UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

THE BLACK & DECKER CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Notes:

Notice Of Annual Meeting Of Stockholders

The 2003 Annual Meeting of Stockholders of The Black & Decker Corporation will be held at the Sheraton Baltimore North Hotel, 903 Dulaney Valley Road, Towson, Maryland 21204, on April 29, 2003, at 9:30 a.m., eastern time, for the following purposes:

| 1. | | To elect eight directors to serve until the next annual meeting; |

| 2. | | To ratify the selection of Ernst & Young LLP as Black & Decker’s independent auditor; |

| 3. | | To approve The Black & Decker 2003 Stock Option Plan; |

| 4. | | To act on two stockholder proposals; and |

| 5. | | To conduct any other business properly brought before the meeting. |

Stockholders of record at the close of business on February 18, 2003, will be entitled to vote at the meeting or any adjournments of the meeting.

Your vote is important to us. We encourage you to vote as soon as possible byoneof three convenient methods:

| | • | | call the toll-free number listed on the proxy card, or |

| | • | | access the Internet site listed on the proxy card, or |

| | • | | sign, date, and return the proxy card in the envelope provided. |

Your Board of Directors recommends a vote“for” each of the nominees included in the Proxy Statement, “for” proposals 2 and 3, and“against” the stockholder proposals.

By Order of the Board of Directors

Barbara B. Lucas

| Senior | | Vice President — Public Affairs and Corporate Secretary |

March 11, 2003

Proxy Statement

The Notice of Annual Meeting, this Proxy Statement, the enclosed proxy card, and the Annual Report of The Black & Decker Corporation, including the Annual Report on Form 10-K that includes the Consolidated Financial Statements for the year ended December 31, 2002, are being sent beginning March 11, 2003, to stockholders of record at the close of business on February 18, 2003 (the “Record Date”). On the Record Date, there were 78,594,593 shares of common stock outstanding held by 13,991 stockholders of record. Each share of common stock entitles the holder to one vote.

The Board of Directors is soliciting proxies to be voted at the 2003 Annual Meeting of Stockholders to be held at the Sheraton Baltimore North Hotel, 903 Dulaney Valley Road, Towson, Maryland 21204, on April 29, 2003, at 9:30 a.m., eastern time. You may vote your shares by: (1) calling the toll-free number listed on the enclosed proxy card; (2) accessing the Internet site listed on the proxy card; (3) signing the enclosed proxy card and returning it in the enclosed envelope; or (4) attending the meeting in person and voting by ballot at the meeting. You may revoke your proxy, whether given by signing the enclosed proxy card or by using the telephone or Internet procedure, at any time before it is exercised by: (1) delivering written notice of revocation to Black & Decker’s Corporate Secretary; (2) delivering another proxy that is properly signed and has a later date; (3) voting by telephone or through the Internet on a later date; or (4) voting in person at the meeting. Voting by mail using the enclosed proxy card, by telephone, or by accessing the Internet does not limit your right to attend the meeting and change your vote by ballot at the meeting.

The telephone and Internet voting procedures are designed to authenticate your vote using the special control number assigned to you and listed on the enclosed proxy card or sent to you by e-mail if you chose to receive your proxy online. These methods allow stockholders to vote and to confirm that their instructions have been properly recorded. Your telephone or Internet instructions will authorize the persons named as Proxies to vote your shares as you direct.

Upon request, Black & Decker will supply proxy materials to brokerage houses and other custodians, nominees, and fiduciaries for distribution to beneficial owners of Black & Decker shares and will reimburse them for their distribution expenses. Black & Decker has hired a proxy solicitation firm, D. F. King & Co., Inc., to assist in the solicitation of proxies and has agreed to pay D. F. King approximately $13,000 and to reimburse its expenses. The solicitation of proxies is being made by mail, and also may be made personally, electronically, or by telephone by Black & Decker employees and representatives of D. F. King.

In accordance with a notice sent to eligible beneficial owners of Black & Decker shares who share a single address, only one copy of the Annual Report and Proxy Statement will be sent to that address unless the broker, bank, or nominee received contrary instructions from any beneficial stockholder at that address. This practice, known as “householding,” is designed to reduce printing and mailing costs. If a beneficial owner at that address wishes to receive an Annual Report or Proxy Statement this year or in the future, he or she may contact the Corporate Secretary at 410-716-3900 or at 701 East Joppa Road, Towson, Maryland 21286.

Black & Decker’s principal executive office is at 701 East Joppa Road, Towson, Maryland 21286, and its telephone number is 410-716-3900.

2

VOTING SECURITIES

On the Record Date, to Black & Decker’s knowledge, no one other than the stockholder listed in the following table beneficially owned more than 5% of the outstanding shares of its common stock.

|

|

Name | | Title of Class | | Amount of Beneficial Ownership | | Percent of Class |

|

FMR Corp.(1) | | Common Stock | | 7,214,256 shares(2) | | 9.18% |

82 Devonshire Street | | | | | | |

Boston, Massachusetts 02109 | | | | | | |

|

| (1) | | The Schedule 13G, as amended, filed by FMR Corp. included Edward C. Johnson 3d, Chairman of FMR Corp., and Abigail P. Johnson, a director of FMR Corp., as reporting persons. According to the Schedule 13G, FMR Corp. has sole voting power for 193,776 shares and sole investment power for 7,214,256 shares. |

| (2) | | Includes 7,002,580 shares (or 8.91% of outstanding common stock) beneficially owned by Fidelity Management & Research Company, a wholly owned subsidiary of FMR Corp. and an investment adviser registered under Section 203 of the Investment Advisers Act of 1940. |

ELECTION OF DIRECTORS

Eight directors will be elected to hold office until their successors are elected and qualified. The presence, in person or by proxy, of the record holders of a majority of the shares of stock entitled to be voted at the meeting constitutes a quorum for the conduct of business. If a quorum is present, the affirmative vote of the record holders of a majority of the shares of stock represented at the meeting in person or by proxy is necessary to elect directors. Abstentions will be treated as shares represented at the meeting and will have the same effect as votes against a director. Unless otherwise specified, the proxies received will be voted for the election of the following persons:

| | Nolan D. Archibald Chairman, President, and Chief Executive Officer The Black & Decker Corporation Mr. Archibald received an undergraduate degree from Weber State University in 1968 and a master of business administration degree from Harvard Business School in 1970. After serving in various executive positions with Conroy, Inc., Mr. Archibald became vice president of marketing for the Airstream Division of Beatrice Companies, Inc. in 1977. His subsequent positions at Beatrice included president of Del Mar Window Coverings, president of Stiffel Lamp Company, and president of the Home Products Division. In 1983, he was elected a senior vice president of Beatrice and president of the Consumer and Commercial Products Group. Mr. Archibald left Beatrice and was elected president and chief operating officer of Black & Decker in 1985 and chief executive officer in 1986. He has served continuously in the additional position of chairman of the board since 1987. Mr. Archibald, who is 59, was first elected a director of Black & Decker in 1985. He also serves as a director of Brunswick Corporation and Lockheed Martin Corporation. |

3

| | Norman R. Augustine Retired Chairman and Chief Executive Officer Lockheed Martin Corporation Mr. Augustine received a bachelor of science degree in 1957 and a master of science degree in 1959, both in aeronautical engineering, from Princeton University. After serving in various capacities with Douglas Aircraft Company and Vought Missiles and Space Company, he joined the United States Department of Defense, where he served as Undersecretary of the Army. Mr. Augustine joined Martin Marietta Corporation, a predecessor of Lockheed Martin Corporation, in 1977 as vice president of Aerospace Technical Operations, became a director in 1986, and rose to the position of chairman of the board and chief executive officer in 1988. Following the merger of Martin Marietta and Lockheed Corporation in 1995, he served as president of Lockheed Martin Corporation and later as chairman of the board and chief executive officer. From 1997 through 1999, Mr. Augustine was a lecturer with the rank of Professor on the faculty of Princeton University. Mr. Augustine, who is 67, was first elected a director of Black & Decker in 1997. He also serves as a director of Lockheed Martin Corporation, ConocoPhillips Company, and Procter & Gamble Co. |

| | Barbara L. Bowles Chairman and Chief Executive Officer The Kenwood Group, Inc. Ms. Bowles received an undergraduate degree from Fisk University in 1968 and a master of business administration degree from the University of Chicago in 1971. Following graduation, she held various positions at First National Bank of Chicago, including vice president of trust investments. From 1981 to 1984, Ms. Bowles was assistant vice president and director of investor relations for Beatrice Companies, Inc. In 1984, she joined Kraft, Inc., where she served as corporate vice president until 1989. Ms. Bowles was president and chief executive officer, and is currently chairman of the board and chief executive officer, of The Kenwood Group, Inc., an investment advisory firm that she founded in 1989. Ms. Bowles, who is 55, was first elected a director of Black & Decker in 1993. She also serves as a director of Wisconsin Energy Corporation, Georgia-Pacific Corporation, Dollar General Corporation, the Chicago Urban League, and the Children’s Memorial Hospital of Chicago. |

4

| | M. Anthony Burns Retired Chairman, President, and Chief Executive Officer Ryder System, Inc. Mr. Burns received an undergraduate degree from Brigham Young University in 1964 and a master of business administration degree from the University of California at Berkeley in 1965. After nine years with Mobil Oil Corporation, he joined Ryder System, Inc. in 1974. He was elected president and chief operating officer and a director of Ryder in 1979, chief executive officer in 1983, and chairman of the board in 1985. He retired as chief executive officer in 2000 and as chairman and member of the board in May 2002. Mr. Burns, who is 60, was first elected a director of Black & Decker in 2001. He also serves as a director of J. P. Morgan Chase & Co., Pfizer Inc., and J. C. Penney Company, Inc. He is a trustee of the University of Miami in Florida and is active in cultural and civic organizations in Florida. |

| | Kim B. Clark Dean of the Faculty and George F. Baker Professor of Administration Harvard Business School Mr. Clark received an undergraduate degree, a master of arts degree, and a doctoral degree in economics from Harvard University. He has been a member of the Harvard faculty since 1978. Currently, Dean Clark’s research is focused on modularity in design and the integration of technology and competition in industry evolution, with a particular focus on the computer industry. He and Carliss Baldwin are co-authors ofDesign Rules: The Power of Modularity (MIT Press, 2000). Mr. Clark, who is 54, is proposed for election as a director of Black & Decker for the first time. He also serves as a director of JetBlue Airways Corporation and FleetBoston Financial Corporation. |

5

| | Manuel A. Fernandez Chairman Emeritus Gartner Group, Inc. Mr. Fernandez received an undergraduate degree in electrical engineering from the University of Florida in 1967 and completed post-graduate studies in electrical engineering at that university in 1969. He also completed post-graduate work in business administration at the Florida Institute of Technology. He held various positions with ITT, Harris Corporation, and Fairchild Semiconductor Corporation before becoming president of Zilog Incorporated in 1979. In 1982, he joined Gavilan Computer Corporation as president and chief executive officer and, in 1984, became president and chief executive officer of DataQuest, Inc., an information technology service company. From 1991, he served as president, chairman of the board, and chief executive officer of Gartner Group, and was elected chairman emeritus in 2001. Since 1998, he also has been the managing director of SI Ventures, a venture capital firm. Mr. Fernandez, who is 56, was first elected a director of Black & Decker in 1999. He also serves as a director of Brunswick Corporation and several private companies and foundations and is a trustee of the University of Florida. |

| | Benjamin H. Griswold, IV Senior Chairman Deutsche Bank Securities Inc. Mr. Griswold received an undergraduate degree from Princeton University in 1962 and a master of business administration degree from Harvard Business School in 1967. He joined Alex. Brown & Sons in 1967, became a partner of the firm in 1972, was elected vice chairman of the board and director in 1984, and became chairman of the board in 1987. Upon the acquisition of Alex. Brown by Bankers Trust New York Corporation in 1997, he became senior chairman of BT Alex. Brown, and upon the acquisition of Bankers Trust by Deutsche Bank in 1999, he became senior chairman of Deutsche Banc Alex. Brown, the predecessor of Deutsche Bank Securities Inc. Mr. Griswold, who is 62, was first elected a director of Black & Decker in 2001. He also serves as a director of Baltimore Life Insurance Company and is a trustee of Johns Hopkins University. |

6

| | Anthony Luiso Retired President-Campofrio Spain Campofrio Alimentacion, S.A. Mr. Luiso received an undergraduate degree from Iona College in 1967 and a master of business administration degree from the University of Chicago in 1982. Upon graduation from college, he was employed by Arthur Andersen & Co. and, in 1971, joined Beatrice Companies, Inc. Mr. Luiso held various positions at Beatrice, including president and chief operating officer of the International Food Division and president and chief operating officer of Beatrice U.S. Food. Mr. Luiso left Beatrice in 1986 to become group vice president and chief operating officer of the Foodservice Group of International Multifoods Corporation and served as chairman of the board, president, and chief executive officer of that corporation until 1996. He served as executive vice president of Tri Valley Growers during 1998. In 1999, he joined Campofrio Alimentacion, S.A., the leading processed meat-products company in Spain, as president-international and subsequently served as president Campofrio Spain through 2001. Mr. Luiso, who is 59, was first elected a director of Black & Decker in 1988. |

BOARD OF DIRECTORS

Independent Directors The Board has determined that all current directors, other than Mr. Archibald, who is a full-time employee of the Corporation, are “independent directors” as defined under the current and proposed rules of the New York Stock Exchange (“NYSE”). Mr. Clark also meets all of the requirements to become an independent director.

Compensation of Directors Non-management directors receive an annual retainer of $140,000, consisting of shares of common stock with a value of $70,000 under The Black & Decker Non-Employee Directors Stock Plan (the “Directors Stock Plan”) and $70,000 in cash. Committee Chairs and members of the Audit Committee receive an additional retainer of $10,000 in cash. No separate meeting fees are paid. Directors have the option to receive their cash fees in shares of common stock or to defer all or a portion of their fees in the form of “phantom shares.”

Black & Decker provides $100,000 of term life insurance for each director who is not an employee and $200,000 of accident insurance coverage during each day that a director travels in connection with Black & Decker’s business.

Black & Decker provides retirement benefits to directors who were elected prior to 1994 and retire after having served for five or more years. The annual amount of the benefit is $15,000 (one-half of the annual retainer on the date the retirement plan was closed to newly elected directors). Retirement benefits are paid in monthly installments to the director or the director’s surviving spouse until: (1) the number of monthly payments made equals the number of months of service by the director; (2) 120 monthly payments have been made; or (3) the last day of the month following the death of the individual entitled to the payments, whichever occurs first. The retirement benefit is based only on service as a non-management director, and no director first elected after 1993 may participate.

7

During 2002, the Board of Directors met five times. All directors attended 75% or more of the total number of meetings of the Board and Board committees on which they served.

Committees The Board has five committees: Executive, Audit, Compensation, Corporate Governance, and Finance. During 2002, the Compensation and Corporate Governance Committees were formed to perform functions previously performed by the Organization Committee. All committees other than the Executive Committee are composed of non-management directors. The charter of each committee is available on Black & Decker’s Web site (www.bdk.com).

Executive Committee The Executive Committee is currently composed of Nolan D. Archibald (Chairman), Norman R. Augustine, Malcolm Candlish, Manuel A. Fernandez, and Anthony Luiso. The Executive Committee meets when required during intervals between meetings of the Board and has authority to exercise all of the powers of the Board except as limited by the Maryland General Corporation Law. The Committee did not meet during 2002.

Audit Committee The Audit Committee, which is currently composed of Malcolm Candlish (Chairman), Norman R. Augustine, Barbara L. Bowles, and M. Anthony Burns, each of whom is independent within the meaning of the current and proposed rules of the NYSE, met five times during 2002. The Audit Committee operates under a written charter adopted by the Board. Its functions and qualifications for membership are set forth in its charter, a copy of which is attached as Exhibit A to this Proxy Statement. The Board amended the Audit Committee’s charter to comply with the recently enacted Sarbanes-Oxley Act of 2002, related rules adopted by the Securities and Exchange Commission (the “SEC”), and corporate governance rules proposed by the NYSE. The Board has determined that Mr. Burns is an “audit committee financial expert” as defined by rules adopted by the SEC and is independent. The Board and the Audit Committee have adopted a Code of Ethics for Senior Financial Officers that applies to Black & Decker’s Chief Executive Officer, Chief Financial Officer, and Controller.

Compensation Committee The Compensation Committee, which succeeded to the compensation functions of the Organization Committee in August 2002, is currently composed of Anthony Luiso (Chairman), Manuel A. Fernandez, and Benjamin H. Griswold, IV. The Compensation Committee met twice in 2002. Its predecessor committee met three times in 2002. The Compensation Committee assists the Board in matters relating to executive compensation, establishes goals for the award of incentive or performance-based compensation, administers Black & Decker’s stock option and similar plans, and monitors the performance of executive officers.

Corporate Governance Committee The Corporate Governance Committee, which succeeded to the corporate governance functions of the Organization Committee in August 2002, is currently composed of Manuel A. Fernandez (Chairman), Barbara L. Bowles, and Benjamin H. Griswold, IV. The Corporate Governance Committee met twice during 2002. Its predecessor committee met three times in 2002. The Corporate Governance Committee identifies individuals qualified to become directors, recommends to the Board a slate of director-nominees for the next annual meeting of stockholders, recommends members of the standing committees, and develops and recommends to the Board corporate governance principles.

8

Finance Committee The Finance Committee, which is currently composed of Norman R. Augustine (Chairman), M. Anthony Burns, Malcolm Candlish, and Anthony Luiso, met five times during 2002. The Finance Committee monitors generally the financial performance of Black & Decker, recommends dividends, reviews and recommends offerings of Black & Decker’s securities, and reviews Black & Decker’s investments.

Non-Management Directors Other than Mr. Archibald, who is a full-time employee of the Corporation, all current directors are non-management directors, and, upon election to the Board, Mr. Clark also will be a non-management director. The non-management directors meet in executive session at the end of each regular Board meeting. The persons who chair the Audit, Compensation, Corporate Governance, and Finance Committees serve in rotation according to seniority as the presiding director of the executive sessions. Interested persons wishing to make their concerns known to the presiding director or to the non-management directors as a group may contact them at the following address:

Presiding Director [or Non-Management Directors]

c/o Corporate Secretary

The Black & Decker Corporation

701 East Joppa Road

Towson, MD 21286

Nomination of Directors Only persons nominated in accordance with Black & Decker’s bylaws are eligible for election as directors. Nominations may be made at the stockholders’ meeting only by the Board, by a nominating committee or person appointed by the Board, or by a stockholder who is entitled to vote and follows the procedures described below.

A stockholder may nominate a person for election as a director by sending a written notice to the Corporate Secretary at 701 East Joppa Road, Towson, Maryland 21286, that is received not less than 90 days nor more than 110 days prior to the meeting. If Black & Decker provides less than 100 days’ notice of the date of the meeting, the stockholder’s notice must be received no later than the close of business on the tenth day after the meeting notice was mailed or the public disclosure was made, whichever occurred first. The stockholder’s notice must include: (1) the name, age, business address, and residence address of the nominee; (2) the principal occupation or employment of the nominee; (3) the number of shares of common stock owned by the nominee; and (4) any other information relating to the nominee that is required to be disclosed in solicitations for proxies for election of directors according to Regulation 14A under the Securities Exchange Act of 1934. The stockholder also must include the stockholder’s name and address and the number of shares of common stock owned by the stockholder. Black & Decker may require any proposed nominee to furnish other information that may be necessary to determine the nominee’s eligibility to serve as a director. If the chairman of the meeting determines that a nomination was not made in accordance with these procedures, the chairman will announce this at the meeting, and the nomination will be disregarded.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The rules of the SEC require that Black & Decker disclose late filings of reports of stock ownership, or changes in ownership, by its directors, officers, and 10% stockholders. Based on

9

its review of the copies of forms it received, or written representations from reporting persons that they were not required to file a Form 5, Black & Decker believes that, during 2002, all reports required under Section 16(a) of the Securities Exchange Act for its directors, officers, and 10% stockholders were filed on a timely basis.

SECURITY OWNERSHIP OF MANAGEMENT

The Board has adopted a stock ownership policy for principal executive officers, the primary purpose of which is to strike a balance between the objectives of stock ownership and individual financial planning. The policy provides for minimum share ownership targets ranging from shares having a market value of two times the base salary of certain officers to five times the base salary of the chief executive officer. Until the minimum share-ownership target is met, an officer is expected to retain at least 50% of the net shares received under stock-based compensation plans. The policy does not apply to officers who are 60 years of age or older.

The following table shows the number of shares of Black & Decker common stock beneficially owned on the Record Date by each director-nominee, each named executive officer, and all current directors and executive officers as a group. Other than Mr. Archibald, who beneficially owns 1.05% of the outstanding shares of common stock, each director and named executive officer beneficially owns less than 1% of the outstanding shares of common stock, and all current directors and executive officers as a group beneficially own 3.88% of the outstanding shares of common stock. The table also includes: (1) shares of common stock that directors and executive officers have the right to acquire within 60 days of the Record Date, including shares that they have the right to acquire by exercising stock options; and (2) stock units that have been deferred by directors, but ultimately will be paid in shares of common stock under the Directors Stock Plan. The stock units are not entitled to be voted and may not be transferred, but have been listed in the table because they represent part of the total economic interest of the directors in Black & Decker stock.

|

|

| | | Number of Shares Beneficially Owned | |

|

Nolan D. Archibald | | 824,155 | (1) |

|

Norman R. Augustine | | 26,054 | (2) |

|

Barbara L. Bowles | | 21,500 | (3) |

|

M. Anthony Burns | | 7,458 | (4) |

|

Malcolm Candlish | | 27,009 | (3,5) |

|

Kim B. Clark | | 0 | |

|

Charles E. Fenton | | 181,119 | (6) |

|

Manuel A. Fernandez | | 17,732 | (7) |

|

Benjamin H. Griswold, IV | | 20,207 | (8) |

|

Paul A. Gustafson | | 198,413 | (9) |

|

Anthony Luiso | | 29,252 | (3,10) |

|

Michael D. Mangan | | 126,439 | (11) |

|

Paul F. McBride | | 555,500 | (12) |

|

All Directors and Executive Officers as a Group (25 persons) | | 3,048,770 | (13) |

|

10

| (1) | | Includes 500,000 shares that may be acquired within 60 days of the Record Date by exercising stock options. Also includes 3,277 shares held under the Retirement Savings Plan and 91,729 shares held by or for the benefit of members of Mr. Archibald’s immediate family as to which Mr. Archibald has sole or shared voting or investment power. |

| (2) | | Includes 14,500 shares that may be acquired within 60 days of the Record Date by exercising stock options granted under The 1995 Stock Option Plan for Non-Employee Directors (the “Directors Stock Option Plan”). Also includes 6,554 stock units held for the benefit of Mr. Augustine in a deferred compensation account under the Directors Stock Plan. The stock units ultimately will be paid in shares of common stock at the end of the deferral period selected by Mr. Augustine. |

| (3) | | Includes 17,500 shares that may be acquired within 60 days of the Record Date by exercising stock options granted under the Directors Stock Option Plan. |

| (4) | | Includes 5,833 shares that may be acquired within 60 days of the Record Date by exercising stock options granted under the Directors Stock Option Plan. |

| (5) | | Includes 8,350 shares owned by a revocable trust over which Mr. Candlish has voting and investment power in his capacity as a settlor and a trustee. Also includes 1,159 stock units held for the benefit of Mr. Candlish in a deferred compensation account under the Directors Stock Plan. The stock units ultimately will be paid in shares of common stock at the end of the deferral period selected by Mr. Candlish. |

| (6) | | Includes 1,874 shares held under the Retirement Savings Plan and 149,000 shares that may be acquired within 60 days of the Record Date by exercising stock options. |

| (7) | | Includes 12,500 shares that may be acquired within 60 days of the Record Date by exercising options granted under the Directors Stock Option Plan. Also includes 5,232 stock units held for the benefit of Mr. Fernandez in a deferred compensation account under the Directors Stock Plan. The stock units ultimately will be paid in shares of common stock at the end of the deferral period selected by Mr. Fernandez. |

| (8) | | Includes 4,375 shares that may be acquired within 60 days of the Record Date by exercising stock options granted under the Directors Stock Option Plan. |

| (9) | | Includes 4,414 shares held under the Retirement Savings Plan and 177,375 shares that may be acquired within 60 days of the Record Date by exercising stock options. Also includes 50 shares held for the benefit of a member of Mr. Gustafson’s immediate family. |

| (10) | | Includes 6,752 stock units held for the benefit of Mr. Luiso in a deferred compensation account under the Directors Stock Plan. The stock units ultimately will be paid in shares of common stock at the end of the deferral period selected by Mr. Luiso. |

| (11) | | Includes 189 shares held under the Retirement Savings Plan and 118,750 shares that may be acquired within 60 days of the Record Date by exercising stock options. |

| (12) | | Includes 550,000 shares that may be acquired within 60 days of the Record Date by exercising stock options. |

| (13) | | Includes 22,673 shares held for the account of the executive officers under the Retirement Savings Plan and 2,516,383 shares that executive officers and directors have the right to acquire within 60 days of the Record Date by exercising stock options. Also includes 19,697 stock units held in deferred compensation accounts for the benefit of non-management directors under the Directors Stock Plan. The stock units ultimately will be paid in shares of common stock at the end of the deferral periods selected by participating directors. |

The information provided in the table above is based on information received from the directors and executive officers. The inclusion of shares in the table is not an admission of beneficial ownership by the director or executive officer next to whose name the shares appear. Unless otherwise indicated in a footnote, the director or executive officer had sole voting and investment power over the shares.

11

EXECUTIVE COMPENSATION

The following tables and text summarize, in accordance with regulations of the SEC, Black & Decker’s compensation of its executive officers.

Summary Compensation The following table shows a three-year history of Black & Decker’s compensation of its chief executive officer and the four other most highly compensated executive officers based on total annual salary and bonus for 2002.

| | | Annual Compensation

| | | Long-Term Compensation

| |

| | | | | | | | | | | | Awards

| | Payouts

| | | |

Name and Principal Position | | Year | | Salary | | Bonus | | Other Annual Compensation | | | Securities Underlying Options/SARs | | LTIP Payouts | | All Other Compensation | |

|

Nolan D. Archibald | | 2002 | | $ | 1,270,833 | | $ | 2,750,000 | | $ | 204,880 | (a) | | 225,000 | | $ | — | | $ | 99,412 | (b) |

Chairman, President, and | | 2001 | | | 1,200,000 | | | 850,000 | | | 99,174 | (c) | | 200,000 | | | — | | | 139,964 | |

Chief Executive Officer | | 2000 | | | 1,100,000 | | | 1,250,000 | | | 154,342 | (d) | | 1,000,000 | | | 1,156,978 | | | 137,964 | |

|

Paul F. McBride | | 2002 | | | 585,000 | | | 850,000 | | | 23,675 | (e) | | 90,000 | | | — | | | 30,162 | (f) |

Executive Vice President | | 2001 | | | 560,000 | | | 275,000 | | | 50,422 | (e) | | 100,000 | | | — | | | 40,313 | |

| | | 2000 | | | 525,000 | | | 350,000 | | | 26,061 | (e) | | 200,000 | | | 550,968 | | | 28,763 | |

|

Charles E. Fenton | | 2002 | | | 413,333 | | | 373,500 | | | 21,651 | (g) | | 30,000 | | | — | | | 26,540 | (h) |

Senior Vice President and | | 2001 | | | 395,000 | | | 162,345 | | | 27,343 | (g) | | 30,000 | | | — | | | 36,624 | |

General Counsel | | 2000 | | | 376,667 | | | 260,000 | | | 27,637 | (g) | | 150,000 | | | 374,716 | | | 35,890 | |

|

Paul A. Gustafson | | 2002 | | | 404,167 | | | 300,000 | | | 20,920 | (i) | | 30,000 | | | — | | | 23,303 | (j) |

Executive Vice President | | 2001 | | | 373,333 | | | 200,000 | | | 26,234 | (i) | | 35,000 | | | — | | | 28,120 | |

| | | 2000 | | | 345,000 | | | 250,000 | | | 26,527 | (i) | | 175,000 | | | 292,085 | | | 39,218 | |

|

Michael D. Mangan | | 2002 | | | 400,000 | | | 400,000 | | | 23,721 | (k) | | 35,000 | | | — | | | 27,650 | (l) |

Senior Vice President and | | 2001 | | | 375,385 | | | 156,180 | | | 27,785 | (k) | | 30,000 | | | — | | | 37,742 | |

Chief Financial Officer | | 2000 | | | 346,667 | | | 230,000 | | | 26,213 | (k) | | 125,000 | | | 183,625 | | | 28,085 | |

|

| (a) | | Includes perquisites and other personal benefits of $105,464. The perquisites and other personal benefits include personal use of Black & Decker’s aircraft at an approximate cost to Black & Decker of $70,097 and reimbursement for financial counseling fees of $20,663. |

| (b) | | Includes $6,000 in contributions to the Retirement Savings Plan, $36,006 in life insurance premiums, and $57,406 in contributions to the Supplemental Retirement Savings Plan, all paid by Black & Decker. |

| (c) | | The total cost to Black & Decker of the perquisites and other personal benefits received by Mr. Archibald did not exceed the lesser of $50,000 or 10% of the total amounts reported in the Salary and Bonus columns and, therefore, is not included. |

| (d) | | Includes perquisites and other personal benefits of $68,166. The perquisites and other personal benefits include personal use of Black & Decker’s aircraft at an approximate cost to Black & Decker of $24,274 and reimbursement for financial counseling fees of $31,057. |

| (e) | | The total cost to Black & Decker of the perquisites and other personal benefits received by Mr. McBride did not exceed the lesser of $50,000 or 10% of the total amounts reported in the Salary and Bonus columns and, therefore, is not included. |

| (f) | | Includes $8,662 in life insurance premiums and $21,500 in contributions to the Supplemental Retirement Savings Plan, both paid by Black & Decker. |

| (g) | | The total cost to Black & Decker of the perquisites and other personal benefits received by Mr. Fenton did not exceed the lesser of $50,000 or 10% of the total amounts reported in the Salary and Bonus columns and, therefore, is not included. |

| (h) | | Includes $4,000 in contributions to the Retirement Savings Plan, $9,269 in life insurance premiums, and $13,271 in contributions to the Supplemental Retirement Savings Plan, all paid by Black & Decker. |

| (i) | | The total cost to Black & Decker of the perquisites and other personal benefits received by Mr. Gustafson did not exceed the lesser of $50,000 or 10% of the total amounts reported in the Salary and Bonus columns and, therefore, is not included. |

| (j) | | Includes $6,000 in contributions to the Retirement Savings Plan and $17,303 in life insurance premiums, both paid by Black & Decker. |

| (k) | | The total cost to Black & Decker of the perquisites and other personal benefits received by Mr. Mangan did not exceed the lesser of $50,000 or 10% of the total amounts reported in the Salary and Bonus columns and, therefore, is not included. |

| (l) | | Includes $4,000 in contributions to the Retirement Savings Plan, $12,714 in life insurance premiums and $10,936 in contributions to the Supplemental Retirement Savings Plan, all paid by Black & Decker. |

12

Option/SAR Grants in Last Fiscal Year The following table shows information about grants of stock options to named executive officers under Black & Decker’s stock option plans during 2002. No freestanding stock appreciation rights (“SARs”) were granted to executive officers during 2002.

|

|

| | | Individual Grants

| | Potential Realized Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

Name | | Number of Securities Underlying Options/SARs Granted | | % of Total Options/SARs Granted to Employees in Fiscal Year | | | Exercise or Base Price | | Expiration Date | | 5% | | 10% |

|

Nolan D. Archibald | | 225,000 | | 17.6 | % | | $ | 48.33 | | 4/29/2012 | | $ | 6,838,758 | | $ | 17,330,753 |

Paul F. McBride | | 90,000 | | 7.0 | | | | 48.33 | | 4/29/2012 | | | 2,735,503 | | | 6,932,301 |

Charles E. Fenton | | 30,000 | | 2.3 | | | | 48.33 | | 4/29/2012 | | | 911,834 | | | 2,310,767 |

Paul A. Gustafson | | 30,000 | | 2.3 | | | | 48.33 | | 4/29/2012 | | | 911,834 | | | 2,310,767 |

Michael D. Mangan | | 35,000 | | 2.7 | | | | 48.33 | | 4/29/2012 | | | 1,063,807 | | | 2,695,895 |

|

These stock options have an exercise price equal to the fair market value of common stock on the date of grant and become exercisable in four equal annual installments beginning 12 months after the date of grant. They also include a limited SAR, i.e., upon a change in control, the stock options would be canceled, and the holder would be entitled to a cash payment equal to the difference between the market value of a share of common stock and the exercise price of each outstanding option.

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year End Option/SAR Values The following table shows information regarding stock options exercised by Black & Decker’s named executive officers during 2002 and the number and value of unexercised stock options at December 31, 2002. The value of unexercised stock options is based on the closing price of $42.89 per share of common stock on December 31, 2002, the last trading day of 2002. As of that date, no freestanding SARs were outstanding.

|

|

Name | | Shares Acquired on Exercise | | Value Realized | | Number of Securities Underlying Unexercised Options/SARs at

December 31, 2002

| | Value of Unexercised In-the-Money Options/SARs at December 31, 2002

|

| | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

|

Nolan D. Archibald | | 360,000 | | $ | 9,481,918 | | 500,000 | | 1,425,000 | | $ | 1,133,750 | | $ | 2,043,050 |

Paul F. McBride | | 25,000 | | | 401,246 | | 550,000 | | 415,000 | | | 10,880 | | | 978,005 |

Charles E. Fenton | | — | | | — | | 149,000 | | 210,000 | | | 958,360 | | | 306,458 |

Paul A. Gustafson | | — | | | — | | 177,375 | | 240,000 | | | 988,333 | | | 357,534 |

Michael D. Mangan | | 7,500 | | | 125,813 | | 100,000 | | 132,500 | | | 2,720 | | | 292,858 |

|

Pension Benefits The following table shows the estimated annual retirement benefits payable under Black & Decker’s pension plans to participating executives, including the executive officers named in the Summary Compensation Table, based on the stated average annual compensation and years of service. Black & Decker maintains non-contributory, tax-qualified defined benefit plans that cover most officers and salaried employees. Tax code provisions limit

13

the annual benefits that may be paid from tax-qualified retirement plans. Black & Decker also maintains supplemental plans for specified executives that authorize payment outside of the tax-qualified plans of annual benefits in excess of amounts permitted to be paid under the tax-qualified plans. The following table reflects benefits payable under both the tax-qualified plans and the applicable supplemental plans for executives participating in the tax-qualified plans and the applicable supplemental plans.

Pension Plan Table

|

|

| | | Years of Service

|

Average Annual Compensation | | 15 | | 20 | | 25 | | 30 | | 35 |

|

$ | 500,000 | | $ | 300,000 | | $ | 300,000 | | $ | 300,000 | | $ | 300,000 | | $ | 300,000 |

| 750,000 | | | 450,000 | | | 450,000 | | | 450,000 | | | 450,000 | | | 450,000 |

| 1,000,000 | | | 600,000 | | | 600,000 | | | 600,000 | | | 600,000 | | | 600,000 |

| 1,250,000 | | | 750,000 | | | 750,000 | | | 750,000 | | | 750,000 | | | 750,000 |

| 1,500,000 | | | 900,000 | | | 900,000 | | | 900,000 | | | 900,000 | | | 900,000 |

| 1,750,000 | | | 1,050,000 | | | 1,050,000 | | | 1,050,000 | | | 1,050,000 | | | 1,050,000 |

| 2,000,000 | | | 1,200,000 | | | 1,200,000 | | | 1,200,000 | | | 1,200,000 | | | 1,200,000 |

| 2,500,000 | | | 1,500,000 | | | 1,500,000 | | | 1,500,000 | | | 1,500,000 | | | 1,500,000 |

| 3,000,000 | | | 1,800,000 | | | 1,800,000 | | | 1,800,000 | | | 1,800,000 | | | 1,800,000 |

| 3,500,000 | | | 2,100,000 | | | 2,100,000 | | | 2,100,000 | | | 2,100,000 | | | 2,100,000 |

| 4,000,000 | | | 2,400,000 | | | 2,400,000 | | | 2,400,000 | | | 2,400,000 | | | 2,400,000 |

| 4,500,000 | | | 2,700,000 | | | 2,700,000 | | | 2,700,000 | | | 2,700,000 | | | 2,700,000 |

|

Although the normal retirement age is 65 for pension plan purposes, normal retirement age is 60 with five years service for supplemental plan purposes. The amounts in the Pension Plan Table assume that benefit payments will start when the participant reaches his or her normal retirement date, which is the later of the date the participant reaches age 60 or completes five years of service. If payments start before the participant’s normal retirement date, the benefit amount would be actuarially reduced. For at least ten but less than 15 years of service, the amounts in this table would be 50% of average annual compensation. For less than ten years of service, the amounts in the table would be 5% of average annual compensation for each year of service. These reductions, however, would not apply to participants when a change in control occurs.

The compensation reflected in the Pension Plan Table is the executive’s base annual salary and bonus (as reported in the Summary Compensation Table), including salary continuance periods. The amount of compensation used when calculating the amounts in the Pension Plan Table is an executive’s highest three-year average of compensation out of the last five years (or the last five calendar years) of employment with Black & Decker, including any salary continuance period. In the event of a change in control, an executive covered by certain supplemental plans and employed by Black & Decker on the date of the change in control will receive full benefits regardless of his or her years of credited service, and the executive’s highest three-year average of compensation out of the last five years of employment by Black & Decker before the date of the change in control will be used to calculate the amount of benefit payments if that average is higher.

14

The credited years of service for pension purposes as of December 31, 2002, and the estimated years of service at the participant’s normal retirement date for each executive named in the Summary Compensation Table are as follows:

|

|

Name | | Years of Service at December 31, 2002 | | Years of Service at Normal Retirement |

|

Nolan D. Archibald | | 17.25 | | 17.75 |

Paul F. McBride | | 3.73 | | 16.83 |

Charles E. Fenton | | 13.67 | | 19.08 |

Paul A. Gustafson | | 38.21 | | 37.38 |

Michael D. Mangan | | 3.17 | | 17.00 |

|

The Pension Plan Table reflects the annual benefit payable beginning at the participant’s normal retirement date in the form of an annuity for the participant’s life. If a participant dies, his or her surviving spouse receives 50% of the monthly benefits for the spouse’s life.

The benefits reflected in the Pension Plan Table are reduced by 100% of the participant’s Social Security benefits and any retirement, disability, death, and similar benefits received from Black & Decker or any other employer.

Severance Benefits and Other Agreements The terms and conditions of employment of Mr. Archibald are governed by a written employment contract. Mr. Archibald’s contract currently provides for an annual salary of $1,375,000, severance payments on basically the same terms and conditions as stated below in the discussion of severance benefits agreements, and the continuation of substantially all benefits and perquisites for a three-year period following termination of employment (other than a voluntary termination by Mr. Archibald), or until he obtains substantially equivalent employment.

In addition to the severance benefits agreements discussed below, Black & Decker has an executive salary continuance plan covering some executives, including Messrs. McBride, Fenton, Gustafson, and Mangan. If a covered executive is terminated other than for cause, the executive’s compensation and benefits will be continued for a specified period of up to two years or until another position of employment is obtained, whichever occurs first. The compensation and benefits payable under the salary continuance plan will be offset by the compensation and benefits paid or credited to the executive by another employer. Black & Decker will continue to pay the difference between the new compensation and benefits and the executive’s base salary and benefits at the time of termination, if higher, for the remainder of the salary continuance period.

In 1986, Black & Decker entered into severance benefits agreements that provided for payments to be made to certain key management employees who are terminated following a change in control of Black & Decker. These agreements have been amended and restated from time to time, and currently cover 18 employees, including each named executive officer. The severance benefits agreements expire on December 31, 2007, unless a change in control occurs prior to that date, in which case the agreements expire 36 months after the date of the change in control. The severance benefits agreements provide for the payment of specified benefits if employment terminates under certain circumstances within three years following a change in control. A change in control is deemed to take place whenever: (1) a person, group of persons, or other

15

entity becomes the beneficial owner of securities of Black & Decker having 20% or more of the combined voting power of Black & Decker’s then-outstanding securities; (2) a significant change in the composition of the Board of Directors occurs; (3) Black & Decker enters into an agreement that would result in a change of control; or (4) the stockholders of Black & Decker approve certain types of extraordinary transactions.

Circumstances triggering payment of severance benefits under these agreements include: (1) involuntary termination of employment for reasons other than death, disability, or cause; or (2) voluntary termination by the employee in the event of significant changes in the nature of his or her employment, including reductions in compensation and changes in responsibilities and powers.

Benefits under the severance benefits agreements generally include: (1) a lump sum severance payment equal to three times the sum of the employee’s annual base salary and the Annual Incentive Plan maximum payment; (2) payment of deferred compensation; (3) maintenance for a period of three additional years of life, disability, accident, medical, dental, and health insurance benefits substantially similar to those benefits to which the employee was entitled immediately prior to termination; (4) additional payments to cover any excise tax imposed by Section 4999 of the Internal Revenue Code; (5) reimbursement of legal fees and expenses incurred as a result of the termination; and (6) cash payments in lieu of common stock issuable under stock option plans. For these purposes, Annual Incentive Plan maximum payment means the maximum potential award under the applicable Annual Incentive Plan after assuming that the employee remained a participant until the end of the applicable year and all performance goals for that year that would entitle the employee to a maximum payment were met or exceeded.

The Board of Directors believes that these severance benefits agreements encourage the commitment and availability of key management employees and ensure that they will be able to devote their full attention and energy to the affairs of Black & Decker in the face of potentially disruptive and distracting circumstances in the event of an attempted or actual change in control or an unsolicited takeover. In any such event, key management employees will be able to analyze and evaluate proposals objectively with a view to the best interests of Black & Decker and its stockholders and to act as the Board may direct without fear of retribution if the change in control occurs. The severance benefits agreements, however, may have the incidental effect of discouraging takeovers and protecting the employees from removal, because the agreements increase the cost that would be incurred by an acquiring company seeking to replace current management.

Certain Relationships and Related Transactions On June 23, 1999, Black & Decker made a $100,000 relocation loan to Christopher Metz, a vice president, in connection with his relocation to California to assume the position of president of Kwikset. The loan, which does not bear interest, will be forgiven over a five-year period ending June 15, 2004. If Mr. Metz voluntarily leaves Black & Decker, however, he will be obligated to pay Black & Decker the entire $100,000, plus 8% per annum interest. If Black & Decker transfers Mr. Metz to a location outside of California before the end of the five-year period, Mr. Metz will receive a $20,000 credit for each year he resides in California.

16

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Recommendations regarding the annual salaries of Black & Decker’s executive officers are made by the Compensation Committee and submitted to the Board for approval. The Board did not reject or modify any of the recommendations of the Committee or its predecessor committee during 2002. Awards of incentive compensation are made by the Committee under the incentive plans described below and are reported to the Board.

Philosophy and Objectives Black & Decker seeks to attract and retain top quality executives by providing a competitive, performance-based executive compensation program. The fixed compensation element of the program is intended to be, in the aggregate with other compensation, competitive in the marketplace. The incentive compensation element is designed to focus management on annual and long-term financial performance, with both annual and long-term objectives and both cash and stock-based rewards. The program reflects Black & Decker’s pay-for-performance philosophy and is intended to provide pay commensurate with performance.

The United States Internal Revenue Code limits deductions for certain compensation in excess of $1 million annually paid to specified executive officers of public companies. The Committee continues to monitor its executive compensation plans and policies with a view toward preserving the deductibility of executive compensation while maintaining an ability to attract and retain those executives necessary to assist Black & Decker in reaching its goals and objectives. Because the Committee believes that the prudent use of discretion in determining pay level is in the best interest of Black & Decker and its stockholders, under some circumstances (other than under the Executive Annual Incentive Plan (“EAIP”) and the Performance Equity Plan (“PEP”)) the Committee may continue to exercise both positive and negative discretion in determining appropriate amounts of compensation. In those situations, part of the compensation paid may not be deductible.

Principal Components of Executive Compensation The principal components of the executive compensation program are base salary, annual and long-term incentive compensation, and stock option incentives.

Black & Decker’s objective is to pay its executive officers base salaries that are sufficient to attract and retain individuals with the qualities believed to be necessary for the long-term financial success of Black & Decker and that are competitive in the marketplace. An individual executive officer’s salary level generally is based on responsibilities, tenure, an evaluation of the officer’s performance during the period in which he or she has been employed, and other special circumstances such as the international nature of Black & Decker’s business, overseas assignments, and direct competition for the officer’s services. The Committee and the Board generally consider increases in base salary at 14-month intervals for executive officers other than the chief executive officer and at 18-month intervals for the chief executive officer. The Committee and the Board from time to time also consider increases in base salary in connection with significant promotions or increases in the responsibilities of executive officers and when it is necessary to respond to competitive pressures.

17

Historically, the Committee has approved annual bonuses under the annual incentive plans, including the EAIP, based upon a number of factors, including earnings per share (“EPS”) performance against established targets. Individual awards generally have been based upon corporate financial performance, business unit performance, and a subjective evaluation of individual performance. Corporate financial performance generally has been measured by EPS excluding non-recurring items, and business unit performance generally has been measured by certain financial objectives, including return on net assets, operating income, and cash flow, against budget. Target incentive awards then have been multiplied by a payout factor and an individual performance factor. Throughout the remainder of this Report, references to EPS mean EPS excluding non-recurring items.

In 2002, the payout factor for executive officers who were members of the corporate staff was entirely dependent upon EPS. For executive officers with operating responsibility for individual business units, 25% of the payout factor was determined by comparing EPS to target, and 75% was determined by comparing actual business-unit performance to target business-unit performance.

The EPS in 2002 exceeded the EPS target established by the Committee at the beginning of the year for purposes of awards under the EAIP. Incentive awards for 2002 ranged from 90% to 200% of base salary, reflecting the relationship of actual EPS to target EPS for the year and the Committee’s evaluation of each individual’s performance and the performance of the business unit or units for which the individual was responsible. For the year ended December 31, 2002, five individuals received awards under the EAIP.

The long-term incentive program is composed of the PEP, stock option plans, and, for the period 2001 through 2003, the Executive Long-Term Performance/Retention Plan for the named executive officers and a companion plan for other executive officers. The two Long-Term Performance/Retention Plans are referred to collectively as the “Performance Plans.” The PEP is a stock-based performance plan. PEP shares provide a potential award, generally payable in stock, based on Black & Decker’s performance during a two-year performance period against established EPS targets and, in the case of executives with operating responsibility, certain financial objectives of the relevant business unit, including return on net assets, operating income, and cash flow. The EPS targets are established by the Committee at the beginning of each performance period after consideration of the long-term operating plan. Stock options generally have a ten-year term, are granted at fair market value on the date of grant, include limited stock appreciation rights exercisable in the event of a change in control, and generally become exercisable in equal annual installments over a four-year period. Under the Performance Plans, which cover the three-year period 2001 through 2003, participants surrendered their PEP grants for the periods then ending and were granted awards payable in cash in 2004 based on Black & Decker’s EPS for fiscal year 2003 against a target set by the Committee at the time the awards were made.

Generally, awards under the long-term incentive program are determined by the officer’s base salary. To maximize the incentive aspects of these programs and focus on those individuals who

18

are in a position to have the greatest effect on Black & Decker’s performance, the percentages of base salary increase as responsibility increases. The number of PEP shares or stock options and the amount of the awards under the Performance Plans are not tied to Black & Decker’s past performance, since the ultimate value of the benefit depends on future corporate performance and the future market values of Black & Decker’s common stock. Approximately 510 individuals received stock options in 2002. The Committee resumed PEP grants in 2003 for performance periods ending on and after December 31, 2004, and 18 individuals received PEP awards for the performance period ending in 2004.

Compensation of the Chief Executive Officer In October 2002, Mr. Archibald’s base salary was increased to $1,375,000. Under the EAIP criteria established at the beginning of 2002 and based on the EPS achieved in 2002, Mr. Archibald received an award of 200% of his base salary.

Stock options and, for the period ending in 2003, the award under the applicable Performance Plan represent Mr. Archibald’s primary long-term incentive opportunity. Coupled with Black & Decker’s stock ownership policy for executive officers, which is discussed above under the caption Security Ownership of Management, these components of the long-term incentive award program are intended to create a strong motivation to develop and implement strategies that lead to consistent and lasting increases in Black & Decker’s return to its stockholders. Mr. Archibald’s stock ownership significantly exceeds the stock ownership policy target of five times his salary established by the Board.

In April 2002, the Committee awarded Mr. Archibald 225,000 stock options, which become exercisable in four equal annual installments beginning 12 months after the date of grant. The grant was made to continue to align his interests with those of stockholders.

Compensation of Other Executive Officers The named and other executive officers received salary increases ranging from 3.8% annualized to 13.2% annualized during 2002.

The named and other executive officers, excluding Mr. Archibald, received annual incentive awards under the applicable annual incentive plan ranging from $135,000 to $850,000. Two officers received special bonuses outside of the applicable annual incentive plan in recognition of their contributions during fiscal year 2002. The incentive awards were determined in a manner consistent with the plans and philosophy described above.

In addition to Mr. Archibald, a number of named and other executive officers received stock option grants during 2002. The level of the option grants was determined based on the long-term incentive compensation philosophy described above. The options have a ten-year term, are exercisable at the fair market value of the shares of common stock on the date of grant and include limited SARs exercisable in the event of a change in control as defined in the plans. The options become exercisable in four annual installments beginning 12 months after the date of grant.

19

Access to Competitive Compensation Data The Committee reviews with management competitive data from recognized national surveys concerning executive compensation levels and practices as part of the process of establishing an appropriate level of overall executive compensation. These surveys include some of the companies that are included in the New Peer Group used by Black & Decker in the comparison of five-year cumulative total return set forth below, as well as many other companies not in the New Peer Group. The Committee has chosen not to limit the survey information to companies in the New Peer Group because the search to attract new executives is not limited to companies within the same industry, and the competition that Black & Decker faces to recruit and retain existing executives comes from companies in many different industries. After reviewing the available competitive data, the Committee evaluates the executive’s performance and considers Black & Decker’s needs to arrive at individual compensation decisions.

Anthony Luiso (Chairman)

Manuel A. Fernandez

Benjamin H. Griswold, IV

20

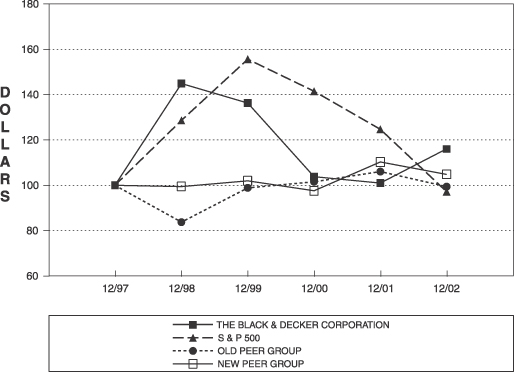

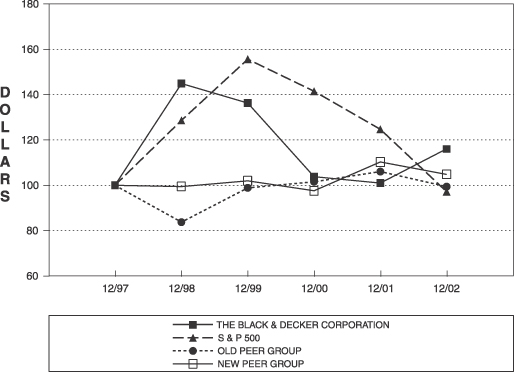

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN

| (1) | | Assumes $100 invested at the close of business on December 31, 1997, in Black & Decker common stock, Standard & Poor’s (S&P) 500 Index, the Old Peer Group, and the New Peer Group. |

| (2) | | The cumulative total return assumes reinvestment of dividends. |

| (3) | | The Old Peer Group consists of the companies in S&P Hardware and Tools, Value Line Home Appliances, Business Week Machine and Hand Tools, and Fortune Industrial and Farm Equipment. The S&P Hardware and Tools and Business Week Machine and Hand Tools indices no longer exist. The New Peer Group consists of the companies in the following indices within the Standard & Poor’s Super Composite 1,500: Household Appliances, Housewares & Specialties, Industrial Machinery, and Building Products. Black & Decker believes the New Peer Group provides a better basis for performance comparison than the Old Peer Group. A list of the companies in the Old and New Peer Groups will be furnished upon request addressed to the Corporate Secretary at 701 East Joppa Road, Towson, Maryland 21286. |

| (4) | | Total return is weighted according to market capitalization of each company at the beginning of each year. |

21

AUDIT COMMITTEE REPORT

The Audit Committee has reviewed and discussed Black & Decker’s audited financial statements for the fiscal year ended December 31, 2002, with management and with Black & Decker’s independent auditor, Ernst & Young LLP (“E&Y”). Management is responsible for Black & Decker’s internal controls and the financial reporting process. E&Y is responsible for performing an independent audit of Black & Decker’s consolidated financial statements in accordance with generally accepted auditing standards and for issuing a report thereon.

The Audit Committee has discussed with E&Y the matters required to be discussed by Statements on Auditing Standards No. 61 and No. 90 relating to the conduct of the audit. The Audit Committee has received the written disclosures and the letter from E&Y required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), has discussed with E&Y their independence, and has considered the compatibility of non-audit services provided by E&Y with their independence.

Based on the review and discussions described above, the Audit Committee recommended to the Board of Directors that the audited financial statements for the fiscal year ended December 31, 2002, be included in Black & Decker’s Annual Report on Form 10-K for the fiscal year ended December 31, 2002, for filing with the SEC.

Malcolm Candlish (Chairman)

Norman R. Augustine

Barbara L. Bowles

M. Anthony Burns

RATIFICATION OF THE SELECTION OF THE INDEPENDENT AUDITOR

The Audit Committee must approve in advance all audit and non-audit services provided by Black & Decker’s independent auditor. The Audit Committee has engaged Ernst & Young LLP (“E&Y”) to serve as Black & Decker’s independent auditor during 2003 and has approved certain non-audit services to be provided by E&Y. Unless a stockholder directs otherwise, proxies will be voted for the ratification of the selection of E&Y as the independent auditor for 2003. If the appointment is not ratified by the stockholders, the Audit Committee will consider the selection of another independent auditor for 2003.

A representative of E&Y is expected to be present at the 2003 Annual Meeting of Stockholders. The representative will be given the opportunity to make a statement and will be available to respond to appropriate questions.

When pre-approving non-audit services provided by Black & Decker’s independent auditor, the Audit Committee determines that the provision of these services is consistent with the basic principles of independence that the auditor cannot: (1) function in the role of management, (2) audit its own work, or (3) serve in an advocacy role of Black & Decker. The Audit Committee also considers the amount of non-audit services previously provided by the independent

22

auditor to determine whether the additional non-audit services are compatible with maintaining the auditor’s independence. If it is necessary for Black & Decker to engage E&Y to provide certain non-audit services between regularly scheduled meetings of the Audit Committee, the Audit Committee has delegated to the Chairman of the Audit Committee the authority to pre-approve particular non-audit services in categories that the Audit Committee has approved and are compatible with maintaining E&Y’s independence. Decisions made by the Chairman of the Audit Committee will be reported to the Audit Committee at its next regularly scheduled meeting.

Although Black & Decker closely monitors the nature of the services provided by its independent auditor, it is possible that the auditor will provide non-audit services that were not recognized as non-audit services at the time of engagement. In order to ensure that the independence of the auditor is consistent with the Sarbanes-Oxley Act of 2002 (the “SOA”), the Audit Committee has authorized the Chairman to approve on its behalf any non-audit services rendered by E&Y if: (a) the services are permitted by the SOA, (b) the services were not recognized by Black & Decker at the time of engagement to be non-audit services, (c) the aggregate amount of fees for all such services provided constitutes no more than 5% of the total amount of revenues paid by Black & Decker to the independent auditor during a fiscal year, (d) the services are promptly brought to the attention of the Audit Committee, and (e) the approval is given prior to the completion of the audit. Black & Decker will disclose in its proxy statement the percentage of fees paid to the independent auditor under this procedure.

Audit Fees The aggregate fees billed by E&Y for professional services rendered for the audit of Black & Decker’s annual financial statements, the reviews of the financial statements included in Black & Decker’s Quarterly Reports on Form 10-Q, and services provided in connection with statutory or regulatory filings was $2,507,000 for the fiscal year ended December 31, 2002, and $2,335,000 for the fiscal year ended December 31, 2001.

Audit-Related Fees The aggregate fees billed by E&Y in each of the last two fiscal years for assurance and related services that are reasonably related to the performance of the audit or review of Black & Decker’s financial statements and not reported under the caption Audit Fees were $210,000 for the year ended December 31, 2002, and $296,000 for the year ended December 31, 2001. These services included employee benefit plan audits, assistance with debt and regulatory compliance issues, due diligence and accounting consultations related to mergers, acquisitions and dispositions, accounting consultations concerning regulatory reporting, attest services, and assistance in the preparation of regulatory reports.

Tax Fees The aggregate fees billed by E&Y in each of the last two fiscal years for professional services rendered for tax compliance, tax advice, and tax planning were $2,828,000 for the year ended December 31, 2002, which included $1,253,000 for tax compliance services and $1,575,000 for tax advice and planning services, and $2,477,000 for the year ended December 31, 2001, which included $1,703,000 for tax compliance services and $774,000 for tax advice and planning services. These services included assistance in the preparation of Black & Decker’s tax returns and expatriate and executive tax returns, assistance with tax audits and appeals, tax advice relating to mergers, acquisitions, dispositions, and employee benefits,

23

requests for rulings or technical advice from taxing authorities, value added tax advice and planning, and organization tax structure evaluation and planning.

All Other Fees The aggregate fees billed by E&Y for professional services rendered during each of the last two fiscal years other than as stated above under the captions Audit Fees, Audit-Related Fees, and Tax Fees were $198,000 for the year ended December 31, 2002, and $164,000 for the year ended December 31, 2001. These services included litigation support and an accounting procedure review.

The Board recommends a vote for the approval of the ratification of Ernst & Young LLP.

Proposal to Approve The Black & Decker 2003 Stock Option Plan

At its meeting held on February 13, 2003, the Board unanimously adopted resolutions declaring it advisable to adopt The Black & Decker 2003 Stock Option Plan, recommending the plan to the stockholders, and directing that the plan be submitted to the stockholders for their approval at the meeting. A copy of the plan is attached to this Proxy Statement as Exhibit B.

The Board continues to believe that stock-based incentives are an important factor in attracting, retaining, and rewarding employees and closely aligning their interests with those of Black & Decker’s stockholders. As such, Black & Decker’s stock option plans have been and will continue to be an important part of the compensation package it offers to officers and other key employees. As of December 31, 2002, there were 916,914 shares of common stock available for future option grants under Black & Decker’s existing stock option plans. The Board believes that, absent stockholder approval of additional shares of common stock for issuance in connection with an appropriate stock option plan, Black & Decker’s ability to continue to attract and retain effective and capable employees will be adversely affected.

After reviewing the terms of the existing stock option plans and the number of shares available for future option grants under those plans, the Board determined that it was appropriate to adopt the plan. Proceeds received by Black & Decker upon the exercise of options granted under the plan will be available for general corporate purposes, and amounts paid in settlement of stock appreciation rights (“SARs”) granted under the plan will be paid from Black & Decker’s general funds. It is not possible at this time to determine the number or identity of all of the individuals who will be eligible for the grant of options or SARs under the plan on or prior to April 29, 2013. During fiscal year 2002, approximately 510 employees received option grants under Black & Decker’s existing stock option plans.

Summary of the Plan The Compensation Committee will administer the plan. No member of the Board who is not also an employee will be eligible to participate in the plan.

The number of shares of common stock reserved for issuance under the plan will be 5,000,000. The Compensation Committee will determine who receives options or SARs and the number of

24

shares on which options should be granted or upon which options should be based. Under the plan, the option price or SAR base value may not be less than the fair market value of the common stock on the date of grant. Fair market value is generally determined as the average of the high and low sale price per share as reported on the NYSE on the date of grant (or if no sales were reported that day, the last preceding day a sale occurred). On December 31, 2002, the average of the highest and lowest quoted sale price of common stock was $42.60 per share. Options and SARs may not be granted under the plan after April 29, 2013.

Options and SARs may extend for a period of up to 10 years from the date of grant unless the Compensation Committee establishes a shorter term at the time of grant. Unless otherwise provided by the Compensation Committee, option and SAR grants will be divided into four equal installments, with 25% becoming exercisable at yearly intervals beginning one year after the date of grant. The Compensation Committee will have the discretion to grant either incentive stock options or non-qualified options under the plan.

Generally, upon termination of an option or SAR holder’s active employment with Black & Decker and its subsidiaries, the holder’s options and SARs terminate, except that in the case of involuntary termination of employment, the option or SAR holder is entitled to exercise that portion of the option or SAR that was exercisable on the date the holder’s employment terminated for a period of 30 days. If an option or SAR holder’s employment with Black & Decker and its subsidiaries terminates by reason of retirement under normal Black & Decker policies or death, the retired employee or personal representative of the deceased employee may elect to exercise the option or SAR within three years of the employee’s death or termination of employment. If an option or SAR holder involuntarily terminates employment, takes a leave of absence from Black & Decker and its subsidiaries for personal reasons or for military service, or terminates employment by reason of illness or disability or other special circumstance, the Compensation Committee may accelerate options or extend the time following termination of employment during which the holder is entitled to exercise options or SARs. In no event may any option be exercised after the expiration of its term. Options and SARs are non-transferable and non-assignable except by inheritance or under certain circumstances to certain relatives or their related trusts or other investment vehicles.

The purchase price for shares of common stock upon the exercise of options generally may be paid either in cash, by delivering to Black & Decker shares of common stock that, together with any cash tendered with the shares, will equal in value the full purchase price, or by other “cashless” exercise methods specified in the plan. Permitting stock-for-stock payments or other cashless exercises allows option holders to acquire shares of common stock without incurring the costs that may arise when the exercise price must be paid in cash. Stock-for-stock payments or other cashless exercises reduce the cash available to Black & Decker as a result of option exercises.

SARs under the plan may be granted as stand-alone rights or in tandem with a related option and are intended to permit the holder in lieu of exercising the option or in exchange for surrendering the SAR to surrender the option or the SAR in exchange for a payment in an amount equal to the difference between the exercise price or SAR base price and the market

25

value of the common stock on the date of exercise. The payment may be made either in cash or in shares of common stock. Under the plan, the form of payment will be determined by the Compensation Committee acting in its sole discretion.

The Board will have the discretion to grant limited SARs under the plan. Limited SARs may be granted in tandem with an option and provide that, in the event of a change in control, as defined in the plan, the related options vest immediately and are automatically deemed exercised and the options canceled. Upon the exercise of limited SARs, the holder is entitled to a cash payment equal to the number of shares covered by the related options multiplied by the excess over the exercise price of the options of the higher of the fair market value of the common stock on the date of the change in control or the highest per share price paid for the common stock in connection with the change in control.