UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21359

MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund

(Exact name of registrant as specified in charter)

2455 Corporate West Drive, Lisle, IL 60532

(Address of principal executive offices) (Zip code)

Nicholas Dalmaso

2455 Corporate West Drive, Lisle, IL 60532

(Name and address of agent for service)

Registrant’s telephone number, including area code: (630) 505-3700

Date of fiscal year end: July 31

Date of reporting period: January 31, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

| Item 1. | Reports to Stockholders. |

The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended, is as follows:

www.mbiaclaymore.com

... your stream to the LATEST,

most up-to-date INFORMATION about the

MBIA Capital/Claymore Managed Duration

Investment Grade Municipal Fund

The shareholder report you are reading right now is just the beginning of the story. Online at www.mbiaclaymore.com, you will find:

| • | Daily, weekly and monthly data on share prices, distributions and more |

| • | Portfolio overviews and performance analyses |

| • | Announcements, press releases, special notices and tax characteristics |

MBIA Capital Management and Claymore are continually updating and expanding shareholder information services on the Fund’s website, in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more way we are working to keep you better informed about your investment in the Fund.

2 | Semiannual Report | January 31, 2007

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund

Dear Shareholder |

We thank you for your investment in MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund (the “Fund”). This report covers performance for the six months ended January 31, 2007.

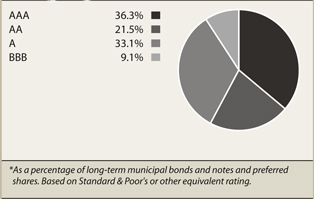

As you may know, the Fund’s investment objective is to provide its common shareholders with high current income exempt from regular Federal income tax while seeking to protect the value of the Fund’s assets during periods of interest rate volatility. The Fund seeks to achieve these objectives by investing at least 80% of its assets in municipal bonds of investment-grade quality and normally investing substantially all of its assets in securities of investment-grade quality.

The Fund’s Investment Adviser, MBIA Capital Management Corp. (“MBIA”), is owned by MBIA Asset Management Group, which manages fixed-income products with a total value of approximately $63 billion dollars as of January 31, 2007. Its parent company, MBIA Inc., is listed on the New York Stock Exchange and is a component stock of the S&P 500 Index. Claymore Securities, Inc. serves as the Fund’s Servicing Agent. Claymore entities provide supervision, management, servicing or distribution on more than $16 billion in assets, through closed-end funds, unit investment trusts, exchange-traded funds, mutual funds and separately managed accounts as of January 31, 2007.

As growth in the U.S. economy began to slow during 2006, the Federal Reserve Board (the “Fed”) moved to a neutral monetary policy, following a series of increases in short-term interest rates designed to slow economic growth and keep inflation low. As investors looked for income-producing securities in an environment of low interest rates, municipal bonds attracted non-traditional municipal investors such as foreign investors and hedge fund managers. The best performing municipal bonds were high-yielding lower quality issues and bonds with the longest maturities. This market environment presented challenges for the Fund, which invests primarily in investment-grade securities with varying maturities. That said, we’re pleased to report that the Fund’s NAV return exceeded the 3.06% return of the Lehman Brothers Municipal Bond Index for the six-month period ended January 31, 2007.

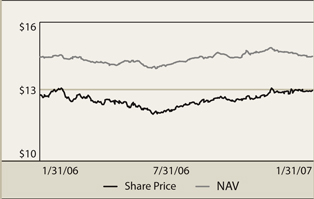

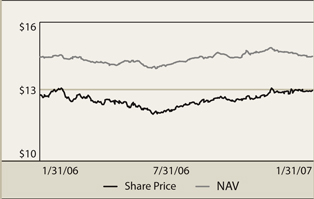

For the six months ended January 31, 2007, the Fund produced a total return of 3.90% at net asset value (“NAV”). This represents a change in NAV to $14.52 on January 31, 2007, up from $14.25 on July 31, 2006, plus the reinvestment of monthly dividends. Beginning with the dividend payable in January 2007, the Fund was able to raise its monthly dividend to $0.0495 per share, from $0.047.

During the six-month period, the Fund generated a total return of 8.93% on a market value basis. This represents a change in the Fund’s market price to $13.04 on January 31, 2007, from $12.29 on July 31, 2006, plus the reinvestment of monthly dividends. As of January 31, 2007, the Fund was trading at a 10.19% discount to NAV versus 13.75% at the beginning of the six month period. The Fund’s current market price discount to NAV represents, in our opinion, a compelling opportunity for investors as common shares of the Fund are available in the market at prices below the value of the securities in the underlying portfolio.

Semiannual Report | January 31, 2007 | 3

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund | Dear Shareholder continued

Shareholders have the opportunity to reinvest their dividends from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 21 of this report. If shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at NAV, subject to an IRS limitation that the purchase price cannot be more than 5% below the market price per share. The DRIP provides a cost effective means to accumulate additional shares and to enjoy the benefits of compounding returns over time.

To learn more about the Fund’s performance, we encourage you to read the Questions & Answers section of the report, which begins on page 5. You will find information about how the Fund is managed, what impacted the performance of the Fund during the six months ended January 31, 2007, and MBIA’s views on the market environment.

We appreciate your investment, and we look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at www.mbiaclaymore.com.

Sincerely,

Clifford D. Corso

MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund

4 | Semiannual Report | January 31, 2007

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund

Questions & Answers |

Clifford D. Corso – Portfolio Manager

Mr. Corso is President of MBIA Capital Management Corp., which is owned by MBIA Asset Management Group. Mr. Corso joined the firm in 1994 and developed its fixed-income asset management platform. He now directs the investment of more than $60 billion in fixed-income assets. Throughout his 20-year career, he has managed a wide array of fixed-income products, including corporate, asset-backed, government, mortgage and derivative products. Mr. Corso holds an MBA degree from Columbia University.

E. Gerard Berrigan – Portfolio Manager

Mr. Berrigan is a Managing Director and head of portfolio management for MBIA Capital Management Corp. He joined the firm in 1994 and is a member of the Investment Strategy Committee, the Investment Review Committee and the Market Risk Committee. Mr. Berrigan has more than 15 years of experience in securities trading and portfolio management. He holds an MBA degree from Columbia University.

In the following interview Portfolio Managers Clifford D. Corso and E. Gerard Berrigan discuss the market environment and the performance of the MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund (the “Fund”) for the six-month period ended January 31, 2007.

Will you please provide an overview of the municipal market during the six-month period ended January 31, 2007?

The economy continued to expand in the last half of 2006, but at a pace somewhat below its long-term trend, in large part because of weakness in the housing market. The Federal Reserve (the “Fed”) demonstrated concern about a slowing economy by moving from a tightening to a neutral policy. After raising its target for the Federal Funds rate 17 times between June 2004 and June 2006, for a total of 425 basis points (4.25 percentage points), the Fed left rates unchanged in the last half of 2006 and in January 2007. Long-term interest rates had remained low throughout the period of rising short-term rates, and long-term rates fell over the last six months, as short-term rates remained steady.

The yield curve for municipal bonds was unusually flat, but it remained steeper than the yield curve for taxable bonds. (The yield curve is a line that traces relative yields on a type of security over a spectrum of maturities ranging from three months to 30 years.) Ordinarily, the yield curve slopes upward, which means that investors willing to invest in longer maturity securities are generally rewarded with higher yields. The difference between tax-exempt yields and taxable yields continued to narrow, as prices of municipal bonds were bid up by property and casualty insurers and non-traditional municipal investors such as hedge fund managers. In the past, most investors in municipal bonds were individuals who could benefit from the bonds’ tax advantages. As more institutional investors have entered the municipal market, new types of bonds and derivatives have been created to respond to the demands of these sophisticated investors who are drawn by the bonds’ attractive yields.

In the current market environment of low yields and relatively flat yield curves, longer-term municipal bonds, non-investment grade bonds, and lower quality investment grade bonds delivered the strongest performance as investors searched for favorable income levels.

How did the Fund perform in this market environment?

For the six-month period ending January 31, 2007, the MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund (the “Fund”) produced a total return of 3.90% at net asset value (“NAV”), including the reinvestment of the Fund’s monthly dividends, and generated a return of 8.93% based on market price, including the reinvestment of monthly dividends. This return is consistent with the Fund’s investment objective, which is to provide its common shareholders with high current income exempt from regular Federal income tax while seeking to protect the value of the Fund’s assets during periods of interest rate volatility. The Fund seeks to achieve these objectives by investing at least 80% of its assets in municipal bonds of investment grade quality and will normally invest substantially all of its assets in securities of investment grade quality.

This market backdrop, with lower-quality securities providing the highest returns, was challenging for the Fund’s performance because the Fund invests substantially all of its assets in high quality investment-grade bonds.

Which trends or investment decisions most helped the Fund’s performance and why?

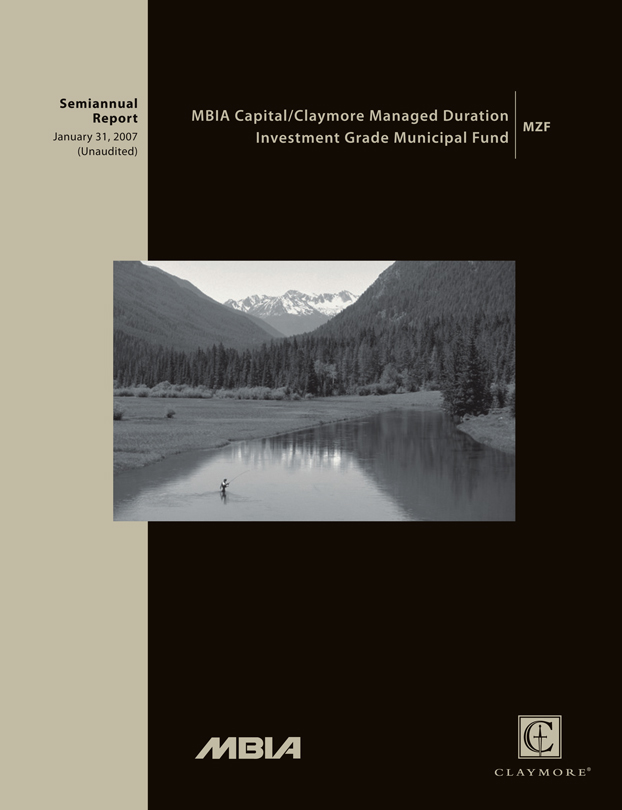

Since longer-duration bonds posted the best performance during the period, the Fund’s duration, which is somewhat longer than the Lehman Brothers Municipal Bond Index, was positive for net asset value performance relative to the index, which returned 3.06%. (Duration is a measure of the interest rate sensitivity of a fixed-income portfolio which incorporates time to maturity and coupon size. The longer the duration, the greater the interest rate risk.)

Semiannual Report | January 31, 2007 | 5

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund | Questions & Answers continued

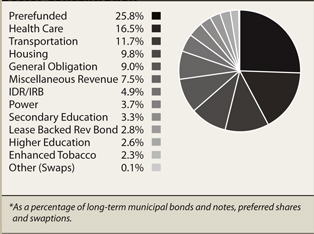

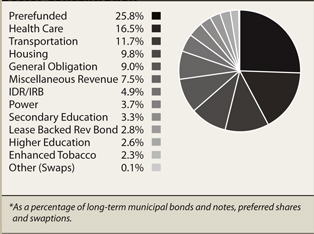

One of the Fund’s highest industry concentrations is in the healthcare sector, which represented approximately 17% of the portfolio at January 31, 2007. The health care sector performed well during the period due in part to the higher yields on health care issues relative to other bonds of similar credit quality.

Which areas of the Fund hurt performance during the period?

The Fund’s long-term hedging strategy cost performance over the last six months, as it has in prior periods. The hedging strategy is designed to contribute to performance in a period of rising long-term interest rates. Historically, long-term rates have risen during periods when the Fed has executed a fed funds rate tightening program, as it did from 2004 through June of 2006. The flattening yield curve over the past two years, with long-term rates generally lower while short-term rates were rising, is highly unusual, and this trend was detrimental to our hedging strategy. The ratio of yields on tax-exempt bonds relative to taxable bonds compressed, and volatility in the bond market decreased substantially; both of these trends were also detrimental to our hedging strategy.

We have maintained the hedge because we believe that long-term rates are likely to increase in the coming year. If that happens, the strategy could benefit the Fund by providing the potential for capital appreciation on the hedge.

Please tell us about the Fund’s distributions during the period.

In December 2006, for the dividend payable in January 2007, the Fund was able to raise its monthly dividend to $0.0495 per share from $0.047 in the previous seven months. Our cost of leverage in the last half of 2006 was lower than we had anticipated because the Fed did not raise its target for the federal funds rate after June. The Fund undertook a number of efforts, with its vendors, to reduce expenses. One example of this is that effective June 16, 2006, the Investment Adviser and Servicing Agent both agreed to voluntary fee waivers in addition to the contractual advisory and servicing fee waivers in place through September 1, 2008. The voluntary fee waivers may be discontinued at the discretion of the Investment Adviser or Servicing Agent. As of January 31, 2007, the Fund’s annualized expense ratio net of fee waivers and excluding interest expenses was brought down to 1.37% from 1.59% a year earlier. We are continuing to look for ways to further reduce the Fund’s expenses.

Now that the Fund has been on the market for several years, are you finding that some bonds you hold are maturing, creating challenges in finding replacement investments in a low interest rate environment?

Maturities of most of our holdings are still many years in the future. However, many of these bonds have call provisions, which allow the issuer to pay off the bonds many years in advance of maturity.

Approximately 26% of the Fund’s holdings are pre-refunded bonds, which means that the issuer has purchased U.S. Treasury or agency securities that provide a stream of cash flow to pay off the bonds on their first call date. Since we believe that interest rates will eventually rise, we view our pre-refunded position as a positive element of our defensive duration strategy.

Please tell us about the Fund’s portfolio and the opportunities in the market.

We did not make any significant changes, in large part because we consider the portfolio to be positioned appropriately. Since yields on municipal bonds were lower during this period than they were when the Fund was introduced in August 2003, it was challenging to make meaningful trades without reducing the Fund’s yield. We are comfortable with the Fund’s positioning on the yield curve and believe that this is the correct position in the context of our outlook and in meeting the objectives of the Fund.

Non-investment grade and some of the more credit sensitive sectors of the investment grade market have enjoyed strong performance relative to higher quality sectors of the market during the reporting period. However, we expect that as interest rates rise and market volatility increases, the market will begin to reevaluate risk. We believe that in this type of environment the market’s emphasis will shift to higher quality investments and these issues should enjoy strong relative performance. The high quality nature of our portfolio should perform well in that type of environment. Furthermore, the market’s revaluation of risk may present opportunities for the Fund and we will continue to look for opportunities to add yield to the portfolio at reasonable prices and with reasonable levels of risk.

Will you tell us about the duration of the Fund and how you manage it?

The Fund’s duration has changed only minimally over the last six months: the option-adjusted duration was 8.2 years at July 31, 2006, and 8.0 years as of January 31, 2007. Approximately 48% of

6 | Semiannual Report | January 31, 2007

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund | Questions & Answers continued

the portfolio is invested in bonds with maturities of 10 to 20 years. We are comfortable with the Fund’s fairly defensive duration stance, as we expect that long-term interest rates will begin to rise.

The Fund’s hedging strategy is designed to manage duration and attempt to reduce portfolio volatility as interest rates trend higher. Should we see a major shift in the interest-rate environment, we would adjust the Fund’s duration to reflect our revised outlook.

Would you explain the Fund’s leverage strategy?

The Fund, like many closed-end funds, utilizes leverage (borrowing) as part of its investment strategy. The purpose of leverage is to fund the purchase of additional securities that provide increased income and potentially greater appreciation to common shareholders than could be achieved from an un-leveraged portfolio. Of course, leverage results in greater NAV volatility and entails more up and down risk than an un-leveraged portfolio. (Volatility is a measure of the extent to which the price of a financial asset fluctuates.) The use of leverage also makes the Fund more vulnerable to rising interest rates.

Over the last six months, steady short-term interest rates meant that the Fund’s cost of leverage was less than we had anticipated. In a period of high returns on municipal bonds and low volatility, the leverage strategy added overall value. We will continue to employ a leverage strategy as long as there is a benefit to doing so.

What is your outlook for the municipal market in 2007?

Since interest rates are an important driver of performance for all bonds, Fed policy is a key question for performance. Some recent economic data indicates that the economy still has substantial life, more than five years into a period of expansion, and the Fed is vigilant in combating inflation. It therefore seems likely that interest rates might begin to rise in the last half of 2007. In particular, we believe that yields on long-term bonds will begin to rise, gradually producing a steeper and more traditional yield curve. Credit spreads in the municipal market are unusually tight right now. We expect to see wider spreads as investors begin returning to higher quality securities as interest rates rise and as negative credit events increase awareness of the risks of lower-quality bonds.

The relatively strong risk-adjusted returns that municipals offer relative to taxable investments have increased the presence of non-traditional investors, including foreign investors, in the municipal market. Structural changes in the municipal market have prompted the issuance of new types of municipal securities and derivative instruments.

New municipal issuance was at its third highest level ever in 2006, after a record year in 2005, and most estimates place issuance in 2007 near the 2006 level. With interest rates still near historic lows, and finances of most issuing authorities reasonably strong, another year of ample supply seems likely.

An unusually high level of demand, prompted by the search for yield, has made longer-maturity municipal bonds and lower-quality bonds expensive on a historical basis. Rising interest rates and greater concern about credit risk among investors should improve relative returns for the high-quality bonds in which this Fund invests.

MZF Risks And Other Considerations

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass.

There can be no assurance that the Fund will achieve its investment objective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. An investment in this Fund may not be suitable for investors who are, or as a result of this investment would become, subject to the federal alternative minimum tax because the securities in the Fund may pay interest that is subject to taxation under the federal alternative minimum tax. Special rules apply to corporate holders. Additionally, any capital gains dividends will be subject to capital gains taxes.

There can be no guarantee that hedging strategies will be employed or will be successful. The premium paid for entering into such hedging strategies will result in a reduction in the net asset value of the Funds and a subsequent reduction of income to the Fund. Any income generated from hedging transactions will not be exempt from income taxes.

Certain risks are associated with the leveraging of common stock. Both the net asset value and the market value of shares of common stock may be subject to higher volatility and a decline in value.

There are also specific risks associated with investing in municipal bonds. The secondary market for Municipal Bonds is less liquid than many other securities markets, which may adversely affect the Fund’s ability to sell its bonds at prices approximating those at which the Fund currently values them. The ability of municipal issuers to make timely payments of interest and principal may be diminished during general economic downturns. In addition, laws enacted in the future by Congress or state legislatures or referenda could extend the time for payment of principal and/or interest. In the event of bankruptcy of an issuer, the Fund could experience delays in collecting principal and interest.

There also risks associated with investing in Auction Market Preferred Shares or AMPS. The AMPS are redeemable, in whole or in part, at the option of the Fund on any dividend payment date for the AMPS, and will be subject to mandatory redemption in certain circumstances. The AMPS will not be listed on an exchange. You may only buy or sell AMPS through an order placed at an auction with or through a broker-dealer that has entered into an agreement with the auction agent and the Fund or in a secondary market maintained by certain broker-dealers. These broker-dealers are not required to maintain this market, and it may not provide you with liquidity.

Semiannual Report | January 31, 2007 | 7

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund

Fund Summary | As of January 31, 2007 (unaudited)

| | | | |

Fund Information | | | |

Symbol on New York Stock Exchange: | | | MZF | |

Initial Offering Date: | | | August 27, 2003 | |

Closing Market Price as of 01/31/07: | | $ | 13.04 | |

Net Asset Value as of 01/31/07: | | $ | 14.52 | |

Yield on Closing Market Price as of 01/31/07: | | | 4.56 | % |

Taxable Equivalent Yield on Closing Market Price as of 01/31/071: | | | 7.01 | % |

Current Monthly Distribution Per Common Share2: | | $ | 0.0495 | |

Leverage as of 01/31/073: | | | 38 | % |

1 | Taxable equivalent yield is calculated assuming a 35% federal income tax bracket. |

2 | Monthly distribution is subject to change. |

3 | As a percentage of total investments. |

Total Returns

| | | | | | |

(Inception 8/27/03) | | Market | | | NAV | |

Six months | | 8.93 | % | | 3.90 | % |

One Year | | 6.57 | % | | 4.41 | % |

Since Inception - average annual | | 1.11 | % | | 5.26 | % |

Sector Concentration*

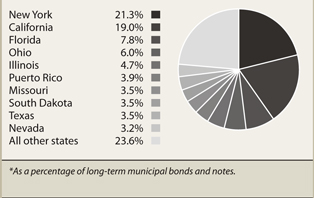

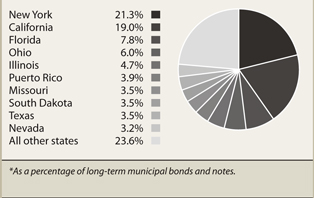

State/Territory Allocation*

Share Price & NAV Performance

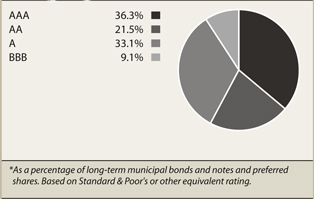

Credit Quality*

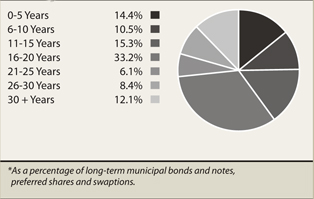

Maturity Breakdown*

8 | Semiannual Report | January 31, 2007

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund

Portfolio of Investments | January 31, 2007 (unaudited)

| | | | | | | | | | |

Rating

(S&P)* | | Principal

Amount (000) | | Description | | Optional Call Provisions** | | Value |

| | | | |

| | | | | Municipal Bonds & Notes – 158.3% | | | | | |

| | | | | Alabama – 4.7% | | | | | |

AA+ | | $ | 4,150 | | Alabama Special Care Fac Fin Auth, 6.13%, 11/15/39 (1) | | 11/15/16 @100 | | $ | 4,468,139 |

BBB | | | 845 | | Courtland, AL Ind Dev Brd Environ Imp Rev, AMT, Ser B, 6.25%, 08/01/25 | | 08/01/13 @ 100 | | | 925,427 |

| | | | | | | | | | |

| | | | | | | | | | 5,393,566 |

| | | | | | | | | | |

| | | | | Arizona – 4.5% | | | | | |

Aaa | | | 5,000 | | Phoenix, AZ Civic Impt Corp Excise Tax Rev, 5.00%, 07/01/41 (FGIC)(2) | | 07/01/15 @ 100 | | | 5,212,250 |

| | | | | | | | | | |

| | | | | California – 30.1% | | | | | |

A- | | | 4,000 | | California Dept of Water Res, Power Supply Rev, Ser A, 5.125%, 05/01/19 (Prerefunded @ 05/01/12)† | | 05/01/12 @ 101 | | | 4,307,920 |

A+ | | | 350 | | California Gen Oblig, 5.50%, 04/01/30 (Prerefunded @ 04/01/14)† | | 04/01/14 @ 100 | | | 387,415 |

A+ | | | 125 | | California Gen Oblig, 5.50%, 04/01/30 | | 04/01/14 @ 100 | | | 136,724 |

A+ | | | 2,025 | | California Gen Oblig, 5.50%, 04/01/30 (Prerefunded @ 04/01/14)† | | 04/01/14 @ 100 | | | 2,241,472 |

A | | | 5,000 | | California Public Works Brd Dept Mental Health Lease Rev, Ser A, 5.00%, 06/01/24 | | 06/01/14 @ 100 | | | 5,217,550 |

AA- | | | 3,500 | | California Statewide Cmntys Dev Auth Rev, Sutter Health, Ser A, 5.00%, 11/15/43 | | 11/15/15 @ 100 | | | 3,610,145 |

A+ | | | 6,000 | | California Various Purpose Gen Oblig, 5.125%, 11/01/24 | | 11/01/13 @ 100 | | | 6,340,440 |

A- | | | 2,500 | | Chula Vista, CA Ind Dev Rev, Ser B AMT, 5.50% 12/01/21 | | 06/02/14 @ 102 | | | 2,710,075 |

AAA | | | 2,750 | | Golden State Tobacco Settlement Rev, Ser B, 5.375%, 06/01/28 (Prerefunded @ 06/01/10)† | | 06/01/10 @ 100 | | | 2,883,843 |

AAA | | | 4,000 | | Port of Oakland, CA Rev, AMT, Ser L, 5.00%, 11/01/22 (FGIC) | | 11/01/12 @ 100 | | | 4,149,040 |

AAA | | | 2,500 | | San Diego, CA Unified School Dist, Ser D, 5.25%, 07/01/25 (Subject to cross over refunding @ 07/01/12) (FGIC)† | | 07/01/12 @ 101 | | | 2,695,350 |

| | | | | | | | | | |

| | | | | | | | | | 34,679,974 |

| | | | | | | | | | |

| | | | | Colorado – 4.1% | | | | | |

AA | | | 4,500 | | Colorado Health Facs Auth Rev, 5.25%, 09/01/21 (Prerefunded @ 09/01/11)† | | 09/01/11 @ 100 | | | 4,769,415 |

| | | | | | | | | | |

| | | | | District of Columbia – 1.8% | | | | | |

Aaa | | | 2,000 | | District of Columbia FHA Multi Henson Ridge-Rmkt, AMT, 5.10%, 06/01/37 (FHA) | | 06/01/15 @ 102 | | | 2,049,900 |

| | | | | | | | | | |

| | | | | Florida – 12.3% | | | | | |

A+ | | | 2,500 | | Highlands Co., FL Health Facs Auth Rev, Ser B, 5.25%, 11/15/23 (Prerefunded @ 11/15/12)† | | 11/15/12 @ 100 | | $ | 2,683,625 |

A+ | | | 3,000 | | Highlands Co., FL Health Facs Auth Rev, Ser D, 5.875%, 11/15/29 (Prerefunded @ 11/15/13)† | | 11/15/13 @ 100 | | | 3,359,190 |

AAA | | | 5,000 | | Miami-Dade Co., FL Aviation Rev, AMT, 5.00%, 10/01/38 (CIFG)(2) | | 10/01/15 @ 100 | | | 5,159,200 |

AA- | | | 2,750 | | South Broward Co., FL Hosp Dist Rev, 5.60%, 05/01/27 | | 05/01/12 @ 101 | | | 2,971,485 |

| | | | | | | | | | |

| | | | | | | | | | 14,173,500 |

| | | | | | | | | | |

| | | | | Illinois – 7.4% | | | | | |

AAA | | | 3,000 | | Chicago IL, O’Hare Intl Airport Rev, 6.13%, 01/01/33 (FGIC)(1) | | 01/01/16 @100 | | | 3,316,860 |

A2 | | | 3,000 | | Illinois Dev Fin Auth Hosp Rev, 5.65%, 11/15/24 (Prerefunded @ 11/15/09)† | | 11/15/09 @ 101 | | | 3,164,520 |

AA | | | 2,000 | | Illinois Hsg Dev Auth Homeowner Mtg, AMT, Ser A-2, 5.00%, 08/01/36 | | 02/01/16 @ 100 | | | 2,018,580 |

| | | | | | | | | | |

| | | | | | | | | | 8,499,960 |

| | | | | | | | | | |

| | | | | Louisiana – 0.9% | | | | | |

BBB | | | 1,000 | | De Soto Parish, LA Environ Imp Rev, AMT, Ser A, 5.85%, 11/01/27 | | 11/01/13 @ 100 | | | 1,052,120 |

| | | | | | | | | | |

| | | | | Massachusetts – 4.7% | | | | | |

AAA | | | 5,000 | | Massachusetts Special Oblig Dedicated Tax Rev, 5.25%, 01/01/26 (Prerefunded 01/01/14) (FGIC)† | | 01/01/14 @ 100 | | | 5,411,300 |

| | | | | | | | | | |

| | | | | Michigan – 1.8% | | | | | |

BBB+ | | | 2,000 | | Michigan Strategic Fund Ltd Oblig Rev Ref, Ser C, 5.45%, 09/01/29 | | 09/01/11 @ 100 | | | 2,106,360 |

| | | | | | | | | | |

| | | | | Missouri – 5.6% | | | | | |

AAA | | | 6,000 | | Missouri Health & Educ Facs Auth Rev, Ser A, 5.25%, 06/01/28 (Prerefunded @ 06/01/11) (AMBAC)† | | 06/01/11 @ 101 | | | 6,404,340 |

| | | | | | | | | | |

| | | | | Nevada – 5.0% | | | | | |

A | | | 5,410 | | Henderson, NV Health Care Fac Rev, Ser A, 5.625%, 07/01/24 | | 07/01/14 @ 100 | | | 5,821,214 |

| | | | | | | | | | |

| | | | | New York – 33.7% | | | | | |

A- | | | 4,600 | | Long Island, NY Power Auth Rev, Ser A, 5.10%, 09/01/29 | | 09/01/14 @ 100 | | | 4,832,530 |

AA- | | | 4,000 | | Metropolitan Trans Auth Rev, Ser A, 5.125%, 01/01/24 | | 07/01/12 @ 100 | | | 4,179,080 |

A+ | | | 1,500 | | New York Dorm Auth Lease Rev, Ser A, 5.375%, 05/15/22 (Prerefunded 05/15/13)† | | 05/15/13 @ 100 | | | 1,630,755 |

A+ | | | 2,500 | | New York Dorm Auth Lease Rev, Ser A, 5.375%, 05/15/23 (Prerefunded 05/15/13)† | | 05/15/13 @ 100 | | | 2,717,925 |

A3 | | | 1,500 | | New York Dorm Auth Rev, North Shore Long Island Jewish Group, 5.375%, 05/01/23 | | 05/01/13 @ 100 | | | 1,587,315 |

AA- | | | 5,000 | | New York, NY Gen Oblig, Ser J, 5.00%, 05/15/23 | | 05/15/14 @ 100 | | | 5,225,950 |

See notes to financial statements.

Semiannual Report | January 31, 2007 | 9

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund | Portfolio of Investments (unaudited) continued

| | | | | | | | | | |

Rating

(S&P)* | | Principal

Amount (000) | | Description | | Optional Call

Provisions** | | Value |

A+ | | $ | 3,650 | | New York Muni Bond Bank Agy Special School Purpose Rev, Ser C, 5.25%, 12/01/22 | | 06/01/13 @ 100 | | $ | 3,871,044 |

AA- | | | 4,000 | | New York Tobacco Settlement Funding Corp, Ser A1, 5.50%, 06/01/19 | | 06/01/13 @ 100 | | | 4,334,320 |

AAA | | | 5,000 | | Port Auth NY and NJ - Cons, 127th Rev, AMT, 5.20%, 12/15/26 (AMBAC) | | 06/15/12 @ 101 | | | 5,275,100 |

A | | | 5,000 | | Suffolk Co, NY Ind Dev Agy Rev, AMT, 5.25%, 06/01/27 | | 06/01/13 @ 100 | | | 5,209,600 |

| | | | | | | | | | |

| | | | | | | | | | 38,863,619 |

| | | | | | | | | | |

| | | | | North Carolina – 3.5% | | | | | |

BBB | | | 1,000 | | North Carolina Eastern Muni Power Agy Sys Rev Ref, Ser D, 5.125%, 01/01/23 | | 01/01/13 @ 100 | | | 1,037,830 |

BBB | | | 1,000 | | North Carolina Eastern Muni Power Agy Sys Rev Ref, Ser D, 5.125%, 01/01/26 | | 01/01/13 @ 100 | | | 1,034,680 |

AAA | | | 1,900 | | North Carolina Housing Fin Agy Rev, AMT, Ser 14A, 5.35%, 01/01/22 (AMBAC) | | 07/01/11 @ 100 | | | 1,959,983 |

| | | | | | | | | | |

| | | | | | | | | | 4,032,493 |

| | | | | | | | | | |

| | | | | Ohio – 9.5% | | | | | |

AA- | | | 3,000 | | Cuyahoga Co., OH Rev Ref, Ser A, 6.00%, 01/01/20 | | 07/01/13 @ 100 | | | 3,321,690 |

AA- | | | 5,000 | | Lorain Co., OH Hosp Rev Ref, Ser A, 5.25%, 10/01/33 | | 10/01/11 @ 101 | | | 5,217,700 |

Aaa | | | 2,250 | | Toledo, OH City School Dist Facs Imp Gen Oblig, 5.00%, 12/01/25 (FSA) | | 12/01/13 @ 100 | | | 2,362,500 |

| | | | | | | | | | |

| | | | | | | | | | 10,901,890 |

| | | | | | | | | | |

| | | | | Pennsylvania – 3.9% | | | | | |

BBB | | | 2,340 | | Pennsylvania Higher Education Facs Auth Rev, 5.25%, 05/01/23 | | 05/01/13 @ 100 | | | 2,433,085 |

BBB+ | | | 2,000 | | Pennsylvania State Higher Education, 5.00%, 07/15/39 | | 07/15/15 @ 100 | | | 2,044,160 |

| | | | | | | | | | |

| | | | | | | | | | 4,477,245 |

| | | | | | | | | | |

| | | | | Puerto Rico – 6.1% | | | | | |

AAA | | | 1,500 | | Puerto Rico Hwy & Trans Auth Rev, Ser J, 5.50%, 07/01/24 (Prerefunded @ 07/01/14)† | | 07/01/14 @ 100 | | | 1,660,140 |

BBB | | | 5,000 | | Puerto Rico Public Bldgs Auth Rev, Ser I, 5.50%, 07/01/25 | | 07/01/14 @ 100 | | | 5,409,800 |

| | | | | | | | | | |

| | | | | | | | | | 7,069,940 |

| | | | | | | | | | |

| | | | | South Carolina – 3.2% | | | | | |

AAA | | | 2,500 | | Florence Co., SC Hosp Rev, Ser A, 5.25%, 11/01/27 (FSA) | | 11/01/14 @ 100 | | | 2,678,575 |

BBB | | | 1,000 | | Georgetown Co., SC Environ Imp Rev, AMT, Ser A, 5.30%, 03/01/28 | | 03/01/14 @ 100 | | | 1,018,840 |

| | | | | | | | | | |

| | | | | | | | | | 3,697,415 |

| | | | | | | | | | |

| | | | | South Dakota – 5.5% | | | | | |

AAA | | | 5,000 | | South Dakota Hsg Dev Auth, Ser K, AMT, 5.05%, 05/01/36 | | 11/01/15 @ 100 | | | 5,100,500 |

A+ | | | 1,200 | | South Dakota St Hlth & Edl Fac, Ser A 5.25%, 11/01/34 | | 11/01/14 @ 100 | | | 1,248,636 |

| | | | | | | | | | |

| | | | | | | | | | 6,349,136 |

| | | | | | | | | | |

| | | | | Texas – 5.5% | | | | | |

Aaa | | | 2,000 | | Bexar Co., TX Housing Fin, AMT, 5.20%, 10/20/34 (GNMA/FHA) | | 10/20/14 @ 100 | | | 2,056,080 |

AAA | | | 4,000 | | Eagle Mtn & Saginaw, TX Indep School Dist, Ser A, 5.25%, 08/15/23 (Prerefunded @ 08/15/23) (PSF)† | | 08/15/13 @ 100 | | | 4,284,720 |

| | | | | | | | | | |

| | | | | | | | | | 6,340,800 |

| | | | | | | | | | |

| | | | | West Virginia – 4.5% | | | | | |

AAA | | | 5,000 | | West Virginia Housing Dev Fund Rev, Ser D, 5.20%, 11/01/21 | | 05/01/11 @ 100 | | | 5,170,400 |

| | | | | | | | | | |

| | | | | Total Municipal Bonds & Notes – 158.3% (Cost $173,099,854) | | | | | 182,476,837 |

| | | | | | | | | | |

Rating

(Moody’s) | | Redemption

Value (000) | | Description | | | | Value |

| | | | | Preferred Shares – 3.7% | | | | | |

A3 | | | 2,000 | | Charter Mac Equity Trust, AMT, Ser A-4-1, 5.75%, 04/30/15 (remarketing), 144A | | | | | 2,143,300 |

A3 | | | 2,000 | | GMAC Municipal Mortgage Trust, AMT, Ser A1-3, 5.30%, 10/31/39, (10/31/19 remarketing), 144A | | | | | 2,096,280 |

| | | | | | | | | | |

| | | | | Total Preferred Shares (Cost - $4,000,000) | | | | | 4,239,580 |

| | | | | | | | | | |

Counterparty | | Notional

Amount (000) | | Description | | Expiration Date | | Value |

| | | | | Swaptions(3) – 0.1% | | | | | |

Goldman Sachs | | | 85,000 | | Option on a pay fixed/receive floating rate 20 year interest rate swap (pay fixed rate of 5.20% and receive BMA rate with a weekly reset) | | 09/03/08 | | | 41,696 |

Goldman Sachs | | | 7,000 | | Option on a pay fixed/receive floating rate 20 year interest rate swap (pay fixed rate of 6.50% and receive LIBOR rate with a weekly reset) | | 09/03/08 | | | 42,607 |

| | | | | | | | | | |

| | | | | Total Swaptions (Cost $5,402,500) | | | | | 84,303 |

| | | | | | | | | | |

See notes to financial statements.

10 | Semiannual Report | January 31, 2007

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund | Portfolio of Investments (unaudited) continued

| | | | | | | | | | | |

Rating

(S&P)* | | Principal

Amount (000) | | Description | | Optional Call Provisions** | | Value | |

| | | | | Short-Term Investments – 1.0% | | | | | | |

| | | | |

| | | | | Alabama -0.7 % | | | | | | |

AAA | | $ | 775 | | Mobile Co., AL, Indl Dev Auth Pollution Ctl Rev, VRDN, 3.70%, 07/15/32 (4) | | No call provision | | $ | 775,000 | |

| | | | |

| | | | | Missouri – 0.3% | | | | | | |

AAA | | | 400 | | Missouri Health & Educ Facs Auth Rev, Ser B, VRDN, 3.75%, 02/15/33 (4) | | No call provision | | | 400,000 | |

| | | | | | | | | | | |

| | | | | Total Short-Term Investments (Cost $1,175,000) | | | | | 1,175,000 | |

| | | | | | | | | | | |

| | | | | Total Investments – 163.1% (Cost $183,677,354) | | | | | 187,975,720 | |

| | | | | | | | | | | |

| | | | | Floating Note Obligations – (4.3%) | | | | | | |

| | | 5,000 | | Interest Rate Notes ranging from 3.65% to 3.68% at January 31, 2007 and contractual maturities of collateral ranging from 2038 to 2041. See Note 1 in the “Notes to the Financial Statements” section of this report. (Cost ($5,000,000)) | | | | | (5,000,000 | ) |

| | | | | | | | | | | |

| | | | | Total Net Investments – 158.8% (Cost - $178,677,354) | | | | | 182,975,720 | |

| | | | | | | | | | | |

| | | | | Other assets in excess of liabilities - 1.5% | | | �� | | 1,715,551 | |

| | | | | Preferred Shares, at redemption value - (-60.3% of Net Assets Applicable to Common Shareholders or -38.0% of Total Investments) | | | | | (69,450,000 | ) |

| | | | | | | | | | | |

| | | | | Net Assets Applicable to Common Shareholders – 100.0%(5) | | | | $ | 115,241,271 | |

| | | | | | | | | | | |

| * | For securities not rated by Standard & Poor’s Rating Group, the rating by Moody’s Investor Services, Inc. or Fitch Ratings is provided. |

| ** | Date and price of the earliest optional call or redemption provision. There may be other call provisions at varying prices at later dates. |

| † | This bond is prerefunded. U.S. government or U.S. government agency securities, held in escrow, are used to pay interest on this security, as well as to retire the bond in full at the date and price indicated under the Optional Call Provisions. |

| (1) | Inverse floating rate investment. Interest rate shown is that in effect at January 31, 2007. See Note 1 in the “Notes to Financial Statements” section of this report. |

| (2) | Underlying security related to inverse floating rate investments entered into by the Fund.See Note 1 in the “Notes to Financial Statements” section of this report. |

| (3) | Non-income producing securities. |

| (4) | Security has a maturity of more than one year, but has variable rate and demand features which qualify it as a short-term security. The rate shown is as of January 31, 2007. |

| (5) | Portfolio percentages are calculated based on net assets applicable to common shareholders. |

Glossary:

AMBAC – Insured by Ambac Assurance Corporation

AMT – Alternative Minimum Tax

BMA – Bond Market Association

CIFG – Insured by CIFG Assurance NA

FGIC – Insured by Financial Guaranty Insurance Co.

FHA – Guaranteed by Federal Housing Administration

FSA – Insured by Financial Security Assurance, Inc.

GNMA – Guaranteed by Ginnie Mae

LIBOR – London Inter-Bank Offered Rate

PSF – Guaranteed by Texas Permanent School Fund

VRDN – Variable rate demand notes are instruments whose interest rates change on a specified date (such as coupon date or interest payment date) and/or whose interest rates vary with changes in a designated base rate (such as the prime interest rate). The rate shown is as of January 31, 2007.

144A – Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. The securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At January 31, 2007 these securities amounted to $4,239,580 which represents 3.7% of net assets applicable to common shareholders.

See notes to financial statements.

Semiannual Report | January 31, 2007 | 11

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund

Statement of Assets and Liabilities | January 31, 2007 (unaudited)

| | | | |

Assets | | | | |

Investments, at value (cost $183,677,354) | | $ | 187,975,720 | |

Cash | | | 97,462 | |

Interest receivable | | | 1,926,031 | |

Other assets | | | 1,528 | |

| | | | |

Total assets | | | 190,000,741 | |

| | | | |

Liabilities | | | | |

Floating rate note obligations | | | 5,000,000 | |

Dividends payable - preferred shareholders | | | 103,694 | |

Investment advisory fee payable | | | 41,309 | |

Servicing agent fee payable | | | 27,514 | |

Administration fee payable | | | 3,938 | |

Accrued expenses and other liabilities | | | 133,015 | |

| | | | |

Total liabilities | | | 5,309,470 | |

| | | | |

Preferred Shares, at redemption value | | | | |

$.001 par value per share; 2,778 Auction Market Preferred Shares authorized, issued and outstanding at $25,000 per share liquidation preference | | | 69,450,000 | |

| | | | |

Net Assets Applicable to Common Shareholders | | $ | 115,241,271 | |

| | | | |

Composition of Net Assets Applicable to Common Shareholders | | | | |

Common stock, $.001 par value per share; unlimited number of shares authorized, 7,935,591 shares issued and outstanding | | $ | 7,936 | |

Additional paid-in capital | | | 112,471,279 | |

Net unrealized appreciation on investments and swaptions | | | 4,298,366 | |

Accumulated undistributed net investment income | | | 433,279 | |

Accumulated net realized loss on investments and swaptions | | | (1,969,589 | ) |

| | | | |

Net Assets Applicable to Common Shareholders | | $ | 115,241,271 | |

| | | | |

Net Asset Value Applicable to Common Shareholders (based on 7,935,591 common shares outstanding) | | $ | 14.52 | |

| | | | |

See notes to financial statements.

12 | Semiannual Report | January 31, 2007

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund

Statement of Operations | For the six months ended January 31, 2007 (unaudited)

| | | | | | |

Investment Income | | | | | | |

Interest | | | | $ | 4,634,581 | |

| | | | | | |

Expenses | | | | | | |

Investment advisory fee | | 363,966 | | | | |

Servicing agent fee | | 242,644 | | | | |

Auction agent fees - preferred shares | | 95,709 | | | | |

Professional fees | | 93,860 | | | | |

Trustees’ fees and expenses | | 39,344 | | | | |

Printing expenses | | 35,670 | | | | |

Fund accounting | | 33,679 | | | | |

Administrative fee | | 25,664 | | | | |

Transfer agent fee | | 18,665 | | | | |

Insurance | | 13,660 | | | | |

NYSE listing fee | | 10,260 | | | | |

Custodian fee | | 10,033 | | | | |

Line of credit fee | | 829 | | | | |

Other | | 13,064 | | | | |

Interest expense on floating rate note obligations | | 91,258 | | | | |

| | | | | | |

Total expenses | | | | | 1,088,305 | |

Investment advisory fees waived | | | | | (118,989 | ) |

Servicing agent fees waived | | | | | (79,326 | ) |

| | | | | | |

Net expenses | | | | | 889,990 | |

| | | | | | |

Net investment income | | | | | 3,744,591 | |

| | | | | | |

Realized and Unrealized Gain (Loss) on Investments | | | | | | |

Net realized gain (loss) on: | | | | | | |

Investments | | | | | 560,118 | |

Swaptions | | | | | — | |

Net change in unrealized appreciation (depreciation) on: | | | | | | |

Investments | | | | | 2,082,431 | |

Swaptions | | | | | (696,937 | ) |

| | | | | | |

Net realized and unrealized loss on investments | | | | | 1,945,612 | |

| | | | | | |

Distributions to Auction Market Preferred Shareholders from | | | | | | |

Net investment income | | | | | (1,235,090 | ) |

| | | | | | |

Net Increase in Net Assets Applicable to Common Shareholders Resulting from Operations | | | | $ | 4,455,113 | |

| | | | | | |

See notes to financial statements.

Semiannual Report | January 31, 2007 | 13

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund

Statements of Changes in Net Assets |

| | | | | | | | |

| | | For the Six Months Ended

January 31, 2007

(unaudited) | | | For the Year Ended

July 31, 2006 | |

Increase in Net Assets Applicable to Common Shareholders Resulting from Operations: | | | | | | | | |

Net investment income | | $ | 3,744,591 | | | $ | 7,107,886 | |

Net realized loss on investments and swaptions | | | 560,118 | | | | (328,157 | ) |

Net change in unrealized appreciation (depreciation) on investments and swaptions | | | 1,385,494 | | | | (2,953,301 | ) |

Distributions to auction market preferred shareholders from net investment income | | | (1,235,090 | ) | | | (2,103,570 | ) |

| | | | | | | | |

Net increase in net assets applicable to common shareholders resulting from operations | | | 4,455,113 | | | | 1,722,858 | |

| | | | | | | | |

Distributions to common shareholders from | | | | | | | | |

Net investment income | | | (2,257,676 | ) | | | (5,189,877 | ) |

| | | | | | | | |

Total change in net assets applicable to common shareholders | | | 2,197,437 | | | | (3,467,019 | ) |

Net assets applicable to common shareholders: | | | | | | | | |

Beginning of period | | | 113,043,834 | | | | 116,510,853 | |

| | | | | | | | |

End of period (including undistributed net investment income of $433,279 and $181,454, respectively.) | | $ | 115,241,271 | | | $ | 113,043,834 | |

| | | | | | | | |

See notes to financial statements.

14 | Semiannual Report | January 31, 2007

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund

Financial Highlights |

| | | | | | | | | | | | | | | | |

Per share operating performance for one common share outstanding throughout

each period | | For the Six Months Ended

January 31, 2007

(unaudited) | | | For the

Year Ended

July 31, 2006 | | | For the

Year Ended

July 31, 2005 | | | For the Period

August 27, 2003*

through July 31, 2004 | |

Net asset value, beginning of period | | $ | 14.25 | | | $ | 14.68 | | | $ | 13.83 | | | $ | 14.33 | ** |

| | | | | | | | | | | | | | | | |

Investment operations | | | | | | | | | | | | | | | | |

Net investment income | | | 0.47 | | | | 0.90 | | | | 0.92 | | | | 0.78 | |

Net realized and unrealized gain on investments and swaptions transactions | | | 0.24 | | | | (0.41 | ) | | | 0.87 | | | | (0.42 | ) |

Distributions to preferred shareholders from net investment income (common share equivalent basis) | | | (0.16 | ) | | | (0.27 | ) | | | (0.16 | ) | | | (0.08 | ) |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.55 | | | | 0.22 | | | | 1.63 | | | | 0.28 | |

| | | | | | | | | | | | | | | | |

Distributions to common shareholders from net investment income | | | (0.28 | ) | | | (0.65 | ) | | | (0.78 | ) | | | (0.63 | ) |

| | | | | | | | | | | | | | | | |

Common share offering costs charged to paid-in-capital in excess of par | | | — | | | | — | | | | — | | | | (0.03 | ) |

Preferred shares offering costs/underwriting discount charged to paid-in-capital in excess of par | | | — | | | | — | | | | — | | | | (0.12 | ) |

| | | | | | | | | | | | | | | | |

Total capital share transactions | | | — | | | | — | | | | — | | | | (0.15 | ) |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 14.52 | | | $ | 14.25 | | | $ | 14.68 | | | $ | 13.83 | |

| | | | | | | | | | | | | | | | |

Market value, end of period | | $ | 13.04 | | | $ | 12.29 | | | $ | 13.15 | | | $ | 13.11 | |

| | | | | | | | | | | | | | | | |

Total investment return(a) | | | | | | | | | | | | | | | | |

Net asset value | | | 3.90 | % | | | 1.57 | % | | | 12.03 | % | | | 1.11 | % |

Market value | | | 8.93 | % | | | -1.60 | % | | | 6.47 | % | | | -8.62 | % |

Ratios and supplemental data | | | | | | | | | | | | | | | | |

Net assets end of period (thousands) | | $ | 115,241 | | | $ | 113,044 | | | $ | 116,511 | | | $ | 109,776 | |

Ratio of expenses to average net assets (excluding interest expense on floating rate note obligations and net of fee waivers) (c) | | | 1.37 | %(b) | | | 1.63 | % | | | 1.53 | % | | | 1.34 | %(b) |

Ratio of expenses to average net assets (excluding interest expense on floating rate note obligations and excluding fee waivers) (c) | | | 1.71 | %(b) | | | 1.89 | % | | | 1.77 | % | | | 1.56 | %(b) |

Ratio of expenses to average net assets (including interest expense on floating rate note obligations(d) and net of fee waivers) (c) | | | 1.53 | %(b) | | | 1.63 | % | | | 1.53 | % | | | 1.34 | % |

Ratio of expenses to average net assets (including interest expense on floating rate note obligations(d) and excluding fee waivers) (c) | | | 1.87 | %(b) | | | 1.89 | % | | | 1.77 | % | | | 1.56 | % |

Ratio of net investment income(loss) to average net assets (c) | | | 6.42 | %(b) | | | 6.21 | % | | | 6.34 | % | | | 5.85 | %(b) |

Portfolio turnover | | | 2 | % | | | 21 | % | | | 15 | % | | | 129 | % |

Preferred shares, at redemption value ($25,000 per share liquidation preference) (thousands) | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | |

Preferred shares asset coverage per share | | $ | 66,484 | | | $ | 65,693 | | | $ | 66,941 | | | $ | 64,516 | |

Asset coverage per $1,000 of indebtedness (e) | | $ | 37,938 | | | | N/A | | | | N/A | | | | N/A | |

| * | Commencement of investment operations. |

| ** | Initial public offering price of $15.00 per share less underwriting discount of $0.675 per share. |

| (a) | Total investment return is calculated assuming a purchase of a common share at the beginning of the period and a sale on the last day of the period reported either at net asset value (NAV) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for returns at NAV or in accordance with the Fund’s dividend reinvestment plan for returns at market value. Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized. |

| (c) | Calculated on the basis of income and expenses applicable to both common and preferred shares relative to average net assets of common shareholders. |

| (d) | See Note 1 of the Notes to Financial Statements for more information on floating rate note obligations. |

| (e) | Calculated by subtracting the Fund’s total liabilities (not including the floating rate note obligations) from the Fund’s total assets and dividing by the total number of indebtedness units, where one unit equals $1,000 of indebtedness. |

See notes to financial statements.

Semiannual Report | January 31, 2007 | 15

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund

Notes to Financial Statements | January 31, 2007 (unaudited)

Note 1 – Organization & Accounting Policies:

The MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund (the “Fund”) was organized as a Delaware statutory trust on May 20, 2003. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended. The Fund’s investment objective is to provide its common shareholders with high current income exempt from regular federal income tax while seeking to protect the value of the Fund’s assets during periods of interest rate volatility. Prior to commencing operations on August 27, 2003, the Fund had no operations other than matters relating to its organization and registration and the sale and issuance of 6,981 common shares of beneficial interest to MBIA Capital Management Corp. The following is a summary of significant accounting policies followed by the Fund.

Securities Valuation: The municipal bonds in which the Fund invests are traded primarily in the over-the-counter markets. In determining net asset value, the Fund uses the valuations of portfolio securities furnished by a pricing service approved by the Board of Trustees. The pricing service typically values portfolio securities at the bid price or the yield equivalent when quotations are readily available. Municipal bonds for which quotations are not readily available are valued at fair market value on a consistent basis as determined by the pricing service using a matrix system to determine valuations. The procedures of the pricing service and its valuations are reviewed by the officers of the Fund under the general supervision of the Board of Trustees. Positions in futures contracts, interest rate swaps and options on interest rate swaps (“swaptions”) are valued at closing prices for such contracts established by the exchange or dealer market on which they are traded, or if market quotations are not readily available, are valued at fair value on a consistent basis using methods approved in good faith by the Board of Trustees.

Securities Transactions and Investment Income: Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Interest income and expenses are accrued daily. All discounts/premiums are accreted/amortized for financial reporting purposes as required.

Swaptions: The Fund may engage in options transactions on interest rate swap agreements, commonly referred to as swaptions. A swaption is an agreement between two parties where one party purchases the right from the other party to enter into an interest rate swap at a specified date and for a specified ”fixed rate” yield (or “exercise” yield). In a pay-fixed swaption, the holder of the swaption has the right to enter into an interest rate swap as a payer of fixed rate interest and receiver of variable rate interest, while the writer of the swaption has the obligation to enter into the other side of the interest rate swap. In a receive-fixed swaption, the holder of the swaption has the right to enter into an interest rate swap as a receiver of fixed rate interest and a payer of variable rate interest, while the writer has the obligation to enter into the opposite side of the interest rate swap. The Fund will enter into such transactions to attempt to hedge some or all of its interest rate exposure in its holdings of municipal bonds. The Fund generally purchases pay-fixed swaptions. Upon the purchase of these pay-fixed swaptions by the Fund, the total purchase price paid was recorded as an investment.

The market valuation is determined as set forth in the preceding securities valuation paragraph. When the pay-fixed swaptions are exercised, the Fund has the right to enter into an interest rate swap as a payer of fixed rate interest and receiver of variable rate interest. When the pay-fixed swaptions reach their scheduled expiration dates, the Fund will record a gain or loss depending on the difference between the purchase price and the value of the swaptions on their exercise date.

Dividends and Distributions: The Fund declares on a quarterly basis and pays on a monthly basis dividends from net investment income to common shareholders. Distributions of net realized capital gains, if any, will be paid at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date. Dividends and distributions to preferred shareholders are accrued and determined as described in Note 5.

Inverse Floating Rate Investments and Floating Rate Note Obligations: Inverse floating rate instruments are notes whose coupon rate fluctuates inversely to a predetermined interest rate index. These instruments typically involve greater risks than a fixed rate municipal bond. In particular, the holder of these inverse floating rate instruments retain all credit and interest rate risk associated with the full underlying bond and not just the par value of the inverse floating rate instrument. As such, these instruments should be viewed as having inherent leverage and therefore involve many of the risks associated with leverage. Leverage is a speculative technique that may expose the Fund to greater risk and increased costs. Leverage may cause the Fund’s net asset value to be more volatile than if it had not been leveraged because leverage tends to magnify the effect of any increases or decreases in the value of the Fund’s portfolio securities. The use of leverage may also cause the Fund to liquidate portfolio positions when it may not be advantageous to do so in order to satisfy its obligations with respect to inverse floating rate instruments.

The Fund may invest in inverse floating rate securities through either a direct purchase or through the transfer of bonds to a dealer trust in exchange for cash and/or residual interests in the dealer trust. For those inverse floating rate securities purchased directly, the instrument is included in the Portfolio of Investments with income recognized on an accrual basis.

For those inverse floating rate securities purchased through a transfer of a fixed rate bond to a dealer trust in exchange for cash and/or residual interests in the dealer trusts’ assets and cash flows, FASB Statement No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities (FAS 140) calls for this transaction to be accounted for as a financing by the dealer trust of the transferred fixed rate bond. In these transactions, the dealer trusts fund the purchases of the fixed rate bonds by issuing floating rate notes to third parties and allowing the Fund to retain residual interests in the bonds. The residual interests held by the Fund (the inverse floating rate investments) include the right of the Fund to cause the holders of the floating rate notes to tender their notes at par at the next interest rate reset date and to transfer the municipal bond from the dealer trusts to the Fund, thereby collapsing the dealer trusts. The Fund accounts for the transfer of bonds to the dealer trusts as secured borrowings, with the securities transferred remaining in the Fund’s Portfolio of Investments, and the related floating rate notes reflected as a liability under the caption

16 | Semiannual Report | January 31, 2007

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund | Notes to Financial Statements (unaudited) continued

“Floating rate note obligations” on the Statement of Assets and Liabilities. The Fund records the interest income from the fixed rate bonds under the caption “Interest” and records the expenses related to floating rate note obligations and any administrative expenses of the dealer trusts under the caption “Interest expense on floating rate note obligations” on the Fund’s Statement of Operations. The notes issued by the dealer trusts have interest rates that reset weekly and the floating rate note holders have the option to tender their notes to the dealer trusts for redemption at par at each reset date. At January 31, 2007, Fund investments with a par value of $10.0 million (market value of $10.3 million) are held by the dealer trusts and serve as collateral for the $5,000,000 in floating rate notes outstanding at that date. Contractual maturities of the floating rate notes and interest rates in effect at January 31, 2007 are presented on the Portfolio of Investments.

Use of Estimates: The preparation of financial statements in accordance with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Note 2 – Agreements:

Pursuant to an Investment Advisory Agreement (the ”Advisory Agreement”) between MBIA Capital Management Corp. (the “Adviser”) and the Fund, the Adviser is responsible for the daily management of the Fund’s portfolio, which includes buying and selling securities for the Fund, as well as investment research, subject to the direction of the Fund’s Board of Trustees. The Adviser is a subsidiary of MBIA Asset Management, LLC which, in turn, is a wholly-owned subsidiary of MBIA, Inc. The Advisory Agreement provides that the Fund shall pay to the Adviser a monthly fee for its services at the annual rate of 0.39% of the sum of the Fund’s average daily managed assets. (“Managed Assets” represent the Fund’s total assets including the assets attributable to the proceeds from any financial leverage but excluding the assets attributable to floating rate note obligations, minus liabilities, other than debt representing financial leverage.) The Adviser contractually agreed to waive a portion of the management fees it is entitled to receive from the Fund at the annual rate of 0.09% of the Fund’s average daily Managed Assets from the commencement of the Fund’s operations through September 1, 2008 and at the annual rate of 0.042% thereafter through September 1, 2009. Effective June 16, 2006, the Adviser voluntarily agreed to waive an additional 0.0375% of advisory fees. This waiver is voluntary in nature and can be discontinued at the Adviser’s discretion.

Pursuant to a Servicing Agreement, Claymore Securities, Inc. (the ”Servicing Agent”) acts as servicing agent to the Fund. The Servicing Agent receives an annual fee from the Fund, payable monthly in arrears, in an amount equal to 0.26% of the average daily value of the Fund’s Managed Assets. The Servicing Agent contractually agreed to waive a portion of the servicing fee it is entitled to receive from the Fund at the annual rate of 0.06% of the average daily value of the Fund’s Managed Assets from the commencement of the Fund’s operations through September 1, 2008 and at the annual rate of 0.028% thereafter through September 1, 2009. Effective June 16, 2006, the Servicing Agent voluntarily agreed to waive an additional 0.025% of servicing fees. This waiver is voluntary in nature and can be discontinued at the Servicing Agent’s discretion.

Under a separate Fund Administration agreement, Claymore Advisors, LLC provides Fund Administration services to the Fund. Claymore Advisors, LLC receives a fund administration fee payable monthly at the annual rate set forth below as a percentage of the average daily managed assets of the Fund:

| | | |

Managed Assets | | Rate | |

First $200,000,000 | | 0.0275 | % |

Next $300,000,000 | | 0.0175 | % |

Next $500,000,000 | | 0.0125 | % |

Over $1,000,000,000 | | 0.0100 | % |

The Bank of New York (“BNY”) acts as the Fund’s custodian, accounting agent and transfer agent. As custodian, BNY is responsible for the custody of the Fund’s assets. As accounting agent, BNY is responsible for maintaining the books and records of the Fund’s securities and cash. As transfer agent, BNY is responsible for performing transfer agency services for the Fund.

Certain officers and/or trustees of the Fund are officers and/or directors of the Adviser and the Servicing Agent.

Note 3 – Investment Transactions:

Purchases and sales of investment securities, excluding short-term investments, for the period ended January 31, 2007, aggregated $4,580,889 and $4,535,880, respectively.

Note 4 – Federal Income Taxes:

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required. In addition, by distributing substantially all of its ordinary income and long-term capital gains, if any, during each calendar year, the Fund intends not to be subject to U.S. federal excise tax.

Information on the tax components of investments as of January 31, 2007 is as follows:

| | | | | | | | | | |

Cost of Investments for Tax Purposes | | Gross Tax

Unrealized

Appreciation | | Gross Tax

Unrealized Depreciation | | | Net Tax

Unrealized

Appreciation on Investments |

$178,618,233 | | $ | 9,740,192 | | $ | (5,382,705 | ) | | $ | 4,357,487 |

There is a $5,000,000 difference between book and tax basis cost of investments due to the GAAP versus tax reporting of inverse floaters. The remaining difference between book and tax basis cost of investments is due to book/tax differences on the recognition of partnership income.

As of July 31, 2006, the components of accumulated earnings/(losses) (excluding paid-in capital) on a tax basis were as follows:

| | | | | | | | | | |

| | | Undistributed

Tax-Exempt

Income | | Accumulated

Capital and

Other Losses | | | Unrealized

Appreciation/

(Depreciation) |

2006 | | $ | 295,438 | | $ | (2,526,982 | ) | | $ | 2,861,474 |

The cumulative timing differences under tax basis accumulated capital loss for the year ended July 31, 2006 is due to post-October losses.

Semiannual Report | January 31, 2007 | 17

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund | Notes to Financial Statements (unaudited) continued

As of July 31, 2006, the Fund had a capital loss carryforward of $2,497,591 available to offset possible future capital gains. The capital loss carryforward is set to expire as follows: $8,249 on July 31, 2012, $1,863,882 on July 31, 2013 and $625,460 on July 31, 2014. Under the current tax law, capital losses realized after October 31 may be deferred and treated as occurring on the first day of the following fiscal year. For the period ended July 31, 2006, the Fund will elect to defer losses occurring between November 1, 2005 and July 31, 2006 in the amount of $29,931.

Distributions paid to shareholders during the tax year ended July 31, 2006 were characterized as follows for tax purposes:

| | | | | | | | | | | | |

| | | Tax-exempt

income | | Ordinary

income | | Long-term

capital gain | | Total

distributions |

2006 | | $ | 7,289,998 | | $ | 3,449 | | $ | — | | $ | 7,293,447 |

Note 5 – Capital:

There are an unlimited number of $.001 par value common shares of beneficial interest authorized and 7,935,591 common shares outstanding at January 31, 2007, of which the Adviser owned 6,981 shares. There were no transactions in common shares for the period ended January 31, 2007 or the year ended July 31, 2006, respectively.

On October 27, 2003, the Fund issued 1,389 shares of Auction Market Preferred Shares, Series M7 and 1,389 shares of Auction Market Preferred Shares, Series W28. The preferred shares have a liquidation value of $25,000 per share plus any accumulated unpaid dividends. As of January 31, 2007, the Fund had 1,389 shares each of Auction Market Preferred Shares, Series M7 and W28, outstanding.

Dividends on the preferred shares are cumulative at a rate that is set by auction procedures. The dividend rate range on the preferred shares of the Fund for the period ended January 31, 2007, were as follows:

| | | | | | | | | | | |

Series | | Low | | | High | | | At 1/31/07 | | | Next Auction Date |

M7 | | 3.30 | % | | 4.00 | % | | 3.35 | % | | 2/05/07 |

W28 | | 3.45 | % | | 3.65 | % | | 3.65 | % | | 2/28/07 |

The Fund is subject to certain limitations and restrictions while preferred shares are outstanding. Failure to comply with these limitations and restrictions could preclude the Fund from declaring any dividends or distributions to common shareholders or repurchasing common shares and/or could trigger the mandatory redemption of preferred shares at their liquidation value plus any accrued dividends. Preferred shares, which are entitled to one vote per share, generally vote with the common shares but vote separately as a class to elect two Trustees and on any matters affecting the rights of preferred shares.

Note 6 – Borrowings:

The Fund has an uncommitted $2,000,000 line of credit with BNY. Interest on the amount borrowed is based on the Federal Funds Rate plus a spread on outstanding balances. At January 31, 2007 there was no outstanding balance in connection with the Fund’s uncommitted line of credit. The average daily amount of borrowings during the period ended January 31, 2007 was $26,967 with a related weighted average interest rate of 6.00%.

Note 7 – Indemnifications:

In the normal course of business, the Fund enters into contracts that contain a variety of representations, which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would require future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

Note 8 – Accounting Pronouncements:

On July 13, 2006, the Financial Accounting Standards Board (“FASB”) released FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Adoption of FIN 48 is required for fiscal years beginning after December 15, 2006, and is to be applied to all open tax years as of the effective date. At this time, management is evaluating the implications of FIN 48 and its impact in the financial statements has not yet been determined.

On September 15, 2006, the FASB released Statement of Financial Accounting Standards No. 157, “Fair Valuation Measurements” (“FAS 157”) which provides enhanced guidance for measuring fair value. The standard requires companies to provide expanded information about the assets and liabilities measured at fair value and the potential effect of these fair valuations on an entity’s financial performance. The standard does not expand the use of fair value in any new circumstances, but provides clarification on acceptable fair valuation methods and applications. Adoption of FAS 157 is required for fiscal years beginning after November 17, 2007. At this time, management is evaluating the implications of FAS 157 and its impact in the financial statements has not yet been determined.

Note 9 – Subsequent Dividend Declarations – Common Shareholders:

The Fund has declared the following dividends to common shareholders:

| | | | | | | | | |

Rate Per Share | | Declaration Date | | Ex-Dividend Date | | Record Date | | Payable Date |

| $ | 0.0495 | | 12/15/06 | | 2/06/07 | | 2/08/07 | | 2/15/07 |

| $ | 0.0495 | | 12/15/06 | | 3/06/07 | | 3/08/07 | | 3/15/07 |

18 | Semiannual Report | January 31, 2007

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund

Supplemental Information | (unaudited)

Results of Shareholder Votes

The Annual Meeting of Shareholders of the Fund was held on December 12, 2006. Holders of the Fund’s common and preferred shares of beneficial interest voted on the election of Trustees.

Voting results for the election of Trustees by common shareholders are set forth below:

| | | | |

| | | # of Shares In Favor | | # of Shares Withheld |

Nicholas Dalmaso | | 7,010,163 | | 593,919 |

Randall C. Barnes | | 7,010,963 | | 593,119 |

The terms of the following Trustees of the Fund did not expire in 2006: Clifford D. Corso and Ronald A. Nyberg. Effective December 31, 2006, Mark Jurish resigned as a member of the Fund’s Independent Board of Trustees.

Voting results for the election of Trustees by preferred shareholders are set forth below:

| | | | |

| | | # of Shares In Favor | | # of Shares Withheld |

Ronald E. Toupin | | 2,712 | | 0 |

Trustees

The Trustees of the MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund and their principal occupations during the past five years:

| | | | | | | | |

Name, Address*, Year of Birth and Position(s) Held with Registrant | | Term of Office**

and Length of

Time Served | | Principal Occupation During the Past Five Years and Other Affiliations | | Number of Portfolios in the

Fund Complex***

Overseen by Trustee | | Other Directorships

Held by Trustee |

| Independent Trustees: | | | | | | | | |

| | | | |

Randall C. Barnes Year of Birth: 1951 Trustee | | Since 2006 | | Formerly, Senior Vice President & Treasurer (1993-1997), President, Pizza Hut International (1991-1993) and Senior Vice President, Strategic Planning and New Business Development (1987-1990) of PepsiCo, Inc. (1987-1997). | | 23 | | None |

| | | | |

Ronald A. Nyberg Year of Birth: 1953 Trustee | | Since 2003 | | Principal of Ronald A. Nyberg, Ltd., a law firm specializing in corporate law, estate planning and business transactions (2000-present). Formerly, Executive Vice President, General Counsel and Corporate Secretary of Van Kampen Investments (1982-1999). | | 26 | | None |

| | | | |

Ronald E. Toupin, Jr. Year of Birth: 1958 Trustee | | Since 2003 | | Formerly, Vice President, Manager and Portfolio Manager of Nuveen Asset Management (1998-1999), Vice President of Nuveen Investment Advisory Corp. (1992-1999), Vice President and Manager of Nuveen Unit Investment Trusts (1991-1999), and Assistant Vice President and Portfolio Manager of Nuveen Unit Investment Trusts (1988-1999), each of John Nuveen & Co., Inc. (1982-1999). | | 24 | | None |

| | | | |

| Interested Trustees: | | | | | | | | |

| | | | |

Clifford D. Corso† 113 King Street Armonk, NY 10504 Year of Birth: 1961 Trustee and President | | Since 2003 | | President of MBIA Asset Management LLC & MBIA Capital Management Corp.; Chief Investment Officer, MBIA Insurance Corp. | | 1 | | None |

| | | | |

Nicholas Dalmaso†† Year of Birth: 1965 Trustee; Chief Executive Officer and Chief Legal Officer | | Since 2003 | | Senior Managing Director and General Counsel of Claymore Advisors, LLC and Claymore Securities, Inc. (2001-present). Formerly, Assistant General Counsel, John Nuveen and Co., Inc. (1999-2000). Former Vice President and Associate General Counsel of Van Kampen Investments, Inc. (1992-1999). | | 26 | | None |

| * | The business address of each Trustee unless otherwise noted is c/o MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund, 2455 Corporate West Drive, Lisle, IL 60532. |

| ** | The Trustees of each class shall be elected at an annual meeting of shareholders or special meeting in lieu thereof called for that purpose, and each Trustee elected shall hold office until his or her successor shall have been elected and shall have qualified. The term of office of a Trustee shall terminate and a vacancy shall occur in the event of the death, resignation, removal, bankruptcy, adjudicated incompetence or other incapacity to perform the duties of the office, or removal, of a Trustee. |

| *** | The Claymore Fund Complex consists of U.S. registered investment companies advised or serviced by Claymore Advisors, LLC or Claymore Securities, Inc. The Claymore Fund Complex is overseen by multiple Boards of Trustees. |

| † | Mr. Corso is an “interested person” (as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended) of the Fund because of his position as an officer of MBIA Asset Management and MBIA Capital Management Co., the Fund’s Investment Adviser. |

| †† | Mr. Dalmaso is an “interested person” (as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended) of the Fund because of his position as an officer of Claymore Securities, Inc., the Fund’s Servicing Agent. |

Semiannual Report | January 31, 2007 | 19

MZF | MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund | Supplemental Information (unaudited) continued

Officers

The Officers of the MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund and their principal occupations during the past five years:

| | | | |

Name, Address*, Year of Birth and Position(s) Held with Registrant | | Term of Office**

and Length of

Time Served | | Principal Occupation During the Past Five Years and Other Affiliations |