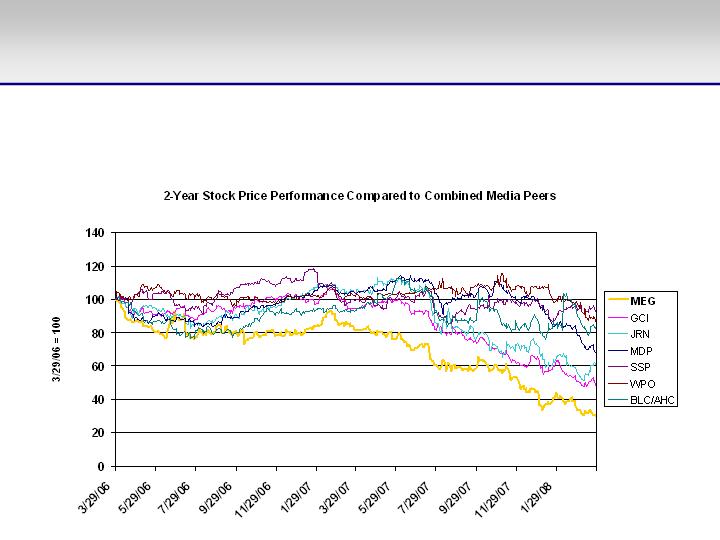

-- The stock has declined 59% since we first invested ten

months ago

-- We're here today, nearly a year after we first became a

shareholder, because we believe the time is appropriate to

enhance the composition of the board in order to rebuild

value for all shareholders

6

Summary of Our Views

1. We believe Media General has been falling behind

its peers for years, has a consistent but consistently

flawed strategy, and has made some major mistakes

-- We believe the composition of the board and the

exclusive presence of directors nominated solely by

the Class B-controlled nominating committee have

allowed these things to occur

-- Moreover, we don't believe the company feels

accountable to its majority public shareholders

7

Summary of Our Views

2. Fixing the company and re-focusing it on rebuilding

shareholder value is possible and doesn't require a

silver bullet

-- In this presentation, we've set forth a series of

strategic and operational principles and initiatives that

we believe will get the company back on track

3. We have nominated three outstanding individuals

who will work with the other directors and help re-

focus the board and management on the company's

core mission of maximizing value for all shareholders

8

Notes About the Data

-- For comparisons to peers we used three sets of

comparables

-- All data for comparables is taken from their fiscal

year end 2007 annual reports unless otherwise noted

Washington Post

Young

Scripps

Sinclair

Meredith

Nexstar

Journal

Communications

McClatchy

Lin TV

Gannett

Lee Enterprises

Hearst-Argyle

Belo (pre-split)

Journal Register

Gray

Combined media

Pureplay newspapers

Pureplay broadcasters

9

Media General Today:

How Did We Get Here?

10

Board Composition

-- To date, 100% of the board has been elected exclusively by

holders of a 2% economic interest in the company or nominated

exclusively by the Class B-controlled nominating committee

-- The majority public shareholders representing a 98% economic

interest have never elected directors independent of Class B

control

Elected by Class A shareholders

but nominated by Class B-

controlled nominating committee

Elected by Class B shareholders

11

Board Composition: Class A Directors

-- The three current Class A directors were all nominated by

the Class B-controlled nominating committee

-- Two of them are lifelong academicians with no stated

business, finance or public board experience except for the

Media General board, and have never purchased MEG

shares personally

-- The third has financial and board experience, but is the

longest serving non-executive director on the board (19

years) and has no stated non-Media General media

experience – whether as an executive, investor, board

member or consultant

12

The Company’s Stated Strategy

“The Company is committed to … successfully executing its

convergence strategy through diversification, forging new partnerships,

and through strategic plans to sell non-core assets and operations.”

“The Company seized strategic opportunities in 2006 which included the

acquisition of four NBC owned and operated television stations as well

as the disposition of several CBS stations in markets which were not

strategically aligned with the Company’s vision.”

“The Company recognizes the challenges facing its Publishing Division

not only from Internet competition, but also … from a generally soft

economy and from a sharp downturn in Florida’s economy…. While

speculation continues to exist regarding the pace and intensity of a shift

away from traditional print advertising, the Company has taken steps to

reposition its newspapers to embrace this change.”

– Media General Inc. 2007 Annual Report

13

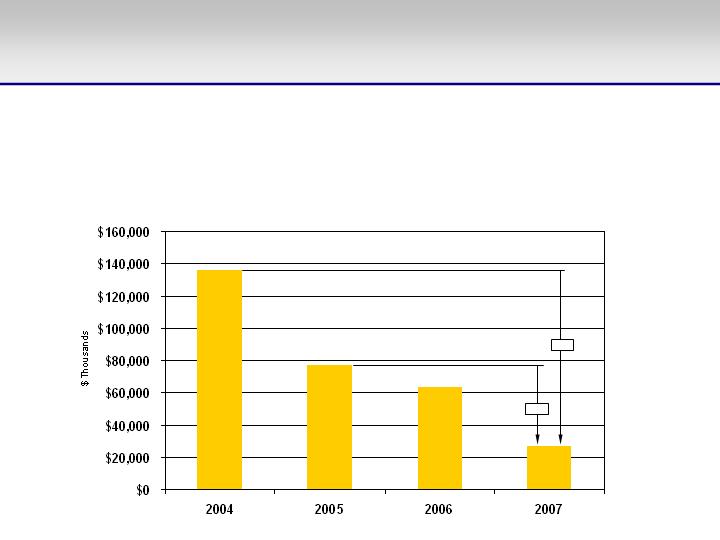

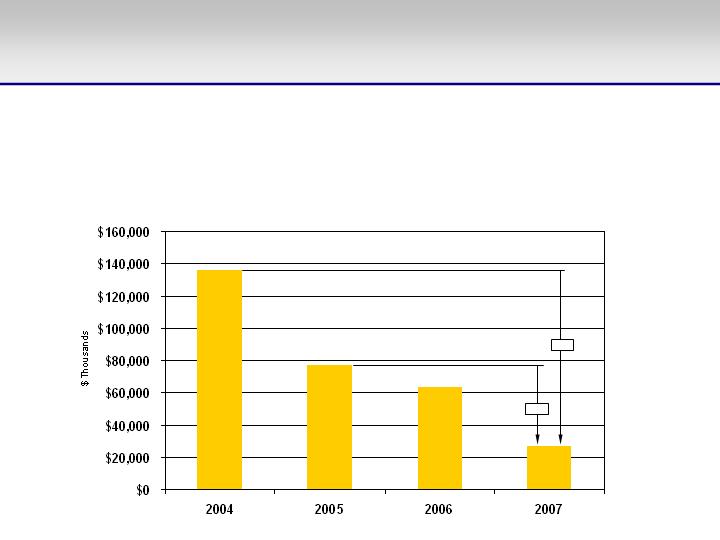

The Board Has Failed Its Shareholders

Consolidated net free cash flow (EBITDA less capex

less interest) has fallen 65% since 2005 and 80% since

2004…

-80%

-65%

14

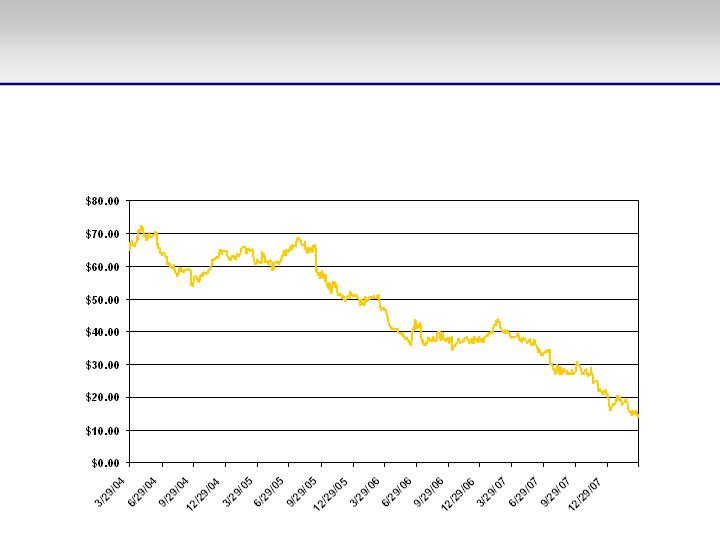

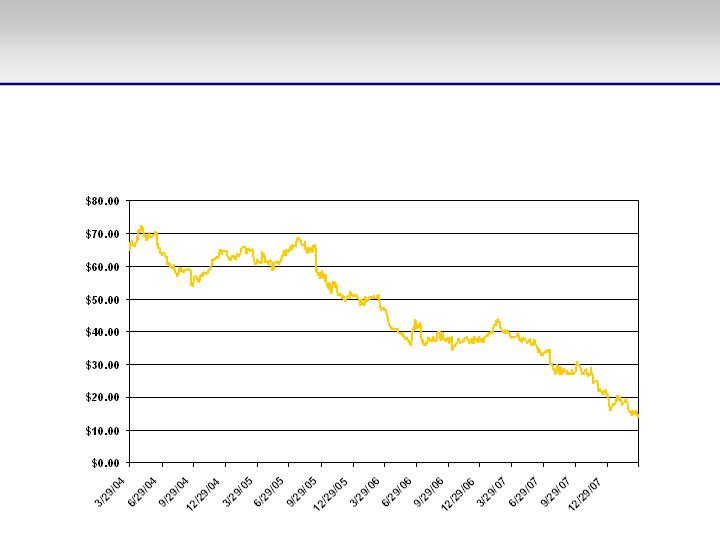

…hurting the company’s stock price, which has fallen

steadily for the last four years…

The Board Has Failed Its Shareholders

15

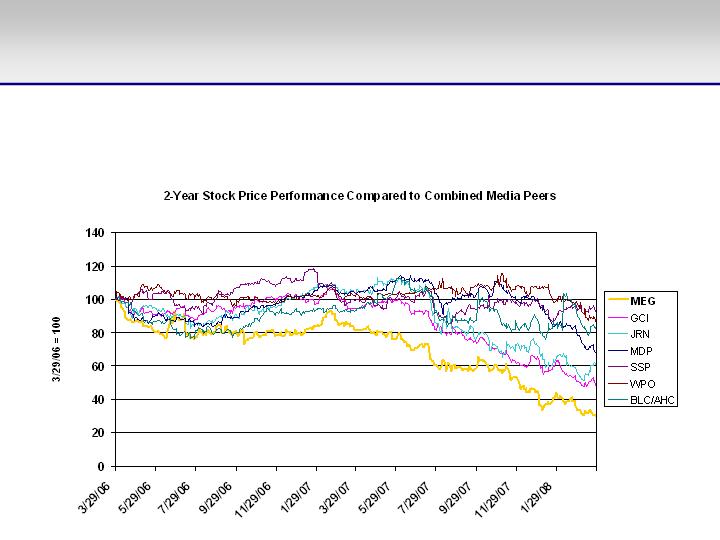

…and has substantially underperformed both the

broader market...

The Board Has Failed Its Shareholders

16

…as well as its peers among combined media

companies.

The Board Has Failed Its Shareholders

17

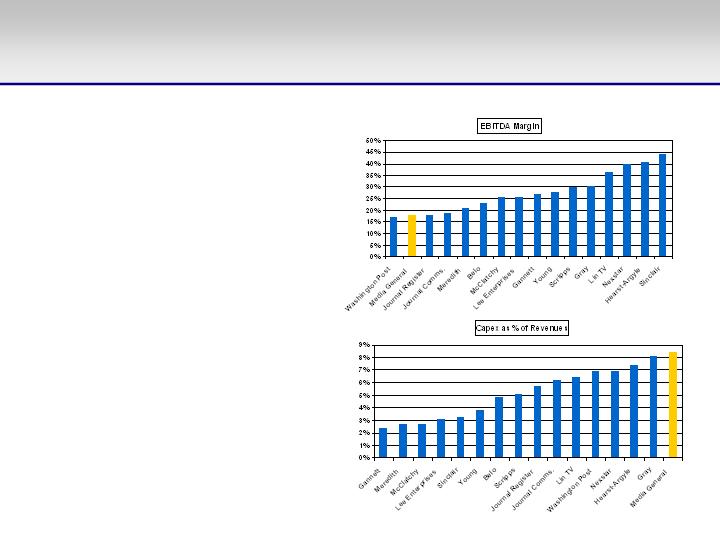

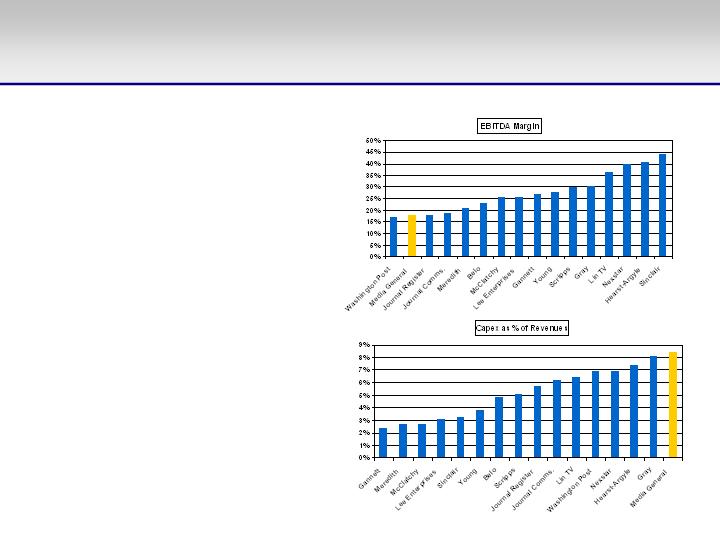

Poor Consolidated Performance

-- In 2007, on a

consolidated basis,

Media General reported

nearly the lowest

EBITDA margin within all

three of its peer groups

-- But the company

outspent all of its peers,

reporting the highest

ratio of capital

expenditures to

revenues

18

Poor Segment Performance – BCF/OCF

-- In 2007, Media General

also reported nearly the

lowest broadcast cash

flow (BCF)margin

among all of its

broadcasting peers

-- The company reported

publishing operating

cash flow in line with the

average of its publishing

peers

19

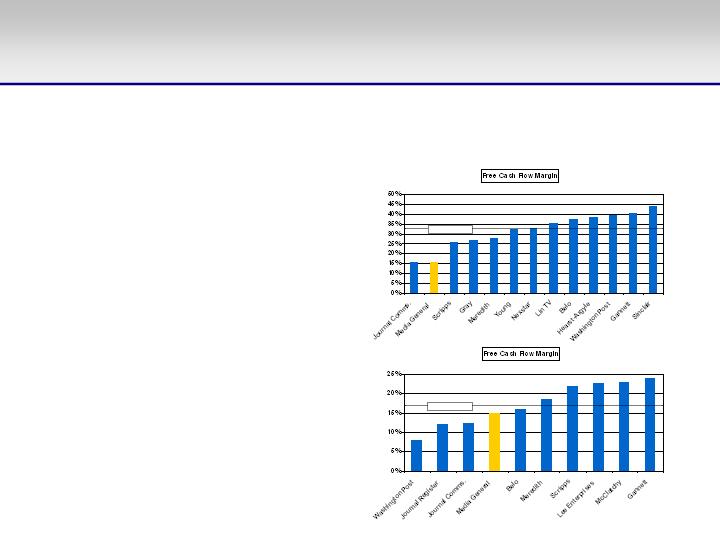

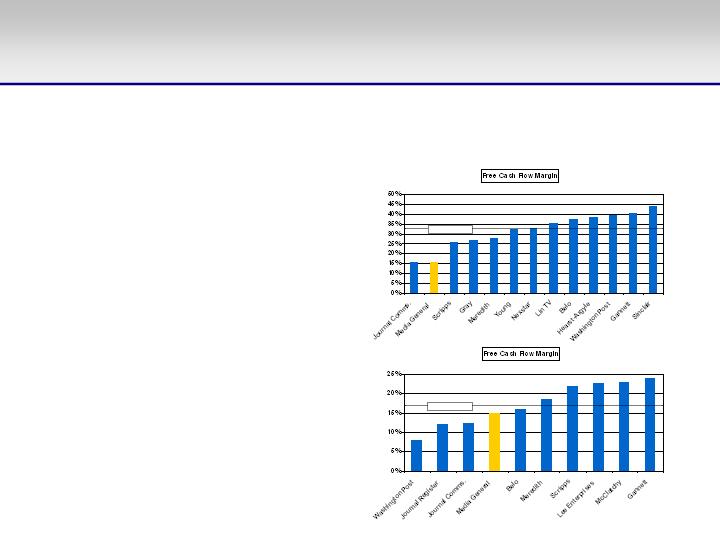

Poor Segment Performance – FCF

-- As a result, the

company’s free cash flow

(FCF) margin for broadcast

was less than half of the

peer average

-- The company’s

publishing FCF margin

was also less than the

peer average

Average = 33%

Average = 17%

-- However, the company also outspent all of its peers in

capex in both broadcast and publishing

20

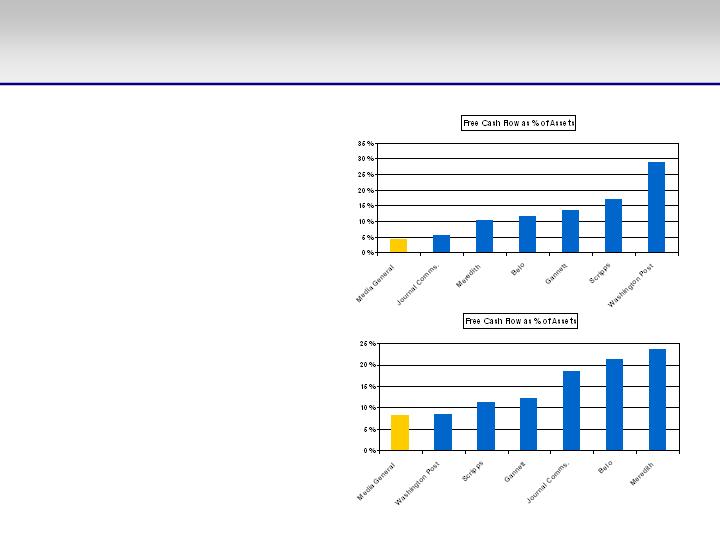

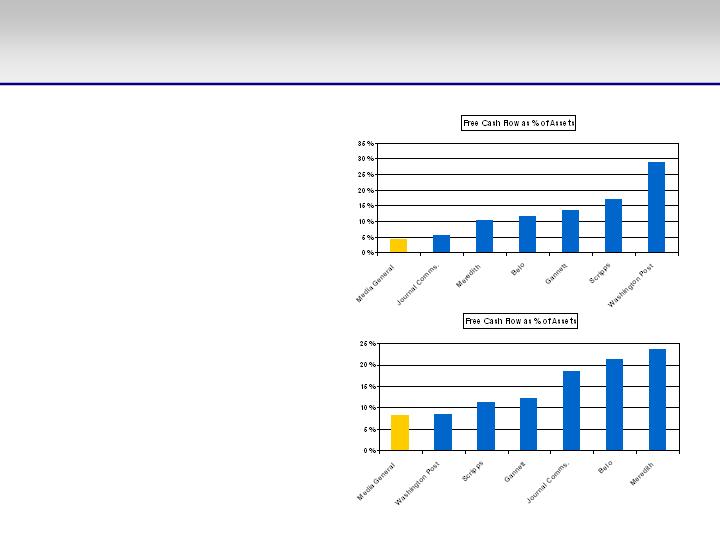

Poor Segment Performance – FCF/Assets

-- In addition, the

company produced only

a 4% free cash flow

return on broadcast

assets

-- And only an 8% free

cash flow return on

publishing assets

8%

4%

21

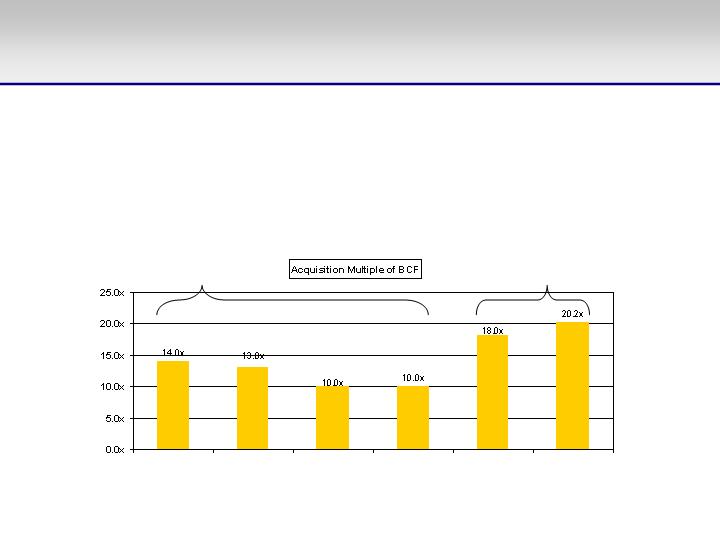

-- In April 2006, the company announced the acquisition of

four NBC owned and operated affiliate stations for

approximately $600 million

-- The stations were located in Birmingham AL, Raleigh, NC,

Columbus, OH, and Providence, RI

-- Within weeks of the announcement in April 2006, the

company’s stock fell more than 10% as we believe the market

concluded that the company had substantially overpaid and

had lost geographic focus by buying large stations outside

the southeast

-- We believe the acquisition also left the company exposed to

excessive risk from network affiliate concentration with NBC

2006 NBC Station Acquisition:

Company Overpaid Substantially

22

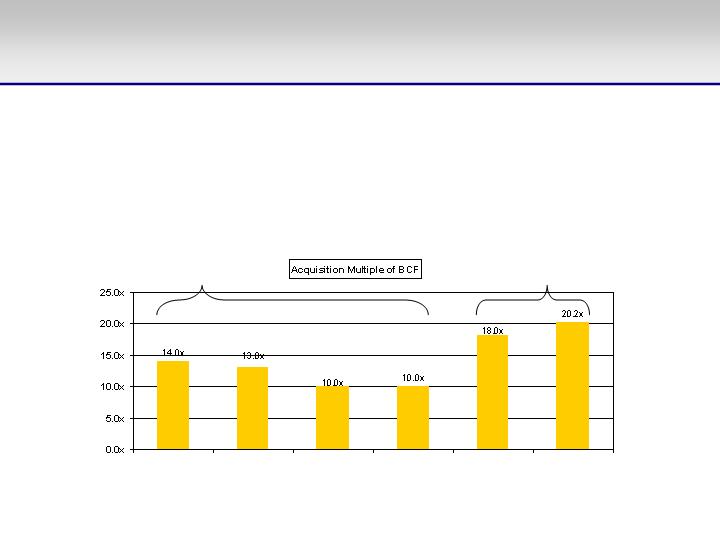

-- The company has made conflicting statements regarding

the BCF multiple paid in the acquisition

-- Based on our estimates, actual forward multiples were

substantially higher than company’s statements then and

now

2006 NBC Station Acquisition:

Company Overpaid Substantially

Sources: (1) Media General press release dated 4/6/06; (2) Media General press release dated 6/26/06; (3) Media General letter dated 3/19/08 attached to 14A proxy materials;

(4)Estimates based on: reported full-year 2005 operating income before depreciation and amortization of $30.3 million for stations acquired; reported full-year 2006 revenues of

$111 million for stations acquired and reported 2006 broadcast segment operating cash flow margin of 33.6% for Media General consolidated; and reported full-year 2007

revenues of $90 million for stations acquired and reported 2007 broadcast segment operating cash flow margin of 25.6% for Media General consolidated

Reported

2004-5 (1)

Reported 2004-5

Assumes synergies

(1)

Reported 2004-5

Assumes synergies

and tax savings (2)

Reported

2004-5 (3)

Est. 2005-6

(4)

Est. 2006-7

(4)

Reported by company

Harbinger estimates

23

Very Limited Use of Broadcast Duopolies

-- Unlike most of its

broadcast peers, Media

General has not

exploited duopoly

opportunities

-- Use of TV broadcast

duopolies is correlated

to higher BCF margins

among Media General’s

peer group

24

No Material Retrans Revenues

-- Also, unlike many of its broadcast peers, Media

General appears not to have pursued opportunities to

secure retransmission consent revenues in the past

25

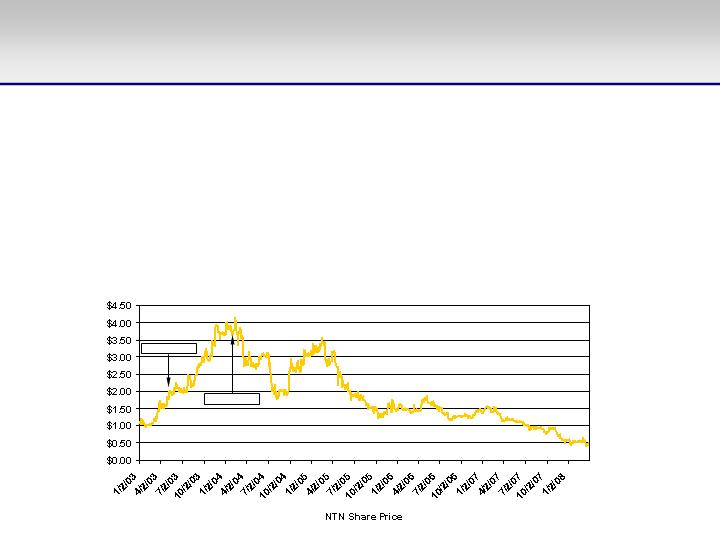

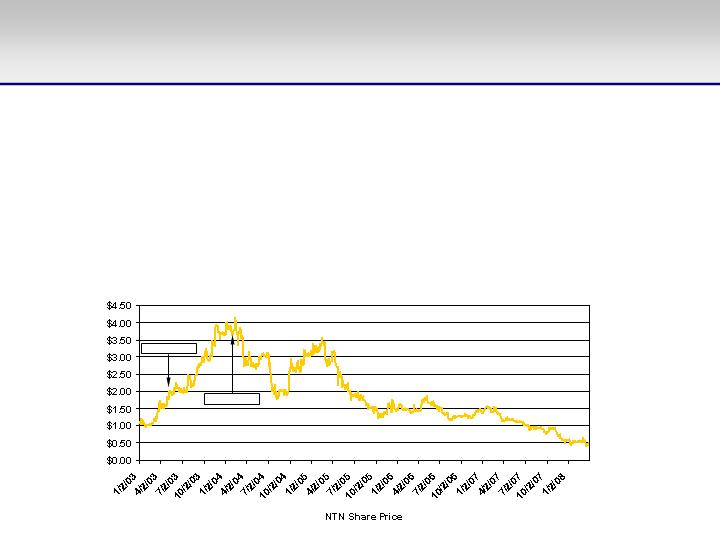

Ill-Conceived NTN Buzztime Investment

-- In May 2003 and again in January 2004, Media General made

investments in NTN Buzztime Inc., a loss-making public

company that produces interactive electronic entertainment,

and placed a representative on the NTN board.

-- To date, the investment has lost 71% of its value.

MEG invested

MEG invested

26

Ill-Conceived Internet Acquisitions

-- In July 2005, Media General acquired BlockDot Inc. , an

online advergaming and game development company. In

February 2008, the company acquired DealTaker.com , an

online social shopping portal and couponing website.

-- The acquisitions of BlockDot and DealTaker.com put Media

General in the business of sponsoring non-core internet

ventures and put it into direct competition with the global

internet giants, creative agencies, better-capitalized online

gaming companies and dozens of online coupon sites in a

very crowded market

-- We believe Media General could have purchased online

game and coupon features for its websites rather than spend

shareholders’ capital to buy the BlockDot and DealTaker.com

businesses

27

Excessive Leverage and Dividend Yield

-- Media General has

accumulated the highest net

leverage of all its combined

media peers

-- This condition will persist

even pro forma for the

company’s debt reduction

initiatives

-- The company also has the

highest dividend yield on its

stock, which restricts the

company’s ability to

deleverage

Note: Belo dividend yield based on weighted average of BLC and AHC.

Dividend yields based on stock prices as of 3/28/08.

28

Solutions Exist

-- Despite the challenges the company faces, we

believe straightforward solutions exist and can be

implemented with the benefit of new perspectives at

the board level

29

Prescription For The Company

30

Change Must Start at the Board

-- The Class A shareholders need to ensure they are

represented by truly independent directors, and should

elect individuals who do not owe their nomination to the

Class B directors

-- The Class A directors should bring a mix of perspectives

that match the specific challenges the company faces, in

particular poor broadcast performance, what we believe

have been questionable capital allocation decisions and

turnaround management in a changing media environment

-- The board must be open to new ideas and must re-

dedicate itself to the company’s core mission of rebuilding

value for all shareholders

31

Restart Broadcast Division

-- Implement substantial increase in management

attention and higher standards given its severe

underperformance relative to peers

-- Pursue duopolies

-- Pursue cable retransmission consent opportunities

-- Reduce spending and apply more scrutiny to

cost/benefit and payback analysis

-- Be opportunistic but disciplined with future

acquisitions and divestitures

32

Improve Publishing Division

-- Cut costs more aggressively

-- Implement higher standards given its

underperformance

-- Reduce spending and apply more scrutiny to

cost/benefit and payback analysis

-- Be opportunistic but disciplined with future

acquisitions and divestitures

-- Most urgently, consider alternatives for Florida

market properties

33

Refocus the Online/Interactive Strategy

-- Exit non-core businesses, including BlockDot and

DealTaker.com, and sell stake in NTN Buzztime

-- Avoid further acquisitions of non-core online

ventures that require national platform or brand to

maximize value or that don’t provide unique strategic

synergy

-- Focus instead on enhancing the websites of the

company’s core television and newspaper properties

to directly leverage and magnify their content, reach

and value and produce meaningful incremental cash

flows

34

Regain Geographic Focus

-- Regain geographic focus, for example through the

sale of the NBC stations in Columbus, OH and

Providence, RI

35

Improve Capital Allocation Decisions

-- Be more disciplined on acquisitions and more

conservative regarding projections to avoid a repeat of

the NBC acquisition mistake and other ill-fated

transactions

-- Tie transaction-related management compensation

to achieving projected performance for assets

acquired, and in general tie management

compensation more directly to creation of shareholder

value

-- Apply more rigorous analysis to determine the

impact of capital allocations on shareholder value

36

Consider Full Range of Strategic Options

-- As a routine matter in the normal course, continually

consider the full range of strategic options

(acquisitions or divestitures, financing transactions,

spin-off transactions, mergers, joint ventures, etc.)

available to the company in order to preserve, rebuild

and maximize value for all shareholders

37

Aggressively Reduce Debt and Rethink Dividend

-- Redouble efforts to reduce leverage

-- Consider reducing the company’s dividend to enable

further debt reduction

38

Change Must Start at the Board

-- In order to achieve these changes, we believe the Class A

shareholders should elect directors who bring the right mix

of perspectives that match the specific challenges the

company faces, in particular:

- Poor broadcast performance

- Questionable capital allocation decisions

- Need for an operational turnaround

39

Our Nominees

40

Our Nominees

-- J. Daniel Sullivan: veteran broadcasting executive

with 35 years of experience and an active senior

broadcasting consultant and media investor

-- Eugene I. Davis: chief executive officer of Pirinate

Consulting Group, a privately held consulting firm

specializing in turn-around management, M&A

consulting, and strategic planning advisory services

-- F. Jack Liebau Jr.: president and founder of Liebau

Asset Management Company and portfolio manager

with over two decades of investing experience

41

J. Daniel Sullivan

Extensive broadcast experience

-- Over 30 years experience as an executive and has

held four C-level positions in the last two decades

-- Started at the ground level in 1973 as an account

executive at WTVK in Knoxville, TN

-- Ultimately rose to operate, manage or own more

than 60 TV stations over his career and has bought or

sold more stations than Media General now owns

42

J. Daniel Sullivan

Extensive broadcast experience

-- Founded and was CEO of three substantial

broadcasting companies starting in 1987

- Clear Channel TV (eventually sold to PEP)

- Sullivan Broadcasting (sold to Sinclair)

- Quorum (merged with Nexstar)

-- Teamed with private equity partners to bid for the New

York Times TV station group, Clear Channel TV, and the

Fox group

-- Currently a director at KDOC-TV in Los Angeles and a

senior consultant there

43

J. Daniel Sullivan

Broadcast-related Internet experience

-- Led the internet strategy at each of his last three

companies as CEO and has been at the forefront of

creating an online presence for his stations since the

emergence of the internet as a commercial medium

-- Led internet strategy at Quorum

-- Was an early adopter of websites at Sullivan

Broadcasting in the 1990s

-- Launched online strategy at Clear Channel and was

one of the earliest clients of WorldNow

44

J. Daniel Sullivan

Financial successes

-- Created well over $1 billion of shareholder value in his

last three positions as CEO

-- At Clear Channel TV, Dan started with $120 million in

equity capital and built over $1 billion of equity value over 8

years by the time he left

-- With Sullivan Broadcasting, Dan generated a 300% return

for his private equity backers over two years

-- Quorum was clipped by 9/11 but Dan converted challenge

to success by merging with Nexstar, which then went

public

45

Eugene I. Davis

Career working for companies in transition

-- Chairman and CEO of Pirinate Consulting Group, which

specializes in turnaround management, strategic planning

and board advisory services

-- Extensive public board experience

-- Previously held CEO, COO, and CFO positions for

various public companies in transition across a range of

industries

-- Originally a partner and head of corporate and securities

at a Dallas law firm

46

Eugene I. Davis

Relevant media experience

-- Gene has served on the boards of Granite

Broadcasting and Ion Media and serves on the board

of a book publisher

47

Eugene I. Davis

Financial successes

Gene has helped facilitate increases in shareholder

value during his tenure on many boards where the

companies undertook substantial strategic

transactions or operational turnarounds

-- American Commercial: 14x increase in share price

-- Atlas Air: 3x increase in share price

-- Chembulk Tankers: 1x increase in TEV

-- Choice One Comms.: 4x increase in share price

-- Contifinancial: 4x increase in asset value

-- Flag Telecom: 30x increase in share price

48

Eugene I. Davis

Financial successes

Gene has helped facilitate increases in shareholder

value during his tenure on many boards

-- General Chemical: 7x increase in TEV

-- Metals USA: 7x increase in share price

-- Metrocall: 150x increase in share price

-- Oglebay Norton: 2.5x increase in share price

-- TelCove: 12x increase in TEV

-- Tipperary: 7x increase in share price

49

F. Jack Liebau Jr.

Portfolio manager with over 20 years experience

-- President and founder of Liebau Asset Management,

an investment manager for individuals, foundations

and corporations established in 2003

-- Previously, Jack was a top-rated portfolio manager

at Primecap Management Company from 1986 to 2003,

and prior to that was ananalyst at Capital Research

Company

-- Jack is often quoted in the national media regarding

the broadcast and newspaper sectors

50

F. Jack Liebau Jr.

Lifelong focus on media companies

-- Has covered Media General and its peers for more than

two decades as an investor, wrote a profile of Media

General for Barron’s

-- Covered media and entertainment as portfolio manager

at Primecap and an analyst at Capital Research Company

-- Worked as a reporter and assistant to the publisher of

the Los Angeles Times early in his career

-- Is a MEG shareholder

51

Our Nominees’ Commitment

-- Work together. Our nominees commit to work

actively and constructively with the other board

members to provide guidance and perspective to

management

-- Personal financial commitment. If elected, each of

our nominees commits to personally acquire at least

5,000 shares in the first year of service

-- Two of the three current Class A directors have

never bought a share of the company’s stock

52

Comparison of Slates

-- Harbinger’s slate brings unmatched experience and

perspective

X

Extensive knowledge of

newspaper sector

X

Deep firsthand

broadcasting expertise

X

All candidates commit

to purchase shares

X

Extensive public board

experience

X

All candidates have

business experience

X

Substantial turnaround

experience

Harbinger slate

Company slate

Rebuilding Value at

HARBINGER CAPITAL PARTNERS

54

Disclaimers

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements. These statements may be identified by the use of forward-looking terminology

such as the words “expects,” “intends,” “believes,” “anticipates” and other terms with similar meaning indicating possible future

events or actions or potential impact on the business or stockholders of Media General, Inc. (“Media General” or the “Company”).

These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties

that could cause actual results to differ materially. These risks and uncertainties include, among others, the ability to successfully

solicit sufficient proxies to elect Harbinger’s nominees to the Company’s board of directors, the ability of Harbinger’s nominees to

influence the Class B directors and the management of the Company and to improve the corporate governance and strategic

direction of the Company, and risk factors associated with the business of the Company, as described in the Company’s annual

report on Form 10-K for the fiscal year ended December 30, 2007, and in other periodic reports of the Company, which are available

at no charge at the website of the Securities and Exchange Commission at http://www.sec.gov. Accordingly, you should not rely

upon forward-looking statements as a prediction of actual results.

IMPORTANT

On March 19, 2008, Harbinger filed a definitive proxy statement with the SEC to solicit proxies in connection with the 2008 Annual

Meeting of stockholders of Media General, Inc. to be held on April 24, 2008. Company stockholders are encouraged to read the

definitive proxy statement and other proxy materials relating to the 2008 Annual Meeting because they contain important

information, including a description of who may be deemed to be “participants” in the solicitation of proxies and the direct or

indirect interests, by security holdings or otherwise, of the participants in the solicitation. Such proxy materials are available at no

charge on the SEC’s website at http//www.sec.gov. In addition, stockholders may also obtain a free copy of the definitive proxy

statement and other proxy materials by contacting our proxy solicitors, Innisfree M&A Incorporated, toll free at (888) 750-5834.