Filed by: Gaz de France

pursuant to Rule 165 and Rule 425(a)

under the Securities Act of 1933, as amended

Subject Company: SUEZ

Exchange Act File Number: 001-15232

Date: October 31, 2006

The following slides were presented by Suez and Gaz de France at a joint press conference on October 30, 2006.

Important Information

This communication does not constitute an offer to purchase or exchange or the solicitation of an offer to sell or exchange any securities of Suez or an offer to sell or exchange or the solicitation of an offer to buy or exchange any securities of Gaz de France, nor shall there be any sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares to be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration.

In connection with the proposed business combination, the required information document will be filed with theAutorité des marchés financiers(“AMF”) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus.Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information.If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site atwww.sec.govand will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website atwww.amf-france.org or directly from Gaz de France on its web site at:www.gazdefrance.com or directly from Suez on its website at:www.suez.com, as the case may be.

Forward-Looking Statements

This communication contains forward-looking information and statements about Gaz de France, Suez and their combined businesses after completion of the proposed business combination. Forward-looking statements are statements that are not historical facts. These statements include financial projections, synergies, cost-savings and estimates and their underlying assumptions, statements regarding plans, objectives, savings, expectations and benefits from the transaction and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares are cautioned that forward-looking information and statements are not guarantees of future performances and are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results, developments, synergies, savings and benefits from the transaction to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with theAutorité des marchés financiers(“AMF”) made by Gaz de France and Suez, including those listed under “Facteurs de Risques” in theDocument deRéférencefiled by Gaz de France with the AMF on May 5, 2006 (under no: R.06-050) and in theDocument de Référenceand its update filed by Suez on April 11, 2006 (under no: D.06-0248), as well as documents filed by Suez with the SEC, including those listed under “Risk Factors” in the Annual Report on Form 20-F for 2006 that Suez filed with the SEC on June 26, 2006. Except as required by applicable law, neither Gaz de France nor Suez undertakes any obligation to update any forward-looking information or statements.

* * * *

Press conference

Merger update:

Proposed structure of the new group

30th October 2006

Disclaimer

Important Information This communication does not constitute an offer to purchase or exchange or the solicitation of an offer to sell or exchange any securities of Suez or an offer to sell or exchange or the solicitation of an offer to buy or exchange any securities of Gaz de France, nor shall there be any sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.The Gaz de France ordinary shares to be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration. In connection with the proposed business combination, the required information document will be filed with the Autorité des marchés financiers (“AMF”) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus. Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information. If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site at www.sec.gov and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website at www.amf-france.org or directly from Gaz de France on its web site at: www.gazdefrance.com or directly from Suez on its website at: www.suez.com, as the case may be.

Forward-Looking Statements This communication contains forward-looking information and statements about Gaz de France, Suez and their combined businesses after completion of the proposed business combination. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with the Autorité des marchés financiers (“AMF”) made by Gaz de France and Suez, including those listed under “Facteurs de Risques” in the Document de Référence filed by Gaz de France on May 5, 2006 (under no: R.06-050) and in the Document de Référence filed by Suez on April 11, 2006 (under no: D.06-0248), as well as under “Risk Factors” in the Annual Report on Form 20-F for 2005 that Suez filed with the SEC on June 26, 2006. Except as required by applicable law, neither Gaz de France nor Suez undertakes any obligation to update any forward-looking information or statements.

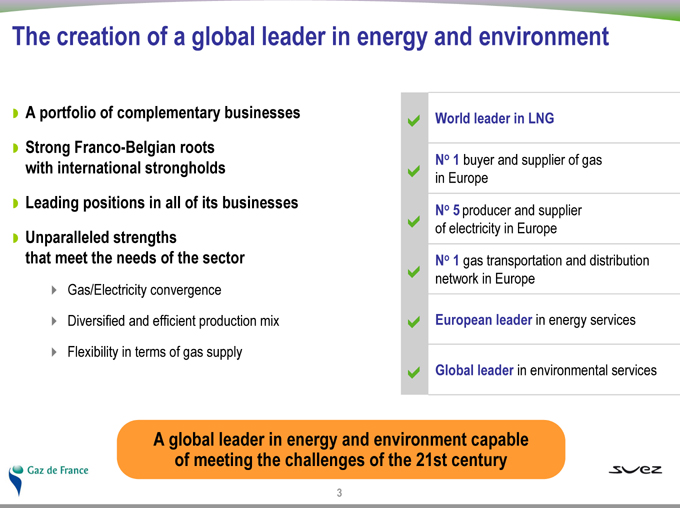

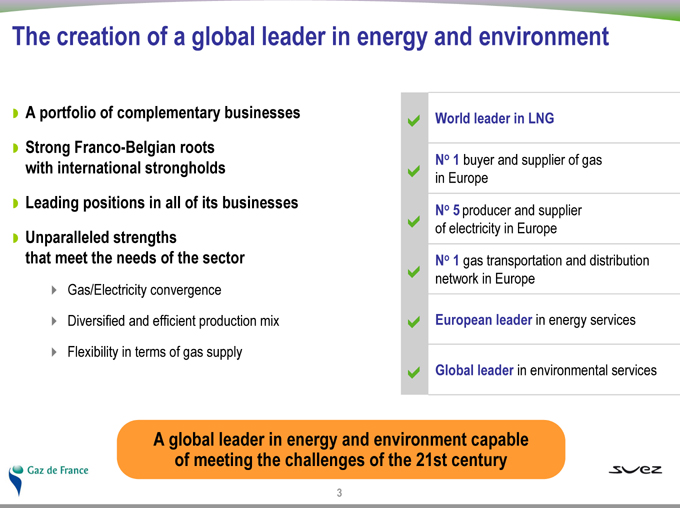

The creation of a global leader in energy and environment

A portfolio of complementary businesses

Strong Franco-Belgian roots with international strongholds

Leading positions in all of its businesses

Unparalleled strengths that meet the needs of the sector

Gas/Electricity convergence

Diversified and efficient production mix

Flexibility in terms of gas supply

World leader in LNG

No 1 buyer and supplier of gas in Europe

No 5 producer and supplier of electricity in Europe

No 1 gas transportation and distribution network in Europe

European leader in energy services

Global leader in environmental services

A global leader in energy and environment capable of meeting the challenges of the 21st century

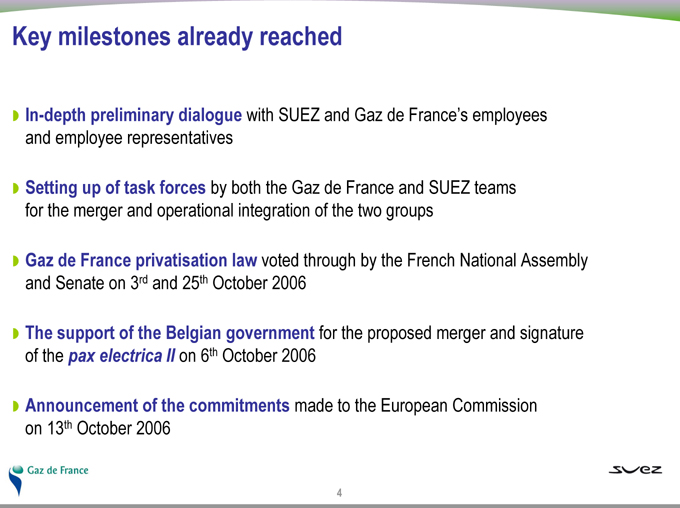

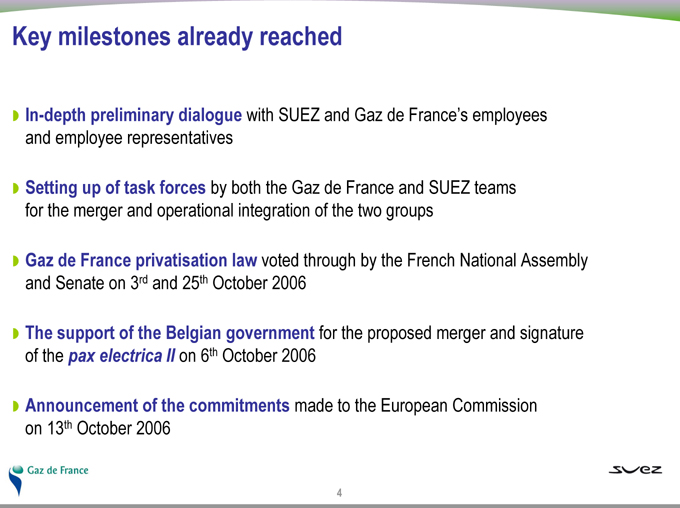

Key milestones already reached

In-depth preliminary dialogue with SUEZ and Gaz de France’s employees and employee representatives

Setting up of task forces by both the Gaz de France and SUEZ teams for the merger and operational integration of the two groups

Gaz de France privatisation law voted through by the French National Assembly and Senate on 3rd and 25th October 2006

The support of the Belgian government for the proposed merger and signature of the pax electrica II on 6th October 2006

Announcement of the commitments made to the European Commission on 13th October 2006

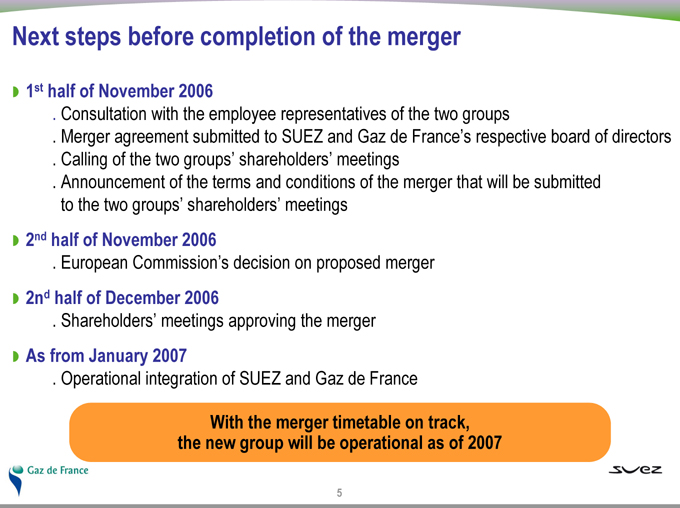

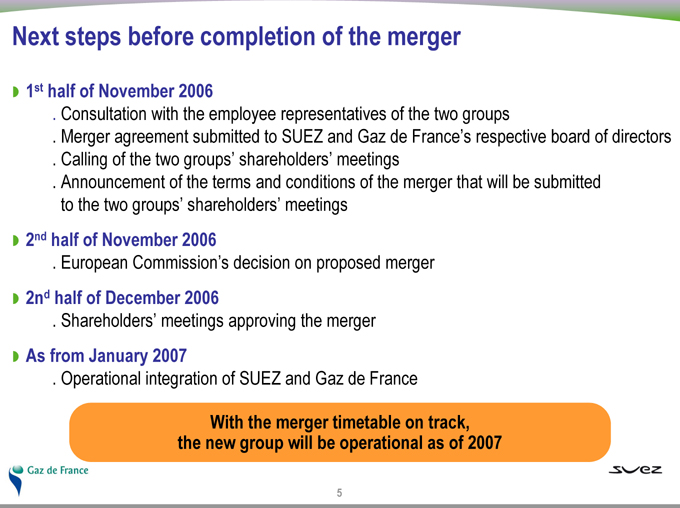

Next steps before completion of the merger

1st half of November 2006

.Consultation with the employee representatives of the two groups

.Merger agreement submitted to SUEZ and Gaz de France’s respective board of directors

Calling of the two groups’ shareholders’ meetings

Announcement of the terms and conditions of the merger that will be submitted to the two groups’ shareholders’ meetings

2nd half of November 2006

.European Commission’s decision on proposed merger

2nd half of December 2006

.Shareholders’ meetings approving the merger

As from January 2007

.Operational integration of SUEZ and Gaz de France

With the merger timetable on track, the new group will be operational as of 2007

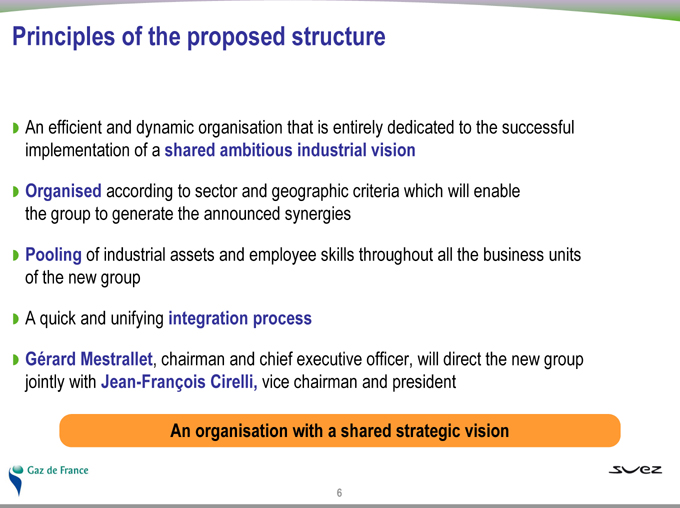

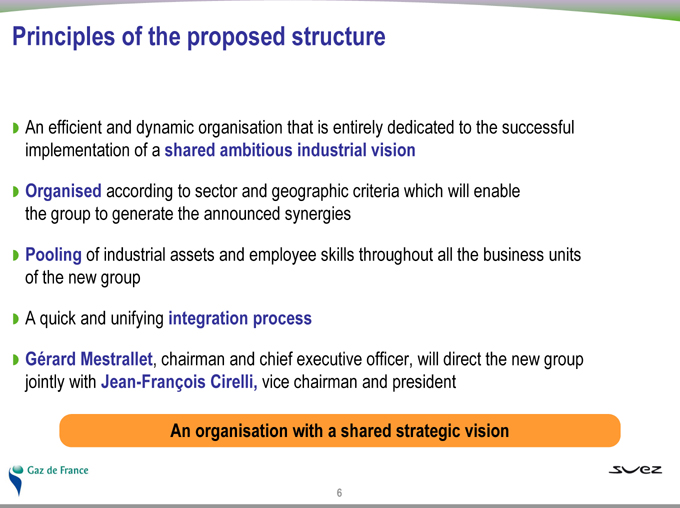

Principles of the proposed structure

An efficient and dynamic organisation that is entirely dedicated to the successful implementation of a shared ambitious industrial vision

Organised according to sector and geographic criteria which will enable the group to generate the announced synergies

Pooling of industrial assets and employee skills throughout all the business units of the new group

A quick and unifying integration process

Gérard Mestrallet, chairman and chief executive officer, will direct the new group jointly with Jean-François Cirelli, vice chairman and president

An organisation with a shared strategic vision

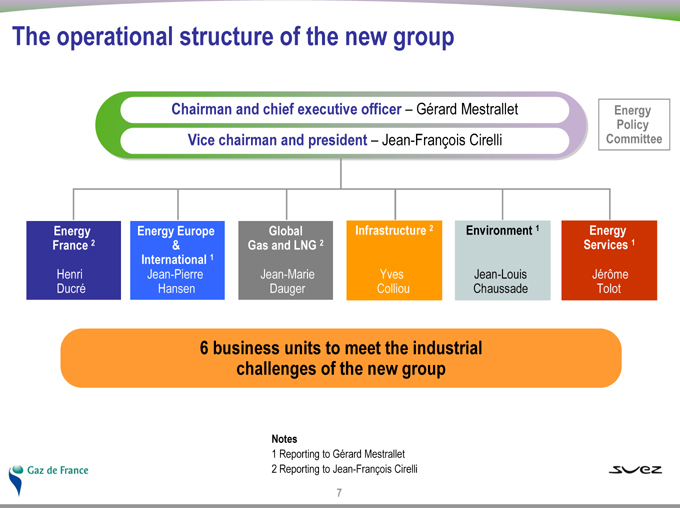

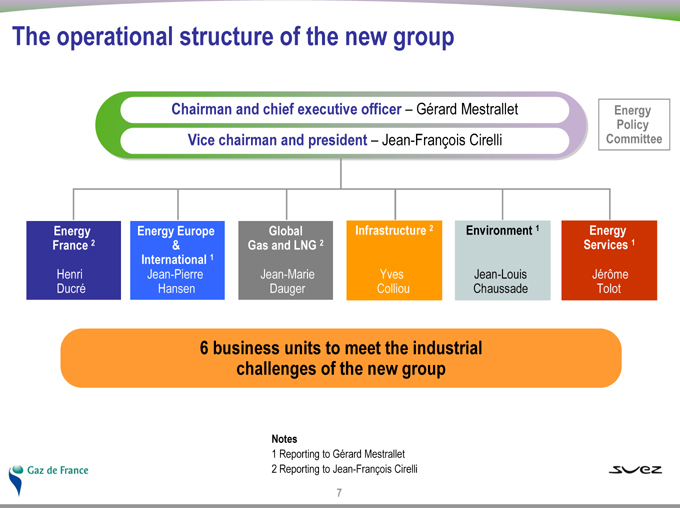

The operational structure of the new group

| | | | |

Chairman and chief executive officer – Gérard Mestrallet | | Energy

Policy

Committee | | |

Vice chairman and president – Jean-François Cirelli | | |

| | | | | | | | | | |

Energy France 2 | | Energy Europe & International 1 | | Global Gas and LNG 2 | | Infrastructure 2 | | Environment 1 | | Energy Services 1 |

Henri | | Jean-Pierre | | Jean-Marie | | Yves | | Jean-Louis | | Jérôme |

Ducré | | Hansen | | Dauger | | Colliou | | Chaussade | | Tolot |

6 business units to meet the industrial challenges of the new group

Notes

1 | | Reporting to Gérard Mestrallet |

2 | | Reporting to Jean-François Cirelli |

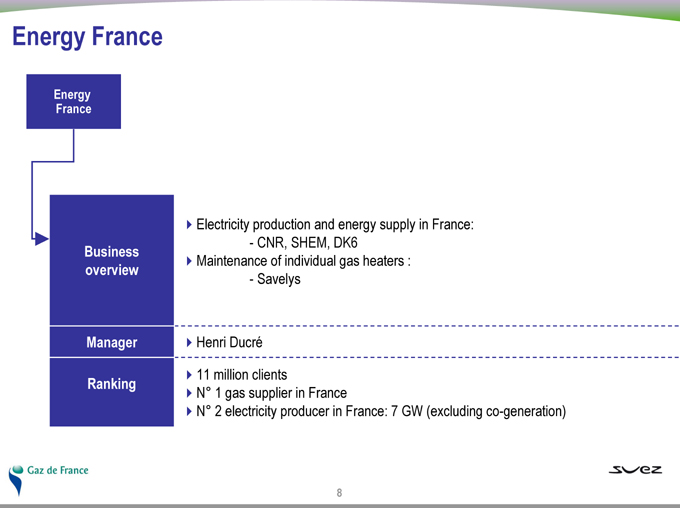

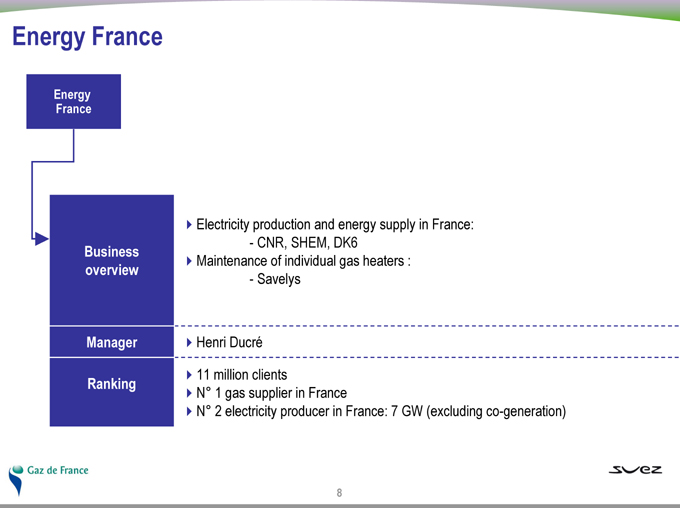

Energy France

Energy France

Business overview

Electricity production and energy supply in France:

- CNR, SHEM, DK6

Maintenance of individual gas heaters :

- Savelys

Manager

Henri Ducré

Ranking

11 million clients

N° 1 gas supplier in France

N° 2 electricity producer in France: 7 GW (excluding co-generation)

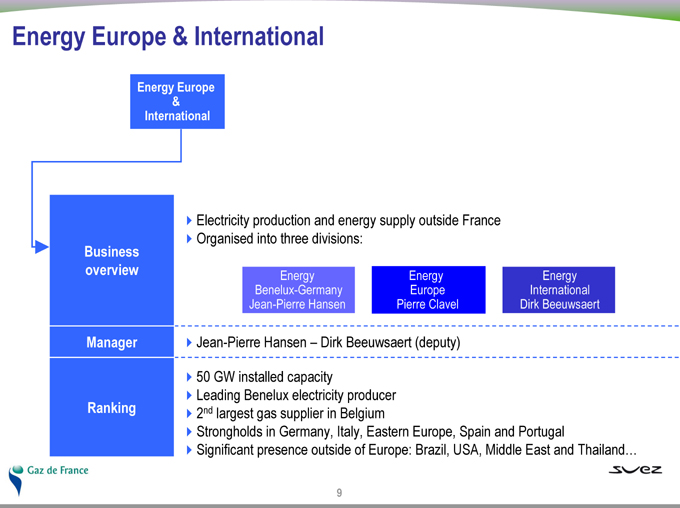

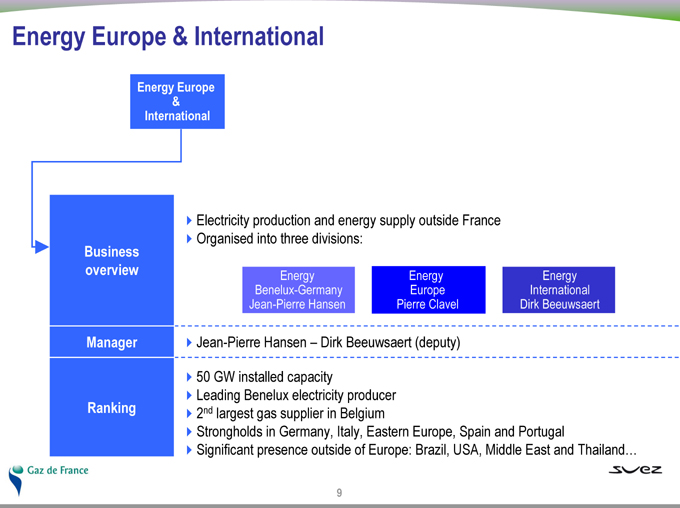

Energy Europe & International

Energy Europe & International

Electricity production and energy supply outside France

Organised into three divisions:

Business overview

| | | | |

Energy | | Energy | | Energy |

Benelux-Germany | | Europe | | International |

Jean-Pierre Hansen | | Pierre Clavel | | Dirk Beeuwsaert |

Manager

Jean-Pierre Hansen – Dirk Beeuwsaert (deputy)

Ranking

50 GW installed capacity

Leading Benelux electricity producer

2nd largest gas supplier in Belgium

Strongholds in Germany, Italy, Eastern Europe, Spain and Portugal

Significant presence outside of Europe: Brazil, USA, Middle East and Thailand…

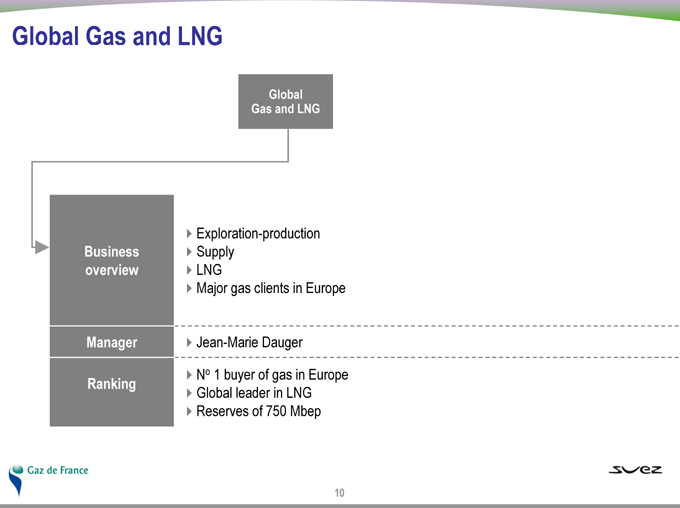

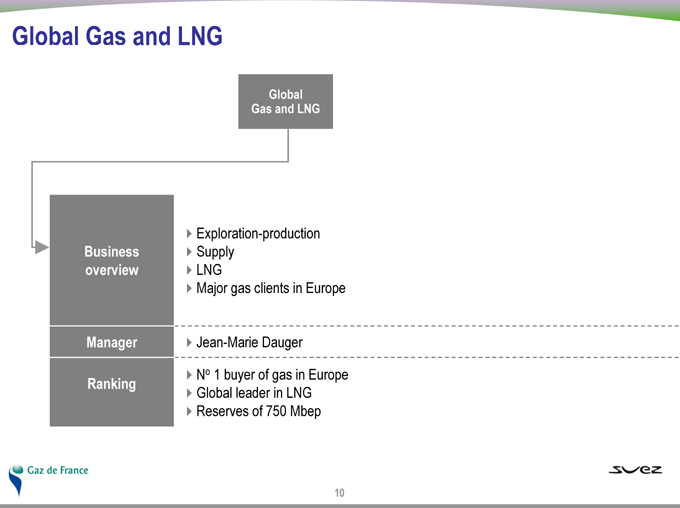

Global Gas and LNG

Global Gas and LNG

Business overview

Exploration-production

Supply

LNG

Major gas clients in Europe

Manager

Jean-Marie Dauger

Ranking

No 1 buyer of gas in Europe

Global leader in LNG

Reserves of 750 Mbep

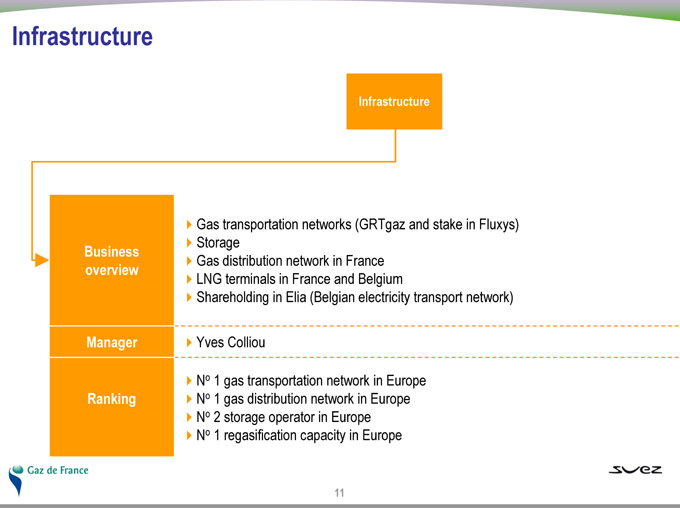

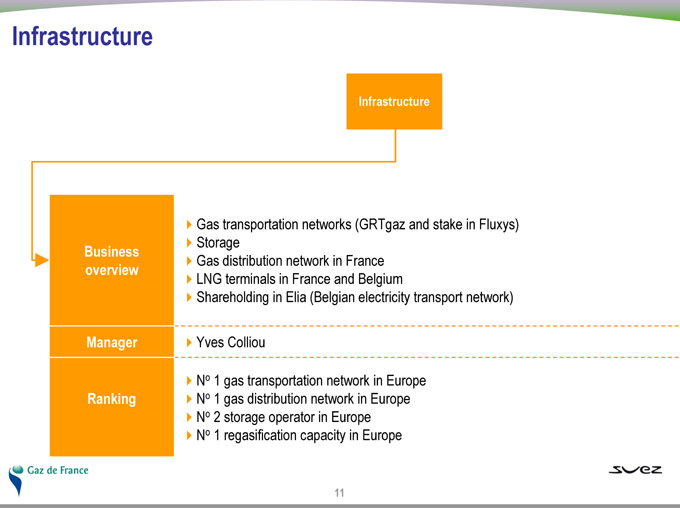

Infrastructure

Infrastructure

Business overview

Gas transportation networks (GRTgaz and stake in Fluxys)

Storage

Gas distribution network in France

LNG terminals in France and Belgium

Shareholding in Elia (Belgian electricity transport network)

Manager

Yves Colliou

Ranking

No 1 gas transportation network in Europe

No 1 gas distribution network in Europe

No 2 storage operator in Europe

No 1 regasification capacity in Europe

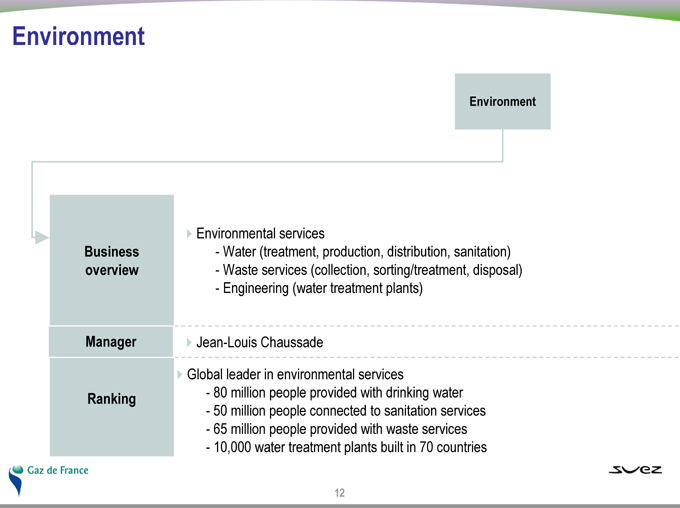

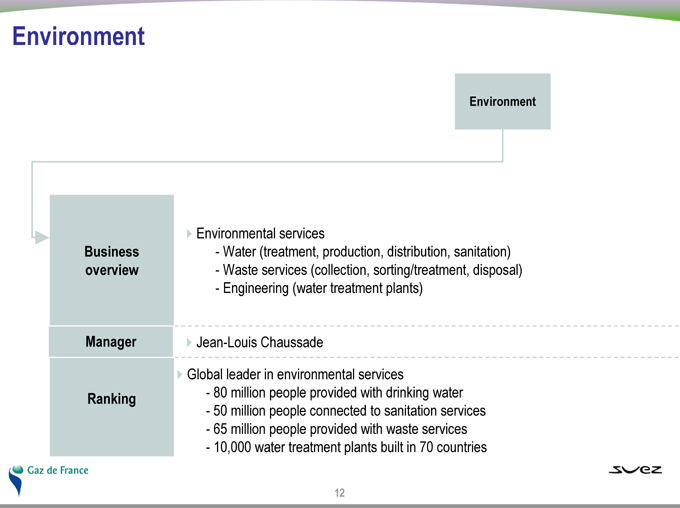

Environment

Environment

Business overview

Environmental services

- | | Water (treatment, production, distribution, sanitation) |

- | | Waste services (collection, sorting/treatment, disposal) |

- | | Engineering (water treatment plants) |

Manager

Jean-Louis Chaussade

Ranking

Global leader in environmental services

- | | 80 million people provided with drinking water |

- | | 50 million people connected to sanitation services |

- | | 65 million people provided with waste services |

- | | 10,000 water treatment plants built in 70 countries |

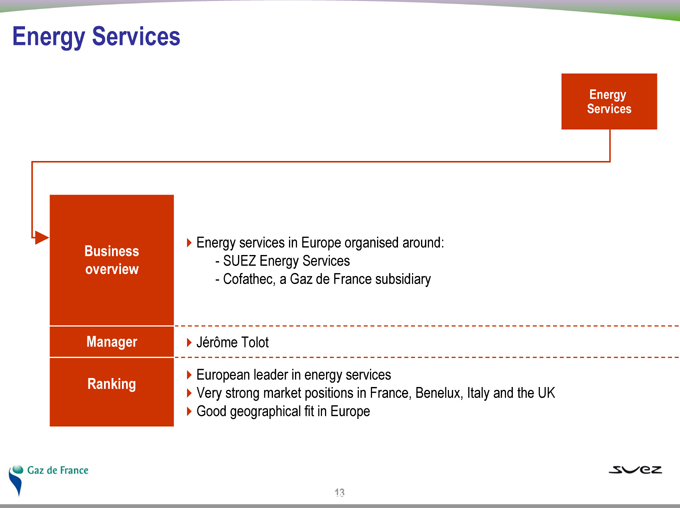

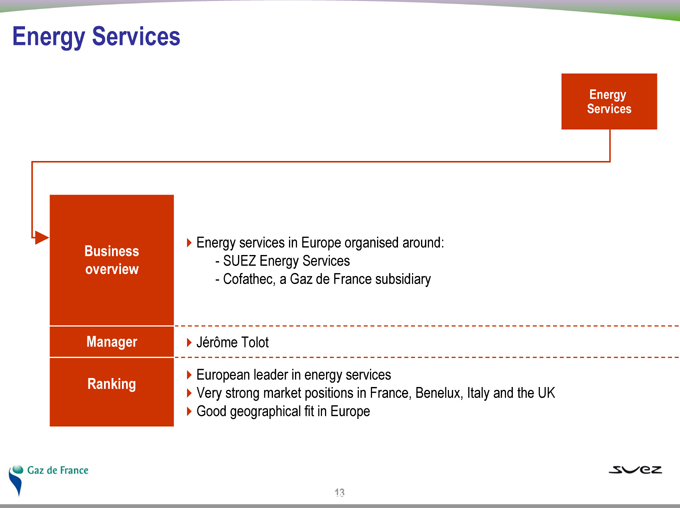

Energy Services

Energy Services

Business overview

Energy services in Europe organised around:

- | | Cofathec, a Gaz de France subsidiary |

Manager

Jérôme Tolot

Ranking

European leader in energy services

Very strong market positions in France, Benelux, Italy and the UK

Good geographical fit in Europe

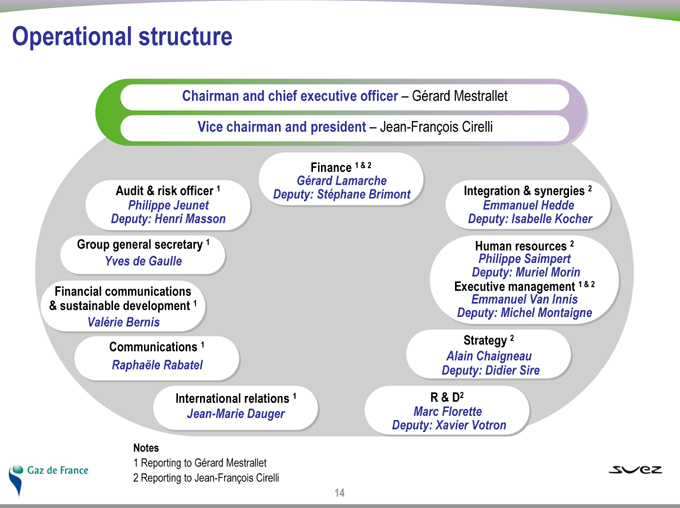

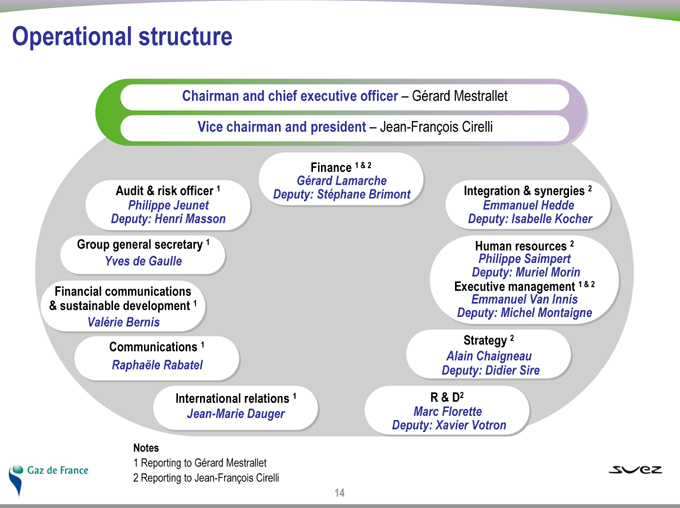

Operational structure

Chairman and chief executive officer – Gérard Mestrallet

Vice chairman and president – Jean-François Cirelli

Finance 1 & 2

Gérard Lamarche

Deputy: Stéphane Brimont

Audit & risk officer 1

Philippe Jeunet

Deputy: Henri Masson

Group general secretary 1

Yves de Gaulle

Financial communications

& sustainable development 1

Valérie Bernis

Communications 1

Raphaële Rabatel

International relations 1

Jean-Marie Dauger

Integration & synergies 2

Emmanuel Hedde

Deputy: Isabelle Kocher

Human resources 2

Philippe Saimpert

Deputy: Muriel Morin

Executive management 1 & 2

Emmanuel Van Innis

Deputy: Michel Montaigne

Strategy 2

Alain Chaigneau

Deputy: Didier Sire

R & D2

Marc Florette

Deputy: Xavier Votron

Notes

1 | | Reporting to Gérard Mestrallet |

2 | | Reporting to Jean-François Cirelli |

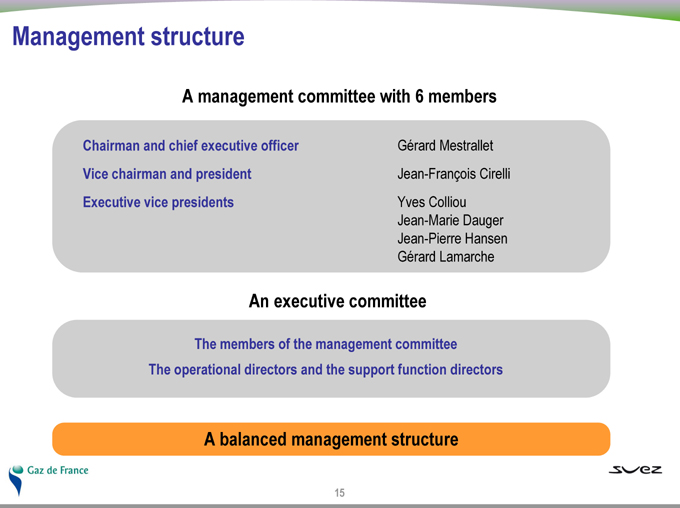

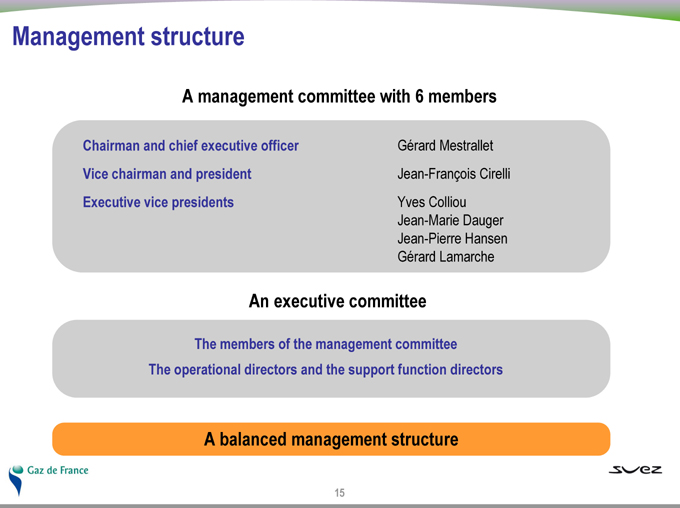

Management structure

A management committee with 6 members

| | |

| |

Chairman and chief executive officer | | Gérard Mestrallet |

| |

Vice chairman and president | | Jean-François Cirelli |

| |

Executive vice presidents | | Yves Colliou |

| |

| | | Jean-Marie Dauger |

| |

| | | Jean-Pierre Hansen |

| |

| | | Gérard Lamarche |

An executive committee

The members of the management committee

The operational directors and the support function directors

A balanced management structure

Press conference

Merger update:

Proposed structure of the new group

30th October 2006