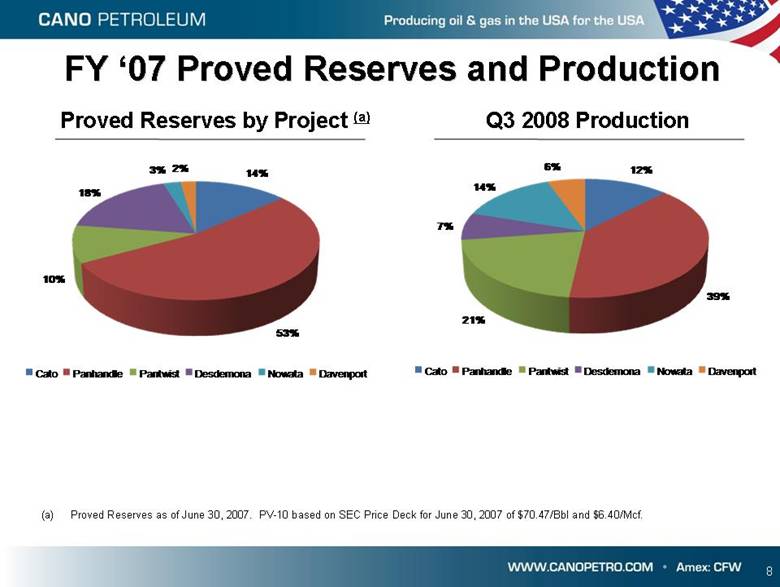

| 2 Disclosure Statements Disclosure Statements Safe-Harbor Statement -- Except for the historical information contained herein, the matters set forth in this presentation are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The company intends that all such statements be subject to the “safe-harbor” provisions of those Acts. Many important risks, factors and conditions may cause the company’s actual results to differ materially from those discussed in any such forward-looking statement. These risks include, but are not limited to, estimates or forecasts of reserves, estimates or forecasts of production, future commodity prices, exchange rates, interest rates, geological and political risks, drilling risks, product demand, transportation restrictions, the ability of Cano Petroleum, Inc. to obtain additional capital, and other risks and uncertainties described in the company’s filings with the Securities and Exchange Commission. The historical results achieved by the company are not necessarily indicative of its future prospects. The company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Cautionary Notes to Investors – The Securities and Exchange Commission (SEC) permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. Cano uses “non-proved reserves” in this presentation, which the SEC’s guidelines strictly prohibit it from including in filings with the SEC. Investors are urged to also consider closely the disclosures in Cano’s Form 10-K for the fiscal year ended June 30, 2007 and Cano’s Form 10-Q for the fiscal quarter ended March 31, 2008 available from Cano by calling 877.698.0900. These forms also can be obtained from the SEC at www.sec.gov . PV10 Calculations of Reserve Values are based on the SEC price deck for June 30, 2007 (Cano’s fiscal year end) of $70.47 per bbl and $6.40 per mcf, are calculated “before tax” (BT) and consider the anticipated costs to develop and produce. |