UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ]Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

GI DYNAMICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | | | | | |

| (1) | | | | Title of each class of securities to which transaction applies: |

| | | | | | |

| (2) | | | | Aggregate number of securities to which transaction applies: |

| | | | | | |

| (3) | | | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | | |

| (4) | | | | Proposed maximum aggregate value of transaction: |

| | | | | | |

| (5) | | | | Total fee paid: |

| | | | | | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | | | |

| (1) | | | | Amount Previously Paid: |

| | | |

| (2) | | | | Form, Schedule or Registration Statement No.: |

| | | |

| (3) | | | | Filing Party: |

| | | |

| (4) | | | | Date Filed: |

| | | |

GI DYNAMICS, INC.

355 Congress Street

Boston, MA 02210

May 1, 2017

Dear Stockholder:

You are cordially invited to attend the 2017 annual meeting of stockholders of GI Dynamics, Inc. (the “Annual Meeting”), to be held on May 22, 2017, at 6:00 p.m., United States Eastern Daylight Time, (which is on May 23, 2017, at 8:00 a.m., Australian Eastern Standard Time), at the offices of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., One Financial Center, Boston, MA 02111. The attached notice of Annual Meeting and proxy statement describe the business which we will conduct at the Annual Meeting and provides information about us that you should consider when you vote your shares of common stock.

During 2016 we focused on stabilizing and rebuilding GI Dynamics from the ground up, starting with significant changes to the leadership team and adding experienced experts in multiple roles. We cut costs and extended our cash runway an extra twelve months. We evaluated the EndoBarrier® benefit:risk analysis and came to the informed and independent conclusion that EndoBarrier is a safe and effective product. We dealt with numerous legacy issues and closed out many. Finally, we re-engaged with the US Food and Drug Administration (“FDA”), closed out the ENDO trial, and continued to support other clinical studies around the globe.

We needed to effect a complete cultural rework of GI Dynamics, and have emerged from 2016 aligned as a team, motivated by our shared goal to help patients suffering from type 2 diabetes and obesity, and with strengthened resolve to deliver on the clinical promise of EndoBarrier.

Our focus in 2017 will be to carry GI Dynamics and EndoBarrier forward and build for the near-term present and the long-term future.

| | • | | We need to raise capital in order to continue to fund our ongoing operations and plans for development; |

| | • | | We must continue to address difficult legacy issues across multiple areas; |

| | • | | We will focus on supporting patients and clinicians using EndoBarrier as a safe and effective device treatment; |

| | • | | We will continue to work towards a new IDE study design in the United States with the FDA; |

| | • | | We will continue to support ongoing clinical studies; |

| | • | | We will continue to operate the company in a highly lean and accountable fashion; and |

| | • | | We will endeavor to accomplish all of the above with a focus on maximizing stockholder value. |

We look forward to sharing our progress with you as the year unfolds.

All stockholders and holders of our CHESS Depositary Interests (“CDIs”) are invited to attend the Annual Meeting in person or via telephone and we hope you will be able to attend the Annual Meeting. Whether or not you expect to attend the Annual Meeting, you are urged to vote or submit your proxy card or CDI Voting Instruction Form as soon as possible so that your shares of common stock (or shares of common stock underlying your CDIs) can be voted at the Annual Meeting in accordance with your instructions. When you have finished reading the proxy statement, we encourage you to vote promptly. You may vote your shares of common stock (or direct CHESS Depositary Nominees Pty Ltd (“CDN”) to vote if you hold your shares of common stock in the form of CDIs) by following the instructions on the enclosed proxy card or the CDI Voting Instruction Form. Internet voting is available as described in the enclosed materials. Therefore, when you have finished reading the proxy statement, you are urged to vote in accordance with the instructions set forth in this proxy statement. We encourage you to vote by proxy so that your shares of common stock will be represented and voted at the meeting, whether or not you can attend. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from them to vote your shares.

Thank you for your ongoing support. We look forward to speaking with you at the Annual Meeting.

Sincerely,

Scott Schorer

Chief Executive Officer

GI DYNAMICS, INC.

355 Congress Street

Boston, MA 02210

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders:

An Annual Meeting of stockholders of GI Dynamics, Inc. (the “Company”), a Delaware corporation, will be held on May 22, 2017, at 6:00 p.m., United States Eastern Daylight Time, (which is on May 23, 2017 at 8:00 a.m., Australian Eastern Standard Time) at the offices of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., One Financial Center, Boston, MA 02111, for the following purposes:

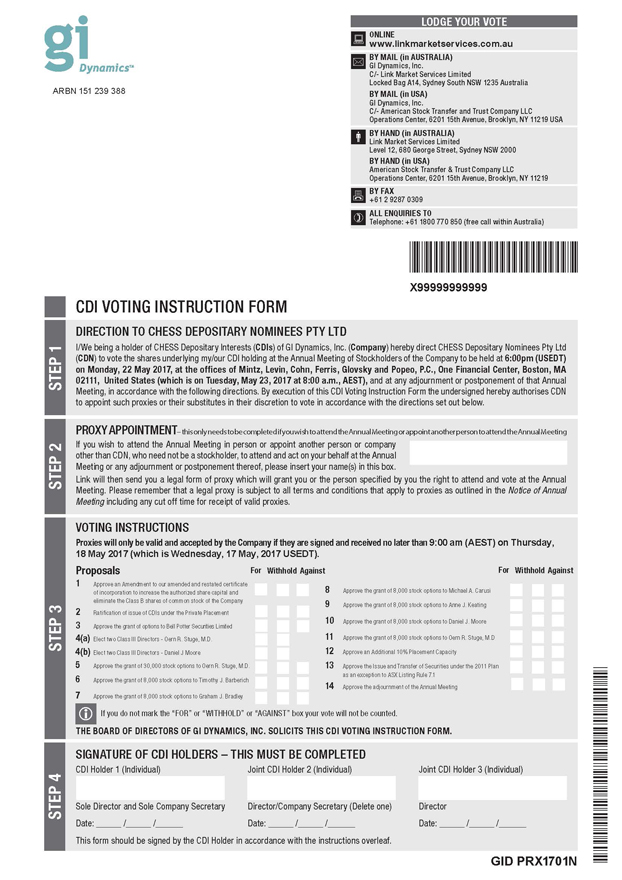

| | 1. | To approve an amendment to our amended and restated certificate of incorporation to increase our authorized shares of common stock (“Shares”) from 13,000,000 to 50,000,000 and to eliminate Class B shares of common stock of the Company; |

| | 2. | For the purposes of Australian Securities Exchange (“ASX”) Listing Rule 7.4 and for all other purposes, to ratify the issue and sale by the Company of 69,865,000 CHESS Depositary Interests (“CDIs”) (equivalent to 1,397,300 Shares) in the capital of the Company with an issue price of A$0.022 per CDI under a private placement to sophisticated and professional investors in Australia and institutional investors in certain other jurisdictions on the terms and conditions set out in the accompanying proxy statement; |

| | 3. | For the purposes of ASX Listing Rule 7.1 and for all other purposes, to approve the issue of 4,117,300 stock options to purchase 4,117,300 CDI’s (equivalent to 82,346 Shares) to Bell Potter Securities Limited on the terms and conditions set out in the accompanying proxy statement, contingent upon the approval of Proposal 1; |

| | 4. | To elect the two Class III director nominees named in the accompanying proxy statement to serve three-year terms expiring in 2020; |

| | 5. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 30,000 stock options to purchase 30,000 shares of common stock to Oern R. Stuge, M.D. on the terms set out in the accompanying proxy statement; |

| | 6. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 8,000 stock options to purchase 8,000 shares of common stock to Timothy J. Barberich on the terms set out in the accompanying proxy statement; |

| | 7. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 8,000 stock options to purchase 8,000 shares of common stock to Graham J. Bradley on the terms set out in the accompanying proxy statement; |

| | 8. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 8,000 stock options to purchase 8,000 shares of common stock to Michael A. Carusi on the terms set out in the accompanying proxy statement; |

| | 9. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 8,000 stock options to purchase 8,000 shares of common stock to Anne J. Keating on the terms set out in the accompanying proxy statement; |

| | 10. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 8,000 stock options to purchase 8,000 shares of common stock to Daniel J. Moore on the terms set out in the accompanying proxy statement; |

| | 11. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 8,000 stock options to purchase 8,000 shares of common stock to Oern R. Stuge, M.D. on the terms set out in the accompanying proxy statement; |

| | 12. | For the purposes of ASX Listing Rule 7.1A and for all other purposes, to approve the issue of equity securities up to 10% of the issued capital of the Company (calculated in accordance with the formula prescribed in ASX Listing Rule 7.1A) on the terms and conditions set out in the accompanying proxy statement; |

| | 13. | For the purposes of ASX Listing Rule 7.2 (Exception 9) and for all other purposes, to approve the issue and transfer of securities under the Company’s 2011 Employee, Director and Consultant Equity Incentive Plan as an exception to ASX Listing Rule 7.1; |

| | 14. | To authorize an adjournment of the Annual Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of Proposals 1 through 13; and |

| | 15. | To transact such other business as may be properly brought before the Annual Meeting and any adjournments thereof. |

Our board of directors recommends a vote “FOR” Proposals 1 through 14, except for Timothy J. Barberich (with respect to Proposal 6 only), Graham J. Bradley (with respect to Proposal 7 only), Michael A. Carusi (with respect to Proposal 8 only), Anne J. Keating (with respect to Proposal 9 only), Daniel J. Moore (with respect to Proposals 4 and 10 only), and Oern R. Stuge, M.D. (with respect to Proposals 4, 5 and 11 only), who abstain from making a recommendation with respect to the specified Proposal(s) due to their personal interest in that Proposal(s).

Stockholders entitled to notice of and to vote at the Annual Meeting shall be determined as of the close of business on April 14, 2017 (Australian Eastern Standard Time), the record date fixed by our Board of Directors for such purpose (the “Record Date”). The owners of common stock as of the Record Date are entitled to vote at the Annual Meeting and any adjournments or postponements of the meeting. Record holders of CDIs, as of the close of business on the Record Date, are entitled to receive notice of and to attend the Annual Meeting or any adjournment or postponement of the meeting and may instruct our CDI Depositary, CHESS Depositary Nominees Pty Ltd (“CDN”), to vote the shares of common stock underlying their CDIs by following the instructions on the enclosed CDI Voting Instruction Form or by voting online at www.linkmarketservices.com.au. Doing so permits CDI holders to instruct CDN to vote on behalf of the CDI holders at the Annual Meeting in accordance with the instructions received via the CDI Voting Instruction Form or online. A list of stockholders of record will be available at the Annual Meeting and, during the 10 days prior to the Annual Meeting, at the office of the Secretary at 355 Congress Street, Boston, MA 02210.

The proxy statement that accompanies and forms part of this Notice of Annual Meeting provides information in relation to each of the matters to be considered at the Annual Meeting. The Notice of Annual Meeting and the proxy statement should be read in their entirety. If a stockholder or a holder of our CDIs is in doubt as to how they should vote at the Annual Meeting, they should seek advice from their legal counsel, accountant or other professional adviser prior to voting.

All stockholders and holders of our CDIs are cordially invited to attend the Annual Meeting. Whether you plan to attend the Annual Meeting or not, you are requested to complete, sign, date, and return the enclosed proxy card or CDI Voting Instruction Form as soon as possible so that your shares (or the shares of common stock underlying your CDIs) can be voted at the Annual Meeting in accordance with the instructions on the proxy card.

BY ORDER OF THE BOARD OF DIRECTORS,

James Murphy

Chief Financial Officer and Secretary

Boston, Massachusetts

May 1, 2017

TABLE OF CONTENTS

i

May 1, 2017

GI DYNAMICS, INC.

355 Congress Street

Boston, MA 02210 U.S.A.

(781) 357-3300

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

May 22, 2017

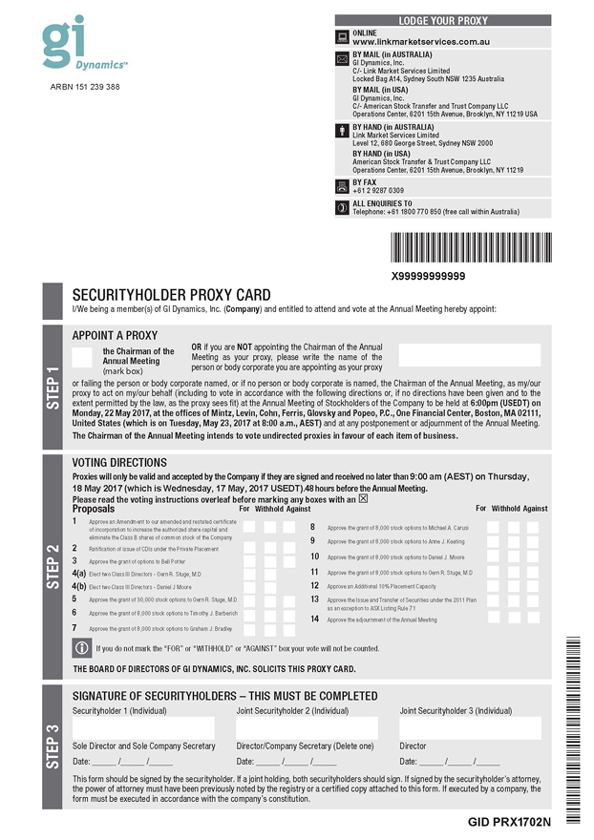

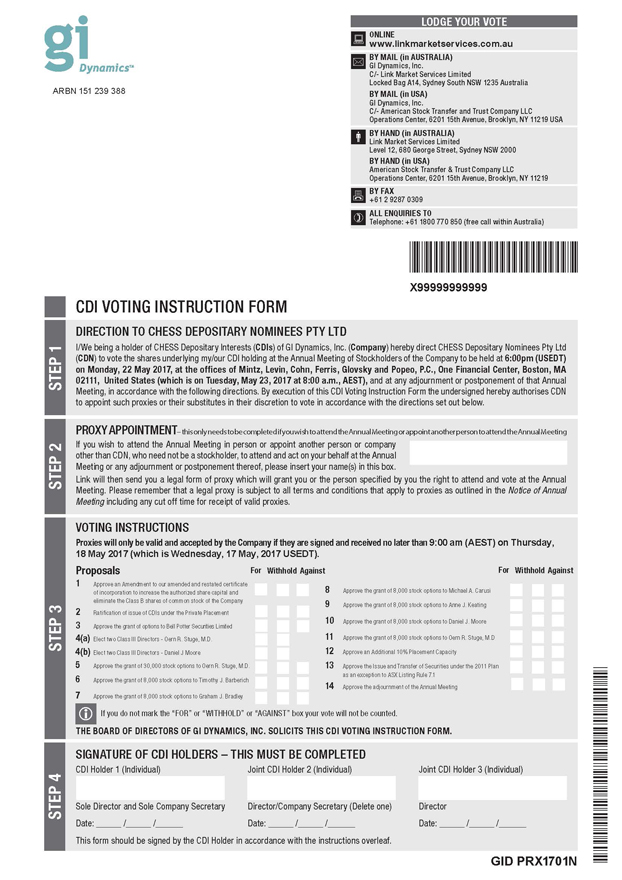

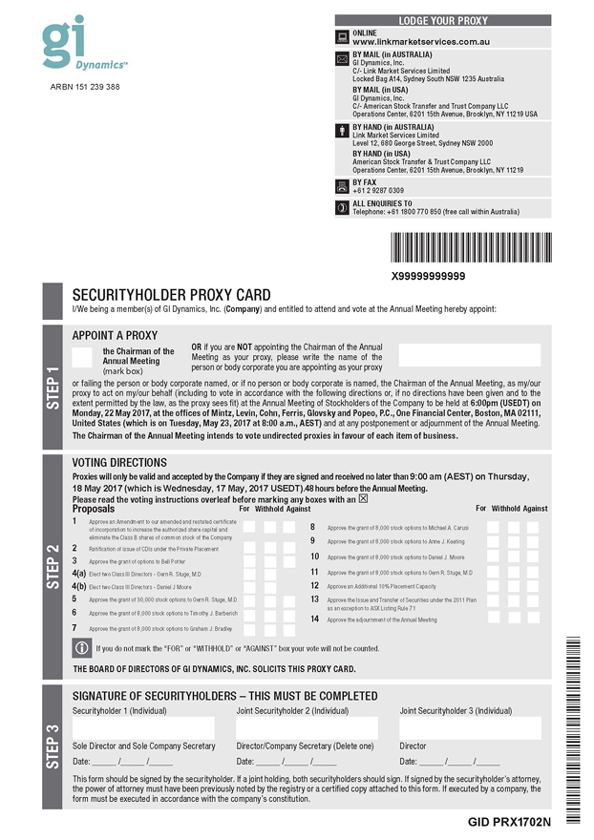

This proxy statement and the enclosed proxy card and CDI Voting Instruction Form are being mailed to stockholders and CDI holders on or about May 1, 2017 and are furnished in connection with the solicitation of proxies by the Board of Directors of GI Dynamics, Inc. (“GI Dynamics”, “we”, “us”, or the “Company”) for use at an annual meeting of stockholders (the “Annual Meeting”) to be held on May 22, 2017, at 6:00 p.m., United States Eastern Daylight Time, (which is on May 23, 2017 at 8:00 a.m., Australian Eastern Standard Time) at the offices of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., One Financial Center, Boston, MA 02111, and at any adjournments or postponements thereof.

IMPORTANT: To ensure that your shares of common stock are represented at the Annual Meeting, please vote your shares of common stock (or, for CDI holders, direct CDN to vote your CDIs) via the Internet or by marking, signing, dating, and returning the enclosed proxy card or CDI Voting Instruction Form to the address specified. If you attend the Annual Meeting, you may choose to vote in person even if you have previously voted your shares of common stock, except that CDI holders may only instruct CDN to vote on their behalf by completing and signing the CDI Voting Instruction Form or voting online at www.linkmarketservices.com.au and may not vote in person.

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

This proxy statement summarizes the information you need to know to vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote your shares of common stock or CDIs. Instead, if you hold shares of common stock you may vote your shares of common stock by marking, signing, dating and returning the enclosed proxy card. If you hold CDIs, you may vote your CDIs by signing and returning the enclosed CDI Voting Instruction Form.

Why is the Company Soliciting My Proxy?

The board of directors of GI Dynamics is soliciting your proxy to vote at the Annual Meeting to be held on Monday, May 22, 2017 at 6:00 p.m., U.S. Eastern Daylight Time (which is 8:00 a.m. on Tuesday, May 23, 2017, Australian Eastern Standard Time) at the offices of Mintz Levin, One Financial Center, Boston, MA 02111 and any adjournments of the Annual Meeting. The proxy statement along with the accompanying Notice of 2017 Annual Meeting of Stockholders summarizes the purposes of the Annual Meeting and the information you need to know to vote at the Annual Meeting.

If you held shares of our common stock at 4:30 p.m. on April 14, 2017 Australian Eastern Standard Time (which is 2:30 a.m. on April 14, 2017 U.S. Eastern Daylight Time) (the “Record Date”), you are invited to attend the Annual Meeting and vote on the proposals described in this proxy statement. Those persons holding CDIs are entitled to receive notice of and to attend the Annual Meeting and may instruct CDN to vote at the Annual Meeting by following the instructions on the CDI Voting Instruction Form or by voting online at www.linkmarketservices.com.au.

We have sent you this proxy statement, the Notice of 2017 Annual Meeting of Stockholders, the proxy card, CDI Voting Instruction Form and a copy of our Annual Report because you owned shares of GI Dynamics, Inc.’s common stock or CDIs on the Record Date. The Company intends to commence distribution of the proxy materials to stockholders on or about May 1, 2017.

Who Can Vote?

If you were a holder of GI Dynamics common stock, either as a stockholder of record or as the beneficial owner of shares held in street name as of 4:30 p.m. on April 14, 2017 Australian Eastern Standard Time (which is 2:30 a.m. on April 14, 2017 U.S. Eastern Daylight Time), the Record Date for the Annual Meeting, you may vote your shares at the Annual Meeting. As of the Record Date, there were 11,157,489 shares of our common stock outstanding and entitled to vote (equivalent to 557,874,430 CDIs assuming all shares of common stock were converted into CDIs on the Record Date). Our common stock is our only class of voting stock. Each stockholder has one vote for each share of common stock held as of the Record Date. Each CDI holder is entitled to direct CDN to vote one vote for every fifty (50) CDIs held by such holder. As summarized below, there are some distinctions between shares held of record and those owned beneficially and held in street name.

You do not need to attend the Annual Meeting to vote your shares (or shares underlying your CDIs). Shares represented by valid proxies or, for CDI holders, by valid CDI Voting Instruction Forms, received in time for the Annual Meeting and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting. For instructions on how to change or revoke your proxy, see “May I Change My Vote or Revoke My Proxy?” below.

What Does It Mean To Be A “Stockholder Of Record?”

You are a “stockholder of record” if your shares are registered directly in your name with our transfer agent, American Stock Transfer and Trust Company. As a stockholder of record, you have the right to grant your voting proxy directly to GI Dynamics or to vote in person at the Annual Meeting. If you received printed proxy materials, we have enclosed or sent a proxy card for you to use. You may also vote by Internet, as described below under the heading “How Do I Vote My Shares of GI Dynamics Common Stock?” Holders of CDIs are entitled to receive notice of and to attend the Annual Meeting and may direct CDN to vote at the Annual Meeting by following the instructions on the CDI Voting Instruction Form or by voting online at www.linkmarketservices.com.au.

What Does It Mean To Beneficially Own Shares In “Street Name?”

You are deemed to beneficially own your shares in “street name” if your shares are held in an account at a brokerage firm, bank, broker-dealer, trust, or other similar organization. If this is the case, the proxy materials

2

were forwarded to you by that organization. As the beneficial owner, you have the right to direct your broker, bank, trustee, or nominee how to vote your shares, and you are also invited to attend the Annual Meeting. If you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposals on which your broker does not have discretionary authority to vote (a “broker non-vote”).

Since a beneficial owner is not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank, trustee, or nominee that holds your shares giving you the right to vote the shares at the meeting. If you do not wish to vote in person or you will not be attending the Annual Meeting, you may vote by proxy. You may vote by proxy or by Internet, as described below under the heading “How Do I Vote My Shares of GI Dynamics Common Stock?”

How Do I Vote My Shares of GI Dynamics Common Stock?

Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. If you vote by proxy, the individuals named on the proxy card, or your “proxies,” will vote your shares of common stock in the manner you indicate. You may specify whether your shares of common stock should be voted for, against, or abstain with respect to all of the Proposals to be voted on at the Annual Meeting. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares of common stock are registered directly in your name through our stock transfer agent, American Stock Transfer and Trust Company, or you have stock certificates registered in your name, you may vote:

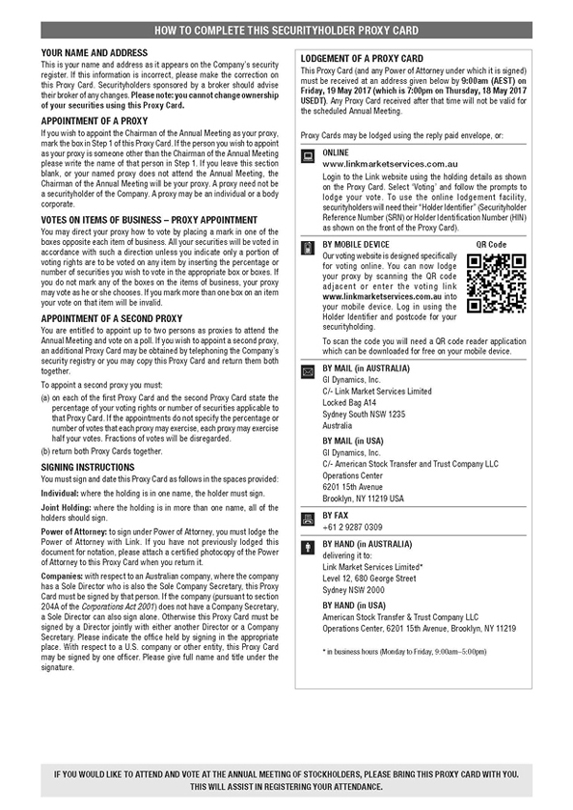

| | • | | By mail. Complete and mail the enclosed proxy card in the enclosed postage prepaid envelope. Your proxy will be voted in accordance with your instructions. If you sign the proxy card but do not specify how you want your shares of common stock voted, they will be voted as recommended by our Board of Directors. The proxy card must be received prior to the Annual Meeting. |

| | • | | By Internet. Follow the instructions attached to the proxy card to vote by Internet. |

| | • | | In person at the meeting. If you attend the Annual Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the Annual Meeting. |

Internet voting facilities for stockholders of record will be available 24-hours a day and will close at 9:00 a.m. on May 19, 2017 Australian Eastern Standard Time (which is 7:00 p.m. on May 18, 2017 United States Eastern Daylight Time).

If your shares of common stock are held in “street name” (held in the name of a bank, broker, or other nominee), you must provide the bank, broker, or other holder of record with instructions on how to vote your shares of common stock and can do so as follows:

| | • | | By mail. Follow the instructions you receive from your broker or other nominee explaining how to vote your shares of common stock. |

| | • | | By Internet or by telephone. Follow the instructions you receive from your broker or other nominee to vote by Internet or telephone. |

| | • | | In person at the meeting. Contact the broker or other nominee who holds your shares of common stock to obtain a broker’s proxy card and bring it with you to the Annual Meeting. You will not be able to vote at the Annual Meeting unless you have a proxy card from your broker. |

How Do I Vote If I Hold CDIs?

Each CDI holder is entitled to direct CDN to vote one vote for every fifty (50) CDIs held by such holder. Those persons holding CDIs are entitled to receive notice of and to attend the Annual Meeting and any adjournment or postponement thereof, and may direct CDN to vote their underlying shares of common stock at the Annual Meeting by voting online at www.linkmarketservices.com.au, or by returning the CDI Voting Instruction Form to Link Market Services Limited, the agent we designated for the collection and processing of voting instructions from our CDI holders, so that it is received by Link Market Services Limited no later than 9:00 a.m. on May 18, 2017 Australian Eastern Standard Time (which is 7:00 p.m. on May 17, 2017 United States Eastern Daylight Time) in accordance with the instructions on such form. Doing so permits CDI holders to instruct CDN to vote on their behalf in accordance with their written directions.

3

Alternatively, CDI holders have the following options in order to vote at the Annual Meeting:

| | • | | informing GI Dynamics that they wish to nominate themselves or another person to be appointed as CDN’s proxy for the purposes of attending and voting at the Annual Meeting; or |

| | • | | converting their CDIs into a holding of shares of GI Dynamics common stock and voting these at the meeting (however, if thereafter the former CDI holder wishes to sell their investment on the ASX, it would be necessary to convert shares of common stock back into CDIs). This must be done prior to the Record Date for the Annual Meeting. |

As holders of CDIs will not appear on GI Dynamics’ share register as the legal holders of the shares of common stock, they will not be entitled to vote at our stockholder meetings unless one of the above steps is undertaken.

How Does the Board of Directors Recommend That I Vote on the Proposals?

The board of directors (with Timothy J. Barberich abstaining from making a recommendation on Proposal 6, Graham J. Bradley abstaining from making a recommendation on Proposal 7, Michael A. Carusi abstaining from making a recommendation on Proposal 8, Anne J. Keating abstaining from making a recommendation on Proposal 9, Daniel J. Moore abstaining from making a recommendation on Proposals 4 and 10, and Oern R. Stuge, M.D. abstaining from making a recommendation on Proposals 4, 5 and 11, due to their respective personal interests in those proposals) recommends that you vote as follows:

| | • | | “FOR” the amendment to our amended and restated certificate of incorporation; |

| | • | | “FOR” the ratification of the issue and sale by the Company of 69,865,000 CDIs (equivalent to 1,397,300 Shares); |

| | • | | “FOR” the issue of the options to Bell Potter Securities Limited; |

| | • | | “FOR” the election of each of the Class III directors named in this proxy statement to hold office for a term of three years; |

| | • | | “FOR” the approval of the grant of stock options to the non-executive directors of the Company; |

| | • | | “FOR” the approval of an additional 10% placement capacity; |

| | • | | “FOR” the approval of the issue and transfer of securities under the 2011 Plan as an exception to ASX Listing Rule 7.1; |

| | • | | “FOR” the adjournment of the Annual Meeting |

If any other matter is presented at the Annual Meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with his best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement

May I Change My Vote or Revoke My Proxy?

If you are a stockholder of record and give us your proxy, you may change your vote or revoke your proxy at any time before the Annual Meeting in any one of the following ways:

| | • | | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; |

| | • | | by re-voting by Internet as instructed above; |

4

| | • | | by notifying our corporate secretary in writing at GI Dynamics, Inc., 355 Congress Street, Boston, MA 02210, U.S.A., Attention: Corporate Secretary before the Annual Meeting that you have revoked your proxy; or |

| | • | | by attending the Annual Meeting in person, revoking your proxy and voting in person. Attending the Annual Meeting in person will not in and of itself revoke a previously submitted proxy. You must specifically request at the Annual Meeting that it be revoked. |

Your most current vote, whether by Internet or proxy card, is the one that will be counted.

If you are a beneficial owner and hold shares of common stock through a broker, bank or other nominee, you may submit new voting instructions by contacting your broker, bank or other nominee. You may also change your vote or revoke your voting instructions in person at the Annual Meeting if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares of common stock.

If you are a holder of CDIs and you direct CDN to vote by completing the CDI Voting Instruction Form, you may revoke those directions by delivering to Link Market Services Limited a written notice of revocation bearing a later date than the CDI Voting Instruction Form previously sent which notice must be received by Link Market Services Limited no later than 9:00 a.m. on May 18, 2017 Australian Eastern Standard Time (which is 7:00 p.m. on May 17, 2017 United States Eastern Daylight Time).

Where Can I find the Voting Results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting. In accordance with the requirements of ASX Listing Rule 3.13.2, we will disclose to ASX the voting results of the Annual Meeting immediately after the meeting and will also report the results on a current report on Form 8-K filed with the U.S. Securities and Exchange Commission.

How Do I Attend the Annual Meeting?

Admission to the Annual Meeting in person is limited to our stockholders or holders of CDIs, one member of their respective immediate families, or their named representatives. We reserve the right to limit the number of immediate family members or representatives who may attend the meeting. Stockholders of record, holders of CDIs of record, immediate family member guests, and representatives will be required to present government-issued photo identification (e.g., driver’s license or passport) to gain admission to the Annual Meeting.

To register to attend the Annual Meeting, please contact our Investor Relations as follows:

| | • | | by e-mail at investor@gidynamics.com; |

| | • | | by phone at +1 781-357-3250 in the U.S or at +61 2 9325 9046 in Australia; |

| | • | | by fax to +1 781-357-3301; or |

| | • | | by mail to Investor Relations at 355 Congress Street, Boston, MA 02210, U.S.A. |

Please include the following information in your request:

| | • | | your name and complete mailing address; |

| | • | | whether you require special assistance at the Annual Meeting; |

| | • | | if you will be naming a representative to attend the Annual Meeting on your behalf, the name, complete mailing address, and telephone number of that individual; |

| | • | | proof that you own GI Dynamics shares of common stock or hold CDIs as of the Record Date (such as a letter from your bank, broker, or other financial institution; a photocopy of a current brokerage or other account statement; or, a photocopy of a holding statement); and |

| | • | | the name of your immediate family member guest, if one will accompany you. |

5

Please be advised that no cameras, recording equipment, electronic devices, large bags, briefcases, or packages will be permitted in the Annual Meeting.

You need not attend the Annual Meeting in order to vote.

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote My Shares of GI Dynamics Common Stock?” If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares only on the adjournment of the Annual Meeting (Proposal 15 of this proxy statement) without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the Annual Meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

Subject to Voting Exclusion Statements for a Proposal, the Vote Required to Approve Each Proposal and How Votes are Counted is set out below. Information on voting exclusion statements is set out in the additional information provided for each Proposal.

| | |

| Proposal 1: Approve an Amendment to our Amended and Restated Certificate of Incorporation to increase the authorized share capital and eliminate the Class B shares of common stock of the Company | | The affirmative vote of a majority of the Company’s outstanding shares of common stock is required to approve the amendment to the Company’s amended and restated certificate of incorporation to increase our authorized shares from 13,000,000 to 50,000,000 and to eliminate Class B shares of common stock of the Company. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Abstentions and broker non-votes will have the same effect as a vote against this proposal. |

| |

| Proposal 2: Ratification of issue of CDIs under the Private Placement | | The affirmative vote of a majority of the votes cast for this proposal is required to approve the ratification of the issue of 69,865,000 CDIs (equivalent to 1,397,300 Shares) in the capital of the Company with an issue price of A$0.022 per CDI under a private placement undertaken in December 2016. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| |

| Proposal 3: Approve the grant of options to Bell Potter Securities Limited | | The affirmative vote of a majority of the votes cast for this proposal is required to approve the issuance of options to purchase 4,117,300 CDIs (equivalent to 82,346 Shares) to Bell Potter Securities Limited. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| |

| Proposal 4: Elect two Class III Directors | | The nominees for director who receive the most “FOR” votes (also known as a “plurality” of the votes cast) will be elected. You may vote either FOR the nominee or WITHHOLD your vote from the nominee. A vote to abstain will not count as a vote cast “FOR” or “AGAINST” a director nominee, and abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of the directors. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

6

| | |

| |

| Proposals 5-11: Approve Non-Executive Director Stock Option Grants | | The affirmative vote of a majority of the votes cast for each of these respective proposals is required to approve the grant to the relevant non-executive director of the stock options described in this proxy statement. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the approval of the option grant. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| |

| Proposal 12: Approve an Additional 10% Placement Capacity | | The affirmative vote of at least 75% of the votes cast for this proposal is required to approve the additional 10% placement capacity. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the approval of an additional 10% placement capacity. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| |

| Proposal 13: Approve the Issue and Transfer of Securities under the 2011 Plan as an exception to ASX Listing Rule 7.1 | | The affirmative vote of a majority of the votes cast for this proposal is required to approve the issue and transfer of securities under the 2011 Plan as an exception to ASX Listing Rule 7.1. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the approval of the issue and transfer of securities under the 2011 Plan as an exception to ASX Listing Rule 7.1. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| |

| Proposal 14: Approve the adjournment of the Annual Meeting | | Our stockholders are being asked to consider and vote upon an adjournment of the Annual Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of a Proposals 1 through 13 described above. Approval of the adjournment of the Annual Meeting requires an affirmative vote of a majority of the votes properly cast for or against this Proposal at the Annual Meeting. Brokerage firms do have authority to vote customers’ unvoted shares held by the firms in street name on this Proposal. If a broker does not exercise this authority, such broker non-votes, as well as any abstentions, will have no effect on the vote total for this Proposal. |

What Constitutes a Quorum for the Annual Meeting?

The presence, in person or by proxy, of the holders of one-third of the voting power of all outstanding shares of our common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Votes of stockholders of record who are present at the Annual Meeting in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Could Other Matters Be Decided at the Annual Meeting?

We are currently unaware of any matters to be raised at the Annual Meeting other than those referred to in this proxy statement. If other matters are properly presented for consideration at the Annual Meeting and you are a stockholder of record and have submitted your proxy, the persons named in your proxy will have the discretion to vote on those matters for you.

Electronic Delivery of Future Stockholder Communications

Most stockholders and CDI holders can elect to view or receive copies of future proxy materials over the Internet instead of receiving paper copies in the mail. If you are a stockholder or CDI holder of record, you can choose this option and save us the cost of producing and mailing these documents by going to www.linkmarketservices.com.au, accessing your account information and following the instructions provided.

7

PROPOSAL 1: APPROVE AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO INCREASE FROM 13,000,000 SHARES TO 50,000,000 SHARES THE AGGREGATE NUMBER OF SHARES OF COMMON STOCK AUTHORIZED TO BE ISSUED

The Board of Directors has determined that it is advisable to increase our authorized common stock from 13,000,000 shares to 50,000,000 shares and to eliminate Class B shares of common stock of the Company, and has voted to recommend that the stockholders adopt an amendment to our Certificate of Incorporation effecting the proposed increase and elimination of Class B shares of common stock. The full text of the proposed amendment to the Certificate of Incorporation is attached to this proxy statement asAppendix A.

As of April 7, 2017, 11,157,489 shares of our common stock were issued and outstanding (excluding treasury shares) and approximately an additional 1,500,600 shares were reserved for issuance upon the exercise of outstanding warrants and options granted under our various stock-based plans. As of April 7, 2017, no Class B shares of our common stock were issued and outstanding and the Company no longer has any obligation to issue any such shares.

The Board of Directors believes it continues to be in our best interest to have sufficient additional authorized but unissued shares of common stock available in order to provide flexibility for corporate action in the future. Management believes that the availability of additional authorized shares for issuance from time to time in the Board of Directors’ discretion in connection with future financings, investment opportunities, stock splits or dividends or for other corporate purposes is desirable in order to avoid repeated separate amendments to our Certificate of Incorporation and the delay and expense incurred in holding special meetings of the stockholders to approve such amendments. We currently have no specific understandings, arrangements or agreements with respect to any future acquisitions that would require us to issue a material amount of new shares of our common stock, however, as stated in our 2016 Annual Report, the Company will need to secure financing no later than the third quarter of 2017 in order to continue its operations and this may require the Company to issue a material amount of new shares of common stock. The Board of Directors therefore believes that the currently available unissued shares do not provide sufficient flexibility for corporate action in the future.

If this proposal is approved, we will not solicit further authorization by vote of the stockholders for the issuance of the additional shares of common stock proposed to be authorized, except as required by law, regulatory authorities or rules of The NASDAQ Stock Market or any other stock exchange on which our shares may then be listed. The issuance of additional shares of common stock could have the effect of diluting existing stockholder earnings per share, book value per share and voting power. Our stockholders do not have any preemptive right to purchase or subscribe for any part of any new or additional issuance of our securities.

Vote Required and Board of Directors Recommendation

The affirmative vote of a majority of our total issued and outstanding voting capital stock is required to approve the amendment to our Certificate of Incorporation to effect the proposed increase in our authorized shares. Abstentions will have no effect on the results of the vote.

THE BOARD OF DIRECTORS HAS DETERMINED THAT PROPOSAL 1 IS IN THE BEST INTERESTS OF THE COMPANY AND UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL 1.

8

PROPOSAL 2: TO RATIFY THE ISSUE AND SALE BY THE COMPANY OF 69,865,000 CDIS (EQUIVALENT TO 1,397,300 SHARES) IN THE CAPITAL OF THE COMPANY WITH AN ISSUE PRICE OF A$0.022 PER CDI UNDER A PRIVATE PLACEMENT ON THE TERMS AND CONDITIONS SET OUT IN THE PROXY STATEMENT

Background

ASX Listing Rule 7.1 prohibits, subject to certain exceptions, a company from issuing or agreeing to issue equity securities that would represent more than 15% of the company’s ordinary securities on issue 12 months prior to the date of issue of (or agreement to issue) such securities, without prior approval of a company’s stockholders.

On 21 December 2016, the Company issued 69,865,000 CDIs (equivalent to 1,397,300 shares of common stock) at an issue price of A$0.022 per CDI to sophisticated and professional investors in Australia and institutional investors in certain other jurisdictions to raise approximately A$1,500,000 (the “Placement”).

The CDIs issued under the Placement were within the 15% limitation imposed under ASX Listing Rule 7.1 and accordingly stockholder approval was not required for their issue.

ASX Listing Rule 7.4 sets out an exception to ASX Listing Rule 7.1. This rule provides that where a company in general meeting ratifies a previous issue of securities (made without stockholder approval under ASX Listing Rule 7.1), those securities will be excluded from the calculation of the number of securities that can be issued by the company in any 12 month period within the 15% limit set out in ASX Listing Rule 7.1 and, if applicable, within the additional 10% limit set out in ASX Listing Rule 7.1A.

By ratifying the issue of the 69,865,000 CDIs, such securities will be excluded from the calculation of the number of securities that can be issued by the Company in the forthcoming 12 month period under ASX Listing Rules 7.1 and if applicable 7.1A, therefore providing the Company with flexibility to issue further CDIs or shares of common stock in the next 12 months, if the board considers it is in the interests of the Company and its stockholders to do so.

Approvals

Stockholder approval is now being sought under ASX Listing Rule 7.4 to ratify the issue of the 69,865,000 CDIs under the Placement.

In accordance with ASX Listing Rule 7.5, the following information is provided in relation to Proposal 2:

| | • | | the total number of CDIs issued by the Company under the Placement was 69,865,000 CDIs (equivalent to 1,397,300 shares of common stock), which were issued under the Company’s 15% placement capacity under ASX Listing Rule 7.1; |

| | • | | the issue price of each CDI was A$0.022; |

| | • | | the issue of the CDIs was made to sophisticated and professional investors in Australia and institutional investors in certain other jurisdictions; |

| | • | | the CDIs rankpari passuwith the Company’s existing CDIs; and |

| | • | | the Company intends to use the proceeds raised to fund the continued development of the Endobarrier and for general working capital purposes. |

If this Proposal 2 is not approved, this will not impact on the validity of the issue of the CDIs under the Placement but will limit the Company’s ability to issue securities, for example, for the purposes of capital raising, in the next 12 months.

Voting Exclusion Statement

The Company will disregard any votes cast on Proposal 2 by investors who participated in the Placement and any person who might obtain a benefit if Proposal 2 is passed (except a benefit solely in the capacity of a holder of CDIs) and any associate of such persons. However, the Company will not disregard a vote if:

| | • | | it is cast by a person as proxy for a person who is entitled to vote, in accordance with the directions on the proxy card; or |

| | • | | it is cast by the person chairing the meeting as proxy for a person who is entitled to vote, in accordance with a direction on the proxy card to vote as the proxy decides. |

9

Vote Required and Board of Directors Recommendation

Approval of Proposal 2 requires the affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the Annual Meeting and voting on the proposal. Abstentions and broker non-votes will have no direct effect on the outcome of this proposal.

THE BOARD OF DIRECTORS HAS DETERMINED THAT PROPOSAL 2 IS IN THE BEST INTERESTS OF THE COMPANY AND UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL 2.

10

PROPOSAL 3: TO APPROVE THE ISSUE OF OPTIONS TO PURCHASE UP TO 4,117,300 CDIS (82,346 SHARES) TO BELL POTTER SECURITIES LIMITED

Background

Bell Potter Securities Limited (“Bell Potter”) acted as the sole lead manager to the Placement referred to in Proposal 2. Under the Placement 69,865,000 fully paid CDIs were issued and under a related Security Purchase Plan 12,481,600 CDIs were issued.

As part of Bell Potter’s remuneration for acting as sole lead manager, the Company agreed, if approved by the Company’s stockholders, to issue Bell Potter options to be issued that number of CDIs that is equal to 5% of the total number of CDIs issued under the Placement (being 69,865,000 CDIs) and the related Security Purchase Plan (being 12,481,600 CDIs). If stockholders approve their issue, Bell Potter will be issued 4,117,300 options (“Options”) to be issued 4,117,300 CDIs (equivalent to 82,346 shares) with each Option entitling Bell Potter to be issued one CDI, having an exercise price of A$0.04 and being capable of being exercised at any time between their date of issue and the third anniversary of that date.

Approvals

ASX Listing Rule 7.1 prohibits, subject to certain exceptions, a company from issuing or agreeing to issue equity securities that would represent more than 15% of the company’s ordinary securities on issue 12 months prior to the date of issue of (or agreement to issue) such securities, without prior approval of a company’s stockholders.

Stockholder approval is now being sought under ASX Listing Rule 7.1 for the issue of the Options to Bell Potter since at the date of this proxy statement the Company does not have sufficient room within the 15% placement capacity under ASX Listing Rule 7.1 to issue the Options without stockholder approval. The approval of this Proposal 3 is contingent upon the approval of Proposal 1 in this proxy statement. Accordingly, if Proposal 1 is not approved this Proposal 3 will not be voted on.

In accordance with ASX Listing Rule 7.3, the following information is provided in relation to Proposal 3:

| | • | | the total number of CDIs to be issued by the Company to Bell Potter upon exercise of all of the Options is 4,117,300 CDIs (equivalent to 82,346 shares of common stock); |

| | • | | the exercise price of each Option is A$0.04; |

| | • | | the CDIs issued on exercise of the Options will rank pari passu with the Company’s existing CDIs at the date of allotment; |

| | • | | the Options are expected to be issued and allotted on May 30, 2017 (but in any event will be issued no later than three months after the Annual Meeting); and |

| | • | | if exercised, the Company intends to use the proceeds raised for general working capital purposes. |

Voting Exclusion Statement

The Company will disregard any votes cast on Proposal 3 by any person who may participate in the proposed issue and any person who might obtain a benefit if Proposal 3 is passed (except a benefit solely in the capacity of a holder of CDIs) and any associate of such persons. However, the Company will not disregard a vote if:

| | • | | it is cast by a person as proxy for a person who is entitled to vote, in accordance with the directions on the proxy card; or |

| | • | | it is cast by the person chairing the meeting as proxy for a person who is entitled to vote, in accordance with a direction on the proxy card to vote as the proxy decides. |

Vote Required and Board of Directors Recommendation

Approval of Proposal 3 requires the affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the Annual Meeting and voting on the proposal. Abstentions and broker non-votes will have no direct effect on the outcome of this proposal.

THE BOARD OF DIRECTORS HAS DETERMINED THAT PROPOSAL 3 IS IN THE BEST INTERESTS OF THE COMPANY AND UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL 3.

11

PROPOSAL 4: ELECTION OF TWO CLASS III DIRECTORS

Our Certificate of Incorporation and Bylaws provide that the maximum number of directors is ten (10) and that this maximum may only be changed by majority vote of the board of directors. Our board is divided into three classes with staggered three-year terms. One class of directors is elected at each annual meeting of stockholders to serve for a three-year term, and those directors will hold office until their successors have been duly elected and qualified. Following the resignation of Jack Meyer, effective January 4, 2017, our board of directors currently consists of six (6) members, classified into three classes as follows: (1) Anne J. Keating and Michael A. Carusi constitute a class with a term ending at the annual meeting of stockholders to be held in 2018 (“Class I Directors”); (2) Timothy J. Barberich and Graham J. Bradley constitute a class with a term ending at the annual meeting of stockholders to be held in 2019 (“Class II Directors”); and (3) Daniel J. Moore and Oern R. Stuge, M.D. constitute a class with a term ending at this Annual Meeting (“Class III Directors”).

On January 4, 2017, our board of directors elected Oern R. Stuge, M.D. as a Class III Director and on April 10, 2017, our board of directors voted to nominate each of Daniel J. Moore and Oern R. Stuge, M.D. for re-election as a Class III Director of the Company at the Annual Meeting for terms of three years to serve until the annual meeting of stockholders to be held in 2020, and in each case until their respective successors have been duly elected and qualified.

Vote Required and Board of Directors Recommendation

Directors are elected by a plurality of the votes cast at the Annual Meeting, which means that the director nominees receiving the highest number of “FOR” votes will be elected as the Class III directors. Abstentions and broker non-votes will have no direct effect on the outcome of this proposal.

Unless authority to vote for any of these nominees is withheld, the shares represented by the enclosed proxy will be voted FORthe election as Class III Directors of Oern R. Stuge, M.D. and Daniel J Moore. In the event that the nominees become unable or unwilling to serve, the shares represented by the enclosed proxy will be voted for the election of such other persons as the board of directors may recommend in the nominees’ place. We have no reason to believe that the nominees will be unable or unwilling to serve as directors.

THE BOARD OF DIRECTORS (EXCLUDING DANIEL J. MOORE AND OERN R. STUGE, M.D., WHO EACH ABSTAIN FROM MAKING A RECOMMENDATION WITH RESPECT TO THEIR OWN ELECTION DUE TO THEIR PERSONAL INTEREST IN THE PROPOSAL) RECOMMENDS THE ELECTION OF DANIEL J. MOORE AND OERN R. STUGE, M.D. AS CLASS III DIRECTORS.

12

PROPOSALS 5 – 11: APPROVE THE GRANT OF STOCK OPTIONS TO NON-EXECUTIVE DIRECTORS OF THE COMPANY

Background

As part of its overall compensation program, our non-executive directors receive, subject to stockholder approval being obtained under the ASX Listing Rules, a significant portion of their annual compensation in the form of long-term incentive equity-based awards.

On January 4, 2017 (January 5, 2017, Australian Eastern Daylight Time), the board approved, subject to obtaining stockholder approval at this meeting, pursuant to the Company’s 2011 Employee, Director and Consultant Equity Incentive Plan (“2011 Plan”), the grant of 30,000 stock options to purchase 30,000 shares of our common stock (collectively, the “NED Initial Options”) to Oern R. Stuge, M.D. under our current non-employee director compensation program.

On April 10, 2017 (April 11, 2017, Australian Eastern Daylight Time), the board approved, subject to obtaining stockholder approval at this meeting, pursuant to the 2011 Plan, the grant of an aggregate of 48,000 stock options to purchase 48,000 shares of our common stock (collectively, the “NED Annual Options” and together with the NED Initial Options, collectively the “NED Options”) in the amounts of 8,000 NED Annual Options to each of Timothy J. Barberich, Graham J. Bradley, Michael A. Carusi, Anne J. Keating, Daniel J. Moore, and Oern R. Stuge, M.D. (the “Non-Executive Directors”) under our current non-employee director compensation program.

As of April 11, 2017, the market value of a share of common stock issuable upon exercise of a NED Option was US$2.33 based upon the closing price of our CDIs on the ASX on April 11, 2017. As of April 7, 2017, the Company had a total of 1,174,415 shares of common stock reserved for potential future issuance for employees, consultants and directors. Proposals 5-11 recommend the issuance of the NED Options to the Non-Executive Directors which, in aggregate, constitute approximately 6.6% of the total number of shares of common stock so reserved for potential future issuance.

Approvals

ASX Listing Rule 10.14 provides that a company must not permit a director to acquire securities under an employee incentive scheme without the prior approval of stockholders. Accordingly, stockholder approval is now being sought for the purposes of ASX Listing Rule 10.14 and for all other purposes for the grant of the NED Options to the Non-Executive Director as described below.

Principal Terms of Options

If any of Proposals 5-11 are approved by stockholders, the corresponding NED Options will be issued to the Non-Executive Director as soon as practicable after the Annual Meeting and, in any case, no later than three years after the Annual Meeting.

The NED Options to be issued to each of the Non-Executive Directors will be issued on the following terms and conditions:

| | (a) | Grant Price: There is no consideration payable for the grant of the NED Options. |

| | (i) | The exercise price of the NED Initial Options is US$0.76, based upon the closing price of the Company’s CDIs on the ASX on January 5, 2017, the date of approval by the board of the grant of the NED Initial Options to Oern R. Stuge, M.D. |

| | (ii) | The exercise price of the NED Annual Options is US$2.33, based upon the closing price of the Company’s CDIs on the ASX on April 11, 2017, the date of approval by the board of the grant of the NED Annual Options to the Non-Executive Directors. |

| | (iii) | The NED Options are immediately exercisable upon issue and may be exercised at any time prior to their lapsing. |

13

| | (i) | The NED Initial Options shall vest over three years from the date of the options grant in (i) one installment of 33% of the shares on the first anniversary of the date of the options grant and (ii) eight substantially equal installments vest on a quarterly basis thereafter. |

| | (ii) | The NED Annual Options are scheduled to vest on the first anniversary of the date of the options grant. |

| | (iii) | Any shares which are received on exercise of NED Options exercised prior to vesting will be subject to a repurchase right by the Company until fully vested at the lesser of cost or fair market value. |

| | (iv) | All NED Options will vest in full upon a change in control event (as defined in the Non-Executive Director’s Option Agreements under the 2011 Plan). |

| | (v) | There are no performance conditions or other requirements attaching to the NED Options other than the requirement that the Non-Executive Director continue to be a director of the Company at each relevant vesting date. |

| | (d) | Lapsing of NED Options: The NED Options will lapse in circumstances where: |

| | (i) | the NED Options have been exercised or otherwise settled; |

| | (ii) | the Non-Executive Director ceases to be a director of the Company on or prior to the date of vesting of the relevant NED Options; or |

| | (iii) | the NED Options have not been exercised by the tenth anniversary of the date of grant. |

As required by ASX Listing Rule 10.15A, the following additional information is provided in relation to Proposals 5-11.

The maximum aggregate number of NED Options that may be granted by the Company under Proposals 5-11 is 78,000 NED Options comprising:

| | • | | 8,000 NED Options to Timothy J. Barberich; |

| | • | | 8,000 NED Options to Graham J. Bradley; |

| | • | | 8,000 NED Options to Michael A. Carusi; |

| | • | | 8,000 NED Options to Anne J. Keating; |

| | • | | 8,000 NED Options to Daniel J. Moore; and |

| | • | | 38,000 NED Options to Oern R. Stuge, M.D. |

Upon exercise, each NED Option will entitle the relevant Non-Executive Director to receive one share of common stock at the exercise price as set out above.

No loans have been or will be made by the Company to the Non-Executive Director in connection with the acquisition of the NED Options or exercise of the NED Options.

No individual referred to in ASX Listing Rule 10.14 has received securities under the 2011 Plan since stockholder approval was last obtained under ASX Listing Rule 10.14.

All directors, being Timothy J. Barberich, Graham J. Bradley, Michael A. Carusi, Anne J. Keating, Daniel J. Moore, and Oern R. Stuge, M.D. are entitled to participate in the 2011 Plan. Details of any securities issued under the 2011 Plan will be published in the Company’s Annual Report relating to the period in which securities have been issued, together with a statement that approval for this issue of securities was obtained under ASX Listing Rule 10.14.

14

Any additional director who becomes entitled to participate in the 2011 Plan after approval ofProposal 5-11 and who is not named in this proxy statement will not participate until approval is obtained under ASX Listing Rule 10.14.

Voting Exclusion Statement

The Company will disregard any votes cast on Proposals 5-11 by the directors of the Company or any associate of the directors of the Company. However, the Company need not disregard a vote if:

| | • | | it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy card; or, |

| | • | | it is cast by the person chairing the meeting as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy card to vote as the proxy decides. |

Vote Required and Board of Directors Recommendation

Approval of Proposals 5-11 require the affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy at the Annual Meeting and voting on the proposal. Abstentions and broker non-votes will have no direct effect on the outcome of this proposal.

THE BOARD OF DIRECTORS (EXCLUDING TIMOTHY J. BARBERICH (WITH RESPECT TO PROPOSAL 6 ONLY), GRAHAM J. BRADLEY (WITH RESPECT TO PROPOSAL 7 ONLY), MICHAEL A. CARUSI (WITH RESPECT TO PROPOSAL 8 ONLY), ANNE J. KEATING (WITH RESPECT TO PROPOSAL 9 ONLY), DANIEL J. MOORE (WITH RESPECT TO PROPOSAL 10 ONLY), AND OERN R. STUGE, M.D. (WITH RESPECT TO PROPOSALS 5 AND 11 ONLY), WHO DO NOT MAKE A RECOMMENDATION WITH RESPECT TO THE PROPOSAL IN PARENTHESIS AFTER THEIR NAME DUE TO THEIR PERSONAL INTEREST IN THAT PROPOSAL) RECOMMENDS A VOTE “FOR” THE APPROVAL OF PROPOSALS 5 THROUGH 11 (INCLUSIVE).

15

PROPOSAL 12: APPROVE AN ADDITIONAL 10% PLACEMENT CAPACITY

Background

ASX Listing Rule 7.1 allows the Company to issue a maximum of 15% of its issued capital in any 12 month period without obtaining stockholder approval. In accordance with ASX Listing Rule 7.1A, eligible entities can issue a further 10% of their issued capital over a 12 month period (“Placement Securities”) without obtaining stockholder approval for the individual issues provided that stockholder approval is obtained at the entity’s annual meeting (and the entity is an “eligible entity” at the time of the annual meeting). The Company is an “eligible “entity” as at the date of this proxy statement.

Under ASX Listing Rule 7.1A, the Placement Securities must be in the same class as an existing quoted class of equity securities of the Company. As at the date of this proxy statement, the Company only has on issue one quoted class of equity securities, namely common stock, traded in the form of CDIs on the ASX.

The purpose of this Proposal 12 is to provide us with flexibility to meet future business and financial needs. We believe that it is advantageous for us to have the ability to act promptly with respect to potential opportunities and that approval of the issuance of the Placement Securities is desirable in order to have the securities available, as needed, for possible future financing transactions, strategic transactions, or other general corporate purposes that are determined by our board to be in the Company’s best interests.

Approval of this Proposal 12 would enable us to issue shares of common stock or CDIs without the expense and delay of holding a meeting of stockholders, except as may be required by applicable law or regulations. The cost, prior notice requirements, and delay involved in obtaining stockholder approval at the time a corporate action may become necessary could eliminate the opportunity to effect the action or could reduce the expected benefits.

If this Proposal and Proposal 2 are approved then, subject to the limitations described below with respect to the additional 10 percent placement capacity, we will generally be permitted to issue up to 25 percent of our issued and outstanding capital without any further stockholder approval in the next 12 months, unless such stockholder approval is required by applicable law, the rules of the ASX, or the rules of another stock exchange on which our securities may be listed at the time. Currently, we have no definitive agreements to issue securities for any purpose, other than equity awards under our 2011 Plan and the proposed issue of options to Bell Potter Securities Limited referred to in Proposal 3, however, as stated in our 2016 Annual Report the Company will need to secure financing no later than the third quarter of 2017 in order to continue its operations and this may require the Company to issue a material amount of new shares of common stock or CDIs. We believe that the adoption of this Proposal 12 will enable us to promptly and appropriately respond to business opportunities or raise additional equity capital. Our board of directors will determine the terms of any issuance of securities in the future.

Approvals

The Company is now seeking stockholder approval to have the ability to issue Placement Securities under ASX Listing Rule 7.1A. The exact number of Placement Securities that may be issued by the Company under ASX Listing Rule 7.1A will be determined in accordance with the formula prescribed in ASX Listing Rule 7.1A.2 (a copy of which is replicated below):

(A x D) - E

| | |

| A = | | The number of fully paid ordinary securities on issue 12 months before the date of issue or agreement: |

| |

| | • plus the number of fully paid ordinary securities issued in the 12 months under an exception in ASX Listing Rule 7.2; |

| |

| | • plus the number of partly paid ordinary securities that became fully paid in the 12 months; |

| |

| | • plus the number of fully paid ordinary securities issued in the 12 months with stockholder approval under ASX Listing Rules 7.1 and 7.4; and |

| |

| | • less the number of fully paid ordinary securities cancelled in the 12 months. |

| |

| D = | | 10% |

| |

| E = | | The number of equity securities issued or agreed to be issued under Listing Rule 7.1A.2 in the 12 months before the date of issue or agreement to issue that are not issued with stockholder approval under ASX Listing Rules 7.1 or 7.4. |

16

If passed, Proposal 12 will allow the board of directors to issue up to an additional 10% of the Company’s issued capital during the 12 month period following the date of the Annual Meeting without requiring further stockholder approval. This is in addition to the Company’s 15% annual placement capacity provided for in ASX Listing Rule 7.1.

As required by ASX Listing Rule 7.3A, the following additional information is provided in relation to Proposal 12:

| (a) | ASX Listing Rule 7.3A.1 –The minimum price at which Placement Securities may be issued pursuant to this ASX Listing Rule 7.1A approval will be no less than 75% of the volume weighted average price of the Company’s CDIs calculated over the 15 trading days on which trades in that class were recorded immediately before: |

| | (i) | the date on which the price at which Placement Securities are to be issued is agreed; or |

| | (ii) | if Placement Securities are not issued within five trading days of the date in paragraph (i), the date on which Placement Securities are issued. |

If Placement Securities are issued for non-cash consideration the Company will provide to the market (in accordance with the ASX Listing Rules) a valuation of the non-cash consideration that demonstrates that the issue price of such Placement Securities complies with ASX Listing Rule 7.3A.

| (b) | ASX Listing Rule 7.3A.2 – If stockholders approve Proposal 12 and the Company issues Placement Securities under ASX Listing Rule 7.1A, the existing stockholders of the Company face the risk of economic and voting dilution as a result of the issue of Placement Securities, to the extent that such Placement Securities are issued, including the risk that: |

| | (i) | the market price for Placement Securities may be significantly lower on the issue date than on the date of the approval under ASX Listing Rule 7.1A; and |

| | (ii) | Placement Securities may be issued at a price that is at a discount to the market price for those securities on the issue date. |

The following table describes the potential dilution of existing stockholders on the basis of three different issue prices and values for variable ‘A’ in the formula in ASX Listing Rule 7.1A.2. The prices and values set out in the table below are examples only and include scenarios prescribed by the ASX Listing Rules. Accordingly, they provide no indication of the actual market price of the Company’s CDIs or the price at which issues of Placement Securities under ASX Listing Rule 7.1A will be made (assuming Proposal 12 is approved by stockholders). In addition, the “current variable ‘A’” reference in the table does not take into account the CDIs that would be added to that number if Proposal 2 is approved.

| | | | | | | | | | | | | | | | | | | | |

Variable A in Listing Rule 7.1A.2 | | | | Dilution |

| | | Issue price of A$0.034

(50% of the current market

price of the Company’s CDIs) | | Issue price of A$0.067

(the current price of the

Company’s CDIs) | | Issue price of A$0.134

(100% increase in the current

price of the Company’s CDIs) |

488,009,450 CDIs (Current variable ‘A’) | | 10% Voting Dilution | | | | | | 48,800,945 CDIs | | | | | | 48,800,945 CDIs | | | | | | 48,800,945 CDIs |

| | Funds raised | | | AUD | | | 1,659,232 | | | AUD | | | 3,269,663 | | | AUD | | | 6,539,327 |

| | | | | | | |

732,014,175 CDIs (50% increase to current variable ‘A’) | | 10% Voting Dilution | | | | | | 73,201,417 CDIs | | | | | | 73,201,417 CDIs | | | | | | 73,201,417 CDIs |

| | Funds raised | | | AUD | | | 2,488,848 | | | AUD | | | 4,904,495 | | | AUD | | | 9,808,990 |

| | | | | | | |

976,018,900 CDIs (100% increase to current variable ‘A’) | | 10% Voting Dilution | | | | | | 97,601,890 CDIs | | | | | | 97,601,890 CDIs | | | | | | 97,601,890 CDIs |

| | Funds raised | | | AUD | | | 3,318,464 | | | AUD | | | 6,539,327 | | | AUD | | | 13,078,653 |

Note: The above table has been prepared based on the following assumptions:

| 1. | The Company issues (as CDIs) the maximum number of Placement Securities available under the 10% placement capacity prescribed by ASX Listing Rule 7.1A. |

17

| 2. | No options are exercised before the date of issue of Placement Securities under ASX Listing Rule 7.1A. |

| 3. | The 10% voting dilution reflects the aggregate percentage dilution against the issued share capital at the time of issue. This is why the voting dilution is shown in each example as 10%. |

| 4. | The table shows only the effect of issues of Placement Securities under ASX Listing Rule 7.1A, not under the Company’s 15% placement capacity under ASX Listing Rule 7.1. |

| 5. | The issue price of A$0.067 is the closing price of the Company’s CDIs on ASX on April 7, 2017. |

| 6. | All shares of common stock are held as CDIs. |

| (c) | ASX Listing Rule 7.3A.3 –The date Placement Securities must be issued by (assuming Proposal 12 is approved by stockholders) is the date that is 12 months after the date of the Company’s 2017 Annual Meeting (i.e., May 23, 2018, Australian Eastern Standard Time) unless the Company approves a transaction under ASX Listing Rule 11.1.2 (a significant change to the nature or scale of the Company’s activities) or ASX Listing Rule 11.2 (disposal of the Company’s main undertaking), in which case the ASX Listing Rule 7.1A approval under Proposal 12 will fall away on the date of stockholder approval for the relevant transaction. |

| (d) | ASX Listing Rule 7.3A.4 –The Placement Securities will be issued for the purpose of funding the Company’s further development of the EndoBarrier® for the treatment of patients who have uncontrolled type 2 diabetes and are obese and for raising working capital for the Company. The Company does not intend to issue any of the Placement Securities for non-cash consideration; however, a valuation report would be provided in relation to any securities that were to be issued for non-cash consideration. |

| (e) | ASX Listing Rule 7.3A.5 – The Company’s allocation policy for issues of Placement Securities pursuant to approval under this Proposal 12 will depend on prevailing market conditions and the Company’s circumstances at the time of any proposed issue. The form and timing of any issue of Placement Securities under ASX Listing Rule 7.1A and the identity of the allottees of Placement Securities will be determined on a case by case basis having regard to any one or more of the following: |

| | (i) | the methods of raising funds available to the Company including, but not limited to, private placements, rights issues or other issues in which existing stockholders of the Company can participate; |

| | (ii) | the effect of the issue of Placement Securities on the control of the Company; |

| | (iii) | the financial situation of the Company; and |

| | (iv) | advice from any one or more of the Company’s professional advisers. |

Allottees for the purposes of the issue of Placement Securities under ASX Listing Rule 7.1A have not been determined as at the date of this proxy statement but may include existing substantial stockholders and/or new stockholders who are not related parties or associates of a related party of the Company. In addition, if the Company is successful in acquiring new assets or investments it is possible that allottees for the purpose of the issue of Placement Securities under ASX Listing Rule 7.1A will be or include vendors of the new assets or investments.

As at the date of this proxy statement, the Company has not formed an intention as to the parties which it may approach to participate in an issue of Placement Securities under ASX Listing Rule 7.1A including whether such an issue would be made to existing stockholders or to new investors.

| (f) | ASX Listing Rule 7.3A.6 – The Company last obtained stockholders approval under ASX Listing Rule 7.1A on May 20, 2013. |

Voting Exclusion Statement

The Company will disregard any votes cast in respect of Proposal 12 by a person who may participate in the proposed issue of any Placement Securities and a person who might obtain a benefit, except a benefit solely in the capacity of a holder of shares, if Proposal 12 is passed, and any associates of those persons. However, the Company need not disregard a vote cast on Proposal 12 if:

| | • | | it is cast by a person as proxy for a person who is entitled to vote, in accordance with the directions on the proxy card; or |

| | • | | it is cast by the person chairing the meeting as proxy for a person who is entitled to vote, in accordance with a direction on the proxy card to vote as the proxy decides. |

18

As at the date of this proxy statement, the Company has not entered into any definitive agreements to issue Placement Securities under ASX Listing Rule 7.1A and therefore it is not known who may participate in a potential issue of Placement Securities (if any) under ASX Listing Rule 7.1A. Accordingly, as at the date of this proxy statement, the Company is not aware of any person who would be excluded from voting on this Proposal 12.

Vote Required and Board of Directors Recommendation

Under ASX Listing Rule 7.1A, Proposal 12 is required to be passed as a “special resolution” for the purposes of the ASX Listing Rules, which means that it must be approved by at least 75% of the votes cast by stockholders entitled to vote on Proposal 12.

THE BOARD OF DIRECTORS HAS DETERMINED THAT PROPOSAL 12 IS IN THE BEST INTERESTS OF THE COMPANY AND UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL 12.

19

PROPOSAL 13: APPROVE THE ISSUE AND TRANSFER OF SECURITIES UNDER THE 2011 PLAN

ASX Listing Rule 7.1 provides that the prior approval of our stockholders is required for an issue of equity securities if the securities will, when aggregated with the securities issued by the Company during the previous 12 months, exceed 15% of the number of securities on issue at the commencement of that 12-month period.

ASX Listing Rule 7.2 (Exception 9) sets out an exception to ASX Listing Rule 7.1. This rule provides that issues under an employee incentive scheme are exempt for a period of three years if stockholders approve the issue of securities under the scheme for the purposes of this exception.

Accordingly, Proposal 13 seeks approval from stockholders (for the purposes of ASX Listing Rule 7.2 (Exception 9)) for the issue and transfer of securities under the 2011 Plan. Approval of this Proposal 13 will mean that for the period of three years following the date of this Annual Meeting, any issues or transfers of securities made under the 2011 Plan will be excluded from the calculation of the Company’s 15% issue capacity under ASX Listing Rule 7.1 and any additional 10% placement capacity under ASX Listing Rule 7.1A (if such additional placement capacity is approved by stockholders in accordance with Listing Rule 7.1A).

The Company adopted its 2011 Plan as a successor equity incentive plan to its 2003 Plan. The board last sought and obtained approval of its stockholders for the issue and transfer of securities under the 2011 Plan for the purposes of ASX Listing Rule 7.2 (Exception 9) at the Company’s Annual Meeting in June 2015.