DOC ID - 47365856.9 LUNA INNOVATIONS INCORPORATED October 25, 2024 White Hat Strategic Partners II LP White Hat Lightning Opportunity LP White Hat Structured Opportunities LP c/o White Hat Capital Partners LP 520 Madison Ave., 33rd Floor New York, NY 10022 Attn: David J. Chanley; James Tong Ladies and Gentlemen: This letter agreement (this “Letter Agreement”) is made and entered into by and between Luna Innovations Incorporated (the “Company”) and the entities that are listed on Exhibit B attached hereto (each, an “Investor” and collectively, the “Investors” and, together with the Company, the “Parties”). Capitalized terms used but not defined herein have the meanings ascribed to them in the Subscription Agreement (as defined below). WHEREAS, on December 21, 2023 (the “Initial Subscription Closing Date”), the Company and the Investors entered into that certain Subscription Agreement (the “Subscription Agreement”) pursuant to which the Investors agreed to purchase up to 65,000 shares of the Company’s Series B Convertible Preferred Stock, par value $0.001 per share (the “Series B Convertible Preferred Stock”), for an aggregate purchase price of up to $62.5 million; WHEREAS, on the Initial Subscription Closing Date, pursuant to the terms of the Subscription Agreement, the Investors purchased an aggregate 52,500 shares of the Series B Convertible Preferred Stock for an aggregate purchase price of $50.0 million; WHEREAS, pursuant to the terms of the Subscription Agreement, the Investors were granted the right to purchase their pro rata portion of an aggregate of 12,500 additional shares of Series B Convertible Preferred Stock at a price of $1,000 per share (each, an “Optional Share Purchase” and, collectively, the “Optional Share Purchases”) on or prior to December 21, 2026; WHEREAS, on July 19, 2024 (the “Loan Agreement Closing Date”), the Company, as borrower, Luna Technologies, Inc. and General Photonics Corp., as guarantors (collectively, the “Guarantors”), certain funds affiliated with White Hat Capital Partners LP, as lenders, and White Hat Lightning Opportunity LP, entered into that certain Loan Agreement (the “Loan Agreement”) providing for a delayed-draw term loan facility in an aggregate principal amount of up to $15.0 million, of which $9.0 million was drawn on the Loan Agreement Closing Date, with the remaining $6.0 million available for future draws, subject to certain conditions; WHEREAS, the parties to the Loan Agreement now wish to enter into (i) that certain First Amendment to the Loan Agreement, dated as of the date hereof, to, among other things, increase the borrowing capacity under certain incremental term facilities to the Company by an aggregate principal amount of $15.0 million, bringing the resulting total term loan commitment to $30.0 million (the “Loan Agreement Amendment”) and (ii) that certain Side Letter, dated as of the date hereof, a copy of which is attached hereto as Exhibit A (the “Side Letter”, and, collectively with

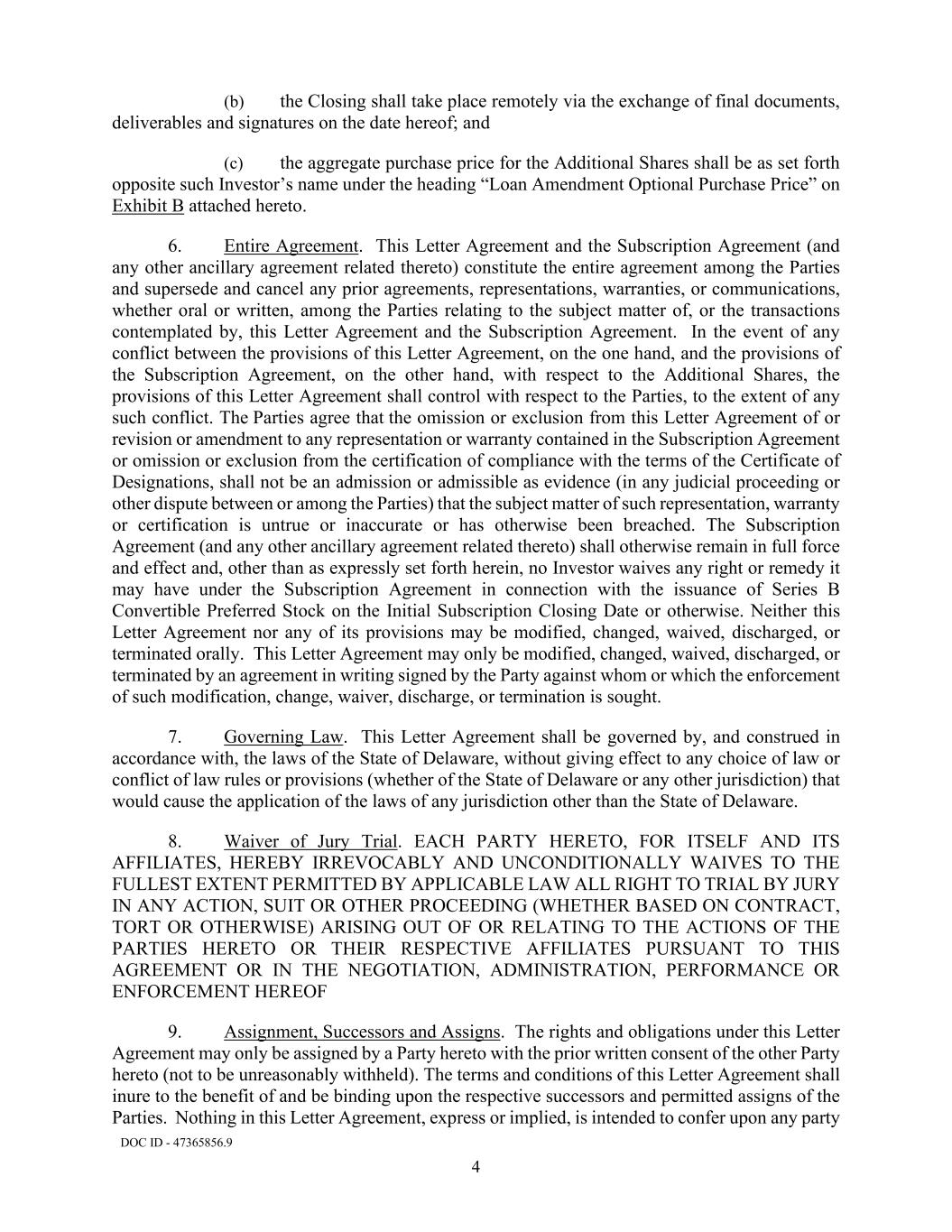

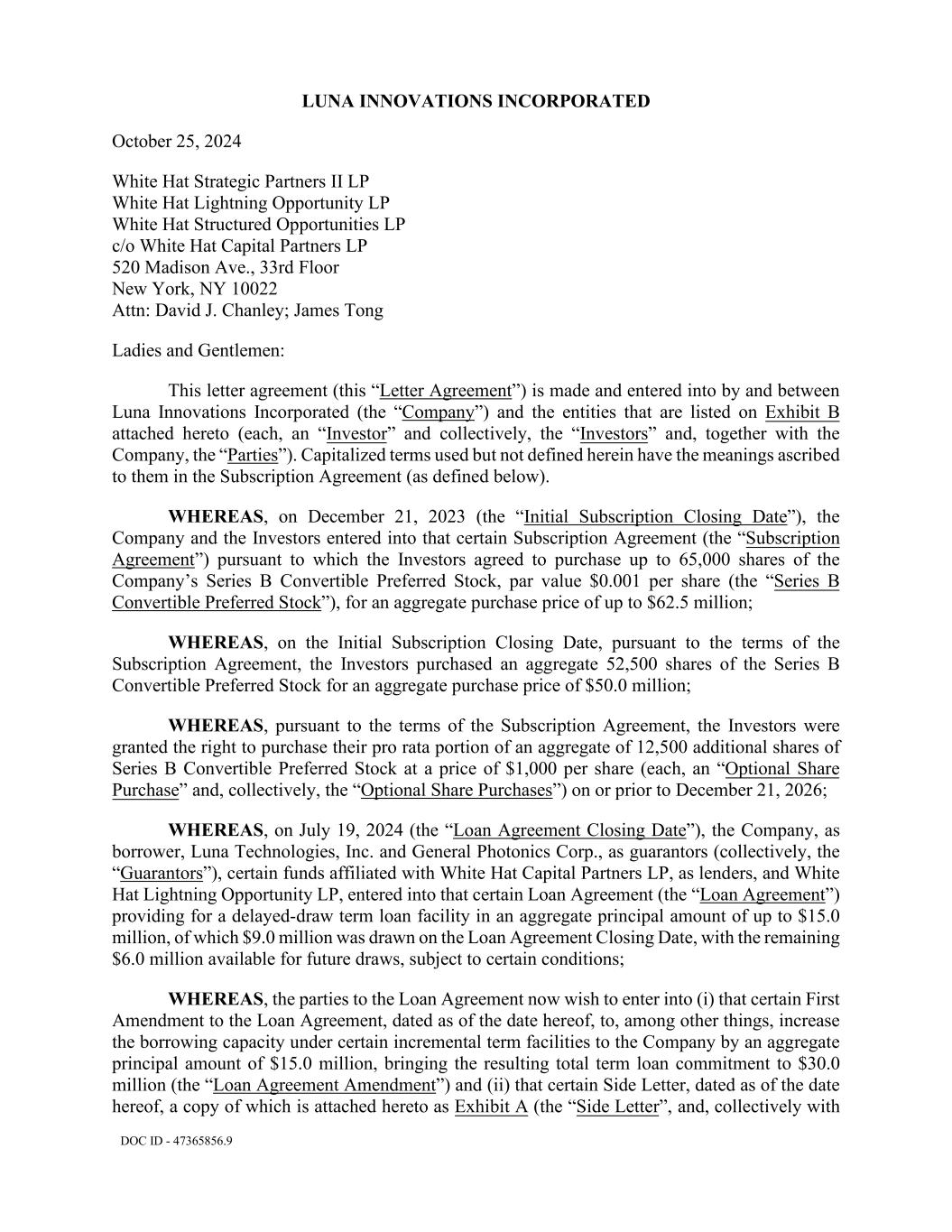

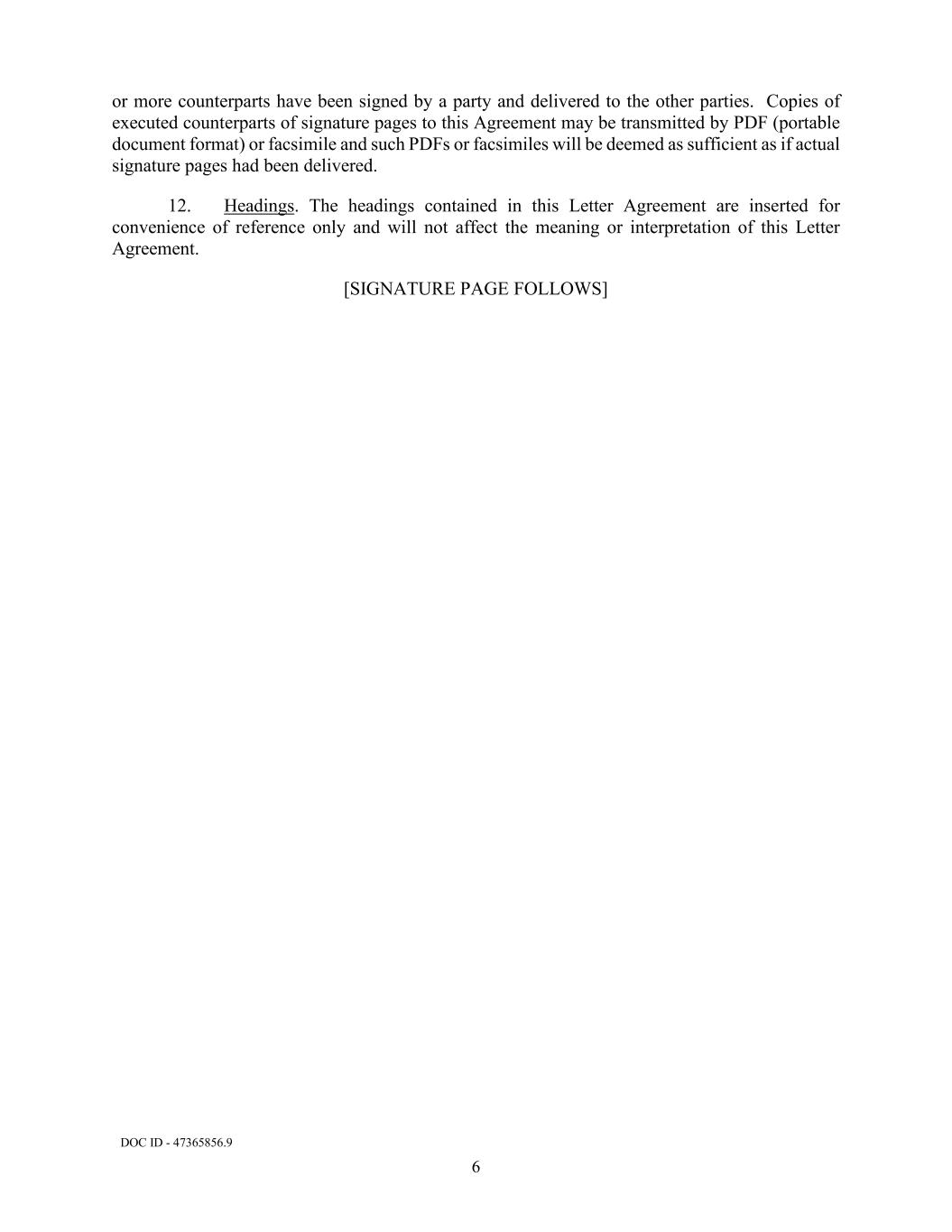

DOC ID - 47365856.9 2 the Loan Agreement Amendment and other ancillary agreement related thereto, the “Transaction Documents”); WHEREAS, the Investors have agreed to exercise a portion of their respective Optional Share Purchase and, in connection therewith, the Company will issue and sell 3,000 shares of Series B Convertible Preferred Stock (the “Additional Shares”) to the Investors, pro rata, at a purchase price per share equal to the par value of such shares and an aggregate purchase price as set forth under the heading “Loan Amendment Optional Purchase Price” on Exhibit B attached hereto (the “Loan Amendment Optional Purchase”); and WHEREAS, the Parties wish to memorialize these arrangements pursuant to this Letter Agreement. NOW, THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, do hereby agree and acknowledge as follows: 1. Loan Amendment Optional Purchase. The Parties hereby agree that, concurrently with the execution of the Transaction Documents, each of the Investors partially exercises its Optional Share Purchase for, and the Company shall issue and sell, the Additional Shares in the amounts set forth opposite such Investor’s name under the heading “Loan Amendment Optional Purchase Shares” on Exhibit B attached hereto in accordance with the terms of this Letter Agreement and the Subscription Agreement. For the avoidance of doubt, (a) the Loan Amendment Optional Purchase constitutes one such exercise by each Investor of an Optional Shares Election Option and thereafter each Investor shall continue to have the right at any time from time to time during the Exercise Period to exercise an Optional Shares Election Option in accordance with the Subscription Agreement for up to the amount of remaining Series B Preferred Stock set forth opposite such Investor’s name under the heading “Remaining Optional Shares” on Exhibit B attached hereto and (b) the issuance of the Additional Shares constitutes an Exempt Issuance (as defined in the Certificate of Designations), and therefore no adjustment to the Conversion Price (as defined in the Certificate of Designations) shall be made as result of the issuance of the Additional Shares. 2. Consideration. The Parties hereby agree that the payment of the par value of the Additional Shares, together with the consent to the execution of the Transaction Documents by the parties thereto set forth in Section 3, shall serve as good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged by the Parties, for the Loan Amendment Optional Purchase and the Company hereby waives the right to any further consideration (in cash or otherwise) for the Additional Shares. 3. Consent. Pursuant to Section 10(b) of the Certificate of Designations, the Company hereby requests the consent of the Majority Holders (as defined in the Certificate of Designations), to enter into the Transaction Documents and to consummate the transactions contemplated therein and by their execution of this Letter Agreement, the Investors, representing the Majority Holders, hereby consent to such entry into the Transaction Documents and the consummation of the transactions contemplated therein.

DOC ID - 47365856.9 3 4. Certifications. (a) The undersigned authorized officer of the Company hereby represents, warrants and certifies to the Investors, pursuant to Section 5.5(d) of the Subscription Agreement, as follows (and no separate certificate shall be required): (i) Subject to Schedule 4(a)(i) hereto, the representations and warranties of the Company contained in Article II of the Subscription Agreement are true and correct in all respects as of the date hereof and at the Closing (as defined below) with the same effect as though made on and as of such date (other than those representations and warranties that address matters as of particular dates, which are true and correct as of such dates) except where the failure of such representations and warranties to be so true and correct (without giving effect to any materiality of Material Adverse Effect qualifications or exceptions contained therein) would not, individually or in the aggregate, have a Material Adverse. (ii) Subject to Schedule 4(a)(ii) hereto, the Company has complied with or performed in all material respects its obligations required to be complied with or performed by it pursuant to the Subscription Agreement and the Certificate of Designations during the period from the Initial Closing Date to the date hereof. (b) The undersigned signatory of each Investor, solely in his capacity as a duly authorized signatory of each Investor and not in his individual capacity, represents, warrants and certifies to the Company, pursuant to Section 5.4(c) of the Subscription Agreement, as follows (and no separate certificate shall be required): (i) The representations and warranties of such Investor contained in Article III of the Subscription Agreement are true and correct in all material respects as of the date hereof with the same effect as though made on and as of such date (other than those representations and warranties that address matters as of particular dates, which are true and correct in all material respects as of such dates). (ii) Such Investor has complied with or performed in all material respects its obligations required to be complied with or performed by it pursuant to the Subscription Agreement and the Certificate of Designations during the period from the Initial Closing Date to the date hereof. (iii) The Investors hereby acknowledge that the Company obtained the requisite consents from the Majority Holders pursuant to Section 10(b) of the Certificate of Designations regarding the matters set forth on Schedule 4(b)(iii) hereto on the dates provided therein. 5. Closing. The closing of the Loan Amendment Optional Purchase (the “Closing”) shall occur in accordance with Section 1.4 of the Subscription Agreement; provided, however, that: (a) the execution of this Letter Agreement shall constitute an Exercise Notice with respect to each Investor;

DOC ID - 47365856.9 4 (b) the Closing shall take place remotely via the exchange of final documents, deliverables and signatures on the date hereof; and (c) the aggregate purchase price for the Additional Shares shall be as set forth opposite such Investor’s name under the heading “Loan Amendment Optional Purchase Price” on Exhibit B attached hereto. 6. Entire Agreement. This Letter Agreement and the Subscription Agreement (and any other ancillary agreement related thereto) constitute the entire agreement among the Parties and supersede and cancel any prior agreements, representations, warranties, or communications, whether oral or written, among the Parties relating to the subject matter of, or the transactions contemplated by, this Letter Agreement and the Subscription Agreement. In the event of any conflict between the provisions of this Letter Agreement, on the one hand, and the provisions of the Subscription Agreement, on the other hand, with respect to the Additional Shares, the provisions of this Letter Agreement shall control with respect to the Parties, to the extent of any such conflict. The Parties agree that the omission or exclusion from this Letter Agreement of or revision or amendment to any representation or warranty contained in the Subscription Agreement or omission or exclusion from the certification of compliance with the terms of the Certificate of Designations, shall not be an admission or admissible as evidence (in any judicial proceeding or other dispute between or among the Parties) that the subject matter of such representation, warranty or certification is untrue or inaccurate or has otherwise been breached. The Subscription Agreement (and any other ancillary agreement related thereto) shall otherwise remain in full force and effect and, other than as expressly set forth herein, no Investor waives any right or remedy it may have under the Subscription Agreement in connection with the issuance of Series B Convertible Preferred Stock on the Initial Subscription Closing Date or otherwise. Neither this Letter Agreement nor any of its provisions may be modified, changed, waived, discharged, or terminated orally. This Letter Agreement may only be modified, changed, waived, discharged, or terminated by an agreement in writing signed by the Party against whom or which the enforcement of such modification, change, waiver, discharge, or termination is sought. 7. Governing Law. This Letter Agreement shall be governed by, and construed in accordance with, the laws of the State of Delaware, without giving effect to any choice of law or conflict of law rules or provisions (whether of the State of Delaware or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the State of Delaware. 8. Waiver of Jury Trial. EACH PARTY HERETO, FOR ITSELF AND ITS AFFILIATES, HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW ALL RIGHT TO TRIAL BY JURY IN ANY ACTION, SUIT OR OTHER PROCEEDING (WHETHER BASED ON CONTRACT, TORT OR OTHERWISE) ARISING OUT OF OR RELATING TO THE ACTIONS OF THE PARTIES HERETO OR THEIR RESPECTIVE AFFILIATES PURSUANT TO THIS AGREEMENT OR IN THE NEGOTIATION, ADMINISTRATION, PERFORMANCE OR ENFORCEMENT HEREOF 9. Assignment, Successors and Assigns. The rights and obligations under this Letter Agreement may only be assigned by a Party hereto with the prior written consent of the other Party hereto (not to be unreasonably withheld). The terms and conditions of this Letter Agreement shall inure to the benefit of and be binding upon the respective successors and permitted assigns of the Parties. Nothing in this Letter Agreement, express or implied, is intended to confer upon any party

DOC ID - 47365856.9 5 other than the Parties or their respective successors and assigns any rights, remedies, obligations, or liabilities under or by reason of this Letter Agreement, except as expressly provided in this Letter Agreement. 10. Notices. All notices, requests, demands and other communications under this Agreement shall be in writing and shall be deemed to have been duly given or made as follows: (a) if sent by registered or certified mail in the United States return receipt requested, upon receipt; (b) if sent by nationally recognized overnight air courier, one (1) Business Day after mailing; (c) if sent by e-mail transmission, when transmitted and receipt is confirmed; and (d) if otherwise actually personally delivered, when delivered; provided, that such notices, requests, demands and other communications are delivered to the address set forth below, or to such other address as any party shall provide by like notice to the other parties to this Agreement: If to the Company, to: Luna Innovations Incorporated 301 1st Street SW, Suite 200 Roanoke, VA 24011 E-mail: rstewart@lunainc.com Attention: Ryan Stewart, General Counsel with a copy (which shall not constitute notice) to: King & Spalding LLP 1180 Peachtree Street, NE Suite 1600 Atlanta, GA 30309 E-mail: zdavis@kslaw.com Attention: Zack Davis If to the Investors, to: c/o White Hat Capital Partners LP 520 Madison Ave. 33rd Floor New York, NY 10022 E-mail: DChanley@whitehatcp.com; JTong@whitehatcp.com Attention: David J. Chanley; James Tong with a copy (which shall not constitute notice) to: Schulte Roth & Zabel LLP 919 Third Avenue New York, NY 10022 E-mail: Eleazer.Klein@srz.com; David.Curtiss@srz.com Attention: Eleazer Klein; David A. Curtiss. 11. Counterparts. This Letter Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement, and will become effective when one

DOC ID - 47365856.9 6 or more counterparts have been signed by a party and delivered to the other parties. Copies of executed counterparts of signature pages to this Agreement may be transmitted by PDF (portable document format) or facsimile and such PDFs or facsimiles will be deemed as sufficient as if actual signature pages had been delivered. 12. Headings. The headings contained in this Letter Agreement are inserted for convenience of reference only and will not affect the meaning or interpretation of this Letter Agreement. [SIGNATURE PAGE FOLLOWS]

Docusign Envelope ID: 904FFEF8-86BB-4E47-9490-E536C9451152 Very truly yours, LUNA INNOVATIONS INCORPORATED G �'"'"·�,,, By: �� 295652318003412 ... Name: Ryan Stewart Title: Corporate Secretary Signature Page to Letter Agreement

DOC ID - 47365856.9 Exhibit B Loan Amendment Optional Purchase Investor Previously Purchased Shares Maximum Optional Shares Loan Amendment Optional Purchase Shares Loan Amendment Optional Purchase Price1 Remaining Optional Shares White Hat Strategic Partners II LP 6,300 1,500 360 $0.36 1,140 White Hat Lightning Opportunity LP 4,200 1,000 240 $0.24 760 White Hat Structured Opportunities LP 42,000 10,000 2,400 $2.40 7,600 Total: 52,500 12,500 3,000 $3.00 9,500 1 Represents the cash purchase price payable to the Company for the Additional Shares. The total consideration for the Additional Shares is set forth in Section 2 of this Letter Agreement.