O C T O B E R 2 0 2 1 Transforming therapeutic endoscopy

Forward Looking Statements & Regulatory Advisory Forward Looking Statements: Certain statements in this presentation are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties that could cause results to be materially different than expectations. All statements other than statements relating to historical matters including statements to the effect that we “believe”, “expect”, “anticipate”, “plan”, “target”, “intend” and similar expressions, should be considered forward-looking statements. You should not place undue reliance on these forward- looking statements. Our actual results could differ materially from those discussed in the forward-looking statements as a result of a number of important factors, including uncertainty about the spread of the COVID-19 virus and the impact it may have on the operations of Apollo Endosurgery, Inc. (“Apollo,” or the “Company”), the demand for the Company’s products, the Company’s liquidity position, global supply chains and economic activity in general. Important factors that could cause actual results to differ materially include: reports of adverse events related to our products, outcomes of clinical studies related to our products, development of competitive medical products by competitors, regulatory approvals and extensive regulatory oversight by the FDA or other regulatory authorities, unfavorable media coverage related to our products or related procedures, coverage and reimbursement decisions by private or government payors, Apollo’s ability to support the adoption of its products and broaden its product portfolio; the potential size of Apollo’s addressable markets; the execution of our gross margin improvement projects; the ability to collect future payments from ReShape; and the availability of cash for Apollo's future operations as well as other factors detailed in Apollo’s periodic reports filed with the Securities and Exchange Commission, or SEC, including its Form 10-K for the year ended December 31, 2020 and its Form 10-Q for the periods ending March 31, 2021 and June 30, 2021. Copies of reports filed with the SEC are posted on Apollo’s website and are available from Apollo without charge. These forward-looking statements are not guarantees of future performance and speak only as of the date hereof, and, except as required by law, Apollo disclaims any obligation to update these forward- looking statements to reflect future events or circumstances. Product Regulatory Advisory: This presentation is intended for the investment and financial community and not for the promotion of Apollo products or related procedures. The X-Tack is cleared for approximation of soft tissue in minimally invasive gastroenterology procedures (e.g. closure and healing of ESD/EMR sites, and closing of fistula, perforation or leaks). The Apollo Intragastric Balloon products are approved in the US as a weight loss aid for adults suffering from obesity, with a body mass index (BMI) ≥30 and ≤40 kg/m2, who have tried other weight loss programs, such as following supervised diet, exercise, and behavior modification programs, but who were unable to lose weight and keep it off. In addition, the Apollo Intragastric balloon has received a Breakthrough Device Designation from the U.S. Food and Drug Administration for use in treating patients with a BMI between 30-40 kg/m2 with noncirrhotic nonalcoholic steatohepatitis (NASH) with liver fibrosis. Outside of the US the indications for Apollo Intragastric Balloon products vary based on product version and local regulatory clearance. The Overstitch is cleared for the endoscopic placement of sutures and the approximation of soft tissue in the GI tract The Overstitch clearance does not include procedure-specific indications for use. Although Apollo has and continues to obtain clinical data on additional uses for its products, the safety and effectiveness of these uses has not been specifically cleared or approved for commercial purposes by the U.S. Food and Drug Administration. 2

Disclaimers 3 This presentation shall not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such an offer or solicitation in such jurisdiction. This presentation contains information regarding the Company’s financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation or as an alternative or superior to GAAP measures. You should be aware that our presentation of these measures may not be comparable to similarly-titled measures used by other companies. This presentation may contain statistics and other data that in some cases has been obtained from or compiled from information made available by third-party service providers. The Company makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness or completeness of such information. Preliminary Financial Results: This presentation includes financial results that are preliminary. The Company reports its financial results in accordance with U.S. generally accepted accounting principles. The expected financial results discussed in this presentation are preliminary and represent the most current information available to the Company's management, as financial closing procedures for the quarter ended September 30, 2021 are not yet complete. These estimates are not a comprehensive statement of the Company's financial results for the quarter ended September 30, 2021 and actual results may differ materially from these estimates as a result of the completion of normal quarter-end accounting procedures and adjustments, including the execution of the Company's internal control over financial reporting, the completion of the preparation and review of the Company's financial statements for the quarter ended September 30, 2021 and the subsequent occurrence or identification of events prior to the formal issuance of the third quarter financial results. Past performance is not indicative nor a guarantee of future returns: The information contained herein does not constitute investment, legal, accounting, regulatory, taxation or other advice and the information does not take into account your investment objectives or legal, accounting, regulatory, taxation or financial situation or particular needs. You are solely responsible for forming your own opinions and conclusions on such matters and the market and for making your own independent assessment of the information.

new strategy Transforming growth trajectory by prioritizing key initiatives: energize lead Expand penetration by advancing commercial traction & awareness accelerate Build clinical support for new indications that open door to new, large markets Execute to become the standard of care new team New CEO building a motivated, experienced team large, expanding market opportunities Creating & expanding addressable opportunities 4

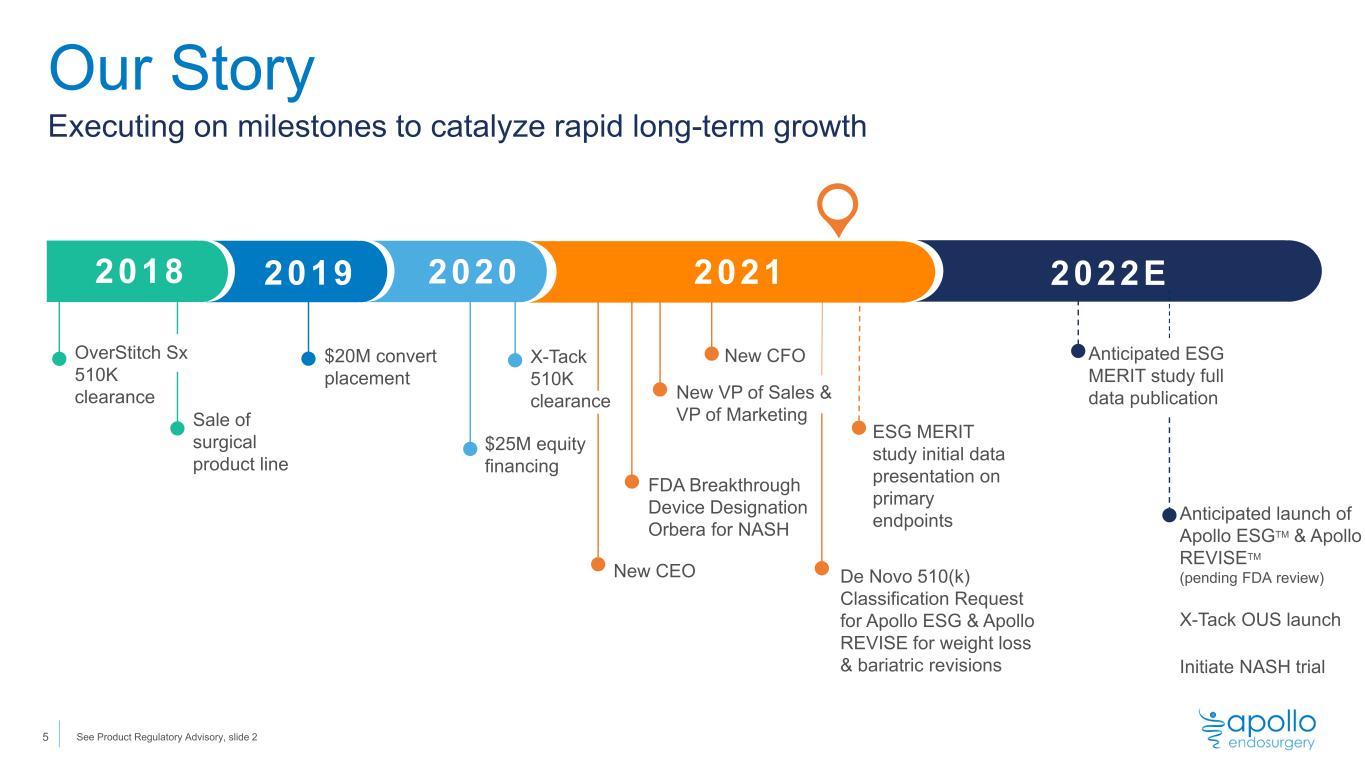

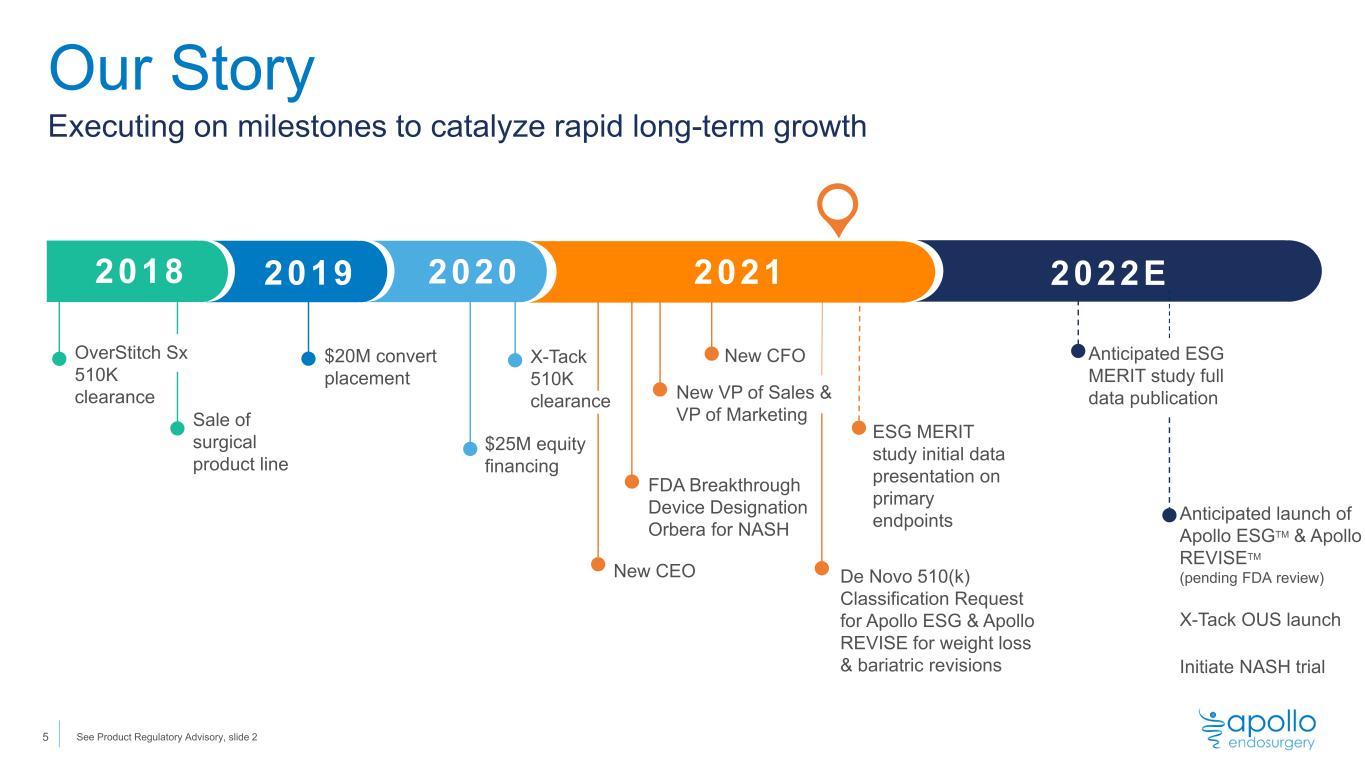

New CEO FDA Breakthrough Device Designation Orbera for NASH New CFO New VP of Sales & VP of Marketing Our Story Executing on milestones to catalyze rapid long-term growth 2022E De Novo 510(k) Classification Request for Apollo ESG & Apollo REVISE for weight loss & bariatric revisions Anticipated launch of Apollo ESGTM & Apollo REVISETM (pending FDA review) X-Tack OUS launch Initiate NASH trial Sale of surgical product line 2018 2019 2020 2021 $20M convert placement $25M equity financing X-Tack 510K clearance Anticipated ESG MERIT study full data publication OverStitch Sx 510K clearance 5 ESG MERIT study initial data presentation on primary endpoints See Product Regulatory Advisory, slide 2

Motivated, Experienced Leadership Team Kirk Ellis David Hooper Chas McKhann Jeff Black P R E S I D E N T & C E O C F O C M O Christopher Gostout, M.D. E X E C U T I V E V P , O P S John Molesphini 25 years of experience in med- device CEO & CCO roles with track record of developing effective growth strategies that deliver results. 30 years of experience in corporate strategy, finance & ops with publicly-traded companies in med device and life sciences. 33 years of experience in Gastroenterology & Hepatology, including Dept of Surgery at Mayo Clinic 40 years of global operational experience in manufacturing, quality, engineering & product development V P , S A L E S V P , M A R K E T I N G & M E D I C A L E D Steve Bosrock V P , Q U A L I T Y & R E G U L A T O R Y V P , C L I N I C A L & M E D I C A L A F F A I R S Tiffanie Gilbreth V P , I N T E R N A T I O N A L S A L E S & M A R K E T I N G Mike Gutteridge 6

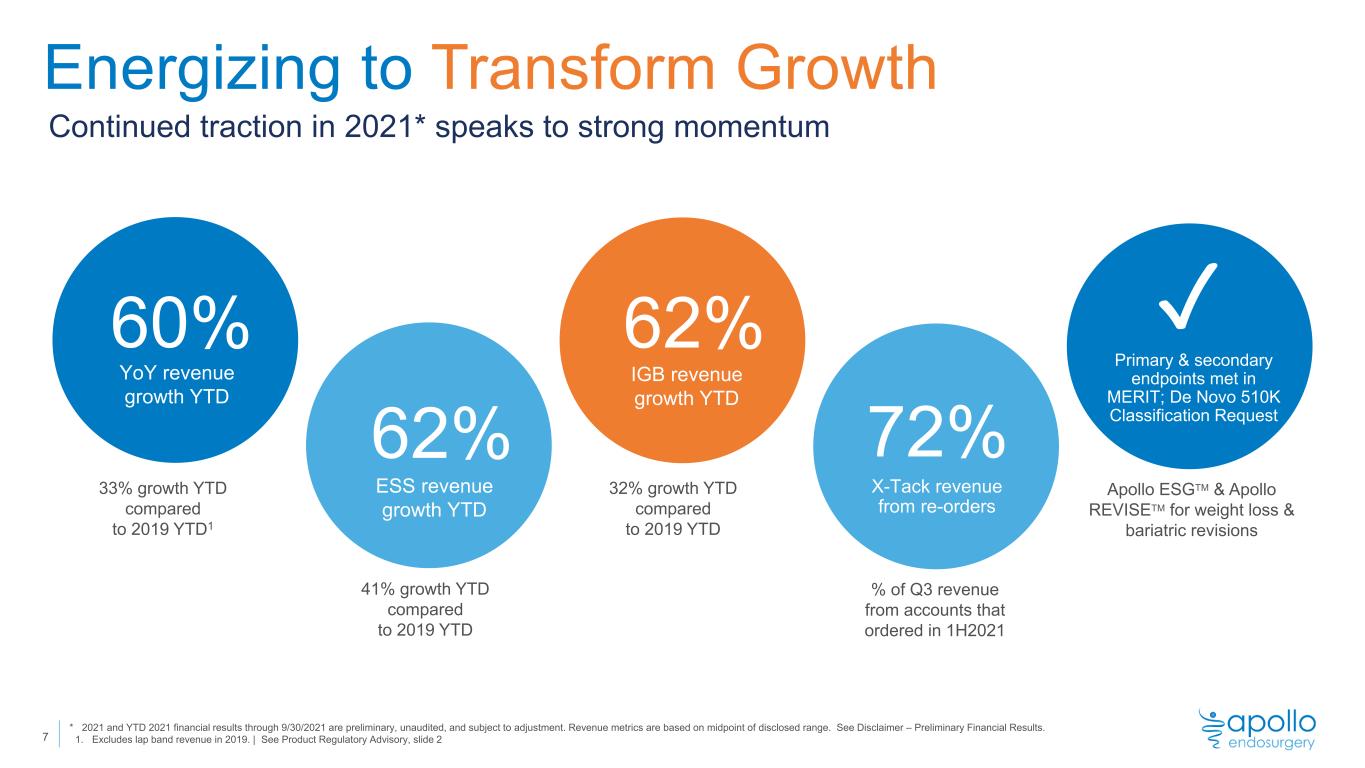

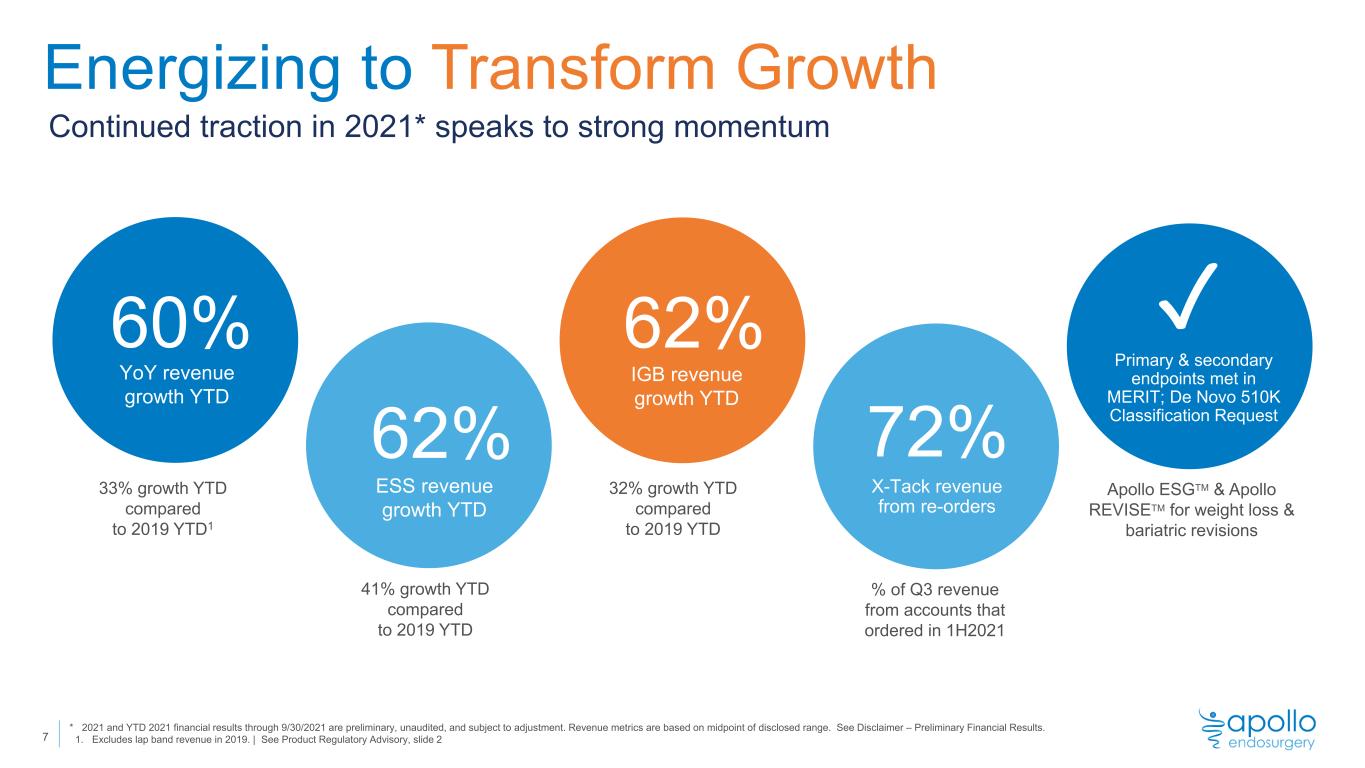

Energizing to Transform Growth Continued traction in 2021* speaks to strong momentum YoY revenue growth YTD 60% 62% ESS revenue growth YTD 72% X-Tack revenue from re-orders ✓ Primary & secondary endpoints met in MERIT; De Novo 510K Classification Request 33% growth YTD compared to 2019 YTD1 Apollo ESGTM & Apollo REVISETM for weight loss & bariatric revisions 7 IGB revenue growth YTD 62% 41% growth YTD compared to 2019 YTD 32% growth YTD compared to 2019 YTD % of Q3 revenue from accounts that ordered in 1H2021 * 2021 and YTD 2021 financial results through 9/30/2021 are preliminary, unaudited, and subject to adjustment. Revenue metrics are based on midpoint of disclosed range. See Disclaimer – Preliminary Financial Results. 1. Excludes lap band revenue in 2019. | See Product Regulatory Advisory, slide 2

Less-Invasive Portfolio Treats Unmet Needs • ESD or EMR site closure • POEM • Stent fixation • Intragastric balloon • Endoscopic revisions of prior bariatric surgery (e.g., gastric bypass) • Endoscopic sleeve gastroplasty (ESG) (De Novo 510K filed in Q3 2021) • Fistula, perforation, other GI tissue closure • Colonoscopy defect closure • Reflux (in development) ADVANCED GI ENDOBARIATRIC endoscopic sutur ing system managed weight loss systemendoscopic hel ix tacking system Orbera 8 See Product Regulatory Advisory, slide 2.

Line of sight to near- and long-term value creation endoscop ic su tu r i ng sys tem endoscop ic he l i x t ack ing sys tem Increase number of users & range of applications; build foundation for endoscopic weight loss Build utilization of X-Tack as a valuable new tool for defect closer in upper & lower GI Improving market conditions globally + new AGA clinical practice guidelinesmanaged we igh t l oss sys tem ENERGIZE LEADACCELERATE Key component of integrated endobariatric weight loss practices Launch Apollo ESGTM for weight loss and Apollo REVISETM for bariatric surgery revisions Extend recent launch to OUS & drive adoption Establish ESG as a market leading procedure and endoscopic revisions as the standard of care Create a leadership position in defect closure Achieve a new indication for treatment of NASH and pathway to reimbursement 9 See Product Regulatory Advisory, slide 2.

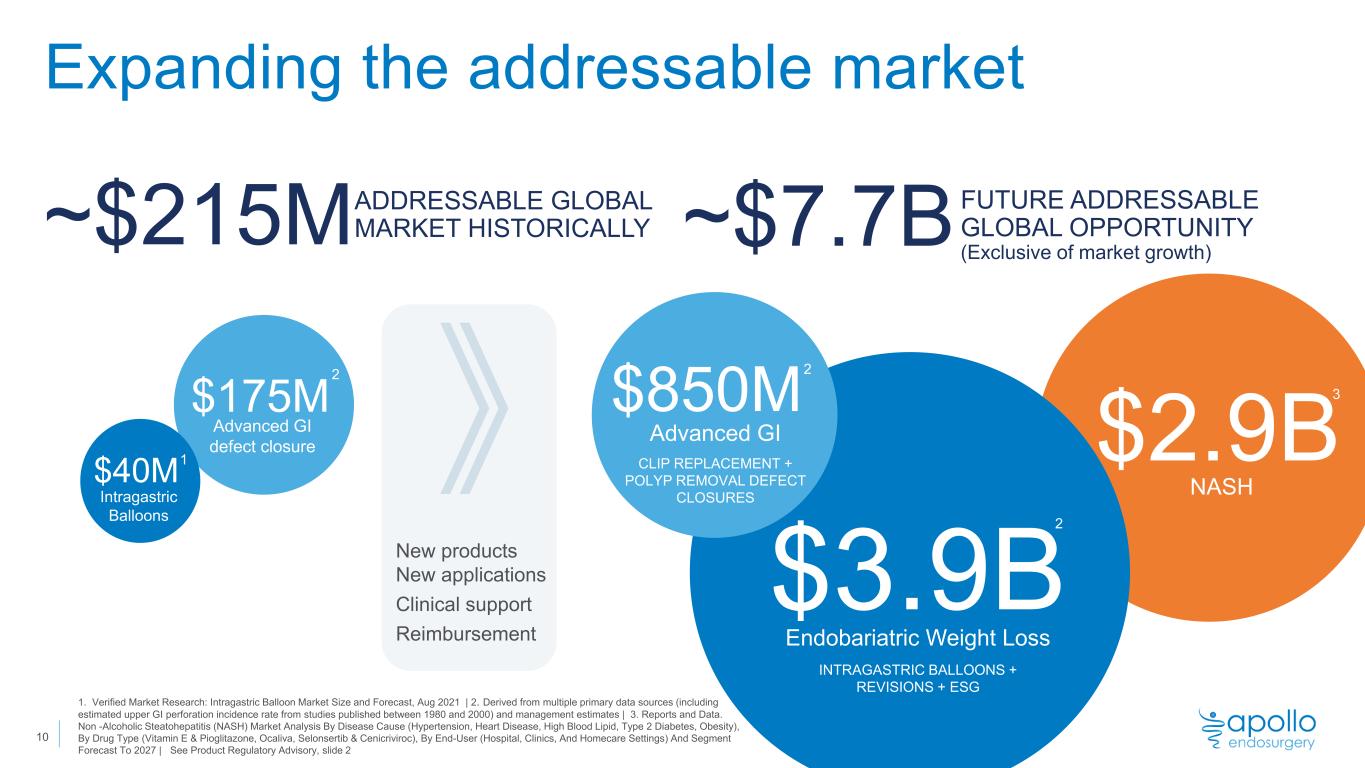

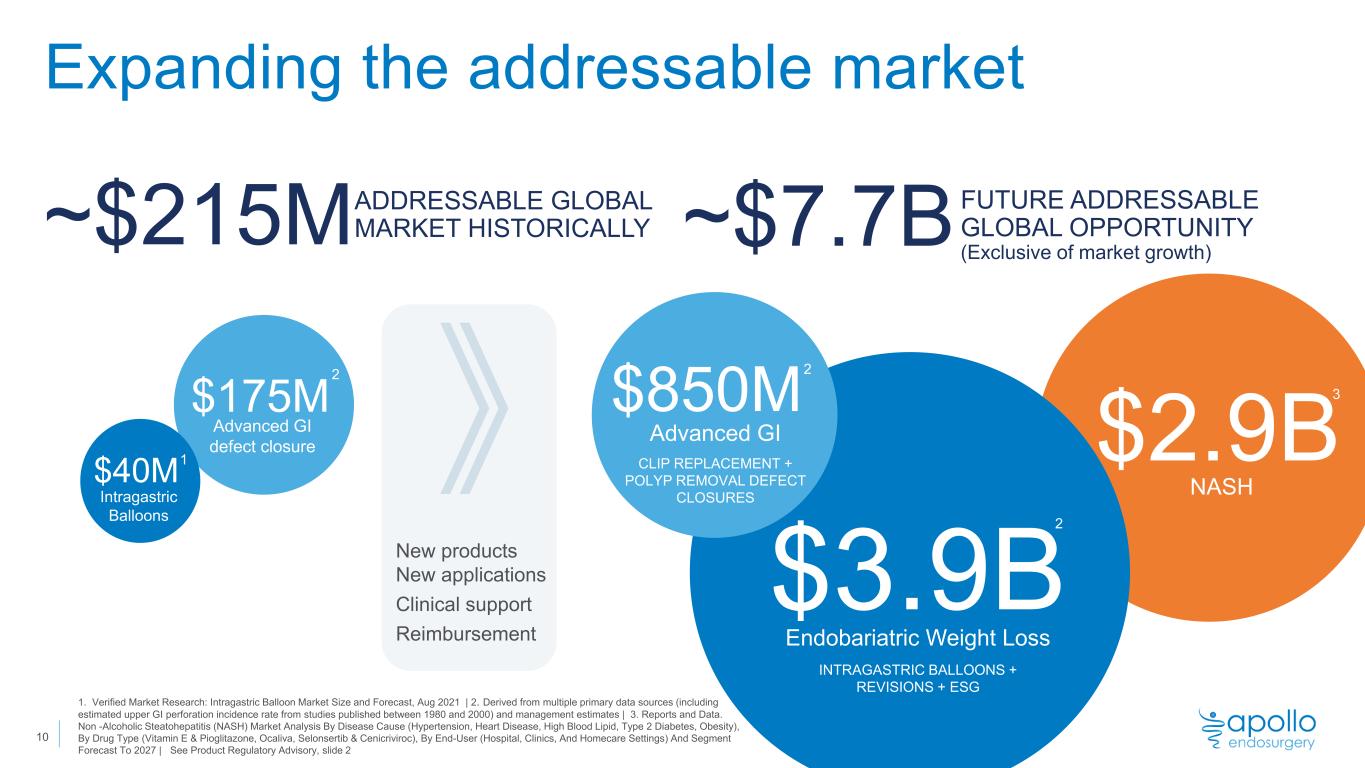

Expanding the addressable market ADDRESSABLE GLOBAL MARKET HISTORICALLY Advanced GI defect closure Intragastric Balloons ~$215M FUTURE ADDRESSABLE GLOBAL OPPORTUNITY (Exclusive of market growth)~$7.7B $175M $40M New products New applications Clinical support Reimbursement 1. Verified Market Research: Intragastric Balloon Market Size and Forecast, Aug 2021 | 2. Derived from multiple primary data sources (including estimated upper GI perforation incidence rate from studies published between 1980 and 2000) and management estimates | 3. Reports and Data. Non -Alcoholic Steatohepatitis (NASH) Market Analysis By Disease Cause (Hypertension, Heart Disease, High Blood Lipid, Type 2 Diabetes, Obesity), By Drug Type (Vitamin E & Pioglitazone, Ocaliva, Selonsertib & Cenicriviroc), By End-User (Hospital, Clinics, And Homecare Settings) And Segment Forecast To 2027 | See Product Regulatory Advisory, slide 2 1 2 $850M Advanced GI CLIP REPLACEMENT + POLYP REMOVAL DEFECT CLOSURES Endobariatric Weight Loss INTRAGASTRIC BALLOONS + REVISIONS + ESG $2.9B NASH $3.9B 2 2 3 10

Advanced Gastro- Intestinal Therapies

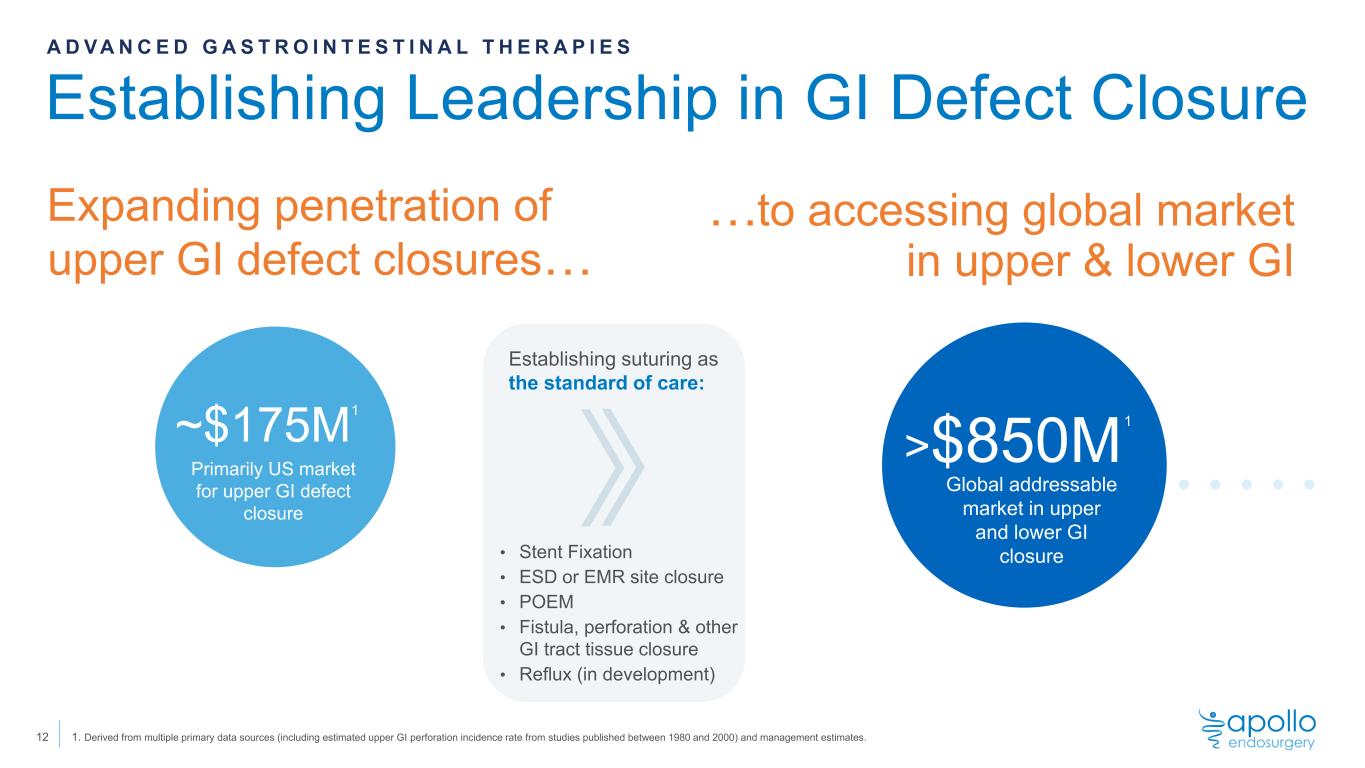

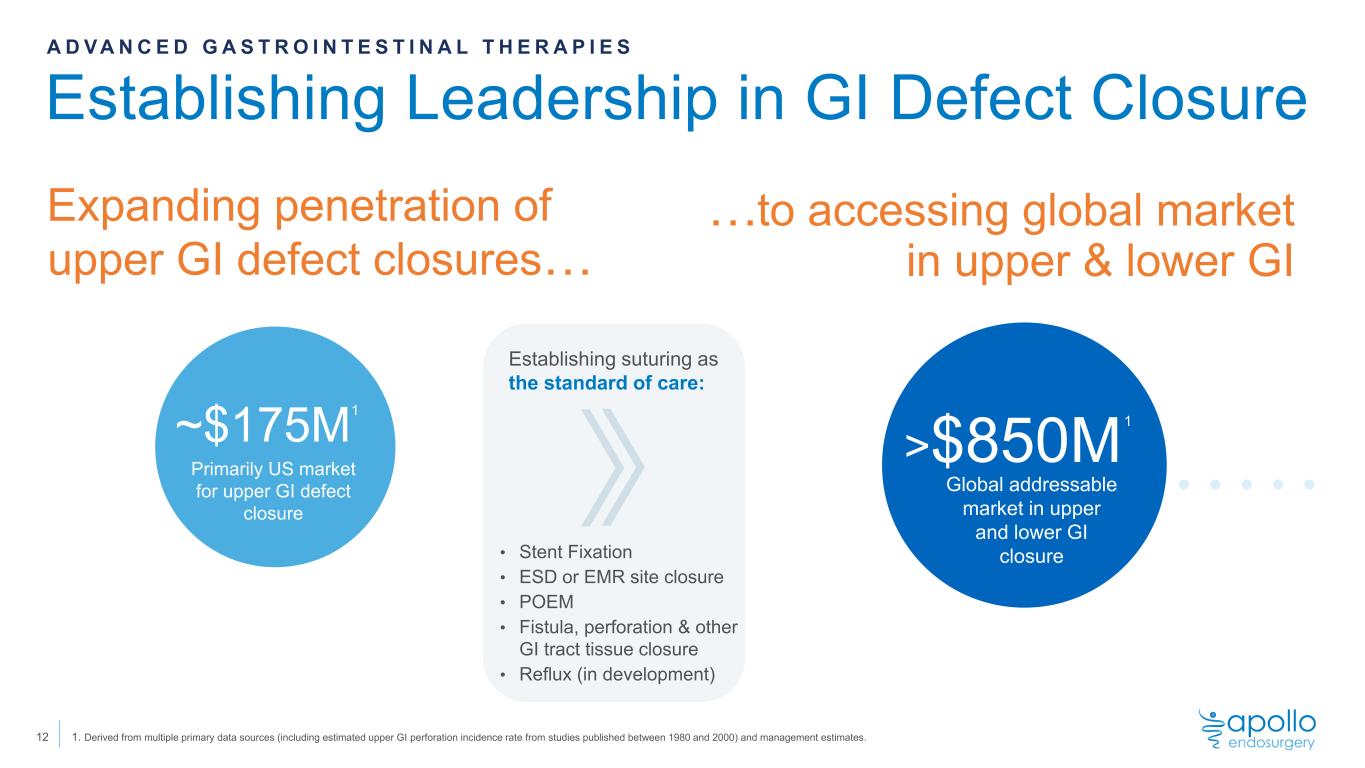

Establishing Leadership in GI Defect Closure 12 Expanding penetration of upper GI defect closures… A D V A N C E D G A S T R O I N T E S T I N A L T H E R A P I E S Establishing suturing as the standard of care: • Stent Fixation • ESD or EMR site closure • POEM • Fistula, perforation & other GI tract tissue closure • Reflux (in development) ~$175M Primarily US market for upper GI defect closure 1. Derived from multiple primary data sources (including estimated upper GI perforation incidence rate from studies published between 1980 and 2000) and management estimates. …to accessing global market in upper & lower GI >$850M Global addressable market in upper and lower GI closure 1 1

65%15% 20% OverStitch Endoscopic Suturing System (ESS) Enhancing medical education for new & advancing users Developing procedure & clinical data Progressing toward ESG indication, which dominates international mix (OUS) GROWTH DRIVERS ESG dominates mix O.U.S. A D V A N C E D G A S T R O I N T E S T I N A L T H E R A P I E S • Places full-thickness sutures through a flexible endoscope LESS-INVASIVE ENDOSCOPIC THERAPY PROCEDURE MIX* Advanced GI Bariatric Revision ESG U S O U S • Supports primarily upper GI procedures that depend on closure, apposition, or hemostasis of soft tissue 13 60%15% 25% See Product Regulatory Advisory, slide 2 | * Percentages are approximations based on YTD 2021 internal sales survey + management estimates. ✓ ✓ ✓

14 X-Tack Endoscopic Helix Tacking System THE NEXT EVOLUTION IN DEFECT CLOSURE • Enabling technology addresses defects created during resection or dissections in upper & lower GI GROWTH DRIVERS A D V A N C E D G A S T R O I N T E S T I N A L T H E R A P I E S • Colonoscope & gastroscope compatible • Readily available, delivered through-the-scope Targeting high volume accounts ✓ Anticipated OUS launch in 2022 <7% ✓ U.S. target account penetration as of Q3 2021 Establishing utilization with multiple customers / account✓ MARKET POSIT ION X-Tack HeliXTTS Clips OverStitch & Sx Large Defects and Therapeutics Medium Defects Requiring ≥ 3 TTS Clips Small Defects 1 1. Derived from multiple primary data sources and management estimates, based on 2019 U.S. procedural volumes data. Management estimates that X-Tack is applicable for roughly 1/3 of total U.S. target accounts.

21M 2.3 U.S. colonoscopies per year1 6% THE NEW STANDARD OF CARE FOR A VAST UNMET NEED 15 Expanding to Common GI Procedures 1. Decision Resource Group: Gastrointestinal Endoscopy Devices, Medtech 360, Market Analysis, US 2016 | 2. Am Journal of Gastroenterol 2020;115:774–782. | 3. Pohl H., et al. Clip Closure Prevents Bleeding After Endoscopic Resection of Large Colon Polyps in a Randomized Trial. Gastroenterology. October 2019. | 4 Derived from multiple primary data sources and management estimates A D V A N C E D G A S T R O I N T E S T I N A L T H E R A P I E S Building opportunity to extend our endoscopic fixation franchise into new applications >$500M Potential U.S. addressable market for polyp removal defect closures4 “Closure... should be attempted in all patients undergoing resection of large non-pedunculated colon polyps in the proximal colon.3 Avg # polyps / colonoscopy2 Polyps >2cm2 ~2.5M polyps >2 cm in U.S. alone 7%Rate of delayed bleeding w/o closure 3

Endobariatric

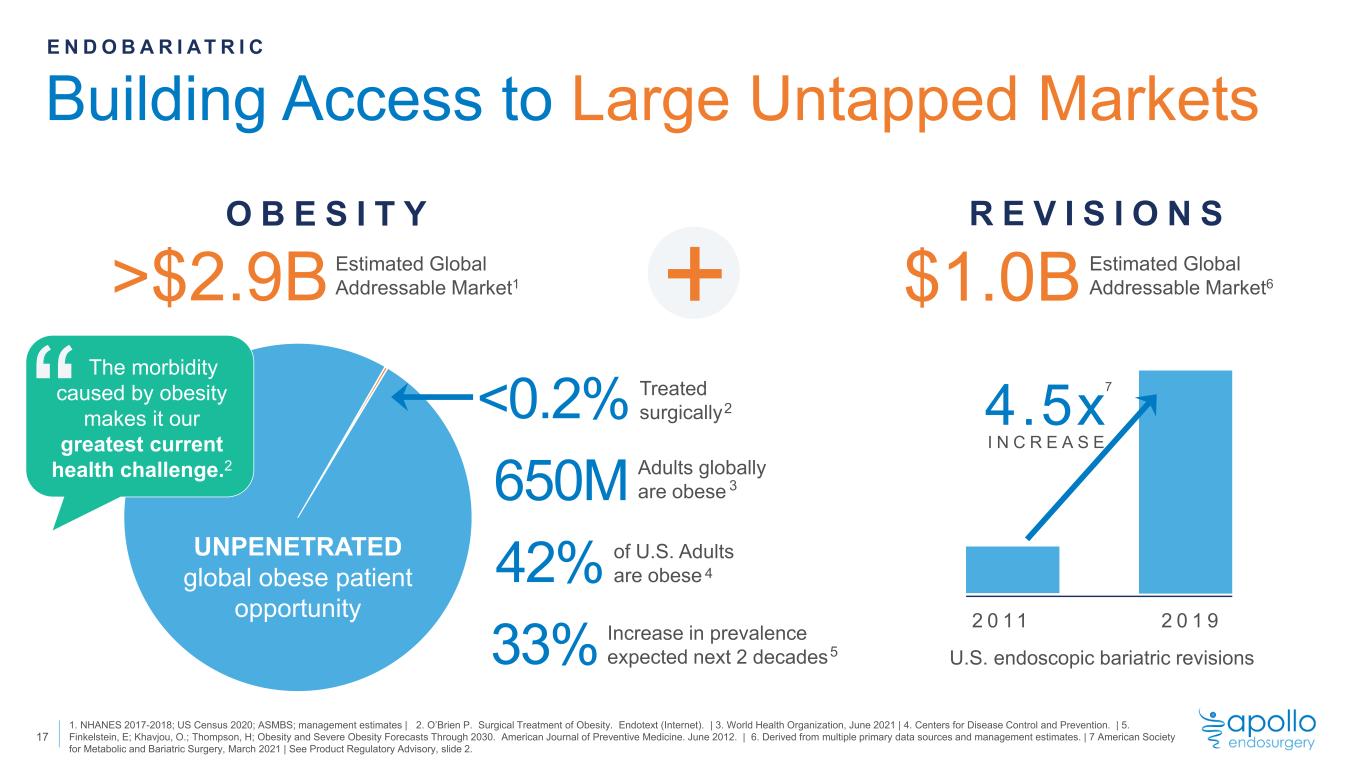

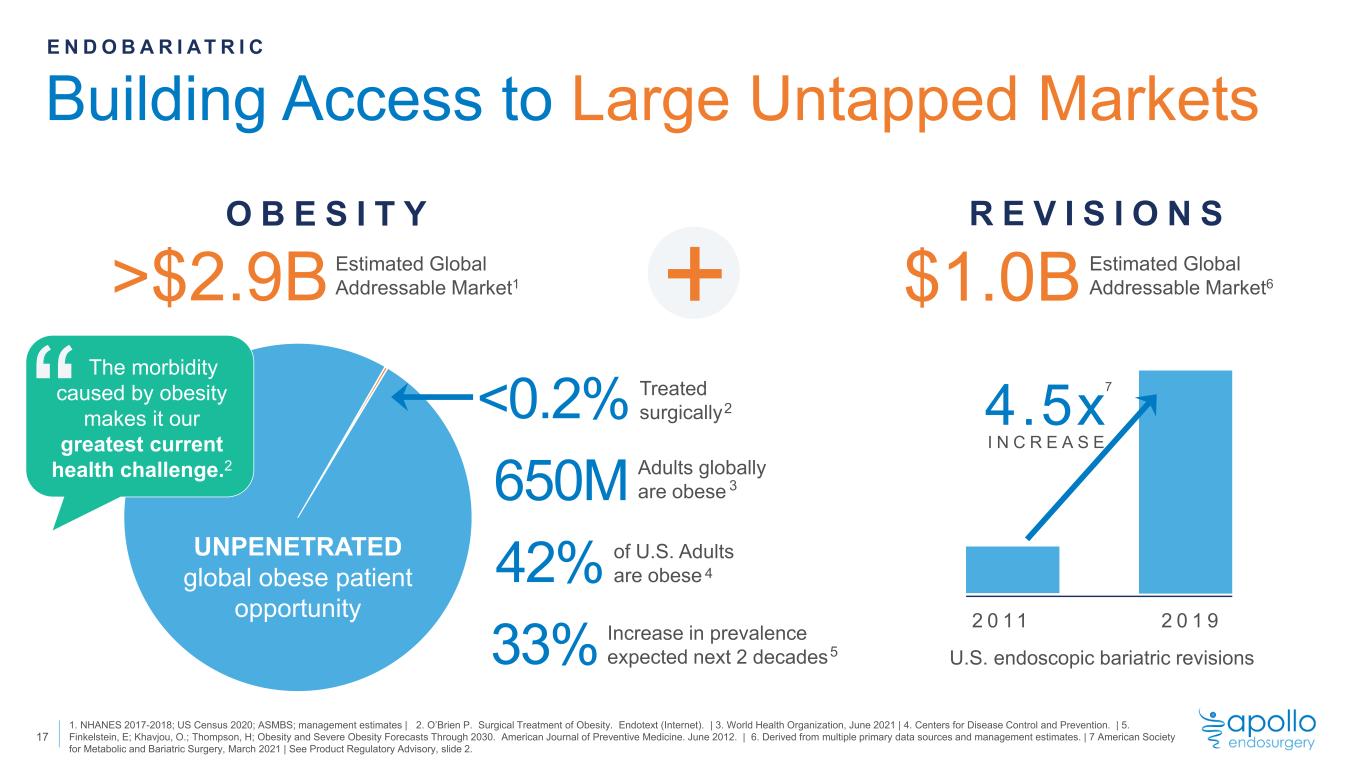

Building Access to Large Untapped Markets E N D O B A R I A T R I C $1.0B Estimated Global Addressable Market6 R E V I S I O N S +>$2.9B O B E S I T Y <0.2% 1. NHANES 2017-2018; US Census 2020; ASMBS; management estimates | 2. O’Brien P. Surgical Treatment of Obesity. Endotext (Internet). | 3. World Health Organization, June 2021 | 4. Centers for Disease Control and Prevention. | 5. Finkelstein, E; Khavjou, O.; Thompson, H; Obesity and Severe Obesity Forecasts Through 2030. American Journal of Preventive Medicine. June 2012. | 6. Derived from multiple primary data sources and management estimates. | 7 American Society for Metabolic and Bariatric Surgery, March 2021 | See Product Regulatory Advisory, slide 2. 1 33% Estimated Global Addressable Market1 Treated surgically UNPENETRATED global obese patient opportunity 650M 42% “ The morbidity caused by obesity makes it our greatest current health challenge.2 Adults globally are obese of U.S. Adults are obese 2 3 4 Increase in prevalence expected next 2 decades5 2 0 1 1 2 0 1 9 4.5x U.S. endoscopic bariatric revisions I N C R E A S E 7 17

framing our opportunity S E E K S U R G I C A L T R E A T M E N T 1818

Anatomically-driven weight regain following weight loss surgery can be addressed with endoscopic surgical revision. Extending Application of OverStitch to Endoscopic Revisions of Bariatric Surgeries 19 E N D O B A R I A T R I C 1.4MU.S. laparoscopic sleeve & gastric bypasses 2011 to ’191 43K U.S. revision procedures in 20191 30-50%of those will be revision candidates1 E N D O S C O P I C V. S U R G I C A L R E V I S I O N >70% of top 100 U.S. Overstitch accounts perform revisions2 In a peer-reviewed study3 that compared results at five years, endoscopic revision demonstrated: • Equivalent efficacy • Improved safety profile ENDO SURGICAL p Efficacy at 5 years 11.5% TBWL 13.1% TBWL 0.67 Adverse events 6.5% 29.0% 0.04 Safety profile 0 SAE rate 19.4% SAE rate 0.024 1. Derived from multiple primary data sources and management estimates | 2. YTD 2021 survey of sales team + management estimate | 3. Dolan, R; Pichamol, J; Thompson, C; Endoscopic versus surgical gastrojejunal revision for weight gain in Roux-en-Y gastric bypass patients: 5-year safety and efficacy comparison. Gastrointestinal Endoscopy. 2021. | See Product Regulatory Advisory, slide 2.

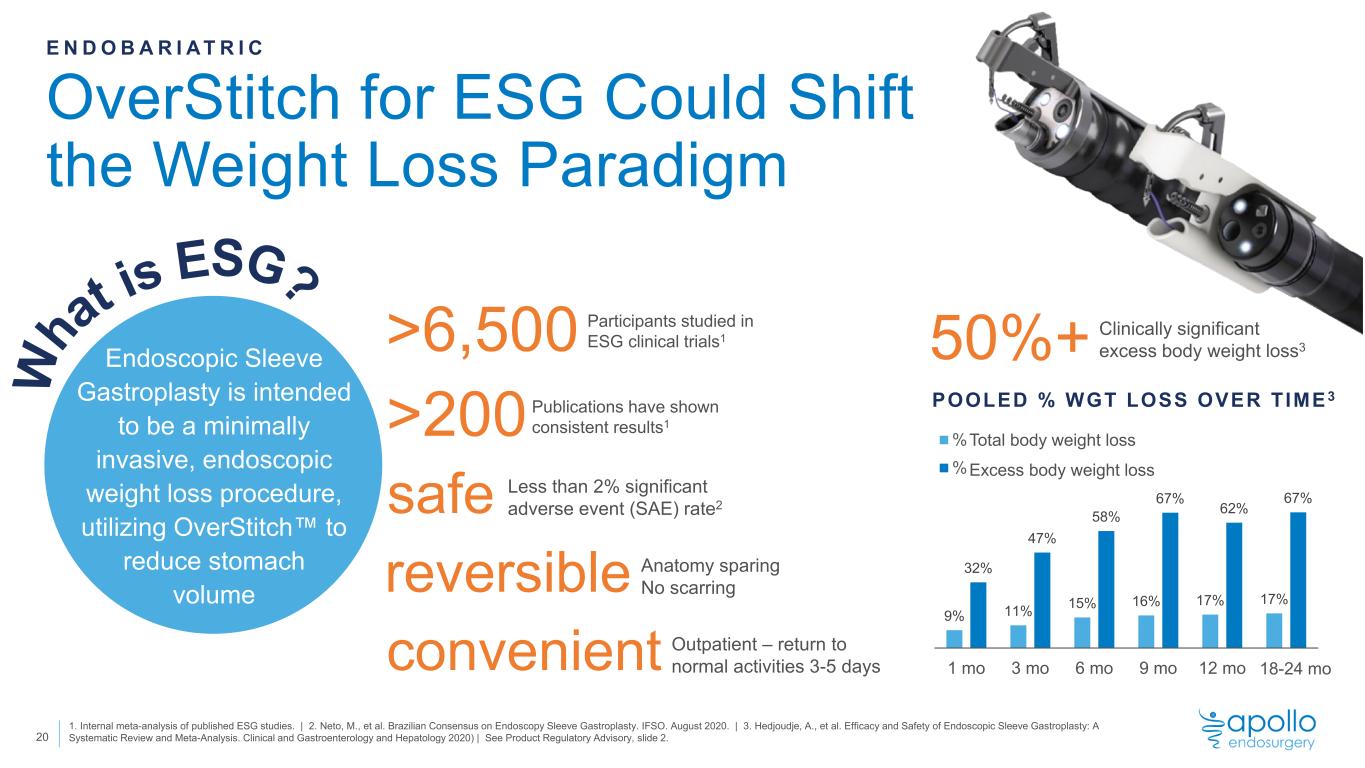

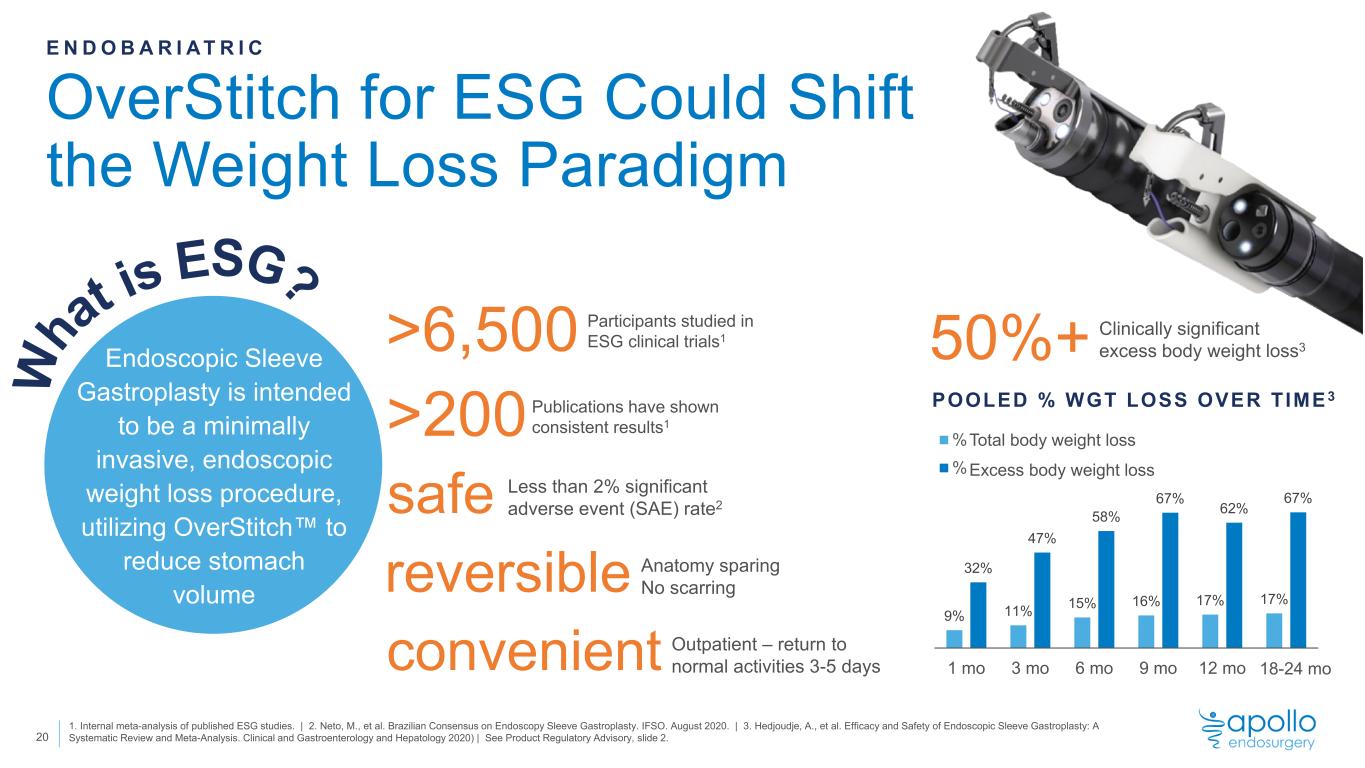

Endoscopic Sleeve Gastroplasty is intended to be a minimally invasive, endoscopic weight loss procedure, utilizing OverStitch™ to reduce stomach volume OverStitch for ESG Could Shift the Weight Loss Paradigm 20 1. Internal meta-analysis of published ESG studies. | 2. Neto, M., et al. Brazilian Consensus on Endoscopy Sleeve Gastroplasty. IFSO. August 2020. | 3. Hedjoudje, A., et al. Efficacy and Safety of Endoscopic Sleeve Gastroplasty: A Systematic Review and Meta-Analysis. Clinical and Gastroenterology and Hepatology 2020) | See Product Regulatory Advisory, slide 2. 50%+ Clinically significant excess body weight loss3>6,500 Participants studied in ESG clinical trials1 safe reversible convenient Less than 2% significant adverse event (SAE) rate2 Anatomy sparing No scarring Outpatient – return to normal activities 3-5 days E N D O B A R I A T R I C >200Publications have shown consistent results1 9% 11% 15% 16% 17% 17% 32% 47% 58% 67% 62% 67% 1 mo 3 mo 6 mo 9 mo 12 mo 18-24 mo % TBWL % EBWL otal body weight loss xcess body weight loss 18-24 mo POOLED % WGT LOSS OVER TIME3

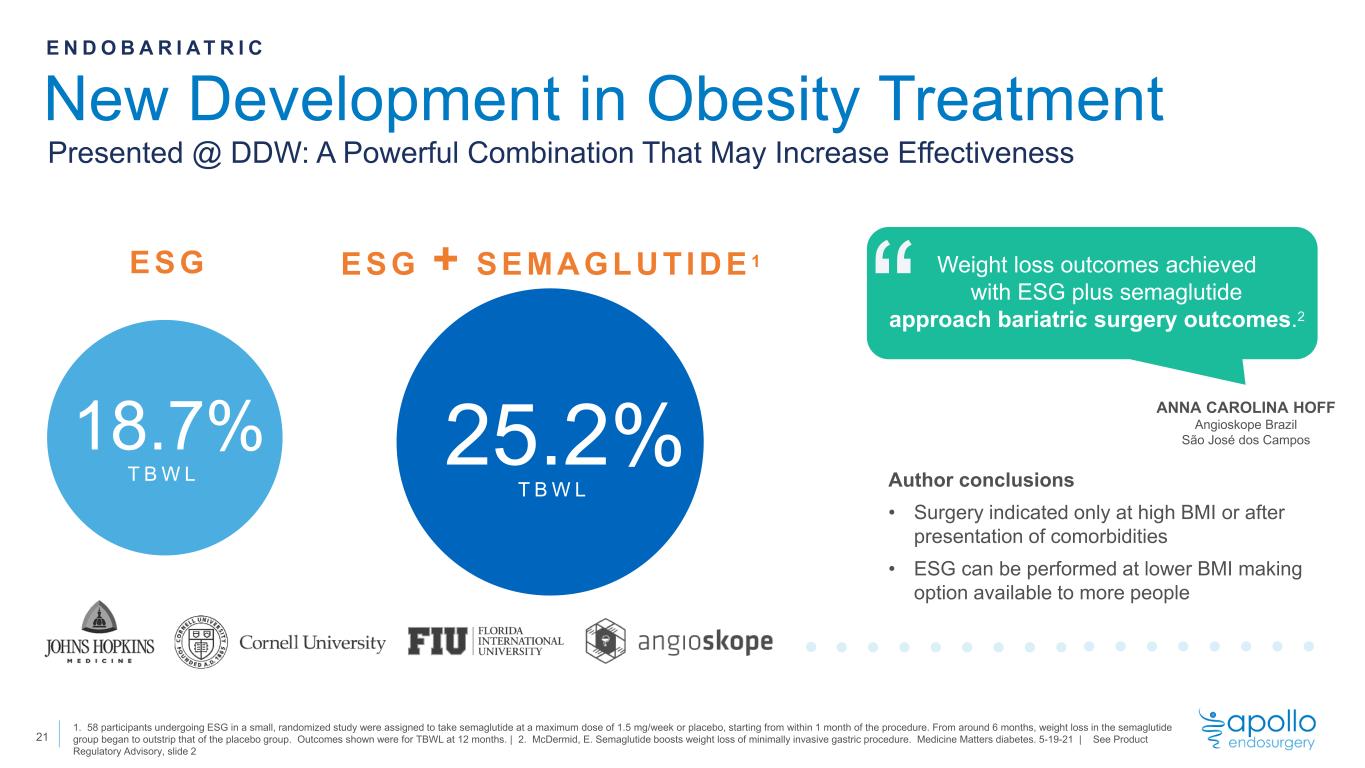

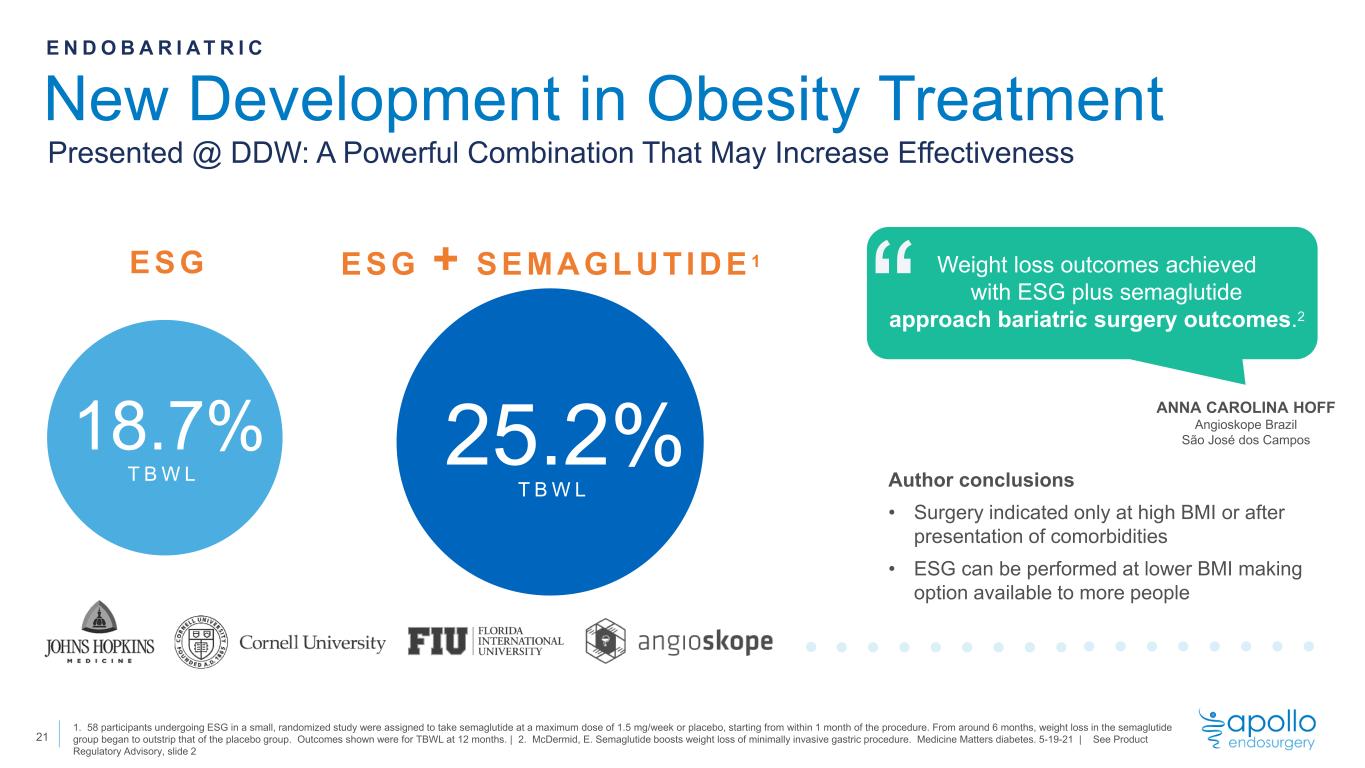

New Development in Obesity Treatment 1. 58 participants undergoing ESG in a small, randomized study were assigned to take semaglutide at a maximum dose of 1.5 mg/week or placebo, starting from within 1 month of the procedure. From around 6 months, weight loss in the semaglutide group began to outstrip that of the placebo group. Outcomes shown were for TBWL at 12 months. | 2. McDermid, E. Semaglutide boosts weight loss of minimally invasive gastric procedure. Medicine Matters diabetes. 5-19-21 | See Product Regulatory Advisory, slide 2 E N D O B A R I A T R I C Presented @ DDW: A Powerful Combination That May Increase Effectiveness ESG 18.7% T B W L ANNA CAROLINA HOFF Angioskope Brazil São José dos Campos “ Weight loss outcomes achieved with ESG plus semaglutide approach bariatric surgery outcomes.2 Author conclusions • Surgery indicated only at high BMI or after presentation of comorbidities • ESG can be performed at lower BMI making option available to more people ESG + SEMAGLUTIDE 1 T B W L 25.2% 21

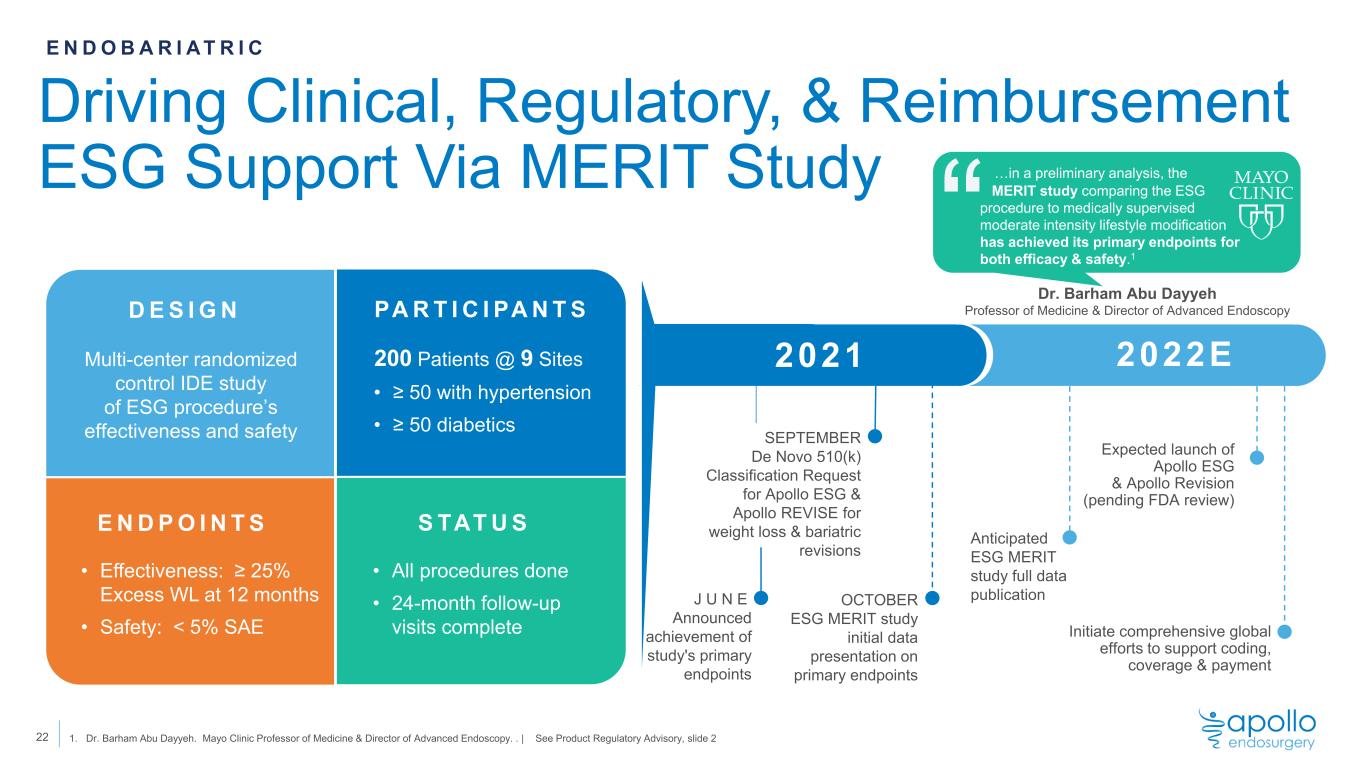

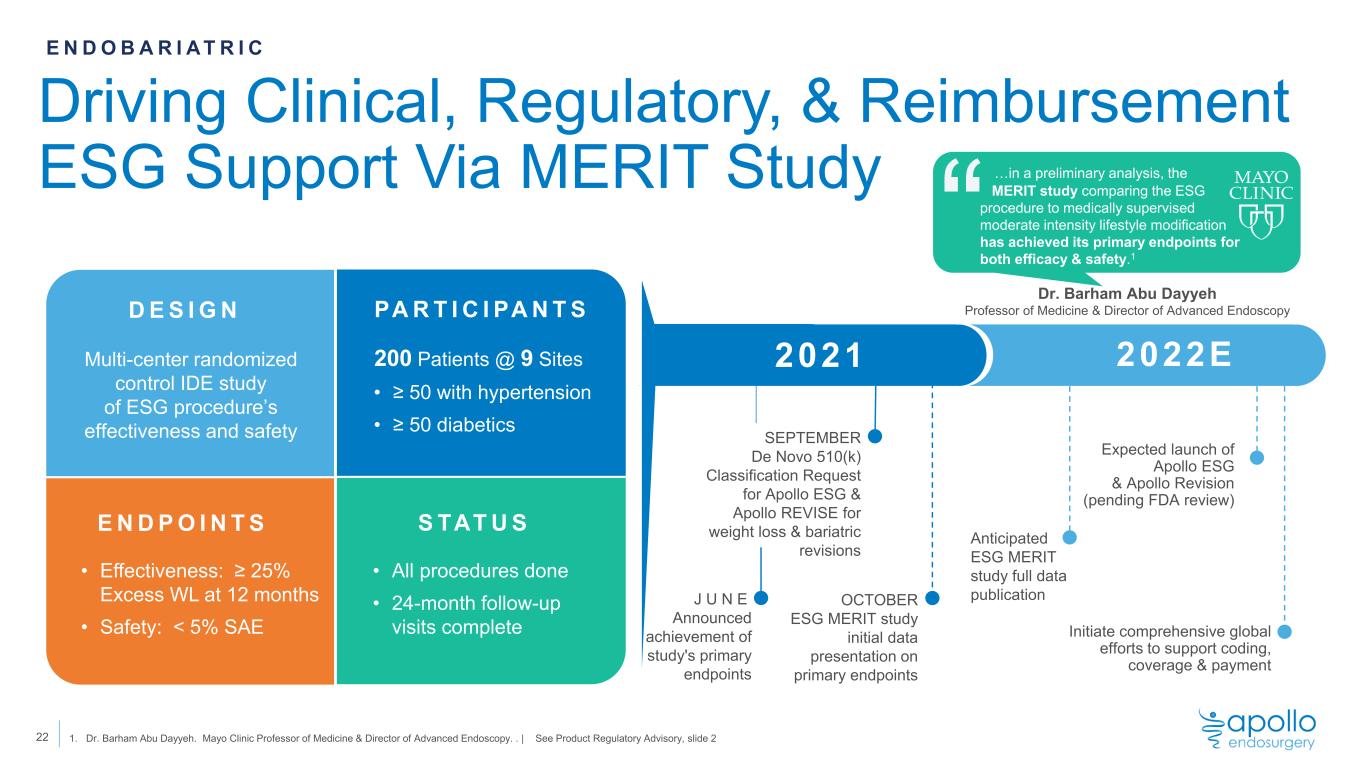

Driving Clinical, Regulatory, & Reimbursement ESG Support Via MERIT Study 22 1. Dr. Barham Abu Dayyeh. Mayo Clinic Professor of Medicine & Director of Advanced Endoscopy. . | See Product Regulatory Advisory, slide 2 D E S I G N PA R T I C I PA N T S E N D P O I N T S S TAT U S Multi-center randomized control IDE study of ESG procedure’s effectiveness and safety 200 Patients @ 9 Sites • ≥ 50 with hypertension • ≥ 50 diabetics • Effectiveness: ≥ 25% Excess WL at 12 months • Safety: < 5% SAE • All procedures done • 24-month follow-up visits complete E N D O B A R I A T R I C J U N E Announced achievement of study's primary endpoints 2022E2021 Initiate comprehensive global efforts to support coding, coverage & payment SEPTEMBER De Novo 510(k) Classification Request for Apollo ESG & Apollo REVISE for weight loss & bariatric revisions Expected launch of Apollo ESG & Apollo Revision (pending FDA review) “ Dr. Barham Abu Dayyeh Professor of Medicine & Director of Advanced Endoscopy OCTOBER ESG MERIT study initial data presentation on primary endpoints Anticipated ESG MERIT study full data publication …in a preliminary analysis, the MERIT study comparing the ESG procedure to medically supervised moderate intensity lifestyle modification has achieved its primary endpoints for both efficacy & safety.1

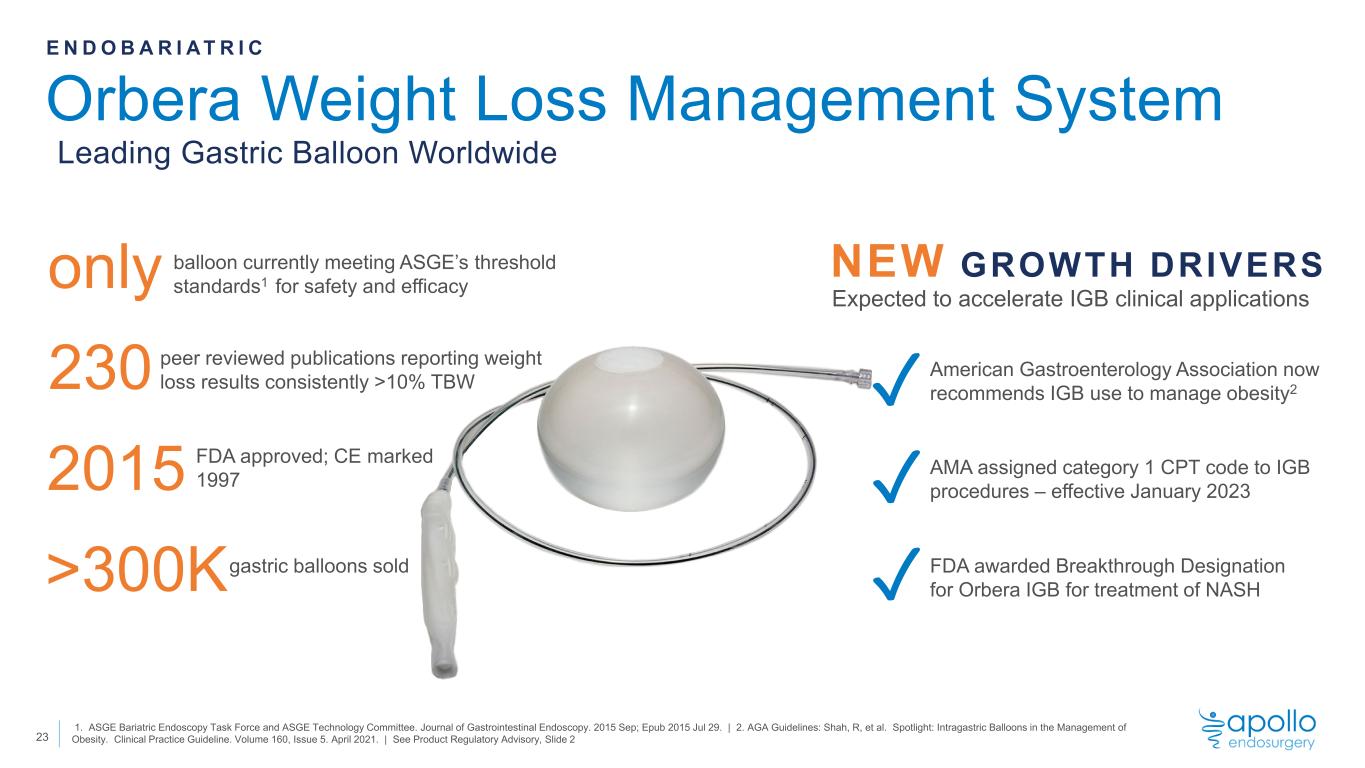

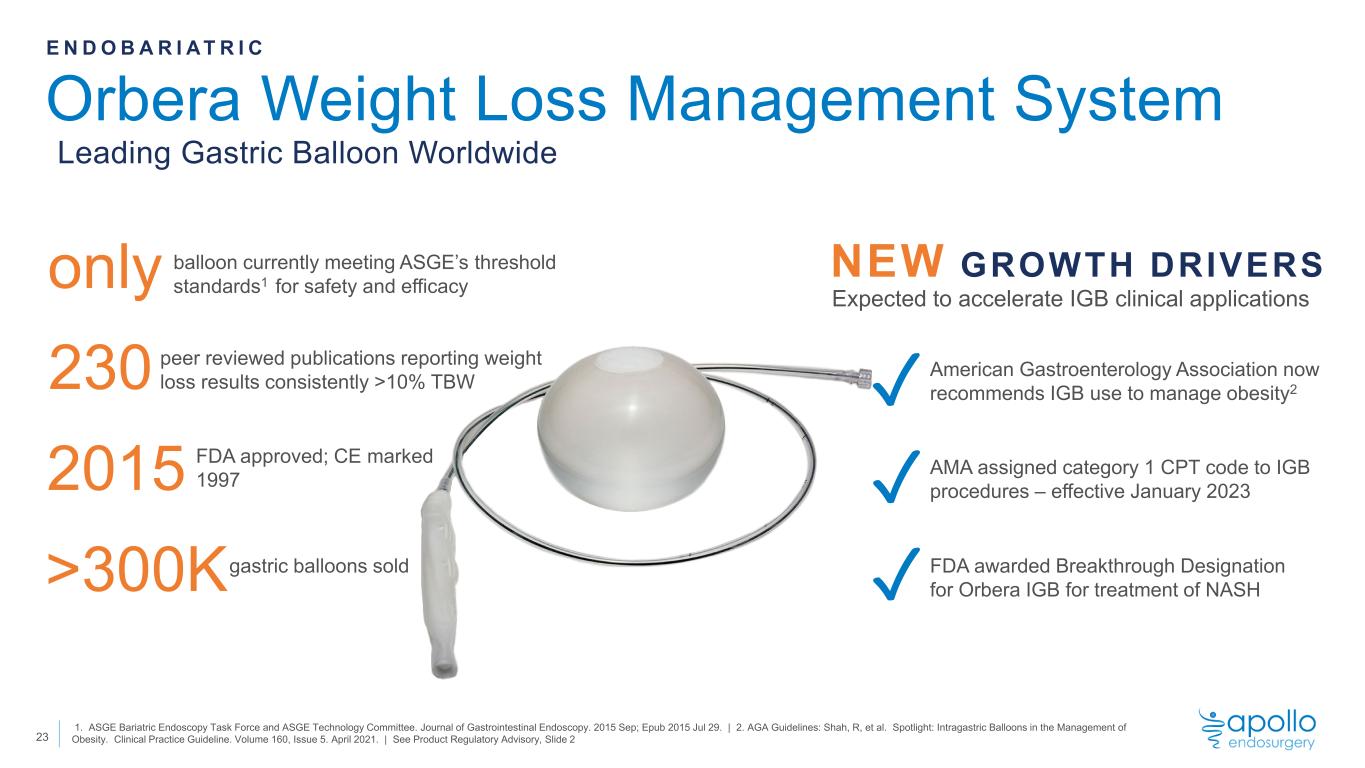

Leading Gastric Balloon Worldwide 23 1 2 3 4 Shah, R, et al. Spotlight: Intragastric Balloons in the Management of Obesity. Clinical Practice Guideline. Volume 160, Issue 5. April 2021. | 1. ASGE Bariatric Endoscopy Task Force and ASGE Technology Committee. Journal of Gastrointestinal Endoscopy. 2015 Sep; Epub 2015 Jul 29. | 2. AGA Guidelines: See Product Regulatory Advisory, Slide 2 Orbera Weight Loss Management System NEW GROWTH DRIVERS Expected to accelerate IGB clinical applications FDA awarded Breakthrough Designation for Orbera IGB for treatment of NASH AMA assigned category 1 CPT code to IGB procedures – effective January 2023 American Gastroenterology Association now recommends IGB use to manage obesity2✓ ✓ ✓ only balloon currently meeting ASGE’s threshold standards1 for safety and efficacy 2015 gastric balloons sold 230 peer reviewed publications reporting weight loss results consistently >10% TBW >300K FDA approved; CE marked 1997 E N D O B A R I A T R I C

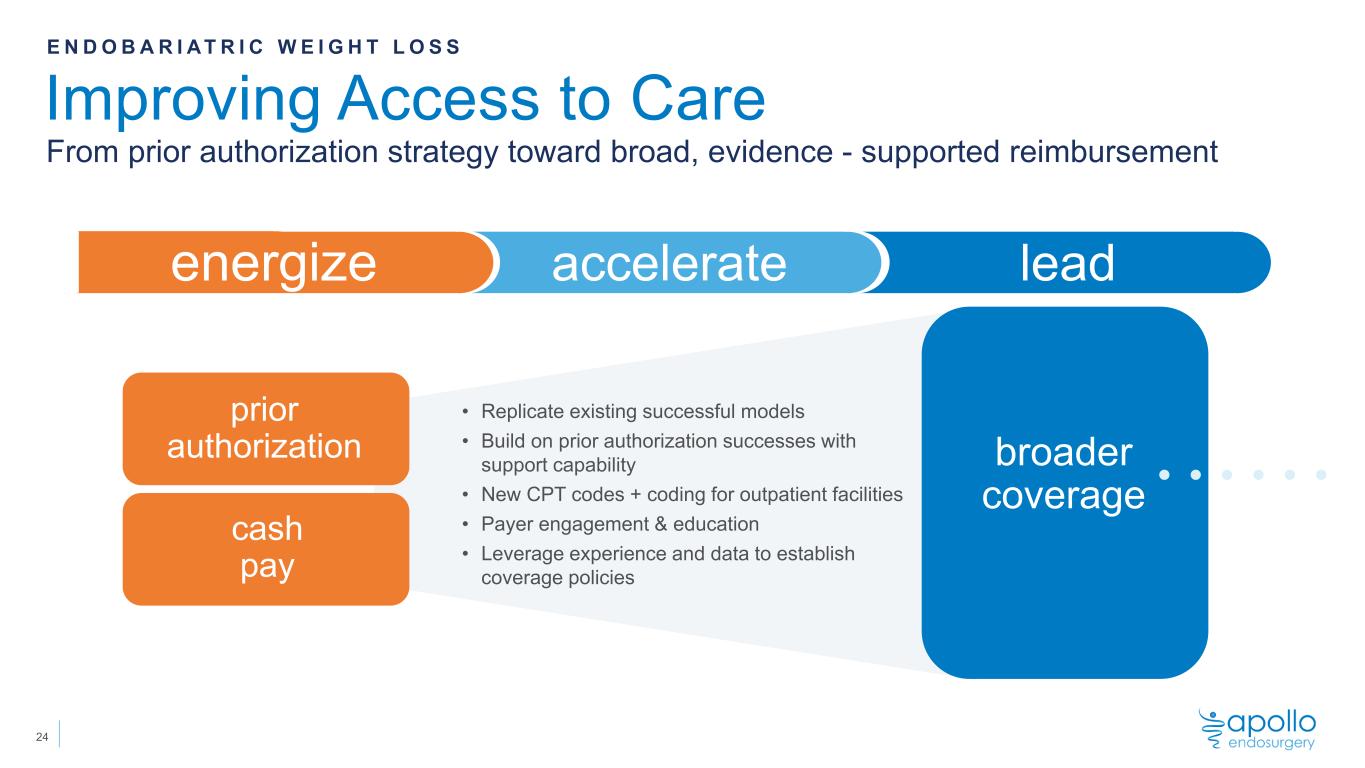

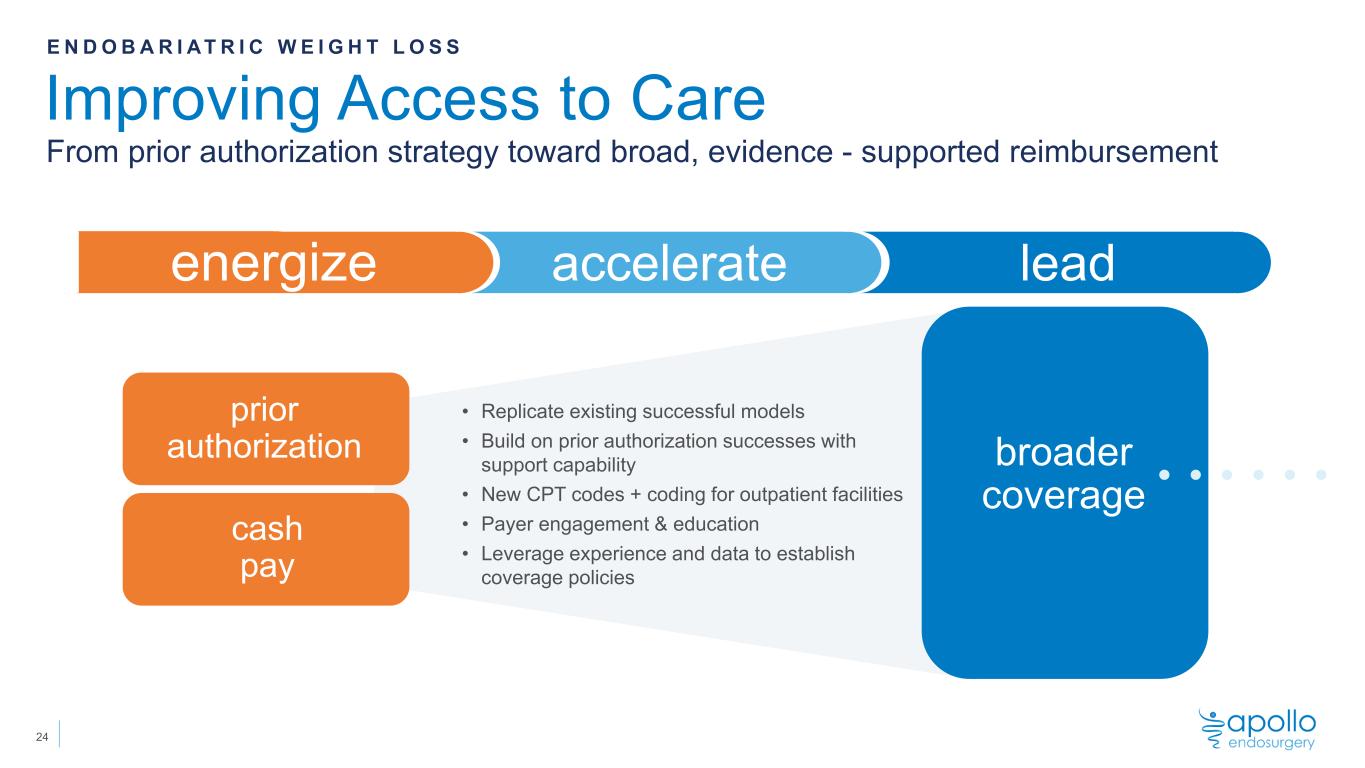

broader coverage • Replicate existing successful models • Build on prior authorization successes with support capability • New CPT codes + coding for outpatient facilities • Payer engagement & education • Leverage experience and data to establish coverage policies energize accelerate lead Improving Access to Care From prior authorization strategy toward broad, evidence - supported reimbursement E N D O B A R I A T R I C W E I G H T L O S S cash pay prior authorization 24

NASH Opportunity

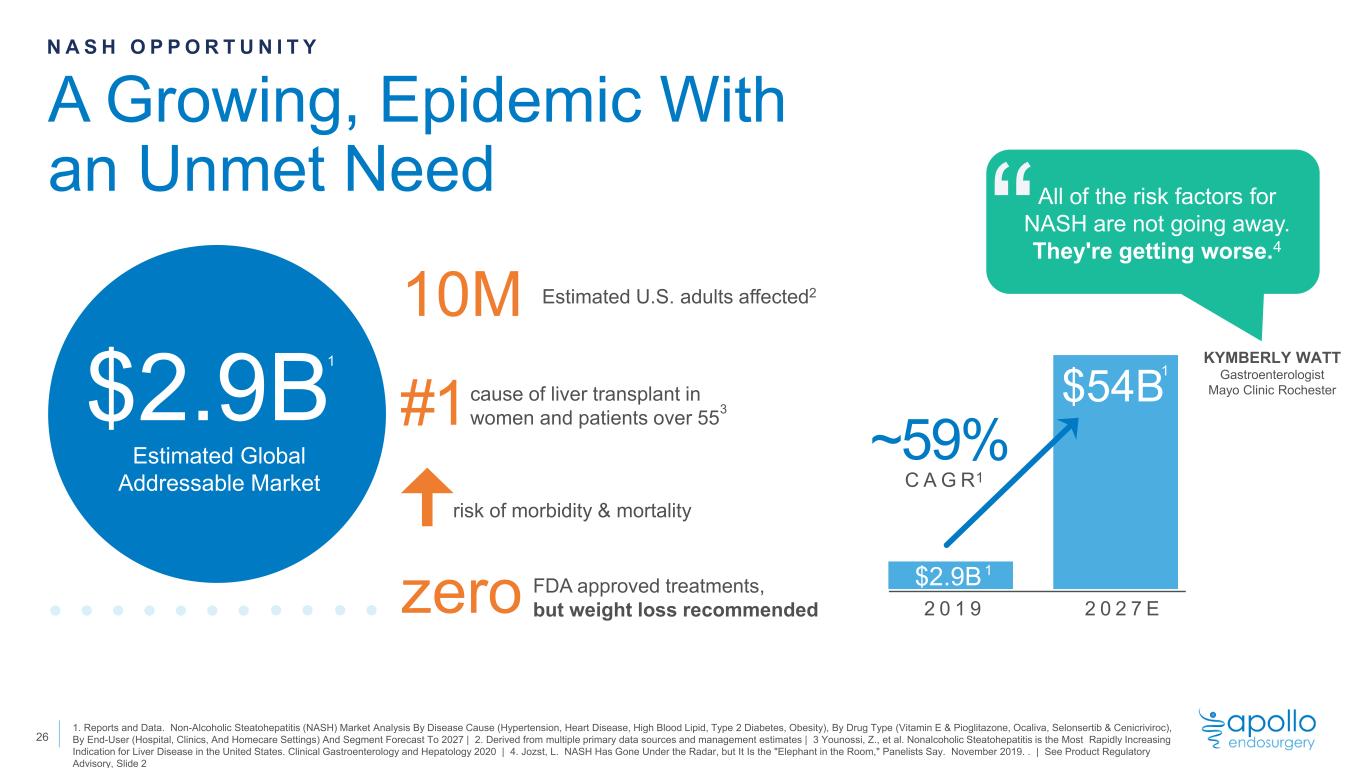

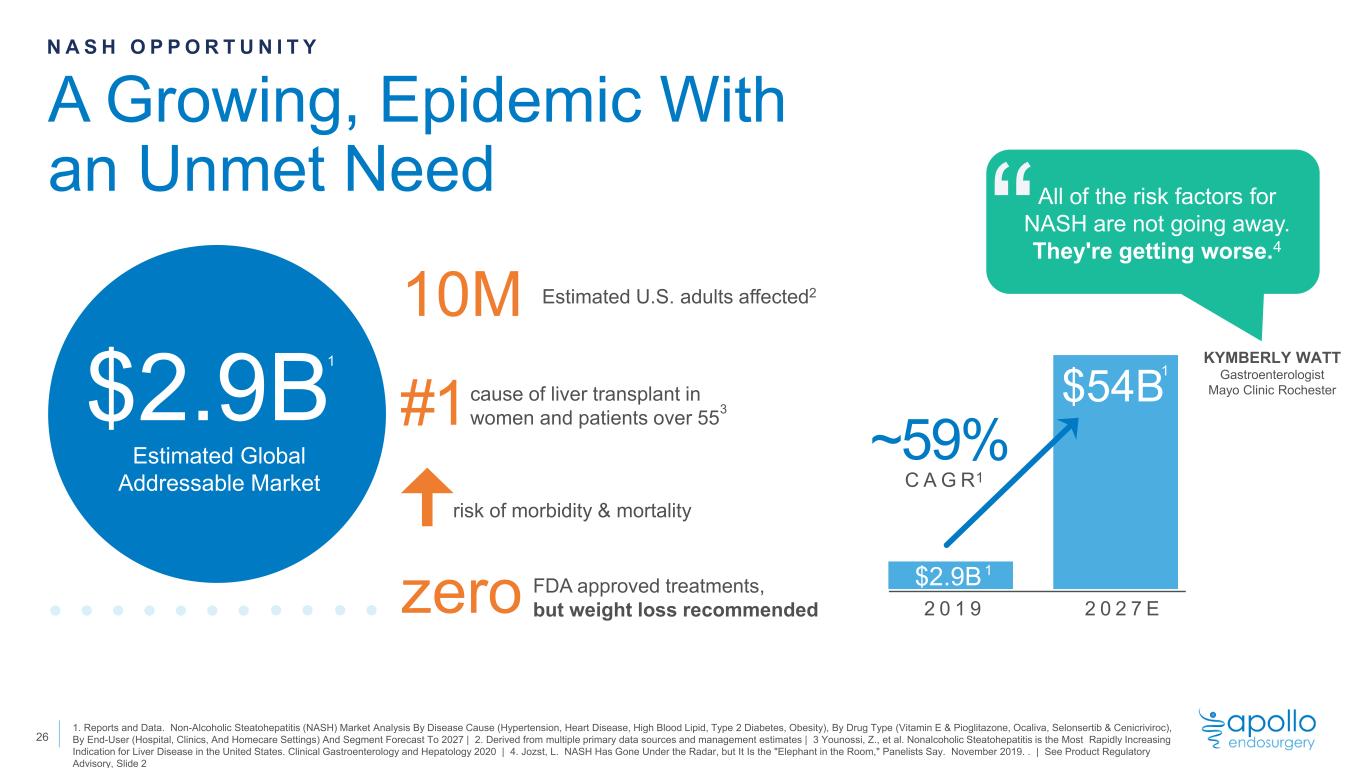

N A S H O P P O R T U N I T Y 2 0 1 9 2 0 2 7 E ~59% C A G R KYMBERLY WATT Gastroenterologist Mayo Clinic Rochester All of the risk factors for NASH are not going away. They're getting worse.4“ “ 1. Reports and Data. Non-Alcoholic Steatohepatitis (NASH) Market Analysis By Disease Cause (Hypertension, Heart Disease, High Blood Lipid, Type 2 Diabetes, Obesity), By Drug Type (Vitamin E & Pioglitazone, Ocaliva, Selonsertib & Cenicriviroc), By End-User (Hospital, Clinics, And Homecare Settings) And Segment Forecast To 2027 | 2. Derived from multiple primary data sources and management estimates | 3 Younossi, Z., et al. Nonalcoholic Steatohepatitis is the Most Rapidly Increasing Indication for Liver Disease in the United States. Clinical Gastroenterology and Hepatology 2020 | 4. Jozst, L. NASH Has Gone Under the Radar, but It Is the "Elephant in the Room," Panelists Say. November 2019. . | See Product Regulatory Advisory, Slide 2 1 1 $2.9B Estimated Global Addressable Market risk of morbidity & mortality #1 10M zero cause of liver transplant in women and patients over 55 Estimated U.S. adults affected2 FDA approved treatments, but weight loss recommended A Growing, Epidemic With an Unmet Need $2.9B $54B1 1 1 3 26

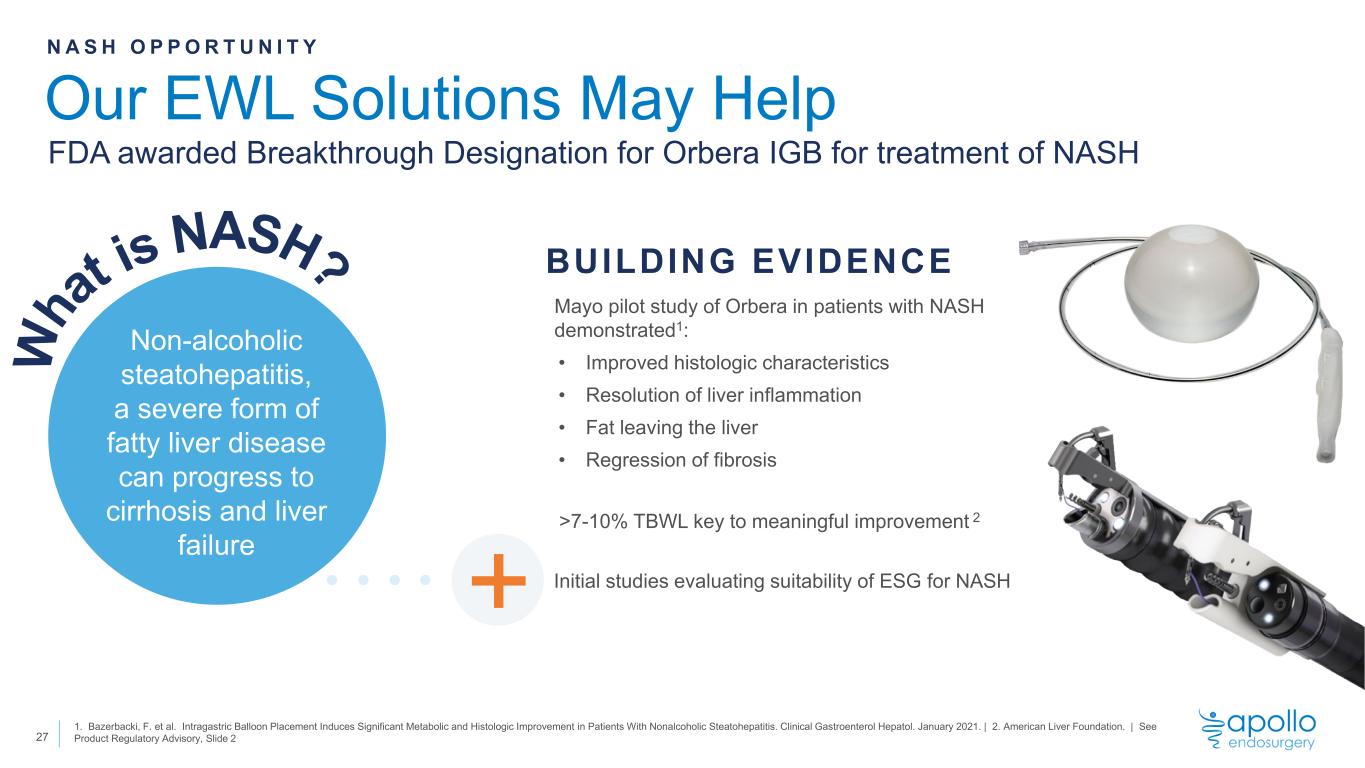

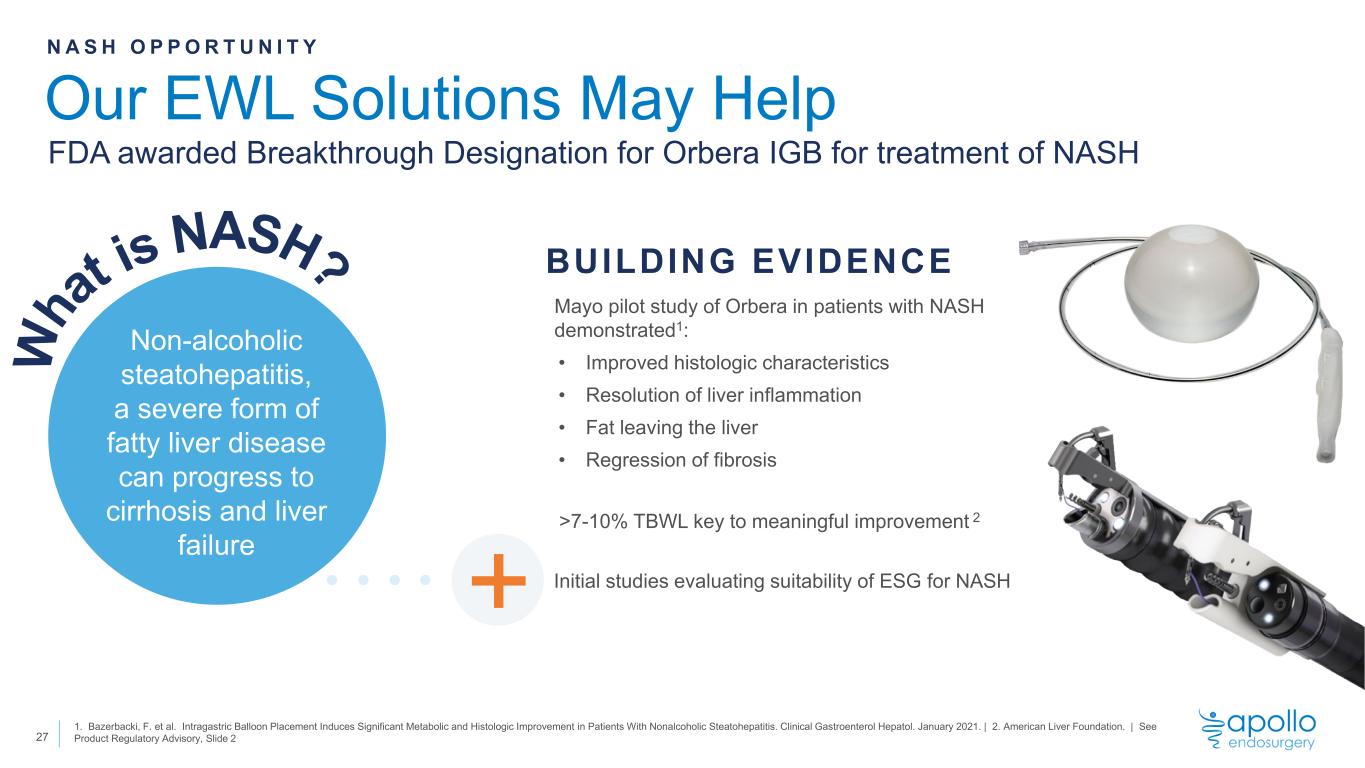

Non-alcoholic steatohepatitis, a severe form of fatty liver disease can progress to cirrhosis and liver failure Our EWL Solutions May Help 27 1. Bazerbacki, F. et al. Intragastric Balloon Placement Induces Significant Metabolic and Histologic Improvement in Patients With Nonalcoholic Steatohepatitis. Clinical Gastroenterol Hepatol. January 2021. | 2. American Liver Foundation. | See Product Regulatory Advisory, Slide 2 N A S H O P P O R T U N I T Y Mayo pilot study of Orbera in patients with NASH demonstrated1: • Improved histologic characteristics • Resolution of liver inflammation • Fat leaving the liver • Regression of fibrosis >7-10% TBWL key to meaningful improvement 2 Initial studies evaluating suitability of ESG for NASH BUILDING EVIDENCE + FDA awarded Breakthrough Designation for Orbera IGB for treatment of NASH

Commercial Priorities

Leveraging Strong Academic Presence 20 of top 20 U . S . r e s e a r c h h o s p i t a l s 1 25 of top 25 G . I . s p e c i a l i z e d h o s p i t a l s 1 Well-positioned to both expand academic stronghold and broaden usage 1. U.S. News and World Report29

Revitalizing the Sales Network New leadership + increasing opportunities attracting high-caliber professionals globally • Experienced reps returning to Apollo • Increasingly attracting from peers ~30 D I R E C T U . S . R E P S E N E R G I Z E ~50 ~70 A C C E L E R A T E L E A D • New growth opportunities: Japan, China, Russia, Canada • Int’l offices in UK & Italy ESTABLISHED O.U.SREVITALIZ ING U.S . 40 Countries with direct sales teams in Europe, Australia & Latin America 14 Countries with distributor relationships 30

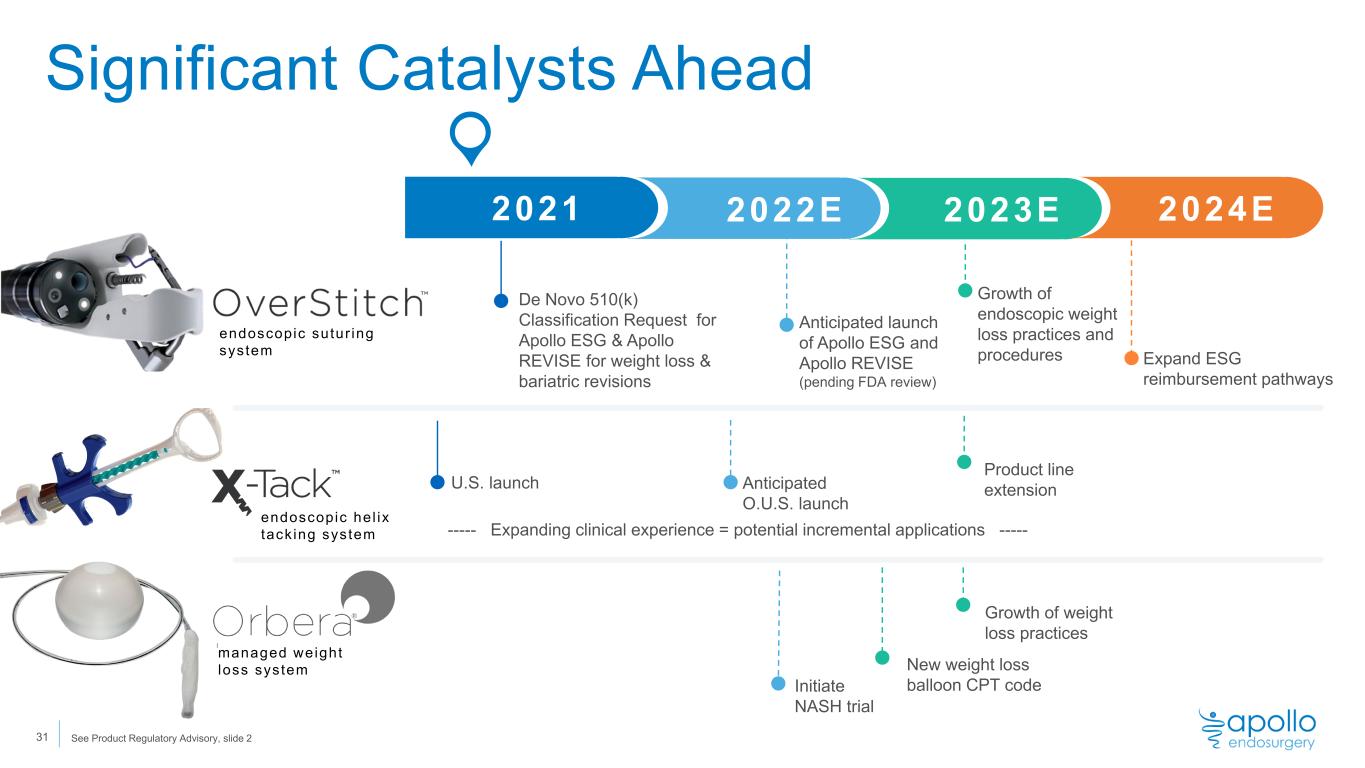

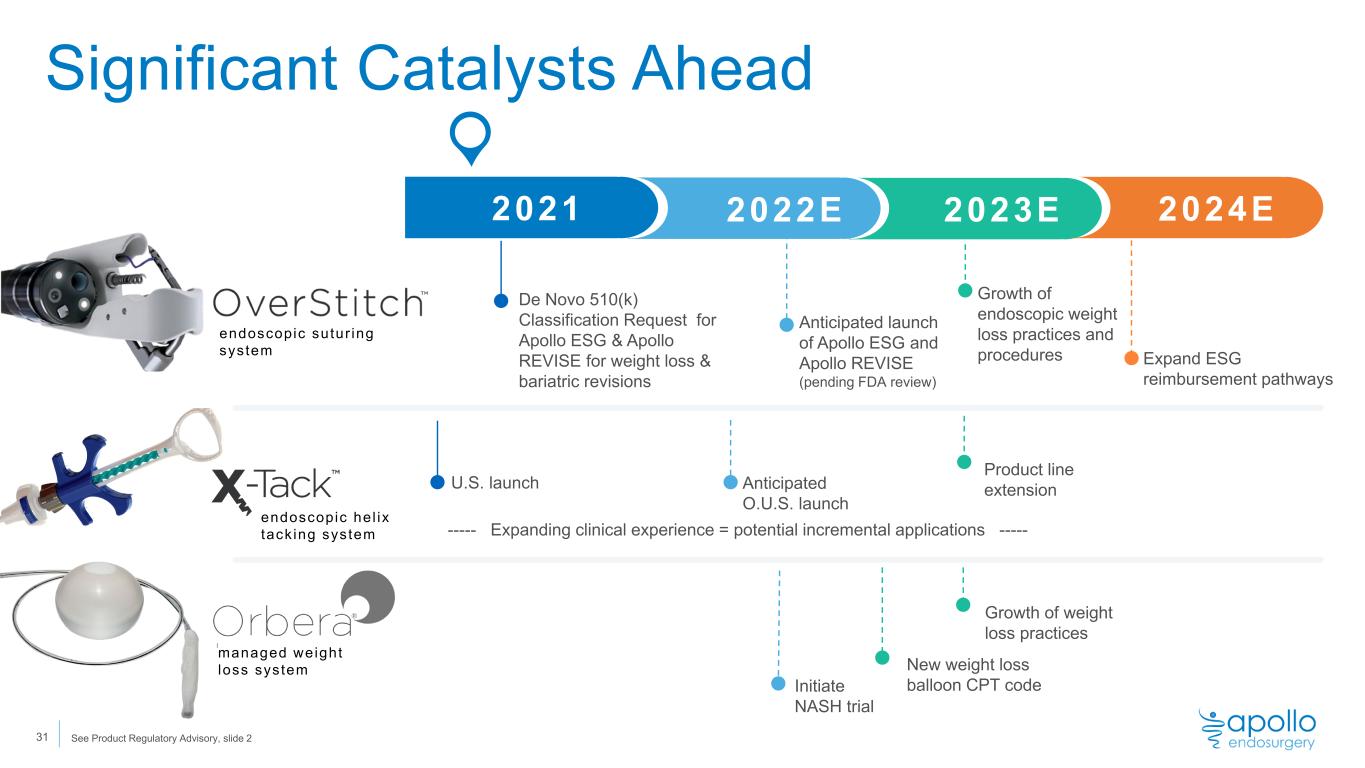

Significant Catalysts Ahead endoscopic sutur ing system endoscopic hel ix tack ing system managed weight loss system 2022 De Novo 510(k) Classification Request for Apollo ESG & Apollo REVISE for weight loss & bariatric revisions 2021 2022E 2023E 024E Anticipated launch of Apollo ESG and Apollo REVISE (pending FDA review) U.S. launch Anticipated O.U.S. launch ----- Expanding clinical experience = potential incremental applications ----- Initiate NASH trial Expand ESG reimbursement pathways New weight loss balloon CPT code Product line extension Growth of weight loss practices 31 Growth of endoscopic weight loss practices and procedures See Product Regulatory Advisory, slide 2

Financials

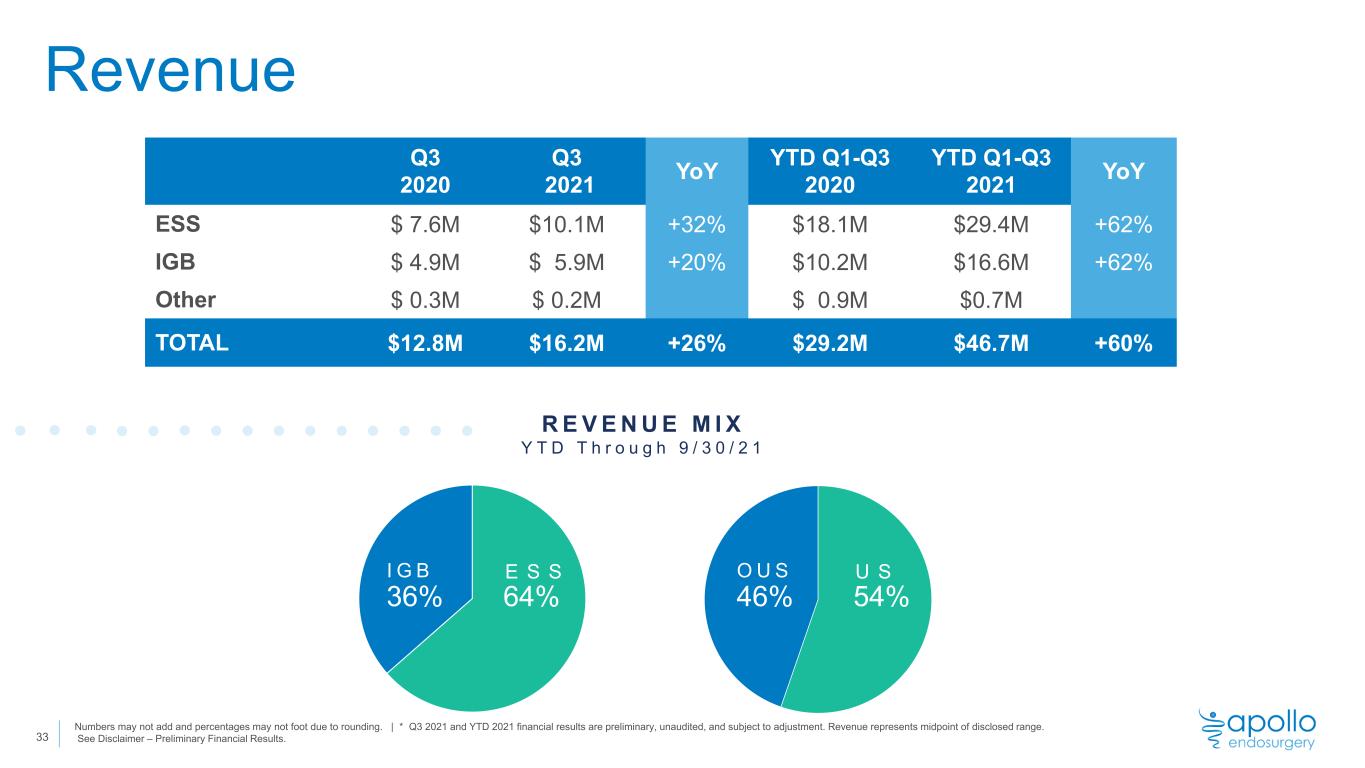

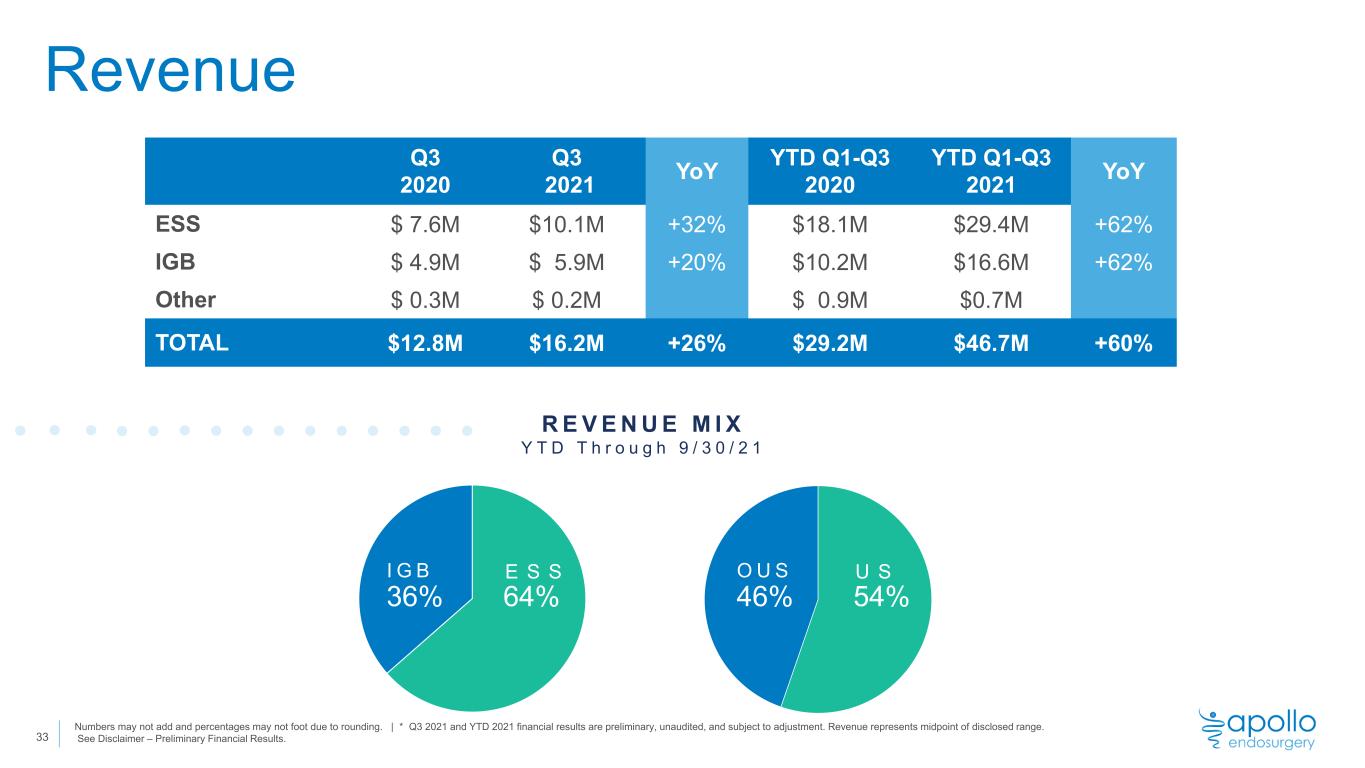

Revenue 33 Q3 2020 Q3 2021 YoY YTD Q1-Q3 2020 YTD Q1-Q3 2021 YoY ESS $ 7.6M $10.1M +32% $18.1M $29.4M +62% IGB $ 4.9M $ 5.9M +20% $10.2M $16.6M +62% Other $ 0.3M $ 0.2M $ 0.9M $0.7M TOTAL $12.8M $16.2M +26% $29.2M $46.7M +60% R E V E N U E M I X Y T D T h r o u g h 9 / 3 0 / 2 1 Numbers may not add and percentages may not foot due to rounding. | * Q3 2021 and YTD 2021 financial results are preliminary, unaudited, and subject to adjustment. Revenue represents midpoint of disclosed range. See Disclaimer – Preliminary Financial Results. 54%46% O U S U S 64%36% I G B E S S

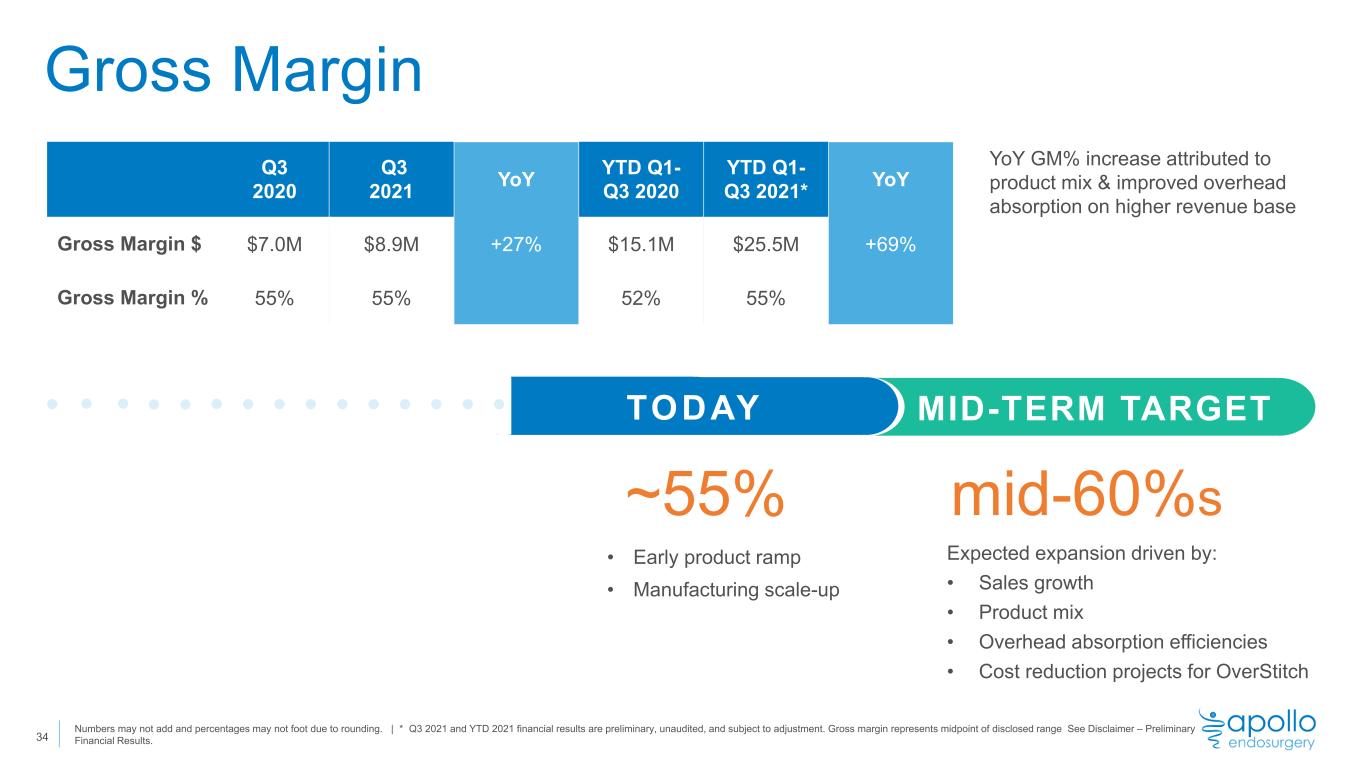

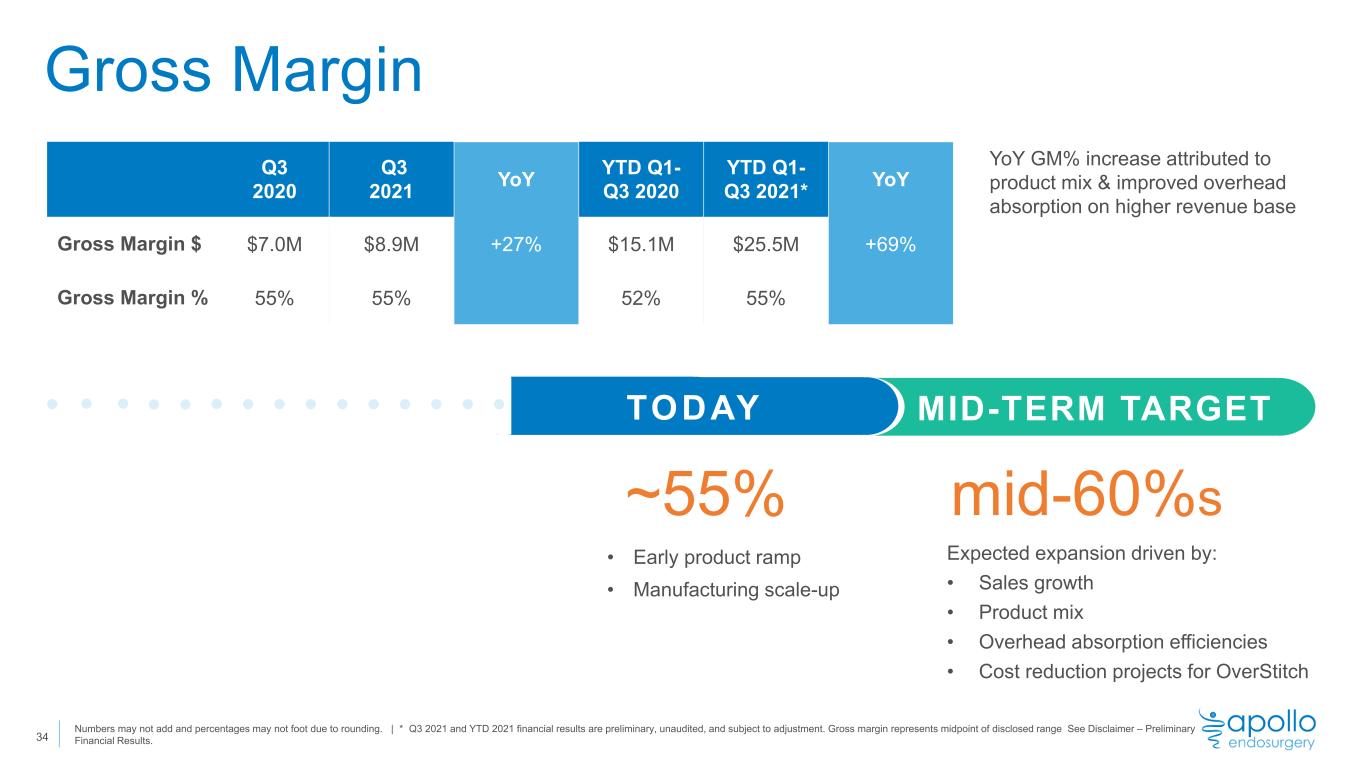

Gross Margin 34 Q3 2020 Q3 2021 YoY YTD Q1- Q3 2020 YTD Q1- Q3 2021* YoY Gross Margin $ $7.0M $8.9M +27% $15.1M $25.5M +69% Gross Margin % 55% 55% 52% 55% Expected expansion driven by: • Sales growth • Product mix • Overhead absorption efficiencies • Cost reduction projects for OverStitch mid-60%s YoY GM% increase attributed to product mix & improved overhead absorption on higher revenue base • Early product ramp • Manufacturing scale-up ~55% TODAY MID-TERM TARGET Numbers may not add and percentages may not foot due to rounding. | * Q3 2021 and YTD 2021 financial results are preliminary, unaudited, and subject to adjustment. Gross margin represents midpoint of disclosed range See Disclaimer – Preliminary Financial Results.

Capitalization 1. Market Capitalization and Enterprise Value with Pre-Funded Warrants are non-GAAP items; Common shares outstanding at September 30, 2021, were 29,829,697; Pre-funded warrants outstanding at September 30, 2021 were 13,948,875 | 2. Long-Term Debt – Matures March 2025, Senior secured, Interest at LIBOR plus 7.5%, interest only through September 2022 | 3. Convertible Debt – Matures August 2026, Interest at 6%, payable in stock, Conversion price of $3.25 (or 6,290,932 common shares) 35 Share Price (as of 10/08/2021) $9.39 Average Daily Volume 131,100 52-Week Range $1.61 / $10.04 Market Capitalization $280 million + Pre-Funded Warrants1 $411 million Long-Term Debt2 (as of 9/30/2021) $36 million Convertible Debt3 (as of 9/30/2021) $19 million Cash (as of 9/30/2021) $28 million Enterprise Value (as of 9/30/2021) $307 million + Pre-Funded Warrants1 $438 million $411M Market cap + pre-funded warrants1 $438M Enterprise value + pre-funded warrants1

leadaccelerate • Advance commercial organization • Drive medical education to increase awareness • Support R&D pipeline • Expand gross margin L E V E R A G E C L I N I C A L S U P P O R T • Broader awareness • Additional indications • Expanded geographies energize I N V E S T TO P E N E T R AT E STANDARD OF CARE • Build clinical evidence to support adoption and expand indications • Broaden reimbursement 2020 Revenue $42M 20%+ Mid-Term Target Revenue CAGR* 36 * Target revenue growth is based solely on management estimates and assumptions as of the date of this presentation and is subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on this forward-looking statement, and there can be no assurance that this target will be achieved.

Appendix

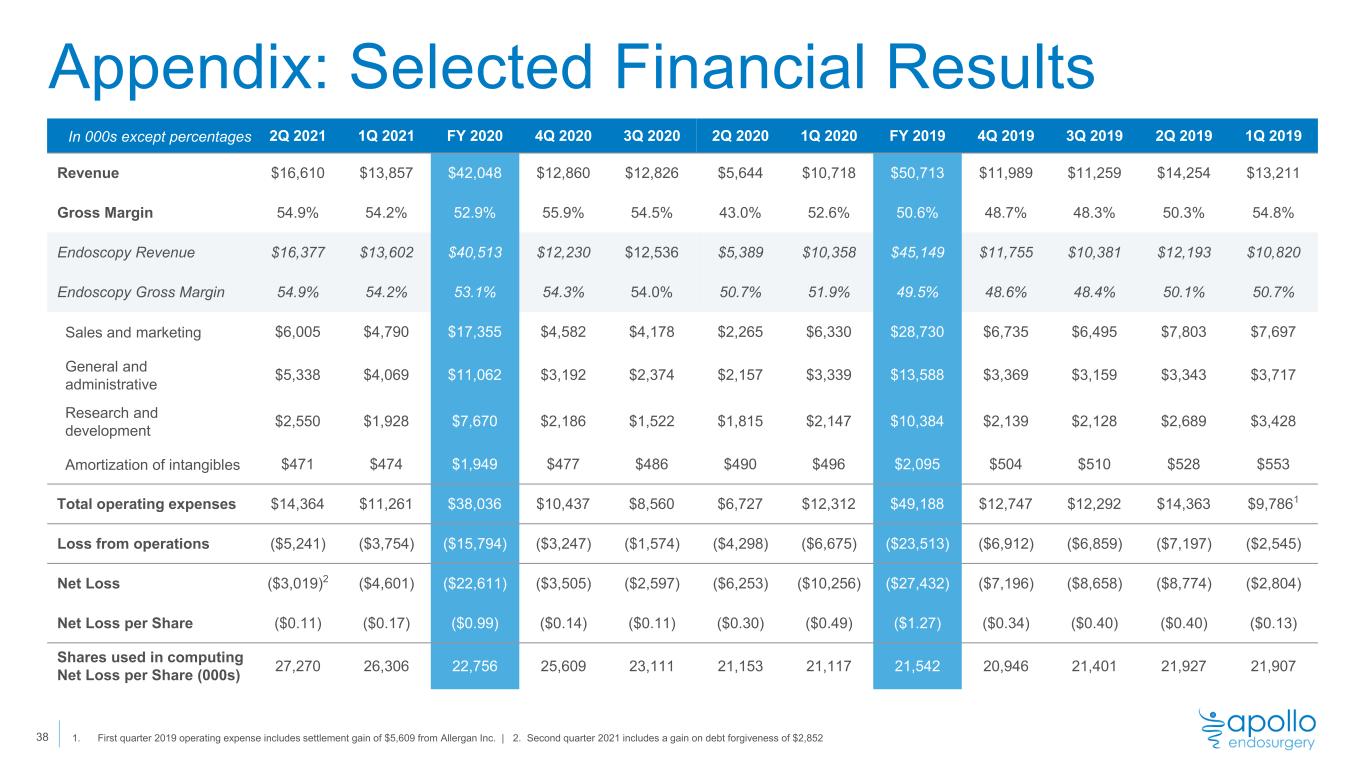

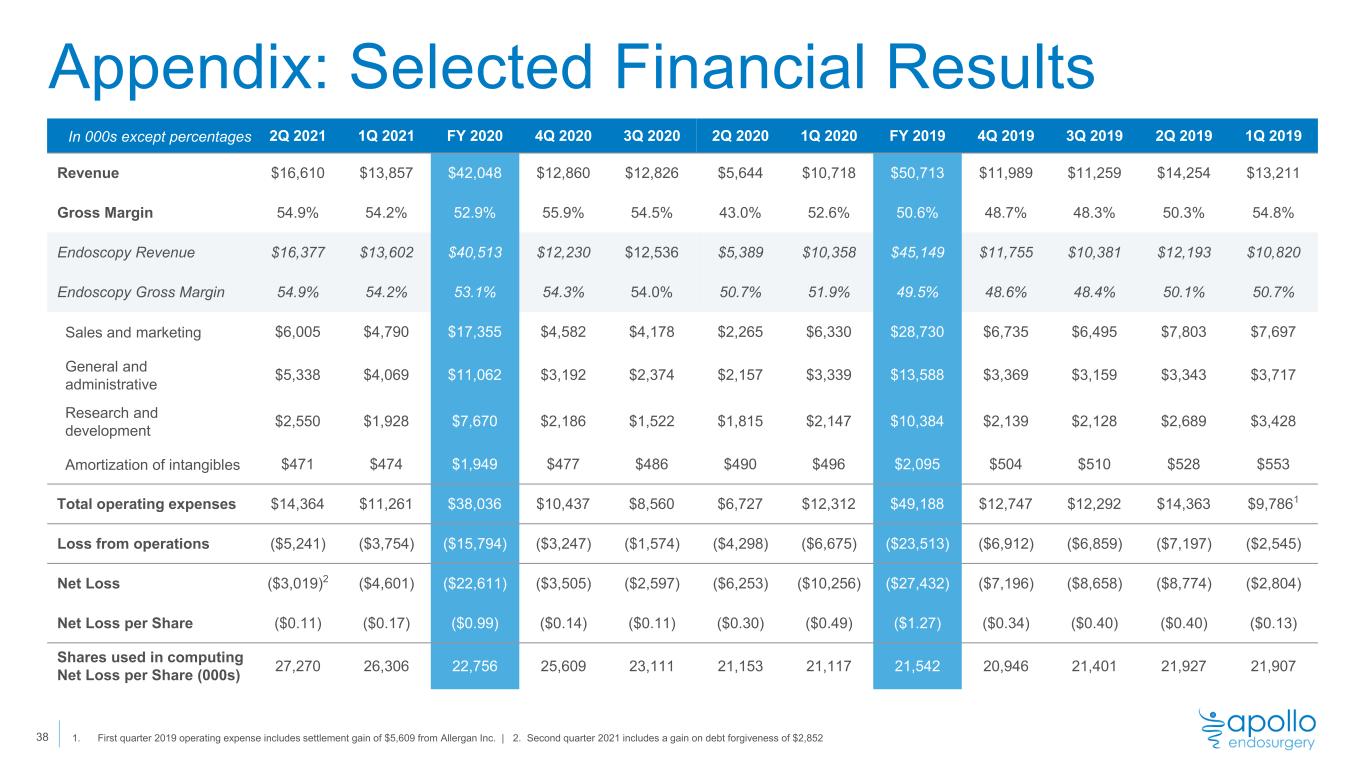

Appendix: Selected Financial Results In 000s except percentages 2Q 2021 1Q 2021 FY 2020 4Q 2020 3Q 2020 2Q 2020 1Q 2020 FY 2019 4Q 2019 3Q 2019 2Q 2019 1Q 2019 Revenue $16,610 $13,857 $42,048 $12,860 $12,826 $5,644 $10,718 $50,713 $11,989 $11,259 $14,254 $13,211 Gross Margin 54.9% 54.2% 52.9% 55.9% 54.5% 43.0% 52.6% 50.6% 48.7% 48.3% 50.3% 54.8% Endoscopy Revenue $16,377 $13,602 $40,513 $12,230 $12,536 $5,389 $10,358 $45,149 $11,755 $10,381 $12,193 $10,820 Endoscopy Gross Margin 54.9% 54.2% 53.1% 54.3% 54.0% 50.7% 51.9% 49.5% 48.6% 48.4% 50.1% 50.7% Sales and marketing $6,005 $4,790 $17,355 $4,582 $4,178 $2,265 $6,330 $28,730 $6,735 $6,495 $7,803 $7,697 General and administrative $5,338 $4,069 $11,062 $3,192 $2,374 $2,157 $3,339 $13,588 $3,369 $3,159 $3,343 $3,717 Research and development $2,550 $1,928 $7,670 $2,186 $1,522 $1,815 $2,147 $10,384 $2,139 $2,128 $2,689 $3,428 Amortization of intangibles $471 $474 $1,949 $477 $486 $490 $496 $2,095 $504 $510 $528 $553 Total operating expenses $14,364 $11,261 $38,036 $10,437 $8,560 $6,727 $12,312 $49,188 $12,747 $12,292 $14,363 $9,7861 Loss from operations ($5,241) ($3,754) ($15,794) ($3,247) ($1,574) ($4,298) ($6,675) ($23,513) ($6,912) ($6,859) ($7,197) ($2,545) Net Loss ($3,019)2 ($4,601) ($22,611) ($3,505) ($2,597) ($6,253) ($10,256) ($27,432) ($7,196) ($8,658) ($8,774) ($2,804) Net Loss per Share ($0.11) ($0.17) ($0.99) ($0.14) ($0.11) ($0.30) ($0.49) ($1.27) ($0.34) ($0.40) ($0.40) ($0.13) Shares used in computing Net Loss per Share (000s) 27,270 26,306 22,756 25,609 23,111 21,153 21,117 21,542 20,946 21,401 21,927 21,907 1. First quarter 2019 operating expense includes settlement gain of $5,609 from Allergan Inc. | 2. Second quarter 2021 includes a gain on debt forgiveness of $2,852 38

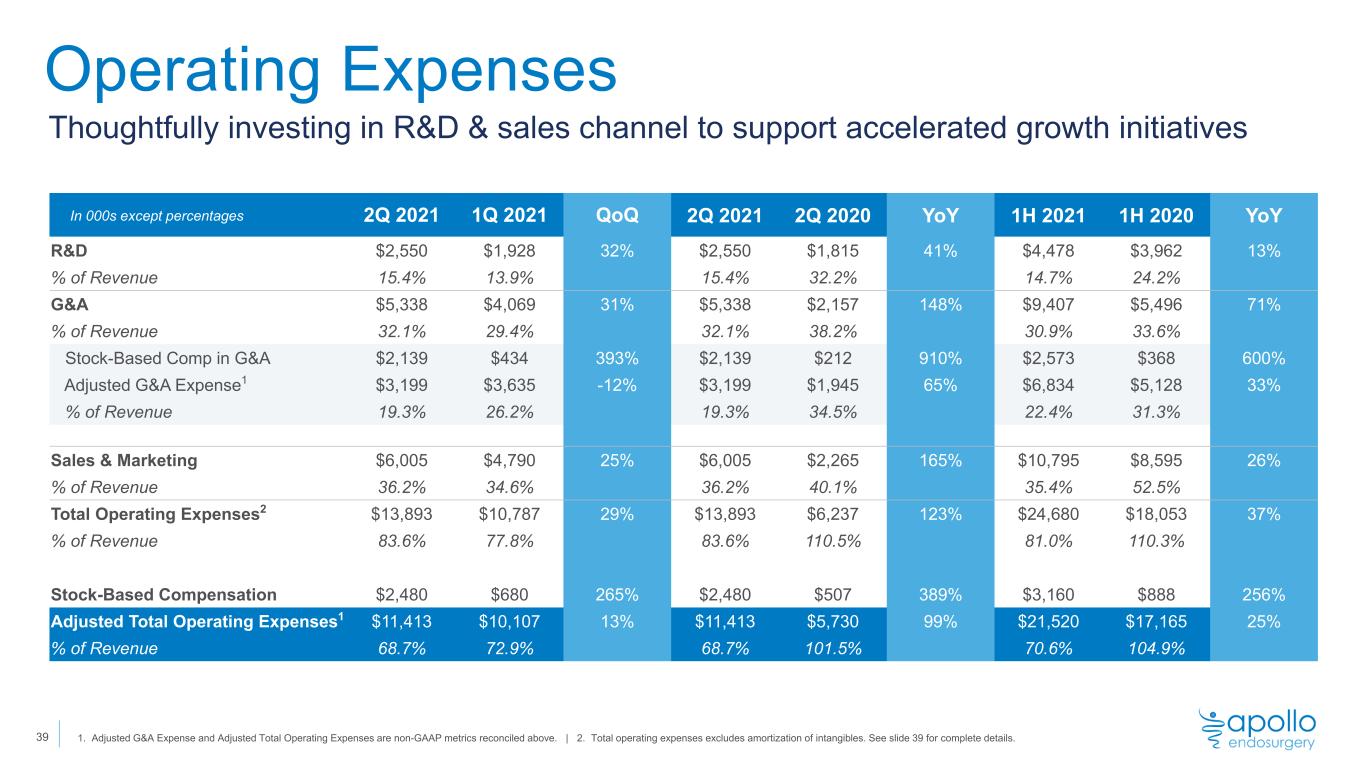

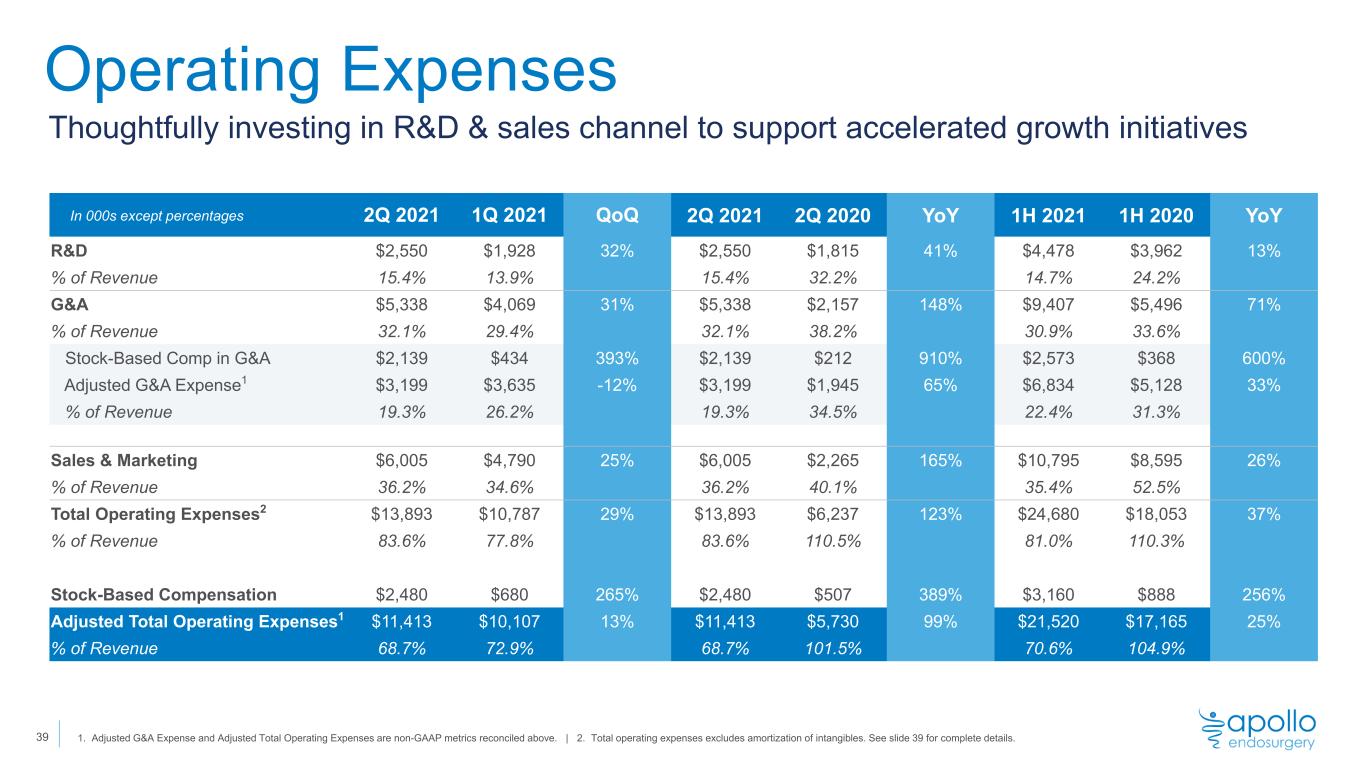

Operating Expenses In 000s except percentages 2Q 2021 1Q 2021 QoQ 2Q 2021 2Q 2020 YoY 1H 2021 1H 2020 YoY R&D $2,550 $1,928 32% $2,550 $1,815 41% $4,478 $3,962 13% % of Revenue 15.4% 13.9% 15.4% 32.2% 14.7% 24.2% G&A $5,338 $4,069 31% $5,338 $2,157 148% $9,407 $5,496 71% % of Revenue 32.1% 29.4% 32.1% 38.2% 30.9% 33.6% Stock-Based Comp in G&A $2,139 $434 393% $2,139 $212 910% $2,573 $368 600% Adjusted G&A Expense1 $3,199 $3,635 -12% $3,199 $1,945 65% $6,834 $5,128 33% % of Revenue 19.3% 26.2% 19.3% 34.5% 22.4% 31.3% Sales & Marketing $6,005 $4,790 25% $6,005 $2,265 165% $10,795 $8,595 26% % of Revenue 36.2% 34.6% 36.2% 40.1% 35.4% 52.5% Total Operating Expenses2 $13,893 $10,787 29% $13,893 $6,237 123% $24,680 $18,053 37% % of Revenue 83.6% 77.8% 83.6% 110.5% 81.0% 110.3% Stock-Based Compensation $2,480 $680 265% $2,480 $507 389% $3,160 $888 256% Adjusted Total Operating Expenses1 $11,413 $10,107 13% $11,413 $5,730 99% $21,520 $17,165 25% % of Revenue 68.7% 72.9% 68.7% 101.5% 70.6% 104.9% 1. Adjusted G&A Expense and Adjusted Total Operating Expenses are non-GAAP metrics reconciled above. | 2. Total operating expenses excludes amortization of intangibles. See slide 39 for complete details. 39 Thoughtfully investing in R&D & sales channel to support accelerated growth initiatives