1

1

2

3

4

5

6

7

8 THE BLACK & DECKER CORPORATION

9 MONDAY, DECEMBER 14, 2009

10 GOUCHER COLLEGE

11 TOWSON, MARYLAND

12

13

14

15

16

17

18

19

20

21

2

1 P R O C E E D I N G S

2 MR. ARCHIBALD: I want to thank you all

3 for being here this morning. We also appreciate

4 having John Lundgren here with us, the chief

5 executive officer of Stanley. And following my

6 brief introductory remarks, we'll hear from John

7 and he will share with you his vision for the

8 combined Stanley Black & Decker Company. Then

9 we'll also give you an opportunity to ask any

10 questions that you would like. And this is being

11 telecast in a lot of different locations, and

12 they'll also be able to dial up and be able to

13 listen in to both presentations as well as the

14 question and answer period any time that they

15 would like.

16 I'm sure when you first heard about the

17 merger between Black & Decker and Stanley, the

18 first two questions that likely came to your mind

19 is why are they doing this and why are they doing

20 this now. And I hope to answer those two

21 questions and tell you some additional thoughts

3

1 of how all of this evolved.

2 Black & Decker and Stanley have a very

3 unique fit and complementary fit that I think

4 very few, if any, companies have throughout the

5 world that produce significant shareholder value

6 through cost synergies; through sales, marketing,

7 and distribution synergies; and a combined

8 financial strength that neither company has on a

9 standalone basis. As I said, I don't believe

10 there is another company in the world who fits

11 quite together like Stanley and Black & Decker.

12 And that's probably why this combination

13 has been attempted three times before the current

14 one that we're talking about. Let me begin by

15 telling you about the long courtship that's

16 happened between our two companies, Stanley and

17 Black & Decker. Twenty-eight years ago then-CEO

18 Frank Lucier of Black & Decker and Don Davis, the

19 CEO of Stanley at the time, those two had

20 extensive discussions and negotiations about

21 putting Black & Decker and Stanley together. I

4

1 am told that they had arrived and reached

2 agreement on every single factor except one. I'm

3 also told that Al Decker was enthusiastic about

4 this combination. And the reason it didn't

5 consummate was because they could not decide who

6 the CEO would be. And so based on that one item,

7 the negotiations broke down.

8 About seven years after that, Dick

9 Ayers, then Stanley CEO, and I had some serious

10 discussions about putting these two companies

11 together. We concluded that it was not a

12 compelling transaction at that time, and so

13 negotiations didn't go any further.

14 Almost seven years after that I got a

15 call from John Trani, the new CEO of Stanley, and

16 he asked if he could meet with me. We met

17 together and he also thought that these two

18 companies should be put together. And we had

19 some discussions about that, but again we just

20 did not feel it was compelling to our

21 shareholders, the deal we eventually talked

5

1 about.

2 Seven months ago I got another call.

3 This time it was from John Lundgren, and he

4 wanted to have lunch with me. And I said, Well,

5 for what reason? He said, I would like to talk

6 to you about putting our two companies together.

7 I told him that we were not looking to sell the

8 company, we were not looking for a merger

9 partner. I didn't think that neither of our time

10 would be well spent if we got together.

11 And he said, well, we've taken a lot of

12 time to look at this and we think there are some

13 tremendous advantages for both companies and both

14 companies' shareholders and both companies'

15 employees, and will you just hear me out.

16 So he and I met for lunch in New York

17 City and discussed the possibility for a fourth

18 time of putting these two companies together.

19 And I told him that I would think about it.

20 Well, as I returned and we gathered just

21 very, very few people to look at this, the more

6

1 we looked at this, and the more we thought that

2 there might be some great potential here, that

3 then evolved into taking a few of our people and

4 a few of their people and meeting in New York

5 City to explore the benefits of both companies

6 and both companies' shareholders.

7 After considerable analysis, after

8 considerable time and additional meetings with

9 the Stanley and Black & Decker people, our board

10 concluded that this was both strategically and

11 financially compelling to our shareholders to

12 discuss seriously about merging these two

13 companies. We also felt like it was in the best

14 interests of our company and our company's

15 employees, and I'll talk about that in just a few

16 minutes.

17 First of all, let me tell you why our

18 board concluded that this was financially

19 compelling to our shareholders. There are three

20 phases of significant shareholder creation in

21 merging Black & Decker and Stanley, for Black &

7

1 Decker shareholders. The first is a 22 percent

2 premium. Each Black & Decker shareholder will

3 receive 1.275 of Stanley shares for each

4 Black & Decker share. At the time of the

5 announcement, this represented a 22 percent

6 premium over the existing Black & Decker stock

7 price. Now, that premium represents a very

8 competitive offer when you compare it to other

9 similar transactions.

10 In addition to the 22 percent premium,

11 the board also wanted to preserve the long-term

12 benefits for our shareholders once the economy

13 turns around. So with a 22 percent premium, why

14 did Black & Decker's stock price increase

15 31 percent at the time of the announcement? The

16 reason that it did is because our shareholders

17 and the market understood Phase 2 and Phase 3 of

18 the significant shareholder creation.

19 Phase 2 factors in the cost synergies

20 that you're able to achieve by combining these

21 two very uniquely and complementary companies.

8

1 When we announced the merger of these two

2 companies, we also announced that we believed

3 that we could achieve $350 million of cost

4 savings by combining these two companies. The

5 present value of $350 million in cost synergies

6 is in excess of $2 billion of shareholder value

7 creation. Now, that's $2 billion of shareholder

8 value creation without any additional increase in

9 sales, without one dollar increase in sales and

10 no improvement in the economy. If you combine

11 our share of the synergies, of that $350 million

12 in synergies with a 22 percent premium, that

13 represents almost a 50 percent premium for our

14 shareholders versus the time of the announcement.

15 Now, because of the $350 million in

16 synergies, Stanley's stock also increased

17 10 percent at the time of the announcement.

18 Now, it is very unusual -- in fact, one of our

19 directors, Ben Griswold says unprecedented --

20 that you would see in an all-stock transaction

21 both companies' stock increase to those levels.

9

1 Because even though Stanley is paying a premium

2 as a result of the exchange ratio, because of

3 their share of the $350 million in synergies,

4 Stanley's shareholders will have significant

5 accretion in year two and thereafter, after the

6 merged companies. The 22 percent premium on day

7 one and the additional premium that's associated

8 with the cost synergies makes this a very

9 compelling financial transaction for our

10 shareholders.

11 However, this is not all. There is a

12 third phase in our shareholder creation.

13 Because of the exchange ratio of 1.275,

14 Black & Decker shareholders will own

15 49.5 percent of the combined company and Stanley

16 will own 50.5 percent of the combined company.

17 Therefore we will share equally in all of the

18 upside that occurs after the economy recovers.

19 And we believe that the upside of these two

20 powerful companies is considerable and is far

21 better than either company on a standalone basis.

10

1 It is estimated that the combined

2 company will generate over $1 billion of free

3 cash flow. It will generate $1.5 billion of

4 EBITDA. It will have an exceptionally strong

5 balance sheet and a strong investment grade

6 rating. With $1 billion in cash flow and the

7 strong balance sheet that we have, the combined

8 company will have the capacity to make

9 significant acquisitions and fund future growth.

10 And lastly Stanley has a rich history of

11 paying a very generous dividend to its

12 shareholders. Their dividend is nearly three

13 times the amount that Black & Decker's dividend

14 is, and our shareholders will enjoy after the

15 companies are combined.

16 In addition to being very financially

17 compelling, this is also a very strategically

18 compelling transaction for our company and its

19 shareholders. While our products don't compete,

20 many of our products are sold to the same markets

21 and the same end users. So in addition to the

11

1 cost synergies that we'll enjoy from combining

2 these two companies, there will also be

3 considerable sales synergies.

4 There are some geographic areas and

5 channels where Black & Decker has superior

6 strength in distribution. For example,

7 Black & Decker has a complete infrastructure and

8 very strong distribution system in Latin America;

9 Stanley does not. We will be able to sell a

10 complete line of Stanley products through Black &

11 Decker's distribution system in Latin America.

12 Black & Decker has stronger distribution in the

13 Middle East, India, Eastern Europe, and STAFDA

14 here in the United States, where we should be

15 able to increase Stanley products.

16 On the other hand, Stanley has much

17 stronger distribution in industrial, both in the

18 United States and Europe. It is also larger than

19 Black & Decker in China. And these are only just

20 a few of the examples of the sales and

21 distribution opportunities that these two

12

1 combined companies will have.

2 We'll also have cross-branding

3 opportunities with the strong stable of brands

4 that you see both in Black & Decker and in

5 Stanley. DeWalt, Stanley, Black & Decker,

6 Bostitch, Porter-Cable, Delta are only a few of

7 the brands that we have in each company.

8 In Europe we currently license the Black

9 & Decker name and sell a line of hand tools. It

10 is also not hard to imagine a mechanic line of

11 DeWalt tools.

12 Our lock and lockset business will be

13 very complementary to Stanley's mechanical

14 security business. And we have envied their

15 electronic security business and we wanted to

16 enter this area for many years. As a result of

17 Stanley's recent aggressive acquisition program,

18 security now represents 43 percent of Stanley's

19 total sales and is very complementary to our own

20 security business.

21 Black & Decker will also become a much

13

1 less cyclical company and less dependent on a few

2 customers. We currently have 30 percent of our

3 sales to two very large customers. Stanley has

4 eight percent of their sales to those two

5 customers. And we'll also have a much broader

6 product line and will be selling in a large

7 geographical area across many different markets,

8 will be a much larger, more stable, less cyclical

9 company with strong free cash flow that will help

10 us further diversify in the years ahead.

11 For all these reasons, our board felt

12 like this was both strategically and financially

13 compelling to our shareholders. That's why both

14 stocks have increased so dramatically. That's

15 why an attempt to merge these companies has taken

16 place four different times. It's also why every

17 investment banker that we've visited with over

18 the last 25 years have always said, well, now,

19 our best idea for you is that you really ought to

20 merge Stanley and Black & Decker. This was an

21 obvious fit to everyone, and our shareholders

14

1 have clearly demonstrated their vote in favor of

2 this by what's happened to the stock price.

3 Now, how is this good for you, the

4 employees of Black & Decker? There will be a

5 reduction in personnel to avoid duplication.

6 This reduction will be less than ten percent.

7 There is no way to put a good face on what will

8 happen to corporate. There can only be one

9 corporate headquarters. Some people at corporate

10 will have opportunities with the combined

11 company, but most will not. Frankly, this was

12 the most difficult part of the entire negotiation

13 and merger decision process. We'll be generous

14 and treat those that will not have a continuing

15 role with the company as fairly as we can and do

16 everything possible to help them find new jobs.

17 However, for the vast majority of

18 Black & Decker employees who will continue with

19 the combined company, this will be very good for

20 you. You will have the professional

21 opportunities that will result from being part of

15

1 a much larger company. You will be part of a

2 lower cost, much more competitive company that is

3 an industry powerhouse.

4 �� You will be part of a company that's

5 less cyclical and therefore less susceptible to

6 the swings of the economy and the accompanying

7 layoffs that come from being part of a cyclical

8 company. And what usually ends up best for

9 shareholders usually ends up best for the

10 employees that work for that company. Because

11 shareholders want to continue to invest in

12 companies that yield a good return, and therefore

13 you're able to invest in the company and grow it

14 for more professional opportunities.

15 And this combined company will be a

16 strong and dynamic competitor in the marketplace.

17 And I believe that once we get through this

18 transition and all the uncertainty, you will be

19 proud to be part of this global marketing

20 powerhouse.

21 I would now like to introduce you to

16

1 John Lundgren, who will become CEO of the new

2 Stanley Black & Decker. As you know, I will

3 become executive chairman of the board with the

4 combined company. John has done a remarkable job

5 of reinventing Stanley in the five years that

6 he's been CEO of the company. He has introduced

7 the Stanley fulfillment system that I believe

8 will make our operation more productive and

9 effective.

10 John began his career in brand

11 management with Gillette. He has held positions

12 in marketing, finance, manufacturing, corporate

13 development, and strategic planning in the United

14 States and Europe with Georgia Pacific and its

15 predecessor companies. In fact, John has lived

16 in Europe for 14 years of his professional

17 career. He was an executive officer of Georgia

18 Pacific and in charge of all of their consumer

19 products companies.

20 John graduated cum laude from Dartmouth

21 College where he was a two-time golf captain.

17

1 In fact, he serves as a director of Callaway

2 Golf. I'm sure he'll be glad to challenge any of

3 you to a golf game. He holds an MBA from

4 Stanford University, and I look forward to

5 working with John in my new role as chairman of

6 the combined companies. So at this time I'd like

7 to introduce you to John Lundgren.

8 MR. LUNDGREN: Nolan, thanks. That was

9 very kind.

10 Good morning to everybody. I normally

11 would be more comfortable roaming the floor and

12 talking, but given the status of this merger and

13 the fact that it's not closed yet, I'll stick a

14 little closer to the script than I normally do.

15 But hopefully over time we'll get to meet and

16 talk on a much more informal basis.

17 But it's certainly great to be here, and

18 I appreciate the courtesy certainly that Nolan

19 and the executive team have extended to me while

20 I've been here. And it's great to be with you

21 this morning and talk to you about how we think

18

1 we can combine these two great companies.

2 We've already started working together

3 cooperatively and collaboratively with each other

4 to the extent, as Nolan indicated, that we've

5 been able and legally allowed to do so.

6 And the spirit not only continues today but will

7 continue throughout the coming months as we

8 undertake the task of putting these two companies

9 together to create the best of Stanley and the

10 best of Black & Decker in the new company.

11 And I'm deeply respectful of the rich

12 histories that both these companies bring to the

13 party. But my primary objective this morning is

14 actually to begin the process of looking forward

15 to the future, rather than looking back into our

16 respective and separate pasts. I'd like you to

17 consider just for a moment Stanley Black & Decker

18 of the future, a new company with the talent, the

19 skill, and the resources to expand globally at an

20 accelerated pace. The combination of our two

21 companies is a step on a transformational journey

19

1 towards becoming a global, diversified,

2 industrial growth company.

3 It's an important, it's a significant,

4 it's even an historic step. But importantly,

5 it's only the first step. The real strength of

6 this combination is the potential it unlocks for

7 the future of the combined Stanley Black &

8 Decker, and the sooner we begin to focus on the

9 future, the more successful we will ultimately

10 be.

11 So let's start today. Today I'd like to

12 lay out three things for you. I briefly recap

13 the strategic rationale for combining the two

14 companies, without duplicating too much of what

15 Nolan presented, as I think it was done as

16 clearly and concisely as it could possibly be

17 done in Nolan's brief introduction. I'll tell

18 you where we stand today about six weeks after

19 the announcement, and finally I'll discuss our

20 vision for the new company, the combined Stanley

21 Black & Decker.

20

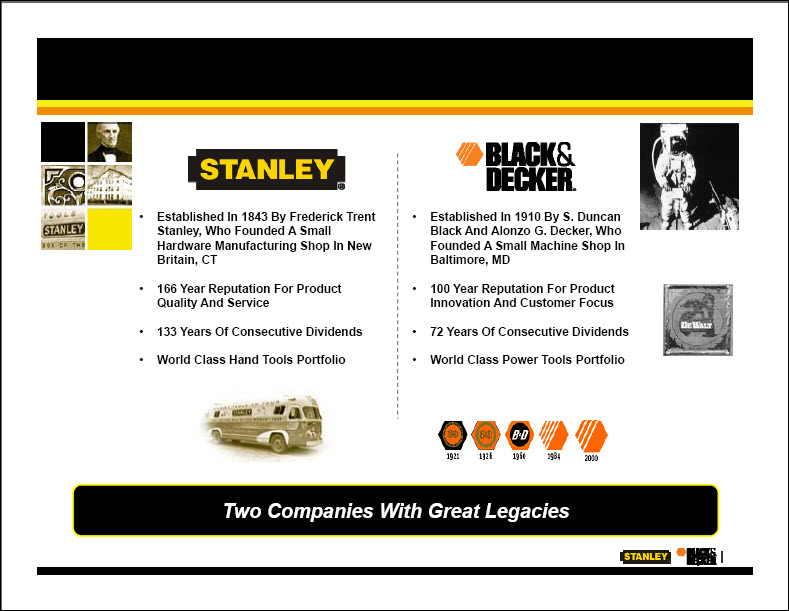

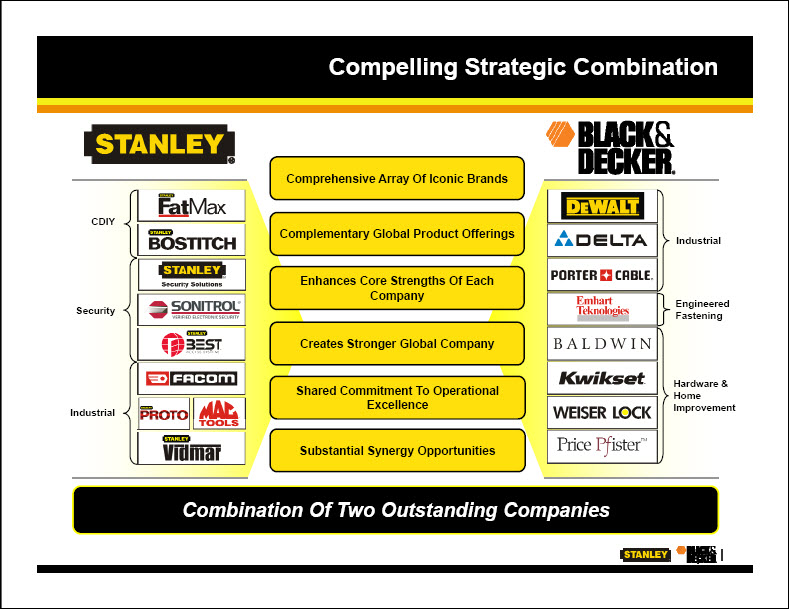

1 I'm sure you're well aware of the

2 strategy behind the transaction, but let me just

3 reiterate it quickly. We're two great companies

4 with long and rich legacies, and we're in a

5 unique position to forge a new company built on

6 our strengths by bringing together two highly

7 complementary companies, as you see at the top of

8 the slide, with a portfolio of iconic brands and

9 virtually no product overlap.

10 The new Stanley Black & Decker will

11 offer a comprehensive global product line in both

12 hand tools and power tools and will be positioned

13 to better serve the end users whose loyalty we've

14 earned and the customers whose business we will

15 continue to earn each and every day. The new

16 Stanley Black & Decker will also build on our

17 respective strengths in a way that's consistent

18 with each company's core strategies and in a way

19 that will allows us to continue to invest in our

20 growth platforms. And finally, the new Stanley

21 Black & Decker will build on commitment to

21

1 operational excellence and continuous improvement

2 to ensure that we're able to capitalize on the

3 significant cost and revenue synergies, but of

4 equal or greater importance, to ensure that we as

5 a new combined company unlock the full potential

6 of the new enterprise.

7 The combination of our two companies,

8 the creation of the new Stanley Black & Decker,

9 is a compelling strategic combination of two

10 great companies that will create significant

11 value for our customers and our shareholders and

12 will create significant opportunities for our new

13 employees. However, there are a few steps we've

14 got to take to ensure that we do this right. I'd

15 like to tell you where we stand, again about six

16 weeks to the day after our announcement.

17 As you know, we must obtain both

18 shareholder and regulatory approval. These are

19 two separate paths that we're pursuing diligently

20 to ensure successful closure of this transaction

21 during the first half of 2010. On the regulatory

22

1 side, we have determined which of the 190

2 countries where Stanley and Black & Decker both

3 sell that require formal antitrust filings. And

4 in many cases we've already filed the necessary

5 documents and opened lines of communications with

6 the regulators to openly and transparently

7 address any issues or any concerns that could

8 arise from their perspective.

9 In the United States, for instance, the

10 Federal Trade Commission is currently conducting

11 their initial review of the proposed transaction.

12 And they have until December 28, that's 30 days

13 from when we filed, to determine whether the

14 transaction requires further investigation.

15 We're communicating with the FTC during this

16 period. We're committed to communicating the

17 agency's decision to you as soon as we can. And

18 we're similarly committed to communicating with

19 other agencies, including the European commission

20 and Canada, with whom we expect to file soon, and

21 to communicate the status of this process to you

23

1 as well.

2 What I can say to you today is that the

3 regulatory approval process is on track. Thus

4 far there have been no surprises. And Charlie

5 Fenton and his team in Towson, Bruce Beatt

6 and his team in New Britain, and many,

7 many of you in the room have done a lot already

8 to get this process to where it is.

9 In addition to the regulatory approval

10 process, we must also ensure that the

11 shareholders of both companies approve the

12 transaction, that they fully understand the value

13 of the combined company, and the benefits that

14 new Stanley Black & Decker will generate. And

15 thus far, they certainly appear to be in that

16 frame of mind.

17 But to that end, as you may have seen,

18 we filed Form S-4 with the United States

19 Securities and Exchange Commission just a week

20 ago or a week ago Friday on December 4. This is

21 a form that's used to register securities that

24

1 will be issued in a business combination

2 transaction such as ours. And it can and should

3 essentially be viewed as a draft proxy statement.

4 It outlines the merger proposal in far greater

5 detail, nearly 200 pages, and it outlines that to

6 our shareholders and other interested

7 stakeholders.

8 This document was filed with the SEC, as

9 I mentioned, just a short time ago, and they will

10 review and comment on our filings within the next

11 several weeks. When the SEC confirms they're

12 comfortable with the Form S-4, we are then in a

13 position to go forward and schedule the

14 shareholder vote.

15 Both Stanley and Black & Decker have

16 separately retained world-class proxy

17 solicitation firms to help communicate the

18 inherent value of the transaction for our

19 shareholders. And again, we're committed to

20 communicating progress of the shareholder

21 approval process as soon as we have information

�� 25

1 and as soon as we're able to do so with you and

2 all of your associates. Again, I can say to you

3 that at this stage the shareholder approval

4 process is on track and thus far we've had no

5 surprises on that end.

6 And while we've been diligently

7 pursuing the regulatory and shareholder approval,

8 we've also begun to tackle the enormous task of

9 successfully integrating our two companies. It's

10 crucial to note that we currently are and as a

11 consequence continue to operate as two separate

12 companies. However, until closing and before

13 closing there are certain activities that we have

14 been advised by our counsel we can participate

15 in, and both parties, along with Bain & Company,

16 a third-party consulting firm and our joint

17 integration partner, have begun those integration

18 activities.

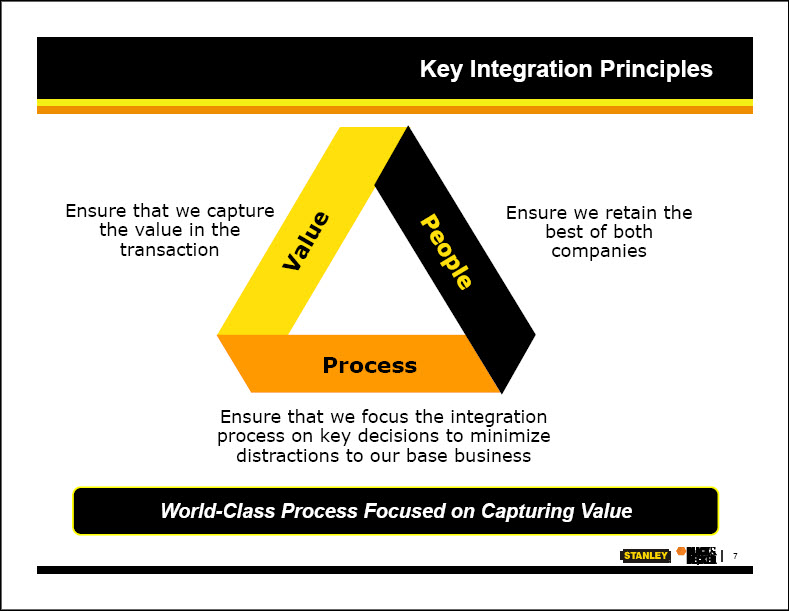

19 Stanley has successfully completed and

20 integrated 52 acquisitions in the past six years

21 and along the way developed and refined an

26

1 integration process that has become, I think, a

2 true core competency at Stanley. That process is

3 based on three key principles: First and

4 foremost, ensure that we capture the value in the

5 transaction; second, ensure that we resolve any

6 personnel issues as quickly and proactively as

7 possible; and third, ensure that we focus the

8 integration process on key decisions and to

9 minimize the distractions to our core or base

10 business. Focus on the big issues and follow the

11 money.

12 To achieve these three goals, we employ

13 a relatively simple methodology. We develop an

14 integration plan for the first hundred days post

15 closing, and we finalize that plan prior to the

16 close. Now, that obviously doesn't mean that we

17 will be successfully integrated in a hundred

18 days, but it does mean that we will have

19 prioritized the most important actions that need

20 to take place and will be in a position to

21 execute those programs very quickly after

27

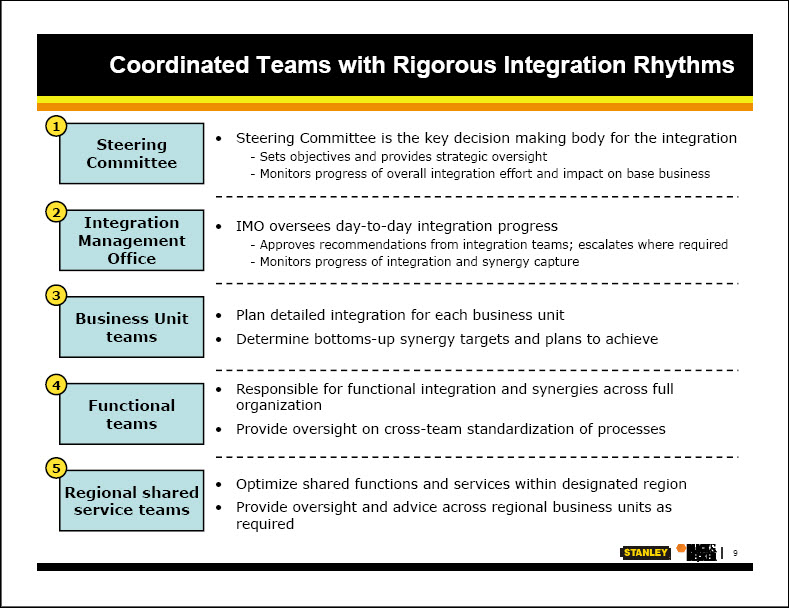

1 closing.

2 That integration plan will reflect the

3 input and seek consensus from both management

4 teams prior to close, and we're already hard at

5 work in that planning process. And finally, we

6 have established an integration management team,

7 rhythms, and milestones that we have found

8 to be successful in helping keep a firm grip on

9 the progress of all phases and areas of the

10 integration. This system gives us regular

11 visibility into the successful integration on all

12 levels and enables quick escalation and

13 resolution of issues as they arise.

14 Using these simple principles and

15 methodologies, just for an example, Stanley has

16 grown its security business from $150 million in

17 2002 to $1.6 billion in 2008. We've done it

18 while retaining and promoting top leaders at

19 companies that have been acquired, and we've done

20 it while retaining significant operations in

21 their local communities, both of which we fully

28

1 expect to continue in the future. We will be

2 happy to dwell on that more in the Q & A section

3 as time allows.

4 We've even successfully

5 reverse-integrated pieces of our existing Stanley

6 business into newly acquired companies whose

7 operations and processes were stronger than ours,

8 using the same principles and methodology.

9 That's because a successful process doesn't keep

10 one business on top of another. It truly

11 integrates the best of each company and it

12 positions the combined company to leverage its

13 strengths for future growth. And this is our

14 plan for Stanley Black & Decker.

15 And we're farther along in this

16 integration process than you may think. We have

17 already identified the key business functional

18 and regional integration teams, as well as

19 integration leaders from both companies. We held

20 our first integration leadership summit with

21 those teams at Stanley Center for Learning and

29

1 Innovation at New Britain last week and we

2 clearly outlined expectations for delivery at our

3 next integration summit which will be held in the

4 middle of January.

5 I'm going to take a moment to talk

6 through the next slide, which, in addition to

7 looking like an eye chart and seeming very

8 complicated, may, once you get more familiar with

9 it, and hopefully will, make a lot of sense.

10 I'll emphasize it's not an organization chart but

11 an overview of our integration teams and our

12 integration process. I'll also note that you're

13 going to receive a little more in-depth look at

14 this chart, along with quick communication about

15 it, within the next couple of days or so to

16 provide the basis to ask even more questions.

17 At the top is what we call the

18 Integration Steering Committee. And along with

19 Nolan and me we have our chief operating officer,

20 Jim Loree; Stanley's chief financial officer, Don

21 Allan; president of Stanley's European

30

1 operations, Massimo Grassi; and Mark Mathieu,

2 head of human resources.

3 The role of the steering committee is to

4 provide oversight, direction, and issue

5 resolution throughout the entire integration

6 process. And you may think that that's a

7 detached or uninvolved group or we're detached

8 and not particularly involved at that level. I

9 can assure you that the opposite is true.

10 We meet weekly for two hours, or more if

11 necessary, to review every open project and

12 ensure the teams are moving in the right

13 direction and properly resourced to facilitate

14 successful integration. It doesn't guarantee

15 success, but it helps avoid surprises and ensures

16 that we can reallocate resources whenever a

17 rudder adjustment is needed.

18 The integration management office, IMO,

19 oversees the business unit and functional and

20 regional shared service teams. In addition to

21 Brett Bontrager, whose name you see on the chart,

31

1 who has successfully led many of Stanley's recent

2 integrations, Tony Milando will co-chair the IMO

3 from the Black & Decker side. This team will have

4 leadership, will also have leadership direction

5 from information technology, human resource and

6 finance leaders, again both companies. And at

7 the business unit and functional or regional

8 level, that's where the work of integrating the

9 two companies and building the new Stanley Black

10 & Decker truly begins.

11 Now, I won't go through the entire lower

12 portion of the slide that you see before you,

13 because I know it's hard to read, but I do want

14 to point out a couple things. And again, you'll

15 see it in a couple days. It will be in your

16 e-mail.

17 One, while I said it isn't an

18 organization chart, it does provide an indication

19 directionally of how we think the integration

20 will proceed. Two, and this is critical -- I've

21 said it already -- note that each team is staffed

32

1 by a Stanley person and a Black & Decker person.

2 We spent a lot of time carefully choosing the

3 right people for these roles. And you may be

4 wondering why we chose one person over another or

5 we may choose or have chosen one person over you.

6 Some of you may even be thankful your names

7 aren't on that chart and you can just continue to

8 run your businesses every day and focus on the

9 core, which is what we've asked you to do.

10 But the simple truth is that the

11 overwhelming majority of you will be involved in

12 one capacity or another during the integration

13 process. One of the critical missteps that

14 companies can make during integration is to lose

15 focus on the base business, and we haven't chosen

16 business line leaders just for that reason, from

17 either Stanley or Black & Decker. The most

18 consistent theme in the customer feedback when

19 Nolan and I spoke to our largest customers is

20 that's great, that's great for you, it's great

21 for us. Please stay focused on us and our

33

1 business with you while this merger is closing

2 and while you're integrating these two companies.

3 So your job is to run the business or

4 focus on your function or region with as much

5 passion and dedication as you've always shown.

6 However, when you are asked for help by one of

7 these integration team members, I would ask that

8 you provide your experience and your assistance

9 in helping that team as quickly and thoroughly as

10 feasible, also the experience and assistance of

11 your team members.

12 Again, while this is not an organization

13 chart, I realize you all have a vested interest

14 in how the new company will look. And I do want

15 to give you an idea of some of the upcoming next

16 steps. We're aiming to share the high-level

17 business structure with you in mid-January. This

18 structure will lay out how we feel the new

19 company will operate. And when you see it, it

20 will be first on the business unit level and it

21 will take into account the recommendations of the

34

1 executive leadership and integration teams of

2 both businesses, giving weight to all

3 recommendations to ensure that we are moving

4 forward with a structure capable of realizing the

5 full synergies, but that also makes logical sense

6 and positions us for future growth.

7 Very shortly afterwards we'll finalize

8 the business structure, in late January or early

9 February, and we'll be in a position to provide

10 additional details around the high-level

11 organization structure of the combined company,

12 including key leadership roles, at that time.

13 Now, obviously I recognize that you're both

14 interested and invested in being kept up to date

15 on all of these developments, and I'm committed

16 to sharing these things with you as soon as we

17 are able to do so.

18 In the meantime, in mid-January, we'll

19 be holding our second integration summit, and at

20 that point will be much further along in our

21 integration process with more to share with you

35

1 on the progress, success, and the level of your

2 involvement in the exciting work of integrating

3 our two companies to build the new Stanley

4 Black & Decker.

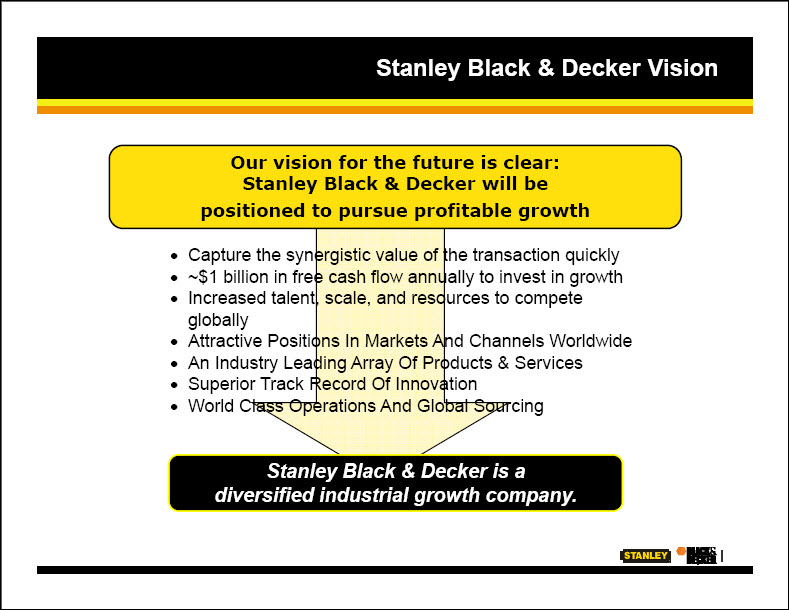

5 Our vision for the future is very clear.

6 Stanley Black & Decker will be better positioned

7 to pursue profitable growth than either company

8 would have been separately. We expect in just a

9 few years we'll be an enterprise generating

10 approximately a billion dollars in free cash

11 flow, $1.5 billion in EBITDA as Nolan mentioned,

12 with the opportunity to fuel our growth engine

13 and invest in high-growth platform such as

14 security solutions and engineered fasteners as

15 well as pursue other new opportunities while at

16 the same time supporting the organic growth and

17 growth opportunities in our core power and hand

18 tools platforms.

19 We'll have increased talent, scale, and

20 resources to compete globally. And there are

21 growth opportunities that we've just begun to

36

1 explore, particularly in developing markets such

2 as Asia and Eastern Europe, and even in developed

3 markets where we have little or no product

4 overlap but channel and distribution synergies.

5 As you know, the expected $350 million

6 in cost synergies were a very important part of

7 why this deal made so much sense. And management

8 of the combined company will be laser-focused on

9 achieving these synergies in order to effectively

10 meet the goals and exceed expectations. The

11 sooner we can achieve our stated synergy goals,

12 the sooner we can reinvest in the business and

13 grow the combined enterprises.

14 Hopefully you've heard the key word the

15 last couple minutes in all of this, and that's

16 growth, probably the most important aspect of

17 this transaction and clearly the most exciting

18 prospect for all of us. This transaction is the

19 means to a very bright future. And while we all

20 have a lot of work to do ahead to meet and exceed

21 all the goals for Stanley Black & Decker, the

37

1 opportunities are plentiful and our potential

2 together is tremendous. When you look across all

3 of our stakeholder groups, you'll see that

4 everyone should share in the significant upside

5 expected from the transaction.

6 Shareholders of both companies will

7 benefit from the realization of synergies,

8 operating margin expansion, and expanded growth

9 opportunities. Employees of both companies will

10 have new opportunities as part of a much larger,

11 globally diversified industrial leader. And

12 customers of both companies will benefit from the

13 combined companies' exceptionally broad array of

14 products and services, world-class innovation

15 processes, and commitment to operational

16 excellence.

17 And as evidenced by our respective stock

18 prices, investors clearly see the potential of

19 our new company. Nolan mentioned Ben Griswold's

20 reaction on the Black & Decker board's side. The

21 advisers advising Stanley said less than one in

38

1 25 times in an all-stock merger does the stocks

2 of both companies go up at all, let alone ten and

3 30 percent. Unprecedented, to use Ben Griswold's

4 words.

5 As I've learned in my conversations with

6 key customers, they see the opportunity for our

7 new company. And it's my hope that you, as

8 Stanley Black & Decker employees, also see the

9 potential as well as the opportunity in our new

10 company.

11 I'd like for just one more thing to be

12 clear when you leave here today. We can't look

13 at the combination of Stanley and Black & Decker

14 as the finish line. Completing the integration

15 work, which will unquestionably be intense over

16 the next few months, that's not the finish line

17 either. While I am confident we'll achieve both

18 the combination and the synergies, once we have

19 done so, it won't be the end of the race.

20 Instead, we have to look at these two things as

21 milestones en route to a much longer and exciting

39

1 journey.

2 This transaction positions Stanley Black

3 & Decker to achieve something that, as I've

4 already said, we simply couldn't achieve

5 separately. It positions us to be stronger and

6 more diversified. It puts us in a place to grow

7 and reach new heights. And, as you might expect,

8 it guarantees nothing without a lot of hard work.

9 When I came to Stanley in 2004, it was

10 less than a $2.5 billion company. Together with

11 the management team, we've almost doubled in size

12 while increasing margins and strengthening our

13 portfolio. And once the proposed transaction,

14 the merger of Stanley and Black & Decker takes

15 place, the company will have doubled in size

16 again.

17 But that's just the beginning.

18 Together with you, there is no intention of

19 stopping there. I'm fully confident that our

20 combined management teams and our combined

21 companies can grow the new Stanley Black & Decker

40

1 even more successfully, particularly more

2 successfully than either company has grown in the

3 past.

4 Easy to say. Let me tell you why I

5 think it will be successful. Beyond our

6 respective track records, beyond the tested and

7 proven integration methodology, beyond the

8 similarities in our mission and our strategies,

9 and beyond all the things that we have that have

10 made this combination attractive in the first

11 place, we have passionate, capable people and we

12 have winning cultures. That what's going to make

13 the difference as we move forward. It's you and

14 it's the approximately 40,000 future Stanley

15 Black & Decker employees who are committed to

16 integrity, accountability, and respect, that will

17 not only position the company for growth but will

18 also drive us towards success. It's your passion

19 for innovation, for customer satisfaction, and

20 for operational excellence that gives me the

21 confidence that we'll achieve successful

41

1 integration quickly and begin to move forward

2 toward the future as one company, sooner rather

3 than later, so that we can begin to realize the

4 true potential of the combination of these two

5 companies.

6 I'll close by saying this:

7 Successfully integrating Stanley and Black &

8 Decker is a monumental task. And when we achieve

9 it, we will have accomplished something to really

10 be proud of. Realizing the synergies and

11 unlocking value of the combined company is also a

12 monumental task. And when we achieve it, we will

13 have accomplished something huge. But the true

14 excitement comes from the potential of the

15 combination of Stanley and Black & Decker. With

16 the power of one combined Stanley Black & Decker,

17 the possibilities are immeasurable.

18 Before I take the questions, I'd like to

19 make two final notes. One, and this is based on

20 feedback over the last six weeks, one, I know you

21 want to hear from us. We're committed to openly

42

1 and transparently communicating throughout this

2 process to the largest extent that we possibly

3 can. But we also want to hear from you as well.

4 In the very near future many of you will

5 be receiving an invitation to participate in an

6 online survey designed to gauge your perceptions

7 of the culture, both at Black & Decker and at

8 Stanley. Please give this survey the thought and

9 attention that it deserves. Stanley's leadership

10 team will receive the exact same survey. You

11 will be the leaders of the combined Stanley Black

12 & Decker, and your thoughts are critical, not

13 only in helping us to assess and form a baseline

14 and identify areas to address, but also in

15 shaping the identity of the new company.

16 And, two, it's been a long, difficult

17 and exciting year for both companies. We began

18 the year amidst the worst economic operating

19 environment that I've ever seen in my career, and

20 we've ended the year with an historic

21 announcement that we're forming a new Stanley

43

1 Black & Decker. While the hard work of

2 integrating our two companies has only begun, I'd

3 like to reiterate that shareholder approval,

4 regulatory approval, and integration planning are

5 on track, and we're committed to answering some

6 of your most important questions by mid-January.

7 So during this busy season take a few

8 moments to refresh and recharge for the work

9 that's ahead of us. I'd also ask you to take a

10 little extra care to ensure the safety of

11 yourselves, your colleagues, and your families.

12 And I'll take this opportunity with the first

13 meeting with many of you to offer my best wishes

14 for a happy, healthy holiday season, and a

15 prosperous new year together.

16 It's an exciting time to be part of the

17 this company. And we have a unique opportunity

18 here to make our mark on a company with almost,

19 with more than 250 years of combined history,

20 legacy, and success. And I, for one, am totally

21 confident that our best days are before us, not

44

1 behind us.

2 Thanks very much. Nolan and I are now

3 happy to take your questions.

4 QUESTION AND ANSWER SESSION

5 MR. COOPER: Good morning. My name is

6 Jeff Cooper. I'm the vice-president of global

7 product development for the consumer products

8 group. We have seen the positive reaction to the

9 stock price, the rise of the stock prices in both

10 companies, but could you expand a little bit

11 further on the reaction from both the shareholder

12 community as well as our key customers?

13 MR. ARCHIBALD: I spoke personally with

14 the CEOs of all of our large customers, and they

15 were very enthusiastic about this combination.

16 It was clear they had respect for both companies

17 and they felt like we could serve them better

18 than we even had on a standalone basis. And so

19 they were very enthusiastic.

20 I also met with virtually all of our

21 major shareholders. They were even more

45

1 enthusiastic. And you can see by what's happened

2 to the stock price. They voted with their

3 wallets. And almost to a person they were very,

4 very pleased with not only what has happened so

5 far but can happen as a result of the combined

6 power of both these companies. So both those

7 groups, shareholders and our customers, are very,

8 very pleased so far.

9 MR. LUNDGREN: And I'll just echo what

10 Nolan said. The day of the announcement, of

11 course, you know, not with all the information

12 here, Nolan and I spoke to some of our customers

13 and investors together, and some separately. The

14 reaction was identical.

15 The only thing I could add, not

16 inconsistent with what Nolan had said, I have

17 been asked by many Black & Decker shareholders

18 who don't own Stanley stock currently,

19 remembering that they're going to own a lot of it

20 when the deal closes, to just understand a little

21 more about Stanley. Because obviously they have

46

1 invested in Black & Decker and this was a very,

2 very large commitment in their future. Nolan's

3 point: Black & Decker's stock is up 30 percent

4 since the announcement, so they feel very good

5 about it. Those were very rewarding and, you

6 know, highly informative meetings. And I guess

7 all we can say is touch wood, so far so good,

8 unprecedented investor reaction.

9 Remember, there's 50 percent overlap in

10 ownership for these two companies. That's why

11 such a large percentage of the investor base

12 understood the logic day one and has stuck with

13 it about six weeks later, where, you know, both

14 stocks continue to trade extraordinarily well,

15 and the customers have been very supportive.

16 MR. COOPER: Thank you very much.

17 MR. FREDERICK: Good morning. My name

18 is Bill Frederick, director of engineering.

19 And, John, we do have a golfer that we think will

20 accept your challenge.

21 MR. LUNDGREN: That was your boss, it

47

1 wasn't me. Let me just say, and I'm only going

2 to say this once: The older I get, the better I

3 used to be. But I'll do my best and we'll play

4 for fun.

5 MR. FREDERICK: Seriously, my question

6 is, could you share with us at this time any

7 thoughts you have for the Towson Design Center

8 and, if possible, all the design centers, like

9 our Spennymoor, England facility?

10 MR. LUNDGREN: I'll take it. While

11 there was so much, if you will, doom and gloom in

12 the local press when this was announced, you

13 know, was it Mark Twain who said the rumors of my

14 death are greatly exaggerated? Mark Twain was

15 from Hartford, by the way. Mark Twain House is

16 in Hartford. It's a National Historic Monument.

17 He lived there many years.

18 The tough side first: Nolan has already

19 said it. We don't need two corporate

20 headquarters. Yet that being said, there is

21 still a role going forward for many, many, many

48

1 of the highly-skilled functional corporate staff

2 professionals within Black & Decker. At the risk

3 of oversimplifying, nothing else will change and

4 in fact may grow in importance.

5 This is the epicenter of the most

6 powerful, biggest, best power tools business in

7 the world. I may look stupid, but why would I

8 want to change that? Simply said. The best

9 example, perhaps, I can give you -- so the words,

10 because we can't commit to anything that we

11 aren't going to deliver later, we have been very

12 careful, we will maintain a major presence in

13 Towson. Let me say, we will maintain a huge

14 presence in Towson.

15 And the best example I think I can give

16 you is six years ago Stanley bought Best Locks,

17 an 80-year-old company headquartered in

18 Indianapolis, privately held. We already did

19 compete with Baldwin and Kwikset and some of the

20 others, but Best was known for the

21 interchangeable cores and patented locks,

49

1 wonderful business headquartered in Indianapolis.

2 It was about 200 million in revenue. Some very

3 good people joined the Stanley security business,

4 which at the time of about $150 million in

5 revenue.

6 Today Stanley's security business is 1.6

7 billion in revenue. 100 percent of our security

8 business is managed from Indianapolis as that's

9 expanding to take up -- because that's where the

10 expertise is. So where the people are, where the

11 knowledge lies, where the intellectual property

12 is - -- we're a global company.

13 I think the second example is our

14 industrial automotive platform globally is run

15 from Morangis, France, not New Britain,

16 Connecticut. We bought a company called Facom,

17 an iconic $500 million, roughly, mechanics tools

18 firm. Most of your North American and those of

19 you who have spent time in Europe, if you're

20 working on a Ferrari, if you're working on a

21 Formula One car, you were using Facom tools.

50

1 They were without question the best

2 collection or center of expertise for our global

3 mechanics tools business. So as we established

4 the global platform, which is how we try to run

5 our businesses, it stayed in Morangis, France.

6 We have a few people in Dallas who work for the

7 folks in Morangis, and we have a few people

8 spread around the country.

9 But simply said, keep the expertise

10 together, keep where the people are. Towson will

11 be a major presence for years to come. And I

12 know it's just a -- it's symbolic that corporate

13 headquarters per se won't be here, but the

14 buildings will be, the overall majority of the

15 people will be.

16 And, you know, that was one of the three

17 jewels, you know, from Stanley's perspective in

18 combining this business. So tremendous presence

19 in Towson going forward. And I'll even mention,

20 I'm sure, based on what I read, more than anybody

21 here is expecting. And, you know, I can't say

51

1 any more than that at this stage of the process.

2 There is just a phenomenal business and wealth of

3 knowledge and experience and wisdom that resides

4 in Towson. There's no reason to move.

5 MR. FREDERICK: Thanks.

6 MS. ERVIN: Good morning. My name is

7 Jennifer Ervin. I manage and oversee all of our

8 brand licensing for the industrial products

9 groups. I'd like to ask John a question, if I

10 could.

11 At Black & Decker licensees have become

12 a more increasingly important part of our growth

13 strategy. The DeWalt business specifically, we

14 focused on developing innovative products,

15 entering the right categories selectively, and

16 finding the right partners that we can co-market

17 and cross-develop products together.

18 MR. LUNDGREN: Absolutely.

19 MS. ERVIN: I want to learn more about

20 Stanley's approach to that and how you see those

21 two businesses integrating.

52

1 MR. LUNDGREN: Sure. Thank you for that

2 question, because it's very important to us as

3 well. My sense is you probably have been at it a

4 little longer and maybe even more aggressively

5 than Stanley. But from what I can understand at

6 this stage, the systems are quite similar.

7 Stanley has been seriously at it for only about

8 ten years, even though we're a 166-year-old

9 company, and I think you've got a sophisticated

10 process in place longer than that.

11 It's very important. The marketing guys

12 will feel good about this, the finance guys

13 won't. I think of licensing revenues as a

14 virtuous circle as in continuous brand support.

15 What we earn in licensing we reinvest in brand

16 support, because the right to earn that money is

17 because of the strength of our brand. Jim Loree

18 and Don Allan want to put that in the corporate

19 coffers. But I refer to it as a virtuous circle

20 and they refer to it as a vicious cycle. So it's

21 -- I happen to be the CEO, so my philosophy

53

1 prevails.

2 But on a more serious note, it's a

3 meaningful source of revenue as it is in

4 Black & Decker. We have about 25 licensees. We

5 employ or use a company called Beanstalk, I'm

6 sure you're we'll aware of, who is the largest

7 licensing, I'll say, affiliate or facilitator in

8 the world. Every year Stanley is overwhelmingly

9 the brand that we license, a little bit of

10 Bostitch.

11 Every year we do what's called a brand

12 permission study, and I'm sure you've seen this

13 with the Black & Decker brand and the DeWalt

14 brand. 85 percent of the people with whom we

15 surveyed, as we looked for relevant categories

16 and relevant partners, thought Stanley made work

17 gloves. We didn't. We don't. But two years

18 later, it's a $20 million licensing program.

19 So that's how we go about it. And our

20 primary licensees are both in the U.S. and

21 Europe. We are active participants in SPLICE,

54

1 who I'm sure you're familiar with, is the, if you

2 will, the nonprofit governing body. And to

3 ensure that we are maximizing the value and

4 potential of our brand, our, if you will,

5 licensing summits, is what we would call them,

6 where some partners but all of our brand people

7 are represented. The last one we did at Fenway

8 Park, and it was really exciting, you know, with

9 all the opportunities. The next one will be at

10 the Liverpool Football Club in the UK where they

11 actually have some stadium advertising

12 electronically. And then lastly, and I don't

13 think it's a conflict, we do run that completely

14 centrally. We do have a corporate vice-president

15 of brand marketing who reports to Jim Loree, who

16 I think ensures -- because the Stanley brand does

17 transcend three different segments within

18 Stanley. So while I think you have licensing

19 specialists within the three businesses, to the

20 extent I understand it, the methodology is

21 identical. We do control that centrally as

55

1 opposed to within the divisions.

2 But it's something we think very

3 seriously about. We think that, our initial

4 view, Black & Decker has done a great job of

5 licensing both Black & Decker and DeWalt.

6 Last aside: My wife's entire

7 company - -- she runs a manufacturing company --

8 they wear DeWalt safety glasses. And it used to

9 really bother me. Now I think it's terrific.

10 MS. ERVIN: Thank you.

11 MS. FURLOUGH-MORRIS: Hi. My name is

12 Stephanie Furlough-Morris. I work in finance,

13 director of finance. My question is around the

14 integration and your framework. It looks like a

15 very robust process. With the size of this

16 integration, what key changes have you made to

17 that framework, if any? And I guess what

18 failures should we be on the lookout for?

19 MR. LUNDGREN: Well, the failures you

20 should be on the lookout for, I want you to get

21 those to me first.

56

1 Well, as said, two things: The

2 question on because of the magnitude of it, it's

3 something we have done at the outset is recognize

4 the magnitude. Brett Brontrager, whose name I

5 mentioned once, is our best -- he might be the

6 best in the world, or one of the best in the

7 world, but he's certainly our best. He has done

8 this successfully with Facom, he's done this

9 successfully with security integrations.

10 And we have assigned Brett and about 13

11 to 15 people full time. So the biggest change

12 is, as opposed to saying, you know, keep your

13 finance organization running and don't miss any

14 deadlines and, oh, by the way, would you

15 participate on the integration? We have taken a

16 very senior leader. Tony will do the same thing

17 from the Black & Decker side. These are

18 full-time assignments for 12 to 24, even 36

19 months if that's what it takes. So that's the

20 most important thing we've done: Taken the very

21 best people we have, dedicating them full time to

57

1 this activity, to be joined at the hip with

2 either their business or functional or regional

3 counterpart.

4 In terms of what failures you should be

5 on the lookout for, I don't know. There's -- it

6 would take until Christmas Eve to tell you all

7 the failures that we've encountered or the

8 problems we've encountered, but fortunately most

9 of which we resolved before they become

10 game-changers or deal-wreckers.

11 And that's the whole idea of this

12 process. If you think about it, every two weeks

13 that team is going to be reporting out to the

14 steering committee that Nolan and I will sit on

15 as well as four senior executives and then, you

16 know, run by the Integration Management Office.

17 And I'll describe the process very

18 quickly. But as I describe it, and you'll see

19 how in my prepared remarks I said it doesn't

20 guarantee success. And it certainly doesn't

21 mean there won't be problems. But it certainly

58

1 helps reduce the big surprises and gives us

2 every opportunity to reallocate resources, fix

3 the problem as it arises. Or if we say that's a

4 problem we didn't anticipate or a failure to

5 achieve synergy, where are we going to find

6 another synergy to fill that gap.

7 And it is that simple as -- let's say

8 it's the European informational technology

9 integration team. We're looking at a dashboard

10 with key program milestones and maybe some cost

11 savings, you know, on the Y-axis and some cost

12 savings on the X-axis, or time. And it's boxes

13 with lots of numbers and way too many to read,

14 and they're color-coded, red, yellow, green. I

15 probably don't need to say any more. But green,

16 no problem; yellow, unless it stays yellow

17 forever we save up front.

18 But if something is red, what is wrong?

19 You know, is it something where we missed

20 because we made a bad estimate? We need to go

21 find synergies somewhere else to fill that gap.

59

1 Or is it something that's behind schedule and it

2 will be yellow and then green?

3 But simply said, the folks running

4 these teams -- this sounds kind of tough --

5 there's nowhere to hide. You know, they can't

6 say - -- no one can say, I didn't advance this

7 program because I couldn't get the approvals to

8 spend the money. I'm sorry, you have the

9 executive chairman and CEO on the phone every

10 two weeks. What more do you need?

11 So it's the rhythm and rigor of the

12 system. It's the process that's tested and

13 proven. And it's the regularity of the meetings

14 and the communication that improve the

15 likelihood for success. I won't say it will

16 guarantee it, but we've just basically taken a

17 tested and proven process and model and staffed

18 it with our very best people, staffed it more

19 fully with the help of Bain, who you'll find are

20 very, very, very bright people. And there's a

21 Bain consultant on every one of these teams.

60

1 They know Stanley quite well.

2 I learned in the process that

3 Black & Decker was Bain's first client many

4 years ago. They know the business. They know

5 the industry well. They know the people well.

6 They're experts in this process as well. So

7 we've invested in Bain's extra help as well.

8 So a long answer to a very simple

9 question. But that's the framework we put in

10 place, not to guarantee but to dramatically

11 increase the likelihood of success.

12 MS. FURLOUGH-MORRIS: Thank you.

13 MR. LUNDGREN: Thank you.

14 How are we doing? Anybody else?

15 It's about, Nolan, where we thought

16 we'd be schedule-wise. Are we on schedule?

17 MR. ARCHIBALD: We are.

18 MR. LUNDGREN: We're on schedule.

19 Listen, it's just -- again, I want to

20 thank you, thank Nolan and all of you for the

21 opportunity to be here. You do have my

61

1 commitment that we will communicate as

2 regularly, as frequently with new information as

3 we can. Recognize there are things we would

4 love to say that we can't, recognize that we

5 understand there are things you'd love to know

6 that we don't know the answers to yet.

7 Keep an open dialogue. As you know,

8 there are websites, there's a great executive

9 management team here, and there's one in New

10 Britain to ask your questions. I have not met

11 most of you in the room. When I opened it up

12 for questions and answers, or this applies going

13 forward: The only bad question is the one you

14 have and you don't ask. Okay? If we can't

15 answer it, we'll tell you. But the only bad

16 question is the question you have and you don't

17 ask it. So please, as I said, we need your

18 input as much as you need our communication.

19 Thanks a lot for your time this

20 morning, and I really look forward to working

21 with all of you as we build a great new company.

62

1 MR. ARCHIBALD: Thank you.

2 (Meeting concluded at 10:03 a.m.)

3 --------------------

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

63

1 STATE OF MARYLAND ) ss

COUNTY OF BALTIMORE)

2

3 I, Susan E. Smith, a Notary Public in

4 and for the State and County aforesaid, do hereby

5 certify that the foregoing is a true and accurate

6 transcription of the proceedings indicated.

7 I certify that I am not of counsel,

8 attorney, or relative and any party, or

9 otherwise interested in the events of this

10 matter.

11 In witness whereof, I have hereunto set

12 my hand and affixed my notarial seal this

13 day of December, 2009.

14

15 ___________________

Susan E. Smith

16 Notary Public

17

My commission expires November 1, 2010.

18

19

20

21