1 1 Investor Presentation (NYSE: GSI) August 2012

2 Forward Looking Statements The material presented is a presentation of general background information about General Steel Holdings, Inc . as of the date of the presentation . The information is in summary form and it does not purport to be complete . It is not intended to be relied upon as advice to potential investors . This presentation is strictly confidential and may not be disclosed to any other person . No representation or warranty, express or implied, is made concerning, and no reliance should be placed on, the accuracy, fairness, or completeness of the information presented herein . The latest financials related to General Steel Holdings, Inc . ’s second quarter of 2011 provided in this presentation are based solely on the management’ review and have not been audited by the Company’s independent auditors . It could be likely that these financials may change and any changes could be material . This presentation (including the financial projections and any subsequent questions and answers) contains statements that are forward - looking within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 . Such forward - looking statements are only predictions and are not guarantees of future performance . Investors are cautioned that any such forward - looking statements are and will be, as the case may be, subject to many risks, uncertainties, certain assumptions and factors relating to the operations and business environments of General Steel Holdings, Inc . and its subsidiaries that may cause the actual results to be materially different from any future results expressed or implied in such forward - looking statements . Although General Steel Holdings, Inc . believes that the expectations and assumptions reflected in the forward - looking statements are reasonable based on information currently available to its management, General Steel Holdings, Inc . cannot guarantee future results or events . General Steel Holdings, Inc . expressly disclaims a duty to update any of the forward - looking statements . Securities may not be offered or sold in the United States unless they are registered or exempt from registration under the Securities Act of 1933 . Any offering of securities to be made in the United States will be made by means of an offering memorandum . Such offering memorandum will contain, or incorporate by reference, detailed information about General Steel Holdings, Inc . and its business and financial results, as well as its financial statements . This presentation does not constitute an offer, or invitation, or solicitation of an offer, to subscribe for or purchase any securities . Neither this presentation nor anything contained herein shall form the basis of any contract or commitment whatsoever .

3 GSI’s Value Proposition Strong financial performance: revenue CAGR of 85% (2005 - 2010) Executing on two - pronged growth strategy: organic growth and strategic M&A Poised to benefit from changing government regulation and industry consolidation, with demonstrated track record of successful acquisitions Large capacity, efficient production and unique sourcing solutions Robust market environment with sustainable steel demand in Western China, supported by ongoing housing and infrastructure development Leading integrated steel producer in China (non - state - owned) with diverse products and customers

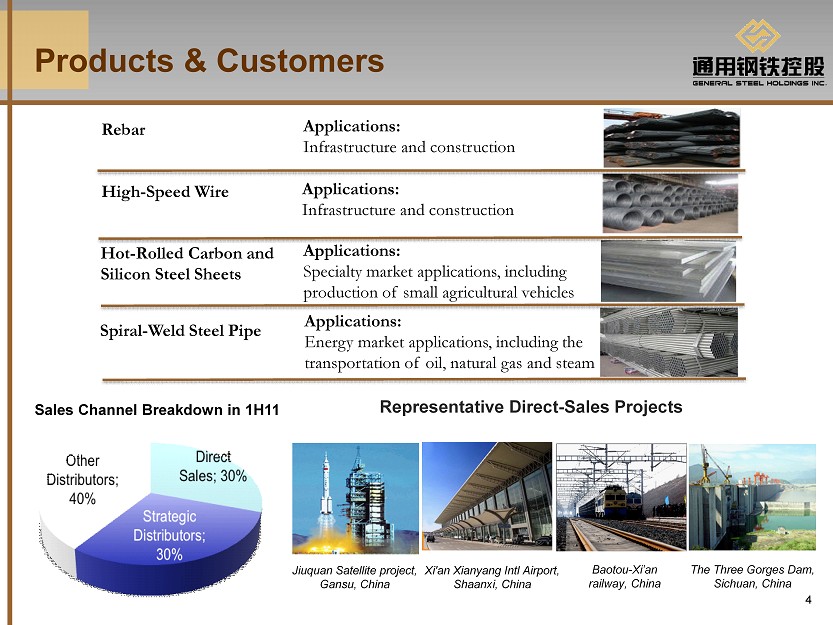

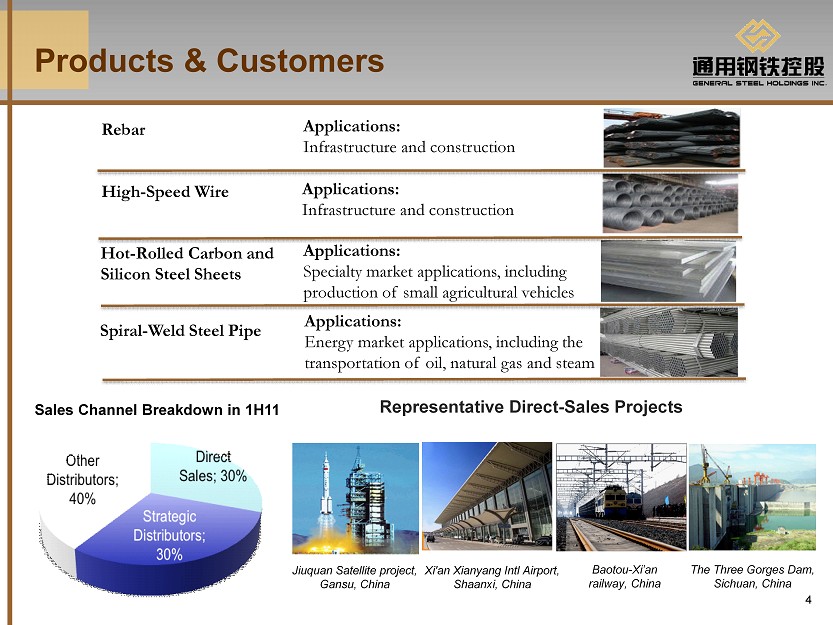

4 Products & Customers Sales Channel Breakdown in 1H11 Baotou - Xi’an railway, China The Three Gorges Dam, Sichuan, China Xi'an Xianyang Intl Airport, Shaanxi, China Representative Direct - Sales Projects Jiuquan Satellite project, Gansu, China Applications: Infrastructure and construction Applications: Infrastructure and construction Rebar High - Speed Wire Applications: Specialty market applications, including production of small agricultural vehicles Hot - Rolled Carbon and Silicon Steel Sheets Spiral - Weld Steel Pipe Applications: Energy market applications, including the transportation of oil, natural gas and steam

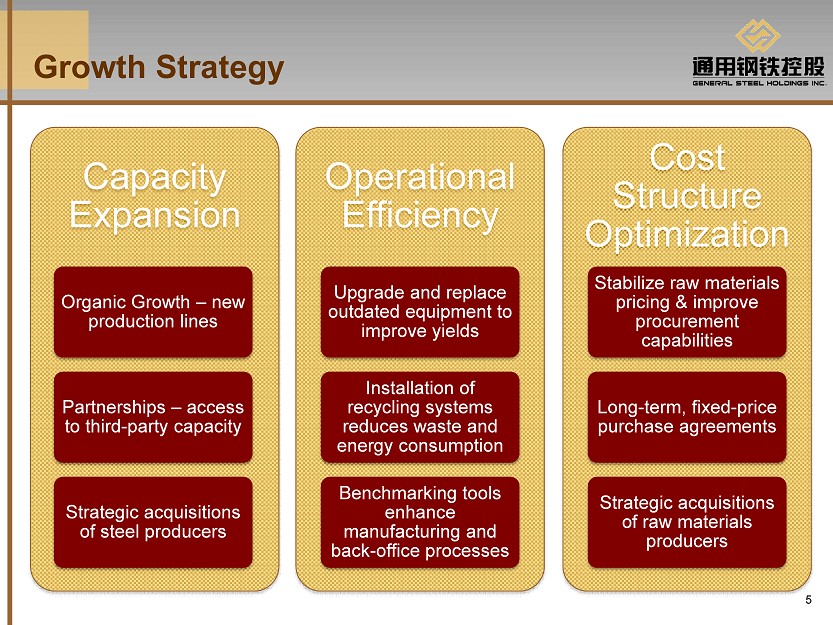

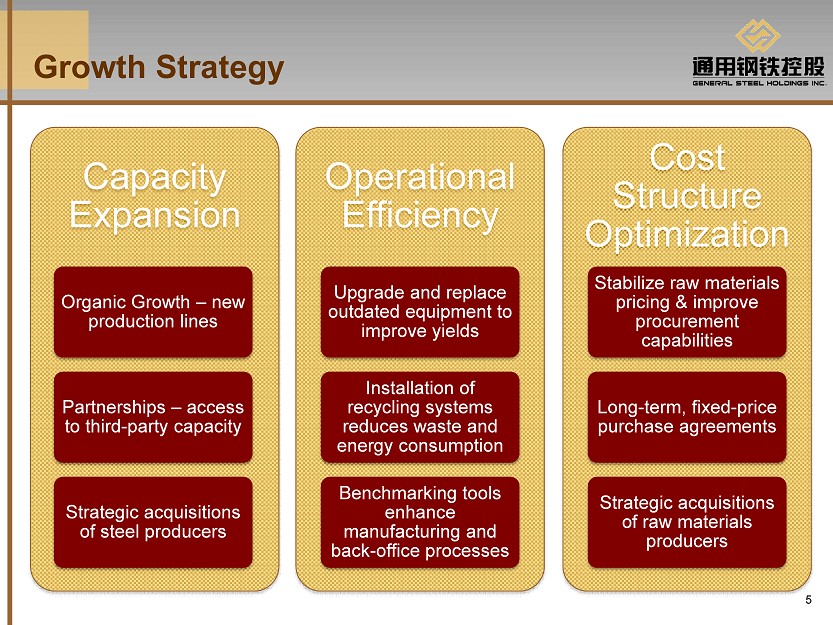

5 Growth Strategy Capacity Expansion Organic Growth – new production lines Partnerships – access to third - party capacity Strategic acquisitions of steel producers Operational Efficiency Upgrade and replace outdated equipment to improve yields Installation of recycling systems reduces waste and energy consumption Benchmarking tools enhance manufacturing and back - office processes Cost Structure Optimization Stabilize raw materials pricing & improve procurement capabilities Long - term, fixed - price purchase agreements Strategic acquisitions of raw materials producers

6 Expanding Production Capacity ▪ New, state - of - the - art equipment reduces energy consumption and improves yields ▪ Unified Management Agreement to operate two 1,280 cubic meter blast furnaces and other equipment installed by Shaanxi Iron and Steel Group -- Equipment valued at approximately $550 million -- Brings annual production capacity to 7 million metric tons of crude steel under management at Longmen Joint Venture Improve Total Output and Manufacturing Efficiency Production Line Relocation ▪ Transferred 1 rebar line & 1 high - speed wire line to Longmen Joint Venture from Maoming Hengda facility ▪ Added 1 rebar line at Maoming Hengda facility ▪ Expects to add more production lines at Longmen Joint Venture

7 Improved Operational Efficiency ▪ Replaced older, inefficient blast furnaces with new, state - of - the - art equipment to reduce energy consumption and improve yields at Longmen Joint Venture ▪ Reallocation of equipment to improve efficiency ▪ Installed new recycling and environmental systems to reduce waste ▪ Capacity expansion to create opportunities to leverage economies of scale ▪ Initiatives collectively reduce per - ton manufacturing costs Equipment Optimization Non - Manufacturing Enhancements ▪ Improving raw materials procurement capabilities ▪ New production management systems ▪ Enhancements to quality control, safety and finance functions

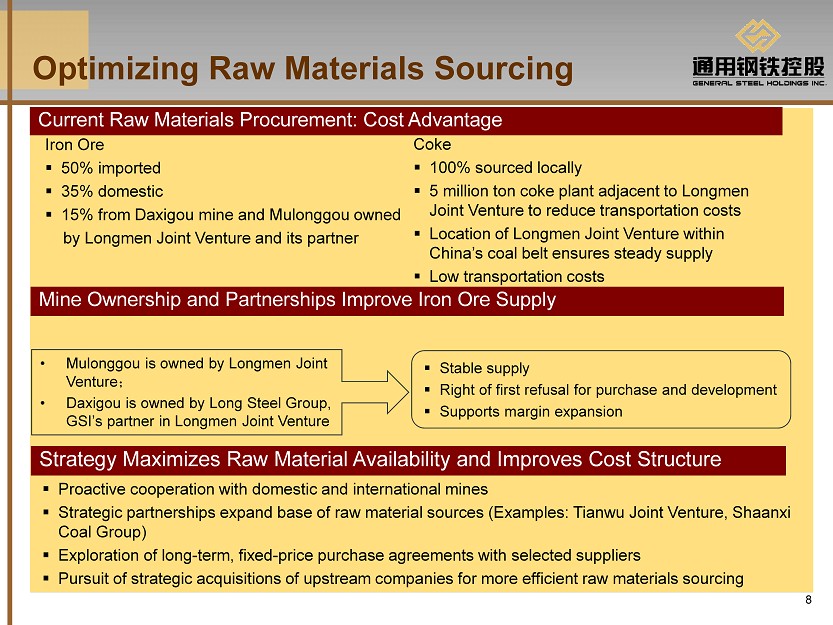

8 Optimizing Raw Materials Sourcing • Mulonggou is owned by Longmen Joint Venture ; • Daxigou is owned by Long Steel Group, GSI’s partner in Longmen Joint Venture Current Raw Materials Procurement: Cost Advantage Iron Ore ▪ 50% imported ▪ 35% domestic ▪ 15% from Daxigou mine and Mulonggou owned by Longmen Joint Venture and its partner Coke ▪ 100% sourced locally ▪ 5 million ton coke plant adjacent to Longmen Joint Venture to reduce transportation costs ▪ Location of Longmen Joint Venture within China’s coal belt ensures steady supply ▪ Low transportation costs Mine Ownership and Partnerships Improve Iron Ore Supply ▪ Proactive cooperation with domestic and international mines ▪ Strategic partnerships expand base of raw material sources (Examples: Tianwu Joint Venture, Shaanxi Coal Group) ▪ Exploration of long - term, fixed - price purchase agreements with selected suppliers ▪ Pursuit of strategic acquisitions of upstream companies for more efficient raw materials sourcing Strategy Maximizes Raw Material Availability and Improves Cost Structure ▪ Stable supply ▪ Right of first refusal for purchase and development ▪ Supports margin expansion

9 Growth Through Strategic M&A Scenario A: Acquire Manufacturing Capacity ▪ Continue industry consolidation through strategic acquisitions of steel producers ▪ Targets include both State - Owned Enterprises and privately - owned facilities ▪ Focus on facilities that meet the government’s stringent efficiency standards ▪ Platform aligns interests of all key industry constituents Scenario B: Acquire Raw Materials Supply ▪ Targets include established upstream companies and mines with proven operations and resources ▪ Strengthens vertical integration ▪ Provides increased control over raw materials procurement and pricing Sources: Wall Street research, CISA, Haitong Securities, UBS Investment Research, State Council announcements, UOB Kay Hian. By end of Blast furnace (cubic meter) Electric furnaces (metric tons) Iron - smelting Capacity (million metric tons) 2010 ≤ 300 ≤ 20 25 2011 ≤400 ≤30 31 2012 - - 10 Total 66 Targets for Removal of Small and Less Efficient Mills

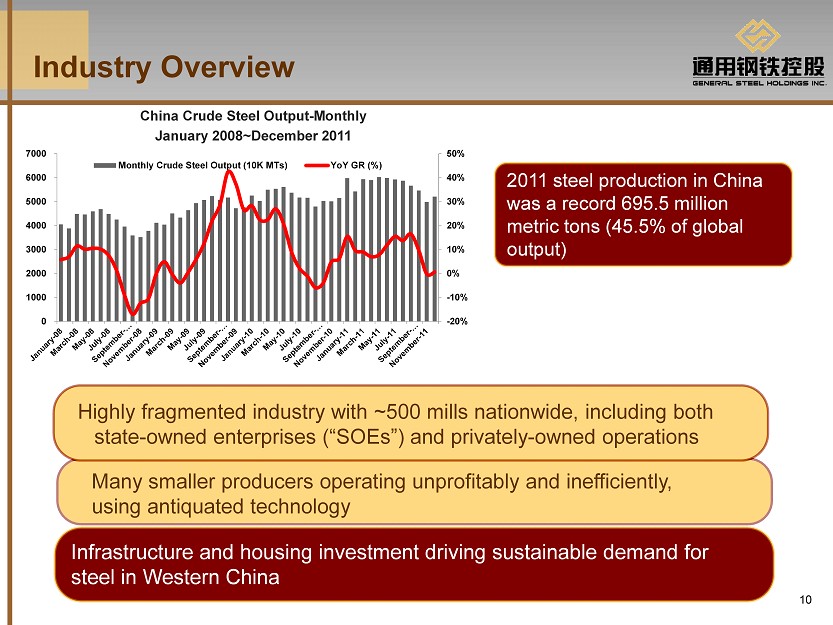

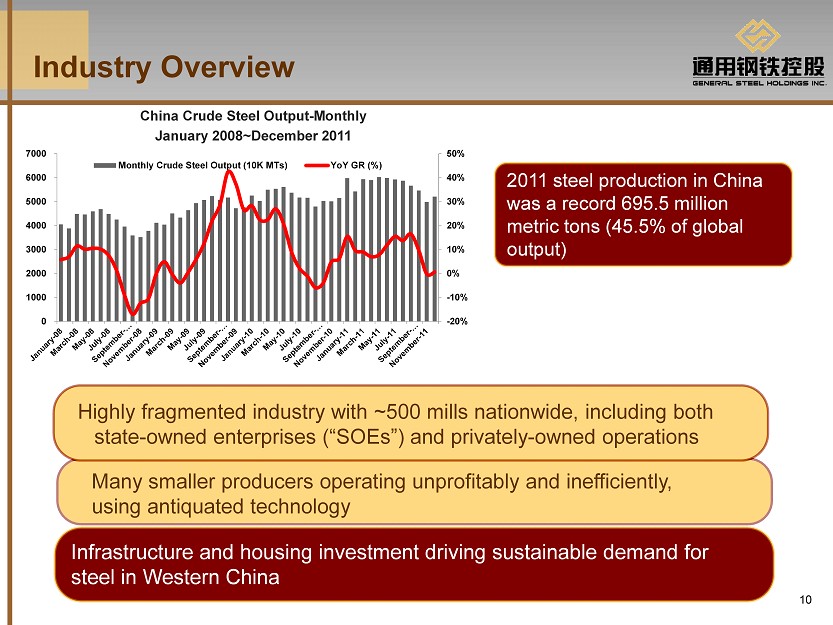

10 Industry Overview Infrastructure and housing investment driving sustainable demand for steel in Western China China Crude Steel Output - Monthly January 2008~December 2011 2011 steel production in China was a record 695.5 million metric tons (45.5% of global output) -20% -10% 0% 10% 20% 30% 40% 50% 0 1000 2000 3000 4000 5000 6000 7000 Monthly Crude Steel Output (10K MTs) YoY GR (%) Highly fragmented industry with ~500 mills nationwide, including both state - owned enterprises (“SOEs”) and privately - owned operations Many smaller producers operating unprofitably and inefficiently, using antiquated technology

11 ▪ Central government initiatives aimed at improving industry efficiency through national consolidation effort ▪ Smaller, less efficient mills are being targeted for shutdown or acquisition ▪ Limitations on new capacity development force larger steel producers to increase capacity through acquisition Strong Catalysts for Industry Consolidation China Steel Industry Consolidation Government Targets 48% of all Chinese steel produced by top 10 players 60% produced by top 10 players 70% produced by top 10 players 2011 2020 2015

12 Operational Philosophy Supports Industry Consolidation ▪ Provides comprehensive solution to the government plan for industry consolidation ▪ Acquires or forms JVs with SOEs and non - state - owned companies ▪ Retains existing management through stock incentive plans ▪ Improves profitability via western management practices and capital investment ▪ Reduces pollution & improves utilization Uniquely positioned to benefit from industry trends Central Government ▪ Sustainable industry development ▪ Efficiency improvement ▪ Reduced environmental impact ▪ Increased profitability ▪ Elimination of backward capacity ▪ Prudent management practices Provincial Government ▪ Local economic development ▪ Sustainable & stable growth ▪ Job creation ▪ Modernization of equipment Local Companies ▪ ~500 small or less efficient steel companies ▪ Choice: Improve, shut down or merge (JV) ▪ Looking for survival & capital Interests

13 Subsidiary Locations M G T Baotou Steel - General Steel Special Steel Pipe JV Co., Ltd. 80% owned / Capacity: 100,000 mts End product: spiral - weld Pipe Tianwu General Steel Material Trading Co., Ltd. 60% owned / C apacity: 2 - 3 million mts Raw Materials Trading Company General Steel (China) Co., Ltd 100% owned / Capacity: 400,000 mts End product: Hot - rolled Carbon Sheet Shaanxi Longmen Iron and Steel Co., Ltd. 60% owned /Capacity: 7,000,000 mts Unified Mgmt. Agreement with SOEs End products: Rebar & High - speed Wire Maoming Hengda Steel Co., Ltd. 99% owned / Capacity: 400,000 mts End product: Rebar Baotou Tianjin Xi’An Guangdong

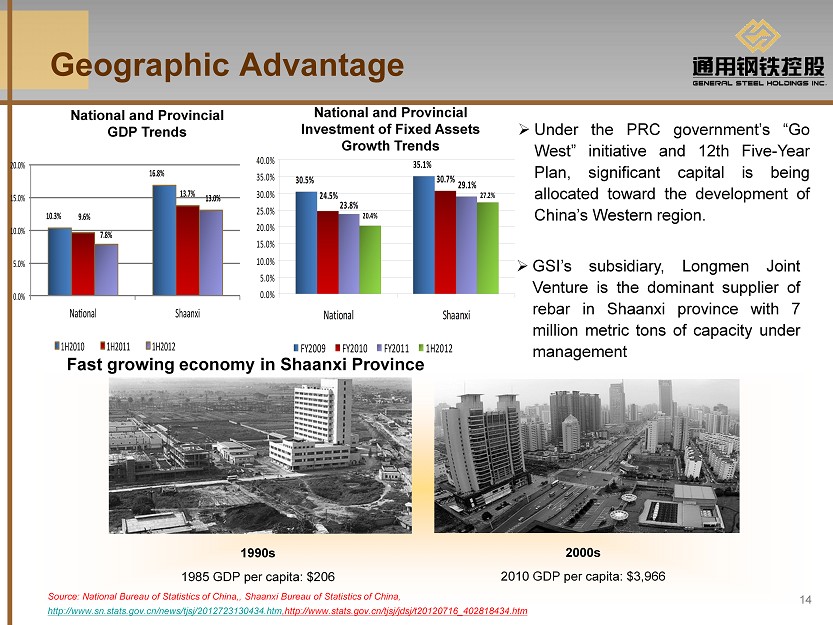

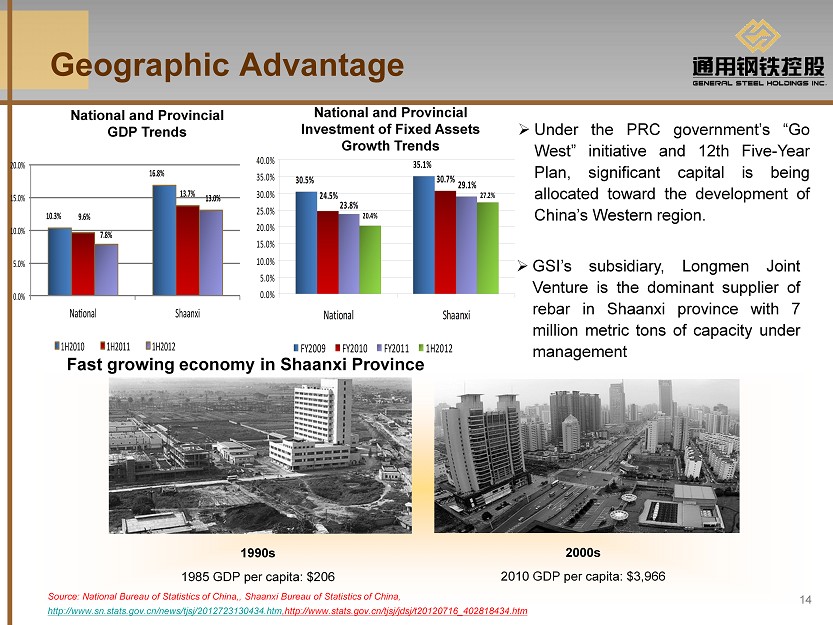

14 » GSI’s subsidiary, Longmen Joint Venture is the dominant supplier of rebar in Shaanxi province with 7 million metric tons of capacity under management Source: National Bureau of Statistics of China,, Shaanxi Bureau of Statistics of China, http://www.sn.stats.gov.cn/news/tjsj/2012723130434.htm ,http://www.stats.gov.cn/tjsj/jdsj/t20120716_402818434.htm Geographic Advantage National and Provincial GDP Trends » Under the PRC government’s “Go West” initiative and 12 th Five - Year Plan, significant capital is being allocated toward the development of China’s Western region . Fast growing economy in Shaanxi Province 1990s 1985 GDP per capita: $206 2000s 2010 GDP per capita: $3,966 30.7% 20.4% 30.5% 35.1% 24.5% 23.8% 29.1% 27.2% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% National Shaanxi FY2009 FY2010 FY2011 1H2012 National and Provincial Investment of Fixed Assets Growth Trends

15 ▪ Fully - integrated operation enables cost - efficient production ▪ 60% ownership interest - acquired stake for US $39M in June 2007 ▪ Approximately 70% market share in Shaanxi province ▪ Limited regional competition ▪ 15% corporate tax rate, incentivized through “Go West” tax policies ▪ 7 million metric tons of annual crude steel capacity under management Longmen Joint Venture Rebar cooling Continuous casting billets Near - term Growth Catalysts Provincial Key Projects ▪ 48 key projects initiated in Shaanxi Province involved RMB 53.3 billion ▪ Encourage private investment to stimulate economy ▪ Expects the faster growth in fixed assets investments in Western China Guanzhong - Tianshui Economic Zone ▪ Construction within greater Xi’an metropolitan area ▪ Projects include railways, highways, subways, airports 12th Five - Year Plan ▪ Significant investment in high - speed railway construction ▪ “Go West” tax incentive ▪ 80 billion RMB allocated for construction of hydroprojects in Shaanxi; 3x increase over 11 th Five - Year Plan Low - income Housing Project ▪ 36 million low - income houses to be built over next five years, including 430,000 low - income houses planned in Shaanxi Province in 2012

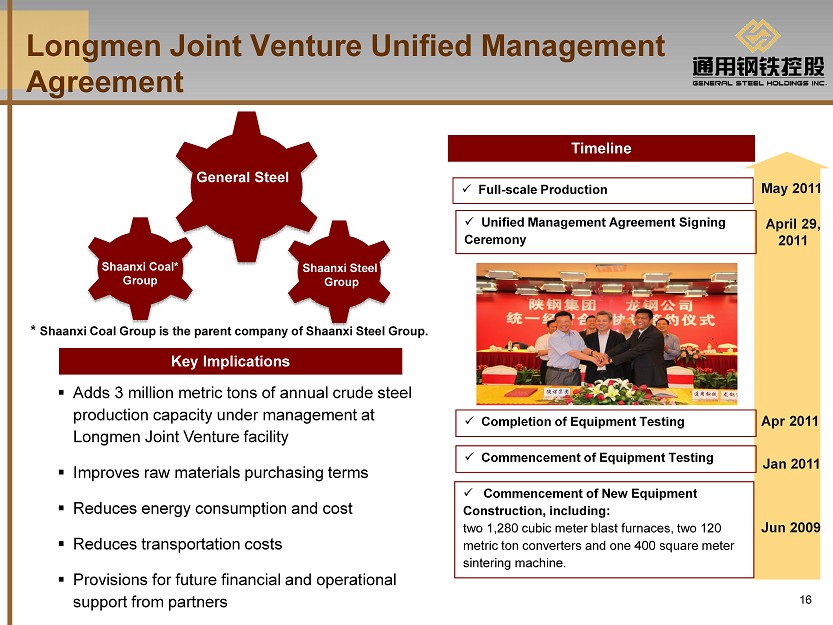

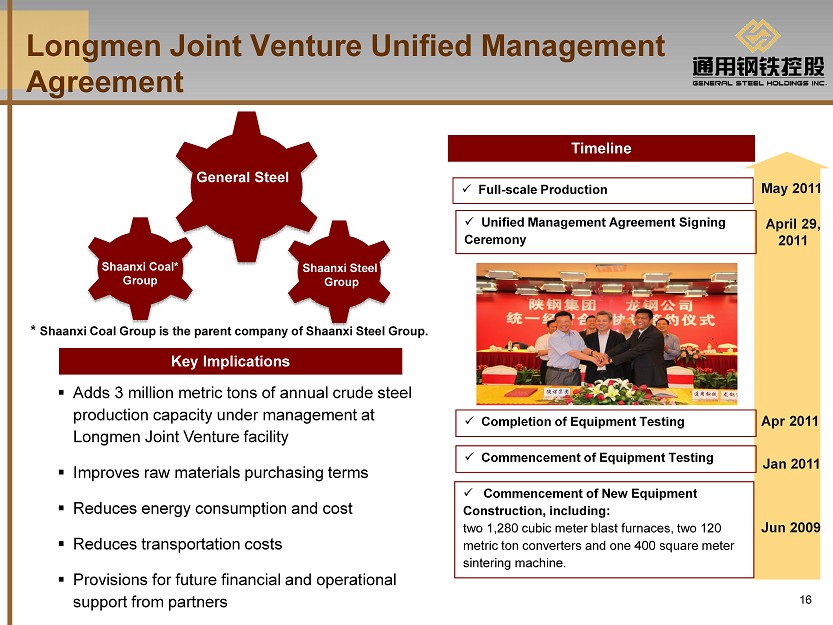

16 Longmen Joint Venture Unified Management Agreement Timeline Key Implications x Unified Management Agreement Signing Ceremony April 29, 2011 x Commencement of Equipment Testing Apr 2011 x Full - scale Production May 2011 Jun 2009 x Completion of Equipment Testing Jan 2011 * Shaanxi Coal Group is the parent company of Shaanxi Steel Group. G eneral Steel Shaanxi Steel Group Shaanxi Coal* Group ▪ Adds 3 million metric tons of annual crude steel production capacity under management at Longmen Joint Venture facility ▪ Improves raw materials purchasing terms ▪ Reduces energy consumption and cost ▪ Reduces transportation costs ▪ Provisions for future financial and operational support from partners x Commencement of New Equipment Construction, including: two 1,280 cubic meter blast furnaces, two 120 metric ton converters and one 400 square meter sintering machine.

17 Longmen Joint Venture is the Principal Management Party ▪ Fully funded construction of new equipment at Longmen Joint Venture, with fair market value of $550 million ▪ Two 1,280 cubic meter blast furnaces, two 120 metric ton converters and one 400 square meter sintering machine ▪ New equipment adds annual crude steel production capacity of 3 million metric tons under management at designed efficiency levels Total Sales Shaanxi Steel Group Contributions ▪ Joint management term: 20 years ▪ Pre - tax profit sharing (for the first 2 years): Longmen Joint Venture Shaanxi Steel Group Accounting Treatment of Key Items Unified Management Total Sales GSI Consolidated Depreciation Cost of Good Sold 100% 100% Pre - tax Profit 40% EBIT attributable to Shaanxi Steel Group 40% Operating Expenses Pre - tax Profit Pre - tax Profit 60%* EBIT attributable to Longmen Joint Venture 60% Longmen Joint Venture Unified Management Agreement * Based on Longmen Joint Venture ownership structure, 36% of pre - tax profit directly attributable to GSI

18 Second Quarter 2011 Highlights Growth Driver: Capacity Expansion & Increase in ASP Capacity Expansion at Longmen Joint Venture ▪ Signed a 20 - year Unified Management Agreement with Shaanxi Coal and Shaanxi Steel ▪ New equipment adds 3 million metric tons of crude steel production capacity annually under management ▪ Q2 11 sales volume totaled approx. 1.8 million metric tons (85% of capacity) Q2 11 Financial Highlights (Unaudited) Second Quarter 2011 Revenue USD Million ▪ Full - year 2011 steel production reached a record 5.0 – 5.5 million metric tons ▪ Benchmarking programs and efficiency improvement initiatives to reduce manufacturing costs ▪ Framework agreements with SOEs improve direct sales capabilities ▪ Sourcing and production agreement with SOEs enables sale of rebar at fixed markup Other Achievements and Recent Developments ▪ Revenue of approx. $1 billion (+100% y/y) ▪ Gross Profit of approx. $28 million (+280% y/y) ▪ Gross Margin of approx. 2.7% (+120 bps y/y) ▪ Crude Steel Capacity of 7 million mt under management (+75% y/y) ▪ Q2 2011 net loss of approx. $(1.5) million vs. net loss of $(2.1) million in Q2 2010

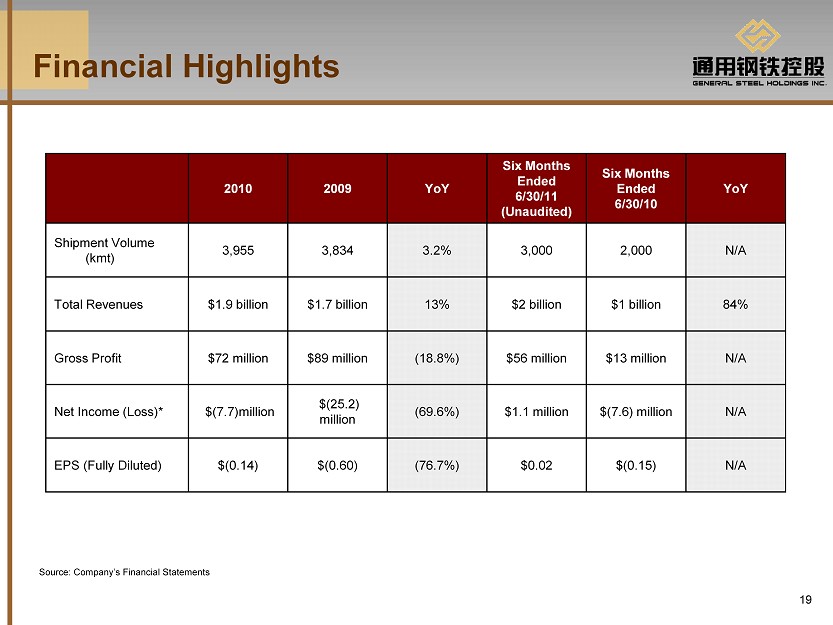

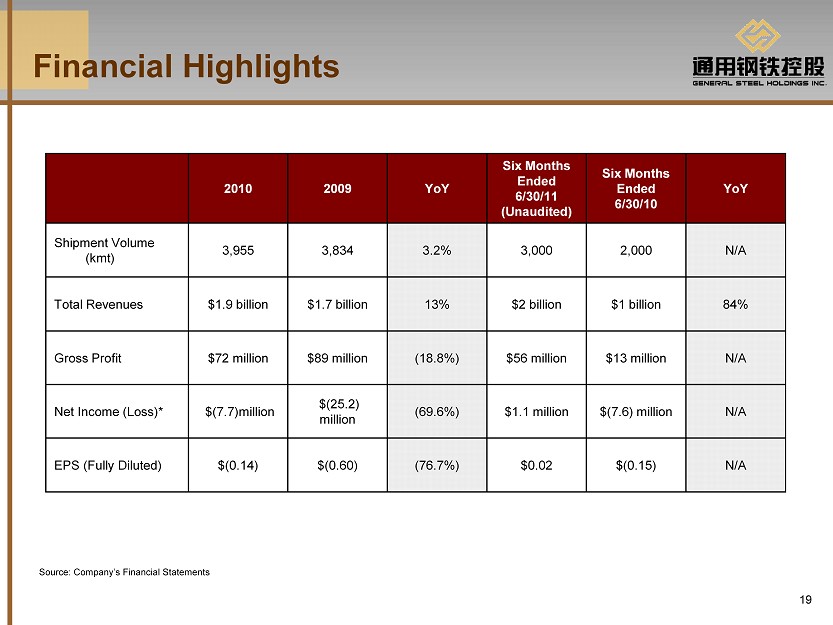

19 Financial Highlights 2010 2009 YoY Six Months Ended 6/30/11 (Unaudited) Six Months Ended 6/30/10 YoY Shipment Volume (kmt) 3,955 3,834 3.2% 3,000 2,000 N/A Total Revenues $1.9 billion $1.7 billion 13% $2 billion $1 billion 84% Gross Profit $72 million $89 million (18.8%) $56 million $13 million N/A Net Income (Loss)* $(7.7)million $(25.2) million (69.6%) $1.1 million $(7.6) million N/A EPS (Fully Diluted) $(0.14) $(0.60) (76.7%) $0.02 $(0.15) N/A Source: Company’s Financial Statements

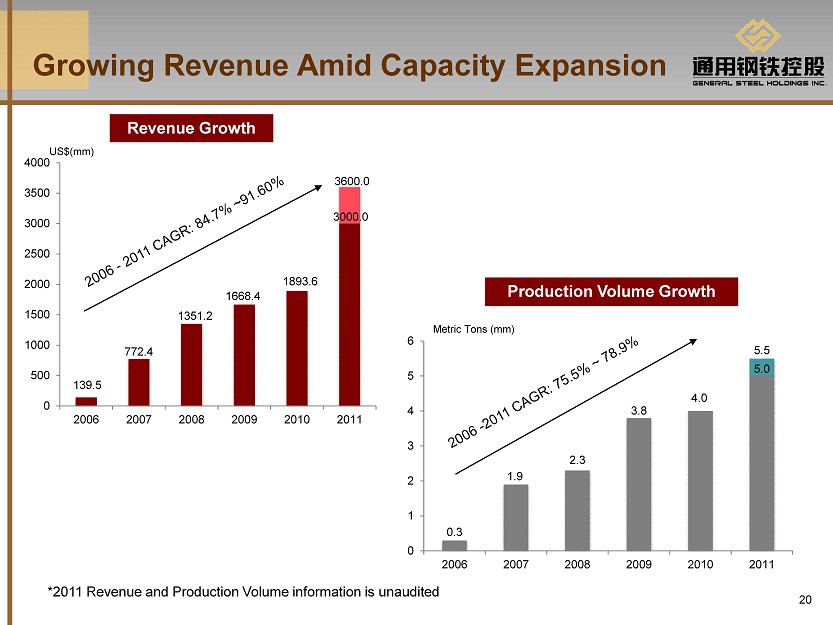

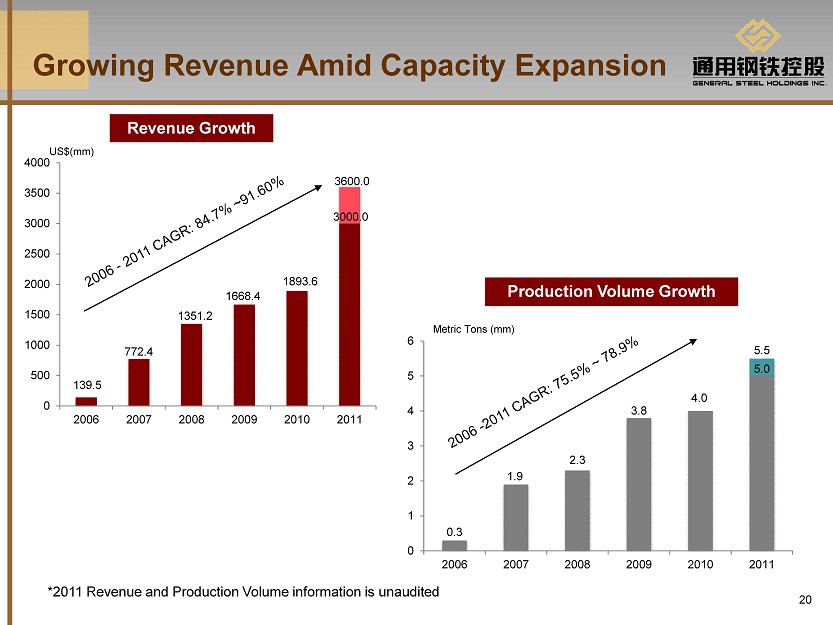

20 0.3 1.9 2.3 3.8 4.0 5.0 5.5 0 1 2 3 4 5 6 2006 2007 2008 2009 2010 2011 139.5 772.4 1351.2 1668.4 1893.6 3000.0 3600.0 0 500 1000 1500 2000 2500 3000 3500 4000 2006 2007 2008 2009 2010 2011 Metric Tons (mm) Production Volume Growth US$(mm) Growing Revenue Amid Capacity Expansion Revenue Growth *2011 Revenue and Production Volume information is unaudited

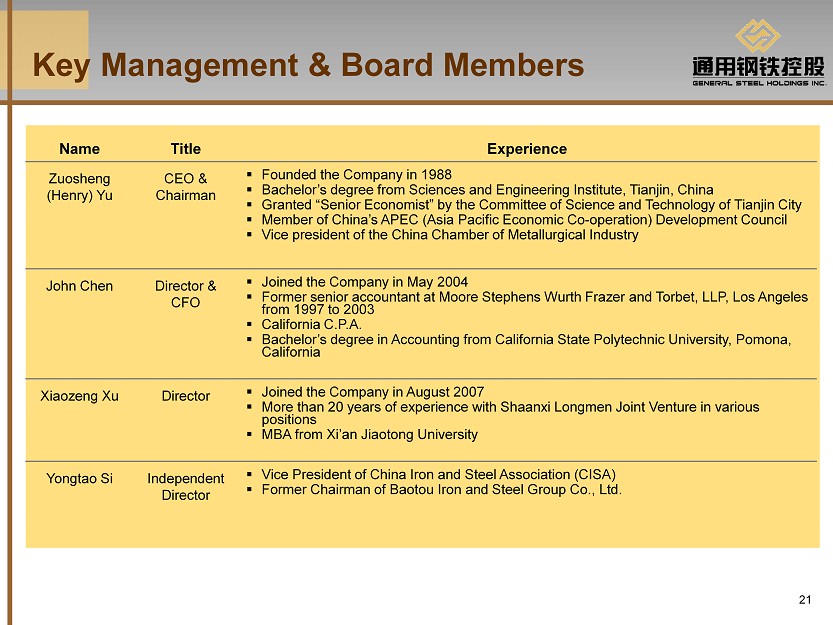

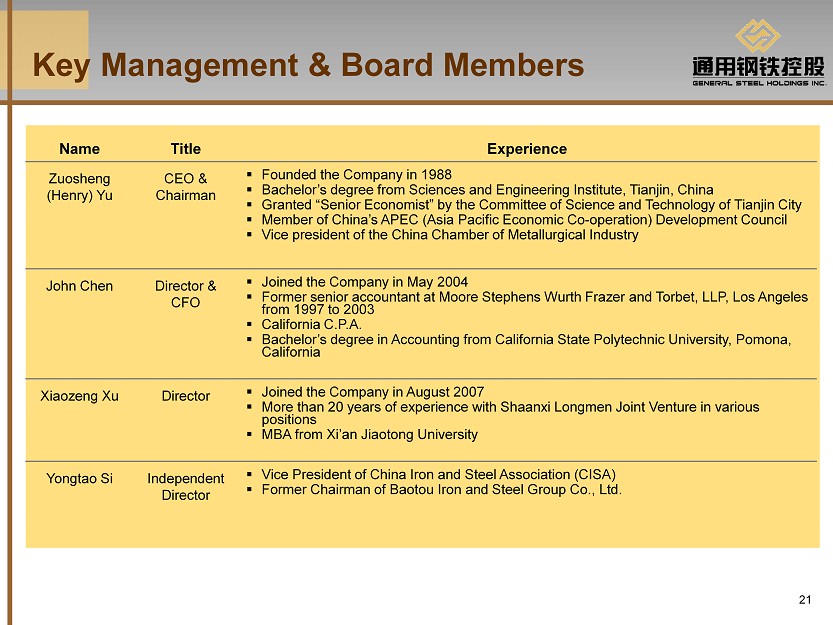

21 Name Title Experience Zuosheng (Henry) Yu CEO & Chairman ▪ Founded the Company in 1988 ▪ Bachelor’s degree from Sciences and Engineering Institute, Tianjin, China ▪ Granted “Senior Economist” by the Committee of Science and Technology of Tianjin City ▪ Member of China’s APEC (Asia Pacific Economic Co - operation) Development Council ▪ Vice president of the China Chamber of Metallurgical Industry John Chen Director & CFO ▪ Joined the Company in May 2004 ▪ Former senior accountant at Moore Stephens Wurth Frazer and Torbet, LLP, Los Angeles from 1997 to 2003 ▪ California C.P.A. ▪ Bachelor’s degree in Accounting from California State Polytechnic University, Pomona, California Xiaozeng Xu Director ▪ Joined the Company in August 2007 ▪ More than 20 years of experience with Shaanxi Longmen Joint Venture in various positions ▪ MBA from Xi’an Jiaotong University Yongtao Si Independent Director ▪ Vice President of China Iron and Steel Association (CISA) ▪ Former Chairman of Baotou Iron and Steel Group Co., Ltd. Key Management & Board Members

22 Key Takeaways x Unified Management Agreement with Shaanxi Steel Group and Shaanxi Coal Group provides multiple benefits x Poised to benefit from changing government policy and industry consolidation x Proven management team with extensive industry experience and relationships x Steel industry leader poised to capture additional market share in growing Western region x Demonstrated track record of successful M&A x Expanding capacity and improving operational efficiency support revenue growth and profitability

23 23 Thank You! Jenny Wang Brandi Floberg / Lee Roth General Steel Holdings, Inc. The Piacente Group Tel: + 86 - 10 - 5775 - 7691 212 - 481 - 2050 Email: jenny.wang@gshi - steel.com Email: generalsteel@tpg - ir.com