Fourth-Quarter and Full-Year 2021 Results Investor Supplemental Materials March 14, 2022

NASDAQ: LUNA Luna Innovations Incorporated© 2022 2 Safe Harbor Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 This presentation includes information that constitutes “forward-looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include the company's expectations regarding its technological and product capabilities, the nature of its market position, the integration of employees, intellectual property position and portfolio, and other expected benefits of recent acquisition, including the breadth of product offerings, complimentary products, expertise and sales opportunities and the ability to expand offerings to combined customer groups, the ability to establish a strong international presence, potential operational improvements and the ability to expand into additional high-growth markets, the company's future financial performance, including 2022 guidance, and market recognition of key technologies and demand for its products, backlog, sales growth, the company’s overall growth potential, its balance sheet and capitalization and access to capital, its strategic position, and corporate and leadership culture. Management cautions the reader that these forward-looking statements are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results, performance, and/or achievements of the company may differ materially from the future results, performance, and/or achievements expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without limitation, failure of demand for the company’s products and services to meet expectations, failure of target markets to grow and expand, technological, operational and strategic challenges, integration of acquisitions, offerings and business operations, potential performance shortfalls as a result of the diversion of management’s attention caused by transactions and integrating operations, global supply chain issues, geopolitical and economic factors and those risks and uncertainties set forth in the company’s periodic reports and other filings with the Securities and Exchange Commission ("SEC"). Such filings are available on the SEC’s website at www.sec.gov and on the company’s website at www.lunainc.com. The statements made in this presentation are based on information available to Luna as of the date of this presentation, March 14, 2022, and Luna undertakes no obligation to update any of the forward-looking statements after the date of this presentation, except as required by law. Adjusted Financial Measures In addition to U.S. GAAP financial information, this presentation includes Adjusted EBITDA and Adjusted EPS, which are non-GAAP financial measures. These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of Net Income to Adjusted EBITDA and Net Income to Adjusted EPS are included in the appendix to this presentation.

Fourth-Quarter and Full-Year FY21 Results

NASDAQ: LUNA Luna Innovations Incorporated© 2022 4 Fourth-Quarter 2021: Key Financial Results Revenues of $24.2M; up 26% year-over-year Reminder – As of Q3 Luna Labs became classified as discontinued operations • Luna is a pure play in fiber optic technology Gross margin of 58%, compared to 61% for the prior-year period Compared to the low 50% range when this metric included Luna Labs Operating income of $1.0M, compared to operating loss of $0.6M for the prior-year period Adjusted EBITDA1 of $3.1M, compared to $3.0M for the prior-year period Adjusted EPS1 of $0.08, compared to $0.05 for the prior-year period 1Adj EPS and EBITDA are a non-GAAP measures. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation.

NASDAQ: LUNA Luna Innovations Incorporated© 2022 5 Fourth-quarter 2021: Highlights Robust demand drove record bookings and revenue 26% YoY revenue growth driven by strong demand for sensing solutions Sensing segment growth driven by successful delivery of multiple large projects 64% YoY revenue growth, record bookings Major deployment in the mining industry for health monitoring of tailings dams Successful deployment of 24x7 acoustic monitoring system for the Roosevelt Bridge, FL USA Multiple systems deployed to monitor four European border sections Strategic sale and delivery of sensing system into Japanese earthquake/tsunami monitoring market Large Hyperion fiber sensing solution order for perimeter security applications Multiple significant new orders for monitoring applications in the off-shore oil market

NASDAQ: LUNA Luna Innovations Incorporated© 2022 6 Fourth-quarter 2021: Highlights (continued) Record bookings and significant, new strategic wins in Q4 for Terahertz sensing products Industrial adhesives and automotive EV and tire manufacturing applications Communications test segment highlights Record bookings for RIO laser products for long-range sensing and LiDAR applications Multiple, large blanket orders for polarization control products for defense and medical applications Multiple strategic wins and new customer placements for silicon photonic and data center testing

NASDAQ: LUNA Luna Innovations Incorporated© 2022 7 Full-Year 2021: Key Financial Results Revenues of $87.5M; up 48% year-over-year Gross Margin of 59%, compared to 61% for the prior-year period Slight margin compression as expected, resulting from early stages of integrating acquisitions; future synergies anticipated as business and sales teams fully integrate into Luna Gross Margins were also pressured by product mix Operating loss of $2.6M, compared to operating income of $0.8M for the prior-year period Decrease primarily due to increase in operating expenses and amortization as the result of acquisitions Impact from pandemic-related sourcing of critical components Adjusted EBITDA1 of $7.6M, compared to $7.9M for the prior-year period Increased expenses and slight margin compression associated with onboarding new acquisitions Adjusted EPS1 of $0.17, compared to $0.18 for the prior-year period Increased expenses and slight margin compression associated with onboarding new acquisitions Slight increase in weighted average shares outstanding 1Adj EPS and EBITDA are a non-GAAP measures. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation.

NASDAQ: LUNA Luna Innovations Incorporated© 2022 8 Full-Year 2021: Highlights and Accomplishments Significant customer successes; strong ongoing pipeline of opportunities Large orders from blue-chip customers for sensing (ODiSI), comms test (OBR 6200) and process control (Terahertz) products Continued strong bookings for RIO lasers and silicon photonics Traction and customer orders remain strong Commercial engagement with customers in EV-battery space for sensing products To support growth, completed implementation of significant new Financial and IT systems Recorded largest backlog in company history and record bookings Significant progress in product development and delivery Successfully delivered first 100+ OBR 6200 units to LMCO for global support of F-35 Released 6th generation DAS data acquisition system, OS6, with integrated machine learning for faster turn-up time Continued successful penetration of distributed sensing solutions in key, target markets: Infrastructure and security; Oil and Gas; Transportation Strengthened executive team with promotions and additions to key roles

NASDAQ: LUNA Luna Innovations Incorporated© 2022 9 $4.0 $7.6 FY19 FY20 FY21 Adjusted EBITDA1,2 (millions) $49.1 $87.5 FY19 FY20 FY21 Revenue1 (millions) $59.1 Strong Financial Results 1 Results shown include the reclassification of Luna Labs to Discontinued Operations. 2 Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation. FY21 Guidance: $85.0 - $88.0 FY21 Guidance: $6.0 to $8.0 $7.9

NASDAQ: LUNA Luna Innovations Incorporated© 2022 10 A Flexible Balance Sheet Strong balance sheet on December 31, 2021: $130.2M in total assets • $17.1M in cash and cash equivalents • $49.8M in working capital Total debt of $15.8M outstanding $8.3M in term debt $7.5M drawn on revolver • $7.5M available Allows us to continue to deploy our capital to generate long-term sustainable growth by increasing organic sales, reinvesting in our business and identifying inorganic opportunities

Subsequent Events

NASDAQ: LUNA Luna Innovations Incorporated© 2022 12 Divestiture of Luna Labs Luna has closed on the divestiture of its Luna Labs business Luna Labs was moved to Discontinued Operations in Q3 2021 Luna is now a pure play in fiber optic technology; Lightwave = Luna Luna Labs leveraged third-party contract research to build a portfolio of technologies outside of Luna’s core, strategic fiber-optic offerings Luna Labs Inc. is a newly formed company backed by its management team with support from Mereo Capital Partners and Point Lookout Capital Partners Luna will retain minority equity ownership

NASDAQ: LUNA Luna Innovations Incorporated© 2022 13 Acquisition of LIOS Sensing Acquired LIOS Sensing, a leader in distributed fiber optic monitoring solutions LIOS adds Distributed Temperature and Strain Sensing (“DTS/DSS”) to Luna’s market leading portfolio With this addition, Luna now has all major fiber sensing modalities • Short range, high resolution (ODiSI) • Long range discrete (Hyperion) • Long range continuous temperature, strain, acoustics (DTS, DSS, DAS) Will accelerate growth in Luna’s sensing segment Brings capabilities that will complement and broaden the Luna portfolio allowing Greater penetration into existing customer base • Infrastructure, oil and gas, pipelines Expansion into adjacent markets • Wind energy, fire detection, power cable monitoring Broadens footprint in Europe Based in Cologne, Germany Approximately 60 employees Approximately 42 active patents and 17 patent applications Anticipate quick, smooth integration

2022 Outlook

NASDAQ: LUNA Luna Innovations Incorporated© 2022 15 2022 Financial Outlook 2022 outlook reflects both the mid-March sale of Luna Labs and the acquisition of LIOS Sensing and considers the ongoing impact of the pandemic: Full-year total revenue of $109M to $115M Full-year adjusted EBITDA1 of $10M to $12M Q1 2022 revenue of $20M to $22M 1 Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation. The outlook above does not include any future acquisitions, divestitures, or unanticipated events.

NASDAQ: LUNA Luna Innovations Incorporated© 2022 16 Luna – Enabling the Future with Fiber Positioned as a global fiber optic leader Proprietary measurement technology, offering unprecedented combination of resolution, accuracy and speed Customers in attractive markets: Military and Defense, Communications, Infrastructure, Energy, Automotive and Aerospace Positioned to take advantage of trends such as vehicle lightweighting, smart infrastructure, and increasing demands on data centers and broadband capacity Adequately capitalized to fund growth Long-tenured, experienced executive team / board Corporate culture of innovation and integrity Overview

Appendix

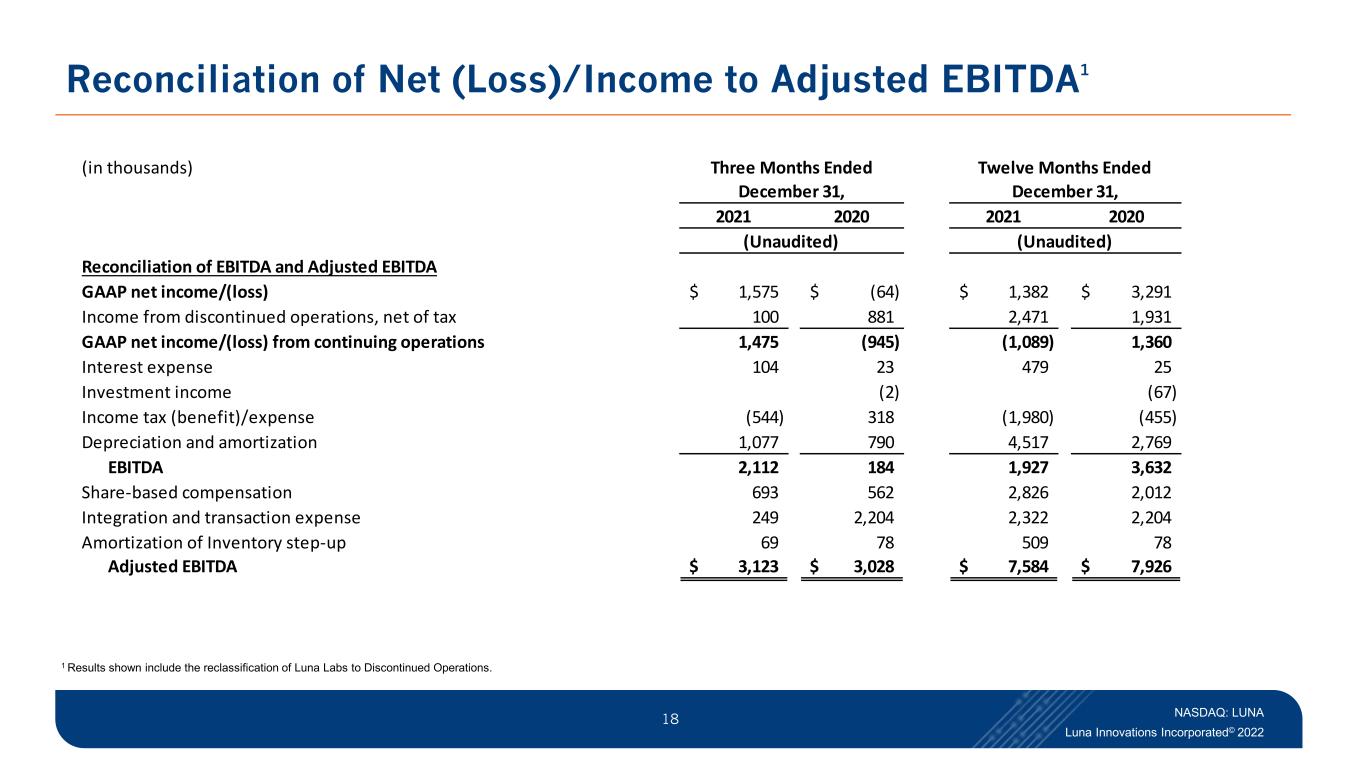

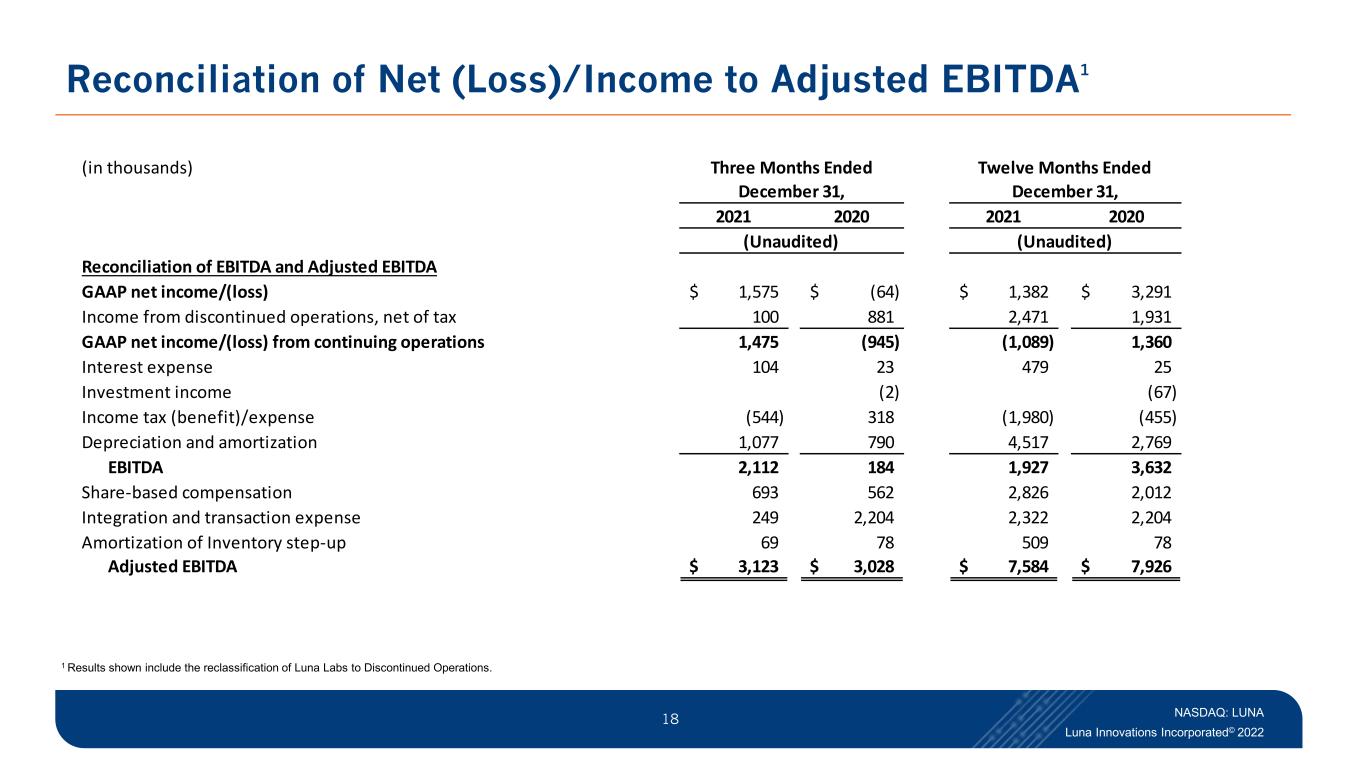

NASDAQ: LUNA Luna Innovations Incorporated© 2022 18 Reconciliation of Net (Loss)/Income to Adjusted EBITDA1 1 Results shown include the reclassification of Luna Labs to Discontinued Operations. (in thousands) 2021 2020 2021 2020 Reconciliation of EBITDA and Adjusted EBITDA GAAP net income/(loss) 1,575$ (64)$ 1,382$ 3,291$ Income from discontinued operations, net of tax 100 881 2,471 1,931 GAAP net income/(loss) from continuing operations 1,475 (945) (1,089) 1,360 Interest expense 104 23 479 25 Investment income (2) (67) Income tax (benefit)/expense (544) 318 (1,980) (455) Depreciation and amortization 1,077 790 4,517 2,769 EBITDA 2,112 184 1,927 3,632 Share-based compensation 693 562 2,826 2,012 Integration and transaction expense 249 2,204 2,322 2,204 Amortization of Inventory step-up 69 78 509 78 Adjusted EBITDA 3,123$ 3,028$ 7,584$ 7,926$ Three Months Ended Twelve Months Ended December 31, December 31, (Unaudited) (Unaudited)

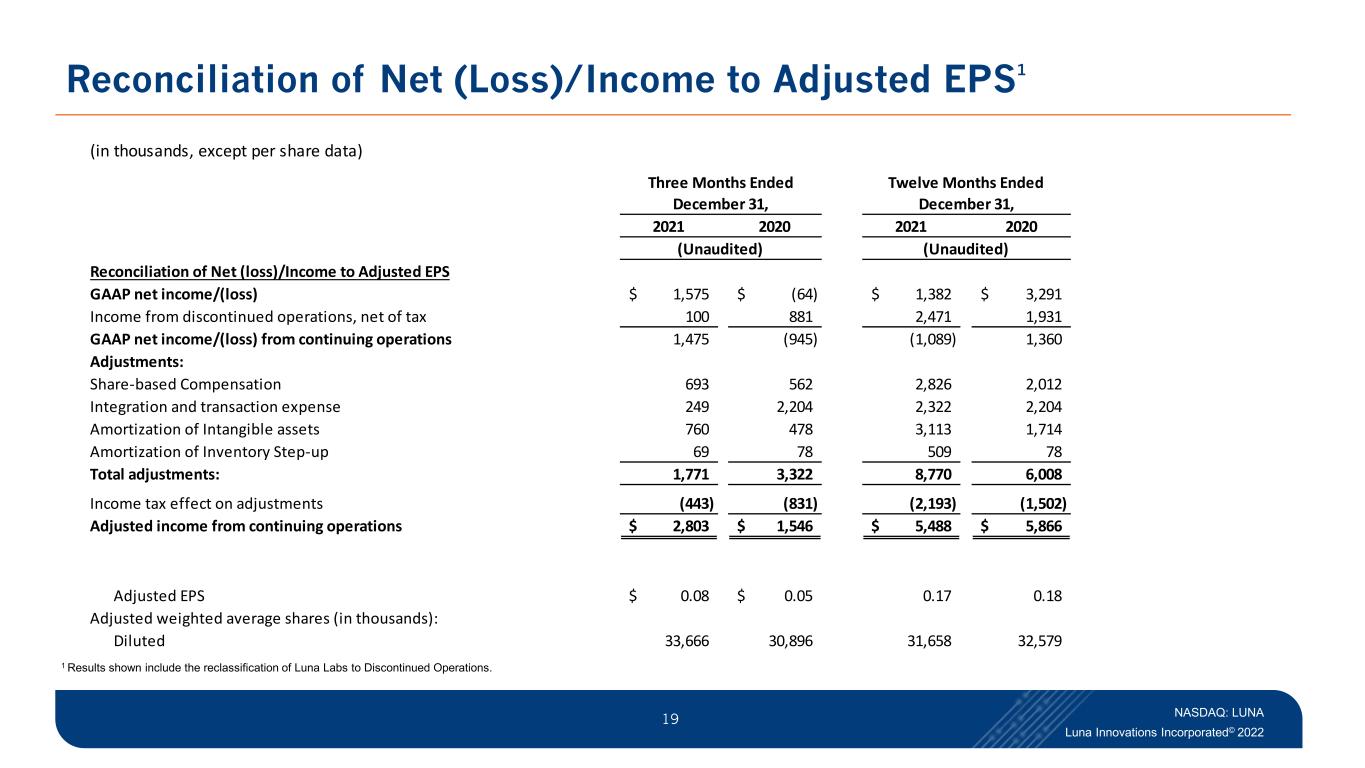

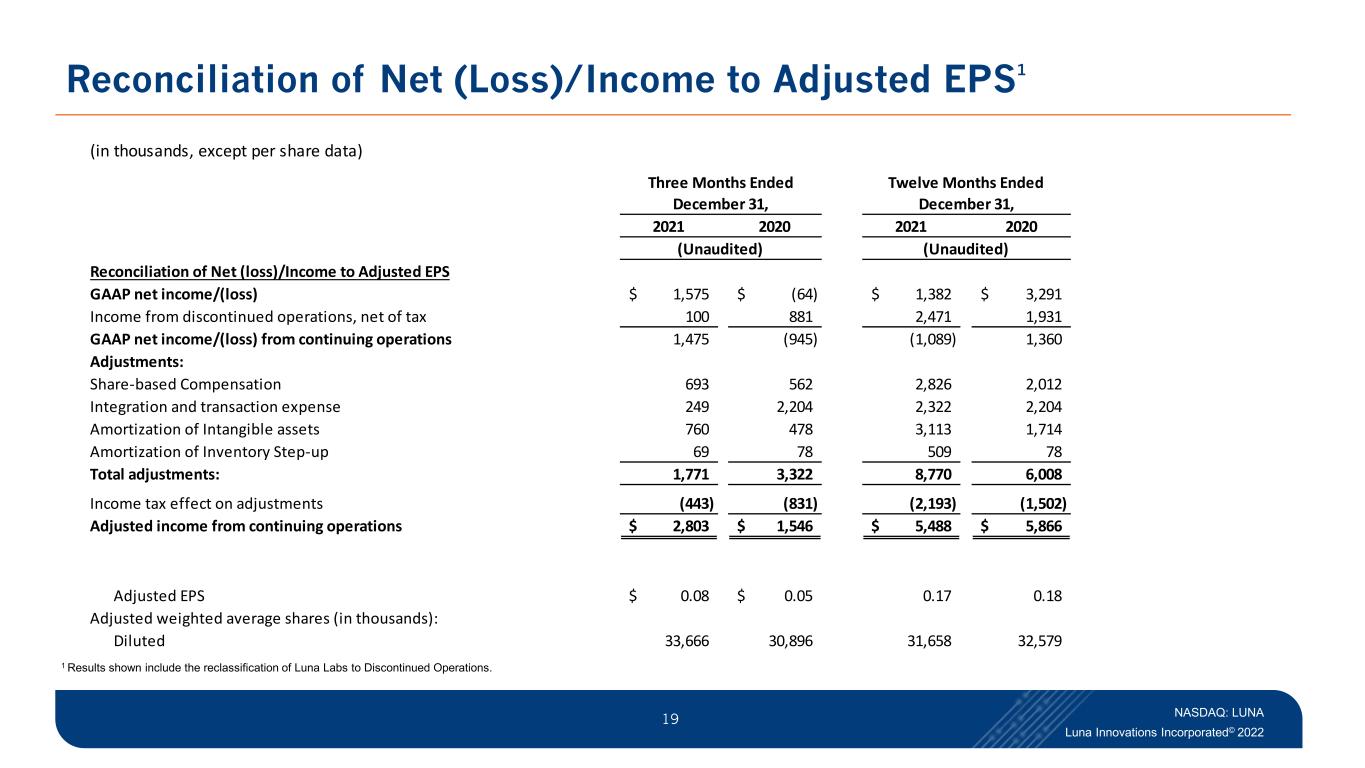

NASDAQ: LUNA Luna Innovations Incorporated© 2022 19 Reconciliation of Net (Loss)/Income to Adjusted EPS1 1 Results shown include the reclassification of Luna Labs to Discontinued Operations. 2021 2020 2021 2020 Reconciliation of Net (loss)/Income to Adjusted EPS GAAP net income/(loss) 1,575$ (64)$ 1,382$ 3,291$ Income from discontinued operations, net of tax 100 881 2,471 1,931 GAAP net income/(loss) from continuing operations 1,475 (945) (1,089) 1,360 Adjustments: Share-based Compensation 693 562 2,826 2,012 Integration and transaction expense 249 2,204 2,322 2,204 Amortization of Intangible assets 760 478 3,113 1,714 Amortization of Inventory Step-up 69 78 509 78 Total adjustments: 1,771 3,322 8,770 6,008 Income tax effect on adjustments (443) (831) (2,193) (1,502) Adjusted income from continuing operations 2,803$ 1,546$ 5,488$ 5,866$ Adjusted EPS 0.08$ 0.05$ 0.17 0.18 Adjusted weighted average shares (in thousands): Diluted 33,666 30,896 31,658 32,579 (in thousands, except per share data) December 31, (Unaudited) (Unaudited) Three Months Ended Twelve Months Ended December 31,

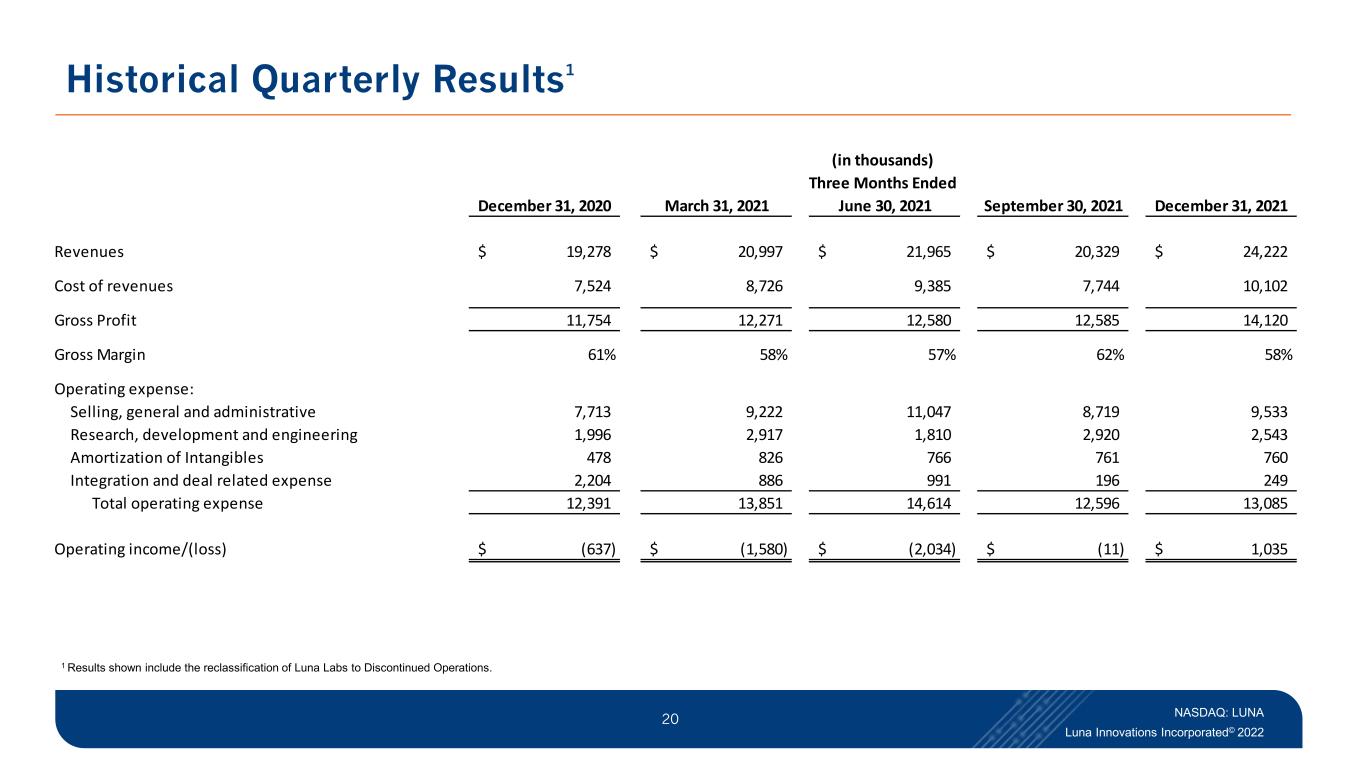

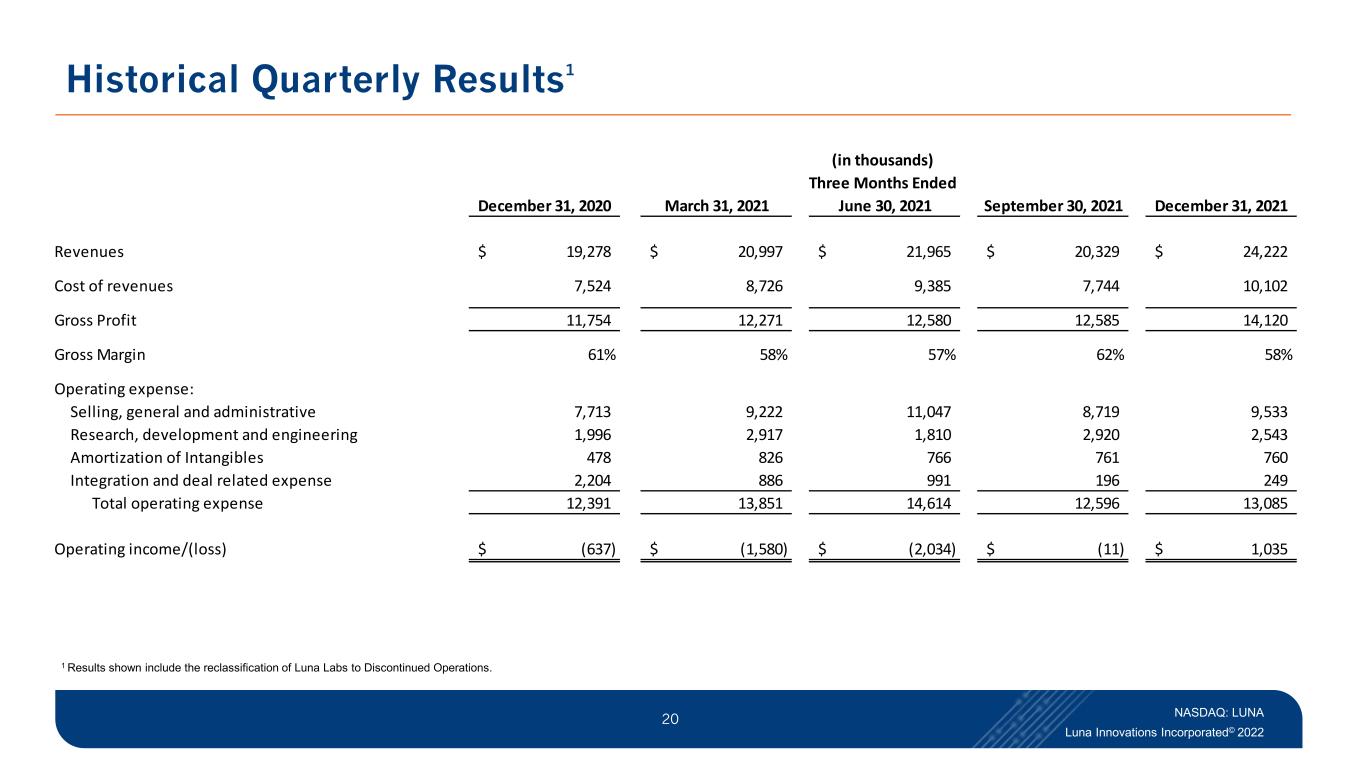

NASDAQ: LUNA Luna Innovations Incorporated© 2022 20 Historical Quarterly Results1 1 Results shown include the reclassification of Luna Labs to Discontinued Operations. December 31, 2020 March 31, 2021 June 30, 2021 September 30, 2021 December 31, 2021 Revenues 19,278$ 20,997$ 21,965$ 20,329$ 24,222$ Cost of revenues 7,524 8,726 9,385 7,744 10,102 Gross Profit 11,754 12,271 12,580 12,585 14,120 Gross Margin 61% 58% 57% 62% 58% Operating expense: Selling, general and administrative 7,713 9,222 11,047 8,719 9,533 Research, development and engineering 1,996 2,917 1,810 2,920 2,543 Amortization of Intangibles 478 826 766 761 760 Integration and deal related expense 2,204 886 991 196 249 Total operating expense 12,391 13,851 14,614 12,596 13,085 Operating income/(loss) (637)$ (1,580)$ (2,034)$ (11)$ 1,035$ (in thousands) Three Months Ended