Filed pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Filing Person: Corporate Property Associates 16 – Global Incorporated

Subject Company: Corporate Property Associates 16 – Global Incorporated

Commission File Number: 001-32162

Dear Financial Advisor,

As you know, the Boards of Directors of CPA®:16 – Global and W. P. Carey Inc. (“W. P. Carey”) have each approved a plan under which the two companies will combine in a merger transaction. W. P. Carey has been the advisor to CPA®:16 – Global since inception and has invested and managed its assets successfully through a variety of economic conditions. We are pleased to be presenting a transaction that we believe will be beneficial to CPA®:16 – Global stockholders by providing them with liquid shares in a company poised for growth and continued stable income.

CPA®:16 – Global’s board has determined that the merger is advisable and recommends that stockholders vote FOR the merger.

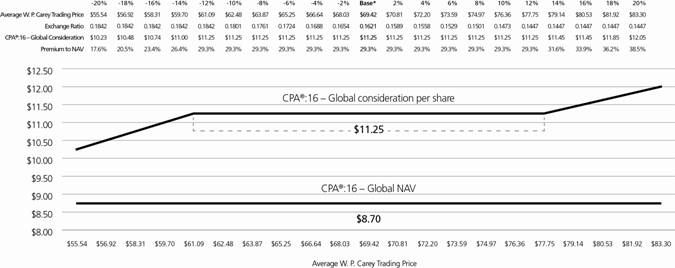

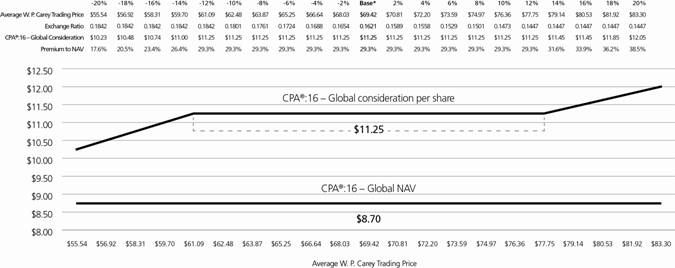

In the merger, CPA®:16 – Global stockholders will receive $11.25 per share in the form of W. P. Carey common stock (NYSE: WPC), subject to a 12% pricing collar, reducing the impact of potential downward changes in W. P. Carey’s stock price on the exchange ratio. The exchange ratio will be determined at the closing of the transaction, which is expected to occur in the first quarter 2014. The merger consideration represents a 29% premium to CPA®:16 – Global’s estimated net asset value of $8.70 per share as of December 31, 2012.

The timeline of events for the proposed merger is as follows:

· November 29, 2013 – Record date for stockholders entitled to vote on the merger proposal.

· December 5, 2013 – Commencement of mailing of the Joint Proxy Statement/Prospectus and accompanying brochure (the “merger materials”) to stockholders. You may download a copy of the merger materials at www.cpa16global.com.

· December 5, 2013 through January 23, 2014 – Proxy solicitation period. All proxies for stockholders not in attendance at the Special Meeting must be received and processed prior to the meeting.

· January 21, 2014 – Share transfers and account maintenance suspended.

· January 24, 2014 – Special Meeting of CPA®:16 – Global Stockholders at 3 p.m. ET at the offices of DLA Piper LLP (US).

· January 31, 2014 – Anticipated closing of the merger.

Enclosed please find a list of your clients who are eligible to vote on the merger. Stockholders may authorize their proxy:

· By mail, in the return envelope stockholders have been provided

· By Internet at www.proxyvote.com

· By telephone (U.S. and Canada residents only) at 1-800-690-6903

We have engaged Computershare Fund Services (“Computershare”) as the solicitation agent for the merger. They may contact your clients to solicit their vote. Please encourage your clients who are CPA®:16 – Global stockholders to vote at their earliest convenience. With your assistance, we will be able to get the votes required without your clients being contacted by Computershare.

Computershare may answer any questions that you or your clients may have as they relate to the proposed merger. They can be reached at their toll-free number, 1-866-432-8736. Please contact our Investor Relations Department at 1-800-WP CAREY (1-800-972-2739) with questions regarding any of your clients’ stockholdings or tax information.

We encourage you and your clients to read the Joint Proxy Statement/Prospectus as well as the accompanying brochure.

Thank you again for your continued confidence and support.

| With best regards, |

| |

| |

| |

| Trevor P. Bond |

| Chief Executive Officer |

Additional Questions and Answers Regarding the Merger:

Who is eligible to vote on the merger?

CPA®:16 – Global stockholders of record on November 29, 2013 are eligible to vote on the merger. Enclosed is a list of your clients who own shares of CPA®:16 – Global common stock as of the record date. The list includes the stockholder’s current registration, total shares owned and current payee of record.

Historical tax information through year-end 2012 for CPA®:16 – Global stockholders who purchased shares during CPA®:16 – Global’s public offerings and hold the shares in their original registration is also included. For additional information regarding the tax basis of your clients, please see the Tax Basis and Capital Gain Analysis.

What will my clients receive if the merger is approved?

CPA®:16 – Global stockholders will receive $11.25 per share in the form of W. P. Carey common stock, subject to a 12% pricing collar, as described below. The exchange ratio with respect to shares of W. P. Carey common stock to be received by CPA®:16 – Global stockholders will be determined at the closing of the transaction.

Each share of CPA®:16 – Global will be converted into W. P. Carey common stock based on the following exchange ratio:

· Floating exchange ratio and fixed $11.25 share price of CPA®:16 – Global within a collar 12% above and below a W. P. Carey reference share price of $69.42, the volume-weighted average trading price (“VWAP”) of W. P. Carey common stock on July 22, 2013 and July 23, 2013, the most recent trading dates prior to the execution of the merger agreement.

· As a result of the collar, the exchange ratio will not exceed 0.1842 or be less than 0.1447.

· Exchange ratio will be set using the VWAP for W. P. Carey’s common stock for the five consecutive trading days ending on the third trading day preceding the Closing (“Average W. P. Carey Trading Price”).

To the extent that a CPA®:16 – Global stockholder is entitled to receive a fraction of a share of W. P. Carey common stock, the stockholder will instead receive a cash payment in lieu of the fractional share in an amount equal to such fraction multiplied by the Average W. P. Carey Trading Price.

How does the pricing collar impact the exchange ratio?

The exchange ratio is determined by dividing $11.25 by the Average W. P. Carey Trading Price and will be subject to a collar 12% above and below a W. P. Carey reference share price of $69.42. The collar feature reduces the impact of potential downward changes in W. P. Carey’s stock price on the exchange ratio by setting a limit on the exchange ratio.

If the Average W. P. Carey Trading Price results in a quotient of less than 0.1447, the exchange ratio will be fixed at 0.1447. If the Average W. P. Carey Trading Price results in a quotient of more than 0.1842, the exchange ratio will be fixed at 0.1842. Therefore, if the Average W. P. Carey Trading Price is between $61.09 and $77.75, the total per share merger consideration would be valued at approximately $11.25 per share of CPA®:16 – Global common stock.

The chart below shows the nominal value of the per share merger consideration to be issued upon the consummation of the merger at various Average W. P. Carey Trading Prices:

For example, if the merger had closed on October 31, 2013, the Average W. P. Carey Trading Price would have been $67.11, resulting in a total per share merger consideration valued at approximately $11.25. The actual exchange ratio and per share merger consideration may be higher or lower depending upon the trading prices of the W. P. Carey common stock prior to the consummation of the merger, subject to the pricing collar.

What is the expected ongoing rate of return of a CPA®:16 – Global stockholder on his or her original investment?

Each CPA®:16 – Global stockholder currently receives $0.6728 of annual distributions per share, which represents an annual rate of return of 6.73% on an original investment of $10.00 per share in CPA®:16 – Global. Following the merger, CPA®:16 – Global stockholders who retain the W. P. Carey common stock they receive in the merger will be entitled to receive any future distributions paid by W. P. Carey. Based on W. P. Carey’s anticipated minimum annualized distribution rate of $3.52 per share following completion of the merger, multiplied by the per share merger consideration of between 0.1447 and 0.1842 per share, each holder of CPA®:16 – Global common stock is expected to receive between $0.509 and $0.648 in annual distributions on each share of W. P. Carey common stock received in exchange for the CPA®:16 – Global common stock that they own. This represents an annual return range between 5.09% and 6.48% on an original investment of $10.00 per share of CPA®:16 – Global common stock.

Based on the closing price of $66.61 per share as of October 31, 2013 for W. P. Carey common stock, the expected annual return would be 5.95% on an original $10.00 investment.

| | Current | | After the Merger

Invested Capital of $10.00 | |

| | | | | | | | | |

| | Invested Capital

of $10.00 | | High Exchange

Ratio (0.1842) | | Current Exchange

Ratio (0.1689)* | | Low Exchange

Ratio (0.1447) | |

| | | | | | | | | |

Rate of Return on Invested Capital | | 6.73% | | 6.48% | | 5.95% | | 5.09% | |

* based on closing price of $66.61 per share for W. P. Carey Inc. stock on NYSE as of 10/31/13

Will accounts be frozen prior to the merger?

Yes. In order to ensure an orderly conversion of accounts to W. P. Carey’s transfer agent, Computershare, Inc., all share transfers and account maintenance items will be suspended at the close of business on January 21, 2014. At that time, any pending or new transfer or account maintenance items will need to be submitted to Computershare after the closing of the merger, which is currently expected to occur on January 31, 2014.

How will my clients’ new W. P. Carey shares be delivered?

Upon completion of the merger, Computershare, Inc. will record the issuance of the shares of W. P. Carey common stock to the holders of CPA®:16 – Global common stock on its stock records in book-entry form. No physical stock

certificates will be delivered. The stockholder will receive confirmation of the number of W. P. Carey shares acquired at the closing of the merger.

How will the cash received in lieu of fractional shares be paid to my clients?

A CPA®:16 – Global stockholder who receives cash in lieu of a fractional share of W. P. Carey common stock will receive payment in the form of a check to their address of record. If shares are held in a custodial or broker-controlled account, payment will be made to the custodian or broker/dealer, as applicable.

How does my client transfer their new W. P. Carey book entry shares into a brokerage account?

If the stockholder’s shares are in a broker-controlled account or registered with a custodian of record, the broker/dealer or custodian, as applicable, may plan to automatically initiate a bulk transfer of the W. P. Carey book entry shares to brokerage on behalf of all stockholders for whom they act as broker/dealer or custodian.

Individual transfer of positions may be completed by an initiation of a Profile transfer using DTC’s Direct Registration System (DRS). This system allows the broker/dealer to electronically move the stockholder’s position from a direct registration book-entry position on the books of the transfer agent to a position recorded at the broker/dealer within the stockholder’s brokerage account. The registration on the records of the transfer agent will need to match the registration on the brokerage account, and the Profile should be initiated by the broker/dealer.

How will my clients determine their tax basis?

A report including your clients who are eligible to vote on the merger is included in this package. Historical estimated tax information through year-end 2012 for CPA®:16 – Global stockholders who purchased shares during CPA®:16 – Global’s public offerings and hold the shares in their original registration is included.

The following analysis is for general information only and does not purport to discuss all aspects of federal income taxation that may be important to a particular investor in light of its investment or tax circumstances or to investors subject to special tax rules. Stockholders are urged to consult their tax advisor regarding the federal, state, and local and foreign income and other tax consequences to them in light of their particular investment or tax circumstances of acquiring, holding, exchanging, or otherwise disposing of W. P. Carey common stock.

Tax Basis and Capital Gain Analysis:

The receipt of W. P. Carey common stock will be tax deferred to CPA®:16 – Global stockholders until such time as those shares of W. P. Carey are sold.

A CPA®:16 – Global stockholder who receives cash in lieu of a fractional share of W. P. Carey common stock will generally be treated as having received the cash in redemption of the fractional share interest. The CPA®:16 – Global stockholder will generally recognize capital gain or loss on the deemed redemption in an amount equal to the difference between the amount of cash received and such holder’s adjusted tax basis allocable to such fractional share.

Will capital gains or losses recognized upon the sale of W. P. Carey common stock be treated as long-term or short-term?

If the shares of W. P. Carey common stock received in the merger are held for more than one year before they are sold, including the holding period of the CPA®:16 – Global common stock exchanged in the merger, the capital gains or losses recognized will be treated as long-term capital gains or losses.

How does the merger affect the per share tax basis for my client?

The original tax basis for each issuance of shares of CPA®:16 – Global common stock is generally equal to the purchase price of such shares. If shares were acquired through inheritance prior to 2010, the fair market value of the shares at the time the shares were inherited should be used as the original basis. If shares were acquired due to inheritance in 2010 or

later, special rules apply for the purpose of determining the basis of the shares. Once the original tax basis of shares of CPA®:16 – Global common stock is determined, the original tax basis should be adjusted by subtracting any return of capital distributions with respect to such shares. CPA®:16 – Global’s historical return of capital distributions are further discussed below.

The aggregate adjusted tax basis of the W. P. Carey common stock received by a CPA®:16 – Global stockholder in the merger will be the same as the aggregate tax basis of the CPA®:16 – Global shares held by such stockholder, reduced by the amount of cash received by such stockholder in the merger in lieu of fractional shares and increased by any gain recognized in the merger.

The per share tax basis of the W. P. Carey common stock received by a CPA®:16 – Global stockholder in the merger can be calculated by dividing the final per share tax basis for the share of CPA®:16 – Global common stock by the exchange ratio in the merger.

What is the estimated tax basis for a full-term CPA®:16 – Global stockholder?

Below please find the historical distribution information for a CPA®:16 – Global stockholder who purchased his or her shares at the inception of CPA®:16 – Global’s initial public offering at the offering price of $10.00 per share and holds the shares through the closing of the proposed merger (a “full-term CPA®:16 – Global stockholder”). This information is for illustration purposes only. Each stockholder should contact his or her tax advisor for advice about the stockholder’s particular tax consequences.

Tax Year | Distribution

Per Share | NonDividend

Distribution % | Per Share

Nondividend

Distribution | Per Share

Estimated

Tax Basis |

2004 | $0.4247100 | 14.11% | $0.0599266 | $9.94 |

2005 | $0.6251110 | 0.00% | $0.0000000 | $9.94 |

2006 | $0.6327000 | 3.22% | $0.0203729 | $9.92 |

2007 | $0.6475000 | 30.54% | $0.1977465 | $9.72 |

2008 | $0.6558000 | 75.96% | $0.4981457 | $9.22 |

2009 | $0.6615000 | 72.13% | $0.4771400 | $8.75 |

2010 | $0.6624000 | 80.07% | $0.5303837 | $8.22 |

2011 | $0.6763458 | 0.00% | $0.0000000 | $8.22 |

2012 | $0.6684000 | 51.57% | $0.3446671 | $7.87 |

1. The estimated tax basis information shown above is applicable only to a share of CPA®:16 – Global common stock that was purchased by a current CPA®:16 – Global investor for $10.00 and is based solely on the distributions and non-taxable return of capital distributions paid by CPA®:16 - Global. The estimated tax basis shown above does not apply to any other shares of common stock of CPA®:16 - Global, including shares acquired pursuant to the merger of CPA®:12 into CPA®:14 in 2006 and the merger of CPA®:14 into CPA®:16 - Global in 2011 (see following tables), shares acquired pursuant to CPA®:16 – Global’s distribution reinvestment plan and shares acquired pursuant to bequest or inheritance.

2. The estimated tax basis does not include any distributions paid or to be paid in 2013 or 2014 and does not reflect a stockholder’s final tax basis. Stockholders will be mailed a Form 1099-DIV for the taxable year 2013 no later than January 31, 2014 and a final Form 1099-DIV for the taxable year 2014 no later than January 31, 2015 that may contain additional return of capital distributions that affect the stockholder’s basis.

What is the estimated tax basis per share of CPA®:16 – Global for an original CPA®:14 stockholder?

Below please find the historical distribution information for a CPA®:14 stockholder who purchased shares of CPA®:14 at the inception of CPA®:14’s initial public offering, elected to receive shares of CPA®:16 – Global common stock in the merger of CPA®:14 into CPA®:16 – Global, and holds these shares of CPA®:16 – Global through the closing of the current proposed merger (a “full-term CPA®:14 investor”). This information is for illustration purposes only. Each stockholder should contact his or her tax advisor for advice about the stockholder’s particular tax consequences.

Tax Year | Distribution Per

Share | NonDividend

Distribution % | Per Share

Nondividend

Distribution | Per Share

Estimated Tax

Basis |

1998 | $0.3167170 | 0.00% | $0.0000000 | $10.00 |

1999 | $0.6491360 | 15.51% | $0.1006810 | $9.90 |

2000 | $0.7707245 | 0.00% | $0.0000000 | $9.90 |

2001 | $0.7317135 | 38.40% | $0.2809780 | $9.62 |

2002 | $0.7493500 | 51.19% | $0.3835923 | $9.23 |

2003 | $0.7542000 | 24.90% | $0.1877958 | $9.05 |

2004 | $0.7582000 | 24.56% | $0.1862139 | $8.86 |

2005 | $0.7629000 | 21.30% | $0.1624977 | $8.70 |

2006 | $1.2451770 | 0.00% | $0.0000000 | $8.70 |

2007 | $0.9159480 | 0.00% | $0.0000000 | $8.70 |

2008 | $0.7983680 | 0.00% | $0.0000000 | $8.70 |

2009 | $0.7914000 | 14.20% | $0.1123788 | $8.59 |

2010 | $0.7989000 | 32.70% | $0.2612403 | $8.32 |

2011 | $1.4639681 | 30.44% | $0.4456319 | $7.88 |

2011 Merger Conversion | | | | $6.60 |

2011 | $0.2887320 | 0.00% | $0.0000000 | $6.60 |

2012 | $0.6684000 | 51.57% | $0.3446671 | $6.26 |

1. The estimated tax basis information shown above is applicable only to a share of CPA®:16 - Global common stock that was purchased by a full-term CPA®:14 investor at $10 before the first non-taxable distribution in 1999 and is based solely on the distributions and non-taxable return of capital distributions paid by CPA®:14 and CPA®:16 - Global. The estimated tax basis shown above does not apply to any other shares of common stock of CPA®:16 - Global, including shares acquired pursuant to the merger of CPA®:12 into CPA®:14 in 2006 (see table below), shares acquired pursuant to CPA®:14 or CPA®:16 - Global’s distribution reinvestment plans and shares acquired pursuant to bequests or inheritance.

2. The estimated tax basis does not include any distributions paid or to be paid in 2013 or 2014 and does not reflect a stockholder’s final tax basis. Stockholders will be mailed a Form 1099-DIV for the taxable year 2013 no later than January 31, 2014 and a final Form 1099-DIV for the taxable year 2014 no later than January 31, 2015 that may contain additional return of capital distributions that affect the stockholder’s basis.

What is the estimated tax basis per share of CPA®:16 – Global for an original CPA®:12 stockholder?

Below please find the historical distribution information for a CPA®:12 stockholder who purchased shares of CPA®:12 at the inception of CPA®:12’s initial public offering, elected to receive shares of CPA®:14 common stock in the merger of CPA®:12 into CPA®:14, elected to receive shares of CPA®:16 – Global common stock in the merger of CPA®:14 into CPA®:16 – Global, and holds these shares of CPA®:16 – Global through the closing of the current proposed merger (a “full-term CPA®:12 investor”). This information is for illustration purposes only. Each stockholder should contact his or her tax advisor for advice about the stockholder’s particular tax consequences.

Tax Year | Distribution Per

Share | NonDividend

Distribution % | Per Share

Nondividend

Distribution | Per Share

Estimated Tax

Basis |

1994 | $0.3503075 | 0.00% | $0.0000000 | $10.00 |

1995 | $0.7828000 | 0.00% | $0.0000000 | $10.00 |

1996 | $0.8035500 | 14.73% | $0.1183629 | $9.88 |

1997 | $0.8072100 | 0.00% | $0.0000000 | $9.88 |

1998 | $0.8104000 | 30.48% | $0.2470099 | $9.63 |

1999 | $0.8136000 | 19.86% | $0.1615728 | $9.47 |

2000 | $0.8168000 | 1.86% | $0.0152088 | $9.46 |

2001 | $0.8200000 | 46.76% | $0.3834238 | $9.07 |

2002 | $0.8232000 | 47.83% | $0.3937366 | $8.68 |

2003 | $0.8262000 | 13.21% | $0.1091328 | $8.57 |

2004 | $0.8268000 | 37.14% | $0.3071066 | $8.26 |

2005 | $0.8805420 | 0.00% | $0.0000000 | $8.26 |

2006 | $1.1539000 | 85.78% | $0.9898154 | $7.27 |

2006 Merger Conversion | | | | $8.37 |

2007 | $0.7480550 | 0.00% | $0.0000000 | $8.37 |

2008 | $0.7983680 | 0.00% | $0.0000000 | $8.37 |

2009 | $0.7914000 | 14.20% | $0.1123788 | $8.26 |

2010 | $0.7989000 | 32.70% | $0.2612403 | $8.00 |

2011 | $1.4639681 | 30.44% | $0.4456319 | $7.55 |

2011 Merger Conversion | | | | $7.55 |

2011 | $0.2887320 | 0.00% | $0.0000000 | $7.55 |

2012 | $0.6684000 | 51.57% | $0.3446671 | $7.21 |

1. The estimated tax basis information shown above is applicable only to a share of CPA®:16 - Global common stock that was purchased by a full-term CPA®:12 investor at $10.00 before the first non-taxable distribution in 1996 who acquired shares pursuant to the merger of CPA®:12 into CPA®:14 in 2006 and is based solely on the distributions and non-taxable distributions paid by CPA®:12, CPA®:14 and CPA®:16 - Global. The estimated tax basis shown above does not apply to any other shares of common stock of CPA®:16 - Global, including shares acquired at the inception of CPA®:14 or CPA®:16 – Global’s initial public offering (see previous tables), shares acquired pursuant to CPA®:12, CPA®:14 or CPA®:16 - Global’s distribution reinvestment plan and shares acquired pursuant to bequests or inheritance.

2. The estimated tax basis does not include any distributions paid or to be paid in 2013 or 2014 and does not reflect a stockholder’s final tax basis. Stockholders will be mailed a Form 1099-DIV for the taxable year 2013 no later than January 31, 2014 and a final Form 1099-DIV for the taxable year 2014 no later than January 31, 2015 that may contain additional return of capital distributions that affect the stockholder’s basis.

Additional Information and Where to Find It:

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of the Joint Proxy Statement/Prospectus. WE URGE INVESTORS TO READ THE JOINT PROXY STATEMENT/ PROSPECTUS AND ANY DOCUMENTS INCORPORATED INTO IT, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT W. P. CAREY, CPA®:16 – GLOBAL AND THE PROPOSED MERGER. INVESTORS ARE URGED TO READ THESE DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY. Investors are able to obtain these materials and other documents filed with the SEC free of charge at the SEC’s website (www.sec.gov). In addition, these materials will also be available free of charge by accessing W. P. Carey’s website (www.wpcarey.com) or by accessing CPA®:16 – Global’s website (www.cpa16global.com). Investors may also read and copy any reports, statements and other information filed by W. P. Carey or CPA®:16 – Global, with the SEC, at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room.