Filed by: Gaz de France

pursuant to Rule 165 and Rule 425(a)

under the Securities Act of 1933, as amended

Subject Company: SUEZ

Exchange Act File Number: 001-15232

Date: December 12, 2007

Amendment to Gaz de France’s Rule 425(a) filing of the press release dated October 15, 2007, as filed with the SEC on October 16, 2007.

Reasons for Filing an Amendment

The following presentation was made available on Gaz de France’s website in connection with the October 15, 2007 joint Gaz de France-Suez press release announcing the operational and financial objectives, corporate governance and timetable of the merger project with Suez. The presentation was inadvertently omitted from the filing of such press release with the Securities and Exchange Commission on October 16, 2007.

Important Information

This communication does not constitute an offer to purchase, sell, or exchange or the solicitation of an offer to sell, purchase, or exchange any securities of Suez, Suez Environment (or any company holding the Suez Environment Shares) or Gaz de France, nor shall there be any offer, solicitation, purchase, sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation, purchase, sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares which would be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration.

In connection with the proposed transactions, the required information document will be filed with theAutorité des marchés financiers(“AMF”) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus.Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information.If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site atwww.sec.gov and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website atwww.amf-france.org or directly from Gaz de France on its web site atwww.gazdefrance.com or directly from Suez on its website atwww.suez.com, as the case may be.

Forward-Looking Statements

This communication contains forward-looking information and statements about Gaz de France, Suez, Suez Environment and their combined businesses after completion of the proposed transactions. Forward-looking statements are statements that are not historical facts. These statements include financial projections, synergies, cost-savings and estimates and their underlying assumptions, statements regarding plans, objectives, savings, expectations and benefits from the transaction and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares are cautioned that forward-looking information and statements are not guarantees of future performances and are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results, developments, synergies, savings and benefits from the proposed transactions to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with theAutorité des marchés financiers(“AMF”) made by Gaz de France and Suez, including those listed under “Facteurs de Risques” in theDocument de Référencefiled by Gaz de France with the AMF on April 27, 2007 (under no: R.07-046) and in theDocument de Référenceand its update filed by Suez on April 4, 2007 (under no: D.07-0272), as well as documents filed by Suez with the SEC, including those listed under “Risk Factors” in the Annual Report on Form 20-F for 2006 that Suez filed with the SEC on June 29, 2007. Except as required by applicable law, neither Gaz de France nor Suez undertakes any obligation to update any forward-looking information or statements.

* * * *

2

GDF SUEZ

Creation of a World Leader in Energy

October 15, 2007

Disclaimer

Important Information

This communication does not constitute an offer or the solicitation of an offer to purchase, sell, or exchange any securities of Suez, Suez Environment securities (or securities of any company holding the Suez Environment Shares) or Gaz de France, nor shall there be any offer, solicitation, purchase, sale or exchange of securities in any jurisdiction (including the U.S., Germany, Italy and Japan) in which it would be unlawful prior to registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares which would be issued in connection with the proposed merger to holders of Suez ordinary shares (including Suez American Depositary Shares (ADRs)) may not be offered or sold in the U.S. except pursuant to an effective registration statement under the U.S. Securities Act of 1933, as amended, or pursuant to a valid exemption from registration. The Suez Environment Shares (or the shares of any company holding the Suez Environment Shares) have not been and will not be registered under the US Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an exemption from registration.

In connection with the proposed transactions, the required information document will be filed with the Autorité des marchés financiers (AMF) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the U.S., Gaz de France may file with the U.S. Securities and Exchange Commission (SEC), a registration statement on Form F-4, which will include a prospectus. Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any related amendments and supplements, because they will contain important information. If and when filed, investors may obtain free copies of the registration statement, the prospectus and other relevant documents filed with the SEC at www.sec.gov and will receive information at an appropriate time on how to obtain these documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at www.amf-france.org or directly from Gaz de France or Suez at www.gazdefrance.com or www.suez.com, as the case may be.

Forward-Looking Statements

This communication contains forward-looking information and statements about Gaz de France, Suez, Suez Environment and their combined businesses after completion of the proposed transactions. Forward-looking statements are statements that are not historical facts. These statements include financial projections, synergies, cost-savings and estimates and their underlying assumptions, statements regarding plans, objectives, savings, expectations and benefits from the transaction and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expects,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares and Suez ADRs are cautioned that forward-looking information and statements are not guarantees of future performances and are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results, developments, synergies, savings and benefits from the proposed transactions to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with the Autorité des marchés financiers (“AMF”) made by Gaz de France and Suez, including under “Facteurs de Risques” in the Document de Référence filed by Gaz de France with the AMF on April 27, 2007 (under no: R.07-046) and in the Document de Référence and its update filed by Suez on April 4, 2007 (under no: D.07-0272), as well as documents filed with the SEC, including under “Risk Factors” in the Annual Report on Form 20-F for 2006 filed by Suez on June 29, 2007. Except as required by applicable law, neither Gaz de France nor Suez undertakes any obligation to update any forward-looking information or statements.

Gaz de France

SUEZ

Table of contents

1. Creation of a world leader in energy

2. Transaction terms and timetable

3. An ambitious and value-creating project

4. A corporate governance in line with best practices

5. Listing of SUEZ Environment, a reference player in water and waste management services

6. Conclusion

Gaz de France

SUEZ

Creation of a world leader in energy

Gaz de France

SUEZ

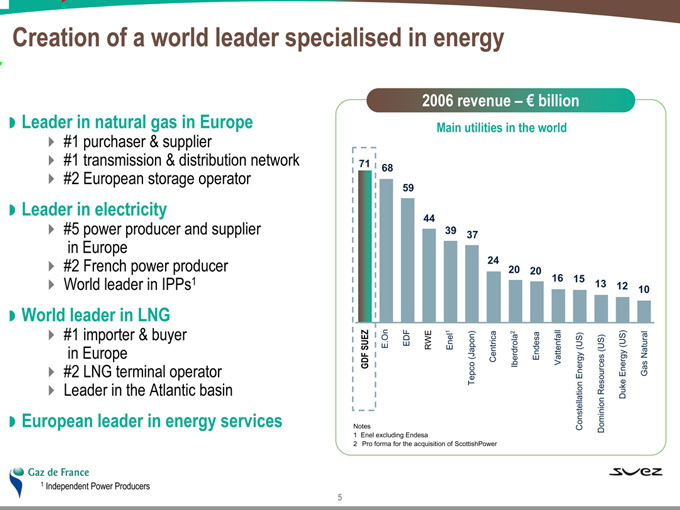

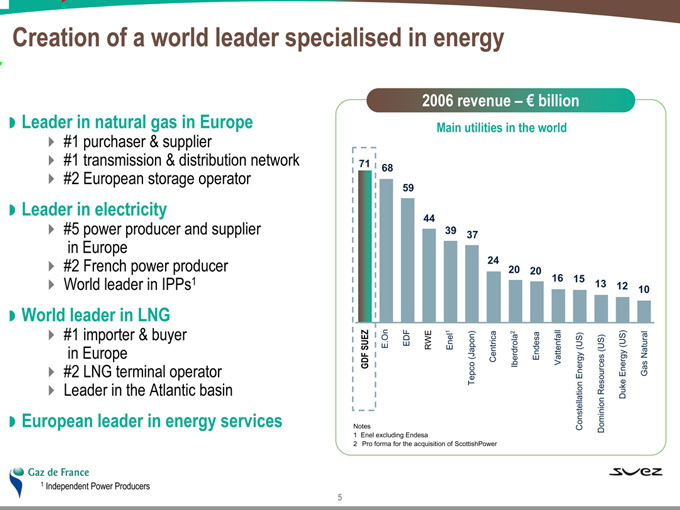

Creation of a world leader specialised in energy

Leader in natural gas in Europe

#1 purchaser & supplier

#1 transmission & distribution network

#2 European storage operator

Leader in electricity

#5 power producer and supplier in Europe

#2 French power producer

World leader in IPPs1

World leader in LNG

#1 importer & buyer in Europe

#2 LNG terminal operator

Leader in the Atlantic basin

European leader in energy services

2006 revenue – € billion

Main utilities in the world

71 68 59

44

39 37

24 20 20

16 15

13 12 10

GDF SUEZ

E.On

EDF

RWE

Enel1

Tepco (Japon)

Centrica

Iberdrola2

Endesa

Vattenfall

Constellation Energy (US)

Dominion Resources (US)

Duke Energy (US)

Gas Natural

Notes

1 Enel excluding Endesa

2 Pro forma for the acquisition of ScottishPower

Gaz de France

SUEZ

1 Independent Power Producers

An industrial player with powerful assets

A unique combination of businesses

Active in the entire energy value chain

Multi-energy offering

Strategic fit between the energy and services businesses

Strong flexibility in energy generation and supply

Diversified and efficient power generation mix

Strong capacity for gas-electricity arbitrage

Diversified gas supplies with a strong LNG component

Optimisation at a global scale (LNG) and on the European market (storage)

A major player in sustainable development

CO2 light generation capacities

High portion of renewable energies

Significant strategic leverage

Strong commercial opportunities

Gaz de France

SUEZ

Transaction terms and timetable

Gaz de France

SUEZ

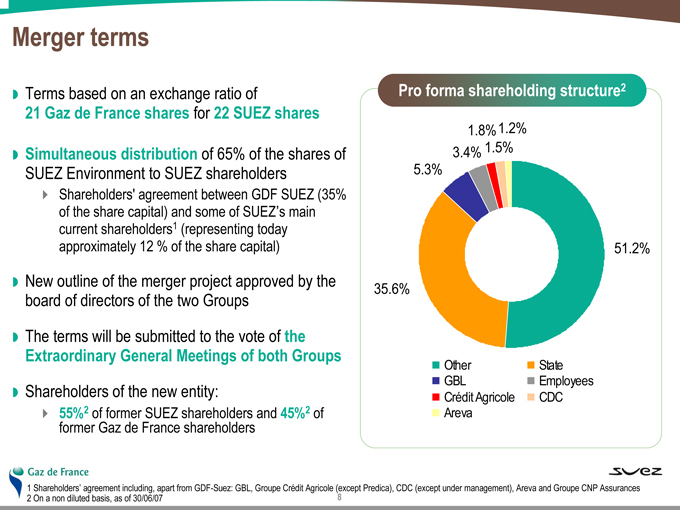

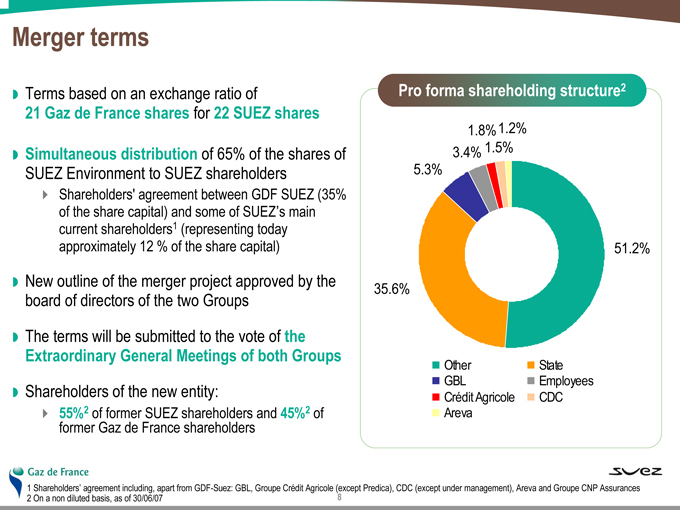

Merger terms

Terms based on an exchange ratio of 21 Gaz de France shares for 22 SUEZ shares

Simultaneous distribution of 65% of the shares of SUEZ Environment to SUEZ shareholders

Shareholders’ agreement between GDF SUEZ (35% of the share capital) and some of SUEZ’s main current shareholders1 (representing today approximately 12% of the share capital)

New outline of the merger project approved by the board of directors of the two Groups

The terms will be submitted to the vote of the Extraordinary General Meetings of both Groups

Shareholders of the new entity:

55%2 of former SUEZ shareholders and 45%2 of former Gaz de France shareholders

Pro forma shareholding structure2

1.8% 1.2% 3.4% 1.5% 5.3%

51.2%

35.6%

Other

GBL

Crédit Agricole Areva

State

Employees CDC

Gaz de France

SUEZ

1 Shareholders’ agreement including, apart from GDF-Suez: GBL, Groupe Crédit Agricole (except Predica), CDC (except under management), Areva and Groupe CNP Assurances

2 On a non diluted basis, as of 30/06/07

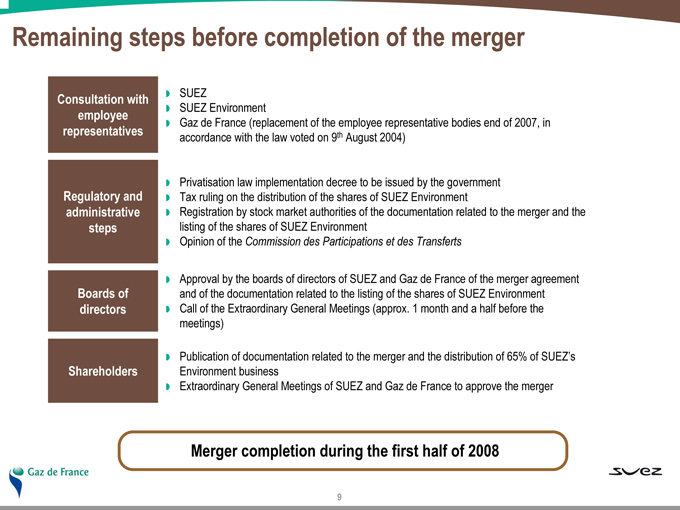

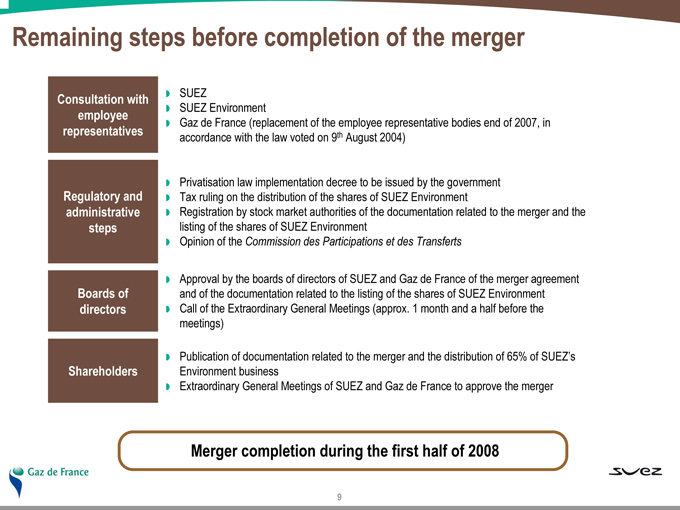

Remaining steps before completion of the merger

Consultation with employee representatives

SUEZ

SUEZ Environment

Gaz de France (replacement of the employee representative bodies end of 2007, in accordance with the law voted on 9th August 2004)

Regulatory and administrative steps

Privatisation law implementation decree to be issued by the government

Tax ruling on the distribution of the shares of SUEZ Environment

Registration by stock market authorities of the documentation related to the merger and the listing of the shares of SUEZ Environment

Opinion of the Commission des Participations et des Transferts

Boards of directors

Approval by the boards of directors of SUEZ and Gaz de France of the merger agreement and of the documentation related to the listing of the shares of SUEZ Environment

Call of the Extraordinary General Meetings (approx. 1 month and a half before the meetings)

Shareholders

Publication of documentation related to the merger and the distribution of 65% of SUEZ’s Environment business

Extraordinary General Meetings of SUEZ and Gaz de France to approve the merger

Merger completion during the first half of 2008

Gaz de France

SUEZ

An ambitious and value-creating industrial project

Gaz de France

SUEZ

An ambitious development strategy

Consolidate leadership positions in domestic markets:

France

Benelux

Leverage complementarities to strengthen customer offerings:

Dual gas / electricity offers

Innovative energy services

Boost its ambitious strategy of industrial development notably in:

Upstream gas activities (E&P, LNG)

Infrastructures

Power generation, in particular nuclear and renewable energies

Accelerate growth in all business lines in Europe

Strengthen development areas internationally (Brazil, Thailand, the USA, Middle-East, Turkey, Russia…)

Development of the IPP business in new fast-growing markets

A combination consistent with both Groups’ strategies and allowing to boost their development

Gaz de France

SUEZ

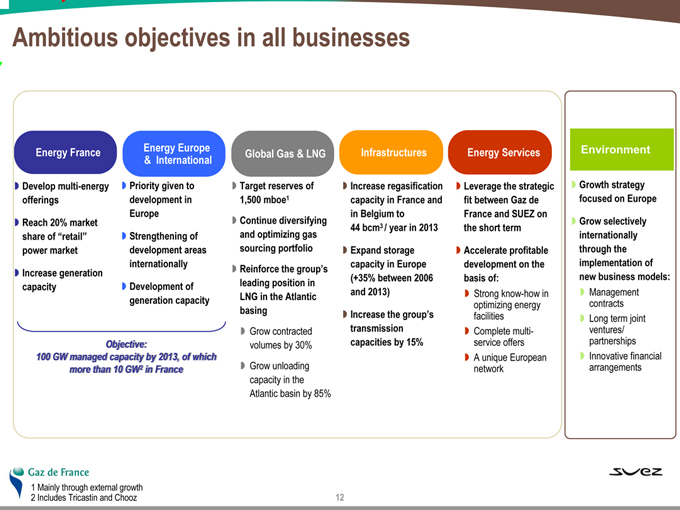

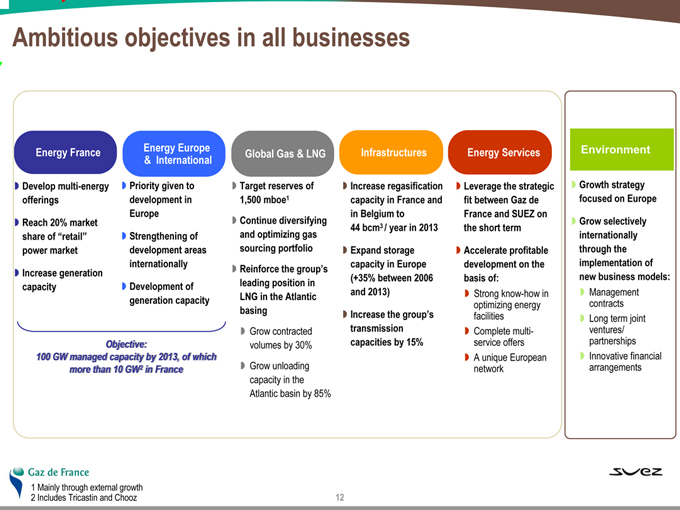

Ambitious objectives in all businesses

Energy France

Develop multi-energy offerings

Reach 20% market share of “retail” power market

Increase generation capacity

Energy Europe & International

Priority given to development in Europe

Strengthening of development areas internationally

Development of generation capacity

Objective:

100 GW managed capacity by 2013, of which more than 10 GW2 in France

Global Gas & LNG

Target reserves of 1,500 mboe1

Continue diversifying and optimizing gas sourcing portfolio

Reinforce the group’s leading position in LNG in the Atlantic basing

Grow contracted volumes by 30%

Grow unloading capacity in the Atlantic basin by 85%

Infrastructures

Increase regasification capacity in France and in Belgium to 44 bcm3 / year in 2013

Expand storage capacity in Europe (+35% between 2006 and 2013)

Increase the group’s transmission capacities by 15%

Energy Services

Leverage the strategic fit between Gaz de France and SUEZ on the short term

Accelerate profitable development on the basis of:

Strong know-how in optimizing energy facilities

Complete multi-service offers

A unique European network

Environment

Growth strategy focused on Europe

Grow selectively internationally through the implementation of new business models:

Management contracts

Long term joint ventures/ partnerships

Innovative financial arrangements

Gaz de France

1 Mainly through external growth

2 Includes Tricastin and Chooz

SUEZ

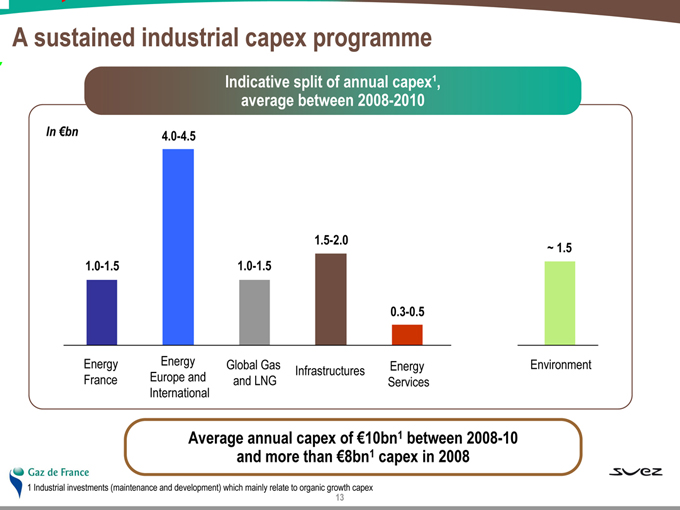

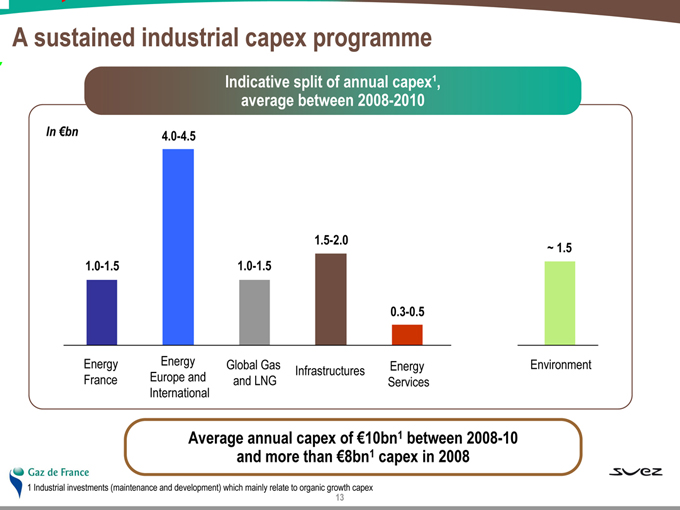

A sustained industrial capex programme

Indicative split of annual capex¹, average between 2008-2010

In €bn

1.0-1.5

Energy France

4.0-4.5

Energy Europe and International

1.0-1.5

Global Gas and LNG

1.5-2.0

Infrastructures

0.3-0.5

Energy Services

~ 1.5

Environment

Average annual capex of €10bn1 between 2008-10 and more than €8bn1 capex in 2008

Gaz de France

1 Industrial investments (maintenance and development) which mainly relate to organic growth capex

SUEZ

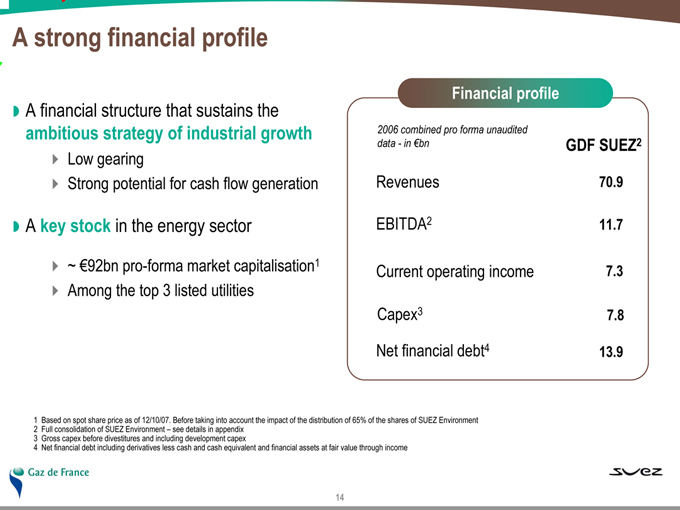

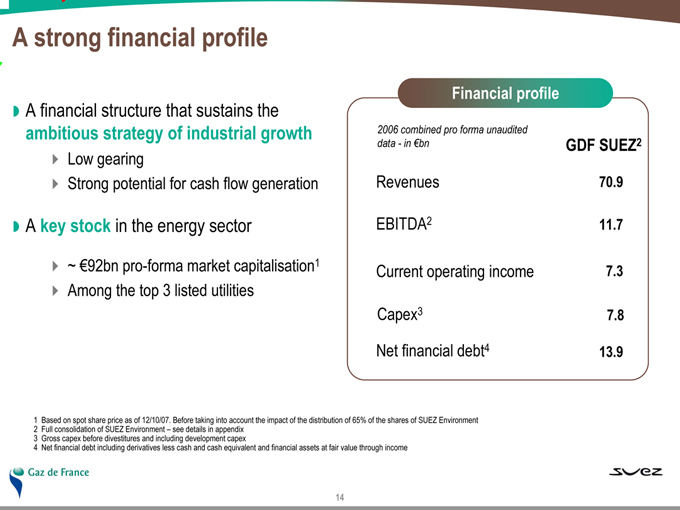

A strong financial profile

A financial structure that sustains the ambitious strategy of industrial growth

Low gearing

Strong potential for cash flow generation

A key stock in the energy sector

~ €92bn pro-forma market capitalisation1

Among the top 3 listed utilities

1 Based on spot share price as of 12/10/07. Before taking into account the impact of the distribution of 65% of the shares of SUEZ Environment

2 Full consolidation of SUEZ Environment – see details in appendix

3 Gross capex before divestitures and including development capex

4 Net financial debt including derivatives less cash and cash equivalent and financial assets at fair value through income

Financial profile

2006 combined pro forma unaudited data - in €bn

Revenues

EBITDA2

Current operating income

Capex3

Net financial debt4

GDF SUEZ2

70.9

11.7

7.3

7.8

13.9

Gaz de France

SUEZ

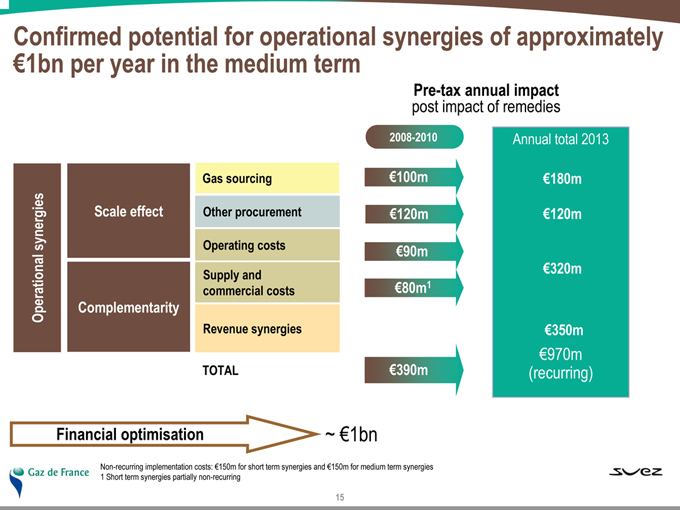

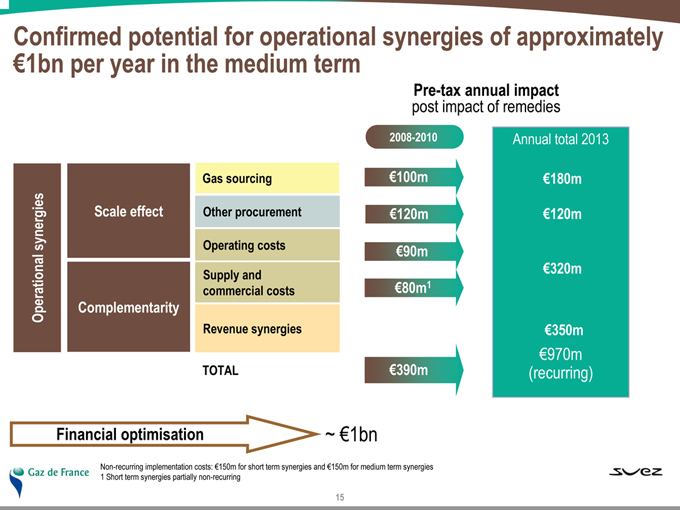

Confirmed potential for operational synergies of approximately €1bn per year in the medium term

Operational synergies

Scale effect

Complementarity

Gas sourcing

Other procurement

Operating costs

Supply and commercial costs

Revenue synergies

Pre-tax annual impact post impact of remedies

2008-2010

€100m

€120m

€90m

€80m1

€390m

Annual total 2013

€180m

€120m

€320m

€350m

€970m (recurring)

Financial optimisation ~ €1bn

Non-recurring implementation costs: €150m for short term synergies and €150m for medium term synergies

1 Short term synergies partially non-recurring

Gaz de France

SUEZ

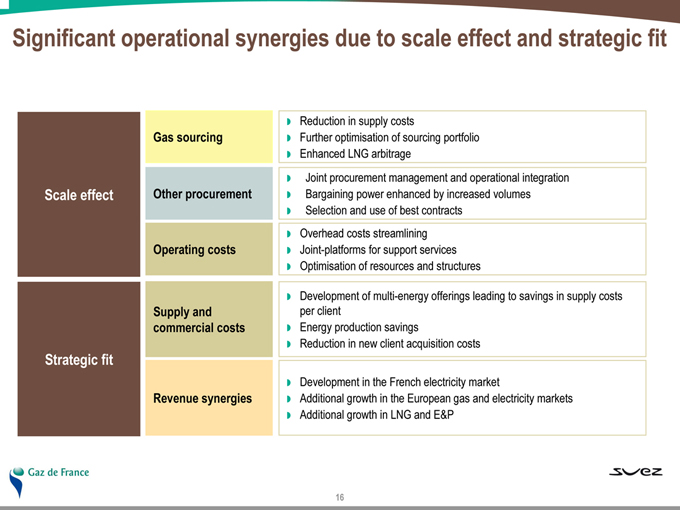

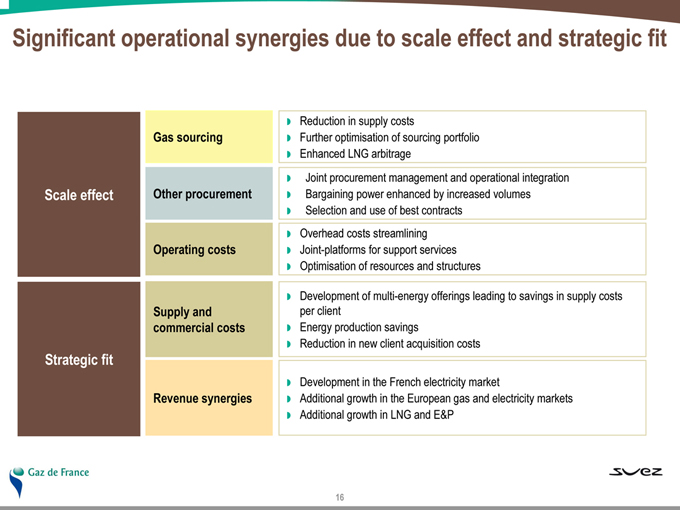

Significant operational synergies due to scale effect and strategic fit

Scale effect

Gas sourcing

Other procurement

Operating costs

Reduction in supply costs

Further optimisation of sourcing portfolio

Enhanced LNG arbitrage

Joint procurement management and operational integration

Bargaining power enhanced by increased volumes

Selection and use of best contracts

Overhead costs streamlining

Joint-platforms for support services

Optimisation of resources and structures

Strategic fit

Supply and commercial costs

Revenue synergies

Development of multi-energy offerings leading to savings in supply costs per client

Energy production savings

Reduction in new client acquisition costs

Development in the French electricity market

Additional growth in the European gas and electricity markets

Additional growth in LNG and E&P

Gaz de France

SUEZ

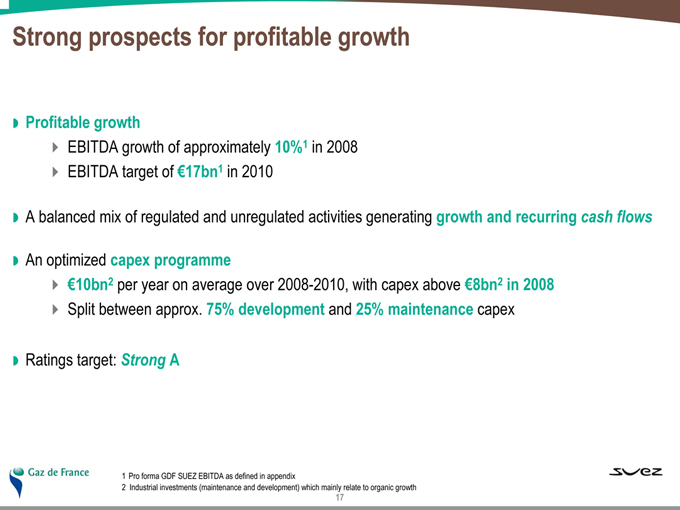

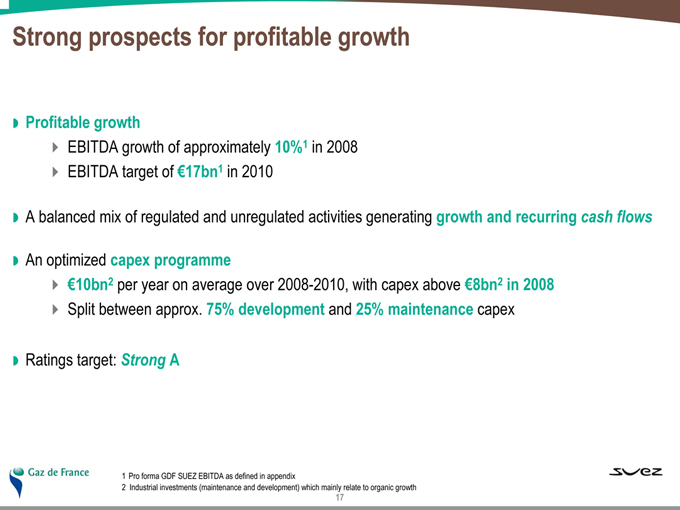

Strong prospects for profitable growth

Profitable growth

EBITDA growth of approximately 10%1 in 2008

EBITDA target of €17bn1 in 2010

A balanced mix of regulated and unregulated activities generating growth and recurring cash flows

An optimized capex programme

€10bn2 per year on average over 2008-2010, with capex above €8bn2 in 2008

Split between approx. 75% development and 25% maintenance capex

Ratings target: Strong A

1 Pro forma GDF SUEZ EBITDA as defined in appendix

2 Industrial investments (maintenance and development) which mainly relate to organic growth

Gaz de France

SUEZ

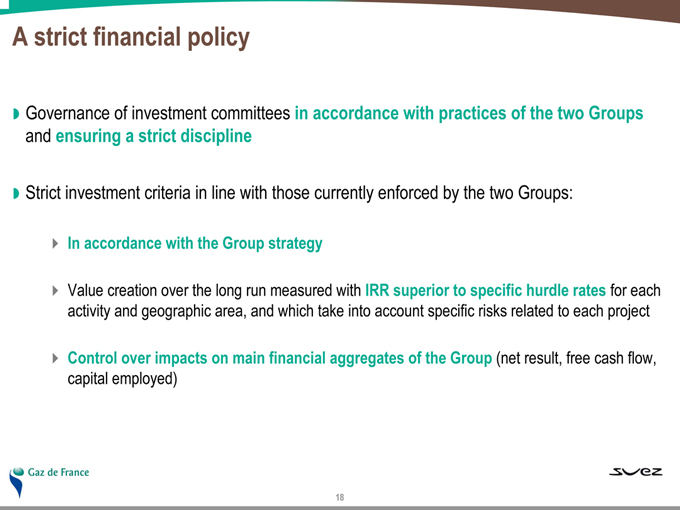

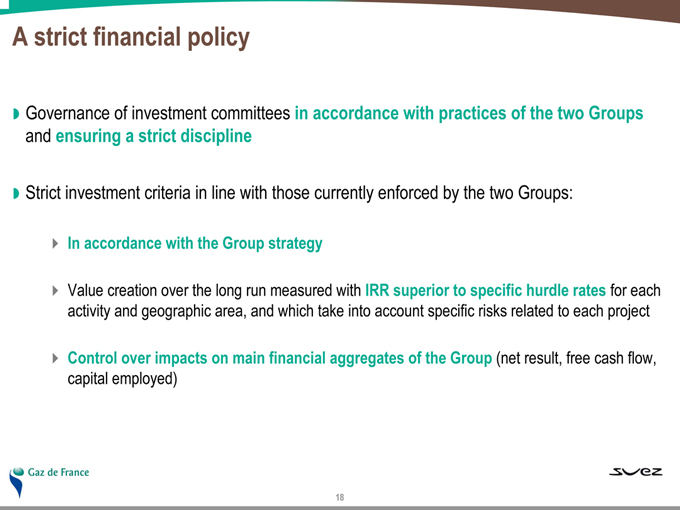

A strict financial policy

Governance of investment committees in accordance with practices of the two Groups and ensuring a strict discipline

Strict investment criteria in line with those currently enforced by the two Groups:

In accordance with the Group strategy

Value creation over the long run measured with IRR superior to specific hurdle rates for each activity and geographic area, and which take into account specific risks related to each project

Control over impacts on main financial aggregates of the Group (net result, free cash flow, capital employed)

Gaz de France

SUEZ

An attractive stock for shareholders

Dynamic dividend policy targeting an attractive yield compared to the sector average

Target payout ratio: above 50% of recurring Group net income

Average annual growth in dividend per share of 10% to 15% between dividend paid in 20071 and dividend paid in 2010

Additional shareholder return and financial optimisation

Exceptional dividends and share buy-backs

Enhanced stock market status

Reference utilities stock (among top 3 in Europe)

Increased weighting of GDF SUEZ in stock market indices (one of the 20 largest companies in the Eurostoxx 50 by size of free float)

1 Based on the Gaz de France dividend paid in 2007 and related to fiscal year 2006 (€1.1 per share); SUEZ shareholders will also benefit from the dividend distributed by SUEZ Environment

Gaz de France

SUEZ

A corporate governance in line with best practices

Gaz de France

SUEZ

A balanced corporate governance structure

Board of Directors including 24 members:

At least 1/3 independent Directors1

10 Directors nominated by Suez

including Chairman and Chief Executive Officer

Gérard Mestrallet

10 Directors nominated by Gaz de France

including Vice Chairman and President

Jean-François Cirelli

including 7 members appointed by the French State

as per French law

4 Employee Representatives

incl. 3 Directors elected by employees and 1 Director elected by GM representing employee shareholders

5 Board Committees each of which will be presided over by an Independent Board Director

Audit Committee, Nomination Committee, Compensation Committee, Ethics, Environment and Sustainable Development Committee and Strategy and Investments Committee

1 According to Bouton Report

Gaz de France

SUEZ

Listing of SUEZ Environment, a reference player in water and waste management services

Gaz de France

SUEZ

SUEZ Environment, a reference player in water and waste management services

A leader in Europe and the world

Global management of the entire water and waste management cycles

Leading positions

68 millions drinking water customers

44 millions sanitation services customers

47 millions waste services customers

1 billion customers served by a Degrémont serviced installation

A European-focused strategy combined with selective international expansion

Key expertise areas, worldwide technical excellence, dynamic research and development

Attractive growth prospects combined with strong cash flow generation predictability

Creation of a reference player in environmental services businesses benefiting from an attractive stock market positioning

Gaz de France

SUEZ

SUEZ Environment, attractive growth prospects

Attractive growth opportunities in favourable market conditions

Growing demand for environmental solutions in context of resources rarefaction (water resources management, waste recycling…)

Increasingly stringent environmental norms

Strong demand for cutting edge value added solutions

Water: desalination, sludge treatment, re-use of waste water…

Waste: metals recycling, deconstruction (ships, planes…), methanisation…

Dynamic development strategy sustained by global leadership position

Strong sales force supported by historical partnership strategy (Spain, Italy, Middle East, China…)

Ability to acquire and integrate profitable external growth opportunities

Gaz de France

SUEZ

Conclusion

Gaz de France

SUEZ

A project on track to deliver high value-creation for shareholders

Creation of a global leader in Energy with powerful assets

Acceleration of growth and profitability prospects

Clearly identified synergies

Dynamic shareholder return

Implementation of best practice corporate governance

Gaz de France

SUEZ

Appendices

Gaz de France

SUEZ

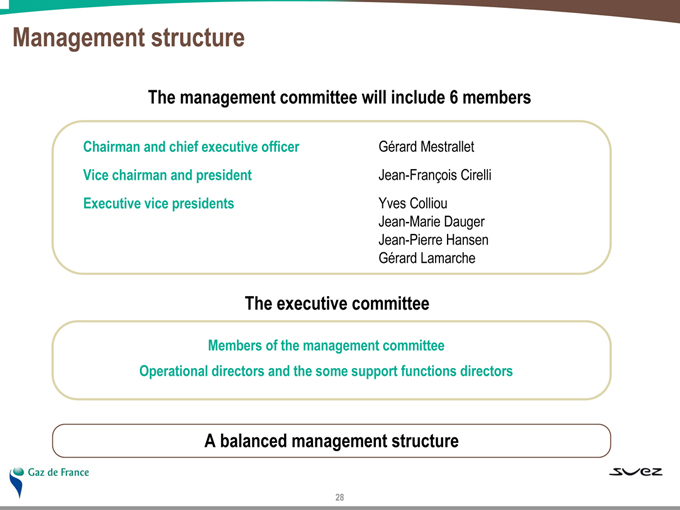

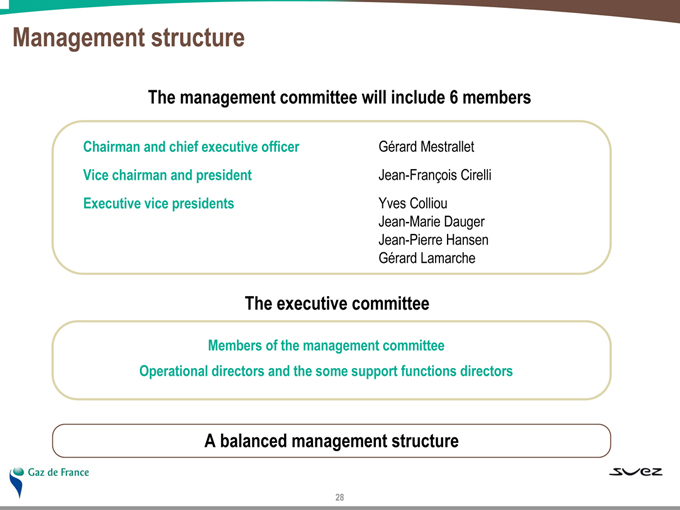

Management structure

The management committee will include 6 members

Chairman and chief executive officer

Gérard Mestrallet

Vice chairman and president

Jean-François Cirelli

Executive vice presidents

Yves Colliou Jean-Marie Dauger Jean-Pierre Hansen Gérard Lamarche

The executive committee

Members of the management committee

Operational directors and the some support functions directors

A balanced management structure

Gaz de France

SUEZ

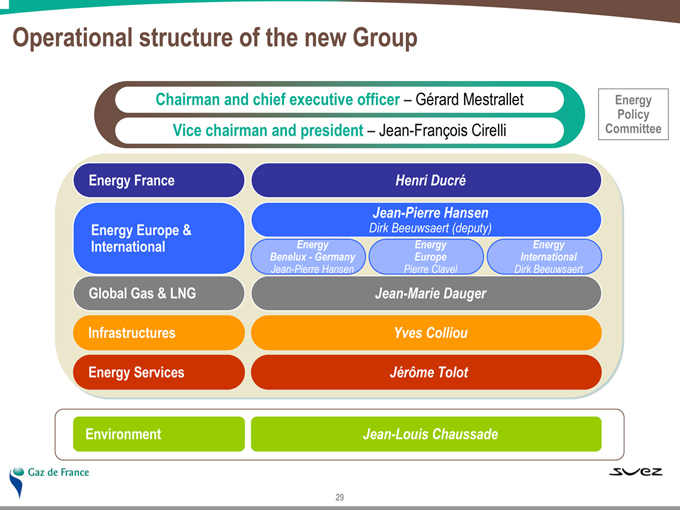

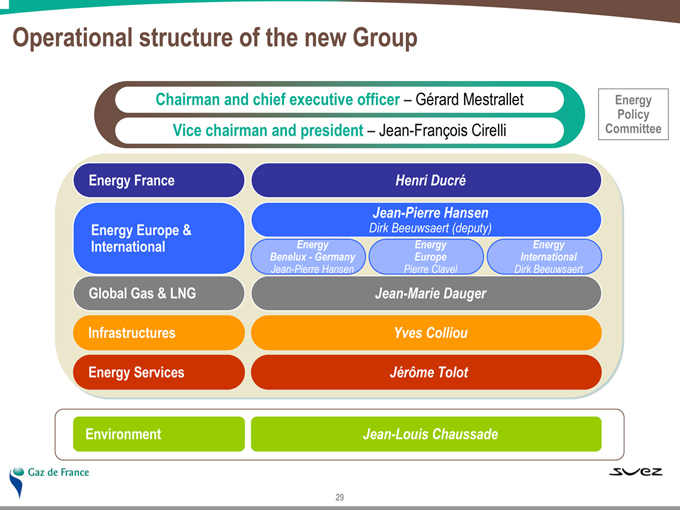

Operational structure of the new Group

Chairman and chief executive officer – Gérard Mestrallet

Vice chairman and president – Jean-François Cirelli

Energy Policy Committee

Energy France

Henri Ducré

Energy Europe & International

Jean-Pierre Hansen

Dirk Beeuwsaert (deputy)

Energy

Benelux—Germany

Jean-Pierre Hansen

Energy Europe

Pierre Clavel

Energy International

Dirk Beeuwsaert

Global Gas & LNG

Jean-Marie Dauger

Infrastructures

Yves Colliou

Energy Services

Jérôme Tolot

Environment

Jean-Louis Chaussade

Gaz de France

SUEZ

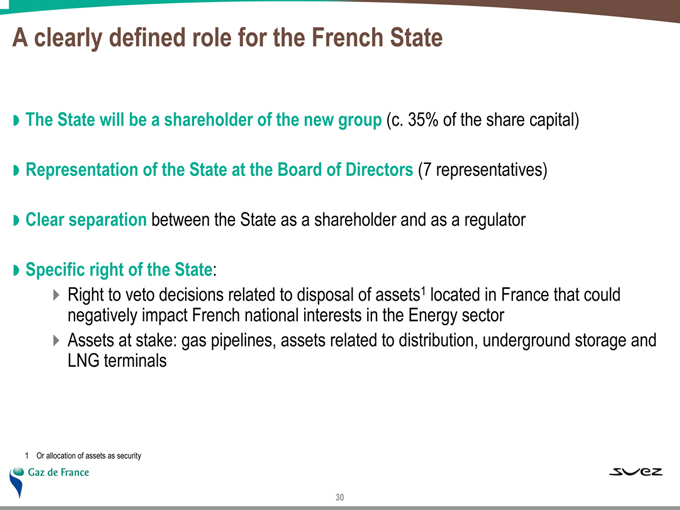

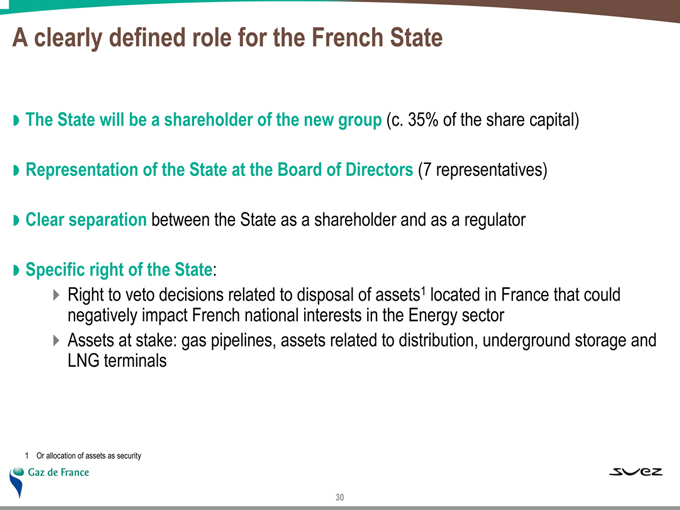

A clealydefined role for the French State

The State will be a shareholder of the new group (c. 35% of the share capital)

Representation of the State at the Board of Directors (7 representatives)

Clear separation between the State as a shareholder and as a regulator

Specific right of the State:

Right to veto decisions related to disposal of assets1 located in France that could negatively impact French national interests in the Energy sector

Assets at stake: gas pipelines, assets related to distribution, underground storage and LNG terminals

1 Or allocation of assets as security

Gaz de France

SUEZ

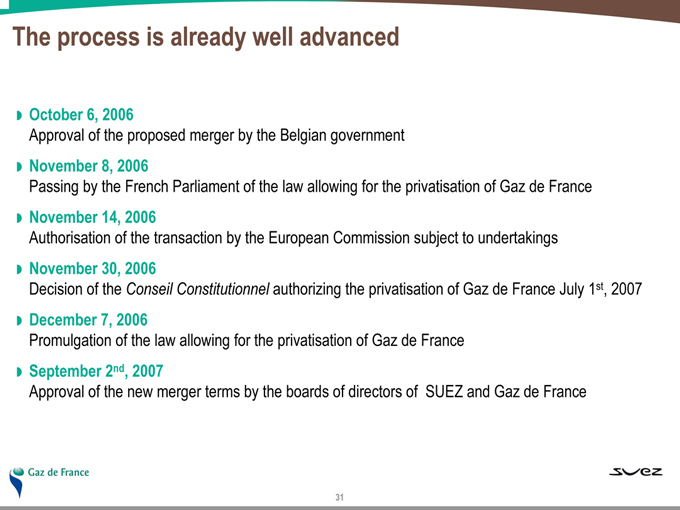

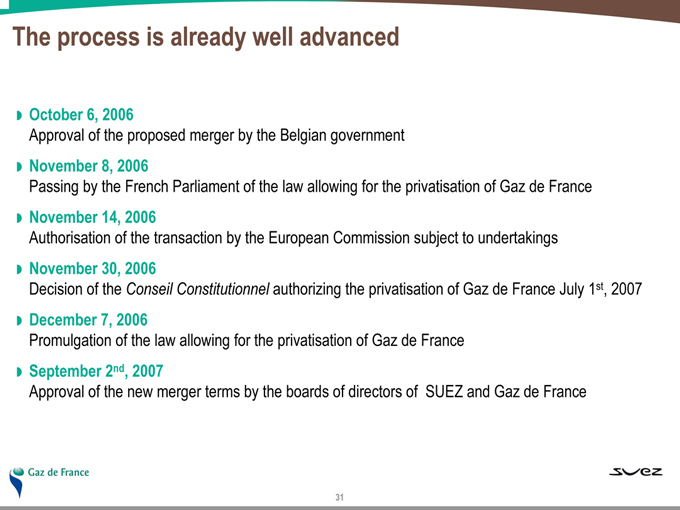

The process is already well advanced

October 6, 2006

Approval of the proposed merger by the Belgian government

November 8, 2006

Passing by the French Parliament of the law allowing for the privatisation of Gaz de France

November 14, 2006

Authorisation of the transaction by the European Commission subject to undertakings

November 30, 2006

Decision of the Conseil Constitutionnel authorizing the privatisation of Gaz de France July 1st, 2007

December 7, 2006

Promulgation of the law allowing for the privatisation of Gaz de France

September 2nd, 2007

Approval of the new merger terms by the boards of directors of SUEZ and Gaz de France

Gaz de France

SUEZ

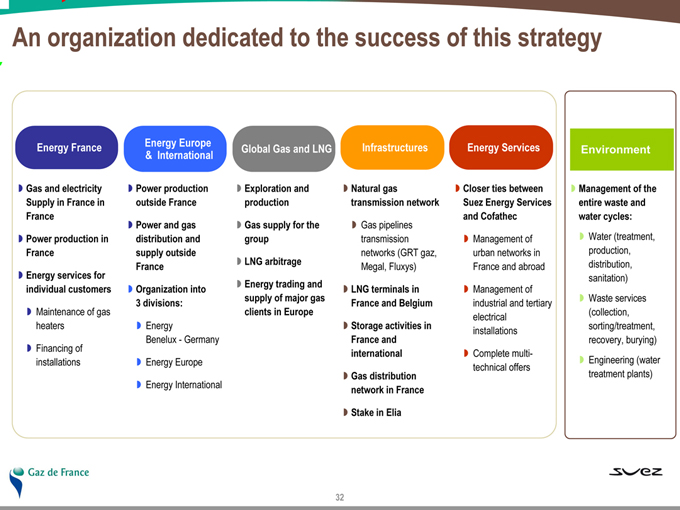

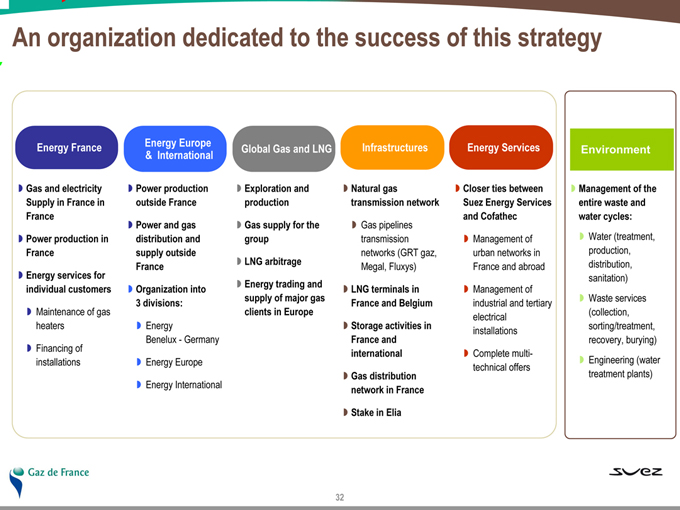

An organization dedicated to the success of this strategy

Energy France

Gas and electricity Supply in France in France

Power production in France

Energy services for individual customers

Maintenance of gas heaters

Financing of installations

Energy Europe

& International

Power production

outside France

Power and gas

distribution and

supply outside

France

Organization into

3 divisions:

Energy

Benelux - Germany

Energy Europe

Energy International

Global Gas and LNG

Exploration and production

Gas supply for the group

LNG arbitrage

Energy trading and supply of major gas clients in Europe

Infrastructures

Natural gas transmission network

Gas pipelines transmission networks (GRT gaz, Megal, Fluxys)

LNG terminals in France and Belgium

Storage activities in France and international

Gas distribution network in France

Stake in Elia

Energy Services

Closer ties between

Suez Energy Services

and Cofathec

Management of

urban networks in

France and abroad

Management of

industrial and tertiary

electrical

installations

Complete multi-

technical offers

Environment

Management of the entire waste and water cycles:

Water (treatment, production, distribution, sanitation)

Waste services (collection, sorting/treatment, recovery, burying)

Engineering (water treatment plants)

Gaz de France

SUEZ

Energy France

Leveraging the leadership position in natural gas supply and Gaz de France’s powerful brands in order to:

Develop multi-energy offers on the existing portfolio of “retail” customers

Develop the retail electricity client base

Develop the complementarities between energy sales and services businesses and “eco-friendly” customer offering

Parallel growth in power generation

New CCGT power plants

Development in Renewable Energies: wind, hydro and biomass

Wind 130 MW end 2007

DK6 786 MW

Nuclear (Chooz) Cogeneration (Elyo) 650 MW 1,700 MW

Basic Montoir hydraulic (CNR) 2,937 MW

Advanced Nuclear (Tricastin) hydraulic (SHEM) 460 MW 773 MW

Fos 2 CCGT

Projects

Energy France

11 million customers at the end of 2006

# 1 natural gas supplier

# 2 electricity producer and supplier with 5.6 GW at the end of 2006 (excl. co-generation)

A new leader in the multi-energy offer in France

Gaz de France

SUEZ

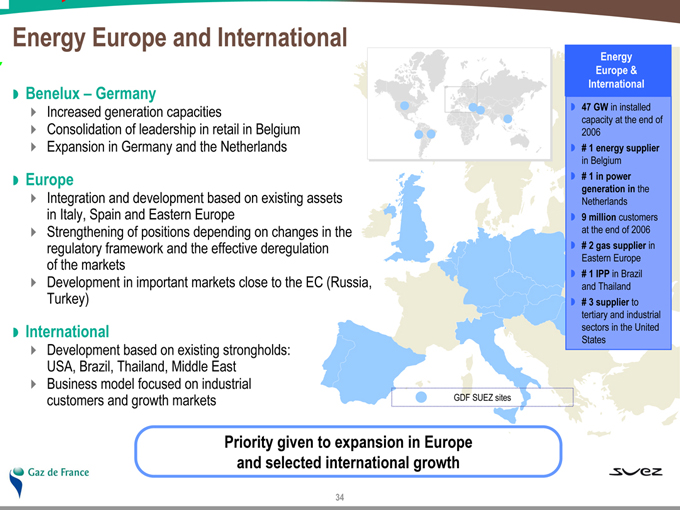

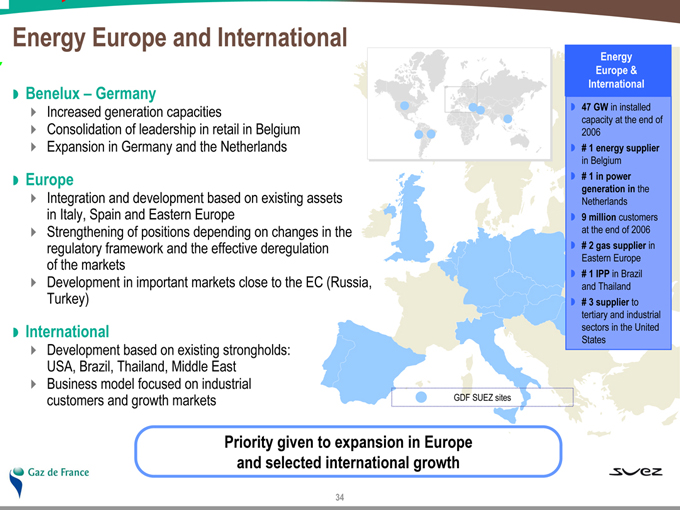

Energy Europe and International

Benelux – Germany

Increased generation capacities

Consolidation of leadership in retail in Belgium

Expansion in Germany and the Netherlands

Europe

Integration and development based on existing assets in Italy, Spain and Eastern Europe

Strengthening of positions depending on changes in the regulatory framework and the effective deregulation of the markets

Development in important markets close to the EC (Russia, Turkey)

International

Development based on existing strongholds: USA, Brazil, Thailand, Middle East

Business model focused on industrial customers and growth markets

GDF SUEZ sites

Energy Europe & International

47 GW in installed capacity at the end of 2006

1 energy supplier in Belgium

1 in power generation in the Netherlands

2 gas supplier in Eastern Europe

1 IPP in Brazil and Thailand

3 supplier to tertiary and industrial sectors in the United States

Priority given to expansion in Europe and selected international growth

Gaz de France

SUEZ

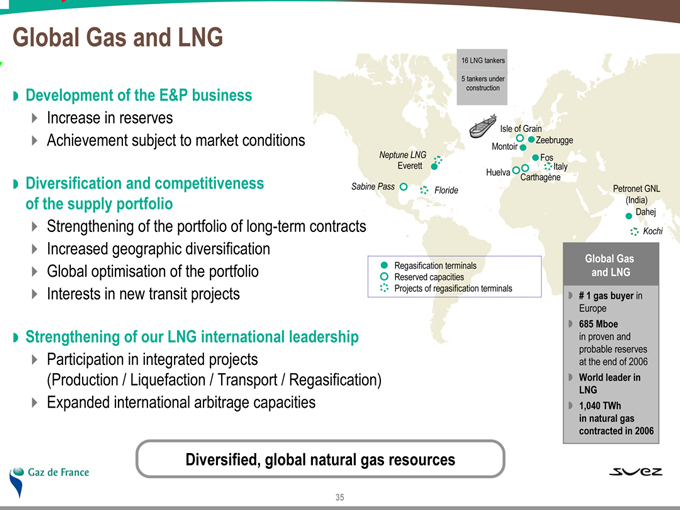

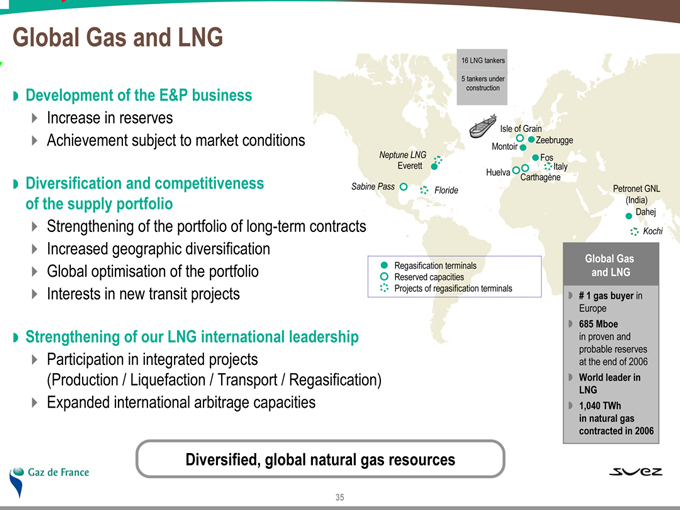

Global Gas and LNG

Development of the E&P business

Increase in reserves

Achievement subject to market conditions

Diversification and competitiveness of the supply portfolio

Strengthening of the portfolio of long-term contracts

Increased geographic diversification

Global optimisation of the portfolio

Interests in new transit projects

Strengthening of our LNG international leadership

Participation in integrated projects

(Production / Liquefaction / Transport / Regasification)

Expanded international arbitrage capacities

16 LNG tankers

5 tankers under construction

Neptune LNG

Everett

Sabine Pass

Floride

Isle of Grain

Zeebrugge

Montoir

Fos

Italy

Huelva

Carthagène

Petronet GNL (India)

Dahej

Kochi

Regasification terminals

Reserved capacities

Projects of regasification terminals

Global Gas and LNG

1 gas buyer in Europe

685 Mboe in proven and probable reserves at the end of 2006

World leader in LNG

1,040 TWh in natural gas contracted in 2006

Diversified, global natural gas resources

Gaz de France

SUEZ

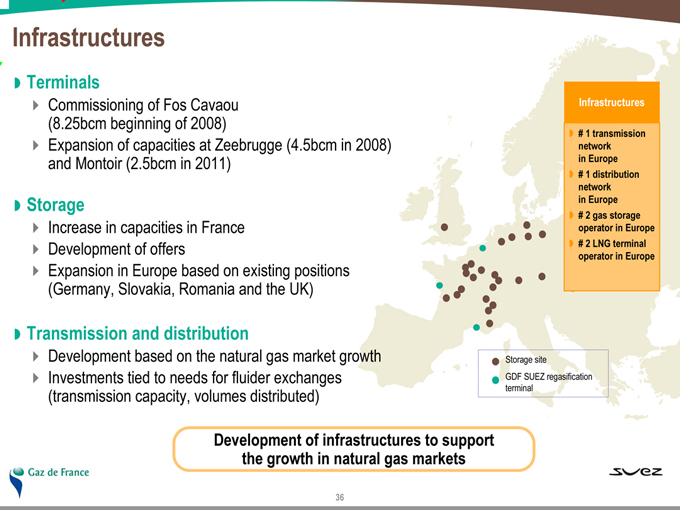

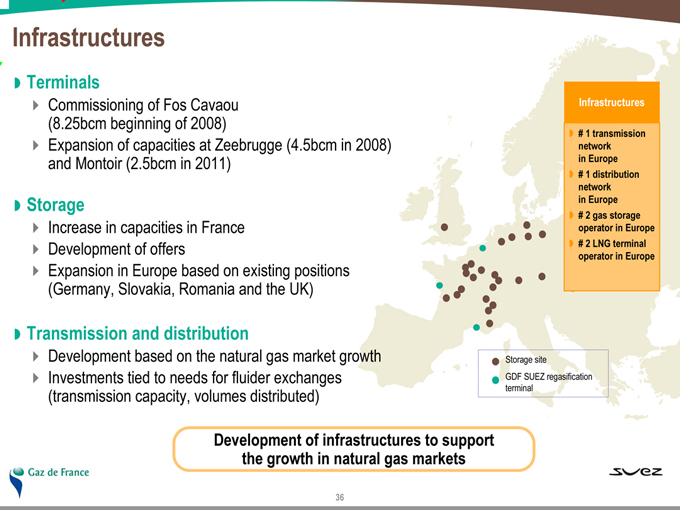

Infrastructures

Terminals

Commissioning of Fos Cavaou (8.25bcm beginning of 2008)

Expansion of capacities at Zeebrugge (4.5bcm in 2008) and Montoir (2.5bcm in 2011)

Storage

Increase in capacities in France

Development of offers

Expansion in Europe based on existing positions (Germany, Slovakia, Romania and the UK)

Transmission and distribution

Development based on the natural gas market growth

Investments tied to needs for fluider exchanges (transmission capacity, volumes distributed)

Infrastructures

# 1 transmission network in Europe

# 1 distribution network in Europe

# 2 gas storage operator in Europe

# 2 LNG terminal operator in Europe

Storage site

GDF SUEZ regasification terminal

Development of infrastructures to support the growth in natural gas markets

Gaz de France

SUEZ

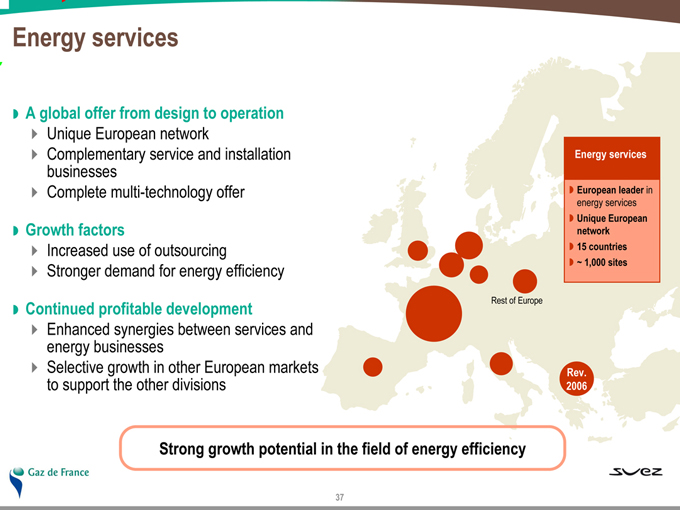

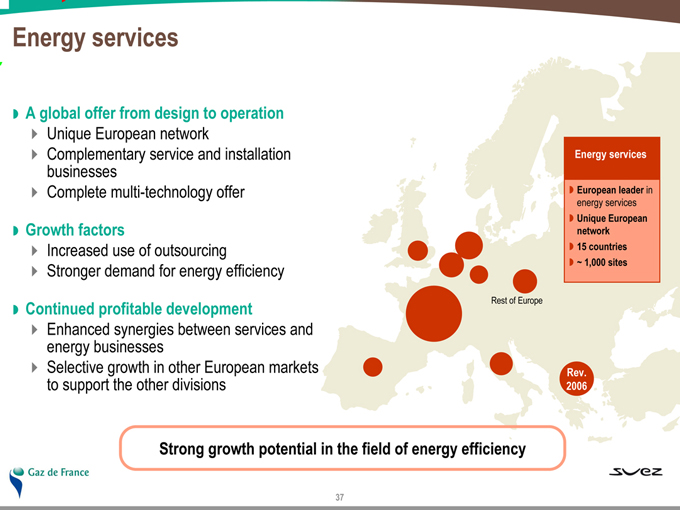

Energy services

A global offer from design to operation

Unique European network

Complementary service and installation businesses

Complete multi-technology offer

Growth factors

Increased use of outsourcing

Stronger demand for energy efficiency

Continued profitable development

Enhanced synergies between services and energy businesses

Selective growth in other European markets to support the other divisions

Rest of Europe

Energy services

European leader in energy services

Unique European network

15 countries

~ 1,000 sites

Rev. 2006

Strong growth potential in the field of energy efficiency

Gaz de France

SUEZ

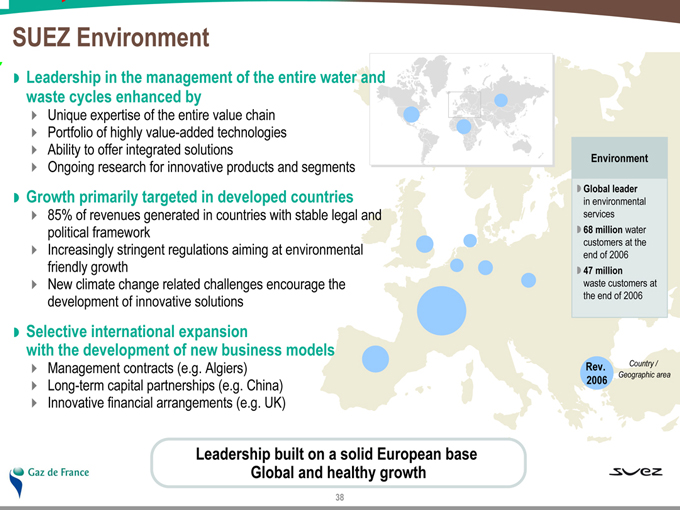

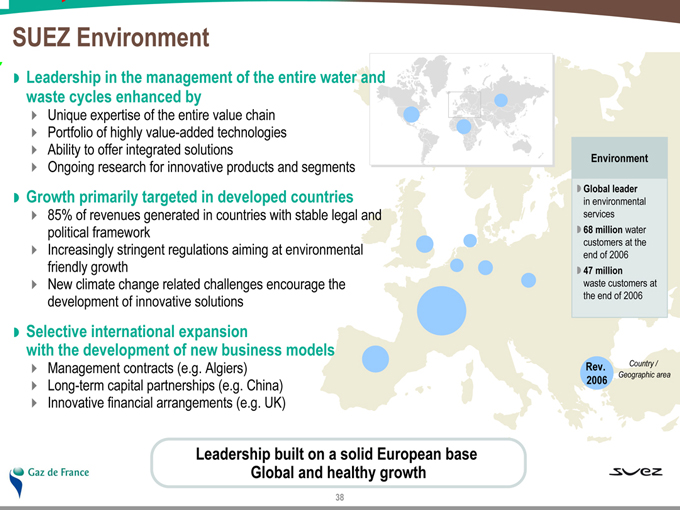

SUEZ Environment

Leadership in the management of the entire water and waste cycles enhanced by

Unique expertise of the entire value chain

Portfolio of highly value-added technologies

Ability to offer integrated solutions

Ongoing research for innovative products and segments

Growth primarily targeted in developed countries

85% of revenues generated in countries with stable legal and political framework

Increasingly stringent regulations aiming at environmental friendly growth

New climate change related challenges encourage the development of innovative solutions

Selective international expansion with the development of new business models

Management contracts (e.g. Algiers)

Long-term capital partnerships (e.g. China)

Innovative financial arrangements (e.g. UK)

Environment

Global leader in environmental services

68 million water customers at the end of 2006

47 million waste customers at the end of 2006

Rev. 2006

Country / Geographic area

Leadership built on a solid European base Global and healthy growth

Gaz de France

SUEZ

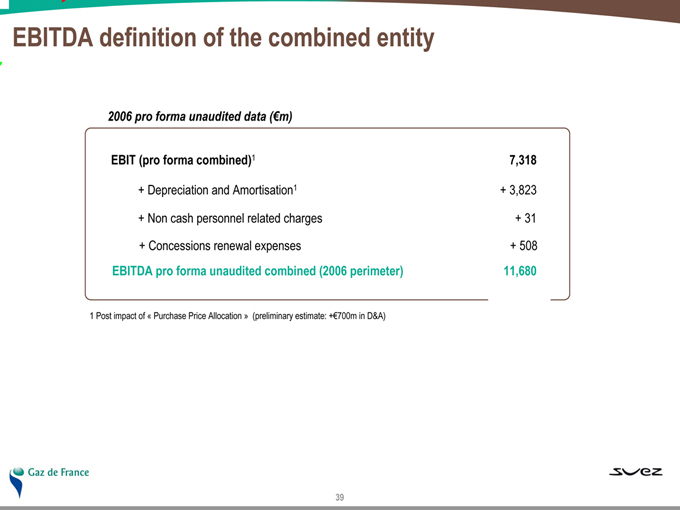

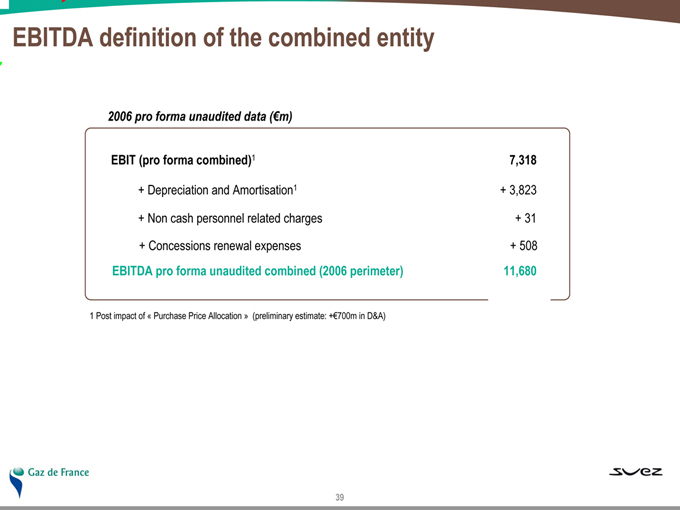

EBITDA definition of the combined entity

2006 pro forma unaudited data (€m)

EBIT (pro forma combined)1 7,318

+ Depreciation and Amortisation1 + 3,823

+ Non cash personnel related charges + 31

+ Concessions renewal expenses + 508

EBITDA pro forma unaudited combined (2006 perimeter) 11,680

1 Post impact of « Purchase Price Allocation » (preliminary estimate: +€700m in D&A)

Gaz de France

SUEZ

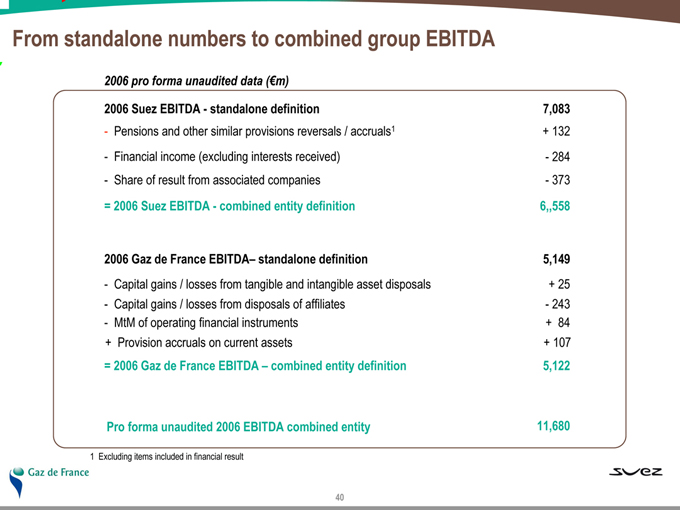

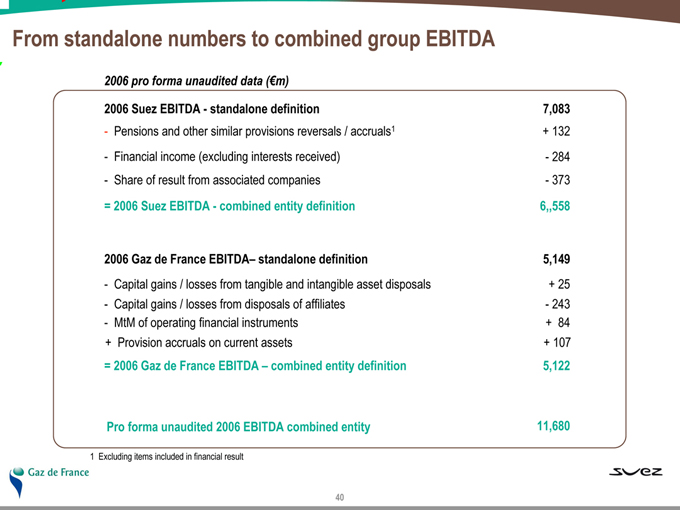

From standalone numbers to combined group EBITDA

2006 pro forma unaudited data (€m)

2006 Suez EBITDA - standalone definition 7,083

- Pensions and other similar provisions reversals / accruals1 + 132

- Financial income (excluding interests received) - 284

- Share of result from associated companies - 373

= 2006 Suez EBITDA - combined entity definition 6,558

2006 Gaz de France EBITDA– standalone definition 5,149

- Capital gains / losses from tangible and intangible asset disposals + 25

- Capital gains / losses from disposals of affiliates - 243

- MtM of operating financial instruments + 84

+ Provision accruals on current assets + 107

= 2006 Gaz de France EBITDA – combined entity definition 5,122

Pro forma unaudited 2006 EBITDA combined entity 11,680

1 Excluding items included in financial result

Gaz de France

SUEZ

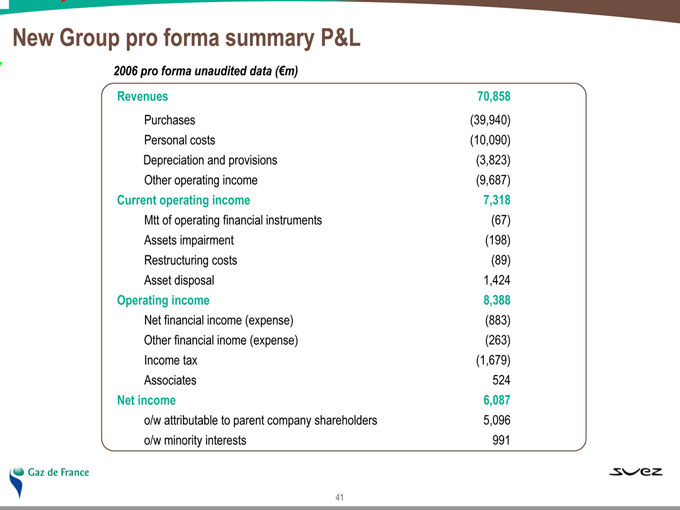

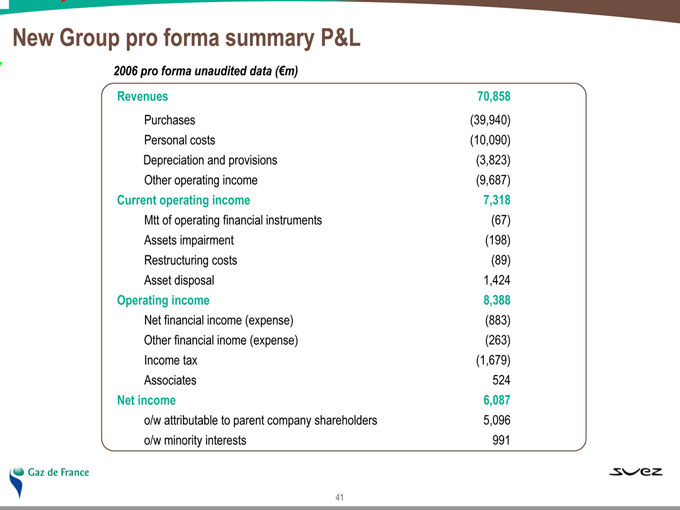

New Group pro forma summary P&L

2006 pro forma unaudited data (€m)

Revenues 70,858

Purchases (39,940)

Personal costs (10,090)

Depreciation and provisions (3,823)

Other operating income (9,687)

Current operating income 7,318

Mtt of operating financial instruments (67)

Assets impairment (198)

Restructuring costs (89)

Asset disposal 1,424

Operating income 8,388

Net financial income (expense) (883)

Other financial income (expense) (263)

Income tax (1,679)

Associates 524

Net income 6,087

o/w attributable to parent company shareholders 5,096

o/w minority interests 991

Gaz de France

SUEZ

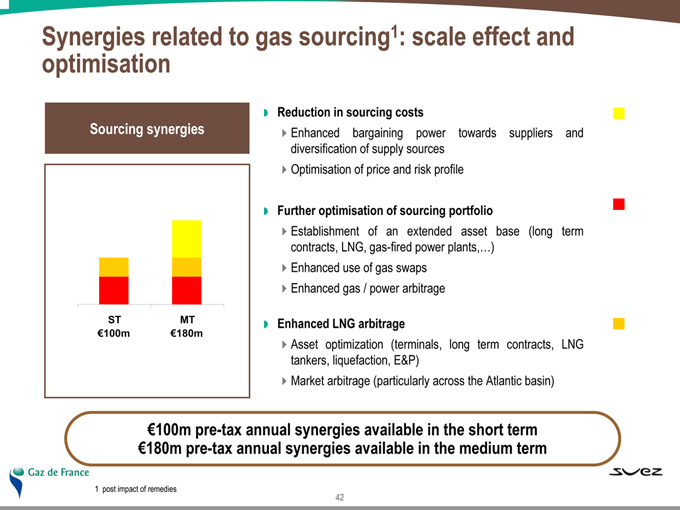

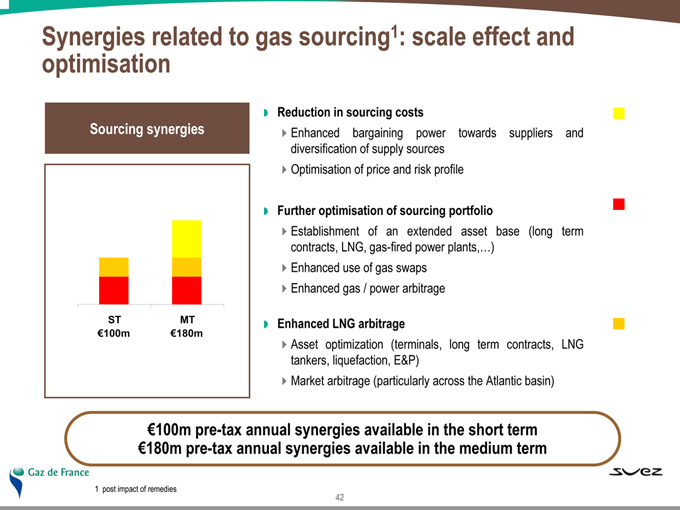

Synergies related to gas sourcing1: scale effect and optimisation

Sourcing synergies

ST

MT

€100m

€180m

Reduction in sourcing costs

Enhanced bargaining power towards suppliers and diversification of supply sources

Optimisation of price and risk profile

Further optimisation of sourcing portfolio

Establishment of an extended asset base (long term contracts, LNG, gas-fired power plants,…)

Enhanced use of gas swaps

Enhanced gas / power arbitrage

Enhanced LNG arbitrage

Asset optimization (terminals, long term contracts, LNG tankers, liquefaction, E&P)

Market arbitrage (particularly across the Atlantic basin)

€100m pre-tax annual synergies available in the short term

€180m pre-tax annual synergies available in the medium term

Gaz de France

SUEZ

1 post impact of remedies

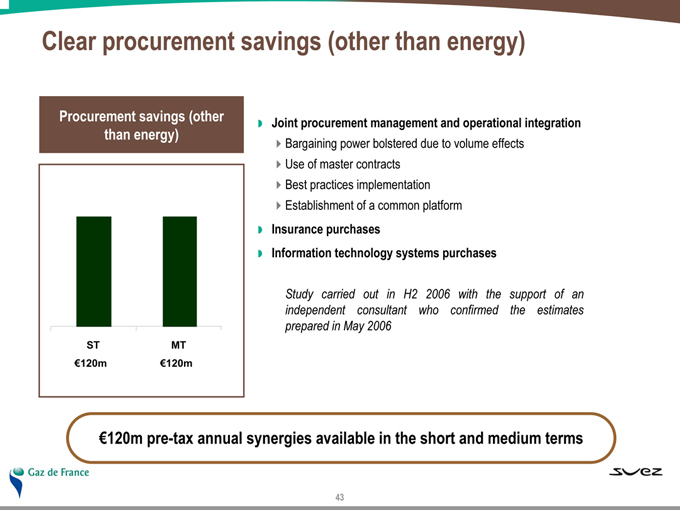

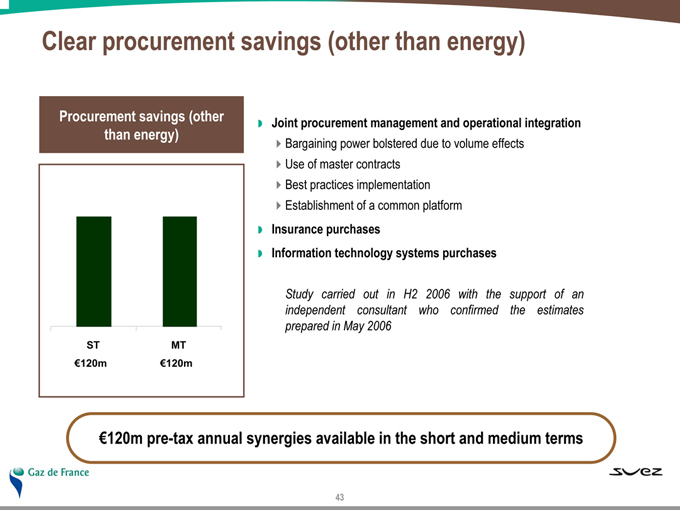

Clear procurement savings (other than energy)

Procurement savings (other than energy)

ST MT €120m €120m

Joint procurement management and operational integration

Bargaining power bolstered due to volume effects

Use of master contracts

Best practices implementation

Establishment of a common platform

Insurance purchases

Information technology systems purchases

Study carried out in H2 2006 with the support of an independent consultant who confirmed the estimates prepared in May 2006

€120m pre-tax annual synergies available in the short and medium terms

Gaz de France

SUEZ

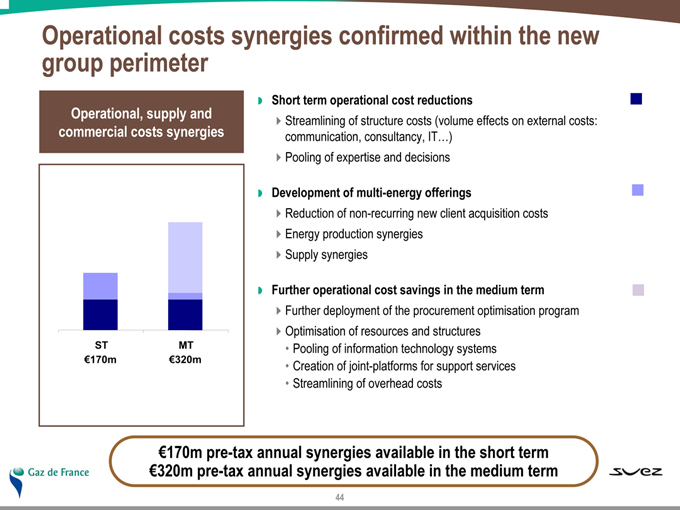

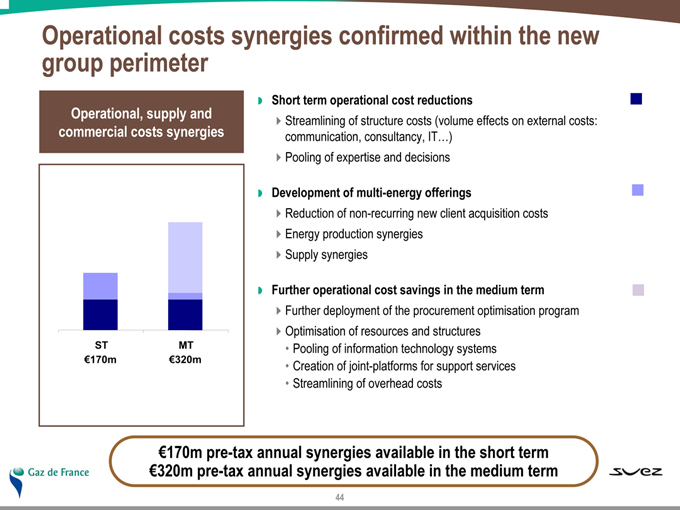

Operational costs synergies confirmed within the new group perimeter

Operational, supply and commercial costs synergies

ST MT €170m €320m

Short term operational cost reductions

Streamlining of structure costs (volume effects on external costs: communication, consultancy, IT…)

Pooling of expertise and decisions

Development of multi-energy offerings

Reduction of non-recurring new client acquisition costs

Energy production synergies

Supply synergies

Further operational cost savings in the medium term

Further deployment of the procurement optimisation program

Optimisation of resources and structures

Pooling of information technology systems

Creation of joint-platforms for support services

Streamlining of overhead costs

€170m pre-tax annual synergies available in the short term €320m pre-tax annual synergies available in the medium term

Gaz de France

SUEZ

Medium term revenue synergies arising from the operational fit between SUEZ and Gaz de France

Revenue synergies

ST MT

€350m

Additional energy production capacity in Europe based on partner’s existing assets

Clients portfolio

Sourcing and gas storage capacities

Development of an integrated LNG chain based in particular on the regasification capacities in the Atlantic basin

Minority stake in E&P project and in a liquefaction train

LNG commercialisation on several markets

Revenue synergies generating in the medium term a €350m pre-tax annual margin

Gaz de France

SUEZ