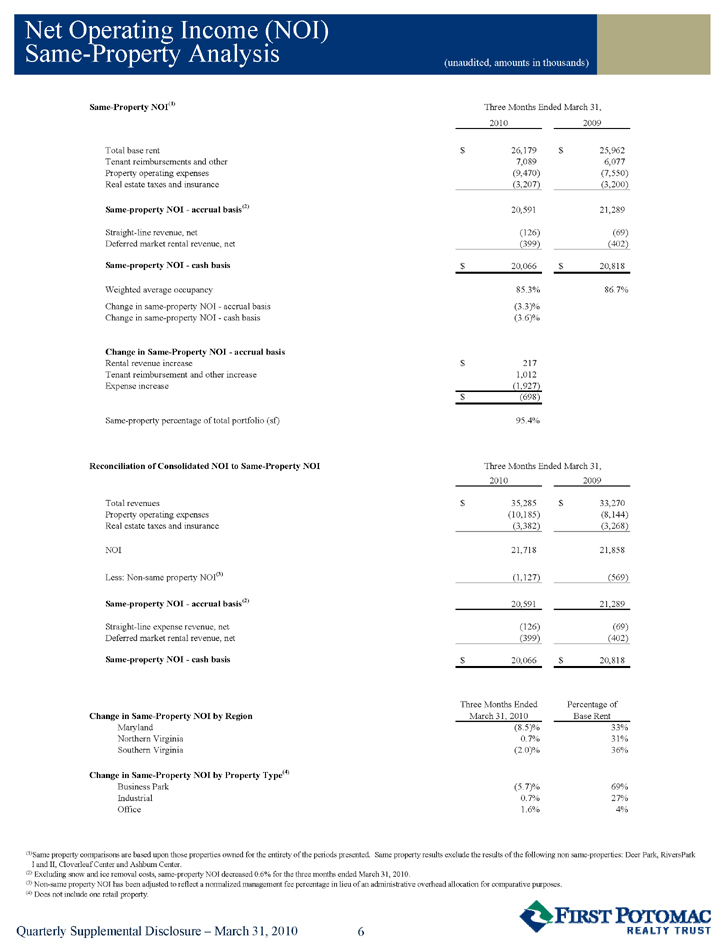

| 31 Management Statements on Non-GAAP Supplemental Measures Investors and analysts following the real estate industry utilize funds from operations ("FFO"), net operating income ("NOI"), earnings before interest, taxes, depreciation and amortization ("EBITDA") and adjusted funds from operations ("AFFO"), variously defined, as supplemental performance measures. The Company believes FFO, NOI, EBITDA and AFFO are appropriate measures given their wide use by and relevance to investors and analysts. FFO, reflecting the assumption that real estate asset values rise or fall with market conditions, principally adjusts for the effects of GAAP depreciation/amortization of real estate assets. NOI provides a measure of rental operations and does not factor in depreciation/amortization and non-property specific expenses such as general and administrative expenses. EBITDA provides a further tool to evaluate the ability to incur and service debt and to fund dividends and other cash needs. AFFO provides a further tool to evaluate the ability to fund dividends. In addition, FFO, NOI, EBITDA and AFFO are commonly used in various ratios, pricing multiples/yields and returns and valuation calculations used to measure financial position, performance and value. NOI Management believes that NOI is a useful measure of the Company's property operating performance. The Company defines NOI as operating revenues (rental, tenant reimbursements and other income) less property and related expenses (property expenses, real estate taxes and insurance). Other real estate investment trust ("REITs") may use different methodologies for calculating NOI, and accordingly, the Company's NOI may not be comparable to other REITs. Because NOI excludes general and administrative expenses, interest expense, depreciation and amortization, gains and losses from property dispositions, discontinued operations and extraordinary items, it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating commercial real estate properties and the impact to operations from trends in occupancy rates, rental rates and operating costs, providing perspective not immediately apparent from net income. The Company uses NOI to evaluate its operating performance since NOI allows the Company to evaluate the impact that factors such as occupancy levels, lease structure, lease rates and tenant base have on the Company's results, margins and returns. In addition, management believes that NOI provides useful information to the investment community about the Company's property and operating performance when compared to other REITs since NOI is generally recognized as a standard measure of property performance in the real estate industry. However, NOI should not be viewed as a measure of the Company's overall financial performance since it does not reflect general and administrative expenses, interest expense, depreciation and amortization costs, the level of capital expenditures and leasing costs necessary to maintain the operating performance of the Company's properties. SAME-PROPERTY NOI The Company defines same-property NOI as NOI for the Company's properties wholly owned during the entirety of the periods reported. Other REITs may use different methodologies for calculating same-property NOI and, accordingly, the Company's same-property NOI may not be comparable to other REITs. EBITDA Management believes that EBITDA is a useful measure of the Company's operating performance. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Management considers EBITDA to be an appropriate supplemental performance measure since it represents earnings prior to the impact of depreciation, amortization, gain (loss) from property dispositions and loss on early retirement of debt. This calculation facilitates the review of income from operations without considering the effect of non-cash depreciation and amortization or the cost of debt. FFO Management believes that FFO is a useful measure of the Company's operating performance. The Company computes FFO as defined by the National Association of Real Estate Investment Trusts, or NAREIT, which states FFO should represent net income (loss) before minority interest (computed in accordance with GAAP) plus real estate related depreciation and amortization (excluding amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures and excluding gains on the sale of property. Further, other REITs may use different methodologies for calculating FFO and, accordingly, the Company's FFO may not be comparable to other REITs. The Company presents FFO per diluted share calculations that are based on the outstanding dilutive common shares plus the outstanding Operating Partnership units for the periods presented. Management considers FFO a useful additional measure of performance for an equity REIT because it facilitates an understanding of the operating performance of its properties without giving effect to real estate depreciation and amortization, which assumes that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, we believe that FFO provides a more meaningful and accurate indication of our performance. In addition, management believes that FFO provides useful information to the investment community about the Company's financial performance when compared to other REITs since FFO is generally recognized as the industry standard for reporting the operations of REITs. CORE FFO Management believes that the computation of FFO in accordance with NAREIT's definition includes certain items that are not indicative of the results provided by the Company's operating portfolio and affect the comparability of the Company's period-over-period performance. These items include, but are not limited to, gains and losses on the retirement of debt, acquisition costs, which due to changes in accounting pronouncements are now recorded in general and administrative expenses, and impairments to real estate assets. AFFO Management believes that AFFO is a useful measure of the Company's liquidity. The Company computes AFFO by adding to FFO equity based compensation expense and the non-cash amortization of deferred financing costs and non-real estate depreciation, and then subtracting cash paid for any recurring tenant improvements, leasing commissions, and recurring capital expenditures, and eliminating the net effect of straight-line rents, deferred market rent and debt fair value amortization. First generation costs include tenant improvements, leasing commissions and capital expenditures that were taken into consideration when underwriting the purchase of a property or incurred to bring the property to operating standard for its intended use. The Company also excludes development and redevelopment related expenditures. AFFO provides an additional perspective on the Company's ability to fund cash needs and make distributions to shareholders by adjusting for the effect of these non-cash items included in FFO, as well as recurring capital expenditures and leasing costs. However, other REITs may use different methodologies for calculating AFFO and, accordingly, the Company's AFFO may not be comparable to other REITs. |