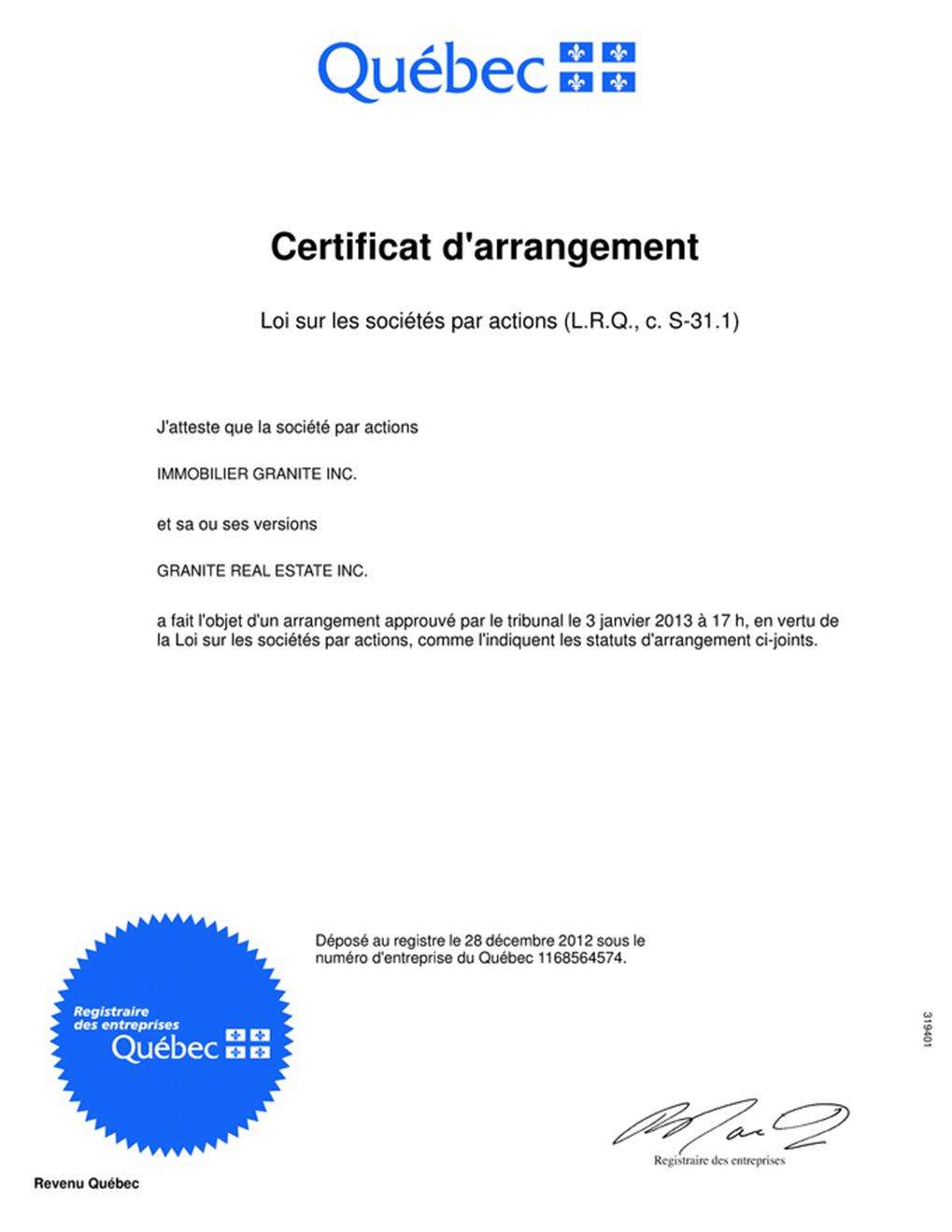

| 319401 Revenu Québec Certificat d'arrangement Loi sur les sociétés par actions (L.R.Q., c. S-31.1) J'atteste que la société par actions IMMOBILIER GRANITE INC. et sa ou ses versions GRANITE REAL ESTATE INC. a fait l'objet d'un arrangement approuvé par le tribunal le 3 janvier 2013 à 17 h, en vertu de la Loi sur les sociétés par actions, comme l'indiquent les statuts d'arrangement ci-joints. Déposé au registre le 28 décembre 2012 sous le numéro d'entreprise du Québec 1168564574. |

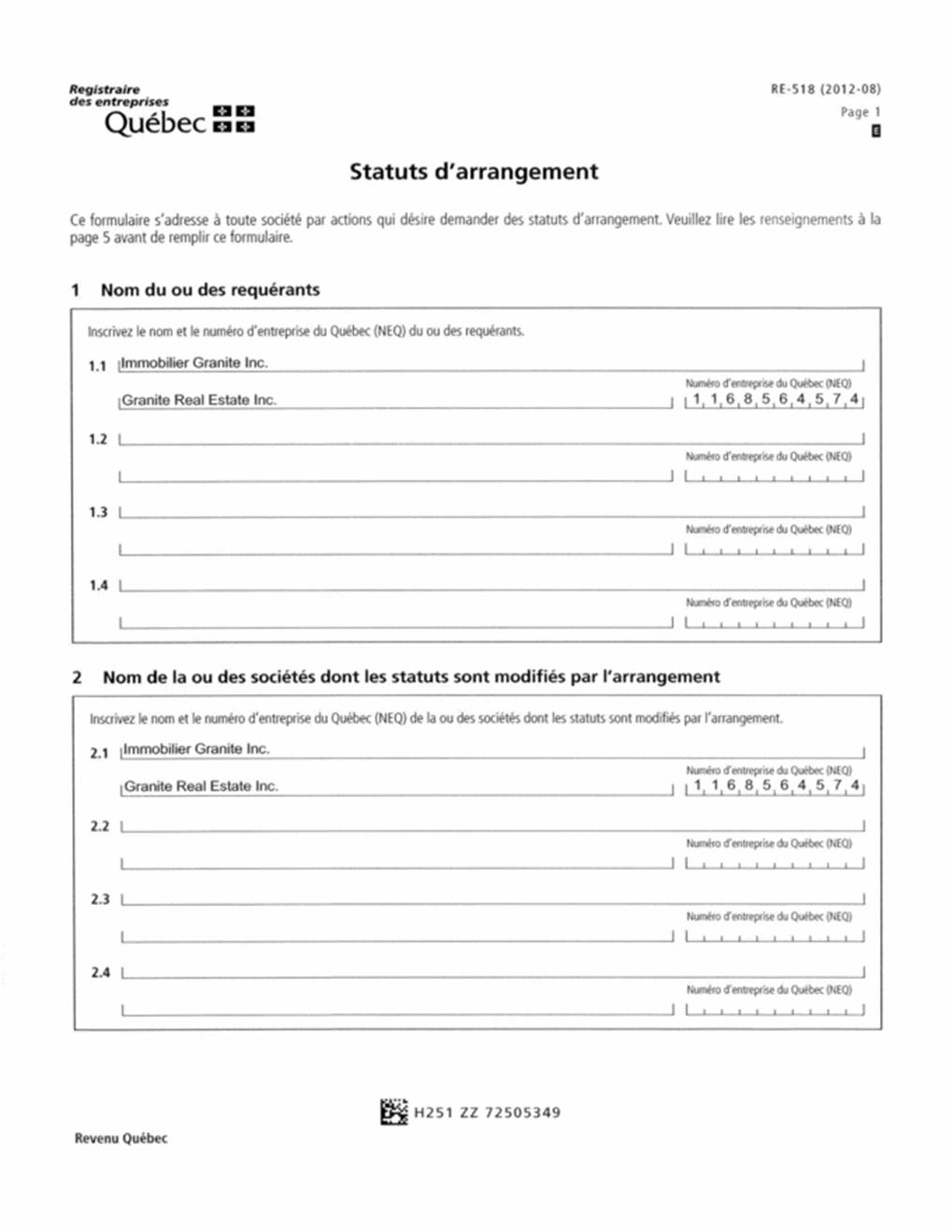

| RE-518 (2012-08) Statuts d’arrangement Ce formulaire s’adresse à toute société par actions qui désire demander des statuts d’arrangement. Veuillez lire les renseignements à la page 5 avant de remplir ce formulaire. 1 Nom du ou des requérants Inscrivez le nom et le numéro d’entreprise du Québec (NEQ) du ou des requérants. 1.1 Immobilier Granite Inc. Numéro d’entreprise du Québec (NEQ) Granite Real Estate Inc. 1168564574 1.2 Numéro d’entreprise du Québec (NEQ) 1.3 Numéro d’entreprise du Québec (NEQ) 1.4 Numéro d’entreprise du Québec (NEQ) 2 Nom de la ou des sociétés dont les statuts sont modifiés par l’arrangement Inscrivez le nom et le numéro d’entreprise du Québec (NEQ) de la ou des sociétés dont les statuts sont modifiés par l’arrangement. 2.1 Immobilier Granite Inc. Numéro d’entreprise du Québec (NEQ) Granite Real Estate Inc. 1168564574 2.2 Numéro d’entreprise du Québec (NEQ) 2.3 Numéro d’entreprise du Québec (NEQ) 2.4 Numéro d’entreprise du Québec (NEQ) H251 ZZ 72505349 Revenu Québec |

| 3 Nom de la ou des sociétés issues de la ou des fusions Inscrivez le nom et le numéro d'entreprise du Québec (NEQ) de la ou des sociétés issues de la ou des fusions. 3.1 S.O. Numéro d’entreprise du Québec (NEQ) 3.2 Numéro d’entreprise du Québec (NEQ) 3.3 Numéro d’entreprise du Québec (NEQ) 3.4 Numéro d’entreprise du Québec (NEQ) 4 Nom de la ou des sociétés dissoutes Inscrivez le nom et le numéro d'entreprise du Québec (NEQ) de la ou des sociétés dissoutes. 4.1 S.O. Numéro d’entreprise du Québec (NEQ) 4.2 Numéro d’entreprise du Québec (NEQ) 4.3 Numéro d’entreprise du Québec (NEQ) 4.4 Numéro d’entreprise du Québec (NEQ) H252 ZZ 72505350 |

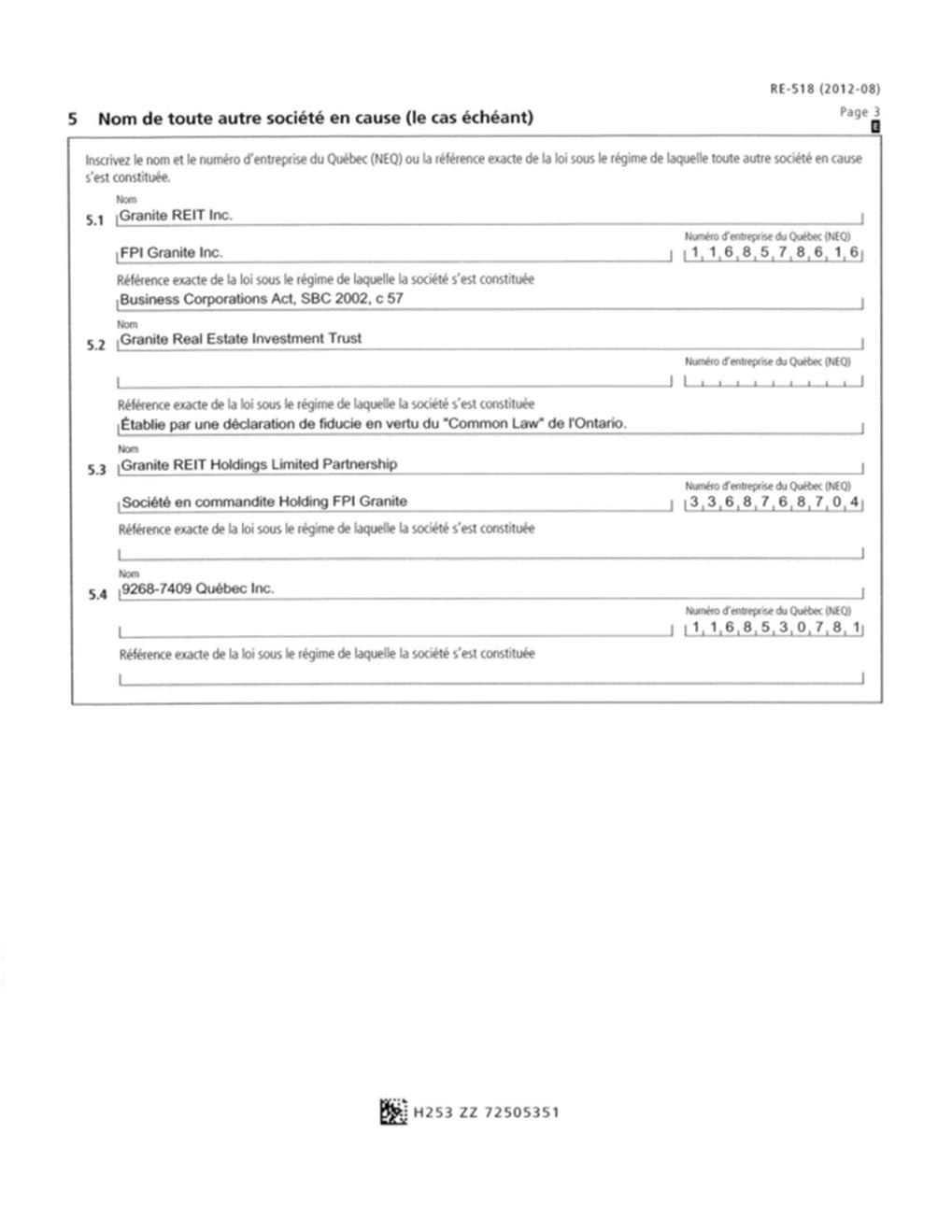

| 5 Nom de toute autre société en cause (le cas échéant) Inscrivez le nom et le numéro d'entreprise du Québec (NEQ) ou la référence exacte de la loi sous le régime de laquelle toute autre société en cause s’est constituée. Nom 5.1 Granite REIT Inc. Numéro d’entreprise du Québec (NEQ) FPI Granite Inc. 1168578616 Référence exacte de la loi sous le régime de laquelle la société s'est constituée Business Corporations Act, SBC 2002, c 57 Nom 5.2 Granite Real Estate Investment Trust Numéro d’entreprise du Québec (NEQ) Référence exacte de la loi sous le régime de laquelle la société s'est constituée Établie par une déclaration de fiducie en vertu du "Common Law" de l’Ontario. Nom 5.3 Granite REIT Holdings Limited Partnership Numéro d’entreprise du Québec (NEQ) Société en commandite Holding FPI Granite 3368768704 Référence exacte de la loi sous le régime de laquelle la société s'est constituée Nom 5.4 9268-7409 Québec Inc. Numéro d’entreprise du Québec (NEQ) 1168530781 Référence exacte de la loi sous le régime de laquelle la société s'est constituée H253 ZZ 72505351 |

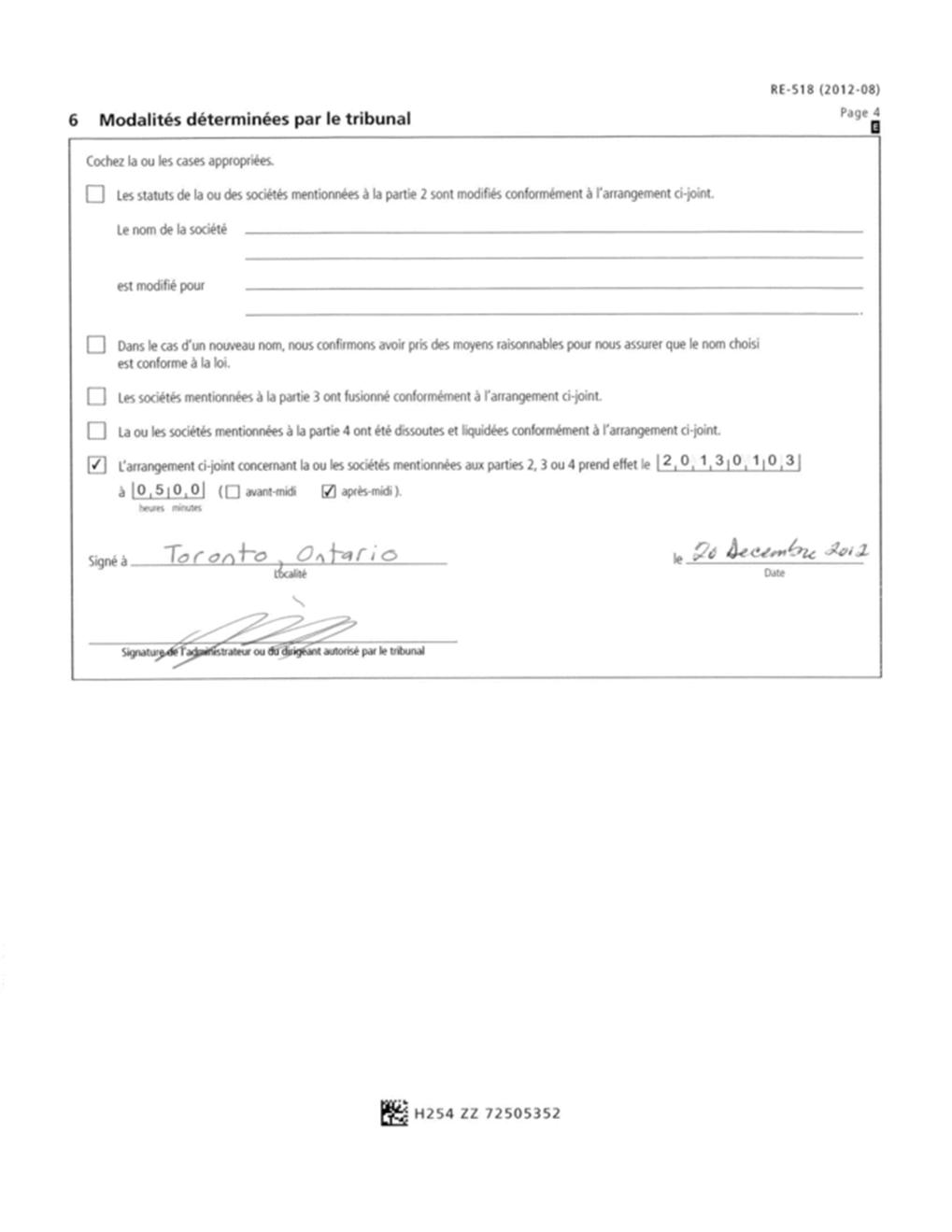

| 6 Modalités déterminées par le tribunal Cochez la ou les cases appropriées. Les statuts de la ou des sociétés mentionnées à la partie 2 sont modifiés conformément à l'arrangement ci-joint. Le nom de la société est modifié pour Dans le cas d'un nouveau nom, nous confirmons avoir pris des moyens raisonnables pour nous assurer que le nom choisi est conforme à la loi. Les sociétés mentionnées à la partie 3 ont fusionné conformément à l'arrangement ci-joint. La ou les sociétés mentionnées à la partie 4 ont été dissoutes et liquidées conformément a l'arrangement ci-joint. L'arrangement ci-joint concernant la ou les sociétés mentionnées aux parties 2, 3 ou 4 prend effet le 20130103 à 0500 ( avant-midi aprés-midi ). neures minutes Signé à Toronto, Ontario le 20 December 2012 Localité Date /s/ [ILLEGIBLE] Signature de l’ adminstrateur ou du dirigeant autorisé par le tribunal H254 ZZ 72505352 |

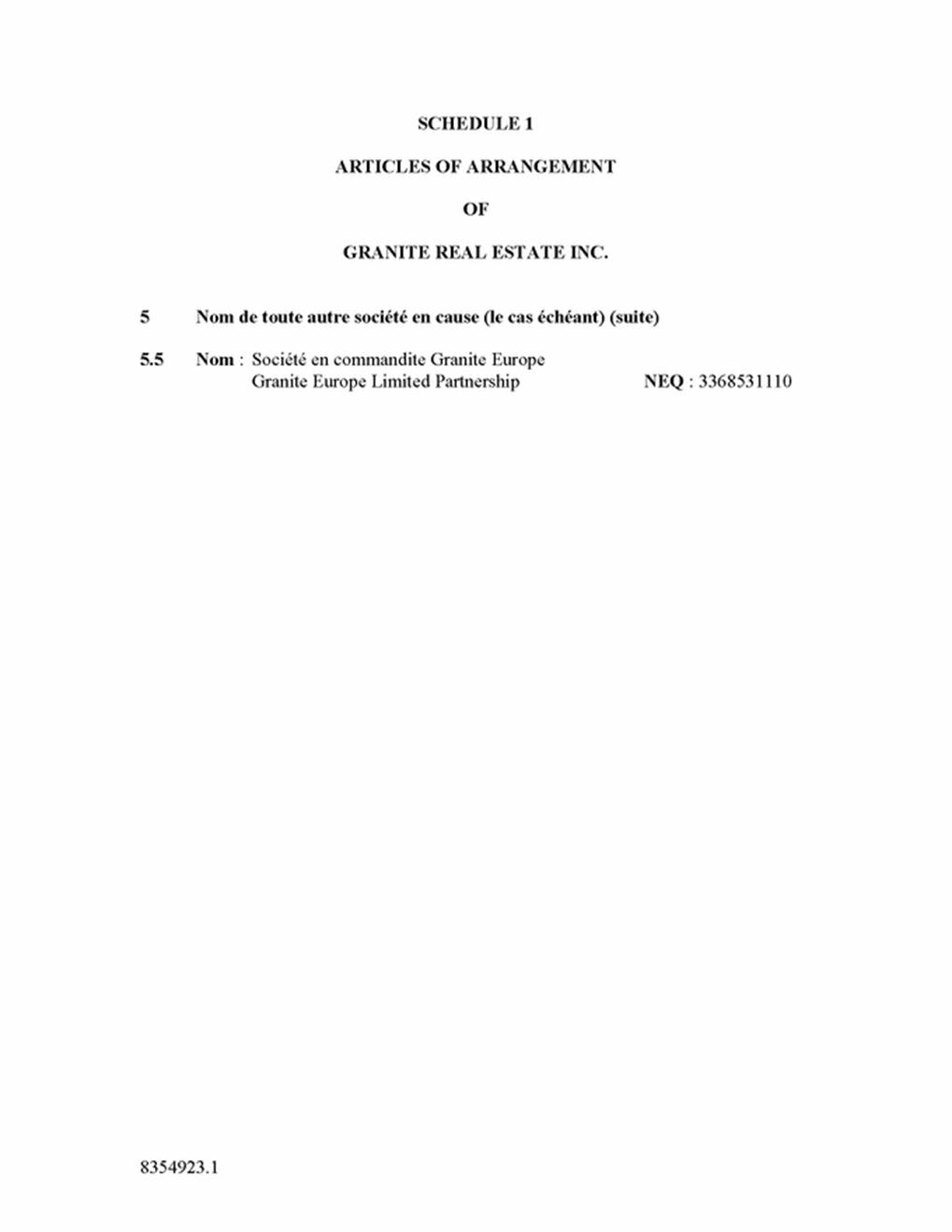

| 8354923.1 SCHEDULE 1 ARTICLES OF ARRANGEMENT OF GRANITE REAL ESTATE INC. 5 Nom de toute autre société en cause (le cas échéant) (suite) 5.5 Nom : Société en commandite Granite Europe Granite Europe Limited Partnership NEQ : 3368531110 |

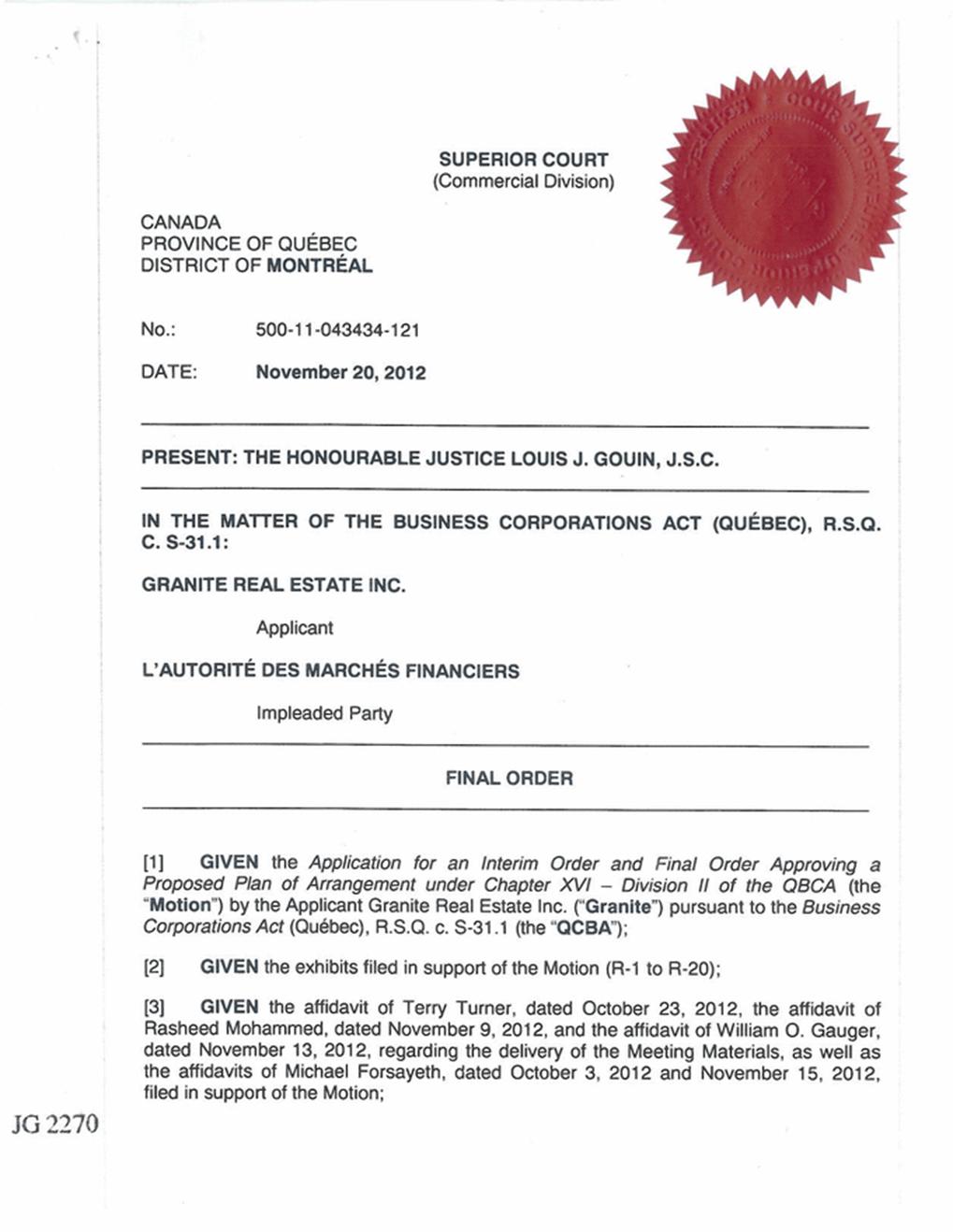

| SUPERIOR COURT (Commercial Division) CANADA PROVINCE OF QUÉBEC DISTRICT OF MONTRÉAL No.: 500-11-043434-121 DATE: November 20, 2012 PRESENT: THE HONOURABLE JUSTICE LOUIS J. GOUIN, J.S.C. IN THE MATTER OF THE BUSINESS CORPORATIONS ACT (QUÉBEC), R.S.Q.C. S-31.1: GRANITE REAL ESTATE INC. Applicant L’AUTORITÉ DES MARCHÉS FINANCIERS Impleaded Party FINAL ORDER [1] GIVEN the Application for an Interim Order and Final Order Approving a Proposed Plan of Arrangement under Chapter XVI — Division II of the QBCA (the “Motion”) by the Applicant Granite Real Estate Inc. (“Granite”) pursuant to the Business Corporations Act (Québec), R.S.Q. c. S-31.1 (the “QCBA”); [2] GIVEN the exhibits filed in support of the Motion (R-1 to R-20); [3] GIVEN the affidavit of Terry Turner, dated October 23, 2012, the affidavit of Rasheed Mohammed, dated November 9, 2012, and the affidavit of William O. Gauger, dated November 13, 2012, regarding the delivery of the Meeting Materials, as well as the affidavits of Michael Forsayeth, dated October 3, 2012 and November 15, 2012, filed in support of the Motion; |

[4] GIVEN the Interim Order rendered by this Court on October 9, 2012 (the “Interim Order”);

[5] GIVEN the Amended and Restated Arrangement Agreement and the Amended Plan of Arrangement found at Schedule A thereto (Exhibit R-14);

[6] GIVEN the representations of counsel for the Applicant;

[7] GIVEN that Granite has complied with the terms of the Interim Order;

[8] GIVEN that the Shareholders of Granite have overwhelmingly approved the proposed Arrangement, with 99.83% of the votes cast by Shareholders voting in person or by proxy voting in favour of the Arrangement Resolution;

[9] GIVEN that, pursuant to the terms of the Interim Order, no Notice of Appearance and/or Contestation was filed by any person in connection with the Hearing for a Final Order;

[10] GIVEN that this Court is satisfied that the Autorité des marchés financiers has been duly served with the Motion and notified of the Hearing for a Final Order and has confirmed in writing that it would not appear or be heard on the Motion;

[11] GIVEN that the evidence, and the following factors in particular, support the conclusion that the Arrangement is fair and reasonable and provides for a fair and balanced resolution of stakeholder objections (if any):

(a) Granite received a Fairness Opinion advising that the Arrangement is fair, from a financial point of view, to the Shareholders;

(b) the Board of Directors of Granite, after considering all relevant factors and information, unanimously determined that the Arrangement is in the best interests of Granite and is fair and reasonable to Granite and to the Shareholders, and unanimously approved the Arrangement and resolved to recommend that the Shareholders vote in favour of the Arrangement Resolution;

(c) the Circular fully discloses the nature and the details of the Arrangement, so as to enable Shareholders to be properly informed in determining whether to approve the Arrangement Resolution;

(d) the Arrangement Resolution was approved by the Requisite Approval in accordance with the Interim Order; and

(e) no person filed a Notice of Appearance or raised any Contestation in connection with the hearing of the Motion.

[12] GIVEN the provisions of the QBCA;

2

[13] GIVEN that this Court is satisfied that the Arrangement conforms with the requirements of the QBCA, has a valid business purpose, resolves any objections by those whose legal rights are being arranged in a fair and balanced way, is put forth in good faith and is fair and reasonable;

[14] GIVEN that this Court has been advised that the approval of the Arrangement by this Court will constitute the basis for an exemption from registration under Section 3(a)(10) of the United States Securities Act of 1933, as amended, with respect to the Stapled Units to be issued pursuant to the Arrangement;

FOR THESE REASONS, THE COURT:

[15] GRANTS the Application for a Final Order;

[16] DISPENSES Granite from further service of the Application;

[17] DECLARES that the service of the Notice of Final Hearing was served in conformity with the Interim Order and is valid and sufficient;

[18] DECLARES that all the capitalized terms used in the Final Order but not otherwise defined shall have the meaning ascribed thereto in the Application or otherwise as specifically stated by the Court;

[19] DECLARES that Granite has complied with all actions or steps required to be taken by it pursuant to the Interim Order and the QBCA or in connection with documents or acts contemplated by the Interim Order, including, without limitation, that the Meeting Materials were distributed in compliance with the Interim Order and the Meeting was called, held and conducted in compliance with the Interim Order and the QBCA;

[20] DECLARES that the Arrangement, as described in the Plan of Arrangement (attached to this Final Order as Schedule “A”), conforms with the requirements of the QBCA, has a valid business purpose, resolves in a fair and balanced way the objections of those whose legal rights are being arranged, and is fair and reasonable;

[21] DECLARES that the approval of the Arrangement Resolution by the Requisite Approval constitutes an approval of the Arrangement by the Shareholders;

[22] DECLARES that the Arrangement, as described in the Plan of Arrangement as it may be amended, modified and/or supplemented by the Parties in accordance with its terms, is approved and the provisions of the Plan of Arrangement shall become effective at the Effective Time and shall be binding, at and after the Effective Time, on the Parties to the Arrangement Agreement and on the Shareholders;

[23] AUTHORIZES Michael Forsayeth, in his capacity as an officer of Granite, or any other director or officer of Granite, to sign Articles of Arrangement of Granite in respect of the Arrangement, and AUTHORIZES the filing of the Articles of Arrangement with the Enterprise Registrar pursuant to Section 418 of the QBCA;

3

[24] DECLARES that the Court has been advised that this Final Order will serve as a basis of a claim to an exemption, pursuant to Section 3(a)(10) of the United States Securities Act of 1933, as amended, from the registration requirements otherwise imposed by such Act regarding the distribution of Stapled Units pursuant to the Plan of Arrangement, and for such purposes DECLARES that the terms and conditions of the Arrangement are procedurally and substantively fair and reasonable to the Shareholders;

[25] DECLARES that Granite is authorized to take all steps and actions necessary or appropriate to implement the Arrangement and the transactions contemplated thereby in accordance with and subject to the terms of the Arrangement Agreement and the Plan of Arrangement (including entering into any agreements or other documents which are to come into effect in connection with the Arrangement);

[26] DECLARES and ORDERS that it seeks and requests the aid and recognition of (i) any court or any judicial, regulatory or administrative body in any province or territory of Canada, (ii) any judicial, regulatory or administrative tribunal or other court constituted pursuant to the Parliament of Canada or the legislature of any province and (iii) any court or any judicial, regulatory or administrative body of the United States or any other country, to act in aid of and to assist this Honourable Court in carrying out the terms of the Final Order as rendered herein;

[27] DECLARES that this Final Order remains in force notwithstanding appeal and without the necessity of furnishing any security;

[28] DECLARES that this Court shall remain seized of this matter to resolve any difficulty which may arise in relation to, or in connection with the implementation of, the Arrangement; and

[29] THE WHOLE WITHOUT COSTS, save in the event of contestation, in which case with entire costs against said contesting party.

| /s/ LOUIS J. GOUIN, J.S.C. |

| LOUIS J. GOUIN, J.S.C. |

| |

| |

Me Sébastien Guy Me Adam T. Spiro Me Paul Martel BLAKE, CASSELS & GRAYDON LLP Attorneys for the Applicant |

|

Date of hearing: November 20, 2012 | |

4

| SCHEDULE A PLAN OF ARRANGEMENT UNDER CHAPTER XVI – DIVISION II BUSINESS CORPORATIONS ACT (QUÉBEC) |

|

| |

|

| |

| ARTICLE 1 INTERPRETATION |

1.1 Definitions

In this Plan of Arrangement, the following terms have the following meanings:

(a) “Affected Subsidiaries” means each body corporate, partnership and other entity, if any, referred to in Section 3.1 that is, immediately preceding the Effective Time, controlled by Granite;

(b) “Arrangement” means the arrangement under Chapter XVI — Division II of the QBCA on the terms and subject to the conditions set out in this Plan of Arrangement, subject to any amendments or variations thereto made in accordance with the Arrangement Agreement or Article 6 of this Plan of Arrangement or made at the direction of the Court in the Final Order with the consent of Granite, acting reasonably;

(c) “Arrangement Agreement” means the amended and restated arrangement agreement dated October 11, 2012 between Granite, Granite REIT, Granite GP, Granite LP, Fin GP and Fin LP, as the same may be amended, supplemented or otherwise modified from time to time in accordance with the terms thereof;

(d) “Arrangement Resolution” means the special resolution approving this Plan of Arrangement to be voted upon by the Granite Common Shareholders at the Meeting;

(e) “Articles of Arrangement” means the articles of arrangement of Granite in respect of the Arrangement, required to be filed pursuant to section 418 of the QBCA with the Enterprise Registrar after the Final Order is made by the Court, which shall be in form and content satisfactory to Granite;

(f) “BCBCA” means the Business Corporations Act (British Columbia), S.B.C. 2002, c. 57, including the regulations promulgated thereunder, in either case as amended;

(g) “Business Day” means any day, other than a Saturday, a Sunday or any other day on which the principal chartered banks located in (i) Toronto, Ontario, or (ii) Montreal, Québec are not open for business during normal banking hours;

(h) “Certificate of Arrangement” means the certificate of arrangement to be issued by the Enterprise Registrar in accordance with Chapter XVIII of the QBCA in respect of the Articles of Arrangement;

(i) “Circular” means the notice of the Meeting and accompanying management information circular/proxy statement, including all schedules, appendices and exhibits thereto, sent to Granite Common Shareholders in connection with the Meeting, as amended, supplemented or otherwise modified from time to time;

(j) “Class X Shares” means the Class X shares to be added to the share capital of Granite pursuant to Section 3.1(h);

(k) “Court” means the Superior Court of Québec;

(l) “Debentures” means the 6.05% Senior Unsecured Debentures, Series 1, due December 22, 2016, issued by Granite under the Indenture;

(m) “Depositary” means Computershare Investor Services Inc., in its capacity as depositary for the Arrangement;

(n) “Dissent Rights” means the rights of a registered Granite Common Shareholder to demand that Granite repurchase all of the Granite Common Shares held by such Granite Common Shareholder in accordance with Chapter XIV of the QBCA, as modified by the Interim Order and Article 5 hereof;

(o) “Dissenting Shareholder” means a registered Granite Common Shareholder that validly exercises Dissent Rights in respect of the Arrangement Resolution and has not renounced or been deemed to have renounced such Dissent Rights;

(p) “Effective Date” means the date the Arrangement is effective under the QBCA;

(q) “Effective Time” means 5:00 p.m. (Montreal time) on the Effective Date or such other time on the Effective Date as may be specified in writing by Granite;

(r) “Enterprise Registrar” means the enterprise registrar appointed by the Minister of Revenue of Québec;

(s) “Fin GP” means 9268-7409 Québec Inc., a corporation incorporated under the QBCA to act as the general partner of Fin LP, and a wholly-owned subsidiary of Granite;

(t) “Fin LP” means Granite Europe Limited Partnership, a limited partnership formed under the laws of Québec, with Fin GP as the general partner thereof and Granite as the initial limited partner;

(u) “Final Order” means the order of the Court made after application therefor, presented to the Court in form and content acceptable to Granite, acting reasonably, approving the Arrangement as such order may be amended by the Court (with the consent of Granite, acting reasonably) at any time prior to the Effective Date or, if appealed, then, unless such appeal is withdrawn or denied, as affirmed or as amended (provided that any requested amendment is acceptable to Granite, acting reasonably) on appeal;

(v) “First Tranche Units” has the meaning ascribed thereto in Section 3.1(i)(i);

(w) “Granite” means Granite Real Estate Inc., a corporation continued under the QBCA;

(x) “Granite Common Shareholders” means the holders of Granite Common Shares;

(y) “Granite Common Shares” means the common shares in the capital of Granite;

(z) “Granite GP” means Granite REIT Inc., a corporation incorporated under the BCBCA that will act as the general partner of Granite LP;

(aa) “Granite GP Common Shares” means the common shares in the capital of Granite GP;

(bb) “Granite GP Non-Voting Shares” means the non-voting shares in the capital of Granite GP;

(cc) “Granite LP” means a limited partnership formed under the laws of Québec to participate in the Arrangement, as contemplated herein and in the Arrangement Agreement;

2

(dd) “Granite Option” means an option to acquire a Granite Common Share issued under the Granite Option Plan;

(ee) “Granite Option Plan” means Granite’s amended and restated incentive stock option plan;

(ff) “Granite REIT” means Granite Real Estate Investment Trust, a trust formed under the laws of Ontario;

(gg) “Granite REIT Units” means the trust units of Granite REIT;

(hh) “Indenture” means the trust indenture dated December 22, 2004 between Granite and BNY Trust Company of Canada providing for the issue of debentures from time to time;

(ii) “Interim Order” means the order of the Court made after application therefor, presented to the Court in form and content acceptable to Granite, acting reasonably, providing for, among other things, the calling and holding of the Meeting, as the same may be amended by the Court at the request of Granite;

(jj) “Law” or “Laws” means all laws (including common law), by-laws, statutes, rules, regulations, principles of law and equity, orders, writs, awards, decrees, rulings, ordinances, judgments, injunctions, determinations or other requirements, whether domestic or foreign, and the terms and conditions of any grant of approval, permission, authority or license of any Governmental Entity or self-regulatory authority (including, where applicable, the TSX and the NYSE), and the term “applicable” with respect to such Laws and in a context that refers to one or more persons, means such Laws as are applicable to such person or its business, undertaking, property or securities and emanate from a person having jurisdiction over the person or persons or its or their business, undertaking, property or securities;

(kk) “Letter of Transmittal” means a letter of transmittal delivered or to be delivered by Granite to Granite Common Shareholders in connection with the Arrangement;

(ll) “Liens” means any hypothecs, mortgages, pledges, assignments, liens, charges, security interests, encumbrances and adverse rights or claims, other third person interests or encumbrances of any kind, whether contingent or absolute, and any agreement, option, right or privilege (whether by Law, contract or otherwise) capable of becoming any of the foregoing;

(mm) “Meeting” means the special meeting of Granite Common Shareholders, including any adjournment or postponement thereof, called and held to consider, among other things, the Arrangement Resolution;

(nn) “number” in respect of a quantity of shares or units includes a fraction of a share or unit, or a whole number plus a fraction of a share or unit;

(oo) “NYSE” means the New York Stock Exchange;

(pp) “Obligation Units” has the meaning ascribed thereto in Section 3.1(i);

(qq) “Outstanding Shareholder” means a holder of Outstanding Shares after giving effect to Section 3.1(a) and before giving effect to Section 3.1(i) and, for greater certainty, all references to the number of Outstanding Shares of Outstanding Shareholders refer to the number of Outstanding Shares held by them within this time period;

(rr) “Outstanding Shares” has the meaning ascribed thereto in Section 3.1(b);

3

(ss) “person” shall be broadly interpreted and includes an individual, partnership, association, body corporate, trust, trustee, executor, administrator, legal representative, government (including any Governmental Entity) or any other entity, whether or not having legal status;

(tt) “Plan of Arrangement” means this Plan of Arrangement and any amendments or variations thereto made in accordance with the Arrangement Agreement or Article 6 hereof or made at the direction of the Court in the Final Order with the consent of Granite;

(uu) “QBCA” means the Business Corporations Act (Québec), R.S.Q. c. S-31.1;

(vv) “resident”, when used in respect of a limited partnership with one general partner, refers to the country of incorporation or formation of such general partner;

(ww) “Residual Number” has the meaning ascribed thereto in Section 3.1(d);

(xx) “Stapled Unit” means a unit consisting of one Granite GP Common Share and one Granite REIT Unit;

(yy) “Stapled Unit Support Agreement” means the agreement between Granite REIT and Granite GP that will contain provisions to facilitate the Stapled Unit structure, including in relation to redemption of Granite REIT Units and Granite GP Common Shares, declaration of distributions and dividends and the holding of meetings of holders of Stapled Units;

(zz) “Settlement Loan” means a loan in the amount of U.S.$900,000.00 owing by MI Developments (America) Inc., a subsidiary of Granite, to Granite REIT, contributed by Granite to Granite REIT to settle Granite REIT;

(aaa) “subsidiary” (or “wholly-owned subsidiary”) in respect of any person includes an indirect subsidiary (or wholly-owned subsidiary) of such person, and includes (including for the purposes of this definition) a subsidiary limited partnership (including a “KG”, or Kommanditgesellschaft) of that person;

(bbb) “Tax Act” means the Income Tax Act (Canada); and

(ccc) “TSX” means the Toronto Stock Exchange.

1.2 Interpretation Not Affected by Headings

The division of this Plan of Arrangement into articles, sections, paragraphs and subparagraphs and the insertion of headings herein are for convenience of reference only and shall not affect the construction or interpretation of this Plan of Arrangement. The terms “this Plan of Arrangement”, “hereof”, “herein”, “hereto”, “hereunder” and similar expressions refer to this Plan of Arrangement and not to any particular article, section or other portion hereof and include any instrument supplementary or ancillary hereto.

1.3 Number and Gender

In this Plan of Arrangement, unless the context otherwise requires, words importing the singular shall include the plural and vice versa and words importing the use of either gender shall include both genders and neuter.

1.4 Date for any Action

If the date on which any action is required to be taken hereunder is not a Business Day, such action shall be required to be taken on the next succeeding day which is a Business Day.

4

1.5 References to Statutes, etc.

In this Plan of Arrangement, references to a particular statute or Law shall be to such statute or Law and the rules, regulations and published policies made thereunder, as now in effect and as they may be promulgated thereunder or amended from time to time. References to any agreement or contract are to that agreement or contract as amended, modified or supplemented from time to time in accordance with the terms hereof and thereof. Any reference in this Plan of Arrangement to a person includes its heirs, administrators, executors, legal personal representatives, predecessors, successors and permitted assigns of that person.

1.6 Governing Law and Time

This Plan of Arrangement shall be governed, including as to validity, interpretation and effect, by the laws of the Province of Québec and the laws of Canada applicable therein. All times expressed herein are local time (Montreal, Québec) unless otherwise stipulated herein.

1.7 Exhibits

The following Exhibits are attached to this Plan of Arrangement and are incorporated in and form part of this Plan of Arrangement:

Exhibit A — European Subsidiaries

Exhibit B — Terms of Class X Shares of Granite Real Estate Inc.

ARTICLE 2

PLAN OF ARRANGEMENT AND EFFECT OF ARRANGEMENT

2.1 Plan of Arrangement

This Plan of Arrangement constitutes an arrangement as referred to in Chapter XVI — Division II of the QBCA and is made pursuant to, and is subject to the provisions of, the Arrangement Agreement.

2.2 Certificate and Articles of Arrangement

(a) The Articles of Arrangement and Certificate of Arrangement shall be filed and issued, respectively, with respect to this Arrangement in its entirety. The Certificate of Arrangement shall be conclusive evidence that the Arrangement has become effective and that each of the provisions of Article 3 has become effective in the sequence and at the times set out therein.

(b) Other than as expressly provided for herein, no portion of this Plan of Arrangement shall take effect with respect to any party or person until the Effective Time. Furthermore, each of the events listed in Article 3 shall be, without affecting the timing set out in Article 3, mutually conditional, such that no event described in said Article 3 may occur without all steps occurring, and those events shall effect the integrated transaction which constitutes the Arrangement.

2.3 Effectiveness of the Arrangement

This Plan of Arrangement, upon the filing of the Articles of Arrangement and the issue of the Certificate of Arrangement, shall become effective on, and be binding on and after, the Effective Time on: (i) all registered and beneficial holders of Granite Common Shares; (ii) Granite, (iii) Granite REIT, (iv) Granite GP and Granite LP, (v) Fin GP and Fin LP, and (vi) the Affected Subsidiaries.

5

ARTICLE 3

ARRANGEMENT

3.1 Arrangement

Commencing at the Effective Time, and ending immediately prior to 5:59 p.m. (Montreal time) on the Effective Date, each of the events set out below shall occur and shall be deemed to occur in the following order on the Effective Date, without any further act or formality except as otherwise provided herein:

Dissenting Shareholders

(a) the Granite Common Shares held by Dissenting Shareholders who have validly exercised Dissent Rights shall be deemed to have been transferred to and repurchased by Granite and cancelled and shall cease to be outstanding and such Dissenting Shareholders shall cease to have any rights as Granite Common Shareholders other than the right to be paid the fair value of their Granite Common Shares;

Granite Subscription for Granite GP Non-Voting Shares

(b) Granite shall subscribe for and purchase, and Granite GP shall issue to Granite, a number of Granite GP Non-Voting Shares equal to the number of outstanding Granite Common Shares (for greater certainty, after the cancellation of Granite Common Shares formerly held by Dissenting Shareholders under Section 3.1(a), above) (the “Outstanding Shares”) in exchange for nominal consideration as agreed between Granite and Granite GP;

Transfer of Certain Loans by Granite to Fin LP and Assets by Granite to Granite LP

(c) �� (i) Granite shall transfer loans owing to it by one or more of its European direct and indirect subsidiaries listed on Exhibit A, except as and to the extent determined otherwise by Granite in a written notice given to the other parties to the Arrangement Agreement prior to the Effective Time, to Fin LP as a contribution of capital; and

(ii) all of the assets of Granite (other than (A) shares or other equity securities of Granite’s subsidiaries which are resident outside Canada and the United States, (B) the Granite REIT Units held by Granite at this time (expected to be 24,975 Granite REIT Units), (C) its Granite GP Common Share(s) and its Granite GP Non-Voting Shares, acquired by it upon incorporation of Granite GP or in Section 3.1(b), above, respectively (D) its common share(s) of Fin GP and (E) such other assets as may be designated by Granite to be retained by it) shall be transferred by Granite to Granite LP, as a contribution of capital (in respect of the net asset value contributed), and Granite LP and Fin LP will agree to become bound by the terms of the Indenture and the Debentures as co-principal debtor, with Granite remaining as co-principal debtor, and Granite LP will assume all of the other liabilities of Granite (except as may be agreed by Granite and Granite LP), and the amounts payable under the Indenture and the Debentures shall be guaranteed by Granite and Granite GP;

Transfer of LP Units of Granite LP by Granite to Granite REIT

(d) Granite shall transfer all of the limited partnership units of Granite LP to Granite REIT in exchange for:

(i) the agreement by Granite REIT to guarantee the Debentures, and

(ii) a number of Granite REIT Units equal to (A) the number of Outstanding Shares, minus (B) the number of Granite REIT Units held by Granite immediately prior to such

6

transfer (expected to be 24,975 Granite REIT Units), minus (C) the number (such number, the “Residual Number”) of Granite REIT Units determined by Granite in accordance with the formula:

(A/B)*C,

where A is the fair market value of all the Class X Shares immediately after the implementation of Section 3.1(l), as determined by Granite, B is the fair market value of the Granite REIT Units at such time, as determined by Granite, and C is the number of Outstanding Shares;

Exchange of Options

(e) each outstanding Granite Option shall be exchanged for a new option to acquire a Granite REIT Unit and a new option to acquire a Granite GP Non-Voting Share (which will be converted into a Granite GP Common Share pursuant to Section 3.1(o) below), with the exercise price under each new option equal to the ratio of the fair market value of the security to which the new option relates immediately after the exchange to the fair market value of a Granite Common Share immediately prior to the exchange multiplied by the exercise price under the Granite Option;

Contribution of Settlement Loan by Granite REIT to Granite LP

(f) Granite REIT shall transfer the Settlement Loan to Granite LP as a contribution of capital;

Transfer of Granite GP Non-Voting Shares by Granite to Granite REIT

(g) Granite shall transfer to Granite REIT, as a contribution of capital, a number of Granite GP Non-Voting Shares equal to the Residual Number;

Amendment of Articles of Granite

(h) the authorized share capital of Granite shall be amended to add Class X Shares having the rights, privileges, restrictions and conditions set out in Exhibit B;

Exchange of Granite Common Shares

(i) all of the Outstanding Shares shall be simultaneously purchased by Granite from the Outstanding Shareholders for cancellation, and simultaneously cancelled by Granite, in exchange for the consideration specified in (i) to (iii) below:

(i) the transfer by Granite, to each of the Outstanding Shareholders having one of the 200 largest shareholdings of Outstanding Shares, of (A) 25 Granite REIT Units (if Granite determines that the fair value of a Granite REIT Unit is Cdn.$25.00 or more) or 100 Granite REIT Units (if Granite does not make such determination) (such Granite REIT Units delivered under this clause (A), the “First Tranche Units”) and (B) the same number of Granite GP Non-Voting Shares as the number of First Tranche Units transferred to such holder;

(ii) the creation of an obligation of Granite to deliver to each Outstanding Shareholder, pursuant to Section 3.1(k), that number of Granite REIT Units and of Granite GP Non-Voting Shares as is equal to the number of Outstanding Shares held by such Outstanding Shareholder minus the sum of (A) the number of Granite REIT Units (if any) delivered to that Outstanding Shareholder pursuant to Section 3.l(i)(i) and (B) the number of Class X Shares issued to such Outstanding Shareholder pursuant to Section 3.l(i)(iii), so that:

7

(A) in the case of Granite Common Shareholders other than those referred to in Section 3.1(i)(i), they will receive a number of such Granite REIT Units and Granite GP Common Shares that corresponds to the number of Outstanding Shares held by them, minus the number of Class X Shares that they will receive in Section 3.1(i)(iii);

(B) in the case of the Granite Common Shareholders referred to in Section 3.1(i)(i), they will receive a number of such Granite REIT Units and Granite GP Common Shares that corresponds to the number of Outstanding Shares held by them, minus the number of Class X Shares that they will receive in Section 3.1(i)(iii), and minus the number of Granite REIT Units which they received in Section 3.1(i)(i);

(iii) the issuance by Granite to each Outstanding Shareholder of that number of Class X Shares determined in accordance with the formula:

(D/E)*F,

where D is the number of Outstanding Shares of such Outstanding Shareholder, E is the total number of Outstanding Shares, and F is the Residual Number;

provided that, for greater certainty, the sum of the number of First Tranche Units, the number of Granite REIT Units (the “Obligation Units”) that Granite becomes obligated pursuant to Section 3.1(i)(ii) to deliver pursuant to Section 3.1(k) and the Residual Number shall equal the total number of Outstanding Shares;

Exchange of Class X Shares for Granite REIT Units and Granite GP Non-Voting Shares

(j) for each outstanding Class X Share, Granite REIT shall issue one Granite REIT Unit and transfer one Granite GP Non-Voting Share to the holder of such Class X Share in exchange for the right to require such Class X Share to be assigned to Granite LP;

Distribution of Remaining Granite REIT Units and Granite GP Non-Voting Shares

(k) the balance of the Granite REIT Units held by Granite, consisting of the Obligation Units, together with an equal number of Granite GP Non-Voting Shares, which Granite has an obligation to transfer pursuant to Section 3.1(i)(ii), above, shall be transferred by Granite to former holders of the Outstanding Shares in satisfaction of the obligation to do so under Section 3.l(i)(ii), above, such that, following this transfer, the number of outstanding Granite REIT Units (other than 25 Granite REIT Units held by Fin GP) and the number of outstanding Granite GP Non-Voting Shares shall be equal to the number of Outstanding Shares previously outstanding and each former holder of Outstanding Shares shall hold the same number of Granite REIT Units and Granite GP Non-Voting Shares as the number of Outstanding Shares held by such holder at the Effective Time;

Transfer of Class X Shares to Granite LP

(l) Granite REIT shall make a contribution of capital to Granite LP by exercising its right to require all the Class X Shares to be assigned to Granite LP, and all the Class X Shares shall thereupon be assigned to Granite LP;

Transfer of Fin LP Units to Granite

(m) all of the voting limited partnership units of Fin LP held by Granite LP (representing slightly under a 20% partnership interest in Fin LP) shall be transferred by Granite LP to Granite, in

8

consideration for the issuance of a number of Granite Common Shares agreed by Granite and Granite LP;

Conversion of Class X Shares of Granite

(n) all of the Class X Shares of Granite shall be converted by Granite LP into Granite Common Shares on a one-for-one basis in accordance with the terms of the Class X Shares;

Cancellation of Initial Granite GP Common Share and Conversion of Granite GP Non-Voting Shares

(o) concurrently:

(i) each Granite GP Common Share held by Granite shall be surrendered to Granite GP and cancelled; and

(ii) all of the Granite GP Non-Voting Shares shall be converted into Granite GP Common Shares on a one-for-one basis, and the Granite GP Non-Voting Shares shall no longer be issuable and shall thereafter be removed from the articles and authorized share capital of Granite GP upon the filing of articles of amendment as provided in the Arrangement Agreement;

Grant of Security for Indebtedness

(p) except as and to the extent determined otherwise by Granite in a written notice given to the other parties to the Arrangement Agreement prior to the Effective Time, movable hypothecs shall be granted in favour of Granite LP or Fin LP, as applicable, by the Affected Subsidiaries described below, to secure indebtedness owed to Granite LP or Fin LP, as applicable, as follows:

(i) a movable hypothec, pledging limited partnership units of subsidiary limited partnerships then held by Ml Developments (America) Inc., a corporation incorporated under the laws of Delaware and a wholly-owned subsidiary of Granite, granted by MI Developments (America) Inc. to Granite LP to secure indebtedness owing by MI Developments (America) Inc. to Granite LP;

(ii) �� a movable hypothec, pledging all promissory notes owed by subsidiaries of Granite to MI Developments Luxembourg S.à r.l., a corporation incorporated under the laws of Luxembourg and a wholly-owned subsidiary of Granite, granted by MI Developments Luxembourg S.à r.l. to Fin LP to secure indebtedness owing by Ml Developments Luxembourg S.à r.l. to Fin LP; and

(iii) (A) a movable hypothec, pledging limited partnership units of subsidiary limited partnerships then held by Magna IV. Beteiligungs GmbH, a corporation incorporated under the laws of Germany and a wholly-owned subsidiary of Granite, granted by Magna IV. Beteiligungs GmbH to Fin LP to secure indebtedness owing by Magna IV. Beteiligungs GmbH to Fin LP, (B) a movable hypothec, pledging limited partnership units of subsidiary limited partnerships then held by Exterior Real Estate GmbH & Co. KG, a limited partnership formed under the laws of Germany and a subsidiary of Granite, granted by Exterior Real Estate GmbH & Co. KG to Fin LP to secure indebtedness owing by Exterior Real Estate GmbH & Co. KG to Fin LP, and (C) a movable hypothec, pledging limited partnership units of subsidiary limited partnerships then held by Intier Automotive Beteiligungs GmbH, a corporation incorporated under the laws of Germany and a subsidiary of Granite, granted by Intier Automotive Beteiligungs GmbH to Fin LP to secure indebtedness owing by Intier Automotive Beteiligungs GmbH to Fin LP; and

9

Stapled Unit Matters

(q) each Granite REIT Unit shall be stapled to a Granite GP Common Share (except for 25 Granite REIT Units held by Fin GP) in accordance with their terms to form Stapled Units, the new options issued in exchange for the outstanding Granite Options pursuant to Section 3.1(e) will be combined to become options to acquire Stapled Units with an aggregate exercise price equal to the exercise price under such previously outstanding Granite Options, and Granite REIT and Granite GP shall enter into the Stapled Unit Support Agreement in connection therewith.

3.2 Transfers Free of Liens

Any transfer of any securities pursuant to the Arrangement shall be free and clear of any Liens.

3.3 Issuance of Stapled Units

(a) Upon the purchase of Granite Common Shares for cancellation under Section 3.1(i), each former registered holder of Granite Common Shares shall, without any further act or formality, cease to be the holder of the Granite Common Shares so purchased and the name of each such former registered holder of Granite Common Shares shall be removed from the register of shareholders.

(b) Upon the completion of the issue of Stapled Units pursuant to Section 3.1, each former registered holder of Granite Common Shares (other than Dissenting Shareholders, if any, that have properly exercised their Dissent Rights and who are ultimately entitled to be paid fair value for their Granite Common Shares) shall become the sole holder of the Stapled Units so issued and shall be added to the register of Stapled Units.

3.4 Withholding Rights

Granite and the Depositary, as applicable, shall be entitled to deduct and withhold from any consideration payable or otherwise deliverable to any former holder of Granite Common Shares such amounts as Granite and the Depositary may be required to deduct and withhold therefrom under any provision of the Tax Act or any other applicable Laws in respect of taxes. To the extent that such amounts are so deducted and withheld, such amounts shall be treated for all purposes hereof as having been paid to the person to whom such amounts would otherwise have been paid. Granite or the Depositary, as applicable, may sell or otherwise dispose of such portion of the consideration otherwise payable or deliverable to such holder as is necessary to provide sufficient funds to enable Granite or the Depositary, as applicable, to comply with such deduction and/or withholding requirements and Granite and the Depositary, as applicable, shall notify the holder thereof and remit any unapplied balance of the net proceeds of such sale.

3.5 Sale of Stapled Units

If it appears to Granite that it would be contrary to applicable Law to issue Granite GP Non-Voting Shares, Granite Class X Shares, Granite GP Common Shares, Granite REIT Units or any other securities pursuant to the Arrangement to a person that is not a resident of Canada or the United States, the Stapled Units that otherwise would be issued to that person may be issued to the Depositary for sale by the Depositary on behalf of that person. The Stapled Units so issued to the Depositary will be pooled and sold as soon as practicable after the Effective Date, on such dates and at such prices as the Depositary determines in its sole discretion. The Depositary shall not be obligated to seek or obtain a minimum price for any of the Stapled Units sold by it. Each such person will receive a pro rata share of the cash proceeds from the sale of the Stapled Units sold by the Depositary (less commissions, other reasonable expenses incurred in connection with the sale of the Stapled Units and any amount withheld in respect of taxes) in lieu of the Stapled Units themselves. None of Granite, Granite GP, Granite REIT or the Depositary will be liable for any loss arising out of any such sales.

10

ARTICLE 4

CERTIFICATES

4.1 Exchange of Certificates

Until surrendered as contemplated by this Section 4.1, each certificate that immediately prior to the Effective Time represented Granite Common Shares shall be deemed after the Effective Time to represent only the right to receive, upon such surrender, the consideration to which the holder thereof is entitled in lieu of such certificate as contemplated by Section 3.1 and this Section 4.1, less any amounts withheld pursuant to Section 3.4. Subject to surrender to the Depositary for cancellation of a certificate which immediately prior to the Effective Time represented outstanding Granite Common Shares, together with a duly completed and executed Letter of Transmittal and such additional documents and instruments as the Depositary may reasonably require, following the Effective Time the holder of such surrendered certificate shall be entitled to receive in exchange therefor, and the Depositary shall deliver to such holder, the consideration to which such holder is entitled under this Plan of Arrangement, less any amounts withheld pursuant to Section 3.4, and any certificate so surrendered shall forthwith be cancelled.

4.2 Lost Certificates

If any certificate which immediately prior to the Effective Time represented an interest in Granite Common Shares that were transferred pursuant to section 3.1 hereof has been lost, stolen or destroyed, upon the making of an affidavit of that fact by the person claiming such certificate to have been lost, stolen or destroyed, the former registered holder thereof shall, as a condition precedent to the receipt of any Stapled Units to be issued to such person, provide to Granite GP and Granite REIT and any relevant transfer agent or registrar a bond, in form and substance satisfactory to Granite GP and Granite REIT, or otherwise indemnify Granite GP and Granite REIT and any relevant transfer agent or registrar to their satisfaction, in their sole and absolute discretion, against any claim that may be made against them with respect to the certificate alleged to have been lost, stolen or destroyed.

ARTICLE 5

DISSENT RIGHTS

5.1 Dissent Rights

(a) Each registered holder of Granite Common Shares shall be entitled to exercise Dissent Rights in respect of the Arrangement in the manner set out in Chapter XIV of the QBCA, as modified by the Interim Order and this Article 5. Such modifications include that the written notice of intent to exercise the right to demand the repurchase of Granite Common Shares contemplated by Section 376 of the QBCA must be sent to the registered office of Granite no later than 5:00 p.m. on the date that is two (2) Business Days before the Meeting.

(b) In no case shall Granite or any other person be required to recognize any holder of Granite Common Shares who exercises Dissent Rights as a holder of Granite Common Shares after the Effective Time.

(c) Registered holders of Granite Common Shares who renounce, or are deemed to renounce, their right to demand the repurchase of their Granite Common Shares shall be deemed to have participated in the Arrangement, as of the Effective Time, and shall be entitled to receive the consideration to which holders of Granite Common Shares who have not exercised Dissent Rights are entitled under Section 3.1 hereof (less any amounts withheld pursuant to Section 3.4).

(d) For greater certainty, in addition to any other restrictions in Chapter XIV of the QBCA, no Granite Common Shareholder who has failed to exercise all the voting rights carried by the Granite Common Shares held by such Granite Common Shareholder against the Arrangement Resolution shall be entitled to exercise Dissent Rights with respect to the Arrangement.

11

ARTICLE 6

AMENDMENTS

6.1 Amendments by the Parties

The parties to the Arrangement Agreement may amend this Plan of Arrangement at any time and from time to time prior to the Effective Time, provided that each such amendment must be: (i) set out in writing; (ii) approved by the parties to the Arrangement Agreement; and (iii) filed with the Court.

6.2 Amendments Without Approval of the Court or Shareholders

Any amendment, modification or supplement to this Plan of Arrangement may be made prior to the Effective Time by Granite, or following the Effective Time by Granite REIT and Granite GP, without the approval of the Court or Granite Common Shareholders, provided that it concerns a matter which, in the reasonable opinion of Granite (or, following the Effective Time, Granite REIT and Granite GP), is of an administrative nature required to better give effect to the implementation of this Plan of Arrangement or is not adverse to the financial or economic interests of Granite Common Shareholders.

6.3 Proposed Amendments Prior to the Meeting

Subject to Section 6.2, any amendment to this Plan of Arrangement may be proposed by Granite at any time prior to or at the Meeting (provided that the other parties to the Arrangement Agreement shall have consented thereto) with or without any prior notice or communication to Granite Common Shareholders, and if so proposed and accepted by the persons voting at the Meeting (other than as may be required under the Interim Order), shall become part of this Plan of Arrangement for all purposes.

6.4 Amendments After the Meeting

Subject to Section 6.2, Granite may amend, modify and/or supplement this Plan of Arrangement at any time and from time to time after the Meeting and prior to the Effective Time with the approval of the Court and, if and as required by the Court, after communication to Granite Common Shareholders.

ARTICLE 7

GENERAL

7.1 Further Assurances

Notwithstanding that the transactions and events set out herein shall occur and be deemed to occur in the order set out in this Plan of Arrangement without any further act or formality, each of the parties to the Arrangement Agreement shall make, do and execute, or cause to be made, done and executed, all such further acts, deeds, agreements, transfers, assurances, instruments or documents as may reasonably be required by any of them in order to further document or evidence any of the transactions or events set out herein.

7.2 Invalidity

If, prior to the Effective Date, any term or provision of this Plan of Arrangement is held by the Court to be invalid, void or unenforceable, the Court, at the request of any parties, shall have the power to alter and interpret such term or provision to make it valid or enforceable to the maximum extent practicable, consistent with the original purpose of the term or provision held to be invalid, void or unenforceable, and such term or provision shall then be applicable as altered or interpreted. Notwithstanding any such holding, alteration or interpretation, the remainder of the terms and provisions of this Plan of Arrangement shall remain in full force and effect and shall in no way be affected, impaired or invalidated by such holding, alteration or interpretation.

12

EXHIBIT A

EUROPEAN SUBSIDIARIES

MI Developments Luxembourg S.à r.l., a corporation incorporated under the laws of Luxembourg and a wholly-owned subsidiary of Granite

Magna IV. Beteiligungs GmbH, a corporation incorporated under the laws of Germany and a wholly-owned subsidiary of Granite

Exterior Real Estate GmbH & Co. KG, a limited partnership formed under the laws of Germany and a subsidiary of Granite

Intier Automotive Beteiligungs GmbH, a corporation incorporated under the laws of Germany and a subsidiary of Granite

EXHIBIT B

TERMS OF CLASS X SHARES OF

GRANITE REAL ESTATE INC.

(for the purposes of these share terms, the “Corporation”)

The rights and restrictions attaching to the Class X Shares are as follows:

(a) Voting. The Class X Shares shall carry and be entitled to one (1) vote per share at all meetings of shareholders of the Corporation, except of a particular class or series. The Class X Shares shall vote together with the holders of Common Shares as a single class (subject to applicable law).

(b) Dividends. The holders of Class X Shares shall he entitled to receive such dividends as may be declared thereon by the Board of Directors, on a pari passu basis with the holders of Common Shares.

(c) Liquidation. In the event of the liquidation of the Corporation, the holders of the Class X Shares shall, together with the holders of Common Shares, be entitled to receive pari passu all of the remaining property of the Corporation available for distribution to shareholders, which shall be paid or distributed equally share for share to such holders.

(d) Conversion. The Class X Shares may be converted, on a one-for-one basis, at any time at the option of the holder thereof or the Corporation, into Common Shares of the Corporation.

(e) Consolidation / Subdivision. If at any time before Class X Shares are converted into Common Shares of the Corporation, there is a consolidation or subdivision of the trust units of Granite Real Estate Investment Trust, the Class X Shares shall be automatically consolidated or subdivided, as applicable, in the same manner.

13