Q1 Supplemental Information 2018

Introduction Executive Summary 3 Company Profile & Investor Contacts 4 Capitalization Analysis & Research Coverage 5 2018 Guidance 6 Financial Information Consolidated Balance Sheet - GAAP 7 Elements of Pro-Rata Balance Sheet - CXP's Interest in Unconsolidated Joint Ventures 8 Consolidated Statements of Operations - GAAP 9 Elements of Pro-Rata Statement of Operations - CXP's Interest in Unconsolidated Joint Ventures 10 11 Net Operating Income 12 Third-Party Management Income 13 Capital Expenditure Summary 14 Debt Overview 15 Debt Covenant Compliance 16 Debt Maturities 17 Summary of Unconsolidated Joint Ventures 18 Operational & Portfolio Information Property Overview - Gross Real Estate Assets, Net Operating Income & Annualized Lease Revenue 19 Property Overview - Square Feet & Occupancy 20 Occupancy Summary 21 Leasing Summary 22 Lease Expiration Schedule 23 Lease Expiration by Market 24 Top 20 Tenants & Tenant Industry Profile 25 Transaction Activity (1/1/15 - 3/31/18) 26 - 27 Additional Information 28 Reconciliation of Cash Flows From Operations to Adjusted Funds From Operations (AFFO) 28 29 29 30 31 Definitions 32 Forward Looking Statements: Supplemental Information - Q1 2018 2 This supplemental package contains certain statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. These forward-looking statements include information about possible or assumed future results of the business and our financial condition, liquidity, results of operations, future plans, and objectives. They also include, among other things, statements regarding subjects that are forward-looking by their nature, such as, our business and financial strategy; our 2018 guidance and underlying assumptions; expectations or occupancy rates; our ability to obtain future financing; future acquisitions and dispositions of operating assets; future repurchases of common stock; and market and industry trends. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this supplemental package is published, and which are subject to certain risks and uncertainties which could cause actual results to differ materially from those projected or anticipated. These risks and uncertainties include, without limitation: general risks affecting the real estate industry (including, without limitation, the inability to enter into or renew leases, dependence on tenants’ financial condition, and competition from other owners and operators of real estate); adverse economic or real estate developments in the company’s target markets; risks associated with the availability and terms of financing, the use of debt to fund acquisitions, and the ability to refinance indebtedness as it comes due; reductions in asset valuations and related impairment charges; risks associated with downturns in foreign, domestic and local economies, changes in interest rates; potential liability for uninsured losses and environmental contamination; risks associated with joint ventures; risks associated with the company’s potential failure to qualify as a REIT under the Internal Revenue Code of 1986, as amended, and possible adverse changes in tax and environmental laws; and risks associated with the company’s dependence on key personnel whose continued service is not guaranteed. We do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. For additional risks and uncertainties that would cause actual results to differ materially from those presented in our forward-looking statements see our Annual Report on Form 10-K for the year ended December 31, 2017 and subsequently filed periodic reports. On the Cover: New York Columbia Property Trust, Inc. Table of Contents Normalized Funds From Operations (NFFO) & Adjusted Funds From Operations (AFFO) Reconciliation of Net Income to Normalized Funds From Operations (NFFO) Reconciliation of Net Income to Net Operating Income (based on cash rents), and Same Store Net Operating Income (based on cash rents) - wholly-owned properties Reconciliation of Net Income to Net Operating Income (based on GAAP rents), and Same Store Net Operating Income (based on GAAP rents) - wholly-owned properties Reconciliation of Net Operating Income (based on GAAP rents) to Net Operating Income (based on cash rents) Reconciliation of Funds From Operations (FFO) to Adjusted Funds From Operations (AFFO)

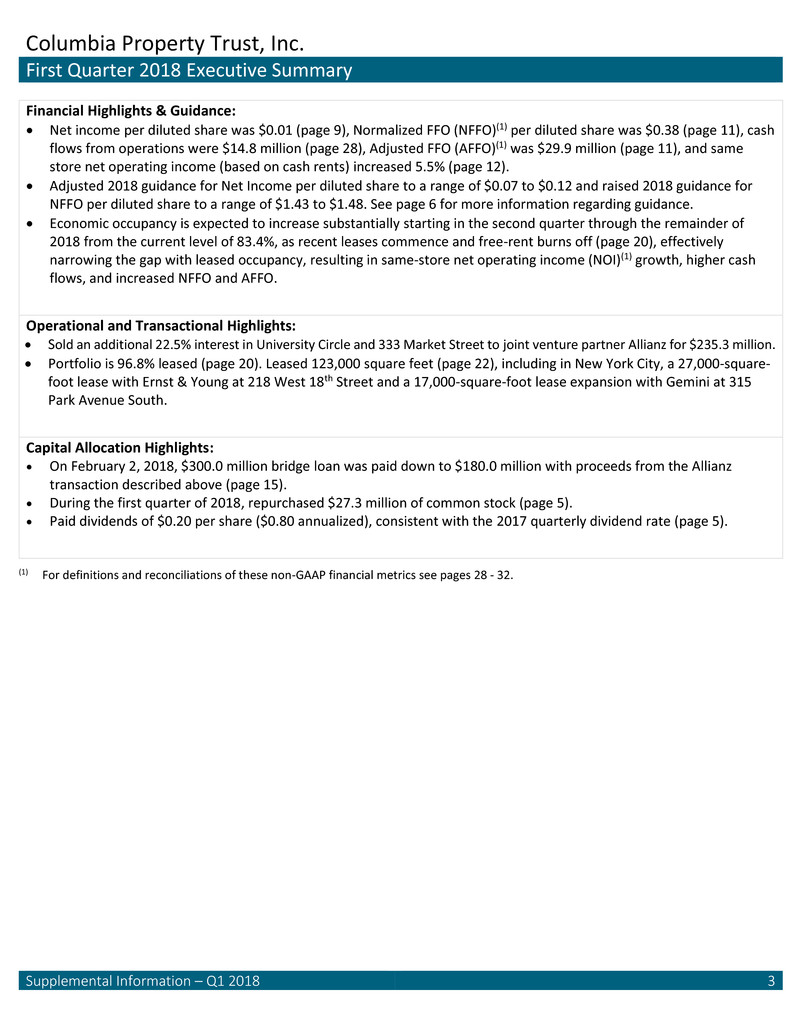

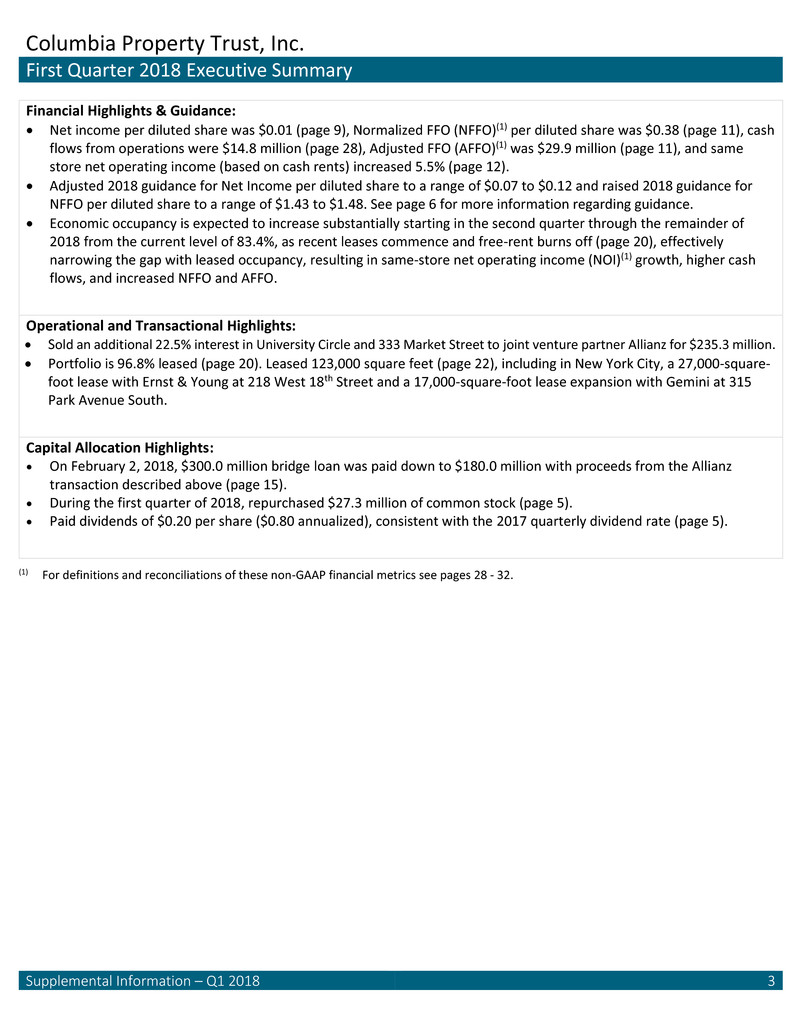

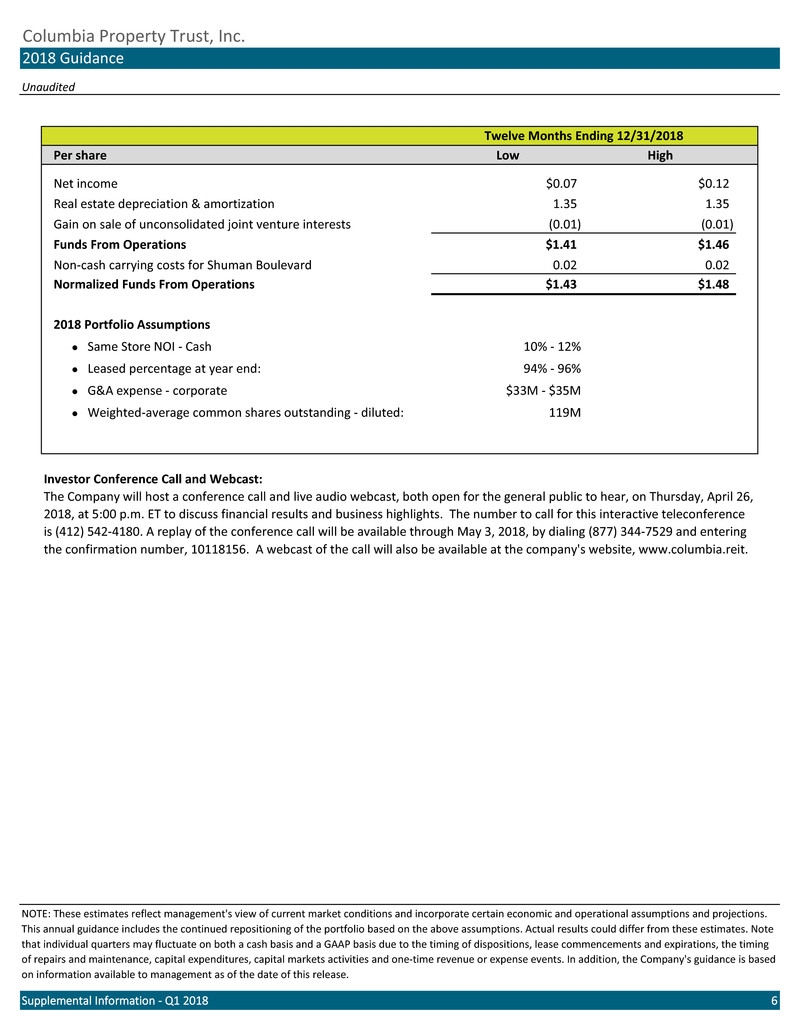

Columbia Property Trust, Inc. First Quarter 2018 Executive Summary Supplemental Information – Q1 2018 3 Financial Highlights & Guidance: Net income per diluted share was $0.01 (page 9), Normalized FFO (NFFO)(1) per diluted share was $0.38 (page 11), cash flows from operations were $14.8 million (page 28), Adjusted FFO (AFFO)(1) was $29.9 million (page 11), and same store net operating income (based on cash rents) increased 5.5% (page 12). Adjusted 2018 guidance for Net Income per diluted share to a range of $0.07 to $0.12 and raised 2018 guidance for NFFO per diluted share to a range of $1.43 to $1.48. See page 6 for more information regarding guidance. Economic occupancy is expected to increase substantially starting in the second quarter through the remainder of 2018 from the current level of 83.4%, as recent leases commence and free-rent burns off (page 20), effectively narrowing the gap with leased occupancy, resulting in same-store net operating income (NOI)(1) growth, higher cash flows, and increased NFFO and AFFO. Operational and Transactional Highlights: Sold an additional 22.5% interest in University Circle and 333 Market Street to joint venture partner Allianz for $235.3 million. Portfolio is 96.8% leased (page 20). Leased 123,000 square feet (page 22), including in New York City, a 27,000-square- foot lease with Ernst & Young at 218 West 18th Street and a 17,000-square-foot lease expansion with Gemini at 315 Park Avenue South. Capital Allocation Highlights: On February 2, 2018, $300.0 million bridge loan was paid down to $180.0 million with proceeds from the Allianz transaction described above (page 15). During the first quarter of 2018, repurchased $27.3 million of common stock (page 5). Paid dividends of $0.20 per share ($0.80 annualized), consistent with the 2017 quarterly dividend rate (page 5). (1) For definitions and reconciliations of these non-GAAP financial metrics see pages 28 - 32.

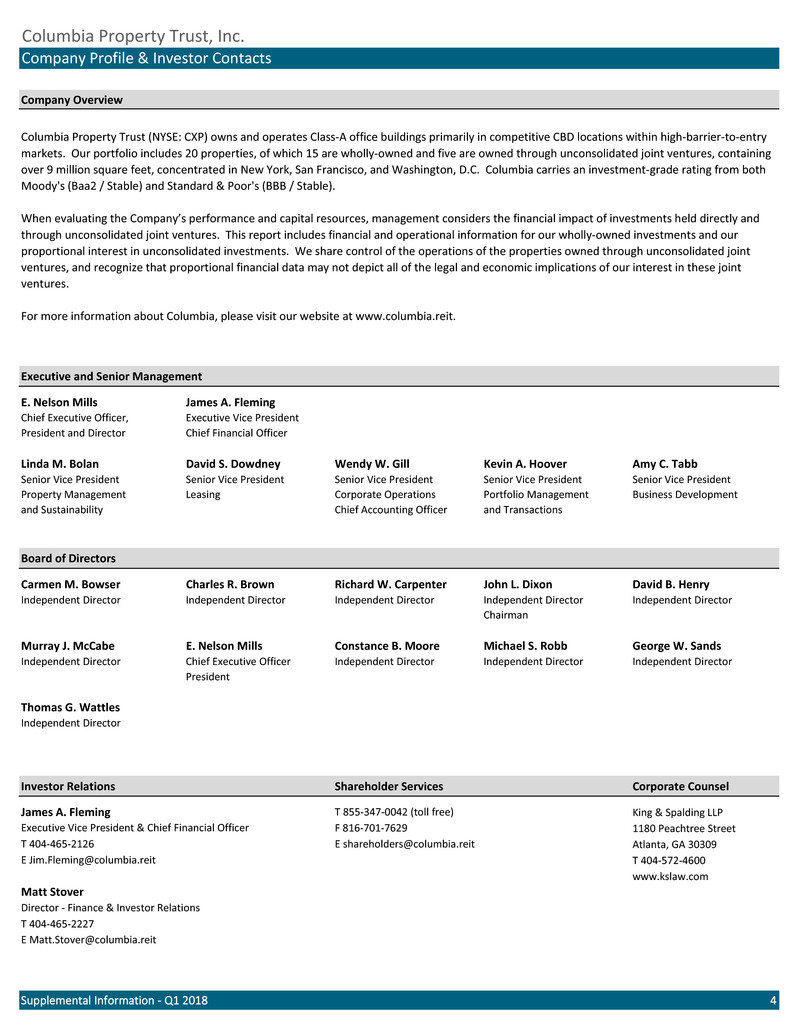

Company Overview Executive and Senior Management E. Nelson Mills James A. Fleming Chief Executive Officer, Executive Vice President President and Director Chief Financial Officer Linda M. Bolan David S. Dowdney Wendy W. Gill Kevin A. Hoover Amy C. Tabb Senior Vice President Senior Vice President Senior Vice President Senior Vice President Senior Vice President Property Management Leasing Corporate Operations Portfolio Management Business Development and Sustainability Chief Accounting Officer and Transactions Board of Directors Carmen M. Bowser Charles R. Brown Richard W. Carpenter John L. Dixon David B. Henry Independent Director Independent Director Independent Director Independent Director Independent Director Chairman Murray J. McCabe E. Nelson Mills Constance B. Moore Michael S. Robb George W. Sands Independent Director Chief Executive Officer Independent Director Independent Director Independent Director President Thomas G. Wattles Independent Director Investor Relations Shareholder Services Corporate Counsel James A. Fleming T 855-347-0042 (toll free) King & Spalding LLP Executive Vice President & Chief Financial Officer F 816-701-7629 1180 Peachtree Street T 404-465-2126 E shareholders@columbia.reit Atlanta, GA 30309 E Jim.Fleming@columbia.reit T 404-572-4600 www.kslaw.com Matt Stover Director - Finance & Investor Relations T 404-465-2227 E Matt.Stover@columbia.reit Supplemental Information - Q1 2018 4 Columbia Property Trust, Inc. Company Profile & Investor Contacts Columbia Property Trust (NYSE: CXP) owns and operates Class-A office buildings primarily in competitive CBD locations within high-barrier-to-entry markets. Our portfolio includes 20 properties, of which 15 are wholly-owned and five are owned through unconsolidated joint ventures, containing over 9 million square feet, concentrated in New York, San Francisco, and Washington, D.C. Columbia carries an investment-grade rating from both Moody's (Baa2 / Stable) and Standard & Poor's (BBB / Stable). When evaluating the Company’s performance and capital resources, management considers the financial impact of investments held directly and through unconsolidated joint ventures. This report includes financial and operational information for our wholly-owned investments and our proportional interest in unconsolidated investments. We share control of the operations of the properties owned through unconsolidated joint ventures, and recognize that proportional financial data may not depict all of the legal and economic implications of our interest in these joint ventures. For more information about Columbia, please visit our website at www.columbia.reit.

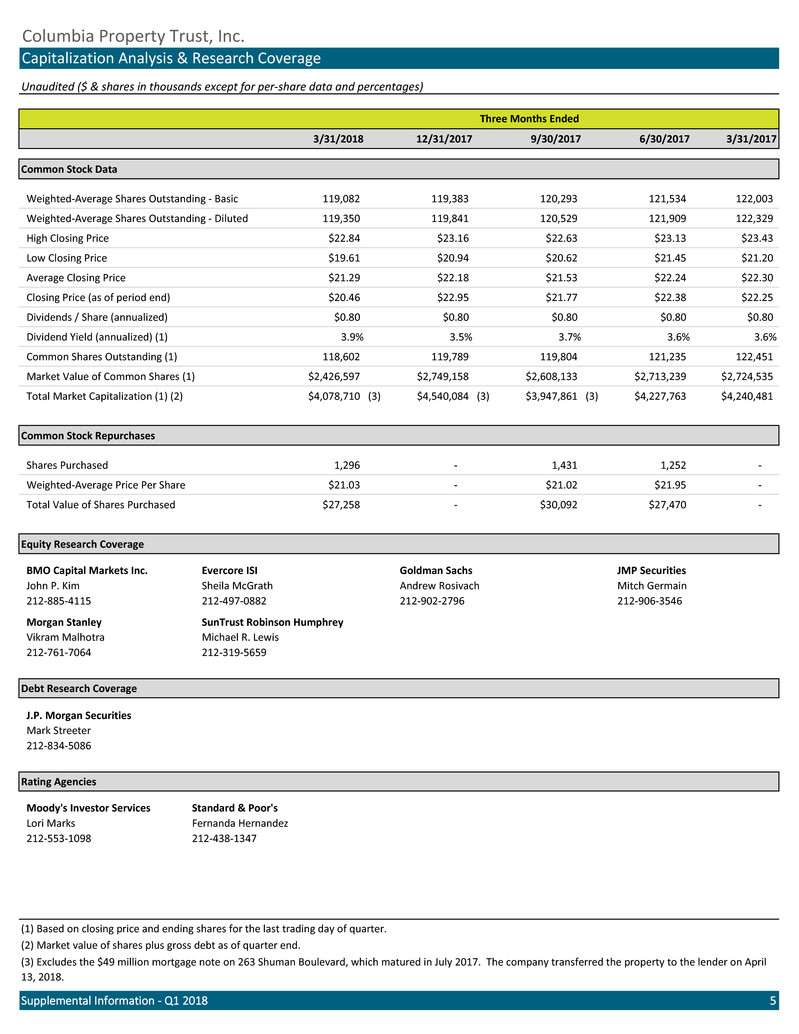

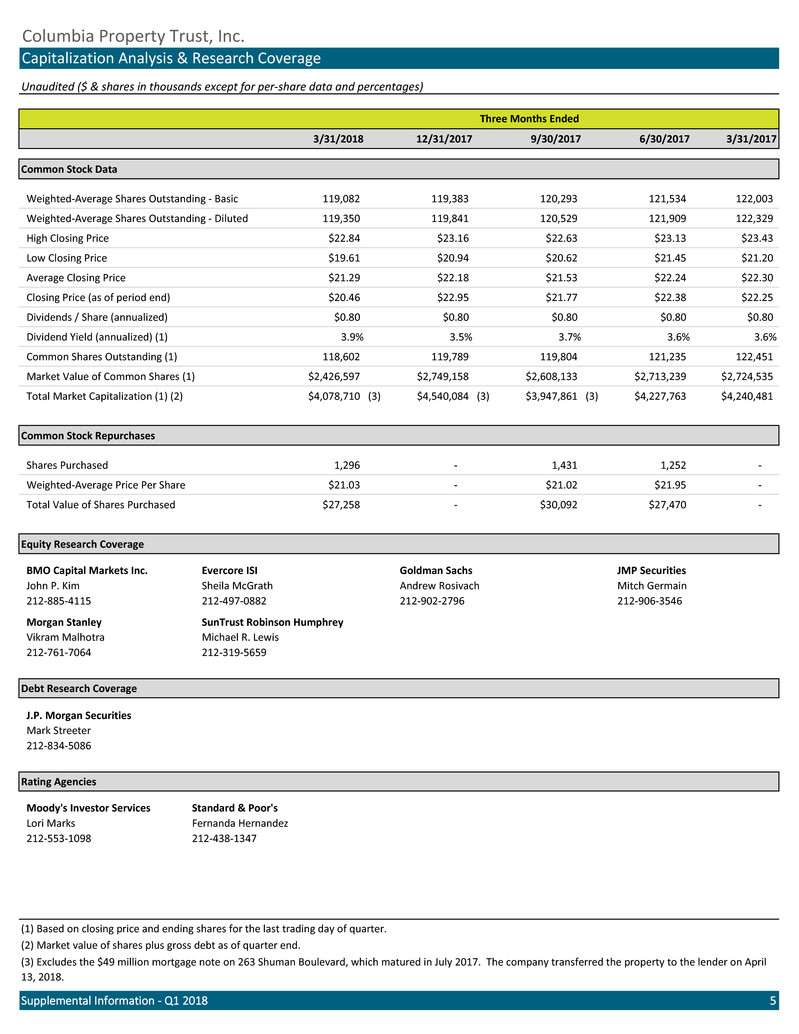

Unaudited ($ & shares in thousands except for per-share data and percentages) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Common Stock Data Weighted-Average Shares Outstanding - Basic 119,082 119,383 120,293 121,534 122,003 Weighted-Average Shares Outstanding - Diluted 119,350 119,841 120,529 121,909 122,329 High Closing Price $22.84 $23.16 $22.63 $23.13 $23.43 Low Closing Price $19.61 $20.94 $20.62 $21.45 $21.20 Average Closing Price $21.29 $22.18 $21.53 $22.24 $22.30 Closing Price (as of period end) $20.46 $22.95 $21.77 $22.38 $22.25 Dividends / Share (annualized) $0.80 $0.80 $0.80 $0.80 $0.80 Dividend Yield (annualized) (1) 3.9% 3.5% 3.7% 3.6% 3.6% Common Shares Outstanding (1) 118,602 119,789 119,804 121,235 122,451 Market Value of Common Shares (1) $2,426,597 $2,749,158 $2,608,133 $2,713,239 $2,724,535 Total Market Capitalization (1) (2) $4,078,710 (3) $4,540,084 (3) $3,947,861 (3) $4,227,763 $4,240,481 Common Stock Repurchases Shares Purchased 1,296 - 1,431 1,252 - Weighted-Average Price Per Share $21.03 - $21.02 $21.95 - Total Value of Shares Purchased $27,258 - $30,092 $27,470 - Equity Research Coverage BMO Capital Markets Inc. Evercore ISI Goldman Sachs JMP Securities John P. Kim Sheila McGrath Andrew Rosivach Mitch Germain 212-885-4115 212-497-0882 212-902-2796 212-906-3546 Morgan Stanley SunTrust Robinson Humphrey Vikram Malhotra Michael R. Lewis 212-761-7064 212-319-5659 Debt Research Coverage J.P. Morgan Securities Mark Streeter 212-834-5086 Rating Agencies Moody's Investor Services Standard & Poor's Lori Marks Fernanda Hernandez 212-553-1098 212-438-1347 (2) Market value of shares plus gross debt as of quarter end. Supplemental Information - Q1 2018 5 Columbia Property Trust, Inc. Capitalization Analysis & Research Coverage Three Months Ended (1) Based on closing price and ending shares for the last trading day of quarter. (3) Excludes the $49 million mortgage note on 263 Shuman Boulevard, which matured in July 2017. The company transferred the property to the lender on April 13, 2018.

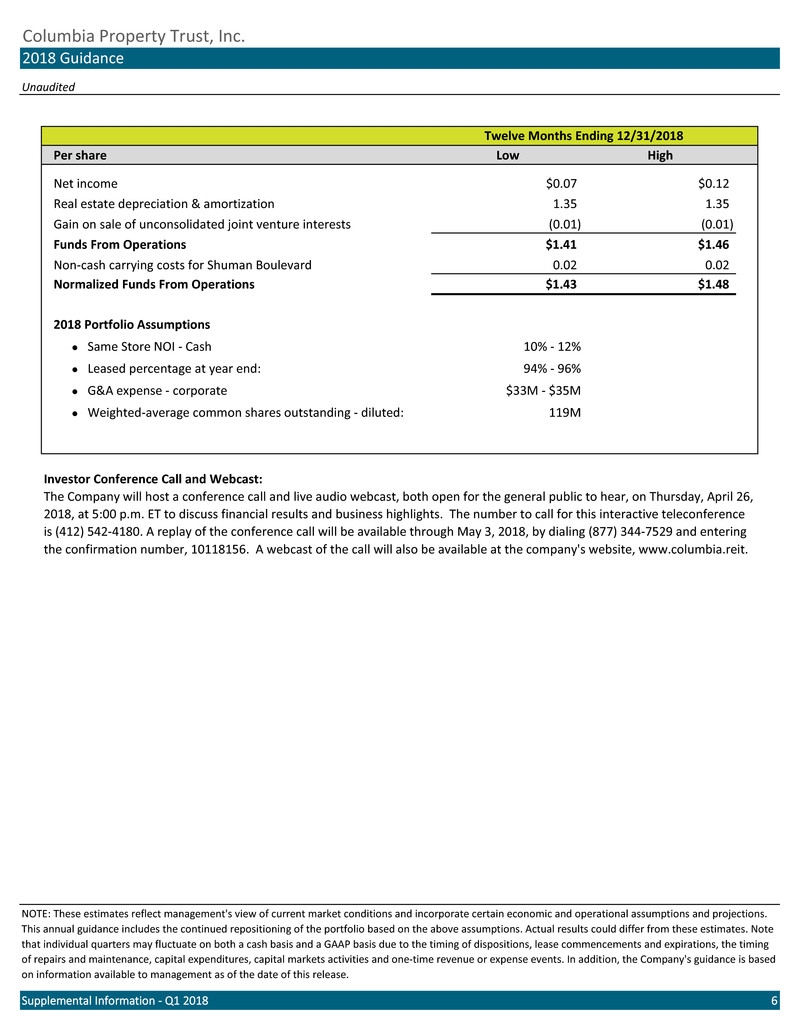

Unaudited Per share Low High Net income $0.07 $0.12 Real estate depreciation & amortization 1.35 1.35 Gain on sale of unconsolidated joint venture interests (0.01) (0.01) Funds From Operations $1.41 $1.46 Non-cash carrying costs for Shuman Boulevard 0.02 0.02 Normalized Funds From Operations $1.43 $1.48 2018 Portfolio Assumptions l Same Store NOI - Cash 10% - 12% l Leased percentage at year end: 94% - 96% l G&A expense - corporate l Weighted-average common shares outstanding - diluted: 119M Supplemental Information - Q1 2018 6 NOTE: These estimates reflect management's view of current market conditions and incorporate certain economic and operational assumptions and projections. This annual guidance includes the continued repositioning of the portfolio based on the above assumptions. Actual results could differ from these estimates. Note that individual quarters may fluctuate on both a cash basis and a GAAP basis due to the timing of dispositions, lease commencements and expirations, the timing of repairs and maintenance, capital expenditures, capital markets activities and one-time revenue or expense events. In addition, the Company's guidance is based on information available to management as of the date of this release. Columbia Property Trust, Inc. 2018 Guidance Twelve Months Ending 12/31/2018 $33M - $35M Investor Conference Call and Webcast: The Company will host a conference call and live audio webcast, both open for the general public to hear, on Thursday, April 26, 2018, at 5:00 p.m. ET to discuss financial results and business highlights. The number to call for this interactive teleconference is (412) 542-4180. A replay of the conference call will be available through May 3, 2018, by dialing (877) 344-7529 and entering the confirmation number, 10118156. A webcast of the call will also be available at the company's website, www.columbia.reit.

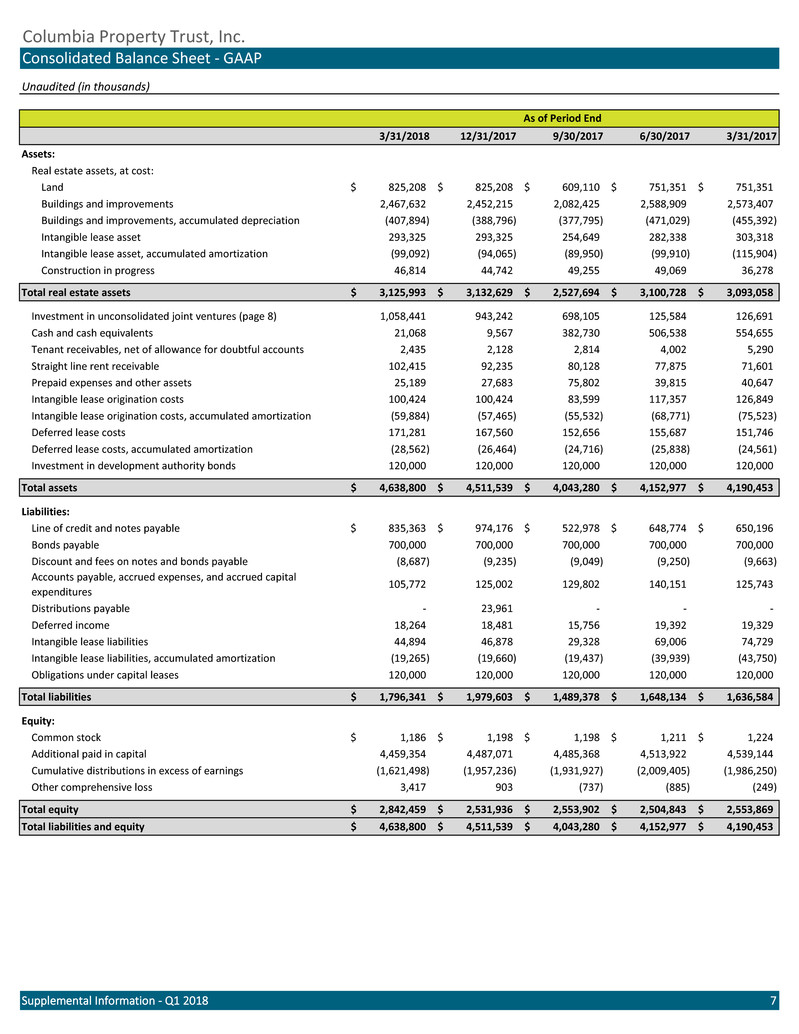

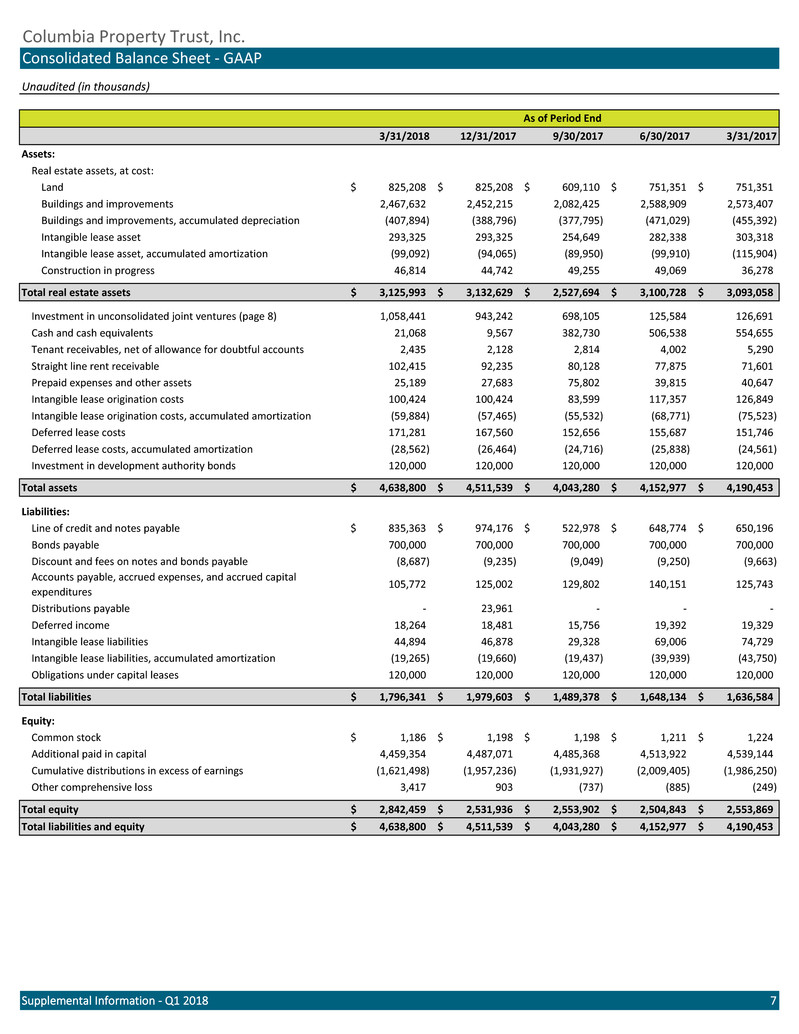

Columbia Property Trust, Inc. Unaudited (in thousands) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Assets: Real estate assets, at cost: Land 825,208$ 825,208$ 609,110$ 751,351$ 751,351$ Buildings and improvements 2,467,632 2,452,215 2,082,425 2,588,909 2,573,407 Buildings and improvements, accumulated depreciation (407,894) (388,796) (377,795) (471,029) (455,392) Intangible lease asset 293,325 293,325 254,649 282,338 303,318 Intangible lease asset, accumulated amortization (99,092) (94,065) (89,950) (99,910) (115,904) Construction in progress 46,814 44,742 49,255 49,069 36,278 Total real estate assets 3,125,993$ 3,132,629$ 2,527,694$ 3,100,728$ 3,093,058$ Investment in unconsolidated joint ventures (page 8) 1,058,441 943,242 698,105 125,584 126,691 Cash and cash equivalents 21,068 9,567 382,730 506,538 554,655 Tenant receivables, net of allowance for doubtful accounts 2,435 2,128 2,814 4,002 5,290 Straight line rent receivable 102,415 92,235 80,128 77,875 71,601 Prepaid expenses and other assets 25,189 27,683 75,802 39,815 40,647 Intangible lease origination costs 100,424 100,424 83,599 117,357 126,849 Intangible lease origination costs, accumulated amortization (59,884) (57,465) (55,532) (68,771) (75,523) Deferred lease costs 171,281 167,560 152,656 155,687 151,746 Deferred lease costs, accumulated amortization (28,562) (26,464) (24,716) (25,838) (24,561) Investment in development authority bonds 120,000 120,000 120,000 120,000 120,000 Total assets 4,638,800$ 4,511,539$ 4,043,280$ 4,152,977$ 4,190,453$ Liabilities: Line of credit and notes payable 835,363$ 974,176$ 522,978$ 648,774$ 650,196$ Bonds payable 700,000 700,000 700,000 700,000 700,000 Discount and fees on notes and bonds payable (8,687) (9,235) (9,049) (9,250) (9,663) 105,772 125,002 129,802 140,151 125,743 Distributions payable - 23,961 - - - Deferred income 18,264 18,481 15,756 19,392 19,329 Intangible lease liabilities 44,894 46,878 29,328 69,006 74,729 Intangible lease liabilities, accumulated amortization (19,265) (19,660) (19,437) (39,939) (43,750) Obligations under capital leases 120,000 120,000 120,000 120,000 120,000 Total liabilities 1,796,341$ 1,979,603$ 1,489,378$ 1,648,134$ 1,636,584$ Equity: Common stock 1,186$ 1,198$ 1,198$ 1,211$ 1,224$ Additional paid in capital 4,459,354 4,487,071 4,485,368 4,513,922 4,539,144 Cumulative distributions in excess of earnings (1,621,498) (1,957,236) (1,931,927) (2,009,405) (1,986,250) Other comprehensive loss 3,417 903 (737) (885) (249) Total equity 2,842,459$ 2,531,936$ 2,553,902$ 2,504,843$ 2,553,869$ Total liabilities and equity 4,638,800$ 4,511,539$ 4,043,280$ 4,152,977$ 4,190,453$ Supplemental Information - Q1 2018 7 Consolidated Balance Sheet - GAAP As of Period End Accounts payable, accrued expenses, and accrued capital expenditures

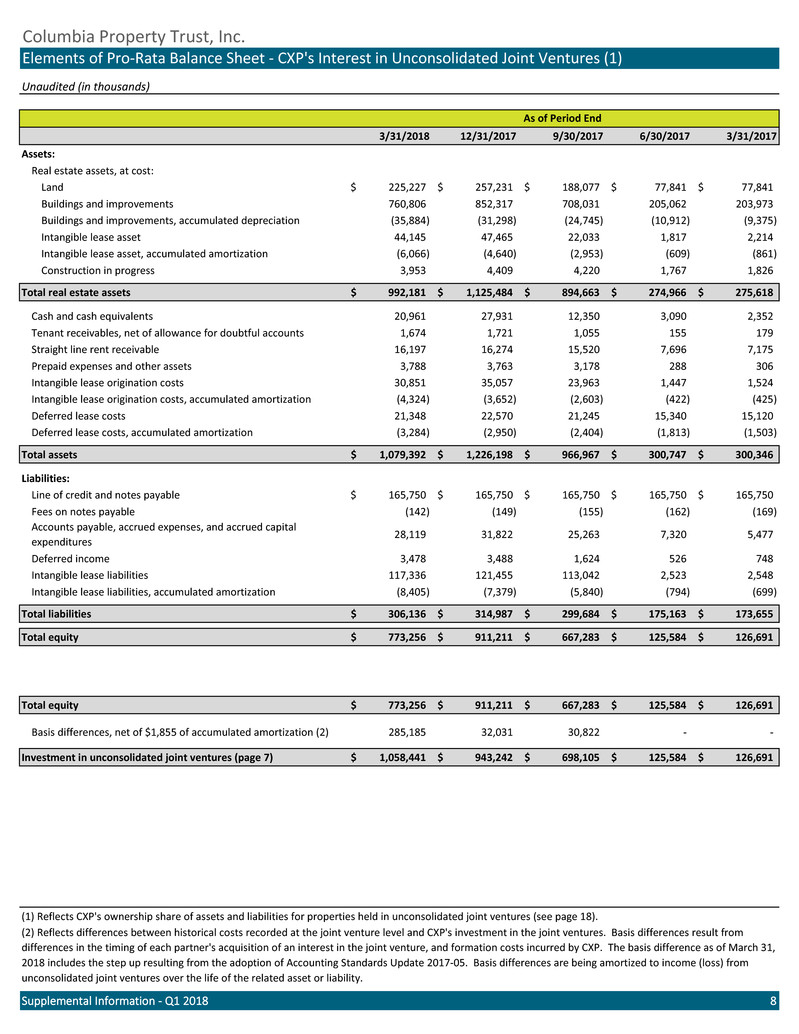

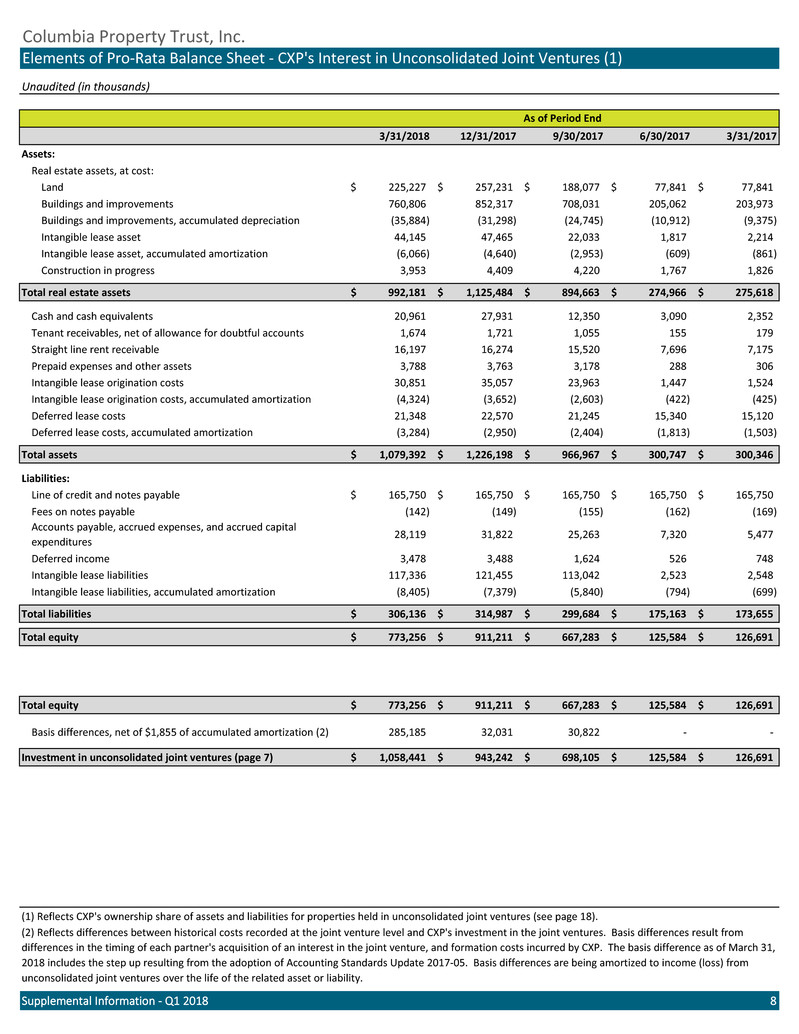

Columbia Property Trust, Inc. Unaudited (in thousands) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Assets: Real estate assets, at cost: Land 225,227$ 257,231$ 188,077$ 77,841$ 77,841$ Buildings and improvements 760,806 852,317 708,031 205,062 203,973 Buildings and improvements, accumulated depreciation (35,884) (31,298) (24,745) (10,912) (9,375) Intangible lease asset 44,145 47,465 22,033 1,817 2,214 Intangible lease asset, accumulated amortization (6,066) (4,640) (2,953) (609) (861) Construction in progress 3,953 4,409 4,220 1,767 1,826 Total real estate assets 992,181$ 1,125,484$ 894,663$ 274,966$ 275,618$ Cash and cash equivalents 20,961 27,931 12,350 3,090 2,352 Tenant receivables, net of allowance for doubtful accounts 1,674 1,721 1,055 155 179 Straight line rent receivable 16,197 16,274 15,520 7,696 7,175 Prepaid expenses and other assets 3,788 3,763 3,178 288 306 Intangible lease origination costs 30,851 35,057 23,963 1,447 1,524 Intangible lease origination costs, accumulated amortization (4,324) (3,652) (2,603) (422) (425) Deferred lease costs 21,348 22,570 21,245 15,340 15,120 Deferred lease costs, accumulated amortization (3,284) (2,950) (2,404) (1,813) (1,503) Total assets 1,079,392$ 1,226,198$ 966,967$ 300,747$ 300,346$ Liabilities: Line of credit and notes payable 165,750$ 165,750$ 165,750$ 165,750$ 165,750$ Fees on notes payable (142) (149) (155) (162) (169) 28,119 31,822 25,263 7,320 5,477 Deferred income 3,478 3,488 1,624 526 748 Intangible lease liabilities 117,336 121,455 113,042 2,523 2,548 Intangible lease liabilities, accumulated amortization (8,405) (7,379) (5,840) (794) (699) Total liabilities 306,136$ 314,987$ 299,684$ 175,163$ 173,655$ Total equity 773,256$ 911,211$ 667,283$ 125,584$ 126,691$ Total equity 773,256$ 911,211$ 667,283$ 125,584$ 126,691$ Basis differences, net of $1,855 of accumulated amortization (2) 285,185 32,031 30,822 - - Investment in unconsolidated joint ventures (page 7) 1,058,441$ 943,242$ 698,105$ 125,584$ 126,691$ -$ Supplemental Information - Q1 2018 8 (2) Reflects differences between historical costs recorded at the joint venture level and CXP's investment in the joint ventures. Basis differences result from differences in the timing of each partner's acquisition of an interest in the joint venture, and formation costs incurred by CXP. The basis difference as of March 31, 2018 includes the step up resulting from the adoption of Accounting Standards Update 2017-05. Basis differences are being amortized to income (loss) from unconsolidated joint ventures over the life of the related asset or liability. Elements of Pro-Rata Balance Sheet - CXP's Interest in Unconsolidated Joint Ventures (1) As of Period End Accounts payable, accrued expenses, and accrued capital expenditures (1) Reflects CXP's ownership share of assets and liabilities for properties held in unconsolidated joint ventures (see page 18).

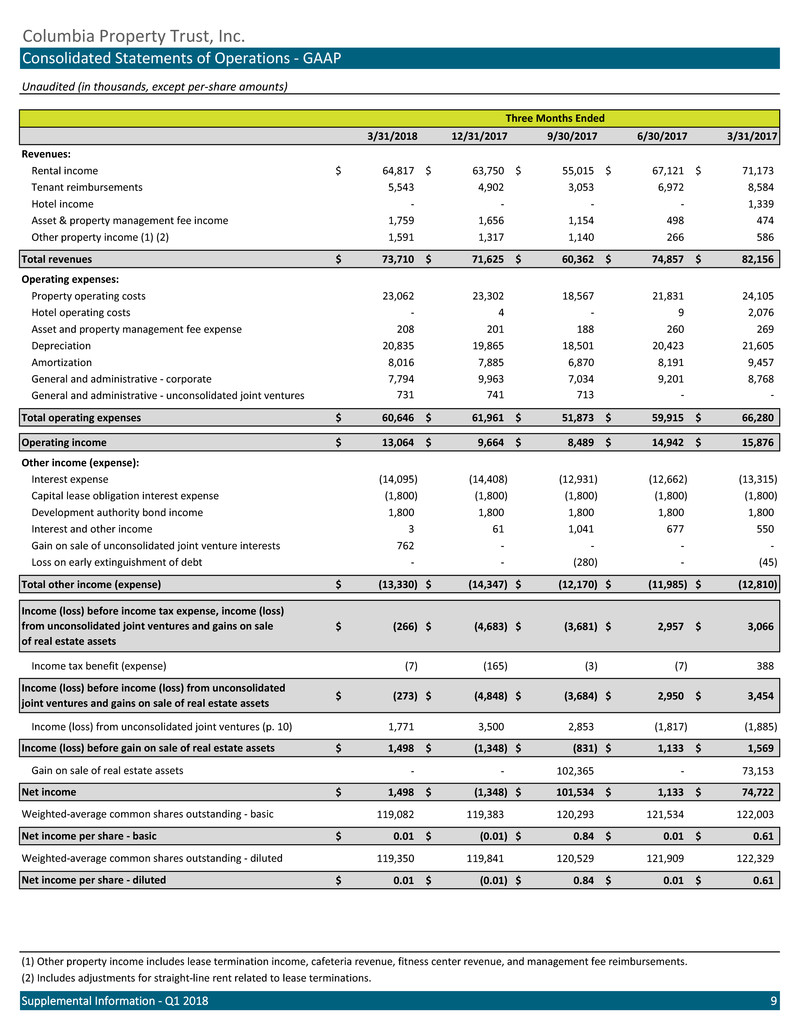

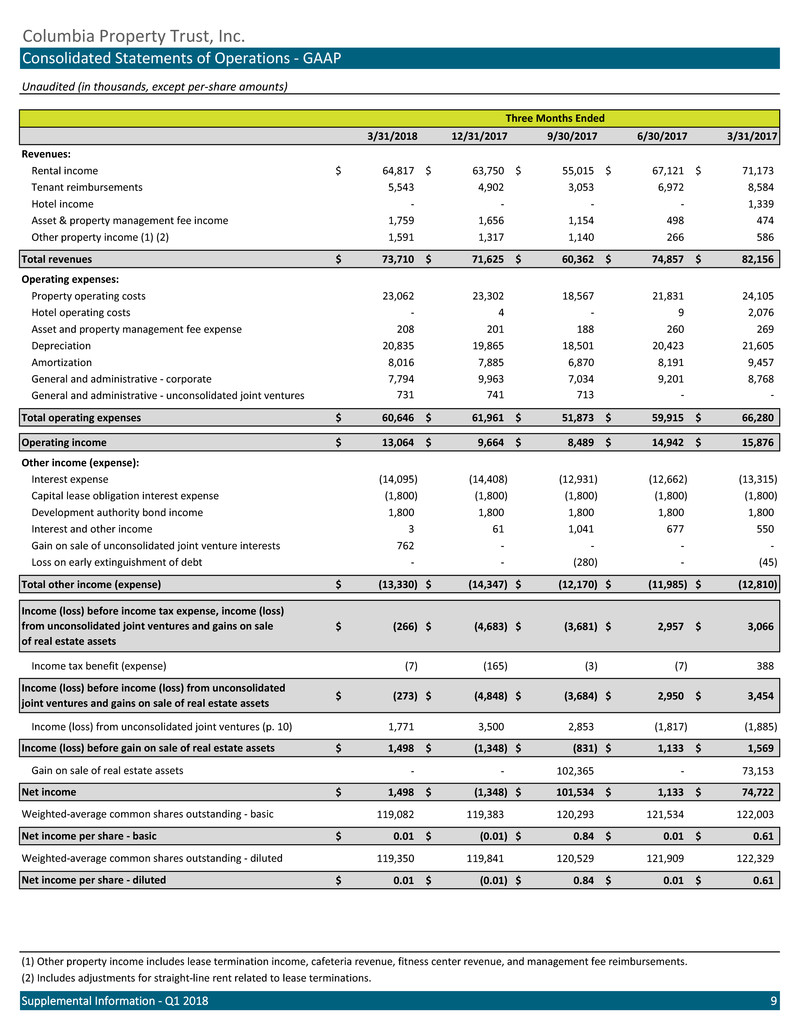

Unaudited (in thousands, except per-share amounts) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Revenues: Rental income 64,817$ 63,750$ 55,015$ 67,121$ 71,173$ Tenant reimbursements 5,543 4,902 3,053 6,972 8,584 Hotel income - - - - 1,339 1,759 1,656 1,154 498 474 Other property income (1) (2) 1,591 1,317 1,140 266 586 Total revenues 73,710$ 71,625$ 60,362$ 74,857$ 82,156$ Operating expenses: Property operating costs 23,062 23,302 18,567 21,831 24,105 Hotel operating costs - 4 - 9 2,076 Asset and property management fee expense 208 201 188 260 269 Depreciation 20,835 19,865 18,501 20,423 21,605 Amortization 8,016 7,885 6,870 8,191 9,457 General and administrative - corporate 7,794 9,963 7,034 9,201 8,768 General and administrative - unconsolidated joint ventures 731 741 713 - - Total operating expenses 60,646$ 61,961$ 51,873$ 59,915$ 66,280$ Operating income 13,064$ 9,664$ 8,489$ 14,942$ 15,876$ Other income (expense): Interest expense (14,095) (14,408) (12,931) (12,662) (13,315) Capital lease obligation interest expense (1,800) (1,800) (1,800) (1,800) (1,800) Development authority bond income 1,800 1,800 1,800 1,800 1,800 Interest and other income 3 61 1,041 677 550 Gain on sale of unconsolidated joint venture interests 762 - - - - Loss on early extinguishment of debt - - (280) - (45) Total other income (expense) (13,330)$ (14,347)$ (12,170)$ (11,985)$ (12,810)$ (266)$ (4,683)$ (3,681)$ 2,957$ 3,066$ Income tax benefit (expense) (7) (165) (3) (7) 388 (273)$ (4,848)$ (3,684)$ 2,950$ 3,454$ Income (loss) from unconsolidated joint ventures (p. 10) 1,771 3,500 2,853 (1,817) (1,885) 1,498$ (1,348)$ (831)$ 1,133$ 1,569$ Gain on sale of real estate assets - - 102,365 - 73,153 1,498$ (1,348)$ 101,534$ 1,133$ 74,722$ 119,082 119,383 120,293 121,534 122,003 0.01$ (0.01)$ 0.84$ 0.01$ 0.61$ 119,350 119,841 120,529 121,909 122,329 0.01$ (0.01)$ 0.84$ 0.01$ 0.61$ (1) Other property income includes lease termination income, cafeteria revenue, fitness center revenue, and management fee reimbursements. Supplemental Information - Q1 2018 9 Income (loss) before income (loss) from unconsolidated joint ventures and gains on sale of real estate assets Columbia Property Trust, Inc. Consolidated Statements of Operations - GAAP Three Months Ended Income (loss) before income tax expense, income (loss) from unconsolidated joint ventures and gains on sale of real estate assets Asset & property management fee income (2) Includes adjustments for straight-line rent related to lease terminations. Income (loss) before gain on sale of real estate assets Net income Weighted-average common shares outstanding - basic Net income per share - basic Weighted-average common shares outstanding - diluted Net income per share - diluted

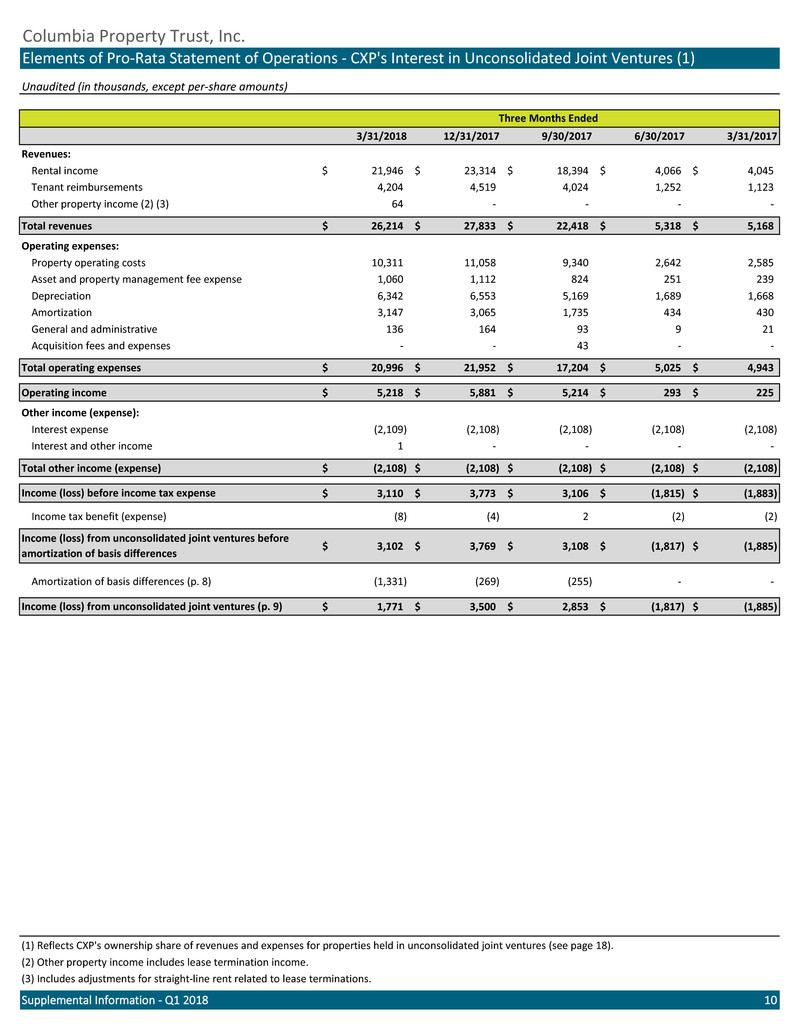

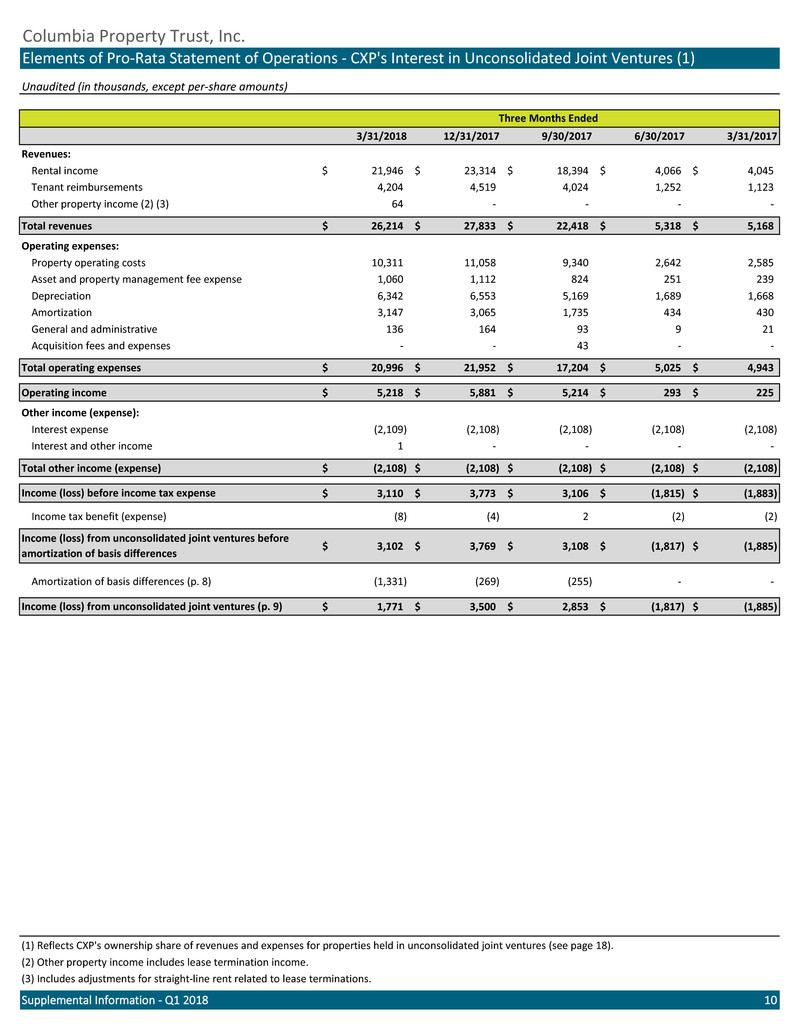

Unaudited (in thousands, except per-share amounts) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Revenues: Rental income 21,946$ 23,314$ 18,394$ 4,066$ 4,045$ Tenant reimbursements 4,204 4,519 4,024 1,252 1,123 Other property income (2) (3) 64 - - - - Total revenues 26,214$ 27,833$ 22,418$ 5,318$ 5,168$ Operating expenses: Property operating costs 10,311 11,058 9,340 2,642 2,585 Asset and property management fee expense 1,060 1,112 824 251 239 Depreciation 6,342 6,553 5,169 1,689 1,668 Amortization 3,147 3,065 1,735 434 430 General and administrative 136 164 93 9 21 Acquisition fees and expenses - - 43 - - Total operating expenses 20,996$ 21,952$ 17,204$ 5,025$ 4,943$ Operating income 5,218$ 5,881$ 5,214$ 293$ 225$ Other income (expense): Interest expense (2,109) (2,108) (2,108) (2,108) (2,108) Interest and other income 1 - - - - Total other income (expense) (2,108)$ (2,108)$ (2,108)$ (2,108)$ (2,108)$ 3,110$ 3,773$ 3,106$ (1,815)$ (1,883)$ Income tax benefit (expense) (8) (4) 2 (2) (2) 3,102$ 3,769$ 3,108$ (1,817)$ (1,885)$ Amortization of basis differences (p. 8) (1,331) (269) (255) - - 1,771$ 3,500$ 2,853$ (1,817)$ (1,885)$ (2) Other property income includes lease termination income. Supplemental Information - Q1 2018 10 (1) Reflects CXP's ownership share of revenues and expenses for properties held in unconsolidated joint ventures (see page 18). Income (loss) from unconsolidated joint ventures before amortization of basis differences Columbia Property Trust, Inc. Elements of Pro-Rata Statement of Operations - CXP's Interest in Unconsolidated Joint Ventures (1) Three Months Ended Income (loss) before income tax expense Income (loss) from unconsolidated joint ventures (p. 9) (3) Includes adjustments for straight-line rent related to lease terminations.

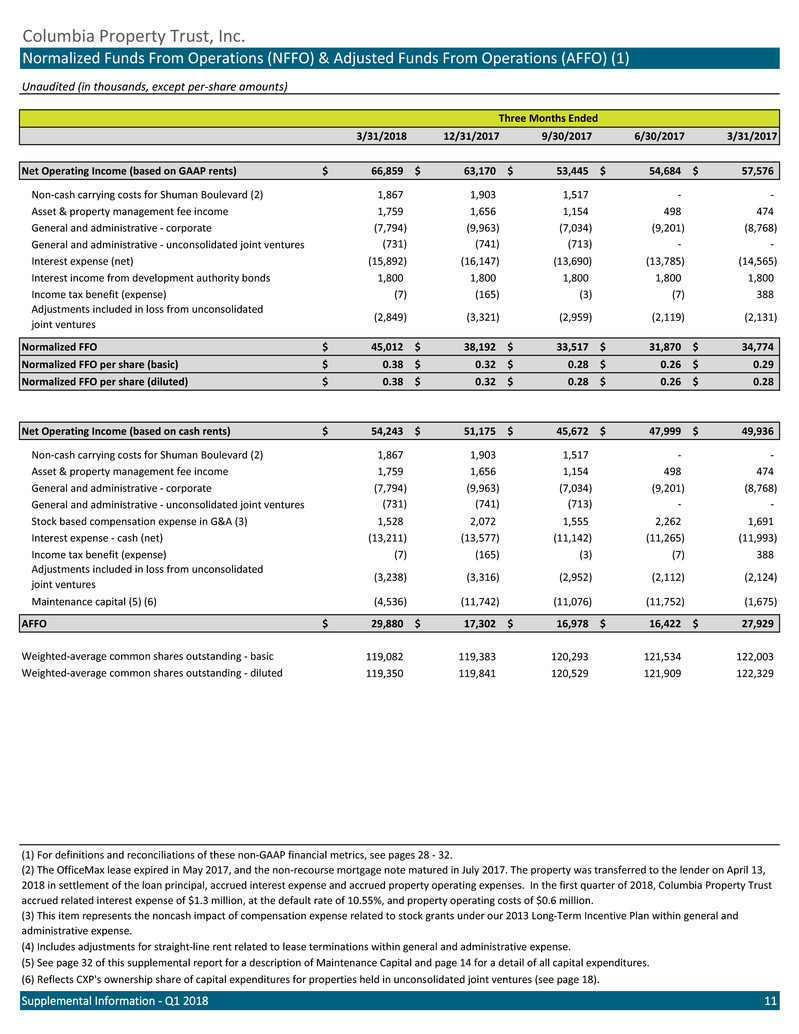

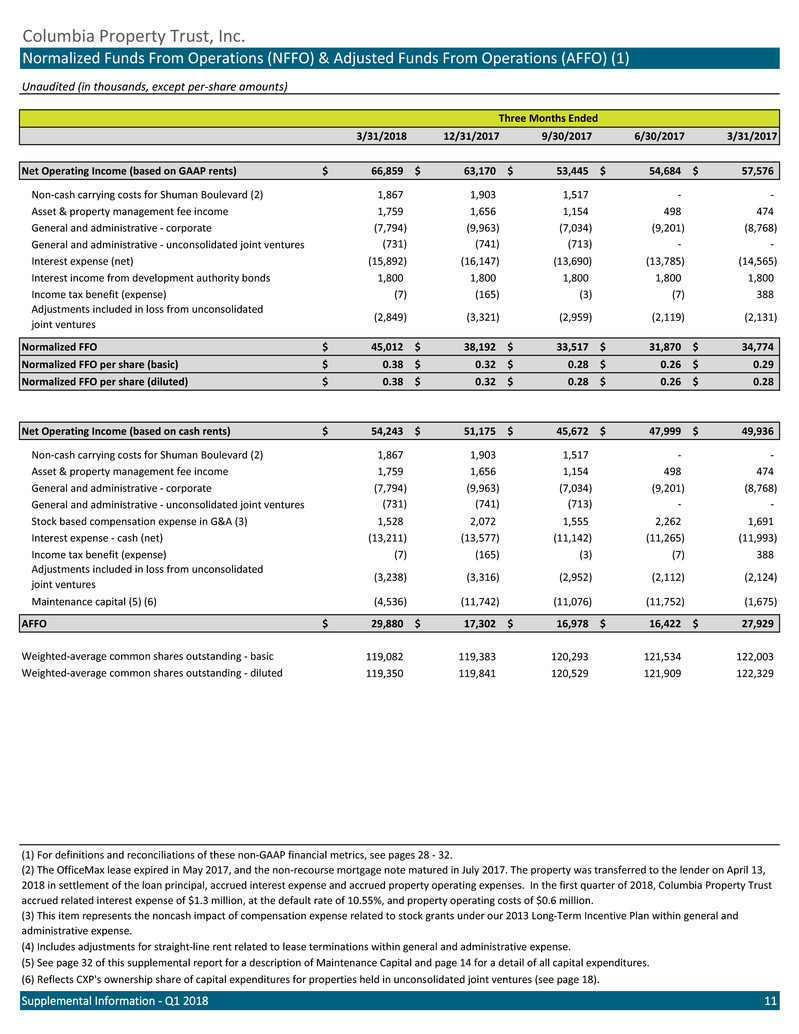

Unaudited (in thousands, except per-share amounts) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Net Operating Income (based on GAAP rents) 66,859$ 63,170$ 53,445$ 54,684$ 57,576$ Non-cash carrying costs for Shuman Boulevard (2) 1,867 1,903 1,517 - - Asset & property management fee income 1,759 1,656 1,154 498 474 General and administrative - corporate (7,794) (9,963) (7,034) (9,201) (8,768) (731) (741) (713) - - Interest expense (net) (15,892) (16,147) (13,690) (13,785) (14,565) Interest income from development authority bonds 1,800 1,800 1,800 1,800 1,800 Income tax benefit (expense) (7) (165) (3) (7) 388 (2,849) (3,321) (2,959) (2,119) (2,131) Normalized FFO 45,012$ 38,192$ 33,517$ 31,870$ 34,774$ Normalized FFO per share (basic) 0.38$ 0.32$ 0.28$ 0.26$ 0.29$ Normalized FFO per share (diluted) 0.38$ 0.32$ 0.28$ 0.26$ 0.28$ Net Operating Income (based on cash rents) 54,243$ 51,175$ 45,672$ 47,999$ 49,936$ Non-cash carrying costs for Shuman Boulevard (2) 1,867 1,903 1,517 - - Asset & property management fee income 1,759 1,656 1,154 498 474 General and administrative - corporate (7,794) (9,963) (7,034) (9,201) (8,768) (731) (741) (713) - - Stock based compensation expense in G&A (3) 1,528 2,072 1,555 2,262 1,691 Interest expense - cash (net) (13,211) (13,577) (11,142) (11,265) (11,993) Income tax benefit (expense) (7) (165) (3) (7) 388 (3,238) (3,316) (2,952) (2,112) (2,124) Maintenance capital (5) (6) (4,536) (11,742) (11,076) (11,752) (1,675) AFFO 29,880$ 17,302$ 16,978$ 16,422$ 27,929$ 119,082 119,383 120,293 121,534 122,003 119,350 119,841 120,529 121,909 122,329 Supplemental Information - Q1 2018 11 (6) Reflects CXP's ownership share of capital expenditures for properties held in unconsolidated joint ventures (see page 18). (5) See page 32 of this supplemental report for a description of Maintenance Capital and page 14 for a detail of all capital expenditures. (3) This item represents the noncash impact of compensation expense related to stock grants under our 2013 Long-Term Incentive Plan within general and administrative expense. (4) Includes adjustments for straight-line rent related to lease terminations within general and administrative expense. Columbia Property Trust, Inc. Normalized Funds From Operations (NFFO) & Adjusted Funds From Operations (AFFO) (1) Three Months Ended Weighted-average common shares outstanding - basic Weighted-average common shares outstanding - diluted Adjustments included in loss from unconsolidated joint ventures Adjustments included in loss from unconsolidated joint ventures (1) For definitions and reconciliations of these non-GAAP financial metrics, see pages 28 - 32. (2) The OfficeMax lease expired in May 2017, and the non-recourse mortgage note matured in July 2017. The property was transferred to the lender on April 13, 2018 in settlement of the loan principal, accrued interest expense and accrued property operating expenses. In the first quarter of 2018, Columbia Property Trust accrued related interest expense of $1.3 million, at the default rate of 10.55%, and property operating costs of $0.6 million. General and administrative - unconsolidated joint ventures General and administrative - unconsolidated joint ventures

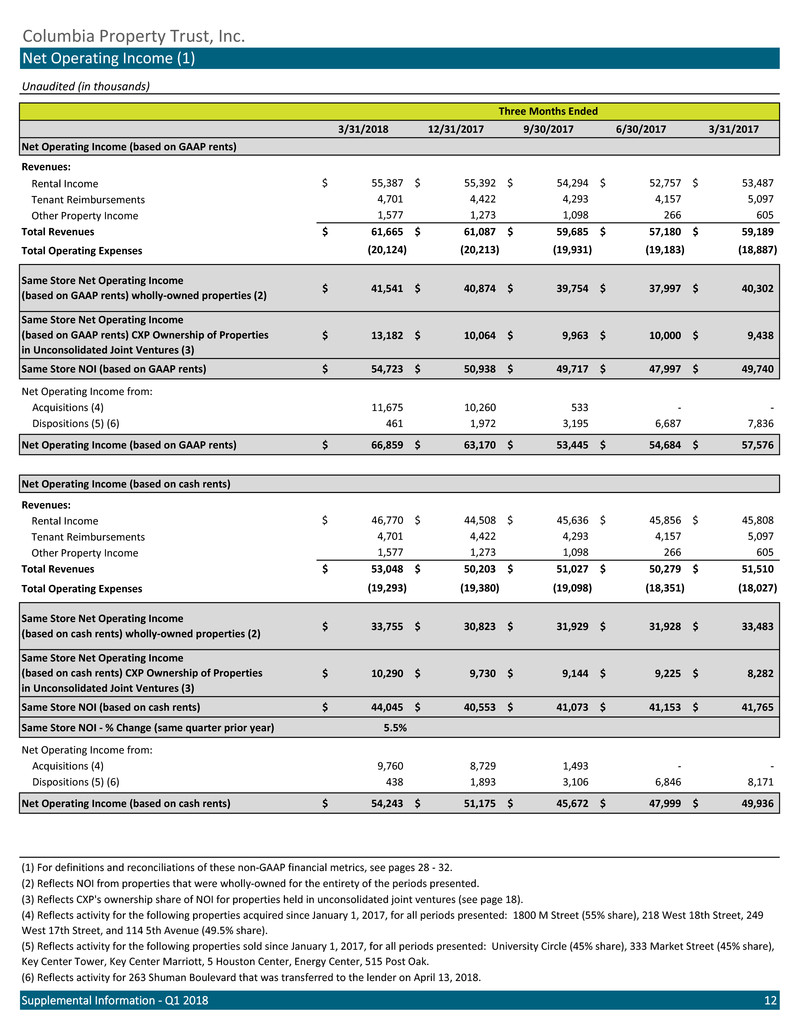

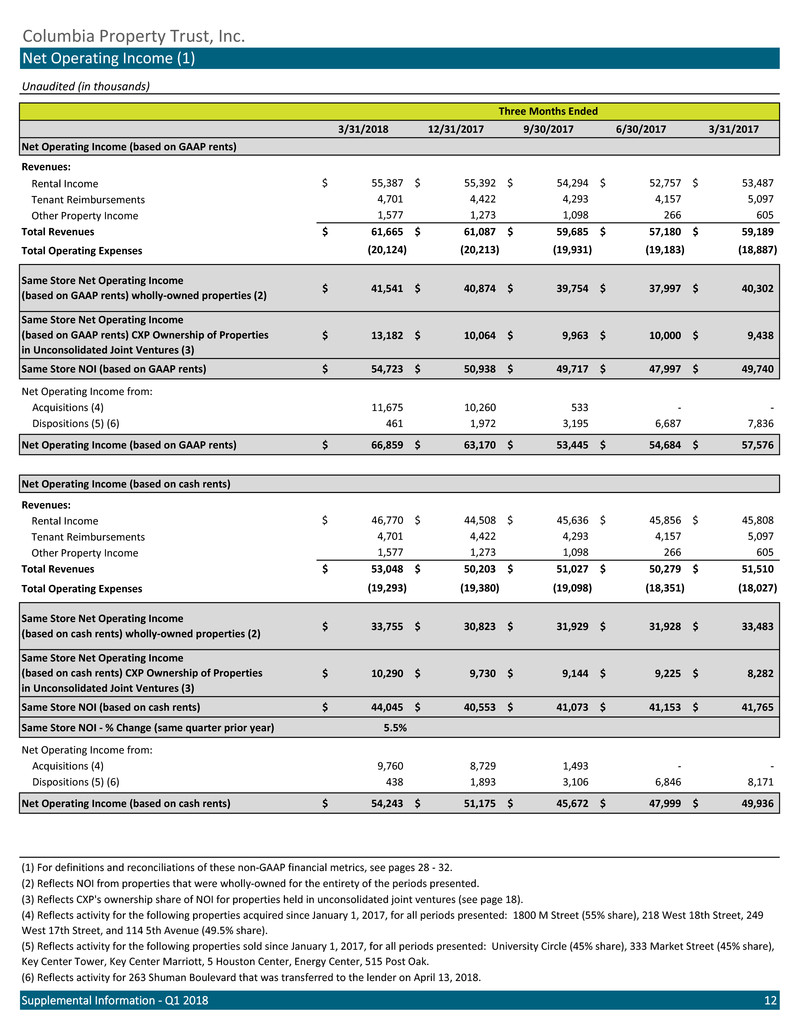

Unaudited (in thousands) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Net Operating Income (based on GAAP rents) Revenues: Rental Income 55,387$ 55,392$ 54,294$ 52,757$ 53,487$ Tenant Reimbursements 4,701 4,422 4,293 4,157 5,097 Other Property Income 1,577 1,273 1,098 266 605 Total Revenues 61,665$ 61,087$ 59,685$ 57,180$ 59,189$ Total Operating Expenses (20,124) (20,213) (19,931) (19,183) (18,887) 41,541$ 40,874$ 39,754$ 37,997$ 40,302$ 13,182$ 10,064$ 9,963$ 10,000$ 9,438$ Same Store NOI (based on GAAP rents) 54,723$ 50,938$ 49,717$ 47,997$ 49,740$ Net Operating Income from: Acquisitions (4) 11,675 10,260 533 - - Dispositions (5) (6) 461 1,972 3,195 6,687 7,836 Net Operating Income (based on GAAP rents) 66,859$ 63,170$ 53,445$ 54,684$ 57,576$ Net Operating Income (based on cash rents) Revenues: Rental Income 46,770$ 44,508$ 45,636$ 45,856$ 45,808$ Tenant Reimbursements 4,701 4,422 4,293 4,157 5,097 Other Property Income 1,577 1,273 1,098 266 605 Total Revenues 53,048$ 50,203$ 51,027$ 50,279$ 51,510$ Total Operating Expenses (19,293) (19,380) (19,098) (18,351) (18,027) 33,755$ 30,823$ 31,929$ 31,928$ 33,483$ 10,290$ 9,730$ 9,144$ 9,225$ 8,282$ Same Store NOI (based on cash rents) 44,045$ 40,553$ 41,073$ 41,153$ 41,765$ Same Store NOI - % Change (same quarter prior year) 5.5% Net Operating Income from: Acquisitions (4) 9,760 8,729 1,493 - - Dispositions (5) (6) 438 1,893 3,106 6,846 8,171 Net Operating Income (based on cash rents) 54,243$ 51,175$ 45,672$ 47,999$ 49,936$ Supplemental Information - Q1 2018 12 (6) Reflects activity for 263 Shuman Boulevard that was transferred to the lender on April 13, 2018. (4) Reflects activity for the following properties acquired since January 1, 2017, for all periods presented: 1800 M Street (55% share), 218 West 18th Street, 249 West 17th Street, and 114 5th Avenue (49.5% share). Same Store Net Operating Income (based on cash rents) CXP Ownership of Properties in Unconsolidated Joint Ventures (3) Same Store Net Operating Income (based on cash rents) wholly-owned properties (2) (5) Reflects activity for the following properties sold since January 1, 2017, for all periods presented: University Circle (45% share), 333 Market Street (45% share), Key Center Tower, Key Center Marriott, 5 Houston Center, Energy Center, 515 Post Oak. (1) For definitions and reconciliations of these non-GAAP financial metrics, see pages 28 - 32. (3) Reflects CXP's ownership share of NOI for properties held in unconsolidated joint ventures (see page 18). (2) Reflects NOI from properties that were wholly-owned for the entirety of the periods presented. Same Store Net Operating Income (based on GAAP rents) wholly-owned properties (2) Same Store Net Operating Income (based on GAAP rents) CXP Ownership of Properties in Unconsolidated Joint Ventures (3) Columbia Property Trust, Inc. Net Operating Income (1) Three Months Ended

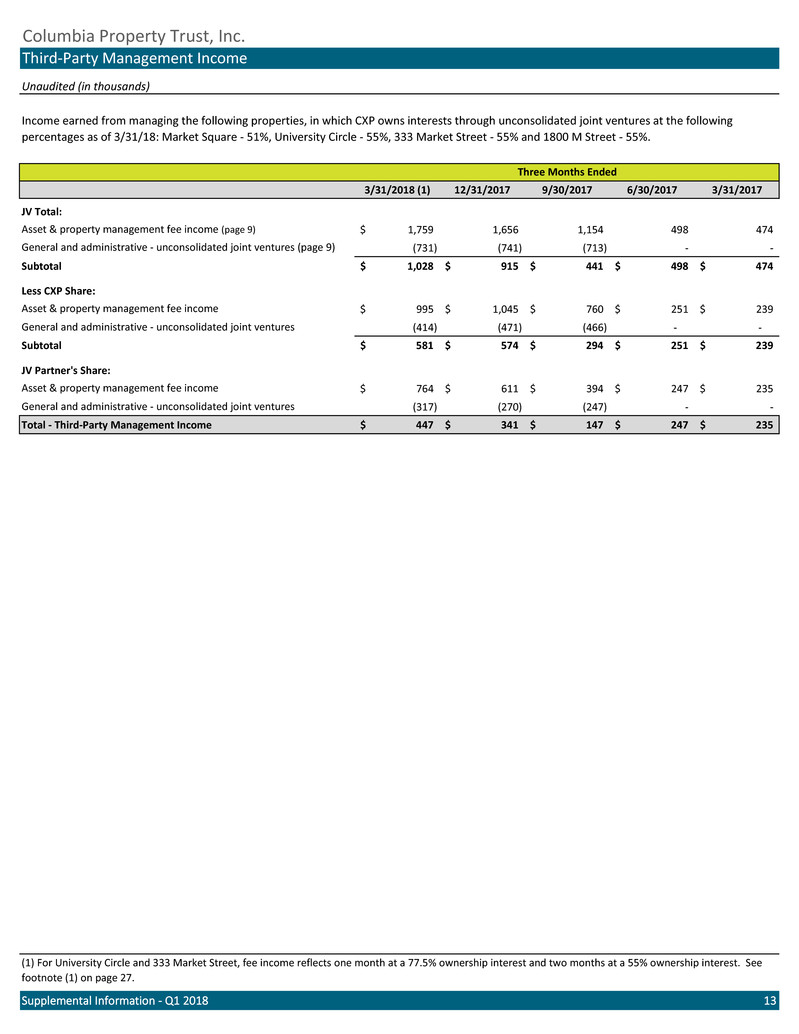

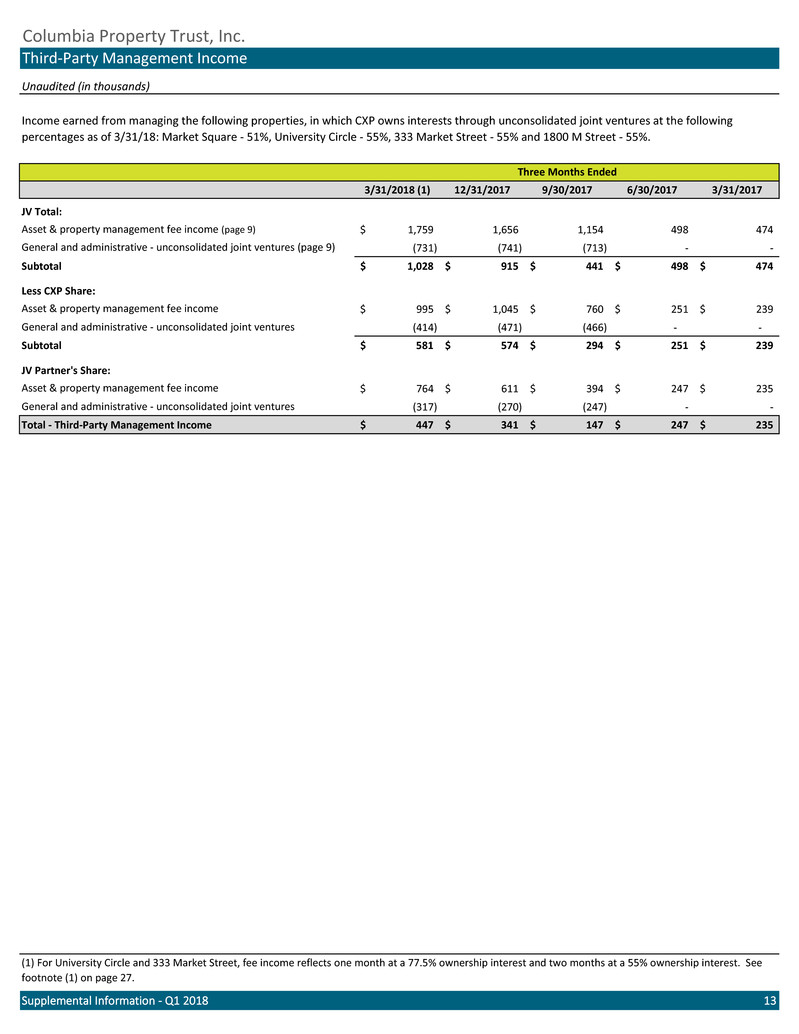

Unaudited (in thousands) 3/31/2018 (1) 12/31/2017 9/30/2017 6/30/2017 3/31/2017 JV Total: 1,759$ 1,656 1,154 498 474 (731) (741) (713) - - Subtotal 1,028$ 915$ 441$ 498$ 474$ Less CXP Share: 995$ 1,045$ 760$ 251$ 239$ (414) (471) (466) - - Subtotal 581$ 574$ 294$ 251$ 239$ JV Partner's Share: 764$ 611$ 394$ 247$ 235$ (317) (270) (247) - - Total - Third-Party Management Income 447$ 341$ 147$ 247$ 235$ Supplemental Information - Q1 2018 13 Columbia Property Trust, Inc. Third-Party Management Income Three Months Ended (1) For University Circle and 333 Market Street, fee income reflects one month at a 77.5% ownership interest and two months at a 55% ownership interest. See footnote (1) on page 27. Asset & property management fee income (page 9) Asset & property management fee income Income earned from managing the following properties, in which CXP owns interests through unconsolidated joint ventures at the following percentages as of 3/31/18: Market Square - 51%, University Circle - 55%, 333 Market Street - 55% and 1800 M Street - 55%. Asset & property management fee income General and administrative - unconsolidated joint ventures (page 9) General and administrative - unconsolidated joint ventures General and administrative - unconsolidated joint ventures

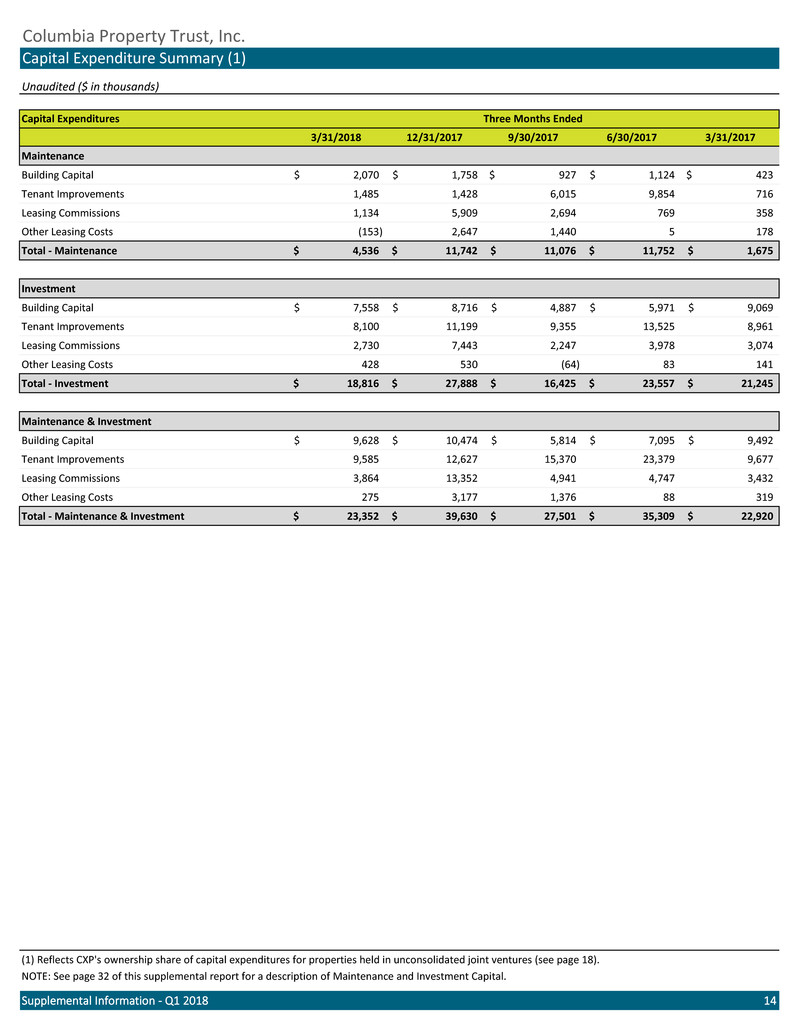

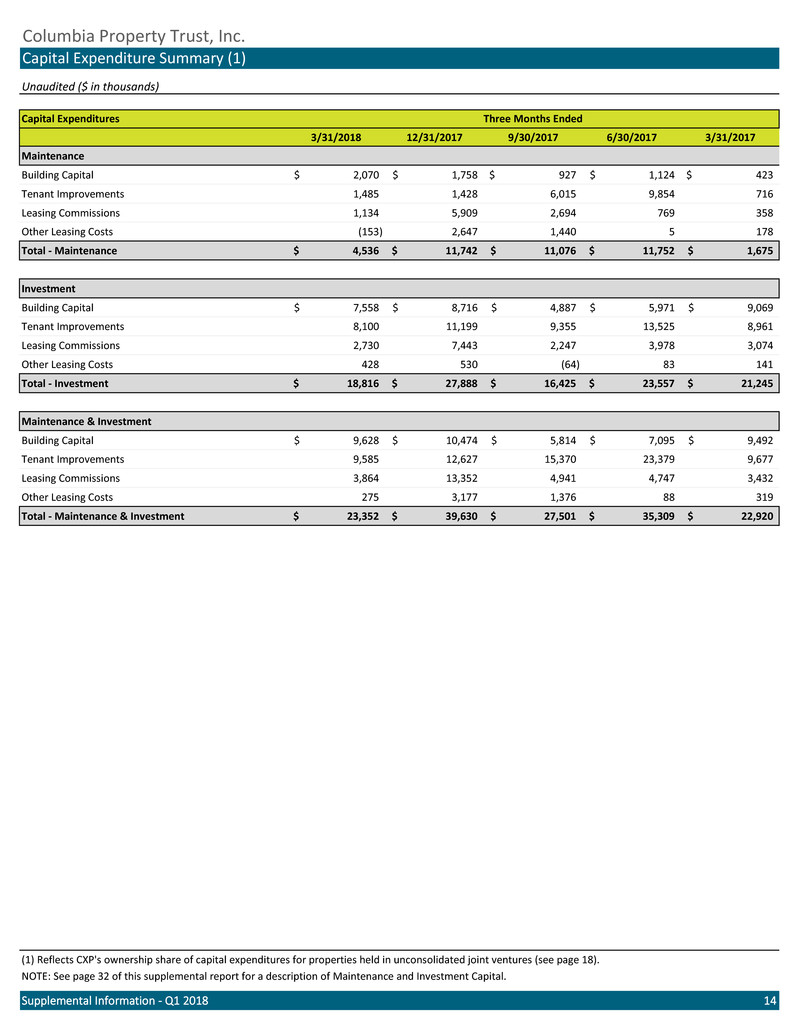

Unaudited ($ in thousands) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Maintenance Building Capital 2,070$ 1,758$ 927$ 1,124$ 423$ Tenant Improvements 1,485 1,428 6,015 9,854 716 Leasing Commissions 1,134 5,909 2,694 769 358 Other Leasing Costs (153) 2,647 1,440 5 178 Total - Maintenance 4,536$ 11,742$ 11,076$ 11,752$ 1,675$ Investment Building Capital 7,558$ 8,716$ 4,887$ 5,971$ 9,069$ Tenant Improvements 8,100 11,199 9,355 13,525 8,961 Leasing Commissions 2,730 7,443 2,247 3,978 3,074 Other Leasing Costs 428 530 (64) 83 141 Total - Investment 18,816$ 27,888$ 16,425$ 23,557$ 21,245$ Maintenance & Investment Building Capital 9,628$ 10,474$ 5,814$ 7,095$ 9,492$ Tenant Improvements 9,585 12,627 15,370 23,379 9,677 Leasing Commissions 3,864 13,352 4,941 4,747 3,432 Other Leasing Costs 275 3,177 1,376 88 319 Total - Maintenance & Investment 23,352$ 39,630$ 27,501$ 35,309$ 22,920$ Supplemental Information - Q1 2018 14 NOTE: See page 32 of this supplemental report for a description of Maintenance and Investment Capital. Columbia Property Trust, Inc. Capital Expenditure Summary (1) Capital Expenditures Three Months Ended (1) Reflects CXP's ownership share of capital expenditures for properties held in unconsolidated joint ventures (see page 18).

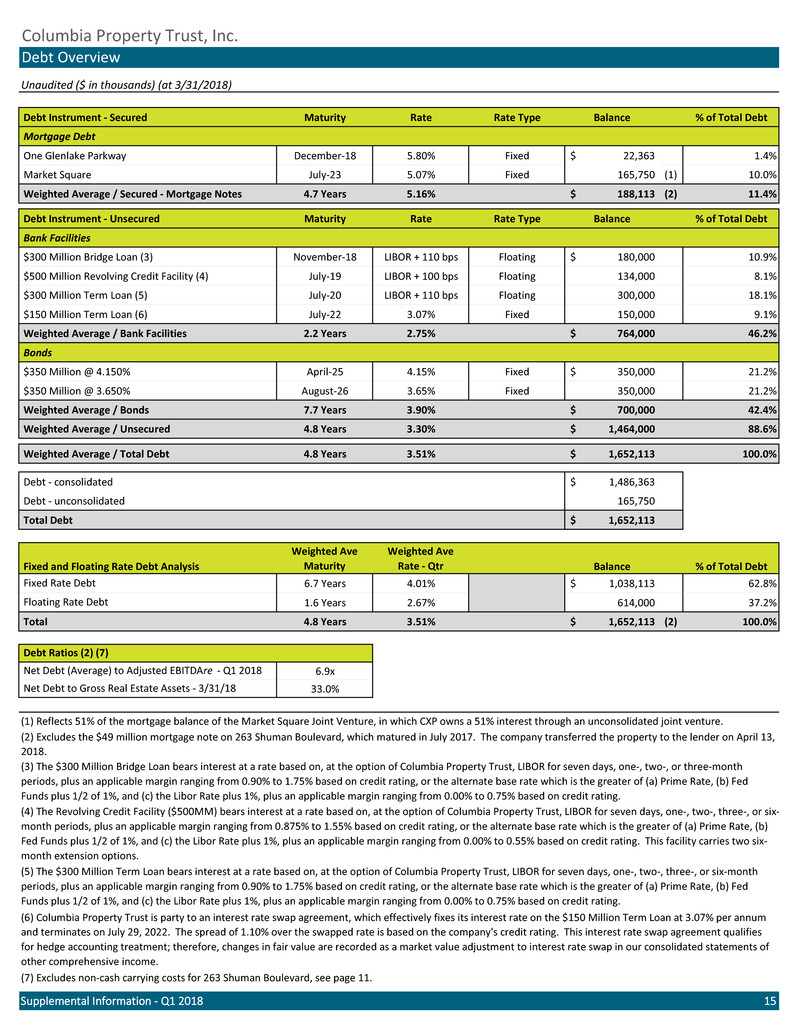

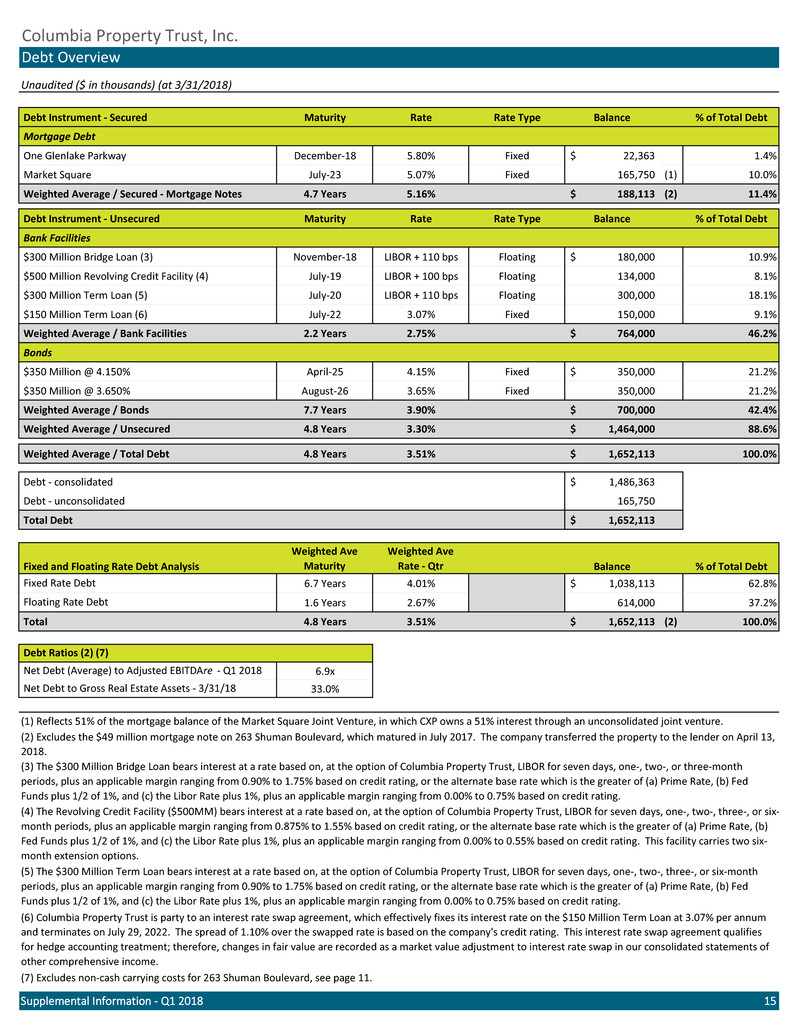

Unaudited ($ in thousands) (at 3/31/2018) Debt Instrument - Secured Maturity Rate Rate Type Balance % of Total Debt Mortgage Debt One Glenlake Parkway December-18 5.80% Fixed 22,363$ 1.4% Market Square July-23 5.07% Fixed 165,750 (1) 10.0% Weighted Average / Secured - Mortgage Notes 4.7 Years 5.16% 188,113$ (2) 11.4% Debt Instrument - Unsecured Maturity Rate Rate Type Balance % of Total Debt Bank Facilities $300 Million Bridge Loan (3) November-18 LIBOR + 110 bps Floating 180,000$ 10.9% $500 Million Revolving Credit Facility (4) July-19 LIBOR + 100 bps Floating 134,000 8.1% $300 Million Term Loan (5) July-20 LIBOR + 110 bps Floating 300,000 18.1% $150 Million Term Loan (6) July-22 3.07% Fixed 150,000 9.1% Weighted Average / Bank Facilities 2.2 Years 2.75% 764,000$ 46.2% Bonds $350 Million @ 4.150% April-25 4.15% Fixed 350,000$ 21.2% $350 Million @ 3.650% August-26 3.65% Fixed 350,000 21.2% Weighted Average / Bonds 7.7 Years 3.90% 700,000$ 42.4% Weighted Average / Unsecured 4.8 Years 3.30% 1,464,000$ 88.6% Weighted Average / Total Debt 4.8 Years 3.51% 1,652,113$ 100.0% Debt - consolidated 1,486,363$ Debt - unconsolidated 165,750 Total Debt 1,652,113$ Weighted Ave Maturity Weighted Ave Rate - Qtr Balance % of Total Debt 6.7 Years 4.01% 1,038,113$ 62.8% 1.6 Years 2.67% 614,000 37.2% Total 4.8 Years 3.51% 1,652,113$ (2) 100.0% 6.9x 33.0% (1) Reflects 51% of the mortgage balance of the Market Square Joint Venture, in which CXP owns a 51% interest through an unconsolidated joint venture. (7) Excludes non-cash carrying costs for 263 Shuman Boulevard, see page 11. Supplemental Information - Q1 2018 15 Debt Ratios (2) (7) Net Debt (Average) to Adjusted EBITDAre - Q1 2018 Net Debt to Gross Real Estate Assets - 3/31/18 (6) Columbia Property Trust is party to an interest rate swap agreement, which effectively fixes its interest rate on the $150 Million Term Loan at 3.07% per annum and terminates on July 29, 2022. The spread of 1.10% over the swapped rate is based on the company's credit rating. This interest rate swap agreement qualifies for hedge accounting treatment; therefore, changes in fair value are recorded as a market value adjustment to interest rate swap in our consolidated statements of other comprehensive income. Columbia Property Trust, Inc. Debt Overview (5) The $300 Million Term Loan bears interest at a rate based on, at the option of Columbia Property Trust, LIBOR for seven days, one-, two-, three-, or six-month periods, plus an applicable margin ranging from 0.90% to 1.75% based on credit rating, or the alternate base rate which is the greater of (a) Prime Rate, (b) Fed Funds plus 1/2 of 1%, and (c) the Libor Rate plus 1%, plus an applicable margin ranging from 0.00% to 0.75% based on credit rating. Fixed and Floating Rate Debt Analysis Fixed Rate Debt Floating Rate Debt (4) The Revolving Credit Facility ($500MM) bears interest at a rate based on, at the option of Columbia Property Trust, LIBOR for seven days, one-, two-, three-, or six- month periods, plus an applicable margin ranging from 0.875% to 1.55% based on credit rating, or the alternate base rate which is the greater of (a) Prime Rate, (b) Fed Funds plus 1/2 of 1%, and (c) the Libor Rate plus 1%, plus an applicable margin ranging from 0.00% to 0.55% based on credit rating. This facility carries two six- month extension options. (2) Excludes the $49 million mortgage note on 263 Shuman Boulevard, which matured in July 2017. The company transferred the property to the lender on April 13, 2018. (3) The $300 Million Bridge Loan bears interest at a rate based on, at the option of Columbia Property Trust, LIBOR for seven days, one-, two-, or three-month periods, plus an applicable margin ranging from 0.90% to 1.75% based on credit rating, or the alternate base rate which is the greater of (a) Prime Rate, (b) Fed Funds plus 1/2 of 1%, and (c) the Libor Rate plus 1%, plus an applicable margin ranging from 0.00% to 0.75% based on credit rating.

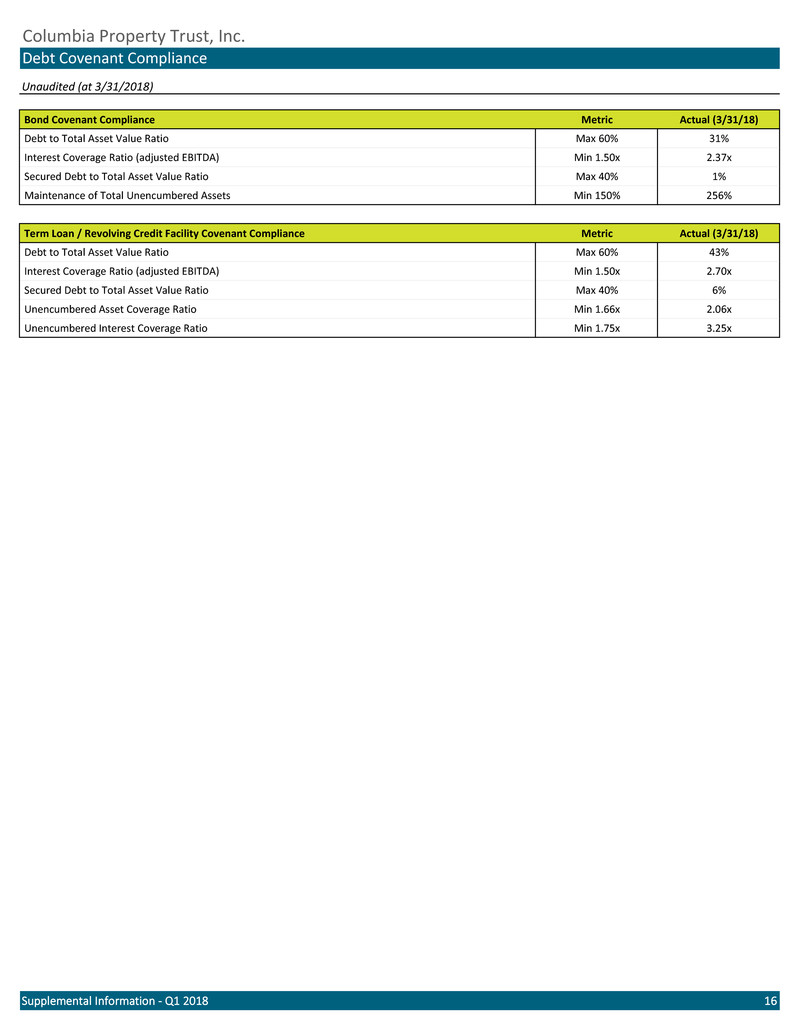

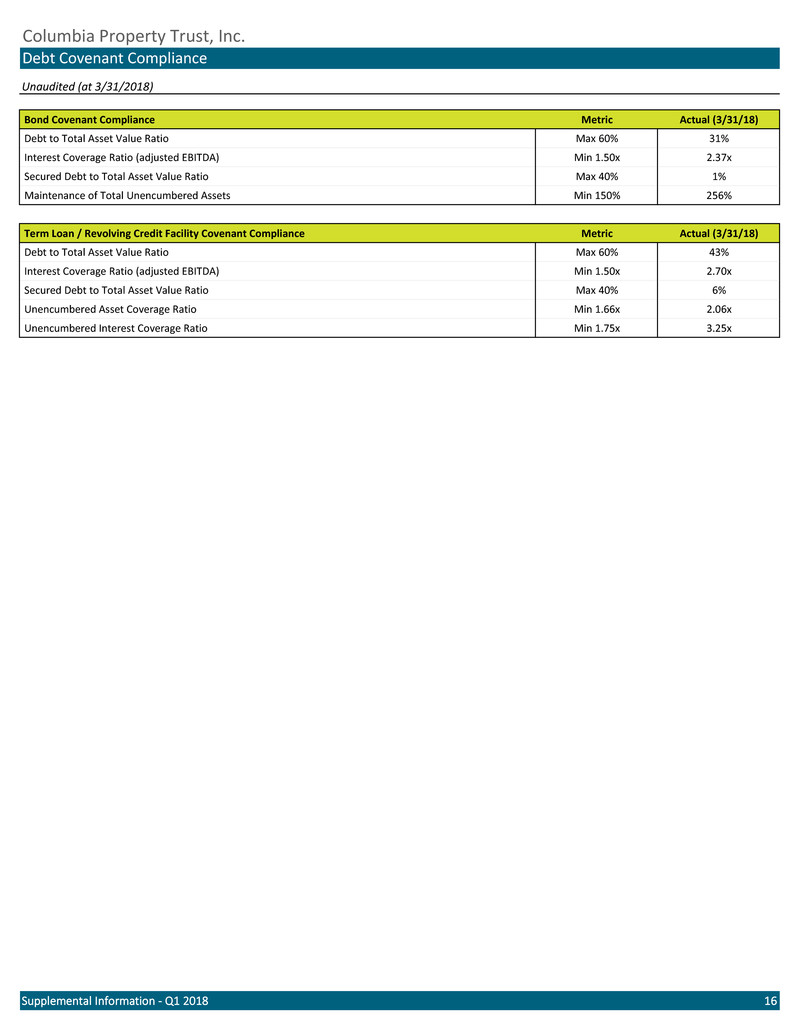

Unaudited (at 3/31/2018) Bond Covenant Compliance Metric Actual (3/31/18) Debt to Total Asset Value Ratio Max 60% 31% Interest Coverage Ratio (adjusted EBITDA) Min 1.50x 2.37x Secured Debt to Total Asset Value Ratio Max 40% 1% Maintenance of Total Unencumbered Assets Min 150% 256% Term Loan / Revolving Credit Facility Covenant Compliance Metric Actual (3/31/18) Debt to Total Asset Value Ratio Max 60% 43% Interest Coverage Ratio (adjusted EBITDA) Min 1.50x 2.70x Secured Debt to Total Asset Value Ratio Max 40% 6% Unencumbered Asset Coverage Ratio Min 1.66x 2.06x Unencumbered Interest Coverage Ratio Min 1.75x 3.25x Supplemental Information - Q1 2018 16 Columbia Property Trust, Inc. Debt Covenant Compliance

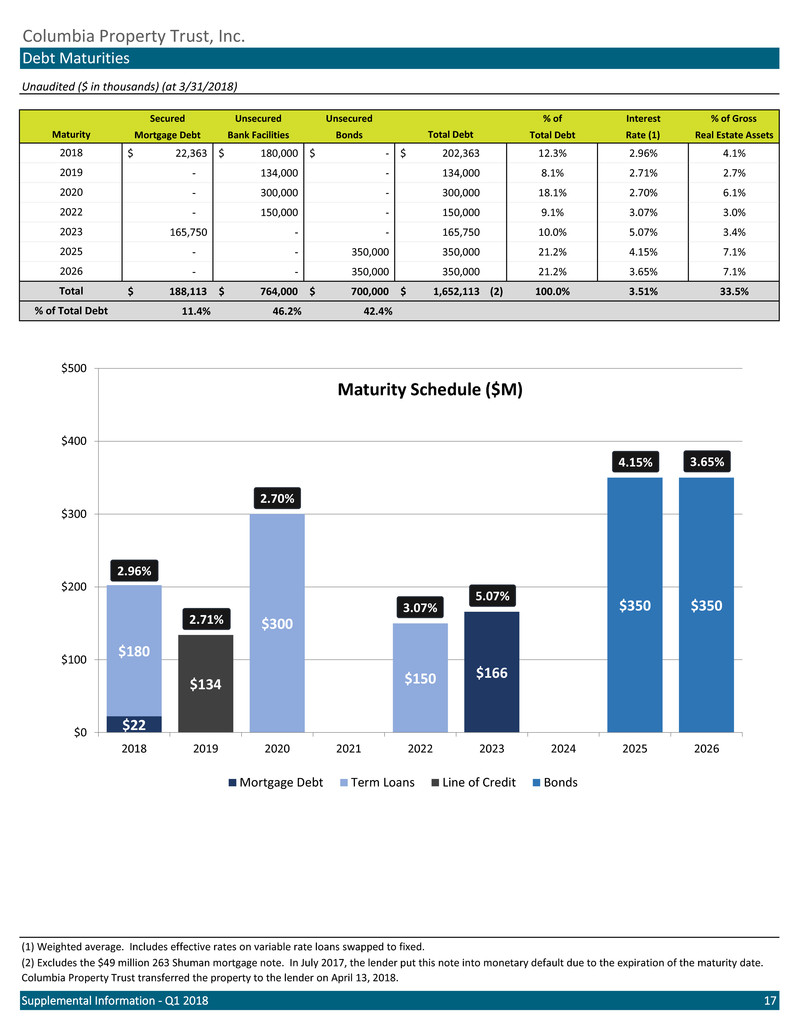

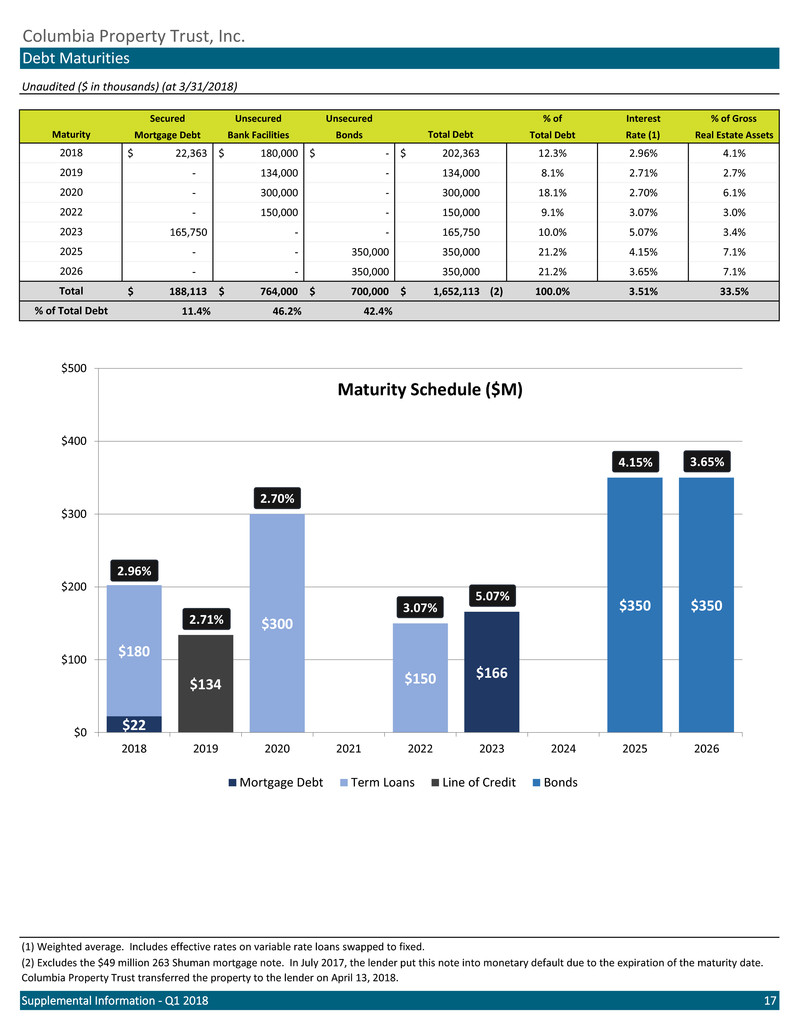

Unaudited ($ in thousands) (at 3/31/2018) Secured Unsecured Unsecured % of Interest % of Gross Mortgage Debt Bank Facilities Bonds Total Debt Rate (1) Real Estate Assets 22,363$ 180,000$ -$ 202,363$ 12.3% 2.96% 4.1% - 134,000 - 134,000 8.1% 2.71% 2.7% - 300,000 - 300,000 18.1% 2.70% 6.1% - 150,000 - 150,000 9.1% 3.07% 3.0% 165,750 - - 165,750 10.0% 5.07% 3.4% - - 350,000 350,000 21.2% 4.15% 7.1% - - 350,000 350,000 21.2% 3.65% 7.1% 188,113$ 764,000$ 700,000$ 1,652,113$ (2) 100.0% 3.51% 33.5% 11.4% 46.2% 42.4% Supplemental Information - Q1 2018 17 2020 Total Debt 2022 2023 (2) Excludes the $49 million 263 Shuman mortgage note. In July 2017, the lender put this note into monetary default due to the expiration of the maturity date. Columbia Property Trust transferred the property to the lender on April 13, 2018. Columbia Property Trust, Inc. Debt Maturities (1) Weighted average. Includes effective rates on variable rate loans swapped to fixed. Maturity 2025 2026 Total % of Total Debt 2018 2019 $22 $166 $180 $300 $150 $134 $350 $350 $0 $100 $200 $300 $400 $500 2018 2019 2020 2021 2022 2023 2024 2025 2026 Maturity Schedule ($M) Mortgage Debt Term Loans Line of Credit Bonds 2.96% 4.15% 3.07% 3.65% 5.07% 2.70% 2.71%

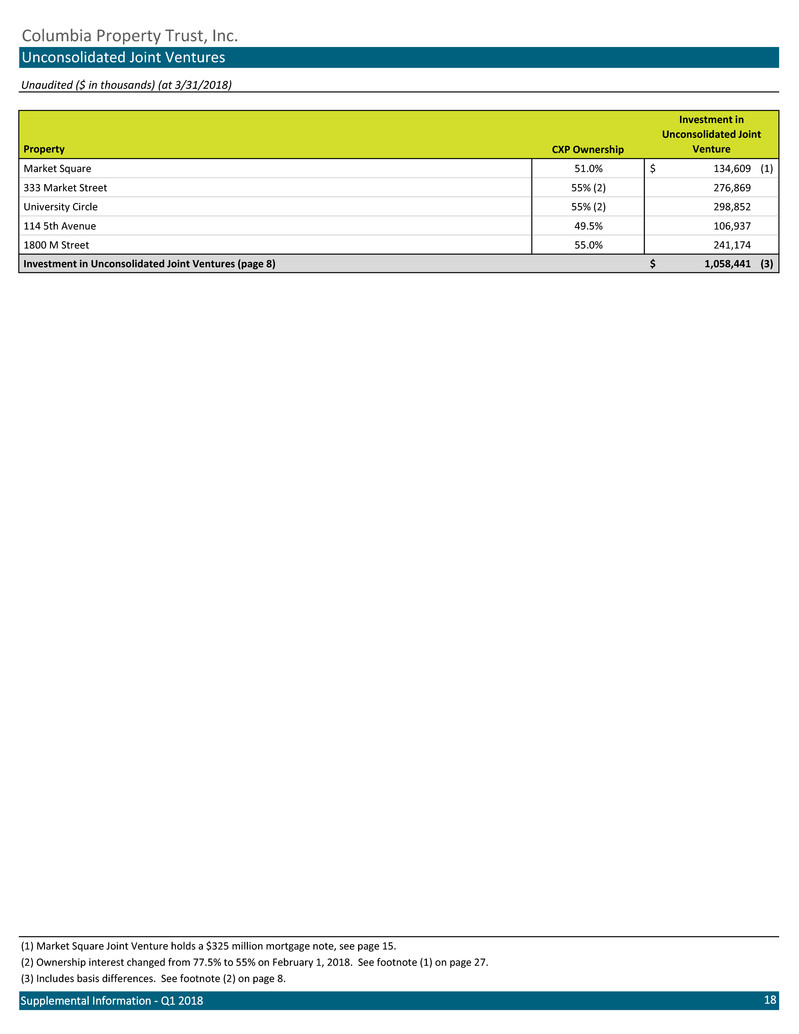

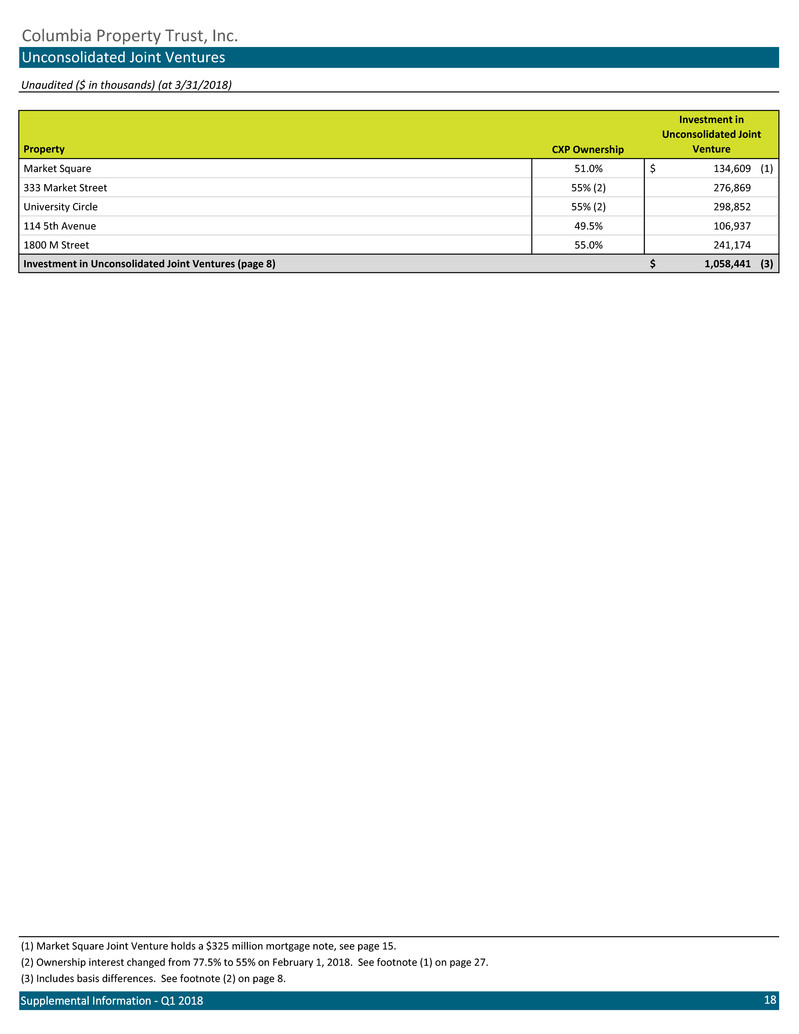

Unaudited ($ in thousands) (at 3/31/2018) CXP Ownership Market Square 51.0% 134,609$ (1) 333 Market Street 55% (2) 276,869 University Circle 55% (2) 298,852 114 5th Avenue 49.5% 106,937 1800 M Street 55.0% 241,174 Investment in Unconsolidated Joint Ventures (page 8) 1,058,441$ (3) 333 Market Street University Circle 114 5th Avenue Total (gross) Amortization Total (net) Supplemental Information - Q1 2018 18 (3) Includes basis differences. See footnote (2) on page 8. Columbia Property Trust, Inc. Unconsolidated Joint Ventures Investment in Unconsolidated Joint Venture (1) Market Square Joint Venture holds a $325 million mortgage note, see page 15. Property (2) Ownership interest changed from 77.5% to 55% on February 1, 2018. See footnote (1) on page 27.

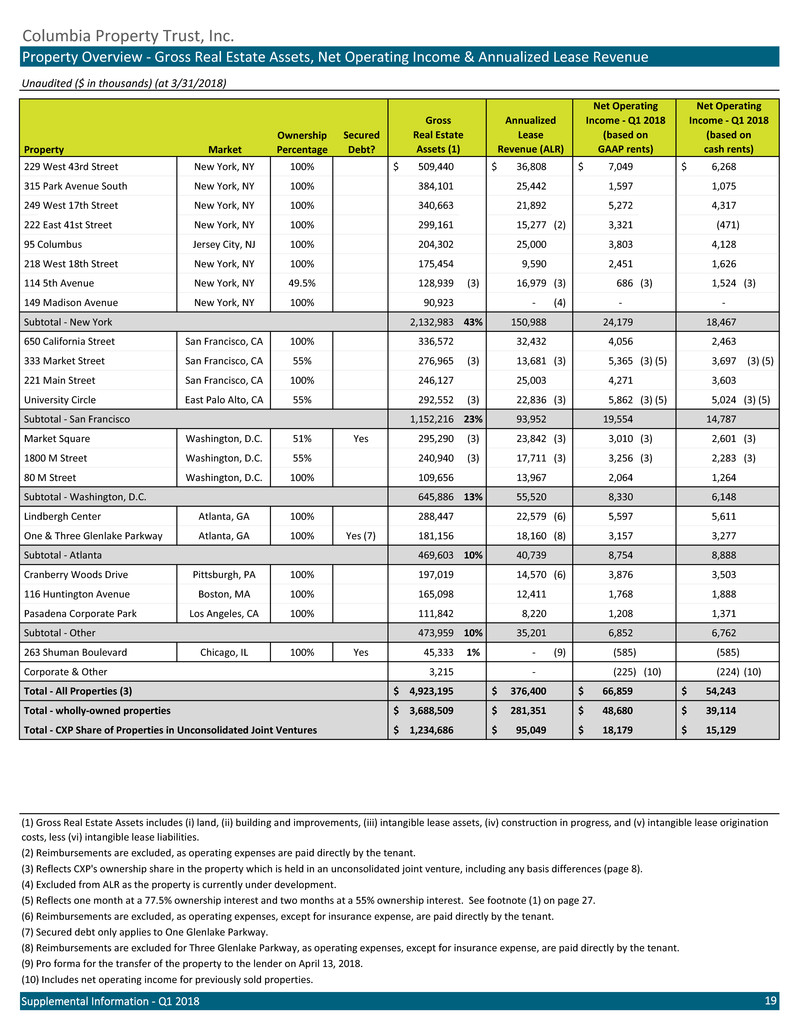

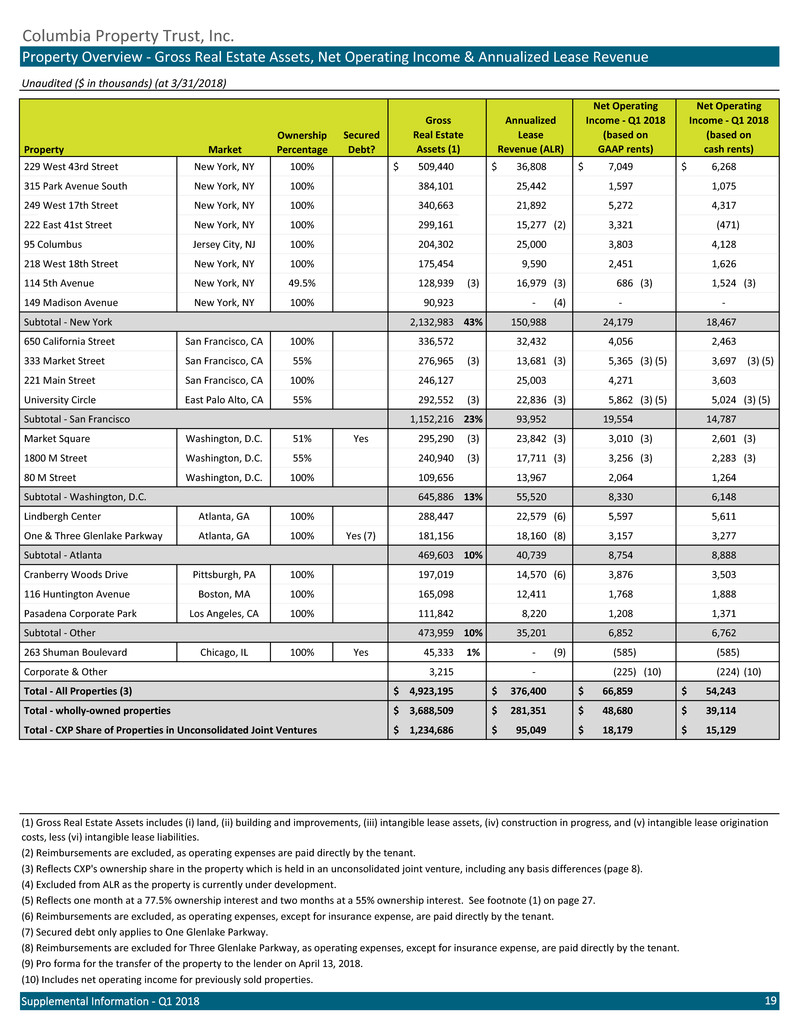

Columbia Property Trust, Inc. Property Overview - Gross Real Estate Assets, Net Operating Income & Annualized Lease Revenue Unaudited ($ in thousands) (at 3/31/2018) Ownership Secured Market Percentage Debt? 229 West 43rd Street New York, NY 100% 509,440$ 36,808$ 7,049$ 6,268$ 315 Park Avenue South New York, NY 100% 384,101 25,442 1,597 1,075 249 West 17th Street New York, NY 100% 340,663 21,892 5,272 4,317 222 East 41st Street New York, NY 100% 299,161 15,277 (2) 3,321 (471) 95 Columbus Jersey City, NJ 100% 204,302 25,000 3,803 4,128 218 West 18th Street New York, NY 100% 175,454 9,590 2,451 1,626 114 5th Avenue New York, NY 49.5% 128,939 (3) 16,979 (3) 686 (3) 1,524 (3) 149 Madison Avenue New York, NY 100% 90,923 - (4) - - Subtotal - New York 2,132,983 43% 150,988 24,179 18,467 650 California Street San Francisco, CA 100% 336,572 32,432 4,056 2,463 333 Market Street San Francisco, CA 55% 276,965 (3) 13,681 (3) 5,365 (3) (5) 3,697 (3) (5) 221 Main Street San Francisco, CA 100% 246,127 25,003 4,271 3,603 University Circle East Palo Alto, CA 55% 292,552 (3) 22,836 (3) 5,862 (3) (5) 5,024 (3) (5) Subtotal - San Francisco 1,152,216 23% 93,952 19,554 14,787 Market Square Washington, D.C. 51% Yes 295,290 (3) 23,842 (3) 3,010 (3) 2,601 (3) 1800 M Street Washington, D.C. 55% 240,940 (3) 17,711 (3) 3,256 (3) 2,283 (3) 80 M Street Washington, D.C. 100% 109,656 13,967 2,064 1,264 Subtotal - Washington, D.C. 645,886 13% 55,520 8,330 6,148 Lindbergh Center Atlanta, GA 100% 288,447 22,579 (6) 5,597 5,611 One & Three Glenlake Parkway Atlanta, GA 100% Yes (7) 181,156 18,160 (8) 3,157 3,277 Subtotal - Atlanta 469,603 10% 40,739 8,754 8,888 Cranberry Woods Drive Pittsburgh, PA 100% 197,019 14,570 (6) 3,876 3,503 116 Huntington Avenue Boston, MA 100% 165,098 12,411 1,768 1,888 Pasadena Corporate Park Los Angeles, CA 100% 111,842 8,220 1,208 1,371 Subtotal - Other 473,959 10% 35,201 6,852 6,762 263 Shuman Boulevard Chicago, IL 100% Yes 45,333 1% - (9) (585) (585) Corporate & Other 3,215 - (225) (10) (224) (10) Total - All Properties (3) 4,923,195$ 376,400$ 66,859$ 54,243$ Total - wholly-owned properties 3,688,509$ 281,351$ 48,680$ 39,114$ Total - CXP Share of Properties in Unconsolidated Joint Ventures 1,234,686$ 95,049$ 18,179$ 15,129$ Supplemental Information - Q1 2018 Gross Annualized Income - Q1 2018 Income - Q1 2018 Net Operating Net Operating Real Estate Lease (based on (based on Property Assets (1) Revenue (ALR) GAAP rents) cash rents) (8) Reimbursements are excluded for Three Glenlake Parkway, as operating expenses, except for insurance expense, are paid directly by the tenant. (9) Pro forma for the transfer of the property to the lender on April 13, 2018. (10) Includes net operating income for previously sold properties. 19 (1) Gross Real Estate Assets includes (i) land, (ii) building and improvements, (iii) intangible lease assets, (iv) construction in progress, and (v) intangible lease origination costs, less (vi) intangible lease liabilities. (2) Reimbursements are excluded, as operating expenses are paid directly by the tenant. (3) Reflects CXP's ownership share in the property which is held in an unconsolidated joint venture, including any basis differences (page 8). (4) Excluded from ALR as the property is currently under development. (6) Reimbursements are excluded, as operating expenses, except for insurance expense, are paid directly by the tenant. (7) Secured debt only applies to One Glenlake Parkway. (5) Reflects one month at a 77.5% ownership interest and two months at a 55% ownership interest. See footnote (1) on page 27.

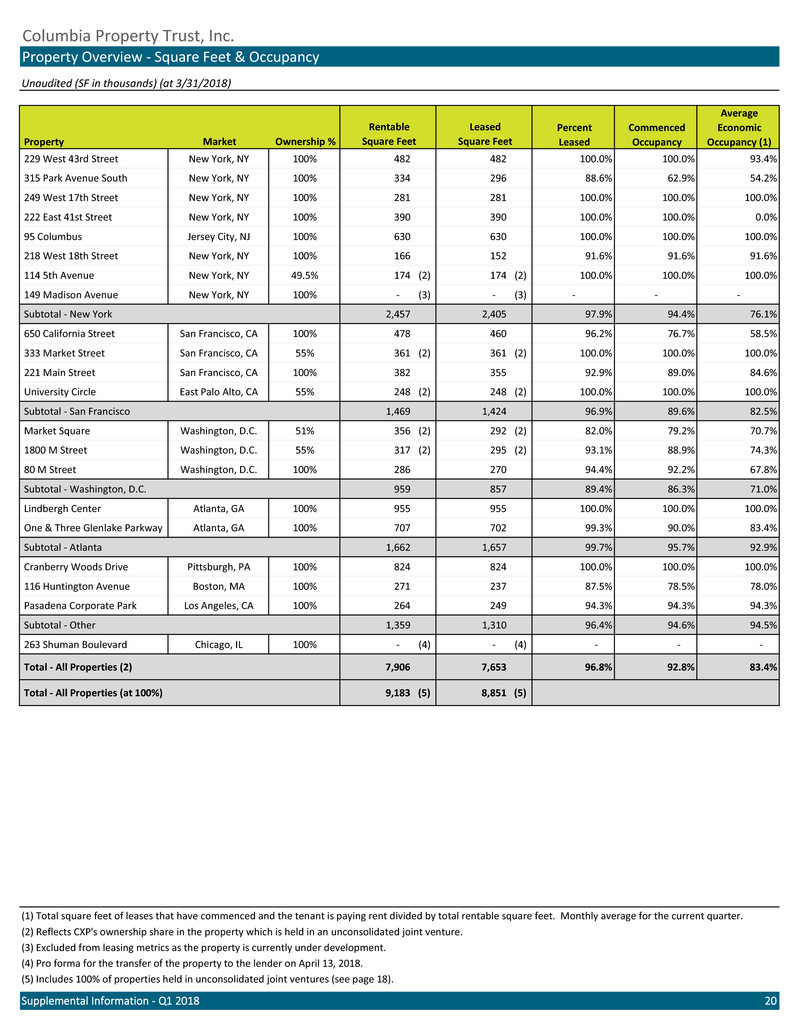

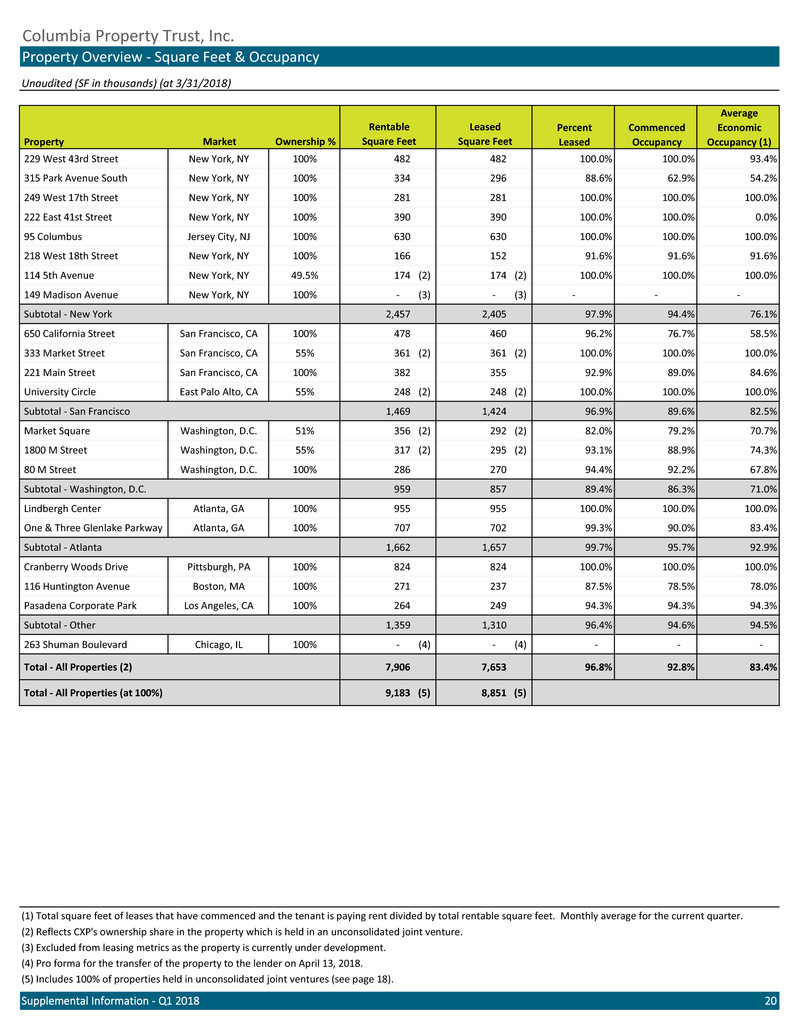

Columbia Property Trust, Inc. Property Overview - Square Feet & Occupancy Unaudited (SF in thousands) (at 3/31/2018) Average Percent Commenced Economic Market Ownership % Leased Occupancy Occupancy (1) 229 West 43rd Street New York, NY 100% 482 482 100.0% 100.0% 93.4% 315 Park Avenue South New York, NY 100% 334 296 88.6% 62.9% 54.2% 249 West 17th Street New York, NY 100% 281 281 100.0% 100.0% 100.0% 222 East 41st Street New York, NY 100% 390 390 100.0% 100.0% 0.0% 95 Columbus Jersey City, NJ 100% 630 630 100.0% 100.0% 100.0% 218 West 18th Street New York, NY 100% 166 152 91.6% 91.6% 91.6% 114 5th Avenue New York, NY 49.5% 174 (2) 174 (2) 100.0% 100.0% 100.0% 149 Madison Avenue New York, NY 100% - (3) - (3) - - - Subtotal - New York 2,457 2,405 97.9% 94.4% 76.1% 650 California Street San Francisco, CA 100% 478 460 96.2% 76.7% 58.5% 333 Market Street San Francisco, CA 55% 361 (2) 361 (2) 100.0% 100.0% 100.0% 221 Main Street San Francisco, CA 100% 382 355 92.9% 89.0% 84.6% University Circle East Palo Alto, CA 55% 248 (2) 248 (2) 100.0% 100.0% 100.0% Subtotal - San Francisco 1,469 1,424 96.9% 89.6% 82.5% Market Square Washington, D.C. 51% 356 (2) 292 (2) 82.0% 79.2% 70.7% 1800 M Street Washington, D.C. 55% 317 (2) 295 (2) 93.1% 88.9% 74.3% 80 M Street Washington, D.C. 100% 286 270 94.4% 92.2% 67.8% Subtotal - Washington, D.C. 959 857 89.4% 86.3% 71.0% Lindbergh Center Atlanta, GA 100% 955 955 100.0% 100.0% 100.0% One & Three Glenlake Parkway Atlanta, GA 100% 707 702 99.3% 90.0% 83.4% Subtotal - Atlanta 1,662 1,657 99.7% 95.7% 92.9% Cranberry Woods Drive Pittsburgh, PA 100% 824 824 100.0% 100.0% 100.0% 116 Huntington Avenue Boston, MA 100% 271 237 87.5% 78.5% 78.0% Pasadena Corporate Park Los Angeles, CA 100% 264 249 94.3% 94.3% 94.3% Subtotal - Other 1,359 1,310 96.4% 94.6% 94.5% 263 Shuman Boulevard Chicago, IL 100% - (4) - (4) - - - Total - All Properties (2) 7,906 7,653 96.8% 92.8% 83.4% Total - All Properties (at 100%) 9,183 (5) 8,851 (5) Supplemental Information - Q1 2018 20 Rentable Leased (5) Includes 100% of properties held in unconsolidated joint ventures (see page 18). Property Square Feet Square Feet (1) Total square feet of leases that have commenced and the tenant is paying rent divided by total rentable square feet. Monthly average for the current quarter. (2) Reflects CXP's ownership share in the property which is held in an unconsolidated joint venture. (3) Excluded from leasing metrics as the property is currently under development. (4) Pro forma for the transfer of the property to the lender on April 13, 2018.

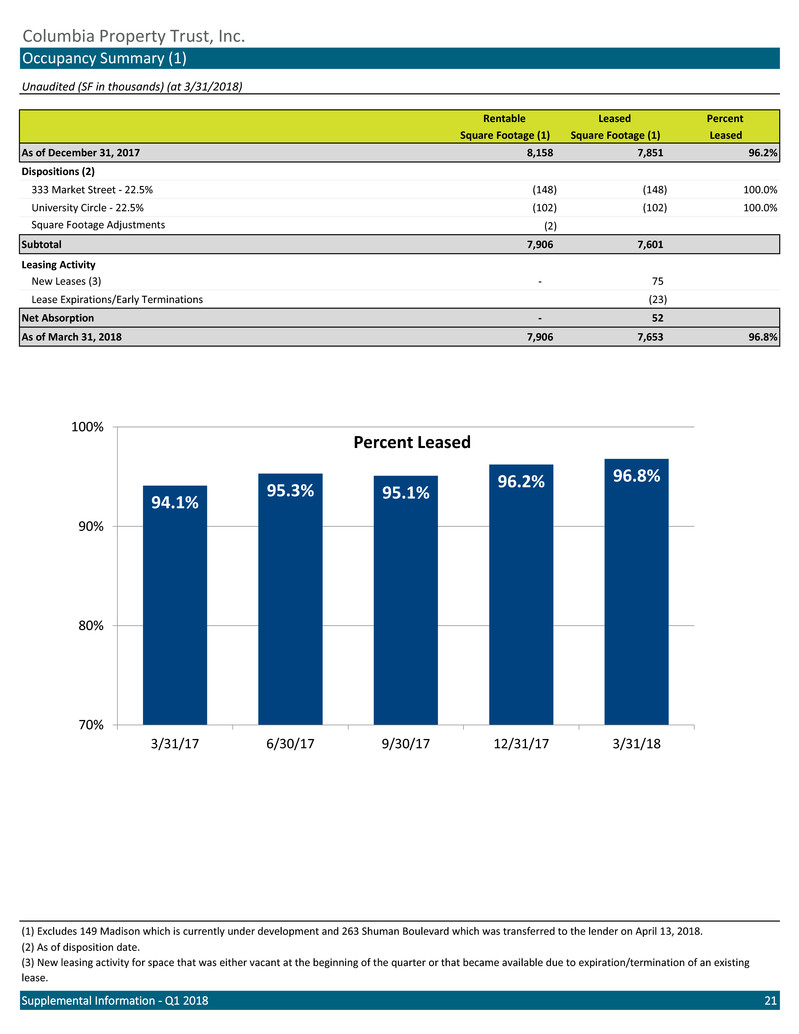

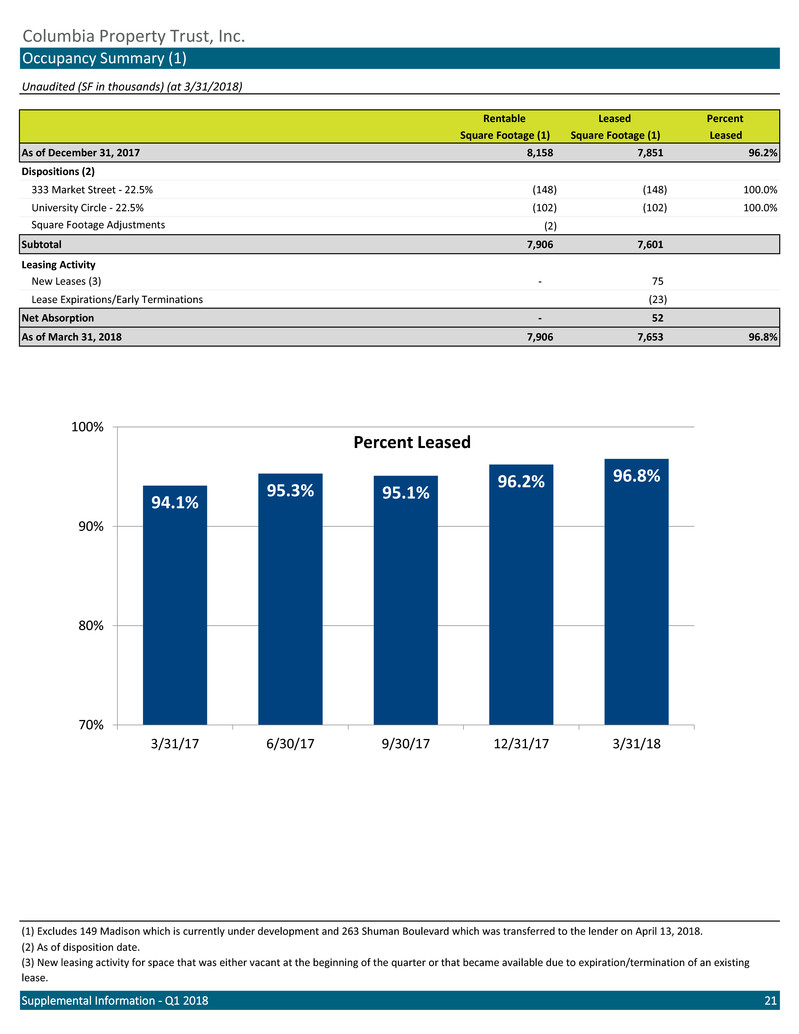

Unaudited (SF in thousands) (at 3/31/2018) Rentable Leased Percent Square Footage (1) Square Footage (1) Leased As of December 31, 2017 8,158 7,851 96.2% Dispositions (2) 333 Market Street - 22.5% (148) (148) 100.0% University Circle - 22.5% (102) (102) 100.0% Square Footage Adjustments (2) Subtotal 7,906 7,601 Leasing Activity New Leases (3) - 75 Lease Expirations/Early Terminations (23) Net Absorption - 52 As of March 31, 2018 7,906 7,653 96.8% 6/30/17 9/30/17 12/31/17 3/31/18 Supplemental Information - Q1 2018 21 Columbia Property Trust, Inc. Occupancy Summary (1) (1) Excludes 149 Madison which is currently under development and 263 Shuman Boulevard which was transferred to the lender on April 13, 2018. (3) New leasing activity for space that was either vacant at the beginning of the quarter or that became available due to expiration/termination of an existing lease. (2) As of disposition date. 94.1% 95.3% 95.1% 96.2% 96.8% 70% 80% 90% 100% 3/31/17 6/30/17 9/30/17 12/31/17 3/31/18 Percent Leased

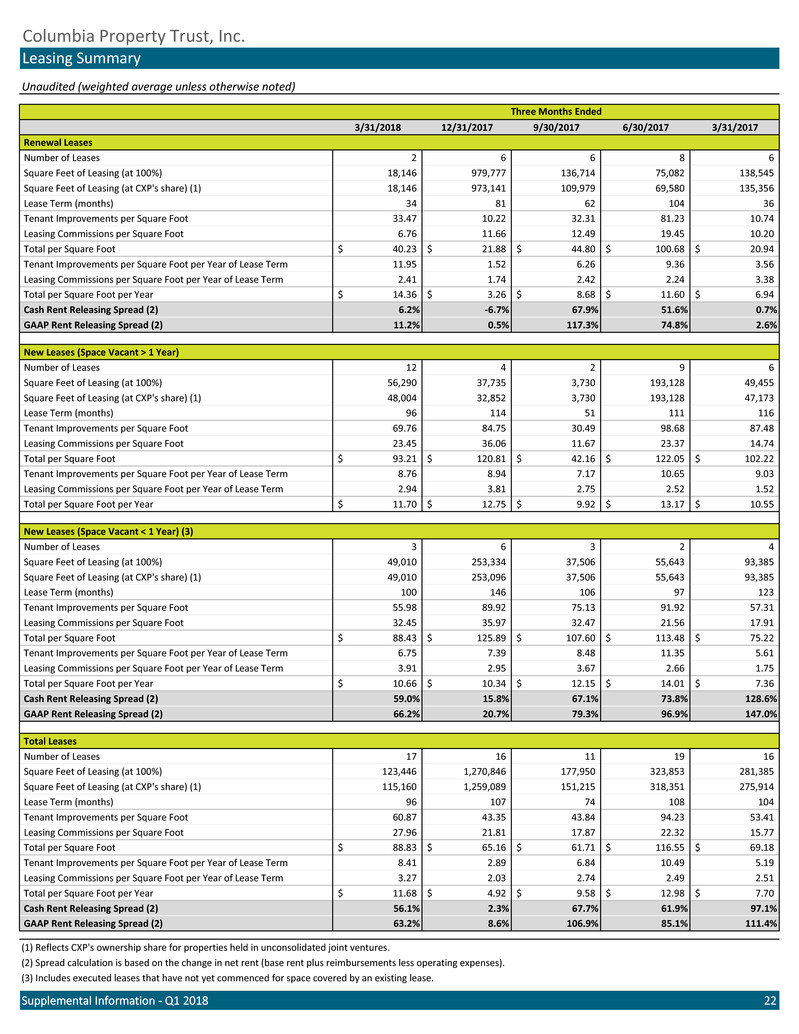

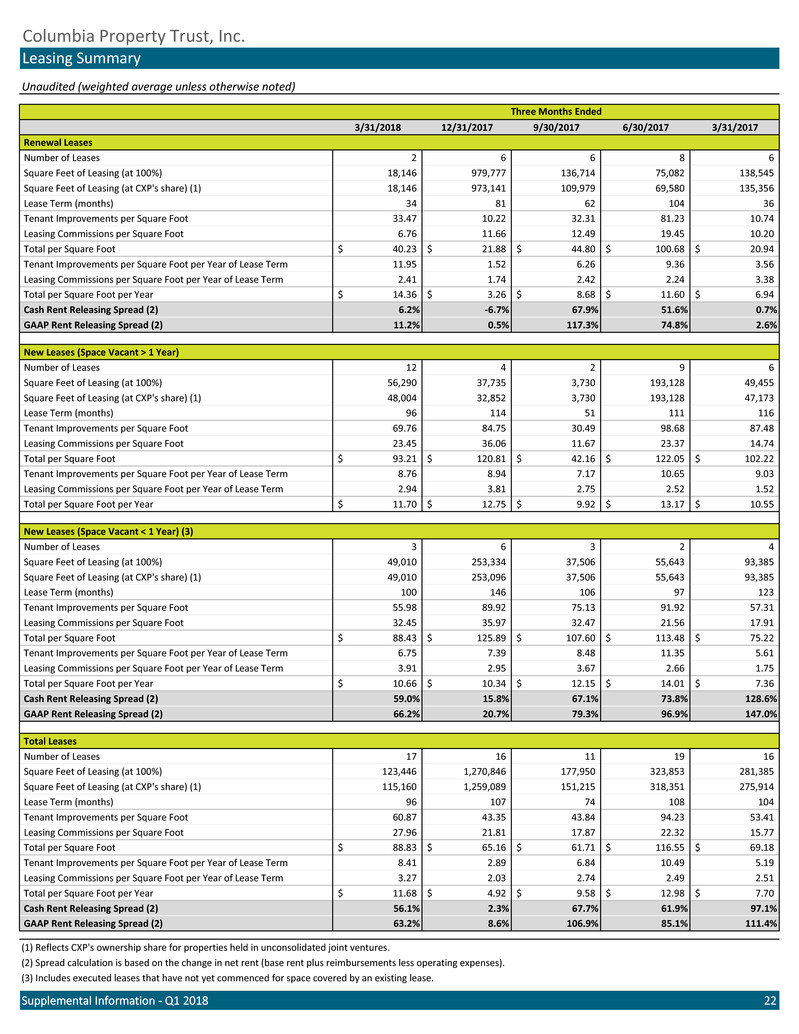

Unaudited (weighted average unless otherwise noted) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Renewal Leases Number of Leases 2 6 6 8 6 Square Feet of Leasing (at 100%) 18,146 979,777 136,714 75,082 138,545 Square Feet of Leasing (at CXP's share) (1) 18,146 973,141 109,979 69,580 135,356 Lease Term (months) 34 81 62 104 36 Tenant Improvements per Square Foot 33.47 10.22 32.31 81.23 10.74 Leasing Commissions per Square Foot 6.76 11.66 12.49 19.45 10.20 Total per Square Foot 40.23$ 21.88$ 44.80$ 100.68$ 20.94$ Tenant Improvements per Square Foot per Year of Lease Term 11.95 1.52 6.26 9.36 3.56 Leasing Commissions per Square Foot per Year of Lease Term 2.41 1.74 2.42 2.24 3.38 Total per Square Foot per Year 14.36$ 3.26$ 8.68$ 11.60$ 6.94$ Cash Rent Releasing Spread (2) 6.2% -6.7% 67.9% 51.6% 0.7% GAAP Rent Releasing Spread (2) 11.2% 0.5% 117.3% 74.8% 2.6% New Leases (Space Vacant > 1 Year) Number of Leases 12 4 2 9 6 Square Feet of Leasing (at 100%) 56,290 37,735 3,730 193,128 49,455 Square Feet of Leasing (at CXP's share) (1) 48,004 32,852 3,730 193,128 47,173 Lease Term (months) 96 114 51 111 116 Tenant Improvements per Square Foot 69.76 84.75 30.49 98.68 87.48 Leasing Commissions per Square Foot 23.45 36.06 11.67 23.37 14.74 Total per Square Foot 93.21$ 120.81$ 42.16$ 122.05$ 102.22$ Tenant Improvements per Square Foot per Year of Lease Term 8.76 8.94 7.17 10.65 9.03 Leasing Commissions per Square Foot per Year of Lease Term 2.94 3.81 2.75 2.52 1.52 Total per Square Foot per Year 11.70$ 12.75$ 9.92$ 13.17$ 10.55$ New Leases (Space Vacant < 1 Year) (3) Number of Leases 3 6 3 2 4 Square Feet of Leasing (at 100%) 49,010 253,334 37,506 55,643 93,385 Square Feet of Leasing (at CXP's share) (1) 49,010 253,096 37,506 55,643 93,385 Lease Term (months) 100 146 106 97 123 Tenant Improvements per Square Foot 55.98 89.92 75.13 91.92 57.31 Leasing Commissions per Square Foot 32.45 35.97 32.47 21.56 17.91 Total per Square Foot 88.43$ 125.89$ 107.60$ 113.48$ 75.22$ Tenant Improvements per Square Foot per Year of Lease Term 6.75 7.39 8.48 11.35 5.61 Leasing Commissions per Square Foot per Year of Lease Term 3.91 2.95 3.67 2.66 1.75 Total per Square Foot per Year 10.66$ 10.34$ 12.15$ 14.01$ 7.36$ Cash Rent Releasing Spread (2) 59.0% 15.8% 67.1% 73.8% 128.6% GAAP Rent Releasing Spread (2) 66.2% 20.7% 79.3% 96.9% 147.0% Total Leases Number of Leases 17 16 11 19 16 Square Feet of Leasing (at 100%) 123,446 1,270,846 177,950 323,853 281,385 Square Feet of Leasing (at CXP's share) (1) 115,160 1,259,089 151,215 318,351 275,914 Lease Term (months) 96 107 74 108 104 Tenant Improvements per Square Foot 60.87 43.35 43.84 94.23 53.41 Leasing Commissions per Square Foot 27.96 21.81 17.87 22.32 15.77 Total per Square Foot 88.83$ 65.16$ 61.71$ 116.55$ 69.18$ Tenant Improvements per Square Foot per Year of Lease Term 8.41 2.89 6.84 10.49 5.19 Leasing Commissions per Square Foot per Year of Lease Term 3.27 2.03 2.74 2.49 2.51 Total per Square Foot per Year 11.68$ 4.92$ 9.58$ 12.98$ 7.70$ Cash Rent Releasing Spread (2) 56.1% 2.3% 67.7% 61.9% 97.1% GAAP Rent Releasing Spread (2) 63.2% 8.6% 106.9% 85.1% 111.4% (3) Includes executed leases that have not yet commenced for space covered by an existing lease. Supplemental Information - Q1 2018 22 Columbia Property Trust, Inc. Leasing Summary Three Months Ended (2) Spread calculation is based on the change in net rent (base rent plus reimbursements less operating expenses). (1) Reflects CXP's ownership share for properties held in unconsolidated joint ventures.

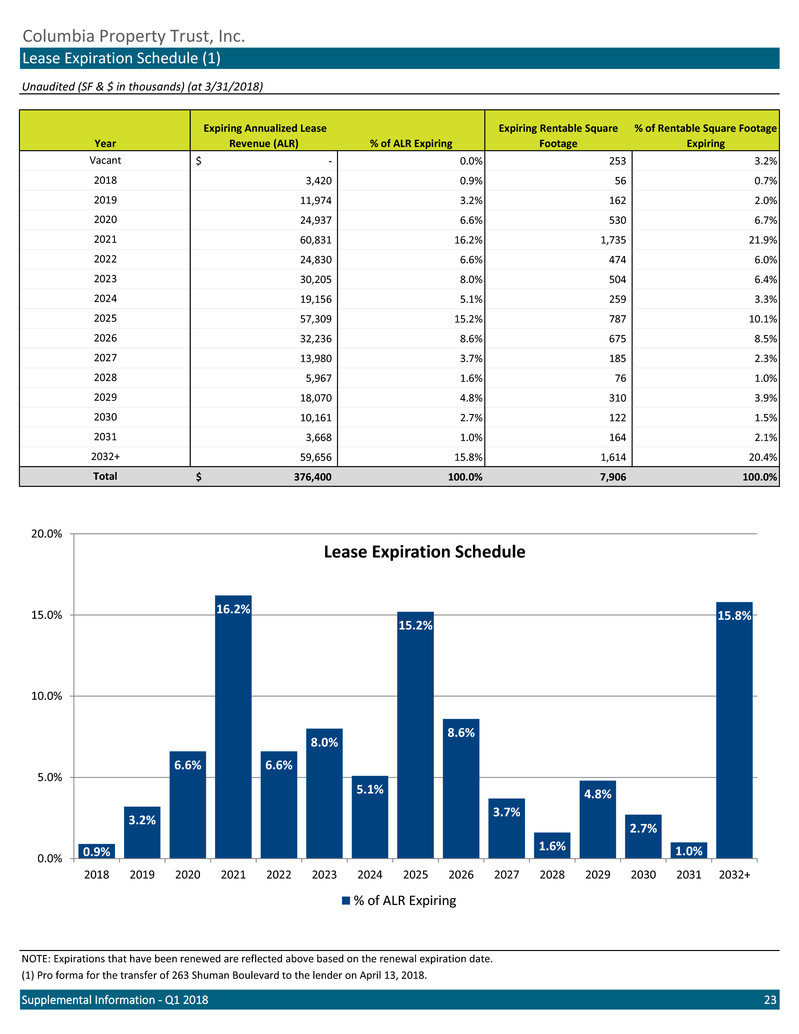

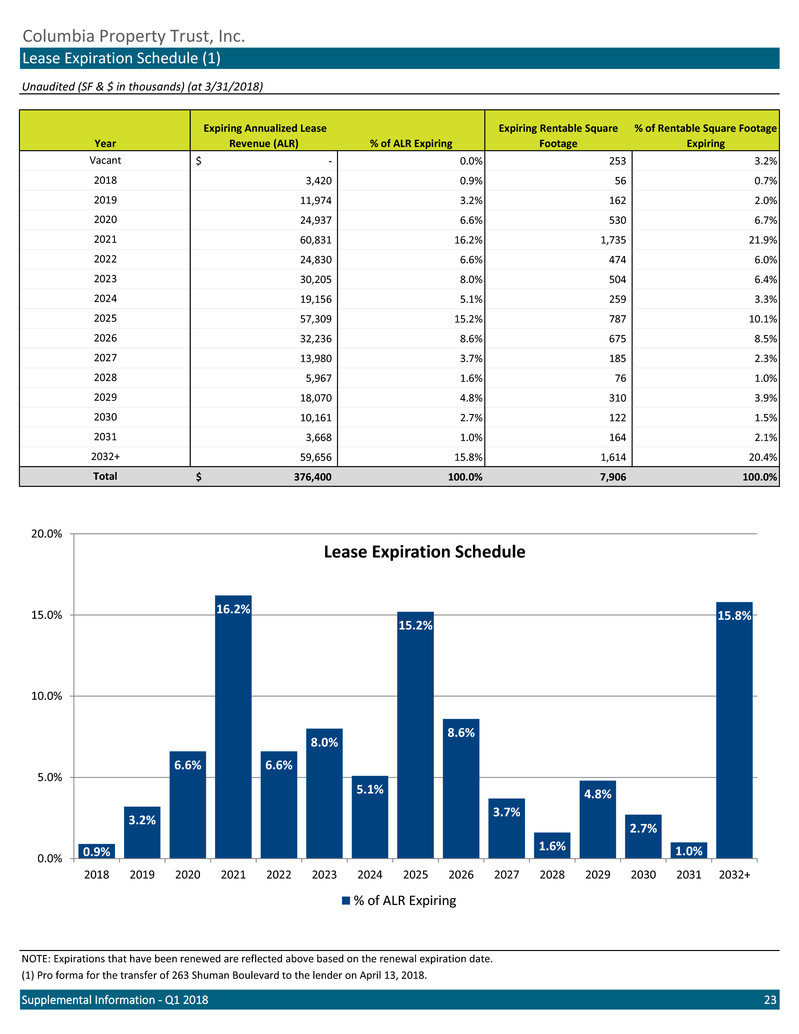

Unaudited (SF & $ in thousands) (at 3/31/2018) Expiring Annualized Lease Revenue (ALR) % of ALR Expiring Expiring Rentable Square Footage % of Rentable Square Footage Expiring -$ 0.0% 253 3.2% 3,420 0.9% 56 0.7% 11,974 3.2% 162 2.0% 24,937 6.6% 530 6.7% 60,831 16.2% 1,735 21.9% 24,830 6.6% 474 6.0% 30,205 8.0% 504 6.4% 19,156 5.1% 259 3.3% 57,309 15.2% 787 10.1% 32,236 8.6% 675 8.5% 13,980 3.7% 185 2.3% 5,967 1.6% 76 1.0% 18,070 4.8% 310 3.9% 10,161 2.7% 122 1.5% 3,668 1.0% 164 2.1% 59,656 15.8% 1,614 20.4% 376,400$ 100.0% 7,906 100.0% Supplemental Information - Q1 2018 23 Vacant Columbia Property Trust, Inc. Lease Expiration Schedule (1) Year 2029 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 (1) Pro forma for the transfer of 263 Shuman Boulevard to the lender on April 13, 2018. 2030 2031 2032+ Total NOTE: Expirations that have been renewed are reflected above based on the renewal expiration date. 0.9% 3.2% 6.6% 16.2% 6.6% 8.0% 5.1% 15.2% 8.6% 3.7% 1.6% 4.8% 2.7% 1.0% 15.8% 0.0% 5.0% 10.0% 15.0% 20.0% 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032+ Lease Expiration Schedule % of ALR Expiring

Columbia Property Trust, Inc. Unaudited (SF & $ in thousands) Current Per Current Per Current Per Period ALR (3) SF ALR (3) SF ALR (3) SF Q2 2018 - - - - - - 1 115 115.00 Q3 2018 - - - 11 534 48.55 7 357 51.00 Q4 2018 - - - 23 1,656 72.00 6 418 69.67 Total - 2018 - - - 34 2,190 64.41 14 890 63.57 Q1 2019 29 2,235 77.07 10 670 67.00 30 1,686 56.20 Q2 2019 - - - 8 841 105.13 8 410 51.25 Q3 2019 - - - 36 3,212 89.22 17 1,076 63.29 Q4 2019 - - - 15 1,101 73.40 9 743 82.56 Total - 2019 29 2,235 77.07 69 5,824 84.41 64 3,915 61.17 72 4,677 64.96 170 12,005 70.62 13 1,012 77.85 472 18,225 38.61 112 9,581 85.54 98 6,422 65.53 83 6,139 73.96 37 3,165 85.54 112 6,583 58.78 1,749 119,712 68.45 1,002 61,187 61.06 556 36,698 66.00 Total 2,405 150,988$ 62.78$ 1,424 93,952$ 65.98$ 857 55,520$ 64.78$ Current Per Current Per Current Per Period ALR (3) SF ALR (3) SF ALR (3) SF Q2 2018 - - - - - - 1 115 115.00 Q3 2018 6 200 33.33 2 140 70.00 26 1,231 47.35 Q4 2018 - - - - - - 29 2,074 71.52 Total - 2018 6 200 33.33 2 140 70.00 56 3,420 61.07 Q1 2019 - - - - - - 69 4,591 66.54 Q2 2019 - - - - - - 16 1,251 78.19 Q3 2019 - - - - - - 53 4,288 80.91 Q4 2019 - - - - - - 24 1,844 76.83 Total - 2019 - - - - - - 162 11,974 73.91 202 4,510 22.33 73 2,733 37.44 530 24,937 47.05 977 23,289 23.84 76 3,314 43.61 1,735 60,831 35.06 26 824 31.69 216 8,119 37.59 474 24,830 52.38 446 11,916 26.72 943 20,895 22.16 4,696 250,408 53.32 Total 1,657 40,739$ 24.59$ 1,310 35,201$ 26.87$ 7,653 376,400$ 49.18$ (1) Pro forma for the transfer of 263 Shuman Boulevard to the lender on April 13, 2018. (2) Reflects CXP's ownership share for properties held in unconsolidated joint ventures. (3) Expiring ALR is calculated as expiring square footage multiplied by the gross rent per square foot of the tenant currently leasing the space. Supplemental Information - Q1 2018 24 Lease Expiration by Market (1) New York (2) San Francisco (2) Washington, D.C. (2) 2021 Expiring Expiring SF SF Expiring SF Expiring SF Other All Markets 2022 Thereafter Expiring SF 2021 2022 Thereafter Atlanta SF 2020 Expiring 2020

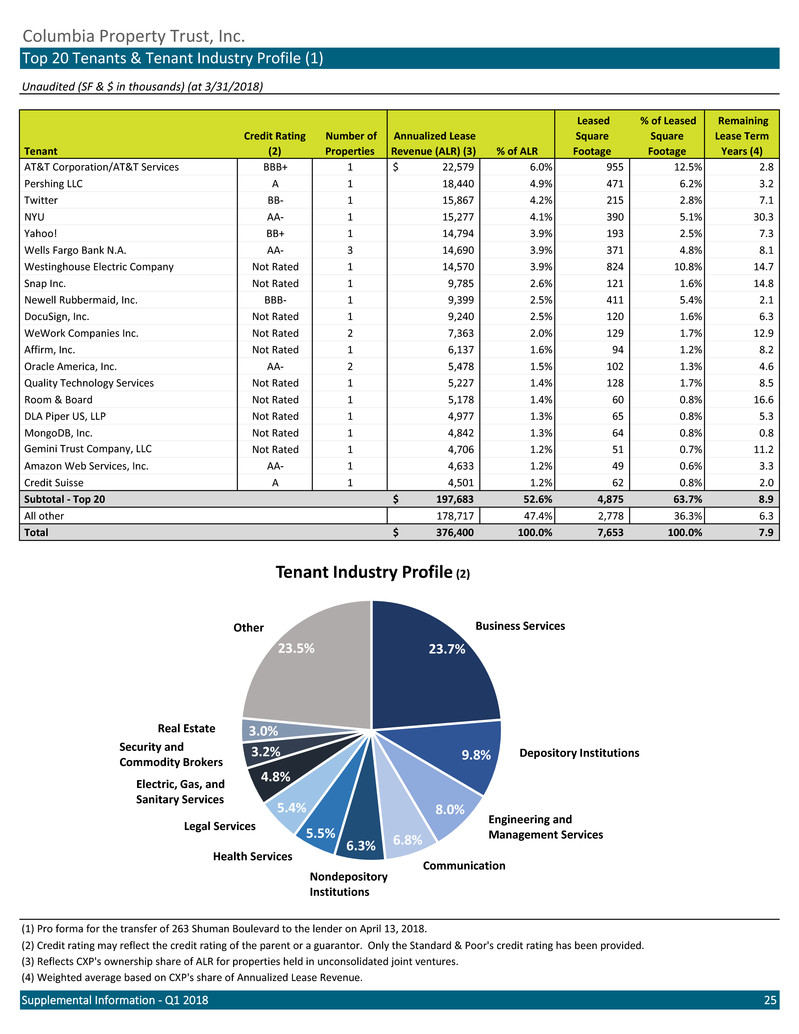

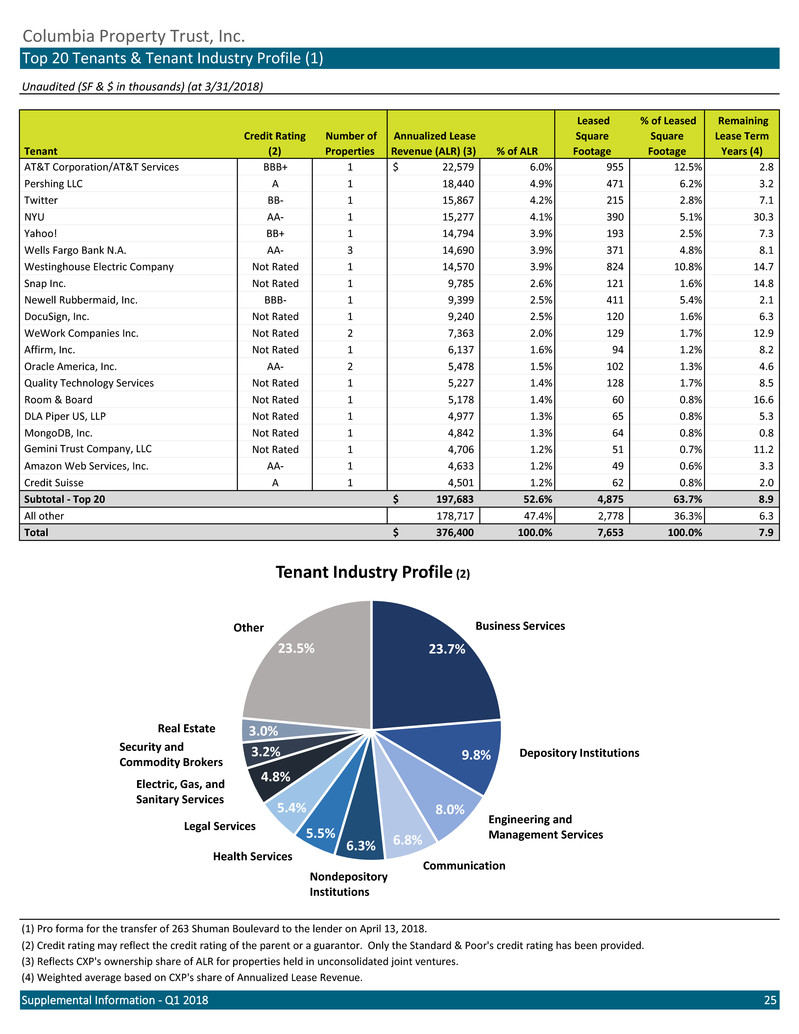

Unaudited (SF & $ in thousands) (at 3/31/2018) Tenant Credit Rating (2) Number of Properties Annualized Lease Revenue (ALR) (3) % of ALR Leased Square Footage % of Leased Square Footage Remaining Lease Term Years (4) AT&T Corporation/AT&T Services BBB+ 1 22,579$ 6.0% 955 12.5% 2.8 Pershing LLC A 1 18,440 4.9% 471 6.2% 3.2 Twitter BB- 1 15,867 4.2% 215 2.8% 7.1 NYU AA- 1 15,277 4.1% 390 5.1% 30.3 Yahoo! BB+ 1 14,794 3.9% 193 2.5% 7.3 Wells Fargo Bank N.A. AA- 3 14,690 3.9% 371 4.8% 8.1 Westinghouse Electric Company Not Rated 1 14,570 3.9% 824 10.8% 14.7 Snap Inc. Not Rated 1 9,785 2.6% 121 1.6% 14.8 Newell Rubbermaid, Inc. BBB- 1 9,399 2.5% 411 5.4% 2.1 DocuSign, Inc. Not Rated 1 9,240 2.5% 120 1.6% 6.3 WeWork Companies Inc. Not Rated 2 7,363 2.0% 129 1.7% 12.9 Affirm, Inc. Not Rated 1 6,137 1.6% 94 1.2% 8.2 Oracle America, Inc. AA- 2 5,478 1.5% 102 1.3% 4.6 Quality Technology Services Not Rated 1 5,227 1.4% 128 1.7% 8.5 Room & Board Not Rated 1 5,178 1.4% 60 0.8% 16.6 DLA Piper US, LLP Not Rated 1 4,977 1.3% 65 0.8% 5.3 MongoDB, Inc. Not Rated 1 4,842 1.3% 64 0.8% 0.8 Not Rated 1 4,706 1.2% 51 0.7% 11.2 Amazon Web Services, Inc. AA- 1 4,633 1.2% 49 0.6% 3.3 Credit Suisse A 1 4,501 1.2% 62 0.8% 2.0 Subtotal - Top 20 197,683$ 52.6% 4,875 63.7% 8.9 All other 178,717 47.4% 2,778 36.3% 6.3 Total 376,400$ 100.0% 7,653 100.0% 7.9 (1) Pro forma for the transfer of 263 Shuman Boulevard to the lender on April 13, 2018. (2) Credit rating may reflect the credit rating of the parent or a guarantor. Only the Standard & Poor's credit rating has been provided. (3) Reflects CXP's ownership share of ALR for properties held in unconsolidated joint ventures. (4) Weighted average based on CXP's share of Annualized Lease Revenue. Supplemental Information - Q1 2018 25 Columbia Property Trust, Inc. Top 20 Tenants & Tenant Industry Profile (1) Gemini Trust Company, LLC 23.7% 9.8% 8.0% 6.8%6.3% 5.5% 5.4% 4.8% 3.2% 3.0% 23.5% Tenant Industry Profile (2) Business Services Depository Institutions Legal Services Electric, Gas, and Sanitary Services Communication Engineering and Management Services Security and Commodity Brokers Health Services Other Real Estate Nondepository Institutions

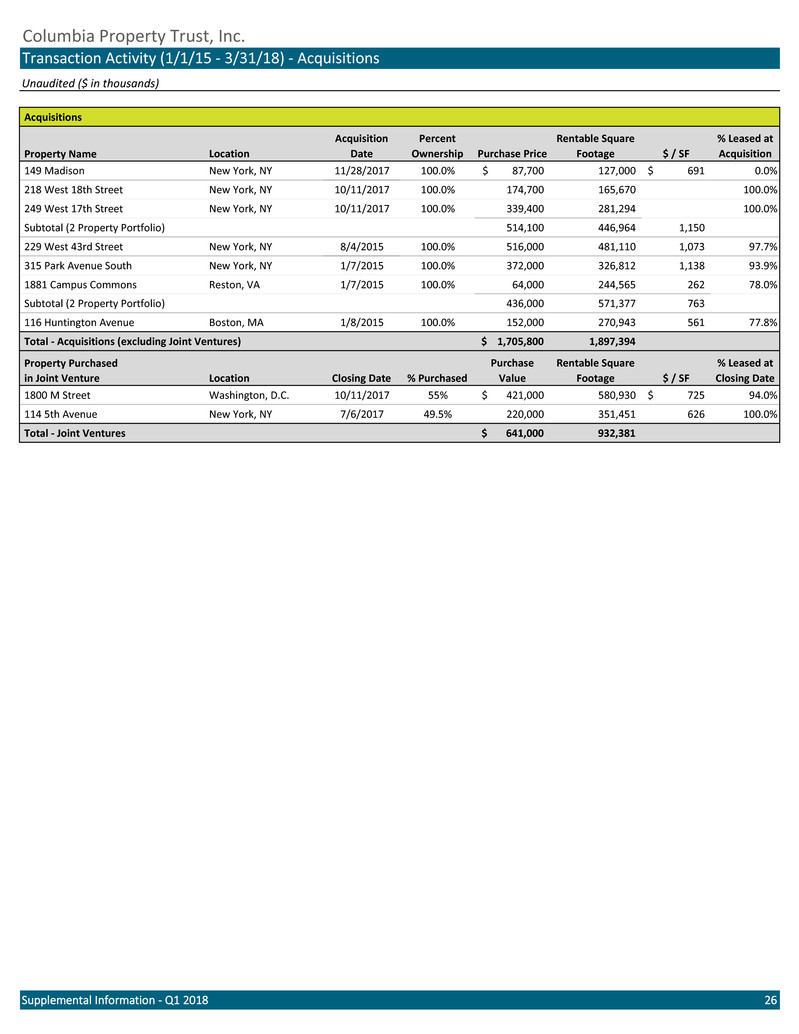

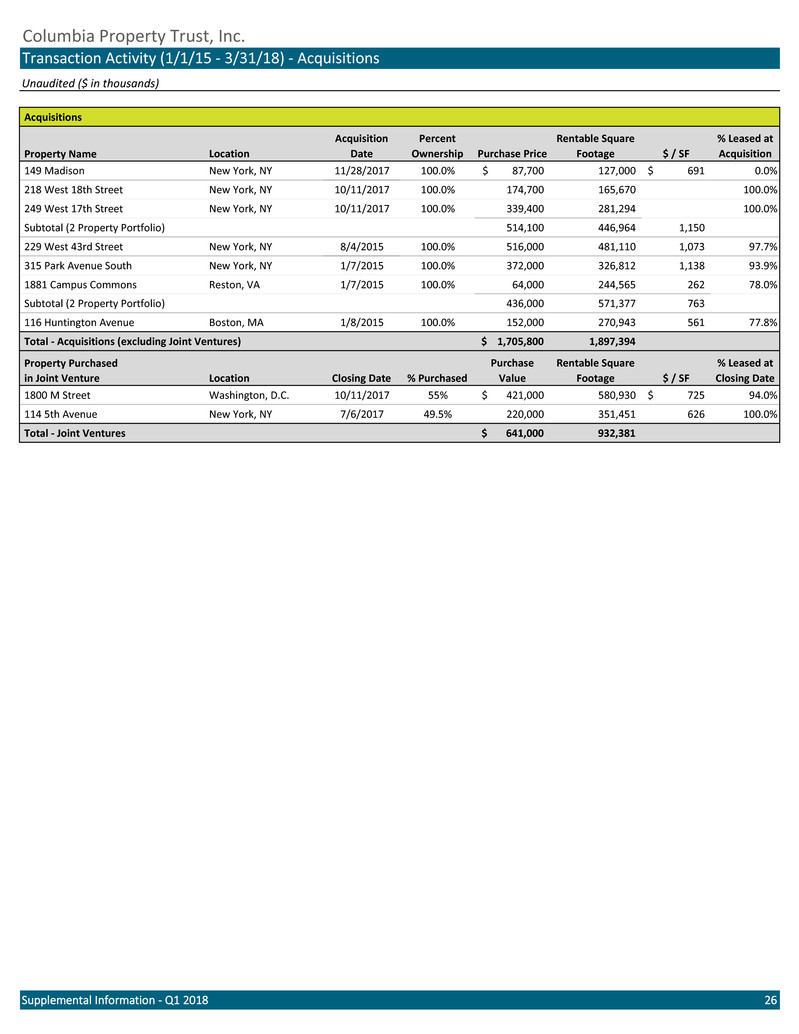

Unaudited ($ in thousands) Acquisitions Location Acquisition Date Percent Ownership Purchase Price Rentable Square Footage $ / SF % Leased at Acquisition 149 Madison New York, NY 11/28/2017 100.0% 87,700$ 127,000 691$ 0.0% 218 West 18th Street New York, NY 10/11/2017 100.0% 174,700 165,670 100.0% 249 West 17th Street New York, NY 10/11/2017 100.0% 339,400 281,294 100.0% Subtotal (2 Property Portfolio) 514,100 446,964 1,150 229 West 43rd Street New York, NY 8/4/2015 100.0% 516,000 481,110 1,073 97.7% 315 Park Avenue South New York, NY 1/7/2015 100.0% 372,000 326,812 1,138 93.9% 1881 Campus Commons Reston, VA 1/7/2015 100.0% 64,000 244,565 262 78.0% Subtotal (2 Property Portfolio) 436,000 571,377 763 116 Huntington Avenue Boston, MA 1/8/2015 100.0% 152,000 270,943 561 77.8% Total - Acquisitions (excluding Joint Ventures) 1,705,800$ 1,897,394 Location Closing Date % Purchased Purchase Value Rentable Square Footage $ / SF % Leased at Closing Date 1800 M Street Washington, D.C. 10/11/2017 55% 421,000$ 580,930 725$ 94.0% 114 5th Avenue New York, NY 7/6/2017 49.5% 220,000 351,451 626 100.0% Total - Joint Ventures 641,000$ 932,381 Supplemental Information - Q1 2018 26 Columbia Property Trust, Inc. Transaction Activity (1/1/15 - 3/31/18) - Acquisitions Property Name Property Purchased in Joint Venture

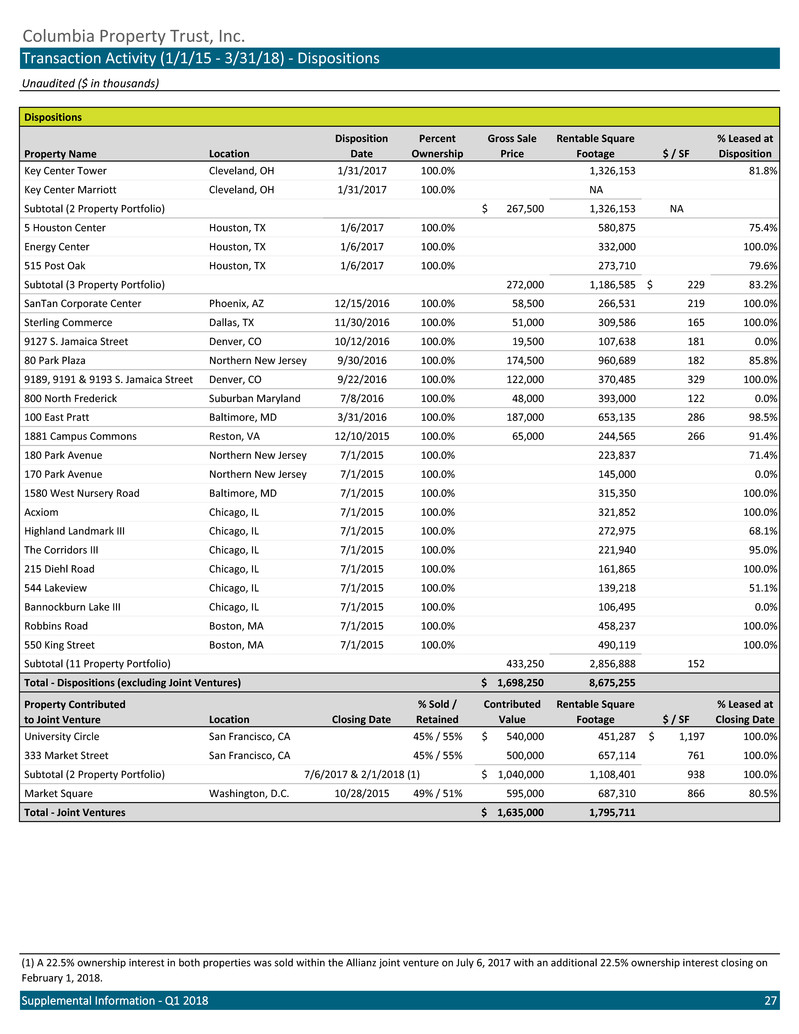

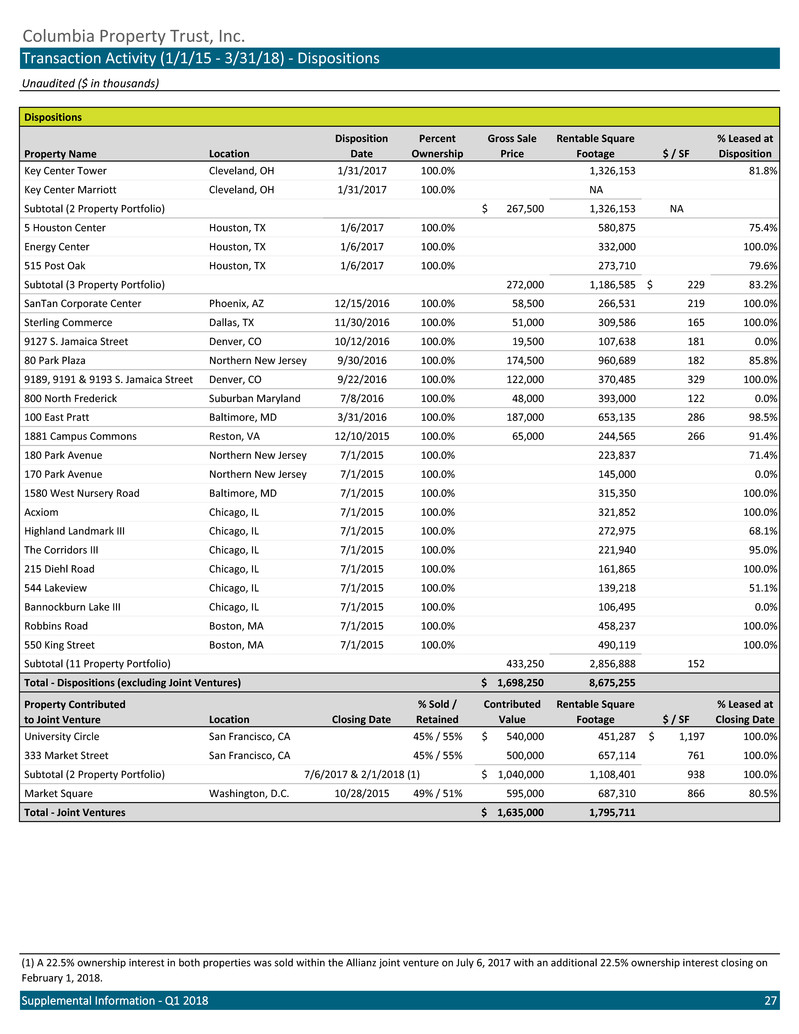

Unaudited ($ in thousands) Dispositions Location Disposition Date Percent Ownership Gross Sale Price Rentable Square Footage $ / SF % Leased at Disposition Key Center Tower Cleveland, OH 1/31/2017 100.0% 1,326,153 81.8% Key Center Marriott Cleveland, OH 1/31/2017 100.0% NA Subtotal (2 Property Portfolio) 267,500$ 1,326,153 NA 5 Houston Center Houston, TX 1/6/2017 100.0% 580,875 75.4% Energy Center Houston, TX 1/6/2017 100.0% 332,000 100.0% 515 Post Oak Houston, TX 1/6/2017 100.0% 273,710 79.6% Subtotal (3 Property Portfolio) 272,000 1,186,585 229$ 83.2% SanTan Corporate Center Phoenix, AZ 12/15/2016 100.0% 58,500 266,531 219 100.0% Sterling Commerce Dallas, TX 11/30/2016 100.0% 51,000 309,586 165 100.0% 9127 S. Jamaica Street Denver, CO 10/12/2016 100.0% 19,500 107,638 181 0.0% 80 Park Plaza Northern New Jersey 9/30/2016 100.0% 174,500 960,689 182 85.8% 9189, 9191 & 9193 S. Jamaica Street Denver, CO 9/22/2016 100.0% 122,000 370,485 329 100.0% 800 North Frederick Suburban Maryland 7/8/2016 100.0% 48,000 393,000 122 0.0% 100 East Pratt Baltimore, MD 3/31/2016 100.0% 187,000 653,135 286 98.5% 1881 Campus Commons Reston, VA 12/10/2015 100.0% 65,000 244,565 266 91.4% 180 Park Avenue Northern New Jersey 7/1/2015 100.0% 223,837 71.4% 170 Park Avenue Northern New Jersey 7/1/2015 100.0% 145,000 0.0% 1580 West Nursery Road Baltimore, MD 7/1/2015 100.0% 315,350 100.0% Acxiom Chicago, IL 7/1/2015 100.0% 321,852 100.0% Highland Landmark III Chicago, IL 7/1/2015 100.0% 272,975 68.1% The Corridors III Chicago, IL 7/1/2015 100.0% 221,940 95.0% 215 Diehl Road Chicago, IL 7/1/2015 100.0% 161,865 100.0% 544 Lakeview Chicago, IL 7/1/2015 100.0% 139,218 51.1% Bannockburn Lake III Chicago, IL 7/1/2015 100.0% 106,495 0.0% Robbins Road Boston, MA 7/1/2015 100.0% 458,237 100.0% 550 King Street Boston, MA 7/1/2015 100.0% 490,119 100.0% Subtotal (11 Property Portfolio) 433,250 2,856,888 152 Total - Dispositions (excluding Joint Ventures) 1,698,250$ 8,675,255 Location Closing Date % Sold / Retained Contributed Value Rentable Square Footage $ / SF % Leased at Closing Date University Circle San Francisco, CA 45% / 55% 540,000$ 451,287 1,197$ 100.0% 333 Market Street San Francisco, CA 45% / 55% 500,000 657,114 761 100.0% Subtotal (2 Property Portfolio) 7/6/2017 & 2/1/2018 (1) 1,040,000$ 1,108,401 938 100.0% Market Square Washington, D.C. 10/28/2015 49% / 51% 595,000 687,310 866 80.5% Total - Joint Ventures 1,635,000$ 1,795,711 Supplemental Information - Q1 2018 27 (1) A 22.5% ownership interest in both properties was sold within the Allianz joint venture on July 6, 2017 with an additional 22.5% ownership interest closing on February 1, 2018. Columbia Property Trust, Inc. Transaction Activity (1/1/15 - 3/31/18) - Dispositions Property Name Property Contributed to Joint Venture

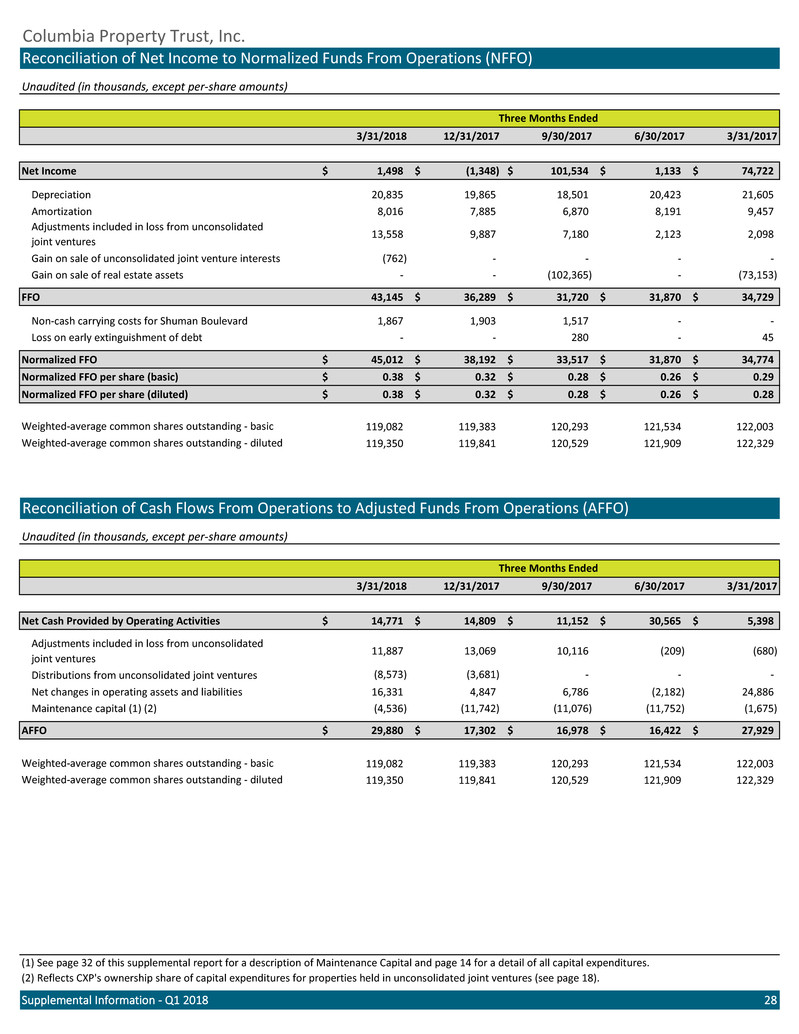

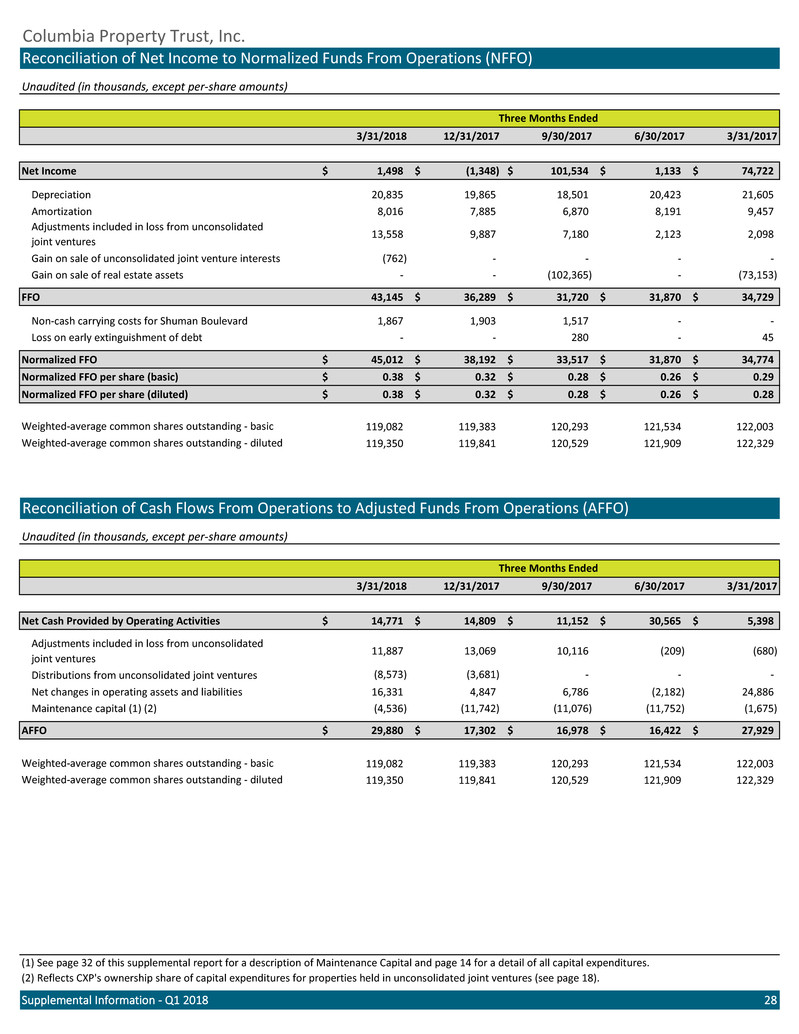

Unaudited (in thousands, except per-share amounts) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Net Income 1,498$ (1,348)$ 101,534$ 1,133$ 74,722$ Depreciation 20,835 19,865 18,501 20,423 21,605 Amortization 8,016 7,885 6,870 8,191 9,457 13,558 9,887 7,180 2,123 2,098 Gain on sale of unconsolidated joint venture interests (762) - - - - Gain on sale of real estate assets - - (102,365) - (73,153) FFO 43,145 36,289$ 31,720$ 31,870$ 34,729$ Non-cash carrying costs for Shuman Boulevard 1,867 1,903 1,517 - - Loss on early extinguishment of debt - - 280 - 45 Normalized FFO 45,012$ 38,192$ 33,517$ 31,870$ 34,774$ Normalized FFO per share (basic) 0.38$ 0.32$ 0.28$ 0.26$ 0.29$ Normalized FFO per share (diluted) 0.38$ 0.32$ 0.28$ 0.26$ 0.28$ 119,082 119,383 120,293 121,534 122,003 119,350 119,841 120,529 121,909 122,329 Unaudited (in thousands, except per-share amounts) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Net Cash Provided by Operating Activities 14,771$ 14,809$ 11,152$ 30,565$ 5,398$ 11,887 13,069 10,116 (209) (680) Distributions from unconsolidated joint ventures (8,573) (3,681) - - - Net changes in operating assets and liabilities 16,331 4,847 6,786 (2,182) 24,886 Maintenance capital (1) (2) (4,536) (11,742) (11,076) (11,752) (1,675) AFFO 29,880$ 17,302$ 16,978$ 16,422$ 27,929$ 119,082 119,383 120,293 121,534 122,003 119,350 119,841 120,529 121,909 122,329 Supplemental Information - Q1 2018 28 Columbia Property Trust, Inc. Reconciliation of Net Income to Normalized Funds From Operations (NFFO) Three Months Ended Adjustments included in loss from unconsolidated joint ventures Weighted-average common shares outstanding - basic Adjustments included in loss from unconsolidated joint ventures (2) Reflects CXP's ownership share of capital expenditures for properties held in unconsolidated joint ventures (see page 18). Weighted-average common shares outstanding - basic Weighted-average common shares outstanding - diluted (1) See page 32 of this supplemental report for a description of Maintenance Capital and page 14 for a detail of all capital expenditures. Weighted-average common shares outstanding - diluted Reconciliation of Cash Flows From Operations to Adjusted Funds From Operations (AFFO) Three Months Ended

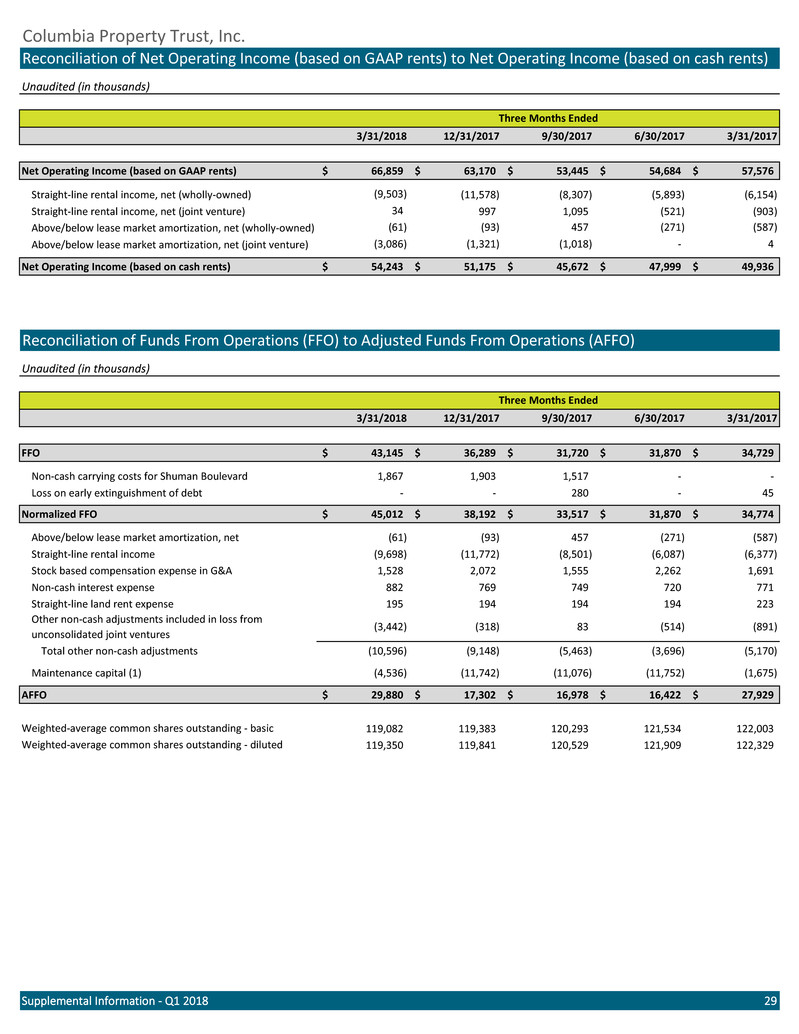

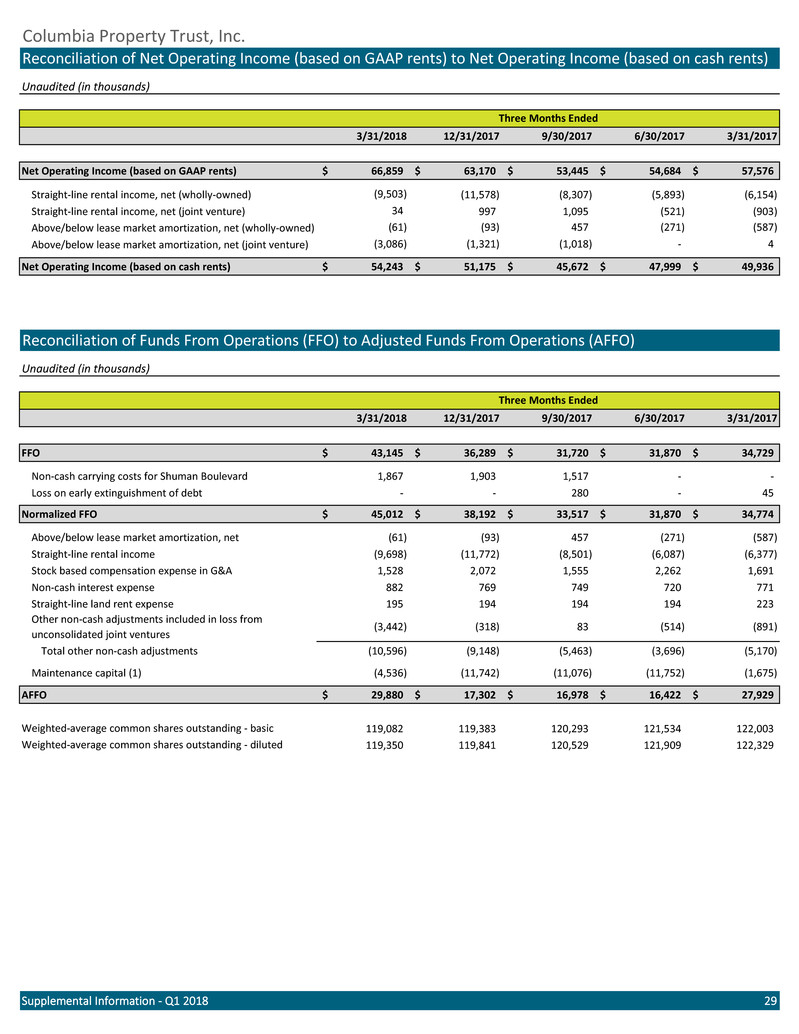

Unaudited (in thousands) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Net Operating Income (based on GAAP rents) 66,859$ 63,170$ 53,445$ 54,684$ 57,576$ Straight-line rental income, net (wholly-owned) (9,503) (11,578) (8,307) (5,893) (6,154) Straight-line rental income, net (joint venture) 34 997 1,095 (521) (903) Above/below lease market amortization, net (wholly-owned) (61) (93) 457 (271) (587) Above/below lease market amortization, net (joint venture) (3,086) (1,321) (1,018) - 4 Net Operating Income (based on cash rents) 54,243$ 51,175$ 45,672$ 47,999$ 49,936$ Unaudited (in thousands) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 FFO 43,145$ 36,289$ 31,720$ 31,870$ 34,729$ Non-cash carrying costs for Shuman Boulevard 1,867 1,903 1,517 - - Loss on early extinguishment of debt - - 280 - 45 Normalized FFO 45,012$ 38,192$ 33,517$ 31,870$ 34,774$ Above/below lease market amortization, net (61) (93) 457 (271) (587) Straight-line rental income (9,698) (11,772) (8,501) (6,087) (6,377) Stock based compensation expense in G&A 1,528 2,072 1,555 2,262 1,691 Non-cash interest expense 882 769 749 720 771 Straight-line land rent expense 195 194 194 194 223 (3,442) (318) 83 (514) (891) Total other non-cash adjustments (10,596) (9,148) (5,463) (3,696) (5,170) Maintenance capital (1) (4,536) (11,742) (11,076) (11,752) (1,675) AFFO 29,880$ 17,302$ 16,978$ 16,422$ 27,929$ 119,082 119,383 120,293 121,534 122,003 119,350 119,841 120,529 121,909 122,329 Supplemental Information - Q1 2018 29 Columbia Property Trust, Inc. Reconciliation of Net Operating Income (based on GAAP rents) to Net Operating Income (based on cash rents) Three Months Ended Reconciliation of Funds From Operations (FFO) to Adjusted Funds From Operations (AFFO) Other non-cash adjustments included in loss from unconsolidated joint ventures Weighted-average common shares outstanding - basic Weighted-average common shares outstanding - diluted Three Months Ended

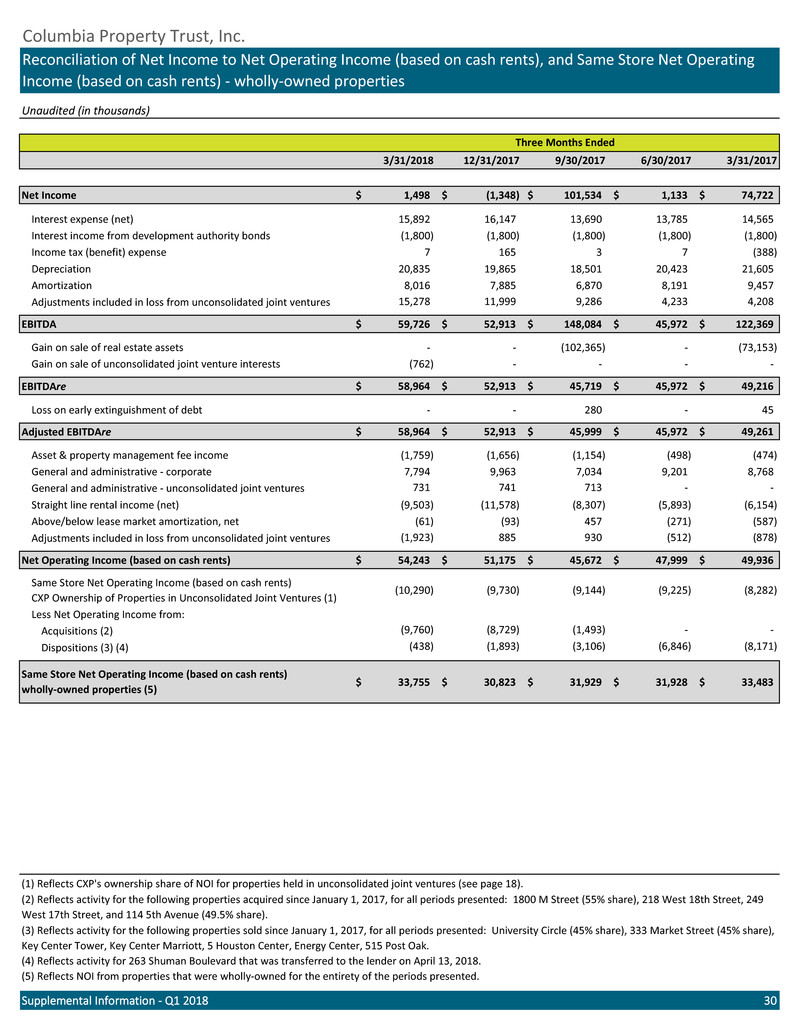

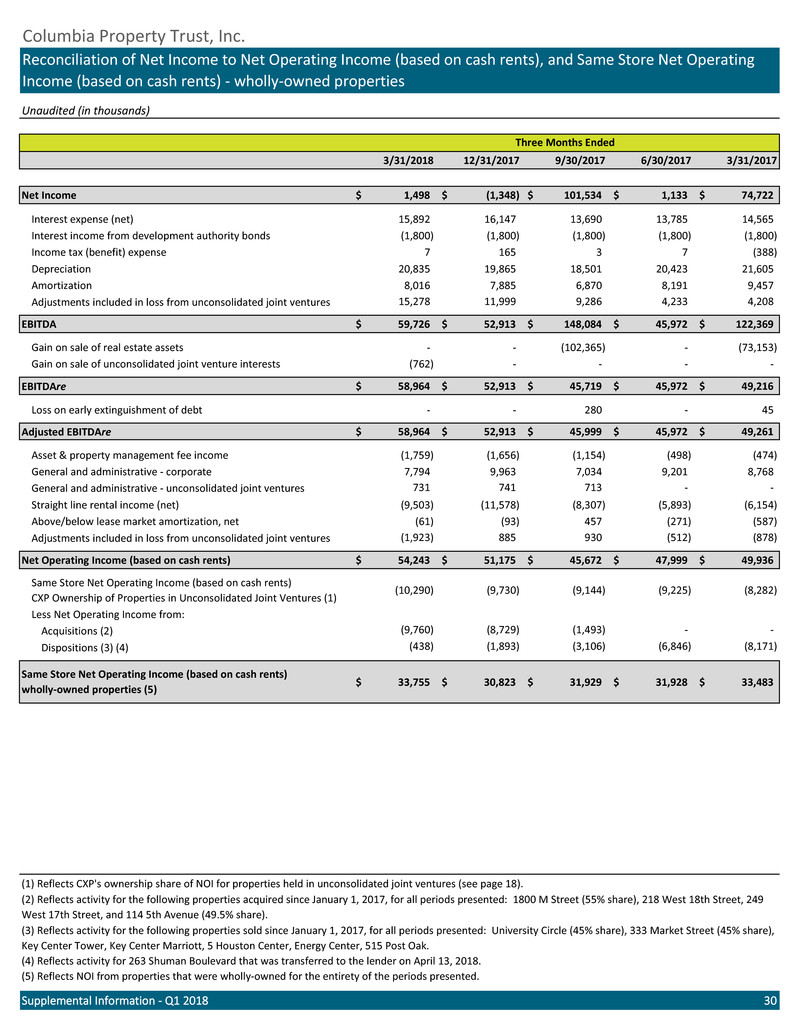

Unaudited (in thousands) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Net Income 1,498$ (1,348)$ 101,534$ 1,133$ 74,722$ Interest expense (net) 15,892 16,147 13,690 13,785 14,565 Interest income from development authority bonds (1,800) (1,800) (1,800) (1,800) (1,800) Income tax (benefit) expense 7 165 3 7 (388) Depreciation 20,835 19,865 18,501 20,423 21,605 Amortization 8,016 7,885 6,870 8,191 9,457 15,278 11,999 9,286 4,233 4,208 EBITDA 59,726$ 52,913$ 148,084$ 45,972$ 122,369$ Gain on sale of real estate assets - - (102,365) - (73,153) Gain on sale of unconsolidated joint venture interests (762) - - - - EBITDAre 58,964$ 52,913$ 45,719$ 45,972$ 49,216$ Loss on early extinguishment of debt - - 280 - 45 Adjusted EBITDAre 58,964$ 52,913$ 45,999$ 45,972$ 49,261$ Asset & property management fee income (1,759) (1,656) (1,154) (498) (474) General and administrative - corporate 7,794 9,963 7,034 9,201 8,768 731 741 713 - - Straight line rental income (net) (9,503) (11,578) (8,307) (5,893) (6,154) Above/below lease market amortization, net (61) (93) 457 (271) (587) (1,923) 885 930 (512) (878) Net Operating Income (based on cash rents) 54,243$ 51,175$ 45,672$ 47,999$ 49,936$ (10,290) (9,730) (9,144) (9,225) (8,282) Less Net Operating Income from: Acquisitions (2) (9,760) (8,729) (1,493) - - Dispositions (3) (4) (438) (1,893) (3,106) (6,846) (8,171) 33,755$ 30,823$ 31,929$ 31,928$ 33,483$ Supplemental Information - Q1 2018 30 (5) Reflects NOI from properties that were wholly-owned for the entirety of the periods presented. (1) Reflects CXP's ownership share of NOI for properties held in unconsolidated joint ventures (see page 18). (2) Reflects activity for the following properties acquired since January 1, 2017, for all periods presented: 1800 M Street (55% share), 218 West 18th Street, 249 West 17th Street, and 114 5th Avenue (49.5% share). Columbia Property Trust, Inc. Reconciliation of Net Income to Net Operating Income (based on cash rents), and Same Store Net Operating Income (based on cash rents) - wholly-owned properties Three Months Ended Same Store Net Operating Income (based on cash rents) wholly-owned properties (5) Same Store Net Operating Income (based on cash rents) CXP Ownership of Properties in Unconsolidated Joint Ventures (1) Adjustments included in loss from unconsolidated joint ventures Adjustments included in loss from unconsolidated joint ventures (3) Reflects activity for the following properties sold since January 1, 2017, for all periods presented: University Circle (45% share), 333 Market Street (45% share), Key Center Tower, Key Center Marriott, 5 Houston Center, Energy Center, 515 Post Oak. General and administrative - unconsolidated joint ventures (4) Reflects activity for 263 Shuman Boulevard that was transferred to the lender on April 13, 2018.

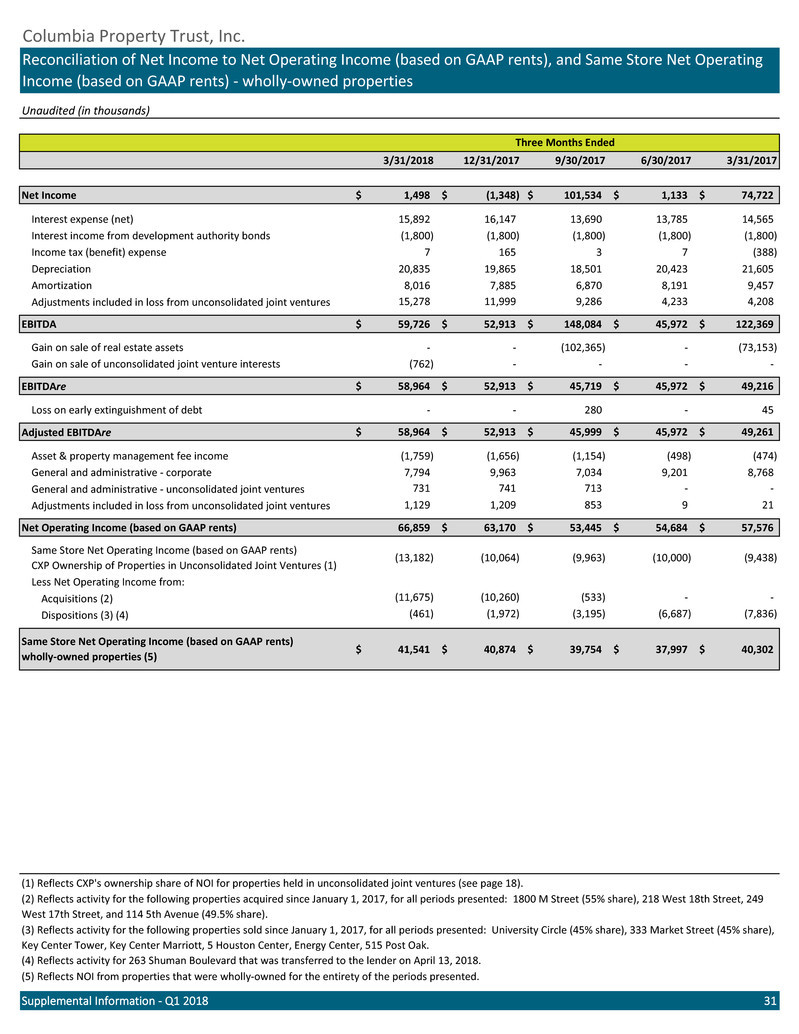

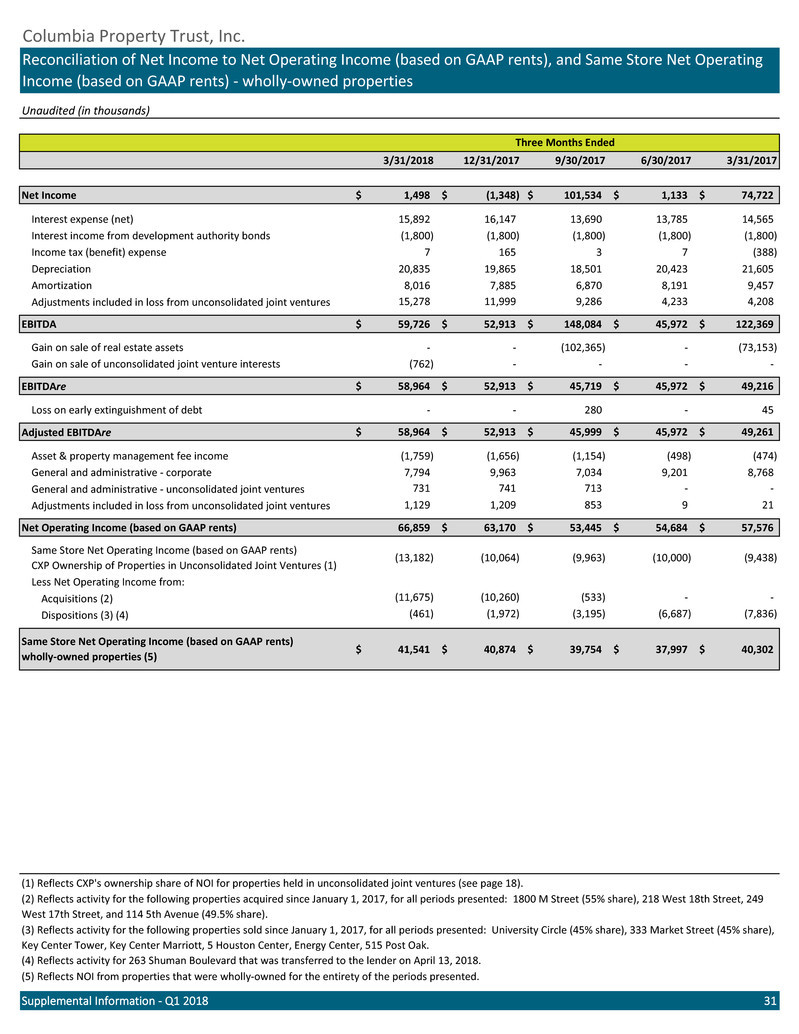

Unaudited (in thousands) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Net Income 1,498$ (1,348)$ 101,534$ 1,133$ 74,722$ Interest expense (net) 15,892 16,147 13,690 13,785 14,565 Interest income from development authority bonds (1,800) (1,800) (1,800) (1,800) (1,800) Income tax (benefit) expense 7 165 3 7 (388) Depreciation 20,835 19,865 18,501 20,423 21,605 Amortization 8,016 7,885 6,870 8,191 9,457 15,278 11,999 9,286 4,233 4,208 EBITDA 59,726$ 52,913$ 148,084$ 45,972$ 122,369$ Gain on sale of real estate assets - - (102,365) - (73,153) Gain on sale of unconsolidated joint venture interests (762) - - - - EBITDAre 58,964$ 52,913$ 45,719$ 45,972$ 49,216$ Loss on early extinguishment of debt - - 280 - 45 Adjusted EBITDAre 58,964$ 52,913$ 45,999$ 45,972$ 49,261$ Asset & property management fee income (1,759) (1,656) (1,154) (498) (474) General and administrative - corporate 7,794 9,963 7,034 9,201 8,768 731 741 713 - - 1,129 1,209 853 9 21 Net Operating Income (based on GAAP rents) 66,859 63,170$ 53,445$ 54,684$ 57,576$ (13,182) (10,064) (9,963) (10,000) (9,438) Less Net Operating Income from: Acquisitions (2) (11,675) (10,260) (533) - - Dispositions (3) (4) (461) (1,972) (3,195) (6,687) (7,836) 41,541$ 40,874$ 39,754$ 37,997$ 40,302$ (1) Reflects CXP's ownership share of NOI for properties held in unconsolidated joint ventures (see page 18). Supplemental Information - Q1 2018 31 (5) Reflects NOI from properties that were wholly-owned for the entirety of the periods presented. (3) Reflects activity for the following properties sold since January 1, 2017, for all periods presented: University Circle (45% share), 333 Market Street (45% share), Key Center Tower, Key Center Marriott, 5 Houston Center, Energy Center, 515 Post Oak. (2) Reflects activity for the following properties acquired since January 1, 2017, for all periods presented: 1800 M Street (55% share), 218 West 18th Street, 249 West 17th Street, and 114 5th Avenue (49.5% share). Columbia Property Trust, Inc. Reconciliation of Net Income to Net Operating Income (based on GAAP rents), and Same Store Net Operating Income (based on GAAP rents) - wholly-owned properties Three Months Ended Same Store Net Operating Income (based on GAAP rents) wholly-owned properties (5) Same Store Net Operating Income (based on GAAP rents) CXP Ownership of Properties in Unconsolidated Joint Ventures (1) Adjustments included in loss from unconsolidated joint ventures Adjustments included in loss from unconsolidated joint ventures General and administrative - unconsolidated joint ventures (4) Reflects activity for 263 Shuman Boulevard that was transferred to the lender on April 13, 2018.

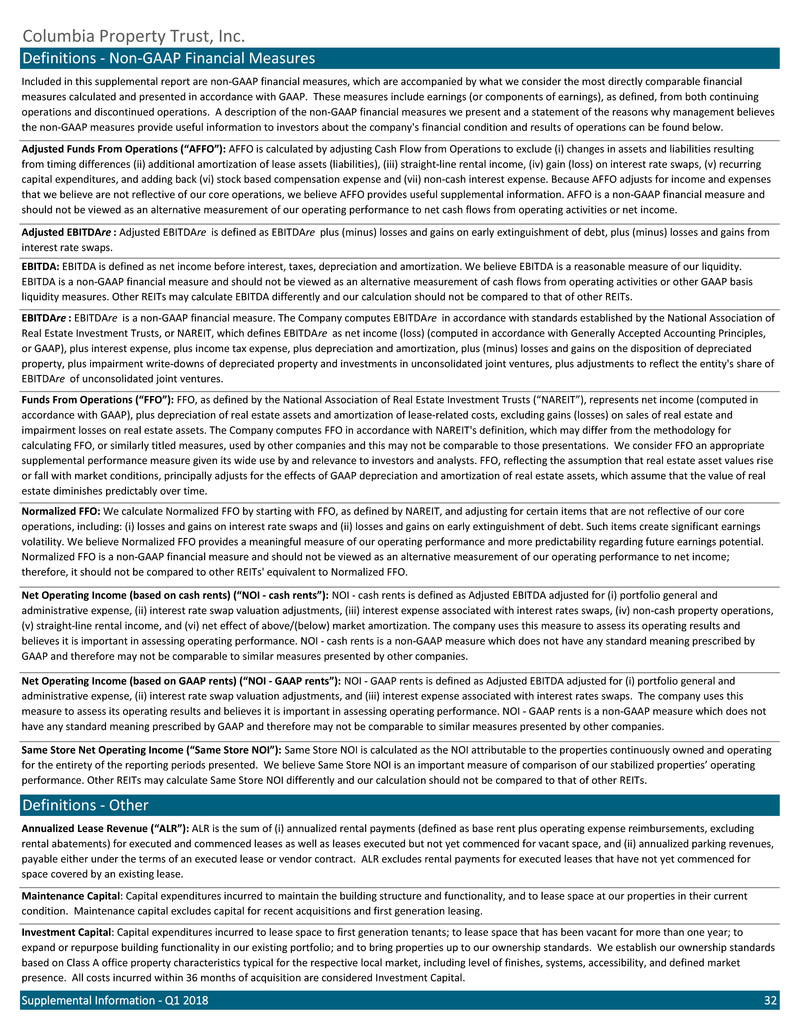

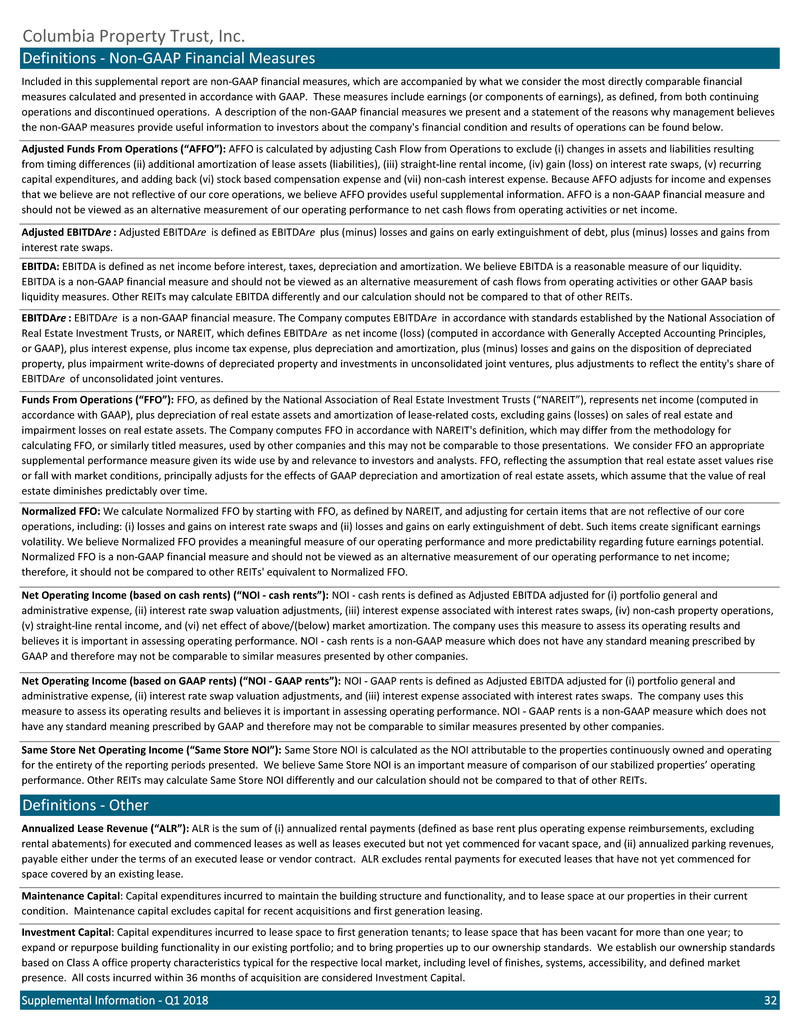

Supplemental Information - Q1 2018 32 EBITDA: EBITDA is defined as net income before interest, taxes, depreciation and amortization. We believe EBITDA is a reasonable measure of our liquidity. EBITDA is a non-GAAP financial measure and should not be viewed as an alternative measurement of cash flows from operating activities or other GAAP basis liquidity measures. Other REITs may calculate EBITDA differently and our calculation should not be compared to that of other REITs. Columbia Property Trust, Inc. Definitions - Non-GAAP Financial Measures Included in this supplemental report are non-GAAP financial measures, which are accompanied by what we consider the most directly comparable financial measures calculated and presented in accordance with GAAP. These measures include earnings (or components of earnings), as defined, from both continuing operations and discontinued operations. A description of the non-GAAP financial measures we present and a statement of the reasons why management believes the non-GAAP measures provide useful information to investors about the company's financial condition and results of operations can be found below. Adjusted Funds From Operations (“AFFO”): AFFO is calculated by adjusting Cash Flow from Operations to exclude (i) changes in assets and liabilities resulting from timing differences (ii) additional amortization of lease assets (liabilities), (iii) straight-line rental income, (iv) gain (loss) on interest rate swaps, (v) recurring capital expenditures, and adding back (vi) stock based compensation expense and (vii) non-cash interest expense. Because AFFO adjusts for income and expenses that we believe are not reflective of our core operations, we believe AFFO provides useful supplemental information. AFFO is a non-GAAP financial measure and should not be viewed as an alternative measurement of our operating performance to net cash flows from operating activities or net income. Adjusted EBITDAre : Adjusted EBITDAre is defined as EBITDAre plus (minus) losses and gains on early extinguishment of debt, plus (minus) losses and gains from interest rate swaps. EBITDAre : EBITDAre is a non-GAAP financial measure. The Company computes EBITDAre in accordance with standards established by the National Association of Real Estate Investment Trusts, or NAREIT, which defines EBITDAre as net income (loss) (computed in accordance with Generally Accepted Accounting Principles, or GAAP), plus interest expense, plus income tax expense, plus depreciation and amortization, plus (minus) losses and gains on the disposition of depreciated property, plus impairment write-downs of depreciated property and investments in unconsolidated joint ventures, plus adjustments to reflect the entity's share of EBITDAre of unconsolidated joint ventures. Annualized Lease Revenue (“ALR”): ALR is the sum of (i) annualized rental payments (defined as base rent plus operating expense reimbursements, excluding rental abatements) for executed and commenced leases as well as leases executed but not yet commenced for vacant space, and (ii) annualized parking revenues, payable either under the terms of an executed lease or vendor contract. ALR excludes rental payments for executed leases that have not yet commenced for space covered by an existing lease. Maintenance Capital: Capital expenditures incurred to maintain the building structure and functionality, and to lease space at our properties in their current condition. Maintenance capital excludes capital for recent acquisitions and first generation leasing. Investment Capital: Capital expenditures incurred to lease space to first generation tenants; to lease space that has been vacant for more than one year; to expand or repurpose building functionality in our existing portfolio; and to bring properties up to our ownership standards. We establish our ownership standards based on Class A office property characteristics typical for the respective local market, including level of finishes, systems, accessibility, and defined market presence. All costs incurred within 36 months of acquisition are considered Investment Capital. Funds From Operations (“FFO”): FFO, as defined by the National Association of Real Estate Investment Trusts (“NAREIT”), represents net income (computed in accordance with GAAP), plus depreciation of real estate assets and amortization of lease-related costs, excluding gains (losses) on sales of real estate and impairment losses on real estate assets. The Company computes FFO in accordance with NAREIT's definition, which may differ from the methodology for calculating FFO, or similarly titled measures, used by other companies and this may not be comparable to those presentations. We consider FFO an appropriate supplemental performance measure given its wide use by and relevance to investors and analysts. FFO, reflecting the assumption that real estate asset values rise or fall with market conditions, principally adjusts for the effects of GAAP depreciation and amortization of real estate assets, which assume that the value of real estate diminishes predictably over time. Normalized FFO: We calculate Normalized FFO by starting with FFO, as defined by NAREIT, and adjusting for certain items that are not reflective of our core operations, including: (i) losses and gains on interest rate swaps and (ii) losses and gains on early extinguishment of debt. Such items create significant earnings volatility. We believe Normalized FFO provides a meaningful measure of our operating performance and more predictability regarding future earnings potential. Normalized FFO is a non-GAAP financial measure and should not be viewed as an alternative measurement of our operating performance to net income; therefore, it should not be compared to other REITs' equivalent to Normalized FFO. Net Operating Income (based on cash rents) (“NOI - cash rents”): NOI - cash rents is defined as Adjusted EBITDA adjusted for (i) portfolio general and administrative expense, (ii) interest rate swap valuation adjustments, (iii) interest expense associated with interest rates swaps, (iv) non-cash property operations, (v) straight-line rental income, and (vi) net effect of above/(below) market amortization. The company uses this measure to assess its operating results and believes it is important in assessing operating performance. NOI - cash rents is a non-GAAP measure which does not have any standard meaning prescribed by GAAP and therefore may not be comparable to similar measures presented by other companies. Net Operating Income (based on GAAP rents) (“NOI - GAAP rents”): NOI - GAAP rents is defined as Adjusted EBITDA adjusted for (i) portfolio general and administrative expense, (ii) interest rate swap valuation adjustments, and (iii) interest expense associated with interest rates swaps. The company uses this measure to assess its operating results and believes it is important in assessing operating performance. NOI - GAAP rents is a non-GAAP measure which does not have any standard meaning prescribed by GAAP and therefore may not be comparable to similar measures presented by other companies. Same Store Net Operating Income (“Same Store NOI”): Same Store NOI is calculated as the NOI attributable to the properties continuously owned and operating for the entirety of the reporting periods presented. We believe Same Store NOI is an important measure of comparison of our stabilized properties’ operating performance. Other REITs may calculate Same Store NOI differently and our calculation should not be compared to that of other REITs. Definitions - Other