Table of Contents

As Filed with the Securities and Exchange Commission on August 19, 2003

Registration No. 333-106529

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DIRECTV HOLDINGS LLC

DIRECTV FINANCING CO., INC.

(Exact name of co-registrants as specified in their charters)

| DIRECTV Holdings LLC—DELAWARE | 5064 | 25-1902628 | ||

| DIRECTV Financing Co., Inc.—DELAWARE | 5064 | 59-3772785 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

SEE TABLE OF ADDITIONAL REGISTRANTS BELOW

DIRECTV Holdings LLC

DIRECTV Financing Co., Inc.

2230 East Imperial Highway, El Segundo, California 90245; (310) 964-5000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Robert M. Hall

Senior Vice President & General Counsel

2230 East Imperial Highway, El Segundo, California 90245; (310) 964-5000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Craig W. Adas

Weil, Gotshal & Manges LLP

201 Redwood Shores Parkway

Redwood Shores, California 94065

(650) 802-3000

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

THE CO-REGISTRANTS HEREBY AMEND THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE CO-REGISTRANTS SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

Table of Contents

TABLE OF ADDITIONAL REGISTRANTS(1)

Exact Name of Additional Registrant as | State or Other Jurisdiction of | I.R.S. Employer Identification Number | ||

DIRECTV Enterprises, LLC | Delaware | 95-4511942 | ||

DIRECTV Customer Services, Inc. | Delaware | 95-4738537 | ||

DIRECTV Merchandising, Inc. | Delaware | 95-4523782 | ||

DIRECTV Operations, LLC | California | 95-4511940 | ||

DIRECTV, Inc. | California | 95-4321465 | ||

USSB II, Inc. | Minnesota | 41-1772351 |

| (1) | The address and telephone number for each of the additional registrants, other than DIRECTV Customer Services, Inc., is 2230 East Imperial Highway, El Segundo, California 90245, (310) 964-5000. The address and telephone number for DIRECTV Customer Services, Inc. is 5800 N. Meeker Avenue, Boise, Idaho 83704, (208) 363-6000. |

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell or offer these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 19, 2003

PROSPECTUS

$1,400,000,000

DIRECTV Holdings LLC

DIRECTV Financing Co., Inc.

OFFER TO EXCHANGE ALL OUTSTANDING

8 3/8% Senior Notes Due 2013

FOR NEWLY-ISSUED

8 3/8% Senior Notes Due 2013

That Have Been Registered Under

the Securities Act of 1933

We are offering to exchange our outstanding notes described above for the new, registered notes described above. The terms of the new notes are identical in all material respects to the terms of the outstanding notes to be exchanged, except for certain transfer restrictions, registration rights and additional interest payment provisions relating to the outstanding notes. In this document, we refer to our outstanding notes as the “Original Notes” and our new notes as the “Registered Notes.” Any reference to “Notes” in this prospectus refers to the Original Notes and the Registered Notes, unless the context requires a different interpretation.

MATERIAL TERMS OF THE EXCHANGE OFFER

| • | Expires at 5:00 p.m., New York City time, on , 2003, unless extended. |

| • | The only conditions to completing the exchange offer are that the exchange offer does not violate applicable law or any applicable interpretation of the staff of the Securities and Exchange Commission; no action or proceeding shall have been instituted or threatened in any court or by any governmental agency which might materially impair our ability to proceed with the exchange offer; all governmental approvals shall have been obtained, which approvals we deem necessary for the consummation of the exchange offer; there shall not have been any material change, or development involving a prospective material change, in our business or financial affairs which, in our reasonable judgment, would materially impair our ability to consummate the exchange offer; and that there shall not have been proposed, adopted or enacted any law, statute, rule or regulation which, in our reasonable judgment, would materially impair our ability to consummate the exchange offer or have a material adverse effect on us if the exchange offer was consummated. |

| • | All Original Notes that are validly tendered and not validly withdrawn will be exchanged. |

| • | Tenders of Original Notes may be withdrawn at any time prior to the expiration of the exchange offer. |

| • | We will not receive any cash proceeds from the exchange offer. |

Each broker-dealer that receives Registered Notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of the Registered Notes. The letter of transmittal states that, by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Registered Notes received in exchange for Original Notes where the Original Notes were acquired by that broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the expiration date of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

CONSIDER CAREFULLY THE “RISK FACTORS” BEGINNING ON PAGE 16 OF THIS PROSPECTUS.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is August , 2003

Table of Contents

| PAGE | ||

| ii | ||

| iii | ||

| iii | ||

| 1 | ||

| 16 | ||

| 34 | ||

| 42 | ||

| 43 | ||

| 44 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION | 46 | |

| 66 | ||

| 67 | ||

| 91 | ||

| 94 | ||

| 95 | ||

| 98 | ||

| 100 | ||

| 131 | ||

| 132 | ||

| 133 | ||

| 133 | ||

| F-1 | ||

i

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the Securities and Exchange Commission, or SEC, a registration statement on Form S-4 under the Securities Act of 1933, as amended (the “Securities Act”) with respect to the Registered Notes. This prospectus, which is a part of the registration statement, omits certain information included in the registration statement and in its exhibits. For further information relating to us and the Notes, we refer you to the registration statement and its exhibits. The descriptions of each contract and document contained in this prospectus are summaries and qualified in their entirety by reference to the copy of that contract or document filed as an exhibit to the registration statement. You may read and copy the registration statement, including its exhibits, at the SEC’s Public Reading Room located at 450 Fifth Street, N.W., Washington D.C. 20549. You may obtain information on the operation of the Public Reading Room by calling the SEC at 1-800-SEC-0300. The SEC also maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements and other information regarding registrants like us who file electronically with the SEC. You can obtain a copy of any of our filings, at no cost to you, by contacting us at the following address:

DIRECTV Holdings LLC

2230 East Imperial Highway

El Segundo, California 90245

Attention: Corporate Secretary

(310) 964-5000

To ensure timely delivery, please make your request as soon as practicable and, in any event, no later than five business days prior to the expiration of the exchange offer.

We are not currently subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Upon effectiveness of the registration statement of which this prospectus is a part, we will file annual, quarterly and current reports and other information with the SEC in accordance with the Exchange Act. You may read and copy any document we file with the SEC at the SEC’s address set forth above. If for any reason we are not subject to the reporting requirements of the Exchange Act in the future, we will still be required under the indenture governing the Notes to furnish the holders of the Notes with certain financial and reporting information. See “Description of Registered Notes—Reports” for a description of the information we are required to provide.

ii

Table of Contents

NOTICE TO NEW HAMPSHIRE RESIDENTS

NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN APPLICATION FOR A LICENSE HAS BEEN FILED UNDER CHAPTER 421-B OF THE NEW HAMPSHIRE REVISED STATUTES ANNOTATED, 1955, AS AMENDED, WITH THE STATE OF NEW HAMPSHIRE NOR THE FACT THAT A SECURITY IS EFFECTIVELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF NEW HAMPSHIRE CONSTITUTES A FINDING BY THE SECRETARY OF STATE THAT ANY DOCUMENT FILED UNDER RSA 421-B IS TRUE, COMPLETE AND NOT MISLEADING. NEITHER ANY SUCH FACT NOR THE FACT THAT AN EXEMPTION OR EXCEPTION IS AVAILABLE FOR A SECURITY OR A TRANSACTION MEANS THAT THE SECRETARY OF STATE HAS PASSED IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF, OR RECOMMENDED OR GIVEN APPROVAL TO, ANY PERSON, SECURITY, OR TRANSACTION. IT IS UNLAWFUL TO MAKE, OR CAUSE TO BE MADE, TO ANY PROSPECTIVE PURCHASER, CUSTOMER, OR CLIENT ANY REPRESENTATION INCONSISTENT WITH THE PROVISIONS OF THIS PARAGRAPH.

In this prospectus, we rely on and refer to information regarding market data obtained from internal surveys, market research, publicly available information and industry publications. Although we believe the information is reliable, we cannot guarantee the accuracy or completeness of the information and have not independently verified it.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

We make “forward-looking statements” throughout this prospectus. Whenever you read a statement that is not simply a statement of historical fact (such as when we describe what we “believe,” “plan,” “estimate,” “expect” or “anticipate” will occur and other similar statements), you must remember that our expectations may not be correct, even though we believe they are reasonable. We do not guarantee that the transactions and events described in this prospectus will happen as described or that they will happen at all. You should read this prospectus completely and with the understanding that actual future results may be materially different from what we expect. Whether actual results will conform with our expectations and predictions is subject to a number of risks and uncertainties. The risks and uncertainties include, but are not limited to, the following:

| • | we are a wholly-owned subsidiary of Hughes Electronics Corporation, or Hughes, and an indirect wholly-owned subsidiary of General Motors Corporation, and any change of control of Hughes or us could adversely affect our business; |

| • | we are highly leveraged and subject to numerous constraints on our ability to raise additional debt; |

| • | we may be unable to obtain needed retransmission consents, Federal Communications Commission, or FCC, authorizations or other governmental licenses; |

| • | our satellite launches may be delayed or fail and our in-orbit satellites may malfunction or fail prematurely; |

| • | the possibility of terrorist attacks, war or other military action against foreign countries, and changes in international political conditions as a result of these events, may continue to adversely affect the United States and the global economy; |

| • | weaknesses in the United States economy may harm our business; |

iii

Table of Contents

| • | service interruptions arising from technical anomalies on some satellites, or caused by war, terrorist activities or natural disasters, may cause customer cancellations or otherwise harm our business; |

| • | we face intense and increasing competition from providers in the multi-channel video programming distribution, or MVPD, industry; new competitors may enter the MVPD business and new technologies may increase competition in the industry; |

| • | satellite programming signals have been pirated and could be pirated in the future, which could cause us to lose subscribers and revenue or result in higher costs to us; |

| • | programming costs may increase beyond our current expectations; |

| • | future acquisitions, strategic partnerships and divestitures may involve additional uncertainties; |

| • | we are party to various lawsuits that, if adversely decided, could have a significant adverse impact on our business; and |

| • | we may face other risks described from time to time in periodic reports filed by us and Hughes with the SEC. |

You should read carefully the section of this prospectus under the heading “Risk Factors” beginning on page 16. We assume no responsibility for updating forward-looking information contained in this prospectus.

We own or have rights to use various copyrights, trademarks, service marks and trade names used in our business. These include the United States registered marks DIRECTV®, the Cyclone Design logo, DIRECT TICKET®, DIRECTV HOME SERVICES®, DIRECTV-The Guide®, OPCIÓN EXTRA ESPECIAL® and TOTAL CHOICE®, and, to the best of our knowledge, the unregistered marks DIRECTV PARA TODOS™, DIRECTV INTERACTIVE™, OPCIÓN ULTRA ESPECIAL™ and OPCIÓN PREMIER™. This prospectus also includes copyrights, trademarks, service marks and trade names of other companies.

iv

Table of Contents

In this prospectus, “we,” “our” and “us” refer to DIRECTV Holdings LLC and its subsidiaries, unless the context indicates a different meaning. “GM” refers to General Motors Corporation and “Hughes” refers to Hughes Electronics Corporation, our parent corporation, and “News Corporation” refers to The News Corporation Limited. You should refer to the section entitled “—The DIRECTV Organization” for a diagram of the current organizational structure of our company. This is only a summary and does not contain all of the information that may be important to you. GM and Hughes have entered into agreements with News Corporation whereby GM has agreed to split-off Hughes and sell its economic interest in Hughes to News Corporation. Additional information with respect to these proposed transactions is included under “—Recent Developments—News Corporation Transactions.” You should read the prospectus, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Results of Operations and Financial Condition” and our financial statements and related notes, before making an investment decision.

DIRECTV Holdings LLC

Our Business

We are the largest provider of direct broadcast satellite, or DBS, television services and the second largest multi-channel video programming distribution, or MVPD, provider in the United States, in each case based on number of subscribers. We currently have seven satellites in orbit and distribute more than 800 digital-quality video and audio channels, including seven high-definition channels and various interactive TV services, to consumers throughout the United States.

We introduced our direct-to-home television service in the United States in June 1994 and have grown rapidly. As of June 30, 2003, we had approximately 11.6 million subscribers, of which 9.9 million were owned and operated and 1.7 million were subscribers who received our service from members and affiliates of the National Rural Telecommunications Cooperative, or NRTC. There are approximately 20 million subscribers to DBS and approximately 90 million total pay television subscribers in the United States. We believe there continues to be significant additional demand for our high quality television programming services.

The DIRECTV® System

To subscribe to our service, customers purchase the receiving equipment from us or through one of approximately 30,000 retail locations in the United States. The receiving equipment consists of a small receiving satellite dish antenna, a digital set-top receiver and a remote control, which we refer to as the “DIRECTV System.” After purchasing and installing the DIRECTV System, customers activate our service by calling us and subscribing to the programming package that matches their viewing habits.

Our Competitive Strengths

Our business is characterized by the following key strengths:

| • | large subscriber base; |

| • | leading brand name; |

| • | high quality digital picture and sound; |

| • | superior customer service; |

| • | valuable orbital slots and satellite-based technology; |

1

Table of Contents

| • | substantial channel capacity and programming content; and |

| • | national distribution and installation network. |

Our Business Strategy

Our operating and financial strategy focuses on improving our financial results in terms of Operating Profit Before Depreciation and Amortization and free cash flow while growing our subscriber base with high quality customers. Our strategy to continue to achieve these goals is based on the following initiatives:

| • | Expand the availability of local channels. Assuming our new spot beam satellite, DIRECTV 7S, is in service in the first quarter of 2004, we expect to increase our local channel coverage from 64 markets to approximately 100 markets, representing approximately 84% of United States television households, during the first quarter of 2004. |

| • | Offer new and compelling programming and services. We plan to offer our subscribers new and compelling programming and services, including next generation digital video recorder, or DVR, services, additional high-definition television, or HDTV, channels and exclusive programming such as NFL SUNDAY TICKET™. |

| • | Reduce subscriber churn. We are working with our retailers to promote the sale of multiple set-top receivers, which we expect will reduce churn and provide higher average monthly revenue per subscriber, or ARPU. We plan to continue to offer consumer promotions, loyalty programs and dealer programs to improve our overall subscriber retention. |

| • | Reduce operating costs. We expect to generate significant cost savings in our billing and customer service areas from the renegotiation of outsourcing contracts and through other continuing initiatives. We also plan to seek to reduce the annual increases in costs under our programming contracts. |

| • | Combat signal theft. We have undertaken initiatives with respect to our conditional access system to further enhance the security of the DIRECTV signal. In addition, we are working with local, state and federal law enforcement to seek out and prosecute signal thieves. |

Enhanced and Interactive Services

We are a leader in introducing enhanced television and interactive service offerings. With the launch of our new HD programming package on July 1, 2003, we currently offer seven HDTV channels. We expect to offer our NFL SUNDAY TICKET™ subscribers access to high-definition telecasts of selected professional football games beginning with the 2003 regular NFL season. Through our strategic relationship with TiVo Inc., we offer our customers DVR services with set-top receivers that can digitally record up to 35 hours of television programs without videotape and allow customers to pause and rewind live television, create their own television programming lineups and watch one program while simultaneously recording another. We also offer our DIRECTV INTERACTIVE service, provided in conjunction with Wink Communications, Inc., which enables our subscribers to access interactive and data-enhanced programming and advertising and perform e-commerce transactions with a Wink-enabled DIRECTV receiver.

Recent Developments

Financing Transactions. On February 28, 2003, we issued $1.4 billion in aggregate principal amount of our Original Notes in a private placement. On March 6, 2003, we entered into a $1.675 billion senior secured credit facility. The senior secured credit facility was initially comprised of a $375.0 million Term Loan A, of which $175.0 million was outstanding at June 30, 2003, a $1.05 billion Term Loan B, which was fully drawn at June 30, 2003, and a $250.0 million revolving credit facility, which was undrawn at June 30, 2003. We distributed $2.559 billion to Hughes which amounted to substantially all of the cash proceeds from the private

2

Table of Contents

placement of the Original Notes and the drawn portions of the term loans under the senior secured credit facility, net of estimated debt issuance costs. Hughes used a portion of the cash distribution to repay existing debt, and the remaining portion will provide operating cash to Hughes’ other subsidiaries and fund Hughes’ general corporate purposes, including working capital. On August 5, 2003, we replaced the $1.05 billion Term Loan B with a new $1.225 billion Term Loan B-1 and prepaid the $175.0 million that was outstanding under the Term Loan A with the $175.0 million of additional borrowings. We may make additional distributions to Hughes from time to time to the extent permitted by the terms of the documents governing our indebtedness. Currently, we expect to draw and distribute to Hughes the remaining $200.0 million available under the Term Loan A by December 2003. Borrowings, if any, under the revolving loan portion of the senior secured credit facility will be used by us to fund our working capital needs and for general corporate purposes.

Exclusive Rights to NFL SUNDAY TICKET™. In December 2002, we announced a new five-year agreement with the National Football League for the exclusive DBS television rights to NFL SUNDAY TICKET™ through 2007 and exclusive multichannel television rights through 2005. Our agreement with the NFL will allow us to distribute expanded programming to our NFL SUNDAY TICKET™ subscribers, including the NFL CHANNEL™ on DIRECTV. The agreement will also allow us to provide our NFL SUNDAY TICKET™ subscribers who have the appropriate set-top receiver with exclusive enhanced technical innovations, which may include high-definition telecasts, viewer-selected cameras and replays and other advanced digital technology.

Transfer of Certain Securities to Hughes. During the first quarter of 2003, we distributed to Hughes all of our marketable equity investments. The distribution was a transfer of assets by entities under common control and reflected at our cost basis as a capital distribution to Hughes. These investments, which included our equity investments in Crown Media Holdings, Inc., TiVo Inc. and XM Satellite Radio Holdings, Inc., had an aggregate book value of $52.6 million at the date of transfer.

News Corporation Transactions. On April 9, 2003, GM, Hughes and News Corporation announced the signing of definitive agreements that provide for, among other things, the split-off of Hughes from GM and the simultaneous sale of GM’s approximately 19.8% retained economic interest in Hughes to News Corporation. GM would receive approximately $3.84 billion, comprised of approximately $3.07 billion in cash with the remainder payable in News Corporation preferred American Depositary Shares, and/or cash, at News Corporation’s election. Immediately after the split-off, News Corporation would acquire an additional approximately 14.2% of the outstanding Hughes common stock from the former GM Class H common stockholders through a merger of a wholly owned subsidiary of News Corporation with and into Hughes, which would provide News Corporation with a total of 34% of the outstanding capital stock of Hughes. In addition, GM would receive a special cash dividend from Hughes of $275 million in connection with the transactions. Hughes expects to pay this dividend using available cash balances.

If the News Corporation transactions are completed, Mr. K. Rupert Murdoch, chairman and chief executive officer of News Corporation, would become chairman of Hughes, and Mr. Chase Carey, who is currently serving as a director of and an advisor to News Corporation, would become president and chief executive officer of Hughes. Mr. Eddy Hartenstein, chairman and chief executive officer of DIRECTV and senior executive vice president of Hughes, would be named vice chairman of Hughes. Hughes would have 11 directors, the majority of whom would be independent directors.

The News Corporation transactions are subject to a number of conditions, including, among other things, obtaining U.S. antitrust and Federal Communications Commission approvals, approval by a majority of each class of GM common stockholders—GM $1 2/3 par value and GM Class H—voting both as separate classes and together as a single class based on their respective voting power and a favorable ruling from the Internal Revenue Service that the split-off of Hughes from GM would be tax-free to GM and its stockholders for U.S. federal income tax purposes. No assurances can be given that the approvals will be obtained or the transactions will be

3

Table of Contents

completed. The financial and other information regarding Hughes contained in this prospectus do not give any effect to or make any adjustment for the anticipated completion of the transactions.

The completion of the News Corporation transactions will not result in a change of control as defined in the senior secured credit facility or the indenture governing the Notes.

Our Executive Offices

Our principal executive offices are located at 2230 East Imperial Highway, El Segundo, California 90245, and our telephone number is (310) 964-5000.

4

Table of Contents

Summary of the Terms of the Exchange Offer

On February 28, 2003, we issued $1.4 billion in aggregate principal amount of our Original Notes in a private placement. We entered into a registration rights agreement with the initial purchasers of the Original Notes in which we agreed to deliver to you this prospectus. You are entitled to exchange your Original Notes in the exchange offer for Registered Notes with identical terms, except that the Registered Notes will have been registered under the Securities Act and will not bear legends restricting their transfer. Unless you are a broker-dealer or unable to participate in the exchange offer, we believe that the Registered Notes to be issued in the exchange offer may be resold by you without compliance with the registration and prospectus delivery requirements of the Securities Act. You should read the discussions under the headings “The Exchange Offer” and “Description of the Registered Notes” for further information regarding the Registered Notes.

Registration Rights Agreement | You are entitled under the registration rights agreement governing your Original Notes to exchange your Original Notes for Registered Notes with substantially identical terms. The exchange offer is intended to satisfy these rights. After the exchange offer is completed, except as set forth in the next paragraph, you will no longer be entitled to any exchange or registration rights with respect to your Original Notes. | |||

| If you would not receive freely tradable Registered Notes in the exchange offer or you are ineligible to participate in the exchange offer and indicate that you wish to have your Original Notes registered under the Securities Act, the registration rights agreement governing your Original Notes requires us to file a registration statement for a continuous offering in accordance with Rule 415 under the Securities Act for your benefit. See “The Exchange Offer—Procedures for Tendering.” | ||||

The Exchange Offer | We are offering to exchange $1,000 principal amount of our 8 3/8 % Senior Notes due 2013, which have been registered under the Securities Act, for each $1,000 principal amount of our 8 3/8% Senior Notes due 2013 that were issued on February 28, 2003 and have not been so registered. | |||

| In order to be exchanged, an Original Note must be properly tendered and accepted. All Original Notes that are validly tendered and not validly withdrawn will be exchanged. | ||||

| As of this date, there are $1.4 billion aggregate principal amount of our unregistered 8 3/8% Senior Notes due 2013 outstanding. | ||||

| We will issue the Registered Notes promptly after the expiration of the exchange offer. | ||||

Resales of the Registered Notes | We believe that Registered Notes to be issued in the exchange offer may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act if you meet the following conditions: | |||

| (1) | the Registered Notes to be issued to you in the exchange offer are acquired in the ordinary course of your business; | |||

| (2) | at the time of the commencement of the exchange offer you have no arrangement or understanding with any person to participate in the distribution (within the meaning of the Securities Act) of the Registered Notes to be issued to you in the exchange offer in violation of the Securities Act; | |||

5

Table of Contents

| (3) | you are not an affiliate (as defined in Rule 405 promulgated under the Securities Act) of us; | |||

| (4) | if you are a broker-dealer, you are not engaging in, and do not intend to engage in, a distribution of the Registered Notes to be issued to you in the exchange offer; | |||

| (5) | if you are a participating broker-dealer that will receive Registered Notes for its own account in exchange for the Original Notes that were acquired as a result of market-making or other trading activities, that you will deliver a prospectus in connection with any resale of the Registered Notes; and | |||

| (6) | you are not acting on behalf of any persons or entities who could not truthfully make the foregoing representations. | |||

| Our belief is based on interpretations by the staff of the SEC, as set forth in no-action letters of Exxon Capital Holdings Corporation (available April 13, 1988), Morgan Stanley & Co. Incorporated (available June 5, 1991) and Shearman & Sterling (available July 2, 1993). The staff has not considered this exchange offer in the context of a no-action letter, and we cannot assure you that the staff would make a similar determination with respect to this exchange offer. | ||||

| If you do not meet the above conditions, you may incur liability under the Securities Act if you transfer any Registered Note without delivering a prospectus meeting the requirements of the Securities Act. We do not assume, or indemnify you against, that liability. | ||||

| Each broker-dealer that is issued Registered Notes in the exchange offer for its own account in exchange for Original Notes that were acquired by that broker-dealer as a result of market-making activities or other trading activities must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any of its resales of those Registered Notes. A broker-dealer may use this prospectus to offer to resell, resell or otherwise transfer those Registered Notes. | ||||

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, on, 2003, unless we decide to extend the exchange offer. We do not intend to extend the exchange offer, although we reserve the right to do so. We refer to this date, as it may be extended, as the expiration date. | |||

Conditions to the Exchange Offer | The only conditions to completing the exchange offer are that: | |||

| (1) | the exchange offer does not violate applicable law or any applicable interpretation of the staff of the SEC; | |||

| (2) | no action or proceeding shall have been instituted or threatened in any court or by any governmental agency which might materially impair our ability to proceed with the exchange offer; | |||

| (3) | all governmental approvals shall have been obtained, which approvals we deem necessary for the consummation of the exchange offer; | |||||

6

Table of Contents

| (4) | there shall not have been any material change, or development involving a prospective material change, in our business or financial affairs which, in our reasonable judgment, would materially impair our ability to consummate the exchange offer; and | |||||

| (5) | that there shall not have been proposed, adopted or enacted any law, statute, rule or regulation which, in our reasonable judgment, would materially impair our ability to consummate the exchange offer or have a material adverse effect on us if the exchange offer was consummated. | |||||

| See “The Exchange Offer—Conditions.” | ||||||

Procedures for Tendering Original Notes Held in the Form of Book-Entry Interests | The Original Notes were issued as global securities in fully registered form without interest coupons. Beneficial interests in the Original Notes which are held by direct or indirect participants in The Depository Trust Company, or DTC, through certificateless depositary interests are shown on, and transfers of the Original Notes can be made only through, records maintained in book-entry form by DTC with respect to its participants. | |||||

| If you are a holder of an Original Note held in the form of a book-entry interest and you wish to tender your Original Note for exchange pursuant to the exchange offer, you must transmit to The Bank of New York, as exchange agent, on or prior to the expiration of the exchange offer either: | ||||||

| • | a written or facsimile copy of a properly completed and executed letter of transmittal and all other required documents to the address set forth on the cover page of the letter of transmittal; or | |||||

| • | a computer-generated message transmitted by means of DTC’s Automated Tender Offer Program system and forming a part of a confirmation of book-entry transfer in which you acknowledge and agree to be bound by the terms of the letter of transmittal. | |||||

| The exchange agent must also receive on or prior to the expiration of the exchange offer either: | ||||||

| • | a timely confirmation of book-entry transfer of your Original Notes into the exchange agent’s account at DTC, in accordance with the procedure for book-entry transfers described in this prospectus under the heading “The Exchange Offer—Book-Entry Transfer;” or | |||||

| • | the documents necessary for compliance with the guaranteed delivery procedures described below. | |||||

| A form of letter of transmittal accompanies this prospectus. By executing the letter of transmittal or delivering a computer-generated message through DTC’s Automated Tender Offer Program system, you will represent to us that, among other things: | ||||||

7

Table of Contents

| • | the Registered Notes to be issued to you in the exchange offer are acquired in the ordinary course of your business; | |||||

| • | at the time of the commencement of the exchange offer you have no arrangement or understanding with any person to participate in the distribution (within the meaning of the Securities Act) of the Registered Notes to be issued to you in the exchange offer in violation of the Securities Act; | |||||

| • | you are not an affiliate (as defined in Rule 405 promulgated under the Securities Act) of us; | |||||

| • | if you are a broker-dealer, you are not engaging in, and do not intend to engage in, a distribution of the Registered Notes to be issued to you in the exchange offer; | |||||

| • | if you are a participating broker-dealer that will receive Registered Notes for its own account in exchange for the Original Notes that were acquired as a result of market-making or other trading activities, that you will deliver a prospectus in connection with any resale of the Registered Notes; and | |||||

| • | you are not acting on behalf of any persons or entities who could not truthfully make the foregoing representations. | |||||

Procedures for Tendering Certificated Original Notes | If you are a holder of book-entry interests in the Original Notes, you are entitled to receive, in limited circumstances, in exchange for your book-entry interests, certificated notes in equal principal amount to your book-entry interests. See “Description of the Registered Notes—Form of Registered Notes.” No certificated notes are issued and outstanding as of the date of this prospectus, other than a single note issued to and held by DTC. If you acquire certificated Original Notes prior to the expiration of the exchange offer, you must tender your certificated Original Notes in accordance with the procedures described in this prospectus under the heading “The Exchange Offer—Procedures for Tendering—Certificated Original Notes.” | |||||

Special Procedures for Beneficial Owner |

If you are the beneficial owner of Original Notes and they are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender your Original Notes, you should promptly contact the person in whose name your Original Notes are registered and instruct that person to tender on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal for your Original Notes and delivering your Original Notes, either make appropriate arrangements to register ownership of the Original Notes in your name or obtain a properly completed bond power from the person in whose name your Original Notes are registered. The transfer of registered ownership may take considerable time. See “The Exchange Offer—Procedures for Tendering—Procedures Applicable to All Holders.” | |||||

8

Table of Contents

Guaranteed Delivery Procedures | If you wish to tender your Original Notes and: | |||

| (1) | they are not immediately available; | |||

| (2) | time will not permit your Original Notes or other required documents to reach the exchange agent before the expiration of the exchange offer; or | |||

| (3) | you cannot complete the procedure for book-entry transfer on a timely basis, | |||

| you may tender your Original Notes in accordance with the guaranteed delivery procedures set forth in “The Exchange Offer—Procedures for Tendering—Guaranteed Delivery Procedures.” | ||||

| Acceptance of Original Notes and Delivery of Registered Notes | Except under the circumstances described above under “Conditions to the Exchange Offer,” we will accept for exchange any and all Original Notes which are properly tendered in the exchange offer prior to 5:00 p.m., New York City time, on the expiration date. The Registered Notes to be issued to you in the exchange offer will be delivered promptly following the expiration date. See “The Exchange Offer—Terms of the Exchange Offer.” | |||

Withdrawal | You may withdraw the tender of your Original Notes at any time prior to 5:00 p.m., New York City time, on the expiration date. We will return to you any Original Notes not accepted for exchange for any reason without expense to you as promptly as we can after the expiration or termination of the exchange offer. | |||

Exchange Agent | The Bank of New York is serving as the exchange agent in connection with the exchange offer. | |||

Consequences of Failure to Exchange | If you do not participate in the exchange offer, upon completion of the exchange offer, the liquidity of the market for your Original Notes could be adversely affected. See “The Exchange Offer—Consequences of Failure to Exchange.” | |||

Federal Income Tax Consequences | The exchange of Original Notes for Registered Notes should not be a taxable event for federal income tax purposes. See “Certain United States Federal Income Tax Considerations.” | |||

9

Table of Contents

Summary of the Terms of the Registered Notes

The summary below describes the principal terms of the Registered Notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of the Registered Notes” section of this prospectus contains a more detailed description of the terms and conditions of the Registered Notes.

Issuers | DIRECTV Holdings LLC and DIRECTV Financing Co., Inc. | |

Securities Offered | $1,400,000,000 aggregate principal amount of 8 3/8% Senior Notes due March 15, 2013. | |

Issue Price | 100%. | |

Maturity | March 15, 2013. | |

Interest Rate | 8 3/8% per year (calculated using a 360-day year). | |

Interest Payment Dates | March 15 and September 15 of each year, commencing September 15, 2003. Interest will accrue (A) from the latter of (x) the last interest payment date on which interest was paid on the Original Notes surrendered for exchange and (y) if the Original Notes are surrendered for exchange on a date in a period which includes the record date for an interest payment date to occur on or after the date of such exchange and as to which interest will be paid, the date of such interest payment date or (B) if no interest has been paid on the Original Notes, from the issue date of the Original Notes. | |

Ranking | The Registered Notes and the guarantees will be senior unsecured obligations and will rank senior to all of our and our guarantors’ subordinated debt. The Registered Notes will effectively rank junior to any of our and our guarantors’ secured debt to the extent of the value of the assets securing that debt and to any debt and other liabilities of our subsidiaries that are not guarantors. As of June 30, 2003, we and the guarantors had approximately $2.625 billion of senior indebtedness of which $1.225 billion was secured. In addition, we have $200 million available under the Term Loan A-2 portion, and up to $250 million available under the revolving loan portion, of the senior secured credit facility. See “Description of Senior Secured Credit Facility.” | |

Guarantees | The Registered Notes will be guaranteed by all of our domestic subsidiaries on a senior unsecured basis. None of GM, Hughes or any of their subsidiaries, other than us and all of our domestic subsidiaries, will guarantee or have any liability under the Registered Notes. See “Description of the Registered Notes—Guarantees.” | |

Optional Redemption | We may redeem some or all of the Registered Notes at any time prior to March 15, 2008 by paying a “make whole” premium and at any time thereafter at stated redemption prices, in each case plus accrued and unpaid interest to the date of redemption.

| |

| In addition, at any time prior to March 15, 2006, we may redeem up to 35% of the outstanding Registered Notes with the net proceeds of one or more equity offerings, at a redemption price equal to 108.375% of the principal amount, plus accrued and unpaid interest to the date of | ||||

10

Table of Contents

| redemption. We may exercise this right more than once, so long as after the redemption at least 65% of the aggregate principal amount of the Registered Notes originally issued remains outstanding. See “Description of the Registered Notes—Optional Redemption.” | ||||

| Repurchase Right of Holders Upon a Change of Control and Rating Decline |

If a change of control triggering event occurs, holders of Registered Notes will have the right, subject to certain conditions, to require us to repurchase their Registered Notes at a purchase price equal to 101% of the aggregate principal amount of the Registered Notes repurchased plus accrued and unpaid interest, if any, as of the date of repurchase. See “Description of the Registered Notes—Change of Control and Rating Decline.” | |||

Certain Other Covenants | The indenture governing the Registered Notes contains covenants limiting our and our restricted subsidiaries’ ability to, among other things: | |||

| • | incur additional debt; | |||

| • | pay dividends or distributions on our capital stock or repurchase our capital stock; | |||

| • | transfer or sell assets; | |||

| • | issue stock of subsidiaries; | |||

| • | make certain investments; | |||

| • | create liens; | |||

| • | enter into transactions with affiliates; and | |||

| • | merge, consolidate or transfer all or substantially all of our assets. | |||

| These covenants are subject to a number of important limitations and exceptions. See “Description of the Registered Notes—Certain Covenants.” | ||||

Registration Rights; Liquidated Damages | In connection with the offering of the Original Notes, we granted registration rights to holders of the Original Notes. We agreed to consummate an offer to exchange the Original Notes for the related series of Registered Notes and to take other actions in connection with the exchange offer by the date specified in the registration rights agreement. In addition, under some circumstances, we may be required to file a shelf registration statement to cover resales of the Original Notes held by you. | |||

| If we fail to take these actions with respect to the Original Notes by the dates specified in the registration rights agreement, we will pay liquidated damages to each holder of the Original Notes until all registration defaults have been cured. See “Description of the Registered Notes—Principal, Maturity and Interest.” |

11

Table of Contents

Form of Registered Notes | The Registered Notes to be issued in the exchange offer will be represented by one or more global securities deposited with The Bank of New York for the benefit of DTC. You will not receive Registered Notes in certificated form unless one of the events set forth under the heading “Description of the Registered Notes—Form of Registered Notes” occurs. Instead, beneficial interests in the Registered Notes to be issued in the exchange offer will be shown on, and transfer of these interests will be effected only through, records maintained in book-entry form by DTC with respect to its participants. | |

Use of Proceeds | We will not receive any cash proceeds upon completion of the exchange offer. | |

Risk Factors | Investing in the Registered Notes involves substantial risks. See “Risk Factors” for a description of certain risks you should consider before investing in the Registered Notes. | |

12

Table of Contents

Summary Financial and Operating Data

The following summary consolidated financial and operating data have been derived from, and should be read in conjunction with, our consolidated financial statements. The consolidated statements of operations data for each of the three years in the period ended December 31, 2002 and the balance sheet data as of December 31, 2002 have been derived from our consolidated financial statements included elsewhere in this prospectus, which have been audited by Deloitte & Touche LLP, our independent auditors. The consolidated statements of operations data for the three and six months ended June 30, 2002 and 2003 and the consolidated balance sheet data as of June 30, 2003 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus and, in the opinion of management, include all adjustments, consisting only of normal recurring items necessary to present fairly such data. Our results of operations for the three and six months ended June 30, 2003 are not necessarily indicative of the results of operations which may be expected for the full 2003 fiscal year.

You should read the data in conjunction with the sections entitled “Management’s Discussion and Analysis of Results of Operations and Financial Condition” and “Business,” and our audited and unaudited consolidated financial statements and the related notes included elsewhere in this prospectus.

| Years Ended December 31, | Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||

| 2000 | 2001 | 2002 | 2002 | 2003 | 2002 | 2003 | |||||||||||||||||

| (dollars in millions) | |||||||||||||||||||||||

Consolidated Statements of Operations Data: | |||||||||||||||||||||||

Revenues | $ | 4,694.0 | $ | 5,552.1 | $ | 6,444.6 | $ | 1,549.6 | $ | 1,800.2 | $ | 3,015.4 | $ | 3,508.3 | |||||||||

Total Operating Costs and Expenses | 4,967.1 | 5,774.5 | 6,195.9 | 1,489.0 | 1,599.5 | 2,946.2 | 3,201.6 | ||||||||||||||||

Operating Profit (Loss) | (273.1 | ) | (222.4 | ) | 248.7 | 60.6 | 200.7 | 69.2 | 306.7 | ||||||||||||||

Net Income (Loss) | $ | (277.7 | ) | $ | (178.3 | ) | $ | 135.8 | $ | 21.2 | $ | 87.8 | $ | 8.8 | $ | 135.1 | |||||||

| As of December 31, 2002 | As of June 30, 2003 | |||||

| (dollars in millions) | ||||||

Consolidated Balance Sheet Data: | ||||||

Cash and cash equivalents | $ | 14.1 | $ | 324.5 | ||

Total current assets | 1,129.2 | 1,351.3 | ||||

Total assets | 6,578.6 | 6,693.3 | ||||

Total long-term debt | — | 2,609.0 | ||||

Total owner’s equity | 4,558.5 | 2,099.7 | ||||

13

Table of Contents

| Years Ended December 31, | Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||

| 2000 | 2001 | 2002 | 2002 | 2003 | 2002 | 2003 | ||||||||||||||||||||||

| (dollars in millions, except per subscriber data) | ||||||||||||||||||||||||||||

Other Data: | ||||||||||||||||||||||||||||

Operating Profit (Loss) | $ | (273.1 | ) | $ | (222.4 | ) | $ | 248.7 | $ | 60.6 | $ | 200.7 | $ | 69.2 | $ | 306.7 | ||||||||||||

Add back: depreciation and amortization expense | 395.4 | 438.5 | 405.6 | 96.0 | 124.1 | 181.1 | 248.5 | |||||||||||||||||||||

Operating Profit Before Depreciation and Amortization(1) | $ | 122.3 | $ | 216.1 | $ | 654.3 | $ | 156.6 | $ | 324.8 | $ | 250.3 | $ | 555.2 | ||||||||||||||

DIRECTV owned and operated subscribers (000’s) | 7,418 | 8,443 | 9,493 | 8,995 | 9,949 | 8,995 | 9,949 | |||||||||||||||||||||

Average monthly revenue per subscriber | $ | 57.70 | $ | 58.70 | $ | 59.80 | $ | 58.10 | $ | 60.90 | $ | 57.50 | $ | 60.10 | ||||||||||||||

Cash flows provided by (used in) operating activities | (263.9 | ) | (88.0 | ) | 153.8 | (121.0 | ) | 106.7 | (39.0 | ) | 414.4 | |||||||||||||||||

Cash flows used in investing activities | (668.5 | ) | (317.6 | ) | (159.3 | ) | (121.0 | ) | (52.5 | ) | (215.0 | ) | (110.1 | ) | ||||||||||||||

Cash flows provided by (used in) financing activities | 932.2 | 402.6 | 4.2 | 249.5 | (3.5 | ) | 262.8 | 6.1 | ||||||||||||||||||||

Depreciation and amortization | 395.4 | 438.5 | 405.6 | 96.0 | 124.1 | 181.1 | 248.5 | |||||||||||||||||||||

Capital expenditures | 653.6 | 450.3 | 379.4 | 121.0 | 52.5 | 215.0 | 110.1 | |||||||||||||||||||||

| (1) | Operating Profit Before Depreciation and Amortization, which is a financial measure that is not determined in accordance with accounting principles generally accepted in the United States of America, or GAAP, is calculated by adding amounts under the caption “Depreciation and amortization expense” to “Operating Profit (Loss)”. This measure should be used in conjunction with other GAAP financial measures and is not presented as an alternative measure of operating results, as determined in accordance with GAAP. Our management and Parent use Operating Profit Before Depreciation and Amortization to evaluate our operating performance and to allocate resources and capital. This metric is also used as a measure of performance for incentive compensation purposes and to measure income generated from operations that could be used to fund capital expenditures, service debt, or pay taxes. Depreciation and amortization expense primarily represents an allocation to current expense of the cost of historical capital expenditures and for intangible assets resulting from prior business acquisitions. To compensate for the exclusion of depreciation and amortization from operating profit, our management and Parent separately measure and budget for capital expenditures and business acquisitions. |

We believe this measure is useful to investors, along with other GAAP measures (such as revenues, operating profit and net income), to compare our operating performance to other communications, entertainment and media service providers. We believe that investors use current and projected Operating Profit Before Depreciation and Amortization and similar measures to estimate our current or prospective enterprise value and make investment decisions. This metric provides investors with a means to compare operating results exclusive of depreciation and amortization. We believe this is useful given the significant variation in depreciation and amortization expense that can result from the timing of capital expenditures, the capitalization of intangible assets in purchase accounting, potential variations in expected useful lives when compared to other companies and periodic changes to estimated useful lives.

14

Table of Contents

The DIRECTV Organization

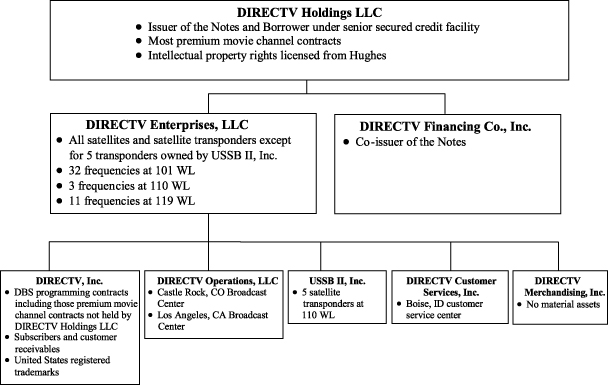

On June 11, 2002, we were formed as a wholly-owned subsidiary of Hughes. Hughes, which is a wholly-owned subsidiary of GM, contributed its wholly-owned subsidiary, DIRECTV Enterprises, LLC, and its subsidiaries to us. The following chart illustrates our corporate structure and the location of our significant assets and liabilities. All of our domestic subsidiaries, except DIRECTV Financing Co., Inc. which is a co-issuer of the Notes, have guaranteed the Notes and all of our domestic subsidiaries have guaranteed the senior secured credit facility. We also have a foreign subsidiary, RSG Resource Supply GmbH, that has not guaranteed the Notes or the senior secured credit facility and that does not have any material assets or liabilities. None of GM, Hughes or any of their subsidiaries, other than us and all of our domestic subsidiaries, have guaranteed or have any liability for the Notes. For the purposes of this table “WL” refers to degrees west longitude.

15

Table of Contents

An investment in the Notes is subject to a number of risks. You should carefully consider the following factors, as well as the more detailed descriptions elsewhere in this prospectus, before making an investment in the Notes. The risks described below are not the only ones facing our company. Additional risks not presently known to us or that we currently deem immaterial may also impair our financial condition or business operations.

If any of the following events occur, our business, financial condition or results of operations could be materially and adversely affected, the value of the Notes could decline and you could lose some or all of your investment.

Risks Related to Our Business

We may be unable to pay interest or principal on the Notes because of our substantial debt outstanding and the possibility that we may have to incur additional debt.

As of June 30, 2003, our total consolidated debt was $2.625 billion. In addition, we have $200 million available under the Term Loan A portion, which we plan to fully draw and distribute to Hughes by December 2003, and up to $250 million available under the revolving loan portion of the senior secured credit facility. Although the indenture governing the Notes contains certain limitations on our ability to incur additional debt, we are permitted to incur substantial additional debt in the future, which may include secured indebtedness. If we incur additional secured debt, it will effectively rank senior to the Notes to the extent of the value of the assets securing that debt. In addition, we could sell additional Notes under the indenture if certain conditions are met.

Our substantial debt could have significant consequences to you, including:

| • | making it more difficult for us to satisfy our obligations with respect to the Notes; |

| • | increasing our vulnerability to general adverse economic conditions, including changes in interest rates; |

| • | limiting our ability to obtain additional financing, including financing to satisfy our obligations with respect to the Notes; |

| • | requiring us to devote a substantial portion of our available cash and cash flow to make interest and principal payments on our debt, thereby reducing the amount of available cash to fund our operations and for other purposes; |

| • | limiting our financial flexibility in responding to changing economic and competitive conditions; and |

| • | placing us at a disadvantage compared to our competitors that have less debt and greater financial resources. |

Increased subscriber turnover or subscriber retention costs could harm our financial performance.

Turnover of customers in the form of subscriber service cancellations, or churn, is a significant cost element for any subscription television provider as is the cost of retaining the customers. Any increase in our retention, upgrade and other marketing costs for our existing customers may cause us to increase our subscription rates, which could increase churn. Any of the risks described in this prospectus that potentially has a material adverse impact on our cost or service quality or that could result in higher prices for our customers could, in turn, cause an increase in churn and consequently harm our financial performance. Churn can also increase due to factors beyond our control, including a slowing economy, significant signal theft, a maturing subscriber base and competitive offers. We cannot assure you that we will continue to be able to manage our churn rates or subscriber retention costs to achieve a reasonable level of financial performance.

16

Table of Contents

Increased subscriber acquisition costs could adversely affect our financial performance.

To obtain new customers, we incur costs relating to third-party customer acquisitions and direct customer acquisitions. These costs are known as subscriber acquisition costs, or SAC. For instance, we provide installation incentives to our retailers to enable them to offer standard professional installation as part of the customer’s purchase of a DIRECTV System. In addition, we pay commissions to retailers so they can offer the DIRECTV System at a lower cost to the consumer. Our SAC, both in the aggregate and on a per new subscriber activation basis, may materially increase to the extent we continue or expand current sales promotion activities or introduce other more aggressive promotions, or due to increased competition. Any material increase in SAC from current levels would negatively impact our earnings and could materially adversely impact us and our financial performance.

We have historically incurred significant operating losses and it is not certain that we will sustain profitability.

Since inception, we have incurred significant operating losses, which have been funded from capital contributions from Hughes. While we have recently achieved profitability, we cannot assure you that we will be able to sustain or improve our level of profitability. If we do not have sufficient income or other sources of cash, our ability to service our debt and pay our other obligations could be adversely affected. Improvements in our results of operations will depend largely upon our ability to increase our customer base, improve ARPU, manage our costs and control churn. We cannot assure you that our efforts in these areas will be successful.

We may need additional capital, which may not be available, in order to continue growing and to make payments on the Notes.

Our ability to increase earnings and to make interest and principal payments on the Notes will depend in part on our ability to continue growing our business by maintaining and increasing our subscriber base. This may require significant additional capital that may not be available to us.

Funds necessary for SAC and retention costs will be satisfied from operating cash flow and borrowings under the revolving loan portion of our senior secured credit facility. In addition, we plan to launch a new spot-beam satellite, DIRECTV 7S, which is expected to be in service in the first quarter of 2004. Funds necessary to complete payments for this satellite will also be satisfied from the same operating cash flows and borrowings. If these sources are insufficient to meet our funding requirements, we may be required to raise additional capital in the future. We are not a publicly traded company and currently there is no market for our debt or equity securities. Therefore, we may encounter difficulties in raising additional capital in the future. In addition, if we experience, or Hughes experiences, a change of control we may be restricted in our ability to raise additional capital. See “—If our company or our parent experiences a change of control, our financial and operating results could be materially affected.” We cannot assure you that additional financing will be available to us from our parent, third parties or the capital markets on acceptable terms, or at all, if needed in the future.

Our satellites are subject to significant operational risks.

Satellites are subject to significant operational risks while in orbit. These risks include malfunctions, commonly referred to as anomalies, that have occurred in our satellites and the satellites of other operators as a result of various factors, such as satellite manufacturing errors, problems with the power systems or control systems of the satellites and general failures resulting from operating satellites in the harsh space environment.

We work closely with our satellite manufacturers to determine and eliminate the cause of anomalies in new satellites and provide for redundancies of critical components in the satellites as well as having back-up satellite capacity. However, we cannot assure you that we will not experience anomalies in the future, whether of the

17

Table of Contents

types described above or arising from the failure of other systems or components, nor can we assure you that our backup satellite capacity will be sufficient for our business purposes.

On two of our existing satellites, DIRECTV 1 and DIRECTV 3, a spacecraft control processor has switched off and is disabled. Both satellites are currently operating normally under control of the spare spacecraft control processor on each satellite. While the spare spacecraft control processor is designed to operate for the life of its satellite, there can be no assurance that a similar or different failure will not occur, rendering either satellite unusable. As a precautionary measure, we have shifted much of the traffic originally carried by these two satellites to other satellites in our fleet, and DIRECTV 3 has been designated as an in-orbit spare and relocated to a storage orbit outside of the geostationary orbit arc. Our satellite DIRECTV 1R experienced a failure of the primary xenon ion propulsion subsystem power processing units. The xenon ion propulsion system is not currently in use on DIRECTV 1R, and the satellite is operating on the liquid fuel system which will provide an estimated fuel life through 2014, the design life of DIRECTV 1R. If the redundant xenon ion propulsion subsystem is successfully activated at the end of this period, the estimated fuel life could extend to 2024. DIRECTV 4S, which also employs both xenon ion propulsion and liquid fuel propulsion systems, is currently operating normally using both systems. The estimated fuel life of 2008 for DIRECTV 4S is based solely on the fuel life using the liquid propulsion system. Should the xenon ion propulsion system prove reliable, the fuel life of DIRECTV 4S could extend to as long as 2019. Our satellite DIRECTV 5 experienced the failure of one of the chemical propulsion thrusters in the fall of 2002. While the satellite is currently operating normally using the remaining thrusters, there can be no assurance that a similar thruster failure will not occur which could impact the capabilities of DIRECTV 5. Another of our satellites, DIRECTV 6, has experienced significant solar array failures. DIRECTV 6 was recently relocated to our 110 WL orbital location pursuant to a Special Temporary Authority granted by the FCC. It began transmitting services from that location on July 16, 2003.

Any single anomaly or series of anomalies could materially adversely affect our operations and revenues and our relationships with current customers, as well as our ability to attract new customers for our DBS services. In particular, future anomalies may result in the loss of individual transponders on a satellite, a group of transponders on that satellite or the entire satellite, depending on the nature of the anomaly. Anomalies may also reduce the expected useful life of a satellite, thereby creating additional expenses due to the need to provide replacement or back-up satellites and potentially reducing revenues if DIRECTV service is interrupted. Finally, the occurrence of anomalies may materially adversely affect our ability to insure our satellites at commercially reasonable premiums, if at all. While some anomalies are currently covered by existing insurance policies, others are not now covered or may not be covered in the future. The initial cost of each of our satellites, which includes costs of construction, launch and insurance, ranges from $175 million to $350 million, depending upon the design. Most of the satellites that we use cost in the range of $200 million to $250 million. Typically, direct broadcast satellites have from 24 to 72 transponders on-board, and most of our satellites have from 30 to 48 transponders.

Meteoroid events pose a threat to all in-orbit satellites, including our satellites. The probability that meteoroids will damage those satellites increases significantly when the Earth passes through the particulate stream left behind by various comets. Occasionally, increased solar activity poses a potential threat to all in-orbit satellites, including our satellites.

Some decommissioned spacecraft are in uncontrolled orbits that pass through the geostationary belt at various points, and present hazards to operational spacecraft, including our satellites. To avoid collisions, we may be required to perform maneuvers that may prove unsuccessful or could reduce the useful life of the satellite due to the unplanned use of fuel to perform these maneuvers. The loss, damage or destruction of any of our satellites as a result of an electrostatic storm, collision with space debris, malfunction or other event could have a material adverse effect on our business. As is common in the industry, our in-orbit insurance, if any, will not cover damage to satellites that occurs as a result of collisions with meteoroids, decommissioned spacecraft or other space debris.

18

Table of Contents

Our satellites could fail earlier than their expected useful lives.

Our ability to earn revenue depends on the usefulness of our satellites. Each satellite has a limited useful life. A number of factors affect the useful life of a satellite, including, among other things:

| • | the design; |

| • | the quality of its construction; |

| • | the durability of its component parts; |

| • | the ability to continue to maintain proper orbit and control over the satellite’s functions; and |

| • | the remaining on-board fuel following orbit insertion. |

Generally, the minimum design life of the satellites in our fleet is 12 years. We can provide no assurance, however, as to the actual useful lives of the satellites. Our operating results could be adversely affected if the useful life of any of our satellites were significantly shorter than 12 years. Additionally, moving any of our satellites in the future, either temporarily or permanently, to another orbital slot could decrease the useful life of the satellite.

In the event of a failure or loss of any of our satellites, we may relocate another satellite and use it as a replacement for the failed or lost satellite. In the event of a complete satellite failure, our programming could be unavailable for several days while our backup in-orbit satellites are repositioned and services are moved. The use of backup satellite capacity for our programming may require us to discontinue some DIRECTV programming services due to reduced channel capacity. Any relocation of our satellites would require prior FCC approval and, among other things, a showing to the FCC that the replacement satellite would not cause additional interference compared to the failed or lost satellite. We cannot be certain that we could obtain such FCC approval.

Construction delays on satellites could materially adversely affect our revenues and earnings.

The construction and launch of satellites are often subject to delays, including delays in the construction of satellites and launch vehicles, periodic unavailability of reliable launch opportunities, possible delays in obtaining regulatory approvals and launch failures, as discussed below. A significant delay in the future delivery of any satellite would materially adversely affect the marketing plan for, or use of, the satellite. If satellite construction schedules are not met, there can be no assurance that a launch opportunity will be available at the time a satellite is ready to be launched. Certain delays in satellite construction could also jeopardize satellite authorizations that are conditioned on timely construction and launch of the satellite.

Currently, we have one satellite under construction, DIRECTV 7S, that is scheduled to be in service in the first quarter of 2004. We intend to use the satellite to deliver local channels into additional local markets, as well as to provide back-up capability for current local programming. Any delay in the launch of this satellite could adversely affect our schedule for and ability to deliver local channels in additional local markets and, as a result, adversely affect our anticipated revenues and earnings.

Our satellites are subject to risks relating to launch.

Satellite launches are subject to significant risks, including launch failure, incorrect orbital placement or improper commercial operation. Certain launch vehicles that we may use have experienced launch failures in the past. Launch failures result in significant delays in the deployment of satellites because of the need both to construct replacement satellites, which can take up to 24 months, and obtain other launch opportunities. Any significant delays in deploying our satellites could materially adversely affect our ability to generate revenues.

19

Table of Contents

The cost of obtaining commercial insurance coverage on certain of our satellites, or the loss of a satellite that is not insured, could materially adversely affect our earnings.

The price, terms and availability of insurance fluctuate significantly. Launch and in-orbit policies on satellites may not continue to be available on commercially reasonable terms or at all. In addition to higher premiums, insurance policies may provide for higher deductibles, shorter coverage periods and satellite health-related policy exclusions.

We use in-orbit and launch insurance to mitigate the potential financial impact of satellite fleet in-orbit and launch failures unless the premium costs are considered non-economical relative to the risk of satellite failure. When insurance is obtained, it generally covers the book value of covered satellites. Although the insurance generally does not compensate for business interruption or loss of future revenues or customers, we rely on in-orbit spare satellites and excess transponder capacity at key orbital slots to mitigate the impact of satellite failure on our ability to provide service. See “Business—Satellite Insurance.”

Any launch vehicle failure, or loss or destruction of any of our satellites for which we do not have commercial insurance coverage could have a material adverse effect on our revenues and earnings, our ability to comply with “must carry” and other regulatory obligations and our ability to fund the acquisition of replacement satellites. In addition, higher premiums on insurance policies would increase our costs, thereby reducing our cash that is available to pay principal and interest on the Notes.

Satellite programming signals have been stolen or could be stolen in the future, which could cause us to incur costs that do not result in subscriber acquisition.

The delivery of subscription programming requires the use of conditional access technology to limit access to programming to only those who subscribe and are authorized to view portions of it. The conditional access system uses, among other things, encryption technology to protect the transmitted signal from unauthorized access. It is illegal to create, sell or otherwise distribute software or devices to circumvent that conditional access technology. However, theft of cable and satellite programming has been widely reported, and the access or “smart” cards used in the DIRECTV conditional access system have been compromised and could be further compromised in the future.

We continue to respond to compromises of our access cards with measures intended to make theft of our programming commercially impractical or uneconomical, including developing and introducing new access cards and replacing older access cards that have been compromised. In April 2002, we introduced our fourth generation access card, or P4 card. This card is the result of a joint design effort by us and our conditional access supplier, NDS Ltd. We believe the P4 card represents a significant improvement in the design and technology used in the older DIRECTV access cards, and includes new technology developed by us. We will also begin deploying a new access card, known as the D1 card. We have also recently agreed with NDS to discuss plans for future generations of conditional access cards to be used by us. See “Business—Legal Proceedings—Intellectual Property Litigation” for a description of the current status of our lawsuits with NDS.

We will continue to utilize a variety of tools to accomplish our goal to enhance our conditional access system including our plan to (as we have in the past) periodically replace the access card in subscribers’ receivers. Once we replace the access card, we cannot guarantee that the new card will prevent the theft of our satellite programming signals. Furthermore, there can be no assurance that we will be successful in developing or acquiring the technology we need to effectively restrict or eliminate signal theft. If we cannot promptly correct a compromise of our conditional access technology, our revenue and our ability to contract for video and audio services provided by programmers could be materially adversely affected. In addition, our expenses could increase if we attempt to implement additional measures to combat signal theft.

20

Table of Contents

Our ability to maintain leading technological capabilities is uncertain.

Our operating results depend to a significant extent upon our ability to continue to introduce new services and encourage the development of new products for the receipt of our services on a timely basis, and to reduce costs of our existing services and the associated products. We cannot assure you that we will continue to successfully identify new service or product opportunities or develop and market these opportunities in a timely or cost-effective manner. The success of new service or product development depends on many factors, including proper identification of customer needs, cost, timely completion and introduction, differentiation from offerings of competitors and market acceptance.