UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-21349

| Name of Fund: | | BlackRock Limited Duration Income Trust (BLW) |

| Fund Address: | | 100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Limited Duration Income Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 12/31/2020

Date of reporting period: 12/31/2020

Item 1 – Report to Stockholders

(a) The Report to Shareholders is attached herewith.

| | |

| | DECEMBER 31, 2020 |

BlackRock Debt Strategies Fund, Inc. (DSU)

BlackRock Floating Rate Income Strategies Fund, Inc. (FRA)

BlackRock Limited Duration Income Trust (BLW)

|

| |

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

| | |

| Supplemental Information (unaudited) | | |

Section 19(a) Notices

BlackRock Debt Strategies Fund, Inc.’s (DSU), BlackRock Floating Rate Income Strategies Fund, Inc.’s (FRA) and BlackRock Limited Duration Income Trust’s (BLW) (collectively the “Funds”, or individually a “Fund”) amounts and sources of distributions reported are estimates and are being provided to you pursuant to regulatory requirements and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon each Fund’s investment experience during its fiscal year and may be subject to changes based on tax regulations. Each Fund will provide a Form 1099-DIV each calendar year that will tell you how to report these distributions for U.S. federal income tax purposes.

December 31, 2020

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total Cumulative Distributions | | | | | | % Breakdown of the Total Cumulative | |

| | | for the Fiscal Period | | | | | | Distributions for the Fiscal Period | |

| | | Net | | | Net Realized | | | Net Realized | | | | | | Total Per | | | | | | Net | | | Net Realized | | | Net Realized | | | | | | Total Per | |

| | | Investment | | | Capital Gains | | | Capital Gains | | | Return of | | | Common | | | | | | Investment | | | Capital Gains | | | Capital Gains | | | Return of | | | Common | |

| Fund Name | | | Income | | | | Short-Term | | | | Long-Term | | | | Capital | (a) | | | Share | | | | | | | | Income | | | | Short-Term | | | | Long-Term | | | | Capital | | | | Share | |

DSU | | $ | 0.648339 | | | $ | — | | | $ | — | | | $ | 0.183661 | | | $ | 0.832000 | | | | | | | | 78 | % | | | — | % | | | — | % | | | 22 | % | | | 100 | % |

FRA | | | 0.696324 | | | | — | | | | — | | | | 0.225076 | | | | 0.921400 | | | | | | | | 76 | | | | — | | | | — | | | | 24 | | | | 100 | |

BLW | | | 1.017530 | | | | — | | | | — | | | | 0.159670 | | | | 1.177200 | | | | | | | | 86 | | | | — | | | | — | | | | 14 | | | | 100 | |

(a) Each Fund estimates that it has distributed more than its net investment income and net realized capital gains; therefore, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of the shareholder’s investment in a Fund is returned to the shareholder. A return of capital does not necessarily reflect a Fund’s investment performance and should not be confused with “yield” or “income.” When distributions exceed total return performance, the difference will reduce a Fund’s net asset value per share. | |

Section 19(a) notices for the Funds, as applicable, are available on the BlackRock website at blackrock.com.

Section 19(b) Disclosure

On September 5, 2019, the Funds, acting pursuant to a U.S. Securities and Exchange Commission (“SEC”) exemptive order and with the approval of each Fund’s Board of Directors (the “Board”), each have adopted a managed distribution plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plans, starting in October 2019, the Funds currently distribute the following fixed amounts per share on a monthly basis:

| | | | |

| | | Amount Per | |

| Exchange Symbol | | Common Share | |

DSU | | $ | 0.0605 | |

FRA | | | 0.0667 | |

BLW | | | 0.0981 | |

The fixed amounts distributed per share are subject to change at the discretion of each Fund’s Board. Under its Plan, each Fund will distribute all available investment income to its shareholders as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient income (inclusive of net investment income and short-term capital gains) is not earned on a monthly basis, the Funds will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board; however, each Fund may make additional distributions from time to time, including additional capital gain distributions at the end of the taxable year, if required to meet requirements imposed by the Code and/or the Investment Company Act of 1940, as amended (the “1940 Act”).

Shareholders should not draw any conclusions about each Fund’s investment performance from the amount of these distributions or from the terms of the Plan. Each Fund’s total return performance is presented in its financial highlights table.

The Board may amend, suspend or terminate a Fund’s Plan at any time without prior notice to the Fund’s shareholders if it deems such actions to be in the best interests of the Fund or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Fund’s stock is trading at or above net asset value) or widening an existing trading discount. The Funds are subject to risks that could have an adverse impact on their ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, changes in interest rates, decreased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code.

| | |

| 2 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

The Markets in Review

Dear Shareholder,

The 12-month reporting period as of December 31, 2020 has been a time of sudden change in global financial markets, as the emergence and spread of the coronavirus (or “COVID-19”) led to a vast disruption in the global economy and financial markets. The threat from the coronavirus became increasingly apparent throughout February and March 2020, and countries around the world took economically disruptive countermeasures. Stay-at-home orders and closures of non-essential businesses became widespread, many workers were laid off, and unemployment claims spiked, causing a global recession and a sharp fall in equity prices.

After markets hit their lowest point of the reporting period in late March 2020, a steady recovery ensued, as businesses began to re-open and governments learned to adapt to life with the virus. Equity prices continued to rise throughout the summer, fed by strong fiscal and monetary support and improving economic indicators. Many equity indices neared or surpassed all-time highs late in the reporting period following a series of successful vaccine trials and passage of additional stimulus. In the United States, both large- and small-capitalization stocks posted a significant advance. International equities from developed economies grew at a more modest pace, lagging emerging market stocks, which rebounded sharply.

During the market downturn, the performance of different types of fixed-income securities initially diverged due to a reduced investor appetite for risk. U.S. Treasuries benefited from the risk-off environment, and posted solid returns, as the 10-year U.S. Treasury yield (which is inversely related to bond prices) touched an all-time low. In the corporate bond market, support from the U.S. Federal Reserve (the “Fed”) assuaged credit concerns and both investment-grade and high-yield bonds recovered to post positive returns.

Following the coronavirus outbreak, the Fed instituted two emergency interest rate cuts, pushing short-term interest rates, already low as the year began, close to zero. To stabilize credit markets, the Fed also implemented a new bond-buying program, as did several other central banks around the world, including the European Central Bank and the Bank of Japan.

Looking ahead, while coronavirus-related disruptions have clearly hindered worldwide economic growth, we believe that the global expansion is likely to accelerate as vaccination efforts get under way. The results of the U.S. elections also cleared the way for additional stimulus spending in 2021, which is likely to be a solid tailwind for economic growth. Inflation should increase as the expansion continues, but a shift in central bank policy means that moderate inflation is less likely to be followed by interest rate hikes that could threaten the equity expansion.

Overall, we favor a positive stance toward risk, with an overweight in both equities and credit. We see U.S. and Asian equities benefiting from structural growth trends in tech, while emerging markets should be particularly helped by a vaccine-led economic expansion. In credit, rising inflation should provide tailwinds for inflation-protected bonds, and Euro area peripherals and Asian bonds also provide attractive opportunities. We believe that international diversification and a focus on sustainability can help provide portfolio resilience, and the disruption created by the coronavirus appears to be accelerating the shift toward sustainable investments.

In this environment, our view is that investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

Total Returns as of December 31, 2020

| | | | |

| | | 6-Month | | 12-Month |

U.S. large cap equities (S&P 500® Index) | | 22.16% | | 18.40% |

U.S. small cap equities (Russell 2000® Index) | | 37.85 | | 19.96 |

International equities (MSCI Europe, Australasia, Far East Index) | | 21.61 | | 7.82 |

Emerging market equities (MSCI Emerging Markets Index) | | 31.14 | | 18.31 |

3-month Treasury bills (ICE BofA 3-Month U.S. Treasury Bill Index) | | 0.07 | | 0.67 |

U.S. Treasury securities (ICE BofA 10-Year U.S. Treasury Index) | | (1.87) | | 10.58 |

U.S. investment grade bonds (Bloomberg Barclays U.S. Aggregate Bond Index) | | 1.29 | | 7.51 |

Tax-exempt municipal bonds (S&P Municipal Bond Index) | | 2.92 | | 4.95 |

U.S. high yield bonds (Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | 11.32 | | 7.05 |

Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

| | |

T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T | | 3 |

Table of Contents

| | |

| The Benefits and Risks of Leveraging | | |

The Funds may utilize leverage to seek to enhance the distribution rate on, and net asset value (“NAV”) of, their common shares (“Common Shares”). However, there is no guarantee that these objectives can be achieved in all interest rate environments.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by a Fund on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of each Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, each Fund’s shareholders benefit from the incremental net income. The interest earned on securities purchased with the proceeds from leverage (after paying the leverage costs) is paid to shareholders in the form of dividends, and the value of these portfolio holdings (less the leverage liability) is reflected in the per share NAV.

To illustrate these concepts, assume a Fund’s capitalization is $100 million and it utilizes leverage for an additional $30 million, creating a total value of $130 million available for investment in longer-term income securities. If prevailing short-term interest rates are 3% and longer-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, a Fund’s financing costs on the $30 million of proceeds obtained from leverage are based on the lower short-term interest rates. At the same time, the securities purchased by a Fund with the proceeds from leverage earn income based on longer-term interest rates. In this case, a Fund’s financing cost of leverage is significantly lower than the income earned on a Fund’s longer-term investments acquired from such leverage proceeds, and therefore the holders of Common Shares (“Common Shareholders”) are the beneficiaries of the incremental net income.

However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other costs of leverage exceed a Fund’s return on assets purchased with leverage proceeds, income to shareholders is lower than if a Fund had not used leverage. Furthermore, the value of the Funds’ portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of portfolio investments. In contrast, the amount of each Fund’s obligations under its leverage arrangement generally does not fluctuate in relation to interest rates. As a result, changes in interest rates can influence the Funds’ NAVs positively or negatively. Changes in the future direction of interest rates are very difficult to predict accurately, and there is no assurance that a Fund’s intended leveraging strategy will be successful.

The use of leverage also generally causes greater changes in each Fund’s NAV, market price and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV and market price of a Fund’s shares than if the Fund were not leveraged. In addition, each Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Fund to incur losses. The use of leverage may limit a Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. Each Fund incurs expenses in connection with the use of leverage, all of which are borne by shareholders and may reduce income to the shareholders. Moreover, to the extent the calculation of each Fund’s investment advisory fees includes assets purchased with the proceeds of leverage, the investment advisory fees payable to each Fund’s investment adviser will be higher than if the Funds did not use leverage.

Each Fund may utilize leverage through a credit facility or reverse repurchase agreements as described in the Notes to Financial Statements, if applicable.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), each Fund is permitted to issue debt up to 33 1/3% of its total managed assets. A Fund may voluntarily elect to limit its leverage to less than the maximum amount permitted under the 1940 Act. In addition, a Fund may also be subject to certain asset coverage, leverage or portfolio composition requirements imposed by its credit facility, which may be more stringent than those imposed by the 1940 Act.

If a Fund segregates or designates on its books and records cash or liquid assets having a value not less than the value of a Fund’s obligations under a reverse repurchase agreement (including accrued interest) then such transaction is not considered a senior security and is not subject to the foregoing limitations and requirements imposed by the 1940 Act.

Derivative Financial Instruments

The Funds may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. The Funds’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | |

T H E B E N E F I T S A N D R I S K S O F L E V E R A G I N G / D E R I V A T I V E F I N A N C I A L I N S T R U M E N T S | | 5 |

| | |

| Fund Summary as of December 31, 2020 | | BlackRock Debt Strategies Fund, Inc. (DSU) |

Investment Objective

BlackRock Debt Strategies Fund, Inc.’s (DSU) (the “Fund”) primary investment objective is to seek to provide current income by investing primarily in a diversified portfolio of U.S. companies’ debt instruments, including corporate loans, which are rated in the lower rating categories of the established rating services (BBB or lower by S&P Global Ratings or Baa or lower by Moody’s Investors Service, Inc. (“Moody’s”)) or unrated debt instruments, which are in the judgment of the investment adviser of equivalent quality. Corporate loans include senior and subordinated corporate loans, both secured and unsecured. The Fund may invest directly in debt instruments or synthetically through the use of derivatives. The Fund’s secondary investment objective is to provide capital appreciation.

No assurance can be given that the Fund’s investment objective will be achieved.

Fund Information

| | |

Symbol on New York Stock Exchange | | DSU |

Initial Offering Date | | March 27, 1998 |

Current Distribution Rate on Closing Market Price as of December 31, 2020 ($10.45)(a) | | 6.95% |

Current Monthly Distribution per Common Share(b) | | $0.0605 |

Current Annualized Distribution per Common Share(b) | | $0.7260 |

Leverage as of December 31, 2020(c) | | 30% |

(a) Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. (b) The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. (c) Represents bank borrowings outstanding as a percentage of total managed assets, which is the total assets of the Fund (including any assets attributable to borrowings), minus the sum of liabilities (other than borrowings representing financial leverage). Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

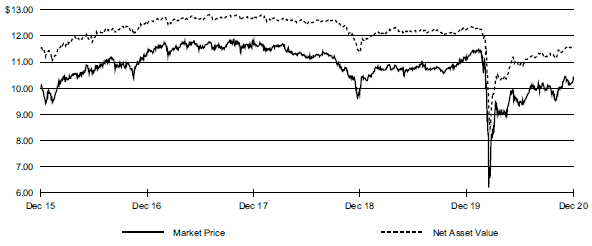

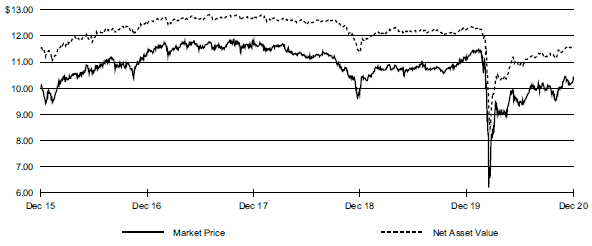

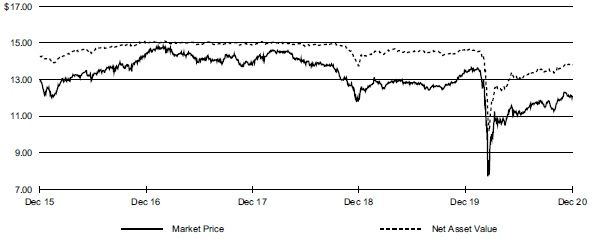

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/20 | | | 12/31/19 | | | Change | | | High | | | Low | |

Market Price | | $ | 10.45 | | | $ | 11.20 | | | | (6.70 | )% | | $ | 11.50 | | | $ | 5.92 | |

Net Asset Value | | | 11.55 | | | | 12.25 | | | | (5.71 | ) | | | 12.35 | | | | 8.46 | |

Market Price and Net Asset Value History for the Past Five Years

| | |

| 6 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

| Fund Summary as of December 31, 2020 (continued) | | BlackRock Debt Strategies Fund, Inc. (DSU) |

Performance and Portfolio Management Commentary

Returns for the period ended December 31, 2020 were as follows:

| | | | | | | | | | | | |

| | | Average Annual Total Returns | |

| | | 1 Year | | | 3 Years | | | 5 Years | |

Fund at NAV(a)(b) | | | 2.57 | % | | | 4.97 | % | | | 7.75 | % |

Fund at Market Price(a)(b) | | | 1.50 | | | | 4.15 | | | | 8.47 | |

Reference Benchmark(c) | | | 5.09 | | | | 5.12 | | | | 6.90 | |

Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index(d) | | | 7.05 | | | | 6.21 | | | | 8.57 | |

S&P/LSTA Leveraged Loan Index(e) | | | 3.12 | | | | 4.01 | | | | 5.24 | |

(a) All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. (b) The Fund’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. (c) The Reference Benchmark is comprised of the Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index (50%) and the S&P/LSTA Leveraged Loan Index (50%). The Reference Benchmark’s index content and weightings may have varied over past periods. (d) An unmanaged index comprised of issuers that meet the following criteria: at least $150 million par value outstanding; maximum credit rating of Ba1; at least one year to maturity; and no issuer represents more than 2% of the index. (e) An unmanaged market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. | |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not indicative of future results.

DSU is presenting the Reference Benchmark to accompany fund performance. The Reference Benchmark is presented for informational purposes only, as the Fund is actively managed and does not seek to track or replicate the performance of the Reference Benchmark or any other index. The portfolio investments of the Fund may differ substantially from the securities that comprise the indices within the Reference Benchmark, which may cause the Fund’s performance to differ materially from that of the Reference Benchmark. The Fund employs leverage as part of its investment strategy, which may change over time at the discretion of BlackRock Advisors, LLC (the “Manager”) as market and other conditions warrant. In contrast, the Reference Benchmark is not adjusted for leverage. Therefore, leverage generally may result in the Fund outperforming the Reference Benchmark in rising markets and underperforming in declining markets. The Board considers additional factors to evaluate the Fund’s performance, such as the performance of the Fund relative to a peer group of funds, a leverage-adjusted benchmark and/or other information provided by the Manager.

More information about the historical performance can be found in the “Closed-End Funds” section of blackrock.com.

The following discussion relates to the Fund’s absolute performance based on NAV:

What factors influenced performance?

After falling sharply in the first calendar quarter of 2020 due to the emergence of COVID-19, the high yield and floating rate loan interest (“bank loan”) markets recovered to finish 2020 with positive returns. Both categories were helped by the combination of aggressive fiscal and monetary stimulus, better-than-expected economic conditions in the second half of the year, and the approval of a coronavirus vaccine in early November 2020.

Bank loans made the largest contributor to the Fund’s absolute return in 2020, followed by high yield and investment grade bonds. From a sector perspective, technology, cable & satellite and building materials were the leading contributors. B rated issues made the largest contribution among the three major credit tiers, followed by CCCs and BBBs.

Energy was by far the largest detractor from performance at the sector level, followed by lodging and aerospace/defense. BB rated securities were the sole detractor by rating.

The Fund continued to use liquid, index-based derivatives in the loan and high-yield markets in order to manage its positioning. The Fund’s use of derivatives had a negative impact on Fund performance.

Describe recent portfolio activity.

The Fund increased its allocation to high yield and investment grade bonds throughout the year due to supportive supply-and-demand conditions and attractive relative valuations. The investment adviser’s credit rating views remained relatively consistent over the past several quarters, focusing on higher-quality B rated issues and avoiding the more volatile, stressed CCC category. The investment adviser tactically managed the Fund’s sector positioning, although it placed a greater focus on individual security selection later in the period.

Describe portfolio positioning at period end.

The Fund remained predominately invested in bank loans, with the rest held mostly in high yield and investment grade corporate bonds. The Fund’s largest sector positions were in technology, health care and consumer cyclical services, while it had less exposure to retailers, home construction and transportation services. Within energy, the Fund remained broadly underweight across the midstream, independent energy and oil field services categories. From a credit rating perspective, the Fund continued to emphasize BB and B rated issues, with a higher allocation to the latter. The Fund also held a smaller in position in CCC rated debt.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Fund Summary as of December 31, 2020 (continued) | | BlackRock Debt Strategies Fund, Inc. (DSU) |

Overview of the Fund’s Total Investments

PORTFOLIO ALLOCATION

| | | | | | | | |

| Asset Type | | 12/31/20 | | | 12/31/19 | |

Floating Rate Loan Interests | | | 82 | % | | | 81 | % |

Corporate Bonds | | | 16 | | | | 15 | |

Investment Companies | | | 1 | | | | 3 | |

Preferred Securities | | | 1 | | | | 1 | |

Other* | | | — | | | | — | |

CREDIT QUALITY ALLOCATION

| | | | | | | | |

| Credit Rating(a)(b) | | 12/31/20 | | | 12/31/19 | |

BBB/Baa | | | 7 | % | | | 7 | % |

BB/Ba | | | 21 | | | | 27 | |

B | | | 64 | | | | 59 | |

CCC/Caa | | | 7 | | | | 3 | |

N/R | | | 1 | | | | 4 | |

| (a) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (b) | Excludes common stocks, warrants, short-term securities, options purchased and options written. |

| * | Includes one or more investment categories that individually represents less than 1% of the Fund’s total investments. Please refer to the Schedule of Investments for details. |

| | |

| 8 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

| Fund Summary as of December 31, 2020 | | BlackRock Floating Rate Income Strategies Fund, Inc. (FRA) |

Investment Objective

BlackRock Floating Rate Income Strategies Fund, Inc.’s (FRA) (the “Fund”) investment objective is to provide shareholders with high current income and such preservation of capital as is consistent with investment in a diversified, leveraged portfolio consisting primarily of floating rate debt securities and instruments. The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its managed assets in floating rate debt securities, including floating or variable rate debt securities that pay interest at rates that adjust whenever a specified interest rate changes and/or which reset on predetermined dates (such as the last day of a month or calendar quarter). The Fund invests a substantial portion of its investments in floating rate debt securities consisting of secured or unsecured senior floating rate loans that are rated below investment grade at the time of investment or, if unrated, are considered by the investment adviser to be of comparable quality. The Fund may invest directly in floating rate debt securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Fund Information

| | |

Symbol on New York Stock Exchange | | FRA |

Initial Offering Date | | October 31, 2003 |

Current Distribution Rate on Closing Market Price as of December 31, 2020 ($12.11)(a) | | 6.61% |

Current Monthly Distribution per Common Share(b) | | $0.0667 |

Current Annualized Distribution per Common Share(b) | | $0.8004 |

Leverage as of December 31, 2020(c) | | 30% |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

| | (c) | Represents bank borrowings outstanding as a percentage of total managed assets, which is the total assets of the Fund (including any assets attributable to borrowings), minus the sum of liabilities (other than borrowings representing financial leverage). Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. | |

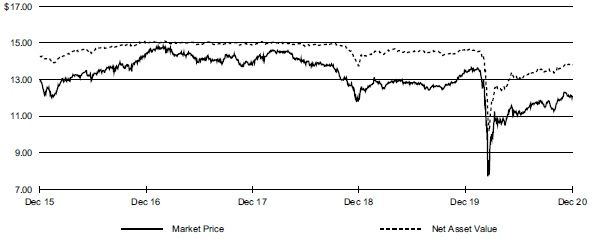

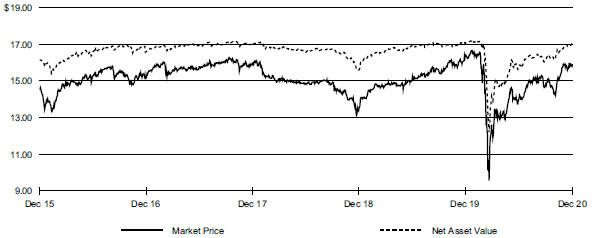

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/20 | | | 12/31/19 | | | Change | | | High | | | Low | |

Market Price | | $ | 12.11 | | | $ | 13.44 | | | | (9.90 | )% | | $ | 13.66 | | | $ | 6.72 | |

Net Asset Value | | | 13.81 | | | | 14.55 | | | | (5.09 | ) | | | 14.66 | | | | 10.16 | |

Market Price and Net Asset Value History for the Past Five Years

| | |

| Fund Summary as of December 31, 2020 (continued) | | BlackRock Floating Rate Income Strategies Fund, Inc. (FRA) |

Performance and Portfolio Management Commentary

Returns for the period ended December 31, 2020 were as follows:

| | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns | |

| | | | | | 1 Year | | | 3 Years | | | 5 Years | |

Fund at NAV(a)(b) | | | | | | | 2.76 | % | | | 4.54 | % | | | 5.89 | % |

Fund at Market Price(a)(b) | | | | | | | (2.45 | ) | | | 2.61 | | | | 5.23 | |

S&P/LSTA Leveraged Loan Index(c) | | | | | | | 3.12 | | | | 4.01 | | | | 5.24 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. | |

| | (b) | The Fund’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | An unmanaged market value-weighted index (the “Reference Benchmark”) designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. | |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not indicative of future results.

More information about the Fund’s historical performance can be found in the “Closed-End Funds” section of blackrock.com.

The following discussion relates to the Fund’s absolute performance based on NAV:

What factors influenced performance?

After falling sharply in the first calendar quarter of 2020 due to the emergence of COVID-19, the floating rate loan interest (“bank loan”) market recovered to finish 2020 with positive returns. As was the case with other credit-oriented segments of the bond market, bank loans were helped by the combination of aggressive fiscal and monetary stimulus, better-than-expected economic conditions in the second half of the year, and the approval of a coronavirus vaccine in early November 2020.

From an asset allocation perspective, the Fund’s core exposure to bank loans and tactical allocations to investment grade and high yield corporate bonds contributed to performance. By sector, the largest contributors included technology, cable/satellite and building materials. With respect to credit tiers, the Fund’s B rated positions were the leading contributors to absolute returns, followed by CCCs and BBBs.

At the sector level, the largest detractors from performance included energy and lodging. By rating class, BB rated issues were the sole detractor.

Describe recent portfolio activity.

The investment adviser increased the Fund’s allocation to high yield and investment grade bonds throughout the year due to the supportive technicals and attractive relative values in these areas. The investment adviser’s credit rating views remained relatively consistent over the past several quarters, focusing on higher-quality B rated issues and avoiding the more volatile, stressed CCC category. The investment adviser tactically managed the Fund’s sector positioning, although it placed a greater focus on individual security selection later in the period. The Fund continued to use liquid, index-based derivatives in the loan and high-yield markets in order to manage its positioning.

Describe portfolio positioning at period end.

The Fund remained predominately invested in bank loans, with the rest primarily invested in high yield and investment grade corporates. By credit rating, B rated loans were the Fund’s largest position, and it had a much smaller weightings in the higher-risk CCC rated segment. Within the single B category, the investment adviser remained focused on higher-quality B+ and B rated areas, with less of an emphasis on B- rated debt.

The investment adviser’s core sector views stayed largely intact. Some of the Fund’s top sector positions were technology companies, particularly in the enterprise software business. Health care, cable/satellite and building materials were also areas where the investment adviser identified compelling risk-reward opportunities. The investment adviser slightly increased the portfolio’s allocation to sectors with above-average sensitivity to COVID-19 during the second half of the year by participating in new issues in the gaming and airline categories. The Fund maintained a lower allocation to energy and to the consumer cyclical sectors, such as retailers and leisure, on the belief that these market segments continued to face significant headwinds.

Additionally, the Fund had a bias toward larger loan tranches, as well as to loan/bond capital structures over the loan-only segment. The Fund remained underweight in the 2017 and 2018 vintages, arguably a period with more aggressive lending standards and weaker protections for loan holders.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

10 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

| Fund Summary as of December 31, 2020 (continued) | | BlackRock Floating Rate Income Strategies Fund, Inc. (FRA) |

Overview of the Fund’s Total Investments

PORTFOLIO ALLOCATION

| | | | | | | | |

| Asset Type | | 12/31/20 | | | 12/31/19 | |

Floating Rate Loan Interests | | | 93 | % | | | 94 | % |

Corporate Bonds | | | 5 | | | | 1 | |

Investment Companies | | | 2 | | | | 5 | |

Other* | | | — | | | | — | |

CREDIT QUALITY ALLOCATION

| | | | | | | | |

| Credit Rating(a)(b) | | 12/31/20 | | | 12/31/19 | |

BBB/Baa | | | 6 | % | | | 8 | % |

BB/Ba | | | 19 | | | | 27 | |

B | | | 67 | | | | 58 | |

CCC/Caa | | | 6 | | | | 2 | |

N/R | | | 2 | | | | 5 | |

| (a) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (b) | Excludes common stocks, warrants, short-term securities, options purchased and options written. |

| * | Includes one or more investment categories that individually represents less than 1% of the Fund’s total investments. Please refer to the Schedule of Investments for details. |

| | |

| Fund Summary as of December 31, 2020 | | BlackRock Limited Duration Income Trust (BLW) |

Investment Objective

BlackRock Limited Duration Income Trust’s (BLW) (the “Fund”) investment objective is to provide current income and capital appreciation. The Fund seeks to achieve its investment objective by investing primarily in three distinct asset classes:

| | • | | intermediate duration, investment grade corporate bonds, mortgage-related securities, asset-backed securities and U.S. Government and agency securities; |

| | • | | senior, secured floating rate loans made to corporate and other business entities; and |

| | • | | U.S. dollar-denominated securities of U.S. and non-U.S. issuers rated below investment grade at the time of investment or unrated and deemed by the investment adviser to be of comparable quality and, to a limited extent, non-U.S. dollar denominated securities of non-U.S. issuers rated below investment grade or unrated and deemed by the investment adviser to be of comparable quality. |

The Fund’s portfolio normally has an average portfolio duration of less than five years (including the effect of anticipated leverage), although it may be longer from time to time depending on market conditions. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Fund Information

| | |

Symbol on New York Stock Exchange | | BLW |

Initial Offering Date | | July 30, 2003 |

Current Distribution Rate on Closing Market Price as of December 31, 2020 ($15.92)(a) | | 7.39% |

Current Monthly Distribution per Common Share(b) | | $0.0981 |

Current Annualized Distribution per Common Share(b) | | $1.1772 |

Leverage as of December 31, 2020(c) | | 31% |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

| | (c) | Represents reverse repurchase agreements as a percentage of total managed assets, which is the total assets of the Fund (including any assets attributable to any borrowings) minus the sum of its liabilities (other than borrowings representing financial leverage). Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. | |

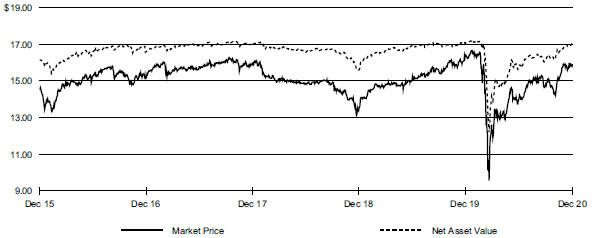

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/20 | | | 12/31/19 | | | Change | | | High | | | Low | |

Market Price | | $ | 15.92 | | | $ | 16.39 | | | | (2.87 | )% | | $ | 16.70 | | | $ | 9.52 | |

Net Asset Value | | | 16.93 | | | | 17.05 | | | | (0.70 | ) | | | 17.22 | | | | 12.19 | |

Market Price and Net Asset Value History for the Past Five Years

| | |

12 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

| Fund Summary as of December 31, 2020 (continued) | | BlackRock Limited Duration Income Trust (BLW) |

Performance and Portfolio Management Commentary

Returns for the period ended December 31, 2020 were as follows:

| | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns | |

| | | | | | 1 Year | | | 3 Years | | | 5 Years | |

Fund at NAV(a)(b) | | | | | | | 7.58 | % | | | 7.26 | % | | | 8.67 | % |

Fund at Market Price(a)(b) | | | | | | | 5.24 | | | | 7.37 | | | | 9.57 | |

Reference Benchmark(c) | | | | | | | 5.06 | | | | 4.73 | | | | 5.63 | |

Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index(d) | | | | | | | 7.05 | | | | 6.21 | | | | 8.57 | |

S&P/LSTA Leveraged Loan Index(e) | | | | | | | 3.12 | | | | 4.01 | | | | 5.24 | |

BATS S Benchmark(f) | | | | | | | 4.43 | | | | 3.72 | | | | 2.98 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. | |

| | (b) | The Fund’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | The Reference Benchmark is comprised of the Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index (33.33%), the S&P/LSTA Leveraged Loan Index (33.33%), and the BATS S Benchmark (33.34%). The Reference Benchmark’s index content and weightings may have varied over past periods. | |

| | (d) | An unmanaged index comprised of issuers that meet the following criteria: at least $150 million par value outstanding; maximum credit rating of Ba1; at least one year to maturity; and no issuer represents more than 2% of the index. | |

| | (e) | An unmanaged market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. | |

| | (f) | A composite index comprised of Bloomberg Barclays ABS 1-3 Year AAA Rated ex Home Equity Index, Bloomberg Barclays Corporate 1-5 year Index, Bloomberg Barclays CMBS Investment Grade 1-3.5 Yr. Index, Bloomberg Barclays MBS 15 Yr Index and Bloomberg Barclays Credit Ex-Corporate 1-5 Yr Index. | |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not indicative of future results.

More information about the Fund’s historical performance can be found in the “Closed-End Funds” section of blackrock.com.

The following discussion relates to the Fund’s absolute performance based on NAV:

What factors influenced performance?

Positive contributors to the Fund’s absolute performance over the period included allocations to both high yield and investment grade corporate bonds as credit sentiment rebounded based on policy support after the market dislocation seen in the first quarter of 2020. Exposure to credit-sensitive floating rate loan interests (“bank loans”) and emerging market debt also added to performance. Finally, U.S. Treasuries also provided positive returns as interest rates declined over the period.

The largest detractors from the Fund’s absolute performance were exposures to tax-exempt municipal bonds, equities and taxable bonds.

Describe recent portfolio activity.

Over the period, the Fund increased its allocation to U.S. high yield corporate credit, investment grade corporate credit and emerging market debt. Over the same period, the Fund reduced exposure to U.S. Treasuries, commercial mortgage-backed securities (“CMBS”) and asset-backed securities (“ABS”).

Describe portfolio positioning at period end.

At period end, the Fund maintained a diversified exposure to non-government spread sectors including high yield corporate credit, investment grade corporate credit, emerging market debt, CMBS and ABS. In addition, the Fund held modest exposures to government securities, including U.S. Treasuries and non-U.S. sovereign securities.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Fund Summary as of December 31, 2020 (continued) | | BlackRock Limited Duration Income Trust (BLW) |

Overview of the Fund’s Total Investments

PORTFOLIO ALLOCATION

| | | | | | | | |

| Asset Type(a) | | 12/31/20 | | | 12/31/19 | |

Corporate Bonds | | | 55 | % | | | 48 | % |

Floating Rate Loan Interests | | | 30 | | | | 31 | |

Preferred Securities | | | 5 | | | | 7 | |

Asset-Backed Securities | | | 3 | | | | 3 | |

Foreign Agency Obligations | | | 3 | | | | 2 | |

U.S. Treasury Obligations | | | 2 | | | | 2 | |

Non-Agency Mortgage-Backed Securities | | | 1 | | | | 1 | |

Investment Companies | | | 1 | | | | 2 | |

U.S. Government Sponsored Agency Securities | | | — | * | | | 4 | |

Other* | | | — | | | | — | |

CREDIT QUALITY ALLOCATION

| | | | | | | | |

| Credit Rating(b)(c) | | 12/31/20 | | | 12/31/19 | |

AAA/Aaa | | | — | % | | | 1 | % |

AA/Aa | | | 2 | | | | 3 | |

A | | | 4 | | | | 7 | |

BBB/Baa | | | 14 | | | | 15 | |

BB/Ba | | | 32 | | | | 35 | |

B | | | 39 | | | | 34 | |

CCC/Caa | | | 7 | | | | 4 | |

N/R | | | 2 | | | | 1 | |

| (a) | Excludes short-term securities, options purchased and options written. |

| (b) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (c) | Excludes common stocks, warrants, short-term securities, options purchased and options written. |

| * | Includes one or more investment categories that individually represents less than 1% of the Fund’s total investments. Please refer to the Schedule of Investments for details. |

| | |

14 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments December 31, 2020 | | BlackRock Debt Strategies Fund, Inc. (DSU) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | Shares | | | Value | |

|

Common Stocks | |

|

Construction & Engineering — 0.1% | |

McDermott International Ltd.(a) | | | | | | | 141,483 | | | $ | 114,601 | |

| | | | | | | | |

|

| Diversified Financial Services — 0.0% | |

Kcad Holdings I Ltd.(b) | | | | | | | 1,075,282,733 | | | | 10,753 | |

| | | | | | | | |

|

| Energy Equipment & Services — 0.0% | |

Pioneer Energy Services Corp.(b) | | | | | | | 809 | | | | 31,416 | |

| | | | | | | | |

|

| Health Care Management Services — 0.0% | |

New Millennium HoldCo, Inc. | | | | | | | 10,718 | | | | 11 | |

| | | | | | | | |

|

| Metals & Mining — 0.0% | |

Ameriforge Group, Inc. | | | | | | | 1,664 | | | | 29,120 | |

Preferred Proppants LLC(b) | | | | | | | 14,576 | | | | 21,864 | |

| | | | | | | | |

| | | | | | | | | | | 50,984 | |

|

| Oil, Gas & Consumable Fuels — 0.0% | |

California Resources Corp.(a) | | | | | | | 2,336 | | | | 55,106 | |

| | | | | | | | |

|

| Semiconductors & Semiconductor Equipment(a) — 0.0% | |

Maxeon Solar Technologies Ltd. | | | | | | | 213 | | | | 6,043 | |

SunPower Corp. | | | | | | | 1,707 | | | | 43,768 | |

| | | | | | | | |

| | | | | | | | | | | 49,811 | |

|

| Software — 0.0% | |

Avaya Holdings Corp.(a) | | | | | | | 40 | | | | 766 | |

| | | | | | | | |

|

| Specialty Retail — 0.0% | |

NMG Parent LLC | | | | | | | 1,477 | | | | 95,414 | |

| | | | | | | | |

|

| Total Common Stocks — 0.1% | |

(Cost: $15,916,895) | | | | | | | | | | | 408,862 | |

| | | | | | | | |

| | | |

| | | | | | Par

(000) | | | | |

|

Corporate Bonds | |

|

Aerospace & Defense — 0.7% | |

Bombardier, Inc.(c) | | | | | | | | | | | | |

8.75%, 12/01/21 | | | USD | | | | 7 | | | | 7,280 | |

6.13%, 01/15/23 | | | | | | | 664 | | | | 649,060 | |

7.50%, 12/01/24 | | | | | | | 58 | | | | 55,638 | |

7.50%, 03/15/25 | | | | | | | 14 | | | | 12,985 | |

7.88%, 04/15/27 | | | | | | | 17 | | | | 15,631 | |

F-Brasile SpA/F-Brasile US LLC, Series XR, 7.38%, 08/15/26(c) | | | | | | | 200 | | | | 194,000 | |

Signature Aviation US Holdings, Inc.(c) | | | | | | | | | | | | |

5.38%, 05/01/26 | | | | | | | 42 | | | | 43,050 | |

4.00%, 03/01/28 | | | | | | | 196 | | | | 197,303 | |

Spirit AeroSystems, Inc., 5.50%, 01/15/25(c) | | | | | | | 58 | | | | 61,184 | |

TransDigm, Inc. | | | | | | | | | | | | |

8.00%, 12/15/25(c) | | | | | | | 656 | | | | 725,077 | |

6.25%, 03/15/26(c) | | | | | | | 1,173 | | | | 1,249,245 | |

6.38%, 06/15/26 | | | | | | | 62 | | | | 64,170 | |

Triumph Group, Inc., 8.88%,

06/01/24(c) | | | | | | | 270 | | | | 296,325 | |

| | | | | | | | |

| | | | | | | | | | | 3,570,948 | |

|

| Airlines — 1.7% | |

Allegiant Travel Co., 8.50%,

02/05/24(c) | | | | | | | 1,065 | | | | 1,139,550 | |

American Airlines, Inc., 11.75%,

07/15/25(c) | | | | | | | 2,177 | | | | 2,510,625 | |

| | | | | | | | | | | | |

| Security | | | Par

(000) | | | Value | |

|

| Airlines (continued) | |

Delta Air Lines, Inc./SkyMiles IP Ltd.(c) | | | | | | | | | | | | |

4.50%, 10/20/25 | | | USD | | | | 75 | | | $ | 80,165 | |

4.75%, 10/20/28 | | | | | | | 259 | | | | 282,702 | |

Mileage Plus Holdings LLC/Mileage Plus Intellectual Property Assets Ltd., 6.50%, 06/20/27(c) | | | | | | | 2,210 | | | | 2,375,750 | |

Spirit Loyalty Cayman Ltd./Spirit IP Cayman Ltd., 8.00%, 09/20/25(c) | | | | | | | 22 | | | | 24,921 | |

United Airlines Pass-Through Trust, Series 2016-1, Class A, 5.88%, 10/15/27 | | | | | | | 2,405 | | | | 2,597,911 | |

| | | | | | | | |

| | | | | | | | | | | 9,011,624 | |

|

| Auto Components — 0.4% | |

Clarios Global LP, 6.75%, 05/15/25(c) | | | | | | | 801 | | | | 863,077 | |

Clarios Global LP/Clarios US Finance Co. | | | | | | | | | | | | |

4.38%, 05/15/26 | | | EUR | | | | 100 | | | | 126,551 | |

6.25%, 05/15/26(c) | | | USD | | | | 122 | | | | 130,845 | |

8.50%, 05/15/27(c) | | | | | | | 488 | | | | 530,168 | |

Dealer Tire LLC/DT Issuer LLC, 8.00%, 02/01/28(c) | | | | | | | 25 | | | | 26,323 | |

Goodyear Tire & Rubber Co., 9.50%, 05/31/25 | | | | | | | 65 | | | | 73,470 | |

Meritor, Inc., 4.50%, 12/15/28(c) | | | | | | | 24 | | | | 24,600 | |

Tenneco, Inc., 7.88%, 01/15/29(c) | | | | | | | 25 | | | | 28,069 | |

Venture Holdings Co. LLC, 12.00%,

07/01/49(a)(b)(d) | | | | | | | 5,150 | | | | 1 | |

ZF Finance GmbH | | | | | | | | | | | | |

3.00%, 09/21/25 | | | EUR | | | | 100 | | | | 126,135 | |

3.75%, 09/21/28 | | | | | | | 100 | | | | 131,022 | |

| | | | | | | | |

| | | | | | | | | | | 2,060,261 | |

|

| Automobiles — 0.8% | |

Allison Transmission, Inc.(c) | | | | | | | | | | | | |

5.88%, 06/01/29 | | | USD | | | | 113 | | | | 124,865 | |

3.75%, 01/30/31 | | | | | | | 100 | | | | 102,312 | |

Asbury Automotive Group, Inc. | | | | | | | | | | | | |

4.50%, 03/01/28 | | | | | | | 35 | | | | 36,488 | |

4.75%, 03/01/30 | | | | | | | 73 | | | | 78,292 | |

AutoNation, Inc., 4.75%, 06/01/30 | | | | | | | 93 | | | | 111,910 | |

FCE Bank PLC, 1.62%, 05/11/23 | | | EUR | | | | 100 | | | | 122,228 | |

Ford Motor Co. | | | | | | | | | | | | |

8.50%, 04/21/23 | | | USD | | | | 169 | | | | 190,211 | |

4.35%, 12/08/26 | | | | | | | 9 | | | | 9,585 | |

4.75%, 01/15/43 | | | | | | | 176 | | | | 179,520 | |

5.29%, 12/08/46 | | | | | | | 78 | | | | 81,510 | |

Ford Motor Credit Co. LLC | | | | | | | | | | | | |

3.81%, 01/09/24 | | | | | | | 200 | | | | 205,000 | |

4.06%, 11/01/24 | | | | | | | 200 | | | | 210,114 | |

5.13%, 06/16/25 | | | | | | | 423 | | | | 459,928 | |

General Motors Co. | | | | | | | | | | | | |

6.13%, 10/01/25 | | | | | | | 581 | | | | 704,735 | |

6.80%, 10/01/27 | | | | | | | 296 | | | | 380,393 | |

5.00%, 10/01/28 | | | | | | | 19 | | | | 22,608 | |

General Motors Financial Co., Inc. | | | | | | | | | | | | |

2.75%, 06/20/25 | | | | | | | 574 | | | | 613,780 | |

5.65%, 01/17/29 | | | | | | | 21 | | | | 26,021 | |

Group 1 Automotive, Inc., 4.00%, 08/15/28(c) | | | | | | | 205 | | | | 211,310 | |

Ken Garff Automotive LLC, 4.88%, 09/15/28(c) | | | | | | | 39 | | | | 40,560 | |

Nissan Motor Co. Ltd., 4.81%, 09/17/30(c) | | | | | | | 200 | | | | 225,203 | |

| | |

S C H E D U L E O F I N V E S T M E N T S | | 15 |

| | |

Schedule of Investments (continued) December 31, 2020 | | BlackRock Debt Strategies Fund, Inc. (DSU) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | Par

(000) | | | Value | |

|

| Automobiles (continued) | |

Penske Automotive Group, Inc., 3.50%, 09/01/25 | | | USD | | | | 62 | | | $ | 63,008 | |

Tesla, Inc., 5.30%, 08/15/25(c) | | | | | | | 135 | | | | 140,737 | |

| | | | | | | | | | | 4,340,318 | |

|

| Banks — 0.0% | |

Banca Monte dei Paschi di Siena SpA, 2.63%, 04/28/25 | | | EUR | | | | 100 | | | | 125,243 | |

Banco Espirito Santo SA(a)(d) | | | | | | | | | | | | |

2.63%, 05/08/17 | | | | | | | 100 | | | | 15,881 | |

4.75%, 01/15/21(e) | | | | | | | 200 | | | | 31,763 | |

4.00%, 01/21/21 | | | | | | | 100 | | | | 15,882 | |

Freedom Mortgage Corp., 7.63%,

05/01/26(c) | | | USD | | | | 22 | | | | 23,269 | |

| | | | | | | | |

| | | | | | | | | | | 212,038 | |

|

| Beverages — 0.3% | |

ARD Finance SA, (6.50% Cash or 7.25% PIK), 6.50%, 06/30/27(c)(f) | | | | | | | 441 | | | | 470,768 | |

Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc., 5.25%, 08/15/27(c) | | | | | | | 208 | | | | 218,360 | |

Trivium Packaging Finance BV | | | | | | | | | | | | |

3.75%, 08/15/26 | | | EUR | | | | 100 | | | | 125,463 | |

8.50%, 08/15/27(c) | | | USD | | | | 814 | | | | 891,330 | |

| | | | | | | | |

| | | | | | | | | | | 1,705,921 | |

|

| Biotechnology — 0.0% | |

Emergent BioSolutions, Inc., 3.88%,

08/15/28(c) | | | | | | | 25 | | | | 25,888 | |

| | | | | | | | |

| | | |

Building Materials — 0.5% | | | | | | | | | | | | |

Boise Cascade Co., 4.88%, 07/01/30(c) | | | | | | | 45 | | | | 48,713 | |

Cornerstone Building Brands, Inc., 6.13%, 01/15/29(c) | | | | | | | 114 | | | | 121,125 | |

CP Atlas Buyer, Inc., 7.00%, 12/01/28(c) | | | | | | | 30 | | | | 31,200 | |

Forterra Finance LLC/FRTA Finance Corp., 6.50%, 07/15/25(c) | | | | | | | 51 | | | | 54,825 | |

Griffon Corp., 5.75%, 03/01/28 | | | | | | | 28 | | | | 29,610 | |

Jeld-Wen, Inc.(c) | | | | | | | | | | | | |

4.63%, 12/15/25 | | | | | | | 32 | | | | 32,656 | |

4.88%, 12/15/27 | | | | | | | 10 | | | | 10,575 | |

Masonite International Corp., 5.38%,

02/01/28(c) | | | | | | | 45 | | | | 48,319 | |

SRM Escrow Issuer LLC, 6.00%,

11/01/28(c) | | | | | | | 1,764 | | | | 1,843,653 | |

Standard Industries, Inc.(c) | | | | | | | | | | | | |

5.00%, 02/15/27 | | | | | | | 34 | | | | 35,530 | |

4.38%, 07/15/30 | | | | | | | 90 | | | | 96,276 | |

3.38%, 01/15/31 | | | | | | | 199 | | | | 199,995 | |

Summit Materials LLC/Summit Materials Finance Corp., 5.25%, 01/15/29(c) | | | | | | | 168 | | | | 176,400 | |

| | | | | | | | |

| | | | | | | | | | | 2,728,877 | |

|

| Building Products(c) — 0.1% | |

LBM Acquisition LLC, 6.25%, 01/15/29 | | | | | | | 64 | | | | 66,080 | |

Specialty Building Products Holdings LLC/SBP Finance Corp., 6.38%, 09/30/26 | | | | | | | 125 | | | | 132,468 | |

SRS Distribution, Inc., 8.25%, 07/01/26 | | | | | | | 403 | | | | 428,187 | |

White Cap Buyer LLC, 6.88%, 10/15/28 | | | | | | | 156 | | | | 166,335 | |

| | | | | | | | |

| | | | | | | | | | | 793,070 | |

|

| Capital Markets — 0.2% | |

Charles Schwab Corp., (10 year CMT + 3.08%), 4.00%(e)(g) | | | | | | | 265 | | | | 278,912 | |

Icahn Enterprises LP/Icahn Enterprises Finance Corp. | | | | | | | | | | | | |

4.75%, 09/15/24 | | | | | | | 101 | | | | 104,914 | |

6.38%, 12/15/25 | | | | | | | 3 | | | | 3,103 | |

| | | | | | | | | | | | |

| Security | | | Par

(000) | | | Value | |

|

| Capital Markets (continued) | |

Icahn Enterprises LP/Icahn Enterprises Finance Corp. (continued) | | | | | | | | | | | | |

5.25%, 05/15/27 | | | USD | | | | 138 | | | $ | 147,936 | |

NFP Corp.(c) | | | | | | | | | | | | |

7.00%, 05/15/25 | | | | | | | 31 | | | | 33,325 | |

6.88%, 08/15/28 | | | | | | | 288 | | | | 307,492 | |

Owl Rock Capital Corp. | | | | | | | | | | | | |

4.25%, 01/15/26 | | | | | | | 58 | | | | 61,093 | |

3.40%, 07/15/26 | | | | | | | 30 | | | | 30,430 | |

Owl Rock Technology Finance Corp., 3.75%, 06/17/26(c) | | | | | | | 40 | | | | 40,217 | |

RP Escrow Issuer LLC, 5.25%, 12/15/25(c) | | | | | | | 50 | | | | 52,253 | |

| | | | | | | | |

| | | | | | | | | | | 1,059,675 | |

|

| Chemicals — 0.6% | |

Atotech Alpha 2 BV, (8.75% Cash or 9.50% PIK), 8.75%, 06/01/23(c)(f) | | | | | | | 289 | | | | 291,497 | |

Atotech Alpha 3 BV/Alpha US Bidco, Inc., 6.25%, 02/01/25(c) | | | | | | | 636 | | | | 647,130 | |

Axalta Coating Systems LLC, 3.38%, 02/15/29(c) | | | | | | | 150 | | | | 150,000 | |

Blue Cube Spinco LLC | | | | | | | | | | | | |

9.75%, 10/15/23 | | | | | | | 10 | | | | 10,275 | |

10.00%, 10/15/25 | | | | | | | 143 | | | | 151,401 | |

Chemours Co., 5.75%, 11/15/28(c) | | | | | | | 38 | | | | 38,760 | |

Element Solutions, Inc., 3.88%, 09/01/28(c) | | | | | | | 378 | | | | 388,867 | |

GCP Applied Technologies, Inc., 5.50%,

04/15/26(c) | | | | | | | 134 | | | | 138,020 | |

HB Fuller Co., 4.25%, 10/15/28 | | | | | | | 31 | | | | 31,775 | |

Illuminate Buyer LLC/Illuminate Holdings IV, Inc., 9.00%, 07/01/28(c) | | | | | | | 181 | | | | 199,100 | |

Ingevity Corp., 3.88%, 11/01/28(c) | | | | | | | 23 | | | | 23,173 | |

Minerals Technologies, Inc., 5.00%,

07/01/28(c) | | | | | | | 55 | | | | 57,552 | |

PQ Corp., 5.75%, 12/15/25(c) | | | | | | | 307 | | | | 315,059 | |

Rayonier AM Products, Inc., 7.63%,

01/15/26(c) | | | | | | | 21 | | | | 21,898 | |

Valvoline, Inc., 4.25%, 02/15/30(c) | | | | | | | 58 | | | | 61,480 | |

WESCO Distribution, Inc.(c) | | | | | | | | | | | | |

7.13%, 06/15/25 | | | | | | | 153 | | | | 168,274 | |

7.25%, 06/15/28 | | | | | | | 198 | | | | 225,183 | |

WR Grace & Co-Conn, 4.88%, 06/15/27(c) | | | | | | | 64 | | | | 67,873 | |

| | | | | | | | |

| | | | | | | | | | | 2,987,317 | |

|

| Commercial Services & Supplies — 0.1% | |

AMN Healthcare, Inc., 4.00%, 04/15/29(c) | | | | | | | 28 | | | | 28,630 | |

APX Group, Inc., 7.88%, 12/01/22 | | | | | | | 163 | | | | 163,407 | |

ASGN, Inc., 4.63%, 05/15/28(c) | | | | | | | 79 | | | | 82,160 | |

Fortress Transportation & Infrastructure Investors LLC, 6.50%, 10/01/25(c) | | | | | | | 24 | | | | 25,083 | |

Fortress Transportation and Infrastructure Investors LLC, 9.75%, 08/01/27(c) | | | | | | | 17 | | | | 19,486 | |

Herc Holdings, Inc., 5.50%, 07/15/27(c) | | | | | | | 106 | | | | 112,360 | |

Interface, Inc., 5.50%, 12/01/28(c) | | | | | | | 38 | | | | 39,995 | |

Prime Security Services Borrower LLC/Prime Finance, Inc.(c) | | | | | | | | | | | | |

3.38%, 08/31/27 | | | | | | | 42 | | | | 41,685 | |

6.25%, 01/15/28 | | | | | | | 117 | | | | 125,610 | |

Team Health Holdings, Inc., 6.38%,

02/01/25(c) | | | | | | | 103 | | | | 88,580 | |

United Rentals North America, Inc. | | | | | | | | | | | | |

5.25%, 01/15/30 | | | | | | | 2 | | | | 2,220 | |

4.00%, 07/15/30 | | | | | | | 6 | | | | 6,315 | |

| | | | | | | | |

| | | | | | | | | | | 735,531 | |

| | |

16 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) December 31, 2020 | | BlackRock Debt Strategies Fund, Inc. (DSU) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | Par

(000) | | | Value | |

| | | |

| Communications Equipment(c) — 0.1% | | | | | | | | | |

Avaya, Inc., 6.13%, 09/15/28 | | | USD | | | | 195 | | | $ | 208,311 | |

CommScope Technologies LLC | | | | | | | | | | | | |

6.00%, 06/15/25 | | | | | | | 101 | | | | 103,273 | |

5.00%, 03/15/27 | | | | | | | 76 | | | | 74,860 | |

CommScope, Inc. | | | | | | | | | | | | |

6.00%, 03/01/26 | | | | | | | 32 | | | | 33,715 | |

8.25%, 03/01/27 | | | | | | | 12 | | | | 12,810 | |

7.13%, 07/01/28 | | | | | | | 12 | | | | 12,780 | |

ViaSat, Inc. | | | | | | | | | | | | |

5.63%, 04/15/27 | | | | | | | 90 | | | | 94,500 | |

6.50%, 07/15/28 | | | | | | | 150 | | | | 162,331 | |

| | | | | | | | |

| | | | | | | | | | | 702,580 | |

| | | |

| Construction & Engineering(c) — 0.0% | | | | | | | | | |

KBR, Inc., 4.75%, 09/30/28 | | | | | | | 61 | | | | 63,592 | |

Weekley Homes LLC/Weekley Finance Corp., 4.88%, 09/15/28 | | | | | | | 23 | | | | 24,035 | |

| | | | | | | | |

| | | | | | | | | | | 87,627 | |

| | | |

| Construction Materials(c) — 0.4% | | | | | | | | | |

American Builders & Contractors Supply Co., Inc., 4.00%, 01/15/28 | | | | | | | 125 | | | | 129,375 | |

Core & Main LP, 6.13%, 08/15/25 | | | | | | | 797 | | | | 823,899 | |

H&E Equipment Services, Inc., 3.88%, 12/15/28 | | | | | | | 41 | | | | 41,439 | |

IAA, Inc., 5.50%, 06/15/27 | | | | | | | 159 | | | | 168,540 | |

Picasso Finance Sub, Inc., 6.13%, 06/15/25 | | | | | | | 159 | | | | 170,130 | |

Williams Scotsman International, Inc., 4.63%, 08/15/28 | | | | | | | 77 | | | | 79,695 | |

Winnebago Industries, Inc., 6.25%, 07/15/28 | | | | | | | 45 | | | | 48,375 | |

Wolverine Escrow LLC, 9.00%, 11/15/26 | | | | | | | 501 | | | | 474,221 | |

| | | | | | | | |

| | | | | | | | | | | 1,935,674 | |

| | | |

| Consumer Discretionary(c) — 0.1% | | | | | | | | | |

Carnival Corp. | | | | | | | | | | | | |

11.50%, 04/01/23 | | | | | | | 30 | | | | 34,702 | |

10.50%, 02/01/26 | | | | | | | 42 | | | | 48,930 | |

7.63%, 03/01/26 | | | | | | | 76 | | | | 82,801 | |

9.88%, 08/01/27 | | | | | | | 61 | | | | 70,150 | |

NCL Corp. Ltd. | | | | | | | | | | | | |

10.25%, 02/01/26 | | | | | | | 37 | | | | 43,290 | |

5.88%, 03/15/26 | | | | | | | 63 | | | | 66,265 | |

Nielsen Finance LLC/Nielsen Finance Co. | | | | | | | | | | | | |

5.63%, 10/01/28 | | | | | | | 112 | | | | 121,693 | |

5.88%, 10/01/30 | | | | | | | 74 | | | | 83,712 | |

Royal Caribbean Cruises Ltd. | | | | | | | | | | | | |

10.88%, 06/01/23 | | | | | | | 45 | | | | 51,205 | |

9.13%, 06/15/23 | | | | | | | 54 | | | | 58,590 | |

11.50%, 06/01/25 | | | | | | | 95 | | | | 111,060 | |

| | | | | | | | |

| | | | | | | | | | | 772,398 | |

| | | |

| Consumer Finance — 0.6% | | | | | | | | | |

MPH Acquisition Holdings LLC, 5.75%, | | | | | | | | | | | | |

11/01/28(c) | | | | | | | 228 | | | | 224,078 | |

Navient Corp. | | | | | | | | | | | | |

7.25%, 09/25/23 | | | | | | | 5 | | | | 5,480 | |

6.13%, 03/25/24 | | | | | | | 96 | | | | 102,480 | |

5.88%, 10/25/24 | | | | | | | 77 | | | | 81,812 | |

5.00%, 03/15/27 | | | | | | | 2 | | | | 2,018 | |

OneMain Finance Corp. | | | | | | | | | | | | |

8.88%, 06/01/25 | | | | | | | 27 | | | | 30,544 | |

6.63%, 01/15/28 | | | | | | | 8 | | | | 9,500 | |

5.38%, 11/15/29 | | | | | | | 14 | | | | 15,750 | |

4.00%, 09/15/30 | | | | | | | 100 | | | | 103,761 | |

PayPal Holdings, Inc., 1.65%, 06/01/25 | | | | | | | 257 | | | | 268,509 | |

| | | | | | | | | | | | |

| Security | | | Par

(000) | | | Value | |

| | | |

| Consumer Finance (continued) | | | | | | | | | |

Refinitiv US Holdings, Inc., 4.50%, 05/15/26 | | | EUR | | | | 855 | | | $ | 1,098,042 | |

Sabre GLBL, Inc.(c) | | | | | | | | | | | | |

5.25%, 11/15/23 | | | USD | | | | 10 | | | | 10,125 | |

9.25%, 04/15/25 | | | | | | | 287 | | | | 341,530 | |

7.38%, 09/01/25 | | | | | | | 81 | | | | 87,885 | |

Shift4 Payments LLC/Shift4 Payments Finance Sub, Inc., 4.63%, 11/01/26(c) | | | | | | | 87 | | | | 90,480 | |

Verscend Escrow Corp., 9.75%, 08/15/26(c) | | | | | | | 851 | | | | 922,271 | |

WEX, Inc., 4.75%, 02/01/23(c) | | | | | | | 8 | | | | 8,010 | |

| | | | | | | | |

| | | | | | | | | | | 3,402,275 | |

| | | |

| Containers & Packaging — 0.1% | | | | | | | | | |

Graham Packaging Co., Inc., 7.13%, 08/15/28(c) | | | | | | | 147 | | | | 162,435 | |

Intelligent Packaging Ltd. Finco, Inc./Intelligent Packaging Ltd. Co-Issuer LLC, 6.00%, 09/15/28(c) | | | | | | | 53 | | | | 54,457 | |

| International Paper Co., 7.30%, 11/15/39 | | | | | | | 5 | | | | 8,012 | |

| LABL Escrow Issuer LLC(c) | | | | | | | | | | | | |

6.75%, 07/15/26 | | | | | | | 116 | | | | 125,625 | |

10.50%, 07/15/27 | | | | | | | 56 | | | | 63,070 | |

| | | | | | | | |

| | | | | | | | | | | 413,599 | |

| | | |

| Diversified Consumer Services(c) — 0.3% | | | | | | | | | |

Allied Universal Holdco LLC/Allied Universal Finance Corp. | | | | | | | | | | | | |

6.63%, 07/15/26 | | | | | | | 868 | | | | 925,548 | |

9.75%, 07/15/27 | | | | | | | 95 | | | | 103,550 | |

Ascend Learning LLC, 6.88%, 08/01/25 | | | | | | | 340 | | | | 349,638 | |

Brink’s Co., 5.50%, 07/15/25 | | | | | | | 15 | | | | 16,013 | |

Garda World Security Corp. | | | | | | | | | | | | |

4.63%, 02/15/27 | | | | | | | 29 | | | | 29,290 | |

9.50%, 11/01/27 | | | | | | | 55 | | | | 60,913 | |

Sotheby’s, 7.38%, 10/15/27 | | | | | | | 200 | | | | 214,250 | |

| | | | | | | | |

| | | | | | | | | | | 1,699,202 | |

| | | |

| Diversified Financial Services — 0.1% | | | | | | | | | |

Arrow Global Finance PLC, 5.13%, 09/15/24 | | | GBP | | | | 100 | | | | 136,187 | |

Central Garden & Pet Co., 4.13%, 10/15/30 | | | USD | | | | 59 | | | | 61,507 | |

Citigroup, Inc., (5 year CMT + 3.60%),

4.00%(e)(g) | | | | | | | 50 | | | | 51,313 | |

Global Aircraft Leasing Co. Ltd., (6.50% Cash or 7.25% PIK), 6.50%, 09/15/24(c)(f) | | | | | | | 24 | | | | 21,271 | |

Intrum AB, 4.88%, 08/15/25 | | | EUR | | | | 100 | | | | 126,135 | |

Spectrum Brands, Inc.(c) | | | | | | | | | | | | |

5.00%, 10/01/29 | | | USD | | | | 18 | | | | 19,330 | |

5.50%, 07/15/30 | | | | | | | 50 | | | | 53,875 | |

Starwood Property Trust Inc., 5.50%, 11/01/23(c) | | | | | | | 9 | | | | 9,405 | |

| | | | | | | | |

| | | | | | | | | | | 479,023 | |

|

| Diversified Telecommunication Services — 1.2% | |

CenturyLink, Inc. | | | | | | | | | | | | |

5.13%, 12/15/26(c) | | | | | | | 618 | | | | 652,583 | |

4.50%, 01/15/29(c) | | | | | | | 202 | | | | 205,535 | |

Series P, 7.60%, 09/15/39 | | | | | | | 183 | | | | 222,345 | |

Series U, 7.65%, 03/15/42 | | | | | | | 103 | | | | 124,630 | |

Cincinnati Bell, Inc.(c) | | | | | | | | | | | | |

7.00%, 07/15/24 | | | | | | | 26 | | | | 27,040 | |

8.00%, 10/15/25 | | | | | | | 20 | | | | 21,325 | |

Consolidated Communications, Inc., 6.50%, | | | | | | | | | | | | |

10/01/28(c) | | | | | | | 150 | | | | 160,500 | |

Frontier Communications Corp.(c) | | | | | | | | | | | | |

5.88%, 10/15/27 | | | | | | | 145 | | | | 156,781 | |

5.00%, 05/01/28 | | | | | | | 216 | | | | 225,180 | |

6.75%, 05/01/29 | | | | | | | 135 | | | | 144,450 | |

Intelsat Jackson Holdings SA, 8.00%, 02/15/24(c) | | | | | | | 155 | | | | 158,681 | |

| | |

S C H E D U L E O F I N V E S T M E N T S | | 17 |

| | |

Schedule of Investments (continued) December 31, 2020 | | BlackRock Debt Strategies Fund, Inc. (DSU) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | Par

(000) | | | Value | |

|

| Diversified Telecommunication Services (continued) | |

Level 3 Financing, Inc.(c) | | | | | | | | | | | | |

4.25%, 07/01/28 | | | USD | | | | 207 | | | $ | 212,693 | |

3.63%, 01/15/29 | | | | | | | 123 | | | | 122,693 | |

Oi SA, (10.00% Cash or 8.00% Cash + 4.00% PIK), 10.00%, 07/27/25(f) | | | | | | | 12 | | | | 12,776 | |

Sprint Capital Corp., 6.88%, 11/15/28 | | | | | | | 171 | | | | 225,460 | |

Switch Ltd., 3.75%, 09/15/28(c) | | | | | | | 100 | | | | 101,500 | |

Telecom Italia Capital SA | | | | | | | | | | | | |

6.38%, 11/15/33 | | | | | | | 58 | | | | 71,340 | |

6.00%, 09/30/34 | | | | | | | 134 | | | | 163,224 | |

7.20%, 07/18/36 | | | | | | | 14 | | | | 18,889 | |

7.72%, 06/04/38 | | | | | | | 51 | | | | 70,890 | |

Telecom Italia SpA, 5.30%, 05/30/24(c) | | | | | | | 314 | | | | 341,475 | |

Zayo Group Holdings, Inc.(c) | | | | | | | | | | | | |

4.00%, 03/01/27 | | | | | | | 2,254 | | | | 2,259,635 | |

6.13%, 03/01/28 | | | | | | | 472 | | | | 499,140 | |

| | | | | | | | |

| | | | | | | | | | | 6,198,765 | |

| | | |

| Electric Utilities — 0.1% | | | | | | | | | |

FirstEnergy Corp. | | | | | | | | | | | | |

2.65%, 03/01/30 | | | | | | | 8 | | | | 8,025 | |

Series B, 3.90%, 07/15/27 | | | | | | | 29 | | | | 31,967 | |

Series B, 2.25%, 09/01/30 | | | | | | | 6 | | | | 5,804 | |

Series C, 4.85%, 07/15/47 | | | | | | | 151 | | | | 187,919 | |

Series C, 3.40%, 03/01/50 | | | | | | | 60 | | | | 57,470 | |

FirstEnergy Transmission LLC(c) | | | | | | | | | | | | |

5.45%, 07/15/44 | | | | | | | 94 | | | | 119,273 | |

4.55%, 04/01/49 | | | | | | | 45 | | | | 52,553 | |

PG&E Corp., 5.25%, 07/01/30 | | | | | | | 108 | | | | 118,800 | |

Pike Corp., 5.50%, 09/01/28(c) | | | | | | | 185 | | | | 195,406 | |

Texas Competitive Electric Holdings Co. | | | | | | | | | | | | |

LLC/TCEH Finance, Inc., Term Loan, 1.00%, 11/10/21(a)(b)(d) | | | | | | | 2,375 | | | | — | |

| | | | | | | | |

| | | | | | | | | | | 777,217 | |

| | | |

| Electrical Equipment — 0.1% | | | | | | | | | |

Gates Global LLC/Gates Corp., 6.25%, | | | | | | | | | | | | |

01/15/26(c) | | | | | | | 291 | | | | 305,550 | |

GrafTech Finance, Inc., 4.63%, 12/15/28(c) | | | | | | | 44 | | | | 44,495 | |

NM Holdings Co. LLC, Series B, 9.50%, 07/01/05(a)(b)(d) | | | | | | | 5,125 | | | | 1 | |

| | | | | | | | |

| | | | | | | | | | | 350,046 | |

|

| Electronic Equipment, Instruments & Components — 0.1% | |

Brightstar Escrow Corp., 9.75%, 10/15/25(c) | | | | | | | 28 | | | | 29,925 | |

BWX Technologies, Inc., 4.13%,

06/30/28(c) | | | | | | | 81 | | | | 84,341 | |

CDW LLC/CDW Finance Corp., 3.25%, 02/15/29 | | | | | | | 125 | | | | 127,463 | |

Energizer Holdings, Inc.(c) | | | | | | | | | | | | |

4.75%, 06/15/28 | | | | | | | 34 | | | | 35,785 | |

4.38%, 03/31/29 | | | | | | | 6 | | | | 6,213 | |

Xerox Corp., 4.80%, 03/01/35 | | | | | | | 181 | | | | 182,357 | |

| | | | | | | | |

| | | | | | | | | | | 466,084 | |

| | | |

| Energy Equipment & Services — 0.2% | | | | | | | | | |

Archrock Partners LP/Archrock Partners Finance Corp.(c) | | | | | | | | | | | | |

6.88%, 04/01/27 | | | | | | | 129 | | | | 138,836 | |

6.25%, 04/01/28 | | | | | | | 86 | | | | 89,523 | |

Pioneer Energy Services Corp.(b)(c)(f) (11.00% Cash), 11.00%, 05/15/25 | | | | | | | 329 | | | | 262,855 | |

| | | | | | | | | | | | |

| Security | | | Par

(000) | | | Value | |

| | | |

| Energy Equipment & Services (continued) | | | | | | | | | |

Pioneer Energy Services Corp.(b)(c)(f) (continued) | | | | | | | | | | | | |

(5.00% PIK), 5.00%, 11/15/25(h) | | | USD | | | | 231 | | | $ | 124,956 | |

USA Compression Partners LP/USA Compression Finance Corp. | | | | | | | | | | | | |

6.88%, 04/01/26 | | | | | | | 331 | | | | 345,895 | |

6.88%, 09/01/27 | | | | | | | 274 | | | | 292,517 | |

| | | | | | | | |

| | | | | | | | | | | 1,254,582 | |

|

| Environmental, Maintenance, & Security Service — 0.1% | |

Covanta Holding Corp., 5.00%, 09/01/30 | | | | | | | 29 | | | | 31,028 | |

GFL Environmental, Inc.(c) | | | | | | | | | | | | |

3.75%, 08/01/25 | | | | | | | 85 | | | | 87,125 | |

5.13%, 12/15/26 | | | | | | | 73 | | | | 77,654 | |

4.00%, 08/01/28 | | | | | | | 98 | | | | 98,735 | |

3.50%, 09/01/28 | | | | | | | 104 | | | | 105,885 | |

Stericycle Inc., 3.88%, 01/15/29(c) | | | | | | | 52 | | | | 53,430 | |

Tervita Corp., 11.00%, 12/01/25(c) | | | | | | | 37 | | | | 39,813 | |

Waste Pro USA, Inc., 5.50%, 02/15/26(c) | | | | | | | 71 | | | | 72,598 | |

| | | | | | | | |

| | | | | | | | | | | 566,268 | |

|

| Equity Real Estate Investment Trusts (REITs) — 0.5% | |

Brookfield Property REIT, Inc./BPR Cumulus LLC/BPR Nimbus LLC/GGSI Sellco LL, 5.75%, 05/15/26(c) | | | | | | | 128 | | | | 126,080 | |

Diversified Healthcare Trust, 9.75%, 06/15/25 | | | | | | | 53 | | | | 60,215 | |

Global Net Lease, Inc./Global Net Lease | | | | | | | | | | | | |

Operating Partnership LP, 3.75%, 12/15/27(c) | | | | | | | 88 | | | | 90,727 | |

Iron Mountain, Inc.(c) | | | | | | | | | | | | |

4.88%, 09/15/29 | | | | | | | 10 | | | | 10,550 | |

5.25%, 07/15/30 | | | | | | | 134 | | | | 144,720 | |

5.63%, 07/15/32 | | | | | | | 151 | | | | 166,477 | |

MGM Growth Properties Operating Partnership | | | | | | | | | | | | |

LP/MGP Finance Co-Issuer, Inc. | | | | | | | | | | | | |

4.63%, 06/15/25(c) | | | | | | | 205 | | | | 219,555 | |

4.50%, 09/01/26 | | | | | | | 139 | | | | 149,550 | |

4.50%, 01/15/28 | | | | | | | 420 | | | | 446,830 | |

3.88%, 02/15/29(c) | | | | | | | 137 | | | | 140,083 | |

MPT Operating Partnership LP/MPT Finance Corp. | | | | | | | | | | | | |

4.63%, 08/01/29 | | | | | | | 296 | | | | 316,350 | |

3.50%, 03/15/31 | | | | | | | 149 | | | | 153,843 | |

Park Intermediate Holdings LLC/PK Domestic Property LLC/PK Finance Co.Issuer, 5.88%, 10/01/28(c) | | | | | | | 29 | | | | 30,885 | |

RHP Hotel Properties LP/RHP Finance Corp., 4.75%, 10/15/27 | | | | | | | 521 | | | | 539,235 | |

Service Properties Trust | | | | | | | | | | | | |

4.50%, 06/15/23 | | | | | | | 15 | | | | 15,075 | |