First-Quarter 2022 Results Investor Supplemental Materials May 16, 2022

NASDAQ: LUNA Luna Innovations Incorporated© 2022 2 Safe Harbor Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 This presentation includes information that constitutes “forward-looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include the company's expectations regarding its technological and product capabilities, the nature of its market position, sales pipeline, intellectual property position and portfolio, and other expected benefits of recent acquisition, including the breadth of product offerings, complimentary products, expertise and sales opportunities and the ability to expand offerings to combined customer groups, the ability to establish a strong international presence, potential operational improvements and the ability to expand into additional high-growth markets, the company's future financial performance, including 2022 guidance, and market recognition of key technologies and demand for its products, backlog, sales growth, the company’s overall growth potential, its balance sheet and capitalization and access to capital, its strategic position, and corporate and leadership culture. Management cautions the reader that these forward-looking statements are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results, performance, and/or achievements of the company may differ materially from the future results, performance, and/or achievements expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without limitation, failure of demand for the company’s products and services to meet expectations, failure of target markets to grow and expand, technological, operational and strategic challenges, integration of acquisitions, potential performance shortfalls as a result of the diversion of management’s attention caused by transactions and integrating operations, global supply chain issues, geopolitical and economic factors and those risks and uncertainties set forth in the company’s periodic reports and other filings with the Securities and Exchange Commission ("SEC"). Such filings are available on the SEC’s website at www.sec.gov and on the company’s website at www.lunainc.com. The statements made in this presentation are based on information available to Luna as of the date of this presentation, May 16, 2022, and Luna undertakes no obligation to update any of the forward-looking statements after the date of this presentation, except as required by law. Adjusted Financial Measures In addition to U.S. GAAP financial information, this presentation includes Adjusted EBITDA and Adjusted EPS, which are non-GAAP financial measures. These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of Net Income to Adjusted EBITDA and Net Income to Adjusted EPS are included in the appendix to this presentation.

First-Quarter FY22 Results

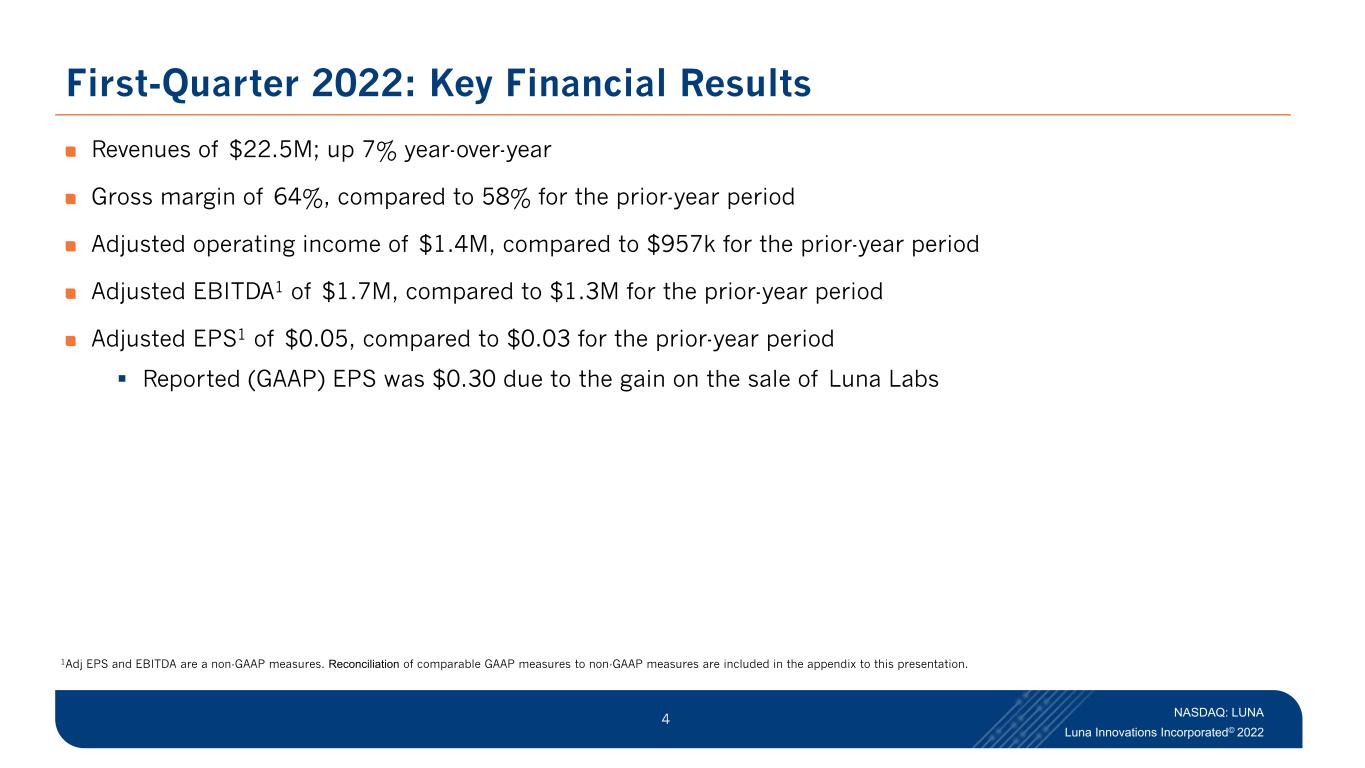

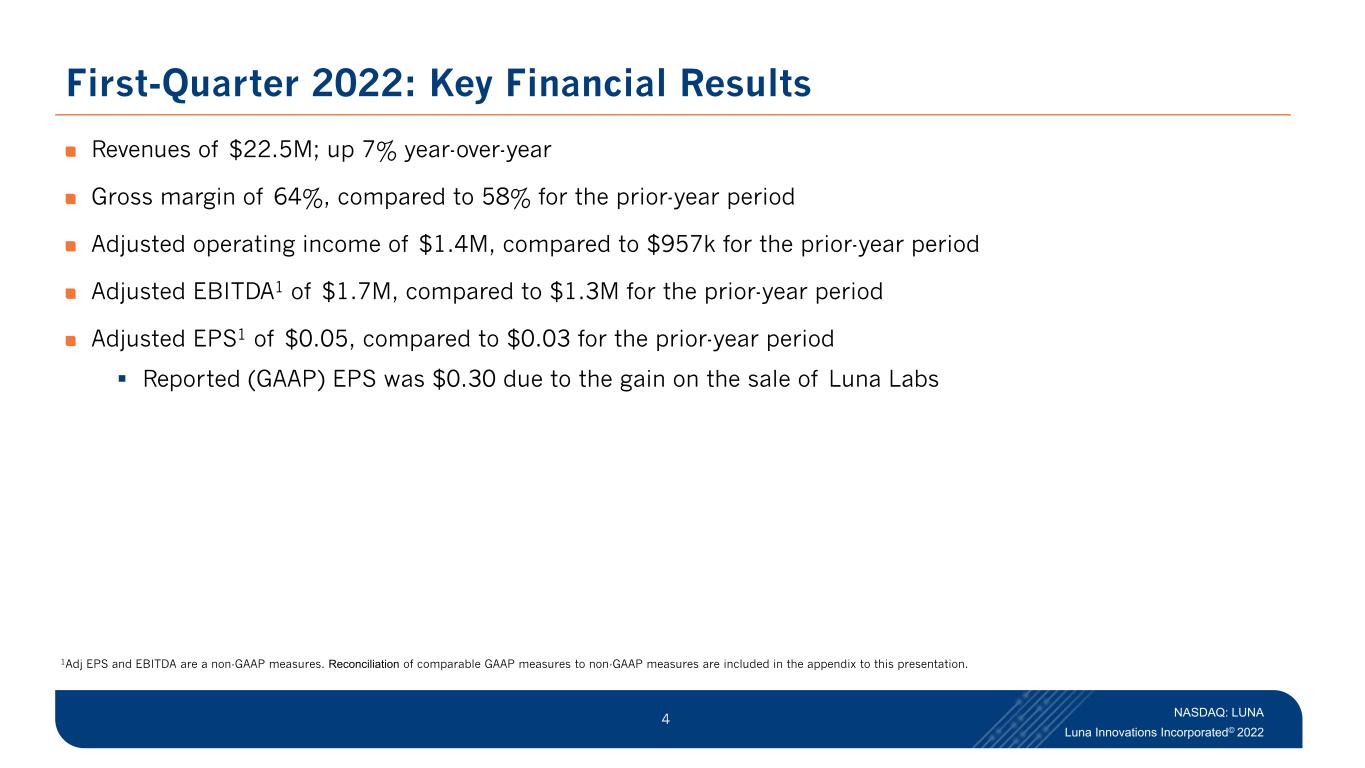

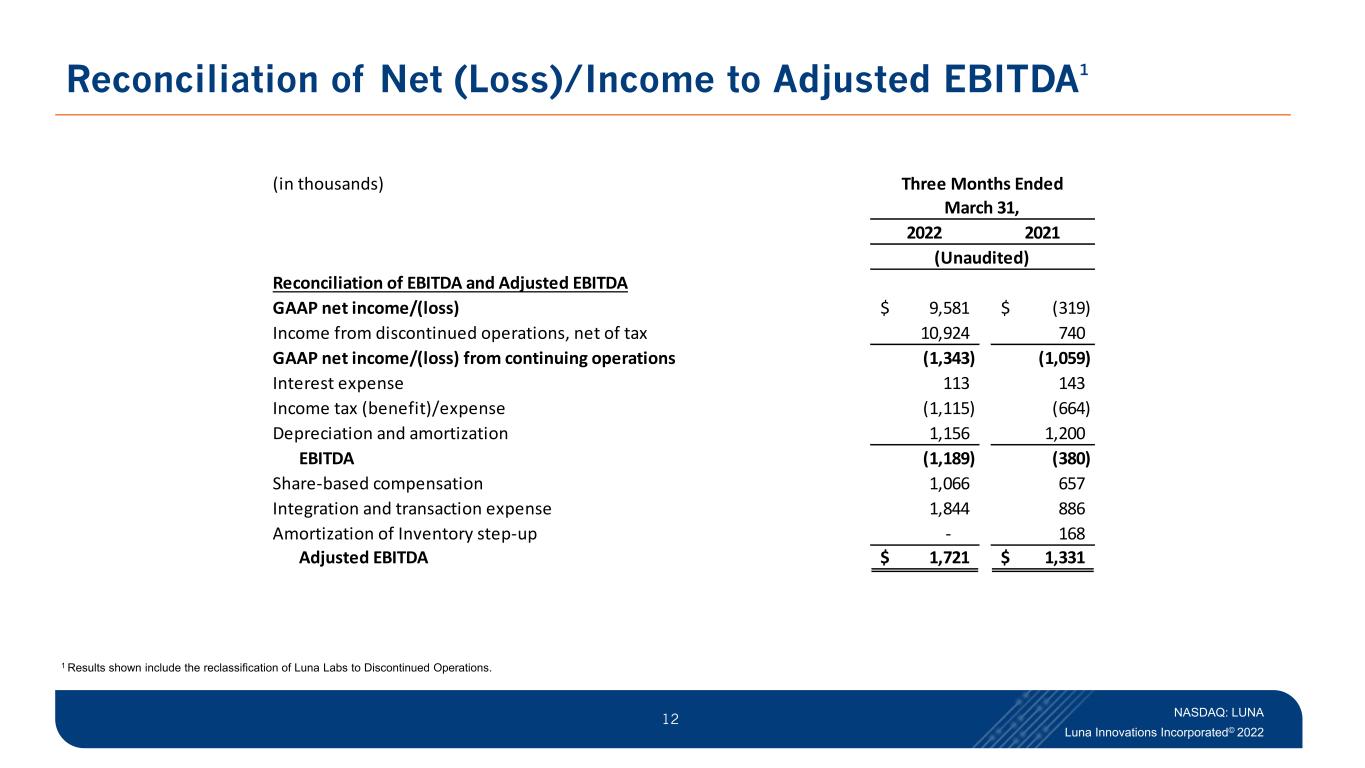

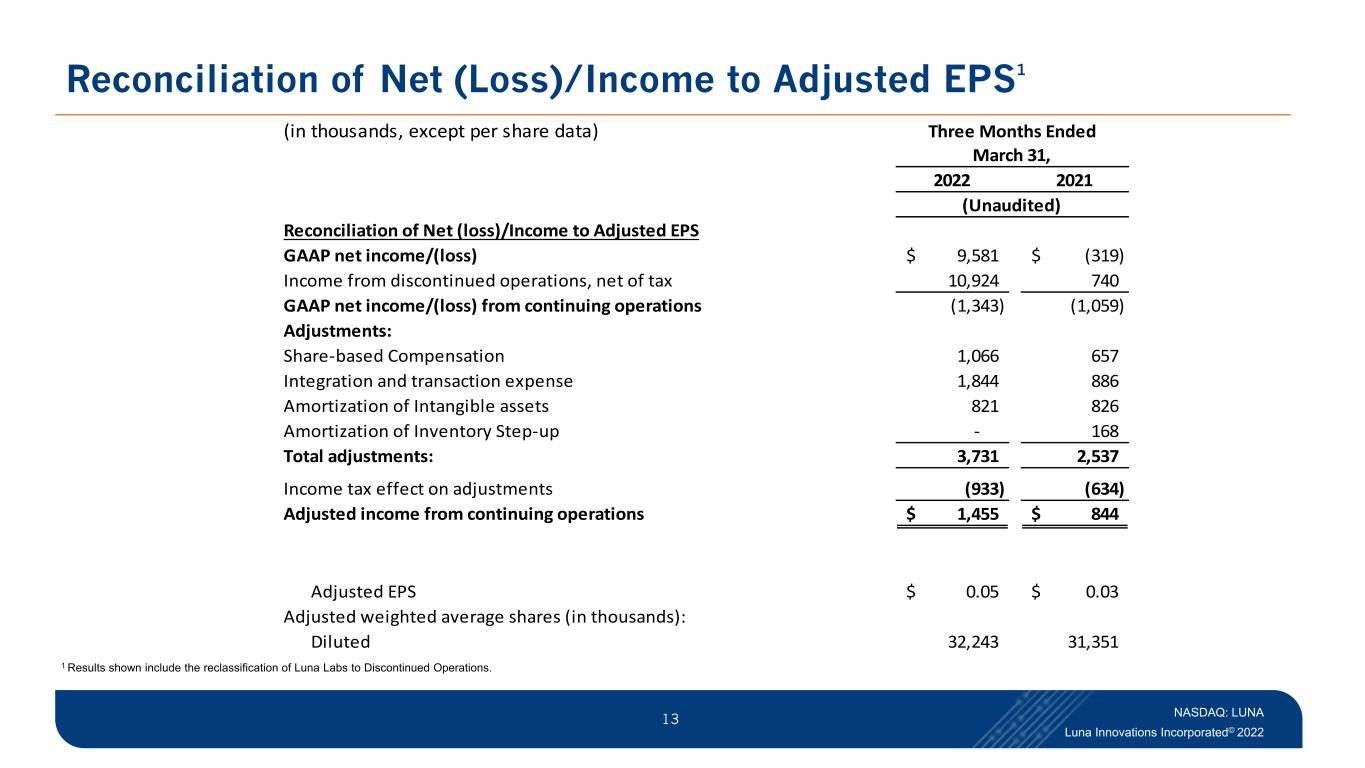

NASDAQ: LUNA Luna Innovations Incorporated© 2022 4 First-Quarter 2022: Key Financial Results Revenues of $22.5M; up 7% year-over-year Gross margin of 64%, compared to 58% for the prior-year period Adjusted operating income of $1.4M, compared to $957k for the prior-year period Adjusted EBITDA1 of $1.7M, compared to $1.3M for the prior-year period Adjusted EPS1 of $0.05, compared to $0.03 for the prior-year period Reported (GAAP) EPS was $0.30 due to the gain on the sale of Luna Labs 1Adj EPS and EBITDA are a non-GAAP measures. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation.

NASDAQ: LUNA Luna Innovations Incorporated© 2022 5 First-Quarter 2022 and Recent Business Highlights Luna Innovations is now a pure play leader in fiber-based technologies with the divestiture of Luna Labs complete Q1 2022 financial performance Record ODiSI shipments Strong backlog in Hyperion and THz; growth in Rio Laser sales Strong demand for OptaSense Closed on the acquisition of Lios, creating the strongest distributed fiber sensing play on the market Further expands global presence, building on existing, strong international customer base and sales capability Building pipeline of larger, multi-unit, blanket orders Expanded relationships with existing customers in aerospace, electric vehicle and perimeter defense markets Secured incremental, multi-unit order for OBR 6200 through strong, long-standing relationship with Lockheed Martin Luna receives Gold Tier Award from BAE Systems, for exceptional performance and contributions to supply chain success

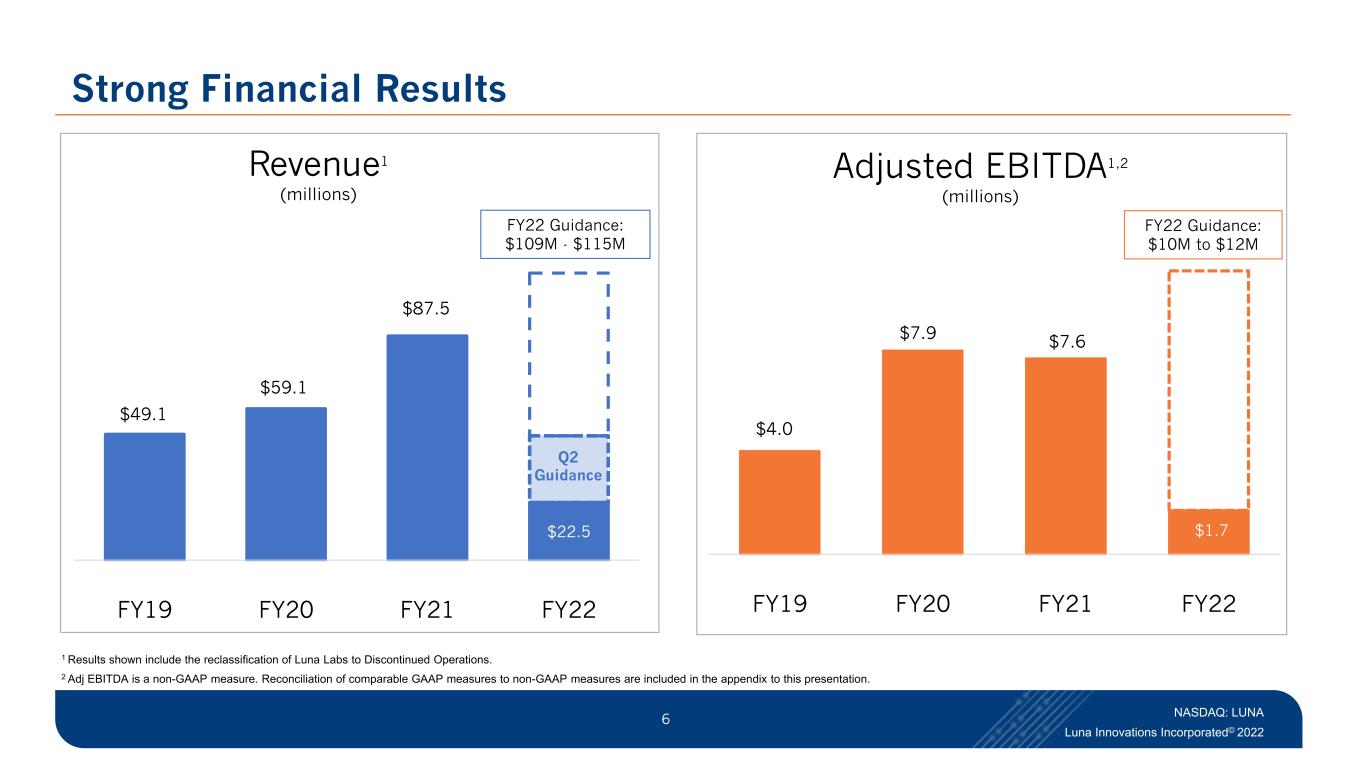

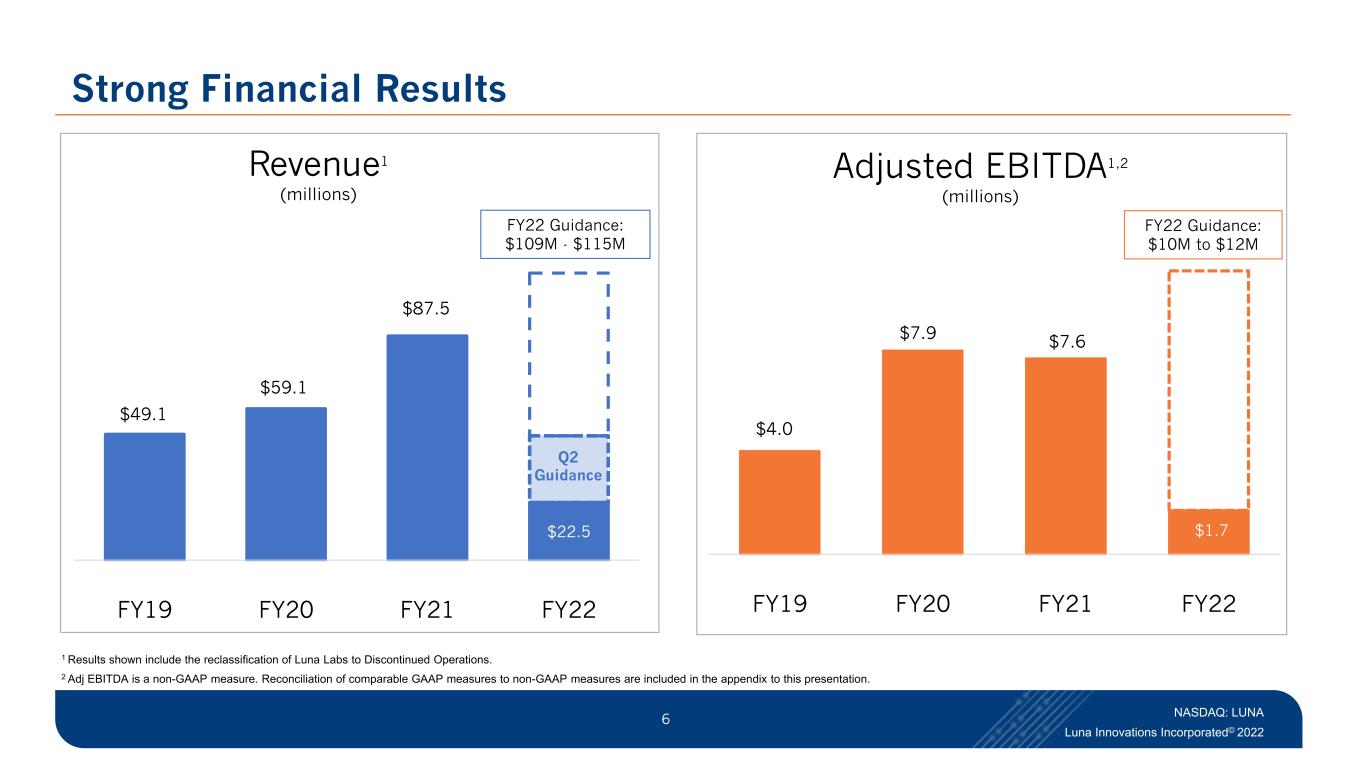

NASDAQ: LUNA Luna Innovations Incorporated© 2022 6 $4.0 $7.6 $1.7 FY19 FY20 FY21 FY22 Adjusted EBITDA1,2 (millions) $49.1 $87.5 $22.5 $22.5FY19 FY20 FY21 FY22 Revenue1 (millions) $59.1 Q2 Guidance Strong Financial Results 1 Results shown include the reclassification of Luna Labs to Discontinued Operations. 2 Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation. FY22 Guidance: $109M - $115M FY22 Guidance: $10M to $12M $7.9

NASDAQ: LUNA Luna Innovations Incorporated© 2022 7 Balance Sheet Balance sheet on March 31, 2022: $144.7M in total assets • $10.8M in cash and cash equivalents • $47.4M in working capital Total debt of $22.3M outstanding $7.3M in term debt $15.0M drawn on revolver All investments over the past five years – in both business and in M&A – have been funded by using the balance sheet through cash and bank debt Luna will continue to deploy capital prudently to generate long-term sustainable growth Increasing organic sales Reinvesting in our business Identifying inorganic opportunities

2022 Outlook

NASDAQ: LUNA Luna Innovations Incorporated© 2022 9 Q2 and Full-Year Guidance 2022 outlook reflects the sale of Luna Labs, the acquisition of Lios and the ongoing impact of the pandemic: Reaffirm the following: • Full-year total revenue of $109M to $115M • Full-year adjusted EBITDA1 of $10M to $12M Top-line guidance for Q2 • Revenue of $25M to $27M

NASDAQ: LUNA Luna Innovations Incorporated© 2022 10 Luna – Enabling the Future with Fiber Positioned as a global fiber optic leader Proprietary fiber-optic based measurement technology, offering unprecedented combination of performance and economics Customers in attractive markets: Defense, Communications, Infrastructure, Energy, Automotive and Aerospace Positioned to take advantage of trends such as vehicle lightweighting, smart infrastructure, increasing needs for global security, and increasing demands on data centers and broadband capacity Adequately capitalized to fund growth Long-tenured, experienced executive team / board Corporate culture of innovation and integrity Overview

Appendix

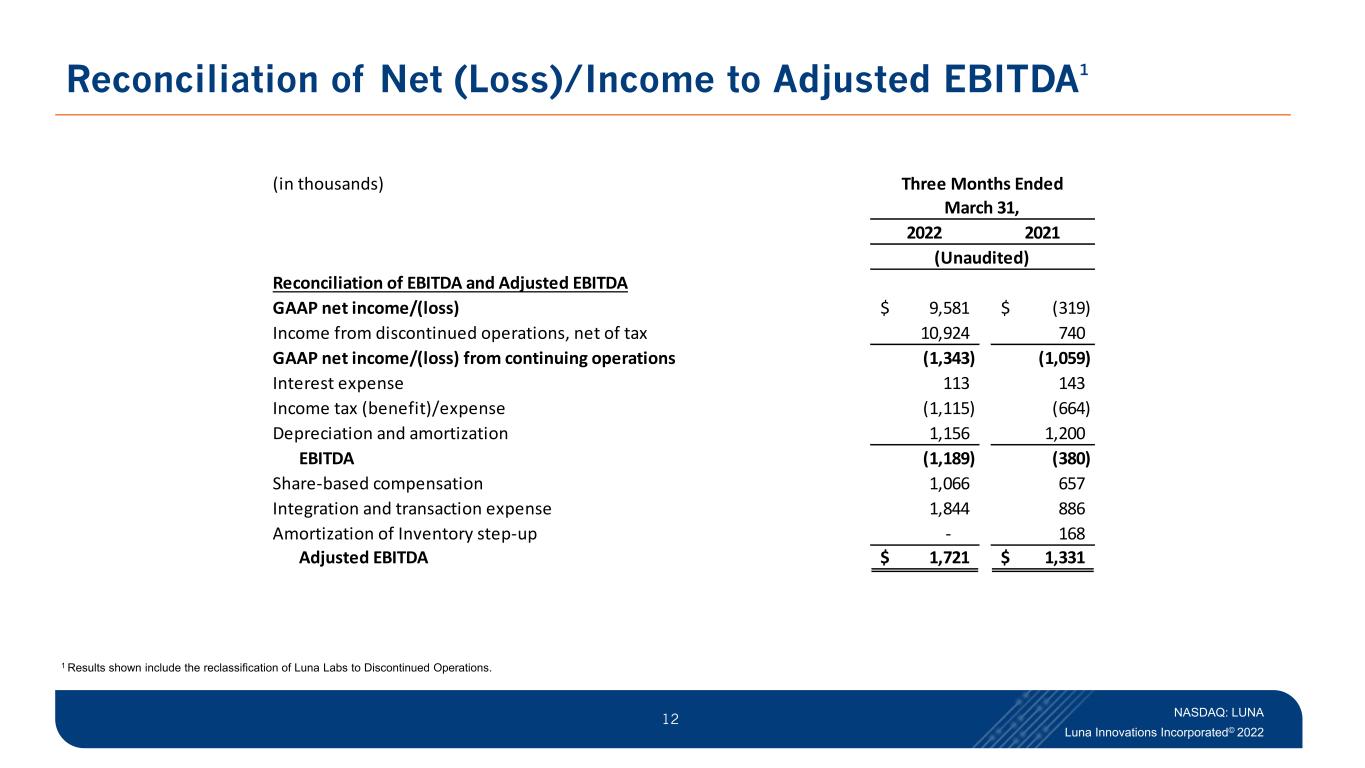

NASDAQ: LUNA Luna Innovations Incorporated© 2022 12 Reconciliation of Net (Loss)/Income to Adjusted EBITDA1 1 Results shown include the reclassification of Luna Labs to Discontinued Operations. (in thousands) 2022 2021 Reconciliation of EBITDA and Adjusted EBITDA GAAP net income/(loss) 9,581$ (319)$ Income from discontinued operations, net of tax 10,924 740 GAAP net income/(loss) from continuing operations (1,343) (1,059) Interest expense 113 143 Income tax (benefit)/expense (1,115) (664) Depreciation and amortization 1,156 1,200 EBITDA (1,189) (380) Share-based compensation 1,066 657 Integration and transaction expense 1,844 886 Amortization of Inventory step-up - 168 Adjusted EBITDA 1,721$ 1,331$ Three Months Ended March 31, (Unaudited)

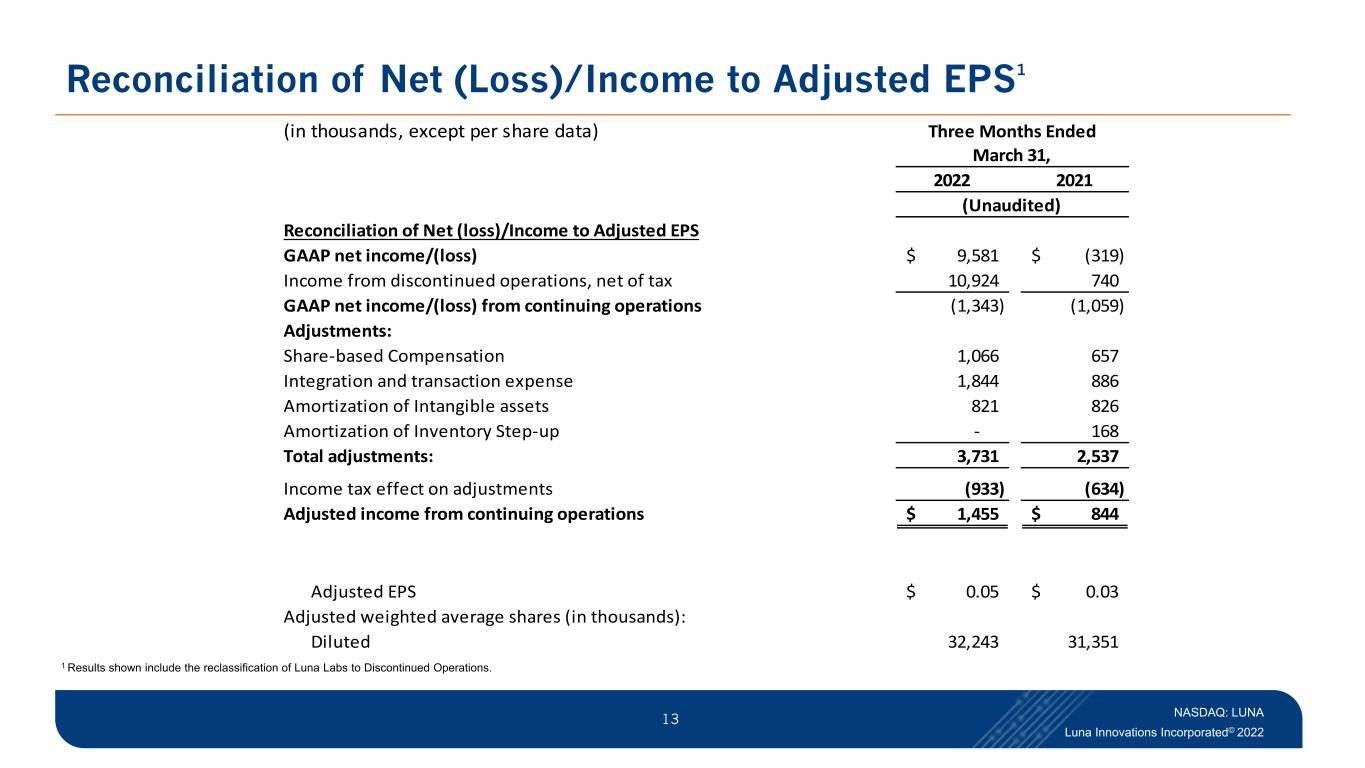

NASDAQ: LUNA Luna Innovations Incorporated© 2022 13 Reconciliation of Net (Loss)/Income to Adjusted EPS1 1 Results shown include the reclassification of Luna Labs to Discontinued Operations. 2022 2021 Reconciliation of Net (loss)/Income to Adjusted EPS GAAP net income/(loss) 9,581$ (319)$ Income from discontinued operations, net of tax 10,924 740 GAAP net income/(loss) from continuing operations (1,343) (1,059) Adjustments: Share-based Compensation 1,066 657 Integration and transaction expense 1,844 886 Amortization of Intangible assets 821 826 Amortization of Inventory Step-up - 168 Total adjustments: 3,731 2,537 Income tax effect on adjustments (933) (634) Adjusted income from continuing operations 1,455$ 844$ Adjusted EPS 0.05$ 0.03$ Adjusted weighted average shares (in thousands): Diluted 32,243 31,351 (in thousands, except per share data) Three Months Ended March 31, (Unaudited)

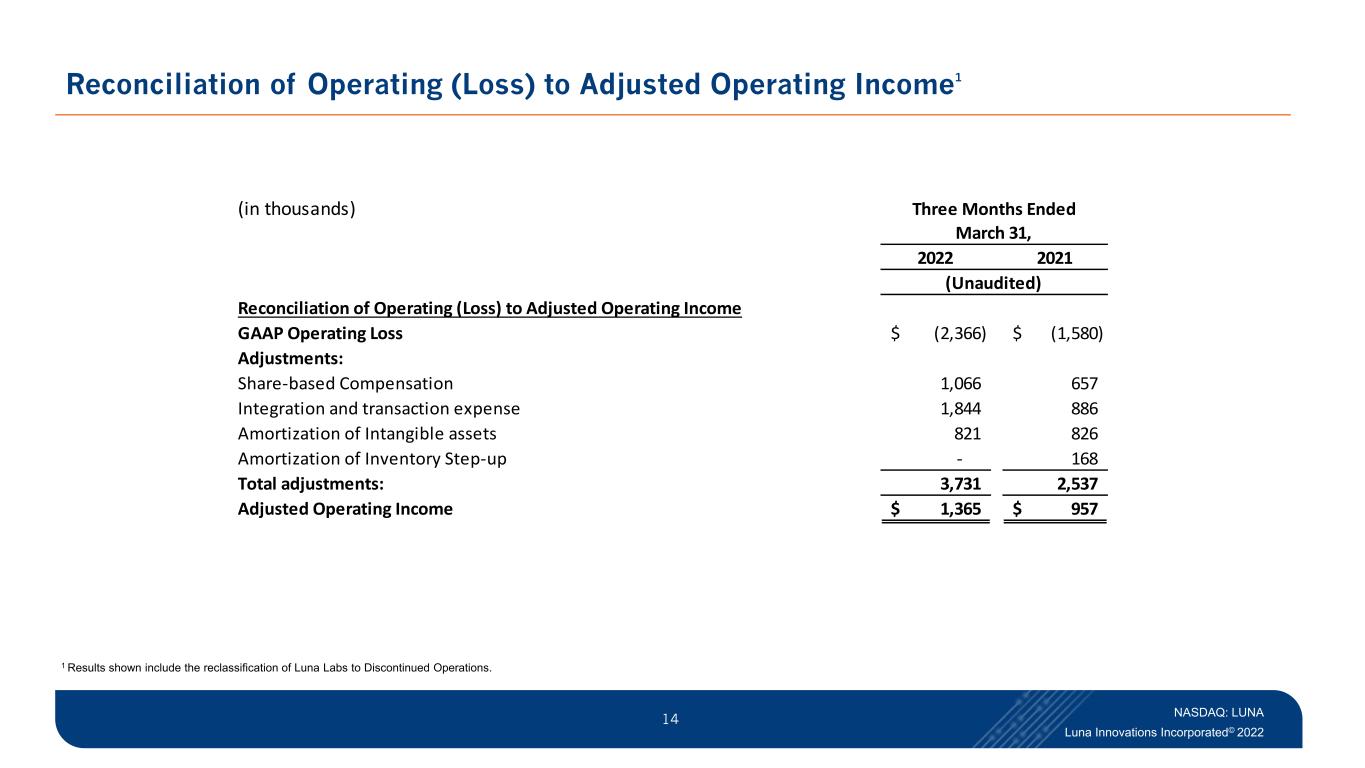

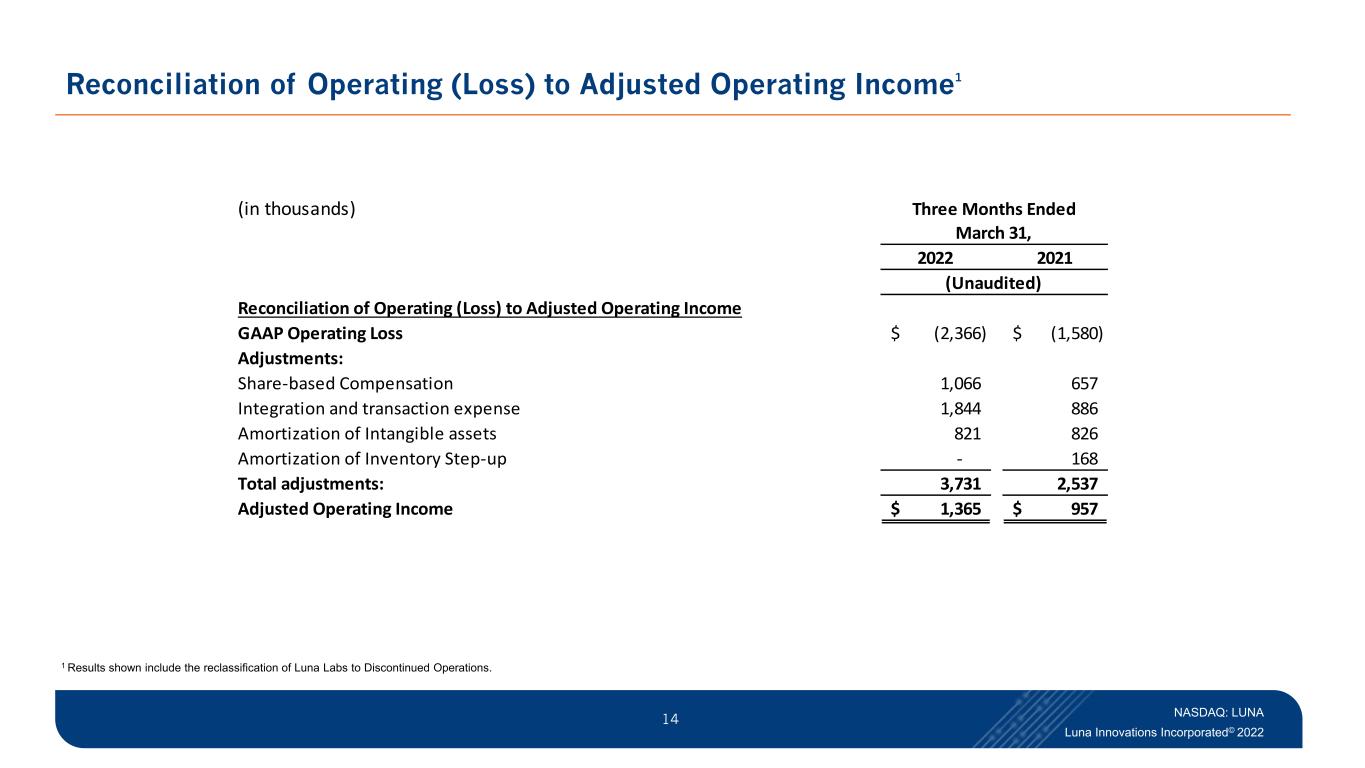

NASDAQ: LUNA Luna Innovations Incorporated© 2022 14 Reconciliation of Operating (Loss) to Adjusted Operating Income1 1 Results shown include the reclassification of Luna Labs to Discontinued Operations. 2022 2021 Reconciliation of Operating (Loss) to Adjusted Operating Income GAAP Operating Loss (2,366)$ (1,580)$ Adjustments: Share-based Compensation 1,066 657 Integration and transaction expense 1,844 886 Amortization of Intangible assets 821 826 Amortization of Inventory Step-up - 168 Total adjustments: 3,731 2,537 Adjusted Operating Income 1,365$ 957$ (in thousands) Three Months Ended March 31, (Unaudited)

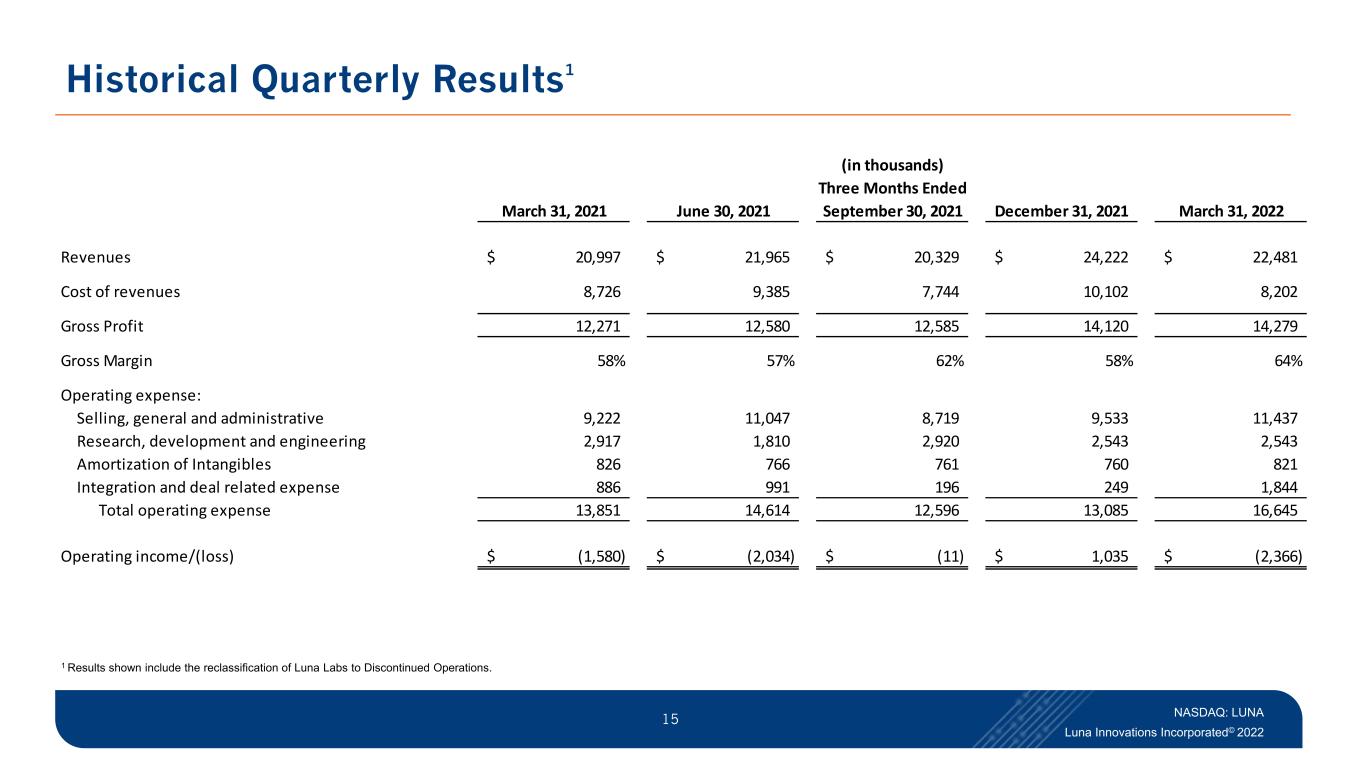

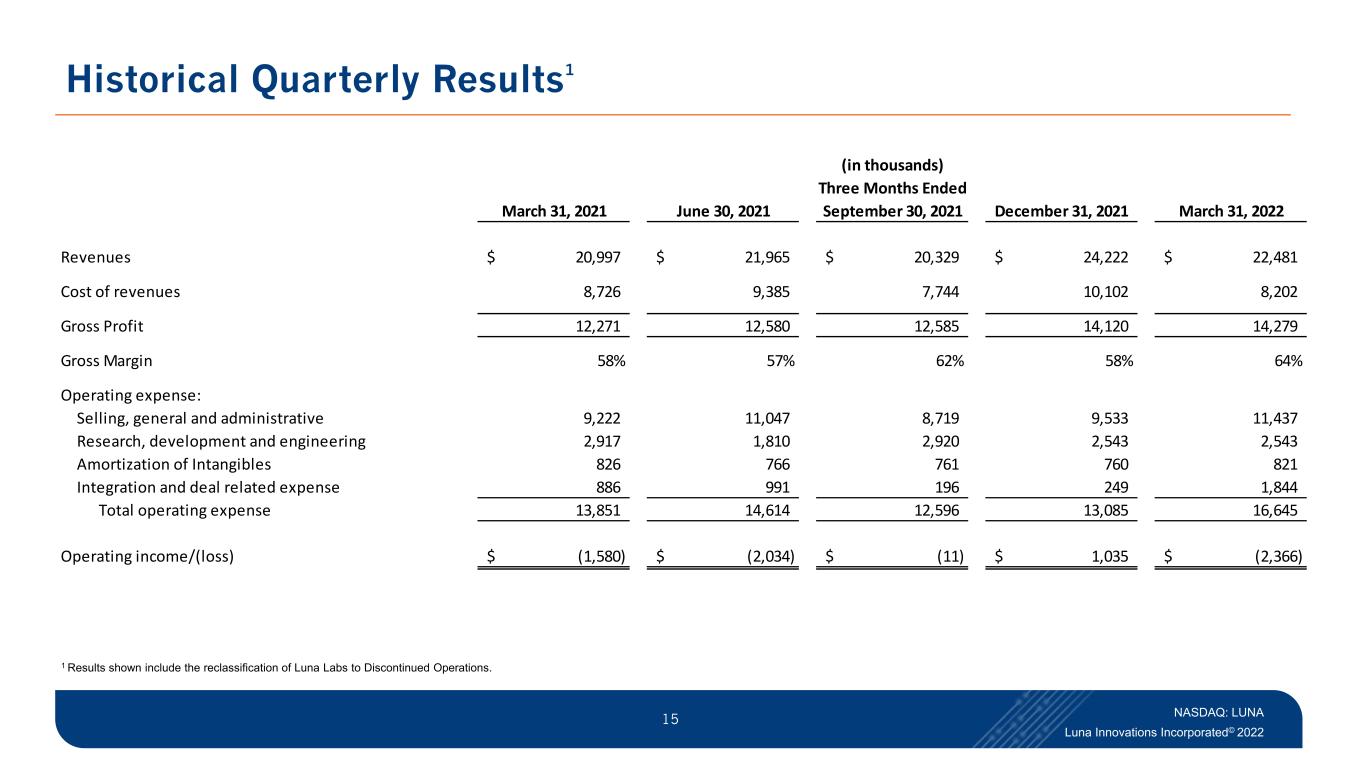

NASDAQ: LUNA Luna Innovations Incorporated© 2022 15 Historical Quarterly Results1 1 Results shown include the reclassification of Luna Labs to Discontinued Operations. March 31, 2021 June 30, 2021 September 30, 2021 December 31, 2021 March 31, 2022 Revenues 20,997$ 21,965$ 20,329$ 24,222$ 22,481$ Cost of revenues 8,726 9,385 7,744 10,102 8,202 Gross Profit 12,271 12,580 12,585 14,120 14,279 Gross Margin 58% 57% 62% 58% 64% Operating expense: Selling, general and administrative 9,222 11,047 8,719 9,533 11,437 Research, development and engineering 2,917 1,810 2,920 2,543 2,543 Amortization of Intangibles 826 766 761 760 821 Integration and deal related expense 886 991 196 249 1,844 Total operating expense 13,851 14,614 12,596 13,085 16,645 Operating income/(loss) (1,580)$ (2,034)$ (11)$ 1,035$ (2,366)$ (in thousands) Three Months Ended