COLUMBIA PROPERTY TRUST INVESTOR PRESENTATION 11.2019 1

CONTENTS Company Overview Page 3 Case Studies Page 16 Appendix Page 22 2

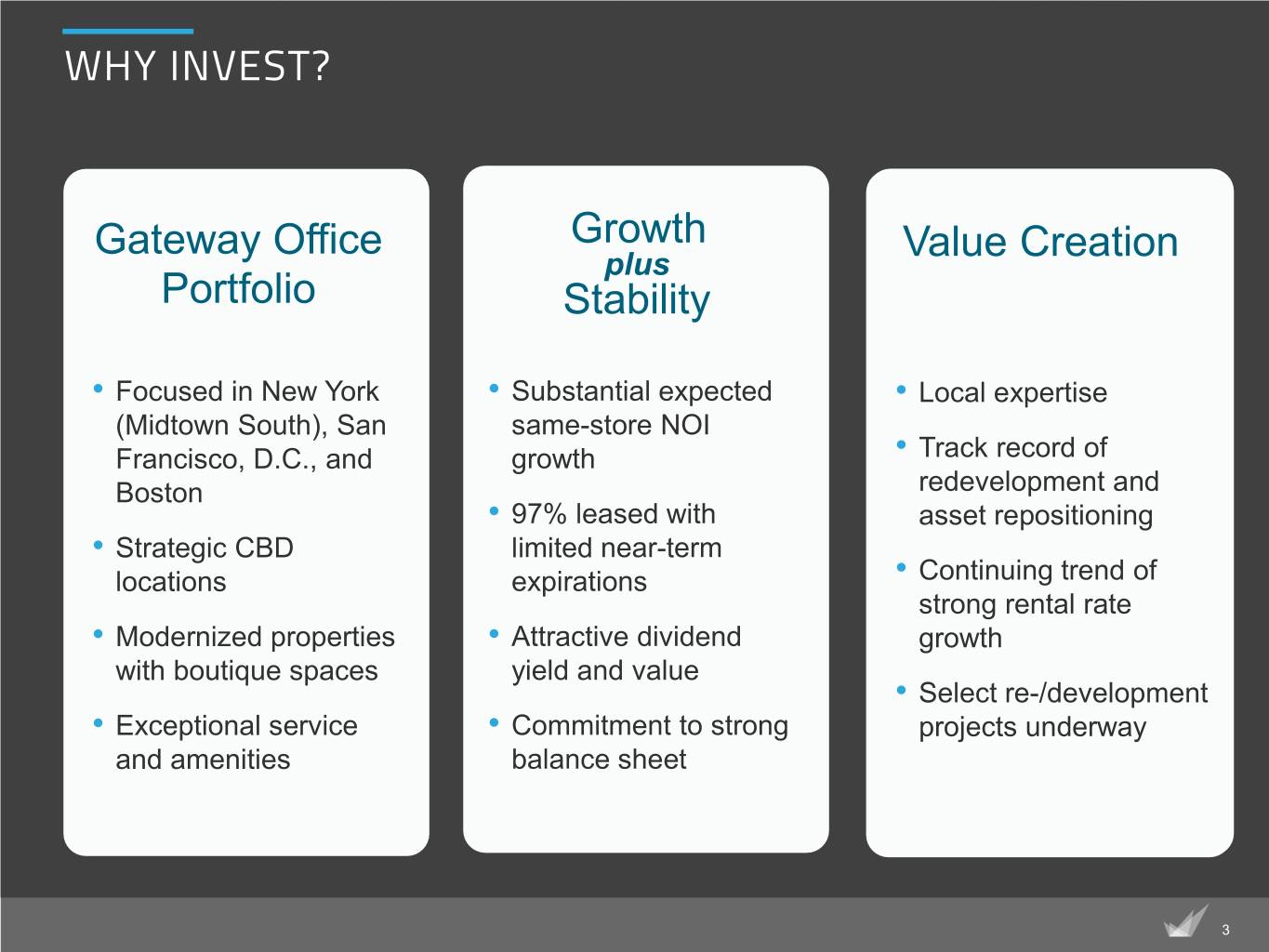

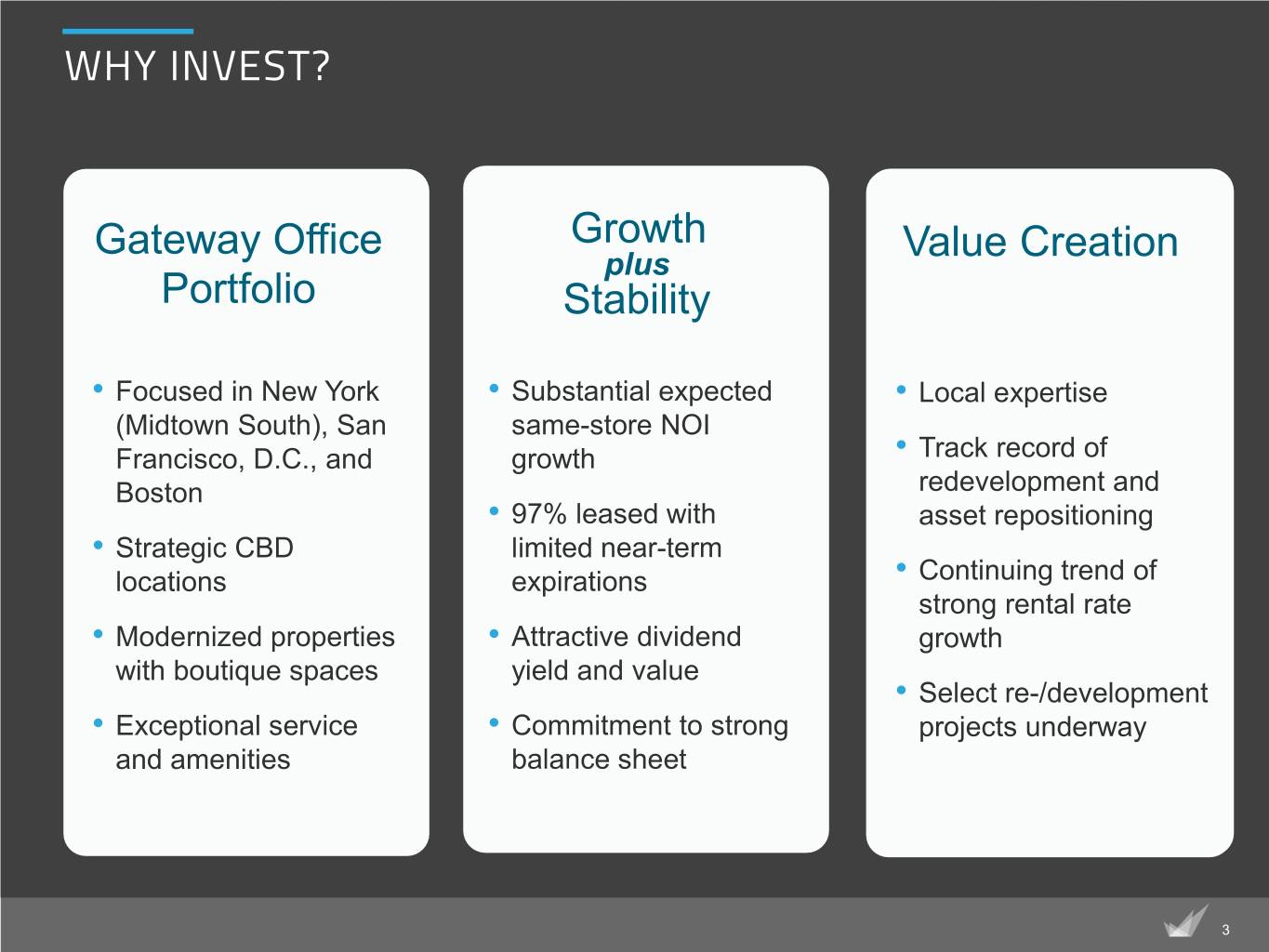

WHY INVEST? Gateway Office Growth Value Creation plus Portfolio Stability • Focused in New York • Substantial expected • Local expertise (Midtown South), San same-store NOI Francisco, D.C., and growth • Track record of Boston redevelopment and • 97% leased with asset repositioning • Strategic CBD limited near-term locations expirations • Continuing trend of strong rental rate • Modernized properties • Attractive dividend growth with boutique spaces yield and value • Select re-/development • Exceptional service • Commitment to strong projects underway and amenities balance sheet 3

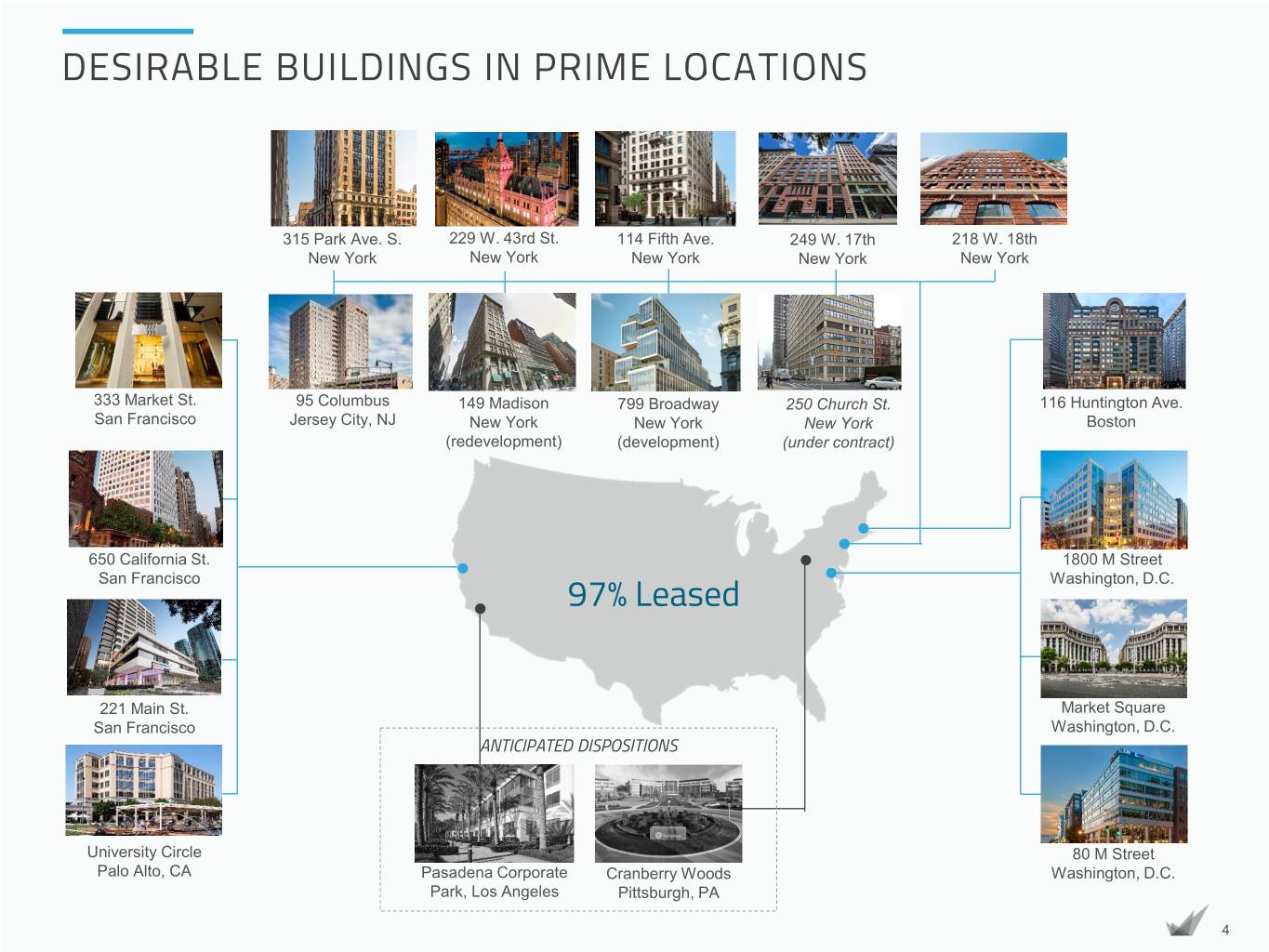

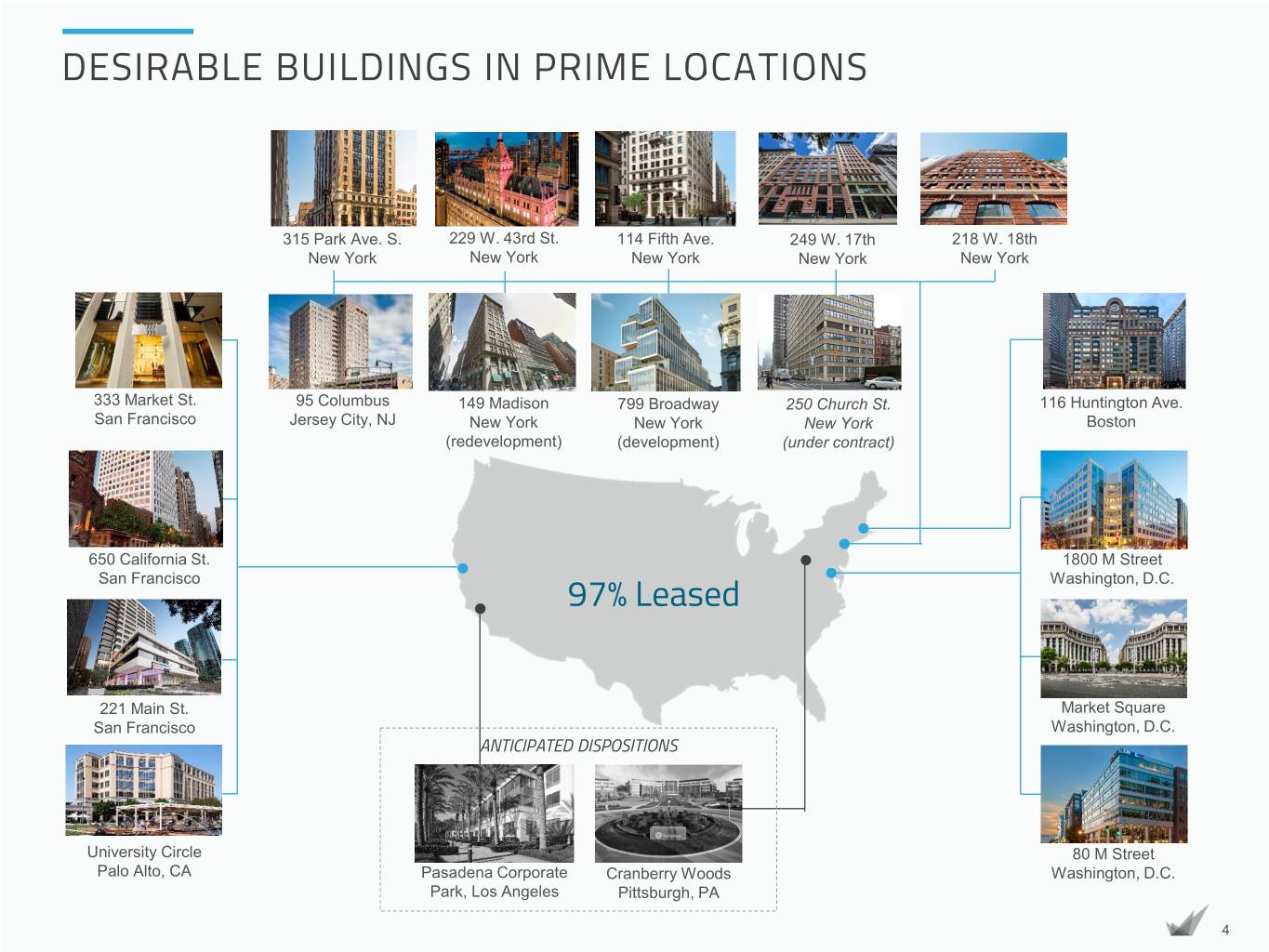

DESIRABLE BUILDINGS IN PRIME LOCATIONS 315 Park Ave. S. 229 W. 43rd St. 114 Fifth Ave. 249 W. 17th 218 W. 18th New York New York New York New York New York 333 Market St. 95 Columbus 149 Madison 799 Broadway 250 Church St. 116 Huntington Ave. San Francisco Jersey City, NJ New York New York New York Boston (redevelopment) (development) (under contract) 650 California St. 1800 M Street San Francisco 97% Leased Washington, D.C. 221 Main St. Market Square San Francisco Washington, D.C. ANTICIPATED DISPOSITIONS University Circle 80 M Street Palo Alto, CA Pasadena Corporate Cranberry Woods Washington, D.C. Park, Los Angeles Pittsburgh, PA 4

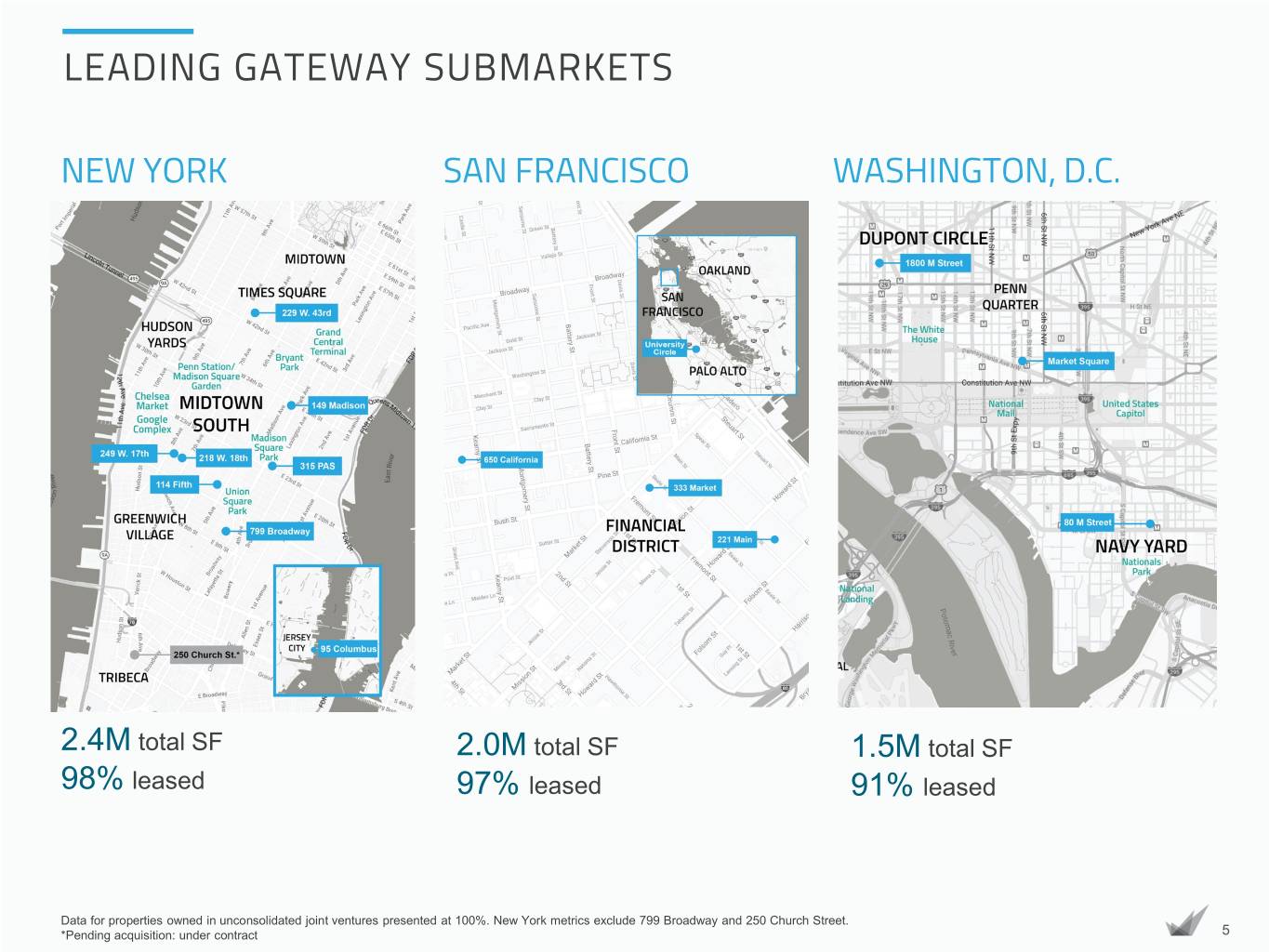

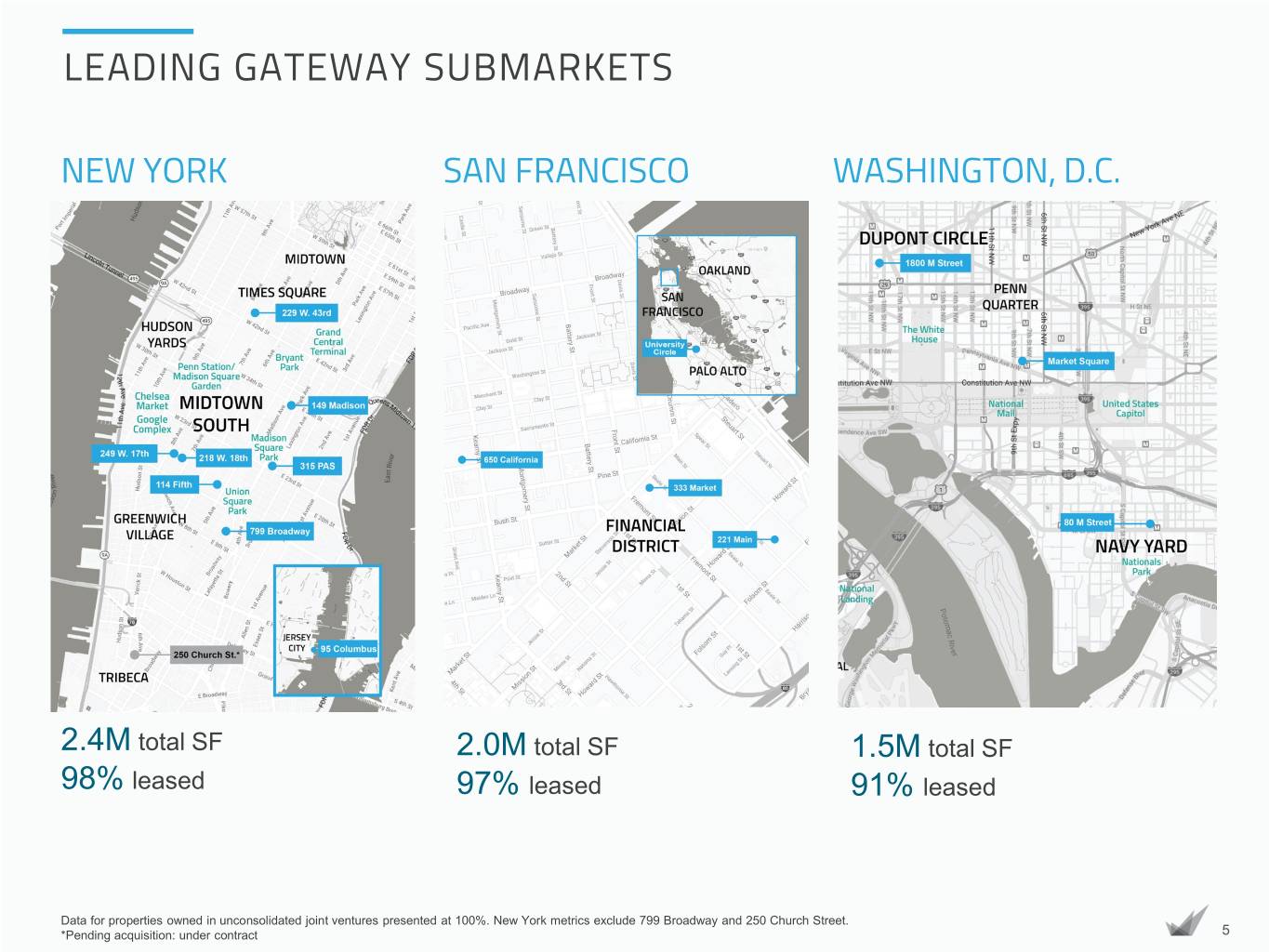

LEADING GATEWAY SUBMARKETS NEW YORK SAN FRANCISCO WASHINGTON, D.C. 2.4M total SF 2.0M total SF 1.5M total SF 98% leased 97% leased 91% leased Data for properties owned in unconsolidated joint ventures presented at 100%. New York metrics exclude 799 Broadway and 250 Church Street. *Pending acquisition: under contract 5

A PROVEN APPROACH • Modernized buildings with architectural distinction • Strategic locations • Efficient floorplates • Attractive amenities • Exceptional service to tenants • Targeted capital investments 6

SECTOR-LEADING SAME-STORE NOI GROWTH • Strategic locations and renovations • 2 million SF •13.9% leased in our core 2018 same-store • Best-in-class service markets 2017-2019 NOI growth1 and amenities • 44% average •8% - 10% • Creative rent roll cash leasing 2019 same-store management spreads NOI guidance 1Non-GAAP financial measure. See Appendix. 7

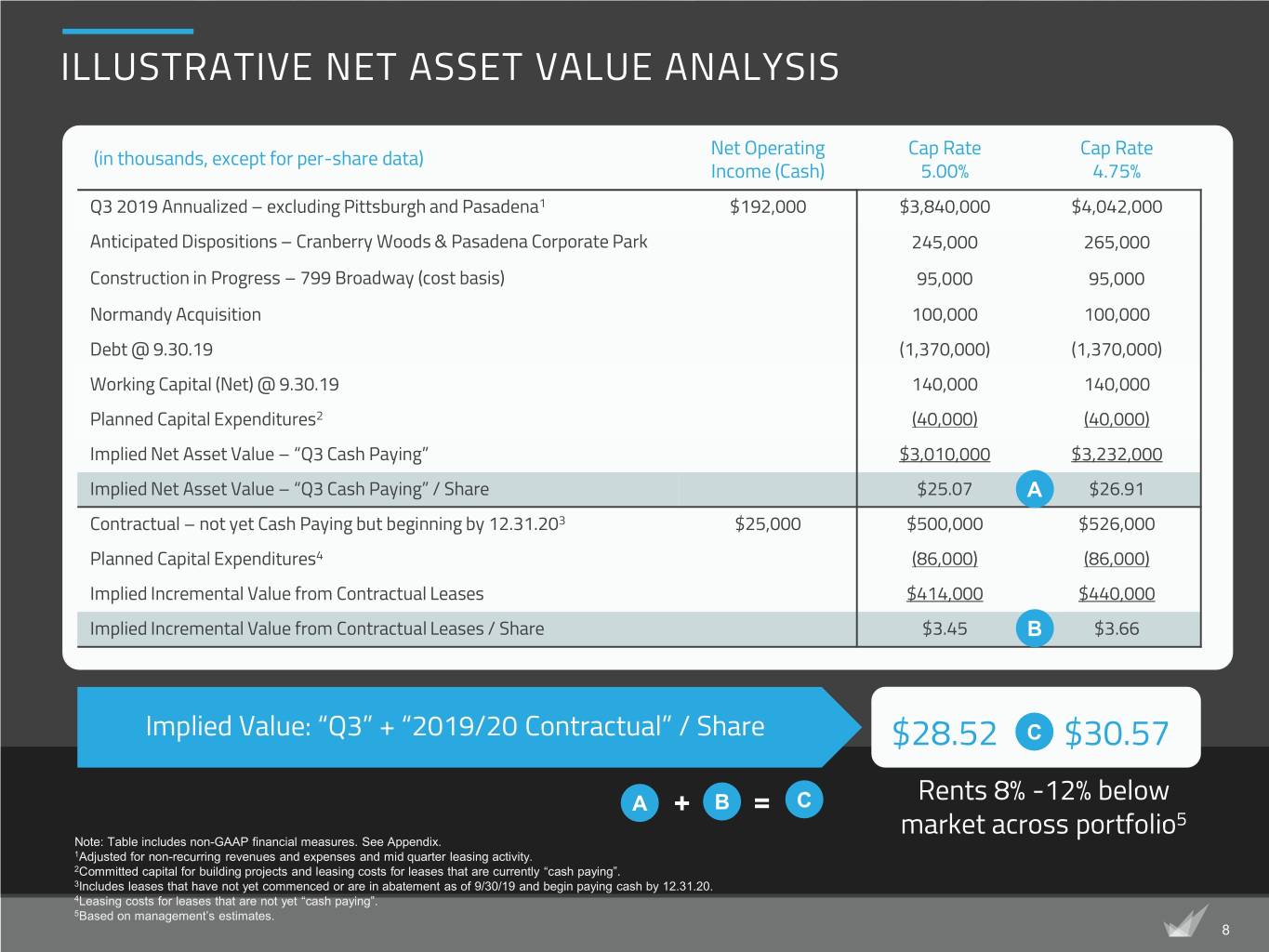

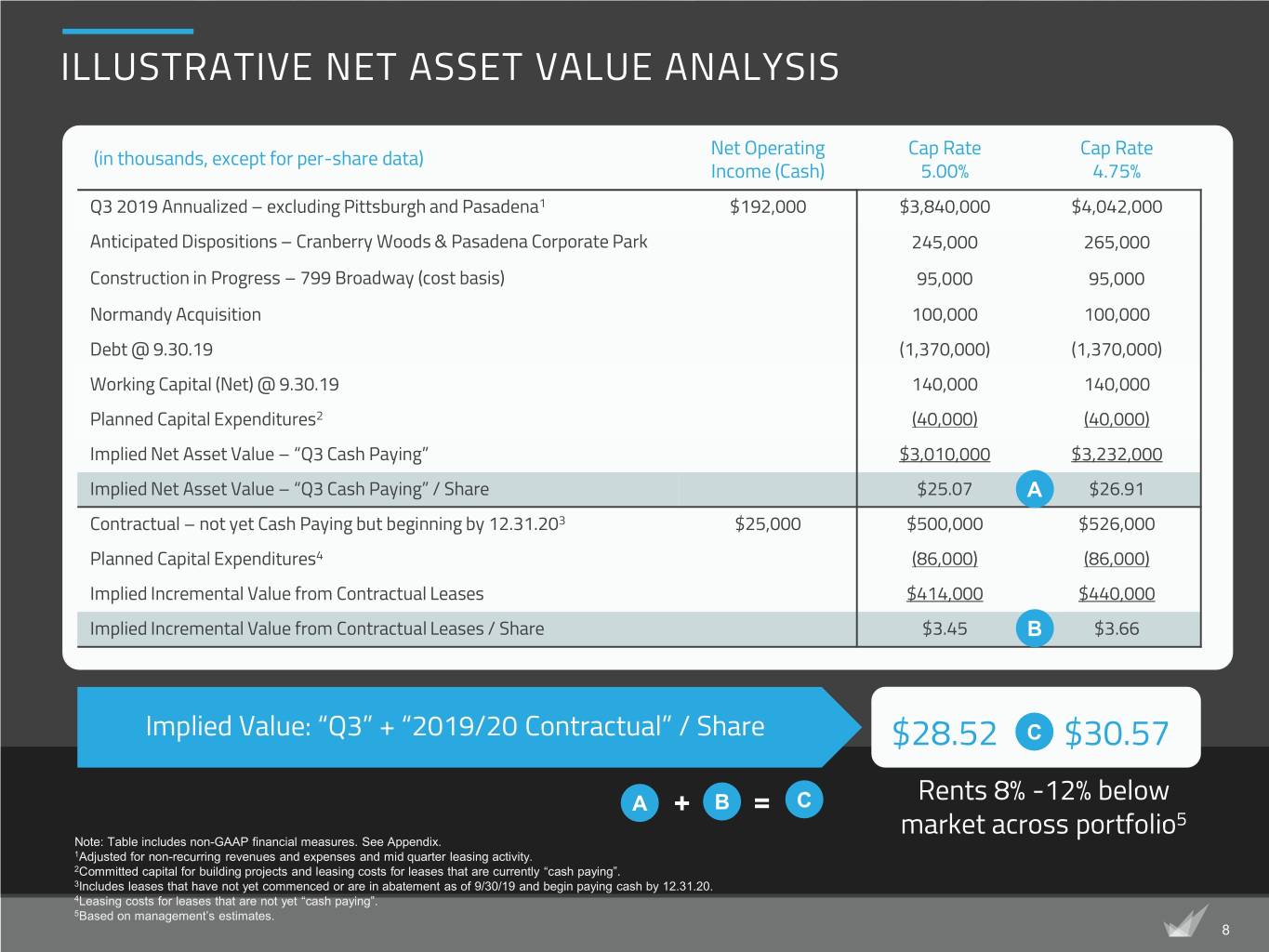

ILLUSTRATIVE NET ASSET VALUE ANALYSIS Net Operating Cap Rate Cap Rate (in thousands, except for per-share data) Income (Cash) 5.00% 4.75% Q3 2019 Annualized – excluding Pittsburgh and Pasadena1 $192,000 $3,840,000 $4,042,000 Anticipated Dispositions – Cranberry Woods & Pasadena Corporate Park 245,000 265,000 Construction in Progress – 799 Broadway (cost basis) 95,000 95,000 Normandy Acquisition 100,000 100,000 Debt @ 9.30.19 (1,370,000) (1,370,000) Working Capital (Net) @ 9.30.19 140,000 140,000 Planned Capital Expenditures2 (40,000) (40,000) Implied Net Asset Value – “Q3 Cash Paying” $3,010,000 $3,232,000 Implied Net Asset Value – “Q3 Cash Paying” / Share $25.07 A $26.91 Contractual – not yet Cash Paying but beginning by 12.31.203 $25,000 $500,000 $526,000 Planned Capital Expenditures4 (86,000) (86,000) Implied Incremental Value from Contractual Leases $414,000 $440,000 Implied Incremental Value from Contractual Leases / Share $3.45 B $3.66 Implied Value: “Q3” + “2019/20 Contractual” / Share $28.52 C $30.57 Rents 8% -12% below A + B = C market across portfolio5 Note: Table includes non-GAAP financial measures. See Appendix. 1Adjusted for non-recurring revenues and expenses and mid quarter leasing activity. 2Committed capital for building projects and leasing costs for leases that are currently “cash paying”. 3Includes leases that have not yet commenced or are in abatement as of 9/30/19 and begin paying cash by 12.31.20. 4Leasing costs for leases that are not yet “cash paying”. 5Based on management’s estimates. 8

EMBEDDED GROWTH FROM SIGNED LEASES1 CASH RENT SF CURRENTLY IN NOT YET COMMENCEMENT TENANT PROPERTY MARKET (000s) ABATEMENT COMMENCED YEAR WeWork 149 Madison Avenue NY 115 ✔ 2020 DocuSign 221 Main Street SF 542 ✔ 2020 Triage Consulting 221 Main Street SF 463 ✔ 2020 Pitchbook Data 315 Park Avenue South NY 34 ✔ ✔ 2019 & 2020 Snap 229 West 43rd Street NY 32 ✔ 2019 Company 3 218 West 18th Street NY 303 ✔ 2021 Ernst & Young 218 West 18th Street NY 273 ✔ 2021 Silversmith Capital 116 Huntington Boston 26 ✔ 2020 Tradeshift 221 Main Street SF 24 ✔ 2020 Other abated leases 75 ✔ 2019 & 2020 Other leases not yet commenced 98 ✔ 2020 & 2021 Total Embedded NOI: Cash Rents beginning by 12.31.204 $9M $16M Total Embedded NOI: Cash Rents beginning beyond 20204 $-M $3M 1SF and NOI for joint ventures are reflected at CXP’s ownership interest. 2Includes a base rent reset on 40k sf of existing space in 2020. 3Lease renewal – only incremental income included here. 4Non-GAAP financial measure. See Appendix. 9

ATTRACTIVE DIVIDEND YIELD DIVIDEND YIELD vs. GATEWAY OFFICE PEERS 4.5% 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% KRC DEI BXP HPP ESRT PGRE CXP SLG VNO As of 11.7.2019 10

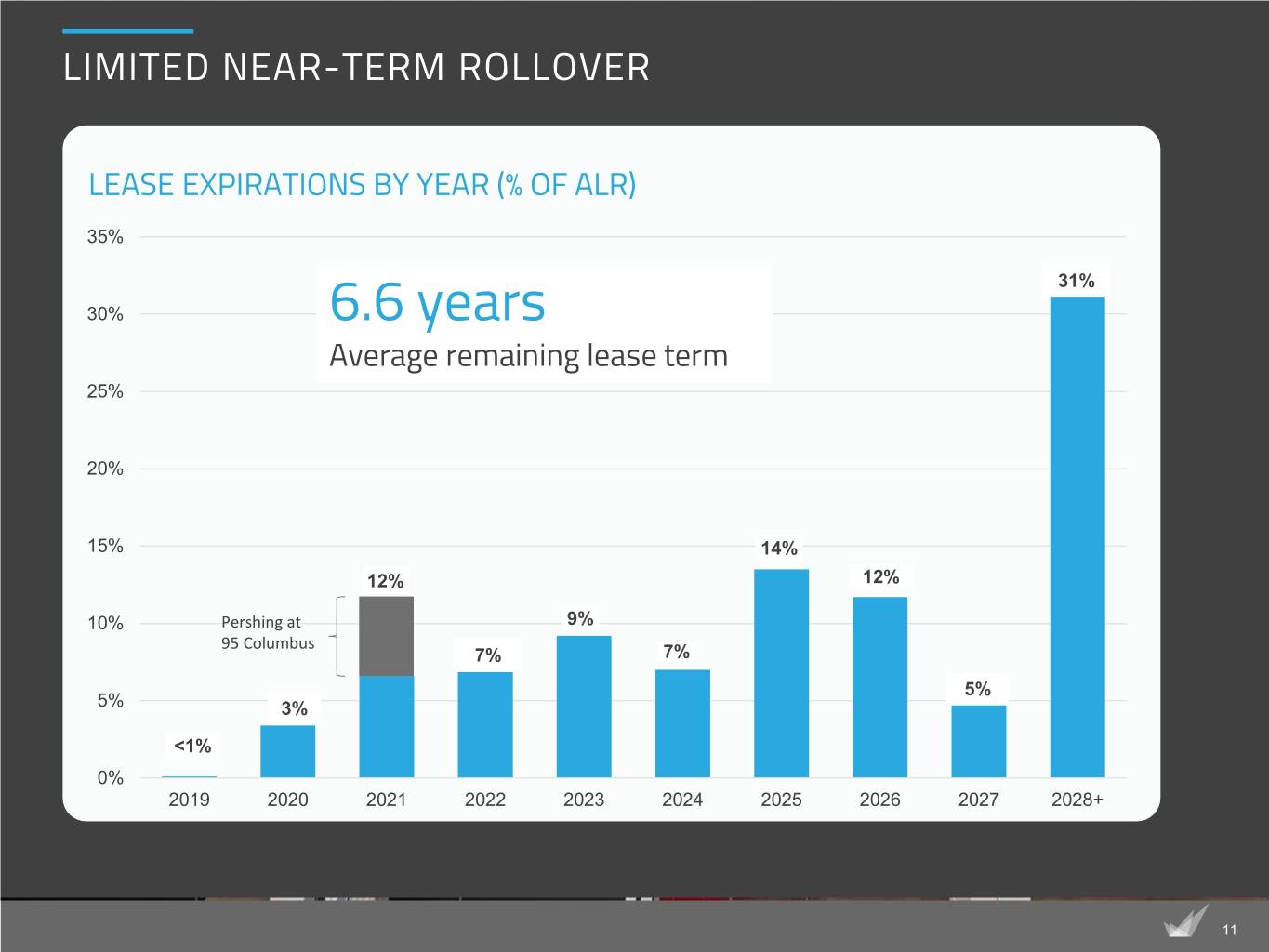

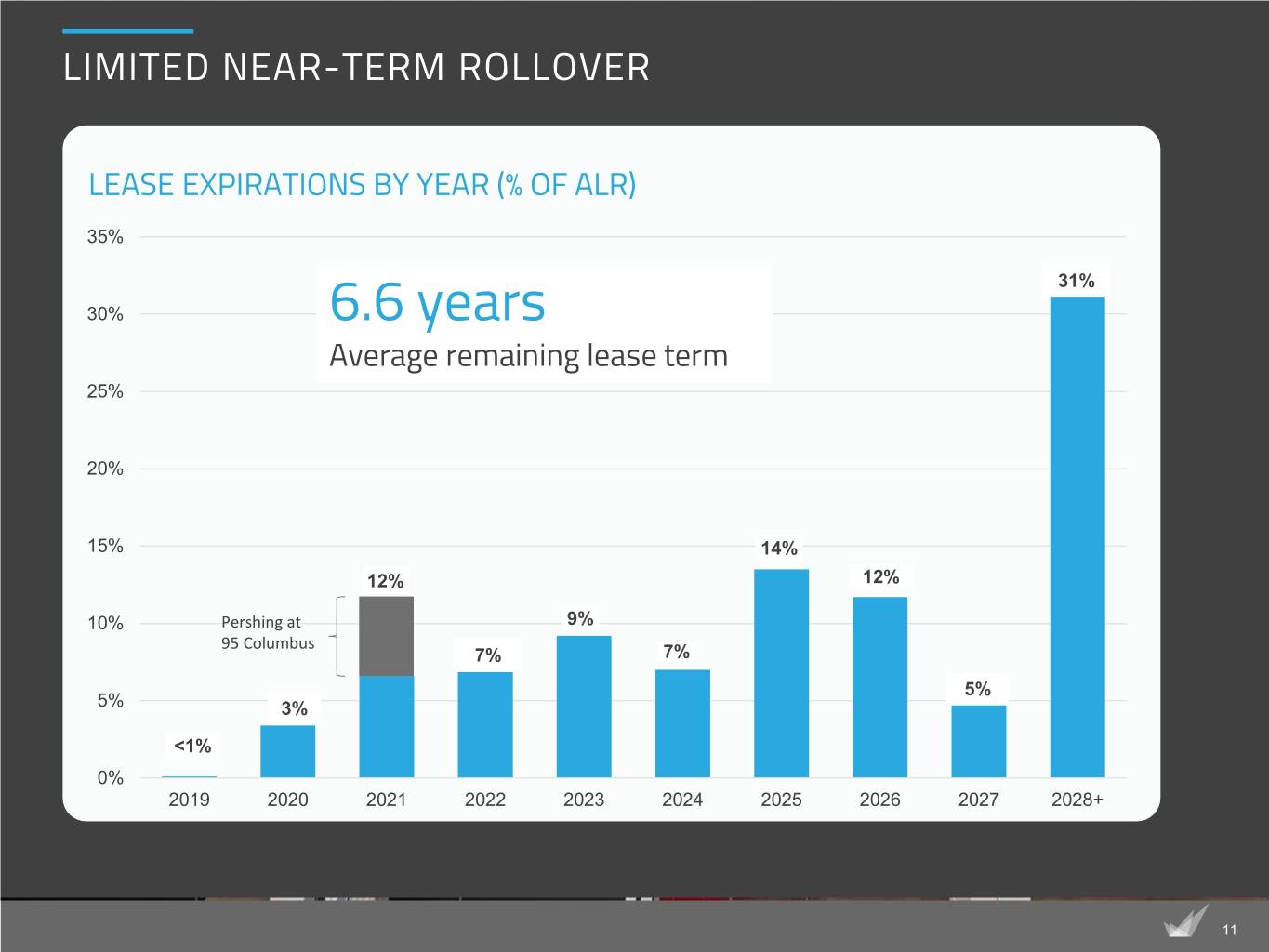

LIMITED NEAR-TERM ROLLOVER LEASE EXPIRATIONS BY YEAR (% OF ALR) 35% 31% 30% 6.6 years Average remaining lease term 25% 20% 15% 14% 12% 12% 10% Pershing at 9% 95 Columbus 7% 7% 5% 5% 3% <1% 0% 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028+ 11

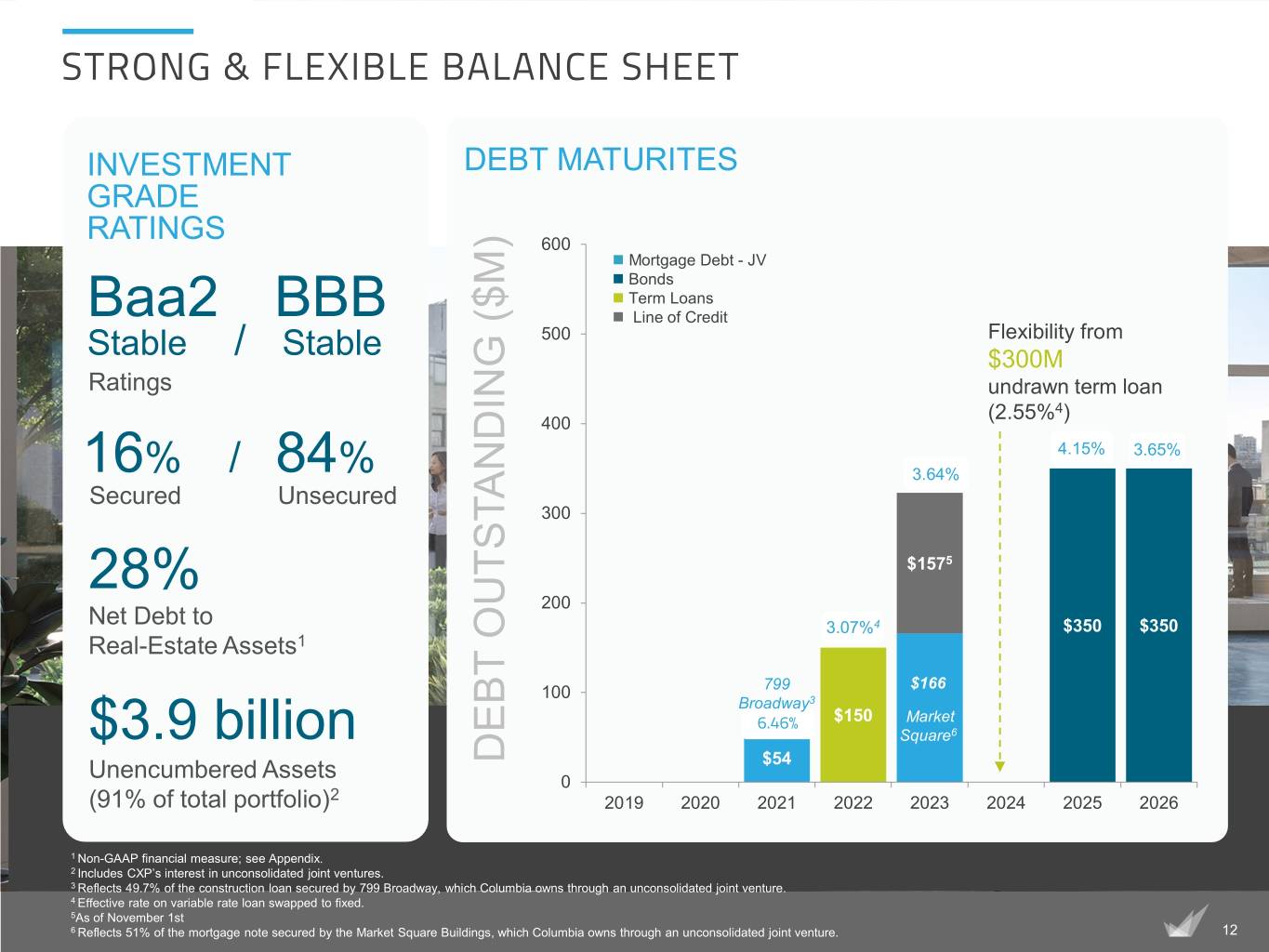

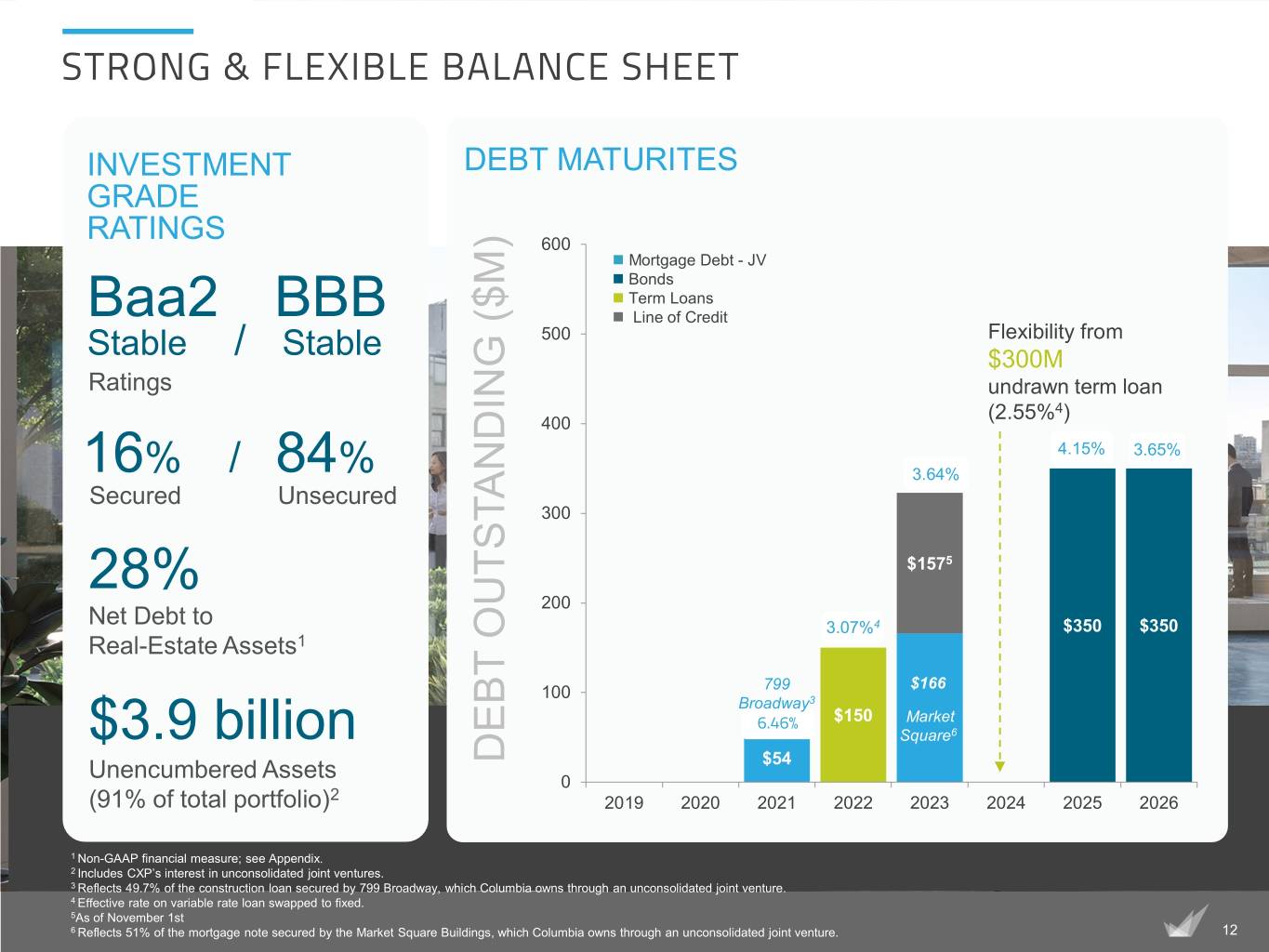

STRONG & FLEXIBLE BALANCE SHEET INVESTMENT DEBT MATURITES GRADE RATINGS 600 Mortgage Debt - JV Bonds Term Loans Baa2 BBB Line of Credit 500 Flexibility from Stable / Stable $300M Ratings undrawn term loan (2.55%4) 400 4.15% 3.65% 16% / 84% 3.64% Secured Unsecured 300 28% $1575 200 Net Debt to 3.07%4 $350 $350 Real-Estate Assets1 100 799 $166 Broadway3 6.46% $150 Market $3.9 billion Square6 DEBT OUTSTANDING ($M) OUTSTANDING DEBT $54 Unencumbered Assets 0 (91% of total portfolio)2 2019 2020 2021 2022 2023 2024 2025 2026 1 Non-GAAP financial measure; see Appendix. 2 Includes CXP’s interest in unconsolidated joint ventures. 3 Reflects 49.7% of the construction loan secured by 799 Broadway, which Columbia owns through an unconsolidated joint venture. 4 Effective rate on variable rate loan swapped to fixed. 5As of November 1st 6 Reflects 51% of the mortgage note secured by the Market Square Buildings, which Columbia owns through an unconsolidated joint venture. 12

REDEVELOPED PORTFOLIO Modest capital needs going forward Portfolio has recently received substantial renovations Properties now positioned among best-in-class for competitive sets 13

COMMITMENT TO CORPORATE RESPONSIBILITY RESPONSIBLE BUILDING MANAGEMENT 87% 75% of portfolio of portfolio certified LEED certified TRANSPARENT AND INVESTOR-CENTERED GOVERNANCE Board composed of supermajority of independent directors Annual elections for all directors Executive pay aligned with performance No legacy family issues among shareholder base or board No tax protection agreements constraining strategic decisions ETHICAL & SOCIALLY-CONSCIOUS BUSINESS PRACTICES Commitments detailed in Human Rights Policy and Vendor Code of Conduct, available on our company website Company and its employees actively support charities and volunteer organizations in our markets All data is as of June 30, 2019 pro forma for the sale of Lindbergh Center and is at 100% of all properties, including those held through joint venture partnerships. LEED and the related logos are trademarks owned by the U.S. Green Building Council and are used with permission. Energy Star and the Energy Star mark are registered trademarks owned by the U.S. Environmental Protection Agency. These logos are used herein to identify Columbia buildings that have been awarded these designations. 14

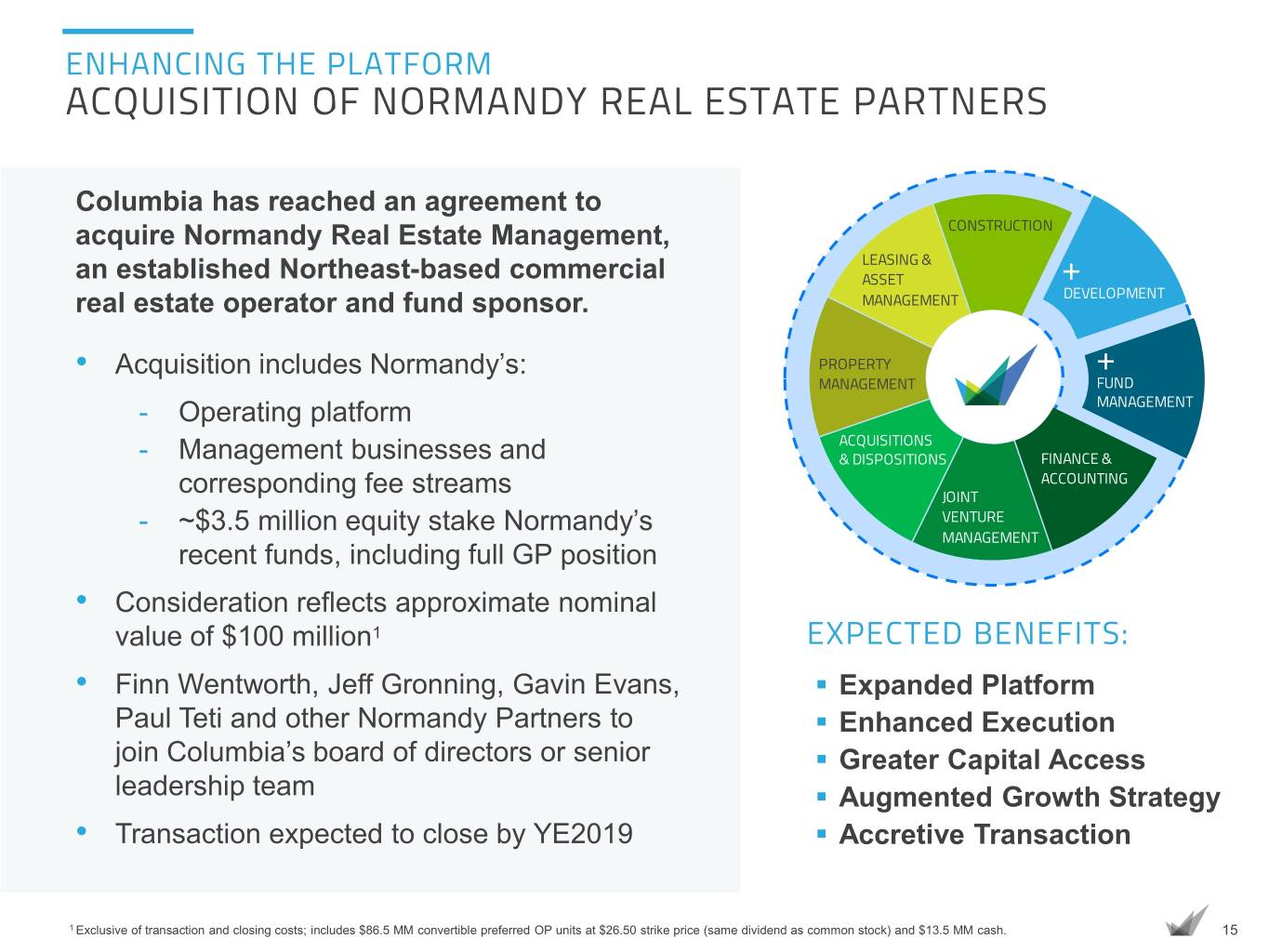

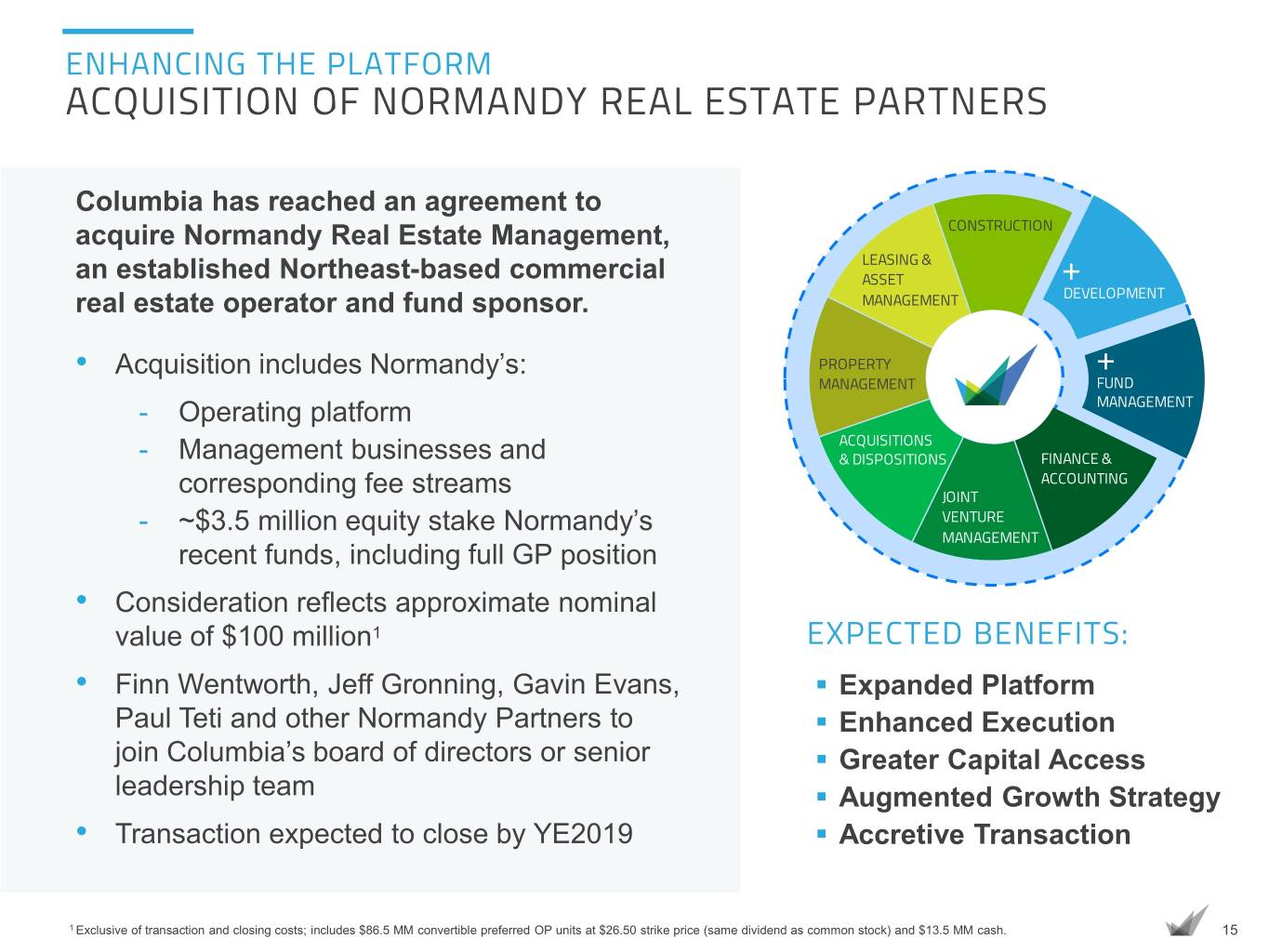

ENHANCING THE PLATFORM ACQUISITION OF NORMANDY REAL ESTATE PARTNERS Columbia has reached an agreement to acquire Normandy Real Estate Management, CONSTRUCTION LEASING & + an established Northeast-based commercial ASSET + real estate operator and fund sponsor. MANAGEMENT DEVELOPMENT + • Acquisition includes Normandy’s: PROPERTY + MANAGEMENT FUND - Operating platform MANAGEMENT ACQUISITIONS - Management businesses and & DISPOSITIONS FINANCE & ACCOUNTING corresponding fee streams JOINT - ~$3.5 million equity stake Normandy’s VENTURE MANAGEMENT recent funds, including full GP position • Consideration reflects approximate nominal value of $100 million1 EXPECTED BENEFITS: • Finn Wentworth, Jeff Gronning, Gavin Evans, . Expanded Platform Paul Teti and other Normandy Partners to . Enhanced Execution join Columbia’s board of directors or senior . Greater Capital Access leadership team . Augmented Growth Strategy • Transaction expected to close by YE2019 . Accretive Transaction 1 Exclusive of transaction and closing costs; includes $86.5 MM convertible preferred OP units at $26.50 strike price (same dividend as common stock) and $13.5 MM cash. 15

CASE STUDIES 16

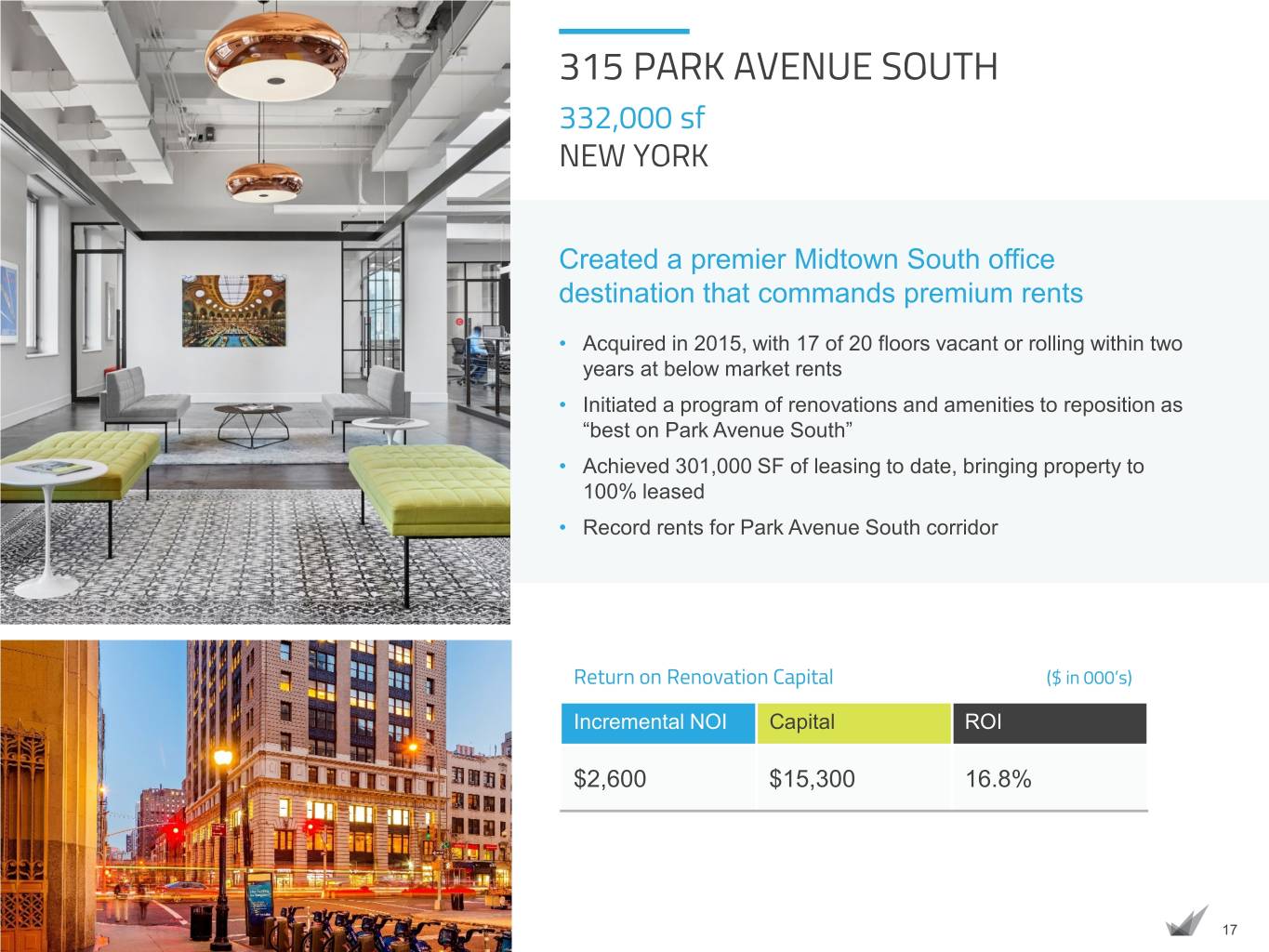

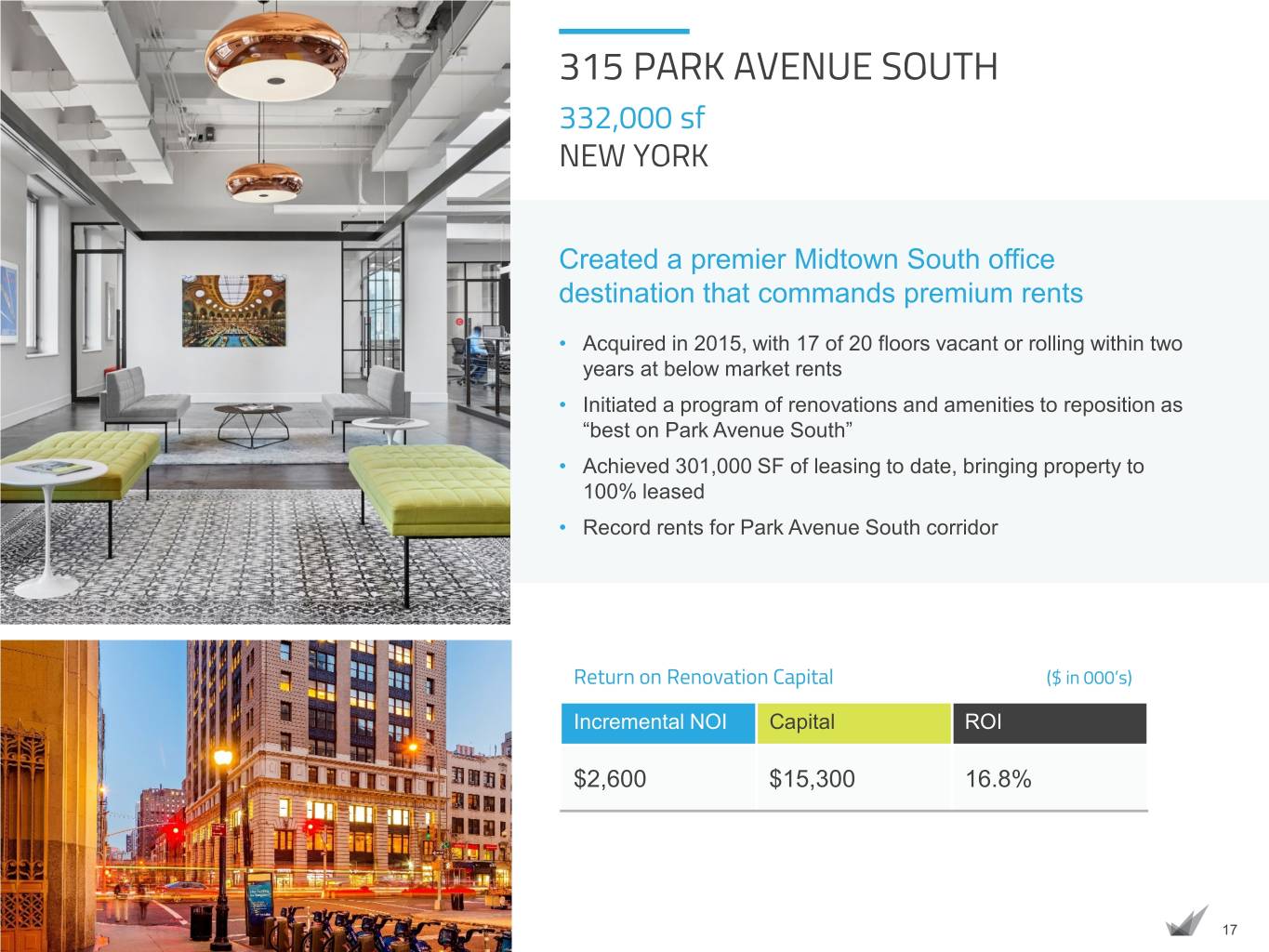

APPENDIX: Case Studies 315 PARK AVENUE SOUTH 332,000 sf NEW YORK Created a premier Midtown South office destination that commands premium rents • Acquired in 2015, with 17 of 20 floors vacant or rolling within two years at below market rents • Initiated a program of renovations and amenities to reposition as “best on Park Avenue South” • Achieved 301,000 SF of leasing to date, bringing property to 100% leased • Record rents for Park Avenue South corridor Return on Renovation Capital ($ in 000’s) Incremental NOI Capital ROI $2,600 $15,300 16.8% 17

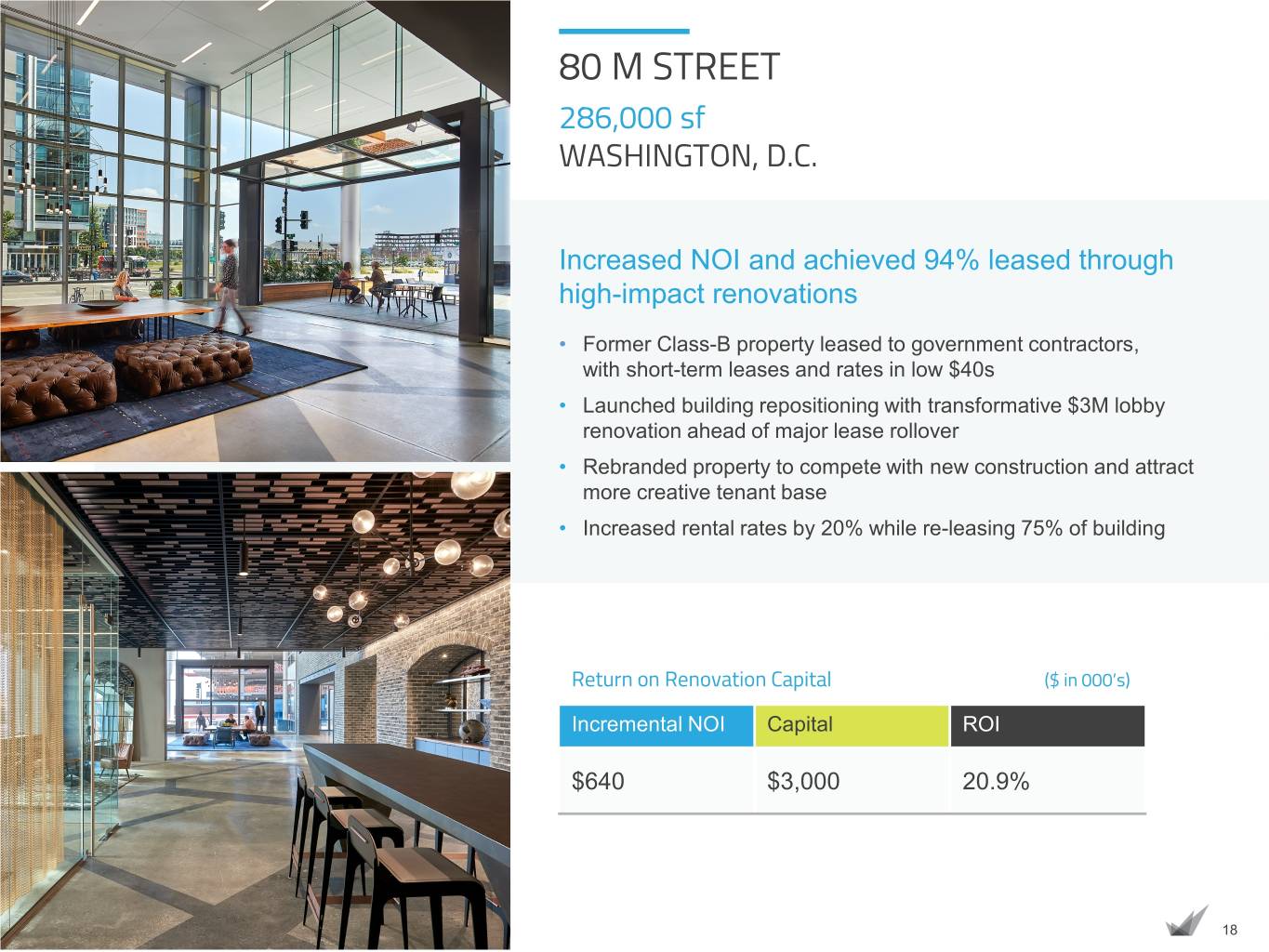

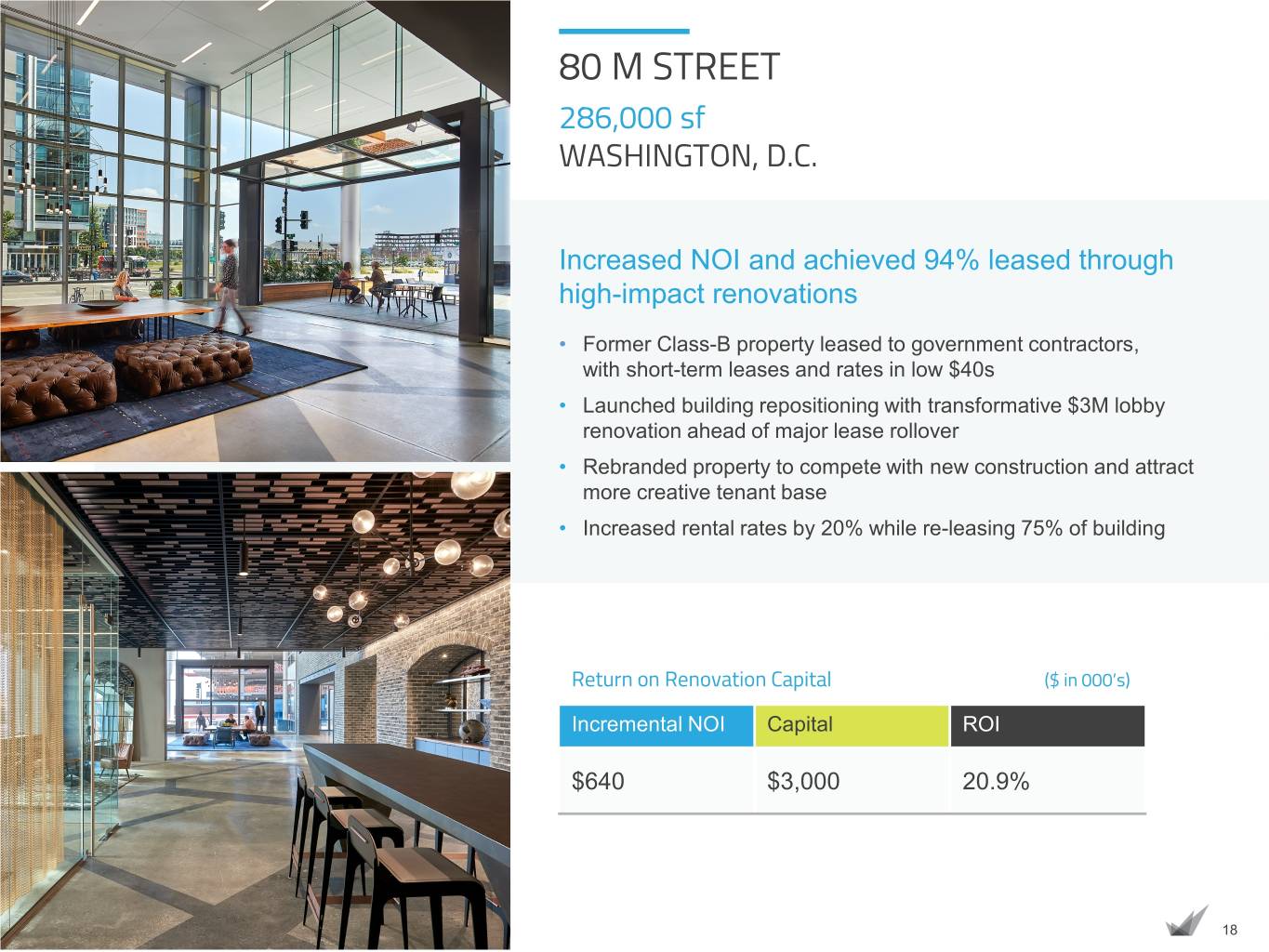

80 M STREET 286,000 sf WASHINGTON, D.C. Increased NOI and achieved 94% leased through high-impact renovations • Former Class-B property leased to government contractors, with short-term leases and rates in low $40s • Launched building repositioning with transformative $3M lobby renovation ahead of major lease rollover • Rebranded property to compete with new construction and attract more creative tenant base • Increased rental rates by 20% while re-leasing 75% of building Return on Renovation Capital ($ in 000’s) Incremental NOI Capital ROI $640 $3,000 20.9% 18

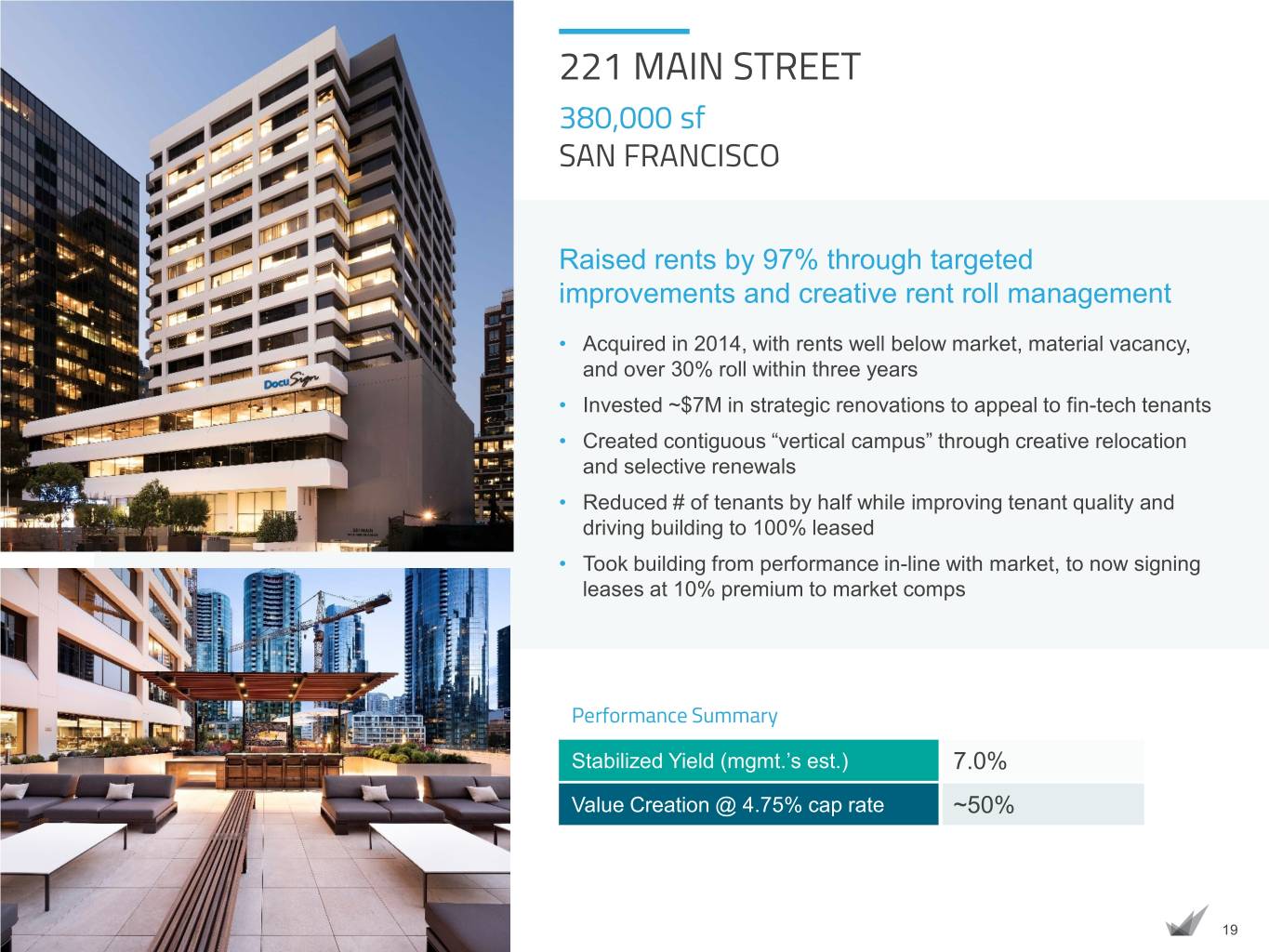

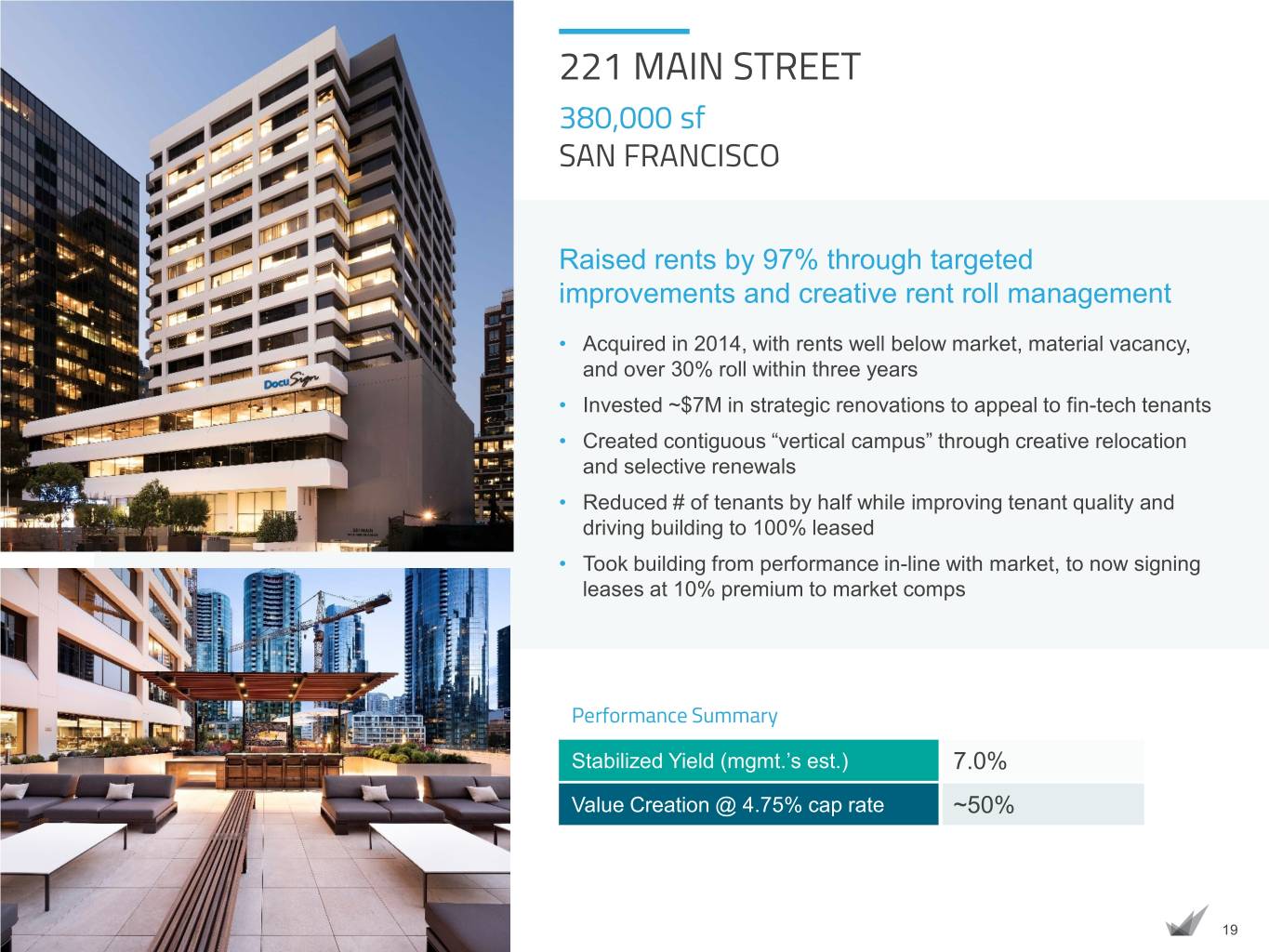

221 MAIN STREET 380,000 sf SAN FRANCISCO Raised rents by 97% through targeted improvements and creative rent roll management • Acquired in 2014, with rents well below market, material vacancy, and over 30% roll within three years • Invested ~$7M in strategic renovations to appeal to fin-tech tenants • Created contiguous “vertical campus” through creative relocation and selective renewals • Reduced # of tenants by half while improving tenant quality and driving building to 100% leased • Took building from performance in-line with market, to now signing leases at 10% premium to market comps Performance Summary Stabilized Yield (mgmt.’s est.) 7.0% Value Creation @ 4.75% cap rate ~50% 19

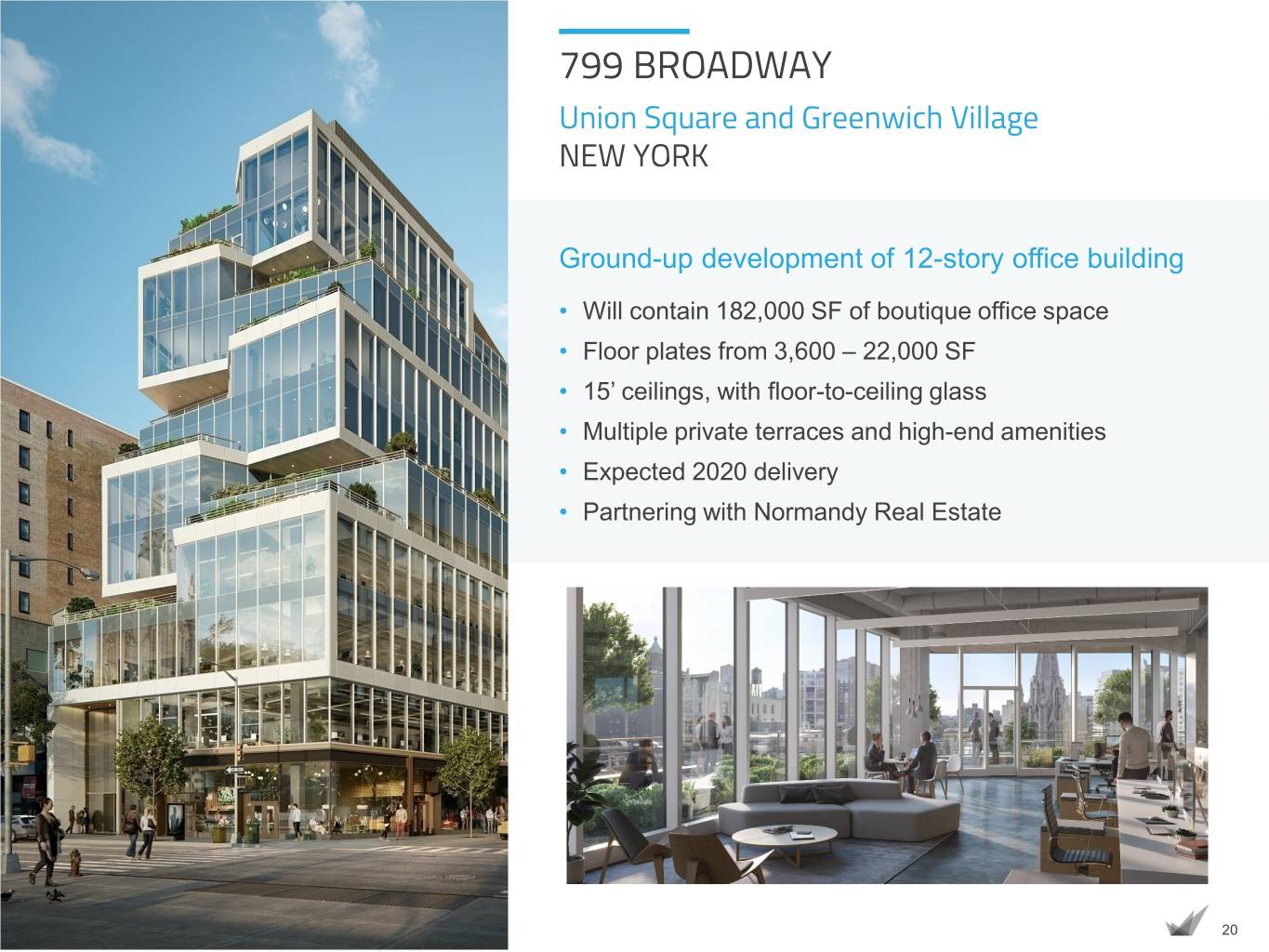

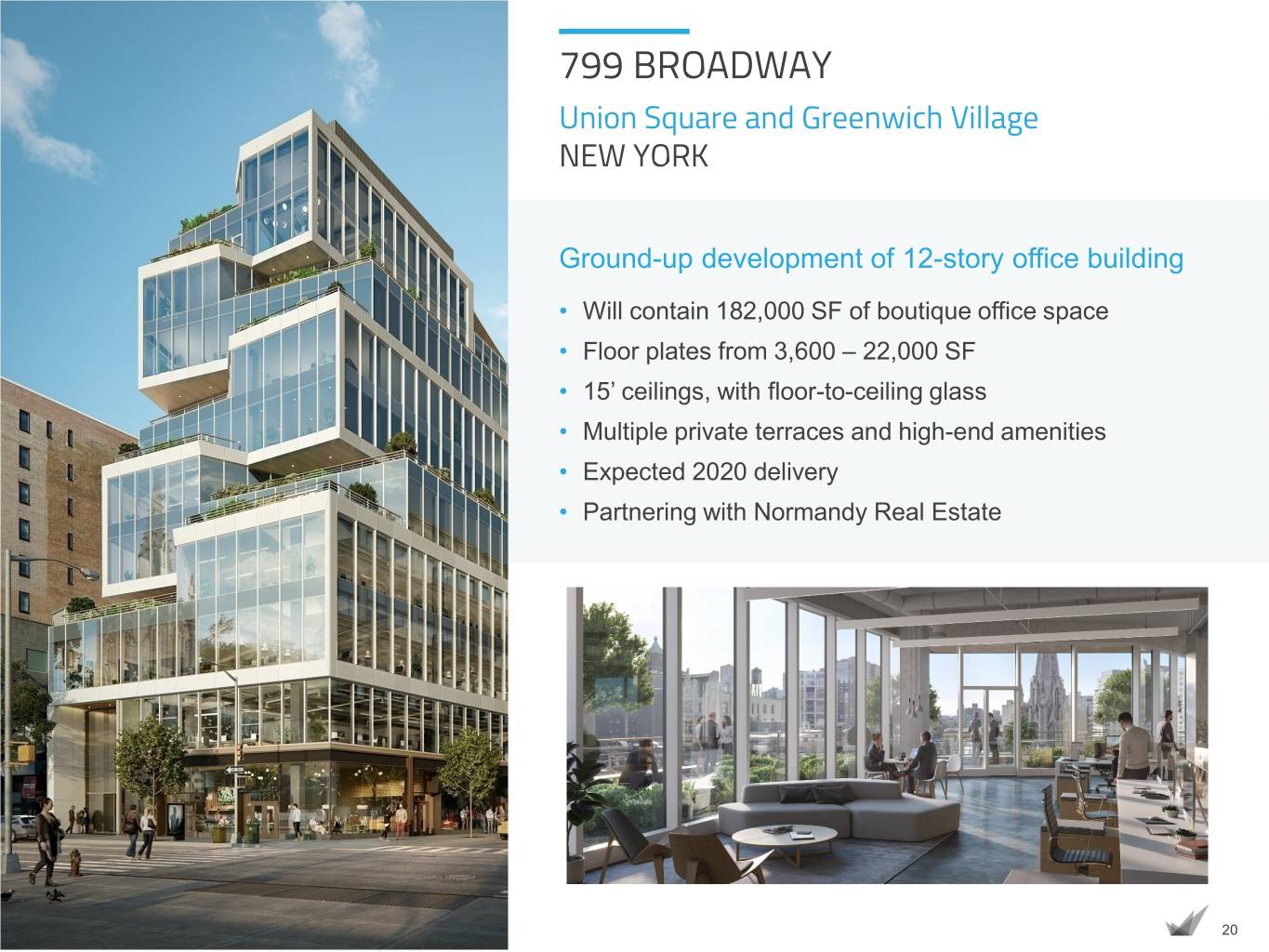

799 BROADWAY Union Square and Greenwich Village NEW YORK Ground-up development of 12-story office building • Will contain 182,000 SF of boutique office space • Floor plates from 3,600 – 22,000 SF • 15’ ceilings, with floor-to-ceiling glass • Multiple private terraces and high-end amenities • Expected 2020 delivery • Partnering with Normandy Real Estate 20

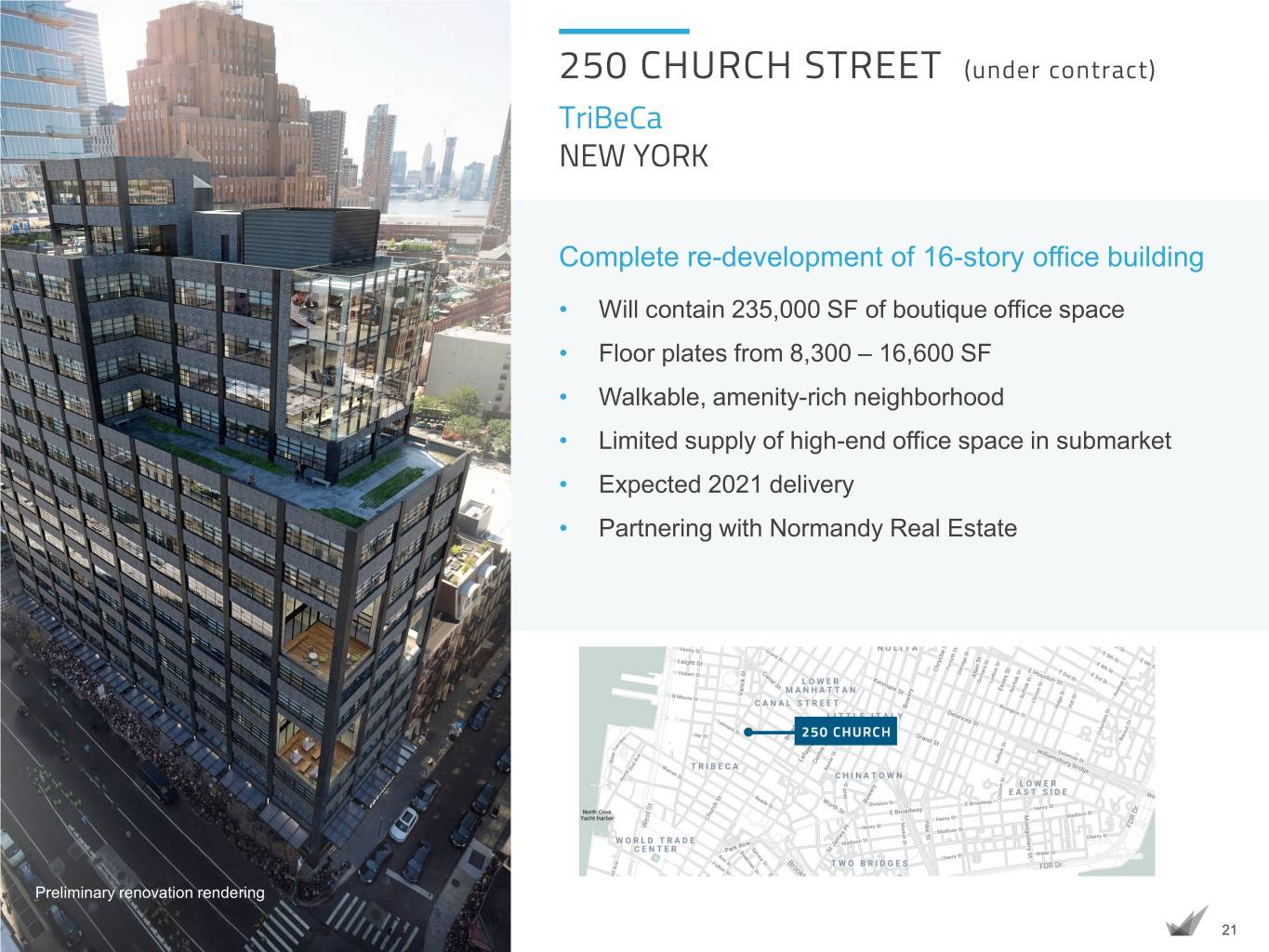

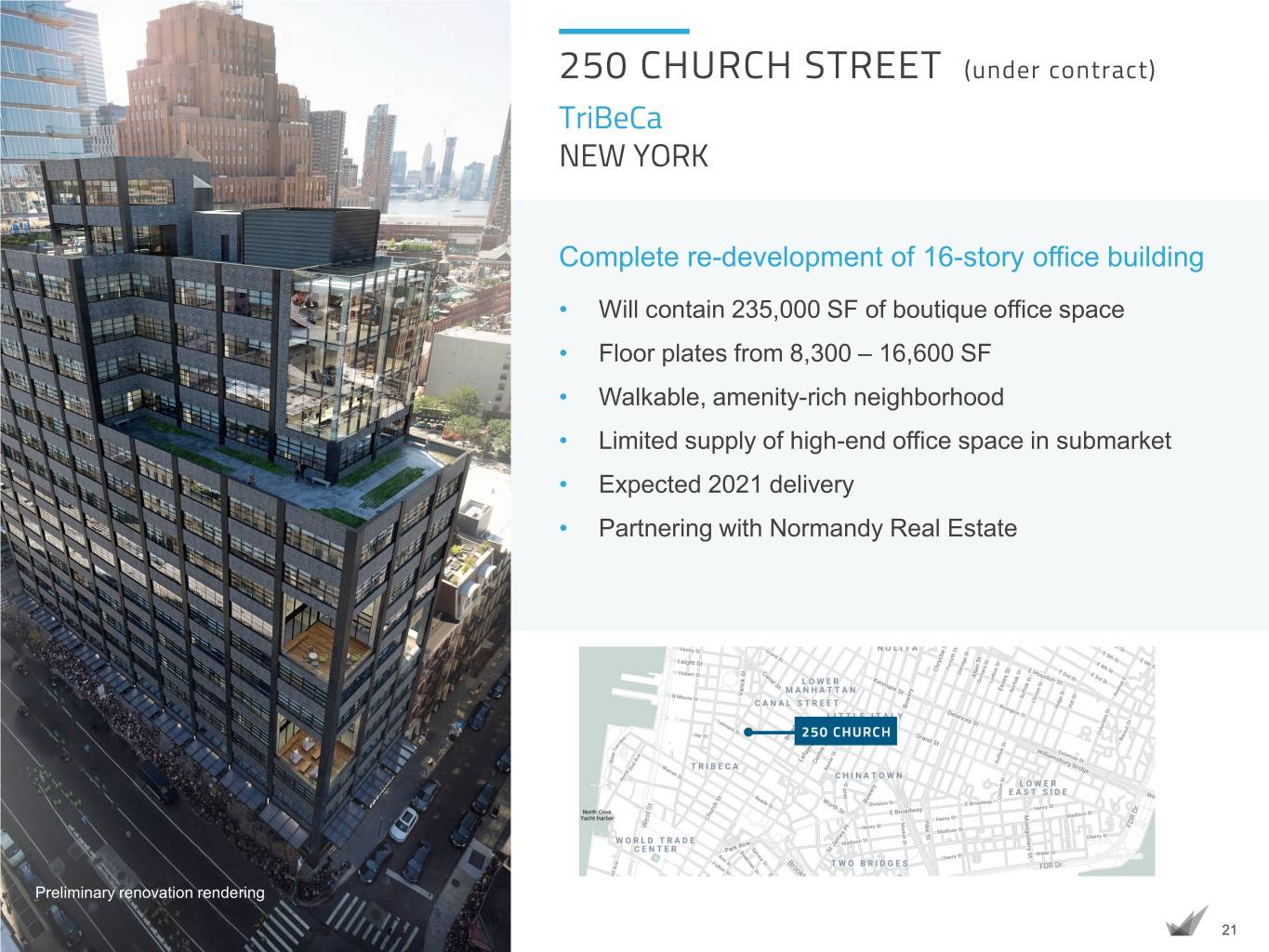

250 CHURCH STREET (under contract) TriBeCa NEW YORK Complete re-development of 16-story office building • Will contain 235,000 SF of boutique office space • Floor plates from 8,300 – 16,600 SF • Walkable, amenity-rich neighborhood • Limited supply of high-end office space in submarket • Expected 2021 delivery • Partnering with Normandy Real Estate Preliminary renovation rendering 21

APPENDIX FOR MORE INFORMATION Columbia Property Trust INVESTOR RELATIONS 404.465.2227 www.columbia.reit ir@columbia.reit 22

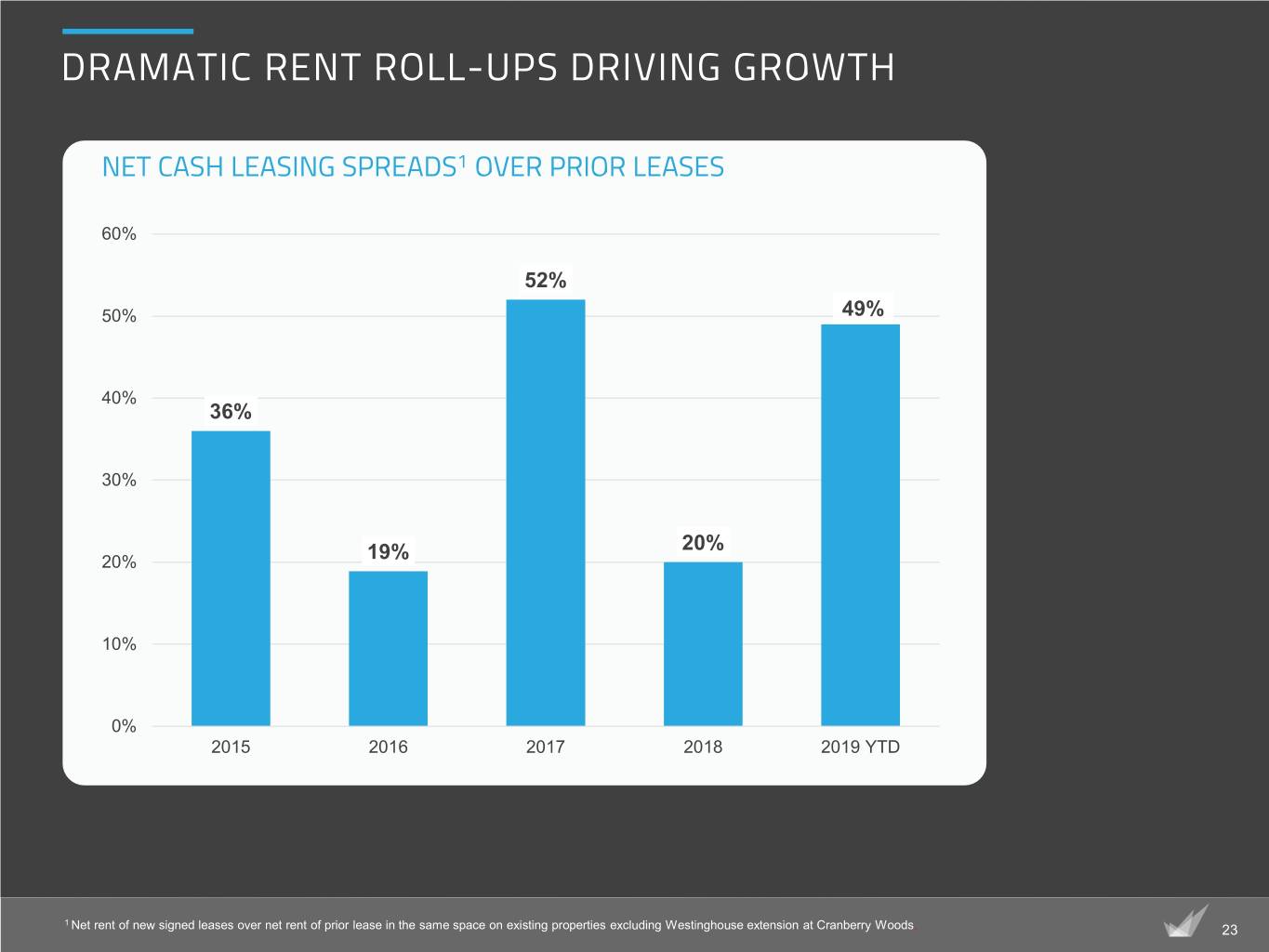

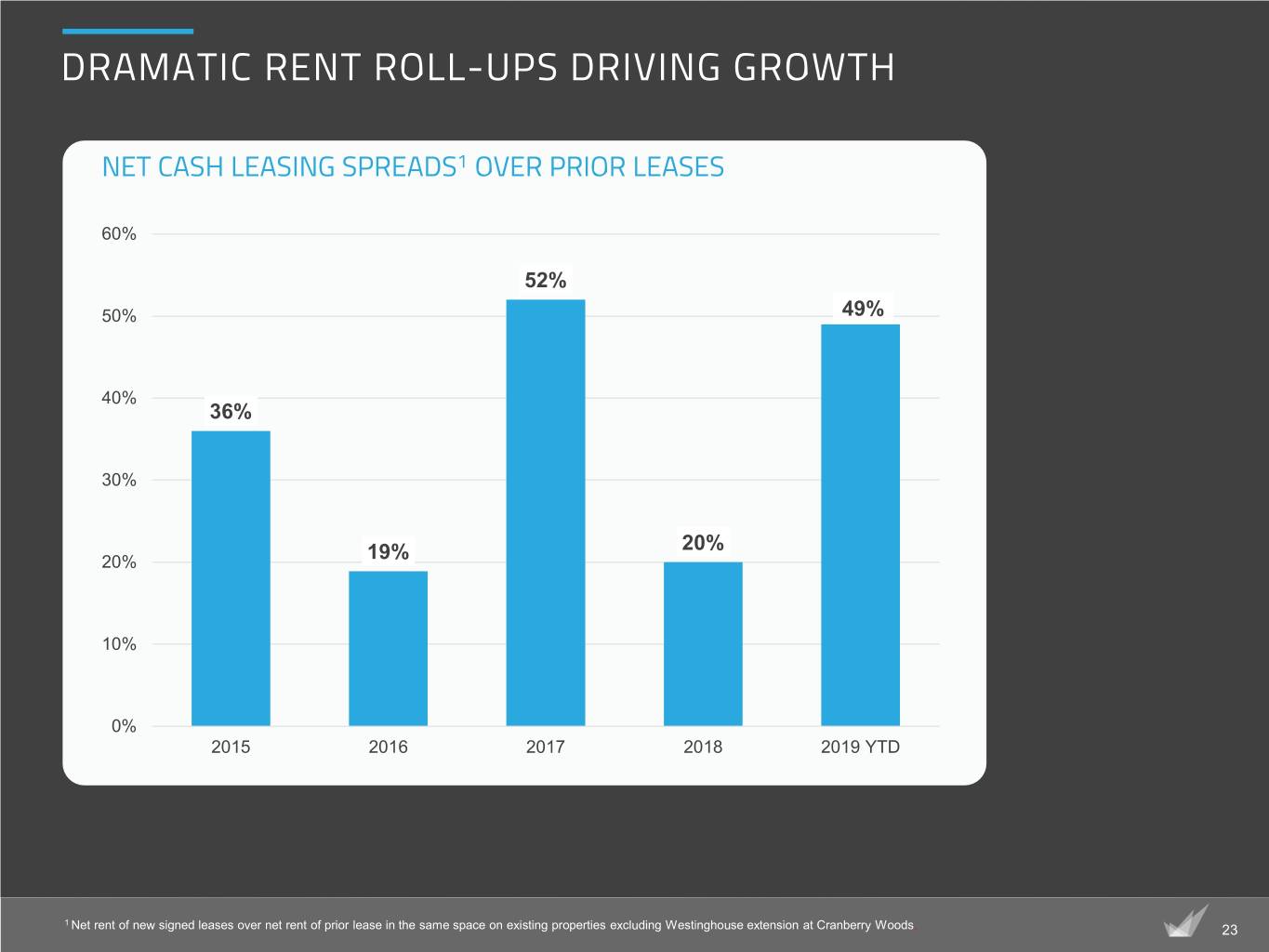

DRAMATIC RENT ROLL-UPS DRIVING GROWTH NET CASH LEASING SPREADS1 OVER PRIOR LEASES 60% 52% 50% 49% 40% 36% 30% 20% 20% 19% 10% 0% 2015 2016 2017 2018 2019 YTD 1 Net rent of new signed leases over net rent of prior lease in the same space on existing properties excluding Westinghouse extension at Cranberry Woods. 23

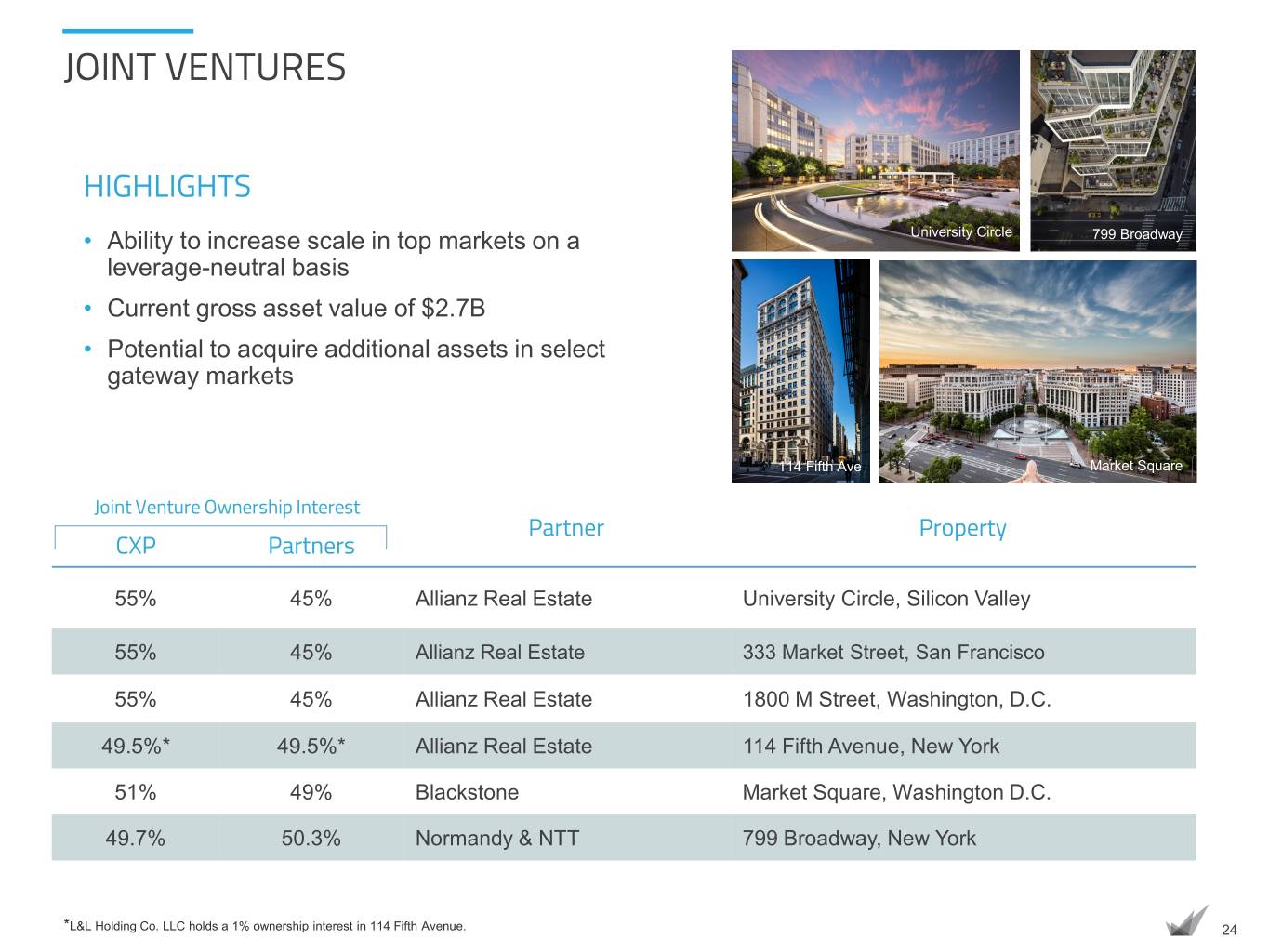

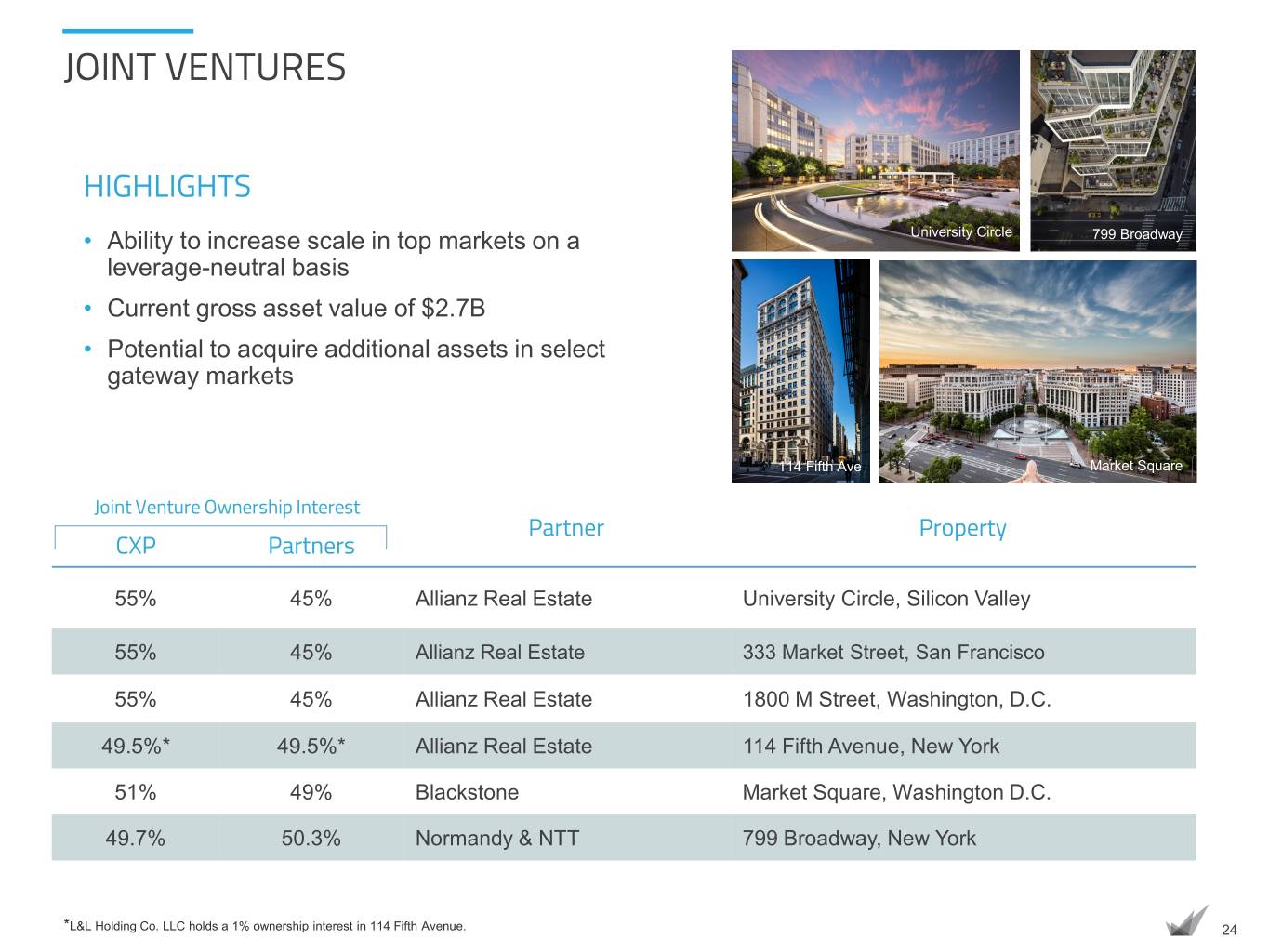

JOINT VENTURES HIGHLIGHTS • Ability to increase scale in top markets on a University Circle 799 Broadway leverage-neutral basis • Current gross asset value of $2.7B • Potential to acquire additional assets in select gateway markets 114 Fifth Ave Market Square Joint Venture Ownership Interest Partner Property CXP Partners 55% 45% Allianz Real Estate University Circle, Silicon Valley 55% 45% Allianz Real Estate 333 Market Street, San Francisco 55% 45% Allianz Real Estate 1800 M Street, Washington, D.C. 49.5%* 49.5%* Allianz Real Estate 114 Fifth Avenue, New York 51% 49% Blackstone Market Square, Washington D.C. 49.7% 50.3% Normandy & NTT 799 Broadway, New York *L&L Holding Co. LLC holds a 1% ownership interest in 114 Fifth Avenue. 24

LEADERSHIP TEAM NELSON MILLS JIM FLEMING LINDA BOLAN DAVID CHEIKIN BILL CAMPBELL KELLY LIM DOUG MCDONALD MICHAEL SCHMIDT President and CEO Executive VP and CFO SVP, Property SVP, Strategic Real VP, Construction VP, Asset VP, Finance VP, Asset Management and Estate Initiatives Management Management Sustainability New York San Francisco DAVID DOWDNEY WENDY GILL KEVIN HOOVER AMY TABB RACHEL WILLIAMS ELKA WILSON SVP, Head of Leasing SVP, Corporate SVP, Portfolio SVP, Business VP, Marketing & VP & Controller Operations and Chief Management and Development Communications Accounting Officer Transactions 25

FORWARD-LOOKING STATEMENTS Certain statements contained in this presentation other than historical facts may be considered forward-looking statements. Such statements include, in particular, statements about our plans, strategies, and prospects, and are subject to certain risks and uncertainties, including known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as "may," "will," "expect," "intend," "anticipate," "estimate," "believe," "continue," or other similar words. These forward-looking statements include information about possible or assumed future results of the business and our financial condition, liquidity, results of operations, future plans and objectives. They also include, among other things, statement regarding subjects that are forward-looking by their nature, such as our business and financial strategy, our 2019 guidance (including projected net operating income, cash rents and contractual growth), projected yield and earnings growth compared to peers, our ability to obtain future financing, future acquisitions and dispositions of operating assets, future repurchases of common stock, and market and industry trends. Readers are cautioned not to place undue reliance on these forward-looking statements. We make no representations or warranties (express or implied) about the accuracy of any such forward-looking statements contained in this presentation, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Any such forward-looking statements are subject to risks, uncertainties, and other factors and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual conditions, our ability to accurately anticipate results expressed in such forward- looking statements, including our ability to generate positive cash flow from operations, make distributions to stockholders, and maintain the value of our real estate properties, may be significantly hindered. See Item 1A in the Company's most recently filed Annual Report on Form 10-K for the year ended December 31, 2018, for a discussion of some of the risks and uncertainties that could cause actual results to differ materially from those presented in our forward-looking statements. The risk factors described in our Annual Report are not the only ones we face but do represent those risks and uncertainties that we believe are material to us. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also harm our business. For additional information, please reference the supplemental report furnished by the Company as Exhibit 99.1 to the Company’s Form 8-K furnished to the Securities and Exchange Commission on October 24, 2019. The names, logos and related product and service names, design marks, and slogans are the trademarks or service marks of their respective companies. When evaluating the Company’s performance and capital resources, management considers the financial impact of investments held directly and through unconsolidated joint ventures. This presentation includes financial and operational information for our wholly-owned investments and our proportional interest in unconsolidated investments. Unless otherwise noted, all data herein is as of September 30, 2019. 052-CORPPRES1905 26

RECONCILIATIONS: NON-GAAP TO COMPARABLE GAAP MEASURES Three Months (in thousands) Ended 9/30/19 Annualized Net Cash Provided by Operating Activities $ 40,548 $ 162,192 Straight line rental income 2,186 8,744 Depreciation of real estate assets (19,773) (79,092) Amortization of lease-related costs (6,377) (25,508) Impairment loss on real estate assets (23,364) (93,456) Gain on sale of real estate 112 448 Income from unconsolidated joint venture 2,194 8,776 Distribution of earnings from unconsolidated joint ventures (7,075) (28,300) Other non-cash expenses (2,382) (9,528) Net changes in operating assets & liabilities (6,355) (25,420) Net Income (loss) $ (20,286) $ (81,144) Interest expense (net) 10,289 41,156 Income tax benefit 2 8 Depreciation of real estate assets 19,773 79.092 Amortization of lease-related costs 7,485 29,940 Adjustments from unconsolidated joint venture 14,224 56,896 EBITDA $ 31,487 $ 125,948 Gain on sale of real estate assets (112) (448) Impairment loss on real estate assets 23,364 93,456 EBITDAre $ 54,739 $ 218,956 Pre-acquisition costs 2,437 9,748 Adjusted EBITDAre $ 57,176 $ 228,704 Asset & property management fee income (1,914) (7,656) General and administrative – corporate 7,103 28,412 General and administrative – unconsolidated joint ventures 839 3,356 Straight line rental income (net) (1,953) (7,812) Above/below lease market amortization (net) (1,108) (4,432) Adjustments from unconsolidated joint venture (1,147) (4,588) Net Operating Income (based on cash rents) $ 58,996 $ 235,984 NOI from Atlanta, Pittsburgh & Pasadena (10,785) (43,140) Adjustment for Non-Recurring Revenues / Expenses (251) (1,004) Net Operating Income (based on cash rents) – Adjusted $ 47,960 $ 191,840 27

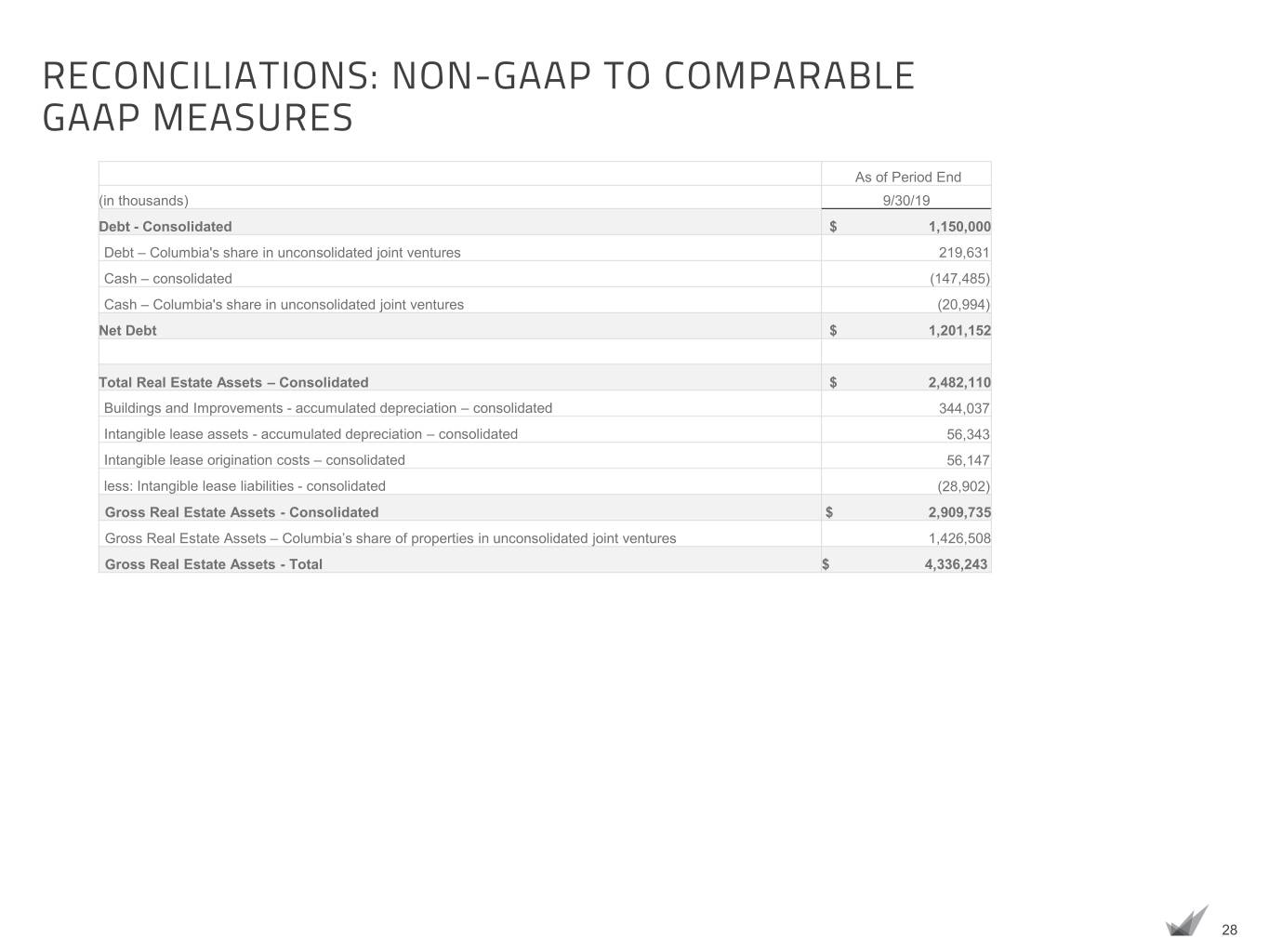

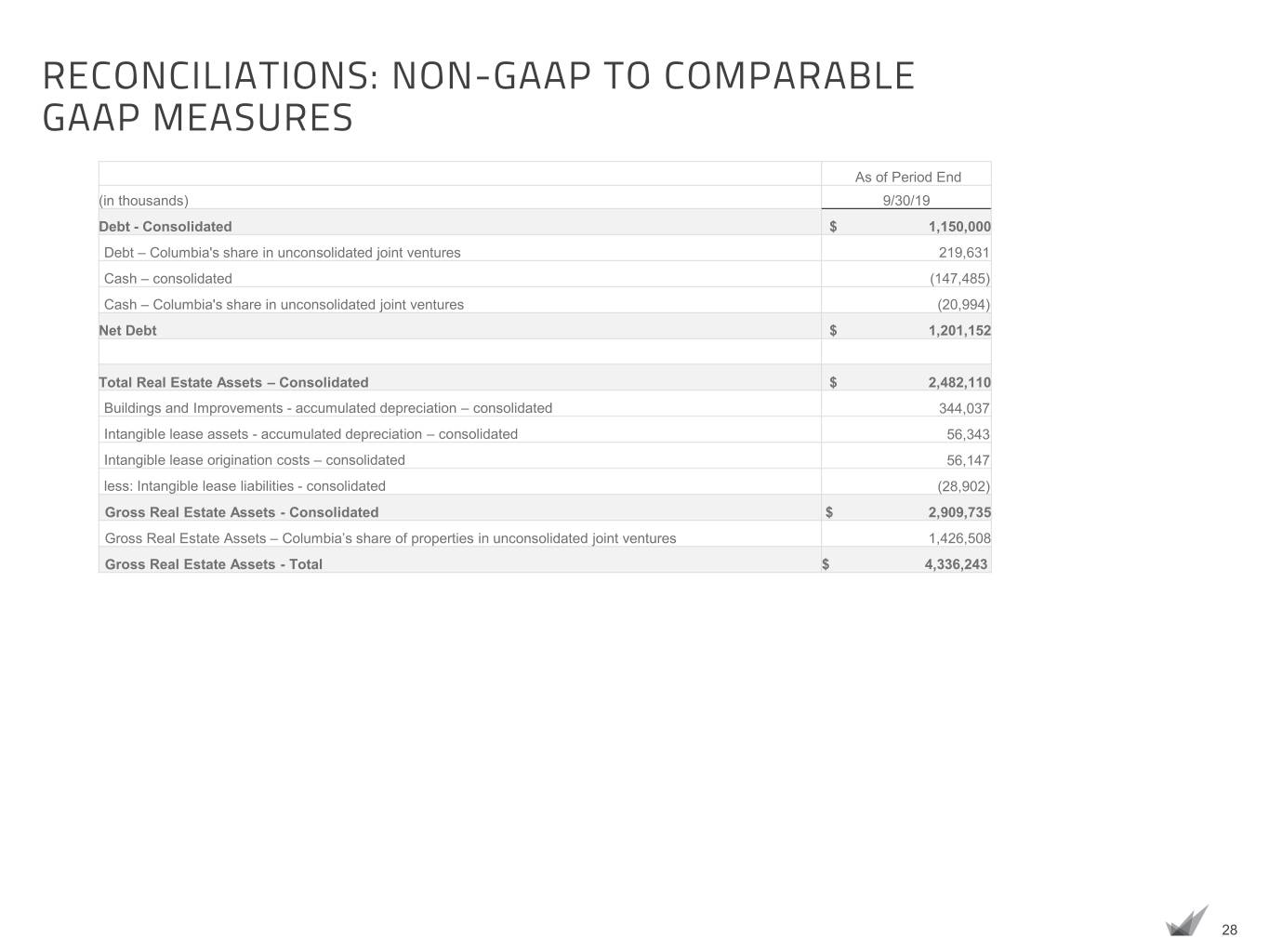

RECONCILIATIONS: NON-GAAP TO COMPARABLE GAAP MEASURES As of Period End (in thousands) 9/30/19 Debt - Consolidated $ 1,150,000 Debt – Columbia's share in unconsolidated joint ventures 219,631 Cash – consolidated (147,485) Cash – Columbia's share in unconsolidated joint ventures (20,994) Net Debt $ 1,201,152 Total Real Estate Assets – Consolidated $ 2,482,110 Buildings and Improvements - accumulated depreciation – consolidated 344,037 Intangible lease assets - accumulated depreciation – consolidated 56,343 Intangible lease origination costs – consolidated 56,147 less: Intangible lease liabilities - consolidated (28,902) Gross Real Estate Assets - Consolidated $ 2,909,735 Gross Real Estate Assets – Columbia’s share of properties in unconsolidated joint ventures 1,426,508 Gross Real Estate Assets - Total $ 4,336,243 28