First-quarter 2021 Results Investor Supplemental Materials May 17th, 2021

NASDAQ: LUNA Luna Innovations Incorporated© 2021 2 Safe Harbor Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 This presentation includes information that constitutes “forward-looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include the company's expectations regarding the company's future financial performance, including 2021 guidance, and the market and potential demand for its products, the company's growth potential, its balance sheet and capitalization and access to capital, its technological advantages and capabilities, its strategic position, and corporate culture. Management cautions the reader that these forward-looking statements are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results, performance, and/or achievements of the company may differ materially from the future results, performance, and/or achievements expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without limitation, failure of demand for the company’s products and services to meet expectations, failure of target markets to grow and expand, technological, operational and strategic challenges, uncertainties related to the ultimate impact of the COVID-19 pandemic and those risks and uncertainties set forth in the company’s periodic reports and other filings with the Securities and Exchange Commission ("SEC"). Such filings are available on the SEC’s website at www.sec.gov and on the company’s website at www.lunainc.com. The statements made in this presentation are based on information available to Luna as of the date of this presentation, May 17, 2021, and Luna undertakes no obligation to update any of the forward-looking statements after the date of this presentation, except as required by law. Adjusted Financial Measures In addition to U.S. GAAP financial information, this presentation includes Adjusted EBITDA, a non-GAAP financial measure. This non-GAAP financial measure is in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of Adjusted EBITDA to Net Income is included in the appendix to this presentation.

1Q FY21 Results

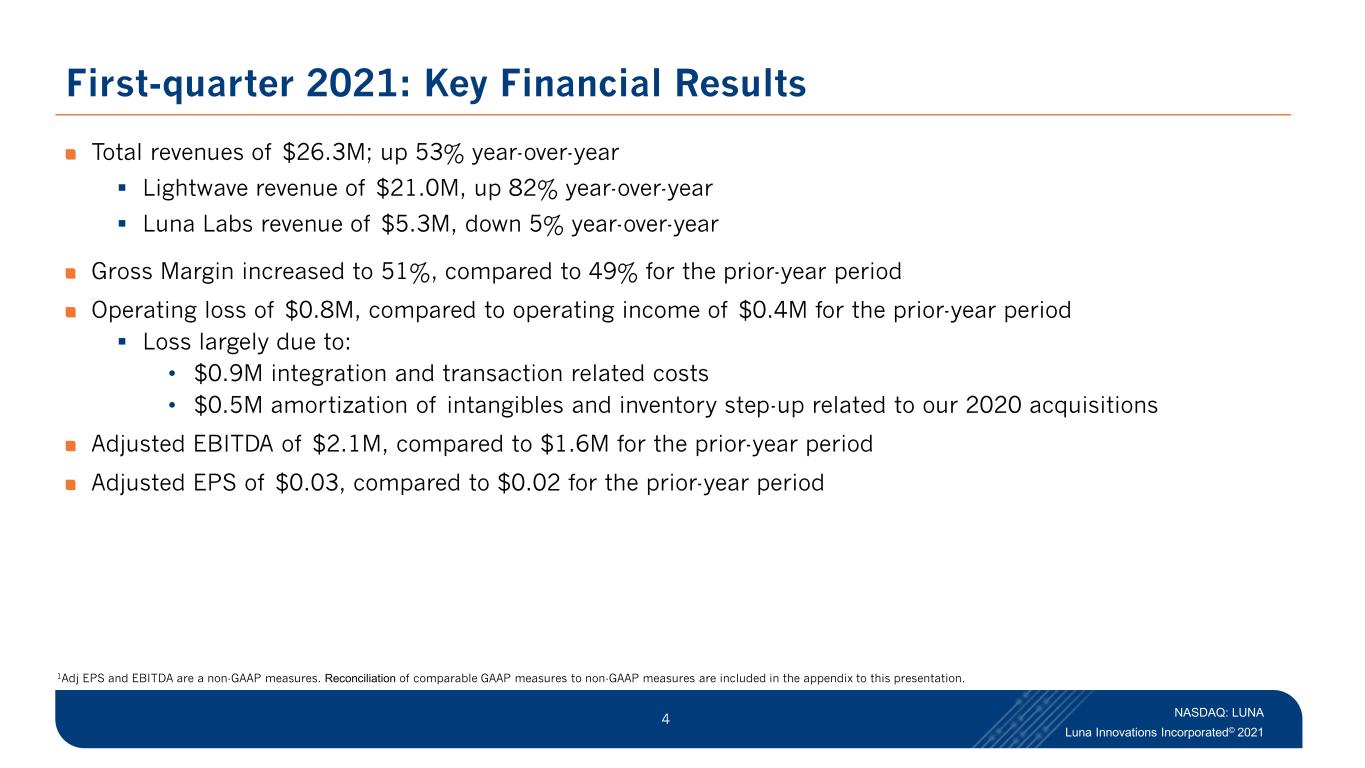

NASDAQ: LUNA Luna Innovations Incorporated© 2021 4 First-quarter 2021: Key Financial Results Total revenues of $26.3M; up 53% year-over-year Lightwave revenue of $21.0M, up 82% year-over-year Luna Labs revenue of $5.3M, down 5% year-over-year Gross Margin increased to 51%, compared to 49% for the prior-year period Operating loss of $0.8M, compared to operating income of $0.4M for the prior-year period Loss largely due to: • $0.9M integration and transaction related costs • $0.5M amortization of intangibles and inventory step-up related to our 2020 acquisitions Adjusted EBITDA of $2.1M, compared to $1.6M for the prior-year period Adjusted EPS of $0.03, compared to $0.02 for the prior-year period 1Adj EPS and EBITDA are a non-GAAP measures. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation.

NASDAQ: LUNA Luna Innovations Incorporated© 2021 5 First-quarter 2021 Highlights Total Lightwave revenues up >80% Legacy Lightwave revenues increased double-digit vs. prior-year quarter Traction and customer orders remain strong: Large ODiSi (sensing product) order from defense contractor Key strategic wins for Terahertz products in process control markets OBR 6200 sales (comms test) OptaSense, a leader in distributed acoustic sensing, operating as stand-alone company in 2021, with key services provided through TSAs for first six months; functional integration begins after first year Employees transitioned / in transition to Luna systems Mapping of OptaSense accounts to Luna complete Financial and IT systems integration ongoing Integration of New Ridge Technologies largely completed

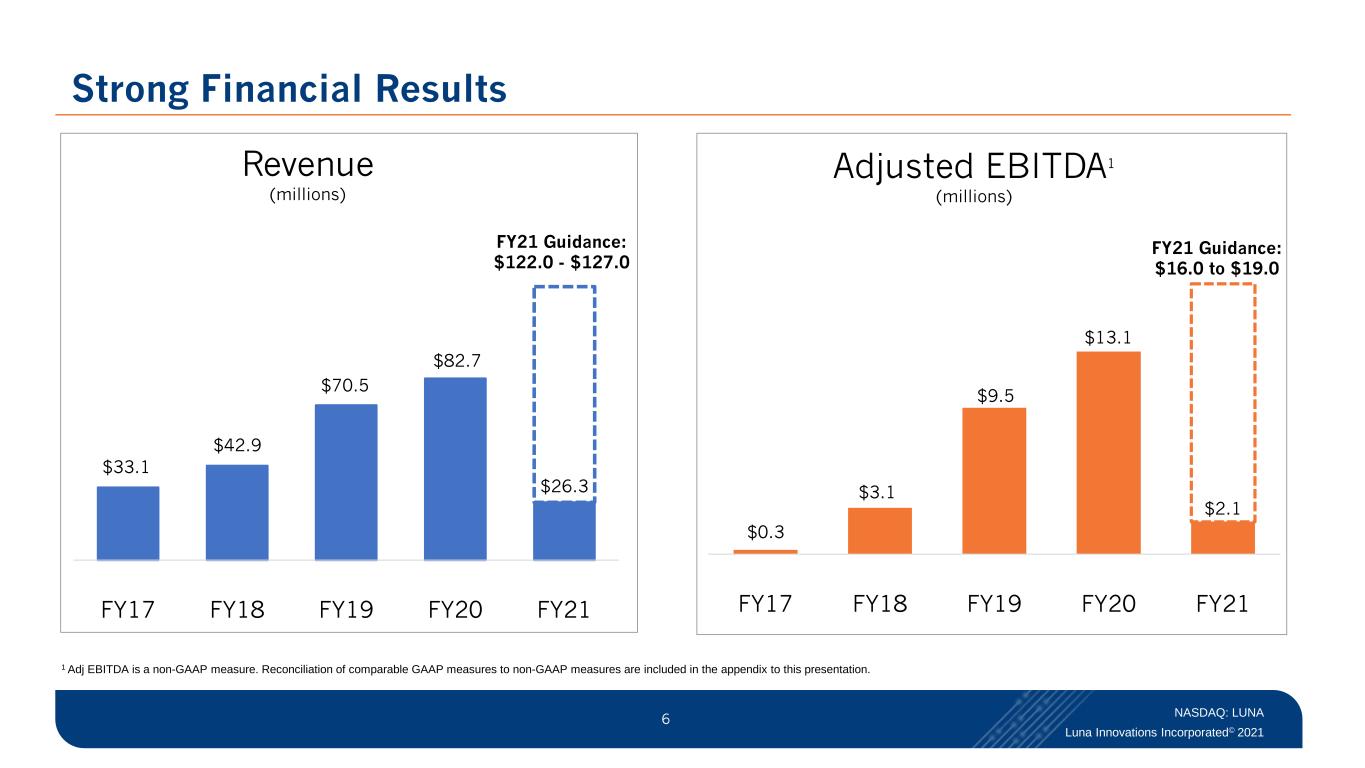

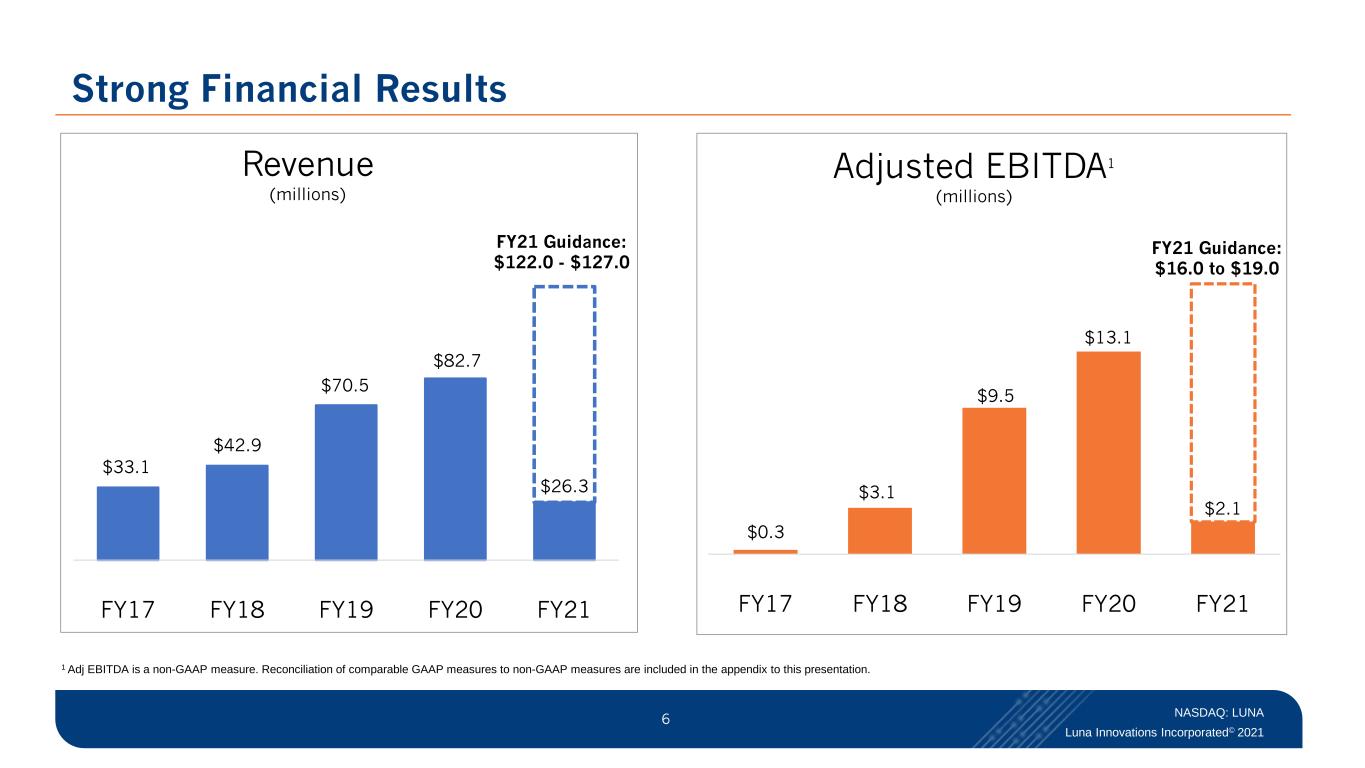

NASDAQ: LUNA Luna Innovations Incorporated© 2021 6 $0.3 $9.5 $2.1 FY17 FY18 FY19 FY20 FY21 Adjusted EBITDA1 (millions) $3.1 $33.1 $42.9 $70.5 $26.3 FY17 FY18 FY19 FY20 FY21 Revenue (millions) $82.7 Strong Financial Results 1 Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation. FY21 Guidance: $122.0 - $127.0 FY21 Guidance: $16.0 to $19.0 $13.1

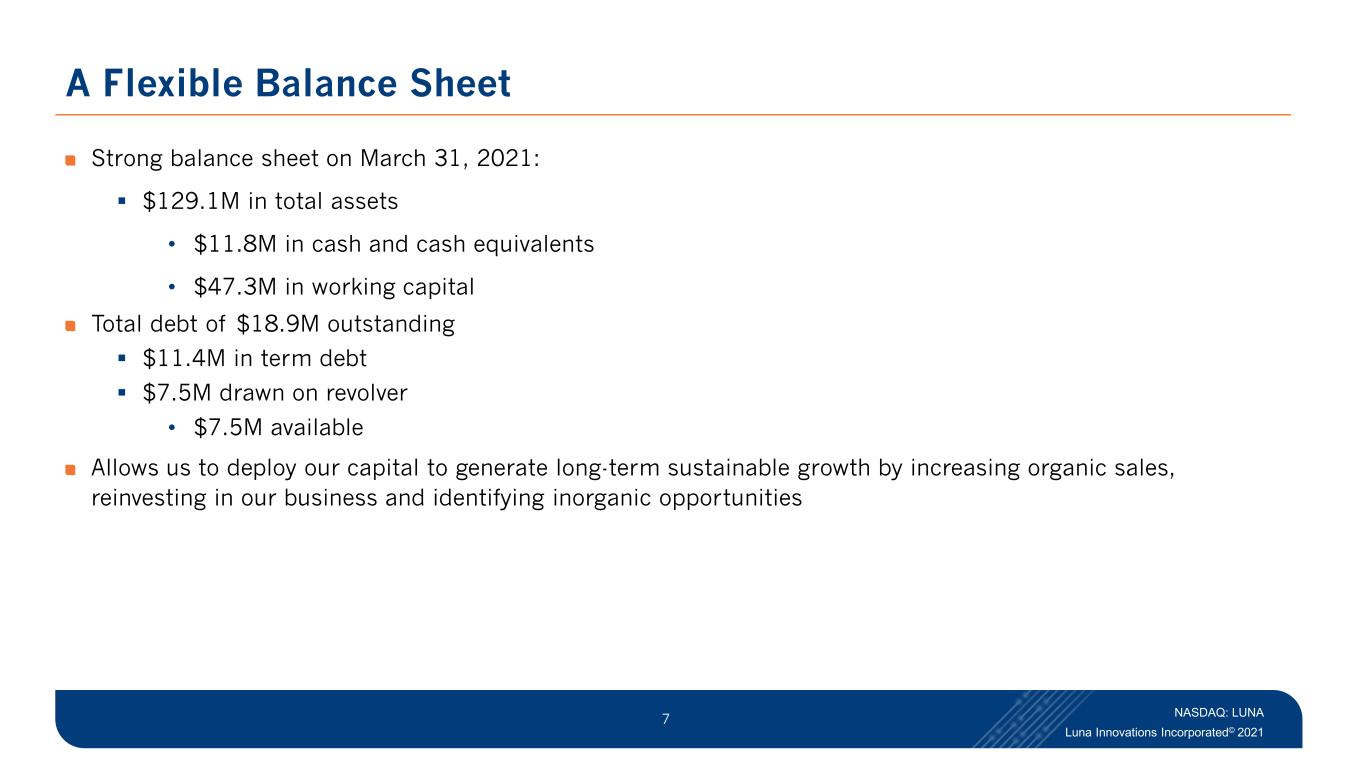

NASDAQ: LUNA Luna Innovations Incorporated© 2021 7 A Flexible Balance Sheet Strong balance sheet on March 31, 2021: $129.1M in total assets • $11.8M in cash and cash equivalents • $47.3M in working capital Total debt of $18.9M outstanding $11.4M in term debt $7.5M drawn on revolver • $7.5M available Allows us to deploy our capital to generate long-term sustainable growth by increasing organic sales, reinvesting in our business and identifying inorganic opportunities

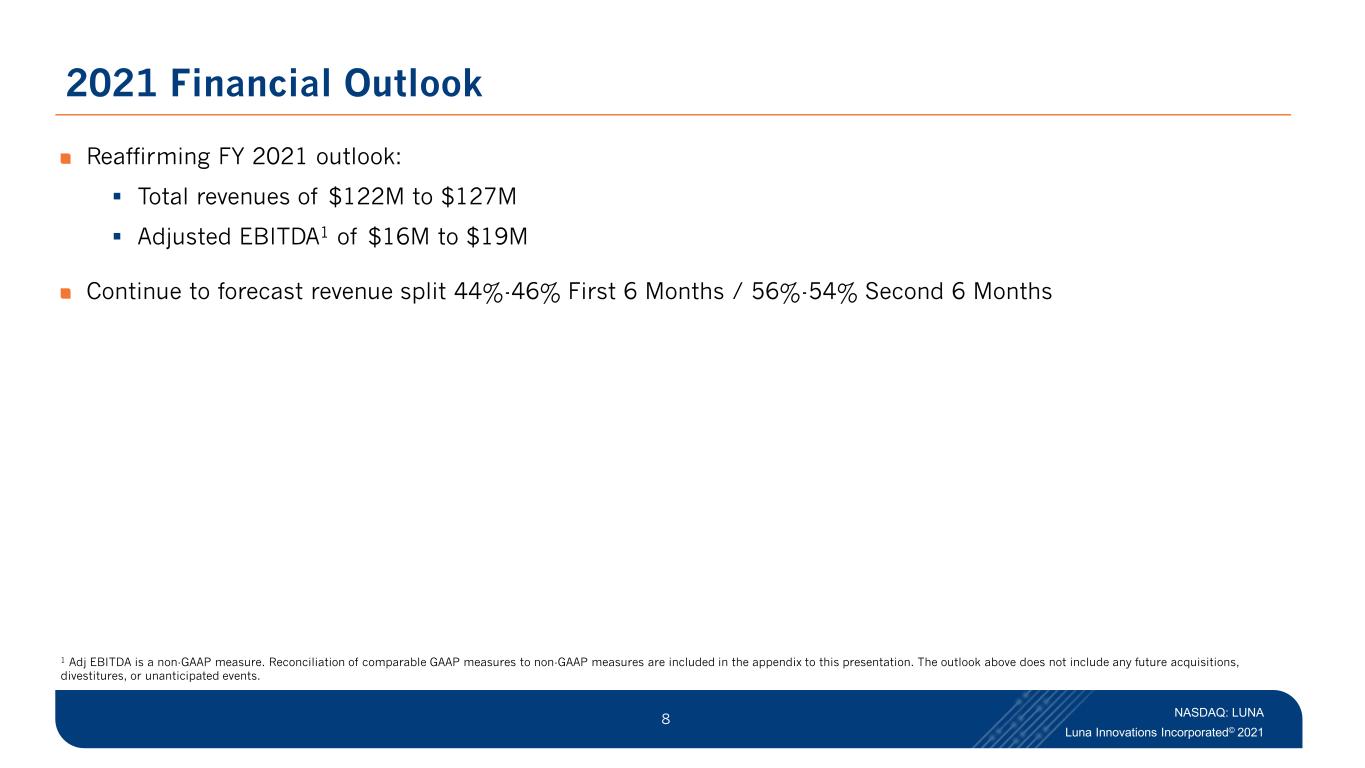

NASDAQ: LUNA Luna Innovations Incorporated© 2021 8 2021 Financial Outlook Reaffirming FY 2021 outlook: Total revenues of $122M to $127M Adjusted EBITDA1 of $16M to $19M Continue to forecast revenue split 44%-46% First 6 Months / 56%-54% Second 6 Months 1 Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation. The outlook above does not include any future acquisitions, divestitures, or unanticipated events.

NASDAQ: LUNA Luna Innovations Incorporated© 2021 9 Luna – Enabling the Future with Fiber Positioned as a global fiber optic leader Proprietary measurement technology, offering unprecedented combination of resolution, accuracy and speed Customers in attractive markets: Military and Defense, Communications, Infrastructure, Energy, Automotive and Aerospace Positioned to take advantage of trends such as vehicle lightweighting, smart infrastructure, and increasing demands on data centers and broadband capacity Adequately capitalized to fund growth Long-tenured, experienced executive team / board Corporate culture of innovation and integrity Overview

Appendix

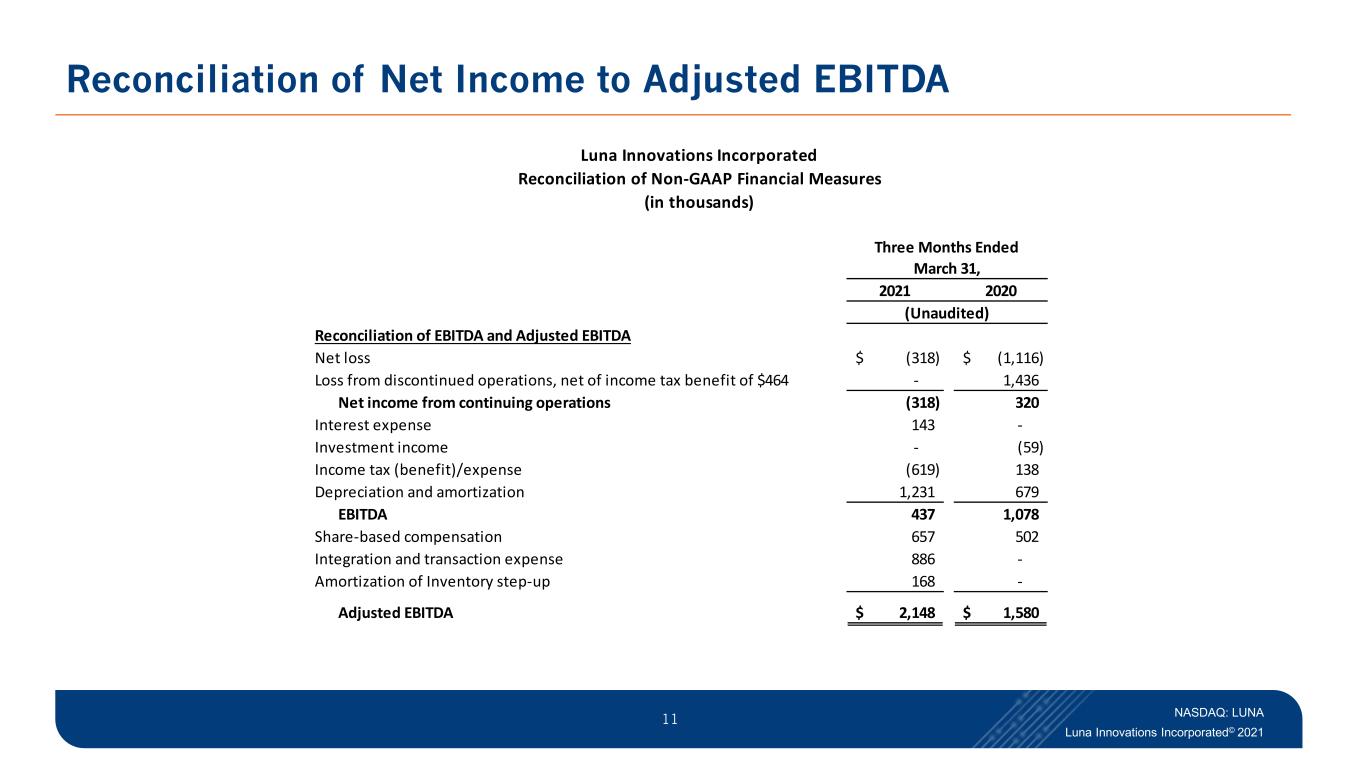

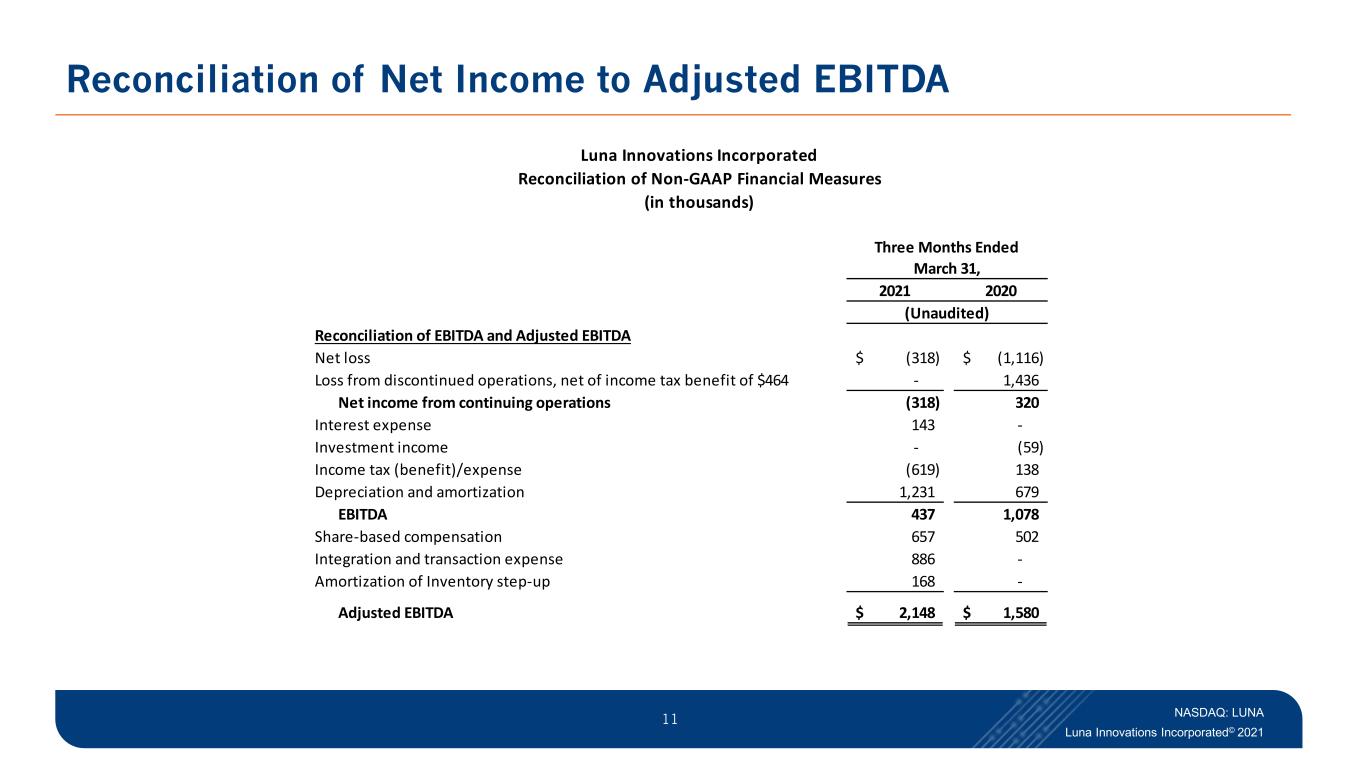

NASDAQ: LUNA Luna Innovations Incorporated© 2021 11 Reconciliation of Net Income to Adjusted EBITDA 2021 2020 Reconciliation of EBITDA and Adjusted EBITDA Net loss (318)$ (1,116)$ Loss from discontinued operations, net of income tax benefit of $464 - 1,436 Net income from continuing operations (318) 320 Interest expense 143 - Investment income - (59) Income tax (benefit)/expense (619) 138 Depreciation and amortization 1,231 679 EBITDA 437 1,078 Share-based compensation 657 502 Integration and transaction expense 886 - Amortization of Inventory step-up 168 - Adjusted EBITDA 2,148$ 1,580$ Luna Innovations Incorporated Reconciliation of Non-GAAP Financial Measures Three Months Ended March 31, (Unaudited) (in thousands)

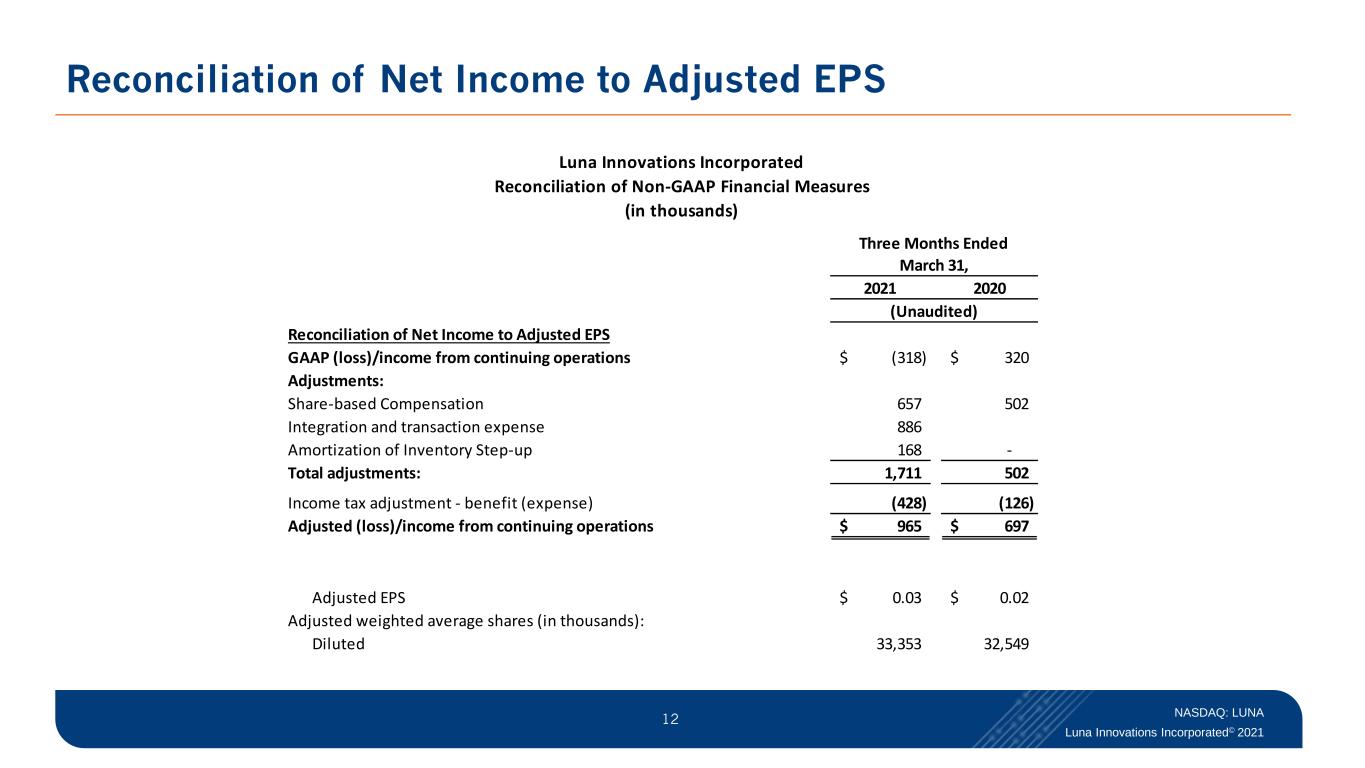

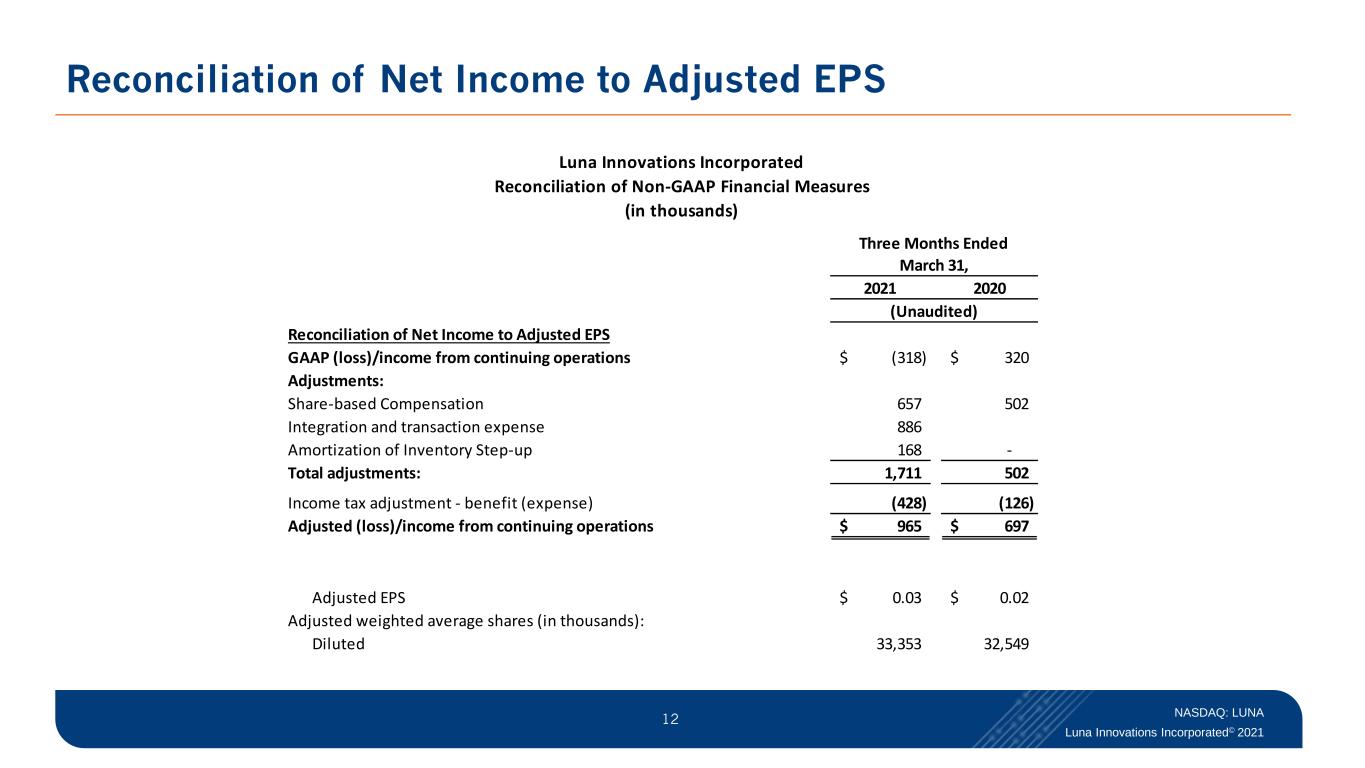

NASDAQ: LUNA Luna Innovations Incorporated© 2021 12 Reconciliation of Net Income to Adjusted EPS 2021 2020 Reconciliation of Net Income to Adjusted EPS GAAP (loss)/income from continuing operations (318)$ 320$ Adjustments: Share-based Compensation 657 502 Integration and transaction expense 886 Amortization of Inventory Step-up 168 - Total adjustments: 1,711 502 Income tax adjustment - benefit (expense) (428) (126) Adjusted (loss)/income from continuing operations 965$ 697$ Adjusted EPS 0.03$ 0.02$ Adjusted weighted average shares (in thousands): Diluted 33,353 32,549 (Unaudited) Luna Innovations Incorporated Reconciliation of Non-GAAP Financial Measures (in thousands) Three Months Ended March 31,

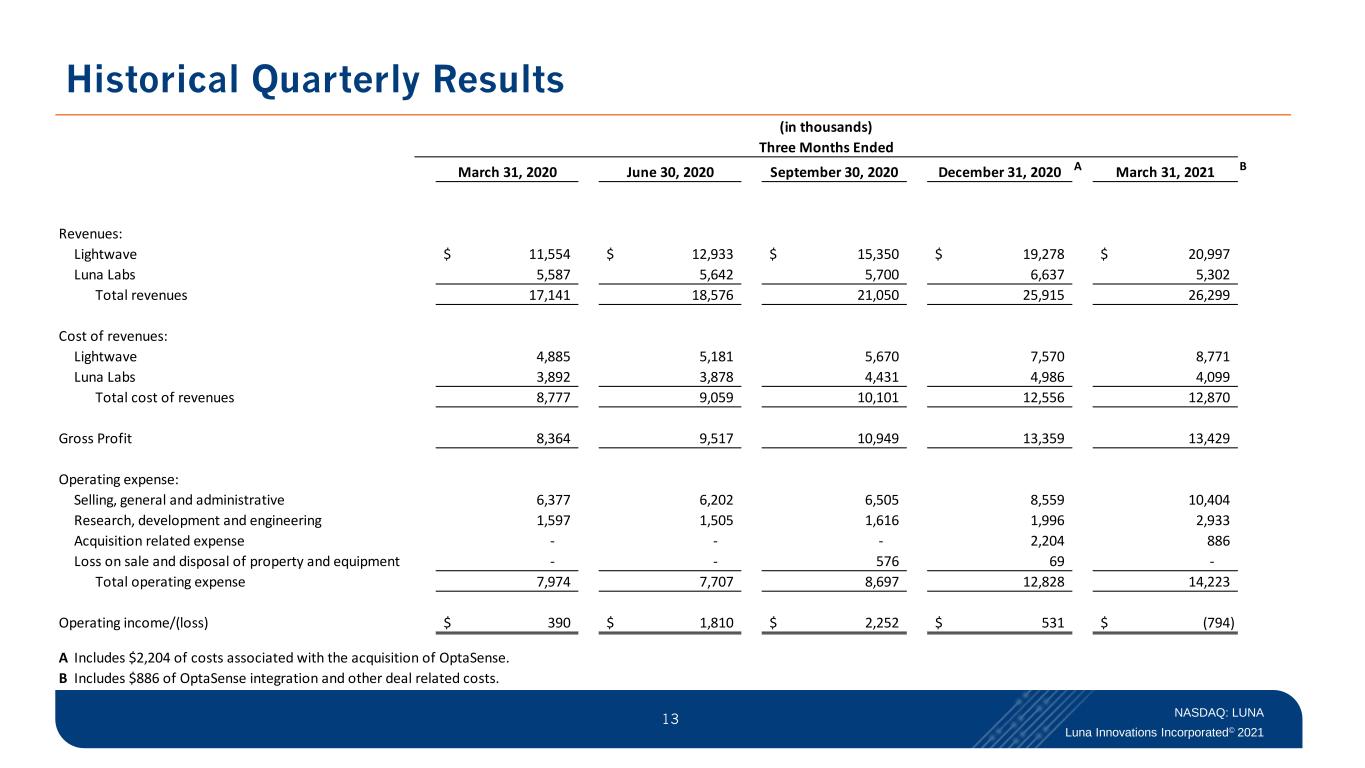

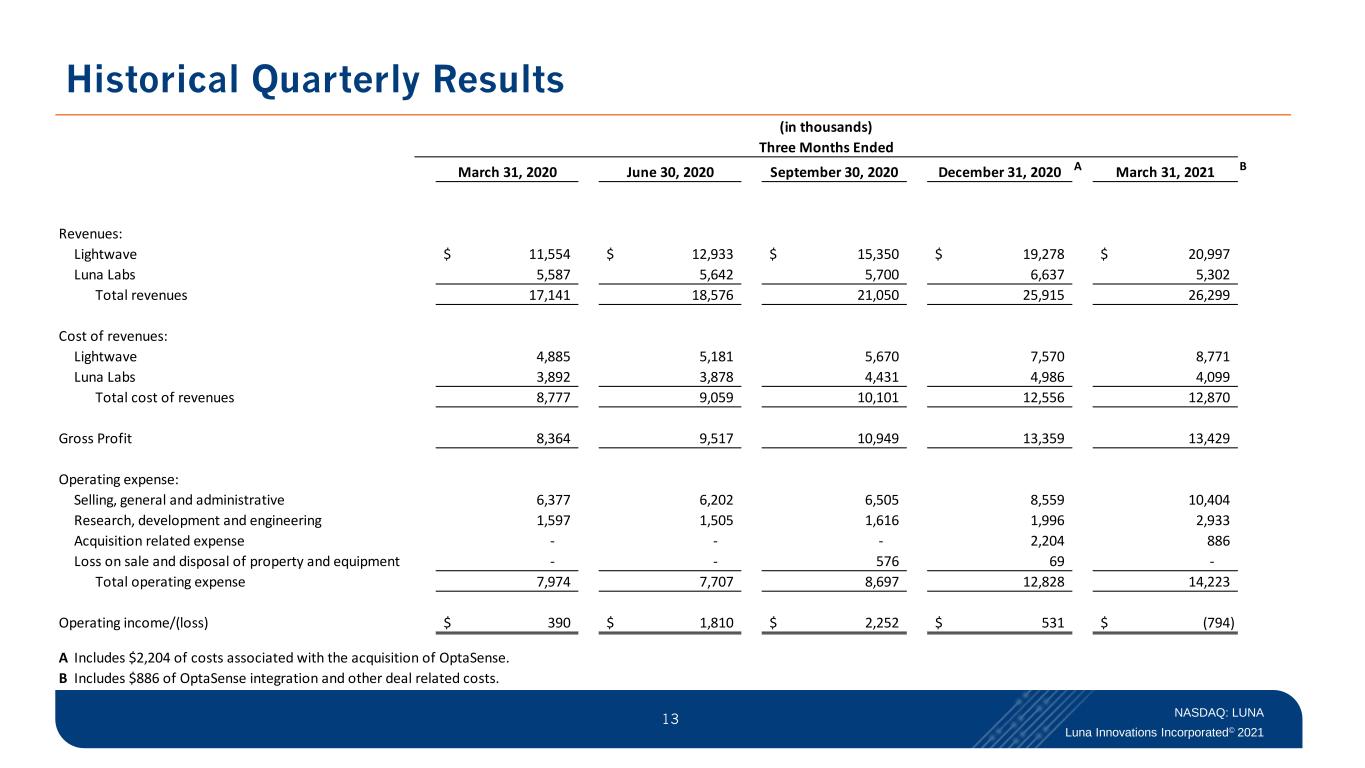

NASDAQ: LUNA Luna Innovations Incorporated© 2021 13 Historical Quarterly Results March 31, 2020 June 30, 2020 September 30, 2020 December 31, 2020 A March 31, 2021 B Revenues: Lightwave 11,554$ 12,933$ 15,350$ 19,278$ 20,997$ Luna Labs 5,587 5,642 5,700 6,637 5,302 Total revenues 17,141 18,576 21,050 25,915 26,299 Cost of revenues: Lightwave 4,885 5,181 5,670 7,570 8,771 Luna Labs 3,892 3,878 4,431 4,986 4,099 Total cost of revenues 8,777 9,059 10,101 12,556 12,870 Gross Profit 8,364 9,517 10,949 13,359 13,429 Operating expense: Selling, general and administrative 6,377 6,202 6,505 8,559 10,404 Research, development and engineering 1,597 1,505 1,616 1,996 2,933 Acquisition related expense - - - 2,204 886 Loss on sale and disposal of property and equipment - - 576 69 - Total operating expense 7,974 7,707 8,697 12,828 14,223 Operating income/(loss) 390$ 1,810$ 2,252$ 531$ (794)$ A Includes $2,204 of costs associated with the acquisition of OptaSense. B Includes $886 of OptaSense integration and other deal related costs. (in thousands) Three Months Ended