Filed by The Stanley Works

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: The Black & Decker Corporation

Commission File No.: 1-01553

2010 Management Meeting &

Integration Summit Update

Topics Covered

• Strategy & Vision

• Culture

• Brand

• Integration

• SFS

• Q & A

The Combined Company Vision

Comprehensive Global Product

Offerings

Complementary Iconic Brands

Enhanced Core Strengths Of Each

Company

Larger, Stronger Global Company

Shared Commitment To

Operational Excellence

Substantial Synergy Opportunities

A Powerful, Diversified Engine for Growth

Our Mission In 2010 Is Clear:

1. Integrate Companies Successfully - Exceed

Expectations

8 Drive SFS - Hard & Fast

8 Avoid Distractions

2. Protect The Core Franchise

8 Be Prepared For Any Environment

3. Be Vigilant On Cost Control And Productivity

8 Achieve Operating Leverage If Growth Resumes

8 Protect Cash Flow And EPS If Growth Stagnates

4. Be Prepared To Ramp Up In A Higher Growth Scenario

8 Assess And Test Your Supply Chain Now

5. Operate With Agility, Courage & Common Sense

The Immediate Mission

Job One: Integrate Successfully While Focusing on Our Core

Ø Continue To Pursue Time

Tested Operational

Formula

Ø Brand Support

Ø Innovative New

Product

Development

Ø 2-3+% Annual

Productivity

Ø Utilize SFS For

Differentiated Service

Levels, Thus

Outdistancing

Competition

Ø Pursue Small Bolt On

Acquisitions To Extend

Reach/Grow Share

Ø Mechanical Security

(Globally)

Ø Electronic Security

(Globally)

Ø Healthcare

Ø Infrastructure

Ø Engineered Fastening

And

Continuously Strengthen

Core Business Portfolio

Growth Platforms

1.

2.

Shed Strategically

Impaired Assets

2a.

Our Strategy for Growth

Leverage $1B+ Annual Cash Flow To Evolve Portfolio

Quickly Into Higher Growth Areas

Ø China

Ø SE Asia

Ø Brazil / Latin

America

Ø Eastern Europe

Ø Middle East

3.

Drive Hard Into

Emerging Markets

Consistent Strategic Focus Emphasizing Profitable Growth, Asset Efficiency

Maintain Portfolio Transition Momentum

• Brand Is Meaningful (Stanley Or Sub-brand)

• Value Proposition Is Definable And Sustainable Through

Innovation

• Global Cost Leadership Is Achievable

Be Selective and Operate In Markets Where:

• Building On Existing Growth Platforms

• Developing New Growth Platforms Over Time

Pursue Growth On Multiple Fronts Through:

Accelerate Progress Via Stanley Fulfillment System (SFS)

Strategic Framework

• Be A Consolidator Of The Tool Industry

• Increase Relative Weighting Of Emerging Markets

8

Financial Objectives (In Place Since 2004)

Sales Growth

Financial Performance

Dividend

Credit Rating

Ø 3-5% Organic

Ø 10-12% Total

Ø Mid-teens % EPS Growth

Ø FCF > Net Income

Ø ROCE in the range of 12-15%

Ø Continued dividend growth

Ø Upper tier investment grade

Long Term Objectives

Performance Consistent With Objectives

6 Keys to Success

Support Our Brands:

•Continue to strengthen

awareness with key

constituents

Institutionalize SFS:

•Further embed company-

wide business system across

the global enterprise

Empower Our Teams:

•Recognize and reward

successful contributions to

our growth

Strengthen the Core:

•Focus on exceeding

operational objectives in

every area of the business

Transition the Portfolio:

•Continue driving portfolio

diversification

Integrate Successfully:

•Maintain best-of-the-best and

achieve “one company”

mentality quickly

11

Elements evaluated through the culture survey

Angles measured

High aspirations

(desire to win)

External focus

Think like owners

Bias toward action

Teamwork &

empowerment

Passion & commitment

High performance

values

Perception of own culture and each other

Cultural ideals for combined company

Leadership behaviors &

communication styles

Decision roles & styles

Openness to change

People systems,

measures & incentives

Working environment

Company personality

Foundational values

& personality

Survey Population

• Stanley MICP

employees

85%

response

rate

Executive Survey Conducted 12/09

12

Source: Stanley Black & Decker Culture Survey, December 2009 (N=617)

Stanley culture provides a strong foundation, which Black &

Decker can enhance and strengthen

• Stanley and Black & Decker

share many more cultural

similarities than differences

- Very similar starting points,

relative to other integrations that

Bain has seen

- Employees at both companies

perceive themselves to have high-

performance cultures (relative to

Bain’s benchmarks)

- Both companies have a large base

of satisfied employees

Strong, Shared Cultural Foundation

• The cultural “ideals” identified as

part of the survey are very

consistent across SWK and BDK

• The similarities across the two

cultures are prized; these should

be preserved and leveraged

• There are opportunities to even

further enhance the Stanley

Black & Decker culture going

forward

13

Strongest characteristics of current cultures

• Pride in our

heritage

• Hard working, with

“can-do” attitude

• Clear set of values

lived each day

• Value new and

better methods

and ideas

• Personal

accountability

Shared

Source: Stanley Black & Decker Culture Survey, December 2009 (N=617)

Stanley

• Results, not efforts

• Bias toward action

• Clearly articulated

vision for future

• Ambitious goals

• High capacity for

change

• Strong operations

& finance base

Black & Decker

• Collaborative, team

spirit; mutual trust

• Do the right thing,

not the easy thing

• Give 100%, all of the

time

• Decentralized

decision making

• Customer focused

Cultures Shared and Complementary

14

• Heritage of the brands

• Clearly articulated vision for

the future

• Work ethic and ‘can do’

attitude

• An empowered,

entrepreneurial spirit

• Collaborative, not competitive

working environment

Preserve

Enhance

• Stronger focus on personal

accountability, with

consequences for missing goals

• More receptivity to good ideas,

no matter who suggests them

• Additional clarity on values

• Improved focus on the

customer

• Increased emphasis on

celebrating success

Source: Stanley Black & Decker Culture Survey, December 2009 (N=617)

Stanley Black & Decker cultural ideals

Shared Cultural Ideals

15

Note: NAs excluded; 1=Strongly disagree, 2=Disagree, 3=Agree, 4=Strongly agree

“I'm excited to be part of this monumental

change for Stanley and Black & Decker

and to be part of this great challenge to

strengthen an already solid company.

MICP 5 or 6, Stanley

“Overall, I believe that the merger makes

good business sense. My biggest

concern…is that Black & Decker will be

viewed as a single entity. Each part of

B&D truly operates independently. I hope

that as part of the integration process,

these differences and the unique benefits

of each B&D division are carefully

considered and maximized.

Director, Black & Decker

Is the merger in the best

interest of your company?

What are your thoughts on the merger

between Stanley and Black & Decker?

Percent of respondents who

agree or strongly agree

Source: Stanley Black & Decker Culture Survey, December 2009 (N=617)

Strongly

agree

Agree

Strongly

agree

Agree

The Right Move

16

• It is common for partners to perceive

their cultures as different

• Stanley and Black & Decker share far

more similarities than differences

• Integration effectiveness will depend

in part on how well the perceived and

actual cultural differences are

managed

- Be aware and open regarding cultural

differences within your team

- Maintain an honest, frequent dialogue

within your team and encourage sub-

team members to do the same

- Communication of the cultural vision

will help minimize disruption

The Road Ahead

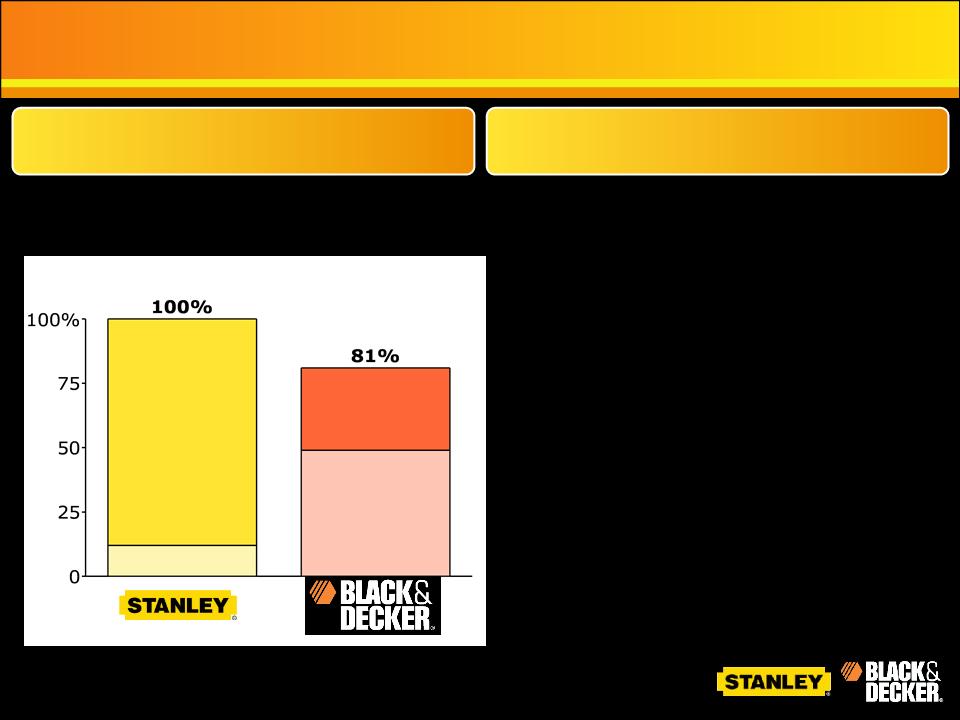

• Awareness Among Professionals:

99%

• Awareness Among DIYers: 93%

• Unaided awareness: +21%

increase since 2002.

• 99% overall brand awareness

• 80% of households own Black &

Decker

• 85% of Black & Decker owners are

satisfied with their products

Powerful Brands

AND

MORE

We Have the Strongest Brands and

Operate in Markets Where Brands Are Meaningful

Brand “Givens”

For Clarity, the Following are Brand Rules of Engagement:

• The Corporate Brand will be “Stanley Black & Decker”

• The Only Operating Units that will Adopt Stanley Black & Decker will be

Construction & DIY (CDIY) and Industrial and Automotive Repair

• Hardware and Home Improvement will Merge with Stanley Hardware

• Combined Unit will Become Part of Stanley Mechanical Access Solutions

• All Divisional Product Brands WILL REMAIN INTACT and Under Control of Their

Business and Regional Leaders

• This includes Stanley, DeWalt, Black & Decker, Facom, and all existing sub-brands

of both companies

• These are valuable assets and there is no reason to change them

• Coordination, Guidance and Issue Resolution will be Administered by the Corporate

Brand Council, Under the Leadership of Scott Bannell

Respected Companies

Household Products

1. Fortune Brands

2. Tupperware Brands

3. Black & Decker

4. Energizer Holdings

5. Stanley Works

Together

We Should Be

#1

Where We Are - Corporate Branding

Design and produce

key communications

and launch materials

to be used on Day 1.

Develop new,

integrated corporate

brand positioning and

messaging strategy

Develop visual identity

for the newly merged

parent company,

“Stanley Black &

Decker”

Quantitatively validate the

optimum corporate name

and brand strategy

(divisional branding,

endorsement branding,

over-branding, co-

branding, etc.) for the long

term.

• Retained the services of

Lippincott - - a leading

global branding agency.

• Process is objective and

fact based

• Integrated identity and

brand positioning

(some Lippincott merger clients)

Ensure that we focus the integration

process on key decisions to

minimize distractions to our base

business

Process

Integration Principles

•Overly complex, lengthy

process distracts

management

•Decisions not made fast

enough, critical milestones

missed

•Integration lacks strong

leadership

•Customers defect in face

of uncertainty

Base business

suffers

Integration

process fails

•Sources of value and risks

not clearly defined

•Failure to prioritize most

critical sources of value

•Synergy targets not

updated

•Integration efforts not

launched prior to close

•Poor hand-off to the line

Synergy targets

missed

Failure to capture

incremental value

Lose key

people

•Lured away by competitors

and headhunters

•Driven away by too much or

too little intervention

- Wait too long to get Newco

leadership in place, or

- “aggressive intervention”

approach without plan for

keepers

•No plan to address

cultural issues

Talent departs

Potential Pitfalls

Detailed Functional &

BU Structures

Layers 3+:

Taskforce Driven Design

(3 to 6 month process)

2

Tiers 3 and below

structure

Decision-making

processes and roles

Location/use of shared

service centers

People selection process

(in conjunction with HR)

Superstructure

Design

“Mega Decisions”

Top 3 layers:

CEO Driven Design

(Completed 60-120 days

post-announcement)

1

Tiers 1 & 2 structure

Governance committees

and charters

HQ location(s)

CEO direct reports

Role for the Center/

Shared Services

Best Practice: Org Design

High Level Org Structure for Stanley Black & Decker Defined

• Inevitably, transaction partners will perceive their

cultures as different. Usually the reality is much less

than the perception

• Allowing the culture for the combined company to

naturally emerge does not usually lead to a high-

performance company

• Awareness of cultural differences and communication of

“how things work” is half the battle

• Strong executive leadership in communicating cultural

ideals is critical to ongoing success

Strong foundational culture of Stanley enhanced by

unique aspects of Black & Decker

Best Practice: Culture

27

Integration Best Practices-DRAFT4

Value:

Process:

People:

Objective:

• Capture “quick-win”

synergies

• Enable fundamental

interactions and Assure

regulation compliance

• Clarify critical reporting lines

• Assure the two businesses

continue to operate

smoothly

Develop stabilization plans

(initial priority)

• Rationalize full cost bases

• Integrate critical systems and

fully capture scale benefits

• Restructure key functions

• Fully combine the two

organizations

Develop integration plans

Strong track record of success with more than 50

transactions and experience with large-scale Facom deal

Our Integration Approach

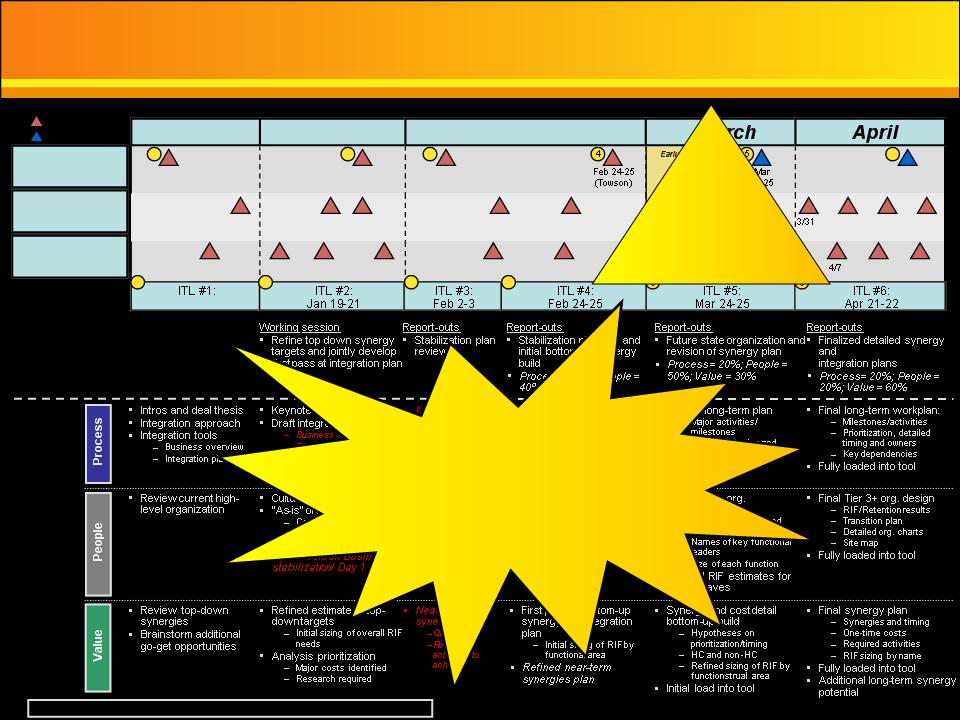

Steering

Committee

ITL Mtgs

IMO

1

Dec

7-8

2

Jan 19-21

(Miami)

6

Apr

21-22

12/21

4/8

4/14

4/29

12/17

1/13

1/27

2/8

2/17

4/13

4/28

Scheduled

Proposed

Primary workout

focus:

Agenda:

Feb 2-3

(New Britain)

Note: Items in red and italics address initiatives to support a March close

3

Dec 7-8

1

2

4

3

December

January

February

1/6

2/18

(Call)

2/9

(Call)

1/21

(Miami)

1/14

(Call)

Integration Calendar

Structured Meeting Rigor

1. Ensures All Issues Discussed

At Least Weekly

2. Alignment From Work Team

Level To Executive Office

Initial

Integration

Plan to be

approved

March 11

Working session

• Initiate joint SWK-BDK

integration planning

• Relationship building

Trust the process and nail the

stabilization plan before closing

In Practice

Process

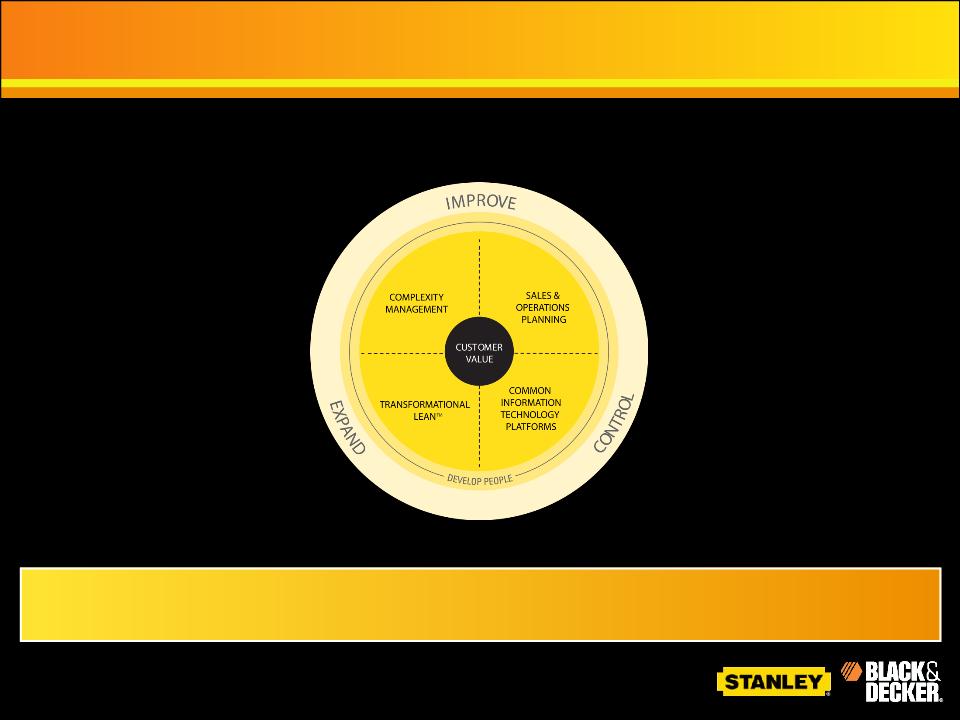

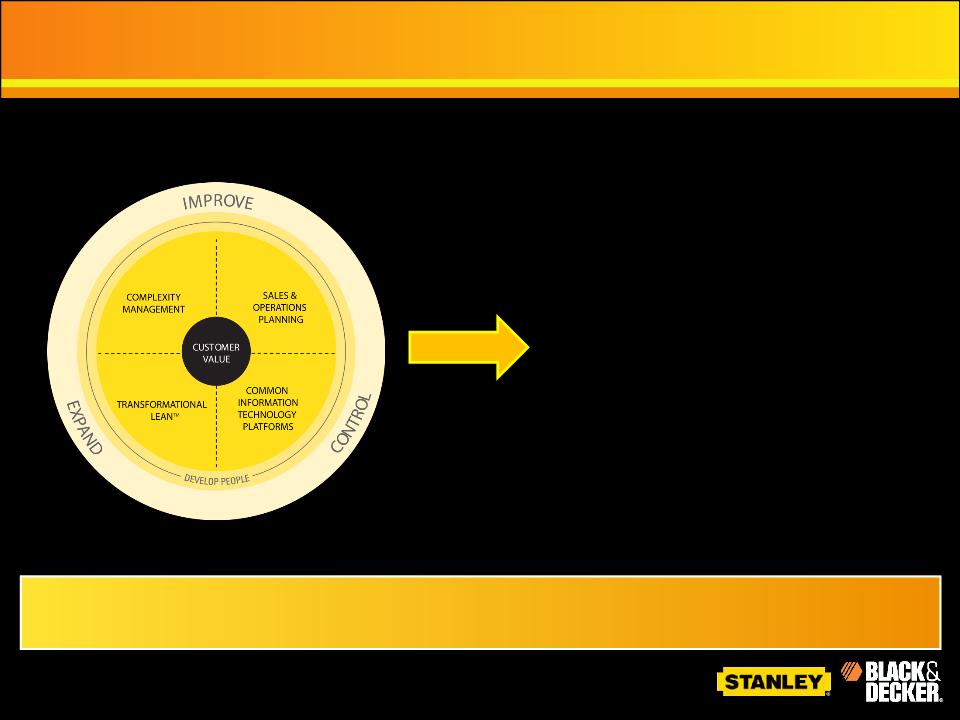

SFS Will Prepare The Company To Double In Size

Again In The Next 5 Years

Complexity

Management:

Eradicate complexity

in everything we do

S&OP:

Tie the front-end

and the back-end to

the same number;

be agile

Transformational

Lean:

Utilize Lean to

change the game

Common

Platforms:

Migrate to a few

good systems

SFS: The Stanley Fulfillment System

• Integration is a catalyst to

drive complexity management

• Connecting our sales

organizations with Global

Operations will allow us to

serve our customers better

than others

• Common platforms drive

efficiency and speed up

decision making

• The combined organization

will have compelling scale to

drive transformational lean

SFS Facilitates and Accelerates Integration

SFS: Imperative to Integration

33

The SFS Tools Are Familiar To The Black & Decker Team

Potential To Generate Significant Cash Flow

From Higher Working Capital Turns

$300M+

• Black and Decker has been

utilizing many of the

principles of SFS

• Opportunity exists to

globalize the process across

all Black & Decker units

• Combined scale creates

opportunity for even larger

results

SFS: Will Drive Real Results

Integration Will Focus On People,

Process and Value…

SFS Principles Will Be Core To The

Integration To Support A Larger,

More Diversified Company In The

Future

SFS: The Stanley Fulfillment System

Additional Information

The proposed transaction involving Stanley and Black & Decker will be submitted to the respective stockholders of Stanley and Black & Decker for their consideration. In connection with the proposed transaction, Stanley has filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that includes a preliminary joint proxy statement of Stanley and Black & Decker that will also constitute a prospectus of Stanley. Investors and security holders are urged to read the preliminary joint proxy statement/prospectus and any other relevant documents filed with the SEC (including the definitive joint proxy statement/prospectus) when they become available, because they contain important information. Investors and security holders may obtain a free copy of the preliminary joint proxy statement/prospectus and other documents (when available) that Stanley and Black & Decker file with the SEC at the SEC’s website at www.sec.gov and Stanley’s and Black & Decker’s website related to the transaction at www.stanleyblackanddecker.com. In addition, these documents may be obtained from Stanley or Black & Decker free of charge by directing a request to Investor Relations, The Stanley Works, 1000 Stanley Drive, New Britain, CT 06053, or to Investor Relations, The Black & Decker Corporation, 701 E. Joppa Road, Towson, Maryland 21286, respectively.

Certain Information Regarding Participants

Stanley, Black & Decker and certain of their respective directors and executive officers may be deemed to be participants in the proposed transaction under the rules of the SEC. Investors and security holders may obtain information regarding the names, affiliations and interests of Stanley’s directors and executive officers in Stanley’s Annual Report on Form 10-K for the year ended January 3, 2009, which was filed with the SEC on February 26, 2009, its proxy statement for its 2009 Annual Meeting, which was filed with the SEC on March 20, 2009, and the preliminary joint proxy statement/prospectus related to the proposed transaction, which was filed with the SEC on January 15, 2010. Investors and security holders may obtain information regarding the names, affiliations and interests of Black & Decker’s directors and executive officers in Black & Decker’s Annual Report on Form 10-K for the year ended December 31, 2008, which was filed with the SEC on February 17, 2009, its proxy statement for its 2009 Annual Meeting, which was filed with the SEC on March 16, 2009, and the preliminary joint proxy statement/prospectus related to the proposed transaction, which was filed with the SEC on January 15, 2010. These documents can be obtained free of charge from the sources listed above. Additional information regarding the interests of these individuals may also be included in the definitive joint proxy statement/prospectus regarding the proposed transaction when it becomes available.

Non-Solicitation

A registration statement relating to the securities to be issued by Stanley in the proposed transaction has been filed with the SEC, and Stanley will not issue, sell or accept offers to buy such securities prior to the time such registration statement becomes effective. This document shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of such securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction.