Exhibit 10.8

Sublease Agreement Between

Cambridge Technology, Inc.

and

GI Dynamics, Inc.

Effective Date 23 May 2013

This Agreement of Sublease (the “Sublease”), dated as of 23 May 2013 (the “Effective Date”), is made by and between Cambridge Technology, Inc., which is a Massachusetts corporation and a wholly-owned subsidiary of GSI Group Corporation, both with a usual place of business located at 125 Middlesex Turnpike, Bedford, MA 01730 (“Landlord”), and GI Dynamics, Inc., a Delaware corporation with a usual place of business located at One Maguire Road, Lexington, MA 02421 (“Tenant”). Landlord and Tenant may be referred to in this Sublease individually as a “Party,” or collectively as the “Parties.”

THIS SUBLEASE WITNESSETH THAT:

WHEREAS: Duffy Hartwell LLC (the “Owner”) is the owner of that certain real property located at 25 Hartwell Avenue, Lexington, MA 02421 containing approximately 33,339 square feet of space which is more particularly described in Exhibit A attached hereto and made a part hereof (“the Premises” or “25 Hartwell” in the Town of Lexington, Middlesex County, Massachusetts (“Lexington”); and

WHEREAS: the Owner, as Lessor, and the Landlord, as Lessee, executed that certain lease agreement dated January 1, 1999 (the “Lease”), a copy of which is attached hereto as Exhibit B, for the lease of 25 Hartwell, and

WHEREAS: Tenant desires to lease the Premises from Landlord and the Landlord desires to lease the Premises to Tenant;

NOW, THEREFORE, in consideration of the above, and the representations, warranties, covenants and conditions contained in this Sublease, Landlord and Tenant, intending to be legally bound, agree as follows:

1.Owner’s Consent. Landlord and Tenant’s obligations under this Sublease, and the effectiveness of this Sublease, are conditioned upon Owner providing written consent to this Sublease in form reasonably acceptable to Tenant, which consent shall include Tenant’s right to transfer its interest in the Sublease without consent as provided in Section 13 hereof. Landlord shall pay any fees or expenses charged by Owner in connection with such consent. If such consent is not obtained within fifteen (15) days after the execution hereof, then Tenant may terminate this Sublease by written notice to Landlord, whereupon any security deposit, letter of credit, or other prepaid amounts shall be promptly refunded and returned by Landlord to Tenant.

2.Demise. By this Sublease, Landlord leases to Tenant, and Tenant does hereby lease and take from Landlord, subject to and upon the terms, covenants, agreements, provisions and conditions hereinafter set forth, the Premises.

3.Rights Granted. The Sublease of the Premises to Tenant includes all rights, privileges, easements and other interests appurtenant to the Premises, including but not limited to any access, utility and other rights and easements benefiting the Premises.

4.Term. The term of this Sublease shall commence as of 12:01:01 AM on the date of Owner’s consent to this Sublease (the “Commencement Date”) and shall expire at 12:59:59 PM on December 31 2016 (the “Term”), unless earlier terminated pursuant to the terms of this Sublease. The Tenant shall not have legal occupancy of the Premises until a Certificate of Occupancy is issued by Lexington, provided, however, that the Tenant’s contractors may be present in the Premises on and after the Effective Date for the purpose of performing the Tenant Improvements permitted under the Sublease, once they have demonstrated that they have the required insurance coverages, and provided that the Tenant will be responsible for the cost of all utilities, water and sewer charges incurred in the Premises by the Tenant or its contractors after the Effective Date.

5.Base Rent. The Tenant covenants and agrees to pay Base Rent to the Landlord as set forth in the following table for the full Term of this Sublease (“Rent”). No Base Rent as set forth the following table shall be payable from the date hereof through April 30, 2014; provided, however, that the Tenant recognizes and agrees that it will pay taxes, fees, and operating expenses as set forth the balance of this Paragraph 5.

| | | | | | | | | | | | | | | | |

| | | Periods of the Term | | Total Rent for the Period | | | Rent/Square Foot | | | Monthly Rent | |

| | | | |

| 1 | | 1 May 2014 to 30 April 2015 | | $ | 583,432.50 | | | at $ | 17.50 PSF | | | $ | 48,619.38 | |

| | | | |

| | 1 May 2015 to 30 April 2016 | | $ | 600,102.00 | | | $ | 18.00 PSF | | | | 50,008.50 | |

| | | | |

| | 1 May 2016 to 31 December 2016 | | $ | 411,181.00 | | | $ | 18.50 PSF | | | | 51,397.62 | |

Base Rent during any partial calendar month during the Term shall be prorated based on the number of days in such month which are included in the Term.

During the Term of the Sublease, or beginning on such earlier date that the Tenant or its agents begin renovation work in the Premises, and except as otherwise specifically set forth in Paragraph 7 below, in addition to the Base Rent set forth above, the Tenant will be as responsible as if it were the Lessee, for the costs of all utilities used in the Premises and for cleaning, trash removal, repairing, and maintaining the Premises. From August 1, 2013 through April 30, 2014, or when the Tenant takes occupancy of the Premises for operation of Tenant’s business if earlier than August 1, 2013, the Tenant will also pay (A) the Capital Reserve Fee (currently $972.39 per month) payable by Lessor under the Lease, and (B) 50% of (i) the escalated real estate taxes, and

(ii) other escalated operating expenses that the Lessee has agreed with the Lessor to pay to Lessor under the Lease (i.e., operating expenses to the extent they exceed the operating expenses for the 2006 calendar year and taxes to the extent they exceed the taxes for the 2006 tax fiscal year). The real estate taxes payable by Lessor under the Lease are estimated to be $2,118.25 (as stipulated in the January 15, 2013 reconciliation letter (identified below as Exhibit C) as “Real Estate Tax payments”) per month (based on the current estimated charge from Owner) and the operating expenses payable by Lessor under the Lease are estimated to be: $901.65 as stipulated in the April 16, 2013 reconciliation letter (identified below as Exhibit C) “Est. operating payments”) per month (based on the current estimated charge from Owner). Notwithstanding the amounts of any estimates, the Tenant will pay the actual amounts, as adjusted by the reconciliations provided for in the last two sentences of this Paragraph 5. Tenant shall pay 50% of such estimated operating expense and tax amounts monthly. Further, from August 1, 2013 through April 30, 2014, or when the Tenant takes occupancy of the Premises for operation of Tenant’s business if earlier than August 1, 2013, the Tenant will pay an amount equal to the entire real estate taxes and operating expenses (each as defined in the Lease) for the Premises without reference to a base year, in estimated monthly installments, for the corresponding August 1, 2013 through April 30, 2014 period. The 2013 operating expenses are currently estimated by Owner to be $52,826.91 per annum ($4,402.24 per month) and the taxes are currently estimated by Owner to be $103,213.45 ($8,601.12 per month). The Landlord has obtained from the Owner provided to the Tenant the Owner’s current detailed breakdown of those taxes and expenses and how they have been calculated, and that breakdown is set forth in Exhibit C annexed hereto and made a part hereof. Upon receiving a reconciliation statement from Owner with respect to operating expenses or taxes payable pursuant to this Section 5 or Sections 8 and 9, Landlord shall provide the same to Tenant, and within ten (10) days thereafter, Tenant shall pay to Landlord any underpayment of operating expenses and taxes or Landlord shall refund to Tenant any overpayment of the same, as the case may be.

6.Access, Tenant Improvements. The Tenant will be allowed access to the Premises immediately following the Effective Date for purposes of construction of Tenant’s build-out, set-up and equipment installation. In making its Tenant Improvements, the Tenant will comply in all respects with Paragraph 12 of the Lease and deal directly with the Lessor as if it were the Lessee under the Lease, mutatis mutandis. The Tenant will comply with all permitting and inspectional requirements of Federal, Massachusetts and Lexington laws, ordinances and Regulations in making its Tenant Improvements. If Landlord consents to Tenant’s making Tenant Improvements in accordance with Paragraph 12 of the Lease, Landlord shall use commercially reasonable efforts to request and obtain any consent from Owner required in connection with the performance of Tenant Improvements.

7.Utilities, Insurance. During the entire Term of the Sublease, in addition to the Base Rental Rate set forth above the Tenant will be as responsible as if it were the Lessee under the Lease, for the additional costs of electricity, water and sewer charges, and all other utilities used in the Premises and for cleaning, trash removal, repairing, and maintaining the Premises. The Tenant will obtain and maintain, and require its contractors performing Tenant Improvements to obtain and maintain, the types and levels of insurance required of the Lessee under Paragraphs 10 and 17 of the Lease from the first day of access through the entire Term of the Sublease, naming the Landlord and the Owner as additional insureds as their interests may appear.

8.Rent Adjustment for Taxes. Paragraph 6 A. of the Lease provides that the Lessee will pay the Lessor for any increase in real estate taxes imposed by Lexington over a certain base year. For the purposes of this Sublease, commencing on May 1, 2014, the Tenant shall pay to the Landlord the amount of any increase in the real estate taxes and water and sewer charges applicable to the Premises over the amount paid in the Town’s 2014 Fiscal Year (ending 30 June 2014). In all respects other than the base year, the provisions of Paragraph 6 of the Lease shall apply to this Sublease as if the Lessor and the Lessee in the Lease were the Landlord and the Tenant, respectively, in this Sublease, mutatis mutandis. Tenant’s obligations in respect of real estate taxes and water and sewer charges for the period before May 1, 2014 are as provided in the last paragraph of Section 5 hereof.

9.Rent Adjustment for Operating Expenses. Paragraph 6 B. of the Lease provides that the Lessee will pay the Lessor for any increase in operating expenses over a certain base year. For the purposes of this Sublease, commencing on May 1, 2014, the Tenant shall pay to the Landlord the amount of any increase in operating expenses applicable to the Premises over the amount paid by the Landlord as Lessee in Calendar Year 2013. In all respects other than the base year, the provisions of Paragraph 6 B. of the Lease shall apply to this Sublease as if the Lessor and the Lessee in the Lease were the Landlord and the Tenant, respectively, in this Sublease,mutatis mutandis. Tenant shall also pay the Capital Reserve Fee described in Section 4 of the Lease. Tenant’s obligations in respect of operating expenses and Capital Reserve Fees for the period before May 1, 2014 are as provided in the last paragraph of Section 5 hereof.

10.Use. Notwithstanding Paragraph 7 of the Lease, the Tenant may use the Premises for all purposes permitted under the Lease including light manufacturing, assembly, and research and development related to Tenant’s non-surgical, non-pharmaceutical therapy for the treatment of type-2 diabetes and/or obesity. Tenant shall have 24/7 access to the Premises and use of all parking spaces appurtenant to the Premises under the Lease.

11.No Option to Extend. Notwithstanding anything contained in Paragraph 25 of the Lease, the Tenant has no option to extend the Term of this Sublease. The Landlord has no objection to the Tenant’s making a separate arrangement with the Owner provided that any such arrangement imposes no obligation whatsoever on the Landlord. Landlord agrees that if Tenant enters into an agreement with Owner giving Tenant the option to enter into a direct lease with Owner, then Landlord shall not extend the term of the Lease or exercise any extension option allowing for the extension of the Lease term. However, such direct lease option agreement shall provide that Tenant must exercise its option to lease the Premises from Owner by notice given to Owner by no later than February 29, 2016, to allow Landlord time to exercise its option to renew under the Lease if Tenant does not exercise the direct lease option. Landlord agrees that if Tenant timely exercises its direct lease option, then Landlord’s extension rights under the Lease shall automatically be of no force and effect, and Landlord agrees that Owner may rely on this statement in entering into a direct lease with Tenant. Upon written request from time to time, Tenant agrees to promptly inform Landlord whether the Tenant’s direct lease option is still in full force or effect, has expired, or the Tenant has decided to waive its right to enter a direct lease with the Owner.

12.Condition of the Premises. Upon the expiration of the Term, the Landlord will not be responsible for removing from the Premises any tenant improvements or alterations constructed

by Tenant, nor for removing any of Tenant’s personal property, fixtures, or equipment, including the property to be conveyed to Tenant pursuant to this paragraph, and the Tenant will indemnify and hold the Landlord harmless from any claim made by the Owner against the Landlord for not removing such tenant improvements, alterations, or property. Upon the expiration or termination of the Lease, unless Tenant and Owner enter into a direct lease agreement, Tenant shall remove all of its personal property, fixtures, and equipment from the Premises, and, if required by Landlord, shall remove all tenant improvements and alterations installed by Tenant. The Parties agree that the Owner’s instrument of consent to this Sublease will contain a provision stating that the Owner as Lessor agrees that if the Tenant fails to restore the Premises upon surrender to the condition existing prior to Tenant making its Tenant Improvements, the Owner will not look to the Landlord for the cost of such restoration, provided, however, that if such instrument of consent does not contain such agreement from the Owner, then the Tenant will indemnify and hold the Landlord harmless from any claim made by the Owner against the Landlord for not restoring the Premises as required. Owner and Landlord agree that upon the expiration or termination of the Term, Tenant shall not be required to remove any tenant improvements or alterations that were existing in the Premises as of the Commencement Date, nor to repair any reasonable wear and tear or damage caused by casualty or condemnation. By this Lease, Landlord hereby conveys to Tenant for $1.00 all of Landlord’s furniture, fixtures, and equipment in the Premises, which Landlord shall leave in the Premises. Tenant agrees to accept such furniture, fixtures, and equipment “AS IS”, “Where Is,” and with no warranties or representations of any kind, except that Landlord shall convey such property free of any liens or claims by third parties, and the Tenant will pay the cost of disposing of any of the furniture, fixtures, and equipment that it elects not to keep or sell.

13.Assignment and Transfer of Sublease. The Tenant shall not assign or further sublet the whole or any part of the Premises without the prior written consent of both the Owner and the Landlord, which consent will be subject to the standards set forth in Paragraph 13 of the Lease. Notwithstanding the foregoing, the Landlord may, upon written notice to the Tenant, assign or transfer its interest in this Sublease (a) to any person or entity succeeding to all or substantially all of the assets of the Landlord, or (b) to a successor entity in a merger or acquisition transaction. Where Owner’s consent is required under the Lease to a proposed sublease, transfer, or assignment by Tenant, Landlord shall use commercially reasonable efforts to request and obtain such consent from Landlord. So long as such transfers are for a bona fide business purpose and not to evade Tenant’s obligations under the Sublease, Owner and Landlord’s consent shall not be required in connection with the assignment of the Tenant’s rights under this Sublease to (i) an entity buying all or substantially all of Tenant’s assets, or (ii) an entity with which or into which Tenant is merged, or (iii) to an entity controlling, controlled by, or under common control with Tenant; provided, however, that in each such case the assignee or sublessee of the Tenant demonstrate financial ability at least equal to the level demonstrated to the Owner at the time of the Owner’s consent to this Sublease and, in the case of sections (ii) and (iii) of this sentence, the Tenant shall retain full responsibility for the performance of the Tenant under this Sublease.

14.Liens. The Tenant shall not directly or indirectly cause, create, incur, assume or suffer to exist any mortgage, pledge, lien (including mechanics’, labor or materialman’s lien), charge, security interest, encumbrance or claim on or with respect to the Premises. If the Tenant breaches its obligations under this Paragraph 14, it shall immediately notify Landlord in writing,

shall promptly cause such liens to be discharged and released of record without cost to Landlord and shall indemnify Landlord against all costs and expenses (including reasonable attorneys’ fees and court costs at trial and on appeal) incurred in discharging and releasing such liens.

15.Indemnification. Tenant and Landlord (each, in such case, an “Indemnifying Party”) shall indemnify, defend and hold the other Party and its employees, directors, officers, managers, members, shareholders and agents (each, in such case, an “Indemnified Party”) harmless from and against any and all third party claims, suits, damages, losses, liabilities, expenses and costs (including reasonable attorney’s fees) including without limitation those arising out of property damage (including environmental claims) and personal injury and bodily injury (including death, sickness and disease) to the extent caused by the Indemnifying Party’s (a) material breach of any obligation, representation or warranty contained herein and/or (b) negligence or willful misconduct; provided, however, that the Indemnifying Party will not have any obligation to indemnify the Indemnified Party from or against any indemnity claims to the extent caused by, resulting from, relating to or arising out of the negligence or willful misconduct of the Indemnified Party. The Indemnifying Party shall have the right to select counsel and to direct the defense or settlement of any such proceeding

16.Clauses of the Lease Incorporated by Reference; Lease Representations and Covenants.

16.1 Paragraphs 14 (Subordination), 15 (Lessor’s Access), 16 (Indemnification and Liability), 18 (Fire, Casualty, Eminent Domain), 21 (Surrender), 30 (Estoppel Certificate), and 31 (Hazardous Substances), are incorporated into this Sublease with the full force and effect as if they were stated in full text herein, except that where the term “the Lessor” appears it shall be deemed to mean the Owner and the Landlord, jointly and severally, and where the term “the Lessee” appears it shall be deemed to mean the Tenant.

16.2 Paragraphs 19 (Default and Subordination) and 22 (Late Fees) are incorporated into this Sublease with the full force and effect as if they were stated in full text herein, except that where the term “the Lessor” appears it shall be deemed to be the Landlord and where the term “the Lessee” appears it shall be deemed to mean the Tenant.

16.3 If there is any conflict between the terms of the Lease and this Sublease, then as between Landlord and Tenant, this Sublease shall control.

16.4 Landlord represents and warrants to Tenant that the Lease is in full force and effect and has not been altered or amended except as set forth in Exhibit A. Landlord represents and warrants to Tenant that to Landlord’s knowledge as of the date hereof, there are no defaults by Landlord or Owner existing beyond any applicable notice and cure periods under the Lease, or any events or circumstances which, by the giving or notice or the passage of time, would constitute a default under the Lease by Landlord or Owner. Landlord has not previously assigned, transferred or subleased its interest in the Premises or the Lease.

16.5 Landlord will pay and perform all obligations under the Lease including without limitation all monetary obligations under the Lease, subject to payment or reimbursement from Tenant to Landlord for those sums to be paid by Tenant hereunder, and other than those other obligations to be performed by Tenant hereunder. Landlord will not voluntarily do, or fail to do,

anything which will constitute a default which is continuing beyond any applicable notice and cure periods under the Lease or permit the Lease to be terminated for any reason. Landlord shall not amend the Lease in any manner that would adversely affect Tenant’s rights or obligations hereunder or terminate the Lease.

16.6 Tenant acknowledges that the maintenance and services to be provided under the terms of the Lease by Lessor will be provided by Owner. Landlord will use commercially reasonable efforts to cause Owner to comply with all obligations of Owner under the Lease with respect to the delivery of services and maintenance to be performed by Owner under the Lease. If Landlord is entitled under the Lease to any abatement of rents thereunder based on Owner’s failure to provide maintenance, repair, or services, then Tenant shall receive a corresponding abatement hereunder.

17. Notices. Any notice required or permitted hereunder will be given in writing and delivered in hand, by national overnight courier, or by certified mail, return receipt requested, postage prepaid and addressed as follows. Courtesy copies shall also be given by fax and e-mail.

| | |

| If to GSIG: | | with a copy to: |

| |

| Mr. Frank Genetti | | John A. Shetterly, Esq. |

| Director, Global Real Estate | | 27 Magazine Street |

| GSI Group Corporation | | Cambridge, MA 02139 3955 |

| 125 Middlesex Turnpike | | tel. 617/547-1717 |

| Bedford, MA 01730 | | fax: 617/547-1661 |

tel. 1-781-266-5723 | | e-mail: jshetterly@comcast.net |

e-mail: Frank.Genetti@gsig.com | | |

| |

| If to the Company: | | with a copy to: |

| |

| Mr. Robert Crane | | Gabriel Schnitzler, Esq. |

| GI Dynamics | | Mintz Levin |

| 25 Hartwell Avenue | | 44 Montgomery Street |

| Lexington, MA 02421 | | 36th Floor |

| | San Francisco, CA 94104 |

tel. 781-357-3300 | | tel. 415-432-6004 |

fax: 781-357-3301 | | fax: 415-432-6001 |

e-mail: rcrane@gidynamics.com | | e-mail: GSchnitzler@mintz.com |

A notice given by United States mail will be deemed given at the close of business on the third (3rd) business day next subsequent to the date of mailing indicated on the official Postal Service receipt, or upon actual receipt or upon refusal to accept delivery, whichever shall first occur. Notice givenby courier or by personal service shall be deemed given upon receipt, as demonstrated by a written or electronic receipt. “Refusal to accept delivery” shall be deemed to occur when the notice is presented for delivery by the postal carrier or courier and a representative of the Party to be served declines to sign to accept service and the notice for that reason cannot be delivered. A Party may change its address for notices by giving notice to the other Party of the change in the manner aforesaid.

18.Brokerage. A brokerage fee shall be paid to NAI Hunneman and Richards Barry Joyce & Partners (the “Brokers”) by the Landlord pursuant to a separate agreement. The Landlord and the Tenant warrant and represent, each to the other respectively, that neither of them, respectively, has dealt with any broker, finder or other person entitled to a brokerage commission in connection with the negotiation or execution of this Agreement, or the consummation of the transactions contemplated herein other than the Brokers. The Landlord and the Tenant agree to indemnify, defend and hold each other, respectively, harmless from and against all damages, claims, losses, and liabilities (including, without limitation, legal fees incurred in defending against such damages, claims, losses and liabilities) arising out of or resulting from the failure of such representation or warranty.

19.Signage. The Tenant, at the Tenant’s cost, will have the right to signage on the monument at the entrance to the Building, subject to Lexington code and to the Landlord and Owner’s approval pursuant to the standards set forth in Paragraph 26 of the Lease. Landlord shall use reasonable efforts to obtain Owner’s approval under the Lease.

20.Force Majeure. In the event that either Party is delayed in or prevented from performing or carrying out its obligations under this Sublease, other than the payment of monetary obligations when due, by reason of any cause beyond the reasonable control of, and without the fault or negligence of, such Party (and excluding lack of funds) (an event of “Force Majeure”), such circumstance shall not constitute an Event of Default, and such Party shall be excused from performance hereunder and shall not be liable to the other Party for or on account of any loss, damage, injury or expense resulting from, or arising out of, such delay or prevention;provided, however, that the Party encountering such delay or prevention shall use commercially reasonable efforts to remove the causes thereof (with failure to use such efforts constituting an Event of Default hereunder). The settlement of strikes and labor disturbances shall be wholly within the control of the Party experiencing that difficulty.

21.Security Deposit. Upon the Effective Date the Tenant will pay to the Landlord the amount of $149,504.58 in the form of cash or a Letter of Credit, which will be held as a security deposit to secure the Tenant’s performance of its obligations under this Sublease. If Tenant initially posts the security deposit in cash, it may at its option subsequently replace such cash deposit with anautomatically-renewable Letter of Credit, and upon doing so, Landlord shall refund to Tenant any cash deposit then held by Landlord. Landlord may apply such cash deposit or Letter of Credit from time to time to Tenant’s obligations under this Sublease should Tenant default beyond applicable notice and cure periods in the timely payment and performance of the same. If the Landlord is required to use any of the security deposit to cover the Tenant’s failure to perform an obligation, then, upon written notice with a summary explanation of the reasons that the Landlord has been required to draw down the security deposit, the Tenant will pay additional money to the Landlord to bring the security deposit up to the original level. Upon the expiration of this Sublease, the Landlord will refund any unused balance of any cash security deposit to the Tenant, or the original Letter of credit, as applicable, less any amounts applied by Landlord to pay or cure any default by Tenant in performance of Tenant’s obligations hereunder.

22.General Provisions.

22.1Quiet Possession. Landlord agrees that the Tenant, subject to Tenant’s compliance with all material provisions contained in this Sublease, will have quiet and peaceful possession of the Premises throughout the Term. Landlord represents and warrants that there are no restrictions, encumbrances or liens on the Premises that would prohibit, limit or restrict the activities contemplated by this Sublease.

22.2Authority of the Landlord. Landlord hereby represents and warrants that: (a) Landlord is duly organized, validly existing and in good standing under the laws of Massachusetts and has all requisite power and authority to enter into this Sublease, to perform its obligations hereunder and to consummate the transactions contemplated hereby; (b) the execution and delivery of this Sublease and the performance of Landlord’s obligations hereunder have been duly authorized by all necessary company action; and (c) this Sublease is a legal, valid and binding obligation of Landlord enforceable against Landlord in accordance with its terms; provided, however, that the enforcement of the rights and remedies herein is subject to (i) bankruptcy and other similar laws of general application affecting rights and remedies of creditors and (ii) the application of general principles of equity (regardless of whether considered in a proceeding in equity or at law).

22.3Authority of the Tenant. The Tenant hereby represents and warrants that: (a) the Tenant is duly organized, validly existing and in good standing under the laws of Delaware and has all requisite power and authority to enter into this Sublease, to perform its obligations hereunder and to consummate the transactions contemplated hereby; (b) the execution and delivery of this Sublease and the performance of the Tenant’s obligations hereunder have been duly authorized by all necessary company action; and (c) this Sublease is a legal, valid and binding obligation of the Tenant enforceable against the Tenant in accordance with its terms; provided, however, that the enforcement of the rights and remedies herein is subject to (i) bankruptcy and other similar laws of general application affecting rights and remedies of creditors and (ii) the application of general principles of equity (regardless of whether considered in a proceeding in equity or at law).

22.4Construction. Where the context so requires or permits, the use of the singular form includes the plural, and the use of the plural form includes the singular, and the use of any gender includes any and all genders. The use in this Sublease of the term “including” means “including without limitation” The words “herein,” “hereof,” “hereunder” and other words of similar import refer to this Sublease as a whole, including the schedules and exhibits, as the same may from time to time be amended, modified, supplemented or restated, and not to any particular section, subsection, paragraph, subparagraph or clause contained in this Sublease. The title of and the section and paragraph headings in this Sublease are for convenience of reference only and shall not govern or affect the interpretation of any of the terms or provisions of this Sublease. Where specific language is used to clarify by example a general statement contained herein, such specific language shall not be deemed to modify, limit or restrict in any manner the construction of the general statement to which it relates. The Parties have participated jointly in the negotiation and drafting of this Sublease. In the event an ambiguity or question of intent or interpretation arises, this Sublease shall be construed as if drafted jointly by the Parties and no presumption or burden of proof shall arise favoring or disfavoring any Party by virtue of the

authorship of any of the provisions of this Sublease. Any reference to any federal, state, local or foreign statute or law shall be deemed also to refer to all rules and regulations promulgated thereunder, unless the context requires otherwise.

22.5Integration, Modification, Counterparts, Time. This Agreement constitutes the entire agreement by and between the Parties with respect to the subject matter herein and supersedes all prior agreements between the Parties, whether written or oral, relating to the same subject matter. Without limiting or modifying the restrictions set forth in this Sublease, the covenants and agreements contained in this Sublease shall be binding upon and shall inure to the benefit of the Parties to this Sublease and their respective permitted successors and assigns. No modification, amendments, or supplements to this Agreement shall be effective for any purpose unless in writing and signed by each Party. Approval or consent of a Party concerning this Agreement shall also be in writing. This Agreement shall be governed by and interpreted in accordance with the law of the Commonwealth of Massachusetts, USA, whose courts shall have jurisdiction of and in which venue shall lie for any dispute which may be brought in connection with the breach or interpretation of this Agreement. Nothing in this Agreement, express or implied, is intended or shall be construed to confer upon or give any third party, whether a natural or a juridical person, any right, covenant or agreement herein set forth; and all rights, covenants, and agreements herein contained shall be for the sole and exclusive benefit of the Parties hereto and their respective permitted successors and assigns. This Agreement may be executed in multiple original counterparts, all of which shall be taken together as one and the same agreement. Any copy of this Sublease executed with original signatures (whether in ink or electronic form) is deemed to be an original of this Sublease for all purposes. Time is of the essence for the performance and observation of each covenant of this Sublease.

22.6Severability, Waiver. If any one or more of the provisions contained in this Sublease shall for any reason be held to be invalid, illegal or unenforceable in any respect, such invalidity, illegality or unenforceability shall not affect any other provision of this Sublease, but this Sublease shall be construed as if such invalid, illegal or unenforceable provision had not been contained in this Sublease. Either Party may enforce all provisions of this Sublease strictly, regardless of (a) any law, usage, or custom to the contrary, (b) any conduct of the enforcing Party in refraining from enforcing any provisions of this Sublease at any time, (c) any conduct of the enforcing Party in refraining from exercising its rights and remedies under this Sublease, and (d) any course of conduct between Landlord and Tenant. Any conduct or custom between Landlord and Tenant must not be construed as having created a custom in any way or manner contrary to any specific provision of this Sublease, or as having in any way or manner modified the same.

22.7No Partnership. Landlord and Tenant agree that nothing contained in this Sublease shall be deemed or construed as creating a partnership, joint venture, or association between Landlord and Tenant, nor cause either of them to be responsible in any way for the debts or obligations of the other Party.

22.8Cooperation. Upon the receipt of a written request from the other Party, each Party will execute such additional documents, instruments and assurances and take such additional actions as are reasonably necessary and desirable to carry out the terms and intent of this Sublease. The Parties acknowledge that they are entering into a long-term arrangement in which their cooperation will be required.

In Witness Whereof, the Landlord and the Tenant have caused their duly authorized officials and representatives to execute this Sublease as of the date first written above.

| | | | | | | | | | |

| | LANDLORD: | | TENANT: |

| | |

| | Cambridge Technology, Inc. | | GI Dynamics, Inc. |

| | | | | |

| | By: | | /s/ Robert J. Buckley | | | | By: | | /s/ Robert Crane |

| | Name: | | Robert J. Buckley | | | | Name: | | Robert Crane |

| | Title: | | President | | | | Title: | | CFO |

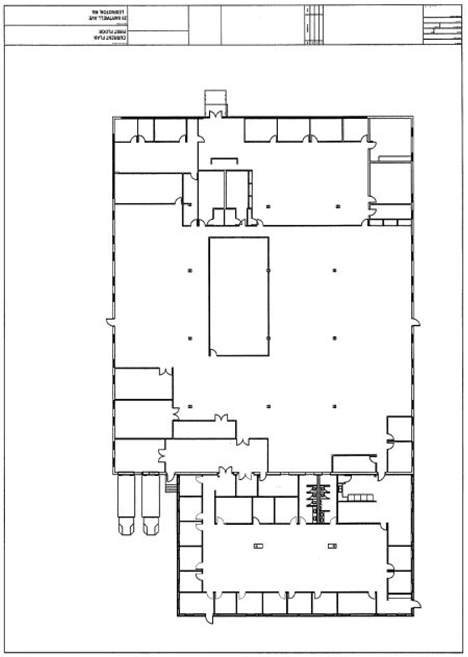

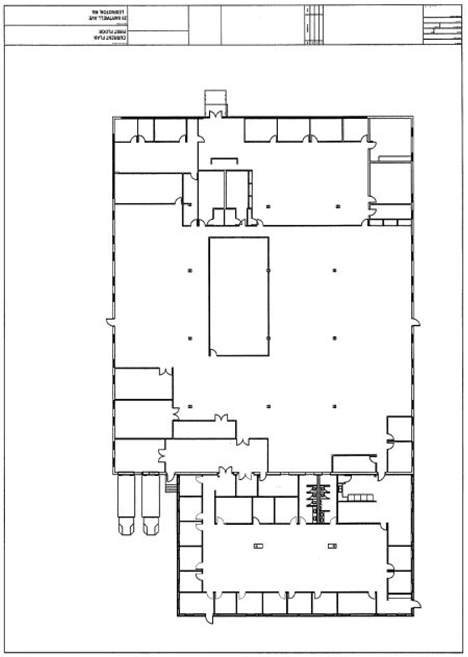

EXHIBIT A

Site Plan Depicting Premises

EXHIBIT B

The Lease

COMMERCIAL LEASE

Duffy Hartwell LLC, a Massachusetts Limited Liability Company, with a principal place of business at 411 Waverley Oaks Road, Suite 340, Waltham, Massachusetts, 02452, (“LESSOR”), which expression shall include its heirs, successors, and assigns where the context so admits, does hereby lease to Cambridge Technology, Inc., a Massachusetts Corporation with a principal place of business at 109 Smith Place, Cambridge, Massachusetts 02138 (“LESSEE”), which expression shall include its successors, executors, administrators, and assigns where the context so admits, and the LESSEE hereby leases the following described premises:

The entire building located at 25 Hartwell Avenue, Lexington, MA 02421 which consists of approximately 33,339 rentable square feet + or -, and is further depicted in Exhibit A hereto (“Leased Premises” or “Premises”). The LESSEE shall be permitted to use all the parking that is available to the Leased Premises, so long as LESSEE occupies the entire building, together with all sidewalks, driveways, and loading docks serving the building.

The term of this lease shall be for ten (10) years commencing upon the Commencement Date which shall be the Substantial Completion Date of the LESSOR’S Work, as defined in Exhibit B hereto, and ending on the later of (i) December 31, 2016, or (ii) the last day of the month in which the tenth (10th) anniversary of the Commencement Date shall occur, provided that, if the Commencement Date shall be the first day of a calendar month, then the lease term shall end on the day before the tenth (10th) anniversary of the Commencement Date. The Commencement Date is currently estimated to be January 1, 2007.

The LESSEE shall pay to the LESSOR base rent in accordance with the schedule noted below, payable in advance in monthly installments in accordance with the schedule noted below. Provided the LESSEE is not in default hereunder, LESSEE’S payment of base rent shall commence 60 days after the Commencement Date as defined above. LESSOR acknowledges that, provided the LESSEE is not in default hereunder, the LESSEE will be granted two (2) months of holiday base rent to be applied to the initial two (2) months of the lease term, and one (I) month of holiday base rent to be applied to the thirteenth (13th) month of the lease term. Payments shall be pro rated on a per diem basis should any payment become due during a portion of any monthly rental period. During the term of the lease, LESSEE shall pay base rent and additional rent to the LESSOR monthly, in advance, not later than the first day of each calendar month. Upon the execution of this lease the LESSEE shall pay to the LESSOR the amount of $40,284.63 which shall be applied to the first month base rent is due in accordance with theabove-mentioned terms.

Base Rent:

| | | | | | | | | | | | |

Year | | PRSF | | | Annual | | | Monthly | |

01/01/07-12/31/07 | | $ | 14.50 | | | $ | 483,415.50 | | | $ | 40,284.63 | |

(subject to the free base rent provisions in Article 4 above) | | | | | | | | | | | | |

01/01/08-12/31/08 | | $ | 15.00 | | | $ | 500,085.00 | | | $ | 41,673.75 | |

(subject to the free base rent provisions in Article 4 above) | | | | | | | | | | | | |

01/01/09-12/31/09 | | $ | 15.50 | | | $ | 516,754.50 | | | $ | 43,062.88 | |

01/01/10-12/31/10 | | $ | 16.00 | | | $ | 533,424.00 | | | $ | 44,452.00 | |

01/01/11-12/31/11 | | $ | 16.50 | | | $ | 550,093.50 | | | $ | 45,841.13 | |

01/01/12-12/31/12 | | $ | 17.00 | | | $ | 566,763.00 | | | $ | 47,230.25 | |

01/01/13-12/31/13 | | $ | 17.50 | | | $ | 583,432.50 | | | $ | 48,619.38 | |

01/01/14-12/31/14 | | $ | 18.00 | | | $ | 600,102.00 | | | $ | 50,008.50 | |

01/01/15-12/31/15 | | $ | 18.50 | | | $ | 616,771.50 | | | $ | 51,397.63 | |

01/01/16-12/31/16 | | $ | 19.00 | | | $ | 633,441.00 | | | $ | 52,786.75 | |

In addition to the payments in the above schedule, LESSEE shall pay to LESSOR each lease year as additional rent an amount equal to 2% of the base rent payable during that year (the “Capital Reserve Fee”) as a reserve for all of LESSOR’S capital replacements and improvements in the Leased Premises and the land of which the Leased Premises is a part. LESSEE may pay the Capital Reserve Fee in equal monthly installments. In the event there are repetitive identical repairs, within a six (6) month period, to the items defined in Exhibit E attached hereto as capital expenditures, LESSEE may elect to give notice to LESSOR that the parties must select a mutually acceptable, independent consultant to determine whether or not a capital improvement or replacement to such item is required. If said consultant determines that continued maintenance and repair is unreasonable and ineffective and that a capital expenditure to repair or replace is necessary, then the LESSOR shall make such repair and/or replacement. In the event LESSOR fails to make such expenditure after the consultant’s determination that same is required, LESSEE may exercise its self help rights under Article 19(B) herein.

Upon the execution of this lease, the LESSEE shall either:

(a) Pay to the LESSOR the amount of $139,607.06 dollars which shall be held as a security for the LESSEE’S performance as herein provided and refunded to the LESSEE at the end of this lease subject to the LESSEE’S satisfactory compliance with the conditions hereof. The LESSEE shall maintain at all times a security deposit equivalent to a minimum of three (3) month’s base rent. This would include any and all options to renew; or

(b) Simultaneously with the execution and delivery of this Lease, LESSEE shall deliver to LESSOR a standby, irrevocable, unconditional, transferable, automatically renewable letter of credit in the amount of $139,607.06 dollars, in substantially the form attached hereto as Exhibit Cs and issued by a Massachusetts bank reasonably acceptable to LESSOR and containing the terms as required herein. LESSOR hereby approves Citizens Bank of Massachusetts as an acceptable issuer of the letter of credit as of the date of this Lease. During the term hereof, and any extensions thereof, or for so long thereafter as LESSEE is in possession of the Premises or has unsatisfied obligations

hereunder to LESSOR, but in no event less than thirty (30) days after the expiration of the lease term as extended, the letter of credit shall be held to ensure the full and timely performance of LESSEE’S obligations under this Lease and for all losses and damages LESSOR may suffer as a result of any default beyond all applicable notice and cure periods, by LESSEE under this Lease; which letter of credit may be drawn upon by LESSOR and applied from time to time against outstanding obligations of LESSEE hereunder without notice or demand provided LESSEE is in default of its obligations under the Lease beyond all applicable notice and cure periods. LESSEE shall have no right to require LESSOR to so draw and apply the letter of credit, nor shall LESSEE be entitled to credit the same against rents or other sums payable hereunder. During the entire term hereof, including any extension thereof, LESSEE shall cause said letter of credit to be renewed, in identical form to that delivered herewith, no later than 30 days prior to the date of expiration of same. It shall be a condition of the letter of credit that the letter of credit shall be deemed automatically extended unless the issuing bank shall notify the LESSOR by certified mail return receipt requested, at least thirty (30) days prior to the then current expiration date of the letter of credit, that the letter of credit will not be extended beyond the then current expiration date. The letter of credit shall state that, without limiting any other remedies of LESSOR, in the event that the LESSOR receives notice of termination or expiration of the letter of credit or if LESSEE fails to renew any letter of credit given hereunder at least 30 days prior to the date of expiration thereof, then LESSOR shall have the right to draw down the entire amount of said letter of credit and hold such sums as a cash deposit. If and to the extent that LESSOR makes such use of the letter of credit, or any part thereof, the sum so applied by LESSOR (from cash or from a drawing on the letter of credit) shall be restored to the letter of credit (or by anew letter of credit equal to the difference) by LESSEE upon notice from LESSOR.

The LESSEE shall cause the letter of credit to be continuously maintained in effect (whether through replacement, renewal, or extension) in an amount equivalent to a minimum of three (3) month’s base rent. This would include any and all options to renew.

In the event LESSEE is unable to obtain the letter of credit on or before the date the LESSEE executes this Lease, LESSEE may, concurrently with LESSEE’S execution of this Lease, provide a cash security in accordance with Article 5(a) above, and thereafter obtain a letter of credit which conforms to the terms of this Article 5(b). Provided the LESSEE obtains said letter of credit within ninety (90) days from the date the LESSEE executes this Lease, the LESSOR shall, so long as the LESSEE is not in default beyond any applicable cure period, refund the cash security in exchange for an acceptable letter of credit which complies with the above-mentioned terms.

A.TAX ESCALATION: If any tax year commencing with the fiscal year ending June 30, 2007, the real estate taxes on the land and buildings, of which the Leased Premises are a part, are in excess of the amount of the real estate taxes thereon for the fiscal year• ending June 30, 2006 (hereinafter called the “Base Year”), then such excess shall be paid by the LESSEE to LESSOR as additional rent hereunder. LESSEE shall be solely

responsible for the amount of all water and sewer charges on the land and buildings, of which the Leased Premises are a part. LESSEE shall pay to LESSOR as additional rent hereunder, when and as designated by notice in writing by LESSOR, all of such real estate taxes and water and sewer charges for each year of the term of this lease or any extension or renewal thereof and proportionately for any part of a fiscal year. LESSEE shall make estimate installment payments, when and as designated by notice in writing by LESSOR, based upon the LESSOR’S projection of the actual real estate taxes and water and sewer charges. If the LESSOR obtains an abatement of any such excess real estate tax, a proportionate share of such abatement, less the reasonable fees and costs incurred in obtaining the same, if any, shall be refunded to the LESSEE. The I .FSSEE shall pay LESSOR, within thirty (30) days of receiving written notice thereof, the balance owed due to insufficient estimated payments made in accordance with the above, and the LESSOR shall credit the LESSEE’S account for any excess estimated payments made in accordance with the above. For purposes of this lease, the term “real estate taxes” shall not include: (a) any taxes which are levied or assessed against the Leased Premises for a period of time prior to the Commencement Date even if same are payable during the term; (b) inheritance, estate, gift, excise, franchise, income, gross receipts, capital levy, revenue, rent, state, payroll, stamp or profit taxes, however designated; (c) any tax upon the sale or transfer of the property of which the Leased Premises is a part, and/or the assignment of this lease; or (e) any interest or penalties resulting from the late payment of taxes by LESSOR.

LESSOR represents and warrants to LESSEE that as of the Commencement Date of this lease, the land and building of which are Leased Premises are a part are assessed and maintained as a single and separate tax parcel or lot by the applicable governmental authority and shall remain so throughout the term of the lease. LESSOR shall pay the taxes when due in a timely manner so that no fines or penalties shall accrue thereon.

In the event that LESSEE requests that LESSOR contest the taxes and LESSOR does not institute such a contest within thirty (30) days of LESSEE’S request, then LESSEE shall, at its own cost and expense, have the right to contest or review any valuation of the building or the Leased Premises, or any tax rate, or the amount of any taxes for such real estate tax year, by legal proceedings or in such other manner as it may deem suitable. LESSOR shall cooperate with LESSEE in such consent.

If LESSOR or LESSEE obtains a refund or abatement of taxes, (i) the parties shall first he entitled to receive reimbursement from any refund or abatement for all expenses, including reasonable attorney’s fees, incurred by them in connection with obtaining such refund or abatement, and (ii) then, if LESSEE has paid a portion taxes or estimated taxes for the period for which the refund or abatement was granted, LESSEE shall be entitled to receive LESSEES proportionate share of the abatement (with interest, if any, paid by the governmental authority on such abatement), adjusted for any period for which LESSEE has made a partial payment.

B.OPERATING COST ESCALATION: The LESSEE shall pay to the LESSOR as additional rent hereunder when and as designated by notice in writing by LESSOR, all increases or projected increases in operating expenses over those incurred during the

calendar year 2006. For the purposes of this paragraph, the calendar year 2006 operating expenses shall be $1.20 per rentable square feet. During the calendar year 2007, the operating expenses escalation paid by the LESSEE shall not increase by more than 5% over the above-mentioned calendar year 2006 operating expenses, the amount of the operating cost expenses incurred during calendar year 2007, subject to the 5% cap, shall be the “Operating Cost Base” (i.e. if the operating cost expenses incurred during calendar year 2007 is equal to $1.21 per rentable square feet, the Operating Cost Base shall be $1.21 per rentable square feet, if the operating cost expenses incurred during calendar year 2007 is equal to $1.31 per rentable square feet, the Operating Cost Base shall be $1.26 per rentable square feet which is the maximum amount allowed for calendar year 2007). During the calendar year 2008, and each year thereafter for the remainder of the lease term, the LESSEE shall pay to the LESSOR as additional rent hereunder when and as designated by notice in writing by LESSOR, all increases or projected increases in operating expenses incurred over the Operating Cost Base. Said payments shall include estimate installment payments based upon the LESSOR’S projection of the actual operating expenses. Actual operating cost expenses will not be known until after the conclusion of each calendar year, retroactive adjustment to estimate payments shall be necessary when actual operating cost expenses are known. The LESSEE shall pay LESSOR, within thirty (30) days of receiving written notice thereof, the balance owed due to insufficient estimated payments made in accordance with the above, and the LESSOR shall credit the LESSEE’S account for any excess estimated payments made in accordance with the above. Within thirty (30) days of its receipt of notice from LESSOR regarding the actual operating cost expenses for any calendar year, LESSEE may request additional written documentation evidencing the actual operating cost expenses for said calendar year and J.FSSOR shall provide such written documentation within thirty (30) days of such request. This request for information shall be in addition to the review or audit available to LESSEE as described below. Operating expenses are defined for the purposes of this agreement in Exhibit E hereto.

This increase shall be prorated should this lease be in effect with respect to only a portion of any calendar year.

Upon at least fourteen (14) days prior written notice from LESSEE, LESSOR shall make available to LESSEE at LESSOR’S address for review or audit by LESSEE and its agents during reasonable hours, all of LESSOR’S books, records and documents relating to Operating expenses and taxes for the Leased Premises for the then-current and the two most recent calendar years. LESSEE shall be entitled to one (1) such audit per calendar year.

The LESSEE shall pay, as they become due, all bills for electricity and other utilities (whether they are used for furnishing heat or other purposes) that are .furnished to or “servicing the land and building of which the Leased Premises are a part. LESSEE agrees to-indemnify and hold LESSOR harmless from LESSEE’S failure to pay in accordance with the above. LESSOR shall not be liable for damages for any reason, or for any inconvenience, interruption or consequences resulting from the failure of utilities

or any service due to any accident, to the making of repairs, alterations, or improvements, to labor difficulties, to trouble in obtaining fuel, electricity, service, or supplies -from the sources from which they are usually obtained for said building, or to any cause beyond the LESSOR’S control.

LESSOR shall have no obligation to provide utilities or equipment additional to those installed as of the Commencement Date of this lease. In the event LESSEE requires additional utilities or equipment, the installation and maintenance thereof shall be the obligation solely of the LESSEE, provided that such installation shall be subject to the written consent of the LESSOR.

| 8. | USE OF LEASED PREMISES: |

The LESSEE shall use the Leased Premises only for the purpose of office and light manufacturing, including, without limitation, manufacturing of optical scanning systems, assembly and research and development. LESSEE shall have access to the Leased Premises 24 hours per day, 365 days per year. LESSEE has the right to install a security system in the Leased Premises and at any ingress and egress points leading to the Leased Premises. LESSEE shall be permitted to conduct its business in the Leased Premises at all times. LESSEE shall provide LESSOR with the means necessary to access the Leased Premises on an emergency basis.

The LESSEE acknowledges that no trade or occupation shall be conducted in the Leased Premises or the building of which the Leased Premises are a part, or use made thereof which will be unlawful, improper, noisy or offensive, or contrary to any law or any municipal bylaw or ordinance in force in the city or town in which the Leased Premises are situated. LESSOR shall be responsible throughout the Term for keeping the property of which the Leased Premises are a part in compliance with all laws, statutes, ordinances, by-laws, rules, regulations, licenses and permits issued with respect thereto, other than those applicable to the Premises solely because of a special use or alteration of the Premises being made by LESSEE. LESSEE shall cooperate with LESSOR’S efforts to comply in accordance with the above.

On the Commencement Date the Leased Premises shall be free of all occupants and their personal property, in good condition and repair, and broom clean. LESSOR represents and warrants that, as of the Commencement Date, the Leased Premises are in compliance with all applicable laws, statutes, ordinances, by-laws, rules, regulations, licenses and permits issued with respect thereto, including, without limitation, the Americans with Disabilities Act (ADA), and that the Leased Premises can be used for LESSEE’S permitted use (as defined in Article 8).

The LESSEE shall not permit any use of the Leased Premises or the building of which the Leased Premises are a part which will make voidable any insurance on the property of which the Leased Premises are a part, or on the contents of said property or which shall

be contrary to any law or regulation from time to time established by the New England Fire Insurance Rating Association, or any similar body succeeding to its powers. The LESSEE shall on demand reimburse the LESSOR, all extra insurance premiums caused by the LESSEES use of the Leased Premises or the building of which the Leased Premises are a part.

A.LESSEE’S OBLIGATIONS: After the Commencement Date, the LESSEE agrees to maintain the interior, non-structural portions of the Leased Premises (excepting those items which are LESSOR’S obligations and included as an operating expense or capital expenditure under this lease) in good condition, reasonable wear and tear, damage by fire or other casualty, eminent domain, default by LESSOR or by the negligent or willful acts or omissions of LESSOR excepted, and whenever necessary, to replace plate glass and other glass therein. The LESSEE shall not permit the Leased Premises to be overloaded, damaged, stripped or defaced, nor suffer any waste. LESSEE shall be solely responsible for all interior cleaning, as well as the collection, removal and disposal of all trash within the Leased Premises or generated by the LESSEE’S operations. LESSEE agrees to maintain the Leased Premises in a clean professional manner, consistent with industry standards and applicable laws, codes and regulations. LESSEE shall obtain written consent of LESSOR, not to be unreasonably withheld, conditioned or delayed, before erecting any sign on the premises.

B.LESSOR’S OBLIGATIONS: The LESSOR agrees to maintain in good order and condition, and to repair and replace as necessary (as either an operating expense or capital expenditure), the exterior structure and structural elements of the building of which the Leased Premises are a part, including the roof and parking areas and all capital replacements or capital repairs, as well as the maintenance, repair, and replacement of the heating ventilation and air conditioning system (“HVAC”), in the same condition as it is at the commencement of the term or as it may be put in during the tern-1 of this lease, reasonable wear and tear, damage by fire and other casualty only excepted, unless such maintenance is required because of the LESSEE or those for whose conduct the LESSEE is legally responsible. LESSOR shall reasonably maintain the exterior landscaping and LESSOR shall clear or remove snow from access ways and parking areas in a commercially reasonable manner and time. LESSOR shall repave the parking areas as and when reasonably necessary.

C.Intentionally Omitted.

D.SELF HELP IN EMERGENCY: In the event of an emergency which threatens the safety of individuals or damage to the building or it’s contents, including personal property, the LESSOR may respond to the emergency, and any costs incurred by the LESSOR on behalf of the LESSEE, or due to the acts or negligence of the LESSEE, shall be charged to and recovered from the LESSEE. LESSOR shall not be liable for any damages caused by said emergency, or any action or omission by the LESSOR under this paragraph.

| 12. | ALTERATIONS - ADDITIONS: |

The LESSEE shall not make structural alterations or additions to the Leased Premises, but may make non-structural alterations provided the LESSOR consents thereto in writing, such consent not to be unreasonably withheld, conditioned or delayed. Written notice thirty (30) days prior to alteration, but not LESSOR consent, shall be required for non-structural alterations costing less than 510,000.00. All such allowed alterations shall be at LESSEE’S expense and shall be in quality at least equal to the present construction. LESSEE shall not permit any mechanics’ liens, or similar liens, to remain upon the Leased Premises for labor and material furnished to LESSEE or claimed to have been furnished to LESSEE in connection with work of any character performed or claimed to have been performed at the direction of LESSEE and shall cause any such lien to be released of record forthwith without cost to LESSOR. LESSEE shall indemnify and hold the LESSOR harmless from any losses, costs and claims arising from all such liens. Any alterations or improvements made by the LESSEE shall become the property of the LESSOR at the termination of occupancy as provided herein and, provided the LESSEE has given LESSOR notice or obtained LESSOR’S consent as provided herein, LESSEE shall not be required to remove such alterations or improvements at the expiration of the term of the lease unless LESSOR gives notice to LESSEE prior to the commencement of such alterations or improvements that same will have to be removed at the expiration of the term.

| 13. | ASSIGNMENT - SUBLEASING: |

The LESSEE shall not assign or sublet the whole or any part of the Leased Premises without LESSOR’S prior written consent, such consent shall not be unreasonably withheld, conditioned, or delayed, and shall be subject to the Addendum attached hereto. Notwithstanding such consent, LESSEE shall remain liable to LESSOR for the payment of all rent and for the full performance of the covenants and conditions of this lease. See Addendum. LESSOR acknowledges and agrees that any merger of LESSEE into or acquisition of LESSEE by Coherent Inc., or any other entity of equal or greater net worth than LESSEE, shall not constitute an assignment or sublease requiring LESSOR’S consent.

Notwithstanding the above, LESSEE warrants and represents to the LESSOR that any merger, acquisition, or sale of assets involving the LESSEE, whether currently or hereafter contemplated, shall not diminish the LESSEE’S ability to perform its obligations under this lease. It is expressly understood by and between the parties hereto as a material term of this lease that the LESSOR is relying on the above-mentioned warranty and representation as a material inducement to enter into this lease.

This Lease is and shall be subject and subordinate to the lien of any and all mortgages, deeds of trust, and other instruments in the nature of a lien or mortgage (collectively, a “Mortgage”), now in existence on the property of which the Leased Premises are a part; provided LESSOR has delivered to LESSEE, within a reasonable period of time after the

execution of this Lease, from the current Mortgagee on the property of which the Leased Premises is a part a Subordination, Non-Disturbance and Attornment Agreement (SNDA) in the Mortgagee’s commercially reasonable standard form similar to the one attached hereto as Exhibit F. If LESSOR fails to deliver such SNDA within ninety (90) days of the date of this Lease, LESSEE shall be entitled to terminate this Lease by giving written notice to LESSOR stating the date on which this Lease shall terminate. LESSEE shall, when requested, promptly execute and deliver such written instruments as shall be necessary to evidence the subordination of this Lease to such Mortgage.

This Lease shall not be subject or subordinate to the lien of any mortgage or lease of the property of which the Leased Premises is a part or the Leased Premises hereafter entered into or placed on the property unless the holder of such mortgage and/or lease executes, acknowledges and delivers to LESSEE a subordination, recognition and non-disturbance agreement in such Mortgagee’s commercially reasonable standard form. LESSEE’S failure to execute and deliver any SNDA which conforms with the above-mentioned terms within thirty (30) days after LESSOR’S request therefore shall be a default hereunder.

The LESSOR or agents of the LESSOR may, at reasonable times, upon reasonable notice, enter to view the Leased Premises if accompanied by a designated employee of LESSEE, and may remove placards and signs not approved and affixed as herein provided, and make repairs and alterations as LESSOR is required under this lease and at any time within six (6) months before the expiration of the term may show the Leased Premises to others, and may affix to any suitable part of the Leased Premises a notice fbr letting or selling the Leased Premises or property of which the Leased Premises are a part and keep the same so affixed without hindrance or molestation. In no event may LESSOR’S entry on the Leased Premises interfere with the business operations of LESSEE. Notwithstanding the above, the LESSOR may enter the Leased Premises in accordance with Article 11 D.

| 16. | INDEMNIFICATION AND LIABILITY: |

| | (a) | The LESSEE shall indemnify and hold the LESSOR harmless from all loss and damage occasioned by the negligence of the LESSEE including loss and damaged occasioned by the use or escape of water or by the bursting of pipes, as well as from any claim or damage resulting from any nuisance made or suffered on the Leased Premises, unless such loss is caused by the negligence of the LESSOR. The LESSEE shall indemnify and hold the LESSOR harmless from all loss and damage occasioned by the LESSEE’S failure to pay for utilities, services, work, product or materials or any other debt owed by the LESSEE. LESSEE shall not install or attach any appurtenances to the plumbing or heating systems and LESSEE shall indemnify and hold LESSOR harmless from any and all loss occasioned by the installation or attachment of said appurtenances. LESSOR shall not be liable for damages arising from the natural accumulation of snow and/or ice. |

| | (b) | Each party shall, upon timely receipt of written notice, defend, indemnify, and save harmless the other, its officers, directors, employees, contractors, servants, guests, business invitees and agents, from and against all loss, costs, damages, and expenses, including without limitation reasonable attorneys’ fees and litigation costs, arising from injury or death of any person or damage to property (other than the property of LESSOR or LESSEE in and about the Leased Premises and the land and the building of which the Leased Premises are a part), except that either party shall not be liable for any loss, costs, damages, or expenses which result from the negligent acts or omissions, or willful acts or omissions, of the other party, its officers, directors, employees, contractors, servants, guests, business invitees or agents. Each party agrees to cooperate with the other party in the defense of any claim. |

| | (c) | The indemnities and duties to defend contained in this Article 16 shall not survive the termination of this lease, and upon such date all obligations of each party to indemnify and defend shall cease, except with respect to claims of which the indemnifying party has received notice prior to such date. |

| 17. | LESSEE’S LIABILITY INSURANCE: |

| | (a) | The LESSEE shall maintain with respect to the Leased Premises and the property of which the Leased Premises are a part therein (i) General Liability Bodily Injury and Property Damage primary liability limit of $1,000,000 on an occurrence basis with a general aggregate limit of $2,000,000, (ii) Umbrella liability limit of a minimum of $2,000,000, (iii) Worker’s compensation statutory liability, (iv) employer’s non-owned and hired auto at a combined single limit for Bodily injury and Property Damage of $1,000,000, each in responsible companies qualified to do business in Massachusetts and in good standing therein insuring the LESSOR as well as LESSEE against injury to persons or damage to property as provided. The LESSEE shall deposit with the LESSOR certificates for such insurance at or prior to the commencement of the term, and thereafter within thirty (30) days prior to the expiration of any such policies. All such insurance certificates shall provide that such policies shall not be canceled without at least ten (10) days prior written notice to each assured named therein. |

| | (b) | LESSOR shall obtain and maintain in force throughout the term “all-risk” property insurance upon the building, on a full replacement cost basis. LESSOR may include the building in a so-called “blanket” policy, but the building shall be specifically listed and its full replacement cost separately stated. LESSOR shall also obtain a General Liability policy similar to that required by LESSEE under Article 17(a)(i) above. |

| | (c) | The Parties to this lease, to the extent they are able, mutually waive their right to subrogate against each other for property losses. Except as provided herein, the Parties to the lease are therefore responsible for insuring their own property. |

| 18. | FIRE, CASUALTY - EMINENT DOMAIN: |

Should a substantial portion (50% or more) of the Leased Premises, or of the property of which they are a part be substantially damaged by fire or other casualty, or be taken by eminent domain, the either party may elect to terminate this lease, When, through no -fault of the LESSEE, such fire, casualty, or taking renders the Leased Premises substantially unsuitable, in whole or part, for their intended use, a just and proportionate abatement of rent shalt be made, and the LESSEE may elect to terminate this lease if;

| | (a) | The LESSOR fails to give written notice within thirty (30) days of intention to restore Leased Premises, or |

| | (b) | The LESSOR fails to restore the Leased Premises to a condition substantially suitable for their intended use within ninety (90) days of said fire, casualty or taking. |

If neither party terminates pursuant to this Article 18, LESSOR shall restore the Leased Premises to the condition they were in prior to the casualty.

The LESSOR reserves and the LESSEE grants to the LESSOR, all rights which the LESSEE may have for damages or injury to the Leased Premises for any taking by eminent domain, except for damage to the LESSEE’S fixtures, property or equipment.

| 19. | DEFAULT AND BANKRUPTCY: |

(A) In the event that:

| | (a) | The LESSEE shall default in the payment of any installment of rent, additional rent, or other sum herein specified and such default shall continue for five (5) business days following written notice; provided that the LESSEE shall only be entitled to two (2) such notice per calendar year; after the second five (5) business day notice in any calendar year, a default shall occur for a default in the payment of any installment of rent, additional rent, or other sum herein specified and such default shall continue for five (5) business days after the date said payment is due; or |

| | (b) | The LESSEE shall default in the observance or performance of any other of the LESSEE’S covenants, agreements, or obligations hereunder and such default shall not be corrected within thirty (30) days after written notice thereof plus such reasonable additional time, not to exceed ninety (90) days, as may be necessary to cure the default so long as LESSEE diligently proceeds to cure the default and continues to take all steps necessary to complete the same; or |

| | (c) | The LESSEE shall be declared bankrupt or insolvent according to law, or, if any assignment shall be made of LESSEE’S property for the benefit of creditors, or if the LESSEE shall be otherwise dissolved, |

then the LESSOR shall have the right thereafter, while such default continues, to re-enter and take complete possession of the Leased Premises, to declare the term of this lease ended, and remove the LESSEES effects, without prejudice to any remedies which might be otherwise used for arrears of rent or other default. The LESSEE shall indemnify the LESSOR against all loss of rem and other payments which the LESSOR may incur by reason of such termination during the residue of the term, or the LESSOR may elect to be indemnified for loss of rent and other sums due under this lease by a lump sum payment representing the then present value of the amount of all sums which would have been paid in accordance with this lease for the remainder of the term minus the then present value of the aggregate market rate, as defined below, and additional charges payable for the Leased Premises for the remainder of the term, taking into account reasonable projections of vacancy and time required to re-lease the Leased Premises, For purposes hereof, market rate shall be the then current effective rate of rent (adjusted, if necessary, to reflect any free rent or comparable concessions), being charged for comparable space in comparable buildings. For the purposes of calculating the rent which would have been paid hereunder for the lump sum payment calculation described herein, the most recent full year’s tax and operating expense payments shall be deemed constant for each year thereafter. The Federal Reserve discount rate (or equivalent) plus 3% shall be used in calculating present values, If the LESSEE shall default, after reasonable notice thereof, in the observance or performance of any conditions or covenants on LESSEES part to be observed or performed under or by virtue of any of the provisions in any article of this lease, the LESSOR, without being under any obligation to do so and without thereby waiving such default, may elect to remedy such default for the account and at the expense of the LESSEE. If the LESSOR makes any expenditures or incurs any obligations for the payment of money in connection therewith, including but not limited to, reasonable attorney’s fees in instituting, prosecuting or defending any action or proceeding, such sums paid or obligations insured, with interest at the rate of 12 per cent per annum and costs, shall be paid to the LESSOR by the LESSEE as additional rent. It is expressly understood and agreed that the LESSEE’S obligation to pay rent, and any and all additional charges, is independent of any obligation or covenant entered into by the LESSOR.

(B) If LESSOR shall default in the performance or observance of its agreements contained in Article 11B hereof or the one (1) year warranty for LESSOR’S Work as stated in Exhibit B hereto, and shall not cure such default within thirty (30) days after written notice from LESSEE specifying the default (or shall not within said period commence to cure such default, and thereafter prosecute the curing of such default to completion with due diligence), LESSEE may, at its option, at any time thereafter cure such default for the account of LESSOR, and any amount paid in so doing shall (except to the extent that LESSEE is required to reimburse the same to LESSOR pursuant to said paragraph) be deemed paid or incurred for the account of LESSOR, and LESSOR agrees to reimburse LESSEE therefore or save LESSEE harmless therefrom; provided that LESSEE may cure any such default as aforesaid prior to the expiration of said waiting period but after written notice to LESSOR, if the curing of such default prior to the expiration of said waiting period is reasonably necessary to protect real estate or LESSEE’S interest therein, or to prevent injury or damage to persons or property. LESSOR shall pay such reimbursement to LESSEE within thirty (30) days from demand. Such demand shall be accompanied by an itemized bill therefore in reasonable detail.

All notices and other communications relating to the Leased Premises or to the occupancy thereof shall be in writing and shall be addressed in the manner herein described and (1) mailed by first class, United States Mail, registered or certified mail, return receipt requested, postage prepaid; or (2) hand delivered to the intended addressee; or (3) sent by a nationally recognized overnight courier service; or (4) sent by facsimile transmission during normal business hours followed by a confirmatory letter sent in another manner permitted hereunder within 24 hours. All notices shall be effective on the date of delivery or the date when proper delivery is refused by the addressee or any representative thereof.

All notices and other communications relating to the Leased Premises or to the occupancy thereof from the LESSOR to the LESSEE prior to the LESSEE’S occupancy shall be addressed to the LESSEE at LESSEE’S address in paragraph one, Attention: Red Aylward, President, Cambridge Technology Inc. fax . All notices and other communications relating to the Leased Premises or the occupancy thereof from the LESSOR to the LESSEE after the LESSEE’S occupancy shall be addressed to the LESSEE at LESSEE’S address in paragraph two, Attention: Red Aylward, President, Cambridge Technology Inc., fax .

All notices, payments and other communications relating to the Leased Premises or to the occupancy thereof from the LESSEE to the LESSOR shall be addressed to the LESSOR at 411 Waverley Oaks Road, Suite 340, Waltham, MA 02452, fax #781-893-6623.

Either party, by written notice to the other, may change the address to which notice is required to be given hereunder.

The LESSEE shall at the expiration or other termination of this lease remove all of LESSEE’S goods and effects from the Leased Premises, (including, without hereby limiting the generality of the foregoing, all signs and lettering affixed or painted by the LESSEE, either inside or outside the Leased Premises), but excluding anything constituting LESSOR’S Work as set forth on Exhibit B. LESSEE shall deliver to the LESSOR the Leased Premises and all keys, locks thereto, and other fixtures connected therewith and all alterations and additions made to or upon the Leased Premises, in good condition, reasonable wear and tear, damage by fire or other casualty, eminent domain, default by LESSOR or by the negligent or willful acts or omissions of LESSOR, its officers, managers, employees, agents, contractors and invitees only excepted. In the event of the LESSEE’S failure to remove any of LESSEE’S property from the premises upon the expiration or other termination of the lease, LESSOR is hereby authorized, without liability to LESSEE for loss or damage thereto, and at the sole risk of LESSEE, to remove and store any of the property at LESSEE’S expense, or to retain same under

LESSOR’S control or to sell at public or private sale, without notice any or all of the property not so removed and to apply the net proceeds of such sale to the payment of any sum due hereunder, or to destroy such property.

In the event that LESSEE continues to occupy, control or remain in any part of the Leased Premises beyond the expiration or earlier termination of the Term of this lease, including any extensions thereto, such holding over shall not be deemed to create any tenancy, but the LESSEE shall be a Tenant at Sufferance only and shall be liable for all loss, damage or expenses incurred by the LESSOR. All other terms of this lease shall apply, except that use and occupancy payments shall be due in full monthly installments which shall be paid to LESSOR at the times and manner determined by the LESSOR, in advance and in an amount equal to the greater of one and a half times of either of the following: (i) base rent, additional rent and other sums due under the lease, including any extensions thereto, immediately prior to termination, or (ii) the reasonable fair market rent for the Leased Premises. It is expressly understood and agreed that such extended occupancy is a Tenancy at Sufferance only, solely for the benefit and convenience of the LESSEE and is of greater rental value. If LESSEE continues to occupy, control or remain in all or any part of the Leased Premises beyond noon of the last day of any monthly rental period, said action shall constitute LESSEE’S occupancy for an entire additional month, and increased payment as provided by this section, shall be due and payable immediately in advance. LESSOR’S acceptance of any payments from LESSEE during such extended occupancy shall not alter LESSEE’S status as a Tenant at Sufferance.