UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Under Rule 14a-12 |

GI DYNAMICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | | | |

| 1) | | | | Title of each class of securities to which transaction applies: |

| | | | | | |

| 2) | | | | Aggregate number of securities to which transaction applies: |

| | | | | | |

| 3) | | | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | | |

| 4) | | | | Proposed maximum aggregate value of transaction: |

| | | | | | |

| 5) | | | | Total fee paid: |

| | | | | | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: |

| | | | | | |

| 1) | | | | Amount Previously Paid: |

| | | |

| 2) | | | | Form, Schedule or Registration Statement No: |

| | | |

| 3) | | | | Filing Party: |

| | | |

| 4) | | | | Date Filed: |

| | | |

April 30, 2015

To Our Stockholders:

You are cordially invited to attend the 2015 annual meeting of stockholders of GI Dynamics, Inc. to be held on Tuesday, June 9, 2015 at 9:00 a.m., Australian Eastern Standard Time (which is 7:00 p.m. on Monday, June 8, 2015 U.S. Eastern Daylight Time) at the offices of DLA Piper Australia, Level 22, No.1 Martin Place, Sydney, NSW, 2000, Australia.

Details regarding the meeting, the business to be conducted at the meeting, and information about GI Dynamics, Inc. that you should consider when you vote your shares are described in this proxy statement.

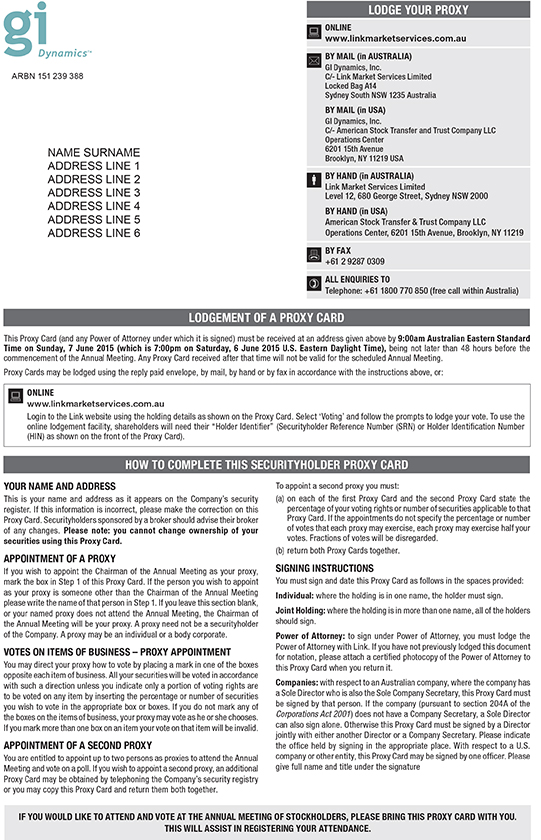

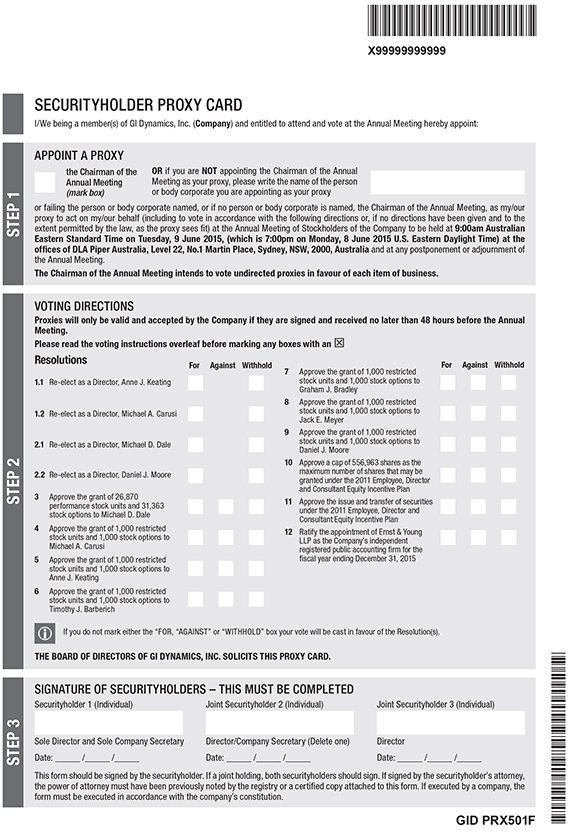

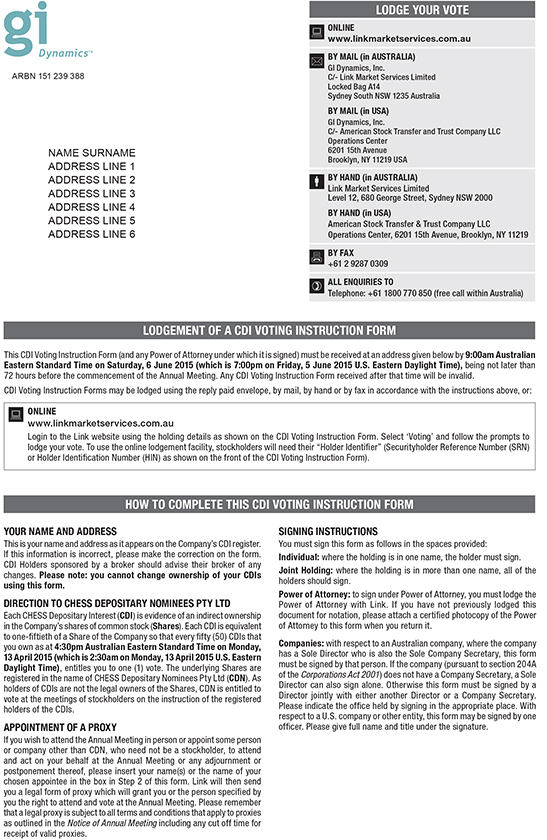

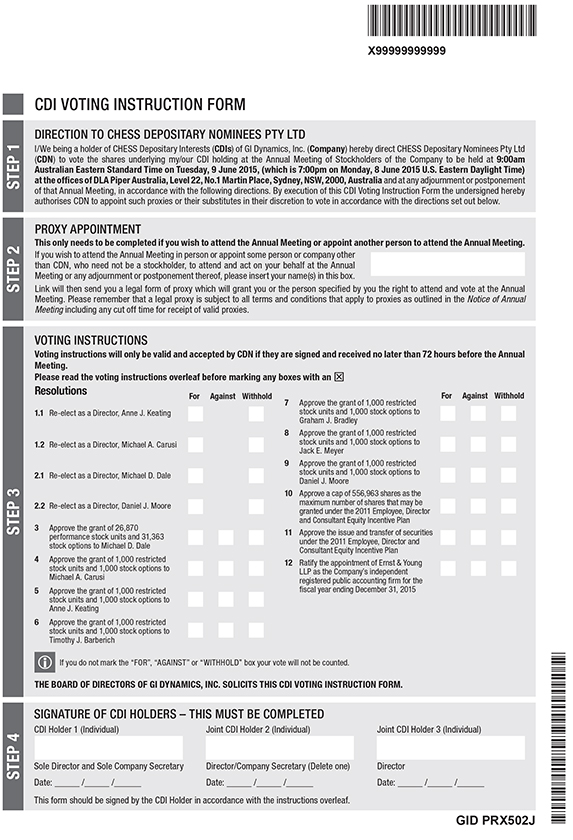

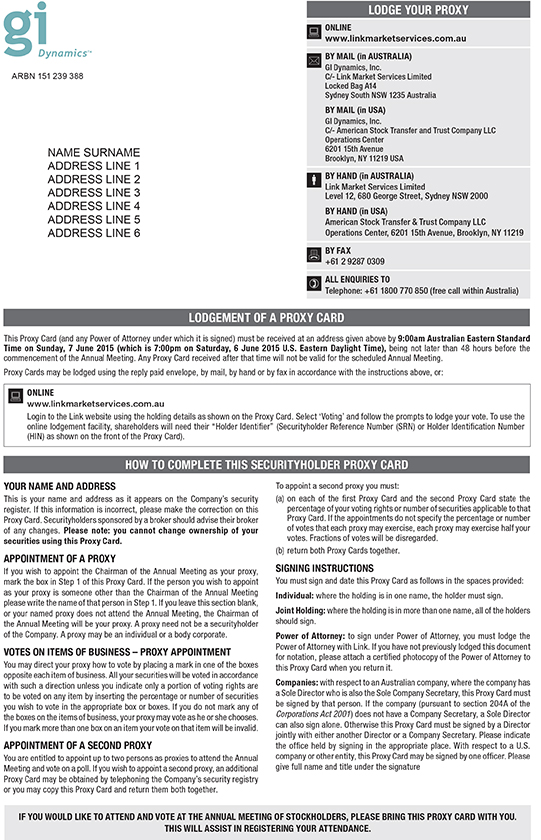

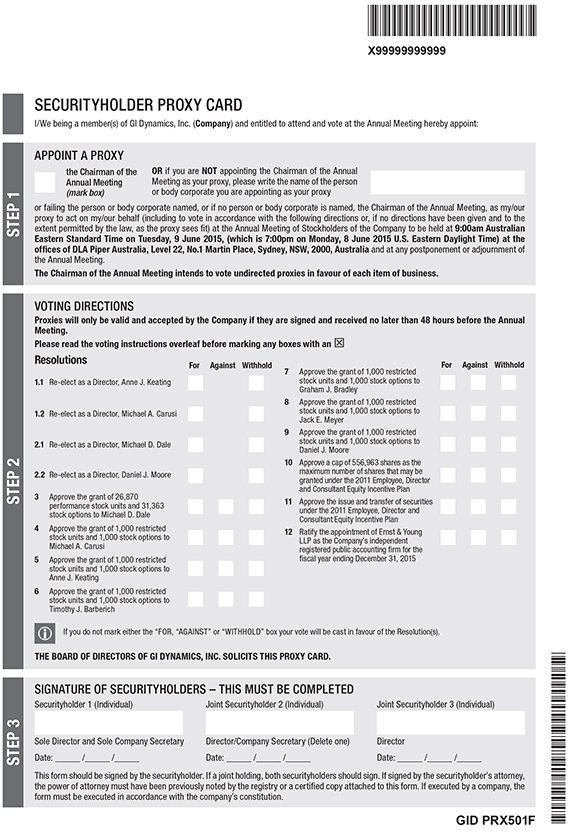

All stockholders and holders of our CHESS Depositary Interests (“CDIs”) are invited to attend the annual meeting in person and we hope you will be able to attend the annual meeting. Whether or not you expect to attend the annual meeting, you are urged to submit your proxy card or CDI Voting Instruction Form as soon as possible so that your shares (or shares underlying your CDIs) can be voted at the annual meeting in accordance with your instructions. Internet voting is available. When you have finished reading the proxy statement, we encourage you to vote promptly. You may vote your shares (or direct CHESS Depositary Nominees Pty Ltd (“CDN”) to vote if you hold your shares in the form of CDIs) by following the instructions on the enclosed proxy card or the CDI Voting Instruction Form. Internet voting is available as described in the enclosed materials.

Thank you for your continued support of GI Dynamics, Inc. We look forward to seeing you at the annual meeting.

Sincerely,

Michael D. Dale

President and Chief Executive Officer

GI DYNAMICS, INC.

25 Hartwell Avenue

Lexington, Massachusetts 02421, U.S.A.

April 30, 2015

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS

The 2015 Annual Meeting of Stockholders (the “Annual Meeting”) of GI Dynamics, Inc. (the “Company”) will be held on Tuesday, June 9, 2015 at 9:00 a.m., Australian Eastern Standard Time (which is 7:00 p.m. on Monday, June 8, 2015 U.S. Eastern Daylight Time) at the offices of DLA Piper Australia, Level 22, No.1 Martin Place, Sydney, NSW, 2000, Australia for the following purposes:

| | 1. | To elect the two Class I directors named in the accompanying proxy statement to serve three-year terms expiring in 2018; |

| | 2. | To re-elect the two Class III directors named in the accompanying proxy statement who were appointed by the board since the last annual meeting; |

| | 3. | For the purposes of Australian Securities Exchange (“ASX”) Listing Rule 10.14 and for all other purposes, to approve the grant of 26,870 performance stock units and 31,363 stock options to Michael D. Dale on the terms set out in the accompanying proxy statement; |

| | 4. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 1,000 restricted stock units and 1,000 stock options to Michael A. Carusi on the terms set out in the accompanying proxy statement; |

| | 5. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 1,000 restricted stock units and 1,000 stock options to Anne J. Keating on the terms set out in the accompanying proxy statement; |

| | 6. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 1,000 restricted stock units and 1,000 stock options to Timothy J. Barberich on the terms set out in the accompanying proxy statement; |

| | 7. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 1,000 restricted stock units and 1,000 stock options to Graham J. Bradley on the terms set out in the accompanying proxy statement; |

| | 8. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 1,000 restricted stock units and 1,000 stock options to Jack E. Meyer on the terms set out in the accompanying proxy statement; |

| | 9. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 1,000 restricted stock units and 1,000 stock options to Daniel J. Moore on the terms set out in the accompanying proxy statement; |

| | 10. | For purposes of complying with Section 162(m) of the Internal Revenue Code of 1986, as amended, to approve a cap of 556,963 shares as the maximum number of shares with respect to which stock options, stock appreciation rights and other similar awards may be granted to any participant in any fiscal year under the Company’s 2011 Employee, Director and Consultant Equity Incentive Plan; |

| | 11. | For the purposes of ASX Listing Rule 7.2 (Exception 9) and for all other purposes, to approve the issue and transfer of securities under the Company’s 2011 Employee, Director and Consultant Equity Incentive Plan as an exception to ASX Listing Rule 7.1; |

| | 12. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015; and |

| | 13. | To transact such other business that is properly presented at the annual meeting and any adjournments or postponements thereof. |

Our board of directors recommends a vote “FOR” Proposals 1 through 12, except for Michael D. Dale (with respect to Proposal 3 only), Michael A. Carusi (with respect to Proposal 4 only), Anne J. Keating (with respect to Proposal 5 only), Timothy J. Barberich (with respect to Proposal 6 only), Graham J. Bradley (with respect to Proposal 7 only), Jack E. Meyer (with respect to Proposal 8 only), and Daniel J. Moore (with respect to Proposal 9 only), who abstain from making a recommendation with respect to the specified Proposal(s) due to their personal interest in that Proposal(s).

You are entitled to vote at the Annual Meeting only if you were a GI Dynamics, Inc. stockholder on the Record Date of 4:30 p.m. on April 13, 2015 Australia Eastern Standard Time (which is 2:30 a.m. on April 13, 2015 U.S. Eastern Daylight Time). This means that owners of common stock as of that date are entitled to vote at the Annual Meeting and any adjournments or postponements of the meeting. Record holders of CHESS Depositary Interests (“CDIs”), as of the close of business on the Record Date, are entitled to receive notice of and to attend the Annual Meeting or any adjournment or postponement of the meeting and may instruct our CDI Depositary, CHESS Depositary Nominees Pty Ltd (“CDN”), to vote the shares underlying their CDIs by following the instructions on the enclosed CDI Voting Instruction Form or by voting online at www.linkmarketservices.com.au. Doing so permits CDI holders to instruct CDN to vote on behalf of the CDI holders at the Annual Meeting in accordance with the instructions received via the CDI Voting Instruction Form or online. For ten days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at our principal offices located at 25 Hartwell Avenue, Lexington, Massachusetts 02421, U.S.A.

The proxy statement that accompanies and forms part of this Notice of Annual Meeting provides information in relation to each of the matters to be considered. This Notice of Annual Meeting and the proxy statement should be read in their entirety. If stockholders are in doubt as to how they should vote, they should seek advice from their legal counsel, accountant, solicitor, or other professional adviser prior to voting.

All stockholders and holders of our CDIs are cordially invited to attend the Annual Meeting.Whether you plan to attend the Annual Meeting or not, we urge you to submit your proxy card or CDI Voting Instruction Form as soon as possible so that your shares (or the shares underlying your CDIs) can be voted at the Annual Meeting in accordance with your instructions.You may change or revoke your proxy at any time before it is voted at the Annual Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

Robert Solomon

Vice President, Finance, Treasurer and Secretary

2

TABLE OF CONTENTS

i

PRELIMINARY COPIES FILED PURSUANT TO RULE 14a-6(a)

GI DYNAMICS, INC.

25 Hartwell Avenue

Lexington, Massachusetts 02421, U.S.A.

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

JUNE 9, 2015

(AUSTRALIAN EASTERN STANDARD TIME)

This proxy statement, along with the accompanying notice of 2015 Annual Meeting of Stockholders, contains information about the 2015 Annual Meeting of Stockholders (the “Annual Meeting”) of GI Dynamics, Inc., including any adjournments or postponements of the Annual Meeting. We are holding the Annual Meeting on Tuesday, June 9, 2015 at 9:00 a.m., Australian Eastern Standard Time (which is 7:00 p.m. on Monday, June 8, 2015 U.S. Eastern Daylight Time) at the offices of DLA Piper Australia, Level 22, No.1 Martin Place, Sydney, NSW, 2000, Australia.

In this proxy statement, we refer to GI Dynamics, Inc. as “GI Dynamics,” “the Company,” “we” and “us.”

This proxy statement relates to the solicitation of proxies by our board of directors for use at the Annual Meeting.

Except where otherwise indicated, all common share and per common share information in this proxy statement has been adjusted to reflect a reverse stock split of our common stock that was effected on April 9, 2015 in which each 10 outstanding shares of our common stock were converted into 1 share of our common stock. As a result of this split, each outstanding share of common stock represents 50 CDIs.

On or about April 30, 2015, we began sending this proxy statement, the attached Notice of 2015 Annual Meeting of Stockholders, proxy card, CDI Voting Instruction Form and Annual Report, which includes our financial statements for the fiscal year ended December 31, 2014 (“Annual Report”) to all stockholders entitled to vote at the Annual Meeting.

IMPORTANT: To ensure that your shares are represented at the Annual Meeting, please vote (or, for CDI holders, direct CDN to vote) your shares via the Internet or by marking, signing, dating, and returning the enclosed proxy card or CDI Voting Instruction Form to the address specified. If you attend the Annual Meeting, you may choose to vote in person even if you have previously voted your shares, except that CDI holders may only instruct CDN to vote on their behalf by completing and signing the CDI Voting Instruction Form or voting online at www.linkmarketservices.com.au and may not vote in person.

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company Soliciting My Proxy?

The board of directors of GI Dynamics is soliciting your proxy to vote at the Annual Meeting to be held on Tuesday, June 9, 2015 at 9:00 a.m., Australian Eastern Standard Time (which is 7:00 p.m. on Monday, June 8, 2015 U.S. Eastern Daylight Time) at the offices of DLA Piper Australia, Level 22, No.1 Martin Place, Sydney, NSW, 2000, Australia and any adjournments of the Annual Meeting. The proxy statement along with the accompanying Notice of 2015 Annual Meeting of Stockholders summarizes the purposes of the Annual Meeting and the information you need to know to vote at the Annual Meeting.

The Annual Meeting is our fourth annual meeting of stockholders as a publicly listed company. In September 2011, we completed our initial public offering and listed on the Australian Securities Exchange (“ASX”). If you held shares of our common stock at 4:30 p.m. on April 13, 2015 Australian Eastern Standard Time (which is 2:30 a.m. on April 13, 2015 U.S. Eastern Daylight Time) (the “Record Date”), you are invited to attend the Annual Meeting and vote on the proposals described in this proxy statement. Those persons holding CDIs are entitled to receive notice of and to attend the Annual Meeting and may instruct CDN to vote at the Annual Meeting by following the instructions on the CDI Voting Instruction Form or by voting online at www.linkmarketservices.com.au.

We have sent you this proxy statement, the Notice of 2015 Annual Meeting of Stockholders, the proxy card, CDI Voting Instruction Form and a copy of our Annual Report because you owned shares of GI Dynamics, Inc.’s common stock or CDIs on the Record Date. The Company intends to commence distribution of the proxy materials to stockholders on or about April 30, 2015.

Who Can Vote?

If you were a holder of GI Dynamics common stock, either as a stockholder of record or as the beneficial owner of shares held in street name as of 4:30 p.m. on April 13, 2015 Australian Eastern Standard Time (which is 2:30 a.m. on April 13, 2015 U.S. Eastern Daylight Time), the Record Date for the Annual Meeting, you may vote your shares at the Annual Meeting. As of the Record Date, there were 9,484,671 shares of our common stock outstanding and entitled to vote (equivalent to 474,233,550 CDIs assuming all shares of common stock were converted into CDIs on the Record Date). Our common stock is our only class of voting stock. Each stockholder has one vote for each share of common stock held as of the Record Date. Each CDI holder is entitled to direct CDN to vote one vote for every fifty (50) CDIs held by such holder. As summarized below, there are some distinctions between shares held of record and those owned beneficially in street name.

You do not need to attend the Annual Meeting to vote your shares (or shares underlying your CDIs). Shares represented by valid proxies or, for CDI holders, by valid CDI Voting Instruction Forms, received in time for the Annual Meeting and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

What does it mean to be a “stockholder of record?”

You are a “stockholder of record” if your shares are registered directly in your name with our transfer agent, American Stock Transfer and Trust Company. As a stockholder of record, you have the right to grant your voting proxy directly to GI Dynamics or to vote in person at the Annual Meeting. If you received printed proxy materials, we have enclosed or sent a proxy card for you to use. You may also vote by Internet, as described below under the heading “How Do I Vote My Shares of GI Dynamics Common Stock?” Holders of CDIs are entitled to receive notice of and to attend the Annual Meeting and may direct CDN to vote at the Annual Meeting by following the instructions on the CDI Voting Instruction Form or by voting online at www.linkmarketservices.com.au.

What does it mean to beneficially own shares in “street name?”

You are deemed to beneficially own your shares in “street name” if your shares are held in an account at a brokerage firm, bank, broker-dealer, trust, or other similar organization. If this is the case, the proxy materials were forwarded to you by that organization. As the beneficial owner, you have the right to direct your broker, bank, trustee, or nominee how to vote your shares, and you are also invited to attend the Annual Meeting. If you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposals on which your broker does not have discretionary authority to vote (a “broker non-vote”).

1

Since a beneficial owner is not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank, trustee, or nominee that holds your shares giving you the right to vote the shares at the meeting. If you do not wish to vote in person or you will not be attending the Annual Meeting, you may vote by proxy. You may vote by proxy or by Internet, as described below under the heading “How Do I Vote My Shares of GI Dynamics Common Stock?”

How Do I Vote My Shares of GI Dynamics Common Stock?

Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet. You may specify whether your shares should be voted for or withheld for each nominee for director and whether your shares should be voted for, against or abstain with respect to each of the other proposals. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the board’s recommendations as noted below. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares are registered directly in your name through our stock transfer agent, American Stock Transfer and Trust Company, or you have stock certificates registered in your name, you may vote:

| | • | | By Internet. Follow the instructions included in the Notice or, if you received printed materials, in the proxy card to vote by Internet. |

| | • | | By mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with the board’s recommendations as noted below. |

| | • | | In person at the Annual Meeting. If you attend the Annual Meeting, you may deliver a completed proxy card in person or you may vote by completing a ballot, which will be available at the Annual Meeting. |

Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 9:00 a.m. on June 7, 2015 Australian Eastern Standard Time (which is 7:00 p.m. on June 6, 2015 U.S. Eastern Daylight Time).

If your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Internet voting may be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares in person at the Annual Meeting, you should contact your broker or agent to obtain a legal proxy or broker’s proxy card and bring it to the Annual Meeting in order to vote.

How Do I Vote If I Hold CDIs?

Each CDI holder is entitled to direct CDN to vote one vote for every fifty (50) CDIs held by such holder. Those persons holding CDIs are entitled to receive notice of and to attend the Annual Meeting and any adjournment or postponement thereof, and may direct CDN to vote their underlying shares of common stock at the Annual Meeting by voting online at www.linkmarketservices.com.au, or by returning the CDI Voting Instruction Form to Link Market Services Limited, the agent we designated for the collection and processing of voting instructions from our CDI holders, so that it is received by Link Market Services Limited no later than 9:00 a.m. on June 6, 2015 Australian Eastern Standard Time (which is 7:00 p.m. on June 5, 2015 U.S. Eastern Daylight Time) in accordance with the instructions on such form. Doing so permits CDI holders to instruct CDN to vote on their behalf in accordance with their written directions.

Alternatively, CDI holders have the following options in order to vote at the Annual Meeting:

| | • | | informing GI Dynamics that they wish to nominate themselves or another person to be appointed as CDN’s proxy for the purposes of attending and voting at the Annual Meeting, or |

| | • | | converting their CDIs into a holding of shares of GI Dynamics common stock and voting these at the meeting (however, if thereafter the former CDI holder wishes to sell their investment on the ASX, it would be necessary to convert shares of common stock back into CDIs). This must be done prior to the Record Date for the Annual Meeting. |

2

If you hold a number of CDIs not exactly divisible by 50, then in respect to any fractional entitlement to a share represented by the balance of these CDIs, as the Company does not issue fractional shares or recognize fractional votes, you will not have any right to vote at any meetings of the Company in respect of the fractional entitlement to underlying shares of common stock such CDIs represent.

As holders of CDIs will not appear on GI Dynamics’ share register as the legal holders of the shares of common stock, they will not be entitled to vote at our stockholder meetings unless one of the above steps is undertaken.

How Does the Board of Directors Recommend That I Vote on the Proposals?

The board of directors (with Michael D. Dale abstaining from making a recommendation on Proposal 3, Michael A. Carusi abstaining from making a recommendation on Proposal 4, Anne J. Keating abstaining from making a recommendation on Proposal 5, Timothy J. Barberich abstaining from making a recommendation on Proposal 6, Graham J. Bradley abstaining from making a recommendation on Proposal 7, Jack E. Meyer abstaining from making a recommendation on Proposal 8, and Daniel J. Moore abstaining from making a recommendation on Proposal 9, due to their respective personal interests in those proposals) recommends that you vote as follows:

| | • | | “FOR” the election of each of the Class I directors named in this proxy statement to hold office for a term of three years; |

| | • | | “FOR” the re-election of each of the Class III directors named in this proxy statement who were appointed by the board since the last annual meeting; |

| | • | | “FOR” the approval of the grant of stock options and performance stock units to Michael D. Dale, our chief executive officer and director; |

| | • | | “FOR” the approval of the grant of stock options and restricted stock units to Michael A. Carusi, a non-executive director of the Company; |

| | • | | “FOR” the approval of the grant of stock options and restricted stock units to Anne J. Keating, a non-executive director of the Company; |

| | • | | “FOR” the approval of the grant of stock options and restricted stock units to Timothy J. Barberich, a non-executive director of the Company; |

| | • | | “FOR” the approval of the grant of stock options and restricted stock units to Graham J. Bradley, a non-executive director of the Company; |

| | • | | “FOR” the approval of the grant of stock options and restricted stock units to Jack E. Meyer, a non-executive director of the Company; |

| | • | | “FOR” the approval of the grant of stock options and restricted stock units to Daniel J. Moore, a non-executive director of the Company; |

| | • | | “FOR” the approval of a cap of 556,963 shares as the maximum number of shares with respect to which stock options, stock appreciation rights and other similar awards may be granted to any participant in any fiscal year under the Company’s 2011 Employee, Director and Consultant Equity Incentive (the “2011 Plan”) for purposes of complying with Section 162(m) of the Internal Revenue Code of 1986, as amended; |

| | • | | “FOR” the approval of the issue and transfer of securities under the 2011 Plan as an exception to ASX Listing Rule 7.1; and |

| | • | | “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2015. |

If any other matter is presented at the Annual Meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with his best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

3

May I Change My Vote or Revoke My Proxy?

If you are a stockholder of record and give us your proxy, you may change your vote or revoke your proxy at any time before the Annual Meeting in any one of the following ways:

| | • | | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; |

| | • | | by re-voting by Internet as instructed above; |

| | • | | by notifying our corporate secretary in writing at GI Dynamics, Inc., 25 Hartwell Avenue, Lexington, Massachusetts 02421, U.S.A., Attention: Corporate Secretary before the Annual Meeting that you have revoked your proxy; or |

| | • | | by attending the Annual Meeting in person, revoking your proxy and voting in person. Attending the Annual Meeting in person will not in and of itself revoke a previously submitted proxy. You must specifically request at the Annual Meeting that it be revoked. |

Your most current vote, whether by Internet or proxy card, is the one that will be counted.

If you are a beneficial owner and hold shares through a broker, bank or other nominee, you may submit new voting instructions by contacting your broker, bank or other nominee. You may also change your vote or revoke your voting instructions in person at the Annual Meeting if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares.

If you are a holder of CDIs and you direct CDN to vote by completing the CDI Voting Instruction Form, you may revoke those directions by delivering to Link Market Services Limited a written notice of revocation bearing a later date than the CDI Voting Instruction Form previously sent which notice must be received by Link Market Services no later than 9:00 a.m. on June 6, 2015 Australian Eastern Standard Time (which is 7:00 p.m. on June 5, 2015 U.S. Eastern Daylight Time).

What if I Receive More Than One Set of Proxy Materials?

It generally means you hold shares registered in multiple accounts. To ensure that all your shares are voted, please submit proxies or voting instructions for each account.

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote My Shares of GI Dynamics Common Stock?” If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares only on the ratification of the appointment of our independent registered public accounting firm (Proposal 12 of this proxy statement) without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the annual meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

Your bank, broker or other nominee does not have the ability to vote your uninstructed shares in the election of directors. Therefore, if you hold your shares in street name it is critical that you cast your vote if you want your vote to be counted for the election of directors (Proposals 1-2 of this proxy statement). Thus, if you hold your shares in street name and you do not instruct your bank, broker or other nominee how to vote in the election of directors, no votes will be cast on that proposal on your behalf.

4

Subject to Voting Exclusion Statements for a Proposal, the Vote Required to Approve Each Proposal and How Votes are Counted is set out below. Information on voting exclusion statements is set out in in the additional information provided for each Proposal.

| | |

| Proposals 1-2: Elect and Re-elect Directors | | The nominees for director who receive the most “FOR” votes (also known as a “plurality” of the votes cast) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. A vote to abstain will not count as a vote cast “FOR” or “AGAINST” a director nominee, and abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of the directors. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| |

| Proposal 3: Executive Director Stock Option and Performance Stock Unit Grants | | The affirmative vote of a majority of the shares cast for this proposal is required to approve the grant to Michael D. Dale of 31,363 stock options to purchase 31,363 shares of our common stock and 26,870 performance stock units which, on vesting, will entitle Mr. Dale to 26,870 shares of our common stock. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the approval of the option grant. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| |

| Proposals 4-9: Non-Executive Director Stock Option and Restricted Stock Unit Grants | | The affirmative vote of a majority of the shares cast for this proposal is required to approve the grant to each of our non-executive directors of 1,000 stock options to purchase 1,000 shares of our common stock and 1,000 restricted stock units which, on vesting, will entitle each non-executive director to 1,000 shares of our common stock. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the approval of the option grant. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote |

| |

| Proposal 10: Approval of a cap of 556,963 shares under the 2011 Plan, for purposes of complying with Section 162(m) of the Internal Revenue Code of 1986, as amended | | The affirmative vote of a majority of the shares cast for this proposal is required to approve the 2011 Plan. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the approval of the 2011 Plan. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| |

| Proposal 11: Approval of the Issue and Transfer of Securities under the 2011 Plan as an exception to ASX Listing Rule 7.1 | | The affirmative vote of a majority of the shares cast for this proposal is required to approve the issue and transfer of securities under the 2011 Plan as an exception to ASX Listing Rule 7.1. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the approval of the issue and transfer of securities under the 2011 Plan as an exception to ASX Listing Rule 7.1. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| |

| Proposal 12: Ratify Selection of Independent Registered Public Accounting Firm | | The affirmative vote of a majority of the shares cast for this proposal is required to ratify the selection of our independent registered public accounting firm. Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote customers’ unvoted |

5

| | |

| |

| | shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to select our independent registered public accounting firm. However, if our stockholders do not ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015, our audit committee of our board of directors will reconsider its selection. |

Is Voting Confidential?

We will keep all the proxies, ballots and voting tabulations private. We only let our Inspectors of Election examine these documents. Other members of management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make, on the proxy card or elsewhere.

Where Can I find the Voting Results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting. In accordance with the requirements of ASX Listing Rule 3.13.2, we will disclose to ASX the voting results of the Annual Meeting immediately after the meeting. We will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What Are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

What Constitutes a Quorum for the Annual Meeting?

The presence, in person or by proxy, of the holders of one-third of the voting power of all outstanding shares of our common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Votes of stockholders of record who are present at the Annual Meeting in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Could Other Matters Be Decided at the Annual Meeting?

We are currently unaware of any matters to be raised at the Annual Meeting other than those referred to in this proxy statement. If other matters are properly presented for consideration at the Annual Meeting and you are a stockholder of record and have submitted your proxy, the persons named in your proxy will have the discretion to vote on those matters for you.

How Do I Attend the Annual Meeting?

We are pleased to offer two options for our Annual Meeting: (1) participating in a teleconference or (2) attending in person. The Annual Meeting and the associated presentation materials may be accessed through the ‘Investors’ section of our website atwww.gidynamics.com. A replay of the Annual Meeting will be available on our website after the meeting.

Admission to the Annual Meeting in person is limited to our stockholders or holders of CDIs, one member of their respective immediate families, or their named representatives. We reserve the right to limit the number of immediate family members or representatives who may attend the meeting. Stockholders of record, holders of CDIs of record, immediate family member guests, and representatives will be required to present government-issued photo identification (e.g., driver’s license or passport) to gain admission to the Annual Meeting.

6

To register to attend the Annual Meeting, please contact our Investor Relations as follows:

| | • | | by e-mail at investor@gidynamics.com; |

| | • | | by phone at +1 781-357-3250 in the U.S or at +61 2 9325 9046 in Australia; |

| | • | | by fax to +1 781-357-3301; or |

| | • | | by mail to Investor Relations at 25 Hartwell Avenue, Lexington, Massachusetts 02421, U.S.A. |

Please include the following information in your request:

| | • | | your name and complete mailing address; |

| | • | | whether you require special assistance at the meeting; |

| | • | | if you will be naming a representative to attend the meeting on your behalf, the name, complete mailing address, and telephone number of that individual; |

| | • | | proof that you own GI Dynamics stock or hold CDIs as of the Record Date (such as a letter from your bank, broker, or other financial institution; a photocopy of a current brokerage or other account statement; or, a photocopy of a holding statement); and |

| | • | | the name of your immediate family member guest, if one will accompany you. |

Please be advised that no cameras, recording equipment, electronic devices, large bags, briefcases, or packages will be permitted in the Annual Meeting.

You need not attend the Annual Meeting in order to vote.

What are the Implications of Being an “Emerging Growth Company”?

As a company with less than $1.0 billion in revenue during our most recently completed fiscal year, we qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, which we refer to as the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable, in general, to public companies that are not emerging growth companies. These provisions include:

| | • | | Reduced disclosure about our executive compensation arrangements; |

| | • | | No non-binding shareholder advisory votes on executive compensation or golden parachute arrangements; and |

| | • | | Exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues as of the end of a fiscal year, if we are deemed to be a large-accelerated filer under the rules of the Securities and Exchange Commission, or the SEC, or if we issue more than $1.0 billion of non-convertible debt over a three-year-period.

7

PROPOSAL 1 – ELECTION OF CLASS I DIRECTORS

Our Certificate of Incorporation and Bylaws provide that the maximum number of directors is ten (10) and that this maximum may only be changed by majority vote of the board of directors. Our board is divided into three classes with staggered three-year terms. One class of directors is elected at each annual meeting of stockholders to serve for a three-year term, and those directors will hold office until their successors have been duly elected and qualified. Our board of directors currently consists of seven (7) members, classified into three classes as follows: (1) Anne J. Keating and Michael A. Carusi constitute a class with a term ending at this Annual Meeting (“Class I Directors”); (2) Timothy J. Barberich and Graham J. Bradley constitute a class with a term ending at the annual meeting of stockholders to be held in 2016 (“Class II Directors”); and (3) Jack E. Meyer, Daniel J. Moore and Michael D. Dale constitute a class with a term ending at the annual meeting of stockholders to be held in 2017 (“Class III Directors”).

On March 23, 2015, our board of directors voted to nominate Anne J. Keating and Michael A. Carusi (“Class I Nominees”) for re-election as Class I Directors of the Company at the Annual Meeting for a term of three years to serve until the annual meeting of stockholders to be held in 2018, and until their respective successors have been duly elected and qualified.

Vote Required and Board of Directors Recommendation

Directors are elected by a plurality of the votes cast at the Annual Meeting, which means that the two director nominees receiving the highest number of “FOR” votes will be elected as Class I directors.

Unless authority to vote for any of these nominees is withheld, the shares represented by the enclosed proxy will be votedFOR the election as Class I Directors of Anne J. Keating and Michael A. Carusi. In the event that either nominee becomes unable or unwilling to serve, the shares represented by the enclosed proxy will be voted for the election of such other person as the board of directors may recommend in that nominee’s place. We have no reason to believe that any nominee will be unable or unwilling to serve as a director.

THE BOARD OF DIRECTORS RECOMMENDS THE ELECTION OF ANNE J. KEATING AND MICHAEL A. CARUSI AS CLASS I DIRECTORS.

8

PROPOSAL 2 — RE-ELECTION OF CLASS III DIRECTORS

Our Certificate of Incorporation and Bylaws provide that the maximum number of directors is ten (10) and that this maximum may only be changed by majority vote of the board of directors. Our board is divided into three classes with staggered three-year terms. One class of directors is elected at each annual meeting of stockholders to serve for a three-year term, and those directors will hold office until their successors have been duly elected and qualified.

Our board of directors currently consists of seven (7) members, classified into three classes as follows: Class I and Class II comprise two directors each and Class III comprises three directors. Further details of these classes of directors and each director in these classes is set out in the background to Proposal No. 1 in this proxy statement. Our board appointed Michael D. Dale on September 18, 2014 and Daniel J. Moore on September 10, 2014 to serve as Class III directors. Under the ASX Listing Rules, where a director is approved by the board during the year, he must not hold office without re-election beyond the next annual meeting after his appointment (being this Annual Meeting) when he must be duly elected by a vote of our stockholders. Accordingly, Michael D. Dale and Daniel J. Moore, will retire and have been nominated by the board for re-election.

If elected, the two directors nominated for re-election as Class III directors will serve until the Company’s annual meeting of stockholders in 2017, and in each case until their successor is elected and qualified.

Vote Required for Approval

Directors are elected by a plurality of the votes cast at the Annual Meeting, which means that the director nominees receiving the highest number of “FOR” votes will be elected as Class III directors. Abstentions and brokernon-votes are not counted as votes cast with respect to that director, and will have no direct effect on the outcome of the election of directors.

THE BOARD OF DIRECTORS RECOMMENDS THE RE-ELECTION OF MICHAEL D. DALE AND DANIEL J. MOORE AS CLASS III DIRECTORS.

9

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Overview

Our Company was incorporated on March 24, 2003 as a Delaware corporation, with operations based in Lexington, Massachusetts. In September 2011, the Company completed an initial public offering of its CDIs (and underlying shares of common stock) pursuant to a prospectus prepared in accordance with the requirements of Chapter 6D of the Australian Corporations Act 2001 (Cth) (“Corporations Act”) and filed with the Australian Securities and Investments Commission. Concurrently with the initial public offering, the Company completed a private placement with certain investors. Our shares of common stock trade on ASX in the form of CDIs. Our CDIs, each currently representing one-fiftieth of one share of our common stock, have been listed on ASX under the trading symbol “GID” since September 7, 2011. Prior to such time there was no public market for our securities.

Board of Directors

The board is responsible for the overall corporate governance of the Company. Issues of substance affecting the Company are considered by the full board, with advice from external advisers as required. Each director must bring an independent view and judgment to the board and must declare all conflicts of interest. Any issue concerning a director must be provided to the board at a board meeting as soon as practicable, and directors may not participate in discussions or resolutions pertaining to any matter in which the director has a material personal interest.

The board’s role in risk oversight includes receiving reports from senior management and the audit committee on a regular basis regarding material risks faced by the Company and applicable mitigation strategies and activities. The reports detail the effectiveness of the risk management program and identify and address material business risks such as technological, strategic, business, operational, financial, human resources and legal/regulatory risks. The board and its committees (described below) consider these reports, discuss matters with management and identify and evaluate any potential strategic or operational risks, and appropriate activity to address those risks.

The responsibilities of the board are set down in the Company’s Board Charter, which has been prepared having regard to the ASX Corporate Governance Council’s ASX Corporate Governance Principles and Recommendations 2nd edition (“ASX Corporate Governance Principles”). A copy of the Company’s Board Charter is available on the Company’s website atwww.gidynamics.com.

Our directors, including the persons nominated as directors, their ages and their position at the Company as of March 31, 2015 are as follows:

| | | | |

Name | | Age | | Position |

Jack E. Meyer(3) | | 71 | | Non-executive Chairman of the Board |

Michael D. Dale | | 55 | | President & Chief Executive Officer, Executive Director |

Timothy J. Barberich (1)(2) | | 67 | | Non-executive Director |

Graham J. Bradley, AM (1) | | 66 | | Non-executive Director |

Michael A. Carusi (2)(3) | | 49 | | Non-executive Director |

Anne J. Keating (1)(3) | | 61 | | Non-executive Director |

Daniel J. Moore(2) | | 54 | | Non-executive Director |

| (1) | Member of audit committee. |

| (2) | Member of compensation committee. |

| (3) | Member of nominating and corporate governance committee. |

The names and certain information regarding each of our director’s experience, qualifications, attributes and skills are set forth below.

10

Class I Nominees

Michael A. Carusi - Non-executive Director

Michael A. Carusi has served as a director of the Company since 2003. Mr. Carusi has over 20 years’ experience in the life sciences and health care industry in business development, management consulting and venture capital roles. As a result of this experience, Mr. Carusi provides us financial and management experience. Since 2012, Mr. Carusi has been a general partner of Lightstone Ventures which is a venture capital firm focused on investments in the life sciences industry. Since October 1998, Mr. Carusi has been a general partner of Advanced Technology Ventures, or ATV, which is a venture capital firm focused on investments in the life sciences and technology sectors. In 2003, Mr. Carusi led the ATV investment in the Company.

Mr. Carusi is a director of private medical companies in which ATV has invested, including Altura Medical, Inc., EndoGastric Solutions, Inc., GluMetrics, Inc., PowerVision, Inc., Holaira, Inc., Second Genome, Inc., and Gynesonics, Inc. He is also a former director of ATV investee companies where he was responsible for investments and successful exits, including Ardian, Inc., which was acquired by Medtronic, Inc., Plexxikon, Inc., which was acquired by Daiichi Sankyo Co, Ltd, and MicroVention, which was acquired by Terumo Medical Corporation, and TranS1 (BAXS) which went public on NASDAQ in 2007. Prior to joining ATV, Mr. Carusi served as the director of business development for Inhale Therapeutic Systems, Inc., a pulmonary drug delivery company that listed on NASDAQ in 1994, where he led partnering activities in the US, Europe and Japan. Mr. Carusi was formerly a principal at The Wilkerson Group, a management consulting firm focused exclusively on health care. Mr. Carusi also serves as a lecturer at the Amos Tuck School of Business Administration at Dartmouth College where he also sits on the Tuck MBA Advisory Board. Previously, Mr. Carusi was a faculty member of the Stanford Biodesign Emerging Entrepreneurs Forum and an advisory board member of the UCSF/Berkeley Venture Innovation Program.

Mr. Carusi holds a Masters of Business Administration from the Amos Tuck School of Business Administration at Dartmouth College and a Bachelors of Science in mechanical engineering from Lehigh University.

Anne J. Keating - Non-executive Director

Anne J. Keating has served as a director of the Company since June 2011. Ms. Keating has had an extensive career in management and as a director of Australian companies, divisions of US companies and not-for-profit organizations. Her extensive business and governance experience makes her qualified to sit on our board of directors.

Ms. Keating is currently a director of a number of ASX-listed companies in a range of different industries, including REVA Medical, Inc., a US-based medical device company developing and commercializing bioresorbable stents for the treatment of coronary artery disease, and Goodman Group Limited.

Ms. Keating is also a director for the Garvan Institute of Medical Research (a leading research institute which studies diabetes and obesity among other diseases) and an Inaugural Governor for the Cerebral Palsy Alliance Research Foundation. Ms. Keating is the chairman of the board of Houlihan Lokey, Australia. From 2012 to March 2015, Ms. Keating was a member of the Advisory Council of CIMB Australia. From 1993 to 2001, Ms. Keating held the position of general manager, Australia for United Airlines and from 1993 to 1998 she was also a governor for the American Chamber of Commerce. She was also a delegate to the Australian/American Leadership Dialogue for 14 years. Ms. Keating was an inaugural board member of the Victor Chang Cardiac Research Institute for 10 years and also served on the board of NRMA Pty Ltd, Insurance Australia Group (IAG) for 9 years and STW Ltd for 16 years. She has recently resigned as a director of Ardent Leisure Management Limited after a 15 year term. She has also held former directorships with Spencer Street Station Redevelopment Holdings Limited, Easy FM China Pty Ltd, Radio 2CH Pty Ltd and Workcover Authority of New South Wales.

Class II Directors Continuing in Office (Terms Expire at the 2016 Annual Meeting of Stockholders)

Timothy J. Barberich - Non-executive Director

Timothy J. Barberich has been a director of the Company since June 2011. Mr. Barberich has nearly 40 years’ experience in pharmaceutical and medical device companies, in technical, sales, marketing and

11

management positions, including as chief executive officer and chairman of the board. Mr. Barberich is the founder and former president, chief executive officer and chairman of Sepracor, Inc., a NASDAQ-listed-pharmaceutical company based in Massachusetts, which was acquired by Dainippon Sumitomo Pharma Co., Ltd. in 2009. Mr. Barberich founded Sepracor in 1984 and served as its chief executive officer from 1984 to 2007 and chairman of the board from 1990 to 2007. From 2007 to 2008, Mr. Barberich served as executive chairman of Sepracor and then chairman of the board from 2008 to 2009. Mr. Barberich led Sepracor through its early-stage research and development, product approvals, commercialization, private financings and initial public offering, partnerships with major companies, several successful spin-outs and achievement of revenues in excess of $1 billion. Prior to founding Sepracor, Mr. Barberich spent 10 years as a senior executive at Millipore Corporation, a company that provides separations products to the life science research, pharmaceutical, biotechnology and electronic markets. Mr. Barberich brings to our board the knowledge and experience of leading a company in the health care industry through every stage of its life cycle. We believe this experience and familiarity with the types of risks we may face, together with his broad medical device and pharmaceutical industry experience, makes Mr. Barberich uniquely suited to serve on our board.

Mr. Barberich is currently chairman of BioNevia Pharmaceuticals, Inc. and is a director of HeartWare International, Inc., a NASDAQ-listed medical device company and Verastem, Inc., a NASDAQ-listed biotechnology company. Mr. Barberich also serves on the board of several private companies including Tokai Pharmaceuticals, Inc. and Neurovance, Inc. Mr. Barberich was formerly a director of BioSphere Medical, Inc., a NASDAQ-listed biotechnology company and Gemin X Biotechnologies, Inc. and Resolvyx Pharmaceuticals, which were acquired in 2011 and 2010, respectively.

Mr. Barberich holds a Bachelor of Science degree in Chemistry from Kings College in Pennsylvania and has taken graduate courses from the School of Chemistry at Rutgers University.

Graham J. Bradley, AM - Non-executive Director

Graham J. Bradley has served as a director of the Company since June 2011. Mr. Bradley has had an extensive career spanning a range of industries across the Australian economy including banking and finance, residential and commercial property, insurance, telecommunications, mining services, minerals and energy, medical research and the arts. From 1995 to 2003, Mr. Bradley was managing director of leading listed investment management and financial services group Perpetual Limited and during his eight-year tenure, Perpetual became one of Australia’s leading listed funds management and financial services groups. Mr. Bradley’s strong financial background provides financial expertise to our board, including an understanding of financial statements, corporate finance, accounting and capital markets.

Mr. Bradley is currently chairman of ASX-listed companies Stockland Corporation Limited, where he was appointed to the board in 2004 and appointed Chairman in 2005, and Po Valley Energy Limited, where he was appointed to the board in 2004. Mr. Bradley also currently serves as chairman of HSBC Bank Australia Limited; Virgin Australia International Holdings Limited; chairman of the advisory board for Anglo American Australian Limited; a council member of the European Australian Business Council; the chairman and director of Energy Australia Holdings Limited and the chairman of Infrastructure New South Wales. From 2009 to 2011, Mr. Bradley served as the president of the Business Council of Australia, the preeminent business leadership organization in Australia representing some 120 of the largest businesses and employers. Mr. Bradley was a director of Garvan Institute for Medical Research, a leading Australian medical research organization, which includes a leading diabetes research group, for 10 years from 1999 to 2009 and also chaired the Garvan Foundation during this time. Mr. Bradley has held former roles including as chairman of Boart Longyear Limited and Proteome Systems Limited; and as a director of Singapore Telecommunications Limited, Queensland Investment Corporation and MBF Australia Limited. Prior to his role at Perpetual, Mr. Bradley was managing partner of the law firm Blake Dawson Waldron and a partner of McKinsey & Company.

Mr. Bradley holds a Bachelor of Arts and a Bachelor of Law with first class honors from the University of Sydney and a Masters of Law from Harvard University. Mr. Bradley is also a Fellow of the Australian Institute of Company Directors and was recognized as a Member of the Order of Australia in July 2009 for his services to business, the arts and medical research.

12

Class III Directors Continuing in Office (Terms Expire at the 2017 Annual Meeting of Stockholders)

Michael D. Dale - Executive Director

Michael D. Dale has served as our president and chief executive officer and a director since September 2014. Mr. Dale has nearly 25 years of experience of operational leadership and global commercialization experience, spanning multiple high technology, transformative medical device companies in the cardiovascular, neuromodulation and electrophysiology markets, all of which makes him qualified to serve on our board. Prior to joining the Company, from September 2012 to June 2014 Mr. Dale served as president and CEO of Helical Solutions, an early stage venture capital funded business dedicated to the treatment of atrial fibrillation. From October 2002 until its acquisition by Medtronic, Inc. in August 2010, Mr. Dale served as chief executive officer, president and chairman of the board of ATS Medical, Inc., a company that developed, manufactured, and marketed medical devices for the treatment of structural heart disease. From 1998 to 2002, Mr. Dale was Vice President of Worldwide Sales and Marketing at Endocardial Solutions, Inc., a company that developed and marketed an advanced cardiac mapping and catheter navigation system for the diagnosis and treatment of cardiac arrhythmias. From 1996 to 1998, Mr. Dale was Vice President of Global Sales for Cyberonics, Inc., a neuromodulation medical device company, and additionally was Managing Director of Cyberonics Europe S.A. From 1988 to 1996, Mr. Dale served in several capacities at cardiovascular medical device manufacturer and marketer St. Jude Medical, Inc., most recently as the Business Unit Director for St. Jude Medical Europe.

Mr. Dale currently serves on the board of directors of several private companies including Neuronetics, Inc., Preceptis Medical, Inc. and, NeoChord, Inc. Mr. Dale also serves on Purdue University’s Weldon School of Biomedical Engineering Advisory Board and the Advanced Medical Technology Association (AdvaMed) Board.

Mr. Dale holds a Bachelor of Science degree from California Polytechnic State University – San Luis Obispo.

Jack E. Meyer - Non-executive Chairman of the Board

Jack E. Meyer has served as a director of the Company since 2003 and as our chairman since June 2011. Mr. Meyer has nearly 40 years’ experience in the medical device, health care and medical technology industries including roles as chief executive officer and in sales and marketing, and has expertise in new medical technologies, commercialization, market expansion and corporate divestment, all of which make Mr. Meyer suited to serve on our board of directors.

Mr. Meyer was formerly the president and chief executive officer of Urologix, Inc., a NASDAQ-listed medical device company, from 1994 to 1998, where he was responsible for developing the company, entering into international distribution arrangements and completing several private and public financings. Mr. Meyer was also president and chief executive officer of Fiberoptic Sensor Technologies, Inc., which was acquired by C.R. Bard, from 1993 to 1994; president & chief executive officer of Carelink Corporation, which was acquired by Tokos Medical Corporation, from 1992 to 1993; executive vice president and chief operating officer of Quest Medical, Inc. from 1982 to 1991, and vice president sales and marketing of IVAC Corporation, which was acquired by Eli Lilly. Mr. Meyer also has served on the board of a number of private medical device companies and currently serves on the board of Minnetronix, Inc.

Mr. Meyer holds a Bachelor of Science and a Masters of Business Administration, each from Drake University.

Daniel J. Moore – Non-executive Director

Daniel J. Moore has served as a director of the Company since 2014. Mr. Moore’s extensive experience in domestic and international sales, management and operations in global medical device manufacturers makes him qualified to sit on our board of directors.

Mr. Moore has served as president, chief executive officer and director of Cyberonics, Inc., a medical technology company with core expertise in neuromodulation, since 2007. From 1989 to 2007, Mr. Moore held positions in sales, marketing, and senior management in the U.S. and in Europe at Boston Scientific Corporation, a diverse maker of minimally invasive medical products. His last position at Boston Scientific was President, International Distributor Management. Prior to that role, he held the position of President, Inter-Continental, the fourth largest business unit of Boston Scientific, with more than 1,000 global employees and revenues exceeding

13

$700 million. Mr. Moore previously held senior management positions at several Boston Scientific U.S. and international divisions.

He currently serves as a member of the board of directors for the Epilepsy Foundation of America, the Medical Device Manufacturers Association (immediate past-Chair), and as a member of the boards or advisory boards for BioHouston, Inc. and the Weldon School of Biomedical Engineering at Purdue University. He currently serves on the board of directors of TriVascular Technologies, Inc., a publicly-traded medical technology company providing device solutions for endovascular aortic repair. He also serves on the board of privately-held BrainScope Company, Inc., a medical technology company focused on traumatic brain injury, where he serves as Chairman. Past board positions include Smiling Kids, Inc., the Epilepsy Foundation of Texas (past-Chair), the Epilepsy Foundation of Texas – Houston (past-President), and Topera, Inc. (acquired by Abbott).

By virtue of his being a director of Boston Scientific Argentina S.A. while he also served as an officer for Boston Scientific, Mr. Moore is named as one of several defendants in a criminal proceeding filed in May 2011 in the Federal Court for Criminal and Correctional Matters No. 4 in Buenos Aires, Argentina. The proceeding pertains to alleged fraudulent conduct in connection with a public tender for the sale of cardiac stents in 2006. Mr. Moore has denied any knowledge of or culpability for the alleged fraudulent conduct and has urged dismissal of the charges. In December 2013, the Argentine federal court dismissed the charges, and the prosecutor appealed the dismissal. In June 2014, the court of appeals dismissed the appeal, concluding the matter as to Mr. Moore.

Mr. Moore holds a B.A. from Harvard University and earned an MBA from Boston University.

Director Independence

Our board of directors currently consists of seven (7) members: Jack E. Meyer; Michael D. Dale; Timothy J. Barberich; Graham J. Bradley, AM; Michael A. Carusi; Anne J. Keating; and Daniel J. Moore. Our board of directors has determined that all of our directors, other than Mr. Dale and Mr. Carusi, are “independent.” We consider that a director is an “independent” director where that director is free from any business or other relationship that could materially interfere, or be perceived to interfere with, the independent exercise of the director’s judgment. We have assessed the independence of our directors regarding the requirements for independence that are set out in Principle 2 of the ASX Corporate Governance Principles. As we have submitted an application to list on NASDAQ, we have assessed the independence of our directors with respect to the definition of independence prescribed by NASDAQ. Though we have submitted an application to list on NASDAQ, there is no guarantee that we will achieve a listing on NASDAQ in any particular timeframe or at all.

While Mr. Carusi is not considered to be an independent director of the Company under the ASX Corporate Governance Principles due to his relationship with one of our substantial shareholders, Mr. Carusi is considered to be an independent director under the rules of NASDAQ.

There are no family relationships among our officers and directors, nor are there any arrangements or understandings between any of our directors or officers or any other person pursuant to which any officer or director was, or is, to be selected as an officer or director.

Committees of the Board of Directors and Meetings

The board of directors presently has the following three standing committees to facilitate and assist the board in fulfilling its responsibilities: (1) an audit committee, (2) a compensation committee and (3) a nominating and corporate governance committee. The board may also establish other committees from time to time to assist in the discharge of its responsibilities.

Meeting Attendance. During the fiscal year ended December 31, 2014 there were nine (9) meetings of our board of directors, and the various committees of the board met a total of eleven (11) times. No director attended fewer than 75% of the total number of meetings of the board and of committees of the board on which he or she served during fiscal 2014. We encourage all of our directors to attend each annual meeting of stockholders. All of our directors attended our 2014 annual meeting of stockholders.

Audit Committee. Our audit committee met five (5) times during fiscal 2014. This committee currently has three (3) members, Graham J. Bradley (chair), Timothy J. Barberich and Anne J. Keating. All members of

14

the Audit Committee satisfy the current independence standards promulgated by the Securities and Exchange Commission (“SEC”); and by The NASDAQ Stock Market, as such standards apply specifically to members of audit committees. Our board of directors has determined that Graham J. Bradley is an “audit committee financial expert,” as the SEC has defined that term. Our audit committee’s role and responsibilities are set forth in the audit committee’s written charter, a copy of which is publicly available on our website atwww.gidynamics.com. The audit committee, among other things, oversees our corporate accounting and financial reporting, including auditing of our financial statements, reviewing the performance of our internal audit function and the qualifications, independence, performance and terms of engagement of our external auditor.

Compensation Committee. Our compensation committee met three (3) times during fiscal 2014. This committee currently has three (3) members, Timothy J. Barberich (chair), Michael A. Carusi and Daniel J. Moore. All members of the compensation committee qualify as independent under the current definition promulgated by The NASDAQ Stock Market. Our compensation committee’s role and responsibilities are set forth in the compensation committee’s written charter, a copy of which is publicly available on our website atwww.gidynamics.com. The compensation committee, among other things, establishes, amends, reviews and approves the compensation and benefit plans with respect to our senior management and employees including determining individual elements of total compensation of our chief executive officer and other members of senior management. The compensation committee is also responsible for reviewing the performance of our executive officers with respect to these elements of compensation.

Nominating and Corporate Governance Committee. Our nominating and corporate governance committee met three (3) times during fiscal 2014 and has three (3) members, Anne J. Keating (chair), Jack E. Meyer and Michael A. Carusi. All members of the nominating and corporate governance committee qualify as independent under the current definition promulgated by The NASDAQ Stock Market. The nominating and corporate governance committee’s role and responsibilities are set forth in the nominating and corporate governance committee’s written charter, a copy of which is publicly available on our website atwww.gidynamics.com. The nominating and corporate governance committee, among other things, recommends the director nominees for each annual general meeting and ensures that the audit, compensation and nominating and corporate governance committees of the board have the benefit of qualified and experienced independent directors.

In addition, under our current Board Charter, the nominating and corporate governance committee will review annually the results of the evaluation of the board and its committees, and the needs of the board for various skills, experience, expected contributions and other characteristics in determining the director candidates to be nominated at the annual meeting. The nominating and corporate governance committee will evaluate candidates for directors proposed by directors, stockholders or management in light of the committee’s views of the current needs of the board for certain skills, experience or other characteristics, the candidate’s background, skills, experience, other characteristics and expected contributions and the qualification standards established from time to time by the nominating and corporate governance committee. If the nominating and corporate governance committee believes that the board requires additional candidates for nomination, the committee may engage, as appropriate, a third party search firm to assist in identifying qualified candidates. All nominees for director positions will submit a completed form of directors’ and officers’ questionnaire as part of the nominating process. The process may also include interviews and additional background and reference checks for nonincumbent nominees, at the discretion of the nominating and corporate governance committee.

The nominating and corporate governance committee will review a reasonable number of candidates for director recommended by a single stockholder who has held over 5% of our common stock for over one year and who satisfies the notice, information and consent provisions set forth in our bylaws. Candidates so recommended will be reviewed using the same process and standards for reviewing board recommended candidates. If a stockholder wishes to nominate a candidate for director, it must follow the procedures described in our bylaws and in “Stockholder Proposals for 2016 Annual Meeting” at the end of this proxy statement.

Compensation Committee Interlocks and Insider Participation

The compensation committee consists of three (3) non-executive directors: Timothy J. Barberich (chair), Michael A. Carusi and Daniel J. Moore. No member of the compensation committee is, or was formerly, one of our executive officers or employees. No interlocking relationship exists between the board of directors or compensation committee and the board of directors or compensation committee of any other company, nor has any interlocking relationship existed in the past.

15

Certain Relationships and Related Party Transactions

There are no existing agreements or arrangements and there are no currently proposed transactions in which the Company was, or is to be, a participant, in which the amount involved exceeded or will exceed $120,000 and in which any current director, executive officer, beneficial owner of more than 5% of our common stock, or entities affiliated with them, had or will have a material interest, except that in September 2011, we entered into agreements with certain of our directors and substantial stockholders with respect to the conversion of the then existing preferred stock into common stock, the repayment of our outstanding convertible term notes and purchases of our CDIs by the note holders in our initial public offering on the ASX.

Policies and Procedures for Review and Approval of Related Party Transactions

We have adopted a policy and procedure for related party transactions. Our audit committee is responsible for reviewing and approving all transactions in which we are a participant and in which any parties related to us, including our executive officers, directors, beneficial owners of more than 5% of our common stock, immediate family members of the foregoing persons and any other persons whom the board determines may be considered related parties of the Company, has or will have a direct or indirect material interest. The audit committee or its chairman, as the case may be, will only approve those related party transactions that are determined to be in, or are not inconsistent with, the best interests of the Company and its stockholders, after taking into account all available facts and circumstances as the audit committee or the chairman determines in good faith to be necessary. Transactions with related parties will also be subject to stockholder approval to the extent required by the listing rules of ASX (“Listing Rules”).

Code of Business Conduct and Ethics

The ASX Corporate Governance Principles require us to establish a code of conduct for all of our directors, officers and employees. We have adopted a Code of Business Conduct and Ethics that applies to all of our employees, including our chief executive officer and chief financial and accounting officers. The text of the Code of Business Conduct and Ethics is posted on our website atwww.gidynamics.com.

Other Corporate Governance Policies

We have also adopted the following policies, each of which is available on our website atwww.gidynamics.com:

| | • | | Continuous Disclosure Policy – The Company needs to comply with the continuous disclosure requirements of the Listing Rules and the Corporations Act to ensure the Company discloses to ASX any information concerning the Company which is not generally available and which a reasonable person would expect to have a material effect on the price or value of the CDIs. As such, this policy sets out certain procedures and measures which are designed to ensure that the Company complies with its continuous disclosure obligations. |

| | • | | Risk Management Policy – This policy is designed to assist the Company to identify, assess, monitor and manage risks affecting the Company’s business. |

| | • | | Insider Trading Policy – This policy is designed to maintain investor confidence in the integrity of the Company’s internal controls and procedures and to provide guidance on avoiding any breach of the insider trading laws in both Australia and the United States. |

| | • | | Shareholder Communications Policy – This policy sets out practices which the Company will implement to ensure effective communication with its shareholders. |

| | • | | Diversity Policy– This policy sets out the Company’s objectives for achieving diversity amongst its employees. |

Stockholder Communications to the Board

Communications to directors must be in writing and sent in care of the Company’s corporate secretary to GI Dynamics, Inc., 25 Hartwell Avenue, Lexington, Massachusetts 02421, U.S.A., Attention: Corporate Secretary or delivered via e-mail to corporatesecretary@gidynamics.com. The name(s) of any specific intended board recipient(s) should be noted in the communication.

16

A copy of each communication received since the date of the last board meeting shall be distributed to each director in advance of each regularly scheduled board meeting, except items that are unrelated to the duties and responsibilities of the board, such as: spam, junk mail and mass mailings, business solicitations and advertisements, and communications that advocate the Company’s engaging in illegal activities or that, under community standards, contain offensive, scurrilous or abusive content.

The Company’s corporate secretary shall be responsible for and oversee the receipt and processing of stockholder communications to board members. An acknowledgement of receipt shall be sent by the corporate secretary or assistant secretary to each stockholder submitting a communication. The Company’s corporate secretary shall retain a copy of each communication for one year from the date of its receipt by the Company. The board of directors or individual directors so addressed shall be advised of any communication withheld for safety or security reasons as soon as practicable. The corporate secretary shall relay all communications to directors absent safety or security issues.

Executive Officers

The following table sets forth certain information regarding our current executive officers who are not also directors. We have employment agreements with Michael D. Dale and David Maggs, M.D.

| | | | |

Name | | Age | | Position |

| | |

David Maggs, M.D. | | 54 | | Chief Medical Officer |

David Maggs, M.D. - Chief Medical Officer