UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | | | |

¨ | | Preliminary Proxy Statement | | | | |

¨ Confidential, For Use of the Commission Only

(as permitted by Rule 14A-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-12

The Black & Decker Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | ¨ | Fee paid previously with preliminary materials. |

| | ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Notice Of Annual Meeting Of Stockholders

The 2007 Annual Meeting of Stockholders of The Black & Decker Corporation will be held at the Sheraton Baltimore North Hotel, 903 Dulaney Valley Road, Towson, Maryland 21204, on April 19, 2007, at 9:00 A.M., Eastern Time, for the following purposes:

| | 1. | | To elect eleven directors to serve until the next annual meeting; |

| | 2. | | To ratify the selection of Ernst & Young LLP as Black & Decker’s independent registered public accounting firm for 2007; |

| | 3. | | To act on one stockholder proposal; and |

| | 4. | | To conduct any other business properly brought before the meeting. |

Stockholders of record at the close of business on February 20, 2007, will be entitled to vote at the meeting or any adjournments of the meeting.

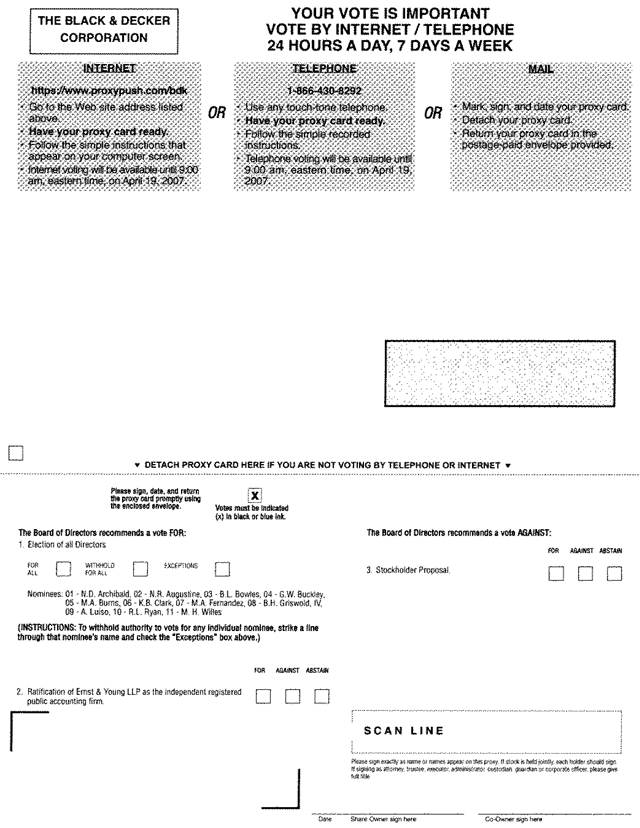

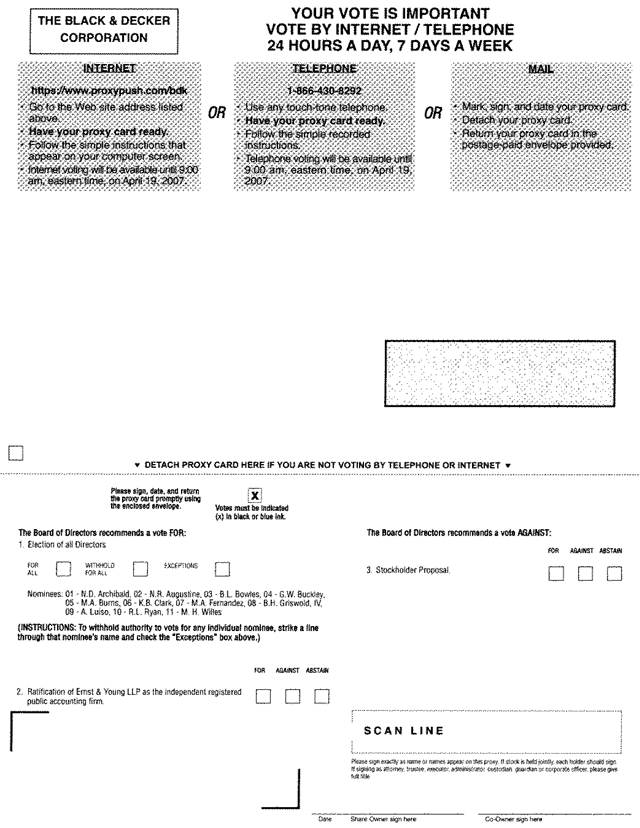

Your vote is important to us. We encourage you to vote as soon as possible byoneof three convenient methods:

| | • | | call the toll-free number listed on the proxy card, or |

| | • | | access the Internet site listed on the proxy card, or |

| | • | | sign, date, and return the proxy card in the envelope provided. |

Your Board of Directors recommends a vote“for” each of the nominees included in the Proxy Statement and“against” the stockholder proposal. The Audit Committee, which has the sole authority to retain Black & Decker’s independent registered public accounting firm, recommends a vote“for”the ratification of the selection of Ernst & Young LLP.

By Order of the Board of Directors

Natalie A. Shields

Vice President and Corporate Secretary

March 12, 2007

INDEX

2

Proxy Statement

The Notice of Annual Meeting, this Proxy Statement, the enclosed proxy card, and the Annual Report of The Black & Decker Corporation, including the Annual Report on Form 10-K that includes the Consolidated Financial Statements for the year ended December 31, 2006, are being sent beginning March 12, 2007, to stockholders of record at the close of business on February 20, 2007 (the “Record Date”). On the Record Date, there were 65,682,976 shares of common stock outstanding held by 11,815 stockholders of record. Each share of common stock entitles the holder to one vote.

The Board of Directors is soliciting proxies to be voted at the 2007 Annual Meeting of Stockholders to be held at the Sheraton Baltimore North Hotel, 903 Dulaney Valley Road, Towson, Maryland 21204, on April 19, 2007, at 9:00 A.M., Eastern Time. You may vote your shares by:

| | • | | calling the toll-free number listed on the enclosed proxy card, |

| | • | | accessing the Internet site listed on the proxy card, |

| | • | | signing and dating the proxy card and returning it in the enclosed envelope, or |

| | • | | attending the meeting in person and voting by ballot at the meeting. |

You may revoke your proxy, whether given by signing the enclosed proxy card or by using the telephone or Internet procedure, at any time before it is exercised by:

| | • | | delivering written notice of revocation to Black & Decker’s Corporate Secretary, |

| | • | | delivering another proxy that is properly signed and has a later date, |

| | • | | voting by telephone or through the Internet on a later date, or |

| | • | | voting in person at the meeting. |

Voting by mail using the enclosed proxy card, by telephone, or by accessing the Internet does not limit your right to attend the meeting and change your vote by ballot at the meeting.

The telephone and Internet voting procedures are described on the enclosed proxy card or were sent to you by e-mail if you chose to receive your materials relating to the annual meeting online. The telephone and Internet voting procedures are designed to verify stockholders’ identities, allow stockholders to give voting instructions, and confirm that their instructions have been properly recorded. Your telephone or Internet instructions will authorize the persons named as Proxies to vote your shares as you direct.

Upon request, Black & Decker will supply proxy materials to brokerage houses and other custodians, nominees, and fiduciaries for distribution to beneficial owners of Black & Decker shares and will reimburse them for their distribution expenses. Black & Decker has hired a proxy solicitation firm, D. F. King & Co., Inc., to assist in the solicitation of proxies and has agreed to pay D. F. King approximately $13,000 and to reimburse its expenses. The solicitation of proxies is being made by mail, and also may be made personally, electronically, or by telephone by Black & Decker employees and representatives of D. F. King.

In accordance with a notice sent to eligible beneficial owners of Black & Decker shares who share a single address, only one copy of the Annual Report and Proxy Statement will be sent to that address unless the broker, bank, or nominee received contrary instructions from any beneficial stockholder at that address.

3

This practice, known as “householding,” is designed to reduce printing and mailing costs. If a beneficial owner at that address wishes to receive an Annual Report or Proxy Statement this year or in the future, he or she may contact the Corporate Secretary at Black & Decker’s principal executive office. Black & Decker’s principal executive office is at 701 East Joppa Road, Towson, Maryland 21286, and its telephone number is 410-716-3900.

VOTING SECURITIES

On the Record Date, to Black & Decker’s knowledge, no one other than the stockholders listed in the following table beneficially owned more than 5% of the outstanding shares of its common stock.

| | | | | | | | |

Name | | Title of Class | | Amount of Beneficial Ownership | | | Percent of Class | |

AXA Financial, Inc. 1290 Avenue of the Americas New York, New York 10104 | | Common Stock | | 11,195,480 shares | (1) | | 17.0 | % |

| | | |

Ariel Capital Management, LLC 200 E. Randolph Drive, Suite 2900 Chicago, Illinois 60601 | | Common Stock | | 4,676,706 shares | (2) | | 7.1 | % |

| | | |

U.S. Trust Corporation 114 West 47th Street, 25th Floor New York, New York 10036 | | Common Stock | | 4,033,701 shares | (3) | | 6.1 | % |

| (1) | | Based on the Schedule 13G/A (Amendment No. 1) filed February 13, 2007, by AXA Assurances I.A.R.D. Mutuelle, AXA Assurances Vie Mutuelle, AXA Courtage Assurance Mutuelle, AXA, and AXA Financial, Inc. According to the Schedule 13G/A, AllianceBernstein L.P., a wholly owned subsidiary of AXA Financial, Inc., is deemed to have sole voting power with respect to 7,883,072 shares, shared voting power with respect to 1,086,553 shares, sole dispositive power with respect to 11,082,154 shares, and shared dispositive power with respect to 2,355 shares in its capacity as an investment advisor. |

| (2) | | Based on the Schedule 13G filed February 13, 2007, by Ariel Capital Management, LLC, in its capacity as an investment advisor. According to the Schedule 13G, Ariel Capital Management is deemed to have sole voting power with respect to 4,202,236 shares and sole dispositive power with respect to 4,653,521 shares. |

| (3) | | Based on the Schedule 13G filed February 14, 2007, by U.S. Trust Corporation and United States Trust Company, N.A. According to the Schedule 13G, U.S. Trust Corporation is deemed to have sole voting power with respect to 936,326 shares, shared voting power with respect to 31,100 shares, sole dispositive power with respect to 3,825,388 shares, and shared dispositive power with respect to 208,183 shares in its capacity as an investment advisor. |

4

ELECTION OF DIRECTORS

Eleven directors will be elected to hold office until their successors are elected and qualified. The presence, in person or by proxy, of the record holders of a majority of the shares of stock entitled to be voted at the meeting constitutes a quorum for the conduct of business. If a quorum is present, the affirmative vote of the record holders of a majority of the shares of stock represented at the meeting in person or by proxy is necessary to elect directors. Abstentions will be treated as shares represented at the meeting and will have the same effect as votes against a director. Unless otherwise specified, the proxies received will be voted for the election of the following persons:

| | |

| | Nolan D. Archibald Chairman, President, and Chief Executive Officer The Black & Decker Corporation Mr. Archibald served in various executive positions with Conroy, Inc. In 1977, he became vice president of marketing for the Airstream Division of Beatrice Companies, Inc. His subsequent positions at Beatrice included president of Del Mar Window Coverings, president of Stiffel Lamp Company, and president of the Home Products Division. In 1983, he was elected a senior vice president of Beatrice and president of the Consumer and Commercial Products Group. Mr. Archibald left Beatrice and was elected president and chief operating officer of Black & Decker in 1985 and chief executive officer in 1986. He has served continuously in the additional position of chairman of the board since 1987. Mr. Archibald, who is 63, was first elected a director of Black & Decker in 1985. He also serves as a director of Brunswick Corporation, Lockheed Martin Corporation, and Huntsman Corporation. |

| | |

| | Norman R. Augustine Retired Chairman and Chief Executive Officer Lockheed Martin Corporation Mr. Augustine served in various capacities with Douglas Aircraft Company and Vought Missiles and Space Company before joining the United States Department of Defense, where he served as Undersecretary of the Army. He joined Martin Marietta Corporation, a predecessor of Lockheed Martin Corporation, in 1977 as vice president of Aerospace Technical Operations, became a director in 1986, and rose to the position of chairman of the board and chief executive officer in 1988 and 1987, respectively. Following the merger of Martin Marietta and Lockheed Corporation in 1995, he served as president of Lockheed Martin Corporation and later as chairman of the board and chief executive officer. From 1997 through 1999, Mr. Augustine was a lecturer with the rank of professor on the faculty of Princeton University. Mr. Augustine, who is 71, was first elected a director of Black & Decker in 1997. He also serves as a director of ConocoPhillips and The Procter & Gamble Company. |

5

| | |

| | Barbara L. Bowles Vice Chair Profit Investment Management Ms. Bowles held various positions at First National Bank of Chicago, including vice president of trust investments. From 1981 to 1984, Ms. Bowles was assistant vice president and director of investor relations for Beatrice Companies, Inc. In 1984, she joined Kraft, Inc., where she served as corporate vice president until 1989. Ms. Bowles was chairman of the board and chief executive officer of The Kenwood Group, Inc., an investment advisory firm that she founded in 1989, until December 2005, when the firm was acquired by Profit Investment Management. Currently, she is vice chair of Profit Investment Management. The Kenwood Group continues to operate as a wholly owned subsidiary of Profit. Ms. Bowles manages all of the client portfolios of The Kenwood Group. Ms. Bowles, who is 59, was first elected a director of Black & Decker in 1993. She also serves as a director of Wisconsin Energy Corporation, Dollar General Corporation, the Chicago Urban League, and the Children’s Memorial Hospital of Chicago. |

| | |

| | George W. Buckley Chairman, President, andChief Executive Officer 3M Company From 1993 to 1997, Mr. Buckley served as the chief technology officer and president of two divisions of Emerson Electric Company. In 1997, he joined the Brunswick Corporation as a vice president, became senior vice president in 1999, and became executive vice president in 2000. Mr. Buckley was elected president and chief operating officer of Brunswick in April 2000 and chairman and chief executive officer in June 2000. In December 2005, he was elected chairman, president, and chief executive officer of the 3M Company. Mr. Buckley, who is 60, was first elected a director of Black & Decker in 2006. Mr. Buckley also serves as a director of the 3M Company. |

| | |

| | M. Anthony Burns Chairman Emeritus Ryder System, Inc. Mr. Burns served for nine years with Mobil Oil Corporation, before joining Ryder System, Inc. in 1974. He was elected president and chief operating officer and a director of Ryder in 1979, chief executive officer in 1983, and chairman of the board in 1985. He retired as chief executive officer in 2000 and as chairman of the board and a director in 2002. Mr. Burns, who is 64, was first elected a director of Black & Decker in 2001. He also serves as a director of Pfizer Inc. and J. C. Penney Company, Inc. He is a life trustee of the University of Miami in Florida and is active in cultural and civic organizations in Florida. |

6

| | |

| | Kim B. Clark President Brigham Young University—Idaho Dr. Clark joined the faculty of Harvard Business School in 1978 and was named Dean of Faculty and George F. Baker Professor of Administration in 1995. He was named president of Brigham Young University—Idaho in 2005. His research is focused on modularity in design and the integration of technology and competition in industry evolution, with a particular focus on the computer industry. He and Carliss Baldwin are co-authors of Design Rules: The Power of Modularity (MIT Press, 2000). Dr. Clark, who is 57, was first elected a director of Black & Decker in 2003. He also serves as a director of JetBlue Airways Corporation. |

| | |

| | Manuel A. Fernandez Chairman Emeritus Gartner, Inc. Mr. Fernandez held various positions with ITT, Harris Corporation, and Fairchild Semiconductor Corporation before becoming president and chief executive officer of Zilog Incorporated in 1979. In 1982, he founded Gavilan Computer Corporation and served as president and chief executive officer and, in 1984, became president and chief executive officer of Dataquest, Inc., an information technology service company. From 1991, he served as president, chairman of the board, and chief executive officer of Gartner, Inc., and was elected chairman emeritus in 2001. Since 1998, he also has been the managing director of SI Ventures, a venture capital firm. Mr. Fernandez, who is 60, was first elected a director of Black & Decker in 1999. He also serves as a director of Brunswick Corporation, Flowers Foods, Inc., SYSCO Corporation, and several private companies and foundations and is chairman of the board of trustees of the University of Florida. |

| | |

| | Benjamin H. Griswold, IV Senior Partner Brown Advisory Mr. Griswold joined Alex. Brown & Sons in 1967, became a partner of the firm in 1972, was elected vice chairman of the board and director in 1984, and became chairman of the board in 1987. Upon the acquisition of Alex. Brown by Bankers Trust New York Corporation in 1997, he became senior chairman of BT Alex. Brown, and upon the acquisition of Bankers Trust by Deutsche Bank in 1999, he became senior chairman of Deutsche Banc Alex. Brown, the predecessor of Deutsche Bank Securities Inc. Mr. Griswold retired from Deutsche Bank Securities Inc. in February 2005 and joined Brown Advisory as senior partner in March 2005. Mr. Griswold, who is 66, was first elected a director of Black & Decker in 2001. He also serves as a director of Baltimore Life Insurance Company, Flowers Foods, Inc., and W.P. Carey & Co., LLC and is a trustee of The Johns Hopkins University. |

7

| | |

| | Anthony Luiso Retired President—Campofrio Spain Campofrio Alimentacion, S.A. Mr. Luiso was employed by Arthur Andersen & Co. and, in 1971, joined Beatrice Companies, Inc. He held various positions at Beatrice, including president and chief operating officer of the International Food Division and president and chief operating officer of Beatrice U.S. Food. Mr. Luiso left Beatrice in 1986 to become group vice president and chief operating officer of the Foodservice Group of International Multifoods Corporation and served as chairman of the board, president, and chief executive officer of that corporation until 1996. He served as executive vice president of Tri Valley Growers during 1998. In 1999, he joined Campofrio Alimentacion, S.A., the leading processed meat-products company in Spain, as president-international and subsequently served as president of Campofrio Spain through 2001. Mr. Luiso, who is 63, was first elected a director of Black & Decker in 1988. |

| | |

| | Robert L. Ryan Retired Senior Vice President and Chief Financial Officer Medtronic Inc. Mr. Ryan was a management consultant for McKinsey and Company and a vice president for Citicorp. He joined Union Texas Petroleum Corporation as treasurer in 1982, became controller in 1983, and was promoted to senior vice president and chief financial officer in 1984. In April 1993, Mr. Ryan was named the senior vice president and chief financial officer of Medtronic, Inc. He retired from Medtronic in 2005. Mr. Ryan, who is 63, was first elected as a director of Black & Decker in 2005. He also serves as a director of UnitedHealth Group Incorporated, The Hewlett-Packard Company and General Mills, Inc. and is a trustee of Cornell University and the Hazleden Foundation. |

8

| | |

| | Mark H. Willes Retired Chairman, President, and Chief Executive Officer The Times Mirror Company Mr. Willes was assistant professor of finance and visiting lecturer at the Wharton School of Finance and Commerce of the University of Pennsylvania from 1967 to 1971. In 1971, Mr. Willes joined the Philadelphia Federal Reserve Bank, where he held a number of positions, including director of research and first vice president. He was president of the Federal Reserve Bank of Minneapolis from 1977 to 1980. He joined General Mills, Inc. in 1980 as executive vice president and chief financial officer, was elected president, chief operating officer, and a director of General Mills in 1985, and was elected vice chairman of the board in 1992. In 1995, Mr. Willes was elected a director, president, and chief executive officer of The Times Mirror Company, a national news and information company, and, in 1996, was elected to the additional post of chairman of the board. He also was publisher of The Los Angeles Times from 1997 to 1999. Mr. Willes, who is 65, was first elected a director of the Corporation in 1990, served until 2001, and was re-elected to the Board in 2004. |

CORPORATE GOVERNANCE

The Board of Directors adopted the Corporate Governance Policies and Procedures Statement to set out the policies and procedures by which the Board performs its duties to direct the management of Black & Decker as provided in the laws of Maryland, to assure compliance with state and federal laws and regulations and applicable rules of the New York Stock Exchange (“NYSE”), and to assure that Black & Decker acts effectively and efficiently in the best interests of its stockholders and other constituencies. The Statement contains the charters of the standing committees of the Board of Directors, the Code of Ethics and Standards of Conduct, and the Code of Ethics for Senior Financial Officers. The Statement is available free of charge on Black & Decker’s Internet Web site(www.bdk.com) or in print by calling (800) 992-3042 or (410) 716-2914.

Independent Directors The Board has determined that, other than Mr. Archibald, who is a full-time employee, no current director has a material relationship with Black & Decker and each is an “independent director” as defined under the current rules of the NYSE and Black & Decker’s Corporate Governance Policies and Procedures Statement. The definition of “independent director” is contained in Black & Decker’s Corporate Governance Policies and Procedures Statement.

The Corporate Governance Committee monitors the independence of directors by reviewing any relationship or transaction in which Black & Decker and a director are participants that may impede the director’s independence or must be disclosed in the Proxy Statement in accordance with the rules and regulations of the SEC. The Corporate Governance Committee reports annually to the Board any relationships or transactions that require a determination by the Board of materiality for proxy reporting purposes. There were no relationships or transactions in which Black & Decker and a director were participants that would impede the director’s independence or must be disclosed in the Proxy Statement. In accordance with its charter, the Audit Committee also receives a report from the General Auditor on a

9

quarterly basis of any transaction between a director and Black & Decker that is out of the ordinary course of business. The General Auditor has never identified any transaction between a director and Black & Decker that required reporting to the Audit Committee.

Compensation of Directors Non-management directors receive an annual retainer of $195,000, consisting of shares of common stock with a value of $97,500 under The Black & Decker Non-Employee Directors Stock Plan (the “Directors Stock Plan”) and $97,500 in cash. The chairmen of the Audit Committee and the Compensation Committee each receives an additional retainer of $20,000 in cash, the chairmen of the Finance Committee and the Corporate Governance Committee each receives an additional retainer of $10,000 in cash, and each member of the Audit Committee other than the chairman receives an additional retainer of $10,000 in cash. No separate meeting fees are paid. Directors have the option to receive their cash fees in shares of common stock or to defer all or a portion of their cash and stock fees in the form of “phantom shares.” A director who elects to defer all or any part of the cash portion of the annual retainer in the form of phantom shares will be credited with shares of common stock having a fair market value (as defined in the Directors Stock Plan) equal to 120% of the amount of cash deferred.

The following table shows the compensation paid to each of the directors during 2006:

| | | | | | | | | | | | | |

Name(1) | | Fees

Earned or

Paid in

Cash | | Stock

Awards(2) | | All Other

Compensation | | | Total |

Norman R. Augustine | | $ | –0– | | $ | 224,500 | | $ | 1,344 | | | $ | 225,844 |

Barbara L. Bowles | | | 91,414 | | | 113,586 | | | 2,139 | | | | 207,139 |

George W. Buckley | | | –0– | | | 214,500 | | | 18,238 | (3) | | | 232,738 |

M. Anthony Burns | | | 79 | | | 234,421 | | | 2,290 | | | | 236,790 |

Kim B. Clark | | | –0– | | | 214,500 | | | 5,796 | | | | 220,296 |

Manuel A. Fernandez | | | –0– | | | 224,500 | | | 1,420 | | | | 225,920 |

Benjamin H. Griswold, IV | | | 97,579 | | | 97,421 | | | 327 | | | | 195,327 |

Anthony Luiso | | | –0– | | | 214,500 | | | 809 | | | | 215,309 |

Robert L. Ryan | | | 107,500 | | | 97,500 | | | 466 | | | | 205,466 |

Mark H. Willes | | | –0– | | | 234,500 | | | 1,839 | | | | 236,339 |

| (1) | | The following table shows the number of stock options held by each director, all of which are immediately exercisable: |

| | |

Director | | Outstanding Stock Options |

Norman R. Augustine | | 14,500 |

Barbara L. Bowles | | 5,000 |

George W. Buckley | | –0– |

M. Anthony Burns | | 5,833 |

Kim B. Clark | | –0– |

Manuel A. Fernandez | | 12,500 |

Benjamin H. Griswold, IV | | 4,375 |

Anthony Luiso | | 14,000 |

Robert L. Ryan | | –0– |

Mark H. Willes | | –0– |

10

| (2) | | Represents the amount recognized in Black & Decker’s financial statements during 2006 for awards of stock and phantom shares under the Directors Stock Plan. The fair value for each share of stock or unit of phantom stock was $92.255. |

| (3) | | Includes $10,000 of product received under the Directors Product Program and $7,986 in tax reimbursement payments. |

Black & Decker provides $100,000 of term life insurance for each director who is not an employee and $200,000 of accident insurance coverage during each day that a director travels in connection with Black & Decker’s business. Black & Decker provides retirement benefits to directors who were elected prior to 1994 and retire after having served for five or more years. The annual amount of the benefit is $15,000 (one-half of the annual retainer on the date the retirement plan was closed to newly elected directors). Retirement benefits are paid in monthly installments to the director or the director’s surviving spouse until: (1) the number of monthly payments made equals the number of months of service by the director; (2) 120 monthly payments have been made; or (3) the last day of the month following the death of the individual entitled to the payments, whichever occurs first. The retirement benefit is based only on service as a non-management director, and no director first elected after 1993 may participate.

Prior to 2003, directors who were not full-time employees of Black & Decker received stock options as compensation for their service as directors. The option exercise price was the average of the high and low sale price per share on the NYSE on the date of grant. The options became exercisable eleven months from the date of grant and remain exercisable for ten years from the date of grant. The Board discontinued granting stock options to directors in October 2002.

The Board of Directors has adopted the Directors Product Program to encourage directors to use Black & Decker products in order to enhance their understanding and appreciation of Black & Decker’s business. Directors may receive Black & Decker products with an aggregate value of up to $10,000 annually. The value of the products is included in the director’s taxable income, and Black & Decker reimburses directors for the applicable tax liability associated with the receipt of the products. Directors may also purchase Black & Decker products at Black & Decker’s cost, which results in no incremental cost to Black & Decker.

Board Attendance During 2006, the Board of Directors met in person or by telephone five times. All directors attended 75% or more of the total number of meetings of the Board and Board committees on which they served. Directors are expected to attend the annual meetings of stockholders, and all of the directors attended the annual meeting in 2006.

Committees The Board has five committees: Executive, Audit, Compensation, Corporate Governance, and Finance. All committees other than the Executive Committee are composed of non-management directors, each of whom is independent within the current rules of the NYSE and the provisions of the Corporate Policies and Procedures Statement. Each committee operates under a written charter adopted by the Board, a copy of which is available on Black & Decker’s Web site (www.bdk.com).

Executive Committee The Executive Committee is currently composed of Nolan D. Archibald (Chairman), Norman R. Augustine, M. Anthony Burns, Manuel A. Fernandez, and Mark H. Willes. The Executive Committee meets when required during intervals between meetings of the Board and has authority to exercise all of the powers of the Board except as limited by the Maryland General Corporation Law. The Executive Committee did not meet in 2006.

11

Audit Committee The Audit Committee, which is currently composed of M. Anthony Burns (Chairman), Barbara L. Bowles, and Robert L. Ryan, met eight times during 2006. The Board has determined that each member of the Audit Committee is an “audit committee financial expert” as defined by rules adopted by the SEC and is independent. The Audit Committee assists the Board in overseeing the integrity of Black & Decker’s financial statements, Black & Decker’s compliance with legal and regulatory requirements, the independent auditor’s qualifications and independence, and the performance of Black & Decker’s internal auditors and independent auditor. The Board and the Audit Committee have adopted a Code of Ethics for Senior Financial Officers that applies to Black & Decker’s chief executive officer, chief financial officer, and controller. The Code is available on Black & Decker’s Web site (www.bdk.com).

Compensation Committee The Compensation Committee, which is currently composed of Mark H. Willes (Chairman), George W. Buckley, Benjamin H. Griswold, IV, and Anthony Luiso, met five times in 2006. The Compensation Committee assists the Board in matters relating to executive compensation, establishes goals for the award of incentive or performance-based compensation, administers Black & Decker’s stock option, restricted stock and other compensation plans, and monitors the performance of executive officers.

Corporate Governance Committee The Corporate Governance Committee, which is currently composed of Manuel A. Fernandez (Chairman), Barbara L. Bowles, Kim B. Clark, and Robert L. Ryan, met four times in 2006. The Corporate Governance Committee performs the functions of a nominating committee by identifying individuals qualified to become directors and recommending to the Board a slate of director nominees for the next annual meeting of stockholders. The Corporate Governance Committee also recommends members of the standing committees and develops and recommends to the Board corporate governance principles.

Finance Committee The Finance Committee, which is currently composed of Norman R. Augustine (Chairman), George W. Buckley, M. Anthony Burns, and Anthony Luiso, met five times during 2006. The Finance Committee monitors the overall financial performance of Black & Decker, recommends dividends, reviews and recommends offerings of Black & Decker’s securities, and reviews Black & Decker’s investments.

Non-Management Directors Other than Mr. Archibald, who is a full-time employee, all current directors are non-management directors. The non-management directors generally meet in executive session at the end of each regular Board meeting in February, July, and December. The persons who chair the Audit, Compensation, Corporate Governance, and Finance Committees serve in annual rotation as the presiding director of the executive sessions. Interested persons wishing to make their concerns known to the presiding director or to the non-management directors as a group may contact them at the following address:

Presiding Director [or Non-Management Directors]

c/o Corporate Secretary

The Black & Decker Corporation

701 East Joppa Road

Towson, Maryland 21286

Stockholder Communications In addition to the procedures provided for any interested party to communicate with the presiding director or the non-management directors as a group, stockholders also

12

may communicate with individual directors or the whole Board by sending communications, marked to show that they are a “stockholder communication,” in care of the Corporate Secretary at the foregoing address. If addressed to individual directors, the communications will be forwarded, unopened, to those directors, and if addressed to the whole Board, will be forwarded, unopened, to the Chairman of the Corporate Governance Committee for review and appropriate dissemination. Stockholder proposals submitted for possible inclusion in the Proxy Statement for an annual meeting of stockholders are not, and should not be marked as, a “stockholder communication.”

Nomination of Directors When a vacancy occurs on the Board of Directors or when the Board increases the number of directors, the Corporate Governance Committee will identify potential candidates to fill the vacancy. Background information on each candidate will be distributed to members of the Corporate Governance Committee, which will screen recommended candidates and, if appropriate, make discreet inquiry to determine the candidate’s interest and availability. Unless eliminated by the screening, the Corporate Governance Committee will report the candidate’s name to the Board and request comments from the other directors. One or more members of the Corporate Governance Committee will meet with the candidate and determine the candidate’s suitability for the Board. Although there are no specific qualifications and standards that must be met by a candidate to be recommended to the Board or any specific qualities or skills that the candidate must possess, a list of desirable characteristics is included in Black & Decker’s Corporate Governance Policies and Procedures Statement, which is posted on Black & Decker’s Web site (www.bdk.com).

The Corporate Governance Committee will consider candidates proposed by one or more substantial, long-term stockholders. Generally, stockholders who individually or as a group have held 5% of Black & Decker’s common stock for over one year will be considered substantial, long-term stockholders. In considering candidates proposed by stockholders, the Corporate Governance Committee will apply the same qualifications and standards it applies when considering nominees proposed by Committee or Board members, including whether a proposed candidate is committed to representing the interests of stockholders generally and not the interests of a particular stockholder or group of stockholders, nor the interests of a particular group whose interests are primarily non-economic or involve a social agenda.

Only persons nominated in accordance with Black & Decker’s bylaws are eligible for election as directors. Nominations may be made at the annual meeting of stockholders only by the Board, by the Corporate Governance Committee (which functions as the nominating committee) or a person appointed by the Board, or by a stockholder who is entitled to vote and follows the procedures described below.

A stockholder may nominate a person for election as a director by sending a written notice to the Corporate Secretary at 701 East Joppa Road, Towson, Maryland 21286, that is received not less than 90 days nor more than 110 days prior to the meeting. If Black & Decker provides less than 100 days’ notice of the date of the meeting, the stockholder’s notice must be received no later than the close of business on the tenth day after the meeting notice was mailed or the public disclosure was made, whichever occurred first. The stockholder’s notice must include: (1) the name, age, business address, and residence address of the nominee; (2) the principal occupation or employment of the nominee; (3) the number of shares of common stock owned by the nominee; and (4) any other information relating to the nominee that is required to be disclosed in solicitations for proxies for election of directors according to Regulation 14A under the Securities Exchange Act of 1934. The stockholder also must include the stockholder’s name and address and the number of shares of common stock owned by the stockholder. Black & Decker may require any

13

proposed nominee to furnish other information that may be necessary to determine the nominee’s eligibility to serve as a director. If the chairman of the meeting determines that a nomination was not made in accordance with these procedures, the chairman will announce this at the meeting, and the nomination will be disregarded. Although following these procedures enables a stockholder to make a nomination at the annual meeting, it does not entitle the stockholder to have the nominee included in Black & Decker’s Proxy Statement.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The rules of the SEC require that Black & Decker disclose late filings of reports of stock ownership, or changes in ownership, by its directors, officers, and 10% stockholders. Based on its review of the copies of forms it received, or written representations from reporting persons that they were not required to file a Form 5, Black & Decker believes that, during 2006, all reports required under Section 16(a) of the Securities Exchange Act for its directors, officers, and 10% stockholders were filed on a timely basis, except for one Form 4 filing for Mr. McBride that was amended to reflect the correct information after a report was timely filed with the SEC but contained erroneous information due to an unintentional administrative oversight.

SECURITY OWNERSHIP BY MANAGEMENT

The following table shows the number of shares of Black & Decker common stock beneficially owned on the Record Date by each director-nominee, each named executive officer, and all current directors and executive officers as a group. Other than Mr. Archibald, who beneficially owns 3.9% of the outstanding shares of common stock, and Mr. McBride, who beneficially owns 1.0% of the outstanding shares of common stock, each director and named executive officer beneficially owns less than 1% of the outstanding shares of common stock, and all current directors and executive officers as a group beneficially own 7.1% of the outstanding shares of common stock. The table also includes:

| | • | | shares of common stock that directors and executive officers have the right to acquire within 60 days of the Record Date, including shares that they have the right to acquire by exercising stock options; |

| | • | | shares of restricted stock held by executive officers; and |

| | • | | phantom shares that have been deferred by directors, but ultimately will be paid in shares of common stock under the Directors Stock Plan. |

14

Executive officers may vote the restricted shares but may not sell or transfer those shares until the restrictions lapse. The phantom shares are not entitled to be voted and may not be transferred, but have been listed in the table because they represent part of the total economic interest of the directors in Black & Decker stock.

| | | |

| | | Number of Shares Beneficially Owned | |

Nolan D. Archibald | | 2,580,300 | (1) |

Norman R. Augustine | | 36,590 | (2) |

Barbara L. Bowles | | 15,169 | (3) |

George W. Buckley | | 2,357 | (4) |

M. Anthony Burns | | 15,230 | (5) |

Kim B. Clark | | 7,399 | (6) |

Charles E. Fenton | | 54,390 | (7) |

Manuel A. Fernandez | | 29,181 | (8) |

Benjamin H. Griswold, IV | | 40,056 | (9) |

Thomas D. Koos | | 74,097 | (10) |

Anthony Luiso | | 40,909 | (11) |

Michael D. Mangan | | 254,955 | (12) |

Paul F. McBride | | 667,169 | (13) |

Robert L. Ryan | | 1,556 | (14) |

John W. Schiech | | 226,625 | (15) |

Mark H. Willes | | 33,915 | (16) |

All Directors and Executive Officers as a Group (28 persons) | | 4,643,114 | (17) |

| (1) | | Includes 2,200,000 shares that may be acquired within 60 days of the Record Date by exercising stock options. Also includes 3,868 shares held under the Retirement Savings Plan and 37,736 shares held by or for the benefit of members of Mr. Archibald’s immediate family as to which Mr. Archibald has sole or shared voting or investment power. |

| (2) | | Includes 14,500 shares that may be acquired within 60 days of the Record Date by exercising stock options granted under The 1995 Stock Option Plan for Non-Employee Directors (the “Directors Stock Option Plan”). Also includes 17,090 phantom shares held for the benefit of Mr. Augustine in a deferred compensation account under the Directors Stock Plan. The phantom shares ultimately will be paid in shares of common stock at the end of the deferral period selected by Mr. Augustine. |

| (3) | | Includes 5,000 shares that may be acquired within 60 days of the Record Date by exercising stock options granted under the Directors Stock Option Plan. Also includes 848 phantom shares held for the benefit of Ms. Bowles in a deferred compensation account under the Directors Stock Plan. The phantom shares ultimately will be paid in shares of common stock at the end of the deferral period selected by Ms. Bowles. |

| (4) | | Represents phantom shares held for the benefit of Mr. Buckley in a deferred compensation account under the Directors Stock Plan. The phantom shares ultimately will be paid in shares of common stock at the end of the deferral period selected by Mr. Buckley. |

| (5) | | Includes 5,833 shares that may be acquired within 60 days of the Record Date by exercising stock options granted under the Directors Stock Option Plan. Also includes 2,879 phantom shares held for the benefit of Mr. Burns in a deferred compensation account under the Directors Stock Plan. The |

15

| | phantom shares ultimately will be paid in shares of common stock at the end of the deferral period selected by Mr. Burns. |

| (6) | | Includes 3,606 phantom shares held for the benefit of Mr. Clark in a deferred compensation account under the Directors Stock Plan. The phantom shares ultimately will be paid in shares of common stock at the end of the deferral period selected by Mr. Clark. |

| (7) | | Includes 17,000 shares that may be acquired within 60 days of the Record Date by exercising stock options. Also includes 3,544 shares held for the benefit of a member of Mr. Fenton’s immediate family. |

| (8) | | Includes 12,500 shares that may be acquired within 60 days of the Record Date by exercising options granted under the Directors Stock Option Plan. Also includes 16,681 phantom shares held for the benefit of Mr. Fernandez in a deferred compensation account under the Directors Stock Plan. The phantom shares ultimately will be paid in shares of common stock at the end of the deferral period selected by Mr. Fernandez. |

| (9) | | Includes 4,375 shares that may be acquired within 60 days of the Record Date by exercising stock options granted under the Directors Stock Option Plan. |

| (10) | | Includes 441 shares held under the Retirement Savings Plan and 37,000 shares that may be acquired within 60 days of the Record Date by exercising stock options. |

| (11) | | Includes 14,000 shares that may be acquired within 60 days of the Record Date by exercising options granted under the Directors Stock Option Plan. Also includes 18,181 phantom shares held for the benefit of Mr. Luiso in a deferred compensation account under the Directors Stock Plan. The phantom shares ultimately will be paid in shares of common stock at the end of the deferral period selected by Mr. Luiso. Also includes 150 shares held for the benefit of a member of Mr. Luiso’s immediate family. |

| (12) | | Includes 567 shares held under the Retirement Savings Plan and 199,750 shares that may be acquired within 60 days of the Record Date by exercising stock options. |

| (13) | | Includes 446 shares held under the Retirement Savings Plan and 620,500 shares that may be acquired within 60 days of the Record Date by exercising stock options. |

| (14) | | Represents phantom shares held for the benefit of Mr. Ryan in a deferred compensation account under the Directors Stock Plan. The phantom shares ultimately will be paid in shares of common stock at the end of the deferral period selected by Mr. Ryan. |

| (15) | | Includes 1,885 shares held under the Retirement Savings Plan and 188,000 shares that may be acquired within 60 days of the Record Date by exercising stock options. |

| (16) | | Includes 7,470 phantom shares held for the benefit of Mr. Willes in a deferred compensation account under the Directors Stock Plan. The phantom shares ultimately will be paid in shares of common stock at the end of the deferral period selected by Mr. Willes. |

| (17) | | Includes 19,687 shares held for the account of the executive officers under the Retirement Savings Plan and 3,694,508 shares that executive officers and directors have the right to acquire within 60 days of the Record Date by exercising stock options. Also includes 70,668 phantom shares held in deferred compensation accounts for the benefit of non-management directors under the Directors Stock Plan. The phantom shares ultimately will be paid in shares of common stock at the end of the deferral periods selected by participating directors. |

The information provided in the table above is based on information received from the directors and executive officers. The inclusion of shares in the table is not an admission of beneficial ownership by the director or executive officer next to whose name the shares appear. Unless otherwise indicated in a footnote, the director or executive officer had sole voting and investment power over the shares.

16

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSIONAND ANALYSIS

Introduction The Compensation Committee consists of four directors, each of whom is independent within the meaning of the current rules of the NYSE and Black & Decker’s Corporate Policies and Procedures Statement. Under its charter, the purpose of the Compensation Committee is to assist the Board in matters relating to executive compensation, establish goals for the award of incentive and performance-based compensation, administer Black & Decker’s equity plans, and monitor the performance of the executive officers. Its functions include the following:

| | • | | Annually, review and approve goals and objectives relevant to compensation of the chief executive officer, evaluate the chief executive officer’s performance in light of those goals and objectives, and recommend to the independent members of the Board the chief executive officer’s compensation level based on that evaluation. |

| | • | | Review the objectives and performance of the executive officers. |

| | • | | Review and recommend to the Board salaries and benefits for the executive officers in addition to the chief executive officer. |

| | • | | Review and make recommendations to the Board with respect to incentive compensation plans and equity-based compensation plans. |

| | • | | Administer all short-term and long-term incentive compensation plans and all equity-based plans. |

| | • | | Monitor compliance with Black & Decker’s policy regarding stock ownership by executives. |

| | • | | Retain the compensation consulting firm on the Compensation Committee’s sole authority. |

To obtain access to independent compensation data, analysis and advice, the Compensation Committee retains the services of a compensation consultant who is hired by, and reports to, the Compensation Committee. The consultant is Watson Wyatt Worldwide, which attends Compensation Committee meetings as needed. Examples of projects assigned to the consultant include evaluation of the composition of the peer group of companies, evaluation of levels of executive compensation as compared to general market compensation data and the peer companies’ compensation data, and evaluation of proposed compensation programs or changes to existing programs.

Each Compensation Committee meeting usually includes an executive session without members of management present. The Compensation Committee met five times in 2006, and each meeting included an executive session. Watson Wyatt attended one meeting. The Compensation Committee believes that input from both management and the consultant provide useful information and points of view to assist the Compensation Committee to determine its own views on compensation. Although the Compensation Committee receives information and recommendations regarding the design of the compensation program and level of compensation for the executive officers from both the consultant and management, the Compensation Committee makes the final decisions as to the design and compensation levels for these executives.

Philosophy and Objectives The Compensation Committee oversees an executive compensation program designed to reflect Black & Decker’s pay-for-performance philosophy and to focus all executives on Black & Decker’s annual and long-term financial performance and long-term stock price performance. The

17

Compensation Committee has established the following objectives for Black & Decker’s executive compensation program:

| | • | | to attract, retain, and motivate top quality executives with the qualifications necessary to drive the long-term financial success of Black & Decker; |

| | • | | to reward the performance of key executives, employees with critical talent, and employees recognized as high potential executives; |

| | • | | to encourage the achievement of key strategic, operational, and financial goals; |

| | • | | to link the majority of the total compensation opportunity to company, business unit, and individual performance; |

| | • | | to align the interests of executive officers with the interests of Black & Decker’s stockholders; and |

| | • | | to give the Compensation Committee the flexibility to respond to the continually changing multinational environment in which Black & Decker operates. |

The key elements of direct compensation for the executive officers are base salary, cash awards under an annual incentive plan, and long-term incentive awards. Long-term awards consist of performance shares, restricted stock, and stock options. Executive officers also are eligible for other elements of indirect compensation, including certain perquisites and retirement benefits. The Compensation Committee considers all elements of compensation when evaluating program design.

Based on the objectives described above, Black & Decker generally strives to set a compensation opportunity for executives based on a target level of performance at the competitive median of compensation paid to similarly situated executives at comparable companies. Actual compensation may be above or below the median based on the actual performance of Black & Decker and the individual, with the opportunity to achieve upper quartile compensation based on superior performance. This approach is intended to ensure that a significant portion of executive compensation is based on Black & Decker’s financial and strategic performance. In making its decisions on an individual’s compensation, the Compensation Committee considers the nature and scope of all elements of an executive’s total compensation package, the executive’s responsibilities, and his or her effectiveness in supporting Black & Decker’s key strategic, operational, and financial goals. The Compensation Committee also considers recommendations from the chairman and chief executive officer regarding total compensation for those executive officers reporting directly to him.

The Compensation Committee strives to align the relative proportion of each element in the compensation opportunity with the competitive market and Black & Decker’s objectives. Generally, as employees move to higher levels of responsibility with greater ability to influence Black & Decker’s results, the percentage of performance-based pay will increase. The Compensation Committee’s goal is to strike the appropriate balance between annual and long-term incentives, and it may adjust the allocation of pay to best support Black & Decker’s objectives.

Black & Decker’s businesses compete within many market segments and none of its competitors operate in all of these segments. Black & Decker also competes with a broad group of companies for talent. Black & Decker, therefore, compares itself to competitive market data from a broad group of companies that fall within a reasonable range (both above and below Black & Decker) of comparison factors such as

18

revenue, market capitalization, and net income. This competitive market data provides a frame of reference for the Compensation Committee when evaluating executive compensation. Some variation may take place from year to year in the composition of this group of companies as the Compensation Committee evaluates the appropriateness of the companies comprising that group.

The Compensation Committee believes that the understanding by executives of the philosophy and objectives described above and the total compensation opportunity is an essential aspect of the compensation program. The Compensation Committee supports initiatives that educate the executives about the total compensation program and reinforce how the program supports Black & Decker’s pay-for-performance philosophy.

Pay-for-Performance Analysis In 2006, the Compensation Committee retained Watson Wyatt to conduct a pay-for-performance analysis of Black & Decker’s executive compensation program to provide a perspective on the alignment of pay and performance versus a peer group. The peer group contained the same companies identified below in the discussion about the compensation of the chief executive officer other than York International, which was acquired by another company during 2006. This historical analysis included a comparison of Black & Decker relative to the peer group with respect to realizable compensation for the named executive officers (other than Mr. McBride, who was not included in the analysis because he was not a named executive officer in 2005) and a number of financial metrics, including earnings per share growth, free cash flow growth, return on invested capital, revenue growth, and total shareholder return, during fiscal years 2003-2005. In its analysis, Watson Wyatt defined realizable compensation as the sum of the cash paid to the executives, current value of the in-the-money stock options and restricted stock, and the value of the payouts under the Performance Equity Plan during the relevant period. The analysis demonstrated that pay and performance are appropriately aligned for the chief executive officer and the other named executive officers included in the analysis because the realizable compensation paid to those executives is correlated with Black & Decker’s financial performance and total shareholder return during the relevant period.

Compensation of Chief Executive Officer In connection with the review of the chief executive officer’s annual salary in October 2005, the Compensation Committee asked Watson Wyatt, its independent compensation consultant, to perform a comprehensive, competitive analysis of the total direct compensation program of Black & Decker’s chief executive officer. The study compared the value of Mr. Archibald’s total direct compensation and retirement benefits to the corresponding opportunities extended to chief executive officers within a peer group of companies. Watson Wyatt developed this list of companies independent from prior peer groups used by Black & Decker to ensure a fresh look at companies in the manufacturing industry and incorporated suggestions from Black & Decker’s management and the Chairman of the Compensation Committee. The final list of companies, which was approved by the Chairman of the Compensation Committee, included the following:

| | | | |

| American Standard Companies | | Illinois Tool Works Inc. | | Parker-Hannifan |

| Danaher Corporation | | Ingersoll-Rand Co. | | Snap-On Inc. |

| Dover Corporation | | ITT Industries | | SPX Corp |

| Eaton Corporation | | Lennox International | | Stanley Works |

| Fortune Brands Inc. | | Masco Corp. | | Textron Inc. |

| Grainger Inc. | | Newell-Rubbermaid | | Timken Co. |

| | | | York International |

19

The report from Watson Wyatt indicated that Mr. Archibald’s total target cash compensation (base salary and annual incentive bonus) was between the 50th and 75th percentile of the market data, while his total target direct opportunity compensation (base salary, annual incentive bonus and stock awards) was slightly above the 75th percentile of the competitive market data. The report noted the current pay package for Mr. Archibald is appropriately designed and executed, effectively balances pay and performance, and provides adequate retention value. Additionally, the report noted that the one- and three-year financial performance of Black & Decker relative to the peer group and the S&P 500 was outstanding for several key metrics, including total shareholder return, earnings per share growth, sales growth, and cash flow growth. Based on this report, the Compensation Committee concluded that Mr. Archibald’s target cash compensation was appropriate and made no changes in his base salary.

Finally, the report noted that Black and Decker’s stock retention and ownership guidelines require the chief executive officer to own five times (in fair market value) his base salary in shares directly owned by the officer and his immediate family. Mr. Archibald’s goal under this program is $7.5 million, which is five times his base salary of $1.5 million. At the time of the consultant’s report, Mr. Archibald directly owned over $24.6 million in Black & Decker shares, which is over 300% of his goal, thus indicating to the Compensation Committee that Mr. Archibald has a strong alignment with Black & Decker’s stockholders.

Annual Salary The Compensation Committee establishes base salaries that are sufficient to attract and retain individuals with the qualities it believes are necessary for the long-term financial success of Black & Decker and that are competitive in the marketplace. The Compensation Committee recommends any increases in an executive officer’s base salary to the independent members of the Board of Directors. The Board of Directors did not modify or reject any of the recommendations of the Compensation Committee in 2006.

An executive officer’s base salary generally reflects the officer’s responsibilities, tenure, job performance, special circumstances such as overseas assignments, and direct competition for the officer’s services. Except for the chief executive officer’s salary, which is reviewed at 18-month intervals, the Compensation Committee reviews executive officer base salaries at 14-month intervals. In addition to these periodic reviews, the Compensation Committee may at any time review the salary of an executive who has received a significant promotion, whose responsibilities have been increased significantly, or who is a retention risk.

When an executive’s base salary is being reviewed by the Compensation Committee, management gathers competitive market data from reputable published surveys for use by the Compensation Committee and submits a report to the Compensation Committee that contains the 25th percentile, the median, and the 75th percentile of base salary of a broad group of companies. The report also provides the executive’s total compensation, equity holdings and merit history and includes a recommendation from the chief executive officer regarding an appropriate amount of base salary for the named executive officers (other than the chief executive officer). After reviewing this report, the Compensation Committee evaluates the executive’s performance and considers Black & Decker’s needs to arrive at individual compensation decisions.

Mr. Archibald’s base salary was $1,500,000 in 2006, unchanged since 2004. The Board of Directors increased Mr. Mangan’s salary by $50,000 in 2006 because of his expanded role in the management of the Fastening and Assembly Systems segment along with his duties as Black & Decker’s chief financial officer.

20

During 2006, the other named executive officers received salary increases ranging from 3.1% annualized to 6.4% annualized based on the Compensation Committee’s periodic reviews of those salaries as described above.

Annual Incentive Awards The Compensation Committee believes that the compensation program should focus the named executive officers and other key executives on the annual financial performance of Black & Decker and should reward individual performance. Under the annual incentive plans, the amount of the incentive award depends on Black & Decker’s performance against performance goals established by the Compensation Committee at the beginning of the year.

In February 2006, the Compensation Committee established threshold, target, and maximum performance goals based on the earnings per share to be achieved by Black & Decker during 2006 and, for the officers with business unit responsibility, operating income of the applicable business unit adjusted for working capital utilization measured against budget. The Compensation Committee believes that earnings per share is the appropriate measure for the performance goal to align the interests of management with the interests of Black & Decker’s stockholders because stock price appreciation is generally based on expected earnings per share growth. The Compensation Committee also established individual incentive targets equal to a percentage of base salary for each executive officer in February 2006, with the targets ranging from 50% to 100% of base salary for the named executive officers, under the annual incentive plans. The individual targets are based on the review of short term incentive targets from a broad group of companies published in independent executive compensation surveys.

If the Compensation Committee determines that an executive officer is eligible for payment under the applicable annual incentive plan because a performance goal has been achieved, the exact amount is determined by multiplying the individual incentive target by a payout factor. For the executive officers who were members of the corporate staff, the payout factor was entirely dependent upon actual earnings per share measured against target earnings per share. For the executive officers with operating responsibility for a business unit, 25% (or 75% in the case of Mr. Mangan) of the payout factor was determined by comparing actual earnings per share against the earnings per share targets established by the Compensation Committee, and 75% (or 25% in the case of Mr. Mangan) was determined by comparing business unit operating income adjusted for working capital utilization to business unit performance in that area measured against the approved 2006 budget. The payout factors established under the annual incentive plans are:

| | • | | 70% if the threshold goal was achieved, |

| | • | | 100% if the target goal was achieved, and |

| | • | | 150% (or 200% in the case of the chief executive officer) if the maximum goal was achieved. |

The payout factors are prorated when the actual performance of Black & Decker or a business unit exceeds a lower performance goal but not the next higher performance goal.

The Compensation Committee established an earnings per share target of $6.73 as the threshold performance goal, $7.20 as the target performance goal, and $7.40 as the maximum performance goal for the 2006 performance period. As mentioned above, a portion of the payout factor for those executive officers with operating responsibility for a business unit was based on the achievement against the 2006 budget for operating income, as adjusted for working capital utilization, with the budget serving as the

21

target performance goal. Black & Decker undertook a rigorous process to develop the budget, which was reviewed and approved by the Board in February 2006. Each business unit is required to develop a budget that is probable, but not certain, of achievement.

In February 2007, the Compensation Committee determined that Black & Decker had not achieved the threshold performance goal based on the actual earnings per share realized during 2006 of $6.55 and the Industrial Products Group of the Power Tools and Accessories segment had not achieved the threshold performance goal applicable to it. Consistent with Black & Decker’s pay-for-performance philosophy, Messrs. Archibald, Fenton, Schiech, and McBride did not receive a payout under the annual incentive plan. The Compensation Committee determined that the Fastening and Assembly Systems segment and the Consumer Products Group of the Power Tools and Accessories segment had achieved the threshold performance goal based on the operating income of each of those units, resulting in payments to Messrs. Mangan and Koos.

In addition to awards under the annual incentive plans based on the achievement of pre-established objectives and to give the Compensation Committee additional flexibility, the Compensation Committee may approve additional bonuses outside of the plan following an evaluation of an executive officer’s performance and success in areas deemed by the Compensation Committee to be significant to Black & Decker as a whole or to a particular business unit. The Compensation Committee did not award any additional bonuses outside of the plan to the named executive officers.

Long-Term Incentive Awards Under the Performance Equity Plan (“PEP”), the Compensation Committee makes awards of performance shares payable in Black & Decker common stock based on Black & Decker’s performance against established performance goals. The performance targets for threshold, target, and maximum awards are established by the Compensation Committee at the beginning of a two-year performance period.

The number of performance shares granted to an executive officer generally is determined by a percentage of the officer’s base salary, with the dollar value of the shares underlying a grant ranging from 50% to 70% of base salary. For those executive officers who are in a position to have the greatest effect on Black & Decker’s long-term performance, the percentages of base salary increase as the level of responsibility of the executive officer increases to maximize the incentive aspects of the PEP. Threshold, target, and maximum awards are equal to 50%, 100% and 150%, respectively, of the performance shares granted under the PEP.

In February, the Compensation Committee establishes the performance goals for the two-year performance period that began the preceding January 1. For corporate officers, these performance goals are based on the earnings per share achieved by Black & Decker during the second year of the performance period. The use of earnings per share as the basis for the performance targets and awards of common stock under the PEP aligns the interests of management with the interests of Black & Decker’s stockholders. For executives with operating responsibility of business units, 50% (or 75% in the case of Mr. Mangan for the 2006-2007 performance period) of the award is based on the achievement of the earnings per share targets indicated above, and 50% (or 25% in the case or Mr. Mangan for the 2006-2007 performance period) of the award is based on the earnings contribution, as adjusted for asset utilization, of the applicable business unit during the performance period against a management forecast. This management forecast serves as the target performance goal under the PEP. When developing the annual budget, each business

22

unit is required also to develop a forecast for the succeeding year that is probable, but not certain, of achievement. Under the terms of the PEP, the Compensation Committee may adjust the performance goals upward or downward to reflect unusual, non-recurring or extraordinary events, changes in Black & Decker’s methods of accounting, changes in applicable tax laws or regulations, or any other factors the Compensation Committee may determine to the extent the adjustment would not disqualify the awards for the performance-based compensation exclusion under Section 162(m) of the Internal Revenue Code.

In February 2005, the Compensation Committee established performance goals based on earnings per share for the two-year performance period that ended December 31, 2006. These performance goals, as adjusted to reflect Black & Decker’s adoption of FAS 123(R), required the achievement of earnings per share during 2006 of $5.55 for minimum payout, $6.15 for target payout, and $6.55 for maximum payout. The performance goals for each of the business units were based on a forecast of the business unit’s earnings contribution, as adjusted for asset utilization, developed in connection with the 2005 budget that management believed was probable, but not certain, of achievement. During 2006, Black & Decker achieved earnings per share of $6.55, which was the maximum target performance goal for this performance period. Under the terms of the PEP, Messrs. Archibald, Mangan, Fenton, and McBride received the number of shares of Black & Decker common stock equal to 150% of the performance shares initially granted to each of them for this performance period. Mr. Schiech and Mr. Koos received the number of shares of Black & Decker common stock equal to 75% of the performance shares initially granted to each of them for this performance period, which reflects a maximum award based on Black & Decker’s earnings per share during 2006 and no award based on the performance of the applicable business unit.

In February 2006, the Compensation Committee established the following performance goals based on earnings per share for the 2006-2007 performance period: the achievement of earnings per share during 2007 of $7.20 for minimum payout, $7.70 for target payout, and $8.14 for maximum payout. The performance goals for each of the business units were based on a forecast of the business unit’s earnings contribution, as adjusted for asset utilization, developed in connection with the 2006 budget that management believed was probable, but not certain, of achievement.

The performance targets are not an indication of how Black & Decker will perform in 2007.The sole purpose of these targets, which were established in February 2006, is to establish internal performance-based goals under a long-term incentive compensation plan. Consistent with Black & Decker’s pay-for-performance compensation philosophy, the Compensation Committee establishes these goals to align executive compensation with Black & Decker’s performance and to encourage the achievement of Black & Decker’s goals. As disclosed in its January 30, 2007 press release, Black & Decker expects earnings per share in the range of $6.25 to $6.55 for the 2007 fiscal year. If Black & Decker’s 2007 performance is consistent with this guidance, awards will not be made under the PEP for the 2006-2007 performance period based on Black & Decker’s 2007 earnings per share. Black & Decker is not providing any guidance, nor updating any prior guidance, of its future performance with the disclosure of these performance targets, and you are cautioned not to place any reliance on these performance targets as an indication of Black & Decker’s future performance.

The Compensation Committee awards restricted stock and stock options for the purpose of retaining current executives, aligning their interests with the interests of Black & Decker’s stockholders, and

23

rewarding the performance of Black & Decker and the individual. Under Black & Decker’s grant guidelines, the number of shares underlying a stock option award and the number of restricted shares granted to an executive are based on:

| | • | | the market value of the shares covered by each award as a percentage of the executive’s base salary, |

| | • | | the market value of the shares covered by the prior year’s stock option and restricted stock award, |

| | • | | a subjective evaluation of the executive’s individual performance, and |

| | • | | any change in the executive’s duties or responsibilities. |

The percentage of annual salary applicable to each executive is based on the review of market competitive data. The amounts recommended by the grant guidelines, however, may be increased or decreased by the Compensation Committee after an evaluation of Black & Decker’s performance and an evaluation of the individual’s performance, his or her potential to impact Black & Decker’s future results, and any retention considerations.

Awards of restricted stock and stock options were made in April 2006. In determining the amount of the restricted stock and stock option grants to the named executive officers (other than the stock option grant to Mr. Archibald, which was in accordance with Black & Decker’s grant guidelines), the Compensation Committee increased the amounts suggested by Black & Decker’s grant guidelines after consideration of the factors discussed in the last sentence of the preceding paragraph. The Compensation Committee noted the following with respect to Black & Decker’s performance:

| | • | | record sales, earnings per share, and free cash flow during 2005, |

| | • | | sales up 21% to a record $6.5 billion during 2005, |

| | • | | earnings per share up more than 23% per year in each of 2002, 2003, 2004, and 2005, |

| | • | | dividend up 33% during 2005, and |

| | • | | 8% of outstanding shares repurchased during 2005. |

Black & Decker does not time, and has never timed, the grant of stock options in coordination with the release of material non-public information and has never back-dated any awards of stock options. Although management may recommend the amount of stock options granted to employees, the Compensation Committee approves the grant of all stock options and does not delegate the timing of stock option grants. Black & Decker has retained a third party service provider to administer the day-to-day activities of the stock option plans and the restricted stock plan, but the provider does not determine the recipient of stock options, the amount of stock options granted to a participant, or the exercise price of stock options.

Perquisites and Retirement Benefits As described in more detail below, Black & Decker provides the named executive officers with specific perquisites and retirement benefits. Black and Decker believes these perquisites and retirement benefits are market competitive elements of an executive’s compensation package and are important to attract and retain top quality executives.

24

As described under the caption Pension Benefits beginning on page 34 of this Proxy Statement, Mr. Archibald is entitled to certain retirement benefits under defined benefit plans maintained by Black & Decker, including the Supplemental Executive Retirement Plan. The Compensation Committee believes that the amount of Mr. Archibald’s retirement benefit reflects his performance as Black & Decker’s chief executive officer over a period of 20 years. In its report to the Compensation Committee in October 2005, Watson Wyatt compared Mr. Archibald’s retirement benefit with the pension retirement benefits of the chief executive officers of the 19 companies comprising the peer group. The chief executive officers at 17 of the peer companies had defined pension benefits similar to Mr. Archibald’s. Based on this report, the Compensation Committee believes Mr. Archibald’s retirement benefits are reasonable and competitive.

Severance Benefits Black & Decker has entered into agreements and maintains plans that will require Black & Decker to provide severance benefits to the named executive officers in the event of a termination of employment or change in control of Black & Decker. These agreements are described in more detail below.

The Board believes that these severance benefits encourage the commitment and availability of key management employees and ensure that they will be able to devote their full attention and energy to the affairs of Black & Decker in the face of potentially disruptive and distracting circumstances in the event of an attempted or actual change in control or an unsolicited takeover. In any such event, key management employees will be able to analyze and evaluate proposals objectively with a view to the best interests of Black & Decker and its stockholders and to act as the Board may direct without fear of retribution if the change in control occurs. The severance benefits, however, may have the incidental effect of discouraging takeovers and protecting the employees from removal, because the benefits increase the cost that would be incurred by a company seeking to acquire Black & Decker.

The officers are entitled to certain benefits, including a cash severance payment, in the event of a change in control of Black & Decker and the subsequent termination of the officer in certain circumstances. Upon the occurrence of a change in control of Black & Decker, these arrangements also provide that:

| | • | | each officer will fully vest in all outstanding stock options, |

| | • | | all shares of restricted stock previously awarded to each officer will become fully vested and no longer subject to forfeiture, |

| | • | | each officer will receive the maximum number of performance shares held by that officer under the PEP, and |

| | • | | each officer will be entitled to the maximum benefit without risk of forfeiture under the Supplemental Executive Retirement Plan regardless of years of credited service or age. |

Black & Decker believes that these provisions offer the appropriate protection of the equity awards and retirement benefits upon a change in control, particularly where the stockholders of Black & Decker are receiving cash for their shares. According to market data obtained from reputable published surveys, a majority of large companies also accelerate the vesting of equity awards solely upon a change in control.