COLUMBIA PROPERTY TRUST INVESTOR PRESENTATION 5.2019 1

FORWARD-LOOKING STATEMENTS Certain statements contained in this presentation other than historical facts may be considered forward-looking statements. Such statements include, in particular, statements about our plans, strategies, and prospects, and are subject to certain risks and uncertainties, including known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as "may," "will," "expect," "intend," "anticipate," "estimate," "believe," "continue," or other similar words. These forward-looking statements include information about possible or assumed future results of the business and our financial condition, liquidity, results of operations, future plans and objectives. They also include, among other things, statement regarding subjects that are forward-looking by their nature, such as our business and financial strategy, our 2019 guidance (including projected net operating income, cash rents and contractual growth), projected yield and earnings growth compared to peers, our ability to obtain future financing, future acquisitions and dispositions of operating assets, future repurchases of common stock, and market and industry trends. Readers are cautioned not to place undue reliance on these forward-looking statements. We make no representations or warranties (express or implied) about the accuracy of any such forward-looking statements contained in this presentation, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Any such forward-looking statements are subject to risks, uncertainties, and other factors and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual conditions, our ability to accurately anticipate results expressed in such forward- looking statements, including our ability to generate positive cash flow from operations, make distributions to stockholders, and maintain the value of our real estate properties, may be significantly hindered. See Item 1A in the Company's most recently filed Annual Report on Form 10-K for the year ended December 31, 2018, for a discussion of some of the risks and uncertainties that could cause actual results to differ materially from those presented in our forward-looking statements. The risk factors described in our Annual Report are not the only ones we face but do represent those risks and uncertainties that we believe are material to us. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also harm our business. For additional information, please reference the supplemental report furnished by the Company as Exhibit 99.1 to the Company’s Form 8-K furnished to the Securities and Exchange Commission on April 25, 2019. The names, logos and related product and service names, design marks, and slogans are the trademarks or service marks of their respective companies. When evaluating the Company’s performance and capital resources, management considers the financial impact of investments held directly and through unconsolidated joint ventures. This presentation includes financial and operational information for our wholly-owned investments and our proportional interest in unconsolidated investments. Unless otherwise noted, all data herein is as of March 31, 2019. 052-CORPPRES1905 2

WHY INVEST? Gateway Office Growth Value Creation plus Portfolio Stability • Concentration in New • Substantial embedded • Local expertise York, San Francisco, same-store NOI and D.C. growth • Track record of redevelopment and • Strategic CBD • 97% leased with asset repositioning locations limited near-term expirations • Significant cash • Modernized properties spreads on leasing with boutique spaces • Attractive dividend yield and valuation • Select re-/development • Exceptional service disconnect vs. NAV projects underway and amenities • Commitment to strong balance sheet 3

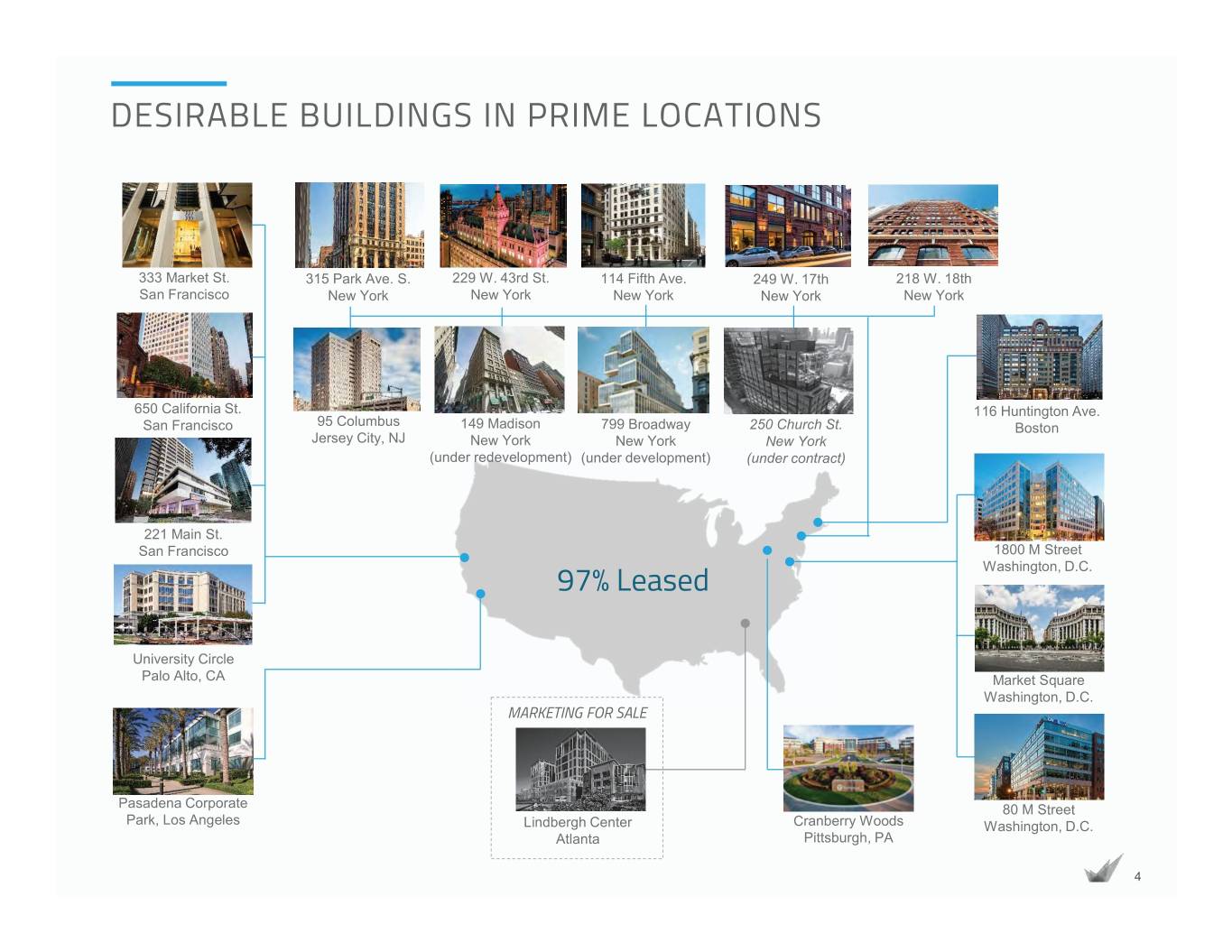

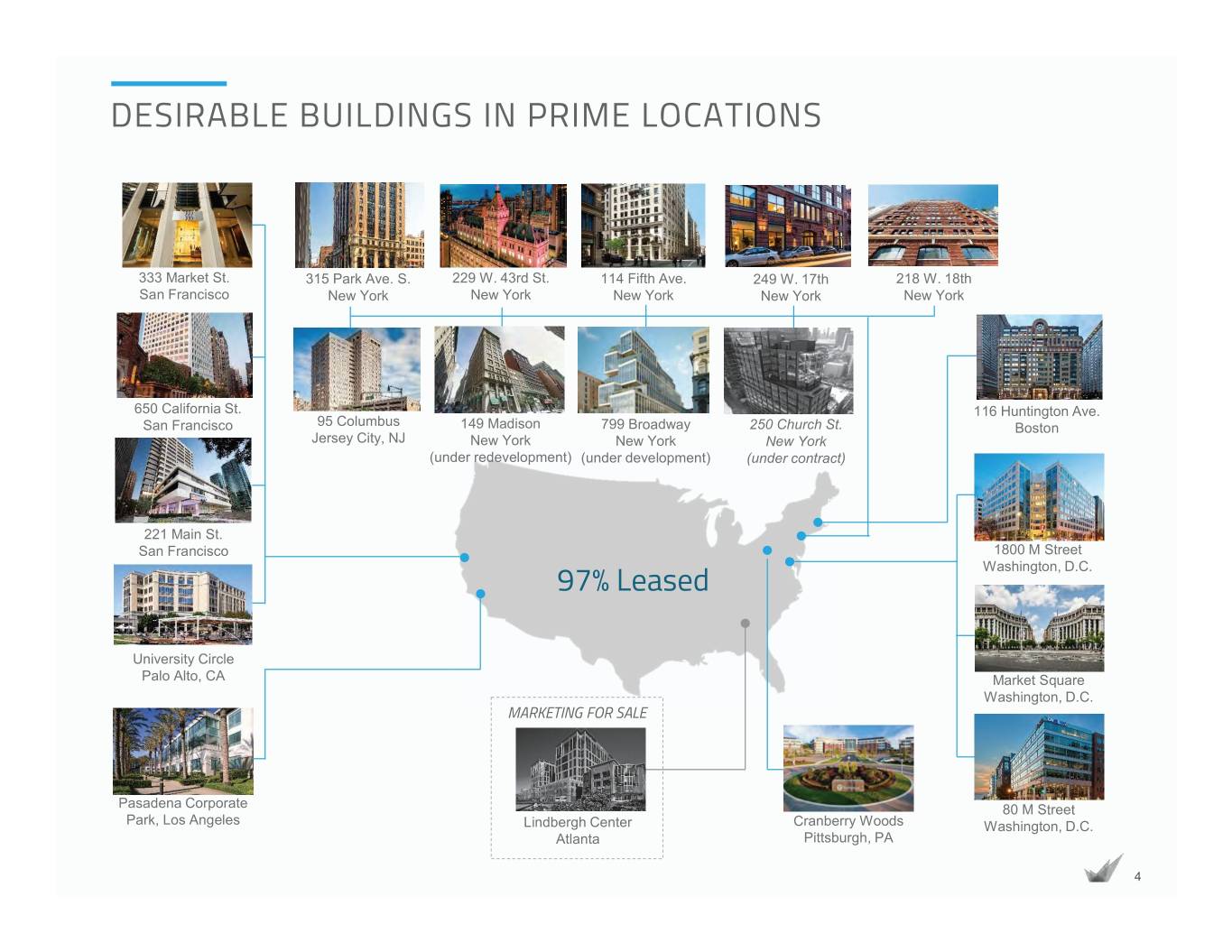

DESIRABLE BUILDINGS IN PRIME LOCATIONS 333 Market St. 315 Park Ave. S. 229 W. 43rd St. 114 Fifth Ave. 249 W. 17th 218 W. 18th San Francisco New York New York New York New York New York 650 California St. 116 Huntington Ave. San Francisco 95 Columbus 149 Madison 799 Broadway 250 Church St. Boston Jersey City, NJ New York New York New York (under redevelopment) (under development) (under contract) 221 Main St. San Francisco 1800 M Street Washington, D.C. 97% Leased University Circle Palo Alto, CA Market Square Washington, D.C. MARKETING FOR SALE Pasadena Corporate 80 M Street Park, Los Angeles Lindbergh Center Cranberry Woods Washington, D.C. Atlanta Pittsburgh, PA 4

LEADING GATEWAY SUBMARKETS NEW YORK SAN FRANCISCO WASHINGTON, D.C. 2.4M total SF 2.0M total SF 1.5M total SF 99% leased 99% leased 90% leased Data for properties owned in unconsolidated joint ventures presented at 100%. New York metrics exclude 799 Broadway. 5

A DIFFERENTIATED APPROACH • Modernized buildings with architectural distinction • Strategic locations • Efficient floorplates • Attractive amenities • Exceptional service to tenants • Targeted capital investments 6

SECTOR-LEADING SAME-STORE NOI GROWTH • Strategic locations and renovations • 3.5 million SF •13.9% leases signed 2018 same-store • Best-in-class service 2016-2019 NOI growth1 and amenities • 30% average •8% - 10% • Creative rent roll cash leasing 2019 same-store management spreads NOI guidance 1Non-GAAP financial measure. See Appendix. 7

ILLUSTRATIVE NET ASSET VALUE ANALYSIS Net Operating Cap Rate Cap Rate (in thousands, except for per-share data) Income (Cash) 5.00% 4.75% Q1 2019 Annualized – excluding Atlanta and Pittsburgh1,2 $189,000 $3,780,000 $3,979,000 Estimated Non-Gateway Value – Lindbergh Center & Cranberry Woods 350,000 375,000 Construction in Progress – 149 Madison & 799 Broadway (cost basis) 183,000 183,000 Debt @ 3.31.191 (1,406,000) (1,406,000) Working Capital (Net) @ 3.31.19 24,000 24,000 Planned Capital Expenditures3 (21,000) (21,000) Implied Net Asset Value – “Q1 Cash Paying” $2,910,000 $3,134,000 Implied Net Asset Value – “Q1 Cash Paying” / Share $24.90A $26.81 Contractual – not yet Cash Paying but beginning by year-end4 $18,000 $360,000 $379,000 Planned Capital Expenditures5 (62,000) (62,000) Implied Incremental Value from Contractual Leases $298,000 $317,000 Implied Incremental Value from Contractual Leases / Share $2.55B $2.71 Implied Value: “Q1” + “2019 Contractual” / Share $27.45C $29.52 A + B = C Rents 5% -10% below market across portfolio6 Note: Table includes non-GAAP financial measures. See Appendix. 1Pro forma for the sale of One & Three Glenlake (NOI excluded from 1Q19 and debt reduced by net proceeds of $194M) 2Adjusted for non-recurring revenues and expenses and mid quarter leasing activity. 3Committed capital for building projects and leasing costs for leases that are currently “cash paying”. 4Includes leases that have not yet commenced or are in abatement as of 3/31/19 and begin paying cash by 12/31/19. 5Leasing costs for leases that are not yet “cash paying”. 6Based on management’s estimates. 8

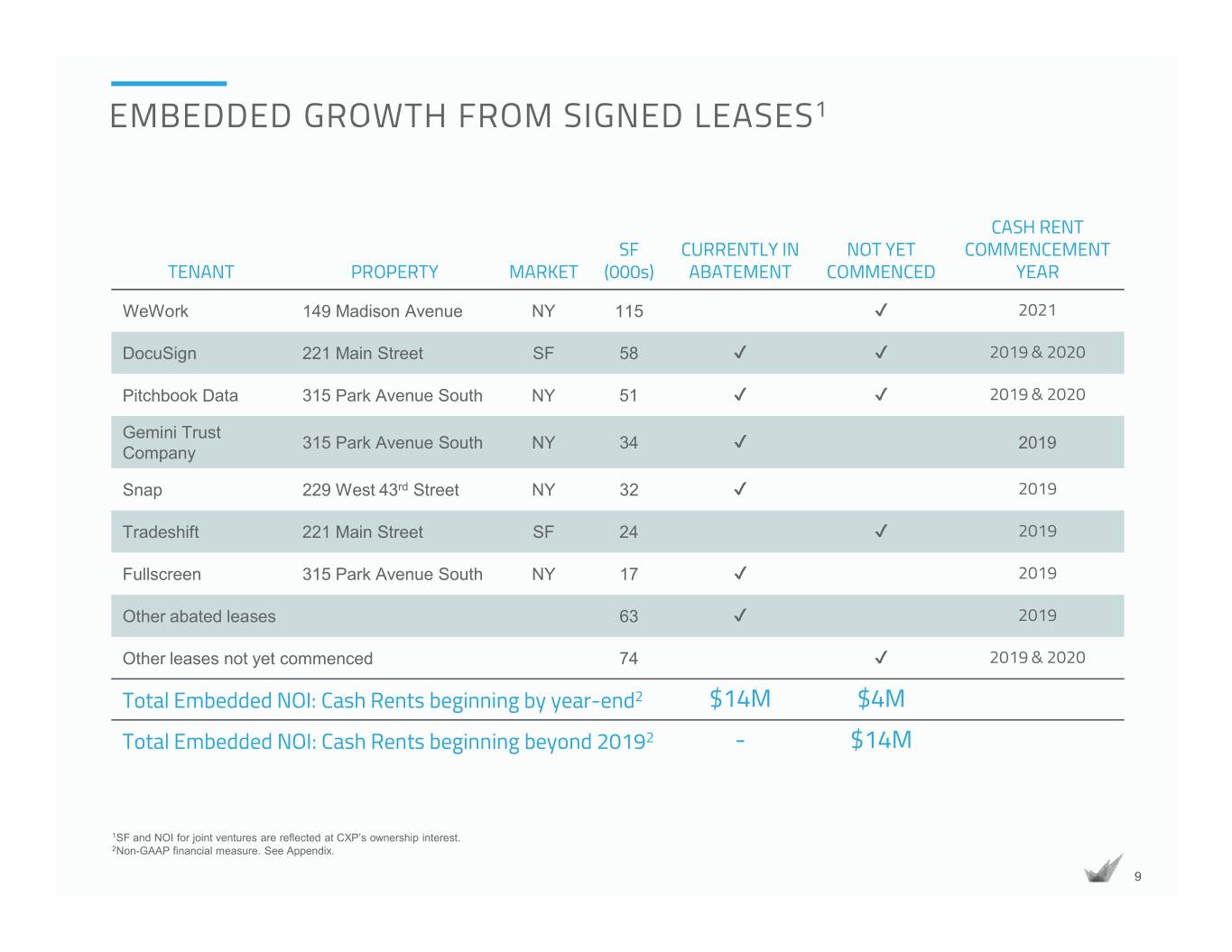

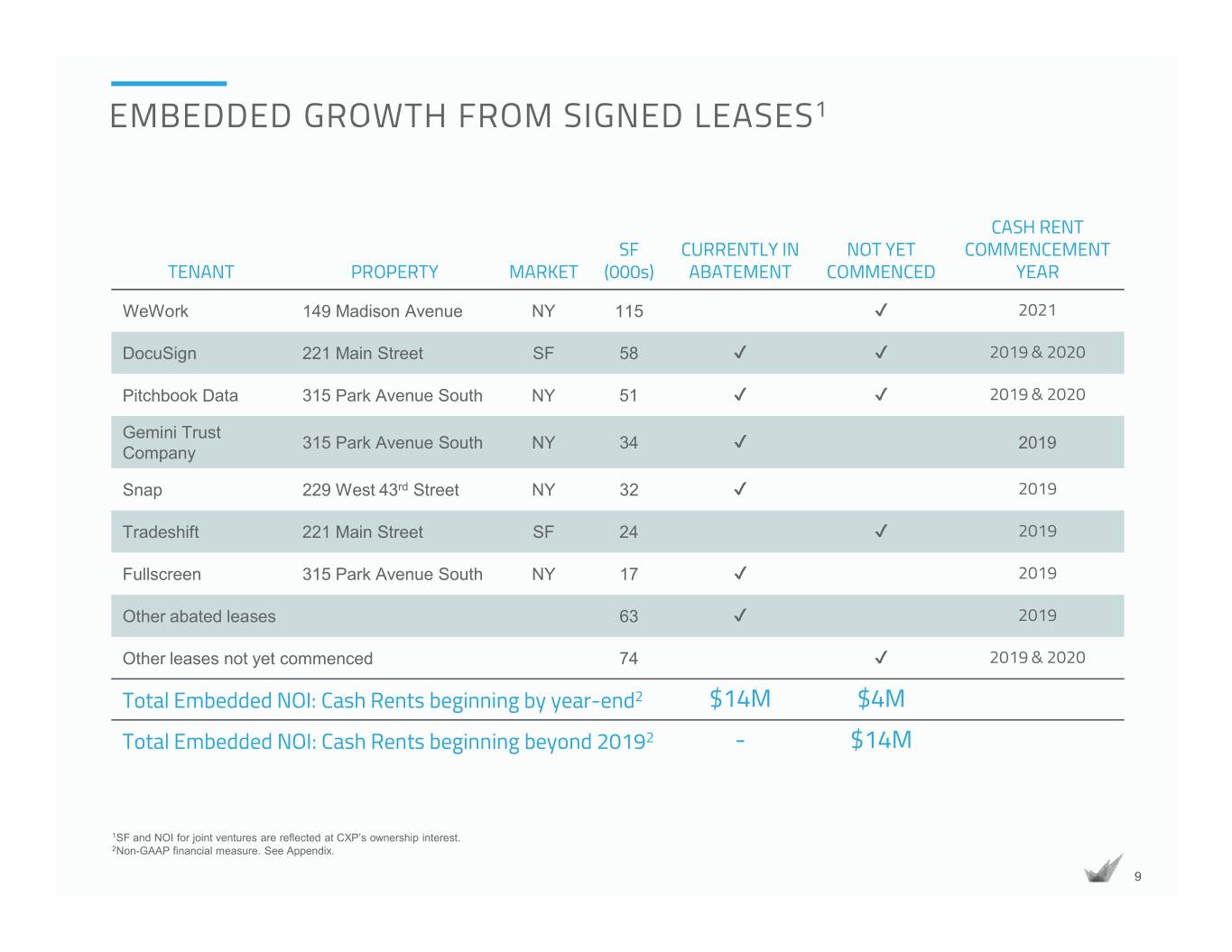

EMBEDDED GROWTH FROM SIGNED LEASES1 CASH RENT SF CURRENTLY IN NOT YET COMMENCEMENT TENANT PROPERTY MARKET (000s) ABATEMENT COMMENCED YEAR 2021 ط WeWork 149 Madison Avenue NY 115 2020 & 2019طط DocuSign 221 Main Street SF 58 2020 & 2019طط Pitchbook Data 315 Park Avenue South NY 51 Gemini Trust 2019 ط Park Avenue South NY 34 315 Company 2019 ط Snap 229 West 43rd Street NY 32 2019 ط Tradeshift 221 Main Street SF 24 2019 ط Fullscreen 315 Park Avenue South NY 17 2019 ط Other abated leases 63 2020 & 2019 ط Other leases not yet commenced 74 Total Embedded NOI: Cash Rents beginning by year-end2 $14M $4M Total Embedded NOI: Cash Rents beginning beyond 20192 - $14M 1SF and NOI for joint ventures are reflected at CXP’s ownership interest. 2Non-GAAP financial measure. See Appendix. 9

ATTRACTIVE DIVIDEND YIELD DIVIDEND YIELD vs. GATEWAY OFFICE PEERS 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% KRC DEI ESRT PGRE BXP HPP CXP SLG VNO As of 5.3.2019 1010

LIMITED NEAR-TERM ROLLOVER LEASE EXPIRATIONS BY YEAR (% OF ALR) 35% 30% 30% 6.6 years average remaining 25% lease term 20% 16% 15% AT&T at 12% Lindbergh 9% 10% 9% 6% 7% 6% 5% 4% 1% 0% 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028+ 11

REDEVELOPED PORTFOLIO Modest capital needs going forward Portfolio has recently received substantial renovations Properties now positioned among best-in-class for competitive sets 12

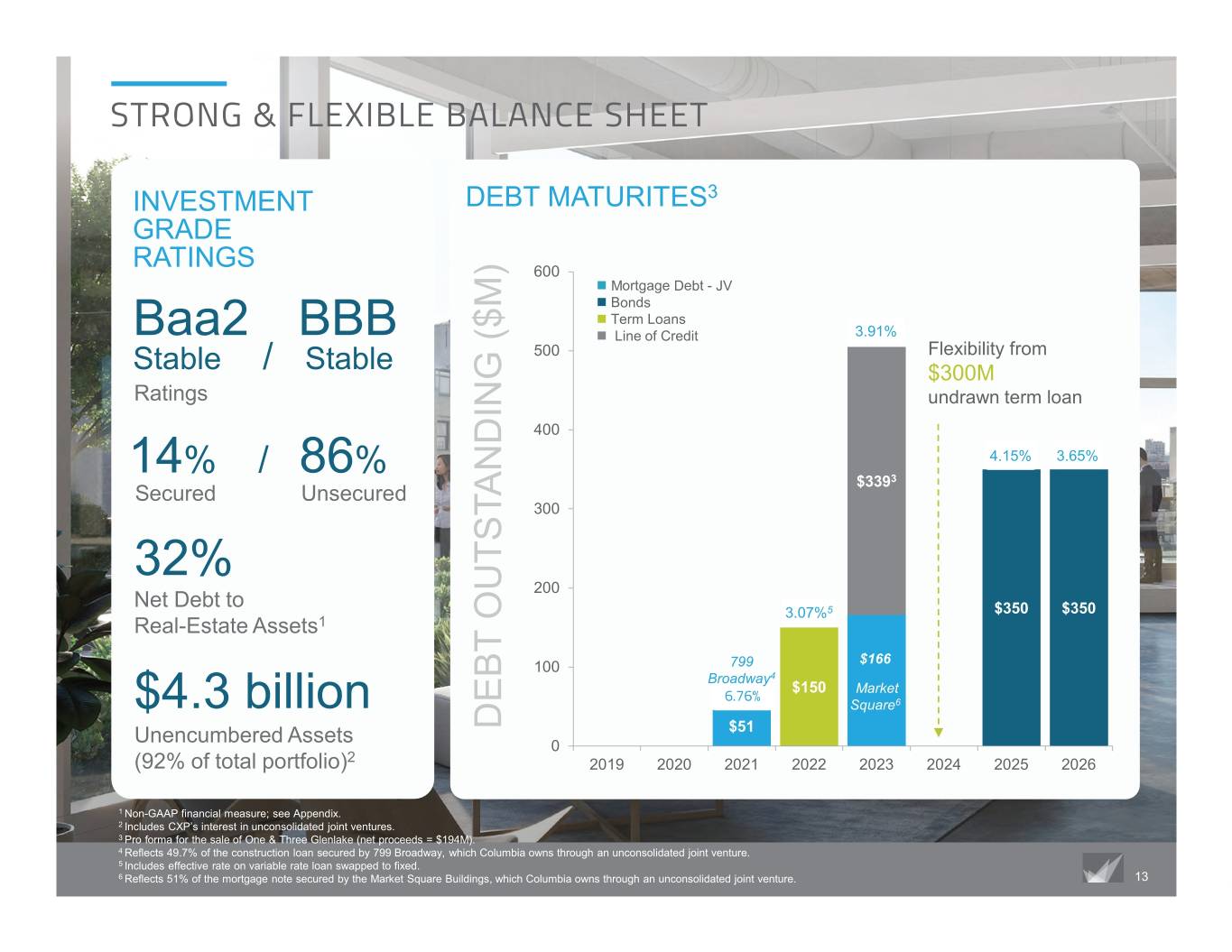

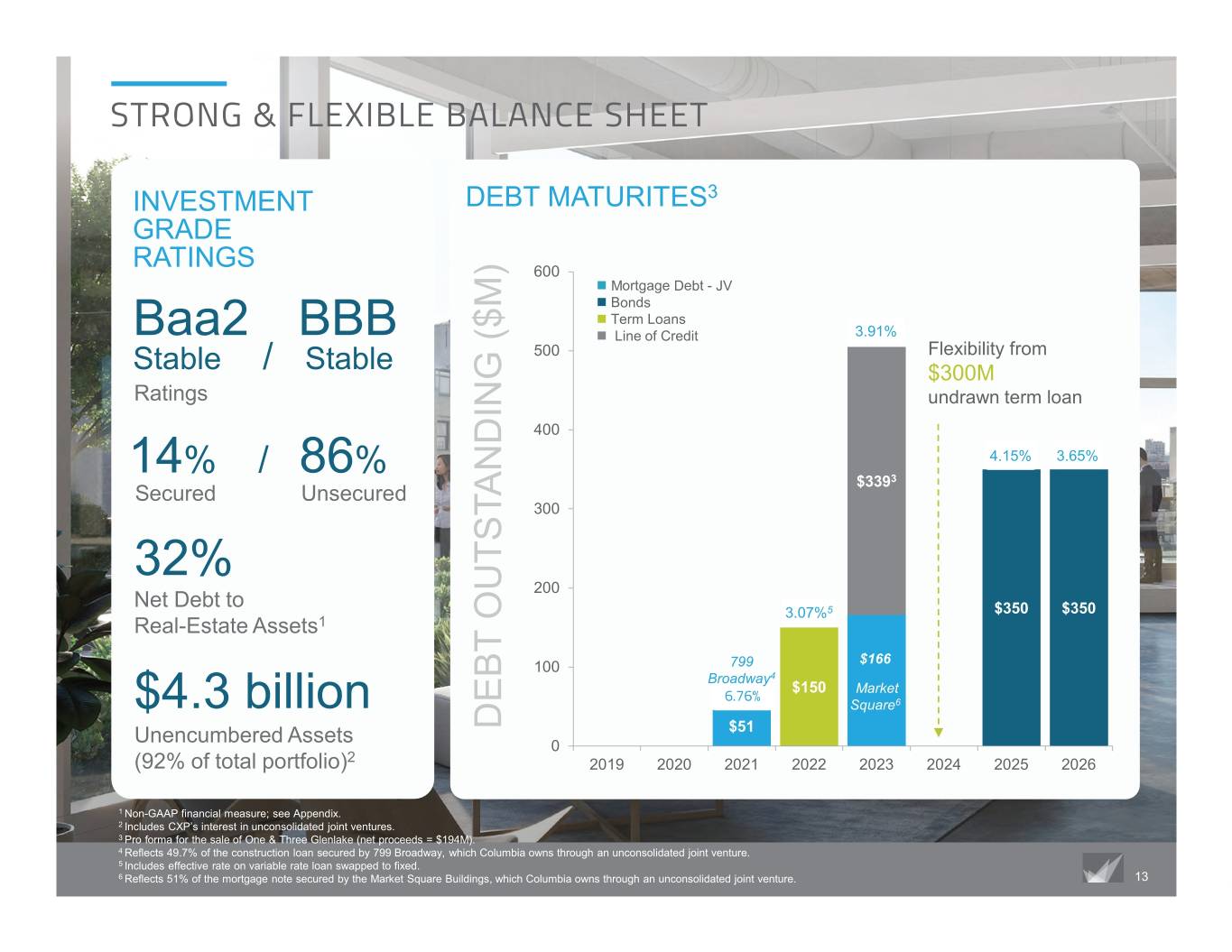

STRONG & FLEXIBLE BALANCE SHEET INVESTMENT DEBT MATURITES3 GRADE RATINGS 600 „ Mortgage Debt - JV „ Bonds „ Term Loans Baa2 BBB „ Line of Credit 3.91% 500 Flexibility from Stable / Stable $300M Ratings undrawn term loan 400 14% / 86% 4.15% 3.65% $3393 Secured Unsecured 300 32% 200 Net Debt to 3.07%5 $350 $350 Real-Estate Assets1 $166 100 799 Broadway4 $150 Market $4.3 billion 6.76% Square6 DEBT OUTSTANDING ($M) OUTSTANDING DEBT $51 Unencumbered Assets 0 (92% of total portfolio)2 2019 2020 2021 2022 2023 2024 2025 2026 1 Non-GAAP financial measure; see Appendix. 2 Includes CXP’s interest in unconsolidated joint ventures. 3 Pro forma for the sale of One & Three Glenlake (net proceeds = $194M). 4 Reflects 49.7% of the construction loan secured by 799 Broadway, which Columbia owns through an unconsolidated joint venture. 5 Includes effective rate on variable rate loan swapped to fixed. 6 Reflects 51% of the mortgage note secured by the Market Square Buildings, which Columbia owns through an unconsolidated joint venture. 13

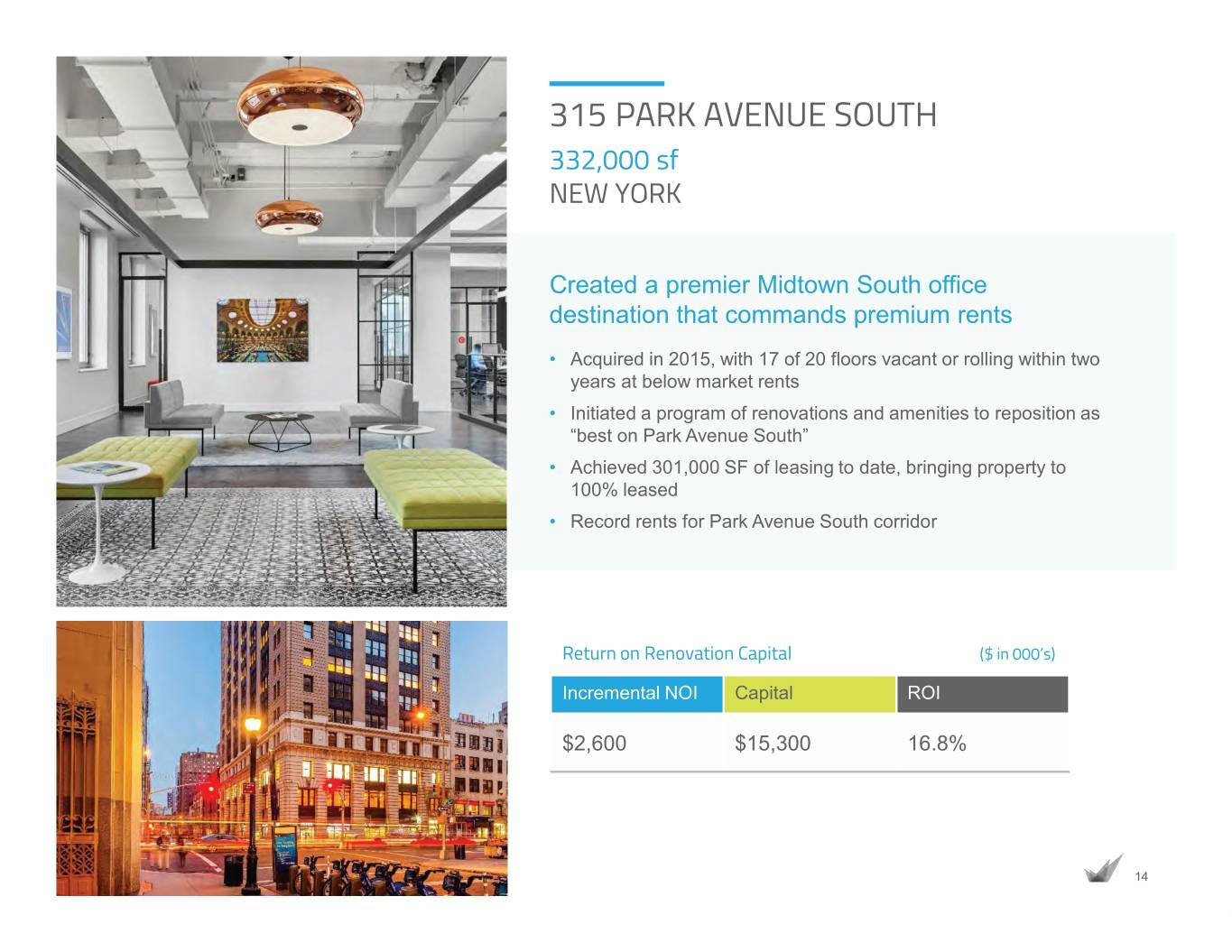

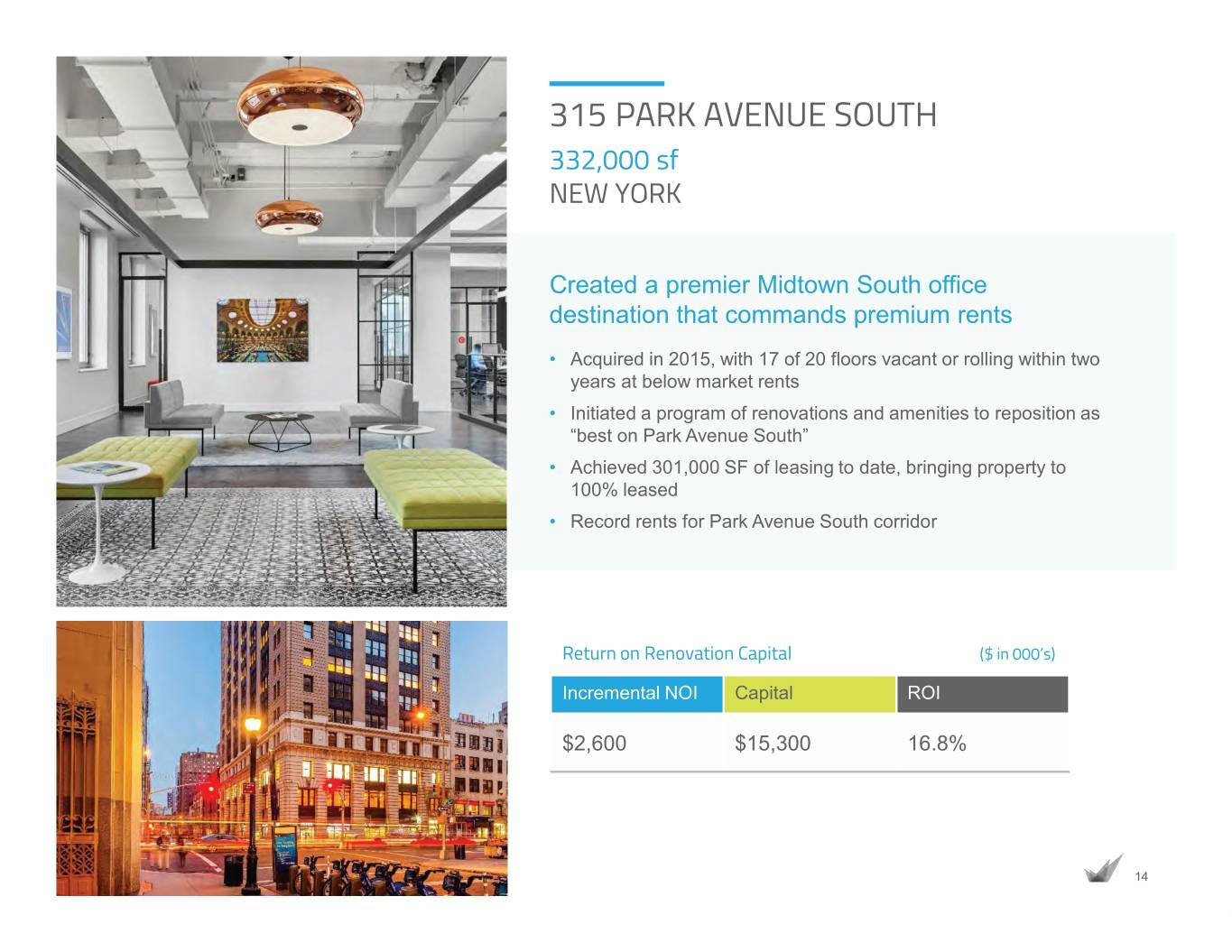

APPENDIX: Case Studies 315 PARK AVENUE SOUTH 332,000 sf NEW YORK Created a premier Midtown South office destination that commands premium rents • Acquired in 2015, with 17 of 20 floors vacant or rolling within two years at below market rents • Initiated a program of renovations and amenities to reposition as “best on Park Avenue South” • Achieved 301,000 SF of leasing to date, bringing property to 100% leased • Record rents for Park Avenue South corridor Return on Renovation Capital ($ in 000’s) Incremental NOI Capital ROI $2,600 $15,300 16.8% 14

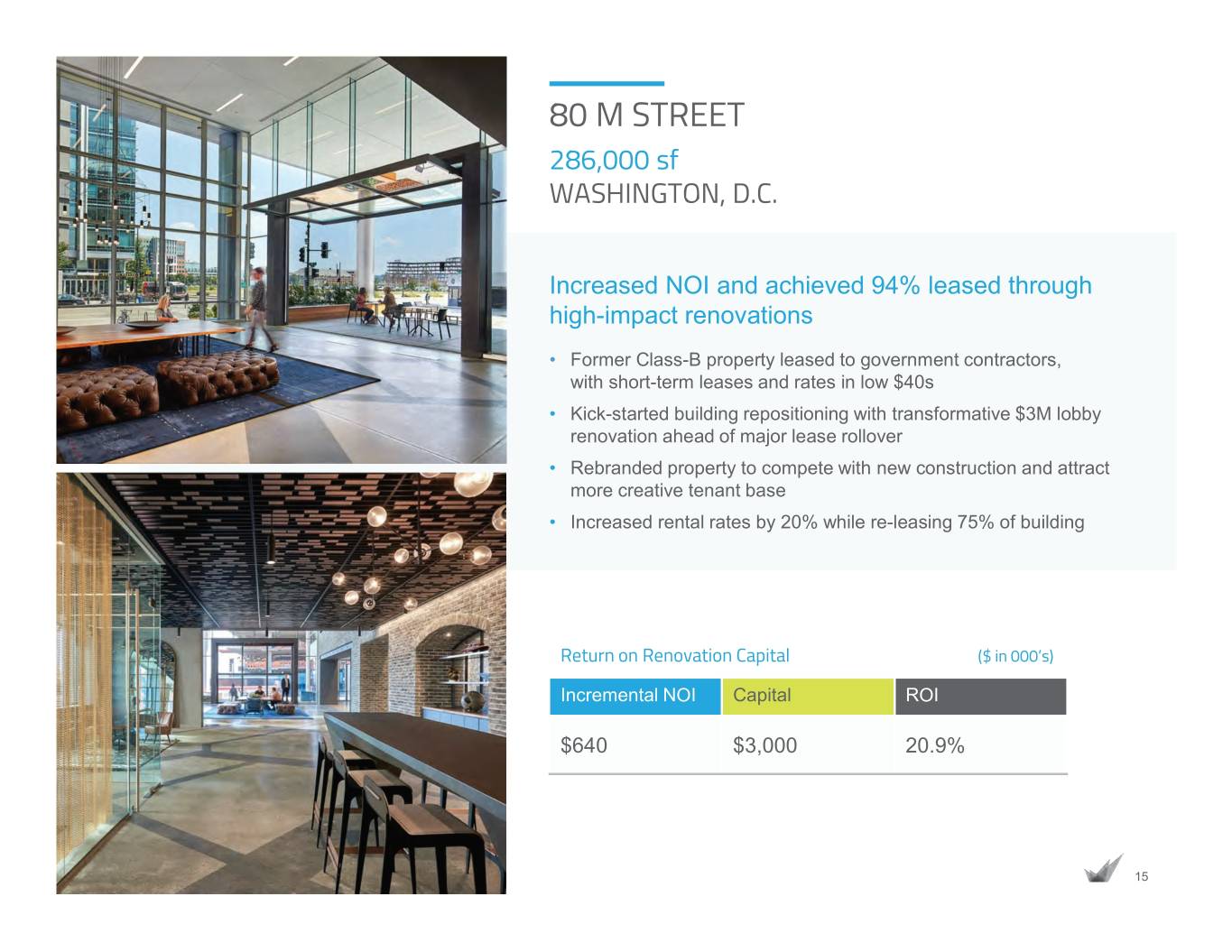

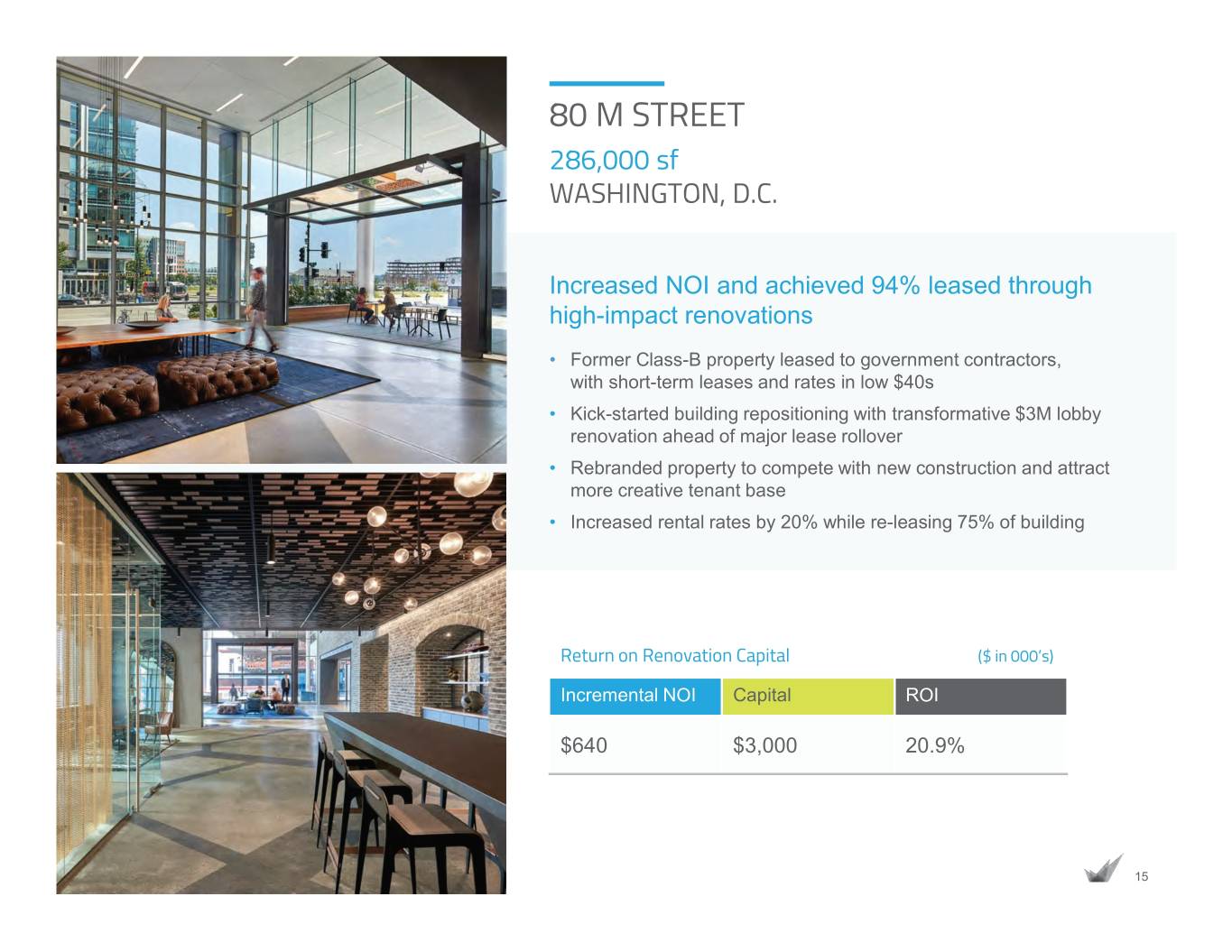

80 M STREET 286,000 sf WASHINGTON, D.C. Increased NOI and achieved 94% leased through high-impact renovations • Former Class-B property leased to government contractors, with short-term leases and rates in low $40s • Kick-started building repositioning with transformative $3M lobby renovation ahead of major lease rollover • Rebranded property to compete with new construction and attract more creative tenant base • Increased rental rates by 20% while re-leasing 75% of building Return on Renovation Capital ($ in 000’s) Incremental NOI Capital ROI $640 $3,000 20.9% 15

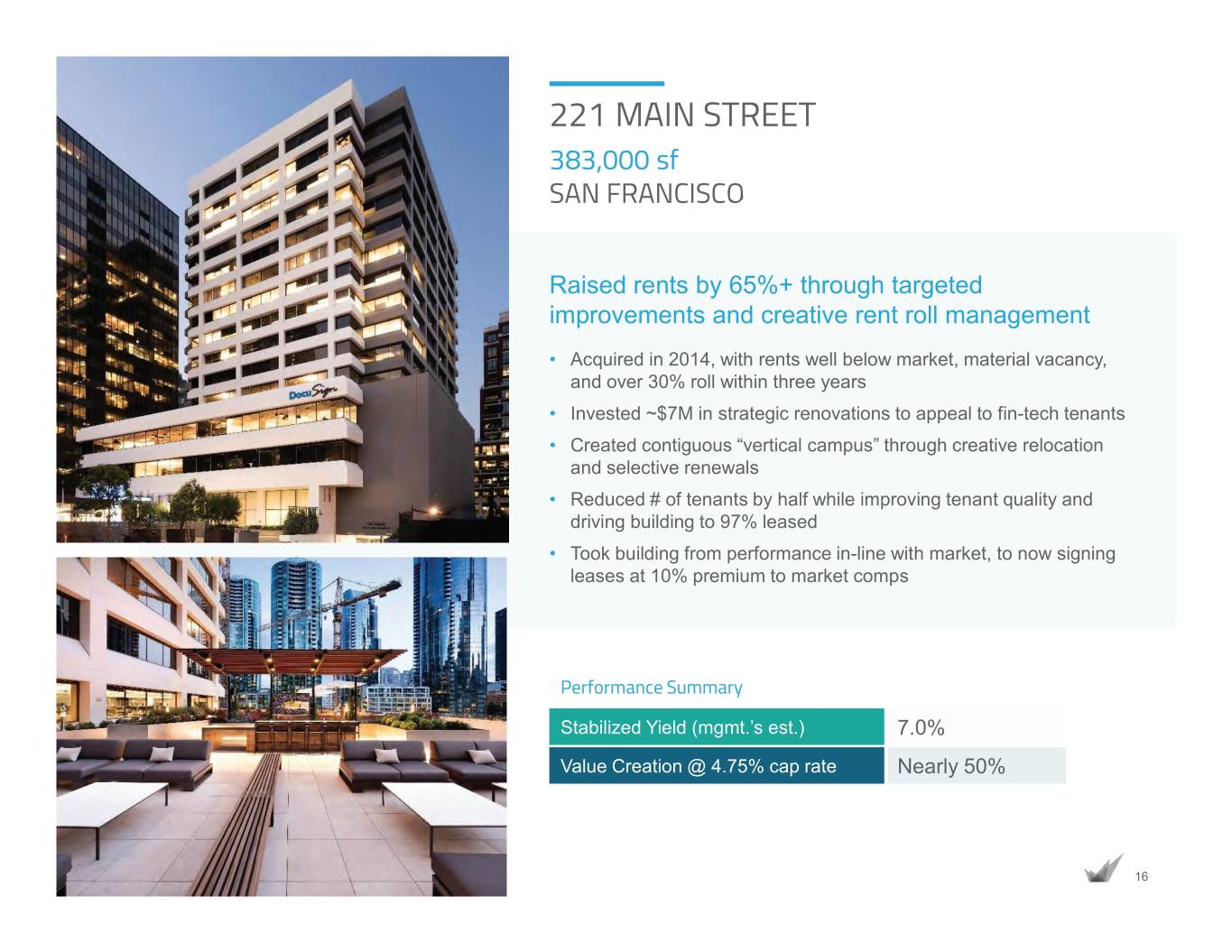

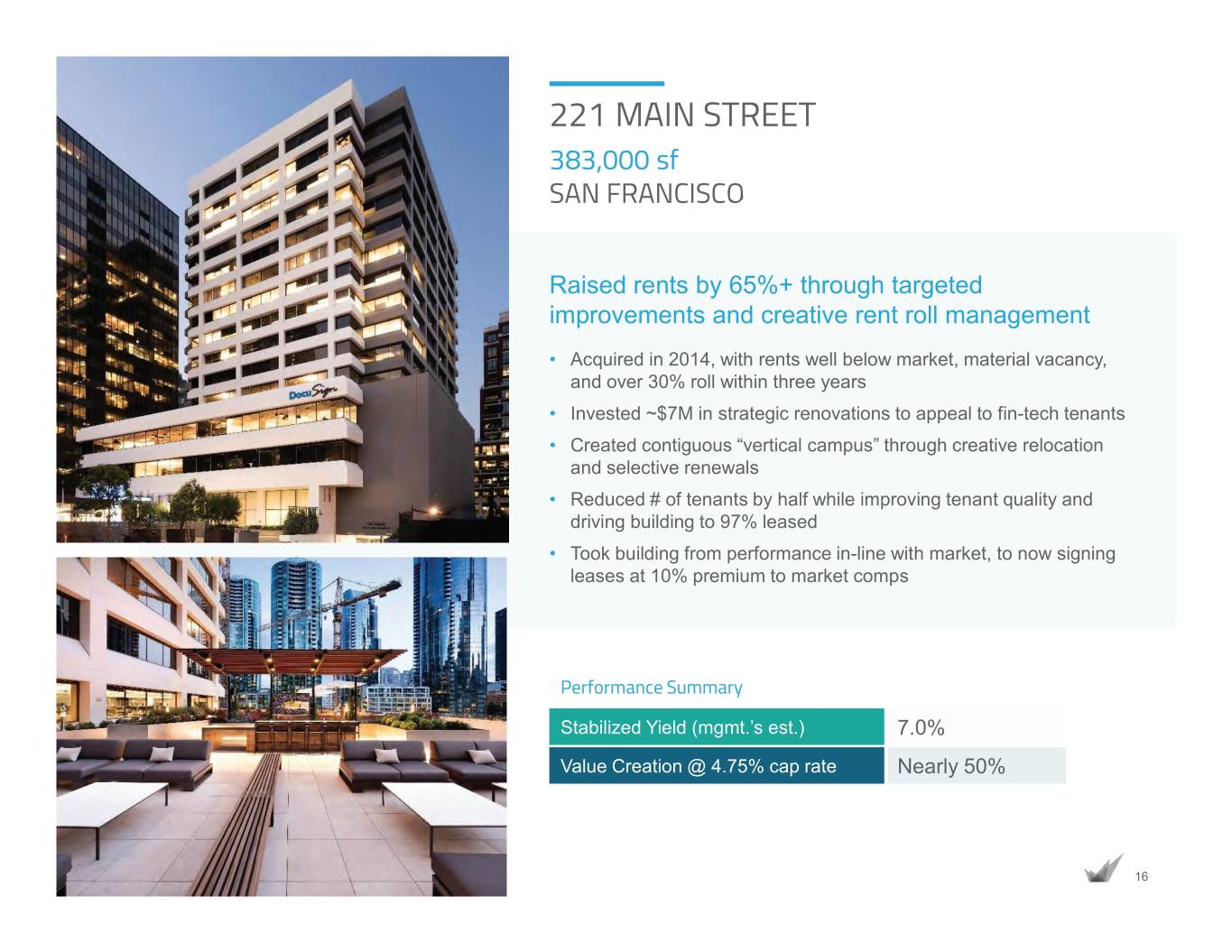

221 MAIN STREET 383,000 sf SAN FRANCISCO Raised rents by 65%+ through targeted improvements and creative rent roll management • Acquired in 2014, with rents well below market, material vacancy, and over 30% roll within three years • Invested ~$7M in strategic renovations to appeal to fin-tech tenants • Created contiguous “vertical campus” through creative relocation and selective renewals • Reduced # of tenants by half while improving tenant quality and driving building to 97% leased • Took building from performance in-line with market, to now signing leases at 10% premium to market comps Performance Summary Stabilized Yield (mgmt.’s est.) 7.0% Value Creation @ 4.75% cap rate Nearly 50% 16

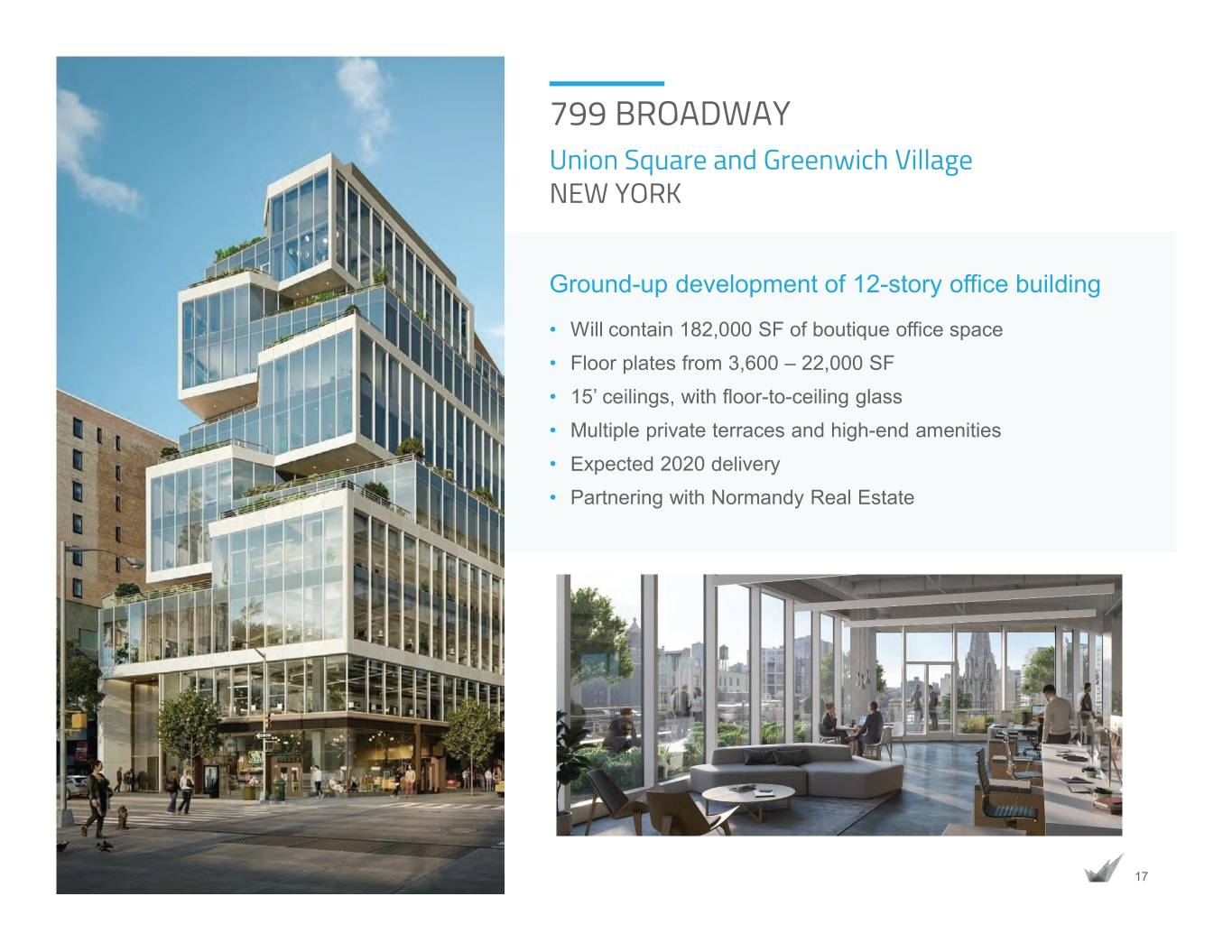

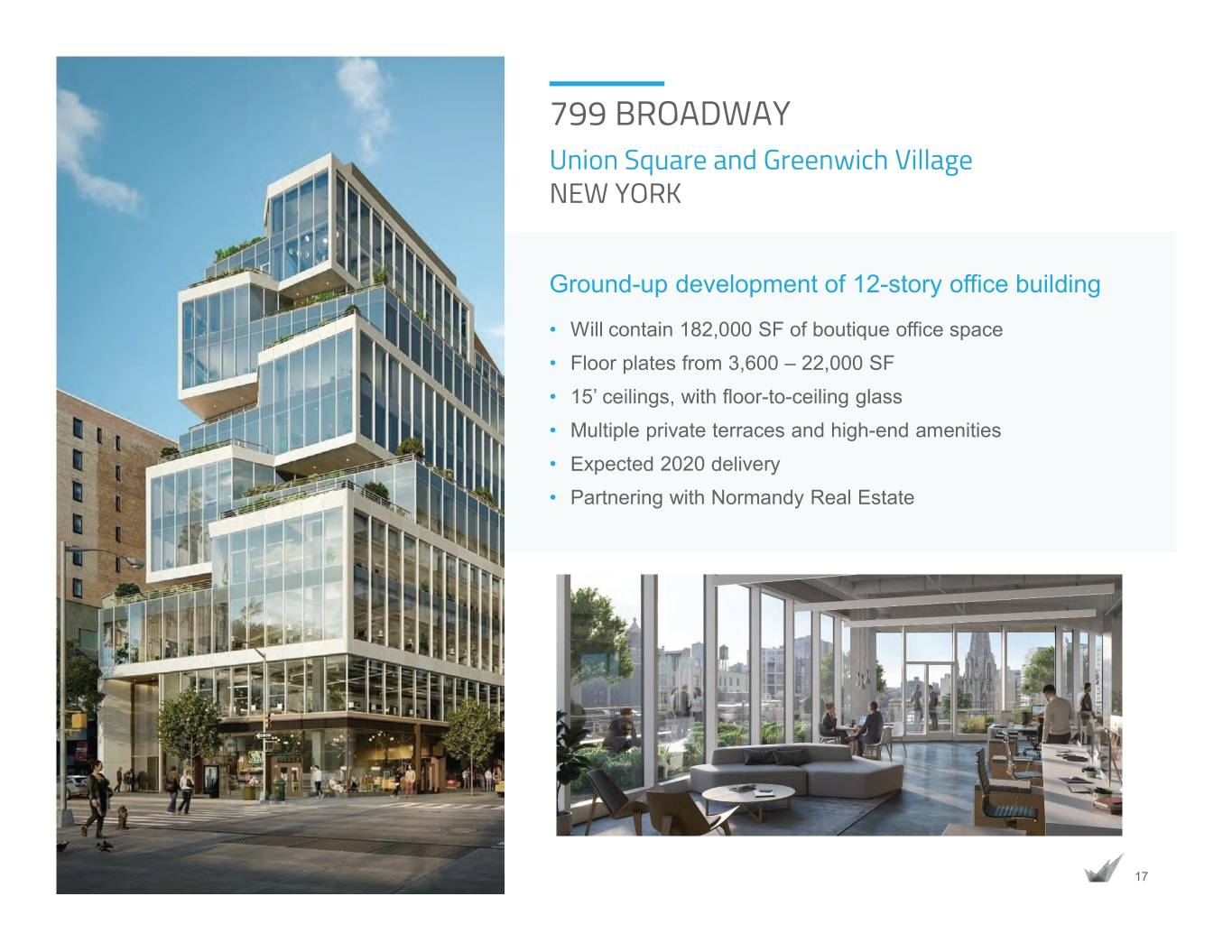

799 BROADWAY Union Square and Greenwich Village NEW YORK Ground-up development of 12-story office building • Will contain 182,000 SF of boutique office space • Floor plates from 3,600 – 22,000 SF • 15’ ceilings, with floor-to-ceiling glass • Multiple private terraces and high-end amenities • Expected 2020 delivery • Partnering with Normandy Real Estate 17

149 MADISON Midtown South / NoMad NEW YORK Full-scale redevelopment underway, with entire office space leased to WeWork • 122,000 RSF of modernized office and retail space • Updating/upgrading infrastructure, interior and exterior finishes, and common areas • Renovation will capitalize on 14’+ slab-to-slab ceiling heights, oversized windows, and boutique-sized floorplates • Strong interest in remaining 6,600 SF of prime corner retail space on ground floor • WeWork’s expected occupancy late 2019 • ~6% expected yield on cost • $10-25 million of implied value creation @ 5.0-5.5% cap rate range 18

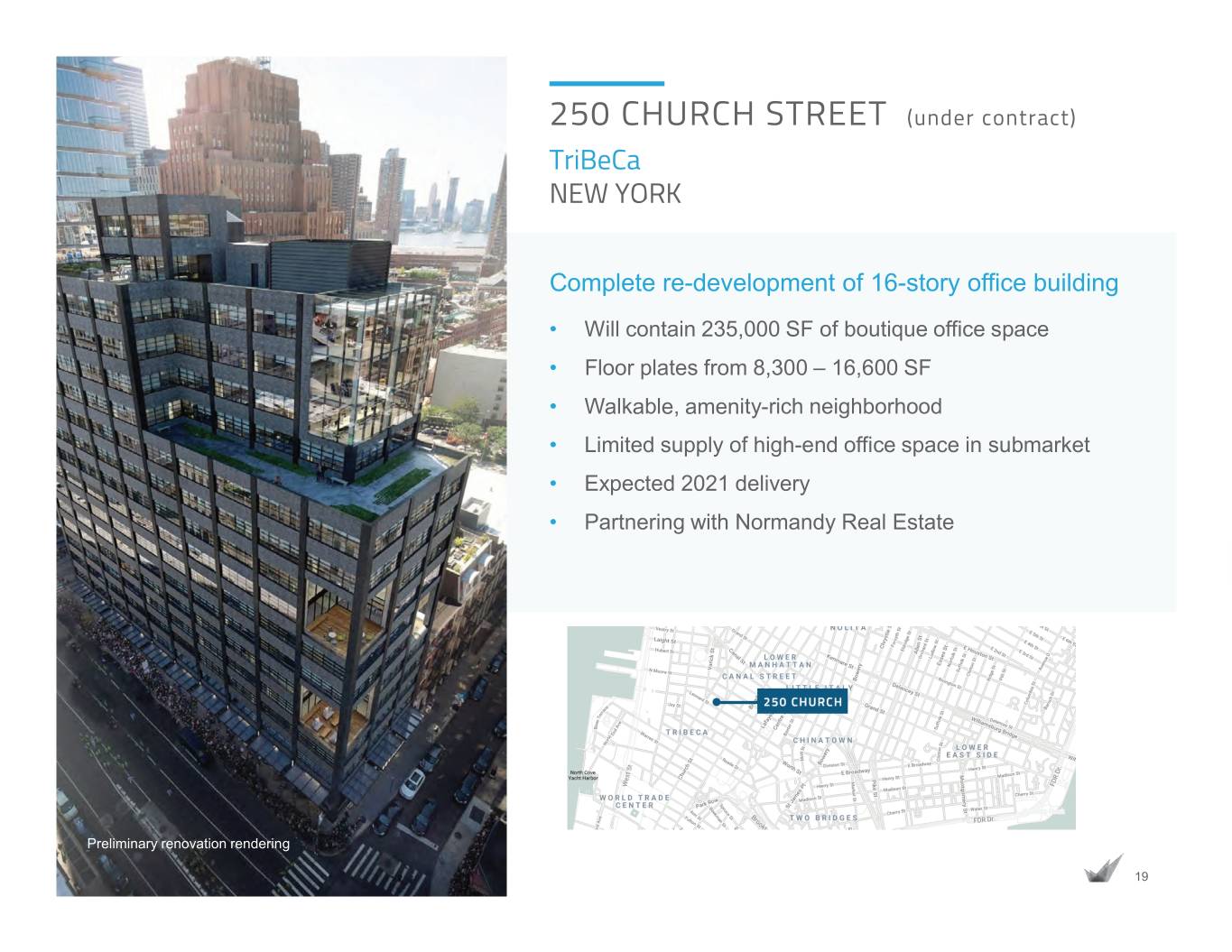

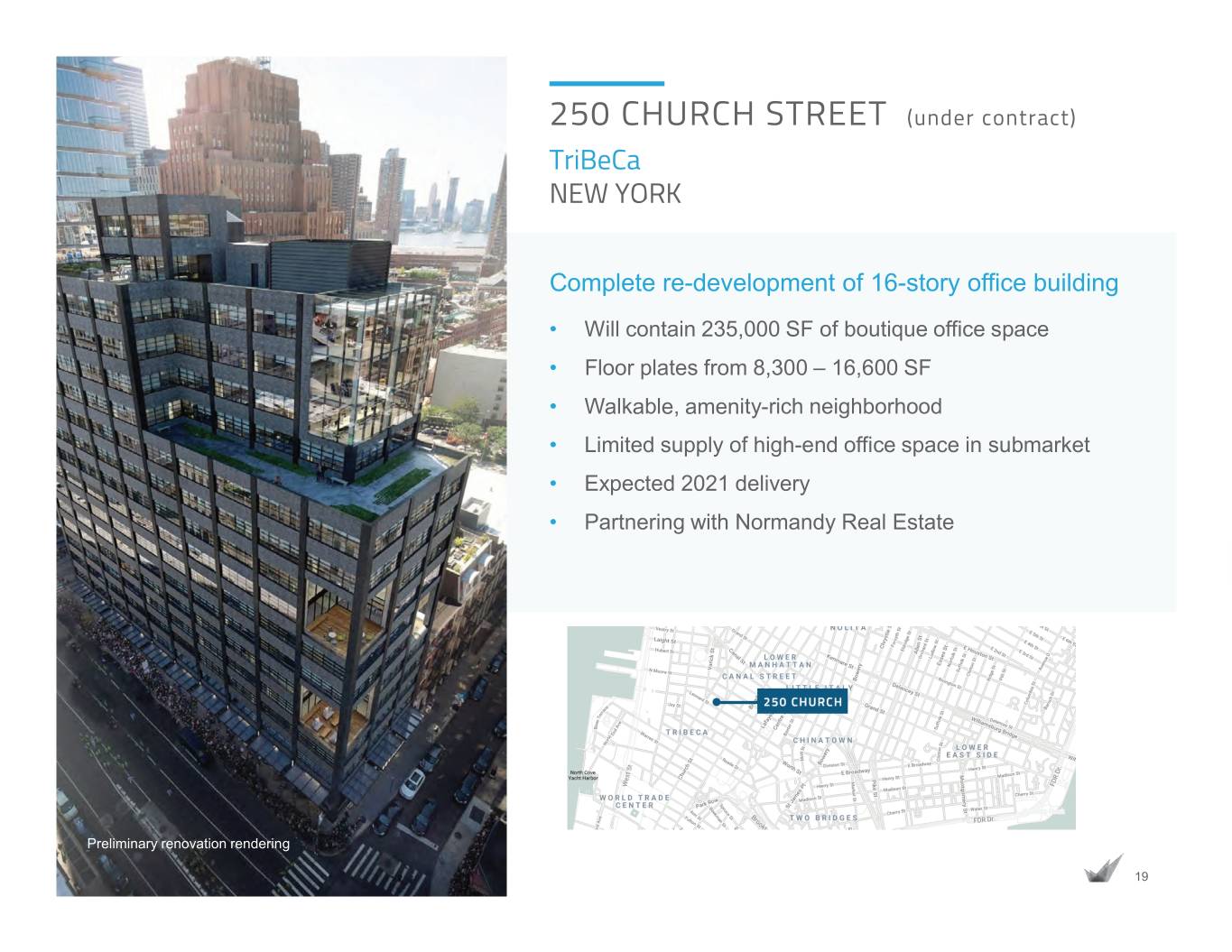

250 CHURCH STREET (under contract) TriBeCa NEW YORK Complete re-development of 16-story office building • Will contain 235,000 SF of boutique office space • Floor plates from 8,300 – 16,600 SF • Walkable, amenity-rich neighborhood • Limited supply of high-end office space in submarket • Expected 2021 delivery • Partnering with Normandy Real Estate Preliminary renovation rendering 19

APPENDIX FOR MORE INFORMATION Columbia Property Trust INVESTOR RELATIONS 404.465.2227 www.columbia.reit ir@columbia.reit 2020

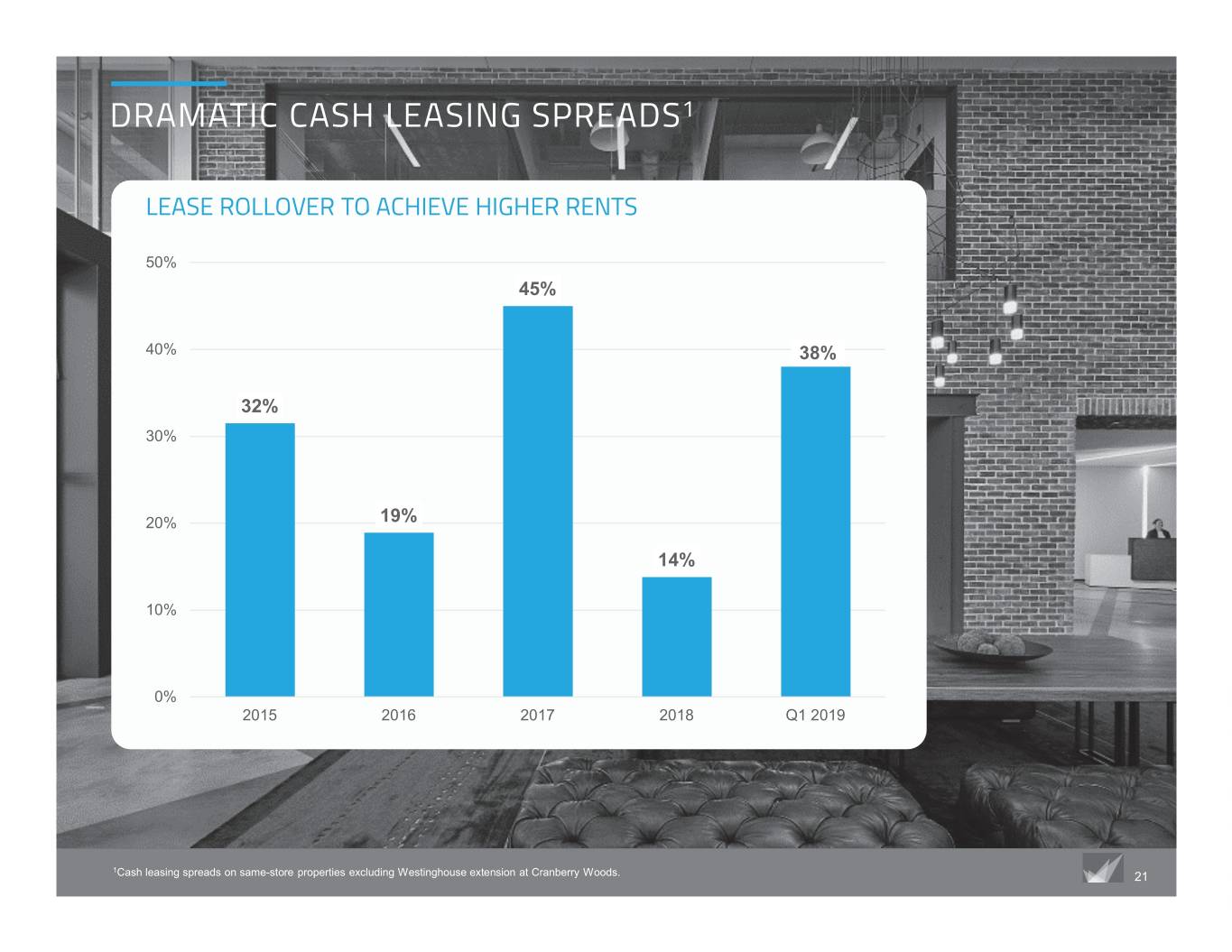

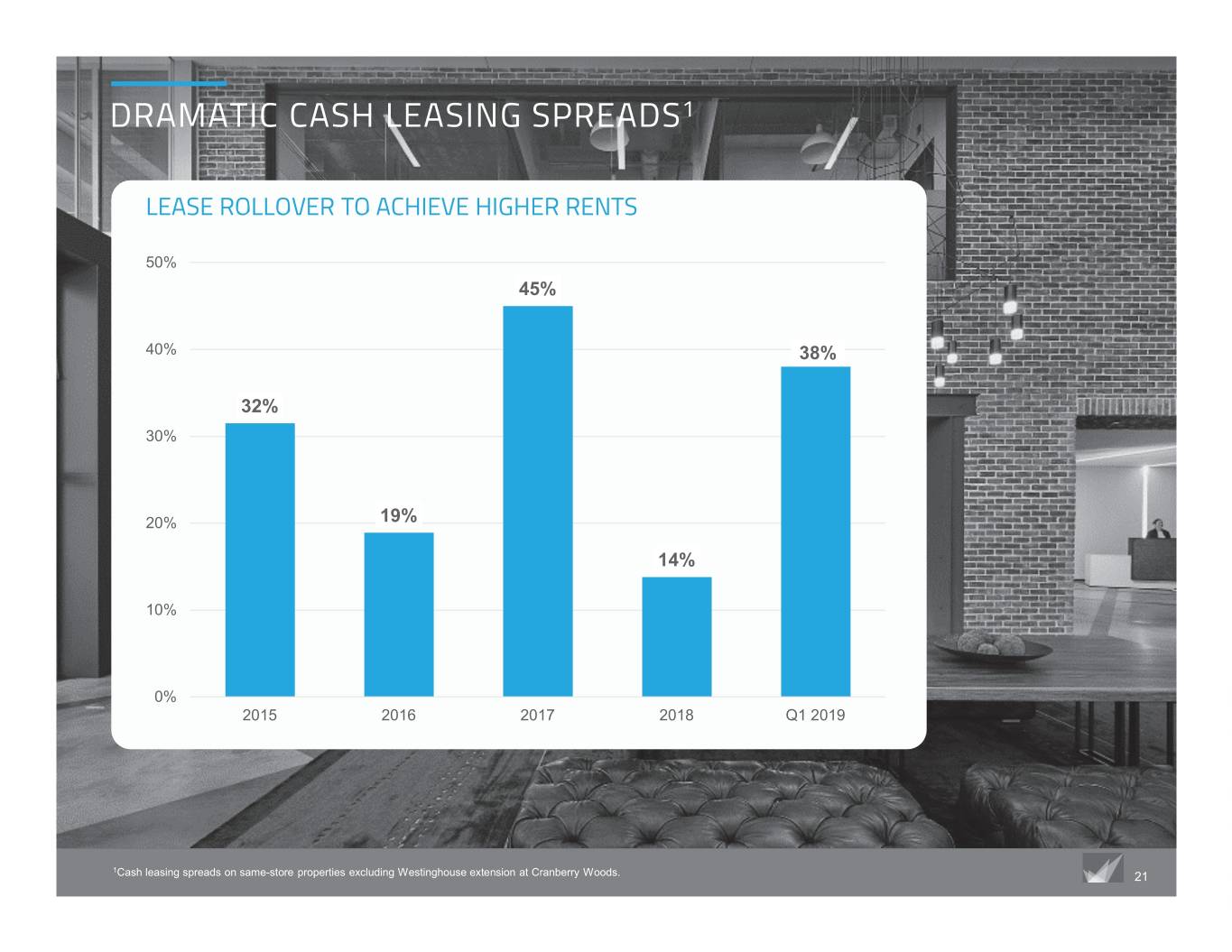

DRAMATIC CASH LEASING SPREADS1 LEASE ROLLOVER TO ACHIEVE HIGHER RENTS 50% 45% 40% 38% 32% 30% 20% 19% 14% 10% 0% 2015 2016 2017 2018 Q1 2019 1 Cash leasing spreads on same-store properties excluding Westinghouse extension at Cranberry Woods. 21

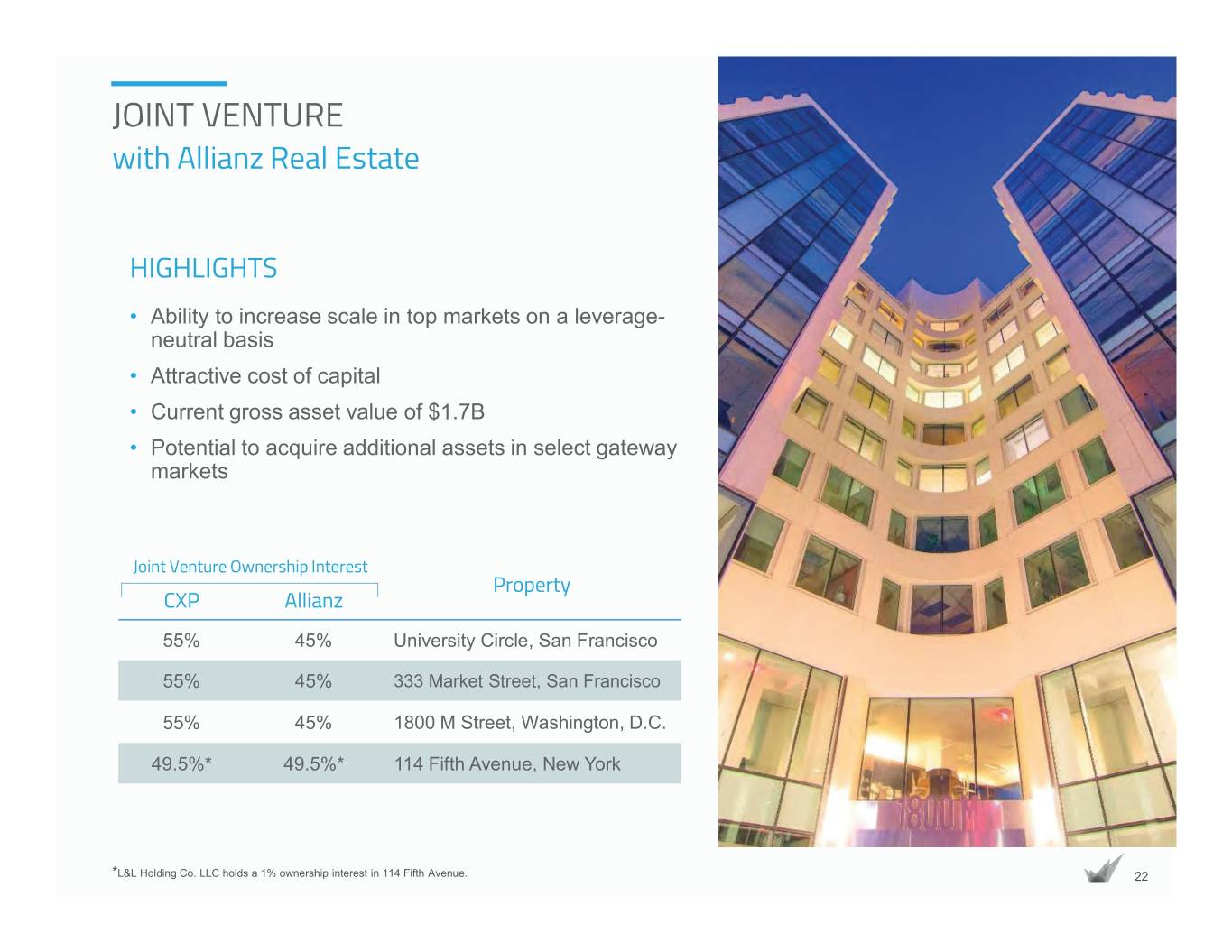

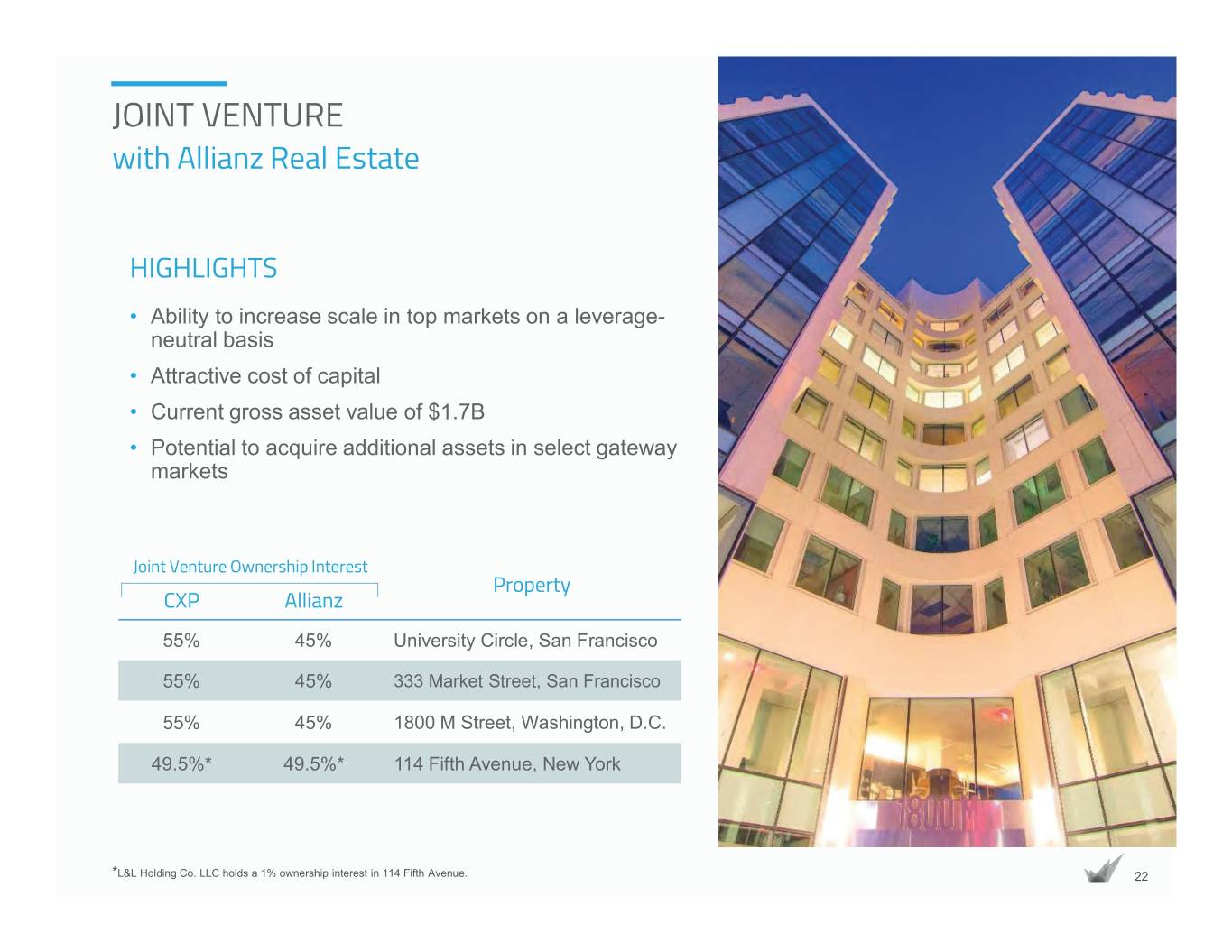

JOINT VENTURE with Allianz Real Estate HIGHLIGHTS • Ability to increase scale in top markets on a leverage- neutral basis • Attractive cost of capital • Current gross asset value of $1.7B • Potential to acquire additional assets in select gateway markets Joint Venture Ownership Interest Property CXP Allianz 55% 45% University Circle, San Francisco 55% 45% 333 Market Street, San Francisco 55% 45% 1800 M Street, Washington, D.C. 49.5%* 49.5%* 114 Fifth Avenue, New York *L&L Holding Co. LLC holds a 1% ownership interest in 114 Fifth Avenue. 2222

LEASING DRIVING GROWTH SF of leases signed Average cash leasing 2019 same-store 2016-2019 spreads during that period NOI guidance 3.5M 30% on current portfolio 8-10% 9315 Park Avenue South 100% leased after 226,000 SF of 650 California 97% leased after 9 leasing (68% of building) since 9Expanded and extended 303,000 SF (65% of building) of 2016, with top floors at record Snapchat for 121,000 SF leases signed since 2016 rents for the property at 229 West 43rd 9Brought University Circle to 100% leased with expansion of 9One Glenlake 100% leased after Amazon Web Services Brought 80 M Street to 94% 156,000 SF of leases (44% of 9 Eliminated only substantial leased (from 66%) after 214,000 building) since 2016 9 near-term roll with 119,000 SF SF total leasing SOLD 4/15/19 9 renewal of DLA Piper Total leasing statistics exclude Westinghouse extension at Cranberry Woods. 2323

LEADERSHIP TEAM NELSON MILLS JIM FLEMING LINDA BOLAN DAVID CHEIKIN BILL CAMPBELL KELLY LIM DOUG MCDONALD MICHAEL SCHMIDT President and CEO Executive VP and CFO SVP, Property SVP, Strategic Real VP, Construction VP, Asset VP, Finance VP, Asset Management and Estate Initiatives Management Management Sustainability New York San Francisco DAVID DOWDNEY WENDY GILL KEVIN HOOVER AMY TABB RACHEL WILLIAMS ELKA WILSON MARK WITSCHORIK SVP, Head of Leasing SVP, Corporate SVP, Portfolio SVP, Business VP, Marketing & VP & Controller VP, Asset Operations and Chief Management and Development Communications Management Accounting Officer Transactions Washington, D.C. 24

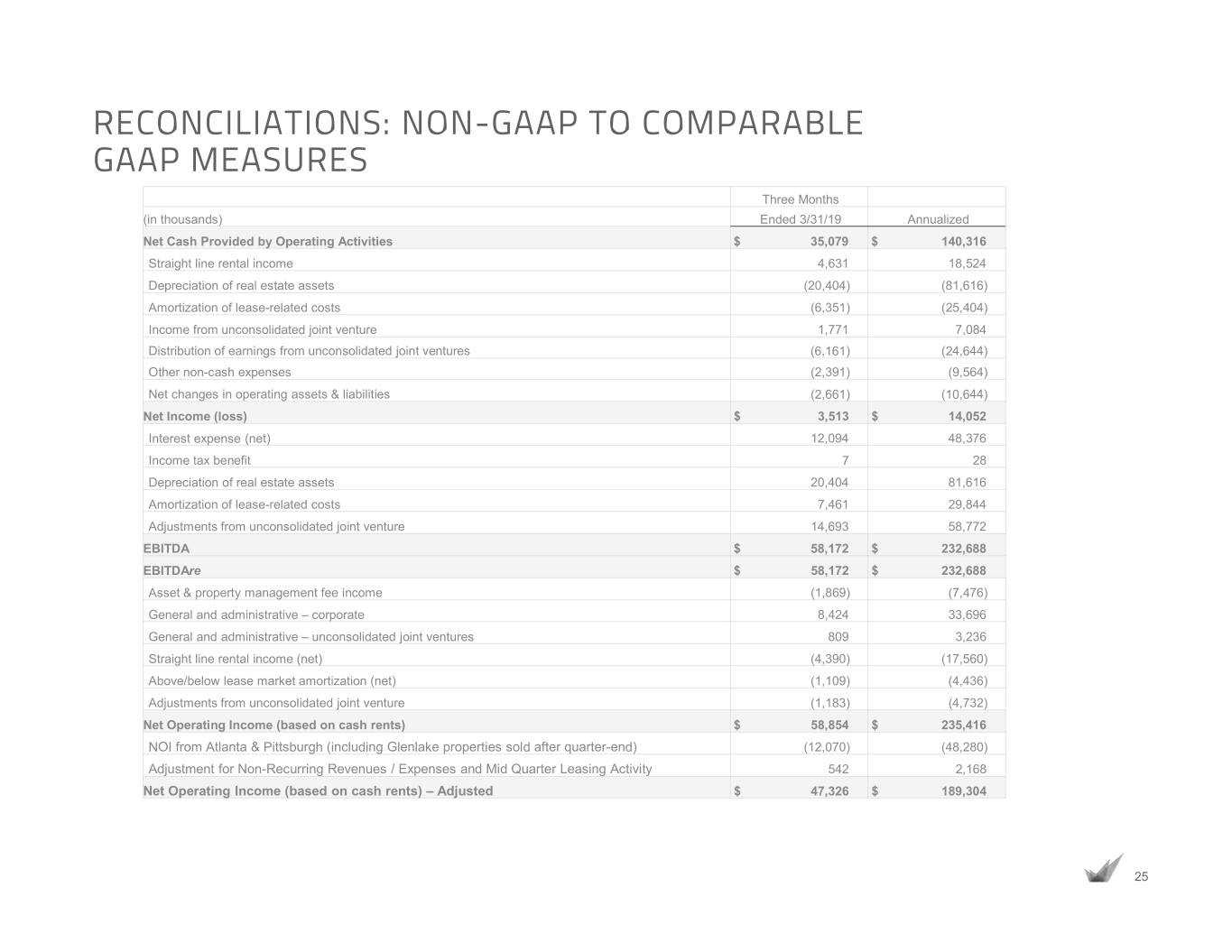

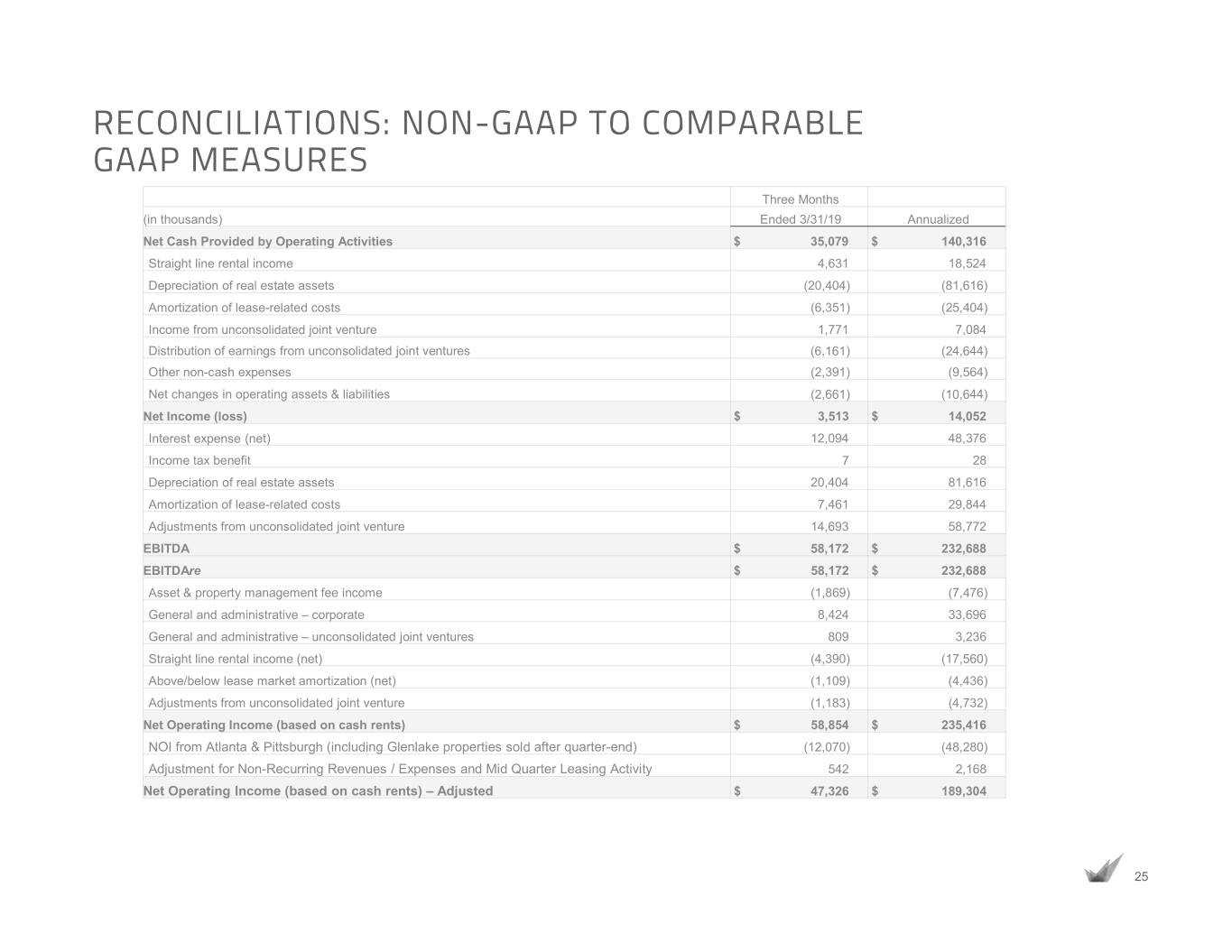

RECONCILIATIONS: NON-GAAP TO COMPARABLE GAAP MEASURES Three Months (in thousands) Ended 3/31/19 Annualized Net Cash Provided by Operating Activities $ 35,079 $ 140,316 Straight line rental income 4,631 18,524 Depreciation of real estate assets (20,404) (81,616) Amortization of lease-related costs (6,351) (25,404) Income from unconsolidated joint venture 1,771 7,084 Distribution of earnings from unconsolidated joint ventures (6,161) (24,644) Other non-cash expenses (2,391) (9,564) Net changes in operating assets & liabilities (2,661) (10,644) Net Income (loss) $ 3,513 $ 14,052 Interest expense (net) 12,094 48,376 Income tax benefit 7 28 Depreciation of real estate assets 20,404 81,616 Amortization of lease-related costs 7,461 29,844 Adjustments from unconsolidated joint venture 14,693 58,772 EBITDA $ 58,172 $ 232,688 EBITDAre $ 58,172 $ 232,688 Asset & property management fee income (1,869) (7,476) General and administrative – corporate 8,424 33,696 General and administrative – unconsolidated joint ventures 809 3,236 Straight line rental income (net) (4,390) (17,560) Above/below lease market amortization (net) (1,109) (4,436) Adjustments from unconsolidated joint venture (1,183) (4,732) Net Operating Income (based on cash rents) $ 58,854 $ 235,416 NOI from Atlanta & Pittsburgh (including Glenlake properties sold after quarter-end) (12,070) (48,280) Adjustment for Non-Recurring Revenues / Expenses and Mid Quarter Leasing Activity 542 2,168 Net Operating Income (based on cash rents) – Adjusted $ 47,326 $ 189,304 25

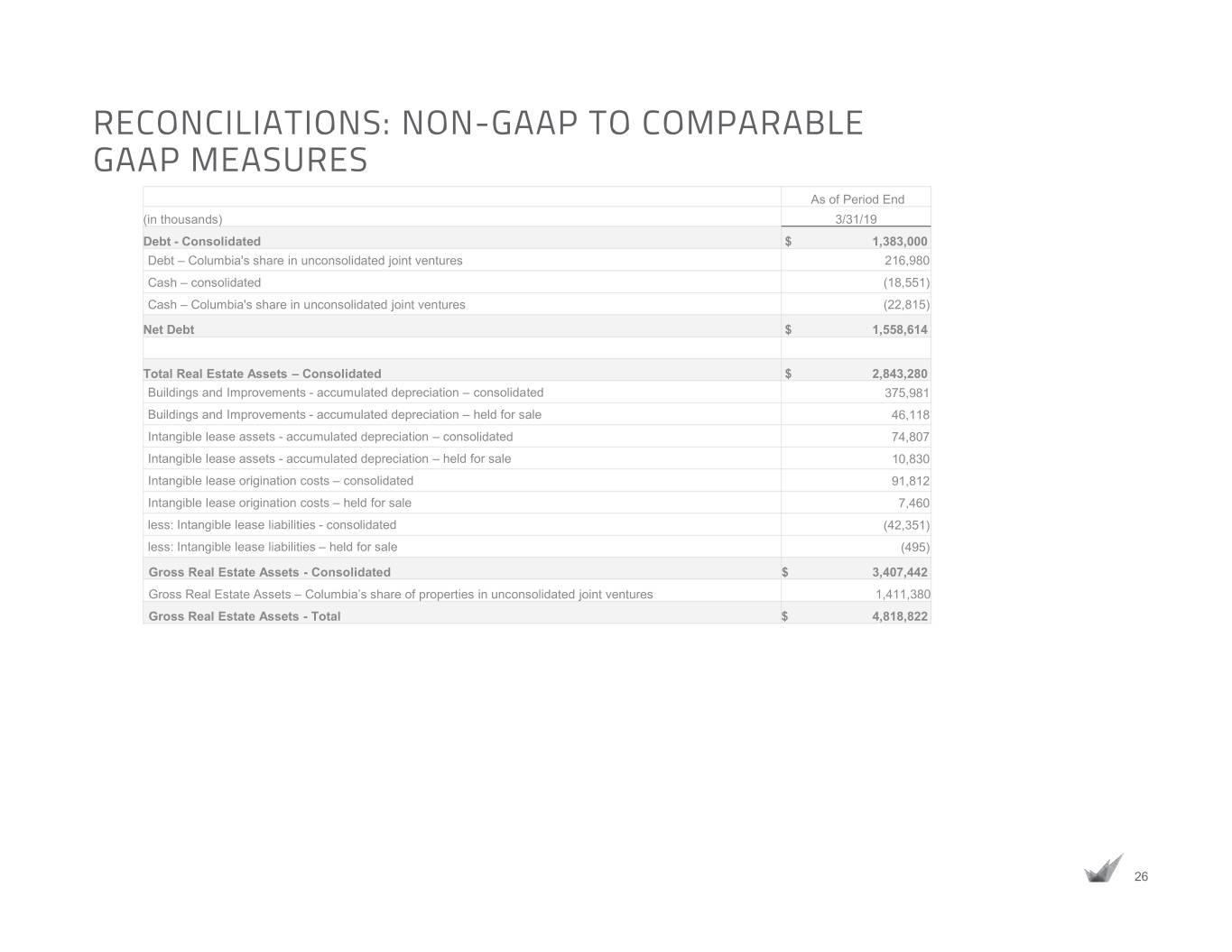

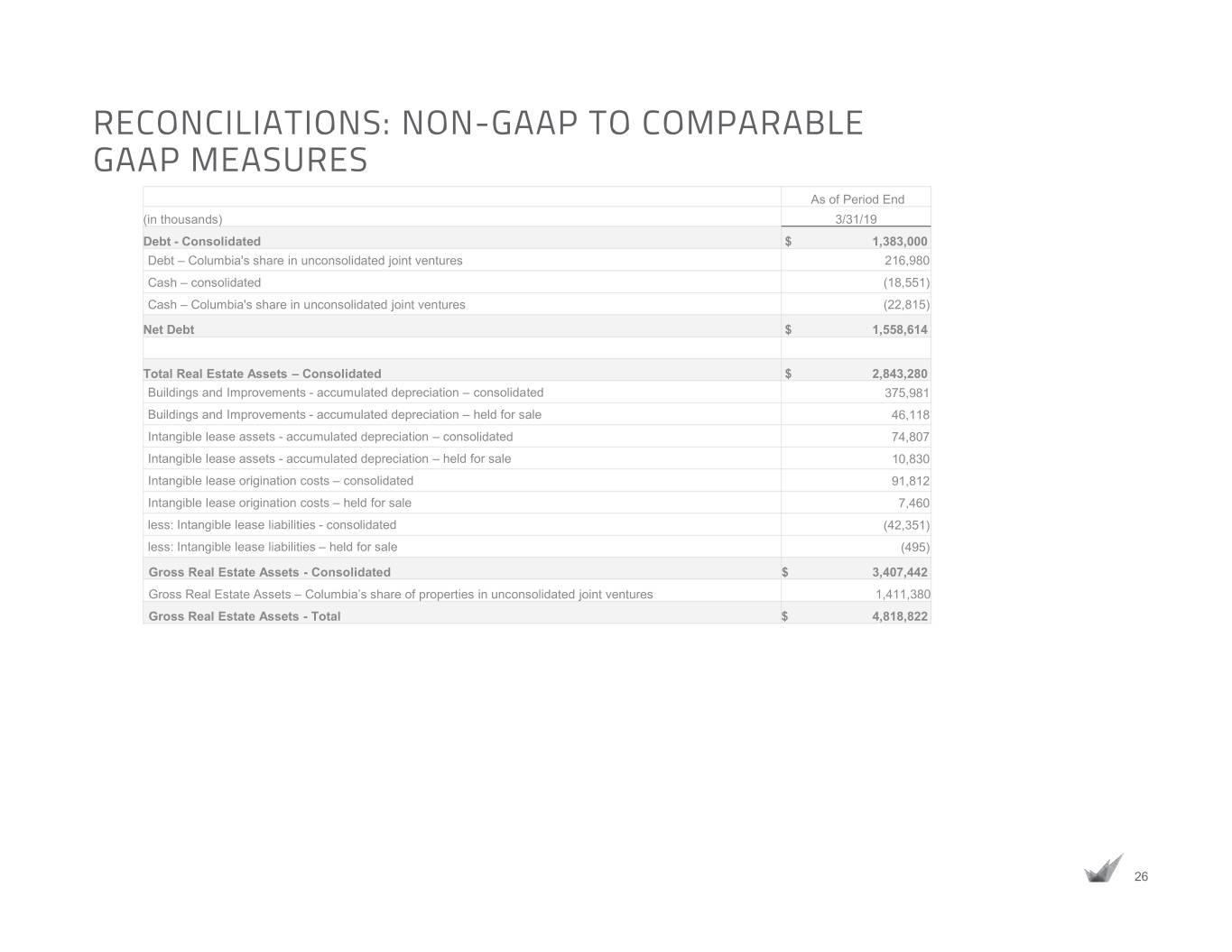

RECONCILIATIONS: NON-GAAP TO COMPARABLE GAAP MEASURES As of Period End (in thousands) 3/31/19 Debt - Consolidated $ 1,383,000 Debt – Columbia's share in unconsolidated joint ventures 216,980 Cash – consolidated (18,551) Cash – Columbia's share in unconsolidated joint ventures (22,815) Net Debt $ 1,558,614 Total Real Estate Assets – Consolidated $ 2,843,280 Buildings and Improvements - accumulated depreciation – consolidated 375,981 Buildings and Improvements - accumulated depreciation – held for sale 46,118 Intangible lease assets - accumulated depreciation – consolidated 74,807 Intangible lease assets - accumulated depreciation – held for sale 10,830 Intangible lease origination costs – consolidated 91,812 Intangible lease origination costs – held for sale 7,460 less: Intangible lease liabilities - consolidated (42,351) less: Intangible lease liabilities – held for sale (495) Gross Real Estate Assets - Consolidated $ 3,407,442 Gross Real Estate Assets – Columbia’s share of properties in unconsolidated joint ventures 1,411,380 Gross Real Estate Assets - Total $ 4,818,822 26