UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-21400

Eaton Vance Tax-Advantaged Dividend Income Fund

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

August 31

Date of Fiscal Year End

August 31, 2014

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Tax-Advantaged Dividend Income Fund (EVT)

Annual Report

August 31, 2014

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The Fund has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC regulation. Because of its management of other strategies, the Fund’s adviser is registered with the CFTC as a commodity pool operator and a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

Annual Report August 31, 2014

Eaton Vance

Tax-Advantaged Dividend Income Fund

Table of Contents

| | | | |

Management’s Discussion of Fund Performance | | | 2 | |

| |

Performance | | | 3 | |

| |

Fund Profile | | | 4 | |

| |

Endnotes and Additional Disclosures | | | 5 | |

| |

Financial Statements | | | 6 | |

| |

Report of Independent Registered Public Accounting Firm | | | 22 | |

| |

Federal Tax Information | | | 23 | |

| |

Annual Meeting of Shareholders | | | 24 | |

| |

Dividend Reinvestment Plan | | | 25 | |

| |

Board of Trustees’ Contract Approval | | | 27 | |

| |

Management and Organization | | | 30 | |

| |

Important Notices | | | 33 | |

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Management’s Discussion of Fund Performance1

Economic and Market Conditions

U.S. stocks delivered solid gains for the 12-month period ended August 31, 2014. Following a choppy start to the period, the market turned upward after a budget agreement in October 2013 ended the 16-day U.S. government shutdown. In December, when the U.S. Federal Reserve (the Fed) made its long-anticipated move to begin “tapering” economic stimulus, U.S. stocks put aside earlier fears of tapering and soared to record highs.

Harsh winter weather and geopolitical tensions weighed on the market in early 2014, but U.S. stocks subsequently resumed their advance amid signs of a gradually strengthening economy. The U.S. equity market generally climbed at a moderate pace through the spring of 2014, until the outbreak of hostilities in Iraq in June sent stocks sharply lower. But equities soon bounced back once the Fed reiterated its pledge to maintain low interest rates. U.S. stocks fell in late July 2014 amid mounting geopolitical and economic concerns, before rebounding in August — a month in which the market, as represented by the S&P 500 Index2, returned 4.00%.

The major U.S. stock indexes ended the 12-month period with strong performance. The S&P 500 Index advanced 25.25% for the period, while the Dow Jones Industrial Average gained 18.18%. The technology-laden NASDAQ Composite Index added 29.15%. Large-cap U.S. stocks (as measured by the Russell 1000 Index) generally fared better than their small-cap counterparts (as measured by the Russell 2000 Index) for the 12-month period. Within the large-cap space, growth stocks generally outpaced value stocks, while the reverse was true in the small-cap category.

Fund Performance

For the 12-month period ended August 31, 2014, Eaton Vance Tax-Advantaged Dividend Income Fund (the Fund) had a total return of 25.90% at net asset value (NAV), outperforming the Fund’s primary benchmark, the Russell 1000 Value Index (the Index), which returned 24.43% for the same period.

The Fund’s overall outperformance during the period, relative to its primary benchmark, was largely driven by the Fund’s use of leverage6. As of period-end on August 31, 2014, the Fund had leverage equal to 21.10% of the Fund’s aggregate net assets plus borrowings outstanding. Leverage has the

effect of magnifying the Fund’s exposure to its underlying investments in both up and down markets. Accordingly, leverage aided the Fund’s performance versus the Index during a period when equities generally performed strongly.

The Fund’s common stock allocation, as well as the Fund’s allocation to preferred securities (i.e., preferred stocks and corporate bonds and notes), underperformed the Index for the 12-month period and thus detracted from relative performance versus the Index.

Within the Fund’s common stock allocation, stock selection in the energy and industrials sectors, along with an underweight in the information technology sector, drove underperformance relative to the Index. In the energy sector, the Fund’s positions in Chevron Corp. and Italian energy firm Eni S.p.A. performed poorly, as world energy demand softened during the period. In the industrials sector, the Fund’s overweight in Danaher Corp., a weak performer during the period, and not owning General Dynamics, which rose sharply, hurt Fund performance versus the Index.

To increase its dividend yield, the Fund invested outside its U.S.-only benchmark in an effort to take advantage of higher yields overseas, particularly in some Western European countries, including Spain and Italy. However, a sluggish European economic recovery weighed on the region’s equity returns. As a result, the Fund’s European holdings dragged on performance versus the Index.

In contrast, stock selection in the materials, telecommunication services and health care sectors aided the performance of the Fund’s common stock allocation relative to the Index during the 12-month period.

As of August 31, 2014, the Fund had approximately 30% of its total investments in preferred securities. Although the Fund’s preferred security allocation underperformed the Index for the 12-month period, the Fund’s preferred security allocation outperformed the preferred market, as measured by the BofA Merrill Lynch Fixed Rate Preferred Securities Index. This outperformance was driven by a combination of factors: investments in some lower-rated, higher-yielding preferred issues; new preferred structures that performed well; and purchases of certain new issues that also performed strongly.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested and includes management fees and other expenses. Fund performance at market price will differ from its results at NAV due to factors such as changing per-ceptions about the Fund, market conditions, fluctuations in supply and demand for Fund shares, or changes in Fund distribu-tions. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their origi-nal cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Performance2,3

Portfolio Managers Edward J. Perkin, CFA, John D. Crowley, Walter A. Row III, CFA, CMT, Michael A. Allison, CFA and John H. Croft, CFA

| | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Inception Date | | | One Year | | | Five Years | | | Ten Years | |

Fund at NAV | | | 09/30/2003 | | | | 25.90 | % | | | 17.02 | % | | | 8.89 | % |

Fund at Market Price | | | — | | | | 24.80 | | | | 16.69 | | | | 8.79 | |

Russell 1000 Value Index | | | — | | | | 24.43 | % | | | 16.61 | % | | | 8.23 | % |

BofA Merrill Lynch Fixed Rate Preferred Securities Index | | | — | | | | 12.86 | | | | 10.01 | | | | 2.75 | |

Blend of 70% Russell 1000 Value Index | | | — | | | | 20.97 | | | | 14.78 | | | | 6.88 | |

30% BofA Merrill Lynch Fixed Rate Preferred Securities Index | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

| % Premium/Discount to NAV4 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | –10.37 | % |

| | | | |

| | | | | | | | | | | | | | | | |

| Distributions5 | | | | | | | | | | | | |

Total Distributions per share for the period | | | | | | | | | | | | | | $ | 1.323 | |

Distribution Rate at NAV | | | | | | | | | | | | | | | 6.06 | % |

Distribution Rate at Market Price | | | | | | | | | | | | | | | 6.76 | % |

| | | | |

| | | | | | | | | | | | | | | | |

| % Total Leverage6 | | | | | | | | | | | | |

Borrowings | | | | | | | | | | | | | | | 21.10 | % |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested and includes management fees and other expenses. Fund performance at market price will differ from its results at NAV due to factors such as changing per-ceptions about the Fund, market conditions, fluctuations in supply and demand for Fund shares, or changes in Fund distribu-tions. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their origi-nal cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Fund Profile

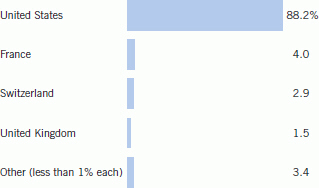

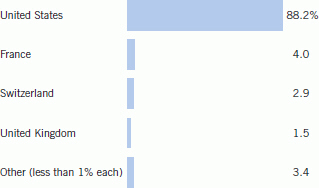

Country Allocation (% of total investments)

Top 10 Common Stock Holdings (% of total investments)

| | | | |

Chevron Corp. | | | 2.5 | % |

| |

Exxon Mobil Corp. | | | 2.3 | |

| |

Wells Fargo & Co. | | | 2.1 | |

| |

Pfizer, Inc. | | | 2.0 | |

| |

Merck & Co., Inc. | | | 2.0 | |

| |

Discover Financial Services | | | 1.7 | |

| |

General Electric Co. | | | 1.7 | |

| |

JPMorgan Chase & Co. | | | 1.6 | |

| |

Bank of America Corp. | | | 1.6 | |

| |

Caterpillar, Inc. | | | 1.6 | |

Total | | | 19.1 | % |

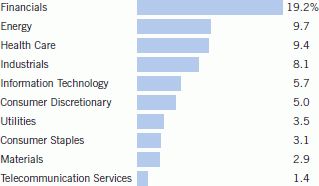

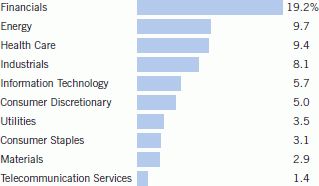

Common Stock Sector Allocation (% of total investments)

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Endnotes and Additional Disclosures

| 1 | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward looking statements”. The Fund’s actual future results may differ significantly from those stated in any forward looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 2 | Russell 1000 Value Index is an unmanaged index of U.S. large-cap value stocks. BofA Merrill Lynch Fixed Rate Preferred Securities Index is an unmanaged index of fixed-rate, preferred securities issued in the U.S. BofA Merrill Lynch® indices not for redistribution or other uses; provided “as is”, without warranties, and with no liability. Eaton Vance has prepared this report, BofAML does not endorse it, or guarantee, review, or endorse Eaton Vance’s products. S&P 500 Index is an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. NASDAQ Composite Index is a market capitalization-weighted index of all domestic and international securities listed on NASDAQ. Russell 1000 Index is an unmanaged index of 1,000 U.S. large-cap stocks. Russell 2000 Index is an unmanaged index of 2,000 U.S. small-cap stocks. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 3 | Performance results reflect the effects of leverage. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. |

| 4 | The shares of the Fund often trade at a discount or premium from their net asset value. The discount or premium of the Fund may vary over time and may be higher or lower than what is quoted in this report. For up-to-date premium/discount information, please refer to http://eatonvance.com/closedend. |

| 5 | The Distribution Rate is based on the Fund’s last regular distribution per share in the period (annualized) divided by the Fund’s NAV or market price at the end of the period. The Fund’s distributions may be comprised of amounts characterized for federal income tax purposes as qualified and non-qualified ordinary dividends, capital gains and nondividend distributions, also known as return of capital. The Fund will determine the federal income tax character of distributions paid to a shareholder after the end of the calendar year. This is reported on the IRS form 1099-DIV and provided to the shareholder shortly after each year-end. For information about the tax character of distributions made in prior calendar years, please refer to Performance-Tax Character of Distributions on the Fund’s webpage available at eatonvance.com. The Fund’s distributions are determined by the investment adviser based on its current assessment of the Fund’s long-term return potential. As portfolio and market conditions change, the rate of distributions paid by the Fund could change. |

| 6 | Total leverage is shown as a percentage of the Fund’s aggregate net assets plus borrowings outstanding. The Fund employs leverage through borrowings. Use of leverage creates an opportunity for income, but creates risks including greater price volatility. The cost of borrowings rises and falls with changes in short-term interest rates. The Fund may be required to maintain prescribed asset coverage for its leverage and may be required to reduce its leverage at an inopportune time. |

| | Fund profile subject to change due to active management. |

Important Notice to Shareholders

| | Effective September 30, 2014, Edward Perkin and John Crowley joined the portfolio management team of the Fund. Mr. Perkin is Vice President and Chief Equity Investment Officer of Eaton Vance Management (EVM) and Mr. Crowley is a Vice President of EVM. Each co-manages other portfolios advised by EVM. |

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Portfolio of Investments

| | | | | | | | |

| Common Stocks — 85.7% | |

| | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Aerospace & Defense — 2.2% | |

Boeing Co. (The) | | | 162,500 | | | $ | 20,605,000 | |

United Technologies Corp.(1) | | | 156,115 | | | | 16,857,298 | |

| | | | | | | | | |

| | | | | | $ | 37,462,298 | |

| | | | | | | | | |

| | |

Air Freight & Logistics — 1.5% | | | | | | | | |

C.H. Robinson Worldwide, Inc.(1) | | | 360,340 | | | $ | 24,596,808 | |

| | | | | | | | | |

| | | | | | $ | 24,596,808 | |

| | | | | | | | | |

| | |

Banks — 11.8% | | | | | | | | |

Bank of America Corp.(1) | | | 2,087,774 | | | $ | 33,592,284 | |

Citigroup, Inc.(1) | | | 633,660 | | | | 32,728,539 | |

JPMorgan Chase & Co.(1) | | | 577,970 | | | | 34,360,316 | |

PNC Financial Services Group, Inc. (The)(1) | | | 378,150 | | | | 32,048,212 | |

Regions Financial Corp.(1) | | | 2,033,070 | | | | 20,635,661 | |

Wells Fargo & Co.(1) | | | 864,330 | | | | 44,461,135 | |

| | | | | | | | | |

| | | | | | $ | 197,826,147 | |

| | | | | | | | | |

| | |

Capital Markets — 1.9% | | | | | | | | |

Goldman Sachs Group, Inc. (The) | | | 44,000 | | | $ | 7,880,840 | |

Morgan Stanley(1) | | | 672,908 | | | | 23,087,474 | |

| | | | | | | | | |

| | | | | | $ | 30,968,314 | |

| | | | | | | | | |

| | |

Chemicals — 2.7% | | | | | | | | |

CF Industries Holdings, Inc. | | | 41,209 | | | $ | 10,618,323 | |

E.I. du Pont de Nemours & Co. | | | 111,663 | | | | 7,382,041 | |

LyondellBasell Industries NV, Class A | | | 177,623 | | | | 20,311,190 | |

PPG Industries, Inc. | | | 36,719 | | | | 7,558,973 | |

| | | | | | | | | |

| | | | | | $ | 45,870,527 | |

| | | | | | | | | |

| | |

Communications Equipment — 1.3% | | | | | | | | |

Cisco Systems, Inc. | | | 898,860 | | | $ | 22,462,511 | |

| | | | | | | | | |

| | | | | | $ | 22,462,511 | |

| | | | | | | | | |

| | |

Consumer Finance — 2.2% | | | | | | | | |

Discover Financial Services(1) | | | 582,560 | | | $ | 36,334,267 | |

| | | | | | | | | |

| | | | | | $ | 36,334,267 | |

| | | | | | | | | |

| |

Diversified Telecommunication Services — 1.7% | | | | | |

AT&T, Inc. | | | 300,000 | | | $ | 10,488,000 | |

Verizon Communications, Inc. | | | 370,000 | | | | 18,433,400 | |

| | | | | | | | | |

| | | | | | $ | 28,921,400 | |

| | | | | | | | | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

| | |

Electric Utilities — 2.8% | | | | | | | | |

Edison International(1) | | | 376,959 | | | $ | 22,293,355 | |

NextEra Energy, Inc.(1) | | | 248,590 | | | | 24,473,686 | |

| | | | | | | | | |

| | | | | | $ | 46,767,041 | |

| | | | | | | | | |

| | |

Electrical Equipment — 1.0% | | | | | | | | |

Emerson Electric Co. | | | 271,620 | | | $ | 17,389,112 | |

| | | | | | | | | |

| | | | | | $ | 17,389,112 | |

| | | | | | | | | |

|

Electronic Equipment, Instruments & Components — 1.8% | |

Corning, Inc. | | | 1,466,700 | | | $ | 30,595,362 | |

| | | | | | | | | |

| | | | | | $ | 30,595,362 | |

| | | | | | | | | |

| | |

Energy Equipment & Services — 0.5% | | | | | | | | |

FMC Technologies, Inc.(2) | | | 135,844 | | | $ | 8,400,593 | |

| | | | | | | | | |

| | | | | | $ | 8,400,593 | |

| | | | | | | | | |

| | |

Food Products — 2.9% | | | | | | | | |

Hershey Co. (The) | | | 302,000 | | | $ | 27,608,840 | |

Mondelez International, Inc., Class A(1) | | | 584,541 | | | | 21,154,539 | |

| | | | | | | | | |

| | | | | | $ | 48,763,379 | |

| | | | | | | | | |

| | |

Health Care Equipment & Supplies — 2.7% | | | | | | | | |

Abbott Laboratories | | | 439,480 | | | $ | 18,563,635 | |

Covidien PLC(1) | | | 214,640 | | | | 18,637,191 | |

Medtronic, Inc. | | | 126,020 | | | | 8,046,377 | |

| | | | | | | | | |

| | | | | | $ | 45,247,203 | |

| | | | | | | | | |

| | |

Health Care Providers & Services — 1.2% | | | | | | | | |

UnitedHealth Group, Inc. | | | 231,749 | | | $ | 20,088,003 | |

| | | | | | | | | |

| | | | | | $ | 20,088,003 | |

| | | | | | | | | |

| | |

Household Durables — 0.6% | | | | | | | | |

Mohawk Industries, Inc.(2) | | | 64,376 | | | $ | 9,400,184 | |

| | | | | | | | | |

| | | | | | $ | 9,400,184 | |

| | | | | | | | | |

| | |

Industrial Conglomerates — 3.4% | | | | | | | | |

Danaher Corp. | | | 284,502 | | | $ | 21,795,698 | |

General Electric Co. | | | 1,349,429 | | | | 35,058,166 | |

| | | | | | | | | |

| | | | | | $ | 56,853,864 | |

| | | | | | | | | |

| | |

Insurance — 4.8% | | | | | | | | |

ACE, Ltd. | | | 179,222 | | | $ | 19,056,675 | |

Aflac, Inc.(1) | | | 388,370 | | | | 23,783,779 | |

| | | | |

| | 6 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

| | |

Insurance (continued) | | | | | | | | |

AXA SA | | | 701,031 | | | $ | 17,395,209 | |

MetLife, Inc. | | | 350,550 | | | | 19,189,107 | |

| | | | | | | | | |

| | | | | | $ | 79,424,770 | |

| | | | | | | | | |

| | |

Internet Software & Services — 1.4% | | | | | | | | |

Google, Inc., Class C(2) | | | 41,000 | | | $ | 23,435,600 | |

| | | | | | | | | |

| | | | | | $ | 23,435,600 | |

| | | | | | | | | |

| | |

Machinery — 2.0% | | | | | | | | |

Caterpillar, Inc. | | | 306,373 | | | $ | 33,416,103 | |

| | | | | | | | | |

| | | | | | $ | 33,416,103 | |

| | | | | | | | | |

| | |

Media — 3.3% | | | | | | | | |

Comcast Corp., Class A(1) | | | 411,578 | | | $ | 22,525,664 | |

Walt Disney Co. (The)(1) | | | 365,730 | | | | 32,871,812 | |

| | | | | | | | | |

| | | | | | $ | 55,397,476 | |

| | | | | | | | | |

| | |

Metals & Mining — 1.0% | | | | | | | | |

Freeport-McMoRan, Inc.(1) | | | 445,658 | | | $ | 16,208,582 | |

| | | | | | | | | |

| | | | | | $ | 16,208,582 | |

| | | | | | | | | |

| | |

Multi-Utilities — 1.6% | | | | | | | | |

Sempra Energy(1) | | | 252,610 | | | $ | 26,769,082 | |

| | | | | | | | | |

| | | | | | $ | 26,769,082 | |

| | | | | | | | | |

| | |

Oil, Gas & Consumable Fuels — 11.8% | | | | | | | | |

Chevron Corp.(1) | | | 400,505 | | | $ | 51,845,372 | |

ConocoPhillips | | | 408,966 | | | | 33,216,219 | |

Devon Energy Corp.(1) | | | 320,000 | | | | 24,134,400 | |

Exxon Mobil Corp.(1) | | | 487,362 | | | | 48,473,025 | |

Occidental Petroleum Corp.(1) | | | 181,610 | | | | 18,838,405 | |

Total SA | | | 306,521 | | | | 20,226,860 | |

| | | | | | | | | |

| | | | | | $ | 196,734,281 | |

| | | | | | | | | |

| | |

Pharmaceuticals — 7.9% | | | | | | | | |

Merck & Co., Inc.(1) | | | 711,124 | | | $ | 42,745,664 | |

Pfizer, Inc.(1) | | | 1,456,890 | | | | 42,817,997 | |

Roche Holding AG PC(1) | | | 95,760 | | | | 27,967,466 | |

Sanofi | | | 168,130 | | | | 18,425,766 | |

| | | | | | | | | |

| | | | | | $ | 131,956,893 | |

| | | | | | | | | |

| |

Real Estate Investment Trusts (REITs) — 3.2% | | | | | |

AvalonBay Communities, Inc.(1) | | | 119,580 | | | $ | 18,427,278 | |

Public Storage, Inc. | | | 132,870 | | | | 23,276,167 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

| |

Real Estate Investment Trusts (REITs) (continued) | | | | | |

Simon Property Group, Inc. | | | 68,835 | | | $ | 11,704,015 | |

| | | | | | | | | |

| | | $ | 53,407,460 | |

| | | | | | | | | |

|

Specialty Retail — 2.5% | |

Home Depot, Inc. (The)(1) | | | 272,278 | | | $ | 25,457,993 | |

TJX Cos., Inc. (The) | | | 260,267 | | | | 15,514,516 | |

| | | | | | | | | |

| | | $ | 40,972,509 | |

| | | | | | | | | |

|

Technology Hardware, Storage & Peripherals — 2.7% | |

Apple, Inc. | | | 239,000 | | | $ | 24,497,500 | |

Hewlett-Packard Co. | | | 525,000 | | | | 19,950,000 | |

| | | | | | | | | |

| | | $ | 44,447,500 | |

| | | | | | | | | |

|

Thrifts & Mortgage Finance — 0.3% | |

Federal National Mortgage Association(2) | | | 1,475,459 | | | $ | 5,739,536 | |

| | | | | | | | | |

| | | $ | 5,739,536 | |

| | | | | | | | | |

|

Tobacco — 1.0% | |

Altria Group, Inc. | | | 384,917 | | | $ | 16,582,224 | |

| | | | | | | | | |

| | | $ | 16,582,224 | |

| | | | | | | | | |

| |

Total Common Stocks

(identified cost $1,128,531,067) | | | $ | 1,432,439,029 | |

| | | | | | | | | |

| | |

| Preferred Stocks — 28.1% | | | | | | | | |

| | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

Banks — 13.6% | | | | | | | | |

AgriBank FCB, 6.875% to 1/1/24(3) | | | 92,513 | | | $ | 9,838,184 | |

Banco Santander SA, 5.95% to 1/30/19(3)(4) | | | 1,270 | | | | 1,360,536 | |

Bank of America Corp., Series U,

5.20% to 6/1/23(3) | | | 4,520 | | | | 4,439,148 | |

Barclays Bank PLC, 8.25% to 12/15/18(3) | | | 11,340 | | | | 12,290,396 | |

Citigroup, Inc., Series K,

6.875% to 11/15/23(3) | | | 412,807 | | | | 11,175,718 | |

CoBank ACB, Series F,

6.25% to 10/1/22(3)(4) | | | 94,700 | | | | 9,857,683 | |

Deutsche Bank Contingent Capital Trust III, 7.60% | | | 204,580 | | | | 5,646,408 | |

Farm Credit Bank of Texas,

6.75% to 9/15/23(3)(4) | | | 13,800 | | | | 1,457,625 | |

Farm Credit Bank of Texas, Series 1, 10.00% | | | 8,678 | | | | 10,739,025 | |

First Tennessee Bank, 3.75%(4)(5) | | | 4,660 | | | | 3,452,332 | |

HSBC Capital Funding LP, Series 2, 10.176% to 6/30/30(1)(3)(4) | | | 4,737 | | | | 7,212,203 | |

JPMorgan Chase & Co., Series Q,

5.15% to 5/1/23(3) | | | 15,781 | | | | 15,730,959 | |

JPMorgan Chase & Co., Series R,

6.00% to 8/1/23(3) | | | 4,566 | | | | 4,730,376 | |

KeyCorp, Series A, 7.75% | | | 81,279 | | | | 10,647,549 | |

Lloyds Banking Group PLC,

6.657% to 5/21/37(1)(3)(4) | | | 12,213 | | | | 13,631,865 | |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Banks (continued) | |

Regions Financial Corp., Series A, 6.375% | | | 471,632 | | | $ | 11,738,920 | |

Royal Bank of Scotland Group PLC, Series 1, 7.648% to 9/30/31(3) | | | 1,759 | | | | 2,141,216 | |

Royal Bank of Scotland Group PLC, Series S, 6.60% | | | 111,140 | | | | 2,781,834 | |

Societe Generale, 7.875% to 12/18/23(3)(4) | | | 8,465 | | | | 8,965,599 | |

Standard Chartered PLC,

7.014% to 7/30/37(1)(3)(4) | | | 135.97 | | | | 15,535,039 | |

SunTrust Banks, Inc., Series E, 5.875% | | | 330,358 | | | | 7,887,297 | |

Synovus Financial Corp., Series C,

7.875% to 8/1/18(3) | | | 50,429 | | | | 1,410,070 | |

Texas Capital Bancshares, Inc., 6.50% | | | 274,290 | | | | 6,720,105 | |

Texas Capital Bancshares, Inc., Series A, 6.50% | | | 47,100 | | | | 1,161,486 | |

Webster Financial Corp., Series E, 6.40% | | | 286,495 | | | | 7,063,907 | |

Wells Fargo & Co., Series L, 7.50% | | | 10,588 | | | | 12,874,690 | |

Wells Fargo & Co., Series T, 6.00% | | | 254,855 | | | | 6,364,366 | |

Zions Bancorporation, Series G, 6.30% to 3/15/23(3) | | | 343,260 | | | | 8,903,306 | |

Zions Bancorporation, Series I,

5.80% to 9/15/23 (3) | | | 7,234 | | | | 7,047,403 | |

Zions Bancorporation, Series J, 7.20% to 9/15/23(3) | | | 4,120 | | | | 4,528,036 | |

| | | | | | | | | |

| | | $ | 227,333,281 | |

| | | | | | | | | |

| | |

Capital Markets — 2.6% | | | | | | | | |

Affiliated Managers Group, Inc., 6.375% | | | 282,688 | | | $ | 7,223,103 | |

Bank of New York Mellon Corp. (The), 5.20% | | | 144,283 | | | | 3,451,249 | |

Goldman Sachs Group, Inc. (The), Series I, 5.95% | | | 171,000 | | | | 4,141,620 | |

Goldman Sachs Group, Inc. (The), Series J, 5.50% to 5/10/23(3) | | | 349,225 | | | | 8,549,028 | |

Morgan Stanley, Series G, 6.625% | | | 507,393 | | | | 12,981,650 | |

State Street Corp., Series D, 5.90% to 3/15/24(3) | | | 253,695 | | | | 6,617,000 | |

| | | | | | | | | |

| | | $ | 42,963,650 | |

| | | | | | | | | |

| | |

Consumer Finance — 1.9% | | | | | | | | |

Ally Financial, Inc., Series A, 8.50% to 5/15/16(3) | | | 187,367 | | | $ | 5,119,335 | |

Capital One Financial Corp., Series B, 6.00% | | | 593,826 | | | | 14,352,774 | |

Discover Financial Services, Series B, 6.50% | | | 506,044 | | | | 12,960,546 | |

| | | | | | | | | |

| | | $ | 32,432,655 | |

| | | | | | | | | |

| | |

Diversified Financial Services — 1.6% | | | | | | | | |

General Electric Capital Corp., Series B,

6.25% to 12/15/22(3) | | | 50.05 | | | $ | 5,663,876 | |

KKR Financial Holdings, LLC, Series A, 7.375% | | | 435,261 | | | | 11,291,323 | |

RBS Capital Funding Trust VII, Series G, 6.08% | | | 395,086 | | | | 9,600,590 | |

| | | | | | | | | |

| | | $ | 26,555,789 | |

| | | | | | | | | |

| | |

Electric Utilities — 1.9% | | | | | | | | |

AES Gener SA, 8.375% to 6/18/19(3)(4) | | | 7,010 | | | $ | 8,147,129 | |

Electricite de France SA, 5.25% to 1/29/23(3)(4) | | | 2,950 | | | | 3,067,447 | |

Entergy Arkansas, Inc., 4.90% | | | 96,455 | | | | 2,236,068 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

| | |

Electric Utilities (continued) | | | | | | | | |

Entergy Arkansas, Inc., 6.45% | | | 308,409 | | | $ | 7,835,532 | |

Entergy Louisiana, LLC, 6.95% | | | 14,484 | | | | 1,450,664 | |

NextEra Energy Capital Holdings, Inc., Series G, 5.70% | | | 112,500 | | | | 2,763,281 | |

NextEra Energy Capital Holdings, Inc., Series I, 5.125% | | | 300,395 | | | | 6,642,484 | |

| | | | | | | | | |

| | | $ | 32,142,605 | |

| | | | | | | | | |

| | |

Food Products — 0.9% | | | | | | | | |

Dairy Farmers of America, 7.875%(4) | | | 94,450 | | | $ | 10,064,828 | |

Ocean Spray Cranberries, Inc., 6.25%(4) | | | 57,835 | | | | 5,252,141 | |

| | | | | | | | | |

| | | $ | 15,316,969 | |

| | | | | | | | | |

| | |

Insurance — 1.5% | | | | | | | | |

American Overseas Group, Ltd., Series A, 7.50% to 12/15/16(3) | | | 13,000 | | | $ | 5,200,812 | |

Aspen Insurance Holdings, Ltd.,

5.95% to 7/1/23(3) | | | 70,552 | | | | 1,820,947 | |

Aspen Insurance Holdings, Ltd.,

7.401% to 1/1/17(3) | | | 89,150 | | | | 2,402,593 | |

Endurance Specialty Holdings, Ltd., Series B, 7.50% | | | 185,750 | | | | 4,875,938 | |

Montpelier Re Holdings, Ltd., 8.875% | | | 359,613 | | | | 10,230,990 | |

| | | | | | | | | |

| | | $ | 24,531,280 | |

| | | | | | | | | |

| | |

Machinery — 1.0% | | | | | | | | |

Stanley Black & Decker, Inc., 5.75% | | | 644,724 | | | $ | 16,158,395 | |

| | | | | | | | | |

| | | $ | 16,158,395 | |

| | | | | | | | | |

| | |

Multi-Utilities — 0.2% | | | | | | | | |

DTE Energy Co., Series C, 5.25% | | | 144,047 | | | $ | 3,494,580 | |

| | | | | | | | | |

| | | $ | 3,494,580 | |

| | | | | | | | | |

| | |

Pipelines — 0.5% | | | | | | | | |

NuStar Logistics LP, 7.625% to 1/15/18(3) | | | 283,020 | | | $ | 7,653,285 | |

| | | | | | | | | |

| | | $ | 7,653,285 | |

| | | | | | | | | |

|

Real Estate Investment Trusts (REITs) — 1.5% | |

American Realty Capital Properties, Inc., Series F, 6.70% | | | 196,383 | | | $ | 4,642,494 | |

Cedar Realty Trust, Inc., Series B, 7.25% | | | 188,900 | | | | 4,816,950 | |

Chesapeake Lodging Trust, Series A, 7.75% | | | 73,431 | | | | 1,940,047 | |

DDR Corp., Series J, 6.50% | | | 250,000 | | | | 6,380,000 | |

DDR Corp., Series K, 6.25% | | | 129,500 | | | | 3,220,989 | |

Sunstone Hotel Investors, Inc., Series D, 8.00% | | | 120,774 | | | | 3,245,801 | |

Taubman Centers, Inc., Series K, 6.25% | | | 70,600 | | | | 1,765,000 | |

| | | | | | | | | |

| | | $ | 26,011,281 | |

| | | | | | | | | |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

| | |

Thrifts & Mortgage Finance — 0.9% | | | | | | | | |

Elmira Savings Bank FSB (The), 8.998% to 12/31/17(3) | | | 4,750 | | | $ | 4,560,000 | |

EverBank Financial Corp., Series A, 6.75% | | | 391,931 | | | | 9,857,065 | |

| | | | | | | | | |

| | | $ | 14,417,065 | |

| | | | | | | | | |

| |

Total Preferred Stocks

(identified cost $449,088,363) | | | $ | 469,010,835 | |

| | | | | | | | | |

| |

| Corporate Bonds & Notes — 9.8% | | | | | |

| | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

| | |

Banks — 3.5% | | | | | | | | |

Banco do Brasil SA, 6.25% to 4/15/24, 10/29/49(3)(4) | | $ | 3,262 | | | $ | 2,625,910 | |

Caixa Economica Federal, 7.25% to 7/23/19, 7/23/24(3)(4) | | | 10,197 | | | | 10,406,038 | |

Credit Agricole SA, 7.875% to 1/23/24, 1/29/49(3)(4) | | | 12,885 | | | | 13,939,959 | |

Credit Suisse Group AG, 6.25% to 12/18/24, 12/29/49(3)(4) | | | 14,150 | | | | 14,121,700 | |

Groupe BPCE, 12.50% to 9/30/19, 8/29/49(1)(3)(4) | | | 5,691 | | | | 7,782,443 | |

Societe Generale SA, 8.25% to 11/29/2018, 9/29/49(3)(6) | | | 5,461 | | | | 5,859,107 | |

SunTrust Preferred Capital I, 4.00%, 6/29/49(5) | | | 5,100 | | | | 4,182,000 | |

| | | | | | | | | |

| | | $ | 58,917,157 | |

| | | | | | | | | |

| | |

Chemicals — 0.2% | | | | | | | | |

Sinochem Group,

5.00% to 11/2/18, 12/29/49(3)(4) | | $ | 2,350 | | | $ | 2,444,000 | |

| | | | | | | | | |

| | | $ | 2,444,000 | |

| | | | | | | | | |

| | |

Diversified Financial Services — 1.3% | | | | | | | | |

Odebrecht Oil & Gas Finance, Ltd., 7.00% to 6/17/24, 12/29/49(3)(4) | | $ | 6,905 | | | $ | 7,112,150 | |

Textron Financial Corp., 6.00% to 2/15/17, 2/15/67(1)(3)(4) | | | 16,261 | | | | 14,960,120 | |

| | | | | | | | | |

| | | $ | 22,072,270 | |

| | | | | | | | | |

|

Diversified Telecommunication Services — 0.5% | |

Koninklijke KPN NV, 7.00% to 3/28/23, 3/28/73(3)(4) | | $ | 8,049 | | | $ | 8,562,124 | |

| | | | | | | | | |

| | | $ | 8,562,124 | |

| | | | | | | | | |

| | |

Electric Utilities — 1.6% | | | | | | | | |

Enel SpA, 8.75% to 9/24/23, 9/24/73(3)(4) | | $ | 11,100 | | | $ | 13,098,000 | |

PPL Capital Funding, Inc., Series A, 6.70% to 3/30/17, 3/30/67(1)(3) | | | 13,510 | | | | 13,786,779 | |

| | | | | | | | | |

| | | $ | 26,884,779 | |

| | | | | | | | | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

| | |

Insurance — 2.1% | | | | | | | | |

Allstate Corp. (The), Series B, 5.75% to 8/15/23, 8/15/53(3) | | $ | 1,237 | | | $ | 1,325,910 | |

MetLife, Inc.,

10.75% to 8/1/39, 8/1/69(1)(3) | | | 4,575 | | | | 7,434,375 | |

QBE Capital Funding II, LP, 6.797% to 6/1/17, 6/29/49(3)(4) | | | 3,685 | | | | 3,841,613 | |

QBE Capital Funding III, Ltd., 7.25% to 5/24/21, 5/24/41(1)(3)(4) | | | 6,719 | | | | 7,316,695 | |

XL Capital, Ltd., Series E, 6.50% to 4/15/17, 12/29/49(1)(3) | | | 16,287 | | | | 15,778,031 | |

| | | | | | | | | |

| | | $ | 35,696,624 | |

| | | | | | | | | |

| | |

Pipelines — 0.6% | | | | | | | | |

DCP Midstream, LLC,

5.85% to 5/21/23, 5/21/43(3)(4) | | $ | 9,687 | | | $ | 9,444,825 | |

| | | | | | | | | |

| | | $ | 9,444,825 | |

| | | | | | | | | |

| |

Total Corporate Bonds & Notes

(identified cost $148,949,732) | | | $ | 164,021,779 | |

| | | | | | | | | |

| |

| Short-Term Investments — 2.4% | | | | | |

| | |

| | | | | | | | |

| Description | | Interest

(000’s omitted) | | | Value | |

Eaton Vance Cash Reserves Fund, LLC, 0.13%(7) | | $ | 39,669 | | | $ | 39,668,793 | |

| | | | | | | | | |

| |

Total Short-Term Investments

(identified cost $39,668,793) | | | $ | 39,668,793 | |

| | | | | | | | | |

| |

Total Investments — 126.0%

(identified cost $1,766,237,955) | | | $ | 2,105,140,436 | |

| | | | | | | | | |

| |

Other Assets, Less Liabilities — (26.0)% | | | $ | (433,967,076 | ) |

| | | | | | | | | |

| |

Net Assets — 100.0% | | | $ | 1,671,173,360 | |

| | | | | | | | | |

The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

| | | | |

| PC | | – | | Participation Certificate |

| (1) | Security has been segregated as collateral with the custodian for borrowings under the Committed Facility Agreement. |

| (2) | Non-income producing security. |

| (3) | Security converts to floating rate after the indicated fixed-rate coupon period. |

| (4) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be sold in certain transactions (normally to qualified institutional buyers) and remain exempt from registration. At August 31, 2014, the aggregate value of these securities is $203,660,004 or 12.2% of the Fund’s net assets. |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Portfolio of Investments — continued

| (5) | Variable rate security. The stated interest rate represents the rate in effect at August 31, 2014. |

| (6) | Security exempt from registration under Regulation S of the Securities Act of 1933, which exempts from registration securities offered and sold outside the United States. Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933. At August 31, 2014, the aggregate value of these securities is $5,859,107 or 0.4% of the Fund’s net assets. |

| (7) | Affiliated investment company, available to Eaton Vance portfolios and funds, which invests in high quality, U.S. dollar denominated money market instruments. The rate shown is the annualized seven-day yield as of August 31, 2014. |

| | | | | | | | |

| Country Concentration of Portfolio (based on country of risk) | |

| | |

| | | | | | | | |

| Country | | Percentage of Total Investments | | | Value | |

United States | | | 88.2 | % | | $ | 1,857,344,459 | |

France | | | 4.0 | | | | 83,629,344 | |

Switzerland | | | 2.9 | | | | 61,145,841 | |

United Kingdom | | | 1.5 | | | | 31,469,498 | |

Ireland | | | 0.9 | | | | 18,637,191 | |

Cayman Islands | | | 0.8 | | | | 15,778,031 | |

Italy | | | 0.6 | | | | 13,098,000 | |

Brazil | | | 0.6 | | | | 13,031,948 | |

Netherlands | | | 0.4 | | | | 8,562,124 | |

China | | | 0.1 | | | | 2,444,000 | |

| | |

Total Investments | | | 100.0 | % | | $ | 2,105,140,436 | |

| | |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Statement of Assets and Liabilities

| | | | |

| Assets | | August 31, 2014 | |

Unaffiliated investments, at value (identified cost, $1,726,569,162) | | $ | 2,065,471,643 | |

Affiliated investment, at value (identified cost, $39,668,793) | | | 39,668,793 | |

Cash | | | 54,525 | |

Foreign currency, at value (identified cost, $3,313,381) | | | 3,202,289 | |

Dividends and interest receivable | | | 8,139,872 | |

Interest receivable from affiliated investment | | | 2,994 | |

Receivable for investments sold | | | 1,044,864 | |

Tax reclaims receivable | | | 4,966,912 | |

Total assets | | $ | 2,122,551,892 | |

|

| Liabilities | |

Notes payable | | $ | 447,000,000 | |

Payable for investments purchased | | | 2,360,252 | |

Payable to affiliate: | | | | |

Investment adviser fee | | | 1,495,269 | |

Accrued expenses | | | 523,011 | |

Total liabilities | | $ | 451,378,532 | |

Net Assets | | $ | 1,671,173,360 | |

|

| Sources of Net Assets | |

Common shares, $0.01 par value, unlimited number of shares authorized, 72,835,900 shares issued and outstanding | | $ | 728,359 | |

Additional paid-in capital | | | 1,382,213,413 | |

Accumulated net realized loss | | | (71,860,872 | ) |

Accumulated undistributed net investment income | | | 20,894,738 | |

Net unrealized appreciation | | | 339,197,722 | |

Net Assets | | $ | 1,671,173,360 | |

|

| Net Asset Value | |

($1,671,173,360 ÷ 72,835,900 common shares issued and outstanding) | | $ | 22.94 | |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Statement of Operations

| | | | |

| Investment Income | | Year Ended August 31, 2014 | |

Dividends (net of foreign taxes, $2,318,739) | | $ | 115,765,121 | |

Interest (net of foreign taxes, $11,705) | | | 9,826,222 | |

Interest income allocated from affiliated investment | | | 38,615 | |

Expenses allocated from affiliated investment | | | (4,892 | ) |

Total investment income | | $ | 125,625,066 | |

|

| Expenses | |

Investment adviser fee | | $ | 17,029,175 | |

Trustees’ fees and expenses | | | 68,000 | |

Custodian fee | | | 534,741 | |

Transfer and dividend disbursing agent fees | | | 19,486 | |

Legal and accounting services | | | 95,643 | |

Printing and postage | | | 162,278 | |

Interest expense and fees | | | 3,445,541 | |

Miscellaneous | | | 171,108 | |

Total expenses | | $ | 21,525,972 | |

Deduct — | | | | |

Reduction of custodian fee | | $ | 655 | |

Total expense reductions | | $ | 655 | |

| |

Net expenses | | $ | 21,525,317 | |

| |

Net investment income | | $ | 104,099,749 | |

|

| Realized and Unrealized Gain (Loss) | |

Net realized gain (loss) — | | | | |

Investment transactions | | $ | 159,083,032 | |

Investment transactions allocated from affiliated investment | | | 267 | |

Proceeds from securities litigation settlements | | | 1,424,224 | |

Foreign currency and forward foreign currency exchange contract transactions | | | (2,072,624 | ) |

Net realized gain | | $ | 158,434,899 | |

Change in unrealized appreciation (depreciation) — | | | | |

Investments | | $ | 86,009,585 | |

Foreign currency and forward foreign currency exchange contracts | | | (1,009,332 | ) |

Net change in unrealized appreciation (depreciation) | | $ | 85,000,253 | |

| |

Net realized and unrealized gain | | $ | 243,435,152 | |

| |

Net increase in net assets from operations | | $ | 347,534,901 | |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended August 31, | |

| Increase (Decrease) in Net Assets | | 2014 | | | 2013 | |

From operations — | | | | | | | | |

Net investment income | | $ | 104,099,749 | | | $ | 101,201,402 | |

Net realized gain from investment, foreign currency and forward foreign currency exchange contract transactions and proceeds from securities litigation settlements | | | 158,434,899 | | | | 75,567,436 | |

Net change in unrealized appreciation (depreciation) from investments, foreign currency and forward foreign currency exchange contracts | | | 85,000,253 | | | | 4,577,541 | |

Net increase in net assets from operations | | $ | 347,534,901 | | | $ | 181,346,379 | |

Distributions to shareholders — | | | | | | | | |

From net investment income | | $ | (96,376,462 | ) | | $ | (93,958,310 | ) |

Total distributions | | $ | (96,376,462 | ) | | $ | (93,958,310 | ) |

| | |

Net increase in net assets | | $ | 251,158,439 | | | $ | 87,388,069 | |

|

| Net Assets | |

At beginning of year | | $ | 1,420,014,921 | | | $ | 1,332,626,852 | |

At end of year | | $ | 1,671,173,360 | | | $ | 1,420,014,921 | |

|

Accumulated undistributed net investment income included in net assets | |

At end of year | | $ | 20,894,738 | | | $ | 13,155,214 | |

| | | | |

| | 13 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Statement of Cash Flows

| | | | |

| Cash Flows From Operating Activities | | Year Ended August 31, 2014 | |

Net increase in net assets from operations | | $ | 347,534,901 | |

Adjustments to reconcile net increase in net assets from operations to net cash provided by operating activities: | | | | |

Investments purchased | | | (1,385,172,274 | ) |

Investments sold | | | 1,399,613,979 | |

Increase in short-term investments, net | | | (23,737,883 | ) |

Net amortization/accretion of premium (discount) | | | 57,521 | |

Decrease in restricted cash | | | 1,476,000 | |

Decrease in dividends and interest receivable | | | 172,119 | |

Increase in interest receivable from affiliated investment | | | (1,316 | ) |

Decrease in receivable for open forward foreign currency exchange contracts | | | 950,637 | |

Decrease in tax reclaims receivable | | | 298,149 | |

Increase in payable to affiliate for investment adviser fee | | | 121,945 | |

Decrease in accrued expenses | | | (18,119 | ) |

Net change in unrealized (appreciation) depreciation from investments | | | (86,009,585 | ) |

Net realized gain from investments | | | (159,083,032 | ) |

Net cash provided by operating activities | | $ | 96,203,042 | |

|

| Cash Flows From Financing Activities | |

Distributions paid to common shareholders, net of reinvestments | | $ | (96,376,462 | ) |

Net cash used in financing activities | | $ | (96,376,462 | ) |

| |

Net decrease in cash* | | $ | (173,420 | ) |

| |

Cash at beginning of year(1) | | $ | 3,430,234 | |

| |

Cash at end of year(1) | | $ | 3,256,814 | |

|

| Supplemental disclosure of cash flow information: | |

Cash paid for interest and fees on borrowings | | $ | 3,456,900 | |

| (1) | Balance includes foreign currency, at value. |

| * | Includes net change in unrealized appreciation (depreciation) on foreign currency of $(53,527). |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Financial Highlights

Selected data for a common share outstanding during the periods stated

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended August 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

Net asset value — Beginning of year (Common shares) | | $ | 19.500 | | | $ | 18.300 | | | $ | 16.780 | | | $ | 15.950 | | | $ | 15.320 | |

| | | | | |

| Income (Loss) From Operations | | | | | | | | | | | | | | | | | | | | |

Net investment income(1) | | $ | 1.429 | (2) | | $ | 1.389 | | | $ | 1.202 | | | $ | 1.354 | (3) | | $ | 1.331 | |

Net realized and unrealized gain | | | 3.334 | | | | 1.101 | | | | 1.608 | | | | 0.766 | | | | 0.589 | |

| | | | | |

Total income from operations | | $ | 4.763 | | | $ | 2.490 | | | $ | 2.810 | | | $ | 2.120 | | | $ | 1.920 | |

| | | | | |

| Less Distributions to Common Shareholders | | | | | | | | | | | | | | | | | | | | |

From net investment income | | $ | (1.323 | ) | | $ | (1.290 | ) | | $ | (1.290 | ) | | $ | (1.290 | ) | | $ | (1.290 | ) |

| | | | | |

Total distributions to common shareholders | | $ | (1.323 | ) | | $ | (1.290 | ) | | $ | (1.290 | ) | | $ | (1.290 | ) | | $ | (1.290 | ) |

| | | | | |

Net asset value — End of year (Common shares) | | $ | 22.940 | | | $ | 19.500 | | | $ | 18.300 | | | $ | 16.780 | | | $ | 15.950 | |

| | | | | |

Market value — End of year (Common shares) | | $ | 20.560 | | | $ | 17.630 | | | $ | 16.600 | | | $ | 15.160 | | | $ | 14.750 | |

| | | | | |

Total Investment Return on Net Asset Value(4) | | | 25.90 | % | | | 14.45 | % | | | 18.42 | % | | | 13.58 | % | | | 13.25 | % |

| | | | | |

Total Investment Return on Market Value(4) | | | 24.80 | % | | | 14.09 | % | | | 18.87 | % | | | 10.96 | % | | | 15.26 | % |

| | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets applicable to common shares, end of year (000’s omitted) | | $ | 1,671,173 | | | $ | 1,420,015 | | | $ | 1,332,627 | | | $ | 1,222,187 | | | $ | 1,161,717 | |

Ratios (as a percentage of average daily net assets applicable to common shares): | | | | | | | | | | | | | | | | | | | | |

Expenses excluding interest and fees(5) | | | 1.15 | % | | | 1.19 | % | | | 1.23 | % | | | 1.13 | % | | | 1.04 | % |

Interest and fee expense | | | 0.22 | % | | | 0.30 | % | | | 0.45 | % | | | 0.36 | % | | | 0.39 | % |

Total expenses(5) | | | 1.37 | % | | | 1.49 | % | | | 1.68 | % | | | 1.49 | % | | | 1.43 | % |

Net investment income | | | 6.63 | %(2) | | | 7.14 | % | | | 6.93 | % | | | 7.47 | %(3) | | | 8.09 | % |

Portfolio Turnover | | | 68 | % | | | 84 | % | | | 94 | % | | | 86 | % | | | 117 | % |

Senior Securities: | | | | | | | | | | | | | | | | | | | | |

Total notes payable outstanding (in 000’s) | | $ | 447,000 | | | $ | 447,000 | | | $ | 447,000 | | | $ | 447,000 | | | $ | 340,000 | |

Asset coverage per $1,000 of notes payable(6) | | $ | 4,739 | | | $ | 4,177 | | | $ | 3,981 | | | $ | 3,734 | | | $ | 4,417 | |

| (1) | Computed using average common shares outstanding. |

| (2) | Net investment income per share reflects special dividends which amounted to $0.501 per share. Excluding special dividends, the ratio of net investment income to average daily net assets applicable to common shares would have been 4.30%. |

| (3) | Net investment income per share reflects special dividends which amounted to $0.191 per share. Excluding special dividends, the ratio of net investment income to average daily net assets applicable to common shares would have been 6.41%. |

| (4) | Returns are historical and are calculated by determining the percentage change in net asset value or market value with all distributions reinvested. Distributions are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. |

| (5) | Excludes the effect of custody fee credits, if any, of less than 0.005%. |

| (6) | Calculated by subtracting the Fund’s total liabilities (not including the notes payable) from the Fund’s total assets, and dividing the result by the notes payable balance in thousands. |

| | | | |

| | 15 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Notes to Financial Statements

1 Significant Accounting Policies

Eaton Vance Tax-Advantaged Dividend Income Fund (the Fund) is a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the 1940 Act), as a diversified, closed-end management investment company. The Fund’s investment objective is to provide a high level of after-tax total return consisting primarily of tax-advantaged dividend income and capital appreciation. The Fund pursues its objective by investing primarily in dividend-paying common and preferred stocks.

The following is a summary of significant accounting policies of the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America.

A Investment Valuation — The following methodologies are used to determine the market value or fair value of investments.

Equity Securities. Equity securities listed on a U.S. securities exchange generally are valued at the last sale or closing price on the day of valuation or, if no sales took place on such date, at the mean between the closing bid and asked prices therefore on the exchange where such securities are principally traded. Equity securities listed on the NASDAQ Global or Global Select Market generally are valued at the NASDAQ official closing price. Unlisted or listed securities for which closing sales prices or closing quotations are not available are valued at the mean between the latest available bid and asked prices or, in the case of preferred equity securities that are not listed or traded in the over-the-counter market, by a third party pricing service that will use various techniques that consider factors including, but not limited to, prices or yields of securities with similar characteristics, benchmark yields, broker/dealer quotes, quotes of underlying common stock, issuer spreads, as well as industry and economic events. The value of preferred equity securities that are valued by a pricing service on a bond basis will be adjusted by an income factor, to be determined by the investment adviser, to reflect the next anticipated regular dividend.

Debt Obligations. Debt obligations (including short-term obligations with a remaining maturity of more than sixty days) are generally valued on the basis of valuations provided by third party pricing services, as derived from such services’ pricing models. Inputs to the models may include, but are not limited to, reported trades, executable bid and asked prices, broker/dealer quotations, prices or yields of securities with similar characteristics, interest rates, anticipated prepayments, benchmark curves or information pertaining to the issuer, as well as industry and economic events. The pricing services may use a matrix approach, which considers information regarding securities with similar characteristics to determine the valuation for a security. Short-term obligations purchased with a remaining maturity of sixty days or less are generally valued at amortized cost, which approximates market value.

Foreign Securities and Currencies. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rate quotations supplied by a third party pricing service. The pricing service uses a proprietary model to determine the exchange rate. Inputs to the model include reported trades and implied bid/ask spreads. The daily valuation of exchange-traded foreign securities generally is determined as of the close of trading on the principal exchange on which such securities trade. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the close of regular trading on the New York Stock Exchange. When valuing foreign equity securities that meet certain criteria, the Fund’s Trustees have approved the use of a fair value service that values such securities to reflect market trading that occurs after the close of the applicable foreign markets of comparable securities or other instruments that have a strong correlation to the fair-valued securities.

Derivatives. Forward foreign currency exchange contracts are generally valued at the mean of the average bid and average asked prices that are reported by currency dealers to a third party pricing service at the valuation time. Such third party pricing service valuations are supplied for specific settlement periods and the Fund’s forward foreign currency exchange contracts are valued at an interpolated rate between the closest preceding and subsequent settlement period reported by the third party pricing service.

Affiliated Fund. The Fund may invest in Eaton Vance Cash Reserves Fund, LLC (Cash Reserves Fund), an affiliated investment company managed by Eaton Vance Management (EVM). The value of the Fund’s investment in Cash Reserves Fund reflects the Fund’s proportionate interest in its net assets. Cash Reserves Fund generally values its investment securities utilizing the amortized cost valuation technique in accordance with Rule 2a-7 under the 1940 Act. This technique involves initially valuing a portfolio security at its cost and thereafter assuming a constant amortization to maturity of any discount or premium. If amortized cost is determined not to approximate fair value, Cash Reserves Fund may value its investment securities in the same manner as debt obligations described above.

Fair Valuation. Investments for which valuations or market quotations are not readily available or are deemed unreliable are valued at fair value using methods determined in good faith by or at the direction of the Trustees of the Fund in a manner that fairly reflects the security’s value, or the amount that the Fund might reasonably expect to receive for the security upon its current sale in the ordinary course. Each such determination is based on a consideration of relevant factors, which are likely to vary from one pricing context to another. These factors may include, but are not limited to, the type of security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies or entities, quotations or relevant information obtained from broker/dealers or other market participants, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company’s or entity’s financial condition, and an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold.

B Investment Transactions — Investment transactions for financial statement purposes are accounted for on a trade date basis. Realized gains and losses on investments sold are determined on the basis of identified cost.

C Income — Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. However, if the ex-dividend date has passed, certain dividends from foreign securities are recorded as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends and

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Notes to Financial Statements — continued

capital gains have been provided for in accordance with the Fund’s understanding of the applicable countries’ tax rules and rates. Interest income is recorded on the basis of interest accrued, adjusted for amortization of premium or accretion of discount.

D Federal Taxes — The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its net investment income, and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary.

At August 31, 2014, the Fund, for federal income tax purposes, had a capital loss carryforward of $50,826,719 which will reduce its taxable income arising from future net realized gains on investment transactions, if any, to the extent permitted by the Internal Revenue Code, and thus will reduce the amount of distributions to shareholders, which would otherwise be necessary to relieve the Fund of any liability for federal income or excise tax. Such capital loss carryforward will expire on August 31, 2018. In addition, such capital loss carryforward cannot be utilized prior to the utilization of new capital losses, if any, created after August 31, 2014.

During the year ended August 31, 2014, a capital loss carryforward of $161,028,290 was utilized to offset net realized gains by the Fund.

Additionally, at August 31, 2014, the Fund had a net capital loss of $20,833,378 attributable to security transactions incurred after October 31, 2013. This net capital loss is treated as arising on the first day of the Fund’s taxable year ending August 31, 2015.

As of August 31, 2014, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund files a U.S. federal income tax return annually after its fiscal year-end, which is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

E Expense Reduction — State Street Bank and Trust Company (SSBT) serves as custodian of the Fund. Pursuant to the custodian agreement, SSBT receives a fee reduced by credits, which are determined based on the average daily cash balance the Fund maintains with SSBT. All credit balances, if any, used to reduce the Fund’s custodian fees are reported as a reduction of expenses in the Statement of Operations.

F Foreign Currency Translation — Investment valuations, other assets, and liabilities initially expressed in foreign currencies are translated each business day into U.S. dollars based upon current exchange rates. Purchases and sales of foreign investment securities and income and expenses denominated in foreign currencies are translated into U.S. dollars based upon currency exchange rates in effect on the respective dates of such transactions. Recognized gains or losses on investment transactions attributable to changes in foreign currency exchange rates are recorded for financial statement purposes as net realized gains and losses on investments. That portion of unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

G Use of Estimates — The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

H Indemnifications — Under the Fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Under Massachusetts law, if certain conditions prevail, shareholders of a Massachusetts business trust (such as the Fund) could be deemed to have personal liability for the obligations of the Fund. However, the Fund’s Declaration of Trust contains an express disclaimer of liability on the part of Fund shareholders and the By-laws provide that the Fund shall assume the defense on behalf of any Fund shareholders. Moreover, the By-laws also provide for indemnification out of Fund property of any shareholder held personally liable solely by reason of being or having been a shareholder for all loss or expense arising from such liability. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

I Forward Foreign Currency Exchange Contracts — The Fund may enter into forward foreign currency exchange contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date. The forward foreign currency exchange contracts are adjusted by the daily exchange rate of the underlying currency and any gains or losses are recorded as unrealized until such time as the contracts have been closed. Risks may arise upon entering these contracts from the potential inability of counterparties to meet the terms of their contracts and from movements in the value of a foreign currency relative to the U.S. dollar.

J Statement of Cash Flows — The cash amount shown in the Statement of Cash Flows of the Fund is the amount included in the Fund’s Statement of Assets and Liabilities and represents the unrestricted cash on hand at its custodian and does not include any short-term investments.

2 Distributions to Shareholders

The Fund intends to make monthly distributions of net investment income to common shareholders. In addition, at least annually, the Fund intends to distribute all or substantially all of its net realized capital gains (reduced by available capital loss carryforwards from prior years). Distributions are recorded on the ex-dividend date. The Fund distinguishes between distributions on a tax basis and a financial reporting basis. Accounting principles generally accepted in the United States of America require that only distributions in excess of tax basis earnings and profits be reported in the financial statements as

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Notes to Financial Statements — continued

a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital. For tax purposes, distributions from short-term capital gains are considered to be from ordinary income.

The tax character of distributions declared for the years ended August 31, 2014 and August 31, 2013 was as follows:

| | | | | | | | |

| | | Year Ended August 31, | |

| | | 2014 | | | 2013 | |

| | |

Distributions declared from: | | | | | | | | |

Ordinary income | | $ | 96,376,462 | | | $ | 93,958,310 | |

During the year ended August 31, 2014, accumulated net realized loss was increased by $16,237 and accumulated undistributed net investment income was increased by $16,237 due to differences between book and tax accounting, primarily for foreign currency gain (loss), premium amortization, accretion of market discount distributions from real estate investment trusts (REITs) and investments in partnerships. These reclassifications had no effect on the net assets or net asset value per share of the Fund.

As of August 31, 2014, the components of distributable earnings (accumulated losses) and unrealized appreciation (depreciation) on a tax basis were as follows:

| | | | |

Undistributed ordinary income | | $ | 20,637,953 | |

Capital loss carryforward and post October capital losses | | $ | (71,660,097 | ) |

Net unrealized appreciation | | $ | 339,253,733 | |

The differences between components of distributable earnings (accumulated losses) on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to investments in partnerships, distributions from REITs, premium amortization and accretion of market discount.

3 Investment Adviser Fee and Other Transactions with Affiliates

The investment adviser fee is earned by EVM as compensation for management and investment advisory services rendered to the Fund. Pursuant to the investment advisory agreement and subsequent fee reduction agreement, the fee is computed at an annual rate of 0.85% of the Fund’s average daily gross assets up to and including $1.5 billion, 0.83% over $1.5 billion up to and including $3 billion, and at reduced rates as daily gross assets exceed $3 billion and is payable monthly. Gross assets as referred to herein represent net assets plus obligations attributable to investment leverage. The fee reduction cannot be terminated without the consent of the Trustees and shareholders. For the year ended August 31, 2014, the Fund’s investment adviser fee amounted to $17,029,175 or 0.85% of the Fund’s average daily gross assets. EVM also serves as administrator of the Fund, but receives no compensation. The Fund invests its cash in Cash Reserves Fund. EVM does not currently receive a fee for advisory services provided to Cash Reserves Fund.

During the year ended August 31, 2014, EVM reimbursed the Fund $2,403 for a trading error. The effect of the loss incurred and the reimbursement by EVM of such amount had no impact on total return.

Trustees and officers of the Fund who are members of EVM’s organization receive remuneration for their services to the Fund out of the investment adviser fee. Trustees of the Fund who are not affiliated with EVM may elect to defer receipt of all or a percentage of their annual fees in accordance with the terms of the Trustees Deferred Compensation Plan. For the year ended August 31, 2014, no significant amounts have been deferred. Certain officers and Trustees of the Fund are officers of EVM.

4 Purchases and Sales of Investments

Purchases and sales of investments, other than short-term obligations, aggregated $1,338,135,826 and $1,366,136,569, respectively, for the year ended August 31, 2014.

5 Common Shares of Beneficial Interest

The Fund may issue common shares pursuant to its dividend reinvestment plan. There were no common shares issued by the Fund for the years ended August 31, 2014 and August 31, 2013.

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Notes to Financial Statements — continued

On November 11, 2013, the Board of Trustees of the Fund authorized the repurchase by the Fund of up to 10% of its then currently outstanding common shares in open-market transactions at a discount to net asset value. The repurchase program does not obligate the Fund to purchase a specific amount of shares. There were no repurchases of common shares by the Fund for the year ended August 31, 2014.

6 Federal Income Tax Basis of Investments

The cost and unrealized appreciation (depreciation) of investments of the Fund at August 31, 2014, as determined on a federal income tax basis, were as follows:

| | | | |

| |

Aggregate cost | | $ | 1,766,181,945 | |

| |

Gross unrealized appreciation | | $ | 352,444,434 | |

Gross unrealized depreciation | | | (13,485,943 | ) |

| |

Net unrealized appreciation | | $ | 338,958,491 | |

7 Financial Instruments

The Fund may trade in financial instruments with off-balance sheet risk in the normal course of its investing activities. These financial instruments may include forward foreign currency exchange contracts and may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. The notional or contractual amounts of these instruments represent the investment the Fund has in particular classes of financial instruments and do not necessarily represent the amounts potentially subject to risk. The measurement of the risks associated with these instruments is meaningful only when all related and offsetting transactions are considered.

At August 31, 2014, there were no obligations outstanding under these financial instruments.

The Fund is subject to foreign exchange risk in the normal course of pursuing its investment objective. Because the Fund holds foreign currency denominated investments, the value of these investments and related receivables and payables may change due to future changes in foreign currency exchange rates. To hedge against this risk, the Fund entered into forward foreign currency exchange contracts.

The Fund enters into forward foreign currency exchange contracts that may contain provisions whereby the counterparty may terminate the contract under certain conditions, including but not limited to a decline in the Fund’s net assets below a certain level over a certain period of time, which would trigger a payment by the Fund for those derivatives in a liability position. At August 31, 2014 the Fund had no open derivatives with credit-related contingent features in a net liability position.

The over-the-counter (OTC) derivatives in which the Fund invests are subject to the risk that the counterparty to the contract fails to perform its obligations under the contract. To mitigate this risk, the Fund has entered into an International Swaps and Derivatives Association, Inc. Master Agreement (“ISDA Master Agreement”) or similar agreement with substantially all its derivative counterparties. An ISDA Master Agreement is a bilateral agreement between the Fund and a counterparty that governs certain OTC derivatives and typically contains, among other things, set-off provisions in the event of a default and/or termination event as defined under the relevant ISDA Master Agreement. Under an ISDA Master Agreement, the Fund may, under certain circumstances, offset with the counterparty certain derivative financial instruments’ payables and/or receivables with collateral held and/or posted and create one single net payment. The provisions of the ISDA Master Agreement typically permit a single net payment in the event of default including the bankruptcy or insolvency of the counterparty. However, bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against the right of offset in bankruptcy or insolvency. Certain ISDA Master Agreements allow counterparties to OTC derivatives to terminate derivative contracts prior to maturity in the event the Fund’s net assets decline by a stated percentage or the Fund fails to meet the terms of its ISDA Master Agreement, which would cause the counterparty to accelerate payment by the Fund of any net liability owed to it.

The collateral requirements for derivatives traded under an ISDA Master Agreement are governed by a Credit Support Annex to the ISDA Master Agreement. Collateral requirements are determined at the close of business each day and are typically based on changes in market values for each transaction under an ISDA Master Agreement and netted into one amount for such agreement. Generally, the amount of collateral due from or to a counterparty is subject to a minimum transfer threshold amount before a transfer is required, which may vary by counterparty. Collateral pledged for the benefit of the Fund and/or counterparty is held in segregated accounts by the Fund’s custodian and cannot be sold, re-pledged, assigned or otherwise used while pledged. The portion of such collateral representing cash, if any, is reflected as restricted cash and, in the case of cash pledged by a counterparty for the benefit of the Fund, a corresponding liability on the Statement of Assets and Liabilities. Securities pledged by the Fund as collateral, if any, are identified as such in the Portfolio of Investments.

Eaton Vance

Tax-Advantaged Dividend Income Fund

August 31, 2014

Notes to Financial Statements — continued

The effect of derivative instruments (not considered to be hedging instruments for accounting disclosure purposes) on the Statement of Operations and whose primary underlying risk exposure is foreign exchange risk for the year ended August 31, 2014 was as follows:

| | | | | | | | |

| Derivative | | Realized Gain (Loss)

on Derivatives Recognized

in Income | | | Change in Unrealized

Appreciation (Depreciation) on

Derivatives Recognized in Income | |

| | |

Forward foreign currency exchange contracts | | $ | (1,725,003 | )(1) | | $ | (950,637 | )(2) |

| (1) | Statement of Operations location: Net realized gain (loss) – Foreign currency and forward foreign currency exchange contract transactions. |

| (2) | Statement of Operations location: Change in unrealized appreciation (depreciation) – Foreign currency and forward foreign currency exchange contracts. |

The average notional amount of forward foreign currency exchange contracts outstanding during the year ended August 31, 2014, which is indicative of the volume of this derivative type, was approximately $138,367,000.

8 Committed Facility Agreement