Filed by: Gaz de France

pursuant to Rule 165 and Rule 425(a)

under the Securities Act of 1933, as amended

Subject Company: SUEZ

Exchange Act File Number: 001-15232

Date: September 21, 2006

On September 12, 2006, Gaz de France made the following slide presentation available on its website and at a presentation in Paris, France of its 2006 half-year results.

Important Information

This communication does not constitute an offer to purchase or exchange or the solicitation of an offer to sell or exchange any securities of Suez or an offer to sell or exchange or the solicitation of an offer to buy or exchange any securities of Gaz de France, nor shall there be any sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares to be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration.

In connection with the proposed business combination, the required information document will be filed with theAutorité des marchés financiers(“AMF”) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus.Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information.If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site atwww.sec.gov and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website atwww.amf-france.org or directly from Gaz de France on its web site at:www.gazdefrance.com or directly from Suez on its website at:www.suez.com, as the case may be.

Forward-Looking Statements

This communication contains forward-looking information and statements about Gaz de France, Suez and their combined businesses after completion of the proposed business combination. Forward-looking statements are statements that are not historical facts. These statements include financial projections, synergies, cost-savings and estimates and their underlying assumptions, statements regarding plans, objectives, savings, expectations and benefits from the transaction and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares are cautioned that forward-looking information and statements are not guarantees of future performances and are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results, developments, synergies, savings and benefits from the transaction to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with theAutorité des marchés financiers(“AMF”) made by Gaz de France and Suez, including those listed under “Facteurs de Risques” in theDocument deRéférencefiled by Gaz de France with the AMF on May 5, 2006 (under no: R.06-050) and in theDocument de Référenceand its update filed by Suez on April 11, 2006 (under no: D.06-0248), as well as documents filed by Suez with the SEC, including those listed under “Risk Factors” in the Annual Report on Form 20-F for 2006 that Suez filed with the SEC on June 26, 2006. Except as required by applicable law, neither Gaz de France nor Suez undertakes any obligation to update any forward-looking information or statements.

* * * *

12 September 2006 Gaz de France 2006 First Half Results Results as at 30 June 2006 Jean-François CIRELLI Chairman & Chief Executive Officer 12 September 2006 |

2 Gaz de France 2006 First Half Results 12 September 2006 Disclaimer The objectives summarised herein are based on data, assumptions and estimates deemed reasonable by Gaz de France. The said data, assumptions and estimates may evolve or be changed as a result of uncertainties due primarily to the economic, financial, competitive, regulatory or climatic environment. In addition, the materialisation of certain risks set out in paragraph 4.17 of the Basic Form filed with the French Financial Markets Authority under Number I.05-037, dated 1 April 2005 (hereinafter referred to as the “Basic Form”) could have an impact on the Group’s operations and its ability to achieve its objectives. In addition, the attainment of those objectives is dependent on the success of the sales strategy set out in Paragraph 4.2 of the Basic Form. Gaz de France thereby does not wish to make any commitments or guarantees on the attainment of the objectives and does not undertake to publish or issue possible corrections or updates of such factors. This communication does not constitute an offer to purchase or exchange or the solicitation of an offer to sell or exchange any securities of SUEZ or an offer to sell or exchange or the solicitation of an offer to buy or exchange any securities of Gaz de France, nor shall there be any sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and SUEZ disclaim any responsibility or liability for the violation of such restrictions by any person. The Gaz de France ordinary shares to be issued in connection with the proposed business combination to holders of SUEZ ordinary shares (including SUEZ ordinary shares represented by SUEZ American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration. In connection with the proposed business combination, the required information document will be filed with the Autorité des marchés financiers (“AMF”) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus. Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information. If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s website at www.sec.gov and will receive information at an appropriate time on how to obtain these transaction- related documents for free from Gaz de France or its duly designated agent. Investors and holders of SUEZ securities may obtain free copies of documents filed with the AMF at the AMF’s website at www.amf-france.org or directly from Gaz de France on its website at: www.gazdefrance.com or directly from SUEZ on its website at: www.suez.com, as the case may be. Forward-Looking Statement Important Information |

3 Gaz de France 2006 First Half Results 12 September 2006 Contents Business development and highlights Consolidated results as at 30 June 2006 Outlook Planned merger with Suez Appendices |

12 September 2006 Gaz de France 2006 First Half Results Business development and highlights Jean-François CIRELLI |

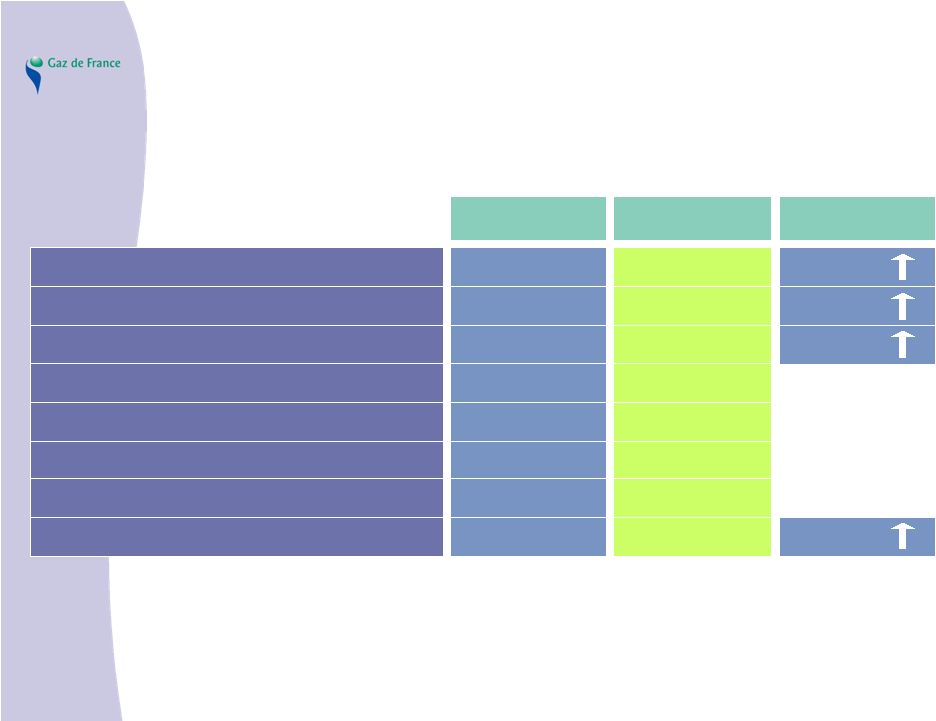

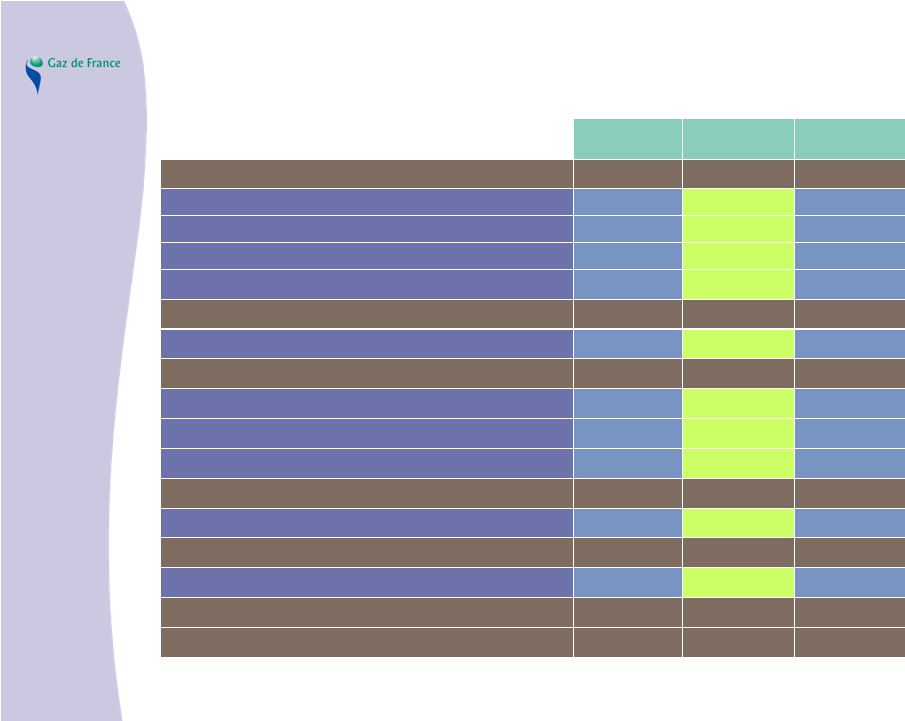

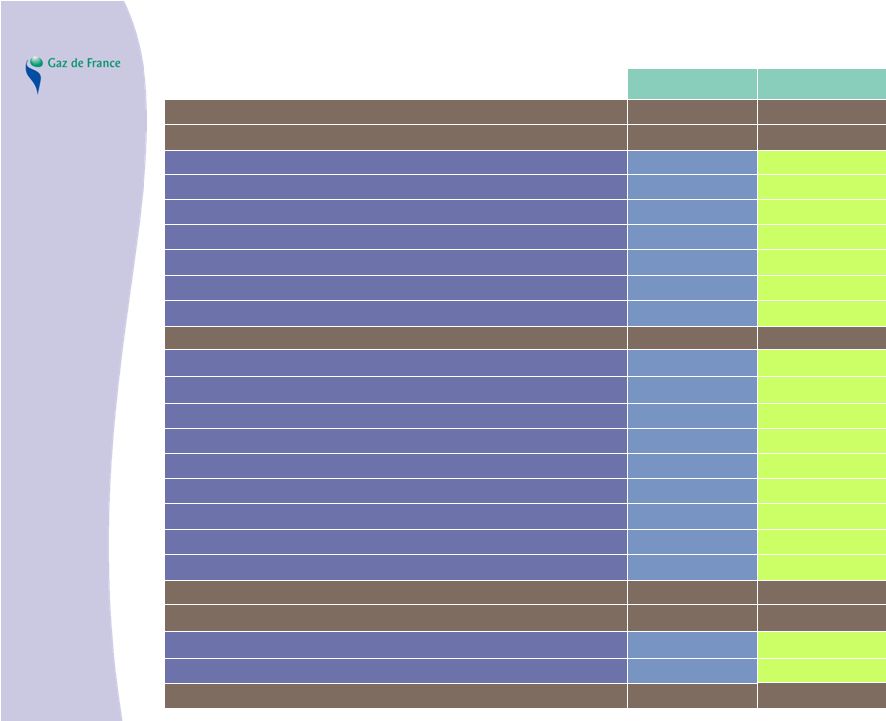

5 Gaz de France 2006 First Half Results 12 September 2006 Change Significantly improved results H1 2005 H1 2006 + 37% 11,089 15,233 Net sales Operating income EBITDA Net income – Group share + 30% 2,520 3,274 + 34% 1,907 2,560 + 44% 1,189 1,707 + 35% 2,546 3,429 In millions of euros Earnings per share** (in €) + 32% 1.32 1.74 Operating cashflow* * Before tax and change in WCR ** Number of shares as at 30/06/2006: 983 871 988 (as compared to 903 000 000 as at 30/06/2005) |

6 Gaz de France 2006 First Half Results 12 September 2006 Hydrocarbon production* (in Mbep) 18.4 20.6 + 12% * consolidated 13.2 15.2 5.2 5.4 H1 2005 H1 2006 Oil Gas The Group’s development continues Electricity sales (in TWh) + 33% 8.5 11.3 H1 2005 H1 2006 Natural gas sales (in TWh) + 11% 396 439 H1 2005 H1 2006 International sales (in M€) + 57% 3,635 5,714 H1 2005 H1 2006 |

7 Gaz de France 2006 First Half Results 12 September 2006 All of the businesses contributed to the Group’s performance Sound Infrastructure business in France Growth in rates and volumes for Exploration-Production Very good performance in Trading and Sales International 2005 acquisitions significantly contributed to overall results |

8 Gaz de France 2006 First Half Results 12 September 2006 2006 targets substantially increased Initial targets Revised targets 2006 EBITDA 2006 Net income Group share Growth > 12% > 2 billion € Growth > + 20% > 5 billion € > 2.2 billion € |

12 September 2006 Gaz de France 2006 First Half Results Consolidated results as at 30 June 2006 Philippe JEUNET |

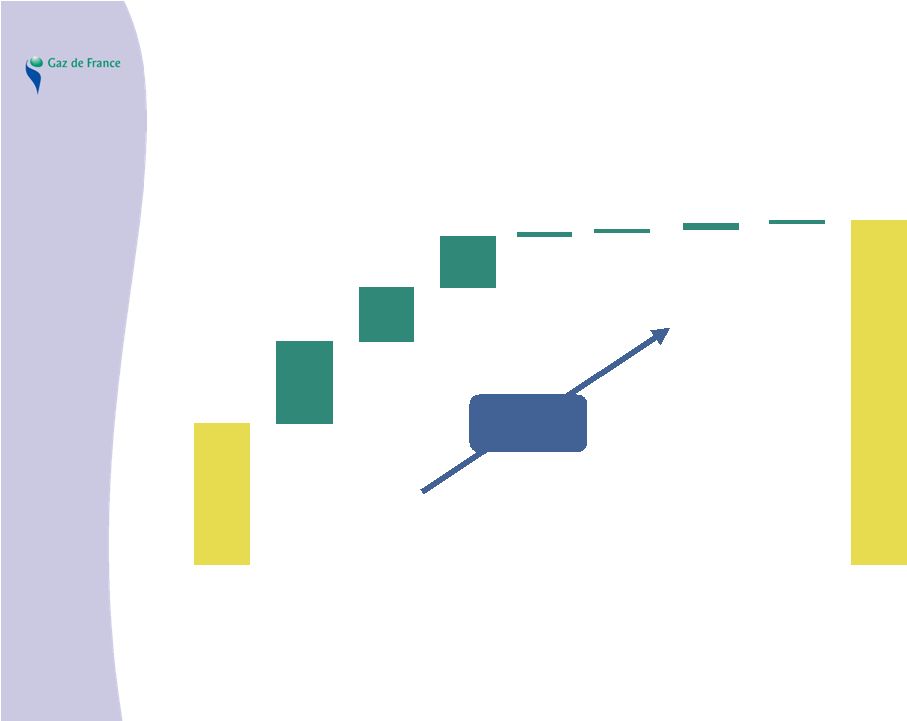

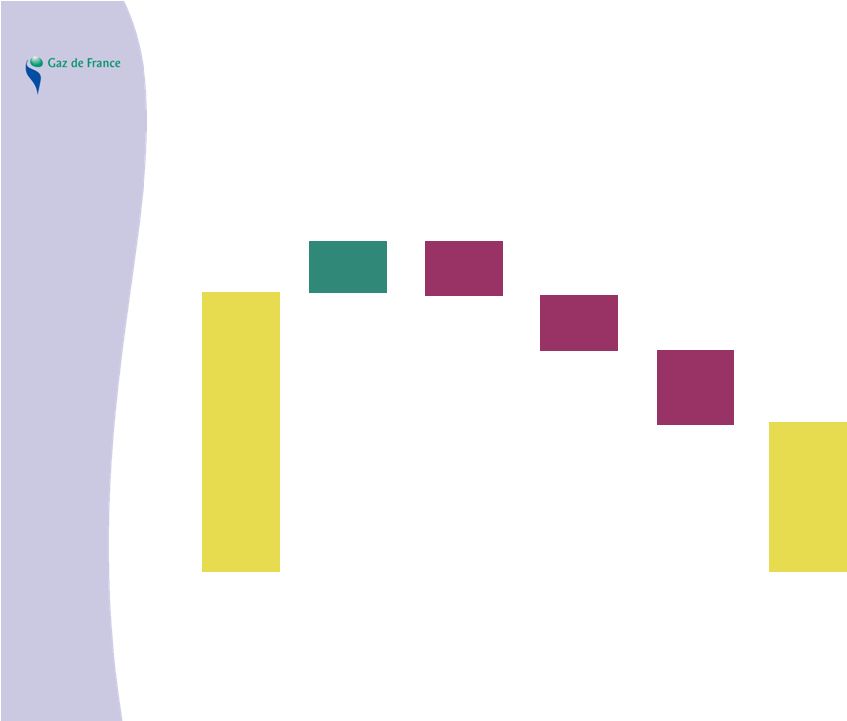

10 Gaz de France 2006 First Half Results 12 September 2006 Net sales reflect a 37% increase around one-third of which comes from volume and scope effects 11,089 Net Sales H1 2005 Net Sales H1 2006 Rate 15,233 In millions of euros + 37% + 2,701 + 624 + 819 Volume Scope |

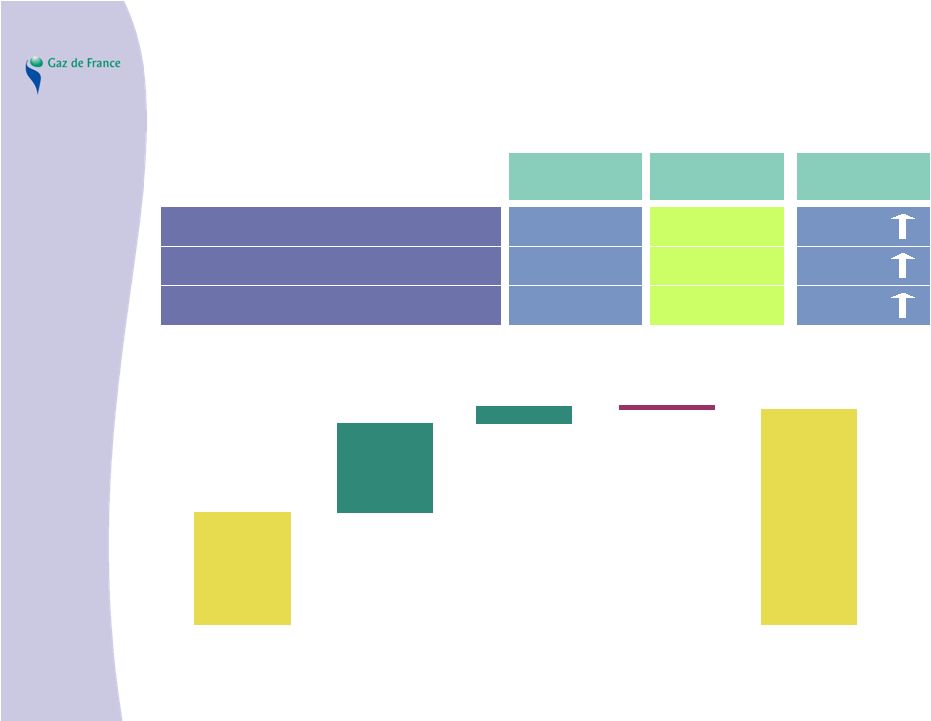

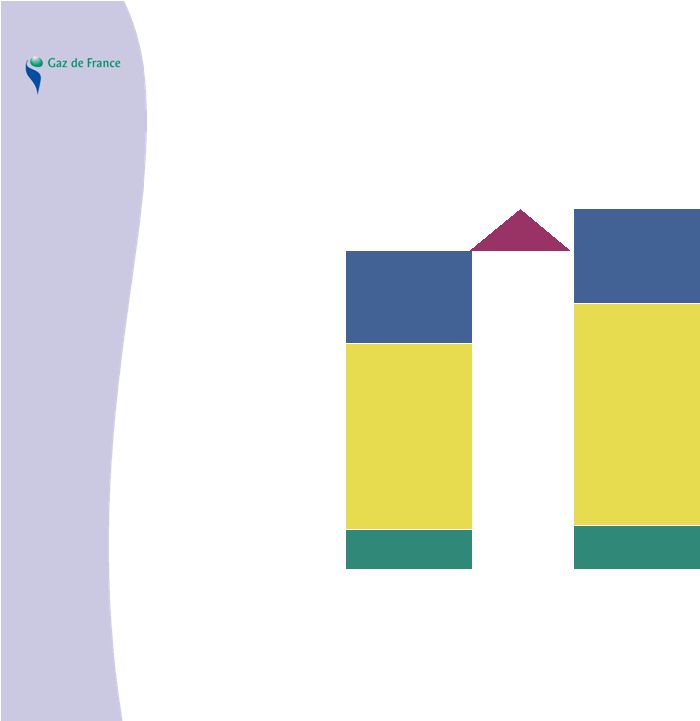

11 Gaz de France 2006 First Half Results 12 September 2006 Sharp EBITDA growth A sound revenue base thanks to the Infrastructures France business and clearly-identified growth drivers + 302 2,520 3,274 + 202 + 190 + 11 EBITDA H1 2005 EBITDA H1 2006 Exploration Production Purchase- Sale of Energy Transmission Distribution International + 15 Services + 13 Transmission Storage France Other and NA + 21 Distribution France In millions of euros + 30% |

12 September 2006 Gaz de France 2006 First Half Results Energy Supply and Services Division |

13 Gaz de France 2006 First Half Results 12 September 2006 635 EBITDA 905 Net sales H1 2006 Operating income Exploration-Production A sharp increase in results due to rise in production and hydrocarbon prices 470 Rate Volume Other 333 635 + 266 - 12 + 48 EBITDA H1 2005 EBITDA H1 2006 333 526 H1 2005 197 In millions of euros + 91% + 72% Change + 139% |

14 Gaz de France 2006 First Half Results 12 September 2006 Purchase-Sale of Energy Significant improvement in EBITDA, despite a limited increase in public distribution rates 641 11,591 612 EBITDA H1 2005 EBITDA H1 2006 439 8,786 420 EBITDA Net sales H1 2006 Operating income H1 2005 In millions of euros + 46% + 32% Change + 46% * Impact on H1 2006 : 331 M€ - impact on H1 2005: 268 M€ ** State-administered rate, applying to less than one-third of overall sales of the Group 439 641 + 40 - 63* + 349 Climate effect Public distribution rate** Current effects - 124 Non- recurring H1 2005 |

15 Gaz de France 2006 First Half Results 12 September 2006 Services Profitable growth continues 96 1,096 57 81 96 EBITDA H1 2005 EBITDA H1 2006 + 10 + 3 DK6 Scope Current effects + 2 81 957 48 EBITDA Net sales H1 2006 Operating income H1 2005 In millions of euros + 19% + 15% Change + 19% |

12 September 2006 Gaz de France 2006 First Half Results Infrastructures Division |

17 Gaz de France 2006 First Half Results 12 September 2006 647 1,097 483 Transmission-Storage France Steady growth 634 647 + 24 EBITDA H1 2005 EBITDA H1 2006 Current effects - 11 Non-recurring H1 2005 634 1,046 471 EBITDA Net sales H1 2006 Operating income H1 2005 In millions of euros + 2% + 5% Change + 3% |

18 Gaz de France 2006 First Half Results 12 September 2006 Distribution France Continuous positive trend 896 1,672 550 875 896 + 27 - 6 EBITDA H1 2005 EBITDA H1 2006 Non-recurring H1 2006 Current effects * Excluding positive one-time effect of 2005 readjustment of replacement values taken into account in determining renewal provision 875 1,636 680 550 Adjusted operating income * 555 EBITDA Net sales H1 2006 Operating income H1 2005 In millions of euros + 2% + 2% Change - 19% ~ |

19 Gaz de France 2006 First Half Results 12 September 2006 Transmission & Distribution International Business and performance progressing, driven by external growth operations and improved margins 355 2,003 272 165 355 + 83 + 63 Non-recurring H1 2005 Scope + 44 Current effects EBITDA H1 2005 EBITDA H1 2006 165 868 114 EBITDA Net sales H1 2006 Operating income H1 2005 In millions of euros + 115% + 131% Change + 139% |

20 Gaz de France 2006 First Half Results 12 September 2006 From EBITDA to Net Income In millions of euros H1 2005 H1 2006 3,274 2,560 - 714 - 148 - 793 120 - 32 1,707 2,520 1,907 - 613 - 224 - 586 95 - 3 1,189 EBITDA Operating income Net reserves for depreciation and prov. Financial income Taxes Share of equity-accounted companies Minority share Net income – Group share Change + 30% + 34% + 17% + 44% |

21 Gaz de France 2006 First Half Results 12 September 2006 Strong cashflow generation 3,429 + 630 - 912 - 669 - 668 Operating cashflow H1 2006 WCR reduction Equipment investments Dividends Taxes and interests 1,810 Free cashflow H1 2006 In millions of euros |

22 Gaz de France 2006 First Half Results 12 September 2006 Increased CAPEX Exploration Production Infrastructures in France Misc.* 242 560 110 912 236 470 100 806 H1 2005 H1 2006 * CAPEX excluding Exploration-Production and Infrastructures in France In millions of euros + 13% |

12 September 2006 Gaz de France 2006 First Half Results Outlook Jean-François CIRELLI |

24 Gaz de France 2006 First Half Results 12 September 2006 A sound outlook Regular growth from Infrastructure revenues… • Regulated infrastructures: a major CAPEX program in the networks business in line with market growth • Storage infrastructures: a key position in the strategic storage market …with clearly identified growth drivers • Exploration-Production: continued growth in production and reserves • Purchase-Sale of Energy: A top-tier trader The benchmark reseller in the opening European market Developing a power supply portfolio |

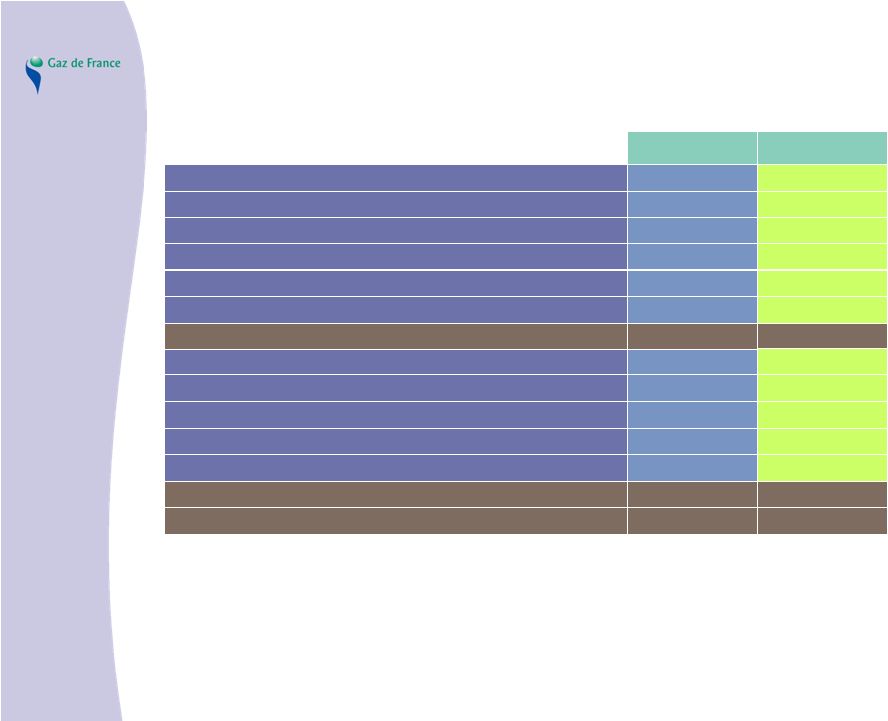

25 Gaz de France 2006 First Half Results 12 September 2006 A growing, stable and recurring revenue base Regulated infrastructures A major CAPEX program in the networks business in line with market growth Transport (31,589 km as at end-2005) LNG terminals Distribution (180,700 km as at end- 2005) 7.75% 9% - 12% Return on investment as at 01/01/06 9.25% - 10.50% 7.25% 1.1 billion € Forecasted investments (2006-2009) 0.6 billion € 2.9 billion € 5.6 billion € Asset base as at 01/01/06 0.4 billion € 12.6 billion € Regulated Asset Base (RAB) 2006: 18.6 billion euros Investments planned for 2006-2009: 4.6 billion euros with AAGR* in RAB of 3.4% between 2006 and 2010 ROI procedures clarified by CRE * Average annual growth rate |

26 Gaz de France 2006 First Half Results 12 September 2006 Storage infrastructures A key position in the strategic storage market An expanding storage business • Number 2 storage operator in Europe • Significant development in 2006-2009: an additional 12% capacity in France Storage rates on lower end of European price range Valuation of European storage capacity increasing 7.5 9 10 11 11.8 Gaz de France Operator 1 Operator 2 Operator 3 Operator 4 Rate in €/MWh for a 45-day tapping offer Storage: growth potential for the Group |

27 Gaz de France 2006 First Half Results 12 September 2006 Exploration-Production Continued growth in production and reserves Snøhvit Njord Gjøa Fram Bains Altmark Elgin Franklin Bassin gazier South (UK) Netherlands Offshore (Proned) Foxtrot (Ivory Coast) Mauritania (Offshore) Touat W EI Burullus Exploration-Production: a growing business Balanced and growing reserve portfolio • Target of 1,000 Mbep in medium-term reserves • 2006-2009 investment effort: - 2.8 billion € in production - 700 million € in exploration • Significant organic portfolio growth Production increasing • AAGR production 2005-2009: 12% PEG PEG NW Damietta |

28 Gaz de France 2006 First Half Results 12 September 2006 Purchase-Sale of Energy A top-tier trader A major natural gas buyer A diverse portfolio of long-term contracts The European leader in LNG Key assets and significant arbitration tools Substantial arbitrage and trading capacity |

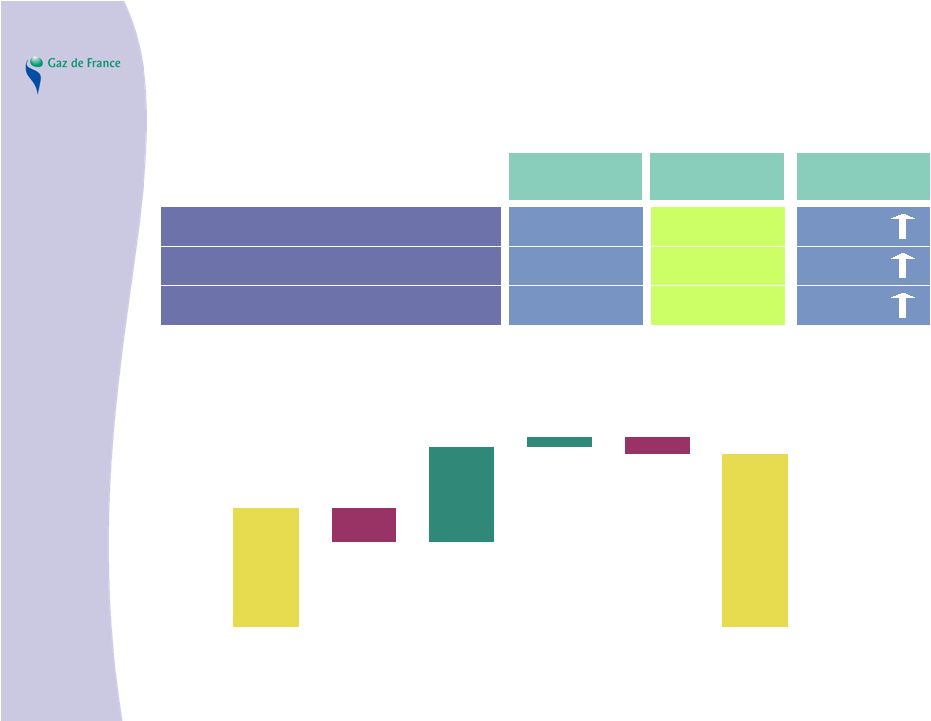

29 Gaz de France 2006 First Half Results 12 September 2006 Purchase-Sale of Energy The benchmark reseller in the opening European market Top-tier reseller in Europe • Sold 367 TWh in First Half 2006 • Sales to major industrial and commercial clients in Europe increasing Sales at State-regulated rates account for less than one-third of the Group’s total sales H1 2005 Major industrial and commercial clients Corporate (excl. rates) Retail and corporate (public distribution rate) Other H1 2006 53 63 + 19 % Major industrial and commercial clients (Europe excluding France) 2005 Volumes 32% |

30 Gaz de France 2006 First Half Results 12 September 2006 DK6 540 MW Shotton 205 MW SPE 1,600 MW (2005) Carthagena 1,200 MW (2006) Cycofos 480 MW (2008) Montoir 420 MW (2009) Wind 1,000 MW DK6 Tolling Arcelor 995 MWe installed • DK6 (790 MWe) • Shotton (205 MWe) 1,600 MWe in SPE • Incl. 25% for Gaz de France 2,200 MWe in development projects • Carthagena (1,200 MWe end-2006) • CycoFos (480 MWe end-2008) • Montoir (420 MWe end-2009) Development in NRE • 10% of total capacity in 2010 • Maia Eolis established as joint venture with Maia Sonnier • Target of 1,000 MWe by 2012 Purchase-Sale of Energy Developing a power supply portfolio Plant name Capacity (MW) (year commissioned) Production is developing rapidly Target: 5,000 Mwe in 2012 |

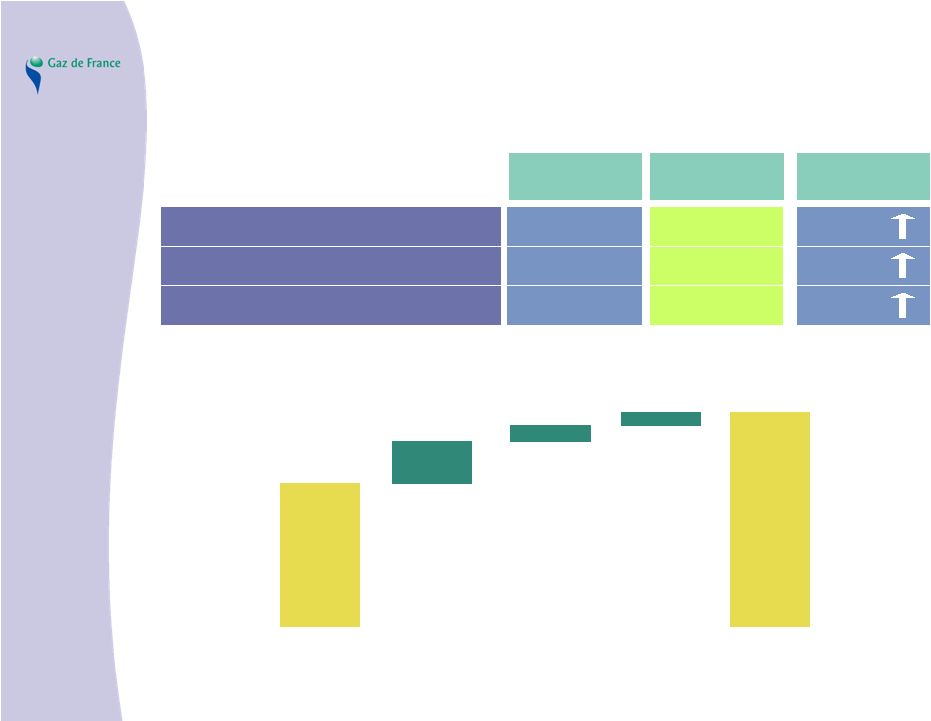

31 Gaz de France 2006 First Half Results 12 September 2006 Objectives revised 2006 Outlook Growth 2005 - 2008 * On average EBITDA > 5 billion euros Net income, Group share > 2.2 billion euros EBITDA > + 10% per year* > + 20% |

32 Gaz de France 2006 First Half Results 12 September 2006 Draft legislative bill on energy sector Separation between network and supply businesses will be finalised • Distribution will become a subsidiary and joint services will continue to be provided with EDF Regulated gas and electricity rates will be maintained after 1 July 2007 • However, rates are expected to continue to reflect cost of gas A "social" gas rate will be instituted • Offset by gas supplier tax, which may be passed on to clients through rates charged State to be authorised to lower stake in Gaz de France |

33 Gaz de France 2006 First Half Results 12 September 2006 Planned merger with Suez Current trends in the energy markets strengthen case for the transaction Merger process well underway Merger: a good opportunity to accelerate our development |

12 September 2006 Gaz de France 2006 First Half Results Appendices |

35 Gaz de France 2006 First Half Results 12 September 2006 Appendices Group Net Sales as at 30 June 2006 by segment Group EBITDA as at 30 June 2006 by Segment Consolidated Income Statement as at 30 June 2006 Consolidated Balance Sheet Assets & Liabilities as at 30 June 2006 Financial Rating Oil and Gas Price Regulated Rates |

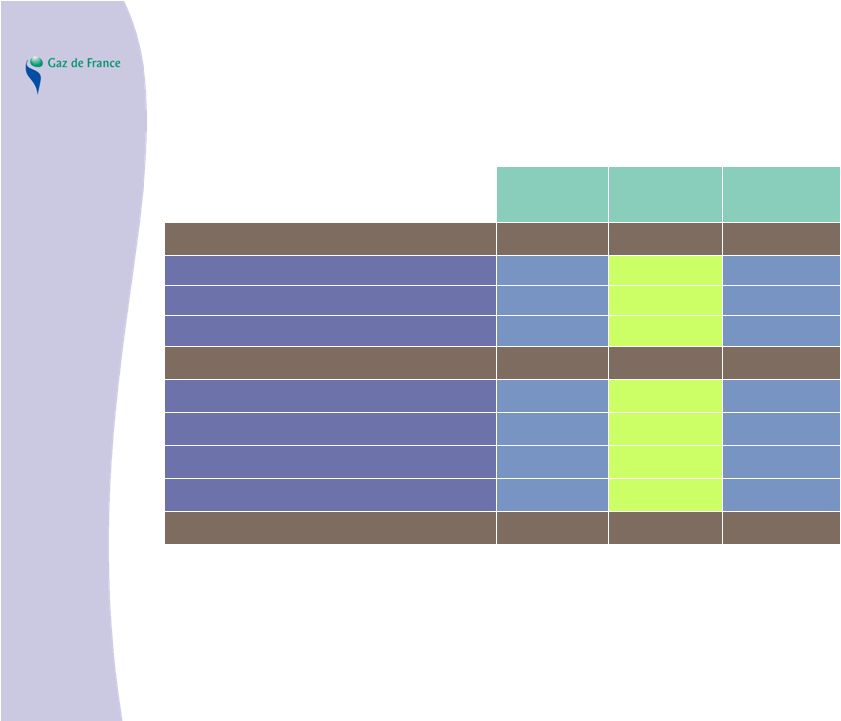

36 Gaz de France 2006 First Half Results 12 September 2006 526 + 72% 905 8,786 + 32% 11,591 957 + 15% 1,096 1,636 1,046 + 5% 1,097 + 2% 1,672 - 2,730 ns - 3,131 11,089 + 37% 15,233 Group Net Sales as at 30 June 2006 by segment H1 2005 H1 2006 868 + 131% 2,003 In millions of euros Energy Supply & Services Division Sales Exploration - Production Purchase - Sale of Energy Services Infrastructure Division Sales Transmission - Storage France Distribution France Elimination and other Net sales Group Transport & Distribution International Change |

37 Gaz de France 2006 First Half Results 12 September 2006 Group EBITDA as at 30 June 2006 by Segment In millions of euros Change 333 + 91% 635 439 + 46% 641 81 + 19% 96 875 634 + 2.1% 647 + 2.4% 896 - 7 ns 4 2,520 + 30% 3,274 H1 2005 H1 2006 165 + 115% 355 Energy Supply & Services EBITDA Exploration - Production Purchase - Sale of Energy Services Infrastructures Division EBITDA Transmission - Storage France Distribution France Elimination, other and non-allocated Total EBITDA Group Transmission Distribution International |

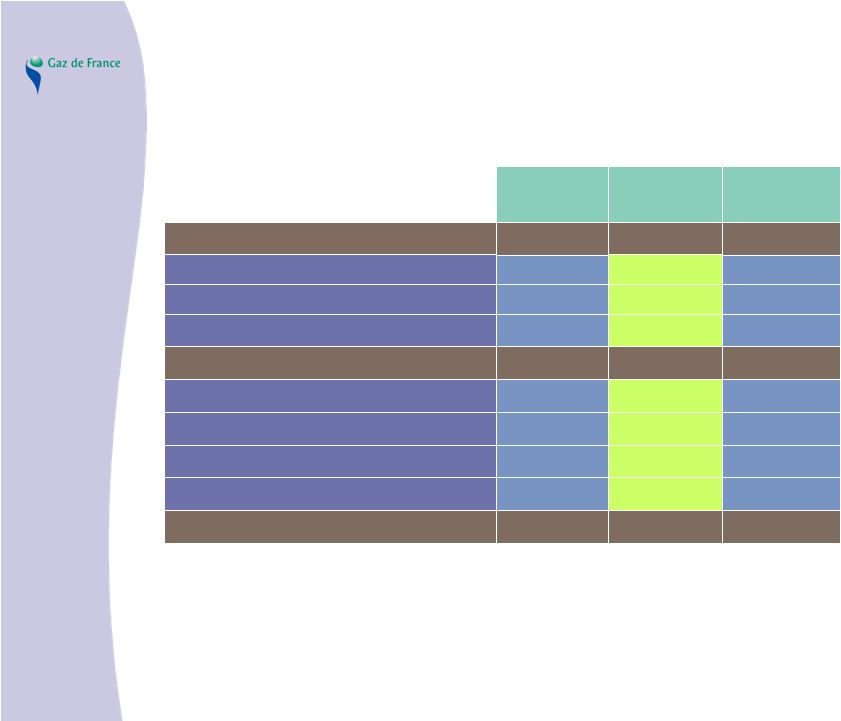

38 Gaz de France 2006 First Half Results 12 September 2006 Group Consolidated Income Statement as at 30 June 2006 In millions of euros Net sales Capitalised expenses Purchases and other external charges Personnel expenses Other operating income and expenses EBITDA Depreciation, amortisation and provisions Operating income Other financial income and expenses Share of income from equity-accounted companies Income before tax Corporate income tax Net consolidated income, Group share Minority interests Net consolidated income – Group share Net finance cost H1 2005 H1 2006 11,089 15,233 141 165 - 7,598 - 10,615 - 1,173 - 1,304 61 - 205 2,520 3,274 - 613 - 714 1,907 2,560 - 101 - 74 95 120 1,778 2,532 - 586 - 793 1,192 1,739 3 32 1,189 1,707 - 123 - 74 1.32 1.74 Net earnings per share* * Number of shares outstanding as at 30/06/2006: 983 760 434 (as compared to 903 000 000 as at 30/06/2005) Change + 37% + 17% + 40% + 11% ns + 30% + 17% + 34% - 27% + 26% + 42% + 35% + 46% ns + 44% - 40% + 32% |

39 Gaz de France 2006 First Half Results 12 September 2006 Group Consolidated Balance Sheet as at 30 June 2006 (assets) In millions of euros TOTAL CURRENT ASSETS Other current assets TOTAL NON-CURRENT ASSETS Inventory and work in process Non-current financial assets TOTAL ASSETS Free cash and cash equivalents Non-franchised tangible fixed assets Franchised tangible assets Goodwill and other intangible fixed assets 10,555 1, 216 2,577 3,329 29,073 30,767 957 1,411 1,251 1,495 39,628 43,983 628 315 14,244 15,058 10,698 10,888 1,720 1,951 H1 2005 H1 2006 Investments in companies accounted for by equity method 411 690 Other non-current assets 749 715 Accounts receivable 5,577 6,965 Current derivative instruments 816 1,196 |

40 Gaz de France 2006 First Half Results 12 September 2006 Group Consolidated Balance Sheet as at 30 June 2006 (Liabilities) In millions of euros TOTAL NON-CURRENT LIABILITIES Other non-current assets Non-current derivative instruments Liabilities from franchises SHAREHOLDER EQUITY 18,427 18,543 298 261 26 7 8,417 8,911 12,024 15,466 H1 2005 H1 2006 Minority interests 326 387 Provisions for employee benefits 1,093 1,093 Provisions 1,712 1,771 Deferred tax liability 2,670 2,664 Financial debt (incl. irredeemable securities) 4,211 3,836 TOTAL CURRENT LIABILITIES Debt from financial affiliates Current derivative instruments Financial debt 8,851 9,587 657 378 1,031 1,146 1,297 776 Trade accounts payable and related payables 1,806 2,503 Tax liabilities 474 579 Other tax liabilities 793 964 Other current liabilities 2,179 2,557 Social liabilities 476 526 Provisions 138 158 Net debt ratio Total shareholder equity (including minority interests) Net debt 24 % 8 % 12,350 15,853 2,931 1,283 TOTAL LIABILITIES 39,628 43,983 |

41 Gaz de France 2006 First Half Results 12 September 2006 AA- on CreditWatch with negative implications The negative CreditWatch action on Gaz de France reflects the dilutive impact the merger would have from a credit standpoint--in terms of both business and financial risk--given Suez’s weaker business mix and financial profile, despite the link-up addressing most of the strategic issues faced by Gaz de France. February 27, 2006 Financial Rating On 27 February 2006, following the announcement that Gaz de France and Suez planned to merge, Standard & Poor’s and Moody’s put Gaz de France’s long-term rating on watch, with negative implications Aa1 on Review for possible downgrade Moody’s decision to place Gaz de France’s long term ratings on review for downgrade reflects (1) the group’s merger with a lower rated entity and the inherently greater business and financial risk associated with Suez vis-a-vis GdF’s largely low-risk operations, which could impact the baseline credit assessment, and (2) the possibility of changes to Moody’s assumptions on state support, given that the government’s share in the combined group is likely to be diluted from 80% to possibly below 40%. February 27, 2006 |

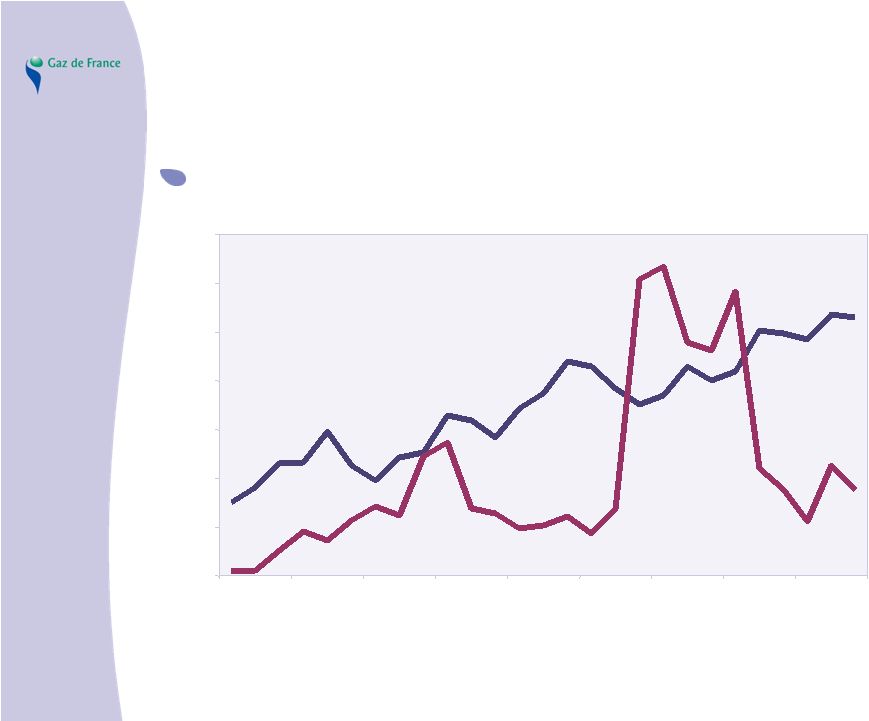

42 Gaz de France 2006 First Half Results 12 September 2006 Oil and Gas Prices The increase in oil and gas prices continues 20 30 40 50 60 70 80 90 June 04 Sept 04 Dec 04 March 05 June 05 Sept 05 Dec 05 March 06 June 06 Brent National Balancing Point |

43 Gaz de France 2006 First Half Results 12 September 2006 Regulated rates Current situation and estimated impact – long-term Brent price 20 25 30 35 40 45 50 55 60 65 70 75 80 Nov 04 Janv05 Mars 05 Mai 05 Juil05 Sept 05 Nov 05 Janv06 Mars 06 Mai 06 Juil06 Sept 06 Nov 06 Janv07 Mars 07 Mai 07 Juil07 Sept 07 Nov 07 Monthly Brent Average 6-month Brent + 70% over 21 months since beginning of trend in November 2004 + 7% over 15 months starting 1 September 2006 Current situation and estimated impact • 5.8% increase as of 1 May 2006 (reflecting* USD 65/barrel and USD 1.30$/€) • Next rate change expected 1 July 2007 • Impact H2 2006: 174 million euros • Estimated impact H1 2007: lower than the H1 2006 impact • No estimated impact H2 2007 Long-term Brent price * Equal to applying formula with 65$ barrel and exchange rate of 1.30 $/€ |

44 Gaz de France 2006 First Half Results 12 September 2006 Regulated rates Two appeals have been filed • An informal appeal to the State (Gaz de France) • A formal appeal (Poweo, FF3C) to the French State Council A formal appeal to the French State Council • Referred to the Council on Competition, asked to: Clarify the concept of overall cost in gas supply Determine whether at-loss sales are occurring • Review by the Council on Competition to begin in the coming months • Conclusion and submission to French State Council for final judgment |