COLUMBIA PROPERTY TRUST 10.15.2019 Enhancing our Platform through the Acquisition of Normandy Real Estate Partners 1

FORWARD-LOOKING STATEMENTS Certain statements contained in this communication other than historical facts may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. We intend for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in those acts. Such statements include, in particular, statements with respect to the anticipated effects of the proposed transaction, expectations with respect to synergies, the proposed transaction’s anticipated benefits to stockholders, the anticipated timing of the closing of the proposed transaction and plans with respect to the leadership of the combined company following the closing of the proposed transaction. These statements are subject to certain risks and uncertainties, including known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this communication. We make no representations or warranties (express or implied) about the accuracy of any such forward-looking statements contained in this communication, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Any such forward-looking statements are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual conditions, our ability to accurately anticipate results expressed in such forward-looking statements, including our ability to generate positive cash flow from operations, make distributions to stockholders, and maintain the value of our real estate properties, may be significantly hindered. See Item 1A in Columbia Property Trust’s most recently filed Annual Report on Form 10-K for the year ended December 31, 2018, for a discussion of some of the risks and uncertainties that could cause actual results to differ materially from those presented in our forward-looking statements. The risk factors described in our Annual Report are not the only ones we face, but do represent those risks and uncertainties that we believe are material to us. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also harm our business. 2

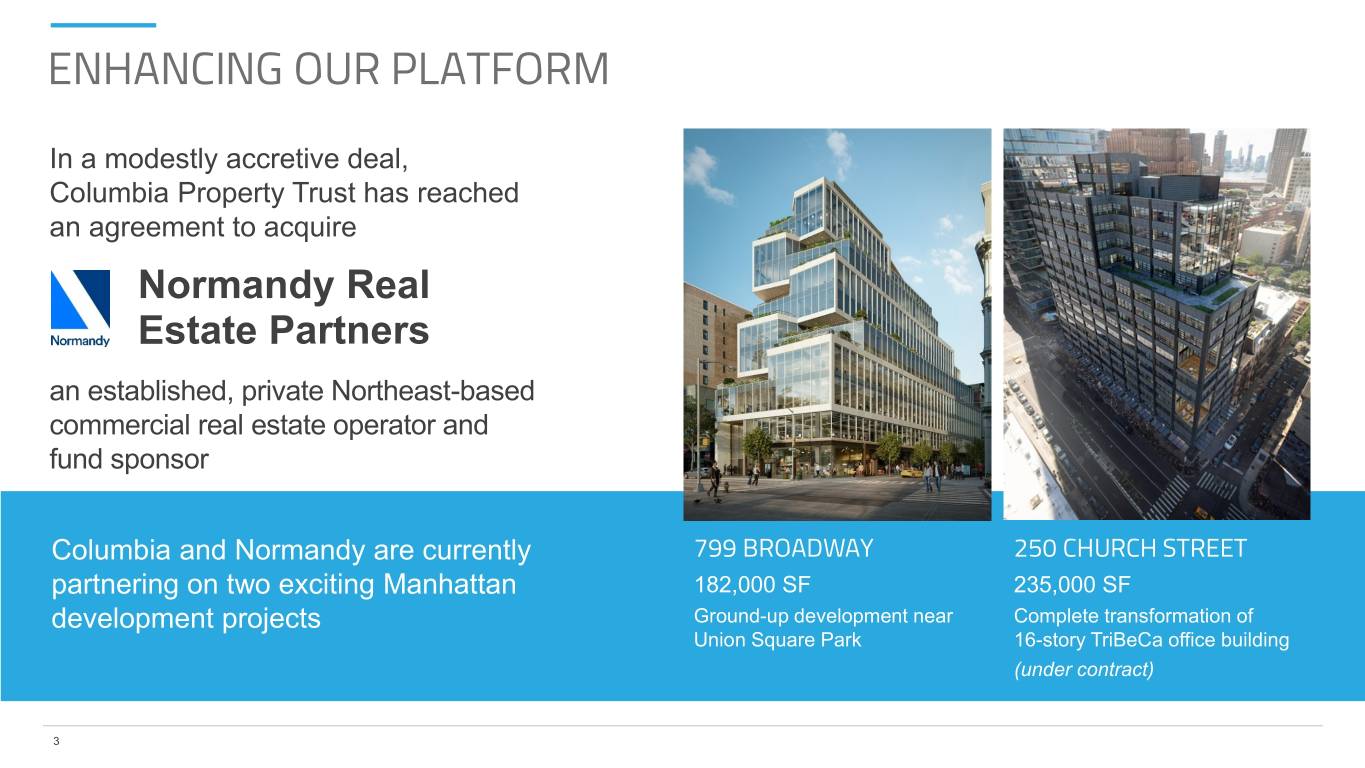

ENHANCING OUR PLATFORM In a modestly accretive deal, Columbia Property Trust has reached an agreement to acquire Normandy Real Estate Partners an established, private Northeast-based commercial real estate operator and fund sponsor Columbia and Normandy are currently 799 BROADWAY 250 CHURCH STREET partnering on two exciting Manhattan 182,000 SF 235,000 SF development projects Ground-up development near Complete transformation of Union Square Park 16-story TriBeCa office building (under contract) 3

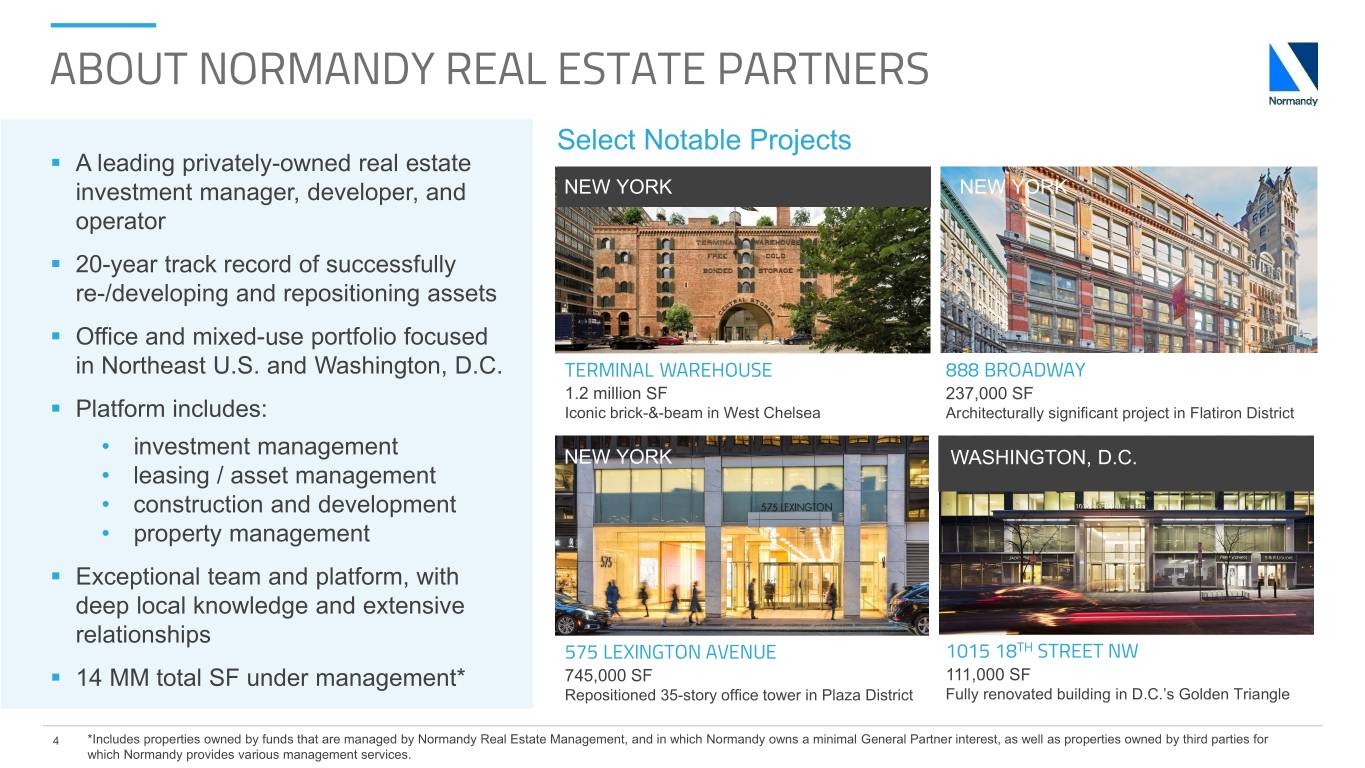

ABOUT NORMANDY REAL ESTATE PARTNERS Select Notable Projects . A leading privately-owned real estate investment manager, developer, and NEW YORK NEW YORK operator . 20-year track record of successfully re-/developing and repositioning assets . Office and mixed-use portfolio focused in Northeast U.S. and Washington, D.C. TERMINAL WAREHOUSE 888 BROADWAY 1.2 million SF 237,000 SF . Platform includes: Iconic brick-&-beam in West Chelsea Architecturally significant project in Flatiron District • investment management NEW YORK WASHINGTON, D.C. • leasing / asset management • construction and development • property management . Exceptional team and platform, with deep local knowledge and extensive relationships 575 LEXINGTON AVENUE 1015 18TH STREET NW . 14 MM total SF under management* 745,000 SF 111,000 SF Repositioned 35-story office tower in Plaza District Fully renovated building in D.C.’s Golden Triangle 4 *Includes properties owned by funds that are managed by Normandy Real Estate Management, and in which Normandy owns a minimal General Partner interest, as well as properties owned by third parties for which Normandy provides various management services.

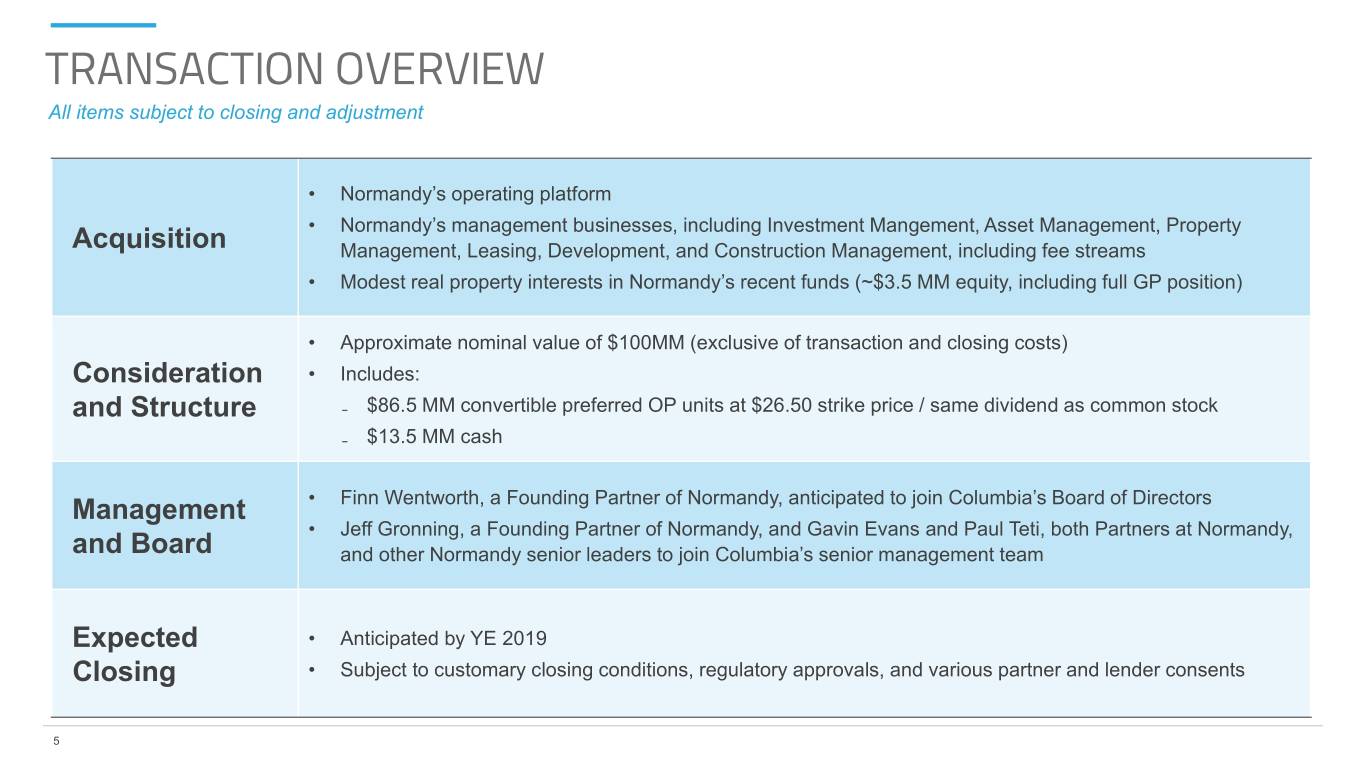

TRANSACTION OVERVIEW All items subject to closing and adjustment • Normandy’s operating platform • Normandy’s management businesses, including Investment Mangement, Asset Management, Property Acquisition Management, Leasing, Development, and Construction Management, including fee streams • Modest real property interests in Normandy’s recent funds (~$3.5 MM equity, including full GP position) • Approximate nominal value of $100MM (exclusive of transaction and closing costs) Consideration • Includes: and Structure ₋ $86.5 MM convertible preferred OP units at $26.50 strike price / same dividend as common stock ₋ $13.5 MM cash • Finn Wentworth, a Founding Partner of Normandy, anticipated to join Columbia’s Board of Directors Management • Jeff Gronning, a Founding Partner of Normandy, and Gavin Evans and Paul Teti, both Partners at Normandy, and Board and other Normandy senior leaders to join Columbia’s senior management team Expected • Anticipated by YE 2019 Closing • Subject to customary closing conditions, regulatory approvals, and various partner and lender consents 5

STRATEGIC RATIONALE AND EXPECTED BENEFITS SYNERGISTIC AND ACCRETIVE ENHANCEMENT TO PLATFORM . Expanded Platform Strengthens sourcing, construction, and other key CONSTRUCTION capabilities, and adds a full development arm LEASING & + ASSET + MANAGEMENT DEVELOPMENT . Enhanced Execution: Enhanced talent base, skill sets, relationships, + presence, and resources in key CXP markets PROPERTY + MANAGEMENT FUND . Greater Capital Access: MANAGEMENT Multiple fund and joint venture partner relationships ACQUISITIONS & DISPOSITIONS FINANCE & . Augmented Growth Strategy: ACCOUNTING Adds full development platform and expanded pipeline JOINT of value-add opportunities VENTURE MANAGEMENT . Accretive Transaction: Expect fee streams to be immediately additive, and synergies to provide longer-term benefits 6

ANTICIPATED FINANCIAL IMPACTS . Transaction expected to be accretive to 2020 NFFO . Anticipated operational, construction and leasing benefits from expanded capabilities and increased scale in key markets . Near-term consolidation of operations and locations should result in synergies, with minimal impact to corporate G&A . Enhanced pipeline of profitable value-add and development opportunities should support long-term growth in NOI . Additional details to be provided at transaction close 7

EXECUTION ALIGNED WITH ONGOING STRATEGY Following the acquisition of Normandy, Columbia will maintain: Our Strategy Deliver sector-leading returns through the acquisition, operation, development and re-development of high-quality real estate Our Market Focus Class-A, boutique office properties in select submarkets in New York, San Francisco, Washington D.C., and Boston Our Risk Profile Leasing exposure due to development, value-add investments, vacancy and near-term roll expected to remain within range of 10% to 20% 8

INTRODUCTIONS FINN WENTWORTH JEFF GRONNING Expected to join CXP board Slated to become Chief Investment Officer Mr. Wentworth is a Founder and Partner of Normandy. Mr. Gronning is a Founder and Partner of Normandy. He co- Prior to forming Normandy, Wentworth was president, chief leads Normandy’s operations, investing, capital formation, operating officer, and a board member of YankeeNets LLC, and financial management activities and serves as the holding company of the New York Yankees, New Normandy’s Chief Compliance Officer. Jersey Nets, and New Jersey Devils. Earlier, Gronning was Executive Director and CFO of Wentworth’s more than 35 years of commercial real estate Morgan Stanley’s real estate investing division, responsible experience also includes co-founding Gale & Wentworth, a for a $13 billion asset portfolio. He was a member of the nationally recognized investment and development firm that Investment Committee and also served as the real estate assembled a multi-billion dollar property portfolio. Operations Officer. GAVIN EVANS PAUL TETI Acquisitions Leasing & Asset Management Mr. Teti is a Partner of Normandy and head of its leasing group, Mr. Evans is a Partner of Normandy and co-heads its responsible for managing the leasing and marketing activities for Investments team, where he is responsible for directing all Normandy’s portfolio. Mr. Teti also spends time on business aspects of the firm’s real estate activities. development and capital raising activities for Normandy. Previously, Evans served as a Director for Westbrook Teti has been with Normandy since 2004 and was previously part Partners in New York City, where he was a member of the of Normandy’s acquisitions team, where he assisted in Acquisitions team that completed numerous transactions in underwriting and closing acquisitions and financings. Teti is a the United States and Europe. three-time member of the U.S. Olympic Rowing Team, competing in the Sydney, Athens, and Beijing Games. 9

FOR MORE INFORMATION INVESTOR RELATIONS 404.465.2227 ir@columbia.reit www.columbia.reit 10 094-CORPPRES1909