UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of June, 2009

Commission File Number 333-151676

GDF SUEZ

(Translation of registrant’s name into English)

16-26, rue du Docteur Lancereaux

75008 Paris — France

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F  | Form 40-F  |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (1): ___

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (7): ___

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furrnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes  | No  |

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

REFERENCE DOCUMENT2008

REDISCOREVING ENERGY

Back to contents

REFERENCE DOCUMENT 2008

Incorporation by reference

Pursuant to Article 28 of European Regulation No. 809/2004 of April 29, 2004, this Reference Document incorporates by reference the following information to which the reader is invited to refer:

•

with regard to the fiscal year ended December 31, 2007 for Gaz de France: management report, consolidated financial statements, prepared in accordance with IFRS accounting principles and the related Statutory Auditors’ reports found on pages 113 to 128 and pages 189 to 296 of the Reference Document, registered on May 15, 2008 withl’Autorité des Marchés Financiers (French Financial Markets Authority, or AMF), under R. 08-056;

•

with regard to the fiscal year ended December 31, 2007 for SUEZ: management report, consolidated financial statements, prepared in accordance with IFRS accounting principles and the related Statutory Auditors’ reports found on pages 117 to 130 and pages 193 to 312 of the Reference Document, filed on March 18, 2008 withl’Autorité des Marchés Financiers(French Financial Markets Authority, or AMF), under D. 08-0122 as well as its update filed on June 13, 2008 under D. 08-0122-A01;

•

with regard to the fiscal year ended December 31, 2006 for Gaz de France: management report, consolidated financial statements, prepared in accordance with IFRS accounting principles and the related Statutory Auditors’ reports found on pages 105 to 118 and pages 182 to 294 of the Reference Document, registered on April 27, 2007 withl’Autorité des Marchés Financiers (French Financial Markets Authority, or AMF), under R. 07-046;

•

with regard to the fiscal year ended December 31, 2006 for SUEZ: management report, consolidated financial statements, prepared in accordance with IFRS accounting principles and the related Statutory Auditors’ reports found on pages 117 to 130 and pages 194 to 309 of the Reference Document, filed on April 4, 2007 withl’Autorité des Marchés Financiers (French Financial Markets Authority, or AMF), under D. 07-0272.

The information included in these Reference Documents, other than that referred to above, is replaced or updated, where applicable, by the information contained in this Reference Document. These Reference Documents are accessible under the conditions described in Section 24 “Documents accessible to the public” of this Reference Document.

This Reference Document contains forward-looking information in Sections 6.1 “Principal Activities”, 12 “Information on Trends” and paragraph “Outlook for 2009” of the Group’s activity report included in Section 9.8. This information does not constitute historical data and there is no assurance that such forward-looking facts, data or objectives will occur or be met in the future. Such information is subject to external factors, such as those described in Section 4 “Risk Management”.

Unless expressly stated to the contrary, the market data included in this Reference Document is based on internal estimates made by GDF SUEZ using publicly available information.

Copies of this Reference Document are available free of charge from GDF SUEZ, located at 22, rue du Docteur Lancereaux – 75008 Paris, and on the Company’s website (www.gdfsuez.com), as well as on that ofl’Autorité des Marchés Financiers (French Financial Markets Authority, or AMF (www.amf-france.org)).

AMF

The French version of this Reference Document was filed with thel’Autorité des Marchés Financiers (French Financial Markets Authority, or AMF)

and was registered under No. D.09-197 on April 6, 2009, in accordance with the provisions of Article 212-13 of the General Regulations of the AMF.

It may be used in support of a financial transaction if it is supplemented by an offering memorandum approved by the AMF.

REFERENCE DOCUMENT 2008  1

1

Back to contents

TABLE OF CONTENTS

1

PARTIES RESPONSIBLE

5

1.1

Parties responsible

5

1.2

Declaration by the persons responsible for the reference document comprising the annual financial report

6

2

PARTIES RESPONSIBLE FOR AUDITING

7

2.1

Statutory Auditors

8

2.2

Resignation or departure of Statutory Auditors

9

3

SELECTED FINANCIAL INFORMATION

11

4

RISK FACTORS

15

4.1

Risk management process

16

4.2

GDF SUEZ operates in a changing environment

17

4.3

The GDF SUEZ business model is subject to numerous constraints

24

4.4

Industrial safety at the heart of GDF SUEZ’s activity

27

4.5

The GDF SUEZ organization in the face of transversal risks

30

4.6

Insurance

33

5

INFORMATION ON THE COMPANY

35

5.1

History and development of the company

36

5.2

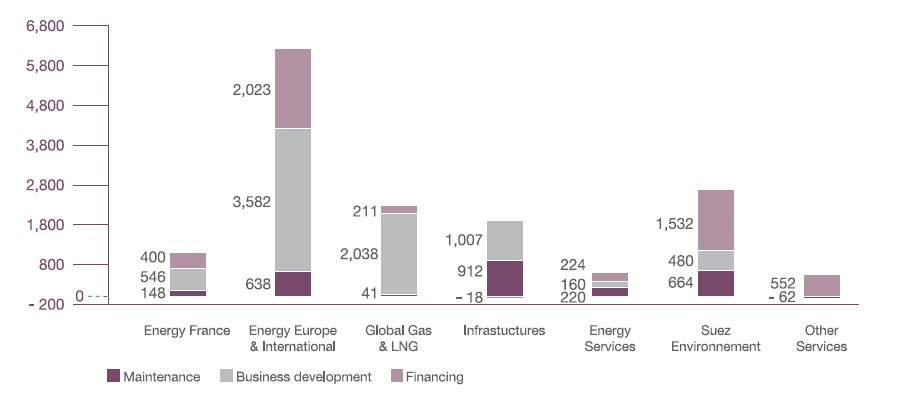

Investments

38

6

OVERVIEW OF ACTIVITIES

39

6.1

Main activities

40

6.2

Main markets

120

6.3

Important events

120

6.4

Dependence on patents, licenses or contracts

122

6.5

Competitive energy position

122

6.6

Sustainable development

123

7

ORGANIZATION CHART

145

7.1

Simplified organization chart

146

7.2

List of major subsidiaries

147

8

REAL ESTATE, FACTORIES, AND EQUIPMENT

149

8.1

Major tangible assets

150

8.2

Environmental issues related to real-estate holdings

152

9

MANAGEMENT REPORT (1)

153

9.1

Revenue and earnings trends

154

9.2

Business trends

157

9.3

Other income statement items

166

9.4

Reconciliation with consolidated income statement figures

167

9.5

Changes in net debt

168

9.6

Other balance sheet items

171

9.7

Parent company financial statements

172

9.8

Outlook for 2009

173

10

CASH FLOW AND SHARE CAPITAL

175

10.1

Issuer capital

176

10.2

Source and amount of issuer cash flows and description of cash flows

176

10.3

Financial structure and borrowing conditions applicable to the issuer

177

10.4

Restrictions regarding the use of capital

179

10.5

Planned sources of financing to meet commitments stemming from investment decisions

179

11

INNOVATION, RESEARCH AND DEVELOPMENT, PATENTS AND LICENSE POLICY

181

11.1

Research and innovation

182

11.2

Intellectual property

189

12

INFORMATION ON TRENDS

191

13

PROFIT FORECASTS OR ESTIMATES

193

14

ADMINISTRATIVE BODIES AND GENERAL MANAGEMENT

195

14.1

Information concerning the administrative bodies

196

14.2

Non-voting Directors

215

14.3

Government Commissioner

216

14.4

Information concerning general management

217

14.5

Composition of the committees of the board of Directors

217

14.6

Conflicts of interest in administrative, management and supervisory bodies and general management

220

15

COMPENSATION AND BENEFITS

221

15.1

Compensation paid and benefits granted

222

15.2

Information on stock options and bonus shares known as performance shares

234

15.3

Summary of transactions declared by executive management and corporate officers during fiscal year 2008

245

15.4

Number of shares and stock options of GDF SUEZ held by members of the GDF SUEZ board of directors in office at december 31, 2008

246

15.5

Loans and guarantees granted or established in favor of directors or Executives

246

15.6

Funded amount

247

16

OPERATION OF ADMINISTRATIVE AND MANAGEMENT BODIES

249

16.1

Operating procedures of the board of directors

250

16.2

Information concerning service contracts between members of the Board of Directors and General Management and the company or any OF its subsidiaries

253

16.3

Committees of the board of Directors

257

16.4

Compliance with corporate governance regulations in the issuer’s home country

264

17

EMPLOYEES

265

17.1

Group HR Policy

267

17.2

ARRANGEMENTS FOR INVOLVING THE EMPLOYEES IN THE CAPITAL OF THE ISSUER

269

17.3

Integration

271

17.4

HR performance

272

17.5

Solidarity

273

17.6

Social relations in the group

274

17.7

Health and Safety policy

276

17.8

Equity interests and stock options of the Directors and Chief Operating Officers

277

18

MAIN SHAREHOLDERS

279

18.1

Breakdown of share capital at December 31, 2008

281

18.2

Voting rights

284

18.3

Control

284

18.4

Agreement relating to change of control

284

REFERENCE DOCUMENT 2008  2

2

Back to contents

19

RELATED PARTY TRANSACTIONS

285

19.1

Relations with the French state and with the CNIEG

286

19.2

Transactions with equity-accounted or proportionately consolidated companies

287

20

FINANCIAL INFORMATION CONCERNING THE ASSETS AND LIABILITIES, FINANCIAL POSITION AND RESULTS OF THE ISSUER

289

20.1

Consolidated financial statements

290

20.2

Notes to the consolidated financial statements

297

20.3

Verification of yearly financial historical data

410

20.4

Pro forma financial information and Statutory Auditors’ report

412

20.5

Parent company financial statements and Statutory Auditors’ report

423

20.6

Dividend distribution policy

484

20.7

Legal and arbitration proceedings

485

20.8

Significant change in the financial or commercial situation

490

21

ADDITIONAL INFORMATION

491

21.1

Amount of subscribed capital

496

21.2

Incorporating documents and bylaws

505

22

IMPORTANT CONTRACTS

513

23

THIRD-PARTY INFORMATION STATEMENTS BY EXPERTS AND DECLARATIONS OF INTEREST

515

24

DOCUMENTS ACCESSIBLE TO THE PUBLIC

517

24.1

Consultation of documents

518

24.2

Corporate communication

518

25

INFORMATION ON HOLDINGS

519

A

APPENDICES TO THE REFERENCE DOCUMENT

521

Report on internal control procedures

522

Statutory Auditors’ Report, prepared in accordance with article L. 225-235 of the French commercial code (Code de Commerce), on the report prepared

by the Chairman of the board of directors of GDF SUEZ

531

Statutory auditors’ report on the review of selected environmental and social indicators

532

Ordinary and Extraordinary Shareholders’ Meeting of May 4, 2009

534

Board of Directors’ report on the resolutions presented to the Ordinary and Extraordinary Shareholders’ Meeting of May 4, 2009

535

Draft resolutions presented to the Ordinary and Extraordinary Shareholders’ Meeting of May 4, 2009

543

Statutory Auditors’ special report on regulated agreements and commitments with related parties

550

Statutory Auditors’ reports on the resolutions of the Ordinary and Extraordinary Shareholders’ Meeting of May 4, 2009

558

Information relating to the company’s management report

560

Concordance with the company’s annual financial report

562

Table of gas, electricity and other energy units of measurement

563

Acronyms

564

Glossary

567

REFERENCE DOCUMENT 2008  3

3

Back to contents

NOTE

For the purposes of this Reference Document, “GDF SUEZ”, “the Company” or “the Issuer” all refer to the company GDF SUEZ SA (formerly called Gaz de France), as a result of the merger of Suez (absorbed company) by Gaz de France (absorbing company) and as identifi ed in Sections 5.1, – “History and Development of the Company” and 6.3.1 “Merger of Gaz de France and Suez”. The term “Group” refers to GDF SUEZ and its subsidiaries.

A glossary of the most commonly used technical terms is appended to this Reference Document.

This document is an informal English translation of the French language Document de Reference, filed with the French Financial Markets Authority(Autorité des Marchés Financiers) under the number D.09-197 on April 6, 2009. It is provided solely for the information and convenience of shareholders of GDF SUEZ, and is of no binding or other legal effect. No assurances are given as to the accuracy or completeness of this translation, and GDF SUEZ assumes no responsibility with respect to this translation or any misstatement or omission that may be contained therein. In the event of any ambiguity or discrepancy between this English translation and the French language Document de Reference, the French language Document de Reference shall prevail. This document is not an offer to sell or the solicitation of an offer to purchase shares of GDF SU EZ, and it is not used for any offer or sale or any such solicitation anywhere in the world. Shares of GDF SUEZ may not be sold in the United States absent registration or an exemption from registration under the U.S. Securities Act of 1933, as amended. GDF SUEZ does not intend to register any portion of any offering in the United States or to conduct a public offering of shares in the United States. s.

REFERENCE DOCUMENT 2008  4

4

Back to contents

1 PARTIES RESPONSIBLE

1.1 PARTIES RESPONSIBLE

Gérard Mestrallet, Chairman and Chief Executive Officer

Jean-François Cirelli, Vice-Chairman and President

REFERENCE DOCUMENT 2008  5

5

Back to contents

1.2 DECLARATION BY THE PERSONS RESPONSIBLE FOR THE REFERENCE DOCUMENT COMPRISING THE ANNUAL FINANCIAL REPORT

“We hereby certify, after having taken all reasonable measures to this effect, that the information contained in this Reference Document is, to our knowledge, in accordance with the facts and makes no omission likely to affect its import.

We certify, to our knowledge, that the financial statements have been prepared in accordance with the applicable accounting standards and give a true and fair view of the assets and liabilities, financial position and profit or loss of the Company and all the undertakings included in the consolidation, and that the management report on pages 153 to 174 presents a fair review of the development and performance of the business and financial position of the Company and all the undertakings included in the consolidation as well as a description of the main risks and uncertainties to which they are exposed.

We have received a completion letter from the Statutory Auditors stating that they have audited the information contained in this Reference Document relating to the financial position and financial statements, and that they have read the Reference Document in its entirety. The letter does not contain any observations.

The Statutory Auditors’ report on the historical financial information presented in Sections 20.1 and 20.2 of this Reference Document is set out in Section 20.3. The report contains an observation regarding the change in accounting policy for reporting segment information following the Group’s early adoption of IFRS 8 “Operating Segments” when preparing the 2008 consolidated financial statements.

The Statutory Auditors’ report on the 2008 pro forma financial information presented in Section 20.4 of this Reference Document contains an observation relating to paragraph 3 “Tax matters” of Note 2 “Basis of presentation” to the pro forma financial information which describes the impact on the consolidated financial statements of the rulings obtained from the French tax authorities and of the discontinued neutralization of certain transactions following the dissolution of the SUEZ SA tax consolidation group. It specifies that the pro forma income statements for the years presented were not restated to take these various items into account.

The Statutory Auditors’ report on the 2008 parent company financial statements presented in Section 20.5 of this Reference Document contains observations relating to the change in accounting policies used to recognize transaction fees on equity investments and bond issue costs, as described in Notes A, B-4 and B-5 to the parent company financial statements.

The Statutory Auditors’ reports on the IFRS consolidated financial statements of Gaz de France for the years ended December 31, 2007 and 2006 are set out (i) for 2007: in Section 20.1.1.2 of the 2007 Reference Document of Gaz de France, registered with the French Financial Markets Authority (Autorité des marchés financiers – AMF) on May 15, 2008 under number R. 08-056, and (ii) for 2006: in Section 20.1.1.2 of the 2006 Reference Document of Gaz de France registered with the AMF on April 27, 2007 under number R. 07-046.

The Statutory Auditors’ reports on the IFRS consolidated financial statements of SUEZ for the years ended December 31, 2007 and 2006 are set out (i) for 2007: in Section 20.3 of the 2007 Reference Document of SUEZ, filed with the AMF on March 18, 2008 under number D. 08-0122, and (ii) for 2006: in Section 20.3 of the 2006 Reference Document of SUEZ, filed with the AMF on April 4, 2007 under number D. 07-0272.”

Chairman and Chief Executive Officer | | Vice-Chairman and President |

Gérard Mestrallet | | Jean-François Cirelli |

REFERENCE DOCUMENT 2008  6

6

Back to contents

2 PARTIES RESPONSIBLE FOR AUDITING

2.1

STATUTORY AUDITORS

8

2.1.1

Statutory Auditors

8

2.1.2

Substitute Statutory Auditors

8

2.2

RESIGNATION OR DEPARTURE OF STATUTORY AUDITORS

9

REFERENCE DOCUMENT 2008  7

7

Back to contents

2.1 STATUTORY AUDITORS

2.1.1 STATUTORY AUDITORS

•

Mazars

Represented by

Mr. Philippe Castagnac andMr. Thierry Blanchetier

Tour Exaltis, 61, rue Henri Regnault, 92075 Paris la Défense Cedex

Mazars has been a Statutory Auditor for the Company since January 1, 2002. Its term of office was renewed at the Combined General Shareholders’ Meeting of May 19, 2008 for a period of six years and will expire at the close of the 2014 Ordinary General Shareholders’ Meeting held to approve the financial statements for the fiscal year ending December 31, 2013.

•

Ernst & Young et Autres

Represented by

Mr. Christian Mouillon andMs. Nicole Maurin

41, rue Ybry, 92576 Neuilly-sur-Seine Cedex

Ernst & Young et Autres has been a Statutory Auditor for the Company since January 1, 2002. Its term of office was renewed at the Combined General Shareholders’ Meeting of May 19, 2008 for a period of six years and will expire at the close of the 2014 Ordinary General Shareholders’ Meeting held to approve the financial statements for the fiscal year ending December 31, 2013.

•

Deloitte & Associés

Represented by

Mr. Jean-Paul Picard andMr. Pascal Pincemin

185, avenue Charles-de-Gaulle, BP 136, 92203 Neuilly-sur-Seine

Deloitte & Associés was appointed Statutory Auditor for the Company for the first time at the Combined General Shareholders’ Meeting of July 16, 2008 for a six-year term that will expire at the close of the 2014 Ordinary General Shareholders’ Meeting held to approve the financial statements for the fiscal year ending December 31, 2013.

2.1.2 SUBSTITUTE STATUTORY AUDITORS

•

CBA

61, rue Henri Regnault, 92400 Paris la Défense Cedex

CBA was appointed substitute Statutory Auditor for the Company for the first time at the Combined General Shareholders’ Meeting of May 19, 2008 for a six-year term that will expire at the close of the 2014 Ordinary General Shareholders’ Meeting held to approve the financial statements for the fiscal year ending December 31, 2013.

•

AUDITEX

81, rue de Miromesnil, 75008 Paris

Auditex has been a substitute Statutory Auditor for the Company since January 1, 2002. Its term of office was renewed at the Combined General Shareholders’ Meeting of May 19, 2008 for a six-year term that will expire at the close of the 2014 Ordinary General Shareholders’ Meeting held to approve the financial statements for the fiscal year ending December 31, 2013.

•

BEAS

7-9, villa Houssay, 92524 Neuilly-sur-Seine

BEAS was appointed substitute Statutory Auditor for the Company for the first time at the Combined General Shareholders’ Meeting of July 16, 2008 for a six-year term that will expire at the close of the 2014 Ordinary General Shareholders’ Meeting held to approve the financial statements for the fiscal year ending December 31, 2013.

REFERENCE DOCUMENT 2008  8

8

Back to contents

2.2 RESIGNATION OR DEPARTURE OF STATUTORY AUDITORS

•

Cailliau Dedouit et Associés

19, rue Clément Marot, 75008 Paris

The term of Cailliau Dedouit et Associés as Substitute Statutory Auditor for the Company, a function held since January 1, 2002, expired and was not renewed at the Combined General Shareholders’ Meeting of May 19, 2008.

REFERENCE DOCUMENT 2008  9

9

Back to contents

REFERENCE DOCUMENT 2008  10

10

Back to contents

3 SELECTED FINANCIAL INFORMATION

KEY FIGURES

12

REFERENCE DOCUMENT 2008  11

11

Back to contents

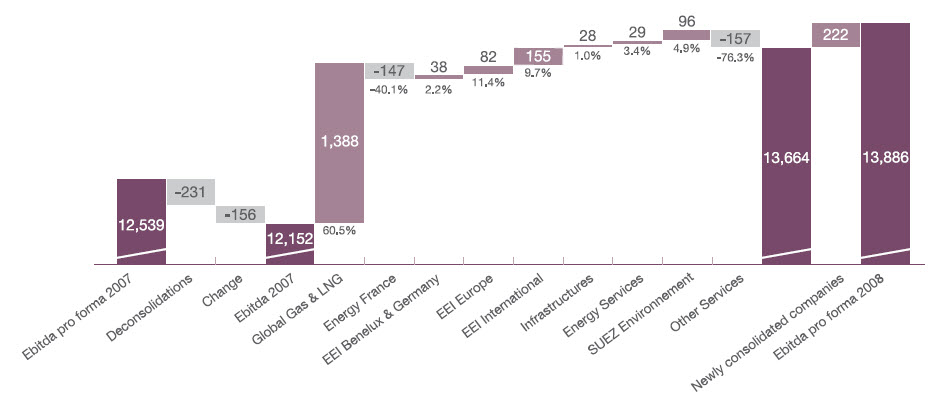

Financial information concerning the assets, liabilities, financial position, and profit and loss of GDF SUEZ, and for the groups comprising the merged entity, i.e., SUEZ and Gaz de France, has been provided for the last five reporting periods (years ended December 31, 2004, 2005, 2006, 2007 and 2008) and has been prepared in accordance with the European Regulation (EC) 1606/2002 on International Accounting Standards (IFRS) dated July 19, 2002 as published by the International Accounting Standards Board (IASB) and adopted for use in the European Union at that date.

The Group’s key figures also include pro forma information for the years ended December 31, 2008 and 2007, as though the merger had taken place on January 1 of each of the periods presented.

KEY FIGURES

In millions of euros | GDF SUEZ

(published) | GDF SUEZ

(pro forma) | GDF SUEZ

(pro forma) | SUEZ | Gaz de France |

2008 | 2008 | 2007 | 2007 | 2007 |

1. Revenues | 67,924 | 83,053 | 71,228 | 47,475 | 27,427 |

of which revenues generated outside France | 47,156 | 52,708 | 43,998 | 35,543 | 11,361 |

2. Income statement | | | | | |

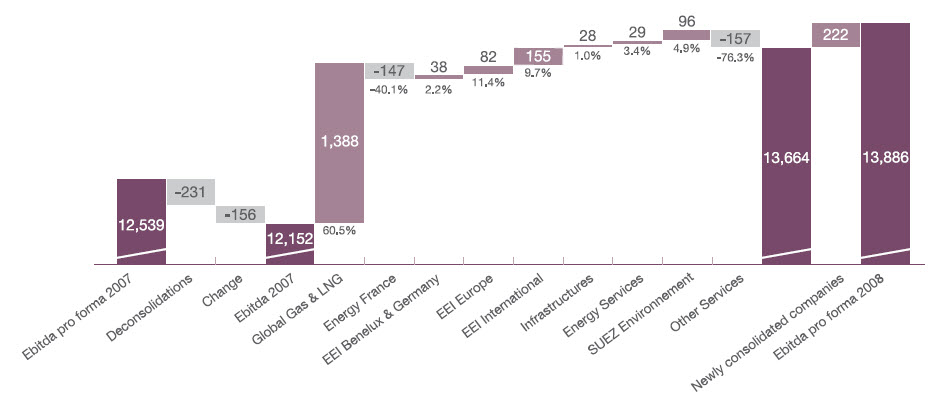

• EBITDA | 10,054 | 13,886 | 12,539 | 7,433 | 5,696 |

• Gross operating surplus | | | | | 5,666 |

• Gross operating income | | | | 7,965 | |

• Operating income | | | | | 3,874 |

• Current operating income | 6,224 | 8,561 | 7,824 | 5,175 | |

• Net income Group share | 4,857 | 6,504 | 5,752 | 3,924 | 2,472 |

3. Cash flows | | | | | |

Cash flow from operating activities | 4,393 | 7,726 | 10,429 | 6,017 | 4,778 |

of which cash generated from operations before income tax and working capital requirements | 9,686 | 13,287 | 12,451 | 7,267 | |

of which operating cash flow | | | | | 5,904 |

Cash flow from (used in) investing activities | (7,348) | (11,845) | (6,937) | (4,681) | (2,623) |

Cash flow from (used in) activities financing | 5,528 | 3,084 | (4,231) | (2,518) | (1,403) |

4. Balance sheet | | | | | |

Shareholders’ equity | 57,748 | 57,748 | NA | 22,193 | 17,953 |

Total equity | 62,818 | 62,818 | NA | 24,861 | 18,501 |

Total assets | 167,208 | 167,208 | NA | 79,127 | 46,178 |

5. Share data(in euros) | | | | | |

• Average number of shares utstanding (a) | 1,630,148,305 | 2,160,674,796 | 2,177,496,287 | 1,269,572,284 | 983,115,173 |

• Number of shares at year-end | 2,193,643,820 | 2,193,643,820 | NA | 1,307,043,522 | 983,871,988 |

• Earnings per share | 2.98 | 3.01 | 2.64 | 3.09 | 2.51 |

• Dividend distributed | 1.40 | 1.40 | NA | 1.36 | 1.26 |

6. Headcount | | | | | |

Total workforce | | | NA | | 47,560 |

Total average workforce | 234,653 | 234,653 | NA | 192,821 | |

• Fully consolidated companies | 194,920 | 194,920 | NA | 146,350 | |

• Proportionately consolidated companies | 31,174 | 31,174 | NA | 37,592 | |

• Equity-accounted companies | 8,559 | 8,559 | NA | 8,879 | |

(a) Earnings per share is calculated based on the average number of shares outstanding, net of treasury shares. 2008 dividend: proposed dividend (including an interim dividend of €0.8 paid in November 2008). |

REFERENCE DOCUMENT 2008  12

12

Back to contents

In millions of euros | SUEZ | Gaz de France | SUEZ | Gaz de France | SUEZ | Gaz de France |

2006 | 2006 | 2005 | 2005 | 2004 | 2004 |

1. Revenues | 44,289 | 27,642 | 41,489 | 22,872 | 38,058 | 18,001 |

of which revenues generated outside France | 33,480 | 10,840 | 31,769 | 8,139 | 29,481 | 5,236 |

2. Income statement | | | | | | |

• EBITDA | 6,559 | | | | | |

• Gross operating surplus | | 5,149 | | 4,248 | | 4,163 |

• Gross operating income | 7,083 | | 6,508 | | 5,932 | |

• Operating income | | 3,608 | | 2,821 | | 2,255 |

• Current operating income | 4,497 | | 3,902 | | 3,737 | |

• Net income Group share | 3,606 | 2,298 | 2,513 | 1,782 | 1,696 | 1,307 |

3. Cash flows | | | | | | |

Cash flow from operating activities | 5,172 | 3,066 | 5,826 | 2,788 | 4,970 | 3,013 |

of which cash generated from operations before income tax and working capital requirements | 6,384 | | 5,751 | | 5,681 | |

of which operating cash flow | | 5,118 | | 4,254 | | 4,199 |

Cash flow from (used in) investing activities | (366) | (2,174) | (8,992) | (2,110) | 124 | (1,681) |

Cash flow from (used in) financing activities | (6,938) | (566) | 6,488 | 299 | (8,083) | (1,121) |

4. Balance sheet | | | | | | |

Shareholders’ equity | 19,504 | 16,197 | 16,256 | 14,484 | 7,774 | 10,940 |

Total equity | 22,564 | 16,663 | 18,823 | 14,782 | 12,828 | 11,151 |

Total assets | 73,435 | 42,921 | 80,443 | 39,936 | 60,292 | 31,907 |

5. Share data(in euros) | | | | | | |

• Average number of shares outstanding (a) | 1,261,287,823 | 983,718,801 | 1,053,241,249 | 942,438,942 | 995,133,046 | 903,000,000(b) |

• Number of shares at year-end | 1,277,444,403 | 983,871,988 | 1,270,756,255 | 983,871,988 | 1,020,465,386 | 903,000,000 |

• Earnings per share | 2.86 | 2.34 | 2.39 | 1.89 | 1.70 | 1.45 |

• Dividend distributed | 1.20 | 1.10 | 1.00 | 0.68 | 0.79 | 0.46 |

6. Headcount | | | | | | |

Total workforce | | 50,244 | | 52,958 | | 38,088 |

Total average workforce | 186,198 | | 208,891 | | 217,180 | |

• Fully consolidated companies | 138,678 | | 157,918 | | 160,966 | |

• Proportionately consolidated companies | 38,567 | | 41,673 | | 50,614 | |

• Equity-accounted companies | 8,953 | | 9,300 | | 5,600 | |

(a) Earnings per share is calculated based on the average number of shares outstanding, net of treasury shares. (b) Based on a nominal value of 1 euro per share. |

REFERENCE DOCUMENT 2008  13

13

Back to contents

REFERENCE DOCUMENT 2008  14

14

Back to contents

4 RISK FACTORS

4.1

RISK MANAGEMENT PROCESS

16

4.1.1

GDF SUEZ Audit Committee role

16

4.1.2

GDF SUEZ global risk management policy

16

4.2

GDF SUEZ OPERATES IN A CHANGING ENVIRONMENT

17

4.2.1

An economic environment in crisis in 2008 and 2009

17

4.2.2

Financial risks of the current crisis

18

4.2.3

Changing competitive environment for several years

21

4.2.4

Climatic uncertainties

21

4.2.5

Changing regulatory environment

22

4.3

THE GDF SUEZ BUSINESS MODEL IS SUBJECT TO NUMEROUS CONSTRAINTS

24

4.3.1

Short- and long-term energy purchases

24

4.3.2

Importance of regulated market sales

24

4.3.3

Development mainly in Europe, but also in other countries around the world

25

4.4

INDUSTRIAL SAFETY AT THE HEART OF GDF SUEZ’S ACTIVITY

27

4.4.1

The Group operates businesses with risks of industrial accidents and interruptions to customer service continuity

27

4.4.2

The Group owns facilities with risks of pollution to the surrounding environment

27

4.4.3

The Group operates several industrial facilities in Europe classified as Sevesos sites (“high threshold”)

28

4.4.4

The Group operates several nuclear power plants in Belgium

28

4.4.5

Petroleum gas exploration-production activities comprise certain specific risks

29

4.5

THE GDF SUEZ ORGANIZATION IN THE FACE OF TRANSVERSAL RISKS

30

4.5.1

Ethics and Compliance

30

4.5.2

Legal risks

30

4.5.3

Risks related to human resources

31

4.5.4

Risks related to health & safety and the protection of corporate assets

31

4.5.5

Risks related to information systems

32

4.6

INSURANCE

33

Main Insurance programs

33

REFERENCE DOCUMENT 2008  15

15

Back to contents

The varied nature of its activities, geographic locations and offers means that GDF SUEZ presents a portfolio of risks and opportunities of a financial, industrial and commercial nature. Its leadership position in the energy and environmental services sectors, allied with its development ambitions, also expose it to strategic and reputational risks that are mainly dependent on climatic changes and changes in its businesses’ regulatory environment.

The Group conducts its business in an environment subject to major changes and this creates numerous risks, some of which are beyond its control. The following is a presentation of the significant risks to which the Group considers itself to be exposed. The Group could also be affected by other unmentioned or currently unknown risks. The occurrence of one of these risks could have a significantly negative impact on the Group’s activity, financial situation and results, its image, its outlook or on the GDF SUEZ share price.

4.1 RISK MANAGEMENT PROCESS

For several years, and based on each Group’s own defined policy, both Gaz de France and SUEZ were equipped with processes for managing their risks. In 2007, both Groups published details of their risk management policies, notably in their latest report on internal control policy as an annex to their 2007 Reference Document. These policies were based on similar foundations, were consistent with industry standards, and demonstrated their intent to reduce their risks to a reasonable level, in line with their targets.

These policies were applied until the merger of the two groups. During the second quarter prior to the merger, each entity’s Business Units updated their respective risk mapping.

4.1.1 GDF SUEZ AUDIT COMMITTEE ROLE

In terms of risks, the Audit Committee has the following role (detailed in Section 16.3.):

•

maintain regular awareness of the Group’s financial and cash situation and its significant commitments and risks;

•

review the risk management policy and procedures adopted to assess and manage these risks.

The global risk management policy guidelines were presented to the Audit Committee on October 14, 2008. The Audit Committee has been kept regularly informed of risk exposure associated with the financial and economic crisis. The initial risk review of all GDF SUEZ activities was presented to the Audit Committee at the beginning of March 2009.

4.1.2 GDF SUEZ GLOBAL RISK MANAGEMENT POLICY

GDF SUEZ aims to manage its risks in order to maintain and develop its growth, asset base, reputation and internal motivation. The Group considers as a risk “any event likely to affect the future existence of the enterprise, its reputation or the achievement of its strategic, financial and operational objectives”. The Group favors reasonable and financially viable risk-taking in compliance with laws and regulations and in line with generally held opinion.

To achieve this ambition, GDF SUEZ has appointed the member of Executive Committee in charge of the Audit and Risk Division as the Group’s Chief Risk Officer. The Risk Management Department reporting to the Chief Risk Officer is responsible for managing the Enterprise Risk Management (ERM) network. Risk Officers from this department at Central level, Business Line level and Business Unit level, along with functional Departments all work to support directors in identifying and assessing risks, as well as in evaluating the means deployed to reduce and cover such risks. In early 2009, a unified risk assessment methodology will be defined, based on industry standards and best practices and the experience acquired by the two former groups.

REFERENCE DOCUMENT 2008  16

16

Back to contents

Depending on their nature, risks are managed by the Business line and/or functional Departments (and their networks). Specifically:

•

the Finance Department manages, measures and controls risks associated with the Group’s financial activities (rates, foreign exchange, liquidity and counterparty risks) within a special risk policy framework. Within the context of Group energy market risk and energy counterparty risk policies laid down by the Finance Department, the latter ensures consolidated measurement of these risks, along with second level control and management of the Energy Market Risk Committee. In addition, the Insurance Department is in charge of drafting, deploying and managing insurance programs (see Section 4.6. for further details);

•

the Legal Department manages the Group’s legal risks;

•

the Strategy and Sustainable Development Department coordinates management of risks within its area of responsibility.

This is also the case for risks associated with ethics, compliance, security, information systems, human resources, health & safety and environmental protection for which control initiatives are coordinated by the relative Departments in charge of these areas.

Preparedness for crisis management is entrusted to the Health & Safety and Management Systems Department. Crisis management affecting personnel working in sensitive locations forms part of the Security Department’s remit.

The Business Units conducted their own risk reviews prior to the merger and have since updated them as required. During the fourth quarter 2008, both the Divisions and the functional Departments conducted an initial review of their new merged activities. A summary of the results of this review was produced to highlight GDF SUEZ’s main risks. The Executive Committee and the Audit Committee conducted a preliminary review of these results in January and a final review at the end of the first quarter 2009.

The Internal Audit Division within the Audit and Risk Department is responsible for preparing the GDF SUEZ audit program. The Department uses risk mapping to identify the most pertinent audit issues and to assess risk coverage. These audit results are then exploited to update risk mapping.

4.2 GDF SUEZ OPERATES IN A CHANGING ENVIRONMENT

4.2.1 AN ECONOMIC ENVIRONMENT IN CRISIS IN 2008 AND 2009

The 2008 fiscal year has been characterized by the spread of the current crisis to a worldwide level, initially in the banking and financial sectors and then in the real and industrial economy. Given its activities, GDF SUEZ is sensitive to these economic climate factors, for which the potential impacts are described below.

4.2.1.1 Group activities are sensitive to economic cycles and changes in demand

Some of the Group’s businesses, such as services to industrial clients, are sensitive to economic cycles. Any economic slowdown has a downward impact on industrial investments such as maintenance operations and consequently has a negative influence on demand for installation and engineering services offered by the Group’s service entities. This fluctuation in demand can cause major variations in the levels of activity and margins for these businesses.

In Western Europe, the Group’s activities could also suffer from relocation (offshoring) on the part of their industrial clients’ businesses towards low-wage countries. In particular, in energy activities, major electricity-intensive clients (metallurgical industry, chemicals industry) could relocate their manufacturing facilities to regions where energy costs are lower than on their domestic markets.

Notably, the economic crisis that worsened at the end of 2008 could lead to a slowdown in activity with the Group’s major clients and consequently contribute to a fall in unitary or overall demand for energy, water, waste management and associated services which would impact the Group via its business volumes and margins. Broad diversification within the Group across numerous geographic zones and business sectors only offers partial protection against this risk.

REFERENCE DOCUMENT 2008  17

17

Back to contents

4.2.1.2 Group activities are sensitive to changes in methods of consumption and production

On top of the crisis, a host of societal, regulatory and climatic factors are combining to hinder the expansion of electricity, gas and water consumption.

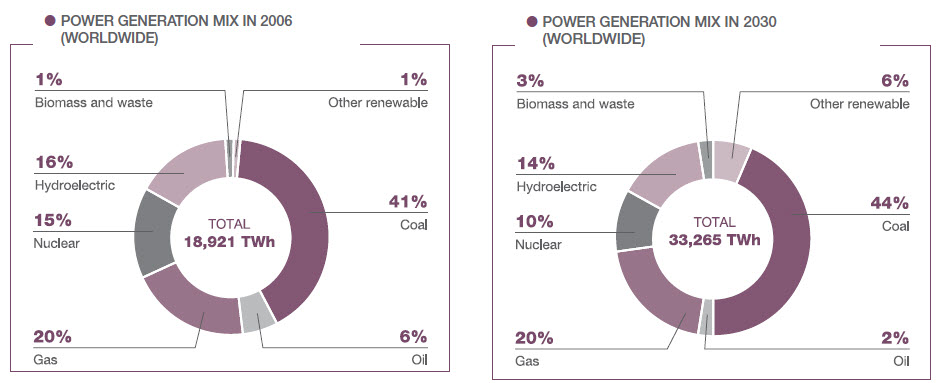

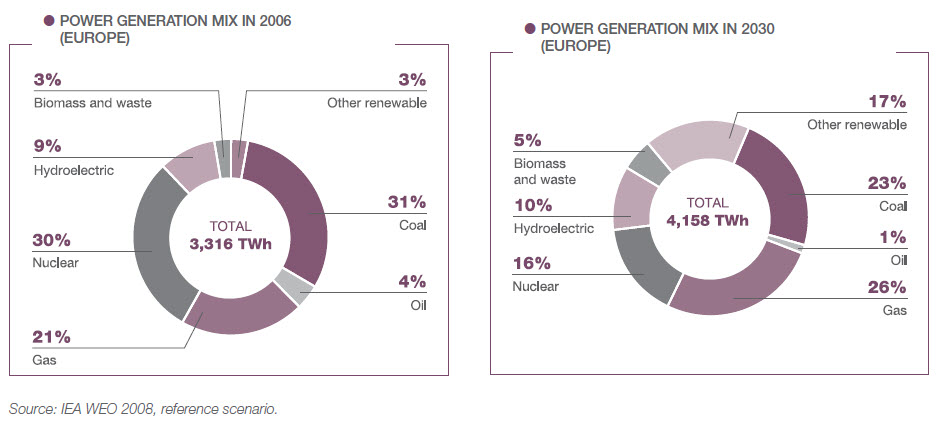

In terms of methods of production, one major noticeable feature is the requirement to integrate CO2 constraints, coupled with measures in support of renewable energies and other regulatory and fiscal measures that are complicating the competitive balance between the various forms of energy and creating greater uncertainty than ever before with respect to appropriate technology choices for the future (gas, nuclear, coal, renewable energy, etc.).

Any forecasting error in terms of these energy mix changes could lead to poor investment choices and compromise the Group’s future profitability. However, the diversified nature and the balance of the Group’s asset and client portfolios contribute to limiting its exposure to this risk, notably vis-à-vis its principal less-diversified competitors.

4.2.2 FINANCIAL RISKS OF THE CURRENT CRISIS

The financial crisis and its multitude of consequences in terms of liquidity and credit risks had an impact on the Group’s financial activities in 2008. The following section describes the financial risks to which the Group is exposed with, as needs be, their indicators, sensitivity analyses and management and reporting methods. The potential impacts of financial risks are detailed by risk category.

At the organizational level, via its Finance Committee, the Group enacts policies with particular reference to financial risk management.

Financial risks (liquidity, rates, foreign exchange and counterparty) are managed globally by specialized financial teams at the Central level, or in the operational entities. All of these teams report ultimately to the Group Chief Financial Officer.

In order to monitor changes in financial risks and guarantee the quality of the financial information, the Group has set up a risk management reporting system based on data that is systematically reconciled with data from consolidation reporting. This reporting system covers all of the companies within the Group and provides a very detailed understanding of financial commitments. This reporting is produced quarterly, and is distributed to the Group Chief Financial Officer and to Division Financial Officers. It enables management to maintain systematic risk monitoring.

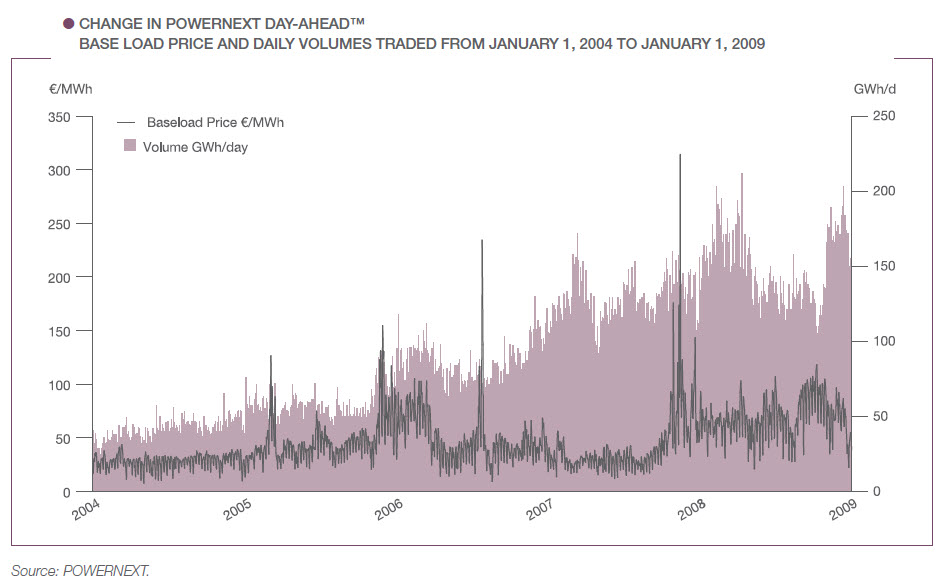

4.2.2.1 Commodities market risk

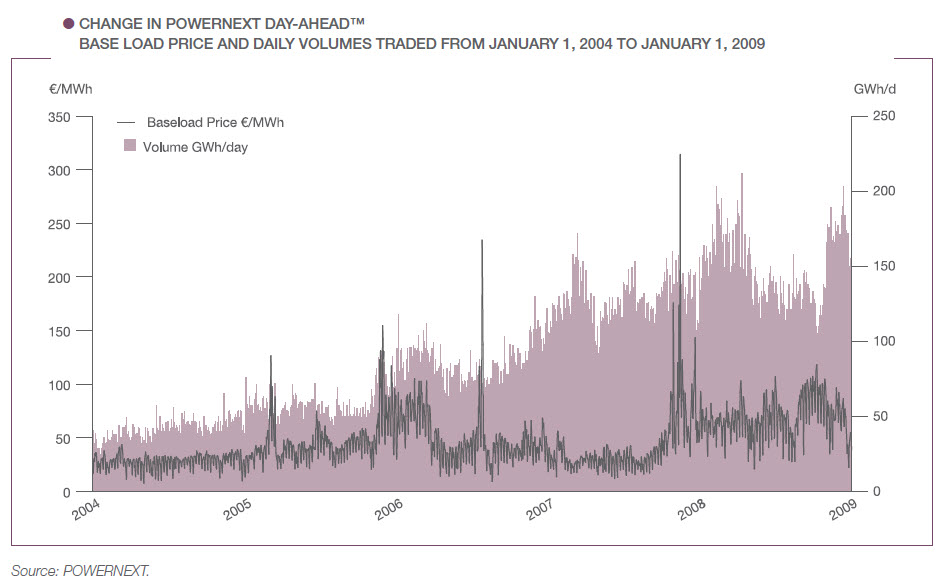

In conducting its business, the Group trades in commodities markets, particularly, in the markets for gas, electricity and various oil products, either to obtain short- and long-term supplies or to optimize and secure its energy production and trading chain. The Group also intervenes on the European Union greenhouse gas emission trading scheme (CO2 quotas).

In the energy sector, the Group also uses derivative products, either to offer price hedging instruments to its customers or as part of its proprietary trading.

Therefore, the Group is exposed to changes in the prices of these commodities on organized or over the counter markets. This risk is managed by using forward firm or optional derivative products.

In each of the Group’s energy trading entities, exposure to these risks is measured and managed on a daily basis, in compliance with limits and management policy set down by General Management. The risk control system associated with this trading activity includes a team specialized in market and credit risk control (the Middle Office department, supported by the Back Office for accounting checks), a dedicated Risk Committee, tight internal control principles (segregation of duties, separation of tasks, verification of data such as price curves, etc.) and a set of formal policies to monitor and control market and credit risks.

The control of market risks associated with trading activities in the Group’s Divisions has been reinforced by a second level control system under the aegis of the Finance Department. In this context, an Energy Market Risks Committee (EMRC) has been formed with the primary tasks of defining the overall market risk control framework and ensuring monitoring of the Group’s main market exposures.

Market risk assessment is performed on the basis of portfolio positions sensitivity or on the “Value at Risk” (VAR) method which quantifies the maximum amount of the risk associated with a given holding period of a position and a given confidence level. This management data is provided in Note 15 to the Consolidated Financial Statements (see Chapter 20.2 of this Reference Document).

4.2.2.2 Liquidity risk

The Group’s financing policy is based on the following principles:

•

centralization of external financing;

•

diversification of financing sources between the banking market and the capital markets;

•

balanced financial debt repayment profile.

REFERENCE DOCUMENT 2008  18

18

Back to contents

The GDF SUEZ Group centralizes almost all the cash needs and surpluses of companies controlled by the Group, as well as the majority of their external medium- and long-term financing requirements.

Centralization is provided via financing vehicles (long-term and short-term), as well as via the Group’s dedicated cash pooling vehicles located in France, Belgium and Luxembourg.

Since the merger, the cash pooling systems existing at SUEZ and at Gaz de France have been the subject of a convergence process that is scheduled for completion in 2009, along with the automation of cash pooling systems that are still managed manually in certain other countries (USA, United Kingdom, Italy etc.).

The Group diversifies its financing resources by proceeding with, as applicable, public or private bond issues in the framework of its Euro Medium Term Notes program and by issuing commercial paper(billets de trésorerie) in France and in Belgium, and Commercial Paper in the United States.

In this context, and since the merger, access to long-term capital markets is concentrated on the parent company GDF SUEZ SA for the Group’s new bond debt and on GDF SUEZ SA and Electrabel for commercial paper issued.

At December 31, 2008, bank resources (excluding bank overdrafts, amortized costs and the effect of derivatives) represented 40% of gross debt, with the balance financed by the capital markets (including €13,719 million in bonds, i.e. 37% of gross debt).

Outstanding short-term paper (billets de trésorerie and commercial paper) represented 23% of gross debt and totaled €8,666 million at December 31, 2008 (refer to Note 14.2.1 in Chapter 20.2). Due to their attractive cost and their liquidity, these programs are used in a cyclical or structural fashion to finance the Group’s short-term requirements. All of the outstanding amounts are backed by confirmed bank credit facilities so that the Group would be able to continue to finance itself in the event that access to this financing source were to dry up.

Liquidity is based on maintaining cash and cash equivalents and confirmed credit facilities. The Group has confirmed credit facilities appropriate to its size with appropriate debt maturity schedules. The amount of these confirmed credit facilities represented €14,522 million as of December 31, 2008, of which €3,117 million was drawn down. 83% of the total lines of credit and 88% of the lines not drawn are centralized. None of these lines contains a default clause tied to financial ratios or ratings.

Cash (net of bank overdrafts) totaled €8,595 million as of December 31, 2008.

Surpluses carried by cash pooling vehicles are managed as part of a single policy.

In the wake of the sub-prime mortgage crisis in the summer of 2007 in the United States, almost all surpluses have been invested in time deposit accounts and regular income money market funds.

The interbank liquidity crisis created by the failure of the Lehman Brothers bank in mid-September 2008 and the ensuing rise in counterparty risk led the Group to immediately refocus this investment policy in order to attain extremely high liquidity (at December 31, 2008, 98% of centralized cash was invested in overnight bank deposits and regular income money market funds with daily liquidity), accompanied by daily monitoring of performance and counterparty risks on both these types of investments to ensure immediate reactivity.

Cash surpluses that cannot be centralized are invested in selected instruments on a case-by-case basis, in relation to local financial market constraints and the financial soundness of counterparties’.

4.2.2.3 Foreign exchange risk

Due to the geographic diversification of its activities, the Group is exposed to conversion risk, which means that its balance sheet and income statement are sensitive to fluctuations in exchange parities at the time of consolidation of the accounts of its foreign subsidiaries outside the euro zone. The interests held by the Group in the United States, Brazil, Thailand, Poland, Norway, and the United Kingdom generate most of the Group’s foreign exchange risk (see Note 3.3 in Chapter 20.2).

For investments in currencies not included in the euro zone, the Group’s translational risk hedging policy consists of creating liabilities denominated in the same currency as the cash flows generated by these assets.

Of the hedging instruments used, debt in foreign currency is the most natural hedge, but the Group also uses currency derivatives that synthetically recreate debt in currencies: cross currency swaps, exchange rate swaps, and exchange rate options.

However, this policy cannot be implemented if the cost of hedging (specifically the interest rate of the reference currency) is too high. This is the case for Brazil where, because of a rate differential that is too high and the local revenue indexing mechanism, the Group opts for catastrophic coverage, i.e. insurance against a major depreciation in the currency (risk of temporary decoupling).

The market context is reviewed monthly for the US dollar and pound sterling. It is monitored, as often as needed, by reviews of emerging countries in order to anticipate any sudden devaluation. The hedging ratio of assets is reviewed periodically depending on the market context and each time an asset is added or removed. Any substantial change in the hedging ratio is subject to prior Management approval.

Liabilities denominated in foreign currencies represent 37% of the Group’s net debt, excluding amortized costs and derivative instrument effects (refer to Note 15.1.3.1 in Chapter 20.2).

A change in currency exchange rates vs. the euro affects results only with regard to liabilities denominated in another currency, rather than the reporting currency of companies bearing these liabilities on their balance sheets, to the expent that these liabilities have not been documented as net investment hedges. Ultimately, an unfavorable, uniform change of 10% in the euro exchange rate has no material impact on earnings.

For financial liabilities (debts and derivatives) recognized as net investment hedging, a uniform unfavorable change of 10% in the euro exchange rate has a shareholders’ equity impact of €176 million. This change is offset by an opposite effect on foreign currencies assets.

REFERENCE DOCUMENT 2008  19

19

Back to contents

The Group is also exposed to transaction risk. This risk is concentrated on transactions involving energy commodities (energy sales or purchase commitments), where commodities flows are settled in US dollars and pounds sterling. The corresponding cash flows are generally hedged by forward currency contracts.

The transactional currency risk is managed by dedicated teams. These specialized teams measure exposure on an ongoing basis and call upon the competence center (the Central headquarters team also responsible for translation risk management) in order to define and implement hedging instruments for these risks (see Note 15.1.3.1 in Chapter 20.2).

4.2.2.4 Interest rate risk

The principal exposures to interest rates for the Group are the result of financing in euros and US dollars, which represented 86% of the net debt as of December 31, 2008.

The Group’s objective is to control its financing expense by limiting the impact of interest rate changes on its income statement.

The Group’s policy is to spread the reference interest rates on net debt among fixed rates, variable rates, and protected or capped variable rates. The Group aims to achieve a balanced distribution of the various reference rates over a medium-term (5 years) timeframe. However, the balance of the mix may fluctuate depending on the market context.

The Group uses hedging instruments, primarily rate swaps and options, in order to manage the interest rate structure for its net debt.

The positions are centrally managed. Rate positions are reviewed quarterly and at the time of any new financing. Any substantial change in the rate structure is subject to prior approval by the Finance Department.

The cost of the Group’s debt is sensitive to rate changes for all debt indexed on variable rates. The cost of the Group’s debt is also affected by changes in the market value of financial instruments not documented as hedges under IAS 39. On the date of this Reference Document, none of the options hedges contracted by the Group are recognized as hedges under IAS 39, even though they offer an economic hedge (see Note 6.1 in Chapter 20.2).

As of December 31, 2008, the Group had a portfolio of hedge options (caps) that protects it against an increase in the euro, dollar and sterling short rates. Given the marked decline in all short rates during the 2008 fiscal year, almost none of the euro, dollar and pound sterling hedge options have been activated for the time being, with the consequence of variability being introduced into the cost of the corresponding debt, euro short rates, US dollars and pound sterling being lower than protected levels. However, the value of this hedge options portfolio appreciates when the short and long rates increase together and depreciates when they decline (see Note 15.1.3.2 in Chapter 20.2).

As of December 31, 2008, after taking account of financial instruments, approximately 58% of the Group’s gross debt was at a variable rate and 42% at a fixed rate. Since almost the Group’s entire surplus is invested short-term, as of December 31, 2008, 55% of net debt was at a fixed rate and 45% at a variable rate. The result of this distribution is to sharply limit the sensitivity to rate increases.

A 1% increase in short-term interest rates (uniform across all currencies) on the balance of net variable-rate debt, and the variable-rate portions of derivatives, would lead to an increase in net interest expense of €129 million. A decline of 1% in short-term interest rates would result in a drop of €131 million in net interest expense. The asymmetry of the impact is linked to the impact of the caps portfolio.

A 1% increase in interest rates (identical for all currencies) would generate a gain of €343 million on the income statement, associated with the change in fair-market value of undocumented derivatives or derivatives recognized for net investment hedging. Conversely, a drop of 1% in interest rates would generate a loss of €246 million. The asymmetry of the impact is associated with the caps portfolio, for which the loss is limited to the Mark-to-Market value posted to the balance sheet.

A uniform change of more or less than 1% in interest rates (identical for all currencies) would generate, in terms of shareholders’ equity, a gain or a loss of €138 million associated with the change in fair market value of documented cash flow hedging derivatives.

4.2.2.5 Counterparty risk

GDF SUEZ is exposed to counterparty risk in both its financial and operational activities.

In respect of its financial activities, GDF SUEZ has deployed counterparty risk management and control procedures based, on the one hand, on counterparties’ accreditation in relation to their external ratings and objective market considerations (credit default swaps, stock market capitalization) and, on the other hand, on the setting of risk limits. With the aim of reducing the risk incurred, GDF SUEZ may also have recourse to contractual instruments such as standardized netting agreements or margin calls with its counterparties. In the wake of the financial crisis, the Group reinforced its control system in the second half of the year with daily monitoring of risk limits and weekly reporting to the Management Committee of the Group’s principal financial counterparty exposures.

Control of counterparty risk associated with operational activities in the Group’s Divisions has been strengthened by way of a second level control system managed by the Finance Department. As part of EMRC procedures, the Finance Department ensures quarterly monitoring of the Group’s principal counterparty exposures.

REFERENCE DOCUMENT 2008  20

20

Back to contents

4.2.2.6 Stock price risk

As of December 31, 2008, the Group holds a number of equity interests in publichy-traded companies (see Note 14 in Chapter 20.2), the value of which fluctuate on the basis of trends in the world’s stock markets. An overall decline of 10% in the value of these securities would have an impact of about €107 million on the Group’s earnings or shareholders’ equity, depending on whether the decline is considered significant and long lasting. The Group’s portfolio of listed and unlisted stocks is managed under a specific investment policy and is subject to regular reporting to management.

4.2.3 CHANGING COMPETITIVE ENVIRONMENT FOR SEVERAL YEARS

In its various activities, the Group is confronted with an increase in competitive pressure, from both major international operators and, in some markets from public and private sector niche players.

4.2.3.1 Energy market deregulation increases competition in these activities

Deregulation of the electricity and gas markets, both in Europe and the United States (see Section 4.2.5 for more information), has opened the door to new competitors, introduced volatility to market prices and called into question the viability of long-term contracts. It may also open up to competition certain distribution concession contracts currently held by GDF SUEZ.

In recent years, we have witnessed a trend towards concentration of the major energy players in Europe. In the gas sector, major producers are becoming interested in the downstream value chain and are entering into direct competition with established distribution companies, including those belonging to the Group. In France specifically, reciprocal competition with EDF on the gas and electricity markets is a sensitive issue, notably in terms of image, given its past as a joint “EDF-GDF” distributor. Furthermore, consumers now seek to have a single energy provider, capable of proposing a combined gas and electricity offer.

Increased competitive pressure could have a significant negative effect on the Group’s activities in terms of selling prices, margins and market share.

4.2.3.2 Environmental services activities confronted with stiff competition

In the Environmental Services sectors (Water and Waste Services), the Group’s activities are also subject to strong competitive pressures from both local and international operators, resulting in pressure on selling prices to industrial and municipal customers, as well as a risk of non-renewal of major contracts as and when they expire. We are currently observing a trend towards consolidation of market players in Waste Services in Europe, particularly in the United Kingdom, Germany and the Benelux countries. Added to this, new forms of competition have appeared recently: aggressive strategies on the part of investment funds, the involvement of certain public sector operators and attempts by local authorities to regain control of such services, etc.

4.2.4 CLIMATIC UNCERTAINTIES

Energy businesses, especially those involved in sales to consumers are directly affected by climatic conditions and the “climate change” issue in general.

4.2.4.1 Climatic conditions have a significant impact on results

In the energy sector, major climatic changes (mainly in terms of temperature) from one year to the next can cause substantial swings in demand, with higher demand during the coldest years and lower demand during warmer ones. This factor is likely to have a direct impact on the Group’s results.

4.2.4.2 Measures taken at the national, European and worldwide level to combat climate change can impact the Group

In the wake of the Kyoto Protocol and more recent agreements, the fight against climate change is becoming widespread and has resulted in the introduction of many regulatory texts in terms of environmental and fiscal legislation in France, Europe and at the international level (see Section 4.2.5 for further details). These moves could have a profound impact on the economic models adopted by the Group. For example, certain uses of gas and coal could be supplanted due to their carbon content. A distorted competitive situation could be created in the electricity sector via exemptions, incentives and subsidies or by reducing margins via tariff squeezing. This would prevent the passing on of CO2 quota costs to customers.

REFERENCE DOCUMENT 2008  21

21

Back to contents

While these developments may have a negative impact on the Group’s results, they also comprise their share of new business opportunities in renewable energy, nuclear energy, carbon storage, and energy efficiency services. Accordingly, while the Group could extend its scope of development, it will also have to confront a new form of competition.

The introduction, from 2005 onwards, of a market for trading greenhouse gas emissions rights in Europe (EUETS(1)), coupled with national CO2 quotas allocation plans creates volume and price risks on these quotas for the entire energy sector. However, the scheme does create arbitrage and trading possibilities for the industry’s most advanced players, including GDF SUEZ. Approximately 200 of the Group’s European sites participate in this CO2 quotas allocation system.

Finally, the Group is working to limit “climate” risks through active monitoring and diversification of its energy portfolio. For the medium term, efforts are converging to boost the share of low carbon energy sources (natural gas, nuclear, renewable energy) in the global energy mix, improve the capture of biogas from waste storage sites, and harness the energy produced by waste incineration, landfills and anaerobic sludge treatment facilities as renewable energy. This policy does not exclude maintaining, upgrading or even increasing the coal-fired power station fleet where this course of action is justified by economic and political circumstances.

For the long term, the Group seeks to diversify its energy sources and is already developing a demonstration program to capture and isolate carbon dioxide emissions in order to make it feasible to maintain its coal facilities in the context of tougher carbon emission restrictions.

4.2.5 CHANGING REGULATORY ENVIRONMENT

The legal and regulatory landscape for the Group’s businesses is undergoing transformation, in terms of both environmental issues and energy sector (de)regulation.

4.2.5.1 Tougher sustainable development requirements could mean even more stringent environmental legislation

The Group’s activities are also subject to a large number of laws and regulations concerning respect for the environment, health protection, and safety standards. These texts govern air quality, greenhouse gases, waste water treatment, drinking water quality, hazardous and household waste treatment, soil contamination and the management of nuclear facilities, gas transport networks, storage facilities and LNG terminals.

A change in regulations, or more stringent regulations, could generate additional costs or investments for the Group, which it cannot guarantee recovering through sufficient additional revenues. Following such changes or stricter regulations, the Group may have to cease an activity, without any assurance that it will be able to offset the associated costs. Finally, regulations imply investments and operating expenses not only by the Group, but also by its customers, and particularly by local government concessionaires, primarily due to compliance obligations.

On the climate change management front, the European Commission has opened a debate about measures aimed at cutting the Union’s greenhouse gas emissions by 20% and final energy consumption by 20%, and renewable energy accounting for 20% of final energy consumption by the year 2020 compared with the 1990 level. On January 23, 2008, the Commission notably proposed a draft directive on renewable energy and a draft revision to the directive 2003/87 relating to the European quota trading scheme; the European Parliament and the Council of Ministers adopted the “energy-climate” package end 2008. In France, the Environment summit (Grenelle de l’environnement) has picked up the challenge of this ambitious project and even added to it.

Among the new regulations introduced in 2008, the European Commission’s technical regulations on fluoride greenhouse gases, implementation of REACH regulations on chemical products and the new framework directive on waste (2008/98) are all examples of the ad-hoc tightening of regulations with impacts on some Group activities. More generally, the directive relating to criminal liability for environmental protection (2008/99) of November 19, 2008 constitutes a harmonized requirement for strict implementation of environmental protection policies across all of the Group’s European sites.

Beyond contractual precautions negotiated on a case by case basis, the Group works to limit all of these risks, principally as part of an active environmental protection policy (see Section 6.6.2.4, “Active Environmental Protection Policy”) and by managing a comprehensive insurance program (see Section 4.6 “Insurance”).

(1)

European Union Emission Trading Scheme, introduced in Directive 2003/87.

REFERENCE DOCUMENT 2008  22

22

Back to contents

4.2.5.2 The Group may not obtain the licenses or permit renewals required to continue its activities

Continued performance of its activities assumes that the Group will obtain or renew various permits and licenses (concessions, Seveso sites, supply permits) from the relevant regulatory authorities. These authorization processes can be long, costly and sometimes unpredictable.

Moreover, the Group may be confronted with objections from the local population to the installation and operation of certain facilities (notably for operating nuclear, thermal and renewable energy power stations, liquefied natural gas terminals, gas storage plants, waste landfill sites and incinerators, waste water treatment plants), based on pollution and landscape deterioration concerns, or more generally on the invasion of their environment. This opposition can make it harder for the Group to obtain building permits or operating licenses or may lead to their non-renewal in the absence of exclusive rights, or even to a review of existing permits. In this respect, the Group may be faced with opposition proceedings lodged by environmental defense associations which may delay or prevent the operation or expansion of its activities.

Finally, official bodies that issue licenses and permits to the Group may introduce significantly tighter restrictions.

The Group’s failure to obtain, or any delay in obtaining, licenses or permits, or the non-renewal, review or significant tightening of conditions attached to licenses and permits obtained by the Group, could have a negative impact on its activity, its financial situation, its results and its development prospects.

4.2.5.3 Energy sector regulatory changes may impact the Group’s strategy and profitability

A great many aspects of the Group’s activities, particularly the production, transmission and distribution of electricity, the operation and maintenance of nuclear facilities, the conveyance and distribution of natural gas and liquefied natural gas (LNG), water management, waste collection and treatment, are subject to stringent regulations at the European, national and local levels (competition, licenses, permits, authorizations, etc.). Regulatory changes may affect operations, prices, margins and investments and, consequently, the Group’s strategy and profitability.

At both the European and national level, plans to introduce regulatory changes are under way which pose a direct threat to GDF SUEZ business model and risk profile. In particular, and for the short term, the main changes are to be found in the third European directive on the internal market for natural gas. This directive could lead to ownership unbundling of gas transport network assets. The financial impacts of such changes will depend on the final terms of the directive and on its conditions of transposition.

In addition, in some EU member states, and at the European level, a desire for a return to, or the emergence of, state intervention in the energy sector is rearing its head via the regulation and the extension of market regulators’ prerogatives in the area of competition. In particular, these moves can appear via price controls, the continued existence or the intent to reintroduce regulated tariffs for both gas and electricity at levels incompatible with procurement or production costs, discriminatory measures such as “windfolltaxes” on energy operators’ profits, the ring-fencing of provisions accrued for dismantling nuclear power stations, regulator intervention in the deregulated market to encourage increased competition or the intent to regain control of services on the part of local authorities.

It is impossible to predict all regulatory changes despite the monitoring systems put in place. However, the Group is diversifying this risk by operating its principal businesses in different countries equipped with their own regulatory systems. Furthermore, and in contrast, some regulatory changes offer new market opportunities for the Group’s activities.

REFERENCE DOCUMENT 2008  23

23

Back to contents

4.3 THE GDF SUEZ BUSINESS MODEL IS SUBJECT TO NUMEROUS CONSTRAINTS

4.3.1 SHORT- AND LONG-TERM ENERGY PURCHASES

4.3.1.1 The Group is engaged in long-term “take-or-pay” gas procurement contracts with minimum volume commitments

The development of the Group’s gas activity in Europe is occurring to a large extent on the basis of long-term “take-or-pay” contracts. According to these contracts, the seller commits on a long-term basis to serve the buyer, in exchange for a commitment on the behalf of the buyer to pay for minimum quantities, whether or not they are delivered. The minimum amounts can only vary partially depending on weather contingencies. However, these commitments are subject to protective (force majeure) and flexibility conditions.

A major proportion of the Group’s contracts are of the “take-or-pay” type in order to guarantee availability of the quantities of gas required to supply its customers in future years. Regular price revision mechanisms are included in the long-term contracts to guarantee competitive gas prices to the buyer on the final market. In the event of the purchased gas losing its price competitiveness, GDF SUEZ would only be exposed to the “take-or-pay” risk on the quantities purchased prior to the following price revision date.

4.3.1.2 The Group is dependent on a limited number of suppliers in some activities, notably for natural gas purchases

To secure its gas supplies, the Group has concluded long-term contracts with its main suppliers, with the assurance of a broadly-diversified supply portfolio, notably in geographic terms. The Group also benefits from flexibility and modulation (flexibility of long term contracts, considerable storage and regasification capacities, and purchasing on markets). Nevertheless, if one of the Group’s major suppliers were to fail over an extended period for any reason whatsoever (geopolitical, technical, financial), the cost of replacing the gas and conveying it from an alternative location could be substantially higher and would affect the Group’s margins, at least over the short term.

In addition, for managing water treatment plans, thermal power stations or waste treatment plants, Group companies may depend on a limited number of suppliers for their supplies of water, household waste, various fuels and equipment. For example, the market for turbines and foundry parts for electrical power plants is, by nature, oligopolistic and will be particularly tight over the coming years.

Any interruption in supplies, any supply delay or any failure to comply with the technical performance guarantee for a piece of equipment, even if caused by a contractual breach on the part of a supplier, could impact the profitability of a project, despite the protective contractual safeguards put in place.

The variety of the Group’s businesses and their diverse geographic locations result in a broad range of situations and provide partial protection against the risk of failure of a major supplier.

4.3.2 IMPORTANCE OF REGULATED MARKET SALES

4.3.2.1 The Group is dependent on a limited number of customers in certain activities, notably in electricity sales and water concessions

Whether in the energy or the environmental sector, some of the Group’s subsidiaries have signed contracts, particularly with public authorities, where performance may depend on just a few customers, or even a single customer. Moreover, these are often long-term contracts, running for up to 30 years, or even longer. This is the case, for example, for delegated water management agreements or certain electricity production and sales activities with medium- and long-term energy purchase agreements (“power purchase agreements”), or even for household waste incinerator management contracts.

The refusal or the inability on the part of a customer to meet its contractual commitments, particularly in the area of tariff adjustments, may compromise the economic balance of such contracts and the profitability of any investments possibly made by the operator. If the contracting parties fail to meet their obligations, despite contractual provisions for this purpose, it may not always be possible to obtain full compensation. This could impact the Group’s revenues and results. The Group has encountered such situations in the past, particularly in Argentina.

REFERENCE DOCUMENT 2008  24

24

Back to contents

The variety of the Group’s businesses and their diverse geographic locations result in a broad range of situations and types of customers (industries, local municipalities and individuals). The Group considers that no relationship exists binding it to a client for which termination would have a significant impact on the Group’s financial situation and results.

4.3.2.2 A major share of Group sales is based on regulated, administered or controlled tariffs, the principles of which may not be adhered to by the authorities

In France, a portion of the Group’s energy and services sales is conducted within the framework of administered tariffs subject to regulations. French laws and regulations and European legislation, as well as rulings by regulation bodies (particularly the Commission for Energy Regulation (CER) for access tariffs to certain infrastructure), may affect the Group’s sales, profits or profitability due to:

•

only partial pass-through on of procurement costs in natural gas sales tariffs (as the current tariff does not reflect costs, the cumulative impact for the Group at the end of 2008 was €1,606 million as explained in Section 6.1.3.1 of this Reference Document);

•

consumer protection measures;

•

only partial pass-through on of costs in gas infrastructure access tariffs;

•

introduction of a transitional market adjustment regulated tariff.

Administered tariffs also apply in the consumer, even industrial energy distribution and sales activities in countries such as Italy, Hungary, Romania, Slovakia and Mexico.

4.3.3 DEVELOPMENT MAINLY IN EUROPE, BUT ALSO IN OTHER COUNTRIES AROUND THE WORLD

4.3.3.1 A growing share of the Group’s activities and gas supplies comes from countries presenting a higher political and economic risk than domestic markets

While the Group’s activities are mainly concentrated in Europe and North America, which together accounted for 90% of consolidated revenues and capital employed in 2008, the Group also conducts business on worldwide markets, notably in emerging countries such as Brazil and China. In the same vein, a significant share of gas supplies and exploration-production business comes from countries such as Russia, Algeria, Egypt and Libya.

The Group’s activities in these countries comprise a certain number of potential risks, particularly in the areas of GDP volatility, economic and governmental instability, modifications to regulations or their imperfect application, nationalization or expropriation of privately-owned assets, payment difficulties, social unrest, major fluctuations in interest rates and exchange rates (devaluation), taxes or associated contributions levied by governments and local authorities, exchange control measures and other unfavorable interventions or restrictions imposed by governments. In addition, the Group could be unable to defend its rights before the courts in these countries in the event of a dispute with the government or other local public entities.

The Group manages these risks within partnerships or contractual negotiations adapted to each location. It chooses its locations in emerging countries by applying a selective strategy on the basis of an in-depth analysis of country risks. Whenever possible, the Group protects its interests contractually by way of international arbitration clauses and political risks insurance.

REFERENCE DOCUMENT 2008  25

25

Back to contents

4.3.3.2 Any external growth transaction presents risks for the Group

In the case of external expansion, notably by means of acquisitions, the Group could be led to issue equity securities, have recourse to borrowings or recognize allowances for intangible asset impairment. Acquisitions also present risks relative to integration difficulties, non-achievement of expected benefits and synergies, involvement of managers of the acquired companies and the departure of key employees. Moreover, in the context of joint companies in which it has an equity holding, the Group may find itself in a conflict of interest or conflict of strategy situation with its partners who, in some cases, hold the majority interest in these ventures. Risks linked to the value of assets or expected income may appear at the end of the acquisition process.

4.3.3.3 Organic growth transactions and major projects require control

The Group is basing its growth on various major industrial asset construction projects, such as gas and electricity plants or waste treatment and seawater desalination facilities. The Group has just been chosen, as a partner with EDF, to build the second EPR type nuclear reactor at Penly, in France.