SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | |

| Filed by the Registrant | | þ |

| Filed by a party other than the Registrant | | o |

| | | |

| Check the appropriate box: | | |

| | | |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the SEC Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | |

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| | | |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. |

| |

| | | Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

PSB GROUP, INC.

1800 East 12 Mile Road

Madison Heights, MI 48071-2600

(248) 548-2900

March 30, 2009

Dear Shareholder:

I am pleased to invite you to attend the PSB Group, Inc.’s 2009 annual meeting of shareholders on Tuesday, April 28, 2009. We will hold the meeting at 9:00 a.m. at the Ukrainian Cultural Center, 26601 Ryan Road, Warren, Michigan.

On the page following this letter, you will find the Notice of Meeting which lists the matters to be considered at the meeting. Following the Notice of Meeting is the proxy statement which describes these matters and provides you with additional information about our Company. Also enclosed you will find your proxy card, which allows you to vote on these matters, and the Company’s 2008 Annual Report.

Your vote is important. A majority of the common stock must be represented, either in person or by proxy, to constitute a quorum for the conduct of business.Please complete and mail in your proxy card promptly, even if you plan to attend the meeting.You can attend the meeting and vote in person, even if you have sent in a proxy card.

The Board of Directors recommends that shareholders vote FOR each of the proposals stated in the proxy statement.

The rest of the Board and I look forward to seeing you at the meeting. Whether or not you can attend, we greatly appreciate your cooperation in returning the proxy card.

Sincerely,

Michael J. Tierney

President and Chief Executive Officer

PSB GROUP, INC.

1800 East 12 Mile Road

Madison Heights, MI 48071-2600

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | | |

| TIME | | 9:00 a.m. on Tuesday, April 28, 2009 |

| | | |

| PLACE | | Ukrainian Cultural Center

26601 Ryan Road

Warren, Michigan |

| | | |

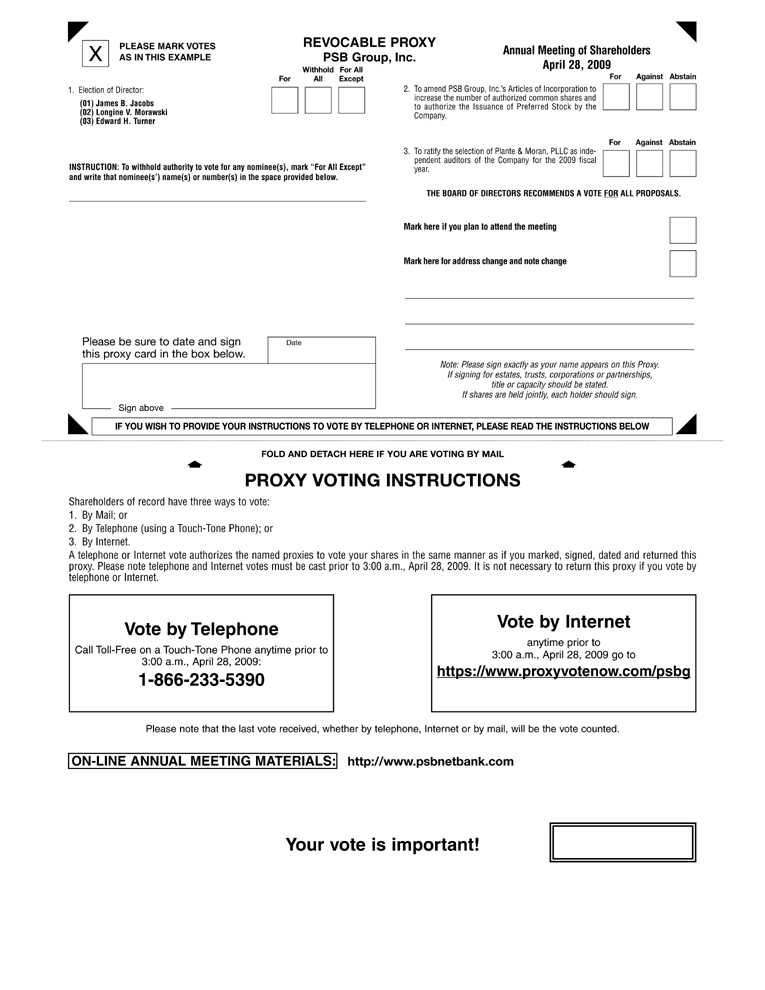

| ITEMS OF BUSINESS | | (1) To elect three members of the Board of Directors each for a three-year term. |

| | | (2) To amend the Company’s articles of incorporation to increase the number of authorized common shares and to authorize the issuance of preferred stock by the Company. |

| | | (3) To ratify the selection of Plante & Moran, PLLC as independent auditors of the Company for the 2009 fiscal year. |

| | | (4) To transact such other business as may properly come before the Meeting. |

| | | |

| ANNUAL REPORT | | Our 2008 Annual Report, which is not a part of the proxy soliciting material, is enclosed. |

| | | |

| RECORD DATE | | You can vote if you are a shareholder of record on March 2, 2009. |

| | | |

| QUORUM | | A majority of the shares of common stock must be represented at the meeting. If there are insufficient shares, the meeting may be adjourned. |

| | |

| | | |

| | | |

| March 30, 2009 | | David A. Wilson |

| | | Secretary |

TABLE OF CONTENTS

| | | | | |

| | | 1 | |

| | | 1 | |

| | | 1 | |

| | | 2 | |

| | | 2 | |

| | | 2 | |

| | | 2 | |

| | | 3 | |

| | | 3 | |

| | | 3 | |

| | | 3 | |

| | | 4 | |

| | | 4 | |

| | | 4 | |

| | | 4 | |

| | | 4 | |

| | | 4 | |

| | | 5 | |

| | | 5 | |

| | | 5 | |

| | | 5 | |

| | | 6 | |

| | | 6 | |

| | | 8 | |

| | | 10 | |

| | | 11 | |

| | | 11 | |

| | | 11 | |

| | | 11 | |

| | | 11 | |

| | | 13 | |

| | | 14 | |

| | | 16 | |

| | | 17 | |

| | | 17 | |

| | | 19 | |

| | | 20 | |

| | | 20 | |

| | | 21 | |

| | | 21 | |

PSB GROUP, INC.

1800 East 12 Mile Road

Madison Heights,MI 48071-2600

SOLICITATION AND VOTING

We are sending you this Proxy Statement and the enclosed proxy card because the Board of Directors of PSB Group, Inc. (the “Company” “we” or “us”) is soliciting your proxy to vote at the 2009 annual meeting of Shareholders (the “Annual Meeting”). This Proxy Statement summarizes the information you need to know to vote intelligently at the Annual Meeting.

You are invited to attend our Annual Meeting of Shareholders on April 28, 2009 beginning at 9:00 a.m. The Annual Meeting will be held at the Ukrainian Cultural Center, 26601 Ryan Road, Warren, Michigan.

This Proxy Statement and the enclosed form of proxy are being mailed starting on or around March 30, 2009.

Shareholders Entitled to Vote

Holders of record of common stock of the Company at the close of business on March 2, 2009 are entitled to receive this notice. Each share of common stock of the Company is equal to one vote.

There is no cumulative voting at the Annual Meeting.

As of the record date, there were 3,476,510 common shares outstanding.

Voting Procedures

You can vote on matters to come before the meeting in one of three ways:

| | • | | you can come to the Annual Meeting and cast your vote there; |

| |

| | • | | you can vote by giving a proxy to another person who can cast your vote at the Annual Meeting; or |

| |

| | • | | you can vote by signing and returning the enclosed proxy card. If you do so, the individuals named as proxies on the card will vote your shares in the manner you indicate. |

You may also choose to vote for all of the nominees for directors and each proposal by simply signing, dating and returning the enclosed proxy card without further direction. All signed and returned proxies that contain no direction as to vote will be votedFOReach of the nominees for director andFOReach of the proposals.

The Board of Directors has selected itself as the persons to act as proxies on the proxy card.

If you plan to attend the Annual Meeting and vote in person, you should request a ballot when you arrive.IF YOUR SHARES ARE HELD IN THE NAME OF YOUR BROKER, BANK OR OTHER NOMINEE, THE INSPECTOR OF ELECTION WILL REQUIRE YOU TO PRESENT A POWER OF ATTORNEY OR PROXY IN YOUR NAME FROM SUCH BROKER, BANK OR OTHER NOMINEE FOR YOU TO VOTE SUCH SHARES AT THE ANNUAL MEETING. Please contact your broker, bank or nominee.

Voting Procedures for Shares in the Company’s 401(k) Plan

If you participate in the Company’s 401(k), Profit Sharing and Employee Stock Ownership Plan (the “401(k) Plan”), please return your proxy in the envelope on a timely basis to ensure that your proxy is voted. If you own or are entitled to give voting instructions for shares in the 401(k) Plan and do not vote your shares or give voting instructions, generally, the Plan Administrator or Trustee will vote your shares in the same proportion as the shares for all plan participants for which voting instructions have been received. Holders of shares in the 401(k) Plan will not be permitted to vote such shares at the Annual Meeting, but their attendance is encouraged and welcome.

Required Vote

The presence, in person or by proxy, of the holders of a majority of the votes entitled to be cast by the shareholders at the Annual Meeting is necessary to constitute a quorum. Abstentions and broker “non votes” are counted as present and entitled to vote for purposes of determining a quorum. A broker “non vote” occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because such broker, bank or nominee does not have discretionary authority to vote and has not received instructions from the beneficial owner.

Once a quorum is achieved, a plurality of votes cast is all that is necessary for the election of Directors. Abstentions and broker “non votes” are not counted in determining the vote. In connection with the proposal to amend the articles of incorporation, the affirmative vote of a majority of the issued and outstanding shares entitled to vote is required for approval. Abstentions and broker non-votes have the effect of a vote against the proposed amendment. As to ratification of Plante & Moran, PLLC and all other matters that may come before the meeting, the affirmative vote of a majority of votes cast is necessary for the approval of such matters. Abstentions and broker non votes are again not counted for purposes of approving the matter.

Revoking a Proxy

If you give a proxy, you may revoke it at any time before it is exercised. You may revoke your proxy in any one of three ways:

| | • | | You may send in another proxy with a later date; |

| |

| | • | | You may notify the Company’s Secretary in writing at PSB Group, Inc., 1800 East 12 Mile Road, Madison Heights, Michigan 48071-2600; or |

| |

| | • | | You may revoke by voting in person at the Annual Meeting. |

If you choose to revoke your proxy by attending the Annual Meeting, you must vote in accordance with the rules for voting at the Annual Meeting. Attending the Annual Meeting alone will not constitute revocation of a proxy.

List of Shareholders

A list of shareholders entitled to vote at the Annual Meeting will be available at the Company’s offices at 1800 East 12 Mile Road, Madison Heights, Michigan for a period of ten days prior to the Annual Meeting. A list will also be available at the Annual Meeting itself.

2

Cost of Proxy Solicitation

We will pay the expenses of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees in person or by telephone, mail or telegram. Directors, officers and employees who solicit proxies will not be compensated for such activities. We have not hired and do not intend to hire a proxy solicitation firm to assist us in the distribution and solicitation of proxies. The Company will also request persons, firms and corporations holding shares in their names for other beneficial owners to send proxy materials to such beneficial owners. The Company will reimburse these persons for their expenses.

Inspector of Election

Your proxy returned in the enclosed envelope will be delivered to the Company’s Secretary, David A. Wilson. The Board of Directors has designated Barbara Heath and Rhonda Kozlowski of PSB Group, Inc. to act as inspectors of election and to tabulate the votes at the Annual Meeting. After the final adjournment of the Annual Meeting, the proxies will be returned to the Company.

Other Matters

The Board of Directors knows of no business which will be presented for consideration at the Annual Meeting other than as stated in the Notice of Annual Meeting of Shareholders. If, however, other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the proxies to vote the shares on such matters in their discretion.

GOVERNANCE OF THE COMPANY

Role and Composition of the Board of Directors

Our Company’s Board of Directors is the ultimate decision making body of the Company, except for matters which law or our Articles of Incorporation requires the vote of shareholders. The Board of Directors selects the management of the Company which is responsible for the Company’s day to day operations. The Board acts as an advisor to management and also monitors its performance. Our Board of Directors has determined that each of Messrs. Wood, Morawski, Jacobs, Ross and Kowalski are independent as independence is defined in NASDAQ’s listing standards, as those standards have been modified or supplemented.

During 2008, the Board of Directors met as the Company’s Board of Directors 12 times. In addition, the Board of Directors has authorized seven Committees to manage distinct matters of the Company. These Committees are the Executive Committee, the Audit Committee, the Directors Loan Committee, the Investment and Asset/Liability Management Committee, the Nominating Committee, the Compensation and Benefits Committee and the Strategic and Long Range Planning Committee. Membership on each of the Committees is set forth on the table below. All of our Directors attended 75 percent or more of the meetings of the Board and the Board Committees on which they served in 2008.

3

COMMITTEES OF THE BOARD

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Investment | | | | | | | | | | Strategic and |

| | | | | | | | | | | | | | | and | | | | | | | | | | Long Range |

| | | | | | | | | | | Directors | | Asset/Liability | | | | | | Compensation | | Planning |

| Name | | Executive | | Audit | | Loan | | Management | | Nominating | | and Benefits | | Committee |

| James B. Jacobs | | | | | | | X | | | | X | | | | X | | | | | | | | | | | | X | |

| Michael J. Kowalski | | | | | | | | | | | X | | | | X | | | | X | | | | X | | | | | |

| Longine V. Morawski | | | X | | | | X | | | | X | | | | | | | | X | | | | X | | | | X | |

| Sydney L. Ross | | | | | | | X | | | | X | | | | | | | | | | | | X | | | | X | |

| Michael J. Tierney | | | X | | | | | | | | X | | | | X | | | | | | | | X | * | | | X | |

| Edward H. Turner | | | | | | | | | | | X | | | | | | | | | | | | | | | | X | |

| David L. Wood | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | |

The Executive Committee(Number of Meetings in 2008:12)

The Executive Committee oversees and evaluates the Chief Executive Officer, develops new initiatives for presentation to the Board of Directors, and is responsible for Board issues which arise during intervals between Board meetings.

The Audit Committee(Number of Meetings in 2008:3)

The Audit Committee is responsible for recommending the annual appointment of the public accounting firm to be our outside auditors, subject to approval of the Board of Directors and shareholders. The Committee is responsible for the following tasks:

| | • | | maintaining a liaison with the outside auditors |

| |

| | • | | reviewing the adequacy of audit and internal controls |

| |

| | • | | reviewing with management and outside auditors financial disclosures of the Company |

| |

| | • | | reviewing any material changes in accounting principles or practices used in preparing statements |

Audit Committee Financial Expert.While the Board of Directors endorses the effectiveness of our Audit Committee, its membership does not include a director who qualifies for designation as an “audit committee financial expert” – a concept under federal regulation that contemplates such designation only when an audit committee member satisfies all five qualification requirements, such as experience (or “experience actively supervising” others engaged in), preparing, auditing, analyzing or evaluating financial statements presenting a level of accounting complexity comparable to what is encountered in connection with our Company’s financial statements.

The Directors Loan Committee(Number of Meetings in 2008:23)

The Directors Loan Committee is responsible for reviewing and making recommendations concerning the Company’s credit policy, providing an annual strategic analysis and business plan for lending, reviewing loans requiring full Board approval prior to presentation and approving loans with total commitments between $2,500,000 and $5,000,000. This committee meets on an adhoc basis as is needed.

The Investment and Asset Liability Management Committee(Number of Meetings in 2008:2)

The primary objective of the Investment and Asset/Liability Management Committee is to review the investment strategy implementation, the asset/liability management results and to review the policies governing the investments and asset/liability management. This committee generally meets once a year.

4

The Nominating Committee(Number of Meetings in 2008:2)

Our Board of Directors has a Nominating Committee which consists of three directors. David L. Wood, Michael J. Kowalski and Longine V. Morawski are the current members of this committee. The Nominating Committee identifies individuals to become board members and selects, or recommends for the board’s selection, director nominees to be presented for shareholder approval at the annual meeting of shareholders or to fill any vacancies.

Our Board of Directors has adopted a written charter for the Nominating Committee, a copy of which is available to shareholders on our website, at www.psbnetbank.com. Each of the members of our Nominating Committee is independent as independence is defined in NASDAQ’s listing standards, as those standards have been modified or supplemented.

The Nominating Committee’s policy is to consider director candidates recommended by shareholders. Such recommendations must be made pursuant to notice in writing by January 1 of the year in which the meeting will be held to:

PSB Group, Inc.

1800 East 12 Mile Road

Madison Heights, Michigan 48071-2600

Attn: David A. Wilson, Secretary

The Nominating Committee has not established specific, minimum qualifications for recommended nominees or specific qualities or skills for one or more of our directors to possess. The Nominating Committee uses a subjective process for identifying and evaluating nominees for director, based on the information available to, and the subjective judgments of, the members of the Nominating Committee and our then current needs, although the committee does not believe there would be any difference in the manner in which it evaluates nominees based on whether the nominee is recommended by a shareholder. Historically, nominees have been existing directors or business associates of our directors or officers.

The Compensation and Benefits Committee(Number of Meetings in 2008:5)

The primary objective of the Compensation and Benefits Committee is to review the entire benefits package for the Company. This includes the salary and wages budget, the Executive Bonus Plan, the 401(k) Profit Sharing Plan, health and welfare benefits and director compensation. The committee makes recommendations to the board, but does not have the authority to establish compensation. The committee may utilize banking industry compensation surveys from time-to-time, but does not utilize compensation consultants in recommending compensation. For officers other than the President and Chief Executive Officer, the committee utilizes advice from the President and Chief Executive Officer in making its recommendation to the board. The committee is also responsible for reviewing and recommending that the Company’s Executive Compensation Discussion be included in this proxy statement. This committee meets as needed, generally three times a year.

Our Board of Directors has adopted a written charter for the Compensation and Benefits Committee, a copy of which is available to shareholders on our website at www.psbnetbank.com. Each of the voting members of our Compensation and Benefits Committee is independent as independence is defined in NASDAQ’s listing standards, as those standards have been modified or supplemented.

The Strategic and Long Range Planning Committee(Number of Meetings in 2008:3)

The Strategic and Long Range Planning Committee is responsible for plans that exceed 2 years. This can include branching, acquisitions, formation of new companies or other items that take a longer timeframe to be completed. It provides management with direction on the long term goals and what needs to be focused on with goals in the 3 to 5 years or longer range.

Code of Ethics

The Company has adopted a Code of Ethics that applies to all of our employees, officers and directors, including our principal executive officer, principal financial officer, principal accounting officer or controller, or

5

persons performing similar functions. Our Code of Ethics contains written standards that we believe are reasonably designed to deter wrongdoing and to promote:

| | • | | Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| |

| | • | | Full, fair, accurate, timely, and understandable disclosure in reports and documents that we file with, or submit to, the Securities and Exchange Commission and in other public communications we make; |

| |

| | • | | Compliance with applicable governmental laws, rules and regulations; |

| |

| | • | | The prompt internal reporting of violations of the code to an appropriate person or persons named in the code; and |

| |

| | • | | Accountability for adherence to the code. |

��This Code of Ethics is included as Exhibit 14 to our Annual Report on Form 10-K. We have also posted it on our website at www.psbnetbank.com. We will provide to any person without charge, upon request, a copy of our Code of Ethics. Requests for a copy of our Code of Ethics should be made to our Secretary at 1800 East 12 Mile Road, Madison Heights, Michigan 48071-2600. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding an amendment to, or a waiver from, a provision of our Code of Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions and that relates to any element of the code definition enumerated in Securities and Exchange Commission, Regulation S-K, Item 406 by posting such information on our website at www.psbnetbank.com within five business days following the date of the amendment or waiver.

Shareholder Communications with the Board

Our Board of Directors has a process for shareholders to send communications to the Board of Directors, its Nominating Committee or its Audit Committee, including complaints regarding accounting, internal accounting controls, or auditing matters. Communications can be sent to the Board of Directors, it’s Nominating Committee or its Audit Committee or specific directors either by regular mail to the attention of the Board of Directors, its Nominating Committee, its Audit Committee or specific directors, at our principal executive offices at 1800 East 12 Mile Road, Madison Heights, Michigan 48071-2600. All of these communications will be reviewed by our Secretary (1) to filter out communications that our Secretary deems are not appropriate for our directors, such as spam and communications offering to buy or sell products or services, and (2) to sort and relay the remainder to the appropriate directors. We encourage all of our directors to attend the annual meeting of shareholders, if possible. All of our directors attended the previous year’s annual meeting of shareholders.

ITEM 1. ELECTION OF DIRECTORS

The Board of Directors is divided into three classes. Each class of directors is elected for a three-year term. One class of directors is up for election each year. This results in a staggered Board which ensures continuity from year to year.

Three directors will be elected at the Annual Meeting, each to serve a three-year term expiring at our Annual Meeting in 2012.

The persons named in the enclosed proxy card intend to vote the proxy for the election of each of the nominees unless you indicate on the proxy card that your vote should be withheld from any or all of such nominees. Each nominee elected as director will continue in office until his or her successor has been elected, or until his death, resignation or retirement.

The Board of Directors has proposed the following nominees for election as directors with the term expiring at the Annual Meeting in the year set forth below:

6

Class II — Term Expiring in 2012

James B. Jacobs

Longine V. Morawski

Edward H. Turner

The Board of Directors recommends a vote FOR the election of the nominees as Directors.

We expect the nominees to be able to serve if elected. If any nominee is not able to serve, proxies may be voted for substitute nominees. The principal occupation and certain other information about the nominees and other directors whose terms of office continue after the Annual Meeting is set forth below.

NOMINEES WHOSE TERMS WILL EXPIRE IN 2012

| | | |

| Name and Age as of | | Position, Principal Occupation, |

| the Annual Meeting | | Business Experience and Directorship |

| James B. Jacobs, Age 65 | | Elected to the board of directors in 2003. President, Macomb Community College (6/08-Present); Director of the Center for Workforce Development, Macomb Community College (6/00-6/08); Associate Vice President, Macomb Community College (1/95-6/00). |

| | | |

| Longine V. Morawski, Age 57 | | President of MP Tool & Engineering, a manufacturing company, since 1974. Mr. Morawski has served as a director of the Company since 1999 and has served as Vice Chairman of the Board of Directors of the Company since 2000. |

| | | |

| Edward H. Turner, Age 62 | | President of Turner and Associates Consultants, a consulting firm which specializes in providing consulting services to financial institutions, since 1994. Mr. Turner was appointed to the Board of Directors in 2001. |

DIRECTORS WITH TERMS EXPIRING 2010

| | | |

| Name and Age as of | | Position, Principal Occupation, |

| the Annual Meeting | | Business Experience and Directorship |

| Michael J. Tierney, Age 54 | | Michael J. Tierney is the current President and Chief Executive Officer of the Company. Mr. Tierney assumed this role beginning January 1, 2007 upon the retirement of Robert L. Cole. Mr. Tierney has served as President of Peoples State Bank since July 2006 and prior to that served as Managing Director for Business Banking in the Midwest Region for JP Morgan Chase from February 2006 to June 2006. Mr. Tierney also spent 28 years at Comerica Incorporated where he held executive positions in retail banking, corporate banking, private banking and product management. Mr. Tierney was appointed as a director of PSB Group, Inc. in July 2006. |

| | | |

| David L. Wood, Age 64 | | David L. Wood retired from Colonial Bushings, Inc., a manufacturer of precision tooling components, where he had been Manager since 1973. Mr. Wood has served as a director of the Company since 1985 and has served as its Chairman since 2000. |

7

DIRECTORS WITH TERMS EXPIRING 2011

| | | |

| Name and Age as of | | Position, Principal Occupation, |

| the Annual Meeting | | Business Experience and Directorship |

| Michael J. Kowalski, Age 45 | | Michael J. Kowalski has served as President of Kowalski Companies, a sausage and meat manufacturer, since 1994. Mr. Kowalski has served as a director of the Company since 1994. |

| | | |

| Sydney L. Ross, Age 59 | | Sydney L. Ross is the President of General Wine and Liquor Company, a wholesale wine and spirit delivery company and has served in such capacity since 1978. Mr. Ross became a director of the Company in 2001. |

Director Compensation

Directors of the Company receive an annual retainer of $10,500. The Chairman and the Vice Chairman of the Board of Directors receive additional annual retainers of $16,800 and $10,500, respectively. Members of the Directors Loan Committee receive $350 per meeting attended. Members of the Board of Directors receive $800 for each special board meeting attended. Members of all other committees receive $350 per meeting attended.

Directors and executive officers of the Company are also eligible to participate in the Company’s Deferred Compensation Plan. The plan provides a means by which directors may defer the receipt of director fees to a later date, when presumably their income will be taxed at a lower tax rate. Similarly, executive officers may defer all or any portion of bonuses which they are awarded. Interest is credited to the deferred benefit accounts of the participants based on the average rate received for the prior month on the Bank’s investment securities. As a result of an amendment to the plan in 2005, participants were permitted to have the investment performance of their deferred benefit account be measured as if it were invested in shares of the Company’s common stock. Payment to these participants when they become eligible under the plan is to be in the form of Company common stock rather than cash.

8

2008 DIRECTOR COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | |

| | | Fees Earned or | | | | | | | | | | All Other | | |

| | | Paid in Cash | | Stock Awards | | Option Awards | | Compensation | | Total |

| Name | | ($) | | ($) (1) | | ($) | | ($) | | ($) |

| James B. Jacobs | | | 21,150 | | | | 2,100 | | | | — | | | | — | | | | 23,250 | |

| | | | | | | | | | | | | | | | | | | | | |

| Michael J. Kowalski | | | 23,800 | | | | 2,520 | | | | — | | | | — | | | | 26,320 | |

| | | | | | | | | | | | | | | | | | | | | |

| Longine V. Morawski | | | 42,000 | | | | 3,885 | | | | — | | | | — | | | | 45,885 | |

| | | | | | | | | | | | | | | | | | | | | |

| Sydney L. Ross | | | 24,500 | | | | 2,205 | | | | — | | | | — | | | | 26,705 | |

| | | | | | | | | | | | | | | | | | | | | |

| Edward H. Turner | | | 23,350 | | | | 2,510 | | | | — | | | | — | | | | 25,660 | |

| | | | | | | | | | | | | | | | | | | | | |

| David L. Wood | | | 53,500 | | | | 5,040 | | | | — | | | | — | | | | 58,540 | |

| | |

| (1) | | The number of stock awards outstanding for each of the Directors is as follows: Mr. Jacobs: 200 ; Mr. Kowalski: 240 ; Mr. Morawski: 370 ; Mr. Ross: 210 ; Mr. Turner: 220 ; and Mr. Wood: 480. |

9

ITEM 2. PROPOSAL TO AMEND THE ARTICLES OF INCORPORATION

General

Our Board of Directors has unanimously approved and recommended that our shareholders adopt an amendment to the Company’s articles of incorporation to authorize the issuance of up to 200,000 shares of preferred stock with such rights and preferences as the Board may determine. The Board of Directors believes that authorizing the Board to issue preferred stock will enable the Company to raise capital to help ensure that its wholly-owned bank subsidiary, Peoples State Bank, remains well-capitalized. We are also asking our shareholders to approve an increase in the number of authorized common shares from 5,000,000 to 10,000,000. Management considers the increase in authorized shares of common stock desirable to provide maximum flexibility with respect to our ability to augment the Company’s capital in the future and to provide flexibility for declaration of stock dividends and for other proper corporate purposes in the long term. Please note that the approval being sought by the Company is not so the Company can participate in the U.S. Department of Treasury’s Capital Purchase Program under the Emergency Economic Stabilization Act of 2008.

Currently, we are not authorized to issue preferred stock. If the amendment is adopted by the shareholders of the Company, the shares of preferred stock will be available for issuance from time to time for such purposes and consideration as the Board may approve. No further vote of the shareholders of the Company will be required, except as provided under Michigan law. The Board of Directors believes that it is advisable to increase the Company’s authorized capital to include preferred stock in order to help ensure that its wholly-owned bank subsidiary, Peoples State Bank, is and remains well-capitalized.

The Company’s preferred stock may have such terms, including dividend or interest rates, conversion prices, voting rights, redemption prices, maturity dates, and other rights, preferences and limitations, as determined by the Board in its sole discretion. The Board will also have the sole authority to issue such shares of preferred stock to whomever and for whatever purposes it may deem appropriate.

Potential Effects of the Proposed Amendment

In deciding whether to issue shares of preferred or common stock, the Board of Directors will consider the terms of such capital stock and the effect of the issuance on the operating results of the Company and its existing shareholders. With the exception of stock dividends, issuances of common stock or one or more series of preferred stock may result in dilution to the investments of existing shareholders. Issuances of common or preferred stock could be used to discourage or make it more difficult for a person to acquire control of the Company or remove management. The Board of Directors did not propose this amendment for the purpose of discouraging mergers or changes in control of the Company.

The text of the proposed amendment to the articles of incorporation is set forth inAppendix A attached hereto. Shareholders are urged to readAppendix A carefully.

While the Board intends to continue to explore various alternatives for improving its capital position, it has no existing agreement for the issuance of shares of preferred stock or common stock. None of our directors or executive officers has any financial or other personal interest in this proposal except as described herein.

Required Vote

The affirmative vote of a majority of issued and outstanding shares of the Company’s common stock entitled to vote is required for approval of this proposal.

The Board of Directors recommends a vote FOR the approval of the amendment to the articles of incorporation to increase the number of authorized common shares and to authorize the issuance of preferred stock by the Company.

10

ITEM 3. APPROVAL OF AUDITORS

The Audit Committee of the Board of Directors has selected Plante & Moran, PLLC to serve as our independent auditors for 2009. The Board of Directors is asking the shareholders to ratify the appointment of Plante & Moran, PLLC.

In the event our shareholders fail to ratify the selection of Plante & Moran, PLLC, the Audit Committee will consider it as a direction to select other auditors for the subsequent year. Representatives of Plante & Moran, PLLC will be present at the Annual Meeting to answer questions. They will also have the opportunity to make a statement if they desire to do so.

Audit Fees

Audit fees and expenses billed to the Company by Plante & Moran, PLLC for the audit of the Company’s financial statements for the fiscal years ended December 31, 2008 and December 31, 2007, and for review of the Company’s financial statements included in the Company’s quarterly reports on Form 10-Q, are as follows:

Audit Related Fees

Audit related fees and expenses billed to the Company by Plante & Moran, PLLC for fiscal years 2008 and 2007 for services related to the performance of the audit or review of the Company’s financial statements that were not included under the heading “Audit Fees”, are as follows:

Tax Fees

Tax fees and expenses billed to the Company for fiscal years 2008 and 2007 for services related to tax compliance, tax advice and tax planning, consisting primarily of preparing the Company’s federal and state income tax returns for the previous fiscal periods and inclusive of expenses are as follows:

All Other Fees

Fees and expenses billed to the Company by Plante & Moran, PLLC for all other services provided during fiscal years 2008 and 2007 are as follows:

In accordance with Section 10A(i) of the Exchange Act, before Plante & Moran, PLLC is engaged by us to render audit or non-audit services, the engagement is approved by our Audit Committee. None of the audit-related, tax and other services described in the table above were approved by the Audit Committee pursuant to Rule 2-01(c)(7)(i)(C) of Regulation S-X. None of the time devoted by Plante & Moran on its engagement to audit the Company’s financial statements for the year ended December 31, 2008 is attributable to work performed by persons other than Plante & Moran employees.

The affirmative vote of a majority of votes cast on this proposal, without regard to abstentions or broker non votes, is required for approval of this proposal.

The Board of Directors recommends a vote FOR the approval of Plante & Moran, PLLC as our independent auditors for the year 2009.

11

SECURITY OWNERSHIP OF DIRECTORS, NOMINEES FOR DIRECTORS

MOST HIGHLY COMPENSATED EXECUTIVE OFFICERS AND

ALL DIRECTORS AND EXECUTIVE OFFICERS AS A GROUP

The following table shows, as of March 2, 2009, the name and capital stock ownership of each director and executive officer of the Company and the Bank, and capital stock ownership of all officers and directors of the Company as a group.

| | | | | | | | | |

| | | Beneficial Ownership | | |

| Name | | Current Shares(1) | | Percent |

| David L. Wood (Director-Chairman) | | | 64,532 | (2) | | | 1.9 | |

| Michael J. Tierney (Director and Executive Officer) | | | 53,041 | | | | 1.5 | |

| James B. Jacobs (Director) | | | 11,120 | | | | | * |

| Michael J. Kowalski (Director) | | | 44,931 | (3) | | | 1.3 | |

| Longine V. Morawski (Director) | | | 78,371 | (4) | | | 2.3 | |

| Sydney L. Ross (Director) | | | 63,210 | | | | 1.8 | |

| Edward H. Turner (Director) | | | 22,814 | | | | | * |

| Michael J. Banks (Executive Officer) | | | 23,251 | | | | | * |

| David A. Wilson (Executive Officer) | | | 22,675 | | | | | * |

| Vincent Szymborski (Executive Officer) | | | 22,483 | | | | | * |

| Jeffrey Moore (Executive Officer) | | | 19,023 | | | | | * |

| | | | | | | | | |

| All directors and executive officers as a group (12 persons) | | | 437,993 | | | | 12.4 | |

| | |

| * | | less than one percent. |

| |

| (1) | | The securities “beneficially owned” by an individual are determined as of March 2, 2009 by information obtained from the persons listed above, in accordance with the definition of “beneficial ownership” set forth in the regulations of the Securities and Exchange Commission. Accordingly, they may include securities owned by or for, among others, the spouse and/or minor children of the individual and any other relative who has the same home as such individual, as well as other securities as to which the individual has or shares voting or investment power. Unless otherwise indicated therein, the persons named in this table have sole voting and sole investment power or share voting and investment power with their respective spouses, with respect to all shares beneficially owned. Beneficial ownership may be disclaimed as to certain of the securities. Includes the following shares which the individual has right to acquire upon exercise of currently vested stock options (or those that are exercisable within 60 days of the record date): Mr. Wood: 4,500; Mr. Tierney: 5,833; Mr. Jacobs: 5,333; Mr. Kowalski: 5,333; Mr. Morawski: 5,333; Mr. Ross: 5,333; Mr. Turner: 5,333; Mr. Banks: 4,500; Mr. Wilson: 5,833; Mr. Szymborski: 3,684; Mr. Moore: 1,667. |

| |

| (2) | | Includes 17,071 phantom stock units acquired by Mr. Wood under the Company’s Deferred Compensation Plan for which payment is to be made in the form of Company common stock. |

| |

| (3) | | Includes 20,040 phantom stock units acquired by Mr. Kowalski under the Company’s Deferred Compensation Plan for which payment is to be made in the form of Company common stock. |

| |

| (4) | | Includes 17,366 shares owned by MP Tooling & Engineering, Inc. and 2,261 shares owned by LVM Enterprises, Inc., both of which companies are 100% owned by Mr. Morawski. |

12

SECURITY OWNERSHIP OF SHAREHOLDERS HOLDING 5% OR MORE

The table below contains shareholder information for persons believed by the Company to own five percent or more of the Company’s common stock. Ownership of the Company’s common stock is shown in terms of “beneficial ownership.” A person generally “beneficially owns” shares if he has either the right to vote those shares or dispose of them. More than one person may be considered to beneficially own the same shares.

In this Proxy Statement, unless otherwise noted, a person has sole voting and dispositive power for those shares shown as beneficially owned by him. The percentages shown below compare the persons beneficially owned shares with the total number of shares of the Company’s common stock outstanding on March 2, 2009 (3,476,510 shares).

| | | | | | | | | |

| | | Number | | | | |

| Name and Address | | Of | | | Percent | |

| Of Beneficial Owner | | Shares | | | Of Class | |

| Christopher S. Olson | | | 276,277 | 1 | | | 8 | % |

22641 Statler

St. Clair Shores, MI 48081 | | | | | | | | |

| | | | | | | | | |

| Lance K. Olson | | | 226,277 | 2 | | | 6.5 | % |

305 Lincoln

Grosse Pointe, MI 48230 | | | | | | | | |

| | |

| 1 | | Based upon information disclosed in a Schedule 13G filed on July 6, 2006. |

| |

| 2 | | Based upon information disclosed in a Schedule 13G filed on July 6, 2006. |

13

EXECUTIVE COMPENSATION DISCUSSION

The Compensation and Benefits Committee of the Board of Directors has adopted a compensation program based on the following compensation principles:

| • | | The Company provides the level of total compensation necessary to attract and retain quality employees at all levels of the organization. |

| • | | Compensation is linked to performance and to the interests of the shareholders. |

| • | | Incentive programs recognize both individual and corporate performance. |

| • | | Compensation balances rewards for short-term and long-term results. |

Compensation Methodology

The Company strives to provide a comprehensive compensation program that is competitive, in order to attract and retain qualified talent.

Each year the Compensation and Benefits Committee reviews market data in order to assess the Company’s competitive position in each component of compensation, including base salary, annual incentive and long-term incentive compensation.

The primary market comparison for cash compensation is provided to the Company by an accounting firm. The comparison is a mix of institutions of the same size and operating within the same general market to recruit personnel.

The descriptions that follow of the components of compensation contain additional detail regarding compensation methodology. Compensation decisions regarding individuals may also be based on factors such as individual performance and level of responsibility.

The Committee has established a Salary Administration Plan, which provides for annual cash compensation consisting of base salary, commissions, and annual incentive. The relationship between base salary and annual incentive is based on salary grade. Personnel at higher-grade levels have a larger percentage of their total cash compensation contingent on the accomplishment of corporate objectives.

Components of Compensation

Base Salary

Annual base salary is designed to compensate personnel for their sustained performance. Salary is based on: (1) grade level; (2) individual performance; and (3) comparative survey data. The Committee approves in advance all salary increases for senior officers.

Annual and Long Term Incentive

In 2007, the Company adopted an executive bonus compensation plan containing both long term and annual compensation programs. Pursuant to the programs, the Company’s board of directors has the sole authority to determine the executives who will be eligible to receive bonus compensation. All awards under the programs will be payable only if both the President of the Company and the board of directors approve the award and the executive is employed in good standing on the date the Board approves the award. If the executive’s employment with the Bank has terminated for any reason prior to that date, the executive shall forfeit the bonus award, unless the Board elects to waive this employment requirement due to circumstances it deems extraordinary.

Annual Awards.The annual awards are based on a combination of the Company’s ROA relative to peers, growth in core deposits and a discretionary component based on the executive’s personal job performance for the

14

most recent year. Maximum awards may range from 20% to 50% of base pay. Awards are payable in a combination of cash payments, stock option awards and restricted stock awards. The stock option and restricted stock awards are subject to the terms and conditions of the Company’s 2004 Stock Compensation Plan.

Long Term Awards.The long term awards are based on total return to the Company’s shareholders for a period longer than the most recent year. Directors and executives of the Company and its affiliated companies may be selected for participation in the long term program. Under the program, the maximum award payable to an individual director or executive is up to 150% of the individual’s base pay. However, the total amount payable to all executives and directors under the long term program may not exceed 10% of the increase in the Company’s market capitalization during the performance period. Awards are payable in the form of restricted stock awards. The restricted stock awards are subject to the terms and conditions of the Company’s 2004 Stock Compensation Plan.

SUMMARY COMPENSATION TABLE ($)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Stock | | Option | | All Other | | |

| Name and Principal Position | | Year | | Salary (1) | | Bonus | | Awards | | Awards | | Compensation | | Total |

| Michael J. Tierney | | | 2008 | | | | 387,213 | | | | — | | | | 217,291 | | | | — | | | | 41,215 | (2) | | | 645,719 | |

| President and CEO | | | 2007 | | | | 254,036 | | | | 50,000 | | | | 29,375 | | | | 1,763 | | | | 22,871 | | | | 358,045 | |

| |

| David A. Wilson | | | 2008 | | | | 169,896 | | | | — | | | | 14,333 | | | | — | | | | 11,601 | (3) | | | 195,830 | |

| Senior Vice President, CFO | | | 2007 | | | | 128,156 | | | | 10,000 | | | | 6,250 | | | | 3,305 | | | | 16,888 | | | | 164,599 | |

| and Secretary | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Michael J. Banks | | | 2008 | | | | 237,583 | | | | — | | | | 24,167 | | | | — | | | | 23,838 | (4) | | | 285,087 | |

| Senior Vice President and | | | 2007 | | | | 135,019 | | | | — | | | | 45,000 | | | | 1,763 | | | | 3,600 | | | | 185,381 | |

| Chief Lending Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Vincent Szymborski | | | 2008 | | | | 189,928 | | | | — | | | | 22,500 | | | | — | | | | 5,659 | (5) | | | 218,087 | |

| Senior Vice President | | | 2007 | | | | 98,902 | | | | — | | | | 38,700 | | | | — | | | | 3,600 | | | | | |

| Retail | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Jeffrey Moore

Executive Vice President | | | 2008 | | | | 207,542 | | | | — | | | | 27,500 | | | | — | | | | 15,202 | (6) | | | 250,244 | |

| Chief Credit Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (1) | | “Salary” includes amounts deferred by the Named Executive Officer under the Bank’s Deferred Comp Plan |

| |

| (2) | | Includes fees for attendance at board meetings of $16,100; auto allowance of $3304; Plan matches of $11,433; and country club fees of $10,378. |

| |

| (3) | | Includes automobile allowance of $5,200; Plan matches of $6,401. |

| |

| (4) | | Includes automobile allowance of $5,200; Plan matches of $6,638; and country club dues of $12,000. |

| |

| (5) | | Includes automobile allowance of $5,200; and Plan matches of $459. |

| |

| (6) | | Includes automobile allowance of $5,200; Plan matches of $6,414; and athletic club dues of $3,588. |

15

Backgrounds of our Executive Officers

In addition to the information about our President and Chief Executive Officer, Michael J. Tierney, which is set forth above, the following is information about the Company’s other current executive officers.

Michael J. Banks, Age 50, has been with the bank since 2007, but has been in banking for over 23 years. Mr. Banks held various banking positions in Commercial Banking and Private Banking and became the bank’s Senior Vice President of Lending at time of hire in March of 2007.

Jeffrey Moore,Age 52, has been with the bank since 2007. He is the Chief Credit Officer and Senior Vice President. Mr. Moore has been in the banking industry for thirty years with two large local regional banks. He has held management roles in Retail Banking, Commercial Banking and Loan Administration. For the past 20 years, he was responsible for developing and managing the small business departments of two banks. At PSB, he is responsible loan administration, credit underwriting, managed assets, loan review and appraisal review

Gregory W. Quick, Age 54, has been with the Bank since 2008. Mr. Quick has been in banking for 31 years and has held positions in international foreign exchange, funds management, and residential mortgage lending. He is a Senior Vice President and is responsible for the Bank’s residential mortgage lending business.

Vincent J. Szymborski, Age 49, has been with the Bank since 2007. Mr. Szymborski was previously with Comerica Bank for 25 years. At Comerica held positions in Retail Branch Management, Operations, and National Product Management. .

David A. Wilson, Age 47, has been in banking for 23 years, 18 at Peoples State Bank. Mr. Wilson has held a number of positions at the bank and became Chief Financial Officer December, 1998.

Employment Agreement with Michael J. Tierney

The employment agreement between the Company and Mr. Tierney provides for a three-year term with automatic one year renewal periods at the expiration of the term, unless either party notifies the other of its intention not to renew not less than 180 days prior to the expiration of the then-current term. Mr. Tierney’s initial base salary under the employment agreement is $245,000 per annum. Mr. Tierney’s base salary was subject to change in the discretion of the board beginning in 2008. Bonuses paid to Mr. Tierney are based on the achievement of performance criteria established by the board and Mr. Tierney.

In addition to customary benefits provided by the Company to its employees generally, Mr. Tierney’s benefits include a car allowance, initial fees and reimbursement of annual dues at the Wyngate Country Club and Detroit Athletic Club, and bank owned life insurance (or other life insurance benefits) providing for an annual retirement benefit of at least $60,000 for a period of at least 10 years commencing upon his reaching age 65, provided Mr. Tierney is employed by the Company for at least 10 years. Mr. Tierney is entitled to five weeks of paid vacation time per year. The employment agreement contains customary indemnification provisions provided to executive officers and provides for coverage under the Company’s directors and officers liability insurance policy.

Mr. Tierney is subject to certain non-competition provisions, including the requirement that, in the event that he is terminated without cause (as defined in the employment agreement) or that he terminates his employment with good reason (also defined in the employment agreement), he may not compete with the Company within a 50 mile radius of the Company’s main office for the shorter of 12 months or the then-remaining term of his employment agreement. Mr. Tierney is also prohibited from soliciting other bank employees for a 12 month period following the termination of his employment.

Mr. Tierney’s employment agreement provides for differing payments in the event of termination and/or a change in control. These are described below under the caption “Payments upon Termination/Change in Control.”

16

401(k) Plan and ESOP

The Bank maintains the 401(k) Plan, which is a tax-qualified profit sharing, 401(k) savings and employee stock ownership plan under Sections 401(a), 401(k) and 409 of the Internal Revenue Code. The 401(k) Plan provides participants with retirement benefits and may also provide benefits upon death, disability or termination of employment with the Bank. An employee is eligible to make salary reduction contributions in the 401(k) portion of the 401(k) Plan as of the first day of the month following the completion of one-quarter year of service in which the employee works 250 or more hours or, if later, the first day of the month following the employee’s attainment of age 21. A participant is always 100% vested in his or her salary reduction contributions. An employee is eligible for Bank contributions in the matching and ESOP portions of the 401(k) Plan as of the first January 1 or July 1 following the completion of one-half year of service in which the employee works 500 or more hours or, if later, the first day of the month following the employee’s attainment of age 21. The employee is immediately vested in any Bank matching contributions. The employee vests in discretionary Bank contributions to the ESOP after completing 5 years of service and is not vested in any portion of ESOP contributions until that time.

Participants may make salary reduction contributions to the 401(k) Plan of up to 25% of their compensation or the legally permissible dollar limit, if less. The 401(k) Plan provides that, with respect to the first 3% of compensation contributed by the employee, the Bank will match 100% of such contribution. In addition, the Bank will match an additional 50% for any amount contributed by the employee in excess of 3% of compensation but not in excess of 6% of compensation.

The Bank makes contributions at the discretion of the board to the ESOP portion of the 401(k) Plan. These contributions are allocated to employees’ accounts in proportion to the percentage that each employee’s compensation bears to the compensation of all eligible employees. In 2005, the ESOP financed the purchase of 38,501 shares of Company common stock for $770,020 by borrowing that amount from LaSalle Bank National Association. The ESOP repays the loan with contributions by the Bank to the ESOP portion of the 401(k) Plan over a 6 year period. As the loan is repaid, the 38,501 shares of Company common stock are allocated to employees’ ESOP accounts in the 401(k) Plan in accordance with the plan and applicable federal law.

All participants receive a quarterly detailed statement including information regarding market value of the participant’s investment and all contributions made on his or her behalf. Any withdrawals prior to age 59 are subject to a 10% tax penalty. Participants may borrow against the vested portion of their accounts.

2004 Stock Compensation Plan

The 2004 Stock Compensation Plan was adopted by the board of directors on February 26, 2004, and approved by the shareholders at the 2004 annual meeting of shareholders held on April 27, 2004. An aggregate of 450,000 shares of common stock have been authorized and reserved under the 2004 Stock Compensation Plan. As of December 31, 2008, 66,100 shares of stock and 169,293 options to acquire shares of common stock had been issued under the plan.

17

2008 OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END TABLE

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Option Awards | | Stock Awards |

| | | | | | | | | | | | | | | | | | | | | | | Market |

| | | Number of | | Number of | | | | | | | | | | Number of | | Value of |

| | | Securities | | Securities | | | | | | | | | | Shares or | | Shares or |

| | | Underlying | | Underlying | | | | | | | | | | Units of | | Units of |

| | | Unexercised | | Unexercised | | Option | | | | | | Stock That | | Stock That |

| | | Options | | Options | | Exercise | | Option | | Have Not | | Have Not |

| | | (#) | | (#) | | Price | | Expiration | | Vested | | Vested |

| | | Exercisable | | Unexercisable | | ($) | | Date | | (#) | | ($) |

| Michael J. Tierney | | | — | | | | 7,500 | (1) | | | 10.50 | | | | 2/21/2018 | | | | 6,250 | (5) | | | 5.00 | |

| | | | 1,667 | (2) | | | 3,333 | | | | 18.00 | | | | 3/15/2017 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| David A. Wilson | | | — | | | | 3,500 | (1) | | | 10.50 | | | | 2/21/2018 | | | | 2,450 | (6) | | | 5.00 | |

| | | | 667 | (2) | | | 1,333 | | | | 18.00 | | | | 3/15/2017 | | | | — | | | | — | |

| | | | 1,333 | (3) | | | 667 | | | | 18.00 | | | | 5/15/2016 | | | | — | | | | — | |

| | | | 2,000 | (4) | | | — | | | | 24.42 | | | | 7/28/2015 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Michael J. Banks | | | — | | | | 3,500 | (1) | | | 10.50 | | | | 2/21/2018 | | | | 11,200 | (7) | | | 5.00 | |

| | | | 1,667 | (2) | | | 3,333 | | | | 18.00 | | | | 3/15/2017 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Jeffrey L. Moore | | | — | | | | 5,000 | (1) | | | 10.50 | | | | 2/21/2018 | | | | 5,500 | (8) | | | 5.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Vincent J. Szymborski | | | — | | | | 3,500 | (1) | | | 10.50 | | | | 2/21/2018 | | | | 9,800 | (9) | | | 5.00 | |

| | | | 1,258 | (2) | | | 2,517 | | | | 18.00 | | | | 3/15/2017 | | | | — | | | | — | |

| | |

| (1) | | the options vest at a rate of 1/3 per year over a three-year period beginning on the one-year anniversary of the grant date (February 21, 2008), subject to acceleration in the event of a change in control of the company. The options expire ten years from the grant date. |

| |

| (2) | | the options vest at a rate of 1/3 per year over a three-year period beginning on the one-year anniversary of the grant date (March 15, 2007), subject to acceleration in the event of a change in control of the company. The options expire ten years from the grant date. |

| |

| (3) | | the options vest at a rate of 1/3 per year over a three-year period beginning on the one-year anniversary of the grant date (May 15, 2006), subject to acceleration in the event of a change in control of the company. The options expire ten years from the grant date. |

| |

| (4) | | the options vest at a rate of 1/3 per year over a three-year period beginning on the one-year anniversary of the grant date (July 28, 2005), subject to acceleration in the event of a change in control of the company. The options expire ten years from the grant date. |

| |

| (5) | | 2,500 shares vest on February 27, 2010, 1,250 shares vest on July 5, 2010 and 2,500 shares vest on February 22, 2011 subject to acceleration in the event of a change of control in the Company. |

| |

| (6) | | 1,250 shares vest on February 27, 2010, and 1,200 shares vest on February 22, 2011 subject to acceleration in the event of a change in control in the Company. |

| |

| (7) | | 10,000 shares vest on March 15, 2010, and 1,200 shares vest on February 22, 2011 subject to acceleration in the event of a change in control in the Company. |

| |

| (8) | | 3,500 shares vest on May 23, 2010 and 2,000 shares vest on February 22, 2011 subject to acceleration in the event of a change in control in the Company. |

| |

| (9) | | 8,600 shares vest on March 15, 2010 and 1,200 shares vest on February 22, 2011 subject to acceleration in the event of a change in control in the Company. |

18

Payments upon Termination/Change-in-Control

Under Mr. Tierney’s current employment agreement, he is entitled to different payments and benefits depending upon the manner in which his employment terminates. If Mr. Tierney becomes disabled, he is entitled to receive his base salary and benefits for the remaining term of his employment agreement. Assuming in accordance with recently enacted SEC disclosure rules that this occurred on December 31, 2008, the estimated aggregate benefits to be provided to Mr. Tierney would be approximately $520,421.

If Mr. Tierney dies, he is terminated for Cause or he terminates other than for Good Reason (defined below), his right to compensation and benefits ends on his date of death or termination, as the case may be.

If Mr. Tierney is terminated other than for Cause, disability or death, he is entitled to continue to receive his base salary and to participate in the Company’s health care plan for the then remaining term of his agreement. Assuming in accordance with recently enacted SEC disclosure rules that this occurred on December 31, 2008, the estimated aggregate compensation and benefits to be provided to Mr. Tierney would be approximately $520,421.

If, within twelve months following a Change of Control (defined below), the agreement is terminated by the Company without Cause or by Mr. Tierney for Good Reason, Mr. Tierney is entitled to his base salary and to continue to participate in the Company’s health care plan for a period of three years following such termination, as well as the immediate acceleration of the vesting of his restricted stock.

The employment agreement provides that, in the event any of the payments to be made upon termination of employment are deemed to constitute “parachute payments” within the meaning of Section 280G of the Internal Revenue Code, then such payments and benefits shall be reduced to the maximum amount that may be paid to Mr. Tierney or for his benefit without any such payment constituting a “parachute payment.” If a termination occurred in the manner described in the immediately preceding paragraph on December 31, 2008, the estimated aggregate value of compensation, benefits and the economic benefit resulting from the acceleration of restricted stock to Mr. Tierney would be approximately $1,079,142.

“Cause” is defined under Mr. Tierney’s agreement to include criminal conduct constituting a felony offense, alcohol or drug abuse which impairs the performance of his duties, willful misconduct, breach of fiduciary duty involving personal profit, intentional failure to perform stated duties or to follow one or more specific written directives of the board, reasonable in nature and scope, or material breach of any provision of his agreement.

“Good Reason” is defined under the agreement to mean (A) if he would be required to move his personal residence or perform his principal job functions more than fifty miles from his office; (B) if, in the organizational structure of the Company or the Bank, he would be required to report to a person or persons other than the Board of Directors; (C) if the Company should fail to maintain his base salary or fail to maintain employee benefit plans; (D) if he would be assigned substantial duties and responsibilities other than those normally associated with his position; or (E) if he is removed from or not re-nominated to the Board of Directors of the Company or the Bank.

“Change in Control” is (A) the acquisition by any person of 50% or more of PSB Group’s outstanding voting securities and (B) the individuals who were members of the Board of Directors (the “Current Board Members”) cease to constitute a majority of the Board of the Company or its successor; however, if the election or the nomination for election of any new director of the Company or its successor is approved by a vote of a majority of the individuals who are Current Board Members, such new director shall be considered a Current Board Member; or (C) the Company’s shareholders approve (1) a merger of the Company and the shareholders of the Company immediately before such merger do not, as a result of the merger, own, directly or indirectly, more than 50% of the combined voting power of the then outstanding voting securities of the resulting company; or (2) a complete liquidation or dissolution or an agreement for the sale or other disposition of all or substantially all of the assets of the Company.

19

Transactions with Certain Related Persons

The Company has had, and expects to have in the future, loan and other banking transactions in the ordinary course of business with many of its directors, officers and associates. All extensions of credit to such persons have been made in the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons, and in the opinion of the management of the Company, do not involve more than a normal risk of collectability or present other unfavorable features. All loans to directors or executive officers of the Company require the approval of the Board of Directors, except that members requesting such loans are prohibited from attending the discussion or participating in the vote on such loan. During 2008, new loans totaling $0 were made to such persons and repayments totaled $168,000. As of December 31, 2008, directors and officers were indebted to the Company for loans totaling $1,975,000.

Services Performed by Turner and Associates Consultants.Turner and Associates Consultants, for which a director, Edward H. Turner, serves as President, was engaged by the Company in 2008 for services in connection with loan review, credit, collections, litigation and administration. Turner and Associates Consultants received approximately $138,300 in 2008 for services rendered to the Company. Similar to the Company’s policy with respect to extensions of credit discussed above, the board reviews all non-credit related transactions involving the Company and related parties. The board requires that such transactions be on an arms-length basis, and on terms which would generally be available from an unaffiliated third party. All such transactions must be approved by a majority vote of the entire board of directors.

AUDIT COMMITTEE REPORT

The Company’s Audit Committee is comprised of four directors (Messrs. Jacobs, Morawski, Ross, and Wood). Mr. Jacobs, Mr. Morawski, Mr. Ross and Mr. Wood are independent, under the definition contained in Rule 4200(a)(15) of the NASDAQ’s listing standards. The Board of Directors has adopted a written charter for the Audit Committee, a copy of which is available on the Company’s website maintained at www.psbnetbank.com.

In connection with the audited financial statements contained in the Company’s 2008 Annual Report on Form 10-K for the fiscal year ended December 31, 2008, the Audit Committee reviewed and discussed the audited financial statements with management and Plante & Moran, PLLC. The Audit Committee discussed with Plante & Moran the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Oversight Board in Rule 3200T. The Audit Committee has also received the written disclosures and the letter from Plante & Moran required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence and has discussed with them their independence.

Based on the review and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2008.

THE AUDIT COMMITTEE

| | | |

| Longine V. Morawski | | James B. Jacobs |

| Sydney L. Ross | | David L. Wood |

20

COMPLIANCE WITH SECTION 16

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers and directors, and persons who own more than 10% of any registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater than 10% shareholders are required by regulation to furnish the Company with copies of all Section 16(a) reports they file.

Based on its review of the copies of the reports it has received and written representations provided to the Company from the individuals required to file the reports, the Company believes that all directors and executives of the Company filed all reports required on a timely basis pursuant to Section 16 of the Securities Exchange Act of 1934, except as follows: Longine Morawski, a director, filed one Form 4 reporting one transaction one day late. Messrs. Tierney, Wilson, Banks, Szymborski, Moore and Quick each filed one Form 4 reporting one transaction 17 days late.

REQUIREMENTS, INCLUDING DEADLINES,

FOR SUBMISSION OF PROXY PROPOSALS, NOMINATION OF DIRECTORS

AND OTHER BUSINESS OF SHAREHOLDERS

In order to have a shareholder proposal included in next year’s proxy statement, under the SEC’s proxy rules, a proposal in compliance with SEC Rule 14a-8 must be received by us in writing addressed to: David A. Wilson, Secretary at the office address set forth above no later than November 30, 2009.

Under our Bylaws, certain procedures are provided which a shareholder must follow to nominate persons for director or to introduce an item of business at an Annual Meeting of Shareholders outside of SEC Rule 14a-8. Nominations for directors or introduction of an item of business should be submitted in writing to the Company’s president at 1800 East 12 Mile Road, Madison Heights, Michigan 48071-2600. The nomination or proposed item must be received:

| | • | | no later than 90 days before the first anniversary of the preceding year’s annual meeting of shareholders; and |

| |

| | • | | no earlier than the close of business on the 120th day before the first anniversary of the preceding year’s annual meeting of shareholders. |

The nomination must contain the following information about the nominee:

| | • | | name and address; |

| |

| | • | | a description of all arrangements or understandings between the shareholder and the nominee; |

| |

| | • | | the number and kinds of securities of the Company held by the nominee; |

| |

| | • | | such other information regarding the proposed nominee as may be requested by the board of directors; and |

| |

| | • | | a signed consent of the nominee to serve as a director of the Company, if elected. |

21

Notice of a proposed item of business outside of SEC Rule 14a-8 must include:

| | • | | a brief description of the matter and the reasons for introducing such matter at the Annual Meeting; |

| |

| | • | | the shareholder’s name and address; |

| |

| | • | | the class and number of shares of the Company’s capital stock held by the shareholder; and |

| |

| | • | | any material interest of the shareholder in such business. |

The chairman of the meeting may refuse to allow the transaction of any business not presented beforehand, or to acknowledge the nomination of any person not made in compliance with the foregoing procedures.

The discussion above is intended merely as a summary. Persons wishing to submit a proposal or a nominee for director should consult the Company’s bylaws, a copy of which can be obtained free of charge by writing to David A. Wilson, Secretary at the office address set forth above.

Whether or not you plan to attend the Meeting, please vote by marking, signing, dating and promptly returning the enclosed proxy in the enclosed envelope.

A copy of PSB Group, Inc.’s 2008 Annual Report onForm 10-K as filed with the Securities and Exchange Commission may be obtained by shareholders, without charge, upon written request to David A. Wilson, Secretary, 1800 East 12 Mile Road, Madison Heights, Michigan 48071-2600.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on April 28, 2009: The proxy statement and annual report to security holders are available at www.psbnetbank.com

By Order of the Board of Directors,

David A. Wilson

Secretary

22

Appendix A

PSB GROUP, INC.

AMENDMENT TO ARTICLES OF INCORPORATION

ARTICLE III

The total number of shares of all classes of the capital stock which the Corporation has authority to issue is 10,200,000, which shall be divided into a class of 10,000,000 shares of common stock and a class of 200,000 shares of preferred stock.

Preferred Stock

Subject to the limitations and restrictions set forth in this Article III, the board of directors is authorized and empowered at any time, and from time to time, to designate and issue any authorized and unissued preferred stock (whether or not previously designated as shares of a particular series, and including preferred stock of any series issued and thereafter acquired by the Corporation) as shares of one or more series, hereby or hereafter to be designated. Each different series of preferred stock may vary as to dividend rate, redemption price, liquidation price, voting rights and conversion rights, if any, all of which shall be fixed as hereinafter provided. Each series of preferred stock issued hereunder shall be so designated as to distinguish the shares thereof from the shares of the other series and classes. All preferred stock of any one series shall be alike in every particular.

The rights, qualifications, limitations or restrictions or each series of preferred stock shall be as stated and expressed in the resolution or resolutions adopted by the board of directors which provides for the issuance of such series, which resolutions may include, but shall not be limited to, the following:

| | (i) | | The distinctive designation and number of shares comprising such series, which number may (except where otherwise provided by the board of directors in creating such series) be increased or decreased (but not below the number of shares then outstanding) from time to time by action of the board of directors; |

| |

| | (ii) | | The rate of the dividends thereon and the relation which such dividends shall bear to the dividends payable on any other class of capital stock or any other series of preferred stock, the terms and conditions upon which and the periods in respect of which dividends shall be payable, whether and upon what conditions such dividends shall be cumulative and if cumulative, the date or dates from which dividends shall accumulate; |

| |

| | (iii) | | The amount per share, if any, which the holders of preferred stock of such series shall be entitled to receive, in addition to any dividends accrued and unpaid thereon, (a) upon the redemption thereof, plus the premium payable upon redemption, if any; or (b) upon the voluntary liquidation, dissolution or winding |

A-1

| | | | up of the Corporation; or (c) upon the involuntary liquidation, dissolution or winding up of the Corporation; |

| |

| | (iv) | | The conversion or exchange rights, if any, of such series, including without limitation, the price or prices, rate or rates, provision for the adjustment thereof (including provisions for protection against the dilution or impairment of such rights), and all other terms and conditions upon which preferred stock constituting such series may be convertible into, or exchangeable for shares of any other class or classes or series; |

| |

| | (v) | | Whether the shares of such series shall be redeemable, and, if redeemable, whether redeemable for cash, property or rights, including securities of any other corporation, at the option of either the holder or the Corporation or upon the happening of a specified event, the limitations and restrictions with respect to such redemption, the time or times when, the price or prices or rate or rates at which, the adjustments with which and the manner in which such shares shall be redeemable, including the manner of selecting shares of such series for redemption if less than all shares are to be redeemed; |

| |

| | (vi) | | Whether the shares of such series shall be subject to the operation of a purchase, retirement, or sinking fund, and, if so, whether and upon what conditions such purchase, retirement or sinking fund shall be cumulative or noncumulative, the extent to which and the manner in which such fund shall be applied to the purchase or redemption of the shares of such series for retirement or to other corporate purposes and the terms and provisions relative to the operation thereof; |

| |

| | (vii) | | The voting rights per share, if any, of each such series, and whether and under what conditions the shares of such series (alone or together with the shares of one or more other series) shall be entitled to vote separately as a single class, upon any merger, share exchange or other transaction of the Corporation, or upon any other matter, including (without limitation) the elections of one or more additional directors of the Corporation in case of dividend arrearage or other specified events; and |

| |