UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21359

Managed Duration Investment Grade Municipal Fund

(Exact name of registrant as specified in charter)

200 Park Avenue, 7th Floor

New York, NY 10166

(Address of principal executive offices) (Zip code)

Clifford D. Corso

200 Park Avenue, 7th Floor

New York, NY 10166

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 527-1800

Date of fiscal year end: March 31

Date of reporting period: March 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

March 31, 2018

DEAR SHAREHOLDER

US gross domestic product (GDP) increased 2.9% in the fourth quarter of 2017, and as has been the trend for several years, growth slowed in the first quarter of 2018 at around 2%. This seasonal pattern was exacerbated by atypically large snowfall and later than usual tax refund checks. As these factors reverse, we believe that GDP should reaccelerate to its previous above-trend pace of nearly 3% over the remainder of 2018. We expect full year 2018 growth to be around 2.5% to 3.0% with trend consumption growth firmly at 2.5% to 2.75% while consumers benefit from the 2017 tax cuts enacted with the Tax Cuts and Jobs Act. We see signs business investment is firming with CEO confidence near cycle highs, and heavy machinery orders accelerating. The labor market is further nearing full employment with discouraged workers re-entering the work force amid continued strength in the construction and manufacturing sectors. Wages are showing some signs of picking up, moving past 2.7%, and unemployment remains at a healthy 4.1%. Inflation continues its modest rebound with the Core Personal Consumption Expenditure Price Index at 1.6% and Core Consumer Price Index up 2.1%, with core PCE likely to near the Federal Reserve Board (the Fed)’s target of 2% over the next 12 months. Higher rates and worries about trade conflicts caused market volatility in the first quarter as euphoria from the 2017 tax cuts faded.

The changing leadership at the Fed normally would have been the focus story of the first quarter. New Chairman Jerome Powell cemented the “continuity” thesis with credibility building congressional testimonies and at the March 2018 Federal Open Market Committee (FOMC) press conference. The Fed did raise rates another 25 basis point (bp) from 1.50% to 1.75%. At the same time, FOMC lowered their 2019 unemployment projection to 3.6% and raised their gross domestic product (GDP) projection to 2.4%. Treasury yields finished the quarter with notably less volatility and modestly higher with the 10-year Treasury yield ending the quarter at 2.74%.

The municipal bond market was irrepressible during the third quarter of 2017 despite a number of events that would typically be associated with increased market volatility. Geopolitical tensions were elevated as North Korea test fired intercontinental ballistic missiles during the quarter – two of which passed over the island of Japan thus heightening fears of an escalation towards war. Hurricane Harvey caused a significant amount of damage in coastal portions of Texas, while Hurricane Maria utterly devastated the Commonwealth of Puerto Rico, leaving many parts of the island without power. As the quarter came to a close, we saw another failed attempt at repealing and replacing the Affordable Care Act (ACA). The municipal market largely shrugged off these events and, in fact, generated positive total returns of 1.06% during the quarter according to the Barclays Bloomberg Municipal Bond Index.

Tax receipts are now at record levels after having increased in six consecutive years while the national unemployment rate stands at a meager 4.1% which is considered by some to be “full employment.” President Trump’s tax reform package has many economists revising their GDP forecasts for 2018 up towards 3.0%. The FOMC tightened monetary policy three times in 2017 and has guided towards another three tightenings in 2018. Municipal defaults have amounted to less than 1% of the market’s total outstandings and that is inclusive of the massive Puerto Rico default. The repeal of the ACA’s individual mandate is a credit negative for not-for-profit hospitals. Labor costs within the healthcare space have been increasing while insurance reimbursement rates continue to fall. This repeal on the margin leaves a larger percentage of the population without healthcare insurance which may lead to an increase in bad debt.

Municipal bond market investors focused on the President’s tax reform package during the fourth quarter of 2017 which has far reaching implications for the tax-exempt market. The reform package was subject to intense debate prior to its late 2017 passage and the end product contained a prohibition on advance refunding activity within the tax-exempt market which may meaningfully

2 | MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

| | |

| DEAR SHAREHOLDER continued | | March 31, 2018 |

curtail the supply of tax-exempt bonds. Advance refunding bonds (legally defeasing previously issued debt with the proceeds of a new issuance that are deposited into eligible US Treasury securities) comprise approximately 30% to 40% of the primary market’s supply. Absent any refunding issuance, a technical dynamic may take hold whereby bond market supply is unable to fulfill the tax-exempt demand resulting in higher bond prices. However, changes to corporate and personal income tax rates make things a bit more complicated and serve as somewhat of a counterbalance. The corporate tax rate was decreased from 35% to 21%, and the top personal income tax rate was decreased to 37% from 39.6% with a less punitive alternative minimum tax. The tax policy also limits the deductibility (up to $10,000) of state and local taxes (SALTS) which may impact municipal credit and perhaps valuations. Residents of certain high tax states who typically deduct SALTS may now have a higher tax liability which may increase the demand for tax-exempt debt within those high tax states. Although we do not view this as a material change, it could exacerbate the population shift towards lower tax states.

Municipal market primary supply amounted to approximately $440 billion in 2017. Looking forward, and due the reasons cited previously, we feel primary market supply is apt to decrease to a range of $325 to $350 million in 2018. The main driver of the decrease is the elimination of the advance refunding bonds. As a result, many issuers pulled-forward their refunding needs into 2017 at the expense of 2018. One caveat to the supply forecast is the passage of an infrastructure rebuild program whereby the financing comes through the municipal market.

The Bloomberg Barclays Municipal Bond Index returned 1.82% in the second half of 2017, with long maturities outperforming the general index as the curve flattened. The index returned 5.45% for calendar year 2017. The slope of the tax-exempt yield curve underwent a significant flattening during the second half of the year decreasing from 188bp to 113bp given an active FOMC and low inflation. The yield on 30-year AAA municipal general obligations decreased by 25bp to 2.54% while 10-year yields decreased by 1bp to 1.98%. The ratio of 30-year tax-exempt yields to like-maturity US Treasury yields decreased to 92.6%.

Return data shows an investor preference for BBB-rated credits as the grab for yield continued. Ahead of the expected cut to 2018’s supply forecasts, investors were inclined to buy higher yielding securities on the long end of the curve and down the credit spectrum. Ten-year maturities underperformed the Bloomberg Barclays Municipal Bond Index by 23bp while 30-year maturities outperformed by 167bp. Credit spreads compressed during the second half of 2017 and according to Barclays, A-rated bonds outperformed the index by 31bp while BBB-rated bonds outperformed the index by 242bp. High yield tax-exempt credits were moderately tighter during the period and the Bloomberg Barclays Municipal High Yield Index outperformed the investment grade index by 154bp.

The Bloomberg Barclays Municipal Bond Index returned -1.11% in the first quarter of 2018, with long maturities underperforming the general index. The tax-exempt curve reversed some of the flattening from the prior year and steepened during the quarter from 113 bps to 141 bps likely related to lower personal and corporate tax rates. The yield on 30-year AAA municipal general obligations increased by 41bp to 2.95% while 10-year yields increased by 44bp to 2.42%. The ratio of 30-year tax-exempt yields to like-maturity US Treasury yields increased to 99.2%.

Given our positive economic outlook, we continue to run overweight positions in the more credit sensitive and cyclical sub-sectors of the municipal market; specifically the transportation and power sectors. While shying away from the high yield component of the market, we believe attractive opportunities exist within A-rated and BBB-rated securities. Given the active FOMC and muted inflation, expectations the portfolio has had a duration that is largely in line with its index. However, we have implemented a duration barbell within the investment portfolio with an overweight to discounted floating-rate notes (coupons increase with FOMC tightenings) along with an overweight

MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT | 3

| | |

| DEAR SHAREHOLDER continued | | March 31, 2018 |

to higher yielding zero coupon bonds. While this strategy may reduce the portfolio’s income generating power near term, we feel confident in our projections that this strategy will deliver total return outperformance versus peers and the benchmark while ultimately increasing the dividend paying capacity of the Fund while the FOMC increases short-term interest rates.

We appreciate your investment, and we look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at www.insightinvestment.com/na/individual-investors.

Sincerely,

Clifford D. Corso

Chief Executive Officer

Managed Duration Investment Grade Municipal Fund

April 30, 2018

4 | MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

| | |

| FUND SUMMARY (Unaudited) | | March 31, 2018 |

| | | | |

| Fund Statistics | | | |

Symbol on New York Stock Exchange | | | MZF | |

Initial Offering Date | | | August 27, 2003 | |

Share Price | | | $13.60 | |

Net Asset Value | | | $14.53 | |

Yield on Closing Market Price | | | 3.97% | |

Taxable Equivalent Yield on Closing Market Price1 | | | 7.01% | |

Monthly Distribution Per Common Share2 | | | $0.0450 | |

Leverage3 | | | 38% | |

Percentage of total investments subject to alternative minimum tax | | | 12.3% | |

| 1 | Taxable equivalent yield is calculated assuming a 43.4% federal income tax bracket. |

| 2 | Monthly distribution is subject to change. |

| 3 | As a percentage of total assets less accrued liabilities. |

AVERAGE ANNUAL TOTAL RETURNS

FOR THE PERIOD ENDED March 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Eight Month (non-annualized) | | | One Year | | | Three Year | | | Five Year | | | Ten Year | | | Since Inception | |

Managed Duration | | | | | | | | | | | | | | | | | | | | | |

Investment Grade | | | | | | | | | | | | | | | | | | | | | | | | |

Municipal Fund | | | | | | | | | | | | | | | | | | | | | | | | |

NAV | | | 1.16% | | | | 5.79% | | | | 3.05% | | | | 4.54% | | | | 7.12% | | | | 6.05% | |

Market | | | 0.61% | | | | 7.29% | | | | 4.93% | | | | 2.36% | | | | 7.71% | | | | 5.18% | |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. All NAV returns include the deduction of management fees, operating expenses, and all other Fund expenses. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit www.insightinvestent.com/na/individual-investors. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

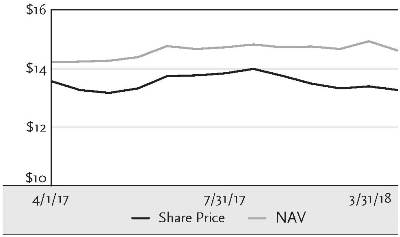

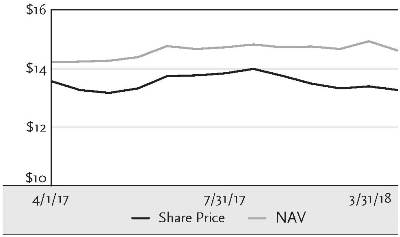

Share Price & NAV History

MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT | 5

| | |

| FUND SUMMARY (Unaudited) continued | | March 31, 2018 |

| | | | |

|

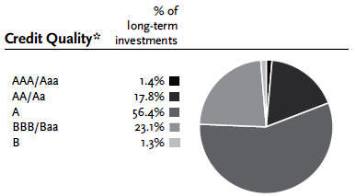

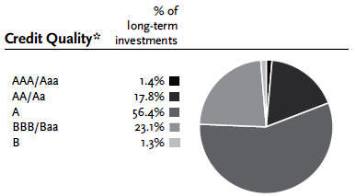

| | * Ratings shown are assigned by one or more independent, Nationally Recognized Statistical Credit Rating Organizations (“NRSRO”), such as S&P, Moody’s and Fitch. The ratings are an indication of an issuer’s creditworthiness and typically range from AAA or Aaa (highest) to D (lowest). When two or more ratings are available, the lowest rating is used; and when only one is available, that rating is used. The Non-Rated category consists of securities that have not been rated by an NRSRO. Unrated investments do not necessarily indicate low credit quality. US Treasury securities and US Government Agency securities are not rated but deemed to be equivalent to securities rated AA+/Aaa. | | |

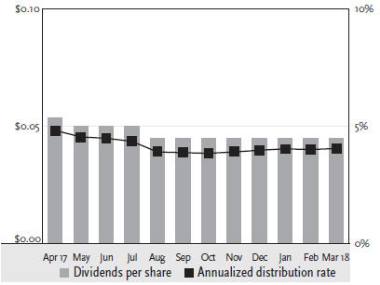

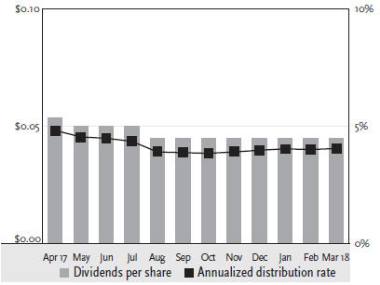

Distributions to Shareholder & Annualized Distribution Rate

|

6 | MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

| | |

| PORTFOLIO OF INVESTMENTS | | March 31, 2018 |

| | | | | | | | |

| | | Face

Amount | | | Value |

MUNICIPAL BONDS† – 158.6% | | | | | | | | |

California – 26.4% | | | | | | | | |

Bay Area Toll Authority Revenue Bonds | | | | | | | | |

(MUNIPSA + 1.25%) 2.83% due 04/01/361 | | $ | 2,000,000 | | | $ | 2,104,420 | |

California Pollution Control Financing Authority Revenue Bonds, AMT | | | | | | | | |

5.00% due 07/01/302 | | | 1,000,000 | | | | 1,079,520 | |

Golden State Tobacco Securitization Corp. Revenue Bonds | | | | | | | | |

5.00% due 06/01/28 | | | 2,500,000 | | | | 2,850,500 | |

Hartnell Community College District General Obligation Unlimited | | | | | | | | |

0.00% due 08/01/423 | | | 5,640,000 | | | | 1,989,905 | |

M-S-R Energy Authority Revenue Bonds | | | | | | | | |

7.00% due 11/01/34 | | | 2,500,000 | | | | 3,542,450 | |

Norman Y Mineta San Jose International Airport Sjc Revenue Bonds, AMT | | | | | | | | |

5.00% due 03/01/47 | | | 605,000 | | | | 675,410 | |

Northern California Gas Authority No 1 Revenue Bonds | | | | | | | | |

(3M LIBOR x 67% + 0.72%), 1.86% due 07/01/271 | | | 3,760,000 | | | | 3,659,646 | |

Patterson Joint Unified School District General Obligation Unlimited, (AGM) | | | | | | | | |

0.00% due 08/01/473 | | | 2,740,000 | | | | 828,549 | |

Sacramento County Sanitation Districts Financing Authority Revenue Bonds, (AGC-ICC FGIC) | | | | | | | | |

(3M LIBOR x 67% + 0.53%), 1.87% due 12/01/351 | | | 3,500,000 | | | | 3,369,555 | |

San Bernardino City Unified School District General Obligation Unlimited, (AGM) | | | | | | | | |

5.00% due 08/01/28 | | | 1,000,000 | | | | 1,127,140 | |

San Diego Unified School District General Obligation Unlimited | | | | | | | | |

0.00% due 07/01/383 | | | 3,145,000 | | | | 1,167,298 | |

San Francisco City & County Airport Comm-San Francisco International Airport Revenue Bonds, AMT | | | | | | | | |

5.00% due 05/01/47 | | | 1,335,000 | | | | 1,503,931 | |

San Mateo County Community College District General Obligation Unlimited, (NATL) | | | | | | | | |

0.00% due 09/01/293 | | | 3,000,000 | | | | 2,133,360 | |

Total California | | | | | | | 26,031,684 | |

Texas – 19.9% | | | | | | | | |

Fort Bend County Industrial Development Corp. Revenue Bonds | | | | | | | | |

4.75% due 11/01/42 | | | 1,000,000 | | | | 1,024,330 | |

Matagorda County Navigation District No 1 Revenue Bonds, AMT, (AMBAC) | | | | | | | | |

5.13% due 11/01/28 | | | 2,515,000 | | | | 2,845,446 | |

North Texas Tollway Authority Revenue Bonds | | | | | | | | |

5.00% due 01/01/45 | | | 2,500,000 | | | | 2,747,050 | |

5.00% due 01/01/43 | | | 1,430,000 | | | | 1,631,101 | |

Tarrant County Cultural Education Facilities Finance Corp. Revenue Bonds | | | | | | | | |

5.00% due 10/01/43 | | | 2,000,000 | | | | 2,186,400 | |

5.00% due 11/15/52 | | | 940,000 | | | | 1,030,588 | |

Texas Municipal Gas Acquisition & Supply Corp. I Revenue Bonds | | | | | | | | |

(3M LIBOR x 67% + 0.70%), 2.12% due 12/15/261 | | | 4,250,000 | | | | 4,214,895 | |

See notes to Financial Statements.

MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT | 7

| | |

| PORTFOLIO OF INVESTMENTS continued | | March 31, 2018 |

| | | | | | | | |

| | | Face Amount | | | Value |

MUNICIPAL BONDS† – 158.6% (continued) | | | | | | | | |

Texas – 19.9% (continued) | | | | | | | | |

Texas Municipal Gas Acquisition & Supply Corp. II Revenue Bonds | | | | | | | | |

(MUNIPSA + 0.55%), 2.13% due 09/15/271 | | $ | 4,000,000 | | | $ | 3,949,720 | |

Total Texas | | | | | | | 19,629,530 | |

New York – 14.0% | | | | | | | | |

Metropolitan Transportation Authority Revenue Bonds | | | | | | | | |

5.00% due 11/15/43 | | | 2,000,000 | | | | 2,224,960 | |

5.25% due 11/15/57 | | | 1,600,000 | | | | 1,841,136 | |

New York State Dormitory Authority Revenue Bonds | | | | | | | | |

5.00% due 07/01/32 | | | 1,000,000 | | | | 1,072,910 | |

New York Transportation Development Corp. Revenue Bonds, AMT | | | | | | | | |

5.00% due 07/01/46 | | | 2,000,000 | | | | 2,165,700 | |

Triborough Bridge & Tunnel Authority Revenue Bonds | | | | | | | | |

0.00% due 11/15/313 | | | 2,750,000 | | | | 1,737,643 | |

Troy Industrial Development Authority Revenue Bonds | | | | | | | | |

5.00% due 09/01/31 | | | 1,000,000 | | | | 1,076,140 | |

TSASC Inc. Revenue Bonds | | | | | | | | |

5.00% due 06/01/35 | | | 1,430,000 | | | | 1,574,430 | |

Westchester Tobacco Asset Securitization Revenue Bonds | | | | | | | | |

5.00% due 06/01/41 | | | 2,000,000 | | | | 2,172,820 | |

Total New York | | | | | | | 13,865,739 | |

Pennsylvania – 11.1% | | | | | | | | |

City Of Philadelphia Pa General Obligation Unlimited, (AGC) | | | | | | | | |

5.38% due 08/01/30 | | | 990,000 | | | | 1,031,679 | |

Commonwealth Financing Authority Revenue Bonds | | | | | | | | |

5.00% due 06/01/35 | | | 1,000,000 | | | | 1,108,330 | |

County of Allegheny General Obligation Unlimited, (AGM) | | | | | | | | |

(3M LIBOR x 67% + 0.55%), 1.74% due 11/01/261 | | | 1,605,000 | | | | 1,573,381 | |

County of Lehigh Revenue Bonds | | | | | | | | |

4.00% due 07/01/43 | | | 1,000,000 | | | | 1,014,390 | |

Delaware River Port Authority Revenue Bonds | | | | | | | | |

5.00% due 01/01/27 | | | 1,500,000 | | | | 1,630,290 | |

Pennsylvania Economic Development Financing Authority Revenue Bonds, AMT | | | | | | | | |

1.70% due 08/01/371 | | | 2,000,000 | | | | 1,980,500 | |

Pennsylvania Turnpike Commission Revenue Bonds | | | | | | | | |

5.00% due 12/01/46 | | | 2,390,000 | | | | 2,651,442 | |

Total Pennsylvania | | | | | | | 10,990,012 | |

Massachusetts – 8.4% | | | | | | | | |

Commonwealth of Massachusetts General Obligation Unlimited, (BHAC-CR FGIC) | | | | | | | | |

(3M LIBOR x 67% + 0.57%), 1.76% due 05/01/371 | | | 2,475,000 | | | | 2,393,003 | |

Massachusetts Bay Transportation Authority Revenue Bonds | | | | | | | | |

0.00% due 07/01/323 | | | 5,105,000 | | | | 3,202,673 | |

See notes to Financial Statements.

8 | MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

| | |

| PORTFOLIO OF INVESTMENTS continued | | March 31, 2018 |

| | | | | | | | |

| | | Face Amount | | | Value |

MUNICIPAL BONDS† – 158.6% (continued) | | | | | | | | |

Massachusetts – 8.4% (continued) | | | | | | | | |

Massachusetts Development Finance Agency Revenue Bonds | | | | | | | | |

5.00% due 07/01/37 | | $ | 1,000,000 | | | $ | 1,101,300 | |

6.25% due 07/01/30 | | | 385,000 | | | | 403,438 | |

Massachusetts Educational Financing Authority Revenue Bonds, AMT | | | | | | | | |

4.70% due 07/01/26 | | | 655,000 | | | | 675,423 | |

5.38% due 07/01/25 | | | 505,000 | | | | 540,340 | |

Total Massachusetts | | | | | | | 8,316,177 | |

Louisiana – 8.0% | | | | | | | | |

City Of Shreveport LaWater & Sewer Revenue Revenue Bonds, (BAM) | | | | | | | | |

5.00% due 12/01/41 | | | 1,000,000 | | | | 1,113,570 | |

Lafayette Consolidated Government Revenue Bonds, (AGM) | | | | | | | | |

5.00% due 11/01/31 | | | 1,000,000 | | | | 1,119,530 | |

Louisiana Local Government Environmental Facilities & Community | | | | | | | | |

Development Authority Revenue Bonds | | | | | | | | |

3.50% due 11/01/32 | | | 2,000,000 | | | | 1,972,960 | |

Louisiana Public Facilities Authority Revenue Bonds | | | | | | | | |

5.25% due 11/01/30 | | | 1,000,000 | | | | 1,052,200 | |

Louisiana Public Facilities Authority Revenue Bonds, (AGM) | | | | | | | | |

5.00% due 06/01/42 | | | 800,000 | | | | 876,456 | |

State of Louisiana Gasoline & Fuels Tax Revenue Bonds | | | | | | | | |

5.00% due 05/01/43 | | | 1,600,000 | | | | 1,747,280 | |

Total Louisiana | | | | | | | 7,881,996 | |

Arizona – 7.9% | | | | | | | | |

Arizona Health Facilities Authority Revenue Bonds | | | | | | | | |

(3M LIBOR x 67% + 0.81%), 1.95% due 01/01/371 | | | 3,500,000 | | | | 3,228,855 | |

(MUNIPSA + 1.85%), 3.43% due 02/01/481 | | | 2,000,000 | | | | 2,074,800 | |

Glendale Municipal Property Corp. Revenue Bonds | | | | | | | | |

5.00% due 07/01/33 | | | 1,250,000 | | | | 1,369,587 | |

Industrial Development Authority of the City of Phoenix Revenue Bonds | | | | | | | | |

5.25% due 06/01/34 | | | 1,000,000 | | | | 1,097,620 | |

Total Arizona | | | | | | | 7,770,862 | |

Michigan – 6.2% | | | | | | | | |

Michigan Finance Authority Revenue Bonds | | | | | | | | |

5.00% due 11/15/41 | | | 1,000,000 | | | | 1,105,230 | |

5.00% due 11/01/44 | | | 1,000,000 | | | | 1,101,160 | |

5.00% due 07/01/44 | | | 1,030,000 | | | | 1,101,029 | |

5.00% due 12/01/31 | | | 1,000,000 | | | | 1,097,940 | |

Michigan State Building Authority Revenue Bonds | | | | | | | | |

5.00% due 04/15/36 | | | 1,500,000 | | | | 1,717,080 | |

Total Michigan | | | | | | | 6,122,439 | |

See notes to Financial Statements.

MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT | 9

| | |

| PORTFOLIO OF INVESTMENTS continued | | March 31, 2018 |

| | | | | | | | |

| | | Face Amount | | | Value |

MUNICIPAL BONDS† – 158.6% (continued) | | | | | | | | |

Alabama – 5.4% | | | | | | | | |

Alabama Economic Settlement Authority Revenue Bonds | | | | | | | | |

4.00% due 09/15/33 | | $ | 3,000,000 | | | $ | 3,082,320 | |

Alabama Special Care Facilities Financing Authority Revenue Bonds | | | | | | | | |

5.00% due 06/01/32 | | | 2,000,000 | | | | 2,242,280 | |

Total Alabama | | | | | | | 5,324,600 | |

Florida – 5.1% | | | | | | | | |

County of Broward Revenue Bonds, AMT, (AGM) | | | | | | | | |

5.00% due 04/01/38 | | | 1,000,000 | | | | 1,072,920 | |

Miami-Dade County Educational Facilities Authority Revenue Bonds | | | | | | | | |

5.00% due 04/01/42 | | | 2,000,000 | | | | 2,170,720 | |

Mid-Bay Bridge Authority Revenue Bonds | | | | | | | | |

5.00% due 10/01/40 | | | 625,000 | | | | 688,494 | |

Town of Davie Revenue Bonds | | | | | | | | |

6.00% due 04/01/42 | | | 1,000,000 | | | | 1,120,450 | |

Total Florida | | | | | | | 5,052,584 | |

Connecticut – 4.3% | | | | | | | | |

City of Bridgeport General Obligation Unlimited, (AGM) | | | | | | | | |

5.00% due 10/01/25 | | | 2,535,000 | | | | 2,868,885 | |

Connecticut State Health & Educational Facility Authority Revenue Bonds | | | | | | | | |

5.00% due 07/01/45 | | | 1,250,000 | | | | 1,368,162 | |

Total Connecticut | | | | | | | 4,237,047 | |

New Jersey – 4.2% | | | | | | | | |

New Jersey Economic Development Authority Revenue Bonds, (ST APPROP) | | | | | | | | |

(MUNIPSA + 1.60%), 3.18% due 03/01/281 | | | 3,000,000 | | | | 2,962,530 | |

New Jersey Health Care Facilities Financing Authority Revenue Bonds | | | | | | | | |

5.00% due 07/01/43 | | | 1,070,000 | | | | 1,187,261 | |

Total New Jersey | | | | | | | 4,149,791 | |

Nebraska – 3.6% | | | | | | | | |

Central Plains Energy Project Revenue Bonds | | | | | | | | |

5.00% due 09/01/35 | | | 3,000,000 | | | | 3,548,310 | |

| | |

Kentucky – 3.5% | | | | | | | | |

County of Owen Revenue Bonds | | | | | | | | |

5.63% due 09/01/39 | | | 1,000,000 | | | | 1,049,310 | |

Kentucky Economic Development Finance Authority Revenue Bonds | | | | | | | | |

5.63% due 08/15/27 | | | 500,000 | | | | 506,515 | |

Kentucky Public Energy Authority Revenue Bonds | | | | | | | | |

4.00% due 04/01/481 | | | 1,750,000 | | | | 1,863,155 | |

Total Kentucky | | | | | | | 3,418,980 | |

Iowa – 3.3% | | | | | | | | |

Iowa Finance Authority Revenue Bonds | | | | | | | | |

5.00% due 08/15/29 | | | 1,090,000 | | | | 1,201,561 | |

See notes to Financial Statements.

10 | MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

| | |

| PORTFOLIO OF INVESTMENTS continued | | March 31, 2018 |

| | | | | | | | |

| | | Face

Amount | | | Value |

MUNICIPAL BONDS† – 158.6% (continued) | | | | | | | | |

Iowa – 3.3% (continued) | | | | | | | | |

Iowa Tobacco Settlement Authority Revenue Bonds | | | | | | | | |

5.60% due 06/01/34 | | $ | 2,000,000 | | | $ | 2,018,580 | |

Total Iowa | | | | | | | 3,220,141 | |

Vermont – 3.0% | | | | | | | | |

Vermont Student Assistance Corp. Revenue Bonds, AMT | | | | | | | | |

(3M LIBOR + 3.00%), 5.03% due 12/03/351 | | | 2,800,000 | | | | 2,973,908 | |

Mississippi – 2.8% | | | | | | | | |

County of Warren Revenue Bonds | | | | | | | | |

6.50% due 09/01/32 | | | 1,000,000 | | | | 1,020,810 | |

State Of Mississippi Revenue Bonds | | | | | | | | |

5.00% due 10/15/35 | | | 1,500,000 | | | | 1,698,765 | |

Total Mississippi | | | | | | | 2,719,575 | |

Washington – 2.2% | | | | | | | | |

Spokane Public Facilities District Revenue Bonds | | | | | | | | |

5.00% due 12/01/38 | | | 1,000,000 | | | | 1,095,430 | |

Washington Higher Education Facilities Authority Revenue Bonds | | | | | | | | |

5.25% due 04/01/43 | | | 1,000,000 | | | | 1,086,710 | |

Total Washington | | | | | | | 2,182,140 | |

Colorado – 2.2% | | | | | | | | |

City & County of Denver CO Airport System Revenue Revenue Bonds | | | | | | | | |

5.00% due 11/15/43 | | | 1,000,000 | | | | 1,096,680 | |

Colorado Health Facilities Authority Revenue Bonds | | | | | | | | |

5.25% due 01/01/45 | | | 1,000,000 | | | | 1,072,220 | |

Total Colorado | | | | | | | 2,168,900 | |

Tennessee – 2.0% | | | | | | | | |

Metropolitan Nashville Airport Authority Revenue Bonds | | | | | | | | |

5.20% due 07/01/26 | | | 520,000 | | | | 535,491 | |

Metropolitan Nashville Airport Authority Revenue Bonds, AMT | | | | | | | | |

5.00% due 07/01/43 | | | 1,310,000 | | | | 1,456,851 | |

Total Tennessee | | | | | | | 1,992,342 | |

Ohio – 1.7% | | | | | | | | |

American Municipal Power, Inc. Revenue Bonds | | | | | | | | |

5.00% due 02/15/42 | | | 1,560,000 | | | | 1,684,301 | |

Delaware – 1.6% | | | | | | | | |

Delaware State Economic Development Authority Revenue Bonds | | | | | | | | |

5.40% due 02/01/31 | | | 1,500,000 | | | | 1,603,350 | |

Nevada – 1.6% | | | | | | | | |

Las Vegas Valley Water District General Obligation Ltd | | | | | | | | |

5.00% due 06/01/31 | | | 1,435,000 | | | | 1,557,463 | |

See notes to Financial Statements.

MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT | 11

| | |

| PORTFOLIO OF INVESTMENTS continued | | March 31, 2018 |

| | | | | | | | |

| | | Face Amount | | | Value |

MUNICIPAL BONDS† – 158.6% (continued) | | | | | | | | |

Arkansas – 1.4% | | | | | | | | |

Arkansas Development Finance Authority Revenue Bonds | | | | | | | | |

(MUNIPSA + 1.55%), 3.13% due 09/01/441 | | $ | 1,400,000 | | | $ | 1,412,558 | |

Virginia – 1.3% | | | | | | | | |

Washington County Industrial Development Authority Revenue Bonds | | | | | | | | |

7.50% due 07/01/29 | | | 1,250,000 | | | | 1,301,162 | |

Alaska – 1.1% | | | | | | | | |

City of Anchorage Electric Revenue Bonds | | | | | | | | |

5.00% due 12/01/41 | | | 1,000,000 | | | | 1,107,800 | |

Wisconsin – 1.1% | | | | | | | | |

Wppi Energy Revenue Bonds | | | | | | | | |

5.00% due 07/01/37 | | | 1,000,000 | | | | 1,102,980 | |

Hawaii – 1.1% | | | | | | | | |

Hawaii Pacific Health Revenue Bonds | | | | | | | | |

5.63% due 07/01/30 | | | 1,000,000 | | | | 1,082,590 | |

New Hampshire – 1.1% | | | | | | | | |

New Hampshire Health And Education Facilities Authority Act Revenue Bonds | | | | | | | | |

5.00% due 01/01/34 | | | 1,000,000 | | | | 1,070,290 | |

Utah – 1.0% | | | | | | | | |

Salt Lake City Corp. Airport Revenue Bonds, AMT | | | | | | | | |

5.00% due 07/01/47 | | | 900,000 | | | | 1,001,277 | |

Illinois – 0.8% | | | | | | | | |

Chicago O’hare International Airport Revenue Bonds, AMT | | | | | | | | |

5.00% due 01/01/35 | | | 750,000 | | | | 826,492 | |

District of Columbia – 0.8% | | | | | | | | |

District Of Columbia Revenue Bonds | | | | | | | | |

5.00% due 04/01/42 | | | 715,000 | | | | 805,376 | |

West Virginia – 0.5% | | | | | | | | |

West Virginia Economic Development Authority Revenue Bonds, AMT | | | | | | | | |

2.88% due 12/15/26 | | | 515,000 | | | | 503,773 | |

Total Municipal Bonds | | | | | | | | |

(Cost 151,306,937) | | | | | | | 156,656,169 | |

See notes to Financial Statements.

12 | MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

| | |

| PORTFOLIO OF INVESTMENTS continued | | March 31, 2018 |

| | | | | | | | |

| | | Shares | | | Value | |

SHORT TERM INVESTMENT – 0.4% | | | | | | | | |

BlackRock Liquidity Funds FedFund Portfolio, 1.55%4 | | | 452,466 | | | $ | 452,466 | |

Total Short Term Investment

(Cost 452,466) | | | | | | | 452,466 | |

Total Investments - 159.0%

(Cost $151,759,403) | | | | | | $ | 157,108,635 | |

Preferred Shares - (60.7)% | | | | | | | (60,000,000) | |

Other Assets & Liabilities, net - 1.7% | | | | | | | 1,672,349 | |

Total Net Assets -100.0% | | | | | | $ | 98,780,984 | |

| | † | Value determined based on Level 2 inputs – See Note 2. |

| | 1 | Variable rate security. Rate indicated is rate effective at March 31, 2018. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description. |

| | 2 | Security is a 144A or Section 4(a)(2) security. The total market value of 144A or Section 4(a)(2) securities is $1,079,520 (cost $1,030,827), or 1.1% of total net assets as of March 31, 2018. These securities have been determined to be liquid under guidelines established by the Board of Trustees |

| | 3 | Zero coupon rate security. |

| | 4 | Represents the 7-day SEC yield as of March 31, 2018. |

| | |

| AGC | | Insured by Assured Guaranty Corporation |

| |

| AGM | | Insured by Assured Guaranty Municipal Corporation |

| |

| AMBAC | | Insured by Ambac Assurance Corporation |

| |

| AMT | | Income from this security is a preference item under the Alternative Minimum Tax |

| |

| BAM | | Insured by Bank of America |

| |

| BHAC-CR | | Insured by Berkshire Hathaway Assurance Corporation |

| |

| FGIC | | Insured by Financial Guaranty Insurance Company |

| |

| LIBOR | | London Interbank Offered Rate |

| |

| MUNIPSA | | SIFMA Municipal Swap Index Yield |

| |

| NATL | | Insured by National Public Finance Guarantee Corporation |

| |

| ST APPROP | | State Appropriation |

See notes to Financial Statements.

MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT | 13

| | |

| PORTFOLIO OF INVESTMENTS continued | | March 31, 2018 |

The following table summarizes the inputs used to value the Fund’s net assets as of March 31, 2018 (See Note 2 in the Notes to Financial Statements):

| | | | | | | | | | | | | | | | |

| | | Level 1 Quoted Prices | | | Level 2 Significant Observable Inputs | | | Level 3 Significant Unobservable Inputs | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Municipal Bonds | | $ | — | | | $ | 156,656,169 | | | | $— | | | $ | 156,656,169 | |

Short Term Investment | | | 452,466 | | | | — | | | | — | | | | 452,466 | |

Total | | $ | 452,466 | | | $ | 156,656,169 | | | | $— | | | $ | 157,108,635 | |

Transfers between investment levels may occur as the markets fluctuate and/or the availability of data used in an investment’s valuation changes. Transfers between valuations levels, if any, are in comparison to the valuation levels at the end of the previous fiscal year, and are effective using the fair value as of the end of the current fiscal period.

For the period ended March 31, 2018, there were no transfers between levels.

See notes to Financial Statements.

14 | MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

| | |

| PORTFOLIO OF INVESTMENTS continued | | March 31, 2018 |

| | | | | | | | |

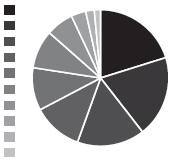

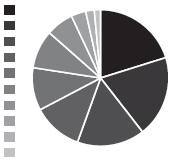

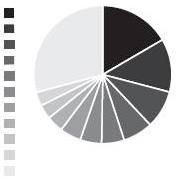

| Sector Concentration* | | |

Industrial Revenue | | | 20.2% | | |  | | |

Transportation | | | 19.3% | | | |

Health Care | | | 16.0% | | | |

Education | | | 11.8% | | | |

Power | | | 10.1% | | | |

Local Obligation | | | 9.1% | | | |

Special Tax | | | 6.5% | | | |

Water & Sewer | | | 3.5% | | | |

Leasing | | | 2.0% | | | |

State Obligation | | | 1.5% | | | |

| | | | | | | | |

*As a percentage of long-term investments. | | |

| |

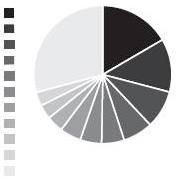

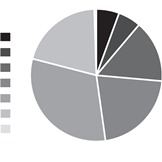

| State/Territory Allocations* | | |

California | | | 16.6% | | |  | | |

Texas | | | 12.5% | | | |

New York | | | 8.9% | | | |

Pennsylvania | | | 7.0% | | | |

Massachusetts | | | 5.3% | | | |

Louisiana | | | 5.0% | | | |

Arizona | | | 5.0% | | | |

Michigan | | | 3.9% | | | |

Alabama | | | 3.4% | | | |

Florida | | | 3.2% | | | |

All Other States | | | 29.2% | | | |

| | | | | | | | |

*As a percentage of long-term investments. | | |

| |

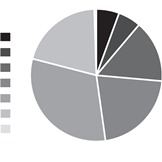

| Maturity Breakdown* | | |

| | | | | |

| | |

| | | | | | | |

Under 1 Yr | | | 5.6% | | | |

1 to 3 Yrs | | | 5.6% | | | |

3 to 5 Yrs | | | 15.2% | | | |

5 to 7 Yrs | | | 21.4% | | | |

7 to 10 Yrs | | | 31.2% | | | |

10 to 20 Yrs | | | 20.5% | | | |

Over 20 Yrs | | | 0.5% | | | | |

| | | | | | | |

| | | | | | | |

*As a percentage of long-term investments. | | |

Portfolio composition and holdings are subject to change daily. For more information, please visit www.insightinvestment.com/na/individual-investors. The above summaries are provided for informational purposes only and should not be viewed as recommendations. Past performance does not guarantee future results.

See notes to Financial Statements.

MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT | 15

| | |

| STATEMENT OF ASSETS AND LIABILITIES | | March 31, 2018 |

| | | | |

ASSETS: | | | | |

Investments, at value | | $ | 157,108,635 | |

Receivables: | | | | |

Interest | | | 1,669,867 | |

Deferred offering costs | | | 204,469 | |

Expense reimbursement due from the Adviser | | | 2,761 | |

Other assets | | | 84,320 | |

Total assets | | | 159,070,052 | |

LIABILITIES: | | | | |

Payable for: | | | | |

Distributions - VMTP shareholders | | | 119,719 | |

Investment advisory fees | | | 52,553 | |

Professional fees | | | 40,514 | |

Administration fees | | | 24,536 | |

Printing fees | | | 23,818 | |

MBSC servicing fees | | | 17,500 | |

Transfer agent fees | | | 2,778 | |

CCO fees | | | 2,761 | |

Custodian fees | | | 1,214 | |

Other Liabilities | | | 3,675 | |

Total liabilities | | | 289,068 | |

PREFERRED SHARES, at redemption value: | | | | |

$0.001 par value per share; 600 Variable Rate MuniFund Term Preferred Shares authorized, issued and outstanding at $100,000 per share liquidation preference | | | 60,000,000 | |

NET ASSETS | | $ | 98,780,984 | |

NET ASSETS CONSIST OF: | | | | |

Common stock, $0.001 par value per share; unlimited shares of shares authorized, 6,800,476 shares issued and outstanding | | $ | 6,800 | |

Additional paid-in capital | | | 92,642,200 | |

Accumulated net investment loss | | | (119,719 | ) |

Accumulated net realized gain on investments | | | 902,471 | |

Net unrealized appreciation on investments | | | 5,349,232 | |

NET ASSETS | | $ | 98,780,984 | |

Shares outstanding ($0.001 par value with unlimited amount authorized) | | | 6,800,476 | |

Net asset value, offering price and repurchase price per share | | $ | 14.53 | |

Investments in securities, at cost | | | 151,759,403 | |

See notes to financial statements.

16 | MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

| | |

| STATEMENT OF OPERATIONS | | March 31, 2018 |

| | | | | | | | |

| | | Eight Months Ended March 31, 2018* | | | Year Ended July 31,2017 |

INVESTMENT INCOME: | | | | | | | | |

Interest | | $ | 3,873,104 | | | $ | 6,649,463 | |

EXPENSES: | | | | | | | | |

Investment advisory fees | | | 416,549 | | | | 660,300 | |

Administration fees | | | 79,421 | | | | 165,049 | |

Legal fees | | | 52,274 | | | | 121,776 | |

Deferred offering costs | | | 48,275 | | | | 1,760 | |

Trustee fees and expenses** | | | 41,072 | | | | 46,612 | |

Printing fees | | | 32,550 | | | | 33,263 | |

Transfer agent fees | | | 22,878 | | | | 24,226 | |

Audit fees | | | 21,000 | | | | 20,041 | |

Insurance | | | 17,756 | | | | 14,125 | |

CCO fees | | | 16,154 | | | | — | |

Listing fees | | | 15,812 | | | | 27,422 | |

MBSC servicing fees | | | 7,636 | | | | 7,500 | |

Custodian fees | | | 4,521 | | | | 9,266 | |

Auction agent fees - AMPS | | | — | | | | 119,229 | |

Servicing fees | | | — | | | | 114,100 | |

Fund accounting fees | | | — | | | | 15,741 | |

Other expenses | | | 37,317 | | | | 28,773 | |

| | |

Total expenses | | | 813,215 | | | | 1,409,183 | |

Investment advisory fees waived | | | — | | | | (39,496 | ) |

Expense reimbursement from the Adviser | | | (16,154 | ) | | | — | |

Servicing fees waived | | | — | | | | (26,331 | ) |

| | |

Net expenses | | | 797,061 | | | | 1,343,356 | |

| | |

Net investment income | | | 3,076,043 | | | | 5,306,107 | |

See notes to financial statements.

MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT | 17

| | |

| STATEMENT OF OPERATIONS continued | | March 31, 2018 |

| | | | | | | | |

| | | Eight Months Ended March 31, 2018* | | | Year Ended July 31, 2017 | |

NET REALIZED AND UNREALIZED GAIN (LOSS): | | | | | | | | |

Net realized gain on: | | | | | | | | |

Investments | | | 1,018,425 | | | | 3,228,090 | |

Net decrease in unrealized appreciation on: | | | | | | | | |

Investments | | | (2,345,780) | | | | (8,045,068) | |

Net realized and unrealized loss | | | (1,327,355) | | | | (4,816,978) | |

Distributions to Auction Market Preferred Shareholders from | | | | | | | | |

Net Investment Income | | | — | | | | (1,648,296) | |

Distributions to Variable Rate MuniFund Term Preferred Shares From | | | | | | | | |

Net Investment Income | | | (804,062) | | | | (59,482) | |

Net increase (decrease) in net assets applicable to common shareholders resulting from operations | | $ | 944,626 | | | $ | (1,218,649) | |

*The Fund changed its fiscal year end to March 31.

**Relates to Trustees not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act.

See notes to financial statements.

18 | MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

| | |

| STATEMENTS OF CHANGES IN ASSETS | | March 31, 2018 |

| | | | | | | | | | | | |

| | | Eight Months Ended March 31, 2018* | | | Year Ended July 31, 2017 | | | Year Ended July 31, 2016 | |

INCREASE IN NET ASSETS FROM OPERATIONS: | | | | | | | | | | | | |

Net investment income | | $ | 3,076,043 | | | $ | 5,306,107 | | | $ | 5,709,552 | |

Net realized gain (loss) on investments | | | 1,018,425 | | | | 3,228,090 | | | | (124,994) | |

Net change in unrealized appreciation (depreciation) from investments | | | (2,345,780 | ) | | | (8,045,068 | ) | | | 5,062,442 | |

Net increase in net assets resulting from operations | | | 1,748,688 | | | | 489,129 | | | | 10,647,000 | |

DISTRIBUTIONS TO PREFERRED SHAREHOLDERS FROM: | | | | | | | | | | | | |

Net investment income | | | (804,062 | ) | | | (1,707,778 | ) | | | (1,097,271) | |

Net increase (decrease) in net assets applicable to common shareholders resulting from operations | | | 944,626 | | | | (1,218,649 | ) | | | 9,549,729 | |

DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | | | | | |

Net investment income | | | (2,448,172 | ) | | | (4,178,892 | ) | | | (4,761,281) | |

Return of capital | | | — | | | | — | | | | (210,547) | |

Total distributions | | | (2,448,172 | ) | | | (4,178,892 | ) | | | (4,971,828) | |

Net increase (decrease) in net assets | | | (1,503,546 | ) | | | (5,397,541 | ) | | | 4,577,901 | |

NET ASSETS: | | | | | | | | | | | | |

Beginning of period | | | 100,284,530 | | | | 105,682,071 | | | | 101,104,170 | |

End of period | | $ | 98,780,984 | | | $ | 100,284,530 | | | $ | 105,682,071 | |

Distributions in excess of net investment income | | $ | (119,719 | ) | | $ | (59,482 | ) | | $ | (106,011) | |

*The Fund changed its fiscal year end to March 31.

See notes to financial statements.

MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT | 19

FINANCIAL HIGHLIGHTS | March 31, 2018 |

| | | | | | | | | | | | |

| | | Eight Months Ended

March 31, 2018* | | | Year Ended July 31,

2017 | | | Year Ended

July 31,

2016 | |

Per Share Data: | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 14.75 | | | $ | 15.54 | | | $ | 14.87 | |

Income from investment operations: | | | | | | | | | | | | |

Net investment income(a) | | | 0.45 | | | | 0.78 | | | | 0.84 | |

Net gain (loss) on investments (realized and unrealized) | | | (0.19) | | | | (0.71) | | | | 0.72 | |

Distributions to preferred shareholders from net investment income (common share equivalent basis) | | | (0.12) | | | | (0.25) | | | | (0.16) | |

Total from investment operations | | | 0.14 | | | | (0.18) | | | | 1.40 | |

Less distributions from: | | | | | | | | | | | | |

Net investment income | | | (0.36) | | | | (0.61) | | | | (0.70) | |

Return of capital | | | — | | | | — | | | | (0.03) | |

Total Distributions | | | (0.36) | | | | (0.61) | | | | (0.73) | |

Net asset value, end of period | | $ | 14.53 | | | $ | 14.75 | | | $ | 15.54 | |

Market Value, end of period | | $ | 13.60 | | | $ | 13.88 | | | $ | 14.62 | |

Total Return(b) | | | | | | | | | | | | |

Net asset value | | | 1.16 | % | | | (0.71) | % | | | 9.68 | % |

Market value | | | 0.61 | % | | | (0.69) | % | | | 12.79 | % |

Ratios/Supplemental Data: | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 98,781 | | | $ | 100,285 | | | $ | 105,682 | |

Preferred shares, at redemption value ($100,000 per share liquidation preference) (thousands) | | $ | 60,000 | | | $ | 60,000 | | | $ | 69,450 | |

Preferred shares asset coverage per share | | $ | 264,635 | | | $ | 267,141 | | | $ | 63,043 | |

Ratio to average net assets of: | | | | | | | | | | | | |

Net investment income(c) | | | 4.60 | %(d) | | | 5.31 | % | | | 5.57 | % |

Expenses (including interest expense and net of fee waivers)(c) | | | 1.19 | %(d) | | | 1.35 | %(e) | | | 1.34 | %(e) |

Expenses (including interest expense and excluding fee waivers)(c) | | | 1.22 | %(d) | | | 1.41 | %(e) | | | 1.59 | %(e) |

Portfolio turnover rate(f) | | | 22 | % | | | 20 | % | | | 14 | % |

*The Fund changed its fiscal year end to March 31.

| (a) | Based on average shares outstanding. |

| (b) | Total investment return is calculated assuming a purchase of a common share at the beginning of the period and a sale on the last day of the period reported either at net asset value (“NAV”) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for NAV returns or the prices obtained under the Fund’s Dividend Reinvestment Plan for market value returns. Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized. Past performance is not a guarantee of future results. |

| (c) | Calculated on the basis of income and expense applicable to both common and preferred shares relative to average net assets of common shareholders. |

| (e) | The impact of interest expense is less than 0.01%. |

| (f) | Portfolio turnover is not annualized for periods less than one year. |

See notes to financial statements.

20 | MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

| | |

| FINANCIAL HIGHLIGHTS continued | | March 31, 2018 |

| | | | | | | | | | |

Year Ended July 31,

2015 | | | Year Ended

July 31,

2014 | | | Year Ended

July 31,

2013 | |

| | $ 14.72 | | | $ | 13.61 | | | $ | 15.41 | |

| | |

| | 0.88 | | | | 0.95 | | | | 1.02 | |

| | 0.17 | | | | 1.13 | | | | (1.74 | ) |

| | |

| | (0.14) | | | | (0.13 | ) | | | (0.14 | ) |

| | 0.91 | | | | 1.95 | | | | (0.86 | ) |

| | |

| | (0.76) | | | | (0.84 | ) | | | (0.94 | ) |

| | — | | | | — | | | | — | |

| | (0.76) | | | | (0.84 | ) | | | (0.94 | ) |

| | $14.87 | | | $ | 14.72 | | | $ | 13.61 | |

| | $13.66 | | | $ | 13.57 | | | $ | 12.46 | |

| | |

| | 6.19 | % | | | 14.87 | % | | | -6.01 | % |

| | 6.43 | % | | | 16.29 | % | | | -18.13 | % |

| | |

| | $ 101,104 | | | $ | 100,125 | | | $ | 92,573 | |

| | |

| | $ 69,450 | | | $ | 69,450 | | | $ | 69,450 | |

| | $ 61,395 | | | $ | 61,042 | | | $ | 58,324 | |

| | |

| | 5.85 | % | | | 6.86 | % | | | 6.70 | % |

| | 1.35 | %(e) | | | 1.40 | %(e) | | | 1.33 | %(e) |

| | |

| | 1.60 | %(e) | | | 1.66 | %(e) | | | 1.58 | %(e) |

| | 12 | % | | | 15 | % | | | 23 | % |

See notes to financial statements.

MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT | 21

| | |

| NOTES TO FINANCIAL STATEMENTS | | March 31, 2018 |

Note 1 – Organization:

The Managed Duration Investment Grade Municipal Fund (the “Fund”) was organized as a Delaware statutory trust on May 20, 2003. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended. The Fund’s investment objective is to provide its common shareholders with high current income exempt from regular federal income tax while seeking to protect the value of the Fund’s assets during periods of interest rate volatility. Prior to commencing operations on August 27, 2003, the Fund had no operations other than matters relating to its organization and registration and the sale and issuance of 6,981 common shares of beneficial interest to MBIA Capital Management Corp. (now known as Cutwater Investor Services Corp.( d/b/a Insight Investment and referred to herein as the “Adviser”)).

On February 16, 2018, the Board of Trustees of the Fund (the “Board”) approved a change to the Fund’s fiscal and tax year end to March 31.

Note 2 – Accounting Policies:

The Fund operates as an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

The following significant accounting policies are in conformity with U.S. generally accepted accounting principles (“GAAP”) and are consistently followed by the Fund. This requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates. All time references are based on Eastern Time.

(a) Valuation of Investments

The Board has adopted policies and procedures for the valuation of the Fund’s investments (the “Valuation Procedures”). Pursuant to the Valuation Procedures, the Board has delegated to the Adviser’s valuation committee (the “Valuation Committee”), the day-to-day responsibility for implementing the Valuation Procedures, including, under most circumstances, the responsibility for determining the fair value of the Fund’s securities or other assets.

The municipal bonds and preferred shares in which the Fund invests are traded primarily in the over-the-counter markets. In determining net asset value, the Fund uses the valuations of portfolio securities furnished by a pricing service approved by the Board. The pricing service typically values portfolio securities at the bid price or the yield equivalent when quotations are readily available. Securities for which quotations are not readily available are valued at fair market value on a consistent basis as determined by the pricing service using a matrix system to determine valuations. The procedures of the pricing service and its valuations are reviewed by the officers of the Fund under the general supervision of the Board.

Investments for which market quotations are not readily available are fair valued as determined in good faith by the Adviser, pursuant to methods established or ratified by the Board. Valuations in accordance with these methods are intended to reflect each security’s (or asset’s) “fair value.” Each such determination is based on a consideration of all relevant factors, which are likely to vary from one pricing context to another. Examples of such factors may include, but are not limited to: (i) the type of security, (ii) the initial cost of the security, (iii) the existence of any contractual restrictions on

22 | MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

| | |

| NOTES TO FINANCIAL STATEMENTS continued | | March 31, 2018 |

the security’s disposition, (iv) the price and extent of public trading in similar securities of the issuer or of comparable companies, (v) quotations or evaluated prices from broker-dealers and/or pricing services, (vi) information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange traded securities), (vii) an analysis of the company’s financial statements, and (viii) an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold (e.g. the existence of pending merger activity, public offerings or tender offers that might affect the value of the security).

There are three different categories for valuations. Level 1 valuations are those based upon quoted prices in active markets. Level 2 valuations are those based upon quoted prices in inactive markets or based upon significant observable inputs (e.g. yield curves; benchmark interest rates; indices). Level 3 valuations are those based upon unobservable inputs (e.g. discounted cash flow analysis; non-market based methods used to determine fair valuation).

The Fund values Level 1 securities using readily available market quotations in active markets. Money market funds are valued at net asset value. The Fund values Level 2 fixed income securities using independent pricing providers who employ matrix pricing models utilizing market prices, broker quotes and prices of securities with comparable maturities and qualities. The Fund values Level 2 equity securities using various observable market inputs as described above. The Fund did not have any Level 3 securities during the eight months ended March 31, 2018.

(b) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date for financial reporting purposes. Realized gains and losses on investments are determined on the identified cost basis. Interest income, including the amortization of premiums and accretion of discount, is accrued daily.

(c) Dividends and Distributions

The Fund declares and pays on a monthly basis dividends from net investment income to common shareholders. Distributions of net realized capital gains, if any, will be paid at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date. Dividends and distributions to preferred shareholders are accrued and determined as described in Note 6.

(d) Inverse Floating Rate Investments and Floating Rate Note Obligations

Inverse floating rate instruments are notes whose coupon rate fluctuates inversely to a predetermined interest rate index. These instruments typically involve greater risks than a fixed rate municipal bond. In particular, the holder of these inverse floating rate instruments retains all credit and interest rate risk associated with the full underlying bond and not just the par value of the inverse floating rate instrument. As such, these instruments should be viewed as having inherent leverage and therefore involve many of the risks associated with leverage. Leverage is a speculative technique that may expose the Fund to greater risk and increased costs. Leverage may cause the Fund’s net asset value to be more volatile than if it had not been leveraged because leverage tends to magnify the effect of any increases or decreases in the value of the Fund’s portfolio securities. The use of leverage may also cause the Fund to liquidate portfolio positions when it may not be advantageous to do so in order to satisfy its obligations with respect to inverse floating rate instruments.

MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT | 23

| | |

| NOTES TO FINANCIAL STATEMENTS continued | | March 31, 2018 |

The Fund may invest in inverse floating rate securities through either a direct purchase or through the transfer of bonds to a dealer trust in exchange for cash and/or residual interests in the dealer trust. For those inverse floating rate securities purchased directly, the instrument is included in the Portfolio of Investments with income recognized on an accrual basis. The Fund did not invest in inverse floating rate securities during the eight months ended March 31, 2018.

(e) Indemnifications

Under the Fund’s organizational documents, its Trustees and Officers are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, throughout the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund and/or its affiliates that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

Note 3 – Agreements:

Pursuant to an Investment Advisory Agreement (the “Advisory Agreement”) between the Adviser and the Fund, the Adviser is responsible for the daily management of the Fund’s portfolio, which includes buying and selling securities for the Fund, as well as investment research, subject to the direction of the Fund’s Board. The Advisory Agreement provides that the Fund shall pay to the Adviser a monthly fee for its services at the annual rate of 0.39% of the sum of the Fund’s average daily managed assets. (“Managed Assets” represent the Fund’s total assets including the assets attributable to the proceeds from any financial leverage but excluding the assets attributable to floating rate note obligations, minus liabilities, other than debt representing financial leverage.) Prior to November 1, 2016, the Adviser contractually agreed to waive a portion of the management fees it is entitled to receive from the Fund at annual rate of 0.09% of the Fund’s average daily Managed Assets. Effective November 1, 2016, the advisory fee waiver was terminated.

Pursuant to a Services Agreement between the Fund, the Adviser and MBSC Services Corporation (“MBSC”), an affiliate of the Adviser, provides a review of the content on the Fund’s website and assists with regulatory filings of this content, if necessary. MBSC receives an annual fee from the Fund of $10,000 each November for their services. As of March 31, 2018, the MBSC servicing fees accrued is $17,500, which is included on the Statement of Assets and Liabilities.

Prior to November 1, 2016, pursuant to a Servicing Agreement, Guggenheim Funds Distributors, LLC (the “Prior Servicing Agent”) acted as servicing agent to the Fund. The Prior Servicing Agent received an annual fee from the Fund, payable monthly in arrears, in an amount equal to 0.26% of the average daily value of the Fund’s Managed Assets. The Prior Servicing Agent contractually agreed to waive a portion of the servicing fee it was entitled to receive from the Fund at the annual rate of 0.06% of the average daily value of the Fund’s Managed Assets. For these services, the Prior Servicing Agent received $114,100 and waived fees of $26,331, which are included in the Servicing fees and Servicing fees waived, respectively, on the Statement of Operations for the year ended July 31, 2017. Effective November 1, 2016, the Servicing Agreement was terminated.

The Fund entered into a chief compliance officer outsourcing agreement (the “CCO Outsourcing Agreement”) with Lebisky Compliance Consulting LLC to serve as the Chief Compliance

24 | MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

| | |

| NOTES TO FINANCIAL STATEMENTS continued | | March 31, 2018 |

Officer (“CCO”) of the Fund dated as of October 3, 2017. For the services provided under the CCO Outsourcing Agreement, the Fund shall pay the CCO an annual base fee of $32,500.

The Fund has entered into a separate fee waiver and expense reimbursement agreement with the Adviser dated as of October 3, 2017. The Adviser has agreed to reimburse the Fund an amount equal to those expenses incurred by the Fund under the CCO Outsourcing Agreement. The fee waiver and expense reimbursement agreement may be terminated by either party without cause by giving the other party at least 60 days’ written notice of its intention to terminate, and shall terminate automatically upon termination of the CCO Outsourcing Agreement or the investment advisory agreement between the Fund and the Adviser.

For the eight months ended March 31, 2018, the Fund incurred $16,154 under the CCO Outsourcing Agreement which was reimbursed by the Adviser. As of March 31, 2018, the amount due from the Adviser under the fee waiver and expense reimbursement is $2,761. The Adviser is not eligible to recoup the amount reimbursed.

Effective November 1, 2016, pursuant to a fund administration and accounting agreement, The Bank of New York Mellon (“BNY Mellon”), provides fund administration and accounting services to the Fund. As compensation for these services BNY Mellon receives a fund administration and accounting fee payable monthly at the annual rate of 0.06% as a percentage of the average daily managed assets of the Fund. BNY Mellon also receives a monthly fee of $3,333 for its services. As of March 31, 2018 and July 31, 2017, BNY Mellon received $79,421 and $152,981, respectively, for these services, which is included in the administration fees on the Statement of Operations. Prior to November 1, 2016, BNY Mellon acted as accounting agent and was responsible for maintaining the books and records of the Fund. BNY Mellon acts as the Fund’s custodian. As custodian, BNY Mellon is responsible for the custody of the Fund’s assets. As auction agent, BNY Mellon was responsible for conducting the auction of the preferred shares. Effective August 3, 2017, the auction agent agreement terminated upon the final distribution payment to the holders of the Auction Market Preferred Shares (“AMPS”).

Prior to October 3, 2016, Rydex Fund Services, LLC (“RFS”), an affiliate of the Prior Servicing Agent, provided fund administration services to the Fund. For these services, RFS received $12,068, which is included in the administration fees on the Statements of Operations.

Certain officers and/or trustees of the Fund are officers and/or directors of the Adviser and BNY Mellon. The Fund does not compensate its officers or trustees who are officers, directors and/or employees of the aforementioned firms.

Note 4 – Federal Income Taxes:

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required. In addition, by distributing substantially all of its ordinary income and long-term capital gains, if any, during each calendar year, the Fund intends not to be subject to U.S. federal excise tax.

At March 31, 2018, the following reclassification was made to the capital accounts of the Fund to reflect permanent book/tax differences. Net investment income, net realized gains and net assets were not affected by these changes.

MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT | 25

| | |

| NOTES TO FINANCIAL STATEMENTS continued | | March 31, 2018 |

| | | | | | | | |

| | | | | | | Accumulated Net | | |

| | | | | Accumulated Net | | Realized Gain | | Additional |

| | | | | Investment Loss | | on Investments | | Paid-in Capital |

| | | | | $115,954 | | $(115,954) | | $— |

Information on the tax components of investments as of March 31, 2018, is as follows: |

| | | | | | | | | Net Tax |

| | | | | Gross Tax | | Gross Tax | | Unrealized |

| | | Cost of Investments | | Unrealized | | Unrealized | | Appreciation |

| | | for Tax Purposes | | Appreciation | | Depreciation | | on Investments |

| | | $151,759,403 | | $6,161,296 | | $(812,064) | | $5,349,232 |

As of March 31, 2018 (the most recent fiscal year end for federal income tax purposes), the components of accumulated earnings/(losses) on a tax basis were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Undistributed | | | | | | Undistributed | | | | | | Other | | | | |

| | | Tax-Exempt | | | Undistributed | | | Long-Term | | | Unrealized | | | Temporary | | | | |

| | | Income | | | Ordinary Income | | | Capital Gains | | | Appreciation | | | Differences | | | Total | |

| | | | $— | | | | $— | | | | $902,471 | | | | $5,349,232 | | | | $(119,719) | | | | $6,131,984 | |

For Federal income tax purposes, capital loss carryforwards represent realized losses of the Funds that may be carried forward and applied against future capital gains. For taxable years beginning on or before December 22, 2010, such capital losses may be carried forward for a maximum of eight years. Under the RIC Modernization Act of 2010, the Funds are permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any losses incurred during those taxable years must be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law. As of March 31, 2018 and July 31, 2017, there were no capital loss carryforwards.

Pursuant to Federal income tax regulations applicable to investment companies, the Fund can elect to treat net capital losses and certain ordinary losses realized between November 1 and March 31 of each year as occurring on the first day of the following tax year. The Fund can also elect to treat certain ordinary losses realized between January 1 and March 31 of each year as occurring on the first day of the following tax year. For the eight months ended March 31, 2018 and for the year ended July 31, 2017, no losses were deferred.

Distributions declared to shareholders during the tax eight months ended March 31, 2018, years ended July 31, 2017 and July 31, 2016 were characterized as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | Tax-exempt | | | Ordinary | | | Long-Term | | | Return of | | | Total | |

| | | income | | | income | | | Capital Gains | | | Capital | | | distributions | |

Eight months ended | | | | | | | | | | | | | | | | | | | | |

March 31, 2018 | | | $3,054,340 | | | | $ 81,940 | | | | $115,954 | | | | $ — | | | | $3,252,234 | |

Year ended July 31, 2017 | | | $5,092,476 | | | | $794,194 | | | | $ — | | | | $ — | | | | $5,886,670 | |

Year ended July 31, 2016 | | | $5,639,827 | | | | $218,725 | | | | $ — | | | | $210,547 | | | | $6,069,000 | |

26 | MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

| | |

| NOTES TO FINANCIAL STATEMENTS continued | | March 31, 2018 |

For all open tax years and all major jurisdictions, management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Uncertain tax positions are tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns that would not meet a more-likely-than-not threshold of being sustained by the applicable tax authority and would be recorded as a tax expense in the current year. Open tax years are those years that are open for examination by taxing authorities (i.e. generally the last four tax year ends and the interim tax period since then). Furthermore, management of the Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Note 5 – Investment Transactions:

Purchases and sales of investment securities, excluding short-term investments, for the eight months ended March 31, 2018, aggregated $35,941,750 and $34,982,136, respectively.

Note 6 – Capital:

There are an unlimited number of $0.001 par value common shares of beneficial interest authorized and 6,800,476 common shares outstanding at March 31, 2018.

In connection with the Fund’s dividend reinvestment plan, the Fund did not issue any shares during the eight months ended March 31, 2018 and year ended July 31, 2017.

Variable Rate MuniFund Term Preferred Shares:

On July 12, 2017, the Fund issued 600 shares of Variable Rate MuniFund Term Preferred Shares (VMTP Shares), Series 2020. The preferred shares have a liquidation value of $100,000 per share plus any accumulated unpaid dividends. The Fund used the proceeds from the sale of the VMTP Shares to redeem the AMPS. Dividends on the preferred shares are cumulative at an applicable dividend rate. Distributions of net realized capital gains, if any, are made annually.

The dividend rate for the VMTP Shares is determined with respect to rate periods that will generally commence on a Thursday and end on the following Wednesday when a new index rate is published. The index rate for any such rate period will be the London Interbank Offered Rate (“LIBOR”) Multiplier times One-Month LIBOR as determined on the rate determination date. The dividend rate for any rate period will be equal to the index rate plus the “applicable spread”. The applicable spread will initially be 0.95% annually but will adjust based on the highest applicable credit rating assigned to the VMTP Shares. The range of dividend rates on the Fund’s VMTP Shares for the eight months ended March 31, 2018 were 1.810% for the low and 2.441% for the high.

The Fund’s VMTP Shares, which are entitled to one vote per share, generally vote with the common shares together as one class, but vote separately as a class to elect two Trustees and on any matters affecting the rights of the Fund’s VMTP Shares. The Fund is required to redeem all outstanding VMTP Shares on July 31, 2020.

Note 7 – Offering Costs:

Costs incurred in connection with the Fund’s original offering of VMTP Shares in the amount of $253,998 were recorded and amortized over a three year period. The amount of amortized deferred offering costs included on the Statement of Assets and Liabilities is $204,469.

MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT | 27

| | |

| NOTES TO FINANCIAL STATEMENTS continued | | March 31, 2018 |

Note 8 – Subsequent Events:

The Adviser has notified the Board that it is undergoing certain internal corporate reorganizations and the Adviser anticipates merging into its affiliate, Insight North America, LLC (“INA”), on or about July 1, 2018 (the “Transition Date”-). Following the Transition Date, the Fund’s investment management agreement will be with INA. The Bank of New York Mellon Corporation will remain INA’s ultimate parent company. The Adviser and INA have been operating under the same brand for some time, and this merger is not expected to have any material impact on the day-to-day management of the Fund. This internal reorganization will not result in a change of control of the Adviser under the Investment Company Act of 1940, as amended, and the rules thereunder.

On May 10, 2018, the Board determined to submit a proposal to liquidate the Fund to a vote of all shareholders at a Special Meeting of Shareholders to be held in July 2018. If shareholders approve the liquidation, the Fund will proceed to wind up its affairs as soon as reasonably practicable thereafter in a timeframe that allows for an orderly liquidation of portfolio holdings. If the liquidation is not approved by shareholders, the Board will consider whether another course of action would benefit the Fund and its shareholders.

Other than noted above, the Fund evaluated subsequent events through the date the financial statements were available for issue and determined there were no material events that would require adjustment or disclose in the Fund’s financial statements.

28 | MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

| | |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | March 31, 2018 |

To the Shareholders and Board of Trustees of Managed Duration Investment Grade Municipal Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Managed Duration Investment Grade Municipal Fund (the “Fund”), including the schedule of investments, as of March 31, 2018, the related statements of operations, the statements of changes in net assets and financial highlights for the period then ended and for the year ended July 31, 2017, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2018, the results of its operations, the changes in net assets and financial highlights for the period then ended and the year ended July 31, 2017, in conformity with accounting principles generally accepted in the United States of America.

The statement of changes in net assets for the year ended July 31, 2016, and the financial highlights for each of the four years in the period then ended, were audited by other auditors, and in their opinion dated September 29, 2016, they expressed an unqualified opinion on said financial statements.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the Fund’s auditor since 2017.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of March 31, 2018 by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

Tait, Weller & Baker LLP

Philadelphia, Pennsylvania

May 14, 2018

MZF | MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT | 29

| | |

| SUPPLEMENTAL INFORMATION (Unaudited) | | March 31, 2018 |

Results of Shareholder Votes

The Fund held its Annual Meeting of Shareholders on December 6, 2017 for the following purposes:

· The election of Ellen D. Harvey as a Class I Trustee of the Fund by holders of common and preferred shares, to serve until 2020 or until her successor is duly elected and qualified;

· The election of Suzanne P. Welsh as a Class I Trustee of the Fund by holders of preferred shares, to serve until 2020 or until her successor is duly elected and qualified;

and

· The election of Thomas E. Spock as a Class III Trustee of the Fund by holders of preferred shares, to serve until 2019 or until his successor is duly elected and qualified

The voting results were as follows:

| | | | | | | | | | | | |

| | | # of shares in Favor | | | | | | # of shares Withheld | |

| | | |

Ellen D. Harvey | | | 3,917,474 | | | | | | | | 2,626,441 | |

| | | |

Suzanne P. Welsh | | | 600 | | | | | | | | — | |

| | | |

Thomas E. Spock | | | 600 | | | | | | | | — | |

Trustees and Officers

The Trustees and Officers of the Managed Duration Investment Grade Municipal Fund and their principal occupations during the past five years:

| | | | | | | | | | | | |

| | | | | | | | | | | Other | | |

| | | | | | | Number of Funds | | | | Directorships | | |