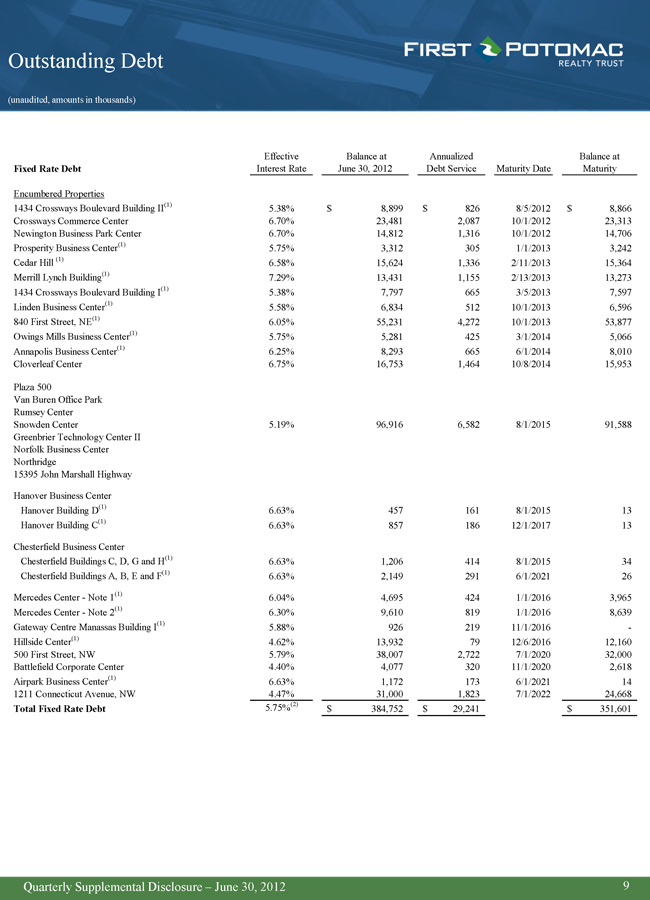

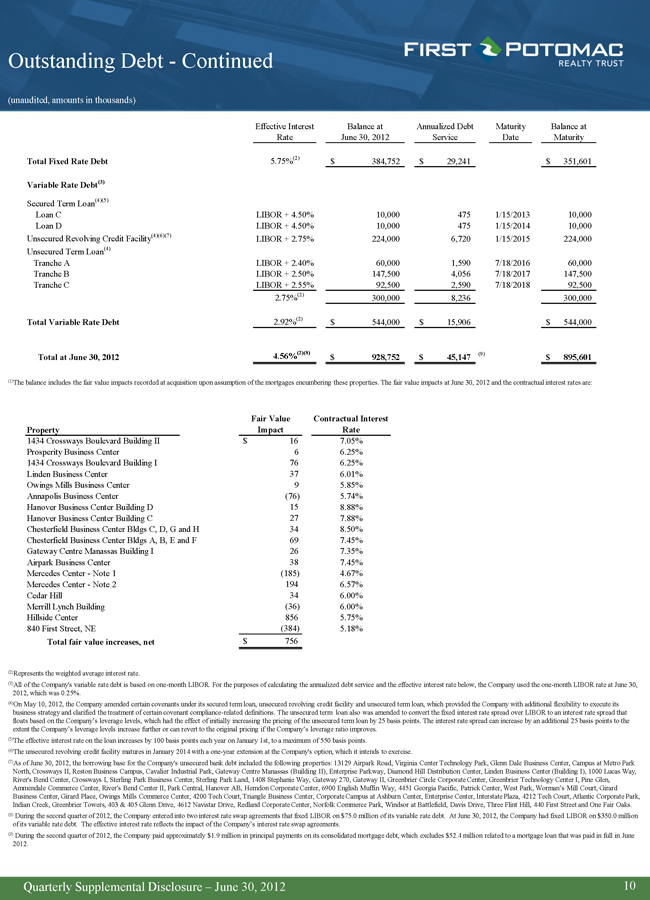

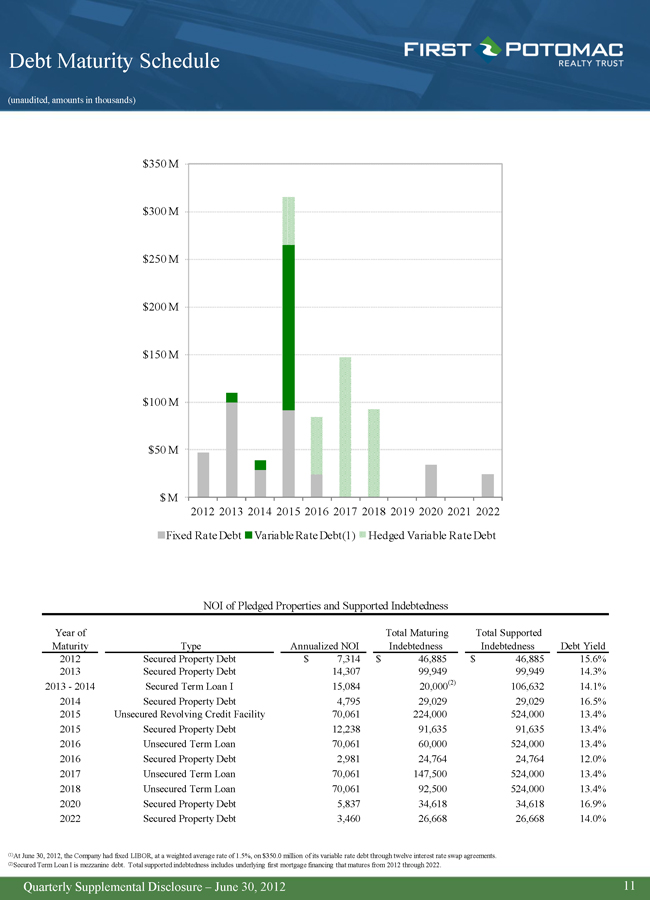

| Outstanding Debt - Continued (unaudited, amounts in thousands) (1)The balance includes the fair value impacts recorded at acquisition upon assumption of the mortgages encumbering these properties. The fair value impacts at June 30, 2012 and the contractual interest rates are: (2)Represents the weighted average interest rate. (3)All of the Company's variable rate debt is based on one-month LIBOR. For the purposes of calculating the annualized debt service and the effective interest rate below, the Company used the one-month LIBOR rate at June 30, 2012, which was 0.25%. (4)On May 10, 2012, the Company amended certain covenants under its secured term loan, unsecured revolving credit facility and unsecured term loan, which provided the Company with additional flexibility to execute its business strategy and clarified the treatment of certain covenant compliance-related definitions. The unsecured term loan also was amended to convert the fixed interest rate spread over LIBOR to an interest rate spread that floats based on the Company's leverage levels, which had the effect of initially increasing the pricing of the unsecured term loan by 25 basis points. The interest rate spread can increase by an additional 25 basis points to the extent the Company's leverage levels increase further or can revert to the original pricing if the Company's leverage ratio improves. (5)The effective interest rate on the loan increases by 100 basis points each year on January 1st, to a maximum of 550 basis points. (6)The unsecured revolving credit facility matures in January 2014 with a one-year extension at the Company's option, which it intends to exercise. (7)As of June 30, 2012, the borrowing base for the Company's unsecured bank debt included the following properties: 13129 Airpark Road, Virginia Center Technology Park, Glenn Dale Business Center, Campus at Metro Park North, Crossways II, Reston Business Campus, Cavalier Industrial Park, Gateway Centre Manassas (Building II), Enterprise Parkway, Diamond Hill Distribution Center, Linden Business Center (Building I), 1000 Lucas Way, River's Bend Center, Crossways I, Sterling Park Business Center, Sterling Park Land, 1408 Stephanie Way, Gateway 270, Gateway II, Greenbrier Circle Corporate Center, Greenbrier Technology Center I, Pine Glen, Ammendale Commerce Center, River's Bend Center II, Park Central, Hanover AB, Herndon Corporate Center, 6900 English Muffin Way, 4451 Georgia Pacific, Patrick Center, West Park, Worman's Mill Court, Girard Business Center, Girard Place, Owings Mills Commerce Center, 4200 Tech Court, Triangle Business Center, Corporate Campus at Ashburn Center, Enterprise Center, Interstate Plaza, 4212 Tech Court, Atlantic Corporate Park, Indian Creek, Greenbrier Towers, 403 & 405 Glenn Drive, 4612 Navistar Drive, Redland Corporate Center, Norfolk Commerce Park, Windsor at Battlefield, Davis Drive, Three Flint Hill, 440 First Street and One Fair Oaks. (8) During the second quarter of 2012, the Company entered into two interest rate swap agreements that fixed LIBOR on $75.0 million of its variable rate debt. At June 30, 2012, the Company had fixed LIBOR on $350.0 million of its variable rate debt. The effective interest rate reflects the impact of the Company's interest rate swap agreements. (9) During the second quarter of 2012, the Company paid approximately $1.9 million in principal payments on its consolidated mortgage debt, which excludes $52.4 million related to a mortgage loan that was paid in full in June 2012. |