Profile

(Negotiations in final stages – estimated to be announced early 2007)

Located along a major waterway and railroad artery serving both Northwestern

and Eastern seaboard regions

Fully-integrated production capabilities: mining, coking, sintering, iron making,

steel-rolling, steel making

Main products include steel bars, strip steel, tubes, billets, pig iron, and coke

Capacity to produce approximatly 3 million tons of finished product annually

Equipment includes 6 sintering machines, 8 blast furnaces, 4 converters, 3

tandem mills, and 2 oxygenerators

Company has about 659 acres of land and 6500 employees

Annual Revenues expected to be in excess of $1 billion

Earnings impact: roughly 8x increase

Phase II of Growth Plan

Central China Steel Company

Phase II of Growth Plan

Central China Steel Company

Subsidiaries

Iron mine with current reserves of approximately 300 million tons

76% of a rolling mill that produces ribbon steel

39% of a iron and steel company that produces 300,000 tons of billets

90% of a steel company that produces 100,000 tons of rebar

Leased railway lines in the Northwest region’s largest steel trading center

51% of an import-export company

100% of an integrated transportation company - 23 loaders, 13 cranes, 1 excavator, and

160 vehicles

75% of a machinery maintenance company

75% of a company that makes products from steel making waste products

100% of a company producing refractory materials

four other subsidiaries

Phase II of Growth Plan

Central China Steel Company

Key Advantages

Secure resource bases of iron ore, coke, water, electricity, limestone

Iron mine with 300,000 ton reserves

Largest coal deposits in province

Transportation access to major highways, and a special railroad connecting

mine directly to the production site

Located at the Bridgehead to the Western region

Western region targeted by Central government for strong infrastructure

and economic development

Large transportation cost advantage for rebar (main product) - not suited

to long haul transportation

Nearest competitor is 500 km. away

Eligible for Western Region Development reduced tax

Phase II of Growth Plan

Central China Steel Company

Phase III of Growth Plan

Coastal Region Steel Company

Profile

(Negotiations well underway – estimated to be announced later 2007)

Location is in a prime domestic and international transportation hub

Main products include rebar and wire

Capacity to produce 2 million tons annually

Equipment is less than 3 years old and state-of-the art

Hot rollers designed by the top institutes in China

Processing equipment imported from Europe and the U.S.

Production site is 1.4 square kilometers with additional 2.5 square kilometers available

Strong existing distribution base

Current run rate $923 million

Expected purchase price 1.6x earnings

Phase III of Growth Plan

Coastal Region Steel Company

Key Advantages

Owned by a company that is a major customer for steel construction products

Company has not been well managed because its managers have

little steel industry experience

GSHO believes it can show dramatic improvement in performance by

installing its trained and expert management team

Company is a dominant supplier to the construction industry in one of the fastest

growing regions of China. It also has a good export business to South East

Asian countries including Vietnam, Thailand, and Malaysia

Management is willing to sell at a very low price in order to ensure a continuous

source of supply for it’s projects

Additional 2.5 square kilometers are available for developing a steel slab facility

in Phase 2 of this project. Construction is planned for 2010-11. The land is very

close to a large seaport

Phase III of Growth Plan

Coastal Region Steel Company

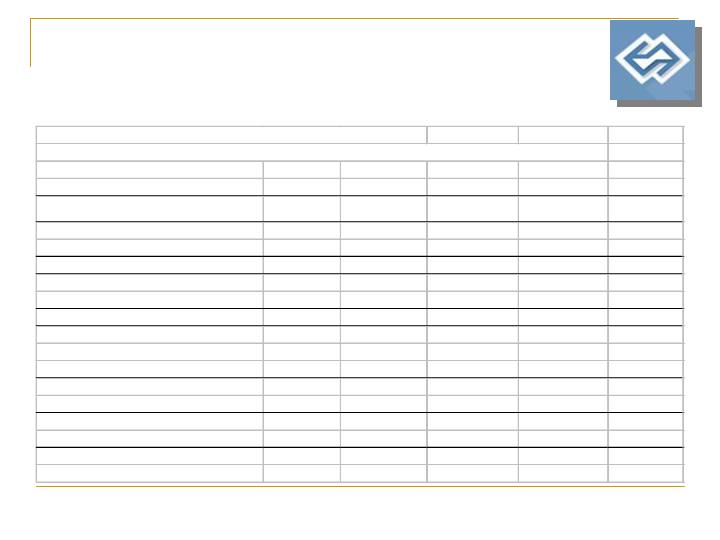

Coastal Region Steel Company

Projected Consolidated Income Statement (in US$ ,000)

For the Years Ended December 31, 2008, 2009, 2010

Year to Dec.31

2008E

2009E

2010E

TOTAL REVENUE

923,077

1,015,385

1,167,693

Total Cost of Revenue

-824,414

-906,855

-1,042,883

Gross Operating Profit

98,663

108,530

124,810

Selling, General & Admin. Expenses

-15,385

-17,693

-19,816

Net Operating Profit

83,278

90,837

104,993

Other income (expense)

-

-

EBIT

83,278

90,837

104,993

Interest Expense

Profit Before Tax & Minority Interest

83,278

90,837

104,993

Taxation

Net Profit Before Minority Interest

83,278

90,837

104,993

Minority Interest

-16,656

-18,167

-20,999

Net Profit

66,622

72,670

83,995

Phase IV of Growth Plan

Major SOE Steel Company

General Profile

Production Volume: One of China’s leading SOEs

Capable to produce 63 varieties of steel and nearly 2000 specifications of steel

products

Market dominance in key transportation infrastructure product

Nearly 30,000 employees

Over 20 subsidiaries, numerous Joint Ventures and partnerships

Nation-wide distribution and sales network, international sales offices

Phase IV of Growth Plan

Major SOE Steel Company

Major SOE Steel Company

Projected Income Statement (in US$ ,000)

For the Years ending December 31, 2009, 2010

Year to Dec.31

2009E

2010E

TOTAL REVENUE

3,825,000

4,398,750

Total Cost of Revenue

-3,366,000

-3,803,580

Gross Operating Profit

459,000

595,170

Selling, General & Admin. Expenses

-76,500

-84,915

Net Operating Profit

382,500

510,255

Other income (expense)

-

EBIT

382,500

510,255

Interest Expense

-104,000

-106,080

EBT Before Minority Interest

278,500

404,175

Taxation

Net Profit Before Minority Interest

278,500

404,175

Minority Interest

-136,465

-194,004

Net Profit

142,035

210,171

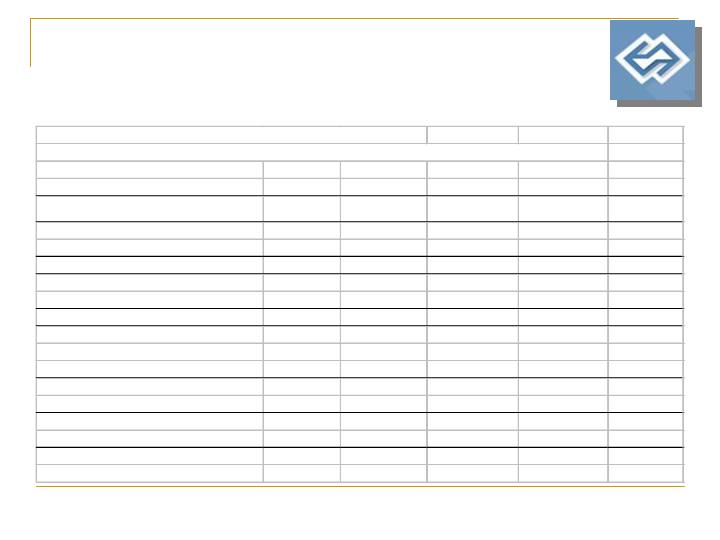

Consolidated Growth Forecast

Consolidated Income Statement (in US$ ,000)

For the Years ending December 31 2006, 2007, 2008, 2009, 2010

Year to Dec.31

2006E

2007E

2008E

2009E

2010E

TOTAL REVENUE

142,253

755,882

2,615,226

6,829,795

7,855,352

Total Cost of Revenue

-135,761

-695,271

-2,376,294

-6,019,856

-6,839,078

Gross Operating Profit

6,492

60,611

238,932

809,939

1,016,275

Selling, General & Admin. Expenses

-2,152

-21,064

-63,772

-150,666

-167,994

Net Operating Profit

4,340

39,547

175,159

659,273

848,281

Other income (expense)

160

-

-

-

EBIT

4,500

39,547

175,159

659,273

848,281

Interest Expense

-2,089

-8,916

-16,929

-123,556

-123,480

EBT bef. Minority Int.

2,411

30,631

158,230

535,717

724,801

Taxation

-

-2,762

-10,422

-27,367

-37,186

Net Profit Before Minority Interest

2,411

27,870

147,808

508,350

687,615

Minority Interest

-769

-11,834

-46,066

-220,237

-295,942

Net Profit

1,642

16,036

101,741

288,113

391,673

No. of O/S Shares

31,250

46,250

56,250

116,250

120,000

EPS

0.05

0.35

1.81

2.48

3.26

Our People

Management Team

Henry Yu: Founder and Chairman of the Board. First private steel enterprise owner in

China (1989), Former CEO of DQ Metal and Sheet; MBA, BA Business Management,

BS in Engineering; China national representative to Asia Pacific Economic

Cooperation (APEC) Development Council

John Chen: Chief Financial Officer. California CPA license; 7 years public and

private practice with US and Chinese companies; BS degree from Cal Poly Pomona.

Bi-lingual English & Chinese

Ross Warner: Director. 17 years management experience with companies working in

Asia; 8 years in China; MBA from Thunderbird; Bi-lingual English & Chinese

Guodong Wang: Director, Chief Technical Officer. Engineer at Anshen Iron and Steel

Company (2nd largest Steel Producer in China), Master’s Degree in Engineering from

Beijing Iron and Steel Research Institute, Professor at Northeastern University,

Shenyang

Our Vision

By 2010, we target to be the largest non-government owned steel product producer in

China

We intend to achieve sales in excess of $6 billion and EPS in excess of $3.50 per share

We target to consolidate operations in Northwest China and establish key subsidiaries in

select markets throughout China

We target to grow our production from 400,000 tons to 16.5 million tons annually and

revenues from $140 million to $6 billion

We intend to grow through aggressive mergers and acquisitions targeting State Owned

Enterprise (SOE) steel companies and selected entities with outstanding potential

For the past ten years we have laid the foundation to execute this strategy and have now

identified 4 key candidates