Investor Supplemental Materials August 7, 2019

Safe Harbor Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 This presentation includes information that constitutes “forward-looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include the company's expectations regarding the company's future financial performance and the potential demand for its products, the company's growth potential, its business focus and competitive advantages, and its expectations about the benefits of its acquisition of General Photonics. Management cautions the reader that these forward-looking statements are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results, performance, and/or achievements of the company may differ materially from the future results, performance, and/or achievements expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without limitation, failure of demand for the company’s products and services to meet expectations, failure of target market to grow and expand, technological and strategic challenges, market valuation of the company and those risks and uncertainties set forth in the company’s periodic reports and other filings with the Securities and Exchange Commission ("SEC"). Such filings are available on the SEC’s website at www.sec.gov and on the company’s website at www.lunainc.com. The statements made in this presentation are based on information available to Luna as of the date of this presentation and Luna undertakes no obligation to update any of the forward-looking statements after the date of this presentation, except as required by law. Adjusted Financial Measures In addition to U.S. GAAP financial information, this presentation includes Adjusted EBITDA, a non-GAAP financial measure. This non-GAAP financial measure is in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of Adjusted EBITDA to Net Income is included in the appendix to this presentation. NASDAQ: LUNA Luna Innovations Incorporated© 2019

2Q FY19 Results

Second-Quarter 2019 Financial Results Raises FY19 outlook: . Total revenues of $66M to $69M; up from $60M to $65M . Adjusted EBITDA of $7.2M to $7.6M; up from $6.0M to $6.5M Strong financial performance: . Seventh consecutive quarter of year-over-year, double-digit revenue growth from continuing operations . $1.5M improvement in Adjusted EBITDA year-over-year Total revenues of $17.8M; up 80% year-over-year: . Products and licensing revenue of $11.4M; up 155% year-over-year . Technology development revenue of $6.4M; up 18% year-over-year Net income attributable to common stockholders of $0.8M or $0.02 per fully diluted share for the three months ended June 30, 2019, compared to $1.0M or $0.03 per fully diluted share for the three months ended June 30, 2018 . Q2FY18 included $0.8M ($0.02 per share) in income from discontinued operations Adjusted EBITDA1 improved to $2.4M for the three months ended June 30, 2019, compared to $0.5M for the three months ended June 30, 2018 1Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation. NASDAQ: LUNA Luna Innovations Incorporated© 2019

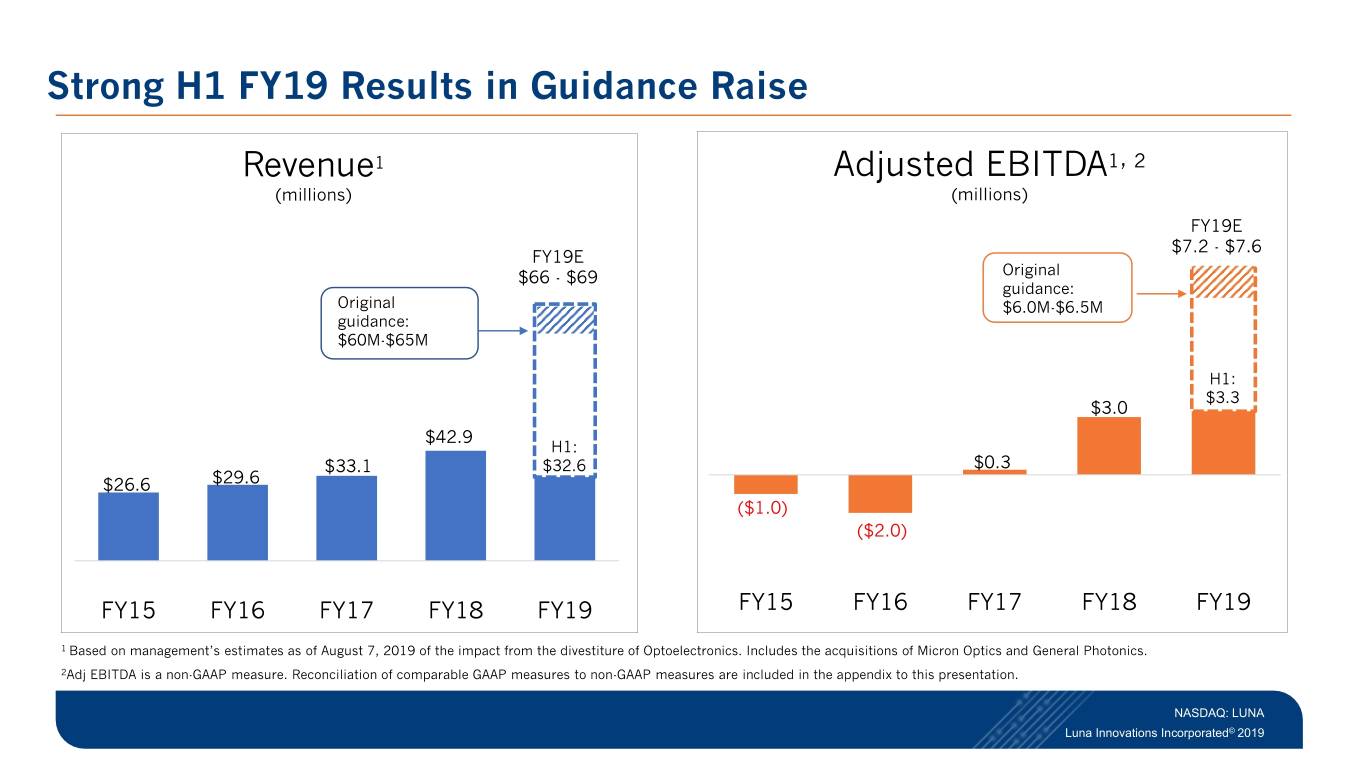

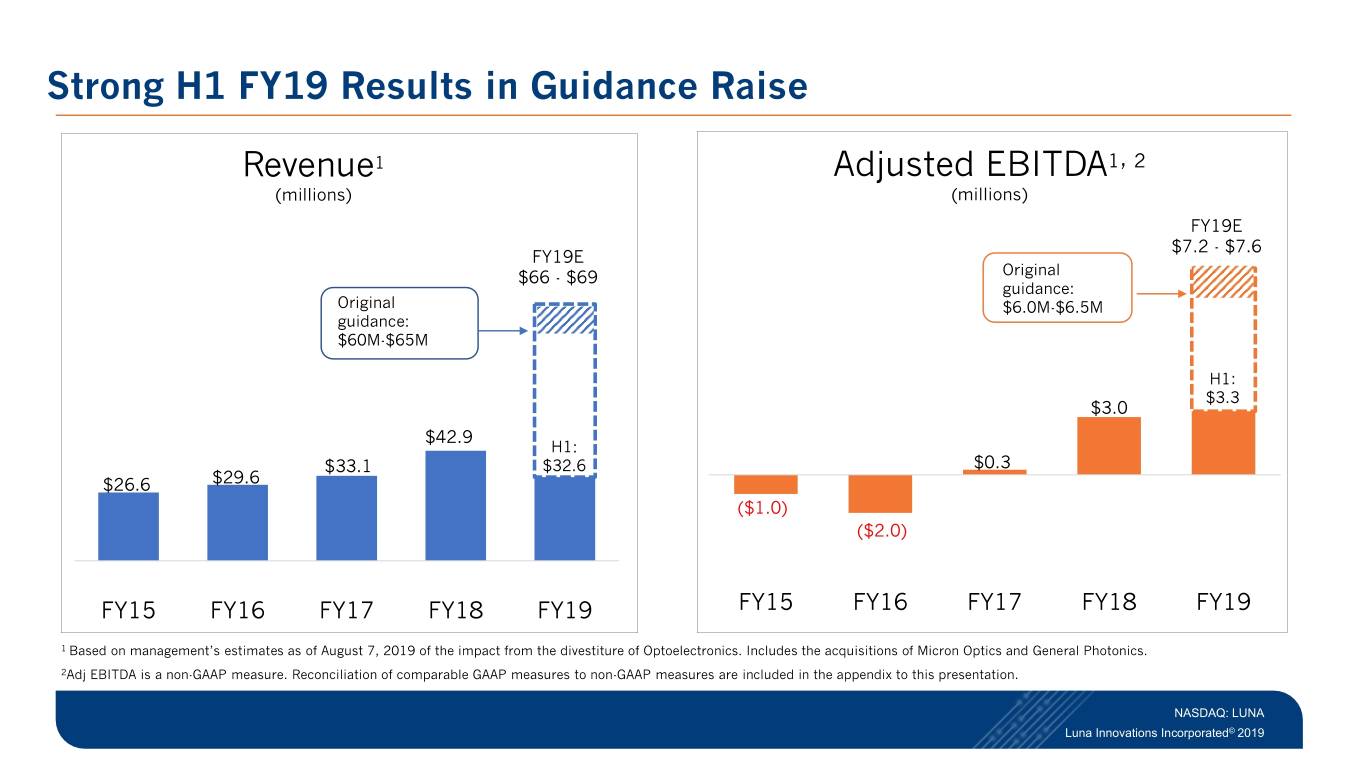

Strong H1 FY19 Results in Guidance Raise Revenue1 Adjusted EBITDA1, 2 (millions) (millions) FY19E $7.2 - $7.6 FY19E $66 - $69 Original guidance: Original $6.0M-$6.5M guidance: $60M-$65M H1: $3.3 $3.0 $42.9 H1: $33.1 $32.6 $0.3 $26.6 $29.6 ($1.0) ($2.0) FY15 FY16 FY17 FY18 FY19 FY15 FY16 FY17 FY18 FY19 1 Based on management’s estimates as of August 7, 2019 of the impact from the divestiture of Optoelectronics. Includes the acquisitions of Micron Optics and General Photonics. 2Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation. NASDAQ: LUNA Luna Innovations Incorporated© 2019

Update on Acquisitions Integration Rapid integration . Merged complementary products into integrated customer solutions . Migrated sales teams to common rewards systems Working as a single integrated company Micron Optics . Integration nearly complete; sales force training complete . Continued positive feedback from customers regarding product offerings General Photonics . Integration proceeding smoothly; no significant “hiccups” to date • Sales force education completed • Customer feedback is positive regarding product offerings • Complementary, additive product lines already contributing to growth NASDAQ: LUNA Luna Innovations Incorporated© 2019

A Flexible Balance Sheet and Strong Cash Position Balance sheet on June 30, 2019: . $82.2M in total assets • $23.5M in cash and cash equivalents • $39.4M in working capital Focus on working capital and reinvestment in business in order to generate long-term sustainable growth Financial Performance NASDAQ: LUNA Luna Innovations Incorporated© 2019

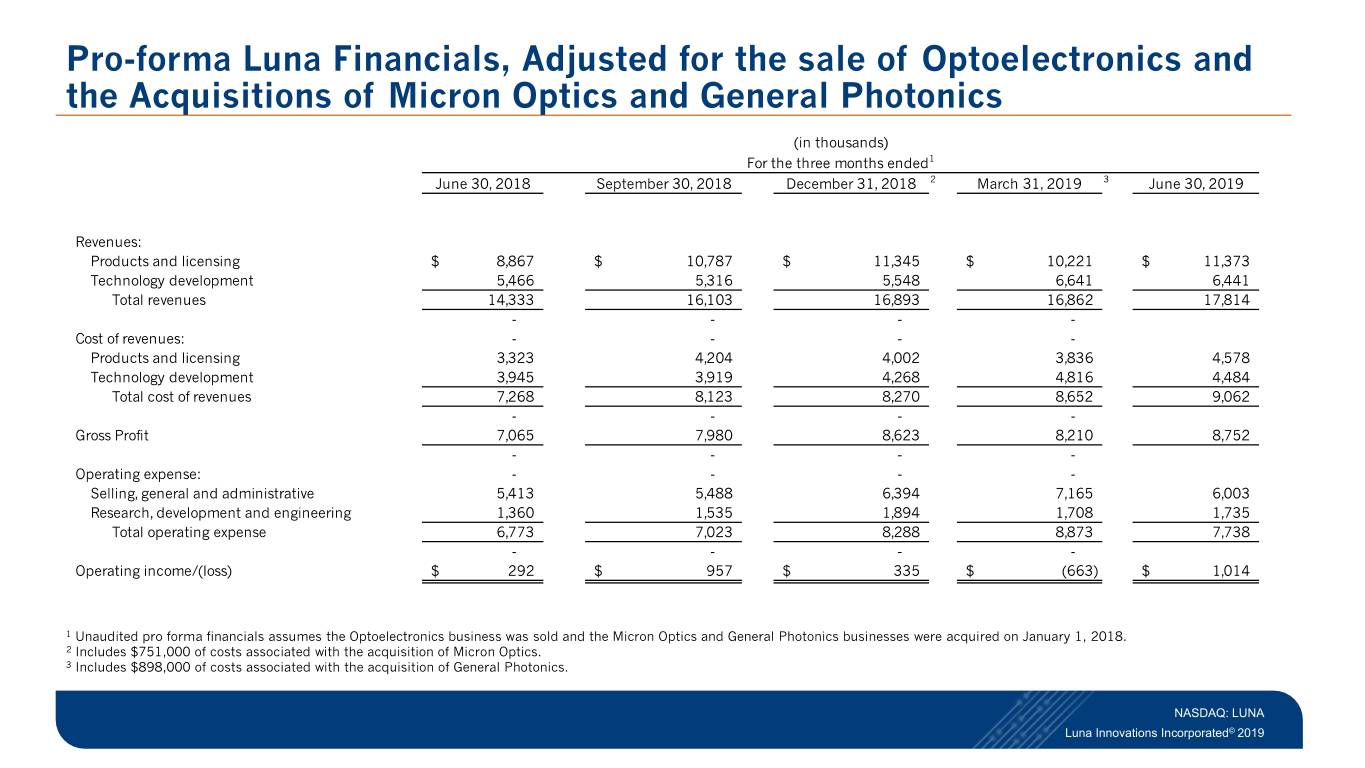

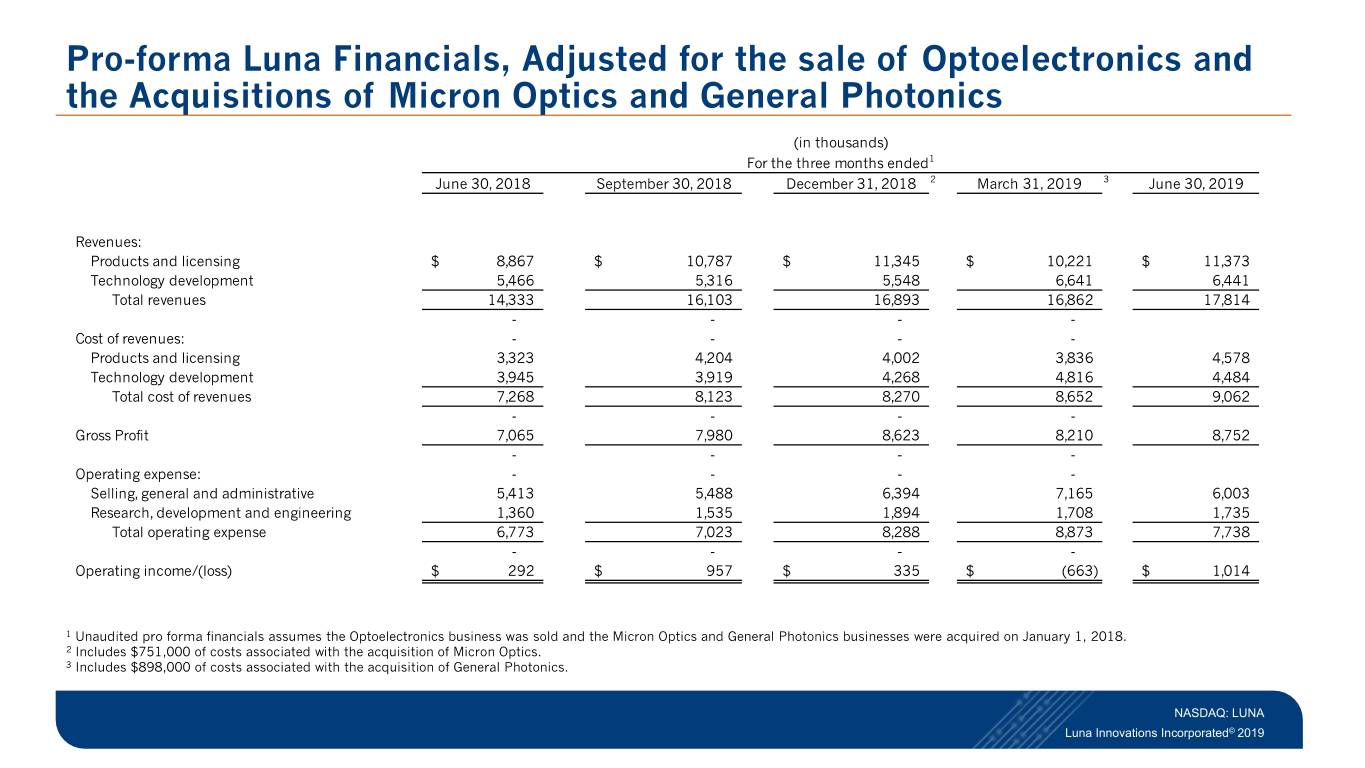

Pro-forma Luna Financials, Adjusted for the sale of Optoelectronics and the Acquisitions of Micron Optics and General Photonics 1 Unaudited pro forma financials assumes the Optoelectronics business was sold and the Micron Optics and General Photonics businesses were acquired on January 1, 2018. 2 Includes $751,000 of costs associated with the acquisition of Micron Optics. 3 Includes $898,000 of costs associated with the acquisition of General Photonics. NASDAQ: LUNA Luna Innovations Incorporated© 2019

Why Invest in Luna? Proprietary, measurement technology, offering unprecedented combination of resolution, accuracy and speed Customers in attractive markets: Aerospace, Automotive, Communications, Energy and Defense Positioned to take advantage of trends such as vehicle light-weighting and increasing demands on data centers and broadband capacity Adequately capitalized to fund growth Long-tenured, experienced executive team / board Corporate culture of innovation and integrity Compelling value: currently trading at an attractive multiple Summary NASDAQ: LUNA Luna Innovations Incorporated© 2019

Appendix

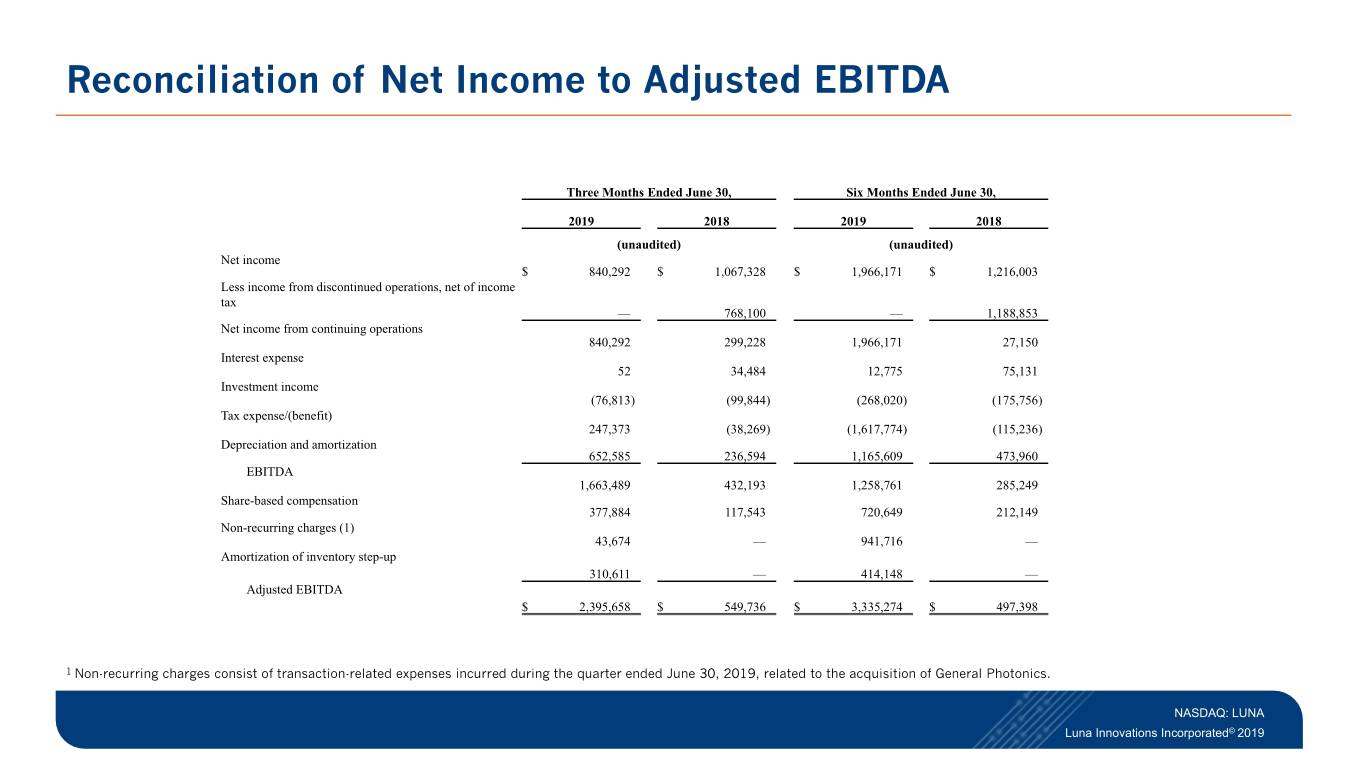

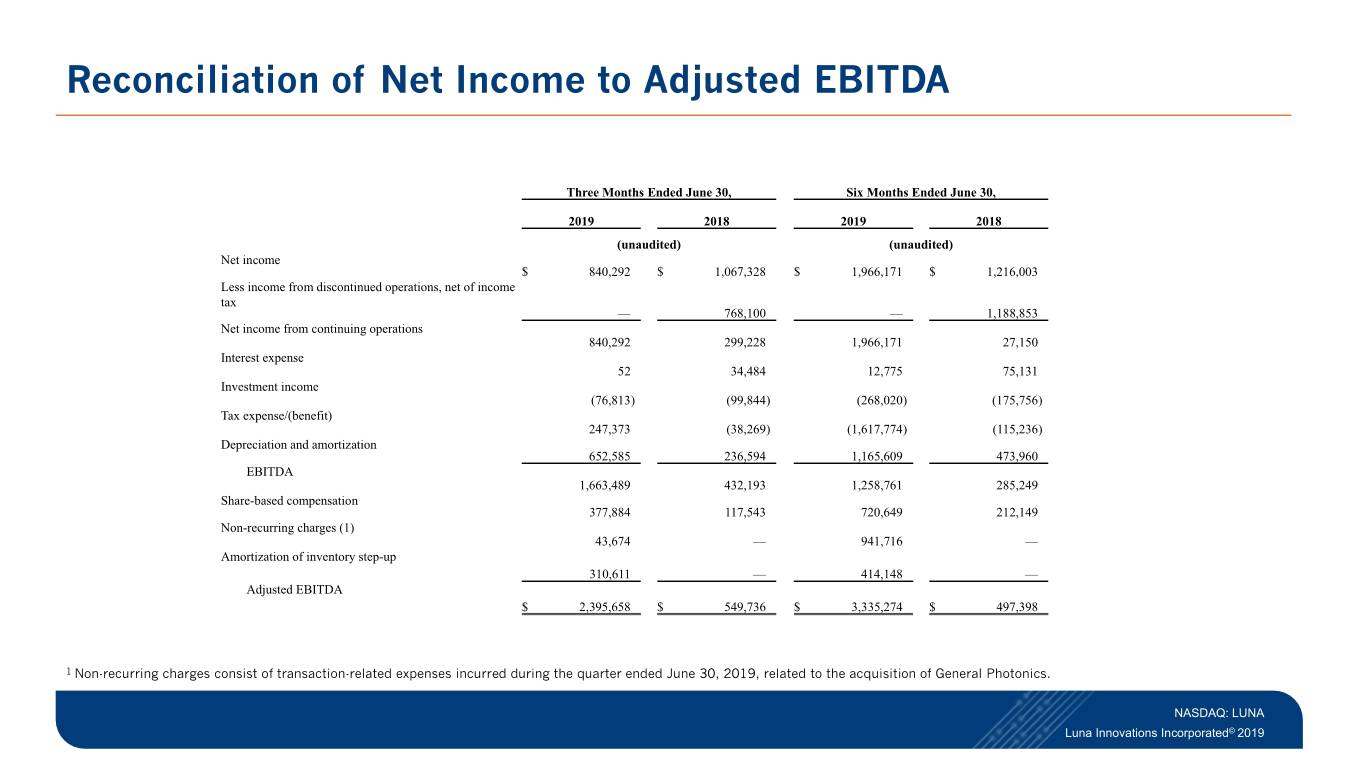

Reconciliation of Net Income to Adjusted EBITDA Three Months Ended June 30, Six Months Ended June 30, 2019 2018 2019 2018 (unaudited) (unaudited) Net income $ 840,292 $ 1,067,328 $ 1,966,171 $ 1,216,003 Less income from discontinued operations, net of income tax — 768,100 — 1,188,853 Net income from continuing operations 840,292 299,228 1,966,171 27,150 Interest expense 52 34,484 12,775 75,131 Investment income (76,813) (99,844) (268,020) (175,756) Tax expense/(benefit) 247,373 (38,269) (1,617,774) (115,236) Depreciation and amortization 652,585 236,594 1,165,609 473,960 EBITDA 1,663,489 432,193 1,258,761 285,249 Share-based compensation 377,884 117,543 720,649 212,149 Non-recurring charges (1) 43,674 — 941,716 — Amortization of inventory step-up 310,611 — 414,148 — Adjusted EBITDA $ 2,395,658 $ 549,736 $ 3,335,274 $ 497,398 1 Non-recurring charges consist of transaction-related expenses incurred during the quarter ended June 30, 2019, related to the acquisition of General Photonics. NASDAQ: LUNA Luna Innovations Incorporated© 2019

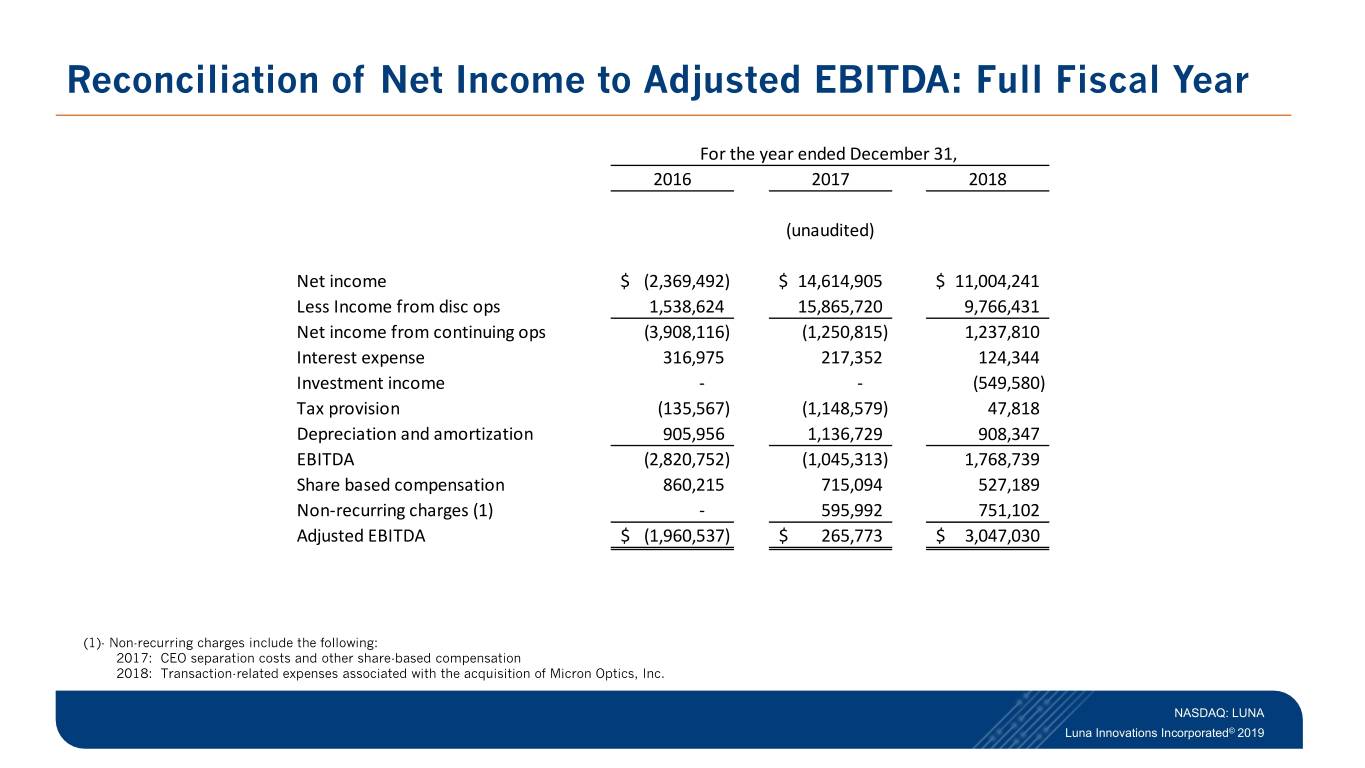

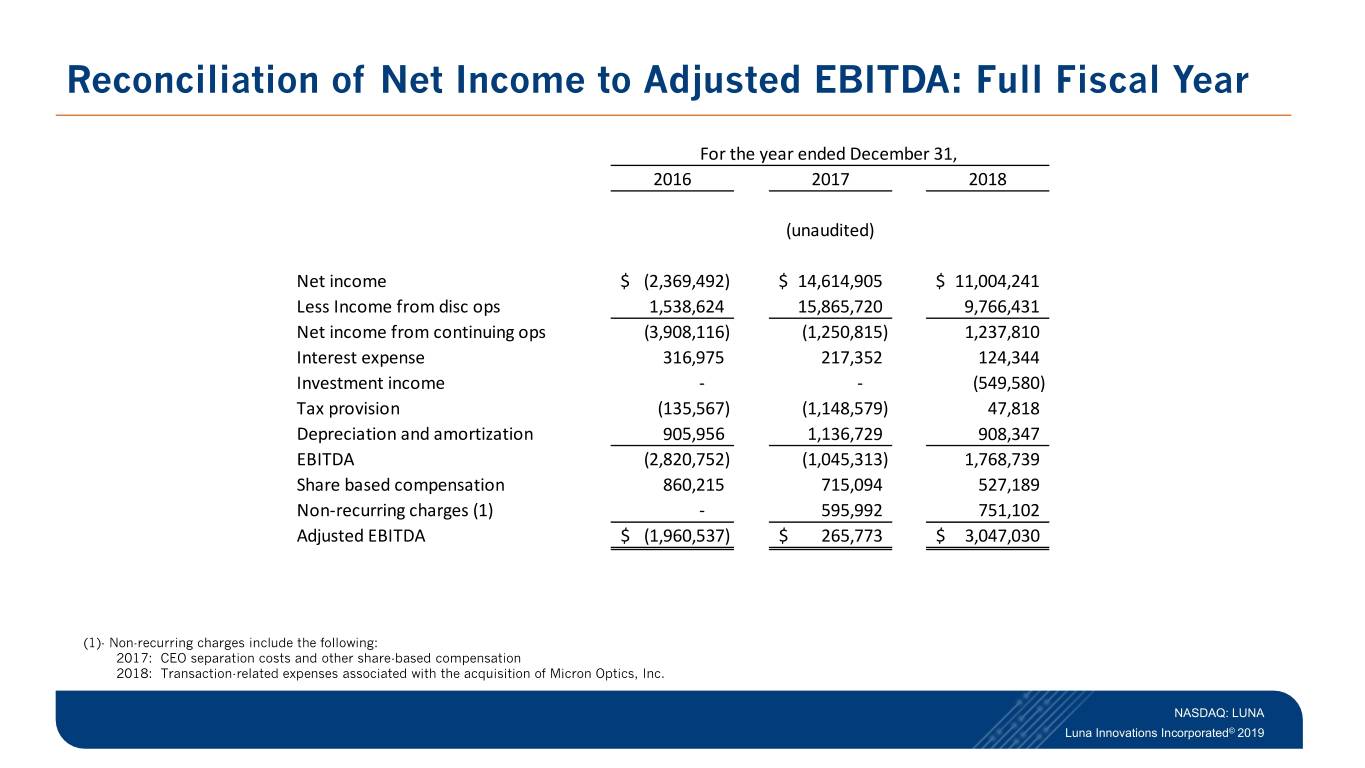

Reconciliation of Net Income to Adjusted EBITDA: Full Fiscal Year For the year ended December 31, 2016 2017 2018 (unaudited) Net income $ (2,369,492) $ 14,614,905 $ 11,004,241 Less Income from disc ops 1,538,624 15,865,720 9,766,431 Net income from continuing ops (3,908,116) (1,250,815) 1,237,810 Interest expense 316,975 217,352 124,344 Investment income - - (549,580) Tax provision (135,567) (1,148,579) 47,818 Depreciation and amortization 905,956 1,136,729 908,347 EBITDA (2,820,752) (1,045,313) 1,768,739 Share based compensation 860,215 715,094 527,189 Non-recurring charges (1) - 595,992 751,102 Adjusted EBITDA $ (1,960,537) $ 265,773 $ 3,047,030 (1)- Non-recurring charges include the following: 2017: CEO separation costs and other share-based compensation 2018: Transaction-related expenses associated with the acquisition of Micron Optics, Inc. NASDAQ: LUNA Luna Innovations Incorporated© 2019